EUROPEAN COMMISSION

EUROPEAN COMMISSION

Brussels, 26.2.2020

SWD(2020) 520 final

COMMISSION STAFF WORKING DOCUMENT

Country Report Poland 2020

Accompanying the document

COMMUNICATION FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT, THE EUROPEAN COUNCIL, THE COUNCIL, THE EUROPEAN CENTRAL BANK AND THE EUROGROUP

2020 European Semester: Assessment of progress on structural reforms, prevention and correction of macroeconomic imbalances, and results of in-depth reviews under Regulation (EU) No 1176/2011

{COM(2020) 150 final}

Contents

Executive summary

1.Economic situation and outlook

2.Progress with country-specific recommendations

3.Reform priorities

3.1.Public finances and taxation

3.2.Financial sector22

3.3.Labour market, education and social policies24

3.4. Competitiveness, reforms and investments32

3.5. Environmental sustainability41

Annex A: Overview Table46

Annex B: Commission debt sustainability analysis and fiscal risks52

Annex C: Standard Tables53

Annex D: Investment guidance on Just Transition Fund 2021-2027 for Poland59

Annex E: Progress towards the Sustainable Development Goals61

References66

LIST OF Tables

Table 1.1:Key economic and financial indicators - Poland

Table 2.1:Assessment of implementation of 2019 country-specific recommendations

Table 3.2.1:Banking sector financial stability indicators

Table C.1:Financial market indicators

Table C.2:Headline Social Scoreboard indicators

Table C.3:Labour market and education indicators

Table C.4:Social inclusion and health indicators

Table C.5:Product market performance and policy indicators57

Table C.6:Green growth58

Table E.1:Indicators measuring Poland’s progress towards the SDGs61

LIST OF Graphs

Graph 1.1:

Real GDP per capita, 2008-2018

Graph 1.2:

Consumer confidence

Graph 1.3:

Labour productivity in market services

Graph 1.4:

Employment, wages and unemployment rate

Graph 1.5:

Gini coefficient of equivalised disposable income, 2008-2018

Graph 1.6:

Index of concentration of goods exports, 2018

Graph 2.1:

Overall multiannual implementation of 2011-2019 CSRs to date

Graph 3.1.1:

General government revenue and expenditure change, fiscal deficit, 2010-2021

Graph 3.1.2:

Tax revenue dynamics

Graph 3.1.3:

Time to comply with tax obligations for a medium-sized company, 2010-2019

Graph 3.1.4:

Medium-term public debt scenarios

Graph 3.3.1:

Employment rate in Poland, 2018

Graph 3.3.2:

Differences in employment rates between Poland and EU, 2019 (p.p.)

Graph 3.3.3:

Working time flexibility for care and inactivity due to family or caring responsibilities, 2018

Graph 3.4.1:

Investment rates

Graph 3.4.2:

Freight transport performance in billion tonne-kilometers (tkm)

Graph 3.5.1:

Greenhouse gas emissions per capita in ten EU countries with the highest emissions in 2017

Graph 3.5.2:

Indigenous production of hard coal

Graph 3.5.3:

Share of solid fossil fuels in final residential energy consumption (%)

LIST OF Boxes

Box 2.1: EU funds and programmes to address structural challenges and to foster growth and competitiveness in Poland

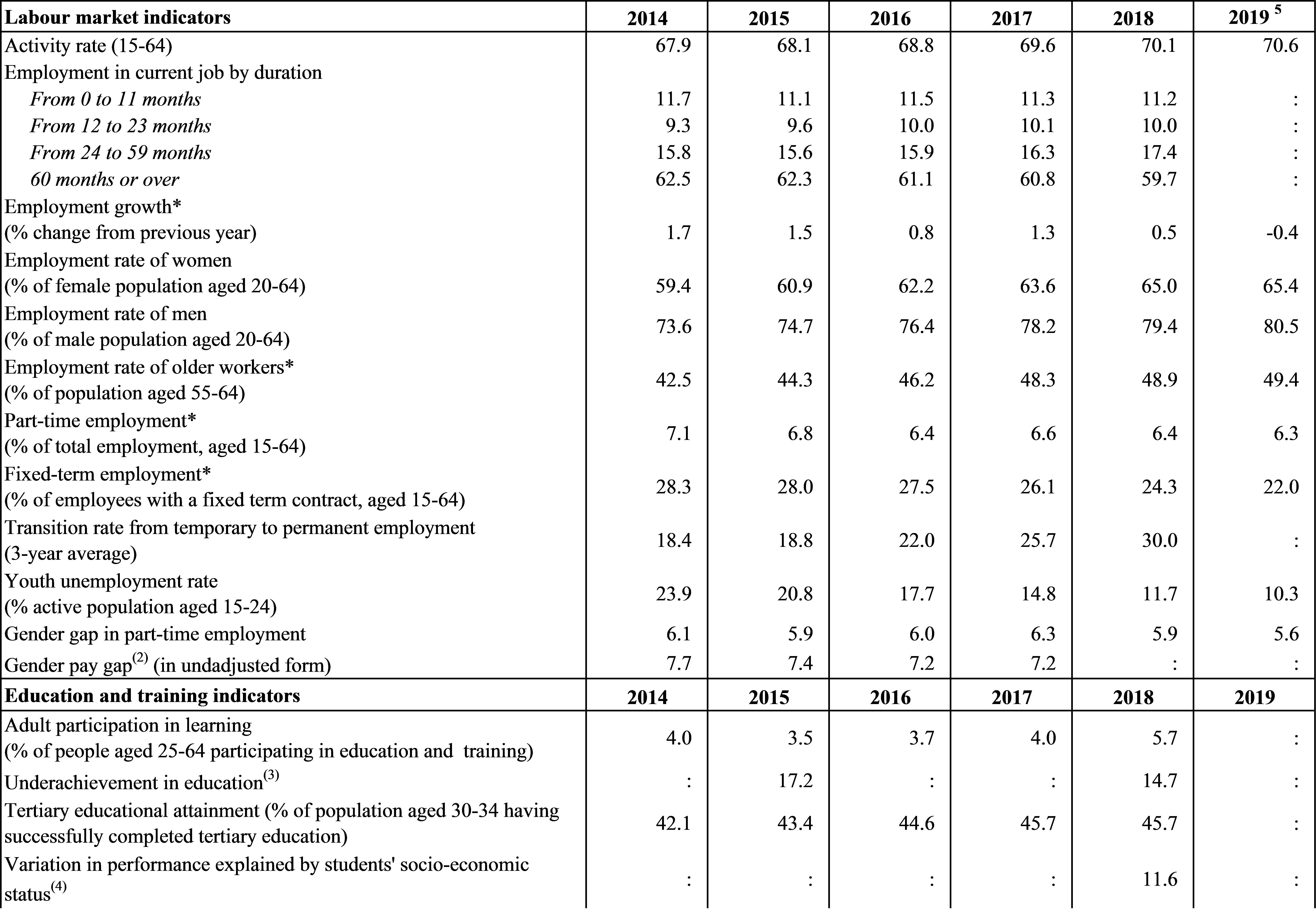

Box 3.3.1: Monitoring performance in light of the European Pillar of Social Rights

Box 3.4.1: Investment challenges and reforms in Poland

Box 3.5.1: Coal Regions in Transition

Executive summary

Slowing but still very solid economic growth creates a good basis for reforms addressing socio-economic challenges (). The Polish economy is successfully catching up. Economic conditions remain favourable despite an outlook of slower growth. Employment is high and the unemployment rate has stabilised at record lows. The short-term situation of public finances appears safe. An ageing population, a falling number of people at working age and the subpar quality of certain key public services such as health and long-term care constitute important challenges. Key long-term challenges include ensuring a gradual shift towards a knowledge-based economy producing advanced products and services. The Polish economy is energy-intensive and highly dependent on fossil fuels. In this respect, limiting greenhouse gas emissions by decarbonising power generation and reducing energy intensity are key. The transition to a low-carbon economy will have a significant impact on society, mainly in affected regions.

Economic growth stayed strong in 2019. Household consumption remained the main driver of GDP growth estimated at 4.0% in 2019. The favourable labour market situation and to some extent increased social transfers and lowered personal income taxes supported this. Private and public investment, including the projects supported by EU funds, also contributed positively to growth. Export performance remained generally favourable, especially against the backdrop of weakened global and EU trade.

Future growth potential will be determined by trends in capital accumulation, skills and migration. A significant inflow of labour migrants from outside the EU has helped to sustain strong growth. Given the increased share of migrants in the total work force and the large number of Polish citizens who have moved to other EU countries, future migration trends are expected to have a substantial impact on growth. Increasing labour participation of certain groups of people will be also important. While gains in skills are likely to have played an important role in driving growth in the past, maintaining positive trends is an important challenge. Capital accumulation, including infrastructure and, machinery, but also non-tangible capital including patented innovation is another important factor with the potential to boost productivity and growth. Perceptions of macroeconomic stability and the quality of Poland’s policies, institutions, and regulatory environment (including the legislative process, in particular public consultations) are expected to be increasingly important in determining investment trends.

Overall, Poland is well integrated economically with the EU and the world, and its economy is well balanced internally and externally. Poland’s current account has remained close to balance and its net foreign debt continued to fall during 2019. Exports remain highly diversified and are gradually shifting towards higher-value-added products and services. Public and private debt remains low in comparison with the EU average.

Economic growth prospects depend on investment in several policy areas. Decarbonising power generation, improving the energy efficiency of buildings and investing in more sustainable transport can put the economy on a more environmentally sustainable development path. Investment in innovation will help Poland produce more advanced products and services. Expanding broadband network will allow for equal access to the internet. Investment in social inclusion, healthcare, childcare and long-term care can improve social cohesion and increase employment.

Poland has made limited () progress in addressing the 2019 country-specific recommendations.

Some progress was observed in strengthening Poland’s capacity for innovation.

There has been limited progress in the following areas:

·Improving the efficiency of public spending;

·Increasing labour force participation;

·Focusing investment-related economic policy on innovation, transport, digital and energy infrastructure, healthcare and cleaner energy.

There has been no progress in the following areas:

·Increasing the effective retirement age;

·Reforming preferential pension schemes;

·Strengthening the role of consultations of social partners and public consultations in the legislative process.

Poland performs relatively well in several areas covered by the European Pillar of Social Rights. In recent years, Poland has made substantial progress in improving labour market outcomes and reducing the share of people at risk of poverty. However, challenges remain notably as regards access to healthcare (as highlighted for instance by data on self-reported unmet need for medical care), the gender employment gap and very low availability of childcare.

Progress in reaching the national targets under the Europe 2020 strategy is mixed. Poland performed best on the employment rate (72.2% in 2018 vs the 71% target), tertiary education attainment (45.7% in 2018 vs 45% target) and poverty reduction (the population at risk of poverty declined by 4.5 million vs the target of 1.5 million). Progress remains limited in R&D investment (1.2% of GDP in 2018 vs 1.7% target) and the share of people leaving early the education system (4.8% in 2018 vs 4.5% target). Reaching the Europe 2020 targets related to energy and climate will be very challenging. In 2018 primary energy consumption reached 101 Mtoe and final energy consumption 72 Mtoe, i.e. both exceeded the 2020 target levels. In 2018, Poland achieved a renewables share of 11.2%, against the 2017-18 indicative trajectory of 12.3%. Emissions from the sectors outside of the EU Emissions Trading System have already increased by 21% from 2005 levels, overshooting Poland’s commitment to limit the increase of these emissions to 14% by 2020.

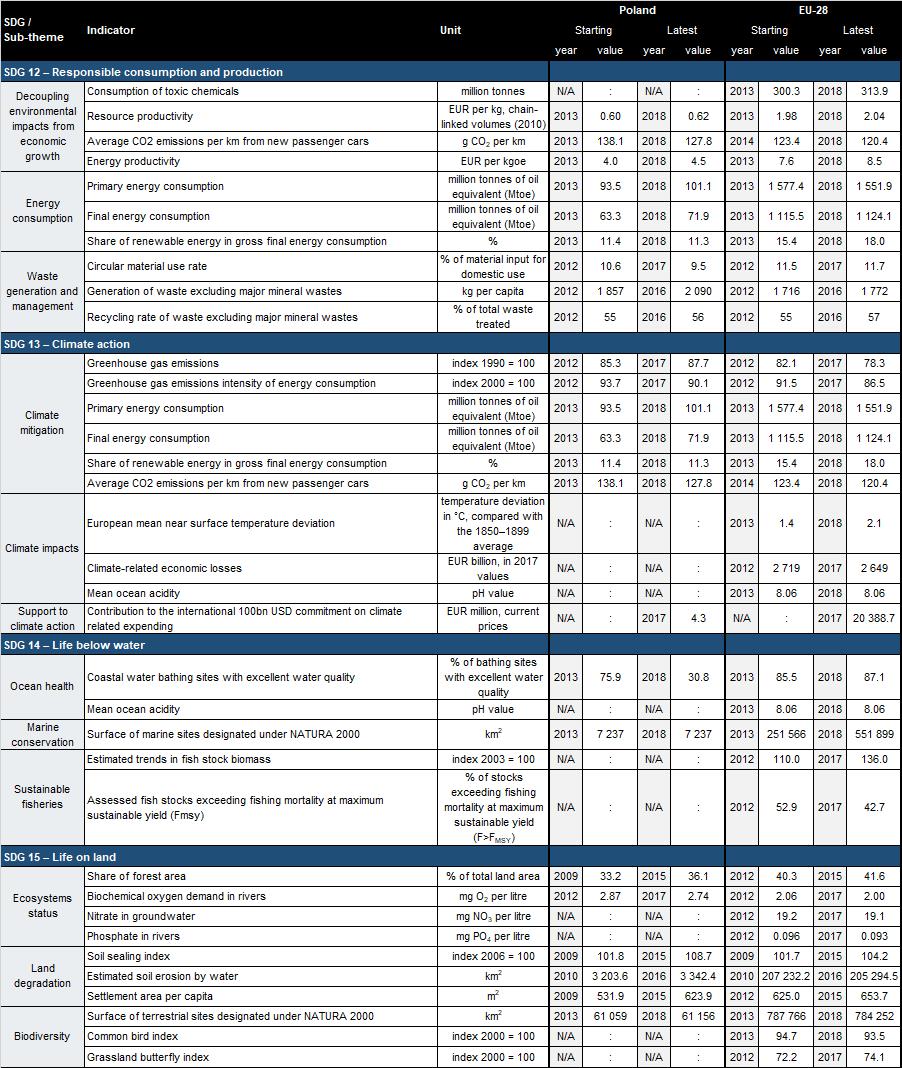

Poland made overall a significant progress with regard to the United Nations’ SDGs. Poland is above the EU average concerning the majority of the indicators pertaining to SDG 1 (no poverty), SDG 4 (quality of education) and SDG 10 (reduced inequalities). Despite significant progress, Poland remains below the EU average with respect to SDG 3 (good health and well-being), SDG 8 (decent work and economic growth), SDG 9 (industry, innovation and infrastructure). The key challenge for Poland with respect to meeting sustainable development objectives concerns SDG 13 (climate action) ().

The key structural issues for Poland’s economy analysed in this report are the following:

·The short term outlook for public finances remains favourable but long-term risks remain. The fiscal deficit is estimated to have increased in 2019, reversing the gradual decline seen in previous years. By contrast, high nominal GDP growth ensured a further decline in the ratio of public debt to GDP. Several changes in taxation were implemented during 2019. Some of them have the potential to simplify tax compliance, but others work in the opposite direction. In a longer term, risks to fiscal sustainability risks are likely to emerge, in particular due to the population ageing.

·Work to reform the budgetary system continues. The expenditure rule remains the cornerstone of the fiscal framework. However, its functioning was weakened by the circumvention of the rule in some recent expenditure programmes. Poland remains the only Member State without an independent fiscal council. The work on reforming the budgetary system has continued and given the complexity it is expected to take several years. It has the potential to increase the efficiency and effectiveness of spending, a crucial challenge considering the increase in public expenditure, which is difficult to reverse as well as expected expenditure pressures, e.g. due to the ageing population.

·The condition of the banking sector remains favourable. Overall, the sector remains well capitalised and resilient. The solvency of most banks remains strong amid prudent regulatory measures. Lending, including residential property financing, has been rising in line with fundamentals. The share of non-performing loans is limited, which keeps risks contained. In turn, following legal actions, the risks related to the remaining stock of foreign-currency denominated mortgages have increased and may require additional capital for some banks. The gradual implementation of the workplace pension scheme might provide support to the development of the capital market.

·Large state ownership in the financial sector increases the importance of independent financial supervision. The state controls close to 40% of the banking sector, as well as the biggest insurance company. This increases the importance of a strong, independent financial supervisor, with appropriate powers.

·Employment rates reached all-time highs, but certain barriers hinder labour market participation for some groups. The unemployment rate stabilised at around 3.5%, a record low. Labour shortages have hampered firms’ growth in many sectors. The future labour supply in part depends on trends in the return migration of Poles living in other EU countries and on the integration of non-EU migrants currently living and working in Poland. Women, older people, persons with disabilities, and those with lower qualifications participate in the labour market much less than in many other EU countries. This is due to several factors, such as limited access to childcare and long-term care, underdeveloped public transport outside large cities, and a low statutory retirement age. Unreformed special pension regimes and a lack of flexibility in working time arrangements are among the factors limiting the labour market flexibility. The share of temporary employment contracts remains high, but has been consistently declining in recent years.

·Skill development has the potential to support productivity and labour market participation. Lower secondary schools, recently abolished due to a reform of the school system, have proven good at fostering basic skills in students, with Polish 15-year-olds being among the best in the EU in 2018. Early school leaving has been among the lowest in the EU. Concerns remain as regards the quality of higher education, average teachers’ skills related to attractiveness of the teaching profession, the labour market relevance of vocational education, development of transversal skills and equal opportunities following the abolition of lower secondary schools. Adults rarely engage in training and other forms of learning. There remain questions on the effectiveness of labour market policies, including measures focusing on acquiring and upgrading skills.

·Poverty and inequality have declined in many dimensions, but certain challenges remain. The share of people at risk of poverty and social exclusion has declined in recent years. Income inequality continued to decline in 2018, following a reduction in previous years. This reduction is to some extent due to favourable labour market trends, including the relatively fast growth of lower wages. The changes to the child benefit introduced in mid-2019 diminished its inequality-reducing impact. Future pensions are expected to be significantly lower in relation to wages, than the ones currently paid. This implies risks for rising old age poverty, amplified by an underdeveloped long-term care system. Given low statutory retirement age, the key challenge lies in encouraging labour market participation beyond this age. Social services remain underdeveloped, including for persons with disabilities.

·Low public expenditure and its suboptimal allocation created problems in the operation of the healthcare system and access to it. Low pay may limit the attractiveness of practising medical professions in Poland. The number of practising doctors and nurses relative to the population remains among the lowest in the EU. Public health expenditure has been among the lowest in the EU for many years. Key challenges regarding the allocation of resources include the underdevelopment of primary care, placing a burden on hospitals.

·Recent policy measures aim to strengthen innovation. Poland took various measures to enhance the economy’s innovative capacity, including changes in higher education, in the organisation of research institutes and the functioning of various tax and subsidy measures. Inputs measured by R&D expenditure have continued rising, while staying well below the EU average. It remains to be seen to what extent these measures will translate into better science-business co-operation and innovation outcomes.

·Various factors act to limit investment activity. Labour shortages are an important investment barrier. While overall the business environment remains favourable, some regulatory deficiencies weigh on confidence and certainty. Business uncertainty remains high concerning some key laws, such as those related to tax and social security systems or energy policies. Some of important laws were passed or proposed using fast-track legislative procedures, without proper social partner and public consultations. A clear risk of a serious breach of the rule of law in Poland continues to exist and may negatively impact the investment climate. The important role played by state-owned and state-controlled companies in some sectors make it essential to ensure a level playing field for private competitors.

·Infrastructure development is progressing, but sizeable investment needs remain. The domestic energy generation infrastructure is ageing and not up to the task of moving to a climate neutral economy. Its renewal is set to require significant investment in the years to come. The capacity and quality of road transport infrastructure have improved, contributing to high growth in road transport, but also to the associated greenhouse gas emissions. In turn, the share of rail in transport services is declining, being hindered by lagging modernisation projects. This also affects the seaports´ inland connections. Despite investments in urban mobility, many people have no direct access to public transport. Improvement in road safety has stalled. There has been significant progress in ultrafast and mobile broadband take-up, although Poland is still far from its connectivity targets.

·Curbing greenhouse gas emissions by decarbonising power generation and heating, and reducing energy intensity are key challenges. Poland faces a risk of missing its 2020 climate and energy targets. Given the difficult starting point, developing a coherent long-term vision for improving the environmental sustainability of Poland’s economy is particularly important. In the absence of coordinated action, greenhouse gas emissions have been increasing since 2014, increasing the future scale and cost of the decarbonisation. The large role of coal in electricity generation, the poor energy efficiency of buildings and fast growing emissions from transport modes represent priority areas for intervention and investment due to not only the climate impact concerns but also environmental pressures of air pollution and water scarcity.

·The transition to a climate neutral economy is an opportunity to modernise the economy, while addressing developmental challenges and citizens’ needs. Continued investment in a carbon-intensive infrastructure poses the risk of stranded assets and competitive disadvantage due to the growing cost of carbon. The future growth of the industry depends on the ability to deploy innovative, technologies aligned with the circular economy model and power sector decarbonisation. The Commission’s proposal for the Just Transition Mechanism under the next multi-annual financial framework for the period 2021-2027 includes a Just Transition Fund, a dedicated just transition scheme under InvestEU, and a new public sector loan facility with EIB. It is designed to ensure that the transition towards EU climate neutrality is fair by helping the most affected regions in Poland to address the social and economic consequences. Key priorities for support by the Just Transition Fund are identified in Annex D, building on the analysis of the transition challenges outlined in this report.

1.

Economic situation and outlook

GDP growth

Economic growth remained strong in 2019. Estimated at 4.0% in 2019, GDP growth slowed from peaks of around 5% annually in the period 2017-2018. Nevertheless, Poland was still among the fastest growing EU Member States. Domestic demand remained the main growth driver and export performance stayed relatively favourable compared to several other EU economies. Nonetheless, weakening global trade affected the performance of Polish exports.

|

Graph 1.1:Real GDP per capita, 2008-2018

|

|

|

|

Source: Eurostat

|

Private consumption contributed the most to growth for the fifth consecutive year. After rising by 4.2% in 2018, private consumption expanded by an estimated 4% in 2019. Several factors contributed. First, labour market conditions remained favourable and were accompanied by high wage growth. Second, tax and benefit measures increased disposable incomes, especially for middle- and high-income households. Third, consumer confidence remained close to multiannual highs in 2019, in particular supported by a favourable view on the labour market situation (Graph 1.2). Finally, spending was also supported by easy access to credit.

Investment kept rising in 2019. Public investment, the key force behind the solid investment expansion in 2018, continued to rise in 2019, yet at a much slower pace. By contrast, private investment growth strengthened in 2019, after several years of weakness. EU funds supported both public and private investments (see Section 3.4.1).

|

Graph 1.2:Consumer confidence

|

|

|

|

Source: ECFIN (BCS)

|

Growth is projected to fall below its potential in 2020 and 2021 (). Private consumption is forecast to continue rising, though at gradually slower rates, thanks to higher consumer confidence driven by favourable labour market conditions and – in early 2020 – also due to changes in personal income tax. Public investment expenditure is expected to increase in 2020, as some previously delayed EU-funded projects should be implemented. Private investment growth is expected to weaken, given the uncertainty on the demand outlook, especially in foreign markets, limiting export growth.

Potential growth

Productivity gains and inflow of foreign workers helped keep potential growth high. The capital accumulation contribution to potential growth increased from the lows of 2016-2017, but remained limited by historical comparison. Productivity gains played the largest role and Poland has continued to catch up in productivity with more developed EU Member States. However, part of the apparent increase in the contribution of total factor productivity to potential growth may be explained by under-reporting of migrant workers in official statistics.

Given the negative demographic outlook, the integration of migrant workers becomes an increasingly important challenge. The working-age population is projected to continue declining in the decades to come. Future growth potential will be increasingly dependent on the successful integration of foreign workers, who already play an important role. Full utilisation of migrants’ skills and competences is an important step for future growth (Section 3.3).

Capital accumulation could contribute more to potential growth. Difficult access to skilled labour increases the incentives to gradually replacing workers by machines in certain tasks to improve labour productivity. New investment may also be needed to move towards a cleaner economy, in particular in the energy sector. The investment outlook remains dependent on perceptions of macroeconomic stability and quality of institutions, including the policy and regulatory environment (Section 3.4).

|

Graph 1.3:Labour productivity in market services

|

|

|

|

Source: Eurostat

|

There is room for faster growth of labour productivity. Starting from very low levels compared to the EU average, labour productivity in Poland has been growing at one of the fastest rates in the EU for the last several years. This growth was broad-based, and visible in both the manufacturing and services sectors (Graph 1.3). Despite this robust performance, there remains substantial room for further catch-up. In 2018, labour productivity was still equivalent to only around 63% of the EU average when controlling for differences in purchasing power. Capital investment and skills upgrading have the potential to continue strengthening productivity growth.

Labour market

With unemployment stabilising at record lows, wage growth remained strong. Total employment gains, as captured by the labour force survey, moderated from 1.4% in 2017 to 0.4% in 2018 and are estimated to essentially have come to a halt in 2019 (Graph 1.4). Constrained labour supply was a key factor behind this deceleration, but increased uncertainty on the demand outlook also affected firms’ hiring intentions. Wages continued to grow at a rate of close to 8%, broadly stable since late 2017. The unemployment rate has stabilised at around 3.5%, a multiannual low and amongst the lowest rates in the EU.

|

Graph 1.4:Employment, wages and unemployment rate

|

|

|

|

Source: Eurostat

|

Firms still face significant labour shortages. While the share of firms indicating lack of skilled labour as a factor hampering their activity declined in 2019 from the highs reached in late 2018, it still remains very high in historical terms. Even with the expected slowdown in economic activity, employers' competition for talent is likely to remain strong in the coming years. Employment rates are particularly low for the less skilled and for women. In addition, while being flexible overall, some institutional settings hinder the functioning of the labour market (see Section 3.3).

Workers from outside the EU play an important role in the labour market. Existing data enable estimates of the number of migrant workers to a limited extent only. This also implies that employment dynamics based on the labour force survey data do not account for changes in the foreign workforce in Poland. In the first three quarters of 2019, the number of foreigners covered by social insurance continued to rise, although more slowly than in 2018. As of September 2019, over 4% of insured were foreigners. In 2018, for the fourth consecutive year, Poland issued the highest number of first residence permits for work-related reasons in the EU. During 2015-2018, Poland accounted for more than half of such permits issued in the whole EU. The vast majority of these permits were for stays of below one year.

Poverty and inequality

Poverty continued to decline. The rate of people at risk of poverty or social exclusion (AROPE) declined from 19.5% in 2017 to 18.9% in 2018, well below the EU average (21.9%), especially driven by a decrease in severe material deprivation (from 5.9% to 4.7%). At the same time, the persistency of poverty, which measure the percentage of people that remained at risk of poverty in at least two of the preceding three years, increased slightly (from 9.1% to 10.5%). Recent reforms focused on increasing social transfers, but social services remain underdeveloped, hampering effective social inclusion (see Section 3.3).

Income inequality declined further in 2017 before stabilising in 2018. The ratio of the total income received by the 20% of the population with the highest incomes to that received by the 20% of the population with the lowest income (S80/S20 income quintile share ratio) also declined in 2018 to 4.25, below the EU average of 5.17. This placed Poland in the middle of the ranking of EU countries in terms of measured inequality levels (see also Graph 1.5). The improvement recorded in Poland can be explained by a combination of growth of employment and wages and, in particular, solid income gains by households in the bottom half of the income distribution. The income of the poorest 40% amounted to 22.6% of the overall income in 2018, on the rise (from 22.1% in 2017) and well above the EU average (21.1%) and the pre-crisis level in Poland (20.9% in 2009).

|

Graph 1.5:Gini coefficient of equivalised disposable income, 2008-2018

|

|

|

|

Source: Eurostat and Statistics Poland

|

The role of social benefits in reducing inequalities likely decreased in 2019, while progress with equality of opportunities is questionable. The tax and benefit system contributed to lowering income inequality in 2016-2017, in particular due to the introduction of the partially means-tested child benefit, but changes to the child benefit introduced in mid-2019 lowered its inequality-reducing impact (Myck et al., 2019). The additional pension lump-sum bonus paid to all pensioners in 2019 strengthened the role of pension in reducing inequality. At the same time, future pensions, in relation to wages, are expected to be significantly lower than the ones currently paid (see Section 3.1). Changes to the organisation of the school system introduced in 2017, whereby pupils are tracked earlier into the vocational and general streams pose a challenge in ensuring equal opportunities, especially for children living in rural areas (European Commission, 2019b). The share of pupils in non-public, fee-paying schools has continued to rise. Access to childcare remains a major challenge. Despite improvements, the enrolment in formal childcare (for children less than 3 years old) stood at 10.9% (EU: 35.1%). In addition, enrolment in early childhood education and care for older children (from 3 years to compulsory school age) was also very low at 59.4%, below the EU average of 86.8% (Section 3.3). Substantial differences to healthcare access also remain visible.

External position

Exports increased faster than global demand. Poland has continued to gain shares in global export markets for both goods and services. The surplus in services trade has continued to grow thanks to the solid performance in sectors such as transport, computer, information services, and other business services.

High diversification of exports and cost-competitiveness helped limit the negative impact of weakening global trade. Poland is increasingly integrated into global value chains, especially in the manufacturing sector. In 2015, Poland had the highest share of domestic value added embodied in foreign manufacturing exports among all EU Member States (). Also, a long-term gradual shift towards higher value added products continues. This is visible for instance in a faster rise in the unit value of intermediate and capital goods exports than in Germany (European Commission, 2019b). At the same time, Poland remains cost-competitive and has a high degree of exports diversification relative to several EU Member States, including neighbouring countries such as Slovakia and Czechia (Graph 1.6). This can partly explain the less severe impact of negative trends in global trade and weaker growth in Germany, the key export destination of Poland.

The current account was close to balance in 2019. The current account has fluctuated close to a balanced position since 2015. In 2019 there was a surplus of 0.6% of GDP, compared to the deficit of 1% in 2018 (based on 12-month moving sums calculated for November 2019).. The balance in trade of goods increased from -1% to 0.2% of GDP on the back of weakening domestic demand and relatively strong export performance. Trends in other major components have been maintained. The primary income balance remained negative at around 3.7 of GDP in 2019, while the surplus in trade in services continued to rise to 4.7% of GDP in 2019 Q3.

|

Graph 1.6:Index of concentration of goods exports, 2018

|

|

|

|

Source: United Nations Conference on Trade and Development (UNCTAD)

|

Poland's negative net international investment position (NIIP) continued to narrow during 2019. The NIIP was -51.3% of GDP at the end of the third quarter of 2019, compared to ‑69% of GDP in 2014. Hence, a gradual improvement has continued since 2015 and even accelerated, mainly as a result of the accumulated stock of net foreign direct investments, which has stabilised at around 36-37% of GDP since 2017. The relative stability of direct investments limits the risks associated with a negative NIIP. In addition, the recent faster improvement in NIIP was associated with risk reduction: the NIIP component excluding non-defaultable instruments went up from ‑19% of GDP in mid-2018 to ‑14% of GDP in mid-2019.

Inflation and monetary policy

Wage pressures transmitted into higher prices of services and a temporary food price hike led to an inflation spike in the second half of 2019. Inflation measured by the harmonised index of consumer prices (HICP) rose gradually during 2019, with divergent trends in its components. Unprocessed food price inflation spiked in the middle of the year to above 10%. Inflation pressures increased gradually in the services sectors, in part due to the transmission of wage increases. By contrast, energy price inflation declined strongly turning negative in the second half of 2019 due to base effects, low global oil prices and administrative controls on electricity prices for households. HICP inflation increased to 2.1% in 2019, reaching even 3.0% in December. Going forward, overall HICP inflation is expected to temporarily go above 3% in early 2020 and to subsequently stay close to 2.5% until the end of 2021. Services price inflation is projected to continue rising at a fast pace, given wage pressures.

The National Bank of Poland has kept interest rates unchanged since March 2015. The forward guidance from the Monetary Policy Council indicates unchanged interest rates in 2020 and beyond. The Council statements indicate a prevailing view that the acceleration of inflation in the second half of 2019 was largely driven by temporary factors beyond the control of monetary policy (especially supply-side induced food price hikes), while slowing economic growth should help keep inflation close to the 2.5% target over the coming quarters. The November 2019 inflation projection of the NBP expected inflation to peak at around 3.5% in early 2020, subsequently fall to 2.5% by mid-2020 and stay around this level until the end of 2021. This is broadly similar to the path implied by the Commission’s Winter forecast (see above). The Polish zloty exchange rate against the main currencies was stable in 2019. After a slight weakening in August and September 2019 (in particular against Swiss franc), the zloty returned to the levels seen in the first half of the year.

Indebtedness, financial sector and markets

Private indebtedness remained low. Polish households and non-financial companies are still among the least indebted in the EU, with total debt stock equivalent to about three quarters of GDP. Loans to the private sector increased by 5% per year in the fourth quarter of 2019, in line with the long-term trend and nominal GDP growth.

The banking sector as a whole has remained in a good condition. The solid capital buffers, stable profitability and liquidity and sound asset quality of Polish banks limit risks to financial stability. While differences between banks are visible, the sector's profitability remained stable and strong in 2019. The uncertainty concerning the remaining stock of foreign currency-denominated mortgage loans increased for banks after the European Court of Justice’s ruling in October 2019, which implied that foreign-currency denominated mortgages could require additional capital (see Section 3.2).

The housing loan market is expanding, but currently it does not pose a significant systemic risk. The outstanding stock of housing loans in relation to GDP remains one of the lowest in the EU. A large share of real estate transactions continues to be paid outright rather than financed by mortgage loans, and such purchases may often be treated as investment given low deposit interest rates. The growth in the value of housing loans strengthened during 2019, to around 6.6%, mainly reflecting a weakening of the zloty exchange rate relative to the Swiss franc, a currency in which some 23% of outstanding loans are denominated. Mortgage loans in zloty have been rising at the steady pace of some 10-13% since 2015. Nearly all mortgages issued in Poland are subject to variable interest rates, which could place substantial financial pressure to households in the event of interest rate increases. Nevertheless, risks are limited so far, as the share of new loans with high loan-to-value has been reduced and the share of non-performing loans is limited (see Section 3.2).

House prices continued to rise fast in 2019, but risks of overheating are limited. According to Statistics Poland data, prices of residential premises in the third quarter 2019, compared to the corresponding quarter of 2018, increased by 9.0% (of which on the primary market by 6.7% and on the secondary market by 10.9%). House prices increased by around 6.5% annually (National Bank of Poland data) in the secondary market in the largest cities and by around 12% if the index is corrected for real estate quality changes. Despite dynamic price growth in recent years, there is no evidence of house price overvaluation. In 2019, deflated house prices grew faster than real wages. However, the opposite was observed for several years before and, hence, real estate remains affordable in historical and EU-wide comparison. In 2018, the average price of a 100 m2 dwelling was equivalent to 9.8 years of average disposable income per capita, close to the EU average.

Stock market performance remained subdued. The main index of the Warsaw Stock Exchange stayed broadly stable during the first half of 2019, before declining in the third quarter. During 2019 as a whole the index declined by 6.4%, in contrast to the Stoxx Europe 600 Index’s 23% gain in 2019. The Warsaw Stock Exchange performance was also weaker than in other markets in the region.

Public finances

Fiscal expansion in 2019 led to an increased headline deficit, breaking the long-trend declining trend. Fast economic growth with rising wages and the ongoing shift of employment towards contracts subject to higher social security contributions explain the strong growth of revenues from personal and corporate income tax and social security contributions in 2019. Personal income tax (PIT) revenues declined at the end of the year due to the lowering of the tax burden (Section 3.1). The dynamics of indirect tax revenues slowed visibly (Section 3.1). The key component of the fiscal stimulus in 2019 was on the expenditure side, in particular new social transfers. A combination of these factors explains an increase in the headline fiscal deficit to an estimated 1% of GDP, up from 0.2% in 2018.

The structural deficit also increased in 2019 and fiscal challenges are visible in the medium term. When adjusting for the effects of the economic cycle and excluding one-off and temporary measures, the fiscal balance improved until 2018 though much more gradually than in the case of the headline balance. In 2018, Poland was close to reaching the medium-term objective of ‑1% of GDP (). According to the Commission’s Autumn 2019 forecast, the structural balance is projected to have declined in 2019 and is not expected to reach the medium-term objective until 2021. The rising share of public expenditure that is difficult to adjust creates challenges in the medium- and long-term perspective given the expenditure pressures likely to arise in certain areas, such as healthcare, human capital and infrastructure investment, and areas impacted by future steps to support the decarbonisation of the economy.

The general government debt continues to fall. Fast nominal economic growth and the low headline deficit helped to lower the general government debt-to-GDP ratio from 49% at the end of 2018 to an estimated 47% at the end of 2019. A further decline in public debt is projected, down to around 44% of GDP at the end of 2021.

Progress towards sustainable development

Poland made overall a significant progress with regard to the United Nations’ Sustainable Development Goals (SDGs). In the environmental dimension, Poland’s energy-intensive economy faces various challenges to move closer to climate neutrality, as reflected long and increasing distance from targets of SDG 13. While Poland performs above the EU average on energy import dependency (despite an increase in short and long-term), primary and final energy consumptions are above the EU average and are moving away from sustainable development objectives. Poland is lagging behind the EU average concerning affordable and clean energy (SDG 7). Improving air quality in Polish cities remains a priority (SDG 11). In turn, concerning the labour market and social dimension, Poland has improved in various areas and performs relatively well, however further steps are needed to achieve sustainable development objectives. Poland stands above the EU average in terms of indicators related to poverty measures (SDG 1), quality of education (SDG 4) and reduced inequalities (SDG 10). Good health and well-being showed some progress over the long term. In turn, Poland is lagging behind the EU average in SDG 5 (gender equality) both in terms of education and employment, and the gender pay and employment gaps are hardly improving.

|

|

|

Table 1.1:Key economic and financial indicators - Poland

|

|

|

|

Source: Eurostat and ECB as of 4-2-2020, where available; European Commission for forecast figures (Winter forecast 2020 for real GDP and HICP, Autumn forecast 2019 otherwise)

|

|

|

2.

Progress with country-specific recommendations

Since the start of the European Semester in 2011, 42% of all country-specific recommendations addressed to Poland have recorded at least ‘some progress' (see Graph 2.1). Substantial progress was achieved in the fields of product markets, with ambitious reforms of access to professional services, and of public finance, with the introduction and successful functioning of the expenditure rule. Some progress was achieved concerning labour market reforms thanks to the implementation of measures targeted at increasing labour market participation and addressing labour market segmentation. Also, some progress was observed in research and innovation thanks to tax reliefs and measures to facilitate the financing of R&D activities. Limited progress was observed in a number of areas, including life-long learning, enforcing contracts or removing obstacles to infrastructure investment. No progress was achieved in reforming special pension regimes, in establishing an independent fiscal council, limiting the use of reduced value added tax (VAT) rates, as well as improving the regulatory environment by safeguarding effective consultations in the legislative process.

In the area of public finance Poland achieved noticeable progress mainly in lowering its headline deficit and improving tax collection. Poland corrected its fiscal deficit and consequently the excessive deficit procedure was closed in 2015. Tax compliance has markedly improved in recent years. The recently implemented new VAT matrix has limited the complexity of the system of reduced VAT rates. However, it did not address the issue of the high foregone revenue resulting from the extensive use of reduced VAT rates. Poland continued the reform of the budget system. At the same time, it remains the only EU member state without a fully-fledged fiscal council. In addition, recent expenditure was implemented in manner that circumvented the expenditure rule. The reversal of the 2012 reform to gradually increase the statutory pension age will reduce the adequacy of pensions in the future and is a risk for the sustainability of public finances. Some of the limited measures to reform special pension arrangements for the uniformed services were reversed in 2019. No effective actions to reform the special pension arrangements for miners and farmers have been undertaken.

|

Graph 2.1:Overall multiannual implementation of 2011-2019 CSRs to date

|

|

|

|

Source: European Commission

|

Although labour market participation increased in recent years it remains, however, below the EU average reflecting insufficient policy measures. The low activity rate of specific groups such as older workers and women persists. Access to early childhood education and care has improved, but still constitutes a major challenge for children below 3. The provision of long-term care services remain very limited as well. Several actions adopted during 2015-2017 helped to reduce labour market segmentation, but the share of open-ended contracts in total employment remains low. The intentions of the recent reforms to improve labour market relevance of vocational education and the quality of higher education are commendable, however, their scope is limited and the full effects remain to be seen. The Integrated Skills Strategy is currently being prepared, but so far coordination of adult learning policy remains inefficient.

Poland has achieved mixed results as regards enhancing the innovative capacity of the economy and the regulatory environment. The country has taken measures to support its research institutions through a comprehensive Higher Education reform that started in 2018. Some measures were taken with respect to strengthening science-business links, including the creation of the Łukasiewicz Network, the introduction of the industrial doctorates programmes and the inclusion of external stakeholders in university councils. In 2016-2019, Poland has diversified and increased the effectiveness of R&D tax incentives by increasing the deducible amounts. Concerning the regulatory environment, the introduction of the 2013-2015 reform allowed substantial progress to be made in liberalisation of the access to professional services. Regarding contract enforcement, most of the provisions of the late payments regulation enter into force in 2020. The new Building Code, simplifying the requirements for construction permits, was adopted by the Sejm. Some measures have been taken to improve the legislative process for the draft laws put forward by the government, but the insufficient scope of the public consultations has not been addressed (see Section 3.4).

Overall, Poland has made limited () progress in addressing the 2019 CSRs. Limited progress was achieved in addressing the recommendation on public finance. The reform of the budgetary process continued in 2019, but the full implementation is still to materialise. There was no progress in increasing the effective retirement age and reforming the preferential pension schemes. Limited progress was observed in increasing labour force participation, as access to childcare continued to improve, but no major actions were taken to remove remaining obstacles to more permanent types of employment. Limited progress was also achieved regarding the quality of education and skills as the higher education reform progresses, but the school system reorganisation has led to worse working and learning conditions in many schools. With a launch of the Łukasiewicz Research Network and measures to support research institutions through the implementation of the Act on Higher Education some progress was registered in the field of strengthening the innovative capacity of the economy. Overall, limited progress was observed in strengthening investment-related policies. Various measures have been taken in innovation (via dedicated measures of the National Strategy of Regional Development 2030), transport (via the Strategy of Sustainable Transport Development until 2030 and dedicated measures of the National Strategy of Regional Development 2030), digital infrastructure (a new broadband fund set up), energy infrastructure transboundary gas and electricity infrastructure development), healthcare (via dedicated measures of the National Strategy of Regional Development 2030) and cleaner energy (e.g. an auction schedule of 2.5 GW onshore wind in total and new subsidy system for rooftop photovoltaics). No progress was observed in improving the regulatory environment, as some crucial laws are still being fast tracked with insufficient social partner and public consultations.

Upon Member State’s request, the Commission can provide tailor-made expertise via the Structural Reform Support Programme to help design and implement growth-enhancing reforms. Since 2017, such support has been provided to Poland for 34 projects. In 2019 several projects have been delivered on the ground. The Commission, for example, provided the authorities with support to develop a plan to improve inclusive education, set up policies for energy poverty reduction that will contribute to the reduction of carbon emissions, and draft a Capital Market Development Strategy. In 2019, work started on developing methodologies for estimating excise and corporate income tax gaps and for the digitalisation of construction planning.

|

|

|

Table 2.1:Assessment of implementation of 2019 country-specific recommendations

|

|

|

|

|

|

Box 2.1: EU funds and programmes to address structural challenges and to foster growth and competitiveness in Poland

Poland is the country benefiting most from EU support in absolute numbers. The financial allocation from the EU Cohesion policy funds (

I

) for Poland amounts to €90.6 billion in the current Multiannual Financial Framework, equivalent to around 2.7% of the GDP annually. By the end of 2019, some €84 billion (around 93% of the total amount planned) were allocated to specific projects (

II

), while €37 billion were reported by beneficiaries as spent, showing a level of project implementation in line with the EU average.

EU Cohesion policy funding play a significant role in addressing structural challenges in Poland. The Cohesion Policy programmes in Poland have allocated EU funding of €18 billion for smart growth (i.e. investment in knowledge and innovation), €40 billion for sustainable growth and transport, which encompasses investments in a more resource efficient, greener and more competitive economy and €16 billion for inclusive growth (i.e. investments in high-employment economy and social and territorial cohesion). In 2019 following a performance review (

III

) €5.4 billion have been made available within performing priorities in Poland.

EU Cohesion policy funding contributes to major transformations of the Polish economy. The European Regional Development Fund, the Cohesion Fund and the European Social Fund are promoting growth and employment via investments. By the end of 2018, 482 km of roads belonging to the Trans-European Transport Networks (TEN-T) were built. Over 10,000 enterprises, including 278 start-ups, received support. Investments contributed to the estimated annual reduction of greenhouse gas emissions by over 100,000 tons of CO2 and over 120,000 people gained access to improved wastewater treatment. Almost 800,000 unemployed and inactive people were supported with activation measures and nearly 70,000 students participated in vocational traineeships in companies. Over 44,000 new places in childcare and preschools were created and more than 200,000 people at risk of poverty or social exclusion benefitted from social or healthcare services.

Agricultural and fisheries funds and other EU programmes also contribute to addressing investment needs. The European Agricultural Fund for Rural Development makes available in total €13.6 billion and the European Maritime and Fisheries Fund in total €710 million (including the national co-financing for both). Poland benefits also from other EU programmes, such as the Connecting Europe Facility, which allocated EU funding of €3.9 billion to specific projects related on strategic transport networks and Horizon 2020, which allocated EU funding of €478 million (including supporting 250 SMEs with about €120 million).

EU funding contributes to mobilisation of important private investment. By the end of 2018, programmes supported by the European Structural and Investment Funds (

IV

) supported programmes alone mobilised additional capital by committing about €3.7 billion in the form of loans, guarantees and equity (

V

), which is 4.6% of all decided allocations of the European Structural and Investment Funds.

EU funds already invest substantial amounts on actions in line with the Sustainable Development Goals (SDGs). In Poland European Structural and Investment Funds support 13 out the 17 SDGs and up to 95% of the expenditure is contributing to those.

|

3.

Reform priorities

3.1.Public finances and taxation

Tax system

Tax burden in Poland continued raising, yet it remained lower than in the EU. At 35.2%, the 2018 tax-to-GDP ratio in Poland was higher than 34.1% observed in 2017. Still, it was below the EU average of 39.2%. This difference is explained mainly by labour taxation.

The gradual decline in the nominal fiscal deficit reversed in 2019. Poland was the only EU Member State that weathered the financial crisis of 2008-2010 without a recession. This came at a cost of, inter alia, a high increase in the headline fiscal deficit. Since then, between 2010 and 2018, the country has carried out a substantial fiscal consolidation, cutting its deficit by over 7 percentage points and bringing its public finances close to balance in 2018. This trend is estimated to have reversed in 2019, due to a set of new tax and social policies reducing direct tax income and increasing social spending (Graph 3.1.1).

|

Graph 3.1.1:General government revenue and expenditure change, fiscal deficit, 2010-2021

|

|

|

|

Source: European Commission

|

Public expenditure is likely to increase. The ratio of expenditure to GDP has constantly declined over recent years, from 44% in 2011 to 41% in 2017. It grew slightly in 2018. Social spending was the biggest expenditure item that – as a share of GDP – grew from some 14% in 2011 to 15% in 2018, following the implementation of new social policies. It is estimated to have further increased in 2019, reflecting the removal of means testing in the universal child allowance scheme and the payment of an additional benefit to pensioners. On top of this, the wage bill of a part of public administration which had been frozen for a number of years until 2015 has since gradually increased, with a significant rise in 2019 and, especially, 2020. Also teachers – representing close to one fifth of the general government wage bill – will see their remuneration gradually rise between 2018 and 2020. These developments, difficult to reverse, will raise the ratio of public spending to GDP to some 42% in the near future.

Poland continued its efforts to increase tax compliance and to combat fraud. In 2019, the split payment scheme became compulsory for some types of transactions covering certain fraud-prone goods and services, including the electronic, coal, steel and building industries. In addition, a new tool, the ‘white list of taxpayers’, was put in place to enforce verification of potential business partners and to diminish the risk of being involved in fraudulent transactions. These changes were complemented by the introduction in 2020 of mandatory online cash registers for certain taxpayers. Moreover, to enforce existing and newly introduced tax requirements, a series of fines were implemented. In the area of the corporate income tax, several changes to increase compliance were introduced, including an automatic exchange of information on cross-border tax schemes.

Maintaining the recent remarkable pace of revenue growth will be challenging. In recent years, public revenue growth was reaching double-digit values. The strong economic environment but also several tax reforms contributed to this (European Commission, 2019b). Tax collection has systematically improved, initially for value added tax (VAT) and then for direct taxes. For instance, the 2019 study on the VAT gap, i.e. the difference between VAT revenue expected and actually collected, showed that in 2017 Poland reduced its VAT gap by around one third, to below 14% (CASE and IAS, 2019), approaching the EU average of 11%. This may indicate that further large collection gains are less likely, as recent tax revenue developments suggest (Graph 3.1.1). In view of expected economic slowdown (Section 1), the strong procyclicality of VAT revenue in Poland is another risk factor weighing on the medium-term prospect for VAT revenue growth (European Commission, 2019b).

|

Graph 3.1.2:Tax revenue dynamics

|

|

|

|

Source: Ministry of Finance

|

Measures aimed at reducing direct taxes will likely reduce revenue. In 2019, Poland decreased the corporate income tax (CIT) rate for small and medium enterprises (SMEs) and start-ups. In 2020, this was followed by a significant increase in an annual turnover threshold to qualify as a ‘small’ taxpayer. In addition, a tax incentive to support innovation was implemented (European Commission, 2019b). Overall, these reforms have a limited budgetary impact, while aiming to boost activity and innovation. In turn, recently implemented changes to the PIT come at a high cost. With a stated objective to reduce the tax wedge, in 2019, the first PIT rate was lowered from 18% to 17% and tax-deductible costs were raised. In addition, a special PIT exemption for young taxpayers was introduced. The above changes will have a negative budgetary impact of some 0.5% of GDP yearly. It will be only marginally compensated by an introduction of a special levy on high-income earners.

Labour taxation complexity has increased. Following recent changes, the default PIT system includes two tax rates of 17% and 32%. In most common situation, employed taxpayers are entitled to deduct one of four lump sums of tax-deductible costs. They can also benefit from a tax-free allowance that declines as their revenue increases. High-income earners have no right to this allowance, while since 2019 a special levy of 4% applies to those whose taxable income is over 1 million złoty. Since 2019, young taxpayers enjoy the right to a special exemption that ends abruptly when they reach 26 years of age. On top, some 0.6 million self-employed use their right to pay a flat PIT rate of 19%, while farmers, in general, do not pay PIT. Some other solutions exist also in specific cases, such as the right to pay a flat tax amount set by the tax authorities independently of the income level.

The labour tax wedge depends strongly on the type of labour contract. In 2018, the labour tax wedge in Poland was slightly lower than the OECD average (OECD, 2019e), with lower differences between low and high income earners than in the OECD. Considering the design of PIT, the tax wedge is driven by social security contributions, particularly at the lower end of income distribution. In Poland, the share of civil, i.e. non-standard, labour contracts is high. In 2018, some 1.1 million people concluded a civil contract without having a standard labour contract elsewhere (Statistics Poland, 2019b). More than 90% of those people worked on the ‘mandate contract’, which offers the possibility not to pay social security contributions for revenue higher than the minimum wage. The remainder, working on a ‘contract of specified work’ did not need to pay social security contributions. Simultaneously, self-employed workers benefit from a significant discretion in determining the level of their social security contributions. This is likely to reduce the adequacy of future pensions.

Several measures aimed to improve the collection of social security contributions. In 2018, the payment of contributions was simplified and the collection of unpaid contributions was strengthened. In addition, the authorities have now more tools and powers to control social security expenditure, for instance for sickness allowances. However, these changes did not target the issue of differentiation in terms of contributions.

Poland took action to reduce tax uncertainty and complexity in the area of VAT, but the cost of compliance remains high. In 2019, the compound and error-prone system of assigning VAT rates to products and services was reviewed and simplified and will become fully applicable in the first half of 2020. A number of ambiguities were removed. This has thus the potential to reduce uncertainty and time needed to comply with tax obligations. In recent years, as estimated by the World Bank (2019a), this time has increased significantly for a model company operating in Poland and has remained significantly above the levels observed in the region (Graph 3.1.3) (). Nevertheless, the reform did not tackle the issue of high foregone revenue due to the application of reduced rates, estimated to be one of the third highest in the EU in 2017 (CASE and IAS, 2019).

|

Graph 3.1.3:Time to comply with tax obligations for a medium-sized company, 2010-2019

|

|

|

|

Source: World Bank

|

Environmental taxes are hardly used as a tool to drive environmentally friendly behaviour. Poland collects relatively high environmental taxes, as compared to other EU countries (European Commission, 2019e). Yet, they do not appear to encourage environmentally oriented behaviour. Most of environmental taxes are energy-related, but there are exemptions, for instance for energy-intensive industries. In addition, in 2019 the excise duties on energy were lowered and energy prices administratively controlled, with the state compensating energy producers for potential losses. Conversely, a tax on plastic bags was modified to more effectively reduce their use.

The outgoing parliament did not modernise the tax framework law. The reform was prepared over several years by a dedicated experts’ tax force and was subject to extensive public consultations. It was intended to set a new, more taxpayer oriented, tax framework. It is currently unclear if and when work will be resumed.

Fiscal framework

The fiscal framework has been weakened as some expenditure increases circumvent existing rules. In recent years, the design of the Polish fiscal framework has remained unchanged. Numerical fiscal rules, defining allowable level of deficit, debt and expenditure at various government levels, appear to be its strongest element. Particularly the stabilising expenditure rule that covers nearly the entire general government sector fulfils an important role in preventing policymakers from overspending. The rule defines a nominal expenditure level of a set of entities and funds specified in the law. Though, several new expenditure items (e.g. the exceptional additional pension payment, development of local bus connections, support for adults with disabilities) are channelled through newly created funds that do not fall under the rule. As a result, their implementation did not trigger savings in other areas. While this practice strongly weakens its role, the rule remains a crucial tool limiting an unsustainable increase in expenditure.

Work is continuing to reform the budget system. Poland – supported by EU funds and in line with Council recommendations – is carrying out a reform to address several weaknesses in the budget system. They include amongst others: complex and outdated budget classifications; suboptimal recording of information; lack of genuine medium-term planning, and a lack of direct leverage of spending reviews on the budget process, all of which hamper the efficient and effective management of funds and clear accountability for them (European Commission, 2019b; Wiczewski, 2020). The ambitious goal of the reform is to achieve a coherent budgeting process that goes beyond one-year planning. The reform appears important in light of the limited room for additional major revenue increases, longer-term expenditure pressures and inefficiencies in spending management. Given the complexity of the reform, its implementation will take several years. Its final completion date has not been announced.

Debt sustainability analysis and fiscal risks

In the short term, fiscal sustainability analysis indicates low risk. Following strong nominal GDP growth and relatively low fiscal deficits over recent years, the general government debt-to-GDP ratio continued to decline to around an estimated 47% in 2019. Following the Commission autumn 2019 forecast, it is expected to continue to gradually decline to some 44% in 2021. The 2019 debt sustainability analysis (European Commission, 2020a) points to a low fiscal sustainability risk in the short run. The structural balance had been gradually improving until 2018, but did not reach the MTO of -1% of GDP. It is estimated to have worsened in 2019, following the implementation of a social and tax package.

No major medium-term risks to fiscal sustainability have been identified. In the medium run, the S1 fiscal sustainability indicator points to a low risk given that the debt-to-GDP ratio is expected to gradually decline in the different scenarios (see Annex B and Graph 3.1.4). Consequently, no fiscal adjustment relative to the baseline ‘no-policy change’ fiscal scenario is warranted to keep the debt-to-GDP ratio below the reference value of 60% by 2030.

Fiscal sustainability risks are likely to emerge in the pension system. By design, the Polish pension system based on a defined contribution is balanced. It assumes that the accumulated capital will be paid over the whole expected period of retirement. Those fulfilling certain criteria will qualify for a minimum pension benefit, currently about €260. In theory, the system does not require public funds’ support, except for topping up minimum pension payments for those who did not accumulate sufficient capital. However, since 2019 all pensioners are receiving an extra monthly benefit equivalent to one month minimum pension, weighing on public finances. Given an expected fast population ageing and relatively low statutory and effective retirement age in Poland, a significant drop in pension adequacy is expected. According to a scenario analysed by the Economic Policy Committee and the European Commission (European Commission, 2018b), after 2060 around one third of pensioners are projected to receive only the minimum pension benefit that would, in turn, fall to some 20% of the then average wage. This might be unsustainable from the social point of view. Also, with the share of pensioners in the population of voters expected to increase strongly, this might lead to political pressure to increase pensions and thus increase fiscal sustainability risks.

|

Graph 3.1.4:Medium-term public debt scenarios

|

|

|

|

Source: European Commission

|

A change to the pension system proposed recently does not tackle adequacy risks. In 2019, the government adopted a draft bill to overhaul the pension system. The current second pension pillar is set to be phased out. Assets managed there will be transferred to the state-managed general pension system (first pillar), or to the privately managed third pillar. Those who opt for the transfer to the third pension pillar will be subject to a conversion fee of 15% of asset value. In turn, these assets will become private property that is inheritable, in contrast to assets transferred to the first pension pillar. Under national rules, the conversion fee will support the public revenue. The measure, however, may not address the risk related to future pension adequacy or pension system sustainability.

3.2.

Financial sector

The banking sector remains resilient to shocks with safe levels of accumulated capital and low leverage. In recent years, the consolidation in the sector has continued and the share of the state has increased. Solvency levels remained high in 2019, while total assets kept growing at 8.7% per year. The sector’s aggregate profitability was also robust due to moderate lending growth and decreasing costs. Risks related to the legacy portfolio of foreign-currency mortgages, following the ruling of the European Court of Justice(), could imply the need to provide additional capital.

|

|

|

Table 3.2.1:Banking sector financial stability indicators

|

|

|

|

Source: European Central Bank

|

|

|

The solvency of most banks remains strong amid prudent regulatory measures. Capital endowment of most banks enabled them to comply with existing prudential requirements as well as requirements on capital buffers. At the end of June 2019, four banks did not meet capital ratios standards, including two small commercial banks and two cooperative banks (with aggregate share in banking sector assets of 1.5%). Compared to regional peers capital adequacy ratios were affected by higher risk weights imposed by the Polish regulator and more stringent regulatory minimum capital requirements (). Moreover, a further capital requirement on the banks’ exposure to foreign-currency mortgages has been applied.

Preventive policies () applied to residential property financing contribute to low risks. Households’ mortgage-related debt is predominantly denominated in Polish złoty. Virtually all mortgage loans are based on variable interest rates implying risks if interest rates increase. According to the central bank’s stress tests, these risks are nevertheless manageable (NBP, 2019a). The ratio of non-performing loans in the housing loan segment is low, at 2.4% and 3% on average, in the case of discontinued legacy mortgages denominated in foreign currencies. These loans represent about 5.5% of the sector’s balance sheet and amortise at 8% each year. With an overall non-performing loans ratio of 6.2% in mid-2019 credit risks remain contained.

Foreign-currency denominated mortgages could require additional capital. In 2019 the authorities dropped plans to set up a relief fund for foreign-currency loan borrowers or apply a systemic conversion of the loan book denominated in Swiss francs. Instead, efforts focused on assisting struggling borrowers, including those with loans in national currency. This has eased pressure on banks. However, risks of legal action by borrowers have considerably increased following the ruling of the Court of Justice of the EU. According to the supervisor, the ruling did not mean an automatic reconversion into złoty of all Swiss franc denominated and indexed loans. However, the question of whether additional reserves need to be created remains open.

The profitability of most banks remained strong. Business growth and improving quality of loan books have helped banks to achieve a stable return on investment (Table 3.2.1). However, differences between lenders are visible with some credit institutions recording losses. Banks continue to struggle with persistently low interest rates, intense competition and costly contributions towards the deposit guarantee fund, the resolution fund, as well as the special levy on financial institutions. As in previous years, to preserve profitability, banks aim to provide higher yielding consumer loans segment and for further decreasing interest rates on term deposits. As in most EU member states, Polish banks continue to cut costs by decreasing the number of employees and branches. Despite the cost burden, the banks' cost-to-income ratio was 57.5% as of June 2019, unchanged from the year before and comparable to regional peers. Going forward, the main risk are possible court cases by Swiss franc borrowers (see above).

The banks’ funding structure remains unchanged. The banking system is primarily funded by stable – mainly households – deposits. Non-financial sector deposits grew by 10.2% per year and funded over 60% of banks assets. Notwithstanding the fact that Poland has one of the most developed capital markets in the region, banks reliance on the wholesale market remains limited. Market funding is slowly rising driven by increased issuances of covered bonds. Going forward, the share of debt issuance aiming to satisfy requirements for ‘bail-in-able liabilities’ (minimum required eligible liabilities, MREL) is bound to rise. However, meeting these targets is likely to be challenging for the Polish banking sector.

The ownership structure of the Polish banking sector continues to change. For a number of foreign parent banks the main factor in considering selling their Polish business were challenges in their own core business profitability and equity position. In addition, declining returns of Polish subsidiaries, uncertainty related to foreign-currency mortgages, the increasing role of state-controlled banks and concerns about the rule of law situation may have negatively impacted the investment climate. Therefore, the consolidation in the sector is bound to continue, possibly leading to the emergence of a market with a small number of universal players and some specialised lenders.

The state’s share in the system is increasing, underlining the role of strong and independent supervision. State ownership (direct and indirect) until recently was limited to the biggest bank and some smaller players. It now accounts for about 40% of total assets including the two major systemically important banks on top of the biggest insurance group. The tight interconnection between the sovereign and the financial system poses particular supervisory challenges, such as: paying close attention to the governance structure, and ensuring that politics are kept at arms’ length from commercial decisions. In addition, given the weight of state control in the system and the size of the state-controlled banks, the supervision authority also needs to focus on preserving competition and a level playing field. Lastly, it remains essential that the rights of minority shareholders be preserved.

Bank lending segments developed in line with underlying fundamentals, with sound fundamentals indicating further growth. Mortgages, representing some 70% of households’ debt, grew by 7.5% per year in June 2019. The lucrative consumer-lending segment remained dynamic with annual growth of 9.1%, exceeding GDP growth. Small and medium enterprises remain cash rich and reluctant to borrow from the banking system. This loan segment grew by 3.9% per year (June 2019), whereas bigger corporates increased their loans by 11%. Low private indebtedness and a housing market without major imbalances (see Section 1) combined with banks’ own funds levels and ample liquidity well beyond the required regulatory minimum allow for future loan growth.

The new employee’ capital plans might support the development of the capital market. So far, the capital market lacks traction in both equity and fixed income segments. These plans are private long-term saving plans aimed at increasing current households’ savings, supporting incomes at retirement, and boosting the capital markets, by increasing invested capital by planned 0.7% of GDP each year. The implementation started mid-2019 with the biggest employers and will gradually involve smaller firms. Once fully implemented in 2021, authorities expect the scheme to cover around 8.6 million employees (with an assumption of a participation rate of 75%; however, at the end of 2019 it reached only around 44% in large companies). These plans are to be funded by employees, employers and the state budget in the form of a subsidy. Each participant may withdraw its funds at any time or opt out from making further contributions.

A new strategy aims at developing the Polish capital market. The main goal of the recently adopted strategy is to improve access to finance for companies (especially SMEs) by increasing the attractiveness of the Polish capital market. To achieve this goal, the strategy aims to overcome about 20 barriers preventing access to finance to firms and to further develop a competitive infrastructure that allows for a more agile market development and innovation. The document – for which the European Commission provided technical support – lists 90 proposals. In addition to access to finance, it looks at improving financial literacy, creating a savings culture and improving trust and governance at Polish firms, including state-owned enterprises.

3.3.

Labour market, education and social policies

Labour market

The labour market performs well on the back of strong economic growth, but some challenges remain. The employment rate of people aged 20-64 has continued to rise reaching around 73% in the third quarter of 2019, an all-time high. However, regional differences are significant. Warsaw has an employment rate (20-64) of 82.5%, much higher than in Warmińsko-Mazurskie Voivodship (66.7%). The shrinking pool of people being able to meet labour market demand weighs on employment growth, which is estimated to have practically come to a halt in 2019. The activity rate has been steadily rising, while the unemployment rate stabilised below 3.5% in 2019, among the lowest in the EU. Both long-term and youth unemployment rates have declined to record lows in 2019 to below 1% and 10.1%, respectively. At the same time, significant differences across regions remain.

|

Graph 3.3.1:Employment rate in Poland, 2018

|

|

|

|

Source: Eurostat

|

Labour shortages in Poland persist. Almost half of the firms in the industry and construction sectors reported labour shortages as a factor limiting production in 2019 according to the Business and Consumer Surveys of the European Commission (), among the highest shares in the EU. Reported labour shortages were also relatively high in services (28.5%), a sector that accounts for close to 60% of total employment. The shortages would be significantly higher without substantial inflows of migrant workers, mainly from Ukraine (see Section 1). An important long-term trend is the changing characteristics of jobs in Poland in-line with ongoing technological development. An increasing share involves non-routine cognitive tasks, requiring high skills (Hardy et al., 2018), which may lead to some mismatches in the labour market in the future.

Employees with permanent contracts account for a low, but increasing share of total employment. In 2018, 60.6% of those in employment had a permanent contract, 1.5 percentage points more than in the previous year. Among employees, the share of temporary contracts has continued to fall, yet remained at 20.8% in Q3 2019, among the highest in the EU. Self-employment, at a share of 17.6% of total employment, remains also significant (Q3-2019, age group 20-64).