EUROPEAN COMMISSION

EUROPEAN COMMISSION

Brussels, 8.11.2017

SWD(2017) 650 final

COMMISSION STAFF WORKING DOCUMENT

IMPACT ASSESSMENT

Accompanying the document

Proposal for a Regulation of the European Parliament and of the Council setting emission performance standards for new passenger cars and for new light commercial vehicles as part of the Union's integrated approach to reduce CO2 emissions from light-duty vehicles and amending Regulation (EC) No 715/2007 (recast)

{COM(2017) 676 final}

{SWD(2017) 651 final}

Figure 11: Van fleet powertrain composition (new vans) in 2025 and 2030 under different TLV options

Figure 11: Van fleet powertrain composition (new

vans) in 2025 and 2030 under different TLV options

Figure 12: Net economic savings over the vehicle lifetime from a societal perspective in 2025 and 2030 (EUR/car)

Figure 12: Net economic savings over the vehicle lifetime from a societal

perspective in 2025 and 2030 (EUR/car)

Figure 13: TCO-15 years (vehicle lifetime) (net savings in EUR/car in 2025 and 2030)

Figure 13: TCO-15 years (vehicle lifetime) (net savings in EUR/car in 2025 and 2030)

79

Figure 14: TCO-first user (5 years) (net savings in EUR/car in 2025 and 2030)

Figure 14: TCO-first user (5 years) (net savings in EUR/car in 2025 and 2030)

80

Figure 15: Final energy demand (ktoe) for passenger cars over the period 2020-2040 under different TLC options

Figure 15: Final energy demand (ktoe) for passenger cars over the period 2020-2040 under different TLC options

81

Figure 16: Share (%) of different fuel types in the final energy demand for cars (entire fleet) under different TLC options - 2025 and 2030

Figure 16: Share (%) of different fuel types in the final energy demand for cars (entire fleet) under different TLC options - 2025 and 2030

82

Figure 17: Net economic savings over the vehicle lifetime from a societal perspective in 2025 and 2030 (EUR/van)

Figure 17: Net economic savings over the vehicle lifetime from a societal perspective in 2025 and 2030 (EUR/van)

86

Figure 18: TCO-15 years (vehicle lifetime) in 2025 and 2030 (net savings in EUR/van)

Figure 18: TCO-15 years (vehicle lifetime) in 2025 and 2030 (net savings in EUR/van)

87

Figure 19: TCO-first user (5 years) in 2025 and 2030 (net savings in EUR/van)

Figure 19: TCO-first user (5 years) in 2025 and 2030 (net savings in EUR/van)

88

Figure 20: Final energy demand (ktoe) for vans over the period 2020-2040 under different TLV options

Figure

20: Final energy demand (ktoe) for vans over the period 2020-2040 under different TLV options

89

Figure 21: Share (%) of different fuel types in the final energy demand for vans (entire fleet) under different TLV options –2025 and 2030

Figure 21: Share (%) of differen

t fuel types in the final energy demand for vans (entire fleet) under different TLV options –2025 and 2030

90

Figure 22: TCO-second user (years 6-10) (EUR/car) – 2025 and 2030

Figure 22: TCO-second user (years 6-10) (EUR/car) – 2025 and 2030

100

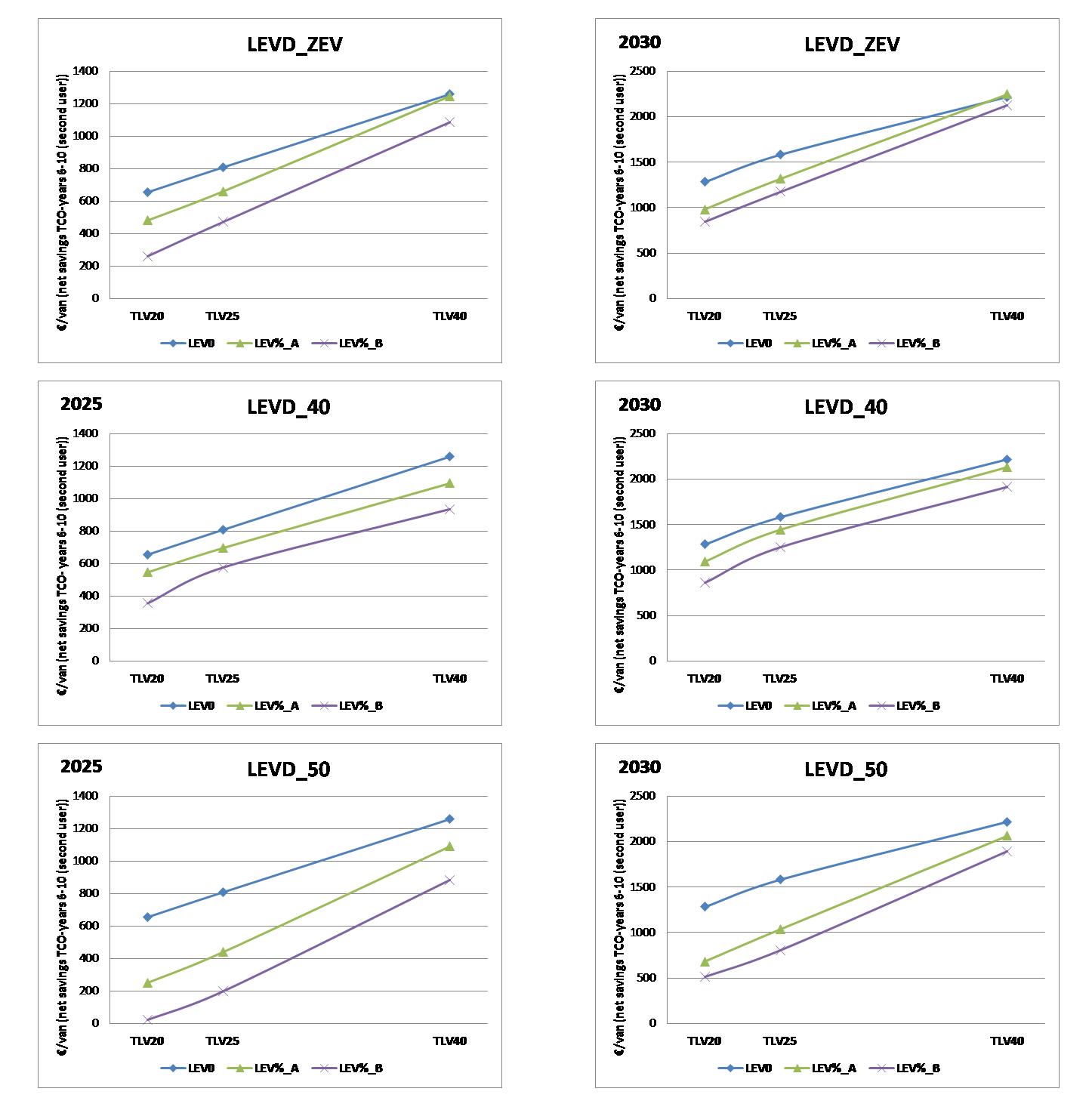

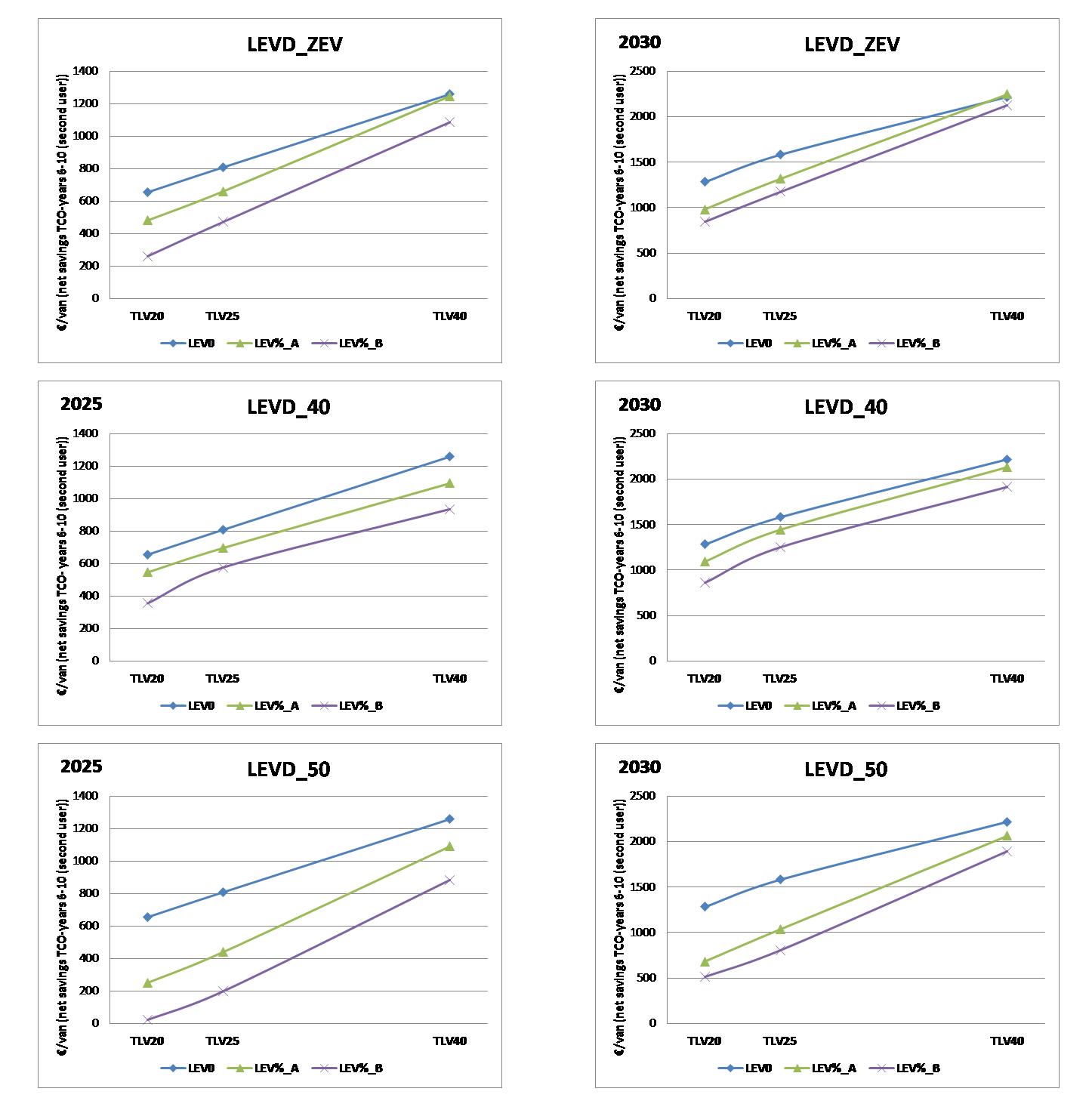

Figure 23: TCO-second user (years 6-10) (EUR/van) – 2025 and 2030

Figure 23: TCO-second user (years 6-10) (EUR/van) – 2025 and 2030

101

Figure 24: (Tailpipe) CO2 emissions of passenger cars in EU-28 - % reduction compared to 2005

Figure 24: (Tailpipe

) CO

2

emissions of passenger cars in EU-28 - % reduction compared to 2005

102

Figure 25: Cumulative (tailpipe) 2020-2040 CO2 emissions of cars for EU-28 – emission reduction from the baseline (kt)

Figure 25: Cumulative (tailpipe) 2020-2040 CO

2

emiss

ions of cars for EU-28 – emission reduction from the baseline (kt)

103

Figure 26: (Tailpipe) CO2 emissions of vans in EU-28 - % reduction compared to 2005

Figure 26: (Tailpipe) CO

2

emissions of vans in EU-28 - % r

eduction compared to 2005

105

Figure 27: Cumulative (tailpipe) 2020-2040 CO2 emissions of vans for EU-28 – emission reduction from the baseline (kt)

Figure 27: Cumulative (tailpipe) 2020-2040 CO

2

emissions of vans for EU-28 – emission reduction from the baseline (kt)

105

Figure 28: Evolution of GHG emissions between 2005 (100%) and 2030 under the EUCO30 scenario and under the baseline and different policy options for the CO2 target levels for new cars and vans considered in this impact assessment

Figure 28: Evolution of GHG emissions between 2005 (

100%) and 2030 under the

EUCO30

scenario and under the baseline and different policy options for the CO

2

target levels for new cars and vans considered in this impact assessment

107

Figure 29: Additional manufacturing costs (EUR/car) for categories of passenger car manufacturers under different options DOE and with the EU-wide fleet CO2 target levels as in option TLC30

Figure 29: Additional manufacturing costs (EUR/car) for categories of passenger car manufacturers under different options DOE and with the EU-wide fleet CO

2

target levels as in option TLC30

114

Figure 30: Additional manufacturing costs relative to vehicle price (% of car price) for categories of passenger car manufacturers under different options DOE and with the EU-wide fleet CO2 target levels as in option TLC30

Figure 30: Additional manufacturing costs relative to vehicle price (% of car price) for categories of passenger car manufacturers under dif

ferent options DOE and with the EU-wide fleet CO

2

target levels as in option TLC30

114

Figure 31: Additional manufacturing costs (EUR/van) for categories of van manufacturers under different options DOE and with the EU-wide fleet CO2 target levels as in option TLV40

Figure 31: Additional manufacturing costs

(EUR/van) for categories of van manufacturers under different options DOE and with the EU-wide fleet CO

2

target levels as in option TLV40

115

Figure 32: Additional manufacturing costs relative to vehicle price (% of van price) for categories of van manufacturers under different options DOE and with the EU-wide fleet CO2 target levels as in option TLV40

Figure 32: Additional manufacturing costs relative to vehicle price (% of van price) for categories of van manufacturers under different options DOE and with

the EU-wide fleet CO

2

target levels as in option TLV40

115

Figure 33: TCO-15 years (vehicle lifetime) (net savings in EUR/car for 2025 and 2030) for different LEV incentive options

Figure 33: TCO-15 years (vehicle lifetime) (net savings in EUR/car for

2025 and 2030) for different LEV incentive options

121

Figure 34: Illustration of the impacts of option LEVT_CRED2 (net savings, TCO-15 years) in case the LEV benchmark is not exactly met (with the CO2 target of option TLC30 and the benchmark of option LEV%_A)

Figure 34: Illustration of the impacts of option LEVT_CRED2 (net savings,

TCO-15 years) in case the LEV benchmark is not exactly met (with the CO

2

target of option TLC30 and the benchmark of option LEV%_A)

124

Figure 35: Illustration of the impacts of option LEVT_CRED1 (net savings, TCO-15 years) in case the LEV benchmark is not exactly met (with the CO2 target of option TLC30 and the benchmark of option LEV%_A)

Figure 35: Illustration of the impacts of option LEVT_CRED1 (net savings, TCO-15 years) in case the LEV benchmark is not exactly met (with the CO

2

target of option TLC30 and the benchmark of option LEV%_A)

125

Figure 36: TCO-second user (years 6-10) (EUR/car) in 2025 and 2030 for different LEVD/LEVT options

Figure 36: TCO-second user (years 6-10) (EUR/car) in 2025 and 2030 for different LEVD/LEVT options

129

Figure 37: TCO- 15 years (EUR/van) in 2025 and 2030 for different LEVD/LEVT options

Figure 37: TCO- 15 years (EUR/van) in 2025 and 2030 for different LEVD/LEVT options

133

Figure 38: TCO-second user (years 6-10) (EUR/van) in 2025 and 2030 for different LEVD/LEVT options

Figure 38: TCO-second user (years 6-10) (EUR/van) in 2025 and 2030 for different LEVD/LEVT options

135

Glossary - acronyms and definitions

ACEA

Federation of European Car Manufacturers

BEV

Battery Electric Vehicle

CNG

Compressed Natural Gas

CO2

Carbon dioxide

EMIS

Emission Measurements In the automotive Sector (Committee of the European Parliament)

ESR

Effort Sharing Regulation

ETS

EU Emission Trading System

EV

Electric Vehicle: covers BEV, FCEV and PHEV

FCEV

Fuel Cell Electric Vehicle

FCM

Fuel Consumption Measurement

GDP

Gross Domestic Product

GHG

Greenhouse gas(es)

HDV

Heavy-Duty Vehicles, i.e. lorries, buses and coaches (vehicles of more than 3.5 tons)

HEV

Hybrid Electric Vehicle (not including PHEV)

ICEV

Internal Combustion Engine Vehicle

IEA

International Energy Agency

LCA

Life-Cycle Assessment

LCV

Light Commercial Vehicle(s): van(s)

LDV

Light-Duty Vehicle(s), i.e. passenger cars and vans

LPG

Liquified Petroleum Gas

LNG

Liquefied Natural Gas

MAC

Mobile Air Conditioning

NEDC

New European Driving Cycle

NGO

Non-Governmental Organisation

NOx

Nitrogen oxides (nitric oxide (NO) and nitrogen dioxide (NO2))

O&M

Operation and Maintenance

OECD

Organisation for Economic Co-operation and Development

OBD

On-Board Diagnostics

PHEV

Plug-in Hybrid Electric Vehicle

PM

Particulate matter

REEV

Range Extended Electric Vehicle (sub-group of PHEV)

SAM

Scientific Advice Mechanism

TLC

CO2 Target Level for passenger Cars (policy option)

TLV

CO2 Target Level for Vans (policy option)

TTW emissions

"Tank-to-wheel" emissions: emissions from the vehicle tailpipe that occur during the drive cycle of vehicles.

WLTP

Worldwide Harmonised Light Vehicles Test Procedure

WTT emissions

"Well-to-tank" emissions: emission occurring during fuel (incl. electricity, hydrogen) production and transport

WTW emissions

"Well-to-wheel" emissions: sum of TTW and WTT emissions

1introduction

1.1Policy context

In his State of the Union Address 2017 President Juncker put it very clearly: while the car industry is a key sector for Europe making world-class products, EU manufacturers will need to invest in the clean cars of the future in order to maintain their strong position. In addition, President Juncker stated "I want Europe to be the leader when it comes to the fight against climate change" and announced that "the Commission will shortly present proposals to reduce the carbon emissions of our transport sector".

The automotive industry is crucial for Europe's prosperity, providing jobs for 12 million people in manufacturing, sales, maintenance and transport and accounting for 4% of the EU's GDP, including in sectors such as steel, aluminium, plastics, chemicals, textiles and ICT. The EU is among the world's biggest producers of motor vehicles and demonstrates technological leadership in this sector.

EU industry, in general, and the automotive sector, in particular, are currently facing major transformations. Digitalization and automation are transforming traditional manufacturing proceses. Innovation in electrified power trains, autonomous driving and connected vehicles constitute major challenges which may fundamentally transform the sector.

Furthermore, following the Paris Agreement, the world has committed to move towards a low-carbon economy. Many countries are now implementing policies for low-carbon transport, including vehicle standards, often in combination with measures to improve air quality. These developments represent an opportunity for the EU automotive sector to continue to innovate and adapt in order to ensure it remains a technological leader.

The EU 2030 framework for climate and energy includes a target of an at least 40% cut in domestic EU greenhouse gas (GHG) emissions compared to 1990 levels. The emission reductions in the Emissions Trading System (ETS) and non-ETS sectors amount to at least 43% and 30% by 2030 compared to 2005, respectively. The Commission has recently proposed 2030 GHG emission reduction targets for Member States under the Effort Sharing Regulation (covering the non-ETS sectors, including road transport) as well as a revised Energy Efficiency Directive. CO2 standards for light-duty vehicles will help to meet the overall goals set out therein.

In addition to that, daily experience on traffic jams, the crisis over diesel cars emissions and the adoption of policy measures at local level to discorage car use in urban areas, have contributed to making EU consumers more aware of the impact of road transport on health and air quality.

These developments take place globally since nowadays automotive industries are increasingly integrated in global value chains. Global automotive markets are expanding faster than ever before, notably in emerging markets such as India and China. The latter, in particular, is taking full advantage of the changing automotive landscape and according to a recent report by the International International Energy Agency , in 2016 it became the country with the highest share of electric vehicles.

In addition, EU sales of passenger cars relative to global sales have decreased from 34% before the crisis (2008/2009) to 20% today. This means that EU industry will have to consider not only increasing exporting volumes but also adapting to changing demands which will require more focus on innovation to retain competitiveness.

Until now, the ambitious emission reduction standards in place in Europe have represented a fundamental tool to push for innovation and investments in low carbon technologies. But today, the EU is no longer the clear leader in this race, with the US, Japan, South Korea and China moving ahead very quickly.

As highlighted in the recently adopted Renewed Industrial Policy Strategy, a modern and competitive automotive industry is key for the EU economy. However, for the sector to maintain its technological leadership and thrive in global markets, it will have to accelerate the transition towards more sustainable technologies and new business models. Only this will ensure that Europe will have the most competitive, innovative and sustainable industry of the 2030 and beyond.

The Commission's Communication 'Europe on the Move: An agenda for a socially fair transition towards clean, competitive and connected mobility for all' makes clear that we want to make sure that the best low-emission, connected and automated mobility solutions, equipment and vehicles will be developed, offered and manufactured in Europe and that we have in place the most modern infrastructure to support them. The Communication identifies that profound changes in how we enjoy mobility are underway and that the EU must be a leader in shaping this change at a global level, building on the key progress already made.

This Communication builds on the earlier Commission's European Strategy for Low-Emission mobility, published in July 2016, which set out an overall vision built on three pillars: (i) moving towards zero-emission vehicles; (ii) low emission alternative energy for transport; (iii) efficiency of the transport system.

The figure below presents an overview of the interlinkages between the various initiatives of the mobility package proposed by the Commission as well as other related EU climate, energy and transport related initiatives.

By pursuing an integrated approach looking both at the demand and supply side and by establishing an enabling environment and a clear vision and robust regulatory framework, the EU can create an environment that provides EU industry with the certainty and clarity needed to innovate and remain competitive for the future.

Figure 1: Overview of interlinkages between this initiative and other climate, energy and transport related initiatives at EU level

This builds on policies proposed or already implemented at national, regional and city level in the EU. Many Member States have set objectives to increase the share of zero and low emission vehicles, including both battery electric vehicles and plug-in hybrids, by 2020.

However, while some Member States have made good progress in achieving their objectives, the majority of Member States has made rather slow progress. Even if the objectives were to be reached, the share of electric vehicles would remain low in the EU in relation to total vehicle registrations. Furthermore, three Member States, representing 35% of total new car registrations in the EU in 2016, have announced plans to phase out CO2 emitting cars (see

Table 1

).

At the same time, many cities in the EU have implemented regulations which limit the access of certain vehicles to urban areas. Most restrictions are within the scope of so-called Low Emission Zones which either limit the city entry of the most polluting vehicles or, in some cases, impose higher fees for such vehicles if they enter the zone. Recently some cities have even announced plans to ban diesel and/or petrol cars (see

Table 1

).

Table 1: Overview of announcements at national and city level to encourage the use of zero- and low-emission vehicles

|

Geographical coverage

|

Announcements

|

|

Member States

|

|

France

|

End the sale of new CO2 emitting cars by 2040

|

|

Netherlands

|

End the sale of new CO2 emitting cars by 2030

|

|

United Kingdom

|

End the sale of all new conventional petrol and diesel cars and vans by 2040

|

|

Cities

|

|

Paris (France)

|

Ban of diesel cars from 2024 and petrol cars from 2030

|

|

Madrid (Spain) and Athens (Greece)

|

Ban of diesel cars from 2025

|

|

Oxford (UK)

|

Ban of all non-electric vehicles in the city centre by 2035

|

A policy framework that further stimulates the accelerated uptake of zero- and low-emission vehicles would complement the on-going efforts to address air quality problems and would be well aligned with on-going action at city, regional, and national level. Zero-emission vehicles do not only reduce CO2 emissions from road transport but deliver also in terms of air pollutant and noise emission free transport.

1.2Legal context

The EU has in place two Regulations setting CO2 targets for new passenger cars and vans, respectively, which are based upon Article 192 of the TFEU (Environment chapter):

·Regulation (EC) No 443/2009 setting a fleet-wide average target for new passenger cars of 130 g CO2/km from 2015 and 95g CO2/km from 2021, and

·Regulation (EU) No 510/2011 setting a fleet-wide average target for new light commercial vehicles of 175 g CO2/km from 2017 and 147 gCO2/km from 2020.

These regulations have been amended in 2014 through Regulation (EU) No 333/2014 and Regulation (EU) No 254/2014 in order to define the modalities for implementing the 2020/2021 targets.

Both Regulations request the Commission to carry out a review by the end of 2015, and to report on it to the Council and the European Parliament, accompanied, if appropriate, by a proposal to amend the Regulations for the period beyond 2020.

The abovementioned emission targets have been set on the basis of the New European Driving Cycle (NEDC) test cycle. From 1 September 2017 on, a new regulatory test procedure, the World Harmonised Light Vehicles Test Procedure (WLTP), developed in the context of the UNECE, has been introduced under the type approval legislation for determining the emissions of CO2 and the new targets will need to take this into account. Furthermore, consumer information on the fuel consumption and CO2 emission of new passenger cars under Directive 1999/94/EC should be based on WLTP as of 1 January 2019.

1.3Evaluation of the implementation

An extensive evaluation of the existing Regulations was carried out as part of REFIT. This was completed in April 2015 and the final report of the consultants has been published

.

The evaluation report assessed the Regulations against the objectives set in the original legislation, which included providing for a high level of environmental protection in the EU and contributing to reaching the EU's climate change targets, reducing oil consumption and thus improving the EU’s energy security of supply, fostering innovation and the competitiveness of the European automotive industry and encouraging research into fuel efficiency technologies.

It concluded that the Regulations were still relevant, broadly coherent, and had generated significant emissions savings, while being more cost effective than originally anticipated for meeting the targets set. They also generated significant EU added value that could not have been achieved to the same extent through national measures. As regards impacts on competitiveness and innovation, the impacts of the Regulations were found to be generally positive.

Box 1 summarises the key outcomes in relation to the main evaluation criteria.

|

Box 1: Key conclusions of the report on the evaluation of Regulations (EC) No 443/2009 and (EU) No 510/2011 ('the Regulations')

Relevance

oThe Regulations are still valid and will remain so for the period beyond 2020, as:

oall sectors need to contribute to the fight against climate change,

othe CO2 performance of new vehicles needs to improve at a faster rate,

oroad transport needs to use less oil (to improve the security of energy supply), and

oCO2 reductions must be delivered cost-effectively without undermining either sustainable mobility or the competitiveness of the automotive industry.

Effectiveness

oThe Regulations have been more successful in reducing CO2 than previous voluntary agreements with industry (annual improvement rate of 3.4-4.8 gCO2/km versus 1.1-1.9 gCO2/km).

oThe passenger car CO2 Regulation is likely to have accounted for 65-85% of the reductions in tailpipe emissions achieved following its introduction. For light commercial vehicles (LCVs), the Regulation had an important role in speeding up emissions reductions.

oImpacts on competitiveness and innovation appear generally positive with no signs of competitive distortion.

oThe evaluation report highlighted the following weaknesses:

oThe NEDC test cycle does not adequately reflect real-world emissions and there is an increasing discrepancy between test cycle and real-world emissions performance which has eroded the benefits of the Regulations.

oThe Regulations do not consider emissions due to the production of fuels or associated with vehicle production and disposal.

oSome design elements (modalities) of the Regulations are likely to have had an impact on the efficiency of the Regulations. In particular, the use of mass as the utility parameter penalises the mass reduction as an emissions abatement option.

Efficiency

oThe Regulations have generated net economic benefits to society.

oCosts to manufacturers have been much lower than originally anticipated as emissions abatement technologies have, in general, proved less costly than expected. For passenger cars, the ex-post average unit costs for meeting the target of 130gCO2/km are estimated at €183 per car, while estimates prior to the introduction of the Regulation ranged from €430-984 per car. For LCVs the ex-post estimate to meet the 175gCO2/km was €115 per vehicle, compared with an ex ante estimate of €1,037 per vehicle.

oLifetime fuel expenditure savings exceed upfront manufacturing costs, but have been lower than anticipated, primarily because of the increasing divergence between test cycle and real world emissions performance.

Coherence

oThe Regulations are largely coherent internally and with each other.

oModalities potentially weakening the Regulations, albeit with limited impacts, are the derogation for niche manufacturers, super-credits and the phase-in period (cars).

EU added value

oThe harmonisation of the market is the most crucial aspect of EU added-value and it is unlikely that uncoordinated action would have been as efficient. The Regulations ensure common requirements, thus minimising costs for manufacturers, and provide regulatory certainty.

|

The evaluation report included some recommendations that would ensure the Regulations remain relevant, coherent, effective and efficient, including:

·With respect to relevance, a potential additional need to be considered for the post 2020 legislation is that road transport needs to use less energy. Hence, energy efficiency would become a more important metric as the LDV fleet moves to a more diverse mix of powertrains

·Concerning effectiveness, the most significant weakness identified was the current (NEDC) test cycle causing an increasing discrepancy between real-world and test cycle emissions, which has eroded a significant portion of the originally expected benefits of the Regulations. This will be largely addressed by the development of WLTP. In addition, sufficient checks are recommended to ensure that the new test does not in future years become subject to the same problems experienced with the NEDC.

·While the lack of consideration of the lifecycle and embedded emissions of vehicles was seen as a relatively minor issue, it was expected to become more significant as the proportion of electric vehicles increases.

·As regards additional incentives to develop low CO2 emission vehicles, it should be considered whether such mechanism is needed and, if so, to choose one that does not potentially weaken the target.

·A need to look at how to improve the ex-ante assessment of costs to manufacturers as the costs assumed prior to the introduction of the current Regulations were much higher than has been the case in reality.

These recommendations are addressed when presenting the policy options in Section 5.

2WHAT IS THE PROBLEM AND WHY IS IT A PROBLEM?

Figure 1 sets out the drivers, problems and objectives that are relevant for the revision of CO2 standards for cars and vans.

While the revision will clearly contribute to all three policy objectives, it should also be clear that it does not aim to address all of the problems and drivers mentioned to the same extent. For this, complementary proposals and flanking measures will be taken, some of are scheduled to be part of the same package of mobility related initiatives. This concerns in particular the EU Action Plan on the Alternative Fuels Infrastructure Directive (limited infrastructure), the proposal for a revised Clean Vehicles Directive 2009/33/EC, as well as the proposal for a revised Directive on road charging ("Eurovignette").

The Commission is also preparing a proposal for setting CO2 standards for heavy-duty vehicles, which would further help to tackle CO2 emissions in the road transport sector.

Beside this, there are a number of areas where complementary Member State or local action would help to tackle the drivers and problems, e.g. through tax measures (in order to help lowering upfront costs, especially for zero- and low-emission vehicles), and measures promoting modal shift (i.e. lowering road transport activity.

A key driver to be addressed by this impact assessment is the lack of stringency of the existing CO2 standards for the period beyond 2021 and the related uncertainty over future standards. Other drivers are addressed to a different degree in the policy options set out in Section 5. Clarifying the policy framework beyond 2021 will help reducing manufacturers' uncertainty over costs and future investment decisions as well as tackling certain market failures. Creating a market demand for more efficient vehicles will also help to reduce upfront costs. In addition, the 'emissions gap' will be addressed.

By contrast, limited infrastructure and increasing transport activity are not directly tackled by the options considered in this impact assessment.

2.1What is the nature of the problem? What is the size of the problem?

An overview of the problems and drivers is presented in

Figure 2

.

Figure 2: Drivers, problems and objectives

2.1.1Problem 1: Insufficient uptake of the most efficient vehicles, including low and zero emission vehicles, to meet Paris Agreement commitments and to improve air quality, notably in urban areas

The evaluation of the CO2 Regulations showed that the CO2 standards have stimulated the uptake of more efficient vehicle technologies, but it also highlighted that the CO2 performance of new vehicles needs to improve at a faster rate in order to achieve the Union's climate goals of at least 40% emissions reduction, as committed under the Paris Agreement, in a cost-effective way. As confirmed in the European Strategy for Low-Emission Mobility, greenhouse gas emissions from transport will need to be at least 60% lower than in 1990 and be firmly on the path towards zero.

With current trends in new vehicles' CO2 emissions, this cannot be achieved. More specifically, the uptake of LEV and ZEV is still very slow. In 2016, battery electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV) represented only 1.1% of the new EU car fleet (for BEV the share was only 0.41%).

Road transport was responsible for 22% of EU GHG emissions in 2015 with a steady increase since 1990 when the share was 13%. GHG emissions from cars and vans accounted for 73% of road transport emissions in 2015; this share has remained more or less constant since 1990.

Figure 3

shows that CO2 emissions from cars and light commercial vehicles in 2015 were still 19% higher than in 1990, despite the decrease observed between 2007 and 2013. While the increase in the share of transport emissions of EU GHG emission may be due to the emissions reduction in other sectors, the evolution of GHG emissions from cars and vans shows a steady increase since 1990 with the exception of the period between 2007 and 2013 when emissions were reduced.

Figure 3: GHG emissions from cars and vans (1990-2015)

While the transport sector has considerably reduced its emissions of air pollutants in the EU over the last decades, it is the largest contributor to NOx emissions (46% in total NOx emissions in the EU in 2014). Of the total emitted NOx from road transport, around 80% comes from diesel powered vehicles. In addition, the transport sector makes an important contribution to the concentration of particulate matter in the atmosphere (13% for PM10 and 15% for PM2.5).

EU air quality legislation sets limit and target values for the concentration of a range of harmful air pollutants in ambient air in order to limit the exposure of citizens. Today, the limit values for NO2 are being exceeded in over 130 cities across 23 Member States and the Commission has initiated legal action against 12 Member States.

The public debate on the announcement of possible "diesel bans" in some major cities has significantly affected the share of diesel vehicles in new car registrations. For instance, in March 2017 a 5-year low in new diesel car registrations was recorded in France, Germany, Spain, and the UK. These Member States represent together almost 60% of new car registrations in the EU.

In the EU as a whole the share of diesel in new car registrations decreased from a peak of 53% in 2014 to 49% in 2016. At the same time the share of new petrol cars increased from 44% in 2014 to 47%.

While urban access restrictions contribute to a shift from diesel to petrol with benefits in terms of lower air pollutant emissions, so far they have not triggered a significant increase in low- and zero-emission vehicles. Although new registrations of battery electric and plug-in hybrid vehicles increased by 46% by July 2017 compared to the same period in 2016, their share in total car registrations in the EU remains low at 1.2% of which 46% were battery electric vehicles.

A policy framework that further stimulates the accelerated uptake of zero- and low-emission vehicles would therefore complement the on-going efforts to address air quality problems and would be well aligned with on-going action at urban, regional, and national level. Zero-emission vehicles do not only deliver benefits in terms of air pollutant and noise emission free transport but also contribute to the reduction of CO2 emissions from road transport.

2.1.2Problem 2: Consumers miss out on possible fuel savings

In understanding potential fuel savings for consumers, including initial and subsequent vehicle purchasers it is important to understand that the current average lifetime of a car is around 15 years with several ownership changes. Consumers have benefitted from net savings over a vehicle's lifetime, although relatively few consumers consider fuel consumption when purchasing a new car.

So far the increases in the purchase prices of more efficient vehicles, as a result of the CO2 standards, have been significantly lower than the fuel savings over the vehicle's lifetime.

According to the evaluation of the CO2 Regulations the additional purchase cost of a new car in 2013 was €183 higher compared with a 2006 vehicle due to measures to meet the CO2 standards. At the same time (discounted) fuel savings, as a result of the CO2 standards, were €1,336 for petrol cars and €981 for diesel cars over the vehicle's lifetime. Lifetime fuel expenditure savings have been lower than anticipated, primarily because of the increasing divergence between test cycle and real world emissions performance. However, even if this gap were to be reduced significantly by the introduction of the WLTP test cycle and additional governance measures (see section 5.5), there remains an important unused cost savings potential. If this potential were to be exploited through more stringent CO2 standards, consumers could benefit from even higher fuel savings. The savings are however spread differently across the vehicle's lifetime.

An analysis of second hand car and van markets and implications for the cost effectiveness and social equity of light-duty vehicles CO2 regulations

shows that subsequent owners of a vehicle, who on average belong to lower income groups, proportionally benefit more from fuels saving than first vehicle owners. The initial cost for the more efficient vehicle is borne by the first owner. This depends however strongly on the initial price premium for the more efficient vehicle.

2.1.3Problem 3: Risk of losing the EU's competitive advantage due to insufficient innovation in low- emission automotive technologies over the long term

The EU automotive sector is crucial to the EU economy, including in terms of the number of direct and indirect jobs it provides. It faces global competition in terms of sales to other markets and, increasingly, from non-EU manufacturers within the EU market. The import of motor vehicles to the EU has increased from 2.5 million vehicles in 2010 to 3.4 million motor vehicles in 2016, worth € 45.7 billion.

The competitiveness of industry is also related to its capacity to innovate. Looking at the relationship between the regulatory standards and industrial innovation, the Evaluation study found that EU fuel efficiency standards for new cars and vans have proven to be a strong driver for innovation and efficiency in automotive technology.

These targets allowed the EU manufacturers to have a first mover competitive advantage which has been especially important as the EU automotive industry exported more than 6 million vehicles in 2016, worth €135 billion.

However, as shown in

Figure 4

, different fuel standards have progressively been implemented around the world, in countries including China, USA, South Korea, Mexico, Brazil and India. These international targets, moving over time towards the levels set in the EU, and coupled with the commitments made on climate change targets under the 2015 Paris Agreement, demonstrate the international demand for efficient vehicles.

Figure 4: Historical fleet CO2 emissions performance and current standards (gCO2/km normalized to NEDC) for passenger cars (ICCT, 2017)

Major non-EU car markets have considered or are about to introduce more ambitious policies including measures to reduce pollutant emissions. In particular, in view of increasing the deployment of zero- and low emission vehicles, ambitious policies have been developed or recently adopted in car markets that are of particular importance for the EU car industry. In the US, the Californian "ZEV" standards to support the market deployment of battery electric, plug-in hybrid, and fuel cell vehicles have also been adopted by nine other States (29% of all new cars sold in the U.S. are sold in these 10 States) (see Box 2 for more details).

Eight US States have signed a memorandum of understanding committing to coordinated action to ensure that by 2025 at least 3.3 million pure battery electric vehicles, plug-in hybrid electric vehicles and hydrogen fuel cell electric vehicles are on their roads.

In China, new mandatory "new energy vehicle" (NEV) requirements will apply to car manufacturers as from 2019 covering battery electric, plug-in hybrid, and fuel cell vehicles (see Box 3 for more details).

The requirements are applicable to all manufacturers with an annual production or import volume of 30,000 or more conventional fuel passenger cars.

Over the last decade China has become the key car market with 24 million new car registrations, meaning that every third new vehicle is now being sold in China. European car manufacturers have been successful in reaching out to this new market. More than 20% of new passenger cars sold in China were from European car manufacturers/joint ventures operating in China. One third of global sales by German manufacturers, i.e. around 15 million vehicles, took place in China: 39% for the VW Group and 22% for the BMW Group and Mercedes Benz Cars. Similarly, China is the most important car market for the PSA Group with more than 600,000 vehicles sold.

A recent analysis of seven global automotive lead markets concludes that China is now in the "pole position" and will dominate the increasing market for electrified powertrains for the foreseeable future due to the importance of the Chinese market and a favourable regulatory framework.

While Japan alone accounts for 40% of EV related patents, the EU automotive industry is the global leader in automotive patents in general. At the same time patents data show that parts of the European car industry have a strong technological potential in LEV/ZEV which are however not sufficiently reflected in new products offered on the European market.

This indicates that the EU industry risks losing its technological leadership and lagging behind these global trends.

2.2What are the main drivers?

2.2.1Driver 1: Consumers value upfront costs over lifetime costs

There are a number of market failures and barriers

which cause end-users to not necessarily purchase the most efficient new vehicles available on the market, even where this would be their optimal choice from an economic perspective, i.e. when the fuel economy benefit outweighs the additional costs for a more efficient vehicle.

When purchasing a new car, end-users tend to undervalue future fuel savings as a result of which it may not appear attractive to pay more for a more efficient vehicle. This is for instance empirically evidenced by the results of the evaluation of the CO2 Regulations, which show that fuel savings are significantly higher than the additional purchase cost of a new car (see Section 1.3). Despite existing fuel taxes, these clear financial benefits were apparently not reaped by the market, but required specific regulation to tap into such economic benefits.

Furthermore, even if the new vehicle purchasers do take account of fuel savings, it would only be rational for them to consider fuel savings for the period in which they intend to own the vehicle. As vehicles have an average lifetime of about 15 years with 4 owners, only a part of the reductions would be experienced by the initial purchaser.

In addition, a wide range of factors and elements other than fuel economy may dominate the purchase decision of a new car. Purchasers of new cars have skewed preferences away from fuel economy and towards factors such as comfort and power.

Another reason for the apparently economically suboptimal uptake of more efficient vehicles therefore lies on the production side. In a highly competitive automotive market, manufacturers may be hesitant to invest heavily in more efficient powertrains, knowing that competitors may have different commercial strategies (focusing on other vehicle attributes such as higher engine capacity, more comfort, etc.) that could be commercially more successful. This is in particular the case if consumers pay little attention to total cost of ownership. A regulatory framework on CO2 emissions for all new vehicles takes away the competitive risk that a manufacturer would be facing when focusing innovation efforts on fuel efficiency, while others do not.

Different purchase dynamics may apply for leased vehicles which have a share of around 30% of new registrations in the EU, with most of them being company cars. Leasing could in principle increase the attractiveness of lower CO2 vehicles, on the one hand by enabling instant payback on fuel saving ‘investments’, and on the other by helping operators optimise vehicle choice by enabling them to better take into account the costs and benefits associated with lower CO2 vehicles in the context of CO2-based national vehicle taxation schemes. However, the extent to which these factors affect the uptake of lower CO2 vehicles in practice could not be quantified due to a current lack of evidence.

2.2.2Driver 2: Consumers' concerns regarding zero emission vehicles (ZEV)

Beyond the issue of undervaluing future benefits from fuel savings, the limited market uptake of ZEV is strongly influenced by additional factors. ZEV (battery EV and fuel cell EV) are still faced with much higher upfront costs as compared to conventional vehicles.

Consumers are also concerned about other issues regarding ZEV. As demonstrated in research, a major barrier is consumer resistance to new technologies that are considered alien or unproved. As other barriers perceived by the consumers, the study mentioned battery range, charging infrastructure, reliability, safety. Furthermore, the perceived limited comfort and style were seen as limiting the attractiveness of available ZEV models.

A key barrier is 'range anxiety', i.e. the perception that the battery capacity is limited and recharging infrastructure is insufficient to ensure recharging 'on time' and at the necessary recharging speed in particular for long-distance trips. This is underlined by the fact that the electric range for the most sold battery electric vehicles in the EU is currently between 150 and 250 km.

Despite important progress and sufficient coverage in most Member States given the low uptake of ZEV so far, the infrastructure for recharging ZEV is insufficient in many Member States in particular in view of the expected uptake of ZEVs by 2020 and beyond. The Commission's Communication, 'Europe on the Move: An agenda for a socially fair transition towards clean, competitive and connected mobility for all' underlines that the deployment of a network of recharging points covering evenly the whole EU road network, is a key enabling condition for zero-emission mobility. The Action Plan on the Alternative Fuels Infrastructure Directive sets out concrete measures for achieving necessary deployment rates. Experience from other regions shows that with an increase in the number of electric vehicles sold investments in the necessary infrastructure increases as well. Besides, reinforced support for research and development of batteries will be provided by Horizon 2020 in the context of the new working programme 2018-2020.

Another concern among consumers is linked to the resale value of ZEV given expected further technical improvements in particular on the battery's performance (range, lifetime, costs).

At the same, the market for ZEV is developing rapidly. New technologies and business models may help to overcome some of the barriers discussed above. For example, new ZEV in the compact car segment are offered in Europe with ranges of up to 380 km. Some ZEV are offered with a lease contract for the battery which lowers upfront costs and can address possible consumer concerns related to the battery technology.

In this context, it should be noted that consumer research in the US and Germany showed that a large share of prospective new vehicle buyers (29% in the US, 44% in Germany) would consider purchasing a battery electric vehicle (BEV) or a plug-in hybrid electric vehicle (PHEV), which indicates a substantial latent demand for such vehicles. However, it was also found that half of all consumers are not yet familiar with electric vehicles. The researchers conclude that there is an opportunity for manufacturers to quickly increase the number of potential buyers by offering more tailored EVs and deploying new business models

. A JRC study covering six EU Member States concluded in 2012 that on average around 40% of the car drivers surveyed would consider buying an electric car when changing their current vehicle.

2.2.3Driver 3: EU standards do not provide enough incentive for further efficiency improvements and for the deployment of low and zero emission vehicles for the period beyond 2021, leading to uncertainty over future policy

The current Regulations for cars and vans set targets of 95 g CO2/km for 2021 and 147 g CO2/km for 2020 respectively. In the absence of new legislation, these targets will remain at their present levels. As the current targets can be largely met by improving conventional vehicles, they do not provide sufficient incentive to invest in and in particular market alternative powertrains, in particular ZEV.

As a consequence there is insufficient uptake of LEVs and ZEVs in the EU as a result of which the necessary GHG emission reductions in the road transport sector cannot be achieved. Given persisting market failures (see Driver 1) under these conditions manufacturers are not likely to develop, produce and offer more efficient vehicles for the EU market at sufficient scale. The EU automotive industry therefore risks losing leadership in low-emission technologies for road transport.

As long as the automotive industry, including manufacturers and suppliers, does not know what will happen to targets beyond 2020/2021 and whether any additional requirements will be put in place, they do not have the regulatory certainty required to invest with confidence for the EU market. Without clarity on the long-term regulatory framework companies cannot take long-term investment decisions in order to meet future market demands and optimise compliance costs.

2.2.4Driver 4: Effectiveness of standards is reduced by growing 'emissions gap'

There is evidence of an increasing divergence between average test and real world CO2 emissions. Recent studies estimate the divergence is up to around 40%

. A number of factors have been identified to explain the divergence including the deployment of CO2 reducing technologies delivering more savings under test conditions than on the road, the optimisation of the test procedure as well as the increased deployment of energy using devices which are not taken into account when a vehicle is tested for its certified CO2 emissions. For example, air conditioning systems are not included when a vehicle is tested for its certified CO2 emissions but are widely installed and used, thus leading to higher real world emissions.

This increasing divergence means that the actual CO2 savings achieved are considerably less than those suggested by the test performance. Since manufacturers' compliance with their specific emissions target is assessed on the basis of the CO2 emissions as certified during the official test cycle, the 'emissions gap' undermines the effectiveness of the CO2 performance standards. In addition, the 'emissions gap' has undermined consumers' trust in the potential CO2/fuel savings of new vehicles which in turn may have affected consumers' willingness to buy the most efficient vehicles.

2.2.5Driver 5: Road transport activity is increasing

EU transport activity is expected to continue growing under current trends and adopted policies, albeit at a slower pace than in the past. Despite profound shifts in mobility being underway, such as shared mobility services and easier shifts between modes, passenger traffic growth is still projected to increase 23% by 2030 (1% per year) and 42% by 2050 (0.9% per year) relative to 2010. Road transport would maintain its dominant role within the EU. Passenger cars and vans would still contribute 70% of passenger traffic by 2030 and about two thirds by 2050, despite growing at lower pace relative to other modes due to slowdown in car ownership increase.

While this increased activity is reflective of economic growth, it brings with it negative impacts in terms of GHG emissions and air quality impacts, if no additional measures are taken. It remains to be seen to what extent other developments such as autonomous driving may affect road transport activity.

2.3Who is affected and how?

The users of vehicles, both individuals and businesses, are affected because they face the cost of the energy required to propel the vehicles. Reducing the vehicle's CO2 emissions will reduce the energy required and result in a cost saving to the user. The use of technology to reduce in-use GHG emissions has a cost which is expected to be passed on to the vehicle purchaser.

Citizens, especially those living in urban areas with high concentrations of pollutants, will benefit from better air quality and less associated health problems due to reduced air pollutant emissions, in particular when the uptake of zero-emission vehicles increases.

CO2 standards require vehicle manufacturers to reduce CO2 emissions as a result of which they will have to introduce technical CO2 reduction measures. In the short-term, this is likely to result in increased production costs and could affect the structure of their product portfolios. However, demand for low- and zero-emission CO2 vehicles is expected to increase throughout the world as climate change and air quality policies develop and other countries introduce similar or even more ambitious standards, manufacturers have an opportunity to gain first mover advantage and the potential to sell advanced low CO2 vehicles in other markets.

Suppliers of components and materials from which vehicles are constructed will be affected by changing demands on them. Component suppliers have a key role in researching and developing technologies and marketing them to vehicle manufacturers. Requirements leading to the uptake of additional technologies or materials (e.g. aluminium, plastics, advanced construction materials) may create extra business activity for them. While often overlooked, EU employment in the component supply industry is as large as in the vehicle manufacturing industry.

Suppliers of fuels are affected by reduced energy demand leading to less utilisation of existing infrastructure. If demand shifts to vehicles supplied with alternative energy sources, this may potentially increase the need for other types of infrastructure and create new business opportunities and challenges for electricity supply companies and network operators.

There may also be impacts for example in the need for or type of vehicle servicing. There will also be lower maintenance requirements for battery electric vehicles.

The production and maintenance of vehicles with an electrified powertrain will pose important challenges to the workforce in the automotive sector including manufacturers and component suppliers as well as repair and maintenance businesses. The workforce will need additional and/or different skills to deal with new components and manufacturing processes.

Other users of fuel and oil-related products (e.g. chemical industry, heating) are expected to benefit from lower prices if demand from the transport sector decreases. Sectors other than transport that emit GHGs will avoid demands to further reduce emissions to compensate for increased transport emissions. In so far as these sectors are exposed to competition, this will be important for their competitiveness.

3WHY SHOULD THE EU ACT?

3.1The EU's right to act

The Environment chapter of the Treaty, in particular Article 191 and Article 192 of TFEU, give the EU the right to act in order to guarantee a high level of environmental protection. As mentioned in Section 1.1, based on Article 192 TFEU, the EU has already acted in the area of vehicle emissions, including adopting Regulations (EC) 443/2009 and (EU) 510/2011 which set limits for CO2 emissions from cars and vans, and with implementing legislation on monitoring and reporting of data (Commission Regulation (EU) No 1014/2010 (cars) and Commission Implementing Regulation 2012/293/EU (vans)).

3.2What would happen without EU action?

EU fuel efficiency standards for new cars and vans have proven to be a strong driver for innovation and efficiency in automotive technology. These targets allowed EU manufacturers to have a first mover advantage and to increase exports globally. Without further action in this field, it will be difficult for the EU automotive sector to retain its leading role in global markets as developing innovation and cutting-edge technologies is the only way to maintain and strengthen European competitiveness.

With all major markets with the exception of China and India projected to stall in the future, it will be important for the EU to maintain or increase the share of high-quality and high-technology vehicles on third markets, notably in those markets that are likely to grow fast. (source GEAR 2030)

Besides, without further EU action in this field it is likely there would be little additional substantial CO2 reduction from new light-duty vehicles. There may be certain expectations that in view of the current CO2 requirements and expected regulatory action in this field in third countries to which European vehicles are exported, the fuel efficiency improvement of vehicles may continue somewhat beyond this rate. However, as seen in the EU in the period between 1995 and 2006 for cars, in the absence of the mandatory CO2 standard this progress is likely to be offset at least to some degree by the increase in power, size or comfort of new cars.

Some reduction in emissions from the overall fleet of light-duty vehicles would still be expected beyond 2021 due to the continuing renewal of the existing fleet with newer cars and vans meeting the 2020/21 CO2 standards. However, transport activity would continue to increase and the overall CO2 reductions would not be sufficient to reach the targets set by the European Council in the 2030 Climate and Energy Package or contribute sufficiently to the goals of the Paris Agreement.

3.3Analysis of subsidiarity and added value of EU action

EU action is justified in view of both the cross-border impact of climate change and the need to safeguard single markets in vehicles.

Without EU level action there would be a risk of a range of national schemes to reduce light duty vehicle CO2 emissions. If this were to happen it would result in differing ambition levels and design parameters which would require a range of technology options and vehicle configurations, diminishing economies of scale.

Since manufacturers hold differing shares of the vehicle market in different Member States they would therefore be differentially impacted by various national legislations potentially causing competitive distortions. There is even a risk that national legislation might be tailored to suit local industry.

This poor coordination of requirements between countries, even if all Member States were to establish regulatory requirements for new vehicle CO2 emissions, would raise compliance costs for manufacturers as well as weaken the incentive to design fuel efficient cars and LCVs because of the fragmentation of the European market. It is unlikely that Member States acting individually would set targets in an equally consistent manner as shown by the widely differing tax treatment of new cars across the EU. This means that greater benefits will be achieved for the same cost from coordinated EU action than would be achieved from differing levels of Member State action.

With action only at Member State level we would not benefit from the lower costs which would arise as a result of the economies of scale that an EU wide policy delivers. The EU light vehicle market is currently around 16 million vehicles per year. The largest Member State market is around 3 million vehicles per year. On their own, individual Member States would represent too small a market to achieve the same level of results and therefore an EU wide approach is needed to drive industry level changes.

The additional costs which would arise from the lack of common standards and common technical solutions or vehicle configurations would be incurred by both component suppliers and vehicle manufacturers. However, they ultimately would be passed on to consumers who would face higher vehicle costs for the same level of greenhouse gas reduction without coordinated EU action.

The automotive industry requires as much regulatory certainty as possible if it is to make the large capital investments necessary to maximise the fuel economy of new vehicles, and even more so for shifting to new primary energy sources. Standards provide this certainty over a long planning horizon and they could not be implemented with the same effectiveness and certainty at Member State level.

4OBJECTIVES

General policy objective

The general policy objective is to contribute to the achievement of the EU's commitments under the Paris Agreement (based on Article 192 TFEU) and to strengthen the competitiveness of EU automotive industry.

Specific objectives

1.Contribute to the achievement of the EU's commitments under the Paris Agreement by reducing CO2 emissions from cars and vans cost-effectively;

2.Reduce fuel consumption costs for consumers;

3.Strengthen the competitiveness of EU automotive industry and stimulate employment.

These three specific objectives are on equal footing.

The first one concerns the climate objective of the Paris Agreement. Further efforts are necessary for all Member States to meet their 2030 targets under the Effort Sharing Regulation. With road transport causing one third of non-ETS emissions and emissions increasing in the last few years, reducing CO2 emissions from cars and vans is of key importance.

Implementing the Paris Agreement requires the decarbonisation of the economy including of road transport. The Low-Emission Mobility Strategy has confirmed the ambition of reducing GHG emissions from transport by at least 60% by 2050, as initially set out in the 2011 Low-Carbon Economy Roadmap and Transport White Paper.

This cannot happen without a very high deployment of zero- and low-emission vehicles. Analysis has shown that by 2050, electrically chargeable vehicles need to represent about 68-72% of all light duty vehicles on the roads. This requires a significantly increasing uptake of zero- and low-emission vehicles already in 2030 as the new vehicles of 2030 will remain on the road until the mid-2040s.

The second specific objective is related to the consumer angle of the CO2 standards, aiming to create benefits for car and van users through the sales of more efficient vehicles.

The third specific objective relates to innovation, competitiveness (including fair competition amongst EU manufacturers) and employment. While the EU automotive sector has been very successful in advanced internal combustion engine vehicles world-wide, it will need to adapt to the ongoing global transitions in the area of mobility and transport in order to maintain its technological leadership.

By providing a clear regulatory signal and predictability for industry to develop and invest in zero- and low-emission vehicles and fuel-efficient technologies, this initiative aims to foster innovation and strengthen EU industry's competitiveness in a fast changing global automotive landscape, without distorting the competition between EU manufacturers.

In addition to the three abovementioned specific objectives, the revision of the CO2 standards for cars and vans are expected to lead to two main co-benefits: improvements in air quality and increased energy security.

5WHAT ARE THE VARIOUS OPTIONS TO ACHIEVE THE OBJECTIVES?

This Section describes the options identified to address the problems listed in Section 3 and to achieve the objectives defined in Section 4. It sets out the rationale for their selection, as well as the reasons for discarding certain options upfront, taking into account the evaluation study, the public consultation, additional stakeholder input; as well as several internal and external study reports. The options cover a number of elements, some of which are already part of the current Regulations. The options are grouped into five categories:

(I)CO2 emission targets (level, timing, metric);

(II)the distribution of effort amongst manufacturers;

(III)incentives for low- and zero-emission vehicles;

(IV)elements for cost-effective implementation;

(V)governance related issues

The following tables show how the policy options, grouped into the five key policy areas, relate to the problems and objectives

Table 2: Policy options and problems

|

Key policy areas

|

Problem 1: Insufficient uptake of the most efficient vehicles, including low and zero emission vehicles, to meet Paris Agreement commitments and to improve air quality, notably in urban areas

|

Problem 2:

Consumers miss out on possible fuel savings (market failures)

|

Problem 3:

Risk of losing the EU's competitive advantage due to insufficient innovation in low- emission automotive technologies over the long term

|

|

Emission targets

|

✓

|

✓

|

✓

|

|

Distribution of effort

|

|

|

✓

|

|

ZEV/ LEV incentives

|

✓

|

✓

|

✓

|

|

Elements for cost-effective implementation

|

|

|

✓

|

|

Governance

|

✓

|

✓

|

|

Table 3: Policy options and objectives

|

Key policy areas

|

PARIS AGREEMENT:

Contribute to the achievement of the EU's commitments under the Paris Agreement Reduce by reducing CO2 emissions from cars and vans cost-effectively

|

CONSUMERS:

Reduce fuel consumption costs for consumers

|

COMPETITIVENESS:

Strengthen the competitiveness of EU automotive industry and stimulate employment

|

|

Emission targets

|

✓

|

✓

|

✓

|

|

Distribution of effort

|

|

|

✓

|

|

ZEV/ LEV incentives

|

✓

|

✓

|

✓

|

|

Elements for cost-effective implementation

|

✓

|

|

✓

|

|

Governance

|

✓

|

✓

|

|

5.1Emission targets (level, timing and metric)

The currently applicable Regulations (EC) No 443/2009 ("Cars Regulation") and (EU) No 510/2011 ("Vans Regulation") set a fleet-wide target of 95 g CO2/km (from 2021, with a phase-in from 2020) and 147 g CO2/km (from 2020), respectively, for the emissions of newly registered vehicles. These targets are based on the NEDC test procedure. Compared to the targets set previously, they represent an average annual reduction of 5.1% for cars (from the 2015 target of 130 g CO2/km) and of 5.6% for vans (from the 2017 target of 175 g CO2/km).

The introduction of the new test procedure WLTP, in September 2017, is expected to bring the tailpipe CO2 emissions from cars and vans determined during type approval closer to the real world emissions. The WLTP will be fully applicable to all new cars and vans from September 2019 (see also Section 5.5).

WLTP is likely to result in increased CO2 emissions for most vehicles but the increase will not be evenly distributed between different manufacturers. Due to this non-linear relationship between the CO2 emission test results from the NEDC and WLTP test-procedures, it is impossible to determine one single factor to correlate NEDC into WLTP CO2 emission values. A correlation procedure will therefore be performed at the level of individual manufacturer. Based on the correlation procedures and the methodology adopted for translating the individual manufacturer targets from NEDC to WLTP values, WLTP-based manufacturer targets will apply from 2021 onwards. Those targets will be confirmed by the Commission and published in October 2022.

More information on the transition from NEDC to WLTP is given in Annex 5.

5.1.1CO2 emission target level (TL)

The likely increase in WLTP CO2 emission values (compared to NEDC) has been taken into account for the purposes of the analytical work underlying this impact assessment (see Annex 4.6).

Since the exact specific WLTP emission target values for 2021 can only be determined in 2022 (as described above), the new emission targets should be defined not as absolute values but in relative terms. The starting point for this are the 2021 EU-wide fleet average WLTP emission targets (i.e. the weighted average of the manufacturers' specific emissions targets for 2021). The new targets can be expressed either as a percentage reduction of those 2021 EU-wide fleet targets or as an average annual reduction rate over a given period.

The options in this section for the new EU-wide fleet average target levels ("TLC" for cars and "TLV" for vans) are defining the target trajectory over the period 2021-2030, without prejudging the target years. Options as regards the timing of the targets are set out in Section 5.1.2.

5.1.1.1CO2 target level for passenger cars (TLC)

·Option TLC0: Change nothing (baseline)

This option represents the status quo, meaning that the CO2 target level set in the current Regulation is maintained after 2021 (WLTP equivalent of 95 g CO2/km as EU-wide fleet average).

·The other options for defining the EU-wide fleet CO2 target level for passenger cars are summarised in the below table.

|

Option

|

Decrease of WLTP CO2 target level (2021-2030)

|

Average annual reduction rate of WLTP CO2 target level (2021-2030)

|

|

TLC10

|

10%

|

1.2%

|

|

TLC20

|

20%

|

2.4%

|

|

TLC25

|

25%

|

3.2%

|

|

TLC30

|

30%

|

3.9%

|

|

TLC40

|

40%

|

5.5%

|

|

TLC_EP40

|

40%

|

5.5%

(8.0% for 2021-2025 and

3.5% for 2025-2030)

|

|

TLC_EP50

|

50%

|

7.4%

|

Option TLC_EP40 differs from option TLC40 by defining a non-linear target trajectory. This covers the strictest end of the 2025 target range referred to in the Statement by the Commission in 2014 in the context of the negotiations on the Cars Regulation

. This also holds true for option TLC_EP50, which defines a 2030 target that is 50% lower than the 2021 target.

Figure 5: EU-wide fleet target level trajectories for new cars under the different TLC options

5.1.1.2CO2 target level for vans (TLV)

·Option TLV 0: Change nothing (baseline)

This option represents the status quo, meaning that the CO2 target level set in the current Regulation is maintained after 2021 (WLTP equivalent of 147 g CO2/km NEDC as EU-wide fleet average).

·The other options for defining the EU-wide fleet CO2 target level for light commercial vehicles are summarised in the below table.

|

Option

|

Decrease of WLTP CO2 target level (2021-2030)

|

Average annual reduction rate of WLTP CO2 target level (2021-2030)

|

|

TLV10

|

10%

|

1.2%

|

|

TLV20

|

20%

|

2.4%

|

|

TLV25

|

25%

|

3.1%

|

|

TLV30

|

30%

|

3.9%

|

|

TLV40

|

40%

|

5.5%

|

|

TLV_EP40

|

36%

|

4.4%

(8.1% for 2021-2025 and

2.2% for 2025-2030)

|

|

TLV_EP50

|

50%

|

7.4%

(8.1% for 2021-2025 and

6.9% for 2025-2030)

|

Options TLV_EP40 and TLV_EP50 are defining a non-linear target trajectory, covering the strictest end of the 2025 target range referred to in the Statement by the Commission in 2014 in the context of the negotiations on the Vans Regulation. For 2025, both options cover a WLTP target equivalent to 105 g CO2/km NEDC, while in 2030 the targets are 36%, respectively 50%, lower than the 2021 targets.

Figure 6: EU-wide fleet target level trajectories for new vans under the different TLV options

5.1.2Timing of the CO2 targets (TT)

The following options will be considered for defining the year(s) for which new targets are set. These options apply both for passenger cars (in relation to options TLC) and for light commercial vehicles (in relation to options TLV).

·Option TT 1: The new EU-wide fleet CO2 targets start to apply in 2030.

This means that the (WLTP equivalent of the) CO2 target levels set in the Cars and Vans Regulations would continue to apply until the year 2029.

·Option TT 2: New EU-wide fleet CO2 targets start to apply in 2025 and will continue to apply until 2029, and stricter EU-wide fleet CO2 targets start to apply from 2030 on.

Under this option, the new EU-wide fleet targets for 2025 and 2030 are calculated according to the annual average reduction rates set out in Section 5.1.1.

·Option TT 3: New EU-wide fleet CO2 targets are defined for each of the years 2022-2030.

Under this option, new annual EU-wide fleet CO2 targets are calculated according to the annual average reduction rates set out in Section 5.1.1

These options include a mid-term review to assess the effectiveness of the policy.

5.1.3Metric for expressing the targets

The CO2 targets set in the Cars and Vans Regulations relate to the tailpipe emissions of newly registered vehicles, applying the so-called Tank-to-Wheel approach (TTW). The targets are expressed in g CO2 /km and apply for the sales-weighted average emissions of the EU-wide fleet. For calculating the average, each newly registered vehicle is counted equally.

Using a TTW metric allows focusing on vehicle efficiency, which has proven to be an effective way of triggering the uptake of vehicle technology and starting a shift towards alternative powertrains. However, the overall GHG emission impact of using (new) vehicles is also affected by the type of fuel/energy used to propel the vehicle, as different energy types differ in the amount of CO2 emissions generated during their production, the so-called Well-To-Tank (WTT) emissions. The sum of the TTW emissions and the WTT emissions is referred to as the Well-To-Wheels (WTW) emissions.

Furthermore, there are also CO2 emissions associated with vehicle manufacturing (including the mining, processing and manufacturing of materials and components), maintenance and disposal. These are referred to as "embedded" CO2 emissions. For determining those emissions, information is needed concerning the different phases of a vehicle's life cycle and tools such as life-cycle assessment (LCA) are often used for this purpose.

The g CO2/km metric allows comparing the emission performance of vehicles on a unit distance basis, but this does not reflect the total emissions of a vehicle over its lifetime. Vehicles with a higher lifetime mileage may contribute more to total CO2 emissions compared to vehicles that are used less intensively, even where the latter perform worse against the g CO2/km targets.

The evaluation study noted that the effectiveness of the Cars and Vans Regulations might have been reduced because some of the emission reductions achieved in terms of tailpipe CO2 emissions may have been accompanied by increased emissions elsewhere.

During the public consultation, some stakeholders also suggested to switch to other metric types to express the targets, in particular by using one of the approaches mentioned hereafter.

Well-to-Wheel (WTW) based metric

In the public consultation, stakeholders representing the fuels industry as well as some component suppliers suggested a change from the TTW metric to a WTW based metric, which takes into consideration the sum of the TTW and WTT emissions in the CO2 target levels. By contrast, consumer organisations, car manufacturers and stakeholders from the power sector did not support such a change. Public authorities had mixed views.

Metric taking into account embedded emissions

In the public consultation, most car manufacturers were against changing to this approach, whereas other stakeholder groups had diverging views.

Metric based on mileage weighting

During the public consultation, the question whether average mileage by fuel and vehicle segment should be taken into account when establishing targets received very mixed replies from stakeholders. A number of environmental and transport NGOs, some research institutions, and all respondents from the petroleum sector were in favour of doing so. By contrast, one NGO and the majority of car manufacturers were against this option. Most consumer organisations were neutral on the issue, whereas public authorities expressed split views.

In the light of the above and the views expressed during the public consultation, the following options will be considered for defining the metric of the EU-wide fleet CO2 targets. These options apply both for passenger cars and for light commercial vehicles.

·Option TM_TTW: change nothing, TTW approach

This option maintains the current metric for setting the targets, i.e. targets expressed in g CO2/km based on a TTW approach and applying for the sales-weighted average EU-wide fleet emissions.

·Option TM_WTW: WTW approach

Under this option, the target would be expressed in g CO2/km based on a WTW approach and would apply for the sales-weighted average EU-wide fleet emissions.

·Option TM_EMB: metric covering embedded emissions

Under this option, the target would be expressed in g CO2/km covering both WTW and embedded emissions and it would apply for the sales-weighted average EU-wide fleet emissions.

·Option TM_MIL: metric based on mileage weighting

Under this option, the target would be set in relation to the mileage-weighted average EU-wide fleet emissions. It could either be expressed in g CO2/km or in different units reflecting the difference in lifetime mileage between vehicle groups.

5.2Distribution of effort (DOE)

The Cars and Vans Regulations use a limit value line to define the specific emission targets for individual manufacturers, starting from the EU-wide fleet targets. This linear curve defines the relation between the CO2 emissions and a "utility parameter" (currently: vehicle mass in running order).

On this line, the EU-wide fleet target value corresponds with the average mass of the new vehicles in the fleet (M0). The slope of the line is the key factor in distributing the EU-wide fleet target as it determines to what extent vehicles (manufacturers) with a higher/lower (average) mass will be allowed/required to have higher/lower CO2 emissions than the EU-wide fleet average. The steeper the slope, the larger the difference in specific emission targets between manufacturers with "heavy" and "light" vehicles.

In order to avoid that the EU-wide fleet targets would be altered due to an autonomous change in the average mass of the fleet, the M0 values are readjusted every three years to align them with the average mass of the new fleet of the previous years.

The choice of slope of the limit value line is merely a decision on how to share efforts amongst manufacturers and does not affect the overall emission target for the EU fleet of new vehicles.

Other approaches (e.g. using another or no utility parameter, changing the slope of the line, using a non-linear curve) are possible for distributing the effort required from each manufacturer in meeting the EU-wide fleet target. The Cars and Vans Regulations explicitly request the Commission to review this modality.

Most car manufacturers and consumer organisations responding to the online consultation were in favour of using a utility parameter to distribute the effort between different manufacturers. A relatively large number of stakeholders across different stakeholder groups were neutral on this question, and only a small number of stakeholders (from different groups) were against the use of a utility parameter. Views diverged on which utility parameter to use. All consumer organisations, some environmental and transport NGOs as well as stakeholders from the petroleum sector supported footprint, while most car manufacturers supported mass as utility parameter. Only two stakeholders referred explicitly to another parameter (loading capacity, in the case of light commercial vehicles).