EUROPEAN COMMISSION

EUROPEAN COMMISSION

Brussels, 17.11.2015

SWD(2015) 207 final

COMMISSION STAFF WORKING DOCUMENT

Accompanying the document

Report from the Commission to the European Parliament and the Council on the application of the Postal Services Directive (Directive 97/67/EC as amended by Directive 2002/39/EC and Directive 2008/6/EC)

{COM(2015) 568 final}

Contents

1.Introduction and background

1.1.Postal Services in the Digital Age

1.2.The Postal Services Directive

1.3.Purpose and Scope of the Fifth Application Report and Staff Working Document

2.Application of the Postal Services Directive 2008/6/EC

2.1.Transposition and Application of Directive 2008/6/EC

2.2.Regulation of Postal Services

2.2.1.National Regulatory Authorities

2.2.2.Authorisation and Licensing Regimes

2.3.The Universal Service: Basic Postal Services for All

2.3.1.Designation of Universal Service Provider(s)

2.3.2.Services Provided under the Universal Service Obligation

2.3.3.Frequency of the Universal Service

2.3.4.Studies on User Needs and the Universal Service Obligation

2.3.5.Tariffs for Universal Service Products

2.3.6.Price Regulation

2.4.Financing the Universal Service Obligation

2.4.1.Regulatory Accounting

2.4.2.Net Cost of the Universal Service Obligation

2.5.Access to Postal Services, Network and Infrastructure

2.5.1.Access Points

2.5.2.Access to Postal Infrastructure

2.5.3.Access to the Postal Network

2.6.Quality of Service

2.7.Protection of Users

2.8.Internal Market for Postal Services: the Cross-Border Dimension

2.8.1.Legal Obligations and Regulatory Oversight

2.8.2.Tariff Principles

2.8.3.Customs and Security Controls

2.9.Data Collection

2.10.Value Added Tax (VAT)

2.11.Application of Competition Rules

3.Market Developments in the Postal Sector

3.1.Sector Overview

3.1.1.Ownership Structures of Universal Service Providers

3.1.2.Financial Position of Postal Operators

3.2.Letter Post Markets

3.2.1.Letter Volumes and Revenues

3.2.2.Competition in Letter Post Markets

3.2.3.Cross-border Letter Post

3.2.4.Outlook

3.3.Parcel and Express Markets

3.3.1.Parcel and Express Markets Overview

3.3.2.Parcel Volumes and Revenues

3.3.3.Competition in Parcel Markets

3.3.4.Cross-border Parcel Delivery

3.4.Employment in the Postal Sector

3.4.1.Overview

3.4.2.Employment in Universal Service Providers

3.4.3.Type of Employment and Working Conditions

3.4.4.Social Partners and Industrial Relations

3.4.5.Managing Restructuring

4.Conclusion

5.Annex on the Calculation of the Net Cost of the Postal Universal Service Obligation

1.Introduction and background

1.1.Postal Services in the Digital Age

Postal services have a central role in creating and sustaining an effective and dynamic single market and are vital for the wider economy. In 2013, the most recent year for which statistics are available, the universal service area alone (i.e. products and services falling within the scope of the universal service) accounted for more than EUR 23 billion for the EU28. Over 85 billion letter post items were dispatched by universal service providers in the EU, as were nearly 2 billion parcels. The postal services sector is also an important employer with about 1.2 million people employed by universal postal service providers (USPs) in 2013, plus those working for other letter and parcel delivery operators. The European Express Industry was estimated to employ 272,000 in 2010, predicted to grow to 300,000 by 2020.

The role of postal services is however changing rapidly and fundamentally, even more so since 2008. On one hand paper-based communications have declined in many Member States, while electronic-based communication witnessed significant growth. On the other hand, new technologies make shopping online more convenient and therefore increase the number of packages and parcels conveyed by postal operators. Consequently parcel and express revenues now account for more than half of the postal sector's total revenues, compared to 2007 when letter post was responsible for over half.

With full market opening in the postal sector accomplished in all Member States, the universal service providers now face the possibility of competition from new market entrants in the letter segment, though in reality the level of competition differs significantly between Member States and is relatively low in majority of them. In the parcel segment, competition appears to be intensifying to take advantage of the opportunities offered by e-commerce.

In response, universal service providers have increased their efficiency and restructured their operations to reduce costs. Many postal operators and other delivery companies are now more innovative and have developed new services, such as apps to track parcel delivery and electronic document exchange solutions. As a result however, postal workers' jobs and the skills needed for them have changed and overall employment (and in particular employment at universal service providers) has decreased.

Nevertheless, a high quality universal service at affordable prices is provided in all Member States. Further improvements have been made in the quality of service, innovation and customer orientation, business efficiency, the work of national regulatory authorities and collaboration with social partners. Shifts in the communications landscape and the advent of the Digital Single Market do however mean that the needs of postal users will continue to evolve and both legislation and regulatory oversight will need to keep pace with these developments, particularly to ensure the ongoing protection of all users and the sustainability of the postal sector.

1.2.The Postal Services Directive

The overall objective of European postal policy is to ensure that efficient, reliable and high-quality postal services are available on at least five working days per week throughout the EU to all its citizens and businesses at affordable prices. In line with the principles of subsidiarity and the differences in the postal markets of Member States, the Postal Services Directive is a framework directive which gives a considerable degree of flexibility to the Member States, allowing them to adapt elements of domestic postal services to their own particular needs.

The First Postal Services Directive, Directive 97/67, was adopted in 1997 after a lengthy period of analysis and consultation. It followed the broad aims set out in the Green Paper on the development of the single market for postal services published in June 1992, which inter alia stated that the analysis showed a sector with underlying structural problems, wide divergences between Member States and the absence of a clear Community-wide approach. Consequently the First Postal Services Directive aimed to improve domestic and intra-EU postal services by addressing the low quality of service and efficiency; the lack of customer focus, choice and innovation; limited cooperation between operators; and ongoing state subsidies.

Among the key elements of the First Postal Services Directive were the establishment of a universal service, with minimum scope, frequency and quality of service requirements, a number of tariff principles and the creation of independent national regulatory authorities (NRAs) for postal services. An essential element of the modernisation strategy was the ‘gradual and controlled liberalisation of the market’. In 2002, as a further step in that direction, the Second Postal Services Directive, among other amendments, reduced the price and weight limits for the reserved area, thus reducing the scope of the monopoly of the national postal operators.

In February 2008 the Council and the European Parliament adopted the Third Postal Services Directive which introduced the legal basis for the accomplishment of the internal market for postal services by providing for a last legislative step in the process of gradual market opening. It set an agreed deadline for full market opening of 31 December 2010 for 16 Member States and 31 December 2012 for the (then) remaining 11 Member States. References to the Postal Services Directive (PSD) or 'the Directive' refer to the consolidated Postal Services Directive (unless otherwise stated).

In addition to setting a timetable for full market opening, the Third Postal Services Directive modified other provisions of the Directive to render them more compatible with ‘full market opening’. Revisions and additions included strengthening the tasks and competences of NRAs; changes in the manner in which universal service could be provided and financed; requiring certain elements of the postal infrastructure (such as address databases and letter boxes) to be accessible to multiple operators; strengthening and broadening the legal requirements for information and data collection by NRAs; and extending consumer protection provisions. The Directive also contains a specific provision requiring the Commission to provide assistance to Member States on its implementation, including on the calculation of any net cost of the universal service, which was initially set out in Annex (I) entitled "Guidance on calculating the net cost, if any, of universal service" and is further addressed as an Annex to this Staff Working Document.

1.3.Purpose and Scope of the Fifth Application Report and Staff Working Document

This Staff Working Document accompanies the Application Report and provides more detailed information on how the Directive has been implemented, market developments and calculations of the net cost of the Universal Service Obligation that have been found to be consistent with the Directive.

The Application Report and Staff Working Document cover developments from late 2008 (when the Fourth Application Report was published) to 2015, although official postal statistics are only available up to 2013 due to the time lag in gathering data and some other estimates, in particular those for the parcel sectors, are for earlier years. Sources used for this Report include studies commissioned by the Commission on Main Developments in the Postal Sector (2008-2010), Pricing behaviour of postal operators and Main Developments in the Postal Sector (2010-2013), a number of reports by the European Regulators Group for Postal Services (ERGP), contributions in the context of the Postal Directive Committee (PDC) and the Postal User Forum, documents and contributions linked to the 2012 Green Paper, An integrated parcel delivery market for the growth of e-commerce in the EU, and the 2013 Communication, A roadmap for completing the single market for parcel delivery Build trust in delivery services and encourage online sales. Eurostat data up to 2011 and the Commission's own statistics, for period after 2012 when Eurostat decided to stop dedicated collection of statistical data for the postal sector, have also been used. The latter are referred to in the Report and Staff Working Document as 'European Commission Postal Statistics. Universal Postal Union statistics have also been used.

The period late 2008 to 2015 is of particular significance for the postal sector in the EU for two main reasons. First, the Application Report and Staff Working Document cover the period in the run up to and directly after full market opening in all EU Member States. Second, there are profound changes in the communications and postal sector, compounded by the economic situation following the 2007/08 financial crisis, which are fundamentally impacting the postal market. Letter volumes have fallen substantially since 2008 in most Member States and by around 40% in the one most affected (Denmark). Parcel deliveries are increasing, but require a different postal infrastructure as well as different skills and patterns of employment for employees.

2.Application of the Postal Services Directive 2008/6/EC

2.1.Transposition and Application of Directive 2008/6/EC

All EU Member States have now transposed Directive 2008/6/EC. This Staff Working Document covers the EU Member States only, unless stated otherwise.

The three European Free Trade Area (EFTA) Members of the European Economic Area (EEA), Iceland (IS), Lichtenstein (LI) and Norway (NO), are not covered by this Staff Working Document as they have not yet transposed Directive 2008/6/EC. It should, however, be noted that the Norwegian government submitted the bill for a new Postal Service Act to the national parliament (i.e. Storing) on 24 April 2015; this bill is implementing Directive 2008/6/EC and also contains certain changes to the universal service.

The Commission continues to monitor whether the legislative measures adopted by Member States constitute a complete transposition of the Directive and if the different elements of the Directive are implemented correctly. Since 2008 the Commission has initiated infringement proceedings against two Member States, namely Belgium and Croatia, on issues of content (rather than timing) in the postal acquis.

2.2. Regulation of Postal Services

2.2.1.National Regulatory Authorities

Independent national regulatory authorities (NRAs) play a key role as they are the competent bodies who – after an appropriate implementation into national legislation

– oversee the Directive's application. NRAs are defined as "the body or bodies, in each Member State, to which the Member State entrusts, inter alia, the regulatory functions falling within the scope of this Directive" (Article 2 (18)). They “have as a particular task ensuring compliance with the obligations arising from this Directive (…)” and “may also be charged with competition rules in the postal sector” (Article 22).

All EU Member States have established an independent NRA for the postal sector. Most Member States combine the regulation of the post and electronic communications sectors, in some cases alongside other network industries (e.g. rail transport and energy). The model of a multi-sector regulator has gained further momentum in the reporting period and regulators who cover the postal sector alone are the now the exception.

Regulatory independence can be reinforced through qualifications, fixed terms of office and legal protection against dismissal without cause. Senior NRA officials should not be permitted to work for the public postal operator or other interested parties immediately after serving with the NRA in order to prevent any actual or perceived conflict of interest. In general the organisational set-up of most NRAs is likely to foster regulatory independence, though there is still room for improvement to bring some governance procedures in line with best practices, for example where the minister responsible for postal policy is able to appoint or dismiss the head of the NRA and approves the NRA's budget.

To help ensure effective regulatory oversight, the PSD requires that NRAs are provided with all necessary resources in terms of staffing, expertise and financial means for the performance of their tasks. Overall, available figures suggest that combined resources for postal NRAs have changed little or decreased slightly since 2008, with an estimated 344 people employed and a budget of EUR 35 million in 2012 for the EEA. The financial and personnel resources available to NRAs vary substantially between Member States. Larger Member States with bigger postal sectors have larger NRAs, although the increase in resources is not proportional to market size. The postal sector’s role in facilitating e-commerce, the growth of the parcel segment and rapid changes in technology means that NRAs should be ready and equipped to face new challenges as they arise.

To ensure compliance with the obligations arising from the Directive, NRAs require sufficient enforcement powers. In some Member States enforcement powers are comprehensive, for example where the NRA can levy significant fines, issue remedial orders or seek court enforcement, though in some instance these powers are more limited.

The vast majority of NRAs appear to have satisfactory procedures in terms of transparency, fairness and clarity. Examples of such procedures include the publication of key documents in national languages, opportunities for the public to comment on proposals and public reporting. At least fifteen NRAs (EU and EEA) show a high level of transparency.

Member States must also, if appropriate, provide for coordination between the NRAs, National Competition Authorities (NCAs) and the consumer protection authorities (Article 22(1)). From a procedural point of view, Member States may entrust enforcement of the competition rules to the NRA, the NCA, or both. Competition rules tend to be delegated to the NCA alone, though six Member States give the NRA equal or exclusive authority over application of the competition rules in the postal sector. In 21 Member States the NRA and NCA are obliged to provide each other with the information necessary for the application of the Postal Directive and the competition rules in the postal sector and /or regularly consult each other on the application of the competition law to the postal sector.

Main institutional regulatory developments since 2008:

On 10 August 2010 the Commission, on the basis of Article 22 of the Postal Services Directive, and with the full support of Member States and NRAs, established the European Regulators Group for Postal Services (ERGP).

The ERGP serves as a body for reflection, discussion and advice to the Commission in the postal services field. Its task is to facilitate consultation, coordination and cooperation between the independent NRAs in the Member States, and between NRAs and the Commission, with a view to consolidating the internal market for postal services and ensuring the consistent application of the Postal Services Directive in all Member States. The ERGP is an advisory group. Membership is limited to independent NRAs of Member States and the EEA and EU candidate countries participate as observers. Participation takes places at a high level (Heads of independent NRAs) and the chair is elected from the membership. The Commission is an observer and provides the Secretariat. Since it was established, the ERGP has played an important role in postal reform and oversight. Comprehensive information about the ERGP including membership and publications is available here:

http://ec.europa.eu/growth/sectors/postal-services/ergp/index_en.htm

Since 2010, several NRAs have been fundamentally reorganized. In the UK, the Postal Services Act 2011 transferred responsibility for regulation of postal services from the single-sector regulator Postcomm to Ofcom (the regulation and competition authority for the UK communications industries). In the Netherlands, a new regulator, the Netherlands Authority for Consumers and Markets (ACM) was created from a merger on 1 April 2013 of the Netherlands Consumer Authority, the Netherlands Competition Authority (NMa) and the Netherlands Independent Post and Telecommunications Authority (OPTA). In Spain the former postal NRA was merged with other national regulators (electronic communications, energy, media, airports and railways) and the Spanish Competition Authority (CNC) creating the Spanish Markets and Competition Authority (Comisión Nacional de los Mercados y de la Competencia (CNMC)).

2.2.2.Authorisation and Licensing Regimes

Article 9 sets out the types of regulatory regime and the conditions that Member States may impose to ensure the provision of a certain level of postal services. For services outside the scope of the Universal Service Obligation (USO) "Member States may introduce general authorisations to the extent necessary to guarantee compliance with the essential requirements". General authorisations do not require operators to obtain an explicit decision from the NRA before starting to offer the service concerned.

For services within the scope of the USO, Member States may go beyond a general authorisation and introduce more stringent conditions, "to the extent necessary to guarantee compliance and to ensure the provision of the universal service". These requirements may include an individual licensing regime, where providers must obtain permission from the NRA before offering a service. In turn the license may contain specific rights and obligations in line with Article 9(2), for example setting certain standards for quality, availability and performance of services; requiring contributions to the financing of the universal service; and imposing technical or operational conditions.

Concerns have been expressed that authorisation procedures for postal operators have been used to expand regulatory controls and erect barriers to market entry following the abolition of the reserved area, rather than to enable new operators to benefit from full market opening. In some Member States new regulatory requirements have been created as individual licences have been introduced for services which were previously outside the scope for regulatory control. Wherever possible, authorisations should be in the form of general authorisations applicable to all postal operators in order to minimise barriers to market entry and create the least market distortion.

Figure 1: Designated and authorised postal operators and licensing/authorisation procedures (2010-2012)

Source: WIK-Consult, Main Developments in the Postal Sector (2010-2013), p37 and 43.

The chart above shows whether Member States use a licensing regime (indicated by L) or a general authorisation (G) and the number of authorisations granted for 2010, 2011 and 2012. Most Member States continue to use a licensing regime. Ten Member States (BG, CY, EE, EL, ES, HU, IT, LU, MT and PT) continue to maintain licence requirements for the entire USO area, while six additional Member States (AT, DE, BE, FI, FR and SE), require licenses for portions of the universal service area. Since 2008, LT, LV, PL, RO, SI and UK have replaced licenses with a general authorisation. While most Member States have granted more than one authorisation, the number of active operators is lower than the number of licenses.

Ten Member States appear to apply conditions relating to the ‘quality, availability, and performance’ of services provided by authorised postal operators other than designated universal service providers (USPs). Conditions are permitted by the Postal Services Directive, but only if they are not comparable to ‘universal service obligations’ and if they are strictly ‘necessary and justified’ to accomplish some other objective of the Postal Services Directive, such as protecting users. In particular they are subject to the proportionality requirement under Article 9(3).

For example, the current Belgian legislation imposes strict licence conditions on providers of postal services. After two years of operation, operators are required to deliver twice a week and after five years to serve all three regions of Belgium, expanding in line with minimum percentages for population coverage, as well as applying a uniform rate throughout the country. Given that these conditions erect high barriers to entry they appear to protect the USP from competition rather than specifying necessary and justified requirements. In November 2014 the Commission started an infringement procedure against Belgium and addressed a letter of formal notice to the Kingdom of Belgium. A study commissioned by the Belgian Institute for Postal Services and Telecommunications (BIPT), the NRA, confirmed that the above requirements are neither necessary nor justified. In April 2015, Belgium indicated to the Commission that it would bring forward legislative proposals in 2015 to remove these requirements by amending current national legislation.

Eleven Member States appear to have several authorisation conditions which duplicate requirements of other legislation, for example covering the confidentiality of correspondence. In principle the implementation of the PSD should not duplicate conditions which are applicable through other non-sector specific national legislation.

2.3.The Universal Service: Basic Postal Services for All

Article 3 of the PSD requires Member States to safeguard the provision of certain basic postal services (the “universal service”). This is key to ensuring reliable and affordable postal services for all users across the EU. As a minimum, Member States must ensure a universal service that provides for the collection, sorting, transport, and distribution at least five working days per week of (i) postal items weighing up to 2 kilograms and (ii) postal packages up to 10 kilograms, as well as services for registered items and insured items in both categories. Within these boundaries Member States have flexibility to decide what exactly constitutes a universal service to fit their domestic circumstances. The universal service covers both national and cross-border services (Article 3, paragraph 7). Cross-border postal services are specifically addressed in section 2.8 whereas the focus of sections 2.3 to 2.7 is primarily domestic (universal) postal services.

Many commonly used postal services are not part of the universal service, even where they are provided by the universal service provider. Such services include for example value-added services like track and trace capability or delivery within a specified time window. Other services such as bulk mail or periodicals are part of the USO in some Member States, but not in all.

2.3.1.Designation of Universal Service Provider(s)

The provision of the universal service must be ensured by Member States using one or more of three mechanisms: market forces; the designation of one or more undertakings to provide different elements of the universal service or to cover different parts of the territory; or the public procurement of universal services (Article 4 (2)). Member States are to determine themselves the "most efficient and appropriate" mechanism while respecting "the principles of objectivity, transparency, non-discrimination, proportionality and least market distortion necessary to ensure the free provision of postal services in the internal market", taking into account national needs and conditions.

Directive 2008/6/EC changed the historic preference for the designation of a particular operator, to encourage greater competition and choice in postal services. Nevertheless, all Member States still designate a single universal service provider (USP), with the exception of Germany, which in principle relies on market forces for the provision of the universal service. In all Member States the universal service provider is the historical public postal operator or its corporate successor.

Reliance on market forces requires the least regulatory intervention, but there may be grounds to justify one of the other solutions. Designating a universal service provider (USP) also has implications beyond the provision of the universal service. For example, the different legal status that results from the designation can trigger different VAT treatment (for a certain limited scope of postal items).

To prevent undue distortions Article 4(2) PSD states that any entrustment should be used proportionately that is, only to the extent objectively necessary to ensure the universal service and should be ‘based on the principles of transparency, non-discrimination and proportionality’, while taking into account that the duration of this designation should provide a sufficient period for return on investments. When Member States conduct the periodic review required by Article 4(2) they will need to engage in an objective, transparent, and non-discriminatory analysis, as stated by Recital 23, and to consider carefully if continued reliance on a historic designation model is appropriate or necessary.

2.3.2.Services Provided under the Universal Service Obligation

There is flexibility in the services that can be provided under the universal service obligation (USO) providing that Member States ensure a universal service that provides for the collection, sorting, transport, and distribution of (i) postal items weighing up to 2 kilograms and (ii) postal packages up to 10 kilograms, as well as services for registered items and insured items in both categories. There is therefore significant variation in how Member States define the universal service obligation and the services that are included within the universal service obligation have changed over time. All Member States include single piece letters and parcels. Eleven member states (c. 56% of the EU/EEA letter post market) include only single piece items, while others also include bulk letters (potentially including bulk mail, direct mail and periodicals), bulk parcels and other items.

Table 1: Variations in the Scope of the Universal Service Obligation (2013)

|

Scope

|

Number

|

Member State

|

|

Single Piece Only

|

9

|

BG, CZ, DE, EE, HK, LT, NL, PL, UK.

|

|

Single Piece and Bulk Letters

|

7

|

EL, FR, IT, CY, LV, SE, SI.

|

|

All

|

11

|

AT, BE, DK, ES, HU, IE, LU, MT, PT, RO, SK.

|

Source: ERGP, Report on the Benchmarking of the universal service tariffs, ERGP (14) 23, 2014

There appears to be a trend towards a narrower scope for the universal service obligation. Fewer Member States now include bulk letters, direct mail and periodicals than previously, though more now include bulk parcels in the universal service obligation.

The designation of services as part of the universal service obligation requires a set of obligations stemming from the Directive to be fulfilled. The broader the range of services included in the universal service, the broader the responsibility of the Member State to ensure cost-orientation, non-discrimination, transparency, service quality, etc.

The Directive currently provides for NRA tasks regarding non-universal postal services in three areas: complaints, statistics, and supervision of the regulatory accounts of USPs. Article 19 requires Member States to ensure that all postal operators, i.e. not only universal service providers, maintain certain measures to protect the rights of users. Article 22a that was introduced by Directive 2008/6/EC requires all postal services providers to provide information for clearly defined statistical purposes and to ensure conformity with the Postal Services Directive to the NRA. Article 14 provides that USPs must account for common costs incurred in providing universal and non-universal postal services (in order to be able to check for any cross-subsidies).

As bulk postal services have in more and more Member States been excluded from the universal service obligation, the NRAs’ authority to control pricing in bulk postal markets has receded. However, as outlined in section 3.2.2, in most Member States the universal service provider faces little effective competition. If these products and services are no longer subject to a sector specific regulatory regime, a universal service provider may be able to block market entry, for example by denying access to elements of the postal infrastructure or denying competitors non-discriminatory access to downstream services ("last mile delivery").

Ongoing monitoring is needed to ensure that the provisions in the Directive which protect competition in the universal service area remain sufficient as postal services evolve. Further statistical information for non-universal parcel services and increased regulatory oversight of cross-border services, given the growing importance of parcel delivery for e-commerce, are areas of particular focus.

2.3.3.Frequency of the Universal Service

Article 3 specifies that the universal service should be guaranteed not less than five working days a week save in circumstances or geographical conditions deemed exceptional. Most Member States guarantee the collection and delivery of letters and parcels on five working days, though some exceed this requirement, some for letters and some for both letters and parcels. Some USPs choose to delivery more often than they are formally required to do, for example in Germany where there is delivery on six days but the legal requirement for five. The table below sets out delivery frequencies.

Table 2: Collection and Delivery Frequencies for the Universal Service Obligation

|

Collection and delivery frequency

|

Member State

|

|

5 days for letters not specified for parcels

|

CY, SE,

|

|

5 days for letters, 5 days for parcels

|

AT*, BE, BG, ES, CZ, EE, FI, EL, HK, HU, IE, IT, LV, LT, LU, NL, PL, PT, RO, SK, SI,

|

|

6 for letters, 5 for parcels

|

DK, UK

|

|

6 for letters, 6 for parcels

|

FR, DE, MT

|

* In Austria newspapers are delivered 6 days a week and all other products on 5 days.

Source: WIK-Consult, Main Developments in the Postal Sector (2010-2013) and ERGP, (14)23 Report on the Benchmarking of the Universal Service Tariffs updated

The importance the Directive attaches to the delivery frequency and thus also the limits to the derogation relating to circumstances or geographical situations deemed exceptional has been reflected in the wording of Recital 21 of Directive 2008/6/EC, which states explicitly: "The universal service guarantees, in principle, one clearance and one delivery to the home or premises of every natural or legal person every working day, even in remote or sparsely populated areas." Therefore, it is clear that any derogation granted by the NRA in accordance with Article 3(3) of the Directive must be based on clear and objective criteria and be subject to regular monitoring as to its scope and effects.

The possibility to provide exemptions from the minimum obligation due to exceptional circumstances or geographical conditions has to date been used in a restricted manner, as was the Directive's intention. 16 Member States apply the derogation as allowed under Article 3(3) of the Postal Services Directive but most exceptions are limited to the exclusion of less than 1% of the population from daily home delivery. An ERGP study on best practice recommended that exemptions should be based on objective and published criteria, monitored regularly and subject to control mechanisms.

Main developments:

From 1 January 2014 Post NL reduced the number of collection and delivery days from six to five. Reductions were also proposed to the number of post boxes and postal agencies required.

In Denmark the law allowed in 2014 for the universal service provider to change the delivery frequency so that first class letters are not delivered to private households on Mondays (only Tuesday-Saturday).

Posti (then Itella) in Finland conducted a trial in autumn 2014 where it delivered non-USO products four days a week while continuing to deliver USO products five days a week. Delivery routes were also changed. Following the trial, 70% of recipients felt that delivery was working well and 80% thought that the mail delivery was normal. Almost two thirds were ready to see the delivery model expanded permanently to the rest of the country.

2.3.4.Studies on User Needs and the Universal Service Obligation

Given the ongoing decline in letter post volumes, and the increasing accessibility and use of e-commerce, some Member States (and other organisations) have conducted reviews of the USO and user needs.

Studies include:

A 2010 study commissioned by the Irish NRA ComReg observed a diminishing importance of letter post and the use of electronic substitutes among residential customers and SMEs. In contrast, large businesses, governmental bodies and NGOs still relied on letter post. Both residential and organisational customers emphasised the importance of delivery to every address and the reliability of the service (i.e. at the same time of the day). Residential customers and SMEs were found to have lower requirements that the universal service specified, but customers were rather dissatisfied with service quality in terms of parcels.

In 2012 Michel Barnier, the former Commissioner for the Internal Market and Services, used the “Postal User Forum” as a forum for a debate between postal users and various stakeholders (including mail-and parcel users, on-line retailers, internet service providers, postal and courier operators) to identify today's needs and experiences on mail and parcel delivery and solutions for the future. The service levels of the universal service definition were questioned by stakeholders in different contexts, including the context of digitalisation and letter volume decline.

A 2012/13 Ofcom study

concluded that the postal market was meeting the reasonable needs of users in the UK although tolerance of changes to the universal service was quite high. Users wanted more convenient delivery of parcels. When questioned about possible future scenarios, residential customers were willing to consider a single tier postal service, slightly more expensive than current second class but quicker, a reduction in frequency from six to five days and greater flexibility in delivery/collection times. Customers were willing to accept significant changes in the service in order to maintain prices. They were not willing to have differences in local and national services.

The ERGP published a discussion paper which set out the key challenges and held a public consultation on the universal service obligation in view of market developments in autumn 2014.

Many of those who responded to the consultation called for a reduction in the scope of the USO, at least at the European level, in order to give Member States greater flexibility given the nature of their domestic letter markets.

ERGP work in this area is continuing in 2015.

2.3.5.Tariffs for Universal Service Products

Article 12 of the PSD requires universal postal services to be affordable for all users, prices to be cost-oriented and transparent and provision to be on a non-discriminatory basis. Member States have a certain margin of discretion as to how to interpret these principles. All Member States apply some form of price control and most Member States have included the principles in their national postal legislation.

The aim of affordability is to ensure basic postal services are within everyone's means. In some Member States the existence of a price cap is deemed sufficient to ensure affordability, though in some cases affordability is tested, for example by regulatory approval of price changes, multi criteria assessments and consultations. Some regulators publish the results of their affordability tests.

Comparisons of 'affordability' across Member States need to take into account the impact of exchange rates, standards of living and the domestic postal product mix. To compare affordability, the ERGP used a range of measures which showed that for single piece 20g domestic priority letters, Latvia was the most expensive and Malta the cheapest of the 26 Member States that were included in a survey using a daily net earnings comparison. Using the published price at adjusted exchange rates and excluding VAT, Latvia (EUR 1.22) was the most expensive and Malta (EUR 0.35) was the cheapest again. The size and weight categories and their corresponding prices were however not always compatible, for example Poland's first weight category is for letters up to 350 grams rather than 20 grams, and some Member States also offer cheaper 'non-priority' alternatives.

Figure 2: Domestic letter price (20g, priority) as proportion of daily net earnings (‰)

Source: ERGP (14) (23) ERGP Report on the benchmarking of the universal service tariffs.

For a heavier weight category, a domestic priority letter weighing up to 500g using adjusted exchange rates, Italy (EUR 5.18) was the most expensive and Cyprus (EUR 0.75) the cheapest Member State. When compared to daily net earnings, Romania was the most expensive and Luxembourg the cheapest.

For a domestic single piece 2kg parcel, Sweden (EUR 13.47) was the most expensive and Denmark (EUR 1.06) the cheapest, adjusted for exchange rates. Compared to daily earnings, Denmark was the cheapest and Hungary the most expensive.

Figure 3: Domestic letter price (20g priority in 2013) using purchasing power parity

Source: European Commission Postal Statistics, own calculations on the basis of the prices of 2013

In terms of affordability, PPP prices in the eastern Member States appear to be higher than prices in the southern or western Member States, although when comparing nominal prices the exact opposite is observed.

Average price trends in EU28 show an average price increase for 2012 to 2013 of 5.4% that is distributed unevenly across Member States. In southern Member States higher price increases are observed compared to the eastern or western ones.

To help compensate for declining volumes, some universal service providers have significantly increased their basic tariffs in recent years, including in Denmark, Estonia, Luxembourg, Hungary and the UK, though in many cases these Member States previously had postal tariffs that were stable or declining in real terms. For example in Estonia, in the first price change since 2011, Eesti Post announced a 22% increase in the cost of sending a domestic standard letter from 1 September 2014 and the price of all universal services (including international letters and parcels up to 20kg) also rose by 18% on average. In Southern and Eastern Member States between 2010 and 2012 tariffs usually remained stable or declined in real terms, though since then some universal service providers have announced notable increases, including Malta Post and Poczta Polska.

Non-priority letter services allow for more flexibility in postal operations and are a way to reduce network cost and help mitigate declining volumes as well as ensuring the continued availability of an affordable service. In around half of the Member States USPs offer non-priority basic letter post services that are delivered the second or the third day after posting (second fastest standard category: SSC), rather than on the next day. In 2011 Austrian Post launched an economy/ D+3 service for business customers, having previously offered only a next day service. La Poste (France) has also introduced a D+2 letter (‘lettre verte’) for consumers and business customers additional to its D+1 service (‘lettre prioritaire’) and D+3/4 service (‘l’écopli’). In Denmark, the UK and Hungary tariffs for second class letters have increased substantially less than those for first class letters, in order to help maintain the affordability of basic services. In Denmark and the UK the second class letter is still subject to ex ante price regulation while the first class letter is not. The price difference between first and second class letters in most Member States is more than 10% and can be as large as 37.5% (Romania).

The cost-orientation requirement aims not only to prevent prices of basic postal services from being too high, but also to prevent pricing below service specific costs, which could restrict competition and could therefore lead to higher prices in the long run. NRAs measure and test cost-orientation in different ways, for example by scrutinising individual prices, the price of a level of service (i.e. counting the different size or weight steps) or the price of a basket of services, and using regulatory and financial accounts. To test the principle of cost-orientation, some NRAs regard price caps as sufficient, while others monitor specific criteria for cost-orientation or perform other tests, primarily using either the regulatory or financial accounts of the USP. Stakeholders other than the USP are usually not involved and the results of these tests are rarely published.

ERGP analysis of the determinants of pricing found that around 20% of the observed difference in letter prices is due to population density. The correlation between price and degree of urbanisation was not statistically significant but the relationship with dwelling type (detached houses, flats etc) was significant. Labour costs accounted for 36.7% of the variation in prices.

Most Member States ensure transparency by requiring the USP to publish prices, in line with the European Committee for Postal Regulation's (CERP) recommendation, although around half do not have defined criteria for 'transparency'. A small number go further than publication alone, for example by requiring pricing models to be submitted to the regulator, requiring the publication of pricing principles and/or the disclosure/publication of individually negotiated prices. Some USPs also publish tariffs outside the scope of the universal service and some publish information in other languages.

The aim of the principle of non-discrimination of tariffs is that customers in comparable conditions should be able to benefit from equivalent tariffs and conditions. A wide range of potential criteria can be used to define non-discrimination, e.g. geographical distribution, volumes, levels of pre-sortation, or access for certain user groups. NRAs in almost all Member States take steps to ensure non-discriminatory tariffs with the exception of Hungary. Non-discrimination is usually tested through ex-ante instruments or ex-post testing. There have been a number of legal cases related to the principle of non-discrimination, see section 2.11 for further details.

2.3.6.Price Regulation

Ex ante approvals can help to ensure that prices of universal services are cost oriented and are therefore necessary where emerging competition might be damaged by universal service providers setting unreasonably low prices or consumers of universal service products or services might be damaged by universal service providers setting unreasonably high prices. On the other hand, the administrative burden of ex ante price regulation is relatively high and postal operators have limited commercial freedom under such a regime. Certain studies suggest that in a market with declining volumes in particular, some degree of pricing flexibility and a lighter touch regulatory regime may be more likely to meet the aims of affordability and competition than price cap regulation.

Member States use both ex ante and ex post price control methods, though to different extents. The majority rely more on ex ante price regulation than on ex post control. Single piece postal items (letters and parcels) are the items most often subject to ex ante control. Price caps are also used in many Member States, again most commonly on single piece items. Several Member States apply other price control measures in addition to ex ante approvals and price caps, for example checking (ex post) the prices subject to a cap. Even where price controls are not currently used, NRAs may have the power to introduce or extend them, in the event that they are deemed necessary in the future.

Table 3: Products Subject to and Methods of Price Regulation

|

|

Single piece letters

|

Bulk letters

|

Direct mail

|

Newspapers magazines

|

Non-priority correspondence

|

Single piece parcels

|

Bulk parcels

|

|

Ex ante approval

|

AT, BG, CY, EL, ES, IE, LT, LU, LV, MT***, RO, SI, SK

|

AT, CY, EL, LU, LV, MT*** RO, SK

|

AT, CY, EL, MT*** RO, SK

|

AT, EL, FR, MT***, RO, SI

|

BG, EL, LT, LV, RO, SK,

|

AT, BG, CY, EL, ES, LT, LU, LV, MT*** RO, SI, SK

|

AT, EL, MT***, RO, SK

|

|

Price cap

|

AT, BE, DE**, EE, FR, HU, IE, IT, NL, PL, PT

|

FR, IE, IT, PT

|

FR, PT

|

IT

|

BE, FR, HU, PL, UK

|

BE, EE, FR, IE, IT, NL, PL, PT

|

FR

|

|

Ex post control

|

DK, FI, HU, SE

|

DE, ES, SE

|

DE, DK, SE

|

DE, SE, SK

|

DK, FI, SE

|

DE, DK, FI, HU, SE

|

DK, ES, HU, SE

|

Source WIK-Consult, Main Developments in the Postal Sector (2010-2013), p141

Main developments:

In 2011 Bundesnetzagentur (BNetzA), the German NRA, deemed the tariffs of Deutsche Post’s (fully owned) subsidiary First Mail to be discriminatory and anticompetitive. First Mail offered regional letter services for business customers using separate delivery to that of Deutsche Post in densely populated areas in Germany and in competition with other postal service providers. The other operators accused First Mail of setting prices too low and hindering competition. In its decision, the NRA concluded that prices offered by a subsidiary of a regulated firm cannot be assessed separately from the parent, and that Deutsche Post and its subsidiary should be considered as one entity. First Mail was therefore obliged to set prices no lower than prices for downstream access at the inward mail centre of Deutsche Post. Following the BNetzA decision, Deutsche Post ended First Mail’s operations at the end of 2011.

In April 2012 the UK NRA, Ofcom, substantially reduced the scope of ex ante price regulation. The goal was to give Royal Mail greater pricing flexibility in order to sustain its financial viability and ensure the provision of universal service in view of changing market conditions. Next day ('first class') letters and downstream access prices are no longer capped. To protect the affordability of universal services for elderly people and low income customers in particular, Ofcom maintained a "safeguard" cap on prices for second class mail (two to three day delivery) only.

The Commission for Communications Regulation (ComReg), the Irish NRA, introduced a price cap for the universal service in 2014. This is the first time the Irish USP, An Post, has been subject to a price cap control. The price cap is effective for five years and sets an upper limit on the amount that An Post can charge, rather than setting actual prices. The cap is indexed to the consumer price index, minus an adjustment to encourage the efficient provision of postal services.

In Portugal, the NRA issued a decision in 2014 on the criteria for setting universal service prices which will be applied from 2015 until 2017. Correspondence, editorial mail and parcel basket of services are controlled by a price cap, as well as legal summons and notifications service. For all other universal postal services, CTT has to notify the NRA of prices to be introduced at least 30 days ahead of the date on which prices take effect and show it complies with the tariff principles (affordability, cost-orientation, transparency and non-discrimination) and pricing criteria defined in the decision. If the NRA deems the proposed prices do not comply with the principles and criteria the USP is notified based on a substantiated decision, so that company may revise such prices within 15 days. If on the other hand the NRA remains silent, then the USP is entitled to introduce the notified prices (when the notification period has elapsed).

In France ARCEP approved higher limits for price changes (concerning the price cap period from 2013 to 2015) than in previous price cap periods due to expected falling revenues of the regulated services. Following a subsequent review in light of declining mail volumes, La Poste and ARCEP implemented a new pricing framework equal to the consumer price index increased by 3.5 points a year on average for universal service prices. La Poste announced an average price increase of 7% for mail from 1 January 2015.

2.4.Financing the Universal Service Obligation

2.4.1.Regulatory Accounting

Article 14 requires universal services providers to keep separate accounts for universal service and non-universal service products and NRAs to ensure compliance with the cost allocation principles set out in the Directive. The primary aim is to require accounts to be kept that can be used to determine any net cost or unfair financial burden created by the universal service, though separate accounts can also help the NRA to determine whether the USP is acting according to the tariff principles set out in Article 12 and, for example, not engaging in discriminatory pricing.

In the majority of the Member States, regulatory accounts cover non-universal services or even non-postal services (such as unaddressed items or financial services), as well as the universal service area. This fits with the totality principle identified by the ERGP that the regulatory accounts should cover any activity that is used by both universal services and non-universal services.

The main cost basis that is used for regulatory accounting is historical costs (as opposed to current costs which are used only in Finland). Most NRAs use activity based costing. The ERGP has clarified that activities should be based on causality, but the USO should not be regarded as a cost driver without being fully evidenced by the USP and agreed by the NRA.

Given that the postal infrastructure is used for both USO and non USO products, the correct allocation of joint costs and common costs is vital. NRAs use different methods for common cost allocation which may, but need not be, based on activity based costing. The most widespread methodology seems to be equi-proportional mark-up (EPMU) which allocates all common costs according to their proportion of total costs and is therefore consistent with Article 14(3)(b)(iii). EMPU does not however reflect how common costs are actually incurred. The long run (average) incremental cost (LRIC) approach may be more accurate and are used in addition or instead of EPMU in several Member States.

In general, cost allocation methods are not public. Few NRAs publish which cost allocation method they use and the structure of regulatory financial reporting also tends not to be public. The NRAs in France and the UK have however published templates for their regulatory cost accounts.

In May 2013 the European Regulators Group for Postal Services (ERGP) published a common position on cost accounting rules. This followed an earlier ERGP report and public consultation in 2012.

2.4.2.Net Cost of the Universal Service Obligation

According to the 2008/06/EC Postal Services Directive, "Member States should be given further flexibility to determine the most efficient and appropriate mechanism to guarantee the availability of the universal service, while respecting the principles of objectivity, transparency, non-discrimination, proportionality and least market distortion necessary to ensure the free provision of postal services in the internal market". In this context the Postal Services Directive recognised that "the external financing of the residual net costs of the universal service may still be necessary for some Member States." The 2008 Directive therefore introduced Annex 1, Guidance on calculating the net cost, if any, of the universal service.

Annex I of the Postal Services Directive provides the general methodological framework for calculating the net costs of the Universal Service Obligation (USO). The details of the calculation and the methodological alternatives available however, are not dealt with by the Directive.

The European Commission commissioned a study in 2012 to evaluate how Member States have assessed the net costs of the universal service obligation to date. At the same time, the European Regulators Group for Postal Services (ERGP) had been conducting related research in this field. There are also a number of state aid decisions already adopted by the European Commission concerning postal operators which apply Annex I to calculate the net cost of the universal service obligation.

Following previous studies and relevant case law and in line with its obligation to provide assistance (Article 23a), an Annex to this Report is included that sets out different approaches to calculate the net costs of the Postal Universal Service Obligation that have been found to be consistent with Annex I of the Postal Services Directive.

The estimated cost of the universal service in western Member States has been estimated to be around five per cent of the overall cost of the USO, whereas in the eastern Member States it is thought to be much higher and in the region of 30% to 70%. There is also some evidence the net cost of the USO is increasing over time, particularly given falling mail volumes.

Article 7 of the Directive provides mechanisms in the event that any net cost of the universal service obligation represents an unfair financial burden on the universal service provider. The alternative mechanisms are compensation from public funds (i.e. general taxation) or a cost-sharing mechanism, potentially a compensation fund "for the sharing of the net cost…between providers of services and/or users."

Several Member States have deemed the universal service obligation to be an unfair burden. Some Member States (including IT and PL) compensate the universal service provider through public funds and others (CY, EE, HK, IT and SK) have established a compensation fund, although a further 18 have authorised the use of a compensation fund. Concerns have been raised that the establishment of a compensation fund could create a barrier to entry, and developments in this respect will need to be closely monitored.

2.5.Access to Postal Services, Network and Infrastructure

2.5.1.Access Points

Article 3(2) requires Member States to ensure that the density of the points of contact and access points takes account of the needs of users, including where appropriate a minimum number of services at the same access point and an appropriate density of access points to postal services in rural and remote regions. Access points are physical facilities, including letter boxes and the premises of the postal service provider, such as post offices, where postal items may be deposited into the postal network. Rural postal points can provide an important infrastructure network for access to electronic communications and e-commerce (for both retailers and consumers).

In 2013 there were around 700,000 post boxes in the EU. In some Member States the number of post boxes has remained relatively stable. In other Member States it has fallen, notably in DK, PT, and PL where the number of post boxes fell by over 10% between 2010 and 2013. Germany is the only Member State where there is a significant number of street letter boxes for other operators as most business customers who use providers other than the USP for bulk mail services in other Member States will have mail collected directly from their premises rather depositing it in a post box or at a post office. Not all Member States have legal requirements specifying a minimum number of post boxes.

In 2013 there were about 145,000 post offices (of USPs) in Member States. Numbers have continued to decline slightly: by 1.6% since 2010 compared to an average of 1.1% between 1998 and 2007 for the EU 25, and by 0.3% between 2012 and 2013. In some Member States, however, the decline has been significantly higher, for example in Estonia, Portugal and the UK.

The nature of access points/post offices is evolving alongside changes in the product mix. Some Member States have reduced their post office networks as letter volumes have fallen and government and other services (e.g. bill payment) have moved from over the counter services to online transactions. The agency model of post office provision has become more popular as it spreads costs over a wider product offering which can also drive footfall (e.g. AT, FR and PL). Some Member States already had a high share of agencies, though others have retained full ownership of the network, perhaps in some circumstances due to the provision of financial services requiring increased security alongside a traditional postal offering.

Parcels also provide opportunities for post offices and other retailers, as customers become more willing to have their parcels delivered to locations other than their homes, or legislation is passed which permits this. In some instances post office opening hours have increased to offer more convenient parcel collection (and sending) times, offering a better service to customers. Retail networks and/or customer collection points are also being developed by other postal operators as express operators and other parcel delivery companies seek to establish a consumer-facing presence.

In 2012 UPS bought Kiala, a network of collection points inside retail outlets. UPS have expanded the network under UPS branding and there are now over 13,000 collection points in nine Member States.

DHL's Packstations are machines that allow customers to collect and return packages 24/7. There are 2,750 packstations in over 1,600 locations in Germany and they are being installed in other European countries. DHL also have a physical presence in other EU markets, through for example through DHL Service points (of which there are 45,000 worldwide).

InPost offers click and collect parcel lockers which offer 24/7 tracked delivery. They operate in 22 international markets with over 3,500 parcel terminals.

2.5.2.Access to Postal Infrastructure

The Third Postal Directive introduced, in Article 11a, a requirement for Member States to ensure transparent, non-discriminatory access conditions to certain elements of the postal infrastructure or services within the scope of the universal services such as address databases, post office boxes, delivery boxes, change of address information and redirection services and return to sender services. Access to such facilities is becoming increasingly important given competition in the postal sector and the contemporary uses of postcode and address services such as navigation systems and personalised transport timetables. The table below summarises the types of access offered.

Table 4: Access to Postal Infrastructure

|

Type of access

|

Member States

|

No answer

|

Number

|

% survey market

|

|

Access to post codes

|

AT*, BE*, BG, CY, CZ, DE*, DK, EE, FI, FR, HU, LT, LU, MT, PL, SE, SI, UK

|

|

18

|

78%

|

|

Access to post office boxes

|

CY, CZ, DE, DK, EE, FR, IT, LT, LU, LV, MT, NL, PL, SE, SI

|

AT, IE, HR

|

15

|

59%

|

|

Access to delivery boxes

|

AT, BE*, BG, CY, DE*, DK, ES, FR, HU, IE, IT, LT, LU, PL, PT, SK

|

HR

|

16

|

65%

|

|

Access to address database

|

CY, CZ, DE, DK, EL*, FR, LT, LU*, SI, UK

|

AT, IE, HR

|

10

|

64%

|

|

Access to change of address database

|

AT, CY, CZ, DE, DK, EL*, FR, LT*, LU*, SI

|

IE, HR

|

10

|

47%

|

|

|

|

|

|

|

|

Access to USP redirection and return services

|

CZ, DE, DK, EE, EL*, FR, LT, LU, MT, SI

|

IE, HR

|

10

|

43%

|

* indicates different answers by USP and NRA.

Source: WIK-Consult, Main Developments in the Postal Sector (2010-2013), p45. Percentage of survey market includes EEA countries surveyed.

In around half the Member States there is access to no more than two elements of the postal infrastructure. Given new innovations in the sector (such as dedicated parcel delivery boxes) it will be even more important that NRAs have the powers and regulatory instruments to assure access to elements of the postal infrastructure wherever necessary to protect the interest of users and/or to promote effective competition.

Main developments include:

Section 34 of the Postal Market Act in Austria came into effect on 1 January 2011. This required all postal service providers to be able to access letter and curbside delivery boxes, including those within buildings. Previously only the universal service provider, Oesterreichishe Post AG, had been able to access all letter boxes. Following a decision of the constitutional court in 2012 letter boxes were exchanged for ones which can be accessed by all operators.

In Slovenia information on postcodes and address databases was only available in paper format until the end of 2012. The information is now available electronically.

The ERGP held a public consultation on access to the postal network and infrastructure in 2012. The aim was to identify different approaches rather than recommending one particular model for all Member States. For access to infrastructure the report found that there was no widespread detailed regulation of access, with national legislation tending to establish principles and detailed arrangements resulting from negotiation between parties. Nevertheless, even in the absence of a legal obligation, operators tended to offer access to the network.

2.5.3.Access to the Postal Network

Article 12 of the Directive allows USPs to conclude individual tariffs with users, provided that such tariffs and their associated conditions are transparent and non-discriminatory and are available to all users posting under similar conditions. Member States are not obliged to require their USPs to provide access to their network in this way, though most who offer some form of access do legally require the USP to offer this service. In Member States where it is offered, access mail can constitute a significant proportion of mail volumes.

There are different stages at which USPs can provide access to their network and the associated special tariffs. These are summarised in the diagram below. Bulk mail access points allow access for business users with middle sized volumes (with restrictions on permissible amounts). Alternatively the USP - or its competitors - can collect mail directly from business customers. Where permissible, consolidators or other competitors can then deposit mail into the USP's network for local distribution and delivery. This usually requires much larger volumes and a higher degree of sorting that mail deposited with the USP for outward processing. In Germany, France and the UK most of the 'access' volumes come from consolidators and competitors, rather than business customers (as they do in Belgium).

Figure 4: Structure of Access Operations

Source: WIK-Consult

Almost all Member States' universal service providers offer special tariffs. Special tariffs are common for bulk parcel services and direct mail, as well as bulk letter services. Discounts are usually offered for volume and/or the level or preparatory work, such as pre-sorting. They are also sometimes offered for early drop-off times or deposits of deliveries notified in advance.

Table 5: Access to Special Tariffs

|

|

Bulk Letter Mail

|

Direct Mail

|

Bulk Parcels

|

|

USP offers special tariffs?

|

AT, BE, BG, CY, DE, DK, EE, EL, FI, FR, HU, IE, IT, LT, LU, MT, NL, PL, PT, RO, SE, SI, SK, UK

|

AT, BE, CY, DE, DK, EL, FR, HU, LU, NL, PL, RO, SE, SK, UK

|

AT, BE, BG, CY, DE, DK, EE, EL, HU, LU, NL, PL, PT, RO, SE, SK, UK

|

|

|

NA: ES, HR

|

NA: BG, CZ, EE, ES, FI, IE, IT, LT, PT, SI

|

NA: CZ, ES, FI, FR, HR, IE, IT, LT

|

|

Transparent and non-discriminatory?*

|

AT, BE, BG, CY, DE, DK, EE, EL, FI, FR, HU, IE, IT, LT, LU, MT, NL, PL, PT, RO, SE, SI, SK, UK

|

AT, BE, CY, DE, DK, EL, FR, HU, LU, NL, RO, SE, SK, UK

|

AT, BE, DE, DK, EE, EL, HU, LU, PL, PT, RO, SK

|

|

|

|

|

NA: BG, SE, UK

|

|

Available to consolidators?*

|

AT, BE, BG, DE, DK, EE, EL, FI, FR, HU, IE, IT, LT, LU, MT, PT, RO, SE, SI, SK

|

AT, BE, DE, DK, EL, FR, HU, LU, NL, RO, SE, SK, UK

|

AT, BE, BG, CY, DE, DK, EE, EL, HU, LU, NL, PL, PT, RO, SK

|

|

|

NA: UK

|

|

NA: BG, SE, UK

|

|

Available to other postal operators?*

|

AT, BE, BG, DE, DK, EE, EL, FI, FR, HU, IE, IT, LT, LU, MT, NL, PT, RO, SE, SI, SK, UK

|

AT, BE, DE, DK, EL, FR, HU, LU, NL, SE, SK, UK

|

AT, BE, BG, DE, DK, EE, EL, HU, LU, NL, PL, PT, SK, UK

|

|

|

NA: UK

|

|

NA: SE, UK

|

* required by law and/or verified in practice

Source: WIK-Consult, Main Developments in the Postal Sector (2010-2013, p49

Transparent and non-discriminatory access to special tariffs is required by law and verified in practice by most Member States. How Member States verify the application of these principles does however vary significantly, for example Belgium requires publication whereas others including Sweden and the UK do not. Special tariffs are not available to consolidators or other postal operators in a few Member States.

Developments include:

ACS SA, a provider of courier and postal services for business mailers in Greece, filed a complaint with EETT, the Greek NRA in 2009, alleging that ELTA, the Greek USP had not been transparent and discriminated against ACS SA regarding the downstream access it already provided to its own subsidiary Tachymetafores Elta. EETT fined ELTA in July 2012 for abuse of its dominant position and obliged ELTA to provide non-discriminatory access.

In 2010 bpost (Belgium) introduced price changes which limited discounts for consolidators and mail handlers according to their individual clients' volumes instead of aggregating them (so called "per sender model"). In 2011 BIPT, the NRA, took the view that this new price system (that was not based on the total volume deposited by the intermediaries) was contrary to the postal legislation, based on a previous judgement of the Court of Justice. In parallel bpost was judged by the Belgian Competition Authority to have acted contrary to competition law (Article 102 TFEU) in relation to the same pricing model. bpost appealed against BIPT’s decision to the Cour d’appel de Bruxelles. The latter referred the case to the European Court of Justice (CJEU). In its judgment of 11 February 2015 (C-340/13) the CJEU stated that a model based on quantity discounts per sender is allowed under Article 12, fifth indent of the Directive and that bulk mailers and consolidators are not in comparable situations as regards the objectives pursued by the system of quantity discounts per sender. The referring court has now to decide on the merits; and the competition case on this issue is still pending. Furthermore, the ERGP is examining the possible implications of this judgment for the development of competition on the postal market. It is nevertheless clear that discount models will have to continue to be compatible with Article 12 of the Postal Service Directive and competition law, although the relationship and interdependency between quantitative and qualitative discounts needs to be carefully assessed.

APEK, the Slovenian NRA, ordered Pošta Slovenije in 2010 to provide discounts of 16.8% - 48.4% for access services, following complaints by a prospective consolidator. The Postal Services Act in Slovenia requires the USP to provide access at the request of an alternative postal operator (a provider of interchangeable postal services). Pošta Slovenije does however allege that as a consequence some bulk senders have registered as postal operators themselves in order to benefit from these discounts.

In 2012 PTS, the Swedish NRA, introduced as a licence condition that Posten AB (the USP) publish prices and discounts for universal services products in full on its website. Posten AB appealed this decision.

The ERGP has conducted analysis of the list prices for bulk mail, although they caution that criteria for bulk mail services differ between Member States. Their 2014 report found that the cost-orientation principle is implemented in different ways, including for bulk mail. Bulgaria, Sweden and Malta are the Member States with the lowest bulk mail (letter) prices.

2.6.Quality of Service

Improving the quality of postal services across the EU has been one of the core aims of EU postal reform since its inception. Article 16 requires quality of service standards focussing on routing times, regulatory and reliability to be set and published in relation to the universal service, and to be subject to independent monitoring. Member States have the flexibility to determine standards for domestic post providing they are compatible with those for intra-Community cross-border services which are set by the Directive. Article 18 and Annex II set out the requirements for intra-Community cross border letter mail services: 85% D+ 3. i.e. delivery within three working days after the date of deposit (D) and 97% D+5, delivery within five working days after deposit.

Transit time standards are most common for single piece services. All Member States have transit time standards for single piece priority letters, though only twelve are known to have them for non-priority letters. Routing time standards are more common for single piece parcels than for bulk.

All Member States have a defined domestic D+1 target except Spain which has only a D+3 target. D+1 targets are between 80% and 97%. Transit time data is published in different ways, including special quality reports by NRAs, annual reports of NRAs, USP publications and market studies.

Figures 5: Priority (D+1) Single Piece Letter Services Quality Achieved Against Target by Country 2012/13

Source: ERGP (14) 23 Report on benchmarking of universal service tariffs, 2014

Source: ERGP (14) 23 Report on benchmarking of universal service tariffs, 2014

Figure 6: Non-priority (D+2 or D+3) Single Piece Letter Services Quality Achieved Against Target by Country 2012/13

Source: ERGP (14) 23 Report on benchmarking of universal service tariffs, 2014

Source: ERGP (14) 23 Report on benchmarking of universal service tariffs, 2014

Where there are defined transit time targets for national mail, this is measured by universal service providers in accordance with the CEN standard EN 13850 which covers single piece priority mail. Use of standard EN 14508, which covers non priority mail, is less common. Time performance measurement of parcels that is compliant with the technical report TR 15472 takes place only three member states.

Intra-EU post is measured by the International Postal Cooperation (IPC), whose measurement is compliant with CEN EN 13850. In 2014 the average time for mail delivery in Europe was 2.4 days, with 90.6% delivered within the three days of posting and 97.8% within five days, exceeding, for the 17th year, the respective targets of 85% and 97%. Even allowing for a change in the measurement standards which caused an estimated 1% reduction in performance, an adjusted D+3 performance of 91.6% (rather than 90.6%) was nevertheless the lowest performance since 1999 (90.7%). The fall can be explained in part by operators seeking to make efficiency improvements to compensate for falling mail volumes. By way of comparison in 2013 D+ 3 performance was 92.5% and D+5 98.2% and since 2008 D+3 performance has ranged varied between 90.6% (2014, unadjusted) and 94.6% (2008).

If transit time targets for letter post are not achieved, most Member States are able to take corrective action. The reverse is true for parcels where a minority of Member States have the competence to address failures to meet standards for parcels.

One of the six priorities in the annual Union work programme for European Standardisation for 2015 is postal services. The Commission aims to issue a standardisation request concerning the specific features of parcel delivery services and is also considering whether a request for the revision of any existing European standards is needed.

2.7.Protection of Users

Article 19 of the Directive requires Member States to ensure that transparent, simple and inexpensive procedures for dealing with complaints are available from all postal operators, and not only from universal service providers. Where warranted, a system of reimbursement and/or compensation is also required. The universal service provider, and where appropriate other undertakings providing services within the scope of the universal service area, are required to publish the number of complaints they receive and how they have been dealt with alongside the annual report on performance against service standards required by Article 16.

In the reporting period the CJEU (Case C-148/10) ruled that Article 19 must be interpreted as "not precluding national legislation which imposes on providers of postal services which are outside the scope of the universal service a mandatory external procedure for dealing with complaints from users of those services". The case arose from DHL International NV's opposition to mandatory participation in the financing of the external complaints scheme (in this case an ombudsman within the NRA and financed by fees on qualifying undertakings), claiming that the express delivery services it provided were not postal services.

All Member States have extended user protection to cover other postal service providers as well as the universal service provider. Most universal service providers have introduced a system of compensation. Most Member States have appointed a 'competent national authority', usually the NRA or ombudsman, to review complaints that have not been satisfactorily resolved by the USP. Less than half of the Member States comply with the (voluntary) European Committee for Standardisation (CEN) standards EN 14012 for handling complaints and providing redress. Enforcement in over half of the Member States is by the NRA and national consumer protection authority (NCPA), by the NRA alone in just under half of the Member States and the NCPA alone one Member State.

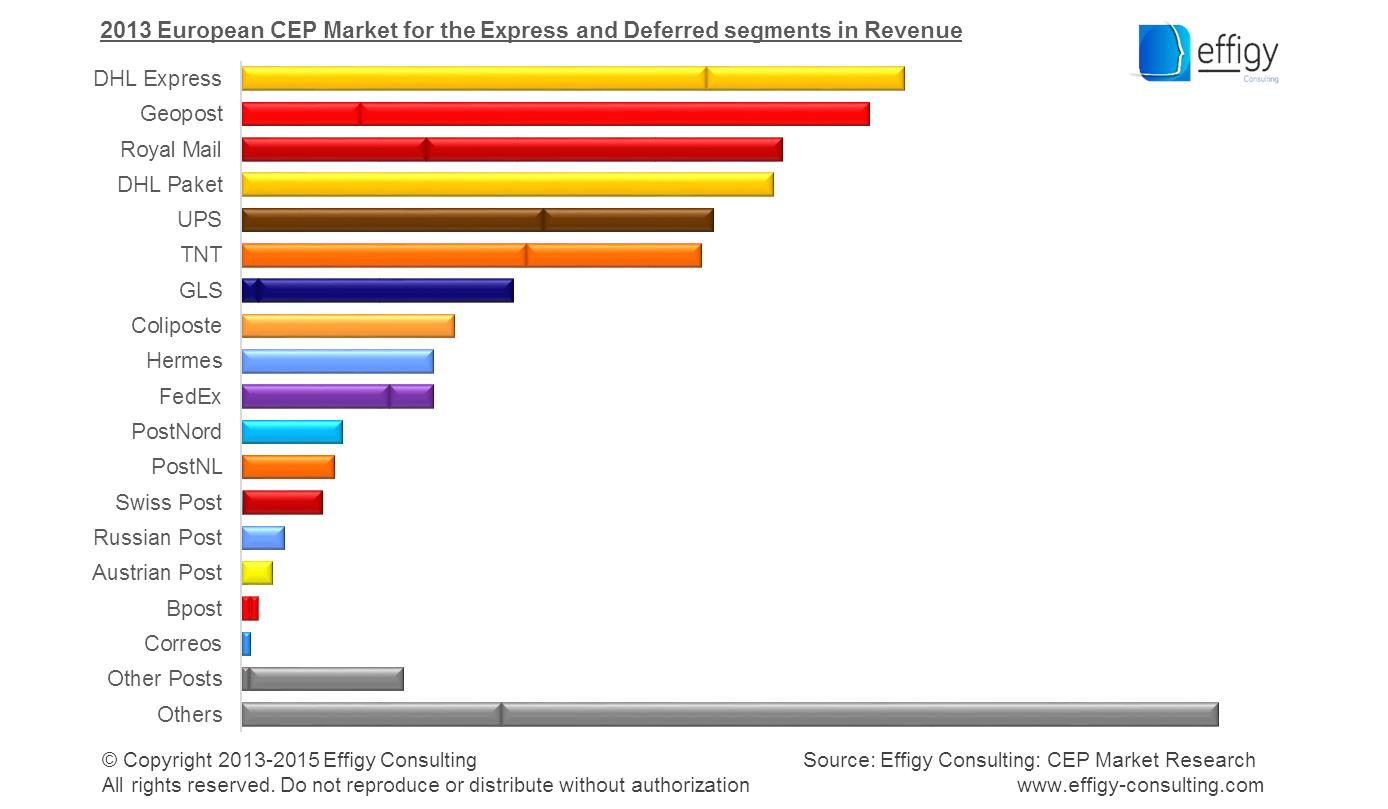

To improve dispute resolution, the Directive also requires Member States to encourage the use of out-of-court schemes. In addition implementation by the Member States of the Alternative Dispute Resolution Directive by mid-2015, the launch of the Online Dispute Resolution Platform in January 2016 will help to encourage cross-border e-commerce.