This document is an excerpt from the EUR-Lex website

Document 52021AE0692

Opinion of the European Economic and Social Committee on ‘Communication from the Commission to the European Parliament, the Council, the European Central Bank, the European Economic and Social Committee and the Committee of the Regions — The European economic and financial system: fostering openness, strength and resilience’ (COM(2021) 32 final)

Opinion of the European Economic and Social Committee on ‘Communication from the Commission to the European Parliament, the Council, the European Central Bank, the European Economic and Social Committee and the Committee of the Regions — The European economic and financial system: fostering openness, strength and resilience’ (COM(2021) 32 final)

Opinion of the European Economic and Social Committee on ‘Communication from the Commission to the European Parliament, the Council, the European Central Bank, the European Economic and Social Committee and the Committee of the Regions — The European economic and financial system: fostering openness, strength and resilience’ (COM(2021) 32 final)

EESC 2021/00692

IO C 341, 24.8.2021, p. 41–49

(BG, ES, CS, DA, DE, ET, EL, EN, FR, HR, IT, LV, LT, HU, MT, NL, PL, PT, RO, SK, SL, FI, SV)

|

24.8.2021 |

EN |

Official Journal of the European Union |

C 341/41 |

Opinion of the European Economic and Social Committee on ‘Communication from the Commission to the European Parliament, the Council, the European Central Bank, the European Economic and Social Committee and the Committee of the Regions — The European economic and financial system: fostering openness, strength and resilience’

(COM(2021) 32 final)

(2021/C 341/07)

|

Rapporteur: |

Tomasz Andrzej WRÓBLEWSKI |

|

Referral |

European Commission, 24.2.2021 |

|

Legal basis |

Article 304 of the Treaty on the Functioning of the European Union |

|

Section responsible |

Economic and Monetary Union and Economic and Social Cohesion |

|

Adopted in section |

25.5.2021 |

|

Date adopted in plenary |

9.6.2021 |

|

Plenary session No |

561 |

|

Outcome of vote (for/against/abstentions) |

158/1/2 |

1. Conclusions and recommendations

|

1.1. |

The EESC welcomes the Commission Communication on The European economic and financial system: fostering openness, strength and resilience. The post-pandemic transformation is causing a significant shift in the global balance of economic power. Therefore, the EU should act swiftly to increase Europe’s economic resilience. |

|

1.2. |

The Committee shares the Commission’s assessment regarding the need to strengthen the international role of euro as a key tool for enhancing Europe’s global position. At the same time, in the Committee’s view, setting ambitious economic objectives is essential to strengthening the single currency, especially given the pace of change in the global economy and the EU’s current position in terms of innovation, competitiveness and a regulatory friendly environment. The Committee is therefore calling for a stronger focus in the Communication on the reasons for the euro’s weakening international role, and for the completion of the Economic and Monetary Union. |

|

1.3. |

The Committee notes that the Communication does not take account of the growing position of China, and recommends that the Communication be supplemented in this regard. |

|

1.4. |

Completion of the Banking Union and of the Capital Markets Union, which helps channel savings toward investment, is essential to increasing the EU’s resilience, in line with previous EESC opinions on that matter (1) (2). The Committee approves all actions proposed by the Commission (3) and proposes introducing measures to help complete the structural changes both at EU and national level, such as revising the economic governance framework in order to make it more prosperity-oriented and investment-friendly (4). |

|

1.5. |

The quality of the regulatory framework has great importance for the development of innovation. Hence, more emphasis should be put on reviewing regulations, in terms of their impact on the competitiveness of European companies. Furthermore, the EESC considers that the Communication fails to recognise the role of universities and research institutions in terms of innovation development. |

|

1.6. |

The Committee fully supports the proposal to create a digital euro and the continued issuance of green bonds denominated in euro as a means of increasing the international role of the euro and consolidating the EU’s dominant position in the field of climate action. |

|

1.7. |

The EESC agrees that developing financial market infrastructures will prevent reliance on the provision of critical services (including data providers) from third-country jurisdictions and help increase the EU’s resilience. |

|

1.8. |

The Committee supports the European Commission’s efforts to develop tools to counteract the effects on EU economic operators of the unlawful, extra-territorial application of unilateral measures by a third country. In the Committee’s view, such instruments can contribute to the EU’s increased independence as a global actor. The Commission should also consider how to cope with the growing EU dependence on non-EU financial and extra financial data providers. |

2. Background

|

2.1. |

The subject of this opinion is the Communication of 19 January 2021 on The European economic and financial system: fostering openness, strength and resilience. This Communication is an integral part of the strategy to strengthen the EU’s open strategic autonomy (5). |

|

2.2. |

The key objective of the EU’s open strategic autonomy is to safeguard and deepen the Single Market, which underpins the euro and the EU’s openness to trade and investment with the rest of the world. |

|

2.3. |

This Communication sets out how the EU can reinforce its open strategic autonomy in the macroeconomic and financial fields. The main reasons for implementing the outlined strategy are as follows:

|

|

2.4. |

In line with this Communication, the Commission will work towards promoting the international role of the euro, strengthening EU financial market infrastructures, improving the enforcement of EU sanctions and increasing the EU’s resilience to the effects of unlawful, unilateral sanctions by third countries. |

3. General comments

|

3.1. |

The EESC welcomes the publication of this Communication, which includes regulatory proposals and enabling measures aimed at increasing the euro’s share of trade and boosting the resilience of the EU financial system. |

|

3.2. |

The euro area has been in existence for more than 20 years and is growing, taking in new Member States (albeit waiting for new countries to join) (6) and maintaining the international reputation of the euro. At the same time, the Committee notes that the euro’s share of foreign exchange reserves fell from 23 % to 19 % in 2019 — ‘close to historical lows’ (7) — and that, according to several acclaimed economists, including Nobel laureates Joseph E. Stiglitz and Paul Krugman, the euro area is still not an optimum currency area (8) as understood by the creator of this theory, Robert Mundell. |

|

3.3. |

The EESC also points out that the role of the rapidly growing Chinese economy, which is becoming increasingly important in the global economy, merits a wider discussion in the context of strengthening EU economic resilience. The average real annual GDP growth rate over the past 30 years was around 10 %, compared with around 2 % in the EU. The pandemic is likely to bring further differences in GDP growth rates: 4,4 % in the EU (-6,1 in 2020) and 8,4 % in China (2,3 % in 2020) (9). |

|

3.4. |

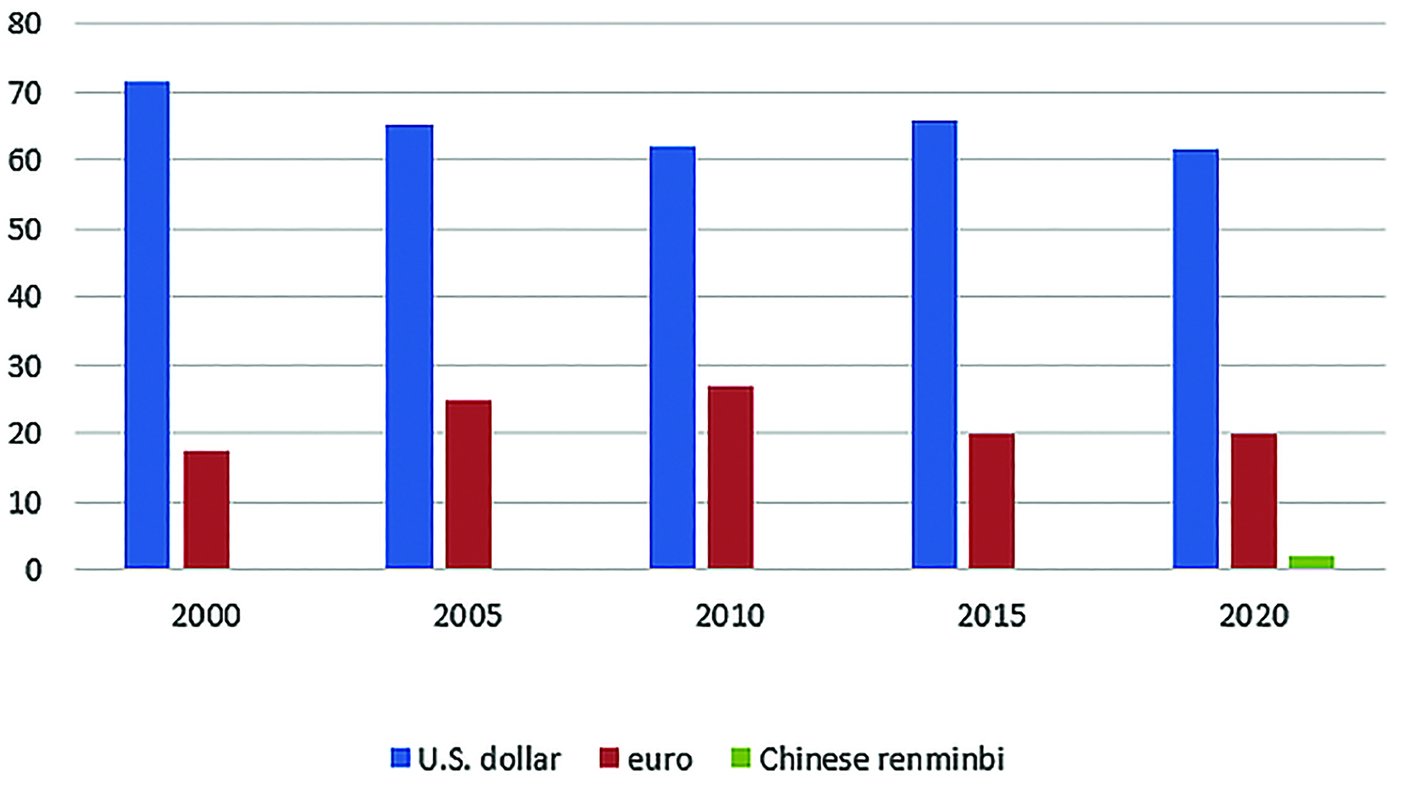

As the Chinese economy grows, so does the role of its currency in international trade and clearing. In the Official Foreign Exchange Reserves, (in the third quarter of 2020) the US dollar had a share of around 60,5 %, the euro 20,5 % and the Chinese renminbi 2,1 %. However, the renminbi’s share is growing rapidly, while the euro’s share has fallen (10). China is also working intensively on its digital currency (testing it already in several cities (11)), leaving most of the world behind (12). |

|

3.5. |

In view of the above, the EESC is concerned that the strategy does not include an action plan that takes account of China’s growing economic position, and recommends that the Communication be supplemented in this regard. |

|

3.6. |

The Committee supports the appeal set out in key action to complete the Banking Union (13) and make further progress on the Capital Markets Union (14) as a means of supporting the resilience of the EU and deepening the Economic and Monetary Union. It notes, however, that ‘[t]he completion of the EMU requires first of all strong political commitment, efficient governance and better use of the available finances’ (15). |

|

3.7. |

The Committee notes that the continuation of structural changes to ensure a closer and coherent monetary union requires political commitment and, at the same time, proposes that the Communication be complemented by a series of measures capable of yielding tangible results:

|

|

3.8. |

The Committee agrees that the regulatory framework is crucial for the development of innovation, but regards the actions proposed in the Communication as insufficient. At the same time, the EESC notes that, as a result of Brexit, the number of globally leading universities in the EU, which play a key role in boosting innovation, has decreased to only a few among the world’s top 50 universities (19). Universities are crucial for increasing innovation and long-term resilience to further economic turmoil. |

|

3.9. |

In the light of the above, the EESC calls for the Communication to be supplemented with measures to:

|

4. Specific comments

4.1. Strengthening the international role of the euro

|

4.1.1. |

According to the Communication, the increase in the euro’s importance in international trade, investment and payment leads to many benefits, such as greater monetary autonomy, stronger transmission of monetary policy, lower transaction costs and a reduction in price shocks. |

|

4.1.2. |

The EESC supports the continued issuance of euro-denominated bonds. However, while understanding the benefits of these measures, the EESC calls for the euro’s growth strategy to be based on strengthening and expanding the euro economic area, in addition to issuing common debt (20). Due to the COVID-19 crisis, ‘[t]he EU will issue close to EUR 1 trillion of new debt by 2026.’ (21) However, ‘[t]he existence of high public debt levels as a share of GDP can pose difficulties with regards to resilience.’ (22) To overcome these, the European financial system should become ‘more resilient by completing the Banking and Capital Markets Unions’ (23). The EESC recommends that the euro’s high position with regard to fixed-income securities before the 2008-09 financial crisis should be restored (24). |

|

4.1.3. |

The Committee therefore calls for some of the competences of national financial supervisors to be transferred to the EU level, creating a common regulatory framework for the creation of the Banking Union and the Capital Markets Union (25). In the EESC’s view, the full movement of capital within the EU should be enabled so that, ultimately, every citizen or SME can benefit from the financial services of any financial institution subject to joint EU financial supervision (26). Any new regulation linked to the building of the CMU should be submitted to tests (27) aimed at checking if it fulfils criteria such as: increased competitiveness and innovation (esp. including digital transition), contribution to the green transition, and financial markets stability. |

|

4.1.4. |

In addition, steps should be taken to strengthen the euro’s presence in the central bank reserves of different countries through swap agreements, and to support the conclusion of large international contracts for European companies (implemented outside the EU) by clearing them in euro. |

|

4.1.5. |

In order to increase the role of the euro in the world economy, it is necessary to increase the competitiveness of EU goods and services. For this to happen, investments are needed in education and in research and development. |

|

4.1.6. |

Key action 6 stipulates that the Commission and the ECB will jointly review a broad range of policy, legal and technical questions emerging from a possible introduction of a digital euro. |

|

4.1.7. |

The Committee supports the idea of a digital euro. However, in the EESC’s view, the digital euro should be implemented not via the ECB only, but via the Eurosystem (28) central banks (and any supervisory institutions) (29). |

|

4.1.8. |

This new settlement system should take into account privacy requirements under the law (especially AMLD V). A properly designed digital euro could support the use of the euro outside the euro area and weaken the role of the US dollar (and in the future of the digital yuan too), especially in international and retail transactions (30). |

|

4.1.9. |

The EU is a leader in the global green bond market. In 2019, almost half of its issuance was denominated in euro (31) and it is also strong among non-euro area residents (32). The EESC welcomes the proposal to introduce new ‘green’ financial instruments (33) with a view to supporting the European Green Deal (34). It will enable the EU to continue and develop its role as a global leader in climate action (35). |

4.2. Increasing the resilience of EU financial market infrastructures and related critical service providers

|

4.2.1. |

The Communication stresses the importance of the EU developing its financial market infrastructures and increasing their resilience so as to avoid reliance on the provision of such critical services from third-country jurisdictions. The Commission should also study how to prevent dependence on non-EU financial and extra financial data providers. The new digital euro-based settlement system could be used to support trade with partners on whom third countries have imposed unilateral sanctions, and through blocking its use by sanctioned countries and persons (by drawing information from the Sanctions Information Exchange Repository database). |

|

4.2.2. |

The EESC also recalls the experience of the beginning of the COVID-19 pandemic, when increased interest in the dollar and US repo market dislocation made it more difficult for non-US financial institutions to refinance their operations in dollars. Consideration could also be given to using the European Stability Mechanism as a liquidity pool in euro, which would also be accessible to large financial institutions. We need a clear roadmap for ESM changes and development of the Capital Markets Union. |

|

4.2.3. |

The EESC agrees in principle with the steps leading to an increase in the EU’s open strategic autonomy, including in terms of boosting the resilience of EU financial market infrastructures. On the other hand, the Committee points out that such measures may, under certain conditions, lead to undesired political effects. |

4.3. Strengthening the implementation and enforcement of EU sanctions

|

4.3.1. |

In order to increase the effectiveness of EU sanctions, it is necessary to ensure that they are implemented and enforced in a uniform manner. Subsidiaries of non-EU companies benefit from legal loopholes to circumvent bans, leading to distortions in the Single Market. |

|

4.3.2. |

The EESC welcomes the proposals aimed at strengthening the EU’s ability to apply sanctions uniformly and to speak with one voice. |

|

4.3.3. |

The Committee also supports the European Commission’s efforts to develop tools to counteract the effects on EU economic operators of the unlawful, extra-territorial application of unilateral measures by a third country. However, the EESC underlines the need to develop mechanisms to ensure consensus among all Member States on the object of the sanctions themselves. In the Committee’s view, such instruments can contribute to the EU’s increased independence as a global actor and protect the Single Market from shocks. |

|

4.3.4. |

At the same time, it should be noted that since the financial crisis of 2008-2009 the EU financial market has been subject to strict discipline, which imposes administrative obligations on those who want to benefit from the EU Single Market. It is important that these regulations are applied with the flexibility necessary to ensure a balance between costs and benefits, assess the effects of new regulations on European financial companies (36) and adapt the regulatory burden also to the size of these entities (large pan-European banks, financial institutions, and start-ups in the financial technology sector) (37). |

Brussels, 9 June 2021.

The President of the European Economic and Social Committee

Christa SCHWENG

(1) EESC opinion on a European Deposit Insurance Scheme (OJ C 177, 18.5.2016, p. 21).

(2) EESC opinion on the Economic and monetary union package (OJ C 262, 25.7.2018, p. 28).

(3) EESC opinion on A Capital Markets Union for people and businesses — new action plan (OJ C 155, 30.4.2021, p. 20).

(4) EESC opinion on the Economic governance review 2020 (OJ C 429, 11.12.2020, p. 227).

(5) COM(2021) 32 final.

(6) COM(2018) 796 final, p. 2.

(7) The international role of the euro, European Central Bank, June 2020.

(8) Can the European Project be saved? Keynote Lecture by Paul Krugman, 23rd International Conference of Europeanists, Philadelphia, April 14-16, 2016.

(9) See World Economic Outlook database, April 2021, International Monetary Fund.

(10) Currency Composition of Official Foreign Exchange Reserves (COFER), International Financial Statistics (IFS), International Monetary Fund, https://data.imf.org/regular.aspx?key=41175

(11) See China Launches Digital Renminbi Trials in 11 Cities, Stages Seven Digital Renminbi Lotteries in Year Following Start of Testing, China Banking News, 19 April, 2021.

(12) PwC CBDC global index, April 2021, https://www.pwc.com/gx/en/industries/financial-services/assets/pwc-cbdc-global-index-1st-edition-april-2021.pdf

(13) EESC opinion on Towards a stronger international role of the euro (OJ C 282, 20.8.2019, p. 27).

(14) EESC opinion on A Capital Markets Union for people and businesses — new action plan (OJ C 155, 30.4.2021, p. 20).

(15) EESC opinion on the Economic and monetary union package (OJ C 262, 25.7.2018, p. 28).

(16) EESC opinion on Euro area economic policy 2021 (OJ C 123, 9.4.2021, p. 12).

(17) COM(2020) 746 final.

(18) Eurofound (2020), Upward convergence in the EU: Definition, measurement and trends, Publications Office of the European Union, Luxembourg, p. 9.

(19) Six according to the Times Higher Education and only one in the QS World University Rankings.

(20) EU faces barriers to boosting single currency's global status, Financial Times, 19 January 2021.

(21) COM(2021) 32 final, p. 8.

(22) EESC opinion on Towards a more resilient and sustainable European economy (OJ C 353, 18.10.2019, p. 23).

(23) See remarks by Commissioner Gentiloni at the Eurogroup press conference, 15 February 2021, Brussels.

(24) See ‘Fixed income market liquidity’, Committee on the Global Financial System Papers, No 55, Bank of International Settlements, January 2016, p. 18.

(25) COM(2020) 590 final and COM(2020) 746 final, p. 8.

(26) EESC opinion on A Capital Markets Union for people and businesses — new action plan (OJ C 155, 30.4.2021, p. 20).

(27) EESC opinion on A Capital Markets Union for people and businesses — new action plan (OJ C 155, 30.4.2021, p. 20), point 1.16.

(28) See Report on a digital euro, European Central Bank, October 2020, p. 7-8.

(29) See Report on a digital euro, European Central Bank, October 2020, p. 36-40.

(30) EU faces barriers to boosting single currency's global status, Financial Times, 19 January 2021.

(31) See The role of the euro in global green bond markets, Box 1, 19th annual review of the international role of the euro, ECB, June 2020.

(32) See Unleashing the euro's untapped potential at global level, speech by F. Panetta, Member of the Executive Board of the ECB.

(33) See Main results of the video conference of the Eurogroup, 15 February 2021.

(34) COM(2019) 640 final.

(35) Remarks by Paschal Donohoe following the Eurogroup video conference of 15 February 2021.

(36) EESC opinion on A Capital Markets Union for people and businesses — new action plan (OJ C 155, 30.4.2021, p. 20).

(37) EESC opinion on a Digital Finance Strategy for the EU (OJ C 155, 30.4.2021, p. 27).

ANNEX

Figure 1

Comparison of average real GDP growth rates

(*) Estimates start from 2019.

Source: own calculations based on: World Economic Outlook Database, International Monetary Fund, October 2020.

Figure 2

Share of the dollar, euro and renminbi in Official Foreign Exchange Reserves (in %)

Source: International Monetary Fund, data.imf.org

Figure 3

Share of the US, EU and China in global GDP (PPP, in %)

Source: World Economic Outlook Database, IMF, October 2020.

Figure 4

Share of the US, EU and China in global exports (in %)

Source: UNCTAD.

Figure 5

Gross domestic expenditure on R&D, 2008-2018 (% of GDP)

Source: Eurostat.