This document is an excerpt from the EUR-Lex website

Document 32012Y0310(01)

Recommendation of the European Systemic Risk Board of 22 December 2011 on US dollar denominated funding of credit institutions (ESRB/2011/2)

Recommendation of the European Systemic Risk Board of 22 December 2011 on US dollar denominated funding of credit institutions (ESRB/2011/2)

Recommendation of the European Systemic Risk Board of 22 December 2011 on US dollar denominated funding of credit institutions (ESRB/2011/2)

IO C 72, 10.3.2012, p. 1–21

(BG, ES, CS, DA, DE, ET, EL, EN, FR, IT, LV, LT, HU, MT, NL, PL, PT, RO, SK, SL, FI, SV)

In force

In force

- Date of document:

- 22/12/2011

- Date of end of validity:

- No end date

- Author:

- Bord Eorpach um Riosca Sistéamach

- Form:

- Moladh

- Treaty:

- An Conradh ar Fheidhmiú an Aontais Eorpaigh

- Legal basis:

-

- 32010R1092 - A03P2PTB) 32010R1092 - A03P2PTD) 32010R1092 - A03P2PTF) 32010R1092 - A16 32010R1092 - A17 32010R1092 - A18

- 32011Y0224(01) - A15P3PTE) 32011Y0224(01) - A18 32011Y0224(01) - A19 32011Y0224(01) - A20

- Link

- Link

- Link

- Select all documents mentioning this document

- Instruments cited:

- Link

- EUROVOC descriptor:

- Subject matter:

- Directory code:

|

10.3.2012 |

EN |

Official Journal of the European Union |

C 72/1 |

RECOMMENDATION OF THE EUROPEAN SYSTEMIC RISK BOARD

of 22 December 2011

on US dollar denominated funding of credit institutions

(ESRB/2011/2)

2012/C 72/01

THE GENERAL BOARD OF THE EUROPEAN SYSTEMIC RISK BOARD,

Having regard to Regulation (EU) No 1092/2010 of the European Parliament and of the Council of 24 November 2010 on European Union macro-prudential oversight of the financial system and establishing a European Systemic Risk Board (1), and in particular Article 3(2)(b), (d) and (f) and Articles 16 to 18 thereof,

Having regard to Decision ESRB/2011/1 of the European Systemic Risk Board of 20 January 2011 adopting the Rules of Procedure of the European Systemic Risk Board (2), and in particular Article 15(3)(e) and Articles 18 to 20 thereof,

Having regard to the views of the relevant private sector stakeholders,

Whereas:

|

(1) |

The US dollar is a material funding currency for Union credit institutions, which obtain most US dollar funding from wholesale markets. |

|

(2) |

There is a material maturity mismatch in the US dollar assets and liabilities of Union credit institutions, with short-term wholesale funding being used to finance longer-term activities and assets; moreover, some counterparties are volatile. The combination of maturity mismatch and volatile investors is a key type of vulnerability. |

|

(3) |

There have been ongoing strains in US dollar funding markets since June 2011, following the material strains experienced in 2008 that led to the introduction of central bank swap lines to provide access to US dollars. These strains create key direct potential system-wide risks: in particular, in the short term, to bank liquidity, and in the medium term, to the real economy from a reduction in lending in US dollars by Union credit institutions and to the solvency of those credit institutions if deleveraging happens at fire-sale prices. |

|

(4) |

Credit institutions, central banks and supervisors have implemented measures to mitigate general funding and liquidity risks in recent years; some of these measures contributed to improve the US dollar funding and liquidity positions of Union credit institutions. However, a more structured approach is needed to prevent a repetition of the tensions in US dollar funding markets. |

|

(5) |

Micro-prudential tools should be strengthened for the macro-prudential purpose of avoiding the levels of tension in US dollar funding for Union credit institutions seen in the recent financial crises. |

|

(6) |

Data gaps at the Union level limit the ability to analyse the possible impact of US dollar funding risks; data quality should therefore be improved. |

|

(7) |

Close monitoring at the level of the banking sector and of individual firms would help the competent authorities to better understand developments in US dollar funding and liquidity risks; it would also help them in encouraging banks to take necessary ex ante measures to limit excessive exposures and correct distortions in risk management. The recommended measures in those fields are consistent with ESRB recommendation F of 21 September 2011 on lending in foreign currencies (3). |

|

(8) |

One of the instruments to mitigate US dollar funding risks is contingency funding plans, to avoid exacerbating funding problems in extreme situations. However, contingency plans could create new systemic problems if they resulted in similar actions taken by credit institutions at the same time. |

|

(9) |

The European Systemic Risk Board (ESRB) will review the progress in the implementation of this Recommendation during the second half of 2012. |

|

(10) |

The Annex to this Recommendation analyses the significant systemic risks to the financial stability in the Union arising from the US dollar funding of Union credit institutions. |

|

(11) |

This Recommendation is without prejudice to the monetary policy mandates of the central banks in the Union, and the tasks entrusted to the ESRB. |

|

(12) |

ESRB recommendations are published after informing the Council of the General Board’s intention to do so and providing the Council with an opportunity to react, |

HAS ADOPTED THIS RECOMMENDATION:

SECTION 1

RECOMMENDATIONS

Recommendation A — Monitoring of US dollar funding and liquidity

National supervisory authorities are recommended to:

|

1. |

closely monitor US dollar funding and liquidity risks taken by credit institutions, as part of their monitoring of the credit institutions’ overall funding and liquidity positions. In particular, national supervisory authorities should monitor:

|

|

2. |

consider, before exposures to the funding and liquidity risk in US dollars reach excessive levels:

|

Recommendation B — Contingency funding plans

National supervisory authorities are recommended to:

|

1. |

ensure that credit institutions provide for management actions in their contingency funding plans for handling a shock in US dollar funding, and that those credit institutions have considered the feasibility of those actions if more than one credit institution tries to undertake them at the same time. At a minimum, contingency funding plans should consider the contingency funding sources available in the event of a reduction in supply from different counterparty classes; |

|

2. |

assess the feasibility of these management actions in the contingency funding plans at the level of the banking sector. If simultaneous action by credit institutions is assessed as likely to create potential systemic risks, national supervisory authorities are recommended to consider action to diminish those risks and the impact of those actions on the stability of the Union banking sector. |

SECTION 2

IMPLEMENTATION

1. Interpretation

|

1. |

For the purposes of this Recommendation, the following definitions apply:

|

|

2. |

The Annex forms an integral part of this Recommendation. In the case of conflict between the main text and the Annex, the main text prevails. |

2. Criteria for implementation

|

1. |

The following criteria apply to the implementation of this Recommendation:

|

|

2. |

Addressees are requested to communicate to the ESRB and to the Council actions undertaken in response to this Recommendation, or adequately justify inaction. The reports should as a minimum contain:

|

3. Timeline for the follow-up

|

1. |

Addressees are requested to communicate to the ESRB and the Council the action taken in response to recommendations A and B, and adequate justification in the case of inaction, by 30 June 2012. |

|

2. |

National supervisory authorities may report in aggregate through the European Banking Authority. |

|

3. |

The General Board may extend the deadline under paragraph 1 where legislative initiatives are necessary to comply with one or more recommendations. |

4. Monitoring and assessment

|

1. |

The ESRB Secretariat:

|

|

2. |

The General Board assesses the actions and the justifications reported by the addressees and, where appropriate, decides whether this Recommendation has not been followed and the addressees have failed to adequately justify their inaction. |

Done at Frankfurt am Main, 22 December 2011.

The Chair of the ESRB

Mario DRAGHI

(1) OJ L 331, 15.12.2010, p. 1.

(3) Recommendation ESRB/2011/1 of the European Systemic Risk Board of 21 September 2011 on lending in foreign currencies (OJ C 342, 22.11.2011, p. 1).

(4) OJ L 177, 30.6.2006, p. 1.

ANNEX

EUROPEAN SYSTEMIC RISK BOARD RECOMMENDATIONS ON US DOLLAR-DENOMINATED FUNDING OF UNION CREDIT INSTITUTIONS

Executive summary

|

I. |

Overview of US dollar funding of Union credit institutions |

|

II. |

Risks stemming from the use of US dollar funding |

|

III. |

European Systemic Risk Board recommendations |

Attachment: Voluntary data collection exercise on the US dollar funding of Union credit institutions

EXECUTIVE SUMMARY

The US dollar is a material funding currency for Union credit institutions, accounting for around 15 % of credit institutions’ total liabilities. Almost all of the funding available for use in the Union is wholesale, and much of it is very short-term. There appears to be a material maturity mismatch between long-term assets and short-term liabilities in US dollars and some counterparties are volatile. This combination of maturity mismatch and volatile investors is a key type of vulnerability.

There has been ongoing evidence of strain in US dollar funding markets since June 2011. Some Union credit institutions have recently announced plans to deleverage US dollar assets, in part to reduce their reliance on US dollar funding. This may give rise to at least two key direct and potentially system-wide risks: the impact on Union credit institutions’ solvency if the assets are sold at fire-sale prices, and the impact on the real economy from a scale-back in lending in US dollars by Union credit institutions.

Market intelligence suggests that the existence of central bank swap lines offers comfort to market participants, thus supporting the functioning of foreign exchange (FX) swap markets, even when not used. This may mean that there is a moral hazard risk hindering Union credit institutions from moving to a more robust funding structure. Indeed, some Union credit institutions in different countries do not provide specifically for funding shocks in US dollars/foreign currencies in their contingency funding plans (CFPs).

The aim of the recommendations in this report is to embark upon a process aimed at avoiding a similar level of tension in US dollar funding of Union credit institutions in the next financial crisis to those seen in the financial crises of 2008 and 2011, rather than policies designed specifically to mitigate current tensions.

The recommendations predominantly involve strengthening micro-prudential tools for macro-prudential purposes, and concern: (i) close monitoring of Union credit institutions’ funding and liquidity risks in US dollars with immediate effect and, where appropriate, limiting those risks before they reach an excessive level, whilst avoiding a disorderly unravelling of current US dollar financing structures; (ii) ensuring that credit institutions’ CFPs include management actions for handling shocks in US dollar funding whilst diminishing potential systemic risks arising from the simultaneous action of credit institutions triggered by similar CFPs.

I. OVERVIEW OF US DOLLAR FUNDING OF CREDIT INSTITUTIONS IN THE UNION

I.1. Key drivers for credit institutions in accessing US dollar funding

Market and regulatory intelligence suggests that a range of factors affects demand for US dollar funding:

(a) diversification: particularly following the crisis, Union credit institutions reported that they were seeking to diversify their sources of funding across currencies, maturities and investor types. Because the US dollar is one of the most liquid and deep markets, it appears as a key funding source in these strategies;

(b) cost: some Union credit institutions have typically sought to access the US dollar as a cheaper source of funds for their non-US dollar assets. There have been persistent cost advantages in some cases from issuing debt in US dollars and swapping it into the desired currency, rather than issuing direct in the desired currency in primary markets;

(c) arbitrage: there is evidence that some Union credit institutions are taking the opportunity to access short-term funding, for example from US mutual money market funds (MMMFs), at below 25 basis points, and that they are depositing at the Federal Reserve at currently 25 basis points;

(d) business model: demand also depends on the international economic environment and therefore on credit institutions’ risk appetite and need for borrowing in US dollars — in particular, credit institutions active in US dollar businesses — and on idiosyncratic factors such as individual Union credit institutions’ development strategies;

(e) there are two (at times, simultaneous) approaches: credit institutions have either emphasised that their headline driver is: (i) an overall diversification strategy where they access the US dollar and then swap it into the currency they require; or (ii) a matching need strategy where they assess their currency need and then look to issue funding to meet it;

(f) supply factors: some US investors are seeking yield in a low interest rate environment; and some report that US MMMFs have limited alternatives to investing in Union credit institutions given that US credit institutions — which often have strong depositor bases — and corporates are currently relatively cash-rich.

I.2. Structural position of Union credit institutions

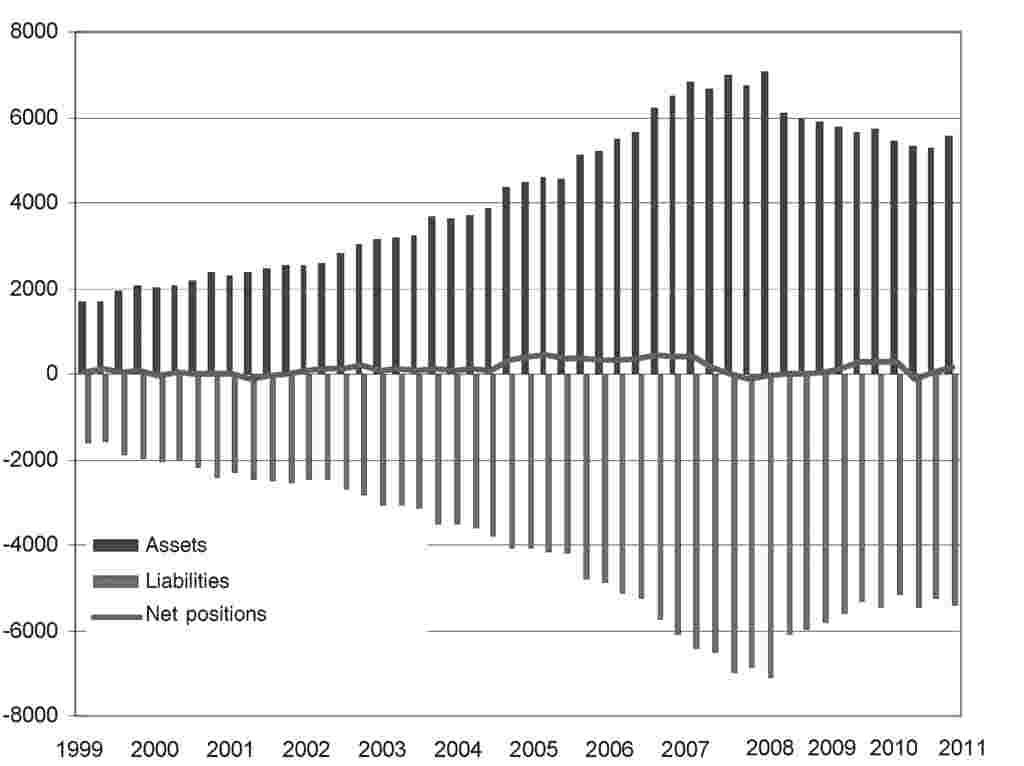

At a headline level, the US dollar balance sheets of Union credit institutions grew materially in the years before the financial crisis. According to data from the Bank for International Settlements (BIS), this trend has reversed since the crisis (Chart 1). This appears to reflect the ongoing deleveraging of Union credit institutions in the wake of the financial crisis, particularly in respect of legacy assets.

Drawing from data collected by the European Systemic Risk Board (ESRB), it is to further analyse the size of the US dollar balance sheets. In some countries the mismatch between US dollar assets and liabilities is relatively small. In others, there are more liabilities than assets, consistent with market intelligence that some Union credit institutions tend to use US dollars as an opportunistic source of funding, in the broader context of their funding diversification, and then swap it into other currencies. US dollar liabilities account for slightly more than 15 % of total liabilities in aggregate at Union level.

Chart 1

Gross and net US dollar positions of Union credit institutions (USD billion)

I.3. Main uses (assets) and sources (liabilities) of US dollar funding

A closer look at the US dollar assets of Union credit institutions shows that US dollars are mainly used for four purposes: (i) loans in US dollars to non-financial corporations (international trade and project financing), with some limited exposure also to the commercial and public sectors in the US; (ii) interbank lending (secured and unsecured), which is usually short-term; (iii) cash reserves on deposit at the Federal Reserve; and (iv) trading activities of Union credit institutions.

With some exceptions, Union credit institutions do not have an extensive US dollar retail base (US dollar retail deposits represent only 3 % of total liabilities). Most funding is obtained from wholesale markets, with repos and CP/CDs the main instruments. US money market investors are key investors in US dollar CP and CD programmes.

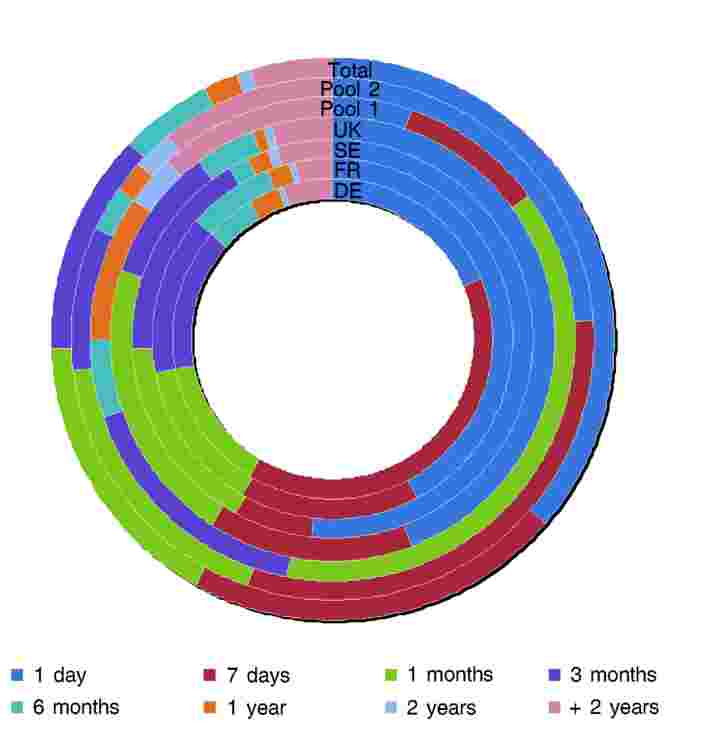

Data collected by the ESRB suggest that secured and unsecured wholesale US dollar funding accounts for around one third of the total wholesale funding activities of Union credit institutions. This in part reflects that the US wholesale markets are among the most liquid in the world. The use of US wholesale markets is particularly relevant in shorter maturities. Around 75 % of wholesale US dollar funding of Union credit institutions has a maturity of less than one month (Chart 2). Term funding beyond one year is not greater than 20 % of total US dollar wholesale funding for any country, according to European Banking Authority (EBA) data.

Chart 2

US dollar wholesale funding by maturity and country

I.4. Maturity profile of US dollar-denominated assets and liabilities

While the US dollar-denominated liabilities of Union credit institutions are mostly short-term, US dollar-denominated assets generally have, as might be expected, a longer-term maturity structure. The tenor of about one-third of US dollar-denominated assets is above one year. Comparison with the overall maturity structure of Union credit institutions’ balance sheets suggests that the maturity mismatch between US dollar assets and liabilities is more pronounced than the overall maturity mismatch in all currencies.

Given euro area and global macroeconomic concerns, US investors have further reduced the size and tenor of their US dollar funding for non-US credit institutions in the second half of 2011. The rollover rates for the unsecured US dollar wholesale funding of many Union credit institutions decreased significantly in the third quarter of 2011. The tenor of new US dollar funding was significantly shorter compared to the second quarter of 2011. The longer-term US dollar unsecured debt market has effectively been closed for most Union credit institutions, with the exception of some Scandinavian/Nordic credit institutions which managed to issue sizeable long-term debt in US dollars. In general, investors appear to discriminate between credit institutions based on their country of origin.

I.5. Liquid asset buffers

As of December 2010, Union credit institutions in the ESRB data sample held stock of around EUR 570 billion of US dollar assets within their overall counterbalancing capacity (1). In aggregate this equates to around 20 % of total US dollar liabilities, when the broadest definition of counterbalancing capacity is used. Approximately two thirds of these amounts were eligible as collateral at central banks. Liquid assets in other currencies could be used to respond to a shock in the US dollar, dependent in part on the functioning of FX markets.

However, in times of financial stress only very liquid assets might be usable as an effective liquidity buffer. If only cash and central bank reserves (in excess of minimum reserve requirements) and zero-percentage-weighted unencumbered sovereign claims deposited at central banks are taken into account, the US dollar liquid asset buffer decreases to EUR 172 billion for the sample of Union credit institutions considered.

I.6. Allocation of US dollar providers

According to the qualitative information gathered by the ESRB, there are seven main categories of providers of short-term US dollars:

|

(a) |

US MMMFs; |

|

(b) |

monetary authorities, central banks and sovereign wealth funds, which are large holders of US dollar assets; |

|

(c) |

securities lending firms; |

|

(d) |

US dollar-rich credit institutions, via the interbank market (usually very short-term) and via the FX swap market; |

|

(e) |

large US corporations; |

|

(f) |

US government-sponsored enterprises (Fannie Mae and Freddie Mac); |

|

(g) |

in addition to the main US funding sources, there is also anecdotal evidence pointing to the use of non-US based markets (mainly Asian markets) for raising US dollars by Union credit institutions. |

Most of these providers are particularly sensitive to perceived credit risk concerns, as US MMMFs have shown in past months. Although US MMMFs are estimated to account for around 2 % of total liabilities for the whole Union banking system, in some Union credit institutions the percentage increases to 10 %.

In recent months, US prime MMMFs have shortened the maturity of their funding to Union credit institutions in several Member States, such that the proportion of funding at one month maturity or less increased to around 70 % in October/November 2011, at least for euro area credit institutions (Chart 3). In addition, they have also reduced their overall exposure to Union credit institutions, although changes between May and November 2011 varied significantly from one country to another (Chart 4).

Chart 3

Maturity profile of US MMMF’s exposure to euro area credit institutions

Chart 4

Changes in US prime MMMF’s exposure to Union credit institutions between May and November 2011

I.7. Market indicators

The largest Union credit institutions extensively tap into the US wholesale markets to fund their US dollar needs. By contrast, many second-tier Union credit institutions appear to rely more on first-tier Union credit institutions and on FX swap markets to receive US dollars. The cost of swapping euros into US dollars — indicated by the EUR/USD basis swap (Chart 5) — peaked after the Lehman failure. After a substantial narrowing of the EUR/USD basis swap in the first four months of 2011, it has widened again since the beginning of May. Since mid-June the intra-day volatility in it has increased, reflecting the uncertainty of financial markets as to US dollar funding conditions for Union credit institutions.

In the wake of the Lehman Brothers failure, the ECB also increased the usage of the US dollar swap line agreed with the Federal Reserve in order to provide US dollar liquidity to Union credit institutions (Chart 6). The outstanding amount of US dollar liquidity providing operations by the ECB peaked at almost USD 300 billion at the end of 2008.

Market intelligence suggests that the existence of the US dollar central bank swap lines provides comfort to market participants and therefore supports the functioning of FX swap markets, even when not used. This may mean that there is a moral hazard risk hindering Union credit institutions from moving to a more robust funding structure — though pricing of those facilities is meant in part to mitigate that risk. Box 1 provides a summary of the use of FX swap markets and of initiatives in this area to improve resilience.

Chart 5

EUR/USD basis swap

Chart 6

ECB usage of the Fed swap line

Outstanding amounts of ECB liquidity-providing operations

BOX 1: Functioning and resilience of FX swap markets

Following the reduction in interbank unsecured lending at the start of the financial crisis, Union credit institutions had to make greater use of secured funding (FX swaps and repos) as an alternative. This greater recourse to secured funding started to impair those markets too, in particular the one for FX swaps. After the bankruptcy of Lehman Brothers, it became very difficult and very expensive to obtain US dollars via currency swaps (in October 2008 the three-month EUR/USD basis swap reached more than – 200 bps).

This general dislocation in US dollar funding markets led to swap lines being established between the Federal Reserve and a number of central banks, including the ECB. At its peak (end of 2008), the total outstanding amount of US dollars lent to central banks by the Federal Reserve reached around USD 550 billion, most of which was lent to European central banks (the ECB, the Bank of England and the Swiss National Bank). For instance, the outstanding amount of US dollar liquidity provided by the ECB to Eurosystem counterparties reached almost USD 300 billion by the end of 2008. This compares to Eurosystem reserves (in convertible foreign currencies) of EUR 145 billion at the end of 2008 (around USD 200 billion equivalent). Even though some of the bidding may have been opportunistic and/or precautionary, the magnitude of the US dollar shortage was such that it would have been difficult or impossible for central banks to fund the provision of such liquidity by themselves (whether from their own reserves or in the market). The swap lines between the Federal Reserve and a number of central banks (the ECB, the Bank of England, the Swiss National Bank, the Bank of Canada and the Bank of Japan) were reactivated in May 2010, as the sovereign debt crisis intensified, and reassured market participants that US dollar funding would be available for non-US based institutions in case of need.

Provision of US dollars by central banks outside the US proved very effective in restoring market functioning. The US dollar swap basis (the difference between the US dollar rate implied in the EUR/USD swap and USD Libor) declined rapidly afterwards. In addition, the usage of the Federal Reserve swap lines has declined since the peak reached at the end of 2008 and is now minimal. This shows that Union credit institutions have managed so far to ‘muddle through’ the recent episode of US dollar funding tensions. Anecdotal evidence and market feedback suggest that the FX swap market provided sufficient liquidity for Union credit institutions to borrow in US dollars against their domestic currency.

A number of papers produced by central banks and market organisations stressed that the FX market demonstrated its resilience during the financial crisis, thanks to Continuous Linked Settlement (CLS) and to the wider use of Credit Support Annexes. European and US regulators are currently considering the appropriateness of making FX swap transactions subject to mandatory central clearing.

The resilience of the FX swap market in times of stress is an important element in the assessment of risks. Two elements argue for prudence in that regard. Firstly, even though no data are available, anecdotal feedback from market participants suggest that the size of the US dollar shortage and demand for borrowing in US dollars via the FX swap market has so far been lower than it was in the immediate aftermath of the demise of Lehman Brothers. Secondly, the existence of swap lines between the Federal Reserve and European central banks provides a safety net which brings comfort to market participants.

The recent coordinated central bank action to address strains in US dollar funding markets (lowering pricing and continuation of three-month tenders) led to some improvement in market funding conditions for Union credit institutions. The basis swap declined moderately but US dollar Libor fixings remained unchanged. Apart from general risk aversion, two elements reportedly contributed to ongoing tensions: the stigma attached to participating in the three-month tenders and the fact that credit institutions’ large clients (pension and mutual funds, corporations) do not have access to the central bank facilities. Therefore, they are still dependent on FX swap markets for hedging purposes in a context where credit institutions are reluctant to do market making.

II. RISKS STEMMING FROM THE USE OF US DOLLAR FUNDING

The ESRB discussed two main channels of risk from Union credit institutions’ reliance on US dollar funding/their maturity mismatch in US dollars: the short-term liquidity risk and the medium-term risk of an impact on the real economy of the Union through changes in business models due to US dollar funding strains.

II.1. Short-term liquidity risk

Liquidity strains in US dollars have prompted repeated coordinated central bank action since 2008. These strains reflect the structure of Union credit institutions’ US dollar funding and the role of the US dollar in the global financial system, as well as current market conditions. Taken together these may mean that there is a particular fragility in Union credit institutions relying on short-term wholesale funding in US dollars. In particular:

(a) limited ‘stable’ funding: Union credit institutions have almost no retail US dollar funding available for use in the Union;

(b) short-term profile: as discussed in Section I, Union credit institutions’ US dollar wholesale funding tends to be very short-term;

(c) foreign investors tend to retrench more than domestic investors in periods of stress: there is a risk that investors retrench to their home markets in a stress scenario or distinguish less between the foreign firms in which they have invested than would domestic investors. In particular, evidence from the crisis and more recently suggests that some classes of US investors tend to move together and are particularly sensitive to negative headlines, leaving Union credit institutions susceptible to quick funding strains particularly when there are concentrations in types of funding provider. This is important given that liquidity in US dollar wholesale funding markets is concentrated at short-term tenors (i.e. less than three months);

(d) the role of US MMMFs: US MMMFs tend to react quickly, and collectively, to headline risks. Recent distress in markets caused by sovereign risk concerns appears once again to have prompted some US investors in Union credit institutions to withdraw or reduce the maturity of their funding since mid-2011. In particular, US MMMFs might continue to disinvest in Union credit institutions for several reasons. There may be structural changes in US MMMFs’ funding activity triggered by a tougher regulatory regime. SEC reforms were put into effect in May 2010, further limiting the maturity at which US MMMFs could lend. A second round of reforms is currently under discussion, which includes proposals for MMMFs to be required to move to a variable net asset value from a constant net asset value (CNAV) framework. Another option is that US regulators will require firms to hold risk-absorbing buffers if they continue with a CNAV business model. Holding a buffer could increase the resilience of MMMFs, but may also mean their business model is uneconomic in the long run. Other regulatory factors that may impact on US MMMFs’ business models include the repeal of regulations preventing US banks from offering interest-bearing savings on on-demand accounts. These regulatory changes are likely to be exacerbated by any further ratings downgrades in the Union;

(e) quality of US dollar assets: in its liquidity risk assessment exercise, the EBA estimates that the quality of US dollar assets in Union credit institutions’ liquid asset buffers is lower than those of home currencies and there is considerable ongoing event risk for Union credit institution funding markets. New, unexpected problems with US banks may also affect the US dollar interbank market;

(f) dependency on FX markets: in a stress scenario, if any short-term requirement for US dollars cannot be met by liquidating US dollar assets, Union credit institutions will need to use FX spot or swap markets to convert liquid assets in other currencies into US dollars. This increases the number of markets (investors) that need to be functioning in a stress scenario, though the ability to transact in multiple markets may also be seen as a risk mitigant. Since mid-2011, tensions in US dollar wholesale markets have also spilled over to FX swap markets (e.g. increasing the cost of swapping euros into US dollars);

(g) time zone frictions: this phenomenon was illustrated in the crisis, when suppliers of US dollars were unwilling to lend until they had a good understanding of their own liquidity position for the day, which was often by the middle of the US day as European markets were closing;

(h) hoarding: global firms and investors look to hoard US dollars in a financial crisis due to its role as a world reserve currency;

(i) small Union credit institutions’ access: large internationally active Union credit institutions appear to provide part of their wholesale funding to smaller Union credit institutions, which have restricted or no access to US dollar funding markets, therefore problems at large Union credit institutions can quickly spill over to the rest of the banking sector;

(j) sovereign risk concerns: markets discriminate among Union credit institutions on the basis of their rating and country of origin. Sovereign debt problems affect Union credit institutions, in particular in countries with stressed sovereign debt markets, and spillover to Union credit institutions with significant sovereign debt exposures can lead to strains on funding in general and in particular as regards US dollar funding.

An ESRB assessment based on data provided by national supervisory authorities (NSAs) reveals a significant funding gap in US dollars for Union credit institutions in a severe stress scenario. Using the contractual US dollar-denominated outflows and inflows a crude funding ‘gap’ of credit institutions in US dollars over 3, 6 and 12 months can be calculated. The Table summarises the results of the assessment.

Table 1

Cumulative funding gaps in US dollar

|

Amounts (EUR bn) |

3 months |

6 months |

12 months |

||

|

Cumulative funding gap |

– 841 |

– 910 |

– 919 |

||

|

– 670 |

– 736 |

– 750 |

||

|

– 386 |

– 467 |

– 500 |

||

|

– 182 |

– 263 |

– 304 |

The first row shows the cumulative funding gap over the three periods, defined as US dollar inflows minus US dollar outflows. The largest element of the net funding gap occurs in respect of very short-term maturities (under three months) reflecting the short-term nature of US dollar funding.

The subsequent three rows show the size of the gap when the Union credit institutions’ counterbalancing capacity is taken into account. Three measures of the counterbalancing capacity are used:

|

(a) |

conservative counterbalancing capacity comprises only cash and reserves at central banks (exceeding minimum reserves requirements) and zero-percentage-weighted sovereign claims eligible for central bank collateral. Therefore, this conservative measure refers in theory to the most liquid assets available to meet outflows in a stress scenario; |

|

(b) |

eligible counterbalancing capacity comprises assets which would be eligible as collateral at central banks; |

|

(c) |

total counterbalancing capacity comprises all assets defined as part of the counterbalancing capacity, which may be a reasonable indication of capacity to meet outflows in normal times, but where components are less liquid during periods of financial stress. |

As one comparator to these numbers, the amount of total drawings on the central bank US dollar swap lines put in place during 2008 was around USD 550 billion. Furthermore, there are differences between national banking systems: using this method and these data, the US dollar shortage is relatively small in some countries and larger in others. As described above, this is a crude measure and other calculation methods are possible.

II.2. Medium-term impact on the real economy

The structure of US dollar funding may mean that there are a number of channels through which a shock to US dollar funding could have knock-on impact via Union credit institutions to the real economy in the medium term. Overall, the ESRB assessment suggests that the potential importance of this is substantial; however, further work is required to assess how big the impact might be before this channel alone could justify limiting maturity mismatches in US dollars.

The key risk channels were seen to be:

|

(a) |

the cost of Union credit institution funding and the knock-on impact on Union credit institutions’ profitability. Some of the market intelligence gathered by the ESRB suggested that Union credit institutions had tended to access US dollar funding because it was typically cheaper to access and swap it into the required currency if necessary than to fund directly in that currency. Any impact on profitability currently could hamper Union credit institutions’ ability to extend credit to European corporations and households and/or make their transition to the Basel III framework (2) (hereinafter ‘Basel III’) more difficult. Some very preliminary analysis of the possible cost carried out by the ESRB suggests that it may not be material, and may constitute either the cost of extending the term of funding or accessing euro or pounds sterling directly instead of raising US dollars and swapping them into those currencies. However, this analysis is necessarily very partial given the quality and coverage of data submitted to the ESRB; a deeper analysis would be needed before drawing any firm conclusions; |

|

(b) |

the availability of Union credit institution funding. Supervisory intelligence suggests that many large Union credit institutions have until recently relied on large and deep US dollar funding markets in part to fund the US dollar activities of European corporations (e.g. firms active in aerospace, shipping, commodities and trade finance businesses). There is some concern that any attempt to limit access to US dollar funding may curb Union credit institutions’ ability to fund these assets and therefore to extend credit to non-financial corporations. Other non-Union credit institutions with more natural access to US dollars may prove able to take over the business. But this again may trigger the risk that they retrench quickly in a crisis (‘home bias’); |

|

(c) |

the impact of any wide-scale deleveraging, where Union credit institutions seek to sell US dollar assets to repay US dollar funding. This could have an impact on the availability of finance to the real economy, but also on the solvency of Union credit institutions if any large sales dampen asset prices through mark to market mechanisms. For example, market intelligence currently suggests that investors are waiting for the price of US dollar assets to fall because a number of Union credit institutions are trying to sell them. Indeed, US dollar asset sales or run-off may also prove difficult if a number of Union credit institutions decide to effect them at the same time, with the risk of knock-on effects. In addition, Union credit institutions may look to use other methods to reduce their need for US dollar funding, e.g. unwinding capital market positions or selling liquid assets. |

II.3. Possible mitigants

In view of the problems experienced following the collapse of Lehman Brothers, Union credit institutions and supervisors have implemented measures to mitigate funding and liquidity risks in general. Union credit institutions have looked to take action to improve their funding structures in the last couple of years and national central banks have provided US dollar liquidity to ease tensions in US dollar funding markets. The main mitigants to risks arising from short-term US dollar funding appear to include:

(a) more US dollar liquidity: Union credit institutions’ cash reserves at the Federal Reserve look to be higher than previously, though there have recently been some reductions. There is some sense that US dollar liquidity is higher than previously, given the monetary policy stance taken by the US, though that does not mean that US dollars would be redistributed around the financial system in a crisis;

(b) increase in secured US dollar funding: some Union credit institutions reacted to the dry-up of short-term unsecured funding by increasing the use of secured US dollar funding (repos) and EUR/USD swaps. However, the capacity of repos is restricted to the amount of short-term high-quality liquid assets which can be pledged as collateral;

(c) deleveraging of US dollar assets: several Union credit institutions have accelerated the deleveraging of their US dollar balance sheets after concerns about their sovereign-debt holdings made US MMMFs reluctant to lend to them. The main channel of deleveraging is the disposal of US dollar legacy assets. However, as outlined above, this deleveraging may have unintended consequences if it triggers a sell-off of US dollar assets and restricts the Union credit institutions’ capacity to lend to the real economy;

(d) central banks’ liquidity support: the Federal Reserve, together with the ECB, the Bank of England, the Swiss National Bank and the Bank of Canada, announced in June the extension of the temporary US dollar liquidity swap arrangements until August 2012. They also announced on 15 September 2011 that they would conduct three US dollar liquidity-providing operations with a maturity of approximately three months covering the end of the year. These measures helped to ease tensions in US dollar funding markets and to secure the US dollar funding needs of Union credit institutions. The central bank FX swap lines, even when not used, appear to provide comfort to market participants and therefore support the functioning of FX swap markets. However, there is a moral hazard risk that Union credit institutions avoid moving to a more robust funding structure as a result, though pricing of those facilities is meant in part to mitigate that risk;

(e) FX swap market infrastructure: market participants have mentioned existing infrastructure which supports the smooth functioning of FX swap markets, e.g. CLS, and practices involving maturity-matching their swaps with the underlying funding.

Some of these mitigants have already contributed to some extent to improving the US dollar funding and liquidity positions of Union credit institutions in the short term and helped them weather recent substantial tensions in US dollar funding markets. However, in addition to these mitigants a more structural approach is likely to be needed in the medium term to prevent a repetition of the tensions in US dollar funding markets in 2008 and 2011;

(f) contingency funding plans: among the instruments designed to mitigate US dollar funding risks in the medium term are CFPs. As part of its data collection exercise, the ESRB gathered information from NSAs on the management actions taken to handle US dollar funding shocks in Union credit institutions’ CFPs. The management actions were common across those countries which reported that Union credit institutions explicitly considered them. The actions, which could either be undertaken separately or in combination depending the nature and severity of the shock, include: reduction (sale or run-off) of assets that require US dollar funding/reduction in lending; use of FX spot and swap markets to use other currencies to raise US dollars; repo or sale of liquid asset buffers; use of central bank facilities (the ECB US dollar facility and the US discount window).

Some of these actions give rise to specific risks. In particular, the use of the FX spot market in large volumes involves a detrimental signalling effect. Reducing US dollar funding needs (through asset sales or run-offs) may also prove difficult if a number of Union credit institutions decide to do so at the same time, with the risk of knock-on effects as outlined earlier in this section. Those that felt US dollar funding was a material part of their banking sector reported that most Union credit institutions had access to Federal Reserve liquidity facilities. However, supervisors from a number of countries noted that their credit institutions’ plans did not contain explicit US dollar funding shock options. This is a serious shortcoming given current market conditions, particularly if it is the case in respect of those Union credit institutions that are material users of short-term US dollar funding.

Significantly, the ESRB noted overall that material data gaps at Union level, which had limited its ability to analyse the possible impact of US dollar funding risks, represented a key risk. This was particularly the case for understanding the profile of assets denominated in the US dollar. Some of the recommendations in the next section are designed in part to improve data quality for subsequent analysis.

III. ESRB RECOMMENDATIONS

POLICY OBJECTIVES

The ESRB recommendations address the apparent short-term liquidity risk existing within the Union and the potential medium-term risk for the Union’s real economy. Any such recommendations to tackle these would be from the perspective of avoiding similar tensions in US dollar funding for Union credit institutions in the next financial crisis, rather than handling current problems.

Moreover, short-term wholesale funding being used to finance longer-term activities and assets, in addressing the issue of fragilities arising from maturity mismatch in US dollars due regard needs to be paid to linkages with other policy topics. It is necessary to take a view on these in order to ensure that any recommendations on US dollars are consistent with them:

(a) short-term wholesale funding: reliance on US dollar funding is a subset of the larger issue of Union credit institutions’ reliance and use of short-term wholesale funding. However, it probably creates more risks for financial stability authorities than short-term funding in general due to the reasons outlined in Section II.1;

(b) diversification of funding sources: as part of improving resilience in Union credit institutions’ funding markets, Union credit institutions are encouraged to diversify their funding sources, which in practice means looking for investors in a range of geographical areas and currencies. Any policy on limiting maturity mismatches in US dollars needs to be consistent with policies taken in this area;

(c) international banking structure/global lender of last resort: one of the drivers of any potential limits on maturity mismatches in US dollars — or in foreign currencies more generally — comes from recognising that currently central banks typically provide liquidity insurance in their home currency only, i.e. there is no ‘global lender of last resort’ function. Central bank swap lines in US dollars provided by the Federal Reserve may be temporary or it may not be possible to rely on them permanently. In the absence of the lender of last resort function there may be a benefit in limiting Union credit institutions’ exposure to liquidity risks in US dollars or foreign currencies more generally. But some argue that any such step would reverse the trend towards more globalised banking;

(d) disclosure policy: Union credit institutions’ disclosure in relation to liquidity and funding is typically very limited in comparison to their disclosure on capital and other balance sheet metrics. The arguments for and against disclosure are frequently rehearsed in a range of other international groups and have not been discussed in detail by the ESRB. In the view of the ESRB, any discussion of the merits of disclosing metrics on funding and liquidity resilience ought also to consider the publication of indicators of reliance on short-term US dollar and foreign currency funding and on maturity mismatches in US dollar or foreign currencies, to promote market discipline.

III.1. Recommendation A — Monitoring of US dollar funding and liquidity

National supervisory authorities are recommended to:

|

1. |

closely monitor US dollar funding and liquidity risks taken by credit institutions, as part of their monitoring of the credit institutions’ overall funding and liquidity positions. In particular, national supervisory authorities should monitor:

|

|

2. |

consider, before exposures to the funding and liquidity risk in US dollars reach excessive levels:

|

III.1.1. Economic reasoning

Closer measuring and monitoring would help authorities better understand developments in US dollar funding risks. It would also help them in encouraging credit institutions to take necessary ex ante measures to correct distortions in risk management and in limiting excessive exposures. From the macro-prudential viewpoint, it is important that this is done at the level of the banking sector as well as at the level of individual firms.

The lower cost of short-term, compared to long-term, funding may give rise to moral hazard, i.e. firms failing to adequately assess the cost of insuring themselves against the risk of problems in FX swap markets. If credit institutions expect public intervention under adverse market conditions, they may be relying too heavily on short-term US dollar funding. The aim of the recommendation is for authorities to understand the exposure of their banking sector to this risk, to better understand the level of insurance being provided and the potential moral hazard issue. The aim is also for credit institutions to be aware of the authorities’ concern, in order to influence behaviour now.

III.1.2. Assessment, including advantages and disadvantages

The advantages arising from this recommendation are:

|

(a) |

close monitoring is a prerequisite for identifying the accumulation of excessive funding risk exposures in US dollars and for the ability to take preventive measures to address potential systemic risks; |

|

(b) |

it may diminish the moral hazard problem of credit institutions relying on US dollar funding by increasing firms’ awareness that NSAs are monitoring this issue. |

There are however disadvantages as well:

|

(a) |

monitoring of sources of US dollar funding by counterparty class might not be feasible, for example in the event that securities are issued through an intermediary dealer; |

|

(b) |

compliance costs for the authorities in enhancing the supervisory processes. |

III.1.3. Follow-up

III.1.3.1.

NSAs are requested to report to the ESRB by 30 June 2012 on the action taken to implement this recommendation.

III.1.3.2.

The following compliance criteria are defined:

|

(a) |

monitoring the funding and liquidity conditions of the banking sector, which should encompass at minimum: (i) the sources and uses of US dollar funding; (ii) maturity mismatches between US dollar assets and US dollar liabilities vs. maturity mismatches between domestic assets and domestic liabilities, for the most relevant time buckets (3) (4); (iii) funding liabilities in US dollars sourced from each significant counterparty class (as part of this, NSAs should give their views on the feasibility of regular monitoring of these kinds of counterparty concentrations); (iv) use of US dollar swap markets; (v) intra-group exposures; |

|

(b) |

limiting exposures, whenever liquidity and funding risks are likely to become excessive. |

III.1.3.3.

The report should refer to all of the compliance criteria and should include:

|

(a) |

processes in place to monitor funding and liquidity risk in US dollars; |

|

(b) |

the indicators defined in the compliance criteria; |

|

(c) |

where relevant, the limits imposed on funding and liquidity risk exposures. |

III.2. Recommendation B — Contingency funding plans

National supervisory authorities are recommended to:

|

1. |

ensure that credit institutions provide for management actions in place in their contingency funding plans for handling a shock in US dollar funding, and that those credit institutions have considered the feasibility of those actions if more than one credit institution tries to undertake them at the same time. At a minimum, contingency funding plans should consider the contingency funding sources available in the event of a reduction in supply from different counterparty classes; |

|

2. |

assess the feasibility of these management actions in the contingency funding plans at the level of the banking sector. If simultaneous action by credit institutions is assessed as likely to create potential systemic risks, national supervisory authorities are recommended to consider action to diminish those risks and the impact of those actions on the stability of the Union banking sector. |

III.2.1. Economic reasoning

Credit institutions need to understand the risks specifically related to their funding in US dollars and prepare themselves for possible disturbances or adverse conditions. The recommendation should ensure in the short term that credit institutions with significant US dollar funding have minimum contingency arrangements in place to avoid exacerbation of funding problems in extreme situations.

If contingency funding plans resulted in identical or similar responses by credit institutions to shocks in US dollar funding markets, they could create new systemic problems as a consequence of market disturbances. For instance, if a large set of credit institutions planned to sell a particular type of liquid asset or to rely on a specific channel of funding during a period of stressed US dollar funding markets, the feasibility of these forms of contingency funding could be placed at risk.

III.2.2. Assessment, including advantages and disadvantages

The advantages arising from this recommendation are:

|

(a) |

by having CFPs for US dollar funding in place, credit institutions would reduce the need for disorderly responses to disturbances in US dollar funding markets; |

|

(b) |

these plans would also help credit institutions to understand and internalise the costs of crisis or other possible disturbances in US dollar funding in their decisions on funding. |

There are however disadvantages as well:

|

(c) |

if the CFPs triggered a lot of similar reactions by credit institutions facing widespread US dollar funding problems, they could result in aggravation of systemic risks due to concentration of contingency funding solutions; |

|

(d) |

there is uncertainty whether in practice there are any contingency measures, apart from certain public sector interventions, which can remain effective particularly in case of a wide-ranging crisis of confidence in US dollar funding markets. |

III.2.3. Follow-up

III.2.3.1.

Addressees are requested to report to the ESRB by 30 June 2012 on the action taken to implement this recommendation.

III.2.3.2.

The following compliance criteria are defined:

|

(a) |

CFPs prepared for US dollar funding in credit institutions where the respective NSA deems the US dollar to be a significant funding currency by the respective NSA; |

|

(b) |

supervisory assessment of plans in order to evaluate whether it is likely that a large set of similar responses would be triggered in the face of a crisis with the possible consequence of further aggravation of the situation; |

|

(c) |

diminution of the risk of exacerbation of systemic risks due to similarity of contingency US dollar funding plans across relevant credit institutions. |

III.2.3.3.

The report should refer to all of the compliance criteria and should include:

|

(a) |

supervisory actions taken to ensure that relevant credit institutions have CFPs in place for US dollar funding; |

|

(b) |

possible systemic problems observed in the assessment of CFPs and supervisory actions taken to address these problems. |

OVERALL ASSESSMENT OF THE POLICY MEASURES

The aim of the recommendations is to avoid in the future a similar level of tension in US dollar funding of Union credit institutions to those seen in the financial crises of 2008 and 2011.

An important benefit of the recommendations is that they will help NSAs and the EBA to better identify the accumulation of excessive funding risks in US dollars, and to be able to take preventive measures to address potential systemic risks.

The recommendations are designed to decrease moral hazard relating to Union credit institutions by ensuring that they adequately assess and internalise the cost of insuring themselves against the risk of funding strains. If Union credit institutions expect public intervention under adverse market conditions, this may contribute to an overreliance on short-term US dollar funding. Enhancing monitoring and supervisory policies will help authorities to better understand the exposure of the banking sector to US dollar funding and liquidity risks and the potential moral hazard issue.

The enforcement of contingency funding plans will facilitate the aim of internalising the risks of Union credit institutions’ funding in US dollars and of strengthening Union credit institutions’ resilience to strains in US dollar funding markets by diminishing the need for disorderly responses to disturbances in US dollar funding markets. From a macro-prudential perspective, it is important that the recommendations aim to diminish systemic risks due to simultaneous actions by Union credit institutions in the event of market stress, and thereby avoid a disorderly unwinding of financing structures.

For all the recommendations, the expected benefits of their implementation outweigh their costs. The main burdens are related to the compliance costs for the NSAs in wider monitoring and reporting requirements, and the more stringent supervisory requirements to be fulfilled by the Union credit institutions.

(1) The counterbalancing capacity is the quantity of funds that a bank can obtain to meet liquidity requirements. A liquidity buffer is typically defined as the short end of the counterbalancing capacity under a ‘planned stress’ view. It needs to be available outright over a defined short period of time (the ‘survival period’).

(2) See Basel Committee on Banking Supervision — ‘Basel III: A global regulatory framework for more resilient banks and banking systems’, December 2010 (revised June 2011); ‘Basel III: International framework for liquidity risk measurement, standards and monitoring’, December 2010. Both documents are available on the BIS’s website at, http://www.bis.org

(3) The time buckets are to be defined by each national authority.

(4) This indicator corresponds to Basel III monitoring tool III.1 on contractual maturity mismatches, see ‘Basel III: International framework for liquidity risk measurement, standards and monitoring’, December 2010, pp. 32-33, which can be found on the BIS’s website at: http://www.bis.org

ATTACHMENT

VOLUNTARY DATA COLLECTION EXERCISE ON THE US DOLLAR FUNDING OF UNION CREDIT INSTITUTIONS

The information gathered by the European Systemic Risk Board (ESRB) in the context of a data collection exercise involving national supervisory authorities comprised two data templates and a questionnaire. The first data template (Template A), was based on the 2011 European Banking Authority (EBA) liquidity risk assessment template and included data on cash inflows and outflows, counterbalancing capacity and funding plans, broken down by maturities. The second data template (Template B) focused on the balance sheet positions of Union credit institutions, specifically in relation to US dollar-denominated assets and liabilities, and is more tailored to the needs of the ESRB. An additional questionnaire was designed to provide qualitative information on Union credit institutions’ reliance on US dollar funding and to gather supervisory information on this issue.

The information request was addressed to all Member States, and sought to collect data on a best effort basis, in order to cover, at least, Union credit institutions with significant positions in US dollar liabilities (i.e. at least 5 % of total liabilities). The data collection exercise covered credit institutions from 17 Member States. Bulgaria, the Czech Republic, Estonia, Ireland, Hungary, Poland, Portugal, Slovenia and Finland opted not to take part in the data collection exercise. Information could be reported at the level of individual institutions. Alternatively, it could be aggregated at national level if data from at least three institutions were included in the aggregate. Confidential data on individual Union credit institutions have been anonymised by pooling the data relating to three or more institutions.

Data from Template A, which in most cases replicate those already reported in the context of the EBA’s liquidity risk assessment, refer to end-December 2010 positions. The reporting date for Template B, in respect of which data were collected only to the extent required by the scope of the ESRB analysis is, with a few exceptions, end-June 2011 (see the Table).

Table

Summary of the data collection sample for Template B

|

Member State |

Number of Union credit institutions in the sample |

Sample's share of the domestic banking sector |

Accounting type |

Reference period |

|

BE |

2 |

33 % |

Solo |

Jun-11 |

|

DE |

8 |

31 % |

Solo |

Jun-11 |

|

DK |

1 |

|

Consolidated |

Dec-10 |

|

ES |

2 |

22 % |

Cons. and sub-cons. |

Dec-10/Jun-11 |

|

FR |

3 |

72 % |

Consolidated |

Jun-11 |

|

GR |

3 |

63 % |

Consolidated |

Mar-11 |

|

IT |

2 |

50 % |

Consolidated |

Dec-10 |

|

LU |

76 |

95 % |

Solo |

Jun-11 |

|

LV |

14 |

40 % |

Solo |

Jan-11 |

|

MT |

12 |

76 % |

Consolidated |

Jun-11 |

|

NL |

2 |

58 % |

Consolidated |

Dec-10/Jun-11 |

|

SE |

4 |

91 % |

Consolidated |

Jun-11 |

|

SK |

31 |

98 % |

Solo |

Jun-11 |

|

UK |

3 |

72 % |

Consolidated |

Jul-11 |

|

Total |

163 |

48 % |

— |

— |

|

Source: ESRB and Member States’ own calculations. Notes: Data for Belgium, Germany, Luxembourg, Latvia and Slovakia are on a non-consolidated basis, and do not include data from US branches and subsidiaries of Union credit institutions. The share of the Union credit institutions in the sample with respect to the total consolidated assets of the Union banking sector is calculated as at end-2010. For Malta, the share refers to the whole banking sector (including foreign-owned credit institutions). For Germany, Luxembourg and Latvia, the share refers to the total non-consolidated assets of the resident monetary financial institutions sector as at June 2011. |

||||