EUR-Lex Access to European Union law

This document is an excerpt from the EUR-Lex website

Document 02001R0747-20120101

Council Regulation (EC) No 747/2001 of 9 April 2001 providing for the management of Community tariff quotas and of reference quantities for products eligible for preferences by virtue of agreements with certain Mediterranean countries and repealing Regulations (EC) No 1981/94 and (EC) No 934/95

Consolidated text: Council Regulation (EC) No 747/2001 of 9 April 2001 providing for the management of Community tariff quotas and of reference quantities for products eligible for preferences by virtue of agreements with certain Mediterranean countries and repealing Regulations (EC) No 1981/94 and (EC) No 934/95

Council Regulation (EC) No 747/2001 of 9 April 2001 providing for the management of Community tariff quotas and of reference quantities for products eligible for preferences by virtue of agreements with certain Mediterranean countries and repealing Regulations (EC) No 1981/94 and (EC) No 934/95

2001R0747 — EN — 01.01.2012 — 011.001

This document is meant purely as a documentation tool and the institutions do not assume any liability for its contents

|

COUNCIL REGULATION (EC) No 747/2001 of 9 April 2001 (OJ L 109, 19.4.2001, p.2) |

Amended by:

|

|

|

Official Journal |

||

|

No |

page |

date |

||

|

L 127 |

3 |

14.5.2002 |

||

|

L 28 |

30 |

4.2.2003 |

||

|

L 6 |

3 |

10.1.2004 |

||

|

L 7 |

24 |

13.1.2004 |

||

|

L 7 |

30 |

13.1.2004 |

||

|

L 385 |

24 |

29.12.2004 |

||

|

L 396 |

38 |

31.12.2004 |

||

|

L 42 |

11 |

12.2.2005 |

||

|

L 83 |

13 |

1.4.2005 |

||

|

L 233 |

11 |

9.9.2005 |

||

|

L 4 |

7 |

7.1.2006 |

||

|

L 321 |

7 |

21.11.2006 |

||

|

L 298 |

11 |

16.11.2007 |

||

|

L 313 |

52 |

28.11.2009 |

||

|

L 127 |

1 |

26.5.2010 |

||

|

COMMISSION IMPLEMENTING REGULATION (EU) No 1351/2011 of 20 December 2011 |

L 338 |

29 |

21.12.2011 |

|

Corrected by:

COUNCIL REGULATION (EC) No 747/2001

of 9 April 2001

providing for the management of Community tariff quotas and of reference quantities for products eligible for preferences by virtue of agreements with certain Mediterranean countries and repealing Regulations (EC) No 1981/94 and (EC) No 934/95

THE COUNCIL OF THE EUROPEAN UNION,

Having regard to the Treaty establishing the European Community, and in particular Article 133 thereof,

Having regard to the proposal from the Commission,

Whereas:|

(1) |

The Additional Protocols to the Cooperation Agreements between the European Economic Community, of the one part, and the People's Democratic Republic of Algeria ( 1 ), the Arab Republic of Egypt ( 2 ), the Hashemite Kingdom of Jordan ( 3 ), the Syrian Arab Republic ( 4 ), of the other part, and the supplementary Protocol to the Agreement establishing an association between the European Economic Community and Malta ( 5 ), provide tariff concessions of which some fall within Community tariff quotas and reference quantities. |

|

(2) |

The Protocol laying down the conditions and procedures for the implementation of the second stage of the Agreement establishing an Association between the European Economic Community and the Republic of Cyprus and adapting certain provisions of the Agreement ( 6 ), supplemented by Council Regulation (EC) No 3192/94 of 19 December 1994 amending the arrangements applying to imports into the Community of certain agricultural products originating in Cyprus ( 7 ), also provide tariff concessions of which some fall within Community tariff quotas and reference quantities. |

|

(3) |

Council Regulation (EEC) No 1764/92 of 29 June 1992 amending the arrangements for the import into the Community of certain agricultural products originating in Algeria, Cyprus, Egypt, Israel, Jordan, Lebanon, Malta, Morocco, Syria and Tunisia ( 8 ), accelerated the tariff dismantling and provided for an increase of the volumes of the tariff quotas and reference quantities laid down in the Protocols to the Association or Cooperation Agreements with the Mediterranean countries in question. |

|

(4) |

The arrangements for importing oranges originating in Cyprus, in Egypt and in Israel into the Community has been adjusted by the Agreements in the form of an Exchange of Letters between the European Community and Cyprus ( 9 ), between the European Community and the Arab Republic of Egypt ( 10 ) and between the European Community and Israel ( 11 ). |

|

(5) |

Decision No 1/98 of the EC-Turkey Association Council of 25 February 1998 on the trade regime for agricultural products ( 12 ) provides for tariff concessions of which some are granted within tariff quotas. |

|

(6) |

The Euro-Mediterranean Interim Association Agreement on trade and cooperation between the European Community, of the one part, and the Palestine Liberation Organization (PLO) for the benefit of the Palestinian Authority of the West Bank and the Gaza Strip ( 13 ), of the other part, as well as the Euro-Mediterranean Agreements establishing an association between the European Communities and their Member States, of the one part, and the Republic of Tunisia ( 14 ), the Kingdom of Morocco ( 15 ), the State of Israel ( 16 ), of the other part, provide tariff concessions of which some fall within Community tariff quotas and reference quantities. |

|

(7) |

These tariff concessions have been implemented by Council Regulation (EC) No 1981/94 of 25 July 1994, opening and providing for the administration of Community tariff quotas for certain products originating in Algeria, Cyprus, Egypt, Israel, Jordan, Malta, Morocco, the West Bank and the Gaza Strip, Tunisia and Turkey, and providing detailed rules for extending and adapting these tariff quotas ( 17 ), and by Council Regulation (EC) No 934/95 of 10 April 1995 establishing a Community statistical surveillance in the framework of reference quantities for a certain number of products originating in Cyprus, Egypt, Israel, Jordan, Malta, Morocco Syria, Tunisia, and the West Bank and the Gaza Strip ( 18 ). |

|

(8) |

As both Council Regulations (EC) No 1981/94 and (EC) No 934/95 have been repeatedly and substantially amended, they now need to be recast and simplified in line with the Council Resolution of 25 October 1996 on the simplification and rationalisation of the Community's customs regulations and procedures ( 19 ). In the interest of rationalising the implementation of the tariff measures concerned, the provisions relating to tariff quotas and reference quantities should be grouped together in one single regulation which takes account of subsequent amendments of Regulations (EC) No 1981/94 and (EC) No 934/95, together with amendments to the Combined Nomenclature codes and to the TARIC-subdivisions. |

|

(9) |

As the preferential agreements concerned are concluded for an unlimited period, it is appropriate not to limit the duration of this Regulation. |

|

(10) |

Entitlement to benefit from the tariff concessions is subject to presentation to the customs authorities of the relevant proof of origin as provided for in the preferential agreements in question between the European Community and Mediterranean countries. |

|

(11) |

The preferential agreements in question provide, when a reference quantity is exceeded, for the Community to have the possibility to replace in the following preferential period the concession granted within that reference quantity by a tariff quota of equal amount. |

|

(12) |

As a result of the agreements reached in the Uruguay Round multilateral negotiations the customs duties of the Common Customs Tariff became as favourable for certain products as the tariff concession granted for these products in the Mediterranean preferential agreements. It is therefore not necessary to continue providing for the management of the tariff quota for prepared or preserved turkey meat originating in Israel or of the reference quantity for peas for sowing originating in Morocco. |

|

(13) |

Council or Commission Decisions amending the Combined Nomenclature and TARIC codes do not entail any substantive changes. For the sake of simplification and of timely publication of regulations implementing the Community tariff quotas and reference quantities provided for in new preferential agreements, protocols, Exchanges of Letters or other acts concluded between the Community and Mediterranean countries, and insofar these acts already specify the products eligible for tariff preferences in the framework of tariff quotas and reference quantities, their volumes, duties, periods and any eligibility criteria, it is appropriate to provide that the Commission may, having consulted the Customs Code Committee, make any necessary changes and technical amendments to this Regulation. This does not affect the specific procedure provided in Council Regulation (EC) No 3448/93 of 6 December 1993 laying down the trade arrangements applicable to certain goods resulting from the processing of agricultural products ( 20 ). |

|

(14) |

Commission Regulation (EC) No 2454/93 of 2 July 1993 laying down provisions for the implementation of Council Regulation (EEC) No 2913/92 establishing the Community Customs Code ( 21 ) codified the management rules for tariff quotas designed to be used following the chronological order of dates of customs declarations and for surveillance of preferential imports. |

|

(15) |

For reasons of speed and efficiency, communication between the Member States and the Commission should, as far as possible, take place by telematic link. |

|

(16) |

Entitlement to benefit from the tariff concessions for large-flowered roses, small-flowered roses, uniflorous (bloom) carnations and multiflorous (spray) carnations is subject to compliance with the conditions of Council Regulation (EEC) No 4088/87 of 21 December 1987 fixing conditions for the application of preferential customs duties on imports of certain flowers originating in Cyprus, Israel, Jordan, Morocco and the West Bank and the Gaza Strip ( 22 ). |

|

(17) |

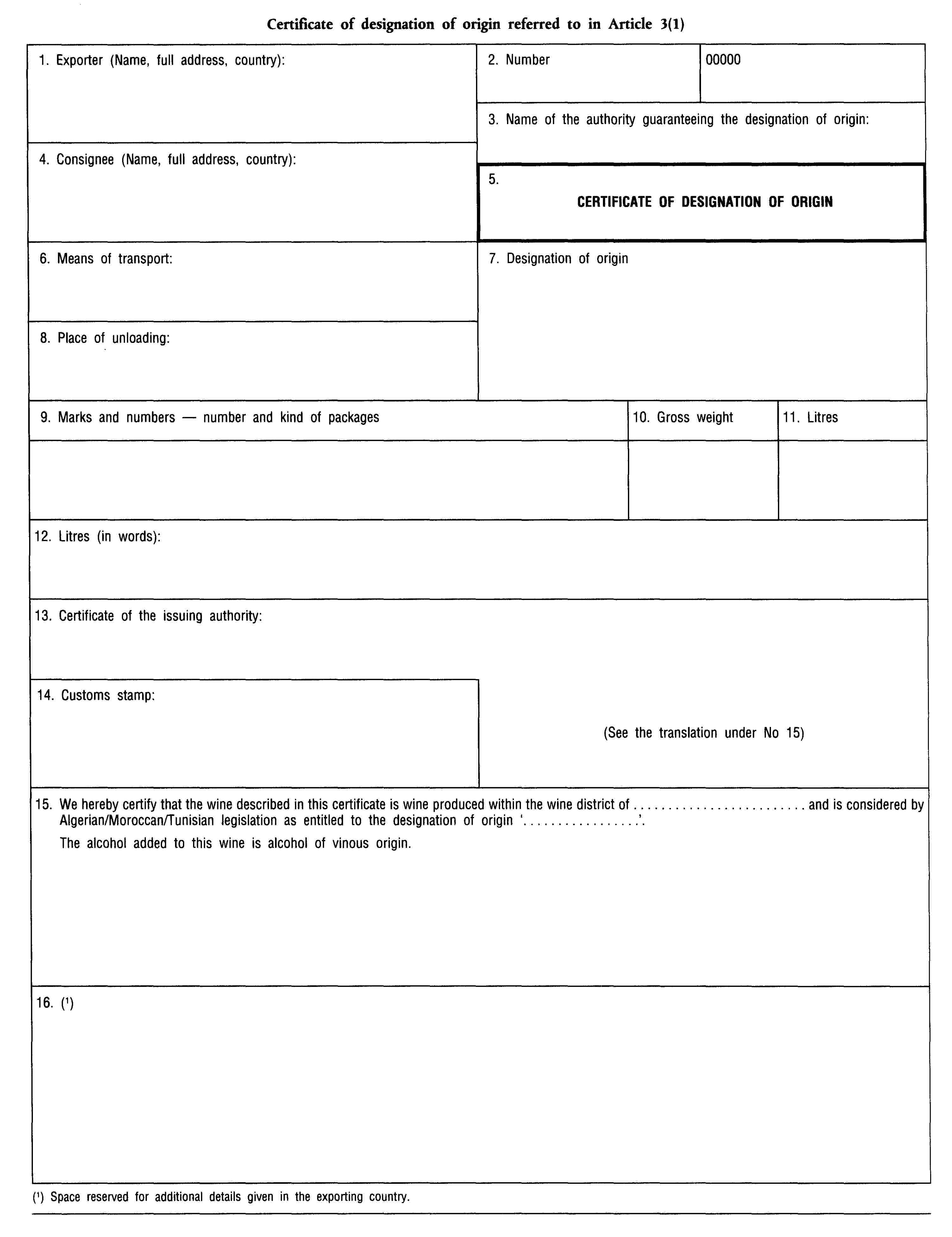

Wines originating in Algeria, Morocco and Tunisia and carrying a registered designation of origin, must be accompanied either by a certificate of designation of origin in accordance with the model specified in the preferential agreement or by the V I 1 document or a V I 2 extract annotated in compliance with Article 9 of Commission Regulation (EEC) No 3590/85 of 18 December 1985 on the certificate and analysis report required for the importation of wine, grape juice and grape must ( 23 ). |

|

(18) |

Entitlement to benefit from the tariff quota for liqueur wines originating in Cyprus is subject to compliance with the condition that the wines be designated as ‘liqueur wines’ in the V I 1 document or a V I 2 extract provided for in Commission Regulation (EEC) No 3590/85. |

|

(19) |

Council Decision of 22 December 2000 on the conclusion of an Agreement in the form of an Exchange of Letters between the European Community and the Republic of Tunisia concerning reciprocal liberalisation measures and amendment of the Agricultural Protocols to the EC/Tunisia Association Agreement ( 24 ), provides for new tariff concessions and for changes to existing concessions of which some fall within Community tariff quotas and reference quantities. |

|

(20) |

The measures necessary for the implementation of this Regulation should be adopted in accordance with Council Decision 1999/468/EC of 28 June 1999 laying down the procedures for the exercise of implementing powers conferred on the Commission ( 25 ), |

HAS ADOPTED THIS REGULATION:

Article 1

Tariff concessions within Community tariff quotas or within reference quantities

When products originating in Algeria, Morocco, Tunisia, Egypt, Jordan, Syria, Lebanon, Israel, the West Bank and the Gaza Strip and Turkey, listed in Annexes I to IX, are put into free circulation in the Community, they shall be eligible for exemption or reduced rates of customs duties within the limits of the Community tariff quotas or in the framework of the reference quantities, during the periods and in accordance with the provisions set out in this Regulation.

Article 1a

Suspension of the application of tariff quotas and reference quantities for products originating in the West Bank and the Gaza Strip

The application of the tariff quotas and reference quantities laid down in Annex VIII for products originating in the West Bank and the Gaza Strip shall be temporarily suspended for a period of 10 years from 1 January 2012.

However, depending on the future economic development of the West Bank and Gaza Strip, a possible extension for an additional period could be considered at the latest 1 year before the expiration of the 10 years period as provided by the Agreement in the form of an Exchange of Letters approved on behalf of the Union by Council Decision 2011/824/EU ( 26 ).

▼M16 —————

Article 3

Special conditions for entitlement to the tariff quotas for certain wines

To benefit from the Community tariff quotas mentioned in Annexes I to III under order numbers 09.1001, 09.1107 and 09.1205, the wines shall be accompanied either by a certificate of designation of origin issued by the relevant Algerian, Moroccan or Tunisian authority, in accordance with the model set out in Annex XII, or by a VI 1 document or a VI 2 extract annotated in compliance with Article 32(2) of Regulation (EC) No 883/2001.

Article 3a

Special provisions for the tariff quotas for tomatoes originating in Morocco

For tomatoes of CN code 0702 00 00 put into free circulation in every period from 1 October to 31 May (hereinafter ‘import season’) drawings on the monthly tariff quotas applicable under order No 09.1104 from 1 October to 31 December and from 1 January to 31 March respectively, shall be stopped each year on 15 January and on the second working day in the Commission following 1 April. On the following working day in the Commission, Commission services shall determine the unused balance of each of these tariff quotas and shall make it available within the additional tariff quota applicable for that import season under the order number 09.1112.

From the dates onwards on which the monthly tariff quotas are stopped, any retroactive drawings from any of the stopped monthly tariff quotas and any subsequent returns of unused volumes to any of the stopped monthly tariff quotas shall be made on the additional tariff quota applicable for that import season.

Article 4

Management of tariff quotas and reference quantities

1. The tariff quotas referred to in this Regulation shall be managed by the Commission in accordance with Articles 308a to 308c of Regulation (EEC) No 2454/93.

2. Products put into free circulation with the benefit of the preferential rates, in particular those provided within the reference quantities referred to in Article 1, shall be subject to Community surveillance in accordance with Article 308d of Regulation (EEC) No 2454/93. The Commission in consultation with the Member States shall decide on the products other than those covered by reference quantities to which surveillance applies.

3. Communication referring to the management of tariff quotas and reference quantities between the Member States and the Commission shall be effected, as far as possible, by telematic link.

Article 5

Conferment of powers

1. Without prejudice to the procedure laid down by Council Regulation (EC) No 3448/93, the Commission can, in accordance with the procedure referred to in Article 6(2) of this Regulation, adopt the provisions necessary for the application of this Regulation, notably:

(a) amendments and technical adjustments necessary following changes to the Combined Nomenclature codes and to the Taric-subdivisions;

(b) the necessary adaptations arising from the entry into force of new agreements, protocols, Exchanges of Letters or any other act concluded between the Community and Mediterranean countries and adopted by the Council, where such agreements, protocols, Exchanges of Letters or other Council acts specify the products eligible for tariff preferences in the framework of tariff quotas and reference quantities, their volumes, duties, periods and any eligibility criteria.

2. The provisions adopted in accordance with paragraph 1 do not authorise the Commission to:

(a) carry over preferential quantities from one period to another;

(b) transfer quantities under one tariff quota or reference quantity to another tariff quota or reference quantity;

(c) transfer quantities from a tariff quota to a reference quantity and vice versa;

(d) change the timetables laid down in the agreements, protocols, Exchanges of Letters or other Council acts;

(e) adopt legislation affecting tariff quotas managed by means of import licences.

Article 6

Management Committee

1. The Commission shall be assisted by the Customs Code Committee set up by Article 248a of Regulation (EEC) No 2913/92 ( 27 ), hereinafter referred to as the ‘Committee’.

2. Where reference is made to this paragraph, Articles 4 and 7 of Decision 1999/468/EC shall apply.

The period laid down in Article 4(3) of Decision 1999/468/EC shall be set at three months.

3. The Committe shall adopt its Rules of Procedure.

Article 7

Cooperation

The Member States and the Commission shall cooperate closely to ensure compliance with this Regulation.

Article 8

Repeals

Regulations (EC) No 1981/94 and (EC) No 934/95 are hereby repealed.

References to Regulations (EC) No 1981/94 and (EC) No 934/95 shall be deemed to refer to this Regulation and read according to the correspondence table in Annex XIII.

Article 9

Entry into force

This Regulation shall enter into force on the day following that of its publication in the Official Journal of the European Communities.

It shall apply from 1 January 2001 for the tariff quotas mentioned in Annex III under order numbers 09.1211, 09.1215, 09.1217, 09.1218, 09.1219 and 09.1220.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

ANNEX I

ALGERIA

Notwithstanding the rules for the interpretation of the Combined Nomenclature, the wording for the description of the products is to be considered as having no more than an indicative value, the preferential scheme being determined, within the context of this Annex, by the coverage of the CN codes as they exist at the time of adoption of this Regulation. Where ex CN codes are indicated, the preferential scheme is to be determined by application of the CN code and corresponding description taken together.

PART A:

Tariff quotas

|

Order No |

CN code |

TARIC sub-division |

Description of goods |

Quota period |

Quota volume (in tonnes net weight) |

Quota duty |

|

09.1002 |

0409 00 00 |

Natural honey |

From 1.1. to 31.12. |

100 |

Exemption |

|

|

09.1004 |

0603 |

Cut flowers and flower buds of a kind suitable for bouquets or for ornamental purposes, fresh, dried, dyed, bleached, impregnated or otherwise prepared |

From 1.1. to 31.12. |

100 |

Exemption |

|

|

09.1005 |

0604 |

Foliage, branches and other parts of plants, without flowers or flower buds, and grasses, mosses and lichens, being goods of a kind suitable for bouquets or for ornamental purposes, fresh, dried, dyed, bleached, impregnated or otherwise prepared |

From 1.1. to 31.12. |

100 |

Exemption |

|

|

09.1006 |

ex070190 50 |

New potatoes, fresh or chilled |

From 1.1. to 31.3. |

5 000 |

Exemption |

|

|

09.1007 |

0809 10 00 |

Apricots, fresh |

From 1.1. to 31.12. |

1 000 |

Exemption (1) |

|

|

09.1008 |

0810 10 00 |

Strawberries, fresh |

From 1.11. to 31.3. |

500 |

Exemption |

|

|

09.1009 |

1509 |

Olive oil and its fractions, whether or not refined, but not chemically modified |

from 1.1. to 31.12. |

1 000 |

Exemption |

|

|

1510 00 |

Other oils and their fractions, obtained solely from olives, whether or not refined, but not chemically modified, including blends of these oils or fractions with oils or fractions of heading 1509 |

|||||

|

09.1010 |

ex151219 90 |

10 |

Refined sunflower-seed oil |

From 1.1. to 31.12. |

25 000 |

Exemption |

|

09.1011 |

2002 10 10 |

Peeled tomatoes, prepared or preserved otherwise than by vinegar or acetic acid |

From 1.1. to 31.12. |

300 |

Exemption |

|

|

09.1012 |

2002 90 31 2002 90 39 2002 90 91 2002 90 99 |

Tomatoes prepared or preserved otherwise than by vinegar or acetic acid, other than whole or in pieces, with a dry matter content of not less than 12 % by weight |

From 1.1. to 31.12. |

300 |

Exemption |

|

|

09.1013 |

2009 50 |

Tomato juice |

From 1.1. to 31.12. |

200 |

Exemption |

|

|

09.1014 |

ex200980 35 |

40, 91 |

Apricot juice |

from 1.1. to 31.12. |

200 |

Exemption (1) |

|

ex200980 38 |

93, 97 |

|||||

|

ex200980 79 |

40, 80 |

|||||

|

ex200980 86 |

50, 80 |

|||||

|

ex200980 89 |

50, 80 |

|||||

|

ex200980 99 |

15, 92 |

|||||

|

09.1001 |

ex220421 79 |

71 |

Wines entitled to one of the following designations of origin: Aïn Bessem-Bouira, Médéa, Coteaux du Zaccar, Dahra, Coteaux de Mascara, Monts du Tessalah, Coteaux de Tlemcen, of an actual alcoholic strength by volume not exceeding 15 % vol, in containers holding 2 l or less |

from 1.1. to 31.12. |

224 000 hl |

Exemption |

|

ex220421 80 |

71 |

|||||

|

ex220421 84 |

51 |

|||||

|

ex220421 85 |

71 |

|||||

|

09.1003 |

2204 10 19 2204 10 99 |

Other sparkling wine |

from 1.1. to 31.12. |

224 000 hl |

Exemption |

|

|

2204 21 10 2204 21 79 |

Other wine of fresh grapes |

|||||

|

ex220421 80 |

71 79 80 |

|||||

|

2204 21 84 |

||||||

|

ex220421 85 |

71 79 80 |

|||||

|

ex220421 94 |

20 |

|||||

|

ex220421 98 |

20 |

|||||

|

ex220421 99 2204 29 10 2204 29 65 |

10 |

|||||

|

ex220429 75 2204 29 83 |

10 |

|||||

|

ex220429 84 |

20 |

|||||

|

ex220429 94 |

20 |

|||||

|

ex220429 98 |

20 |

|||||

|

ex220429 99 |

10 |

|||||

|

(1) The exemption applies only to the ad valorem duty. |

||||||

PART B:

Reference quantities

|

Order No |

CN code |

TARIC sub-division |

Description of goods |

Reference quantity period |

Reference quantity volume (in tonnes net weight) |

Reference quantity duty |

|

18.0410 |

0704 10 00 |

Cauliflowers and headed broccoli, fresh or chilled |

From 1.1. to 14.4. and from 1.12. to 31.12. |

1 000 |

Exemption |

|

|

0704 20 00 |

Brussels sprouts, fresh or chilled |

From 1.1. to 31.12. |

||||

|

0704 90 |

Other cabbages, kohlrabi, kale and similar edible brassicas, fresh or chilled |

From 1.1. to 31.12. |

||||

|

18.0420 |

0709 52 00 |

Truffles, fresh or chilled |

From 1.1. to 31.12. |

100 |

Exemption |

|

|

18.0430 |

ex200510 00 |

10 20 40 |

Homogenised asparagus, carrots and mixtures of vegetables, prepared or preserved otherwise than by vinegar or acetic acid, not frozen |

From 1.1. to 31.12. |

200 |

Exemption |

|

18.0440 |

ex200510 00 |

30 80 |

Other homogenised vegetables, prepared or preserved otherwise than by vinegar or acetic acid, not frozen, other than asparagus, carrots and mixtures of vegetables |

From 1.1. to 31.12. |

200 |

Exemption |

|

18.0450 |

2005 51 00 |

Beans, shelled, prepared or preserved otherwise than by vinegar or acetic acid, not frozen |

From 1.1. to 31.12. |

200 |

Exemption |

|

|

18.0460 |

2005 60 00 |

Asparagus, prepared or preserved otherwise than by vinegar or acetic acid, not frozen |

From 1.1. to 31.12. |

200 |

Exemption |

|

|

18.0470 |

2005 90 50 |

Globe artichokes, prepared or preserved otherwise than by vinegar or acetic acid, not frozen |

From 1.1. to 31.12. |

200 |

Exemption |

|

|

18.0480 |

2005 90 60 |

Carrots, prepared or preserved otherwise than by vinegar or acetic acid, not frozen |

From 1.1. to 31.12. |

200 |

Exemption |

|

|

18.0490 |

2005 90 70 |

Mixtures of vegetables, prepared or preserved otherwise than by vinegar or acetic acid, not frozen |

From 1.1. to 31.12. |

200 |

Exemption |

|

|

18.0500 |

2005 90 80 |

Other vegetables, prepared or preserved otherwise than by vinegar or acetic acid, not frozen |

From 1.1. to 31.12. |

200 |

Exemption |

|

|

18.0510 |

2007 91 90 |

Jams, fruit jellies, marmalades, purées and pastes, obtained by cooking of citrus fruit, with a sugar content not exceeding 13 % by weight, other than homogenised preparations |

From 1.1. to 31.12. |

200 |

Exemption |

|

|

18.0520 |

2007 99 91 |

Apple purée, including compotes, with a sugar content not exceeding 13 % by weight |

From 1.1. to 31.12. |

200 |

Exemption |

|

|

18.0530 |

2007 99 98 |

Jams, fruit jellies, marmalades, purées and pastes, obtained by cooking of other fruit, with a sugar content not exceeding 13 % by weight, other than homogenised preparations |

From 1.1. to 31.12. |

200 |

Exemption |

ANNEX II

MOROCCO

Notwithstanding the rules for the interpretation of the Combined Nomenclature, the wording for the description of the products is to be considered as having no more than an indicative value, the preferential scheme being determined, within the context of this Annex, by the coverage of the CN codes as they exist at the time of adoption of the current regulation. Where ex CN codes are indicated, the preferential scheme is to be determined by application of the CN code and corresponding description taken together.

PART A: Tariff quotas

|

Order No |

CN code |

TARIC subdivision |

Description of goods |

Quota period |

Quota volume (in tonnes net weight) |

Quota duty |

|

09.1135 |

Fresh cut flowers and flower buds of a kind suitable for bouquets or for ornamental purposes: |

from 15.10.2003 to 31.5.2004 |

3 000 |

Exemption |

||

|

0603 10 10 |

— Roses |

|||||

|

0603 10 20 |

— Carnations |

|||||

|

0603 10 40 |

— Gladioli |

|||||

|

0603 10 50 |

— Chrysanthemums |

From 15.10.2004 to 31.5.2005 |

3 090 |

|||

|

From 15.10.2005 to 31.5.2006 |

3 180 |

|||||

|

From 15.10.2006 to 31.5.2007 |

3 270 |

|||||

|

From 15.10.2007 to 31.5.2008 and for each period thereafter from 15.10 to 31.5 |

3 360 |

|||||

|

09.1136 |

Fresh cut flowers and flower buds of a kind suitable for bouquets or for ornamental purposes: |

from 15.10.2003 to 14.5.2004 |

2 000 |

Exemption |

||

|

0603 10 30 |

— Orchids |

|||||

|

0603 10 80 |

— Other |

From 15.10.2004 to 14.5.2005 |

2 060 |

|||

|

From 15.10.2005 to 14.5.2006 |

2 120 |

|||||

|

From 15.10.2006 to 14.5.2007 |

2 180 |

|||||

|

From 15.10.2007 to 14.5.2008 and for each period thereafter from 15.10 to 14.5 |

2 240 |

|||||

|

09.1115 |

ex070190 50 |

New potatoes and so-called ‘new potatoes’, fresh or chilled |

From 1.12.2003 to 30.4.2004 |

120 000 |

Exemption |

|

|

ex070190 90 |

10 |

From 1.12.2004 to 30.4.2005 |

123 600 |

|||

|

From 1.12.2005 to 30.4.2006 |

127 200 |

|||||

|

From 1.12.2006 to 30.4.2007 |

130 800 |

|||||

|

From 1.12.2007 to 30.4.2008 and for each period thereafter from 1.12 to 30.4 |

134 400 |

|||||

|

09.1104 |

0702 00 00 |

Tomatoes, fresh or chilled |

From 1.10. to 31.10. |

10 600 |

||

|

09.1104 |

0702 00 00 |

Tomatoes, fresh or chilled |

From 1.11. to 30.11. |

27 700 |

||

|

09.1104 |

0702 00 00 |

Tomatoes, fresh or chilled |

From 1.12. to 31.12. |

31 300 |

||

|

09.1104 |

0702 00 00 |

Tomatoes, fresh or chilled |

From 1.1. to 31.1. |

31 300 |

||

|

09.1104 |

0702 00 00 |

Tomatoes, fresh or chilled |

From 1.2. to 28/29.2. |

31 300 |

||

|

09.1104 |

0702 00 00 |

Tomatoes, fresh or chilled |

From 1.3. to 31.3. |

31 300 |

||

|

09.1104 |

0702 00 00 |

Tomatoes, fresh or chilled |

From 1.4. to 30.4. |

16 500 |

||

|

09.1104 |

0702 00 00 |

Tomatoes, fresh or chilled |

From 1.5. to 31.5.2004 |

4 000 |

||

|

From 1.5. to 31.5.2005 and for each period thereafter from 1.5. to 31.5. |

5 000 |

|||||

|

09.1112 |

0702 00 00 |

Tomatoes, fresh or chilled |

From 1.11.2003 to 31.5.2004 |

15 000 |

||

|

From 1.11.2004 to 31.5.2005 |

28 000 (3) |

|||||

|

From 1.11.2005 to 31.5.2006 |

38 000 (4) |

|||||

|

From 1.11.2006 to 31.5.2007 and for each period thereafter from 1.11. to 31.5. |

48 000 (5) |

|||||

|

09.1127 |

0703 10 11 0703 10 19 |

Onions, including wild onions of the species Muscari comosum, fresh or chilled |

From 15.2 to 15.5.2004 |

8 240 |

Exemption |

|

|

ex070990 90 |

50 |

From 15.2 to 15.5.2005 |

8 480 |

|||

|

From 15.2 to 15.5.2006 |

8 720 |

|||||

|

From 15.2 to 15.5.2007 and for each period thereafter from 15.2 to 15.5 |

8 960 |

|||||

|

09.1102 |

0703 10 90 0703 20 00 0703 90 00 |

Shallots, garlic, leeks and other alliaceous vegetables, fresh or chilled |

From 1.1. to 31.12.2004 |

1 030 |

Exemption |

|

|

From 1.1. to 31.12.2005 |

1 060 |

|||||

|

From 1.1. to 31.12.2006 |

1 090 |

|||||

|

From 1.1. to 31.12.2007 and for each year thereafter |

1 120 |

|||||

|

09.1106 |

ex07 04 |

Cabbages, cauliflowers, kohlrabi, kale and similar edible brassicas, fresh or chilled, excluding Chinese cabbage |

From 1.1. to 31.12.2004 |

515 |

Exemption |

|

|

From 1.1. to 31.12.2005 |

530 |

|||||

|

From 1.1. to 31.12.2006 |

545 |

|||||

|

From 1.1. to 31.12.2007 and for each year thereafter |

560 |

|||||

|

09.1109 |

ex070490 90 |

20 |

Chinese cabbage, fresh or chilled |

From 1.1. to 31.12.2004 |

206 |

Exemption |

|

From 1.1. to 31.12.2005 |

212 |

|||||

|

From 1.1. to 31.12.2006 |

218 |

|||||

|

From 1.1. to 31.12.2007 and for each year thereafter |

224 |

|||||

|

09.1108 |

0705 11 00 |

Cabbage lettuce (head lettuce), fresh or chilled |

From 1.1. to 31.12.2004 |

206 |

Exemption |

|

|

From 1.1. to 31.12.2005 |

212 |

|||||

|

From 1.1. to 31.12.2006 |

218 |

|||||

|

From 1.1. to 31.12.2007 and for each year thereafter |

224 |

|||||

|

▼M9 ————— |

||||||

|

09.1137 |

0707 00 05 |

Cucumbers, fresh or chilled |

From 1.11.2003 to 31.5.2004 |

5 429 + 85,71 tonnes net weight increase from 1.5. to 31.5.2004 |

||

|

From 1.11.2004 to 31.5.2005 and for each period thereafter from 1.11. to 31.5. |

6 200 |

|||||

|

09.1113 |

0707 00 90 |

Gherkins, fresh or chilled |

From 1.1. to 31.12.2004 |

103 |

Exemption |

|

|

From 1.1. to 31.12.2005 |

106 |

|||||

|

From 1.1. to 31.12.2006 |

109 |

|||||

|

From 1.1. to 31.12.2007 and for each year thereafter |

112 |

|||||

|

09.1138 |

0709 10 00 |

Globe artichokes, fresh or chilled |

From 1.11 to 31.12 |

500 |

||

|

09.1120 |

Other vegetables, fresh or chilled: |

from 1.1. to 31.12.2004 |

9 270 |

Exemption |

||

|

0709 40 00 |

— Celery other than celeriac |

|||||

|

ex070951 00 |

90 |

— Mushrooms of the genus Agaricus, other than cultivated mushrooms |

From 1.1. to 31.12.2005 |

9 540 |

||

|

0709 59 10 |

— Chanterelles |

From 1.1. to 31.12.2006 |

9 810 |

|||

|

0709 59 30 |

— Flap mushrooms |

from 1.1. to 31.12.2007 and for each year thereafter |

10 080 |

|||

|

ex070959 90 |

90 |

— Other mushrooms, other than cultivated mushrooms |

||||

|

0709 70 00 |

— Spinach, New Zealand spinach and orache spinach (garden spinach) |

|||||

|

09.1133 |

0709 90 70 |

Courgettes, fresh or chilled |

From 1.10.2003 to 20.4.2004 |

13 276 |

||

|

for each period thereafter from 1.10 to 20.4 |

20 000 |

|||||

|

09.1143 |

ex07 10 |

Vegetables (uncooked or cooked by steaming or boiling in water), frozen, excluding peas of subheadings 0710 21 00 and ex071029 00 and excluding other fruits of the genus Capsicum or of the genus Pimenta of subheading 0710 80 59 |

From 1.1. to 31.12.2004 |

10 300 |

Exemption |

|

|

From 1.1. to 31.12.2005 |

10 600 |

|||||

|

From 1.1. to 31.12.2006 |

10 900 |

|||||

|

From 1.1. to 31.12.2007 and for each year thereafter |

11 200 |

|||||

|

09.1125 |

0711 40 00 0711 51 00 0711 59 00 0711 90 30 0711 90 50 0711 90 80 0711 90 90 |

Cucumbers and gherkins, mushrooms, truffles, sweet corn, onions, other vegetables (excluding fruits of the genus Capsicum or Pimenta) and mixtures of vegetables, provisionally preserved but unsuitable in that state for immediate consumption |

From 1.1. to 31.12.2004 |

618 |

Exemption |

|

|

From 1.1. to 31.12.2005 |

636 |

|||||

|

From 1.1. to 31.12.2006 |

654 |

|||||

|

From 1.1. to 31.12.2007 and for each year thereafter |

672 |

|||||

|

09.1126 |

ex07 12 |

Dried vegetables, whole, cut, sliced, broken or in powder, but not further prepared, excluding onions of subheading 0712 20 00 and excluding olives of ex071290 90 |

From 1.1. to 31.12.2004 |

2 060 |

Exemption |

|

|

From 1.1. to 31.12.2005 |

2 120 |

|||||

|

From 1.1. to 31.12.2006 |

2 180 |

|||||

|

From 1.1. to 31.12.2007 and for each year thereafter |

2 240 |

|||||

|

09.1122 |

0805 10 10 (12) |

Fresh oranges |

From 1.12.2003 to 31.5.2004 |

300 000 + 1 133,33 tonnes net weight increase from 1.5. to 31.5.2004 |

||

|

0805 10 30 (12) |

||||||

|

0805 10 50 (12) |

||||||

|

ex080510 80 |

10 |

|||||

|

From 1.12.2004 to 31.5.2005 and for each period thereafter from 1.12. to 31.5. |

306 800 |

|||||

|

09.1130 |

ex080520 10 |

05 |

Fresh clementines |

From 1.11.2003 to 29.2.2004 |

120 000 |

|

|

From 1.11.2004 to 28.2.2005 and for each period thereafter from 1.11. to 28/29.2. |

143 700 |

|||||

|

09.1145 |

0808 20 90 |

Fresh quinces |

From 1.1 to 31.12 |

1 000 |

Exemption |

|

|

09.1128 |

0809 10 00 |

— Fresh apricots |

from 1.1. to 31.12.2004 |

3 605 |

Exemption (11) |

|

|

0809 20 |

— Fresh cherries |

|||||

|

0809 30 |

— Fresh peaches, including nectarines |

From 1.1. to 31.12.2005 |

3 710 |

|||

|

From 1.1. to 31.12.2006 |

3 815 |

|||||

|

From 1.1. to 31.12.2007 and for each year thereafter |

3 920 |

|||||

|

09.1134 |

0810 50 00 |

Fresh kiwifruit |

From 1.1 to 30.4.2004 |

257,5 |

Exemption |

|

|

From 1.1 to 30.4.2005 |

265 |

|||||

|

From 1.1 to 30.4.2006 |

272,5 |

|||||

|

From 1.1 to 30.4.2007 and for each period thereafter from 1.1 to 30.4 |

280 |

|||||

|

09.1140 |

1509 |

— Olive oil and its fractions, whether or not refined, but not chemically modified |

From 1.1. to 31.12.2004 |

3 605 |

Exemption |

|

|

1510 00 |

— Other oils and their fractions, obtained solely from olives, whether or not refined, but not chemically modified, including blends of these oils or fractions with oils or fractions of heading 1509 |

From 1.1. to 31.12.2005 |

3 710 |

|||

|

From 1.1. to 31.12.2006 |

3 815 |

|||||

|

From 1.1. to 31.12.2007 and for each year thereafter |

3 920 |

|||||

|

09.1147 |

ex200110 00 |

90 |

Gherkins, prepared or preserved by vinegar or acetic acid |

From 1.1. to 31.12.2004 |

10 300 tonnes drained net weight |

Exemption |

|

From 1.1. to 31.12.2005 |

10 600 tonnes drained net weight |

|||||

|

From 1.1. to 31.12.2006 |

10 900 tonnes drained net weight |

|||||

|

From 1.1. to 31.12.2007 and for each year thereafter |

11 200 tonnes drained net weight |

|||||

|

09.1142 |

2002 90 |

Tomatoes prepared or preserved otherwise than by vinegar or acetic acid, other than whole or in pieces |

From 1.1. to 31.12.2004 |

2 060 |

Exemption |

|

|

From 1.1. to 31.12.2005 |

2 120 |

|||||

|

From 1.1. to 31.12.2006 |

2 180 |

|||||

|

From 1.1. to 31.12.2007 and for each year thereafter |

2 240 |

|||||

|

09.1119 |

2004 90 50 2005 40 00 2005 59 00 |

Peas (Pisum sativum) and immature beans in pod prepared or preserved otherwise than by vinegar or acetic acid, whether or not frozen |

From 1.1. to 31.12.2004 |

10 815 |

Exemption |

|

|

From 1.1. to 31.12.2005 |

11 130 |

|||||

|

From 1.1. to 31.12.2006 |

11 445 |

|||||

|

From 1.1. to 31.12.2007 and for each year thereafter |

11 760 |

|||||

|

09.1144 |

2008 50 61 2008 50 69 |

Apricots, otherwise prepared or preserved, not containing added spirit, containing added sugar and in immediate packings of a net content exceeding 1 kg |

From 1.1. to 31.12.2004 |

10 300 |

Exemption |

|

|

From 1.1. to 31.12.2005 |

10 600 |

|||||

|

From 1.1. to 31.12.2006 |

10 900 |

|||||

|

From 1.1. to 31.12.2007 and for each year thereafter |

11 200 |

|||||

|

09.1146 |

2008 50 71 2008 50 79 |

Apricots, otherwise prepared or preserved, not containing added spirit, containing added sugar and in immediate packings of a net content not exceeding 1 kg |

From 1.1. to 31.12.2004 |

5 150 |

Exemption |

|

|

From 1.1. to 31.12.2005 |

5 300 |

|||||

|

From 1.1. to 31.12.2006 |

5 450 |

|||||

|

From 1.1. to 31.12.2007 and for each year thereafter |

5 600 |

|||||

|

09.1105 |

ex200850 92 |

20 |

Apricot pulp, not containing added spirit or sugar, in immediate packings of a net content of 4,5 kg or more |

From 1.1. to 31.12.2004 |

10 300 |

Exemption |

|

ex200850 94 |

20 |

From 1.1. to 31.12.2005 |

10 600 |

|||

|

From 1.1. to 31.12.2006 |

10 900 |

|||||

|

From 1.1. to 31.12.2007 and for each year thereafter |

11 200 |

|||||

|

09.1148 |

2008 50 99 |

Apricots, otherwise prepared or preserved, not containing added spirit or sugar, in immediate packings of a net content of less than 4,5 kg |

From 1.1. to 31.12.2004 |

7 416 |

Exemption |

|

|

ex200870 98 |

21 |

Peach halves (including nectarines), otherwise prepared or preserved, not containing added spirit or sugar, in immediate packings of a net content of less than 4,5 kg |

From 1.1. to 31.12.2005 |

7 632 |

||

|

From 1.1. to 31.12.2006 |

7 848 |

|||||

|

From 1.1. to 31.12.2007 and for each year thereafter |

8 064 |

|||||

|

09.1149 |

2008 92 51 2008 92 59 2008 92 72 2008 92 74 2008 92 76 2008 92 78 |

Mixtures of fruit, containing added sugar, but not containing added spirit |

From 1.1. to 31.12.2004 |

103 |

Exemption |

|

|

From 1.1. to 31.12.2005 |

106 |

|||||

|

From 1.1. to 31.12.2006 |

109 |

|||||

|

From 1.1. to 31.12.2007 and for each year thereafter |

112 |

|||||

|

09.1123 |

2009 11 2009 12 00 2009 19 |

Orange juice |

From 1.1. to 31.12.2004 |

51 500 |

Exemption (1) |

|

|

From 1.1. to 31.12.2005 |

53 000 |

|||||

|

From 1.1. to 31.12.2006 |

54 500 |

|||||

|

From 1.1. to 31.12.2007 and for each year thereafter |

56 000 |

|||||

|

09.1192 |

2009 21 00 2009 29 |

Grapefruit juice |

From 1.1. to 31.12.2004 |

1 030 |

Exemption (1) |

|

|

From 1.1. to 31.12.2005 |

1 060 |

|||||

|

From 1.1. to 31.12.2006 |

1 090 |

|||||

|

From 1.1. to 31.12.2007 and for each year thereafter |

1 120 |

|||||

|

09.1131 |

2204 10 19 2204 10 99 |

Other sparkling wine |

From 1.1. to 31.12.2004 |

98 056 hl |

Exemption |

|

|

2204 21 10 |

Other wine of fresh grapes |

From 1.1. to 31.12.2005 |

100 912 hl |

|||

|

2204 21 79 |

From 1.1. to 31.12.2006 |

103 768 hl |

||||

|

ex220421 80 |

72 79 80 |

from 1.1. to 31.12.2007 and for each year thereafter |

106 624 hl |

|||

|

2204 21 83 |

||||||

|

ex220421 84 |

10 72 79 80 |

|||||

|

ex220421 94 |

10 30 |

|||||

|

ex220421 98 |

10 30 |

|||||

|

ex220421 99 2204 29 10 2204 29 65 |

10 |

|||||

|

ex220429 75 2204 29 83 |

10 |

|||||

|

ex220429 84 |

10 30 |

|||||

|

ex220429 94 |

10 30 |

|||||

|

ex220429 98 |

10 30 |

|||||

|

ex220429 99 |

10 |

|||||

|

09.1107 |

ex220421 79 |

72 |

Wines entitled to one of the following designations of origin: Berkane, Saïs, Beni M'Tir, Guerrouane, Zemmour and Zennata, of an actual alcoholic strength by volume not exceeding 15 % vol and in containers holding 2 l or less |

from 1.1. to 31.12.2004 |

57 680 hl |

Exemption |

|

ex220421 80 |

72 |

|||||

|

ex220421 83 |

72 |

From 1.1. to 31.12.2005 |

59 360 hl |

|||

|

ex220421 84 |

72 |

From 1.1. to 31.12.2006 |

61 040 hl |

|||

|

From 1.1. to 31.12.2007 and for each year thereafter |

62 720 hl |

|||||

|

09.1150 |

Fresh cut flowers and flower buds of a kind suitable for bouquets or for ornamental purposes: |

From 1.6. to 30.6.2004 |

51,5 |

Exemption |

||

|

0603 10 10 |

— Roses |

|||||

|

0603 10 20 |

— Carnations |

|||||

|

0603 10 40 |

— Gladioli |

|||||

|

0603 10 50 |

— Chrysanthemums |

|||||

|

From 1.6. to 30.6.2005 |

53 |

|||||

|

From 1.6. to 30.6.2006 |

54,5 |

|||||

|

From 1.6. to 30.6.2007 and for each period thereafter from 1.6. to 30.6. |

56 |

|||||

|

09.1118 |

0810 10 00 |

Fresh strawberries |

From 1.4. to 30.4. |

100 |

Exemption |

|

|

(1) The exemption applies only to the ad valorem duty. (2) Within this tariff quota the specific duty provided in the Community's list of concessions to the WTO is reduced to zero if the entry price is not less than EUR 461/tonne, being the entry price agreed between the European Community and Morocco. If the entry price of a consignment is 2, 4, 6 or 8 % lower than the agreed entry price, the specific customs quota duty shall be equal respectively to 2, 4, 6 or 8 % of this agreed entry price. If the entry price of a consignment is less than 92 % of the agreed entry price, the specific customs duty bound within the WTO shall apply. (3) This quota volume shall be reduced to 8 000 tonnes net weight if the total volume of tomatoes originating in Morocco put into free circulation in the Community during the period of 1 October 2003 to 31 May 2004 exceeds the volume of 191 900 tonnes net weight. (4) This quota volume shall be reduced to 18 000 tonnes net weight if the total volume of tomatoes originating in Morocco put into free circulation in the Community during the period of 1 October 2004 to 31 May 2005 exceeds the sum of the volumes of the monthly tariff quotas with order number 09.1104 applicable during the period of 1 October 2004 to 31 May 2005 and the volume of the additional tariff quota with order number 09.1112 applicable during the period of 1 November 2004 to 31 May 2005. For the determination of the total imported volume a maximum tolerance of 1 % shall be allowed. (5) This quota volume shall be reduced to 28 000 tonnes net weight if the total volume of tomatoes originating in Morocco put into free circulation in the Community during the period of 1 October 2005 to 31 May 2006 exceeds the sum of the volumes of the monthly tariff quotas with order number 09.1104 applicable during the period of 1 October 2005 to 31 May 2006 and the volume of the additional tariff quota with order number 09.1112 applicable during the period of 1 November 2005 to 31 May 2006. For the determination of the total imported volume a maximum tolerance of 1 % shall be allowed. These provisions will apply to the volume of each thereafter provided additional tariff quota that will apply from 1.11. to 31.5. (6) Within this tariff quota the specific duty provided in the Community's list of concessions to the WTO is reduced to zero if the entry price is not less than EUR 449/tonne, being the entry price agreed between the European Community and Morocco. If the entry price of a consignment is 2, 4, 6 or 8 % lower than the agreed entry price, the specific customs quota duty shall be equal respectively to 2, 4, 6 or 8 % of this agreed entry price. If the entry price of a consignment is less than 92 % of the agreed entry price, the specific customs duty bound within the WTO shall apply. (7) Within this tariff quota the specific duty provided in the Community's list of concessions to the WTO is reduced to zero if the entry price is not less than EUR 571/tonne, being the entry price agreed between the European Community and Morocco. If the entry price of a consignment is 2, 4, 6 or 8 % lower than the agreed entry price, the specific customs quota duty shall be equal respectively to 2, 4, 6 or 8 % of this agreed entry price. If the entry price of a consignment is less than 92 % of the agreed entry price, the specific customs duty bound within the WTO shall apply. (8) Within this tariff quota the specific duty provided in the Community's list of concessions to the WTO is reduced to zero if the entry price is not less than: — EUR 424/tonne from 1 October to 31 January and from 1 to 20 April, being the entry price agreed between the European Community and Morocco, — during the period from 1 February to 31 March the WTO entry price of EUR 413/tonne which is more favourable than the agreed entry price shall apply. (9) Within this tariff quota the specific duty provided in the Community's list of concessions to the WTO is reduced to zero if the entry price is not less than EUR 264/tonne, being the entry price agreed between the European Community and Morocco. If the entry price of a consignment is 2, 4, 6 or 8 % lower than the agreed entry price, the specific customs quota duty shall be equal respectively to 2, 4, 6 or 8 % of this agreed entry price. If the entry price of a consignment is less than 92 % of the agreed entry price, the specific customs duty bound within the WTO shall apply. (10) Within this tariff quota the specific duty provided in the Community's list of concessions to the WTO is reduced to zero if the entry price is not less than EUR 484/tonne, being the entry price agreed between the European Community and Morocco. If the entry price of a consignment is 2, 4, 6 or 8 % lower than the agreed entry price, the specific customs quota duty shall be equal respectively to 2, 4, 6 or 8 % of this agreed entry price. If the entry price of a consignment is less than 92 % of the agreed entry price, the specific customs duty bound within the WTO shall apply. (11) The exemption applies only to the ad valorem duty, except for fresh cherries for which from 1 to 20 May the exemption also applies to the specific minimum duty. (12) From 1 January 2005 the CN codes 0805 10 10, 0805 10 30 and 0805 10 50 will be replaced by 0805 10 20. |

||||||

PART B: Reference quantity

|

Order No |

CN code |

Description of goods |

Reference quantity period |

Reference quantity volume (in tonnes net weight) |

Reference quantity duty |

|

18.0105 |

0705 19 00 |

— Lettuce (Lactuca sativa), fresh or chilled, other than cabbage lettuce |

From 1.5. to 31.12.2004 |

2 060 |

Exemption |

|

0705 29 00 |

— Chicory (Cichorium spp.), fresh or chilled, other than witloof chicory |

||||

|

0706 |

— Carrots, turnips, salad beetroot, salsify, celeriac, radishes and similar edible roots, fresh or chilled |

||||

|

From 1.1. to 31.12.2005 |

3 180 |

||||

|

From 1.1. to 31.12.2006 |

3 270 |

||||

|

For each period thereafter from 1.1. to 31.12. |

3 360 |

ANNEX III

TUNISIA

Notwithstanding the rules for the interpretation of the Combined Nomenclature, the wording for the description of the products is to be considered as having no more than an indicative value, the preferential scheme being determined, within the context of this Annex, by the coverage of the CN codes as they exist at the time of adoption of this Regulation. Where ex CN codes are indicated, the preferential scheme is to be determined by application of the CN code and corresponding description taken together.

PART A: Tariff quotas

|

Order No |

CN code |

TARIC subdivision |

Description of goods |

Quota period |

Quota volume (in tonnes) |

Quota duty |

|

09.1218 |

0409 00 00 |

Natural honey |

From 1.1 to 31.12 |

50 |

Exemption |

|

|

09.1211 |

0603 10 |

Fresh cut flowers and flower buds of a kind suitable for bouquets or for ornamental purposes |

From 1.1 to 31.12 |

1 000 (1) |

Exemption |

|

|

09.1213 |

ex070190 50 |

New potatoes, fresh or chilled |

From 1.1 to 31.3 |

16 800 (1) |

Exemption |

|

|

09.1219 |

0711 20 10 |

Olives provisionally preserved, for uses other than the production of oil (2) |

From 1.1 to 31.12 |

10 |

Exemption |

|

|

09.1207 |

0805 10 10 |

Fresh oranges |

from 1.1 to 31.12 |

35 123 (1) |

Exemption (3) |

|

|

0805 10 30 |

||||||

|

0805 10 50 |

||||||

|

ex080510 80 |

10 |

|||||

|

09.1201 |

ex160413 11 |

20 |

Prepared or preserved sardines of the species Sardina pilchardus |

from 1.1 to 31.12 |

100 |

Exemption |

|

ex160413 19 |

20 |

|||||

|

ex160420 50 |

10 |

|||||

|

09.1215 |

2002 90 31 2002 90 39 2002 90 91 2002 90 99 |

Tomatoes prepared or preserved otherwise than by vinegar or acetic acid, other than whole or in pieces, with a dry matter content of not less than 12 % |

From 1.1 to 31.12 |

2 500 (4) |

Exemption |

|

|

09.1220 |

2003 20 00 |

Truffles, prepared or preserved otherwise than by vinegar or acetic acid |

From 1.1 to 31.12 |

5 |

Exemption |

|

|

09.1203 |

ex200850 92 |

20 |

Apricot pulp, not containing added spirit or sugar, in immediate packings of a net content of 4,5 kg or more |

from 1.1 to 31.12 |

5 160 |

Exemption |

|

ex200850 94 |

20 |

|||||

|

09.1217 |

2008 92 51 2008 92 59 2008 92 72 2008 92 74 2008 92 76 2008 92 78 |

Mixtures of fruit, not containing added spirit, containing added sugar |

From 1.1 to 31.12 |

1 000 |

Exemption |

|

|

09.1205 |

ex220421 79 |

73 |

Wines entitled to one of the following designations of origin: ►C1 Coteaux de Tebourba, ◄ Coteaux d'Utique, Sidi-Salem, Kelibia, Thibar, Mornag, Grand cru Mornag, of an actual alcoholic strength by volume of 15 % vol or less and in containers holding 2 l or less |

from 1.1 to 31.12 |

56 000 hl |

Exemption |

|

ex220421 80 |

73 |

|||||

|

ex220421 83 |

73 |

|||||

|

ex220421 84 |

73 |

|||||

|

09.1209 |

2204 10 19 2204 10 99 |

Other sparkling wine |

from 1.1 to 31.12 |

179 200 hl |

Exemption |

|

|

Other wine of fresh grapes |

||||||

|

2204 21 10 |

||||||

|

2204 21 79 |

||||||

|

ex220421 80 |

73 79 80 |

|||||

|

2204 21 83 |

||||||

|

ex220421 84 |

10 73 79 80 |

|||||

|

ex220421 94 |

10 30 |

|||||

|

ex220421 98 |

10 30 |

|||||

|

ex220421 99 |

10 |

|||||

|

2204 29 10 |

||||||

|

2204 29 65 |

||||||

|

ex220429 75 |

10 |

|||||

|

2204 29 83 |

||||||

|

ex220429 84 |

10 30 |

|||||

|

ex220429 94 |

10 30 |

|||||

|

ex220429 98 |

10 30 |

|||||

|

ex220429 99 |

10 |

|||||

|

(1) This quota volume shall be increased from 1 January 2002 to 1 January 2005 on the basis of 4 equal instalments each corresponding to 3 % of this volume. (2) Entry under this subheading is subject to conditions laid down in the relevant Community provisions (see Articles 291 to 300 of Commission Regulation (EEC) No 2454/93 (OJ L 253, 11.10.1993, p. 71) and subsequent amendments). (3) The exemption applies only to the ad valorem duty. (4) This quota volume shall be increased to 2 875 tonnes on 1 January 2002, to 3 250 tonnes on 1 January 2003, to 3 625 tonnes on 1 January 2004 and to 4 000 tonnes from 1 January 2005. |

||||||

PART B: Reference quantities

|

Order No |

CN code |

TARIC subdivision |

Description of goods |

Reference quantity period |

Reference quantity volume (in tonnes) |

Reference quantity duty |

|

18.0110 |

0802 11 90 0802 12 90 |

Almonds, other than bitter almonds, whether or not shelled |

From 1.1 to 31.12 |

1 120 (1) |

►C1 Exemption ◄ |

|

|

18.0125 |

ex080510 80 |

90 |

Oranges, other than fresh |

From 1.1 to 31.12 |

1 680 (1) |

Exemption |

|

18.0145 |

0809 10 00 |

Apricots, fresh |

From 1.1 to 31.12 |

2 240 (1) |

Exemption (2) |

|

|

(1) This reference quantity volume shall be increased from 1 January 2002 to 1 January 2005 on the basis of 4 equal instalments each corresponding to 3 % of this volume. (2) The exemption applies only to the ad valorem duty. |

||||||

ANNEX IV

EGYPT

Notwithstanding the rules for the interpretation of the Combined Nomenclature, the wording for the description of the products is to be considered as having no more than an indicative value, the preferential scheme being determined, within the context of this Annex, by the coverage of the CN codes as they exist at the time of adoption of this Regulation. Where ex CN codes are indicated, the preferential scheme is to be determined by application of the CN code and corresponding description taken together.

Tariff quotas

|

Order No |

CN code |

TARIC sub-division |

Description of goods |

Quota period |

Quota volume (in tonnes net weight) |

Quota duty |

|

09.1712 |

0703 20 00 |

Garlic, fresh or chilled |

From 1.6 to 30.6.2010 |

727 |

Exemption |

|

|

From 15.1.2011 to 30.6.2011 and for each period thereafter from 15.1 to 30.6 |

4 000 (1) |

|||||

|

09.1783 |

0707 00 05 |

Cucumbers, fresh or chilled |

From 15.11.2010 to 15.5.2011 and for each period thereafter from 15.11 to 15.5 |

3 000 (2) |

Exemption (3) |

|

|

09.1784 |

0805 10 20 |

Sweet oranges, fresh |

From 1.12 to 31.5 |

36 300 (4) |

Exemption (5) |

|

|

09.1799 |

0810 10 00 |

Strawberries, fresh |

From 1.10.2010 to 30.4.2011 |

10 000 |

Exemption |

|

|

From 1.10.2011 to 30.4.2012 |

10 300 |

|||||

|

From 1.10.2012 to 30.4.2013 |

10 609 |

|||||

|

From 1.10.2013 to 30.4.2014 |

10 927 |

|||||

|

From 1.10.2014 to 30.4.2015 |

11 255 |

|||||

|

From 1.10.2015 to 30.4.2016 and for each period thereafter from 1.10 to 30.4 |

11 593 |

|||||

|

09.1796 |

1006 20 |

Husked (brown) rice |

From 1.6 to 31.12.2010 |

11 667 |

Exemption |

|

|

From 1.1 to 31.12.2011 |

20 600 |

|||||

|

From 1.1 to 31.12.2012 |

21 218 |

|||||

|

From 1.1 to 31.12.2013 |

21 855 |

|||||

|

From 1.1 to 31.12.2014 |

22 510 |

|||||

|

From 1.1 to 31.12.2015 and for each period thereafter from 1.1 to 31.12 |

23 185 |

|||||

|

09.1797 |

1006 30 |

Semi-milled or wholly milled rice, whether or not polished or glazed |

From 1.6 to 31.12.2010 |

40 833 |

Exemption |

|

|

From 1.1 to 31.12.2011 |

72 100 |

|||||

|

From 1.1 to 31.12.2012 |

74 263 |

|||||

|

From 1.1 to 31.12.2013 |

76 491 |

|||||

|

From 1.1 to 31.12.2014 |

78 786 |

|||||

|

From 1.1 to 31.12.2015 and for each period thereafter from 1.1 to 31.12 |

81 149 |

|||||

|

09.1798 |

1006 40 00 |

Broken rice |

From 1.6 to 31.12.2010 |

46 667 |

Exemption |

|

|

From 1.1 to 31.12.2011 |

82 400 |

|||||

|

From 1.1 to 31.12.2012 |

84 872 |

|||||

|

From 1.1 to 31.12.2013 |

87 418 |

|||||

|

From 1.1 to 31.12.2014 |

90 041 |

|||||

|

From 1.1 to 31.12.2015 and for each period thereafter from 1.1 to 31.12 |

92 742 |

|||||

|

09.1785 |

1702 50 00 |

Chemically pure fructose in solid form |

From 1.6 to 31.12.2010 |

583 |

Exemption |

|

|

For each period thereafter from 1.1 to 31.12 |

1 000 |

|||||

|

09.1786 |

ex170490 99 |

91 99 |

Other sugar confectionery, not containing cocoa, containing 70 % or more by weight of sucrose (including invert sugar expressed as sucrose) |

From 1.6 to 31.12.2010 |

583 |

Exemption |

|

From 1.1 to 31.12.2011 |

1 100 |

|||||

|

From 1.1 to 31.12.2012 |

1 210 |

|||||

|

From 1.1 to 31.12.2013 |

1 331 |

|||||

|

From 1.1 to 31.12.2014 |

1 464 |

|||||

|

From 1.1 to 31.12.2015 and for each period thereafter from 1.1 to 31.12 |

1 611 |

|||||

|

09.1787 |

ex180610 30 |

10 |

Sweetened cacao powder, containing 70 % or more but less than 80 % of sucrose (including invert sugar expressed as sucrose) or isoglucose expressed as sucrose |

From 1.6 to 31.12.2010 |

292 |

Exemption |

|

From 1.1 to 31.12.2011 |

525 |

|||||

|

From 1.1 to 31.12.2012 |

551 |

|||||

|

From 1.1 to 31.12.2013 |

579 |

|||||

|

From 1.1 to 31.12.2014 |

608 |

|||||

|

From 1.1 to 31.12.2015 and for each period thereafter from 1.1 to 31.12 |

638 |

|||||

|

09.1788 |

1806 10 90 |

Sweetened cacao powder, containing 80 % or more by weight of sucrose (including invert sugar expressed as sucrose) or isoglucose expressed as sucrose |

From 1.6 to 31.12.2010 |

292 |

Exemption |

|

|

From 1.1 to 31.12.2011 |

525 |

|||||

|

From 1.1 to 31.12.2012 |

551 |

|||||

|

From 1.1 to 31.12.2013 |

579 |

|||||

|

From 1.1 to 31.12.2014 |

608 |

|||||

|

From 1.1 to 31.12.2015 and for each period thereafter from 1.1 to 31.12 |

638 |

|||||

|

09.1789 |

ex180620 95 |

90 |

Chocolate and other food preparations containing cocoa, in blocks, slabs or bars weighing more than 2 kg or in liquid, paste, powder, granular or other bulk form, in containers or immediate packings of a content exceeding 2 kg, containing less than 18 % by weight of cocoa butter, containing 70 % or more by weight of sucrose (including invert sugar expressed as sucrose) |

From 1.6 to 31.12.2010 |

292 |

Exemption |

|

From 1.1 to 31.12.2011 |

525 |

|||||

|

From 1.1 to 31.12.2012 |

551 |

|||||

|

From 1.1 to 31.12.2013 |

579 |

|||||

|

From 1.1 to 31.12.2014 |

608 |

|||||

|

From 1.1 to 31.12.2015 and for each period thereafter from 1.1 to 31.12 |

638 |

|||||

|

09.1790 |

ex190190 99 |

36 95 |

Other food preparations of flour, groats, meal, starch or malt extract, not containing cocoa or containing less than 40 % by weight of cocoa calculated on a totally defatted basis, not elsewhere specified or included, food preparations of goods of headings 0401 to 0404, not containing cocoa or containing less than 5 % by weight of cocoa calculated on a totally defatted basis, not elsewhere specified or included, containing 70 % or more by weight of sucrose/isoglucose |

From 1.6 to 31.12.2010 |

583 |

Exemption |

|

From 1.1 to 31.12.2011 |

1 100 |

|||||

|

From 1.1 to 31.12.2012 |

1 210 |

|||||

|

From 1.1 to 31.12.2013 |

1 331 |

|||||

|

From 1.1 to 31.12.2014 |

1 464 |

|||||

|

From 1.1 to 31.12.2015 and for each period thereafter from 1.1 to 31.12 |

1 611 |

|||||

|

09.1791 |

ex210112 98 |

92 97 |

Preparations with a basis of coffee, containing 70 % or more by weight of sucrose/isoglucose |

From 1.6 to 31.12.2010 |

583 |

Exemption |

|

From 1.1 to 31.12.2011 |

1 100 |

|||||

|

From 1.1 to 31.12.2012 |

1 210 |

|||||

|

From 1.1 to 31.12.2013 |

1 331 |

|||||

|

From 1.1 to 31.12.2014 |

1 464 |

|||||

|

From 1.1 to 31.12.2015 and for each period thereafter from 1.1 to 31.12 |

1 611 |

|||||

|

09.1792 |

ex210120 98 |

85 |

Preparations with a basis of tea or mate, containing 70 % or more by weight of sucrose/isoglucose |

From 1.6 to 31.12.2010 |

292 |

Exemption |

|

From 1.1 to 31.12.2011 |

525 |

|||||

|

From 1.1 to 31.12.2012 |

551 |

|||||

|

From 1.1 to 31.12.2013 |

579 |

|||||

|

From 1.1 to 31.12.2014 |

608 |

|||||

|

From 1.1 to 31.12.2015 and for each period thereafter from 1.1 to 31.12 |

638 |

|||||

|

09.1793 |

ex210690 59 |

10 |

Other flavoured or coloured sugar syrups (excluded isoglucose, lactose, glucose and maltodextrine syrups), containing 70 % or more by weight of sucrose/isoglucose |

From 1.6 to 31.12.2010 |

292 |

Exemption |

|

From 1.1 to 31.12.2011 |

525 |

|||||

|

From 1.1 to 31.12.2012 |

551 |

|||||

|

From 1.1 to 31.12.2013 |

579 |

|||||

|

From 1.1 to 31.12.2014 |

608 |

|||||

|

From 1.1 to 31.12.2015 and for each period thereafter from 1.1 to 31.12 |

638 |

|||||

|

09.1794 |

ex210690 98 |

26 34 53 |

Other food preparations not elsewhere specified or included, of a kind used in drink industries, containing 70 % or more by weight of sucrose/isoglucose |

From 1.6 to 31.12.2010 |

583 |

Exemption |

|

From 1.1 to 31.12.2011 |

1 100 |

|||||

|

From 1.1 to 31.12.2012 |

1 210 |

|||||

|

From 1.1 to 31.12.2013 |

1 331 |

|||||

|

From 1.1 to 31.12.2014 |

1 464 |

|||||

|

From 1.1 to 31.12.2015 and for each period thereafter from 1.1 to 31.12 |

1 611 |

|||||

|

09.1795 |

ex330210 29 |

10 |

Other preparations of a kind used in drink industries, containing all flavouring agents characterising a beverage, of an actual alcoholic strength by volume not exceeding 0,5 %, containing 70 % or more by weight of sucrose/isoglucose |

From 1.6 to 31.12.2010 |

583 |

Exemption |

|

From 1.1 to 31.12.2011 |

1 100 |

|||||

|

From 1.1 to 31.12.2012 |

1 210 |

|||||

|

From 1.1 to 31.12.2013 |

1 331 |

|||||

|

From 1.1 to 31.12.2014 |

1 464 |

|||||

|

From 1.1 to 31.12.2015 and for each period thereafter from 1.1 to 31.12 |

1 611 |

|||||

|

(1) From 15 January 2011, this tariff quota volume shall be annually increased by 3 % of the volume of the previous year. The first increase shall take place on the volume of 4 000 tonnes net weight. (2) From 15 November 2011, this tariff quota volume shall be annually increased by 3 % of the volume of the previous year. The first increase shall take place on the volume of 3 000 tonnes net weight. (3) The exemption applies only to the ad valorem duty. (4) Within this tariff quota, the specific duty provided in the Union’s list of concessions to the WTO is reduced to zero, if the entry price is not less than EUR 264/tonne, being the entry price agreed between the European Union and Egypt. If the entry price for a consignment is 2, 4, 6 or 8 % lower than the agreed entry price, the specific customs quota duty shall be equal respectively to 2, 4, 6 or 8 % of this agreed entry price. If the entry price of a consignment is less than 92 % of the agreed entry price, the specific customs duty bound within the WTO shall apply. (5) Also exemption of the ad valorem duty, in the framework of this tariff quota. |

||||||

ANNEX V

JORDAN

Notwithstanding the rules for the interpretation of the Combined Nomenclature, the wording for the description of the products is to be considered as having no more than an indicative value, the preferential scheme being determined, within the context of this Annex, by the coverage of the CN codes as they exist at the time of adoption of this Regulation. Where ex CN codes are indicated, the preferential scheme is to be determined by application of the CN code and corresponding description taken together.

Tariff quotas

|

Order No |

CN code |

Description of goods |

Quota period |

Quota volume (in tonnes net weight) |

Quota duty |

|

09.1152 |

0603 10 |

Fresh cut flowers and flower buds of a kind suitable for bouquets or for ornamental purposes |

From 1.1. to 31.12.2006 |

2 000 |

Exemption |

|

From 1.1. to 31.12.2007 |

4 500 |

||||

|

From 1.1. to 31.12.2008 |

7 000 |

||||

|

From 1.1. to 31.12.2009 |

9 500 |

||||

|

From 1.1. to 31.12.2010 and for each period thereafter from 1.1 to 31.12. |

12 000 |

||||

|

09.1160 |

0701 90 50 |

New potatoes, from 1 January to 30 June, fresh or chilled |

From 1.1. to 31.12.2006 |

1 000 |

Exemption |

|

0701 90 90 |

Other potatoes, fresh or chilled |

From 1.1. to 31.12.2007 |

2 350 |

||

|

From 1.1. to 31.12.2008 |

3 700 |

||||

|

From 1.1. to 31.12.2009 |

5 000 |

||||

|

09.1163 |

0703 20 00 |

Garlic, fresh or chilled |

From 1.1. to 31.12.2006 and for each period thereafter from 1.1 to 31.12., until 31.12.2009 |

1 000 |

Exemption |

|

09.1164 |

0707 00 |

Cucumbers and gherkins, fresh or chilled |

From 1.1. to 31.12.2006 |

2 000 |

|

|

From 1.1. to 31.12.2007 |

3 000 |

||||

|

From 1.1. to 31.12.2008 |

4 000 |

||||

|

From 1.1. to 31.12.2009 |

5 000 |

||||

|

09.1165 |

0805 |

Citrus fruit, fresh or dried |

From 1.1. to 31.12.2006 |

1 000 |

|

|

From 1.1. to 31.12.2007 |

3 350 |

||||

|

From 1.1. to 31.12.2008 |

5 700 |

||||

|

From 1.1. to 31.12.2009 |

8 000 |

||||

|

09.1158 |

0810 10 00 |

Strawberries, fresh |

From 1.1. to 31.12.2006 |

500 |

Exemption |

|

From 1.1. to 31.12.2007 |

1 000 |

||||

|

From 1.1. to 31.12.2008 |

1 500 |

||||

|

From 1.1. to 31.12.2009 |

2 000 |

||||

|

09.1166 |

1509 10 |

Virgin olive oil |

From 1.1. to 31.12.2006 |

2 000 |

Exemption (5) |

|

From 1.1. to 31.12.2007 |

4 500 |

||||

|

From 1.1. to 31.12.2008 |

7 000 |

||||

|

From 1.1. to 31.12.2009 |

9 500 |

||||

|

From 1.1. to 31.12.2010 and for each period thereafter from 1.1. to 31.12. |

12 000 |

||||

|

(1) The exemption applies only to the ad valorem duty. (2) For imports during the period from 1 November to 31 May of cucumbers of CN code 0707 00 05, the specific duty provided in the Community’s list of concessions to the WTO is reduced to zero if the entry price is not less than EUR 44,9/100 kg net weight, being the entry price agreed between the European Community and Jordan. If the entry price of a consignment is 2, 4, 6 or 8 % lower than the agreed entry price, the specific customs duty shall be equal respectively to 2, 4, 6 or 8 % of this agreed entry price. If the entry price of a consignment is less than 92 % of the agreed entry price, the specific customs duty bound within the WTO shall apply. (3) For imports during the period from 1 December to 31 May of sweet oranges, fresh of CN code 0805 10 20, the specific duty provided in the Community’s list of concessions to the WTO is reduced to zero if the entry price is not less than EUR 26,4/100 kg net weight, being the entry price agreed between the European Community and Jordan. If the entry price of a consignment is 2, 4, 6 or 8 % lower than the agreed entry price, the specific customs duty shall be equal respectively to 2, 4, 6 or 8 % of this agreed entry price. If the entry price of a consignment is less than 92 % of the agreed entry price, the specific customs duty bound within the WTO shall apply. (4) For imports during the period from 1 November to the end of February of fresh clementines of CN code ex080520 10 (TARIC subheading 05), the specific duty provided in the Community’s list of concessions to the WTO is reduced to zero if the entry price is not less than EUR 48,4/100 kg net weight, being the entry price agreed between the European Community and Jordan. If the entry price of a consignment is 2, 4, 6 or 8 % lower than the agreed entry price, the specific customs duty shall be equal respectively to 2, 4, 6 or 8 % of this agreed entry price. If the entry price of a consignment is less than 92 % of the agreed entry price, the specific customs duty bound within the WTO shall apply. (5) The elimination of customs duties shall only apply to imports into the Community of untreated olive oil, wholly obtained in Jordan and transported directly from Jordan to the Community. Products not complying with this condition shall be subject to the relevant customs duty as laid down in the Common Customs Tariff. |

|||||

ANNEX VI

SYRIA

Reference quantity

Nothwithstanding the rules for the interpretation of the Combined Nomenclature, the wording for the description of the products is to be considered as having no more than an indicative value, the preferential scheme being determined, within the context of this Annex, by the coverage of the CN codes as they exist at the time of adoption of this Regulation. Where ex CN codes are indicated, the preferential scheme is to be determined by application of the CN code and corresponding description taken together.

|

Order No |

CN code |

TARIC subdivision |

Description of goods |

Reference quantity period |

Reference quantity volume (in tonnes) |

Reference quantity duty |

|

18.0080 |

0712 20 00 |

Dried onions, whole, cut, sliced, broken or in powder, but not further prepared |

From 1.1 to 31.12 |

840 |

Exemption |

ANNEX VIa

LEBANON