This document is an excerpt from the EUR-Lex website

Document 52019XC1106(01)

Communication from the Commission Commission Notice on the calculation of the cost of capital for legacy infrastructure in the context of the Commission’s review of national notifications in the EU electronic communications sector (Text with EEA relevance) 2019/C 375/01

Communication from the Commission Commission Notice on the calculation of the cost of capital for legacy infrastructure in the context of the Commission’s review of national notifications in the EU electronic communications sector (Text with EEA relevance) 2019/C 375/01

Communication from the Commission Commission Notice on the calculation of the cost of capital for legacy infrastructure in the context of the Commission’s review of national notifications in the EU electronic communications sector (Text with EEA relevance) 2019/C 375/01

C/2019/7858

OJ C 375, 6.11.2019, p. 1–11

(BG, ES, CS, DA, DE, ET, EL, EN, FR, HR, IT, LV, LT, HU, MT, NL, PL, PT, RO, SK, SL, FI, SV)

|

6.11.2019 |

EN |

Official Journal of the European Union |

C 375/1 |

COMMUNICATION FROM THE COMMISSION

Commission Notice on the calculation of the cost of capital for legacy infrastructure in the context of the Commission’s review of national notifications in the EU electronic communications sector

(Text with EEA relevance)

(2019/C 375/01)

1. Introduction

|

1. |

This Notice sets out the Commission’s methodology for estimating the weighted average cost of capital (WACC) (1) as a reference in the context of reviewing draft measures notified by national regulatory authorities (NRAs or regulators) under Article 7 of the Framework Directive, which is part of the EU’s regulatory framework for electronic communications (the Framework) (2). As of 21 December 2020, Article 32 of the new European Electronic Communications Code (3) will replace Article 7 of the Framework Directive. |

|

2. |

The WACC measures companies’ cost of capital. In line with economic theory (4), the cost of capital is the opportunity cost of making a specific investment instead of a different investment with equal risk. Thus, the cost of capital is the rate of return required by a company to make a given investment. The cost of capital can be split into cost of equity and cost of debt, depending on the source of financing. |

|

3. |

NRAs use the WACC in the context of regulating operators designated as having significant market power (SMP). NRAs may impose price control obligations for the provision of specific types of interconnection and/or access in situations where there is a lack of effective competition. In cases of price controls, NRAs shall take into account the investment made by the operator and allow a reasonable rate of return. (5) |

|

4. |

In the context of Article 7 notifications, the Commission has observed significant discrepancies in estimating the WACC for services provided over electronic communications networks. There is not only a lack of consistency across Member States but also over time (i.e. the same NRA uses different methods at different points in time). The Commission considers that such methodological inconsistencies are likely to distort investment incentives in the Digital Single Market (6) and undermine the development of the internal market by hindering the creation of convergent conditions for investment in electronic communications networks. (7) |

|

5. |

The Framework aims at ensuring that NRAs contribute to the development of the internal market by cooperating with each other and with the Commission to ensure the development of consistent regulatory practice and the consistent application of the Framework. (8) In line with the objectives of the Framework, this Notice aims at increasing the consistency of WACC calculations across the Union. |

|

6. |

The scope of the Notice is limited to the WACC calculation for legacy infrastructure. For the purposes of this Notice, legacy infrastructure means infrastructure of an SMP operator not subject to a Next Generation Access (NGA) premium. (9) The Notice does not address the applicability or the calculation of NGA risk premiums and excludes any consideration of the appropriateness of price control obligations for new very high capacity networks as defined in Article 2(2) of the Code (10). |

|

7. |

In accordance with the objectives of the Framework, NRAs, BEREC and the Commission should all contribute to the development of the internal market by promoting consistent regulatory approaches and the consistent application of the Framework. (11) NRAs should also apply objective, transparent, non-discriminatory and proportionate regulatory principles. (12) |

|

8. |

In line with the objectives of the Framework, this Notice is based on the following four regulatory principles: (i) consistency in the methodology used to determine the parameters in the WACC formula; (ii) regulatory predictability to limit unexpected variations in the regulatory approach and in the value of the parameters over time; (iii) the promotion of efficient investment and innovation in new and enhanced infrastructures, taking account of the risk incurred by the investing undertakings; and (iv) transparency of the method to determine the reasonable rate of return on their investments, avoiding unnecessary complexity. |

|

9. |

This Notice seeks to achieve these objectives and contribute to a stable regulatory environment that supports efficient investments in electronic communications networks in the Union to the benefit of end users. It will discourage the distortion of investments by inconsistencies in NRAs’ approaches over time and across the Union, which could harm the functioning of the Digital Single Market. |

|

10. |

With this Notice, the Commission seeks to provide greater transparency and predictability of its policy and decision-making in the area of electronic communications regulation. Based on the methodology of this Notice, the values of each WACC parameter will be calculated and published annually. The Commission will use these values as reference for its review of draft measures notified under Article 7 of the Framework Directive. |

|

11. |

This Notice, together with the annual publication of WACC parameter values consistent with it, will provide greater transparency regarding the Commission’s assessment of the cost of capital, where this is an element of the measures notified to it under Article 7 of the Framework Directive. |

|

12. |

This Notice and the accompanying Staff Working Document are without prejudice to the interpretation that may be given by the Commission to the cost of capital in other economic sectors. |

2. Estimating the weighted average cost of capital (WACC)

|

13. |

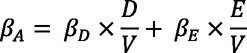

The WACC is calculated as a weighted average of the cost of a company’s two sources of finance: debt and equity. The weights reflect the relative share of each financing source in the total value of the firm: |

![]()

where:

|

— |

RE is the cost of equity; |

|

— |

RD is the cost of debt; |

|

— |

E is the value of equity, with |

|

— |

D is the value of debt, with |

2.1. The cost of equity

|

14. |

Cost of equity is the return that a company needs to deliver to its shareholders to compensate for the risk of investing/owning a portion of the company. The most commonly used method for estimating cost of equity is the Capital Asset Pricing Model (CAPM) (13) . All NRAs in the electronic communications sector estimate the cost of equity by using the CAPM. The main reasons for this are the relative simplicity of its calculation and its long track record (when compared to alternatives). (14) The Commission considers this as the appropriate approach to promote a predictable and homogeneous methodology across NRAs. |

|

15. |

According to the CAPM, in a competitive market investors are willing to hold risky equities if their return is higher than the return they could earn on a risk-free asset (the risk-free rate, RFR) (15). This additional return is called market risk premium or equity risk premium (ERP) (16). |

|

16. |

According to the basic assumption of the CAPM, risks can be divided into two categories:

|

|

17. |

In the CAPM framework, specific or diversifiable risks should not be taken into account to estimate the cost of capital. This is because in efficient capital markets investors should be able to reduce such risks by holding a diversified investment portfolio. (19) |

|

18. |

In contrast, systematic risks cannot be diversified away. For this reason, in the CAPM framework the estimated cost of capital only reflects the compensation for systematic risks. |

|

19. |

According to the CAPM, the cost of equity is the sum of the RFR and ERP, multiplied by the beta coefficient (20). The beta coefficient is included to capture and adjust for the specific sensitivity of the equity to market fluctuations. |

|

20. |

In this regard, in the CAPM framework, the cost of equity is calculated as follows:

RE = RFR + β × ERP where:

|

2.2. The cost of debt

|

21. |

The cost of debt can be measured directly as the interest paid by the company on its debt, but it is often expressed as the sum of the RFR and a debt premium: |

RD = RFR + Debt Premium

where:

|

— |

RD is the cost of debt; |

|

— |

RFR is the risk-free rate; and |

|

— |

The debt premium is the additional return that lenders require from a company with a given credit risk, over and above the RFR. |

2.3. Estimating the parameters of the WACC

|

22. |

The formula for estimating the WACC is the following: |

![]()

|

23. |

There are two sets of methodological assumptions affecting the WACC values estimated by NRAs across the Union. Some assumptions are common to several parameters (e.g. length of the averaging period) while others are specific to a single parameter in the WACC formula (e.g. adjustment to the estimation of the beta). Further, two types of parameters need to be distinguished: those that reflect general economic conditions (RFR and ERP) and those that reflect conditions affecting specific companies (or industry sector) (debt premium, beta and gearing (21)). |

|

24. |

The next sections address both sets of methodological assumptions: common vs single parameters and general economic vs company-specific conditions. |

3. Assumptions common to several WACC parameters

|

25. |

The next subsections describe assumptions that are common to several WACC parameters. |

3.1. The length of the averaging period

|

26. |

The averaging period is the length of the reference period that regulators use to derive an average value for the RFR, beta and cost of debt. |

|

27. |

To ensure consistency in the estimation of WACC parameters, the Commission considers it appropriate to use the same averaging period for all parameters. Longer averaging periods are likely to promote greater predictability and stability in the value of the parameters, albeit at the cost of lower static efficiency. A 5-year averaging period, which is the one most commonly used by NRAs, is likely to strike the right balance between predictability and efficiency. (22) |

3.2. The averaging method

|

28. |

When estimating WACC parameters, regulators need to decide which averaging method to use. Typically, they use (i) an arithmetic average, (ii) a geometric average or (iii) a median. |

|

29. |

The Commission considers the arithmetic average method the most appropriate for estimating WACC parameters. Firstly, using a single averaging method is likely to be more transparent for stakeholders than combinations of several methods. Secondly, the arithmetic average is the most commonly used approach and the easiest to calculate. (23) |

3.3. The frequency of the sampling period

|

30. |

The frequency of the observations used by regulators to estimate the RFR and the beta and debt premium is typically daily, weekly or monthly. The choice of the frequency of the observations, together with the length of the averaging period, determines the size of the sample and is therefore liable to influence the parameter values and, ultimately, the final WACC value. |

|

31. |

Using the same frequency of observations to estimate all parameters ensures consistency. A weekly frequency is likely to be an efficient choice, as, combined with a 5-year averaging period, it is likely to provide sufficient observations to derive a robust estimate and mitigate problems of low liquidity of shares (if any). |

4. Parameters reflecting general economic conditions

|

32. |

There are two WACC parameters reflecting general economic conditions: the risk-free rate and the equity risk premium. |

4.1. The risk-free rate (RFR)

|

33. |

The RFR is the expected rate of return on a risk-free investment. For an investment to be free of risk, the risk of default on payments needs to be zero and there must be no reinvestment risk (i.e. the investor can reinvest future interest payments at the same rate of return as at the time the asset was first purchased). NRAs typically approximate RFRs using the yields of domestic government bonds. |

|

34. |

Government bond yields are likely to reflect appropriately the respective domestic RFR. The Commission considers that the use of domestic government bonds, together with a consistent methodology, will ensure that differences in RFRs reflect actual differences in financing conditions between Member States. |

|

35. |

NRAs frequently use government bonds with a residual maturity (24) of 10 years. Yields of 10-year bonds tend to be less volatile than shorter-term bonds and more consistent with the long lifetime of investments in electronic communications networks. The Commission therefore considers them the most appropriate benchmark for the purposes of this Notice. (25) |

|

36. |

To ensure consistency in the estimation of the RFR, it is preferable to use a single, reliable, transparent and easily accessible source of information for government bond yields (e.g. Eurostat (26)). An adjustment for central bank quantitative easing programmes is not necessary. (27) |

4.2. The equity risk premium (ERP)

|

37. |

The ERP is the expected return on equities over and above the RFR, i.e. the expected additional interest for holding higher-risk equities compared with the interest for holding risk-free assets. The ERP compensates for the added risk of investing in equity rather than in a risk-free asset. |

|

38. |

The Commission identified disparities in the approaches used by regulators to estimate the ERP, with some using an EU benchmark, others a national ERP or a combination of both. A Union-wide ERP is consistent with empirical evidence suggesting that financial markets in the Union are increasingly integrated (as shown by their increased correlation) and therefore have convergent ERPs. (28) It is also consistent with the evidence suggesting that investors in the EU telecoms sector do not display ‘home bias’, as a significant share of electronic communications companies’ shareholders are non-nationals. (29) The Commission therefore considers a single Union-wide ERP to be appropriate for the purposes of this Notice. Further, in line with the approach most commonly used by regulators, the Commission considers it appropriate to estimate this Union-wide ERP using historical series of market premiums in Member States. |

5. Company-specific parameters

|

39. |

Some WACC parameters capture general economic conditions (RFR and ERP) while others (beta, gearing and debt premium) reflect the economic conditions of the specific company for which the regulator estimates the WACC. |

|

40. |

To derive the values of company-specific WACC parameters, regulators typically rely on a group of electronic communications companies (‘peer group’), usually including their national SMP operator(s). NRAs use the parameter values of the companies in the peer group as reference to derive appropriate values for company-specific parameters in their regulatory measures. |

|

41. |

The first important step in estimating company-specific parameters is to decide on the criteria for selecting the companies that will be part of the peer group. |

5.1. Criteria for selecting the peer group

|

42. |

For the peer group, companies listed on a stock exchange and having liquidly traded shares (30) are the most suitable. Further, companies that own electronic communications infrastructure, as opposed to renting it, and have their main operations in the Union are best suited for calculating a WACC in accordance with the aims of this Notice. |

|

43. |

Efficiency considerations favour confining the peer group to companies with investment grade credit rating (31) and companies not involved in any substantial mergers and acquisitions, as the latter would affect a company’s value in ways unrelated to its underlying systematic risk. |

|

44. |

In summary, the following criteria would be in line with the regulatory principles presented in this Notice. The companies selected for the peer group:

|

5.2. The equity beta

|

45. |

Within the CAPM framework, equity beta reflects the systematic risk faced by a company relative to the average company in the market. In practice, the equity beta is estimated through a regression analysis, i.e. by estimating the correlation between the returns of a company’s share and the returns of a market index (which is meant to approximate the whole economy). |

|

46. |

A European market index is more consistent with the use of a Union-wide ERP value than a domestic one. The academic literature expresses a preference for broadly-based indices and for value-weighted indices. (32) In line with these criteria, there are several market indices encompassing European equities such as STOXX Europe TMI (33), S&P Europe 350 (34), Eurostoxx50 (35), and MSCI Europe (36). The Commission considers it appropriate to use a market index representing a large share of the free float market capitalisation in the Union (e.g. the STOXX Europe TMI). |

|

47. |

In estimating the equity beta, the Commission does not consider it appropriate to make adjustments (37), as these are unlikely to improve the efficiency of the beta estimator and make the estimation unnecessarily complex and less transparent. |

|

48. |

To compare companies’ betas within the peer group, it is necessary to convert (unlever) their equity betas into asset betas. (38) Asset betas reflect companies’ systematic risk, free of financial risk (i.e. risk associated with the level of financial leverage). A simple formula to derive asset betas from equity betas is the following:

where:

|

|

49. |

There are significant practical difficulties in estimating debt betas but values typically range from 0-0,2 (39). Using a single value for the debt beta would reduce complexity and improve transparency of the WACC calculation. An intermediate debt beta value of 0,1 seems a reasonable choice. |

|

50. |

For estimating the WACC, the asset beta of the peer group is converted (back) into equity beta (i.e. add back the impact of debt on the company beta) using the formula above, which, when solving for the equity beta, results in: |

![]()

5.3. The gearing

|

51. |

As mentioned above, companies can finance themselves through debt (D) or equity (E). The sum of debt and equity equals the company value (V): |

V = D + E

|

52. |

The share of debt in the company value (i.e.  ) is called ‘gearing’. Gearing is a leverage ratio. It shows to what extent a company is funded by lenders as opposed to shareholders. ) is called ‘gearing’. Gearing is a leverage ratio. It shows to what extent a company is funded by lenders as opposed to shareholders.

|

|

53. |

The share of debt (i.e.  ) and the share of equity (i.e. ) and the share of equity (i.e.  ) and the cost of equity (i.e. ) and the cost of equity (i.e. |

|

54. |

The most common approach for estimating the gearing, which is considered appropriate for the purposes of this Notice, is to use the book value of a company’s net debt, including the value of financial leases. (40) |

5.4. The debt premium and the cost of debt

|

55. |

The cost of debt can be measured directly as the interest paid by a company on its debt or indirectly as a premium on the RFR. |

|

56. |

The debt premium can be estimated as the spread between the domestic RFR and the yield of long-term corporate bonds (as close as possible to the 10-year maturity used for the RFR). (41) |

|

57. |

For reasons of consistency, the Commission considers it more appropriate to estimate the cost of debt (indirectly) as the sum of the RFR and the debt premium. |

6. Taxes and inflation

The tax treatment of debt and inflation expectations affect the WACC and thus need be incorporated in the WACC calculation.

6.1. Taxes

|

58. |

Interest on debt is a tax-deductible expense for corporations. The post-tax WACC accounts for this favourable tax treatment of debt as follows: |

![]()

where:

|

— |

RE is the cost of equity and RD is the cost of debt; |

|

— |

|

|

— |

Tc is the marginal tax rate. |

|

59. |

NRAs typically uplift the (post-tax) cost of equity (42) – to meet the requirements of equity investors, as estimated by the CAPM – to a pre-tax cost of equity. The pre-tax WACC is calculated by dividing the post-tax WACC by (1 – Tc

), in order to account for corporate taxes, and can be expressed as follows:

|

|

60. |

The Commission considers it appropriate to use the relevant domestic corporate tax rate, which is the common approach adopted by NRAs, to estimate the pre-tax WACC. |

6.2. Inflation

|

61. |

Investors maximise their inflation-adjusted or real returns. There are typically two ways in which NRAs take inflation into account: (43)

|

|

62. |

NRAs using the first approach typically convert the nominal WACC to the real WACC. One common conversion method is the Fisher equation: |

where π is the inflation rate.

|

63. |

The Commission considers it appropriate to use a Eurozone-wide inflation estimate for Eurozone Member States; for non-Eurozone Member States national inflation estimates may be justified. In both cases, forward-looking estimates are more appropriate and ideally cover a period equal to the 10-year maturity of government bonds used to estimate the RFR. In practice 10-year inflation forecasts are rarely available, thus shorter term forecasts may be used (e.g. inflation forecast 5 year ahead by ECB). |

7. Role of BEREC and the Commission in the calculation of WACC parameters

|

64. |

In the preparatory steps leading to the adoption of the Notice, the Commission services worked in close cooperation with BEREC. In the context of this collaboration, the Commission invited BEREC to estimate the WACC parameters consistent with the approach described in this Notice. BEREC agreed to estimate the parameter values and publish them on an annual basis. (44) This will greatly facilitate the work of NRAs in preparing periodic WACC reviews and the Commission’s review of such notifications. |

|

65. |

In the annual calculation exercise, BEREC, in close collaboration with the Commission, will estimate (i) the parameters reflecting general economic conditions and (ii) the company-specific parameters for the peer group. |

|

66. |

Regarding the parameters reflecting general economic conditions, BEREC will estimate the RFR for each Member State and a single Union-wide ERP. |

|

67. |

Regarding the company-specific parameters, BEREC will prepare a list of companies suitable for the peer group and estimate the equity beta, gearing, debt premium and cost of debt for each company included in the list. Further, BEREC will describe factors that may justify NRAs removing one or more companies from the list to take account of national specificities. |

8. Frequency of WACC reviews

|

68. |

NRAs set/review the WACC with different periodicity, ranging from more than once a year up to once every 4-5 years. This difference in the frequency is one of the factors behind differences in WACC values across Member States. |

|

69. |

Increasing the consistency in the frequency of WACC calculations across Member States would reduce unjustified differences in WACC values. |

|

70. |

The Commission considers that updating the national WACC value at least once per year is appropriate to take account of recent economic conditions. (45) |

9. Transitional period towards the adoption of the methodology in this Notice

|

71. |

When reviewing notifications under the Article 7 procedure, the Commission will, as a rule, use the methodology described in the present Notice from 1 July 2020. However, in justified cases and at the request of the notifying NRA, the Commission will not base its review of draft measures on this methodology during a transitional period of up to one year (starting from 1 July 2020) (46). For example, this may be justified when the review based on this methodology, if applied by the national regulator, would result in significant changes in the WACC value undermining regulatory stability and predictability. During the transitional period of one year, the Commission will also take into consideration if the full set of WACC parameters to be published by BEREC is available and the possibility for the NRAs to rely on those parameters in their analysis. |

(1) The WACC represents the value for which the investor needs to be compensated for an investment. In the context of telecoms regulation, the WACC is calculated by the relevant national regulatory authority and added to the maximum allowed wholesale price that the regulated operator can charge for access to its infrastructure. For a comprehensive explanation of the concept of WACC, see section 2 in the Staff working document accompanying this Notice.

(2) The regulatory framework currently in force consists of (i) Directive 2002/21/EC of the European Parliament and of the Council of 7 March 2002 on a common regulatory framework for electronic communications networks and services (Framework Directive) (OJ L 108, 24.4.2002, p. 33), as amended by Directive 2009/140/EC (OJ L 337, 18.12.2009, p. 37), and Regulation (EC) No 544/2009 (OJ L 167, 29.6.2009, p. 12); (ii) Directive 2002/20/EC of the European Parliament and of the Council of 7 March 2002 on the authorisation of electronic communications networks and services (Authorisation Directive) (OJ L 108, 24.4.2002, p. 21); (iii) Directive 2002/19/EC of the European Parliament and of the Council of 7 March 2002 on access to, and interconnection of, electronic communications networks and associated facilities (Access Directive) (OJ L 108, 24.4.2002, p. 7); (iv) Directive 2002/22/EC of the European Parliament and of the Council of 7 March 2002 on universal service and users’ rights relating to electronic communications networks and services (Universal Service Directive) (OJ L 108, 24.4.2002, p. 51) and (v) Regulation (EU) No 531/2012 of the European Parliament and of the Council of 13 June 2012 on roaming on public mobile communications networks within the Union (OJ L 172, 30.6.2012, p. 10), as amended by Regulation (EU) 2015/2120 of the European Parliament and of the Council of 25 November 2015 (OJ L 310, 26.11.2015, p. 1) and Regulation (EU) 2017/920 of the European Parliament and of the Council of 17 May 2017 (OJ L 147, 9.6.2017, p. 1).

(3) Directive (EU) 2018/1972 of the European Parliament and the Council of 11 December 2018 establishing the European Electronic Communications Code (the Code) (OJ L 321, 17.12.2018, p. 36). Pursuant to Article 124(1) of the Code, Member States are required to adopt national transposition measures by 21 December 2020 and apply them from that date. References in existing laws, regulations and administrative provisions to the Directives repealed by the Code shall be construed as references to the Code.

(4) See for example Brealey, Myers, Allen (2014), Principles of Corporate Finance, McGraw Hill, Chapter 9.

(5) In accordance with Article 13 of the Framework Directive. See also Commission Recommendation 2013/466/EU of 11 September 2013 on consistent non-discrimination obligations and costing methodologies to promote competition and enhance the broadband investment environment (OJ L 251, 21.9.2013, p. 13), on circumstances under which wholesale pricing flexibility may be justified and, as from 21 December 2020, Article 74 of the Code.

(6) The Digital Single Market strategy (https://ec.europa.eu/digital-single-market/en/policies/shaping-digital-single-market) aims at ensuring access to online activities for individuals and businesses under conditions of fair competition, consumer and data protection.

(7) In accordance with the objectives set out in Article 8(2)(b) and 8(2)(c) of the Framework Directive.

(8) In accordance with the objective set out in Article 7(2) and 8(3)(d) of the Framework Directive.

(9) The Notice does not prejudge whether additional premiums for specific investments (e.g. next generation access networks) are justified. On this issue, see Commission Recommendation 2010/572/EU of 20 September 2010 on regulated access to Next Generation Access Networks (NGA) (NGA Recommendation) (OJ L 251, 25.9.2010, p. 35), in particular point 25 and Annex I. The lower risk profile of investment into FTTN/VDSL (compared to fibre to the home) is discussed in Annex I, section 6 of the NGA Recommendation. In such cases, NGA networks fall within the scope of legacy infrastructure.

(10) The Code tasked the Body of European Regulators for Electronic Communications (BEREC) with issuing guidelines on the criteria that a network is to fulfil to be considered a very high capacity network, by 21 December 2020. Further, the Code includes several provisions regarding the process of migration from legacy infrastructure to new very high capacity networks, for example, in Article 81.

(11) See Article 8(3)(d) and 8(5)(a) of the Framework Directive.

(12) See Article 8(5) of the Framework Directive.

(13) W.F. Sharpe, ‘Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk’, The Journal of Finance, Vol. 19 (September 1964), pp. 425-442; and J. Lintner, ‘The Valuation of Risk Assets and the Selection of Risky Investments in Stock Portfolios and Capital Budgets’, The Review of Economics and Statistics, Vol. 47 (February 1965), pp. 13-37.

(14) For more details, see section 2.1 of the Staff working document accompanying this Notice.

(15) The return required by investors on a risk-free investment.

(16) The return in excess of the RFR expected by investors for the additional risk involved in a market investment.

(17) Specific risks may also be referred to as unsystematic risks, residual risks, unique risks or diversifiable risks.

(18) Non-diversifiable risks may also be referred to as market risks, systematic risks or undiversifiable risks.

(19) Diversification works because prices of different stocks do not move exactly together (from a statistical point of view, stock price changes are less than perfectly correlated). In a diversified investments portfolio, movements in individual assets are likely to be compensated by movements of other assets in the portfolio over the long term.

(20) The beta is the covariance between the return of an asset (typically, the market value of the company) and the market return (typically, the market value of a stock index that is taken to represent the whole market or economy) divided by the variance of the market return. Shares with betas greater than 1,0 amplify the overall movements of the market whereas those with betas between 0 and 1,0 reduce the overall movements of the market. For example, a beta of 0,5 means that if the market declines by 1 %, one would expect the value of the investment to decline by 0,5 %. A beta of 1,5 means that if the market declines by 1 %, one would expect the value of the investment to decline by 1,5 %.

(21) Gearing is a measure of a company’s financial leverage. It compares the amount of debt financing to the amount of owner’s equity. The gearing determines the weight of cost of debt and cost of equity in the WACC. The gearing is explained further in section 5.3 of this Notice.

(22) For more details, see section 5.1.1 (in particular 5.1.1.4) of the Staff working document accompanying this Notice.

(23) See section 5.1.2 of the Staff working document accompanying this Notice.

(24) Residual maturity is the remaining time until the repayment of the bond. Throughout the Notice, bond maturity refers to residual bond maturity.

(25) See section 5.2.1.3 and section 5.2.1.4 of the Staff working document accompanying this Notice.

(26) Eurostat publishes the yields of 10-year government bonds for each Member State on a monthly basis (see https://ec.europa.eu/eurostat/tgm/table.do?tab=table&plugin=1&language=en&pcode=teimf050).

(27) See section 5.2.2 of the Staff working document accompanying this Notice.

(28) See section 5.2.1.3 and section 5.2.1.4 of the Staff working document accompanying this Notice.

(29) See section 5.2.2.3 of the Staff working document accompanying this Notice.

(30) Thinly traded shares may not reveal the correct and up-to-date value of the underlying companies because they cannot be easily sold without a significant change in price. They also tend to be more volatile than liquid ones.

(31) Investment grade credit rating depends on the specific credit rating agency: it corresponds to ratings from Aaa to Baa3 in the case of Moody’s and to ratings from AAA to BBB in the case of Standard and Poor’s.

(32) See section 5.3.3.2 of the Staff working document accompanying this Notice.

(33) https://www.stoxx.com/index-details?symbol=BKXP

(34) http://us.spindices.com/indices/equity/sp-europe-350

(35) https://www.stoxx.com/index-details?symbol=sx5e

(36) https://www.msci.com/europe

(37) Traditional adjustments to the equity beta are those proposed by Dimson (correcting distortions in the beta estimate when using daily returns due to mismatch between changes in market index and the time for the company stock to react to these); Blume (in the long term companies’ beta should tend towards a value of 1); or Vasicek (in the long term companies’ beta should tend towards an industry average).

(38) The conversion (unlevering) removes the impact of debt on the equity (or levered) beta. In other words, the asset beta abstracts away from the specific financing structure of a company, thereby allowing for comparisons between the betas of different companies (irrespective of their individual financing structures).

(39) See The Brattle Group, Review of approaches to estimate a reasonable rate of return for investments in electronic communications networks in regulatory proceedings and options for EU harmonization, final report published on 14 July 2016, p. 88, available at https://publications.europa.eu/en/publication-detail/-/publication/da1cbe44-4a4e-11e6-9c64-01aa75ed71a1/language-en

(40) See section 5.3.4 of the Staff working document accompanying this Notice.

(41) See section 5.3.5 of the Staff working document accompanying this Notice, and the literature cited therein.

(42) See section 5.4.1 of the Staff working document accompanying this Notice.

(43) See section 5.4 of the Staff working document accompanying this Notice.

(44) At the 38th Ordinary Plenary Meeting of the Board of Regulators of 7-8 March 2019, BEREC agreed to calculate the WACC parameters (BEREC envisaged calculating the risk-free rate and the equity risk premium already in 2019 and the beta, gearing and cost of debt starting from 2020). It has since emerged that BEREC expects to have published the full set of relevant parameters by mid-2020. The conclusions of this meeting (BoR (19) 45) are available at

https://berec.europa.eu/eng/document_register/subject_matter/berec/board_of_regulators_meetings/meeting_conclusions/8549-conclusions-of-the-38th-berec-board-of-regulators-plenary-meetings-on-7-8-march-2019-in-budapest-hungary

(45) See section 8 of the Staff working document accompanying this Notice.

(46) See section 9 of the Staff working document accompanying this Notice.