EUROPEAN COMMISSION

EUROPEAN COMMISSION

Brussels, 26.2.2020

SWD(2020) 503 final

COMMISSION STAFF WORKING DOCUMENT

Country Report Denmark 2020

Accompanying the document

COMMUNICATION FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT, THE EUROPEAN COUNCIL, THE COUNCIL, THE EUROPEAN CENTRAL BANK AND THE EUROGROUP

2020 European Semester: Assessment of progress on structural reforms, prevention and correction of macroeconomic imbalances, and results of in-depth reviews under Regulation (EU) No 1176/2011

{COM(2020) 150 final}

Executive summary

1.Economic situation and outlook

2.Progress with country-specific recommendations

3.Reform priorities

3.1Public finances and taxation

3.2.Financial sector

3.3.Labour market, education and social policies

3.4.Competitiveness, reforms and investment

3.5.Environmental sustainability

A.Overview table

B.Commission debt sustainability analysis and fiscal risks

C.Standard tables

D.Investment guidance on Just Transition Fund 2021-2027 for Denmark

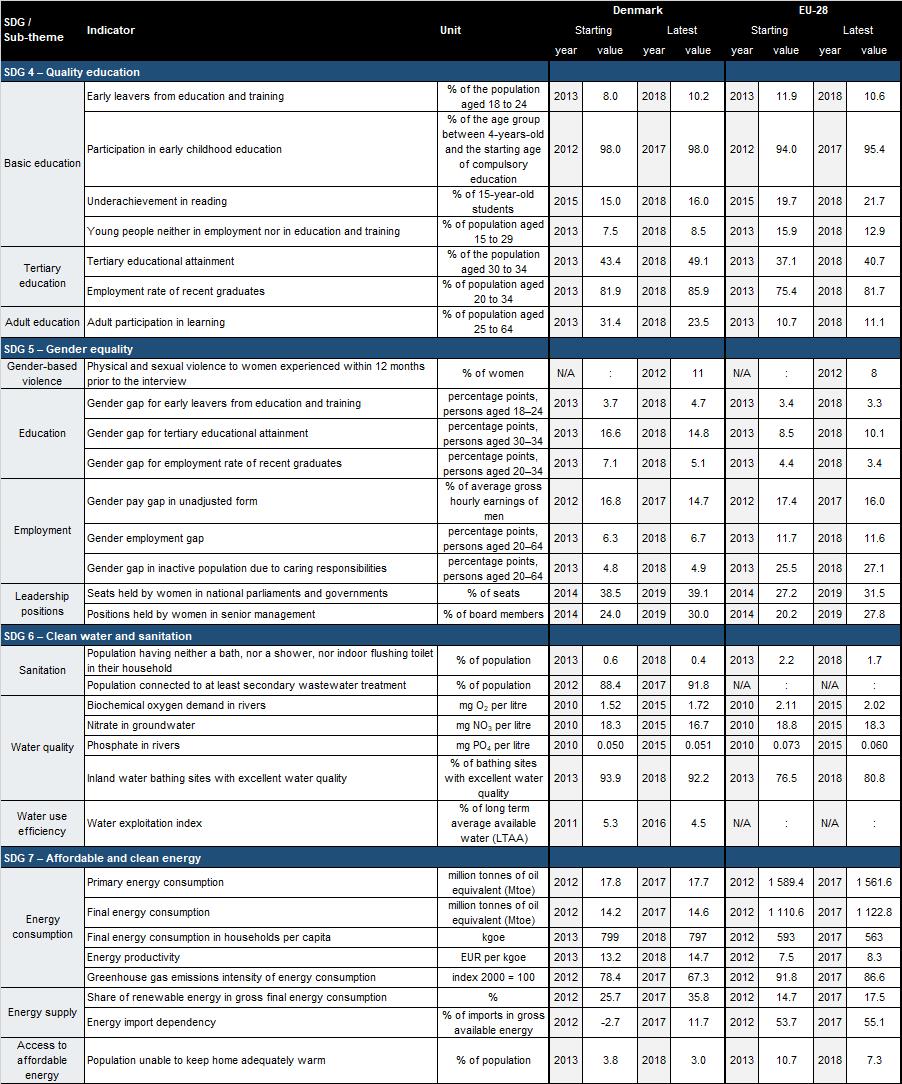

E.Progress towards the Sustainable Development Goals (SDGs)

References

LIST OF Tables

3.2.1.Financial soundness indicators, all banks in Denmark

3.4.1.Selected indicators on digitisation of businesses, 2019 (% of enterprises)

C.1.Financial market indicators

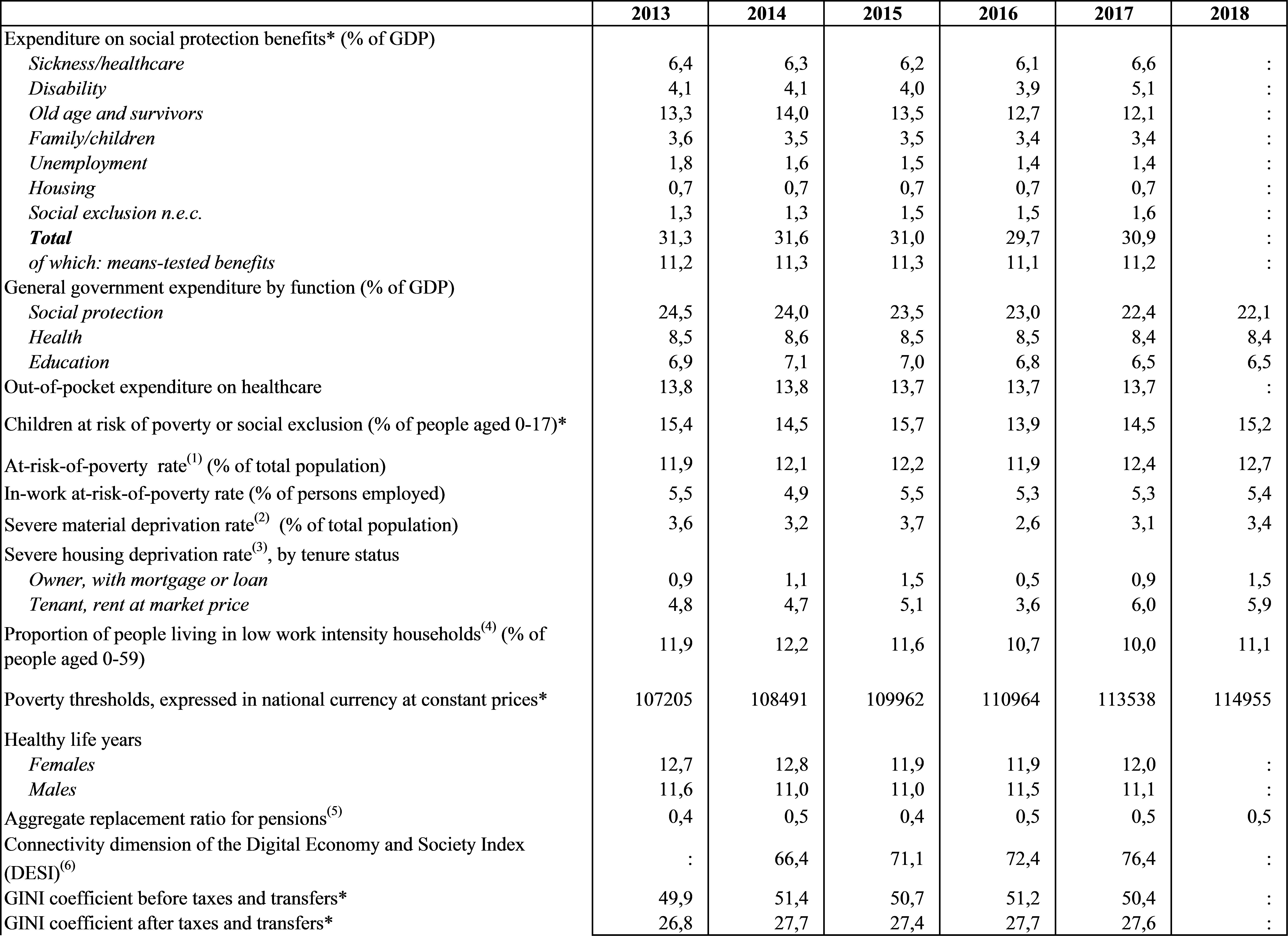

C.2.Headline Social Scoreboard indicators

C.3.Labour market and education indicators

C.4.Social inclusion and health indicators

C.5.Product market performance and policy indicators

C.6.Green growth

LIST OF Graphs

1.1.GDP growth and contributions

1.2.Contributions to potential growth

1.3.Goods and services inflation

1.4.Contribution to export growth

1.5.Primary income (% of GDP)

1.6.Breakdown of unit labour cost rate of change

1.7.Pension yield tax revenues and 10-year DK government bond yields

2.1.Level of implementation today of 2011-2019 CSRs

3.2.1.Credit growth

3.2.2.Household debt

3.2.3.Nominal real estate prices

3.2.4.Mortgage loans by type of loan

3.3.1.Real compensation per employee (GDP deflator, National Currency)

3.3.2.Youth: in education and training, employment rate, unemployment rate, unemployment-to-population ratio, NEET

3.3.3.At-risk-of-poverty or social exclusion rate, age groups

3.3.4.Underachievers in reading by socio-economic status (ESCS 2018)

3.3.5.People holding tertiary education degree

3.4.1.Current account developments

3.4.2.Terms of trade development

3.4.3.Sectoral labour productivity

3.4.4.Job destruction per sector

3.4.5.Contribution of intangible capital growth to productivity growth

3.5.1.Greenhouse gas emissions per sector

3.5.2.Energy efficiency: Primary and final energy consumption

3.5.3.Renewable energy: Share in gross final energy consumption

3.5.4.Revenues from environmental taxes (% of total tax revenues)

LIST OF Boxes

2.1.EU funds and programmes to address structural challanges and foster growth and competitiveness in Denmark

3.1.1.Revenue neutral tax reform within the general personal income tax system

3.4.1.Investment challenges and reforms in Denmark

3.5.1.Transition to a low-carbon economy

Denmark has benefited from a prolonged period of sustained and balanced economic growth, but challenges remain. Additional public funding has been allocated for education, research and transport to improve productivity and bolster long-term competitiveness. The anti-money-laundering framework has been strengthened, but further measures will be necessary to regain trust in the integrity and anti-money laundering defence capabilities of Danish financial institutions. Despite recent measures, the high level of household debt combined with high house price levels and risky loan taking remains a potential financial stability risk. Denmark’s ambitious target for reducing greenhouse gas emissions will require significant investments and reforms across the economy().

Economic growth has been solid, averaging 2.4 % since 2015, well above the euro area average. Consumption and investment have been the main drivers of growth in this period. Households have experienced robust income growth, which they have used for both consumer spending and debt reduction. Labour market reforms and an influx of mainly EU workers contributed to a marked increase in the labour force. This supported Denmark’s prolonged economic expansion, while avoiding an overheating of the labour market. In 2018, the employment rate reached 77.5 %, markedly surpassing the long-term average, while the unemployment rate declined to 5.1 %. Consumer price inflation remained subdued, reaching 0.7 % in 2019.

Investment has risen strongly since 2012. Business investment has been particularly strong, and, since 2015, housing construction further added to the growth in investment, supported by rising housing prices. Investment amounted to 22.0 % of GDP in 2018, well above the euro area average. Public investment amounted to some 3.5 % of GDP, a little down from its peak in 2014.

The current account surplus is estimated to have jumped above 8 % of GDP in 2019 due to strong goods export performance. Danish exports have proven resilient to an economic slowdown in several of Denmark’s trade partner countries, suggesting that its export product mix is less sensitive to cyclical developments. Successful Danish multinational companies provide additional impetus for goods exports and economic growth. The high external net asset position implies that Denmark receives capital income from abroad and provides significant support to the current account balance. On the savings side, persistently high household savings contribute to a substantial current account surplus.

Real GDP growth is forecast to slow down to around 1.5 %, slightly below its potential level. Consumer spending is projected to remain the main factor driving growth. Labour demand is expected to increase at a slower pace, but companies may still face some difficulties with hiring skilled workers. Considering this, wages are expected to grow faster than productivity, weighing on competitiveness. Investment is set to remain flat amidst slowing global economy and a cooling housing market.

The government budget surplus in 2019 is estimated to have reached 2.2% of GDP, largely due to a significant hike in pension yield tax revenue. The budget is forecast to remain in surplus in 2020 and to be close to balance in 2021, as the unexpectedly high pension yield tax revenue levels off and public expenditure, notably on education, research and healthcare, is set to increase. In addition, the repayment in 2020-2022 of unduly collected housing tax revenue (amounting to 0.8% of GDP) will also contribute to reducing the government surplus.

Denmark faces significant investment needs. Although it has an investment-friendly business environment, some factors are holding back investment. Investment in research and innovation is concentrated in a small number of large companies. Broadening this investment to a wider range of companies would promote innovation diffusion. The growing productivity gaps between large and small companies suggest weaknesses in this diffusion of technological advances. Channelling investments to vocational education and adult and lifelong learning is also key to preventing skills mismatches and labour market tensions. Road congestion is projected to increase around the larger cities, and there is a need to decarbonise the transport sector. To deliver on the climate and energy objectives and shape a new growth model, Denmark needs to identify investment needs in green technologies and sustainable solutions, and secure adequate funding for these projects.

Denmark has made some() progress in addressing the 2019 country-specific recommendation on investment.

There has been some progress in the following areas:

·Denmark has taken measures to focus investment-related economic policy on education and skills. The 2020 budget allocates more funds to research in energy and climate technology, but without specific measures to broaden the innovation base. The government has presented a specific transport plan to tackle road congestion in key areas (Section 3.4).

·Denmark took several significant legislative steps, improved the supervision and enforcement of its anti-money laundering framework and increased the financial and human resources dedicated to anti-money laundering, but several issues remain (Section 3.2).

Denmark continues to perform well on the indicators of the Social Scoreboard supporting the European Pillar of Social Rights. Employment is high, the gender employment gap is narrow and long-term unemployment remains one of the lowest in the EU. Unemployment has further declined in recent years. On the other hand, the proportion of young people who drop out of education and training (early school leavers) has increased in recent years, and reached a level slightly above the Europe 2020 target of 10 % in 2018. This is likely to be linked to the fact that there is a higher labour demand, which makes it easier for people to find work. In terms of education, there has been a slight increase in the overall proportion of low achievers, with the proportion of foreign-born students who are low achievers in reading being nearly three times as high as the proportion of low achievers among non-migrant students.

Denmark has made good progress towards its targets under the Europe 2020 strategy, notably in employment, research and development, greenhouse gas emissions, renewable energy and tertiary education. However, Denmark is not likely to achieve its target of reducing the number of people at risk of poverty or social exclusion.

On the United Nations Sustainable Development Goals, Denmark has made strong progress on climate action (SDG13), where it is an international leader. On the other hand, Denmark’s results on quality education (SDG4) are sliding, although the levels remain satisfactory ().

The key structural issues, which have been analysed in this report, point to particular challenges for Denmark’s economy, are the following:

·Denmark’s ambitious target for reducing greenhouse gas emissions by 70 % by 2030 (relative to 1990 level) will require significant investments and reforms across the economy, in line with the European Green Deal. Achieving this target would give the country an opportunity to improve economic growth, job creation and health benefits. Denmark’s strong position as regards SDG13 on climate action is a good starting point. The European Green Deal could support Denmark’s efforts through such channels as green investments and increasing the demand for Danish climate technology. To reach the 2030 targets for greenhouse gas emissions not covered by the EU emissions trading system, Denmark faces challenges to reduce emissions from transport and agriculture.

·The Commission’s proposal for a Just Transition Mechanism under the next multi-annual financial framework for 2021-2027, includes a Just Transition Fund, a dedicated just transition scheme under InvestEU, and a new public sector loan facility with the European Investment Bank. It is designed to ensure that the transition towards EU climate neutrality is fair by helping the most affected regions in Denmark to address the social and economic consequences. Key priorities for support by the Just Transition Fund, set up as part of the Just Transition Mechanism, are identified in Annex D, building on the analysis of the transition challenges outlined in this report.

·Energy consumption has increased for four consecutive years, which highlights the need for additional policy and measures. Reducing total consumption may require additional steps, notably in energy efficiency, in order to reach its ambitious decarbonisation target.

·Productivity growth has been sluggish for a prolonged period of time. However, labour productivity growth has picked up since 2015 due to the strong performance of the manufacturing sector, while remaining moderate in the domestically oriented services sector.

·The current account surplus remains high, but this is mainly due to high savings rather than low investment. Declining corporate saving is compensated by increasing household and government saving. Corporate investment, driven by large companies, is well above the euro area average, but investment by smaller companies remains relatively subdued. Increasing investment made in smaller companies and targeting more R&D investment towards smaller companies could help sustain the recent positive trends.

·Denmark has improved the supervision and enforcement of the anti-money laundering framework. It took several significant legislative steps over a relatively short period, but these still have to prove their effectiveness. The Financial Action Task Force has confirmed the improvements in Denmark’s anti-money laundering supervision framework, but further progress is necessary, for instance on the supervision of both financial and non-financial entities. The government has increased the budget and the number of staff at the Money Laundering Secretariat and the Financial Supervisory Authority.

·Although housing price inflation is slowing, the valuation of property prices still seems on the high side. Housing prices have been easing in all regions and housing categories. A forthcoming new property taxation system, strong residential construction activity and already introduced macroprudential measures are expected to further curb housing price inflation, despite mortgage interest rates being at historical lows.

·Households continue to reduce their high debt. They have used the favourable economic environment to reduce debt, notably through refinancing mortgage loans, thereby increasing resilience to adverse shocks and contributing to financial stability. Despite the positive trends, however the proportion of variable-interest-rate and interest-only loans in the overall mortgage stock remains high, and Danish households have one of the highest spending on mortgage debt services in the EU. The debt level remains above what is warranted by economic fundamentals and represents a risk to financial stability. Several measures have been put in place to address this, but it will take time for their positive effects to be visible in the overall mortgage stock and for overall financial risks to be effectively reduced. The high level of household gross debt should be seen in relation to significantly higher, albeit less liquid, financial assets, notably houses and pension savings.

·The tax deductibility of mortgage interest payments encourages home ownership and indebtedness. The tax deductibility of interest payments adds a dimension of debt bias to the tax system, which fosters house ownership and by extension household indebtedness. Abandoning the tax deductibility of interest rates and compensating with an increase in the overall personal income tax allowance would change these incentives and make the Danish tax system more progressive and less biased towards homeowners.

·The Danish banking sector is well capitalised, and a number of macroprudential measures contribute to making it more resilient. The Danish Systemic Risk Council has recommended to gradually increase the countercyclical capital buffer from 1 % to 2 % in 2021. Furthermore, a number of macroprudential and conduct measures are in place to mitigate risks in the real estate sector.

·Labour shortages persist, but the situation is improving. Reported numbers of unsuccessful recruitments are declining and the labour shortages seem to be specific to certain sectors and geographic regions. However, in order to increase the supply of skilled workers, it remains crucial to incentivise youth to choose vocational education and training and to reduce dropout rates.

·A reform of the tax administration is under way. The reforms are a reaction to a series of problems encountered by the Danish tax administration. Challenges remain, such as the modernisation of the property tax system, which was delayed from 2021 to 2024 due to delays in the readiness of IT systems.

GDP growth

Denmark has experienced a solid upswing in recent years, expanding above potential growth. The economy was slow to recover from the global financial crisis, which coincided with the burst of a housing bubble, but economic growth accelerated from 2012 onwards. The Danish economy shifted into a higher gear from 2015, growing at an estimated average rate of 2.4 % from 2015 to 2019 period (Graph 1.1), well above the euro area average of 1.6 % during the same. Denmark has also benefited from improving terms of trade and increasing returns on its foreign assets, which has increased the wealth of Danish households over the last 10 years. As a result, Denmark has experienced a robust growth in its gross national income, above the average seen in the euro area and among peer countries (Section 3.4.1).

|

Graph 1.1:GDP growth and contributions

|

|

|

|

Source: European Commission

|

Household consumption has been a key driver of growth. Private consumption has been expanding steadily since 2015 by around 2.2 % per year supported by a strong labour market and steadily rising disposable real incomes. Nevertheless, household consumption as a share of disposable income is lower than the pre-crisis average. After the crisis, private consumption growth lagged behind disposable income growth, as households focussed on building up savings and reducing their debt. Since 2015, household consumption to disposable income remained relatively stable, while at the same time household indebtedness continued to decrease (see Section 3.2).

Investment growth has been particularly robust since 2012. Investment fosters progress towards SDG8 (decent work and economic growth). In 2018, investment accounted for 22.0 % of GDP, which is above the euro area average of 20.8 % of GDP. Business investment has been the main driver reaching a historical high of 13.9 % of GDP in 2018, with highest contributions from manufacturing, transport and dwellings. Public investment remained relatively high at 3.5 % of GDP in 2018, a little down from the peak of 3.9 % of GDP in 2014. Household investment contracted sharply following the crisis, but has been increasing robustly since 2015, in line with the rising housing prices. Overall investment is projected to decline in 2019 partly due to the negative base effect of a large acquisition in 2018 that raised investment, but high capacity utilisation rates suggest a steady, but moderate growth in the coming years.

Danish goods export growth and industrial production has decoupled from the other peer countries until the third quarter of 2019. While Danish industrial production rose by 4.8 %, it decreased by 1.7 % in the euro area in September 2019 compared to a year before. Danish goods export is estimated to have increased by around 9 % in 2019, the largest growth in the last 25 years. Favourable industrial specialisation and strong sectoral performance provided a boost for the Danish economy (Section 3.4). Nevertheless, the global slowdown started to impact and industrial production, exports and investment growth has been significantly slowing down since the last quarter of 2019. Following several years of strong expansion, real GDP growth is set to moderate to around 1.5 % in both 2020 and 2021, slightly below to its potential level.

Consumption is projected to remain robust. While employment growth is forecast to slow down, dynamic wage growth is set to underpin solid private consumption growth. A significant decline in interest rates led to a record-high number of mortgage loan re-financings in 2019. Mortgage refinancing is set to continue supporting households’ consumption by lowering their debt service(). Households have shifted towards longer fixation of interest rates and thus more predictable payment patterns (Section 3.2), while also benefiting from higher disposable income (Nationalbanken 2019a). Private consumption will be further supported by a one-off repayment of excessively collected property taxes to households being repaid from the end of 2020 until 2022 (Section 3.1). Government consumption is set to expand at a more dynamic pace due to increased spending on healthcare, education and transport infrastructure.

On the other hand, investment is expected to remain weak in the coming years. Easing housing market dynamics suggest moderate housing construction dynamics ahead. Equipment investment growth is projected to remain modest due to the uncertain global economic outlook. Both exports and imports are forecast to resume around their trend growth and net export’s contribution to real GDP growth is expected to be marginal.

Denmark’s commitment to become carbon neutral by 2050 at the latest will require substantial investments. Denmark’s ambitious climate target will require public and private investments across the economy, with the energy, transport, agriculture and some other sectors particularly prominent. Denmark is already among the best performing EU countries as regards developing and taking-up environmental technologies. Danish “green enterprises” on average are larger, more export intensive and more productive than the rest of enterprises, placing Denmark in a strong position to also economically benefit from the green transition. The green transition could thus provide additional impetus to economic growth (Section 3.5).

Potential growth

Potential growth() has been gradually strengthening and is now stabilising. Since its low of 0.8 % between 2010 and 2012, potential growth rose to 1.8 % in 2018. The main driver behind this pick-up was capital accumulation, reflecting the strong investment activity. Total labour productivity contribution was solid until 2018, but is forecast to level off, as employment growth is set to moderate in the coming years. The contribution of total factor productivity, which reflects how efficiently labour and capital inputs are combined, is expected to improve and compensate moderating capital and labour contribution. As a result, potential growth rate is set to remain stable (Graph 1.2).

|

Graph 1.2:Contributions to potential growth

|

|

|

|

Source: European Commission

|

Following prolonged sluggishness, productivity growth has picked up since 2015, but it has not accelerated enough to close the accumulated gap with peer countries. Total factor productivity has been growing in line with the peer countries since 2013 and is therefore insufficient to reduce the productivity gap vis-à-vis them that opened in 2006. Labour productivity developments have a clear sectoral dimension, with labour productivity increasing by 70 % in manufacturing and by mere 18 % in services since 2000. In view of the increasing role of services in the economy, this is dragging aggregate productivity down. Positive labour productivity developments in the manufacturing sector benefitted in particular from the strong performance of the pharmaceutical sector (Section 3.4.1).

Inflation

Consumer price inflation remains moderate. The Harmonised Index of Consumer Prices (HICP) headline inflation was 0.7 % both in 2018 and in 2019. Danish inflation has been below the euro area rate since 2016 mainly reflecting lower food price inflation. While goods prices have been flat since 2017, services prices continue decelerating despite solid labour wage growth (Graph 1.3). Inflation is expected to increase moderately to 1.4 % in 2020 and to 1.5 % in 2021, helped by announced hikes in duties on tobacco.

|

Graph 1.3:Goods and services inflation

|

|

|

|

Source: Eurostat

|

Labour market and social developments

Employment continues growing and the labour force has increased. Employment grew by 1.4 % in 2018. As a result, the employment rate reached 78.2 %, approaching the national 2020 target of 80 %, and going well above the EU average of 73.2 %. Recent years’ growth in the labour force is mainly driven by inflows of foreign workers, accounting for approximately one third of the growth in the period 2013-2018, as well as older workers staying longer on the labour market due to pension reform related increases in the retirement age. The expansion of the labour force helped sustain the economic upswing: without the labour market reforms and access to international labour, GDP growth would have been one percentage point (pps) lower (Danish Nationalbank 2018a). The strongest employment growth has occurred in the private sector, in particular the services and construction sectors.

At 1.1 % in 2018, Denmark's long-term unemployment rate is among the lowest in the EU. Unemployment fell to 5.1 % in 2018, the lowest level since 2008, but the gap to the EU average (1.1 pps below EU average in 2018) has narrowed in recent years. Lower than average employment rates can be observed for youth, migrants and people with disabilities. Improving the employment rates of youth and vulnerable groups remains a challenge. While the total number of marginalised persons has decreased, the remaining are even more marginalised and more difficult to integrate applying standard policy tools.

Denmark is facing continuous labour shortages in certain sectors, but the situation appears to be stabilising. Firms report a lack of workers in construction, agriculture and services, which reflects continuous labour market tightness. Labour market bottlenecks are expected to reduce along with more moderate real GDP growth in 2020 and 2021. While higher numbers of vocational education and training (VET) graduates would help meet labour market needs, participation in such schemes remains low.

The labour force is projected to continue growing, but unevenly distributed among different sectors, which may increase the risk of skills mismatches. Skills gaps could become more severe with the current low unemployment rate. Ensuring supply of the right skills is crucial to boost productivity through better utilisation of advanced technology. However, the flexible labour market, some growth in labour supply and strong policies for reskilling of job seekers provide a strong basis to facilitate the needed reallocation of workers across sectors. Denmark has taken further measures to focus investment-related economic policy on education and skills (Section 2).

Participation in adult learning has decreased significantly in recent years, albeit from a high level. Despite this rate being more than double that of the EU average (11.1 % in 2018), the relatively sharp decline from 31.3 % in 2015 to 23.5 % in 2018 is, however, of concern. The exact drivers behind this trend remain unclear, but along with high economic activity and the need to ensure business continuity, employers may be more reluctant to allow workers to take part in trainings.

In-work poverty, at risk of poverty or social exclusion (AROPE()) and income inequality remain low. At 17.4 % in 2018, the AROPE rate remains above the 2008 pre-crisis level. For foreign-born adults, this rate is above that of the EU average and more than double the rate of the native-born population. In 2018, in-work poverty (5.4 %) was almost half that of the EU average (9.2 %), reflecting the relatively high level of compensation. The median household income (single person) has increased to EUR 17,234 in 2018, which is among the highest in the EU (average of EUR 15,310). At the same time, income inequality appears to have stagnated in recent years, below the EU average.

The employment situation of recently arrived migrants (including refugees) remains critical but has improved. On the other hand, the situation for those who have resided in Denmark longer showed no sign of improvement. This is a result of high economic activity in addition to intensified integration measures introduced since 2016, e.g. the fast-track Integration Education (IGU) programme. On the other hand, further actions would be needed to ensure labour market integration of those who have resided in Denmark for more than five years, in particular women.

External position and competitiveness

The current account surplus increased further in 2019. Increasing savings are the main reason for the sustained high surplus. As business investment picked up, corporate saving has declined from 9 % of GDP in 2014 to 3.2 % of GDP in 2018. On the other hand, increasing household and government savings have largely compensated for the declining corporate savings and are set to sustain a current account surplus above 8 % of GDP in the coming years.

From the production side, successful Danish multinational companies are driving the current account surplus. Just five large industrial groups were responsible for almost the entire current account surplus in 2018 (Christensen et al 2019). The surplus is to a large extent driven by exports of goods, an increasing proportion of which never cross the Danish border because the goods are produced in foreign subsidiaries (Section 3.4). The current account surplus remains well above the level warranted by economic fundamentals supported by high pension savings ().

Denmark’s share in world exports has been relatively stable since 2012. This is in line with the performance of Sweden or the Netherlands, but falls behind Germany’s robust export growth. Since 2015, two sectors have been responsible for more than 70 % of Denmark's export growth since 2015 (Graph 1.4), namely chemical products (including pharmaceuticals) and machinery (including wind turbines). This changing export mix has so far proven to be less sensitive to the general slowdown in the main trading partners and provided a boost to real GDP growth in 2019.

|

Graph 1.4:Contribution to export growth

|

|

|

|

Source: Statistics Denmark

|

Continued high current account surpluses have contributed to the increase in the net international investment position (NIIP). The NIIP increased from close to balance in 2008 to an estimated 64 % of GDP in 2018. While the financial account surplus was the main driver of recent NIIP increases for instance in Germany or the Netherlands, Denmark mostly benefited from investment income and valuation effects. A large share of the NIIP is in equity investment. Components that may be subject to default or partly be used as collateral remain low, amounting to less than a third of the NIIP in 2018. The high net stock of foreign assets generates significant investment income, further boosting the current account surplus above that of peer countries (Graph 1.5). Substantial primary income is produced by the pharmaceutical sector, which generates high returns on investment (Isaksen et al 2016).

|

Graph 1.5:Primary income (% of GDP)

|

|

|

|

Source: European Commission, Macrobond

|

There are mixed signals regarding Denmark’s competitiveness. The combination of higher wage growth and lower labour productivity growth fuelled unit labour costs, which increased by 1.7 % in 2018, compared to 1.6 % in 2017. These developments have so far been in line with EU trends (Graph 1.6). In nominal terms, compensation per employee has outpaced labour productivity growth since 2012. Regarding non cost-competitiveness factors, Danish exports tend to rely more on high and medium quality products and a favourable industrial specialisation (see Section 3.4).

|

Graph 1.6:Breakdown of unit labour cost rate of change

|

|

|

|

Source: European Commission

|

Risks from the domestic market appear to be contained at this stage, but several developments warrant continuous monitoring. The unemployment rate appears close to its structural level() in certain sectors, leading to labour constraints, but labour shortages appear to have eased recently (Section 3.3). Wages have been increasing above productivity since 2016 although the impact on competitiveness appear to be limited at this stage (Section 3.4). House prices are slightly overvalued and household indebtedness exceeds prudential and fundamental benchmarks, though several policy measures were introduced to increase the resilience of Danish financial sector and households (Section 3.2).

Monetary policy

The central bank deposit rate has been almost continuously negative since 2012, the longest period among EU countries. Denmark is the only country in the ERM‑II mechanism and maintains a central rate of DKK 7.46038 to the euro with a narrow fluctuation band of ±2.25 %. Following the European Central Bank’s reduction of its monetary policy rates by 0.10 pp in September 2019, Danmarks Nationalbank (Denmark's central bank) has also reduced the interest rate on deposits by 0.10 pps. The policy spread between Danmarks Nationalbank and the ECB has remained unchanged at -0.25 pps since March 2016. The rate cut brings the Danish benchmark to the level where it was before the last rate change in January 2016.

Financial sector

Danish banks are generally well capitalised and remain profitable, amid a challenging low interest rate environment. Negative yields and interest rates are becoming more pervasive in the Danish economy, affecting an increasing share of deposits, including by households. The authorities have required that banks progressively increase the countercyclical capital buffer, which will further strengthen their resilience against cyclical downside risks (Section 3.2).

Housing market dynamics in Denmark have eased over recent quarters. This slowdown is broad-based across regions and housing categories. It is reflected in slowing housing prices, as well as falling housing starts and permits since 2016. Many borrowers take advantage of historically low mortgage rates by taking up new or converting existing mortgages to loans with a fixed rate and amortisation, making them more resilient vis-à-vis income and interest rate shocks. The increase in the share of these less risky mortgages also suggests that the macro-prudential and conduct requirements for banks put in place by Danish authorities over the past years have been effective (Section 3.2).

Danish household debt keeps declining, and, while it remains high, counterbalanced by large assets. Household debt dropped from 124.9 % of GDP in 2018 to an estimated 113.5 % in 2019, and is now estimated 2.4 times higher than gross disposable income. The high level of gross debt is matched by substantial household assets, which implies a comfortable solvency position. Danish households nonetheless remain vulnerable to certain adverse economic shocks due to liquidity mismatches on their balance sheets, even though the share of debt at variable rates, which is particularly susceptible to an interest rate shock, is declining. Danish households have one of the highest debt-servicing ratios in the EU, and despite the recent positive developments, the share of interest-only, variable interest rate loans, which are the most sensitive to shocks, remained high (Section 3.2).

Public finances

Denmark is expected to have reached a significant general government account surplus of 2.2 % GDP in 2019. The large surplus reflects strong revenue from the pension yield tax, amounting to close to 2 % of GDP, driven by particularly strong valuation effects for bonds and stocks held by pension funds (Graph 1.7). More generally, general government finances benefitted from low cyclical expenditures and strong tax revenue. Volatile revenue components, particularly the pension yield tax item, generate large fluctuations in the government finances.

|

Graph 1.7:Pension yield tax revenues and

10-year DK government bond yields

|

|

|

|

Source: Macrobond

|

The budgetary position is expected to normalise over the next couple of years and become broadly neutral by 2021. This is partly triggered by an expected normalisation of the pension yield tax revenue as well as a slightly less favourable cyclical position. The deterioration in the headline position is also influenced by the repayment of excessively-collected property taxation in 2020/2022, which in total is estimated at approximately DKK 18.5 billion (0.8 % of GDP).

The structural general government budget balance is expected to deteriorate over the next years, while remaining positive. The cyclically-adjusted budget balance is forecast to fall from some 2 % of GDP to around 0.2 % of GDP by 2021, reflecting not least the above-mentioned normalisation of pension yield tax revenue.

Sustainable development goals

Denmark performs well with regard to the United Nations’ Sustainable Development Goals on equality, education and institutions. Denmark is a strong performer in all the indicators pertaining to Sustainable Development Goals (SDG) 1 (no poverty), SDG5 (gender equality) and SDG10 (reducing inequalities). Likewise, Denmark performs very well on SDG8 (decent work and economic growth), where it is among the best performers. Denmark also performs well on SDG4 (quality of education). On SDG16 (peace, justice and strong institutions) Denmark does particularly well and is ranked very high in a global context regarding the perceived absence of corruption. Denmark performs well on affordable and clean energy (SDG7). On the other hand, Denmark’s results with respect to quality education (SDG4) is sliding, albeit the levels remain satisfactory (). Denmark has high energy independence, notably due to a very high share of renewable energy. By contrast, Denmark is merely an average performer as regards greenhouse gas emissions per capita (SDG13 on climate action). On SDG9 (industry, innovation and infrastructure), Denmark is ranked first of the EU Member States on R&D personnel as a share of the active population. On SDG15 (life on land), Denmark’s intensively farmed land area implies that Denmark has very little forest area as a share of the land mass. On waste generation and recycling, Denmark is broadly at the EU average (SDG11, sustainable cities and communities and SDG12, responsible consumption and production).

|

|

|

Table 1.1: Key economic and financial indicators

|

|

|

|

Source: Eurostat and ECB as of 12-12-2019, where available; European Commission for forecast figures (Autumn forecast 2019)

|

|

|

Since the start of the European Semester in 2011, 97 % of all CSRs addressed to Denmark since 2011 have recorded at least ‘some’ progress. Only 3 % of these country specific recommendations recorded 'limited' or 'no progress' (Graph 2.1). Substantial progress and full implementation have been achieved, in particular in areas of public finances, labour market policies and the financial sector.

|

Graph 2.1:Level of implementation today of 2011-2019 CSRs

|

|

|

|

Source: European Commission

|

Following a CSR in 2011, Denmark delivered a timely and durable correction of its excessive deficit by 2013, and has since made the fiscal framework more robust. Denmark introduced legally binding multi-annual expenditure ceilings on all three levels of the public sector (i.e. central Government, regional and municipal), applicable from 2014 onwards. The comply-or-explain principle was also added to the fiscal framework in 2016, making national law compliant with the Fiscal Compact. Since 2016, Denmark’s structural balance consistently outperformed its medium-term objective of -0.5 % of GDP.

The labour market and education system was subject to CSRs in the period 2011 to 2014, as well as in 2019. Long-term labour supply, the employability of people at the margins of the labour market and the quality of the education system were the subject of CSRs between 2011 and 2014. A number of labour market, pension, social and educational reforms were implemented during this period in response to these recommendations. Since then, the labour market performance has improved, and the number of people receiving social assistance has declined. Although labour shortages have been easing recently, challenges remain. Ensuring supply of the right skills is crucial to boost productivity and fostering sustainable and inclusive growth. The educational performance of children with a migrant background remains a challenge. In 2019, the Council recommended therefore Denmark to focus investment-related economic policy on education and skills.

The housing market and the financial sector were subject to CSRs in 2011 and 2012. Following the recommendations, the Danish authorities have implemented several macro- and micro-prudential measures to safeguard financial stability and limit risky loan taking. Although there was no CSR on this topic since 2013, the European Commission closely monitors the developments in this area. The Danish authorities have continued to implement measures every year since then. Recent measures include a Systemic Risk Buffer for six systemically important banks, the reduction in mortgage interest tax deductibility, limits to risky debt taking and the activation of a countercyclical capital buffer. A 2017 reform will re-align property taxes with actual property values by 2021, also better addressing regional house price divergences, although the new valuation system behind the property tax reform has been delayed.

Increasing competition and productivity has been subject to CSRs between 2011 and 2018. The Danish authorities have taken gradually several steps to address these challenges. For instance, the Parliament has adopted reforms on the services market, including the easing of retail planning and increasing competition in the taxi sector and in the mortgage market. Building regulations have been reviewed and Denmark has continued its work with implementing the utilities strategy. Denmark has made sufficient progress when examined over a longer time horizon, and as a result, the CSR in this area has been dropped in 2019.

Research and development has been subject to CSR in 2016 and in 2019. Although overall research and development spending is high in Denmark, this has not translated into higher productivity growth. In 2016 Denmark was recommended to promote cooperation between businesses and universities. Denmark demonstrated sufficient progress in this area through a number of measures, including a prominent role to research and technology organisations and the creation of an innovation fund, which supports investments and long-term projects/partnerships. Nevertheless, the research and innovation activity remains concentrated in a small number of large firms and foundations and mostly in the pharmaceutical and biotechnology sectors. Therefore, in 2019, the Council recommended broadening the innovation base to include more companies.

|

|

|

Table 2.1:Summary table on CSR assessments (*)

|

|

|

|

Source: European Commission

(*) “The assessment of CSR 1 does not take into account the contribution of the EU 2021-2027 cohesion policy funds. The regulatory framework underpinning the programming of the 2021-2027 EU cohesion policy funds has not yet been adopted by the co-legislators, pending inter alia an agreement on the multiannual financial framework (MFF).

|

|

|

Denmark has made some progress () in addressing the 2019 country-specific recommendations (see Table 2.1).

Denmark has taken measures to focus investment-related economic policy on education and skills. The 2020 Budget Bill has allocated a marked increase in public expenditure on primary schools. Furthermore, a broad political agreement (October 2019) earmarked DKK 102 million to initiatives to upskill low-skilled workers. These initiatives should help to address sector-specific labour shortages. Nonetheless, there is a continued need to incentivise youth to choose a vocational education and training (VET) programme, and to increase the skills level of people on the margins of the labour market.

As part of the 2020 budget, research in climate technology will be markedly strengthened, however without specific measures to broaden the innovation base and include more companies. The Research Reserve for 2020 has been increased from the original plan by 38 %, totalling DKK 1.925 billion. The budget earmarks an additional DKK 1 billion for green research in 2020 raising it to a total of DKK 2.3 billion. These expenses will focus on areas such as agricultural transformation, environmentally-friendly transport and sustainable cities. The aim of the increased R&D budgets is to contribute to the objective of reducing greenhouse gas emissions by 70 % by 2030 and will open new possibilities for SMEs to participate in climate-related R&D activities.

Sustainable transport is a key priority for the government. The Government has presented a specific transport plan to tackle key road congestion areas, notably in the Greater Copenhagen and Lillebælt areas. The Government has taken action to disseminate European Rail Traffic Management System (ERTMS) signalling on Danish railroads, which is a prerequisite for more frequent train schedules and for further electrification of the rail network. In October 2019, the government announced that it is set to negotiate an agreement on infrastructure investments. Such a plan can been seen in Denmark’s overall ambition on climate and environmental issues. One part of the plan is supposed to tackle road congestions through investments in public transport and cycling. In addition, the government announced a plan to phase out sales of new traditional diesel and petrol cars as of 2030. The government has set up a Commission for Green Transition to foster the sale of electric vehicles ().

Denmark has made some progress in addressing the 2019 country-specific recommendation related to anti-money laundering (AML). Denmark took several significant legislative steps over a relatively short period of time. The new AML law entered into force in January 2020 and intends to transpose the 4th and the 5th AML Directives. The recently implemented policy measures still have to prove their effectiveness. Denmark has made some advances in supervision and enforcement of the AML framework. The Financial Supervisory Authority has made progress in enhancing its supervisory capacity, but more needs to be done. Risk analysis tools and supervision manuals have been drawn up, but are still to be applied. An upgrade has yet to be sought and obtained in respect of Financial Task Force standards relevant for anti-money laundering supervision of financial entities. The Government has boosted the budget at the Money Laundering Secretariat (Denmark’s Financial Intelligence Unit) and the Danish FSA to increase supervision capacity. The FSA established an AML Division and increased the number of AML-dedicated staff by close to 50 % in 2019.

3.1Public finances and taxation

Debt sustainability analysis and fiscal risks

Danish public finances are sound with limited risks to sustainability. The European Commission’s assessment of the short, medium and longer-term sustainability of public finances, notably in the view of population ageing, suggests that sustainability risks remain low over all of these time horizons (). At 33.8 % of GDP in 2018, Danish government debt is low in comparison with most Member States. The debt ratio has been on a declining trend over recent years, which is expected to continue over the medium term, to reach 15.4 % of GDP by 2030 (Commission baseline no-policy change scenario). A change of the financing model for social housing could however result in a lower pace of gross debt reduction (Convergence Programme scenario).

Fiscal Framework

Denmark has a strong fiscal framework. The budget law sets out boundaries for the Danish general government deficit. It is the result of the implementation of the Fiscal Compact in Denmark and is intended to subject Danish public finances to a comparable level of fiscal discipline. Despite wide tax and expenditure autonomy at local and regional levels, Denmark has a developed system for ensuring compliance at all levels of government with the decided budgetary policy stance. Notwithstanding this, the Economic Councils, in its capacity as fiscal watchdog (see below), has noted that over the period 2013-2018 municipalities failed to comply with the investment ceilings. However, with the exception of 2018 this was more than offset by lower government consumption. For 2019, the framework appears to have been respected at the general government level.

Denmark has an independent fiscal institution (IFI). The Economic Councils, in their capacity as IFI, carry out analysis on the effectiveness and efficiency of economic policy. This includes analysing the impact of taxes, transfers and public services on behaviour of other economic agents. The IFI does not, however, carry out spending reviews stricto senso. The transfer in 2018 to Horsens has had some negative effects in terms of staff shortages and delays in reports.

Taxation

Denmark’s tax revenue as a share of GDP is high in an EU comparison. At 45.9 % of GDP in 2018, Denmark has one of the highest tax revenue ratio among the EU Member States. Notwithstanding this, Denmark recorded the highest fall among all EU Member States, as the tax to GDP ratio fell from 46.8 % of GDP in 2017 to 45.9 % in 2018. Thus, Denmark continues the path of a moderately falling tax to GDP ratio, albeit from high levels.

The debt bias of the tax system encourages house ownership. The Danish tax system allows tax deductions for mortgage interest payments, which constitutes an incentive for households to take up mortgage lending. The mortgage interest deductibility bias of the tax system contributes to the high gross indebtedness of Danish households. At around 113.5 % of GDP, Danish households have the highest debt levels of all EU Member States, albeit the debt should be seen in the perspective of much larger (but largely illiquid) financial assets, notably real estate and pension savings (see also Section 3.2).

Tax expenditure stemming from mortgage interest deductibility raises questions as regards fairness, equality and potentially financial stability. Box 3.1.1 shows that a simultaneous abolishment of tax deductibility of mortgage interest payments and an equivalent increase in personal income tax allowance could increase welfare and economic equality while strengthening households’ resilience. The current period of very low interest rates with reduced mortgage interest payments could provide a window of opportunity to improve the current system.

Corporate income taxation encourages debt over equity financing. In Denmark, as in most EU Member States, it is possible to deduct interest, typically from a loan or debt, as expenditure when determining the amount of taxable profits, while this is generally not possible for paid out dividends. This favours the use of debt or loans for financing, instead of equity. The distortion could be addressed through the introduction of an allowance for deduction in respect of corporate equity (ACE). While the latter would contribute to narrowing the corporate tax base, it could incentivise firms to invest. The budget proposal for 2017 included an ACE, but it has not been implemented. Based on estimates published by the Ministry of Finance at that time (Finansministeriet 2017) an ACE could boost GDP by 1.7 % in the long run through its positive impact on investment. Similar recommendations have been recently made by the Economic Councils (DORS 2019), the International Monetary Fund (IMF 2019) and the OECD (2019c).

Denmark’s revenues from environmentally relevant taxes have been decreasing but still among the highest in the EU. However, the falling share of environmental and labour taxes in total tax revenues are taking Denmark further away from the objectives of SDG17. Environmental taxes accounted for 3.7 % of GDP in 2018 (EU average: 2.4 %), which has however decreased from 4.9 % of GDP in 2005. In the same year, energy taxes accounted for 2 % of GDP against an EU average of 1.9 % of GDP (Chapter 3.5). In particular, Denmark has high environmental taxes on road transport. While the tax system has components that reflects fuel economy, changes in the design of the car taxes in 2017 has contributed to an increase in the sales of heavier cars with higher emissions. There are no taxes on air transport. Energy taxation and taxation on pollution/use of resources are around EU averages.

In terms of transport fuel taxation, Denmark taxes petrol significantly more than diesel. The marked difference in taxation (diesel is taxed some 32 % lower than petrol in 2018) is significantly above the EU average and implicitly creates an incentive for diesel cars, despite higher nitric oxide (NOx) pollution. While diesel cars are subject to a higher registration fee, the tax structure favours diesel cars in the case of high annual mileage. Fossil fuel subsidies fell in the past decade, thanks to the phasing out of indirect tax subsidy for diesel, which has a reduced energy duty compared to petrol. In 2016, fossil fuel subsidies, essentially the reduced energy duty on diesel, amounted to some DKK 9 billion (0.4 % of GDP).

Tax Administration

The Danish tax administration is undergoing a period of structural reform. As from 2018, the Danish tax administration has adopted a new structure, moving from one single administration to a group of seven agencies, each one focussing on a particular area of tax and customs administration. The reform aims to make tax collection more efficient and effective. There have been some positive results already. Among others, in September 2019, following years of investigation after a major tax scandal regarding dividends tax, the Danish tax authorities managed to obtain a large amount of tax information from Dubai, where an individual accused of having played a major role in the scandal is tax resident (which amounted to approximately 0.6 % of GDP). This signals the continuous determination of the Danish tax administration to address the consequences of the fraud case and follows successes in recovering some of the money lost. At the same time, as recently pointed out by government auditors, challenges remain more generally in the area of recovery of taxes and other fees, such as police fines due by Danish taxpayers to the Danish state.

While progress with administrative reform is visible in some areas, challenges remain in others. A much-needed modernisation of the property tax system planned for 2021 has been delayed to 2024, because of continued IT development challenges within the Danish tax administration. The development of a new IT system was markedly behind schedule, implying that any entry into operation of the new system from 2021 was considered unfeasible and could lead to additional challenges for the already-troubled housing evaluation system and the linked taxation system.

Financial sector developments

Total private credit growth has evolved at a steady pace in 2018. There has been a moderate increase in credit growth to households (1.3 %), but it remains below that of its neighbouring countries. More recently, a hike in mortgage activity has also taken place (1.3 %), largely due to mortgage refinancing. Credit to non-financial companies slowed down significantly in 2019, after a strong expansion in 2018. In access to finance, Denmark is among the top performers in the EU, although the relative cost of small loans (up to EUR 1 million) compared to the cost of large loans is high (European Commission 2019f).

|

Graph 3.2.1:Credit growth

|

|

|

|

Source: ECB

|

Danish banks are generally profitable, well capitalised and in a good liquidity position, but the low interest rate environment may pose challenges going forward. Negative yields and interest rates are becoming more pervasive in the Danish economy. For a majority of households, deposits are unremunerated and some banks have announced plans to charge negative interest rates to large private depositors, as they already do for a majority of corporate depositors. Banks’ reliance on net interest income (NII) is thus increasingly under strain and only partly offset by revenues from fees and commissions. Higher expenses related to compliance with anti-money laundering provisions and to the implementation of new financial technologies also weigh on profits (). With a return on equity of an estimated 8 % in 2019, the profitability of Danish banks has been declining somewhat compared with previous years, but remains sound and higher than that of European peers. Solvency indicators are also sound, with the total capital ratio and the CET1 ratio standing at an estimated 21.5 % at 17.5 %, respectively, in the second quarter of 2019.

Banks could come under stress in an adverse scenario. While capital levels exceed the regulatory requirements, the latest stress test by the national central bank suggests that some banks would come under pressure in a severe recession scenario (Danmarks Nationalbank, 2019b). All significant banks complied with their minimum requirements for own funds and eligible liabilities (MREL) that had to be met by 1 July 2019. The short maturities of Danish banks’ MREL-eligible instruments relative to similar issuances in other Member States may, however, pose rollover risks (Danmarks Nationalbank, 2019c). The liquidity position is comfortable, as reflected in a liquidity coverage ratio of 173 % at the end of the same period. Finally, asset quality is high, as it is reflected in the low ratio of non-performing loans.

Macro-prudential buffers are being progressively built to further strengthen banks’ resilience. While credit growth has been easing overall, this nonetheless masks a build-up in systemic risk as intensified competition among banks may result in an easing of credit standards and as investors take higher risks in their search for yield. Against this background, the Danish Systemic Risk Council has recommended further increases in the rate of the countercyclical capital buffer (CCyB). That rate, currently at 1 %, will progressively increase to 1.5 % in the third quarter of 2020 and to 2 % in the first quarter of 2021. The Council has announced its intention to recommend a further increase of the buffer rate to 2.5 %. This buffer will contribute to further safeguarding financial stability and can be released with immediate effect if the degree of systemic risk

were to decline. It complements other prudential measures specific to real estate (see below).

The government launched a review of Denmark’s participation in the European banking union. The review was announced in July 2017 and the final report was released in December 2019. The government’s review was the second study on the subject. Similarly to the 2015 report, the 2019 report also concluded that joining the banking union would in principal be advantageous for Denmark, as it would inter alia strengthen oversight of Danish financial institutions’ cross-border activities. Some uncertainties highlighted in the 2015 report (for instance related to Denmark’s mortgage-credit system) have now been clarified. However, the 2019 report highlights that the Banking Union is still developing and that there is ongoing work on additional measures at EU-level, which could change the regulatory framework for Danish credit institutions, whether or not Denmark participates in the Banking Union.

|

|

|

Table 3.2.1:Financial soundness indicators, all banks in Denmark

|

|

|

|

Source: ECB - CBD2 - Consolidated Banking data

|

|

|

Household indebtedness

Debt of Danish households remains high but has been declining in recent years. Denmark is among the EU Member States among the highest household debt-to-GDP ratio. Household debt progressively fell from its peak of 143 % of GDP in 2009. The reduction between 2018 and 2019 is estimated to have been particularly strong, with debt falling by 11 pps to an estimated 113.5 % of GDP. Danish household debt was 2.4 times higher than gross disposable income in 2019, down from a multiple of three at the peak in 2009. This overall reduction primarily reflects GDP (i.e. denominator) growth and not the contraction of credit. However, credit flows have slowed recently and households have used the low interest environment to deleverage to refinance their existing debt (Graph 3.2.2).

|

Graph 3.2.2:Household debt

|

|

|

|

Source: Eurostat

|

Commission analyses suggest a need for further reductions in gross household debt. Estimates of prudent or fundamentals-based levels of gross household debt implied by cross-country models are significantly below Danish households’ actual debt level (). The model-implied gap between those benchmarks of sustainable debt levels and the actual debt has narrowed in recent years, but would in principle point to a need for a further deleveraging. This is under way, as households increasingly switch to mortgages with amortisation (see also Graph 3.2.4).

There are several factors that mitigate debt sustainability risks. Households have strong balance sheets and the high level of gross debt is matched by a high level of household assets – net assets of Danish households amounted to 185 % of GDP in the second quarter of 2019 ‑ implying a comfortable solvency position. While the high level of gross debt may thus be an imperfect indicator of debt sustainability, there are nonetheless frictions that may result from the liquidity mismatch in Danish households’ balance sheets and the asymmetric reaction of assets and liabilities to certain shocks.

A large share of the assets mentioned above is illiquid. These include as housing or pension savings (which may also suffer from negative valuation effects in a downturn), while there is still a high, albeit declining, share of debt at variable rates that is susceptible to an interest rate shock. However, debt service ratios have declined from around 24 % at the end of 2008 to around 15 % at the end of 2018, suggesting that household resilience vis-à-vis such shocks has increased. Furthermore, gross household debt is highly correlated with high household income, indicating that the balance sheet risks reside predominantly at households more resilient to adverse shocks (Danmarks Nationalbank 2018d).

Housing market

Housing prices have been rising relatively strongly, compared with other EU Member States, but market dynamics in Denmark have eased over recent quarters. The slowdown has affected all regions and housing categories. At the national level, annual growth of prices of one-family houses decelerated from 3.9 % in 2018 to 2.4 % in the first half of 2019. In the capital region, price growth slowed from 4.9 % in 2018 to 2.8 % in the second quarter of 2019, the lowest rate observed since the third quarter of 2012. Annual price growth of owner-occupied flats, which averaged 8 % between mid-2012 and mid-2018, decelerated from the second quarter of 2018 onwards, with prices even contracting in the first half of 2019. This pattern is mirrored in the capital region (Graph 3.2.3). The number of one-family house sales at national level in 2018 stagnated compared to the previous year, while transactions of owner-occupied flats declined, driven by developments in the Copenhagen region. The slowdown in market dynamics is also reflected in a decline in housing starts and permits for new constructions since mid-2018 and a slowdown in loans for house purchases.

|

Graph 3.2.3:Nominal real estate prices

|

|

|

|

Source: Statistics Denmark

|

House prices valuation estimates are on the upside, but provide no signs of significant overvaluation. Increases in the price-to-income and price-to-rent ratios above their long-term values point to a marginal worsening of housing affordability over recent years.. House prices in Denmark, both at national and regional level appear broadly in line with fundamentals. This contrasts somewhat with price-to-rent or price-to-income indicators, which point to higher valuation gaps and pressures on housing affordability. However, the latter indicators do not take account of regulations affecting rental market, supply constraints and other fundamental drivers of prices, such as population growth or urban migration.

Mortgage financing conditions remain favourable with mortgage rates at historical lows. While the average effective mortgage interest rate has been declining for a long time, in September 2019 it has fallen for the first time below 1 % to 0.93 %. The average rate for new loans was 0.73 % in September 2019, as some Danish banks started offering residential mortgages with negative interest rates. The decline in the average rate is mainly driven by the refinancing of existing mortgages at lower rates, which are counted as new loans.

Since 2014, the Danish authorities have put in place macro-prudential and requirements on banks to limit borrowing. These restrictions predominantly take the form of limits to the debt-to-income (DTI) and loan-to-value (LTV) ratios, and target in particular borrowers in areas that have experienced high price increases (the so-called “growth areas” around Copenhagen and Aarhus) and loans with characteristics that are considered risky, i.e. loans with adjustable interest rates or without amortisation. These measures seem to have been effective both in slowing down loan growth in the “growth areas” (Danmarks Nationalbank, 2018c) and in steering borrowers towards loans with longer interest rate fixation and amortisation, and thus decreasing financial stability risks emanating from the residential real estate sector. In February 2019, 46 % of the outstanding mortgage loan amount was concentrated in loans with instalments, while 57 % of that amount in loans with variable interest rates (Graph 3.2.4). This compares with shares of 54 % and 64 %, respectively, four years earlier.

|

Graph 3.2.4:Mortgage loans by type of loan

|

|

|

|

Source: Danmarks Nationalbank

|

In June 2019, the European Systemic Risk Board (ESRB) issued a recommendation to Denmark() on vulnerabilities in the residential real estate sector (). The Board in particular focussed on the high share of loans with risky characteristics (deferred amortisation and variable interest rates) in combination with the high indebtedness of Danish households. It recommends Denmark to monitor these vulnerabilities and consider the tightening or activation of further capital- or borrower-based measures in the medium term, if necessary. Policy measures that are in place appear to be fairly effective in addressing the identified risks.

A new credit database will strengthen risk assessment. In addition, the Danish Systemic Risk Council and its members carry out regular assessments of both the risks emanating from the housing market and of the policies to mitigate them. In this context it is positive that as of end 2019, the Danish authorities will have access to a new credit database that will allow to further deepen their assessments. Finally, the ESRB also commends Denmark to review other policies that may support imbalances in the mortgage market, such as rental market regulation, tax deductibility of mortgages and housing taxation.

The implementation of the new, albeit delayed, housing taxation system should bring efficiency gains. Once in place, this reform will ensure that the amount of taxes paid on a property will reflect its underlying value and that of the land on which it stands. Currently, this link is weak, implying that in urban areas with high structural demand, the ratio of taxes to house prices is relatively low when compared to rural areas. As such, the current system may create feedback loops by further fuelling the demand for properties with high intrinsic value and push up their prices above levels justified by fundamentals.

Anti-money laundering

The Danske Bank money laundering case revealed end 2018 led to strengthening Denmark’s anti money laundering (AML) framework. Danske Bank is currently under investigation for clearing financial transactions totalling over EUR 200 billion through its branch in Estonia between 2007 and 2015. This case has led to a loss of trust in the integrity and anti-money laundering defence capabilities of Danish financial institutions and drawn international scrutiny to cross-border fight against money laundering. Important shortcomings in the prevention and investigation of money laundering had been highlighted already by the Financial Action Task Force (FATF) report of 2017 (). The IMF has also stressed that Danish banks’ exposure to higher-risk countries poses a more substantial money laundering threat relative to the other Nordic countries (IMF, 2019). The Danish Court of Auditors (Rigsrevisionen) in its January 2020 report assessed Denmark’s anti-money laundering administration for the period of 2016-2018 and highlighted important deficiencies in the AML prevention framework.

In 2019, Denmark has reaffirmed its commitment to address the identified issues and undertook several significant legislative steps over a relatively short period. A broad political agreement to further reinforce anti-money laundering efforts was reached in March 2019. The initiatives can be grouped into three categories: (1) strengthening of control and intervention powers, (2) significant tightening of sanctions and increased resources, and (3) clearer organisational focus. Legislative amendments to the Financial Business Act were adopted in December 2018 and June 2019, and will allow the Danish FSA to revoke financial institutions’ licenses for gross violations of the AML Act and to substantially increase the fines for failure to comply with that act. The Financial Supervisory Authority (FSA) adopted a report in January 2019 on its supervision of Danske Bank with regard to its Estonian branch. The report has identified 23 initiatives that could improve anti-money laundering supervision. As of July 2019, fit and proper requirements have become applicable to anti-money laundering compliance officers employed by financial institutions.

The FATF upgraded Denmark on ten of its 40 recommendations in 2018 and on three additional recommendations in 2019. The FATF now considers Denmark “largely compliant” with its duty to assess risks and as regards the application of a risk-based approach to fighting money laundering. Despite this, Denmark remains under enhanced monitoring and an upgrade has yet to be sought and obtained in respect of FATF standards relevant for anti-money laundering supervision of financial entities. The Danish Parliament adopted the AML package in December 2019, which entered into force on 10 January 2020. The legislative package intends to transpose the 5th Anti-money laundering directive, introduce measures translating the political agreement of March 2019 into actions and the right for supervisors to issue administrative penalties. These measures allow Danish competent authorities to apply the new tools, fine-tuning procedures and keeping abreast of new trends and vulnerabilities. However, these measures are yet to be assessed and yield results.

Substantial increases in financial and human resources dedicated to AML tasks have taken place within competent authorities. The Government has boosted the budget as well as number of personnel at the Money Laundering Secretariat (Denmark’s Financial Intelligence Unit) and the Danish FSA in the agreement of March 2019. The DFSA established an AML Division and increased the number of AML-dedicated staff by close to 50 % in 2019. The report by Rigsrevisionen might lead to additional actions to strengthen the Danish Financial Intelligence Unit..

3.3.1.Employment developments

Supported by a solid economic upswing, the Danish labour market is performing well. The employment rate reached 77.5 % in 2018, approaching the national 2020 target of 80 %, and well above the EU average of 73.2 %. The gap between the female and the male employment rate has decreased in recent years, reaching 7.0 pps in 2018, well below the average gap at EU level (11.6 pps). The unemployment rate has continued to decline, down to 5.1 % in 2018, the lowest since the pre-crisis level in 2008. Long-term unemployment, which has dropped to 1.0 %, remains one of the lowest in the EU.

The size of the labour force reached a record in 2018 (2.8 million). This is driven by a significant inflow of foreign workers, mainly from other EU Member States, and the increasing number of older workers staying longer on the labour market. In 2018, the employment rate of people aged 55-64 stood at 73.3 %, corresponding to a 13.4 pps increase relative to 2008 (59.9 %). This is the impact of reforms introduced in the 2000’s, incentivising people to stay on the labour market. Since 2006, the statutory and early retirement ages have been indexed to life expectancy. A reform in 2011 brought the indexation mechanism into effect sooner than initially decided. In the current scheme, the retirement age is increased by 0.5 years each year until 2022 and then increased to 68 in 2030. The Danish Parliament has not yet adopted further increases in the retirement age but is expected to raise the retirement age to 69 in 2035 and to 70 in 2040. These reforms are set to contribute to long-term fiscal sustainability and to help make up the 2.5 pps shortfall from the country’s Europe 2020 employment target (80 %).

The labour force is projected to continue growing, but sector-specific differences may increase the risk of skills mismatches. The estimated 11 % increase of the labour force by 2030 (relative to 2016) is expected to be driven by demographic changes (Cedefop, 2018). The age cohorts of those aged 30-34 and 35-39, are expected to increase to 33 % and 29 % respectively. Overall employment is forecast to grow between 2021 and 2030, but with significant sector-specific differences (lowest in engineering by 0.7 % p.a. and highest in the primary sector and utilities by 2.2 % p.a.).

Labour shortages persist, but the overall situation appears to be slightly improving. The total number of unsuccessful recruitments (61,110) stood at 20 % in December 2019, which is slightly below the February 2019 level (70,300) of 22 % (Agency for Labour Market and Recruitment, 2019). This reflects a continuous, but slightly declining, labour market tightness. The shortages concern mainly sector-specific skilled workers, in particular in the construction sector (32 % unsuccessful recruitments), the agricultural sector (29 % unsuccessful recruitments) and the services sector (29 % unsuccessful recruitments). The low share of ICT specialists also remains a challenge. The risks of labour shortages may decline along with more moderate economic growth in 2020 and 2021, estimated at 1.5 % and 1.6 %, respectively.

Wages accelerated in 2018 and are forecast to continue growing. Nominal compensation per employee increased by 2 % in 2018, from 1.7 % in 2017. The upward pressure on wages is expected to continue in 2019. As nominal wages grew ahead of inflation, real wages have also seen an increase (1.4 % in 2018), supporting employees' purchasing power. In sectors experiencing labour shortages, construction and services, wage growth was around that of the whole economy at 2.1 % and 1.9 % in 2018, respectively (Graph 3.3.1).

|

Graph 3.3.1:Real compensation per employee (GDP deflator, National Currency)

|

|

|

|

Source: Eurostat

|

The supply of vocational education and training (VET) graduates is crucial to meet labour market needs, but participation remains low. Despite a slight increase in the share of youth starting a VET programme directly after compulsory school, from 19.4 % in 2018 to 20.1 % in 2019, this remains significantly below the government’s 2025 target of 30 %. Regional differences are significant, with youth residing in the larger cities having the lowest VET participation rates. The employability rate of recent VET graduates is 85.6 % in 2018, well above the EU average (79.5 %). Previously, the lack of apprenticeship places was a barrier, but the 2016 tripartite agreement has resulted in approx. 3,000 additional apprenticeship places, well on track in reaching the overall goal of establishing 8-10,000 new places by 2025. Nonetheless, the VET programmes fail in attracting youth to choose this direction. There appears to be a gender imbalance, with 39.7 % female VET students in 2018.

The relatively low share of the workforce specialising in ICT (4.3 %) remains a challenge. The national Technology Pact aims to increase the number of tertiary Science, Technology, Engineering and Mathematics (STEM) graduates by 20 % by 2028. Recent government initiatives focus on promotional activities, in with expected participation of 1 million persons. A key challenge is the occupation of women in digital jobs and entrepreneurship (European Commission 2019h). In the Women in Digital Scoreboard (European Commission 2019i) Denmark scores 65.4 (EU average of 50), but only 1.8 % of employed women are ICT specialists. Furthermore, 59 % of the SMEs reports difficulties recruiting ICT specialists, which is above the EU average (55.5 %).

Launched in February 2019, the National Coalition for digital skills and jobs aims to promote the enhancement of digital skills. With more than 10,000 members, it supports actions targeting adequate and continuous supply of high quality graduates in line with labour market needs. It divides digital skills in three categories: 1) basic user’s skills for all citizens, 2) coding skills and 3) reflective skills that focus on developing the basic literature and culture around ICT (European Commission 2019h).

Youth unemployment has fallen in recent years, but the share of early school leavers has increased. This development hampers Denmark’s progress towards SDG8. Youth unemployment fell to 10.5 % in 2018, well below the EU average of 15.2 %. The share of early leavers from education and training (aged 18-24) has, however, gradually increased from 7.2 % in 2016 to 10.2 % in 2018, slightly below the EU average of 10.6 % and is classified as “to watch” in the Social Scoreboard. The drivers remain unknown, but the relatively high chances of finding unskilled or skilled jobs, may have incentivised working instead of finishing their studies (Graph 3.3.2).

|

Graph 3.3.2:Youth: in education and training, employment rate, unemployment rate, unemployment-to-population ratio, NEET

|

|

|