This document is an excerpt from the EUR-Lex website

Document E2015C0319(01)

Invitation to submit comments pursuant to Article 1(2) in Part I of Protocol 3 to the Agreement between the EFTA States on the Establishment of a Surveillance Authority and a Court of Justice on state aid issues concerning a power contract between the Icelandic National Power Company, Landsvirkjun, and PCC Bakki Silicon hf. and an electricity transmission agreement between Landsvirkjun’s subsidiary, the transmission system operator, Landsnet, and PCC Bakki Silicon hf. for a planned silicon metal plant with a capacity of 33000 tons per annum to be built in Iceland

Invitation to submit comments pursuant to Article 1(2) in Part I of Protocol 3 to the Agreement between the EFTA States on the Establishment of a Surveillance Authority and a Court of Justice on state aid issues concerning a power contract between the Icelandic National Power Company, Landsvirkjun, and PCC Bakki Silicon hf. and an electricity transmission agreement between Landsvirkjun’s subsidiary, the transmission system operator, Landsnet, and PCC Bakki Silicon hf. for a planned silicon metal plant with a capacity of 33000 tons per annum to be built in Iceland

Invitation to submit comments pursuant to Article 1(2) in Part I of Protocol 3 to the Agreement between the EFTA States on the Establishment of a Surveillance Authority and a Court of Justice on state aid issues concerning a power contract between the Icelandic National Power Company, Landsvirkjun, and PCC Bakki Silicon hf. and an electricity transmission agreement between Landsvirkjun’s subsidiary, the transmission system operator, Landsnet, and PCC Bakki Silicon hf. for a planned silicon metal plant with a capacity of 33000 tons per annum to be built in Iceland

OJ C 92, 19.3.2015, p. 3–29

(BG, ES, CS, DA, DE, ET, EL, EN, FR, HR, IT, LV, LT, HU, MT, NL, PL, PT, RO, SK, SL, FI, SV)

|

19.3.2015 |

EN |

Official Journal of the European Union |

C 92/3 |

Invitation to submit comments pursuant to Article 1(2) in Part I of Protocol 3 to the Agreement between the EFTA States on the Establishment of a Surveillance Authority and a Court of Justice on state aid issues concerning a power contract between the Icelandic National Power Company, Landsvirkjun, and PCC Bakki Silicon hf. and an electricity transmission agreement between Landsvirkjun’s subsidiary, the transmission system operator, Landsnet, and PCC Bakki Silicon hf. for a planned silicon metal plant with a capacity of 33 000 tons per annum to be built in Iceland

(2015/C 92/03)

By means of Decision No 543/14/COL of 10 December 2014, reproduced in the authentic language on the pages following this summary, the EFTA Surveillance Authority initiated proceedings pursuant to Article 1(2) in Part I of Protocol 3 to the Agreement between the EFTA States on the Establishment of a Surveillance Authority and a Court of Justice. The Icelandic authorities have been informed by means of a copy of the decision.

By means of this notice the EFTA Surveillance Authority gives the EFTA States, EU Member States and interested parties notice to submit their comments on the measure in question within one month of the date of publication to:

|

EFTA Surveillance Authority |

|

Registry |

|

Rue Belliard/Belliardstraat 35 |

|

1040 Bruxelles/Brussel |

|

BELGIQUE/BELGIË |

The comments will be communicated to the Icelandic authorities. The identity of the interested party submitting the comments may be withheld following a request in writing stating the reasons for the request.

SUMMARY

Procedure

On 15 and 17 April 2014 the Icelandic authorities notified to the Authority for legal certainty pursuant to Article 1(3) of Part I of Protocol 3, a power contract entered into on 17 March 2014 between Landsvirkjun, the National Power Company, and PCC Bakki Silicon hf. By letter dated 19 May 2014 the Authority requested additional information from the Icelandic authorities regarding the pricing of electricity and the necessary grid investment by the transmission system operator. The Authority received a partial reply on 19 June 2014 from Landsvirkjun. The Authority sent a second information request on 22 July 2014 to which it received a reply from Landsvirkjun on 23 September 2014 and from the Icelandic authorities on 20 October 2014.

Assessment of the measure

PCC Bakki Silicon hf. is a limited liability company incorporated in Iceland, owned by the international holding company PCC SE in Duisburg, Germany. The company plans to construct and operate an energy-intensive silicon metal plant in the North-East of Iceland. For that purposes, it has concluded an agreement with the state owned power company, Landsvirkjun, for the purchase of 58 megawatts of power for the duration of 15 years.

Iceland notified the contract to the Authority for legal certainty. The state owned power company will construct a geothermal power plant to provide the electricity to the silicon metal plant. The profitability calculations provided by Landsvirkjun for the power plant demonstrate that, with the already accrued costs of constucting the power plant, it is not profitable, with the projected income of the power contract. Therefore, the Authority has doubts as to whether the national power company acted as a market economy operator when concluding the terms of the power contract.

Moreover, the transmission system operator, Landsnet, has concluded a transmission agreement with PCC Bakki Silicon hf. for the transmission of the contract power, which is doubtful whether is in line with the statutory rules in Iceland on cost coverage by a new energy-intensive user connecting to the national transmission grid by means of (i) a surcharge for stepping down the voltage of the power from the transmission voltage (a step-down surcharge); and (ii) a contribution to cover the extra costs that connecting the energy-intensive user would otherwise entail for the excisting users of the grid (a system contribution). The exemptions may entail state aid.

Conclusion

In light of the above, the Authority has doubts as to whether the terms of the power contract and the step-down surcharge and system contribution in the transmission agreement contain elements of state aid within the meaning of Article 61(1) of the EEA Agreement which comply with its Article 61(3).

Therefore, the Authority has decided to open the formal investigation procedure in accordance with Article 1(2) of Part I of Protocol 3 to the Agreement between the EFTA States on the Establishment of a Surveillance Authority and a Court of Justice into the power contract and the step-down surcharge and system contribution in the transmission agreement with PCC Bakki Silicon hf.

Interested parties are invited to submit their comments within one month from publication of this notice in the Official Journal of the European Union.

EFTA SURVEILLANCE AUTHORITY DECISION

No 543/14/COL

of 10 December 2014

to initiate the formal investigation procedure with regard to the Power Contract and the Transmission Agreement for the PCC Silicon Metal Plant at Bakki

(Iceland)

[non-confidential version]

THE EFTA SURVEILLANCE AUTHORITY (‘THE AUTHORITY’),

HAVING REGARD to the Agreement on the European Economic Area (‘the EEA Agreement’), in particular to Articles 61 to 63 and Protocol 26,

HAVING REGARD to the Agreement between the EFTA States on the Establishment of a Surveillance Authority and a Court of Justice (‘the Surveillance and Court Agreement’), in particular to Article 24,

HAVING REGARD to Protocol 3 to the Surveillance and Court Agreement (‘Protocol 3’), in particular to Article 1(3) of Part I and Articles 4(4) and 6 of Part II,

HAVING REGARD to the consolidated version of the Authority's Decision No 195/04/COL of 14 July 2004 on the implementing provisions referred to under Article 27 of Part II of Protocol 3,

Whereas:

I. FACTS

1. Procedure

|

(1) |

By letter submitted electronically on 15 April 2014 (1) and a letter from Landsvirkjun, the national power company, received on 17 April 2014 (2), the Icelandic authorities notified for legal certainty a contract on the sale of electric power for a silicon metal plant to be constructed and operated by PCC Bakki-Silicon hf. at Bakki at Húsavík in North-East Iceland pursuant to Article 1(3) of Part I of Protocol 3. |

|

(2) |

By letter dated 19 May 2014 (3) the Authority requested additional information from the Icelandic authorities regarding the pricing of electricity and the necessary investment. The Authority received a partial reply on 19 June 2014 by way of registered mail from Landsvirkjun (4). The Authority sent a second information request on 22 July 2014 (5) to which it received a reply from Landsvirkjun by way of registered mail on 23 September 2014 (6) and from the Icelandic authorities by an electronically submitted letter on 20 October 2014 (7). Landsvirkjun also submitted information by way of e-mail on 22 August 2014 (8). |

2. Description of the measures and the parties

2.1. The background and the scope of this Decision

|

(3) |

By Decision No 111/14/COL (9), adopted on 12 March 2014, the Authority approved 23,33 million EUR (net present value (NPV) 13,64 million) regional investment aid to PCC Bakki-Silicon hf. for its planned energy-intensive silicon metal plant in Bakki at Húsavík, according to an investment agreement entered into between the company and the Icelandic Government on 27 September 2013 on the basis of Act No 52/2013 (‘the PCC Act’). The investment agreement was notified to the Authority on 4 July 2013 and in the course of the administrative procedure of that case the Icelandic authorities informed the Authority that a power purchase agreement had been signed between Landsvirkjun and PCC Bakki-Silicon hf. on 28 June 2012 for the purposes of providing PCC Bakki-Silicon with the contract power, 52 – 58 megawatts (MW). However, the exact terms and conditions were not yet concluded. Furthermore, they explained that the national transmission system operator, Landsnet, and PCC Bakki-Silicon hf. were discussing an agreement on the transmission of the contract power. The Icelandic authorities informed that they intended to later notify a power purchase agreement for reasons of legal certainty. Therefore, agreements relating to the power were not subject to assessment in Decision No 111/14/COL (10). |

|

(4) |

The power purchase agreement subject to assessment in the present case was entered into between Landsvirkjun and PCC Bakki-Silicon hf. on 17 March 2014 (‘the Power Contract’) (11). It refers to a separate agreement, entered into on 7 February 2014, between Landsnet and PCC Bakki-Silicon hf., on the transmission of the contract power (‘the Transmission Agreement’) (12). The Power Contract and the Transmission Agreement are so closely linked to each other that they are considered to be inseparable from one another. Therefore, the Authority will in this Decision assess the relevant elements of both agreements. |

2.2. The contracting parties

2.2.1. PCC

|

(5) |

PCC Bakki-Silicon hf. (‘PCC’) is a limited liability company incorporated in Iceland in June 2012, majority owned by PCC SE, an international holding company based in Duisburg, Germany. The group employs more than 2 800 employees at 36 sites in 16 countries. Their group sales are generated in three divisions, i.e. chemicals, energy and logistics. In 2013, group sales amounted to EUR 625 million (13). |

2.2.2. Landsvirkjun

|

(6) |

Landsvirkjun is a public partnership company regulated by Act No 42/1983 on Landsvirkjun, as amended (‘the Landsvirkjun Act’). |

|

(7) |

The company was established as an enterprise, jointly owned by the State Treasury and the City of Reykjavík in equal parts, on the basis of Act No 59/1965 on Landsvirkjun (14), by a Partnership Agreement of 1 July 1965 between the Government of Iceland and the City Council of Reykjavík. Laxá Power Station, a power company jointly owned by the Town of Akureyri and the State Treasury, was merged with Landsvirkjun with effect from 1 July 1983 and as a result Landsvirkjun became a national electricity company operating all over Iceland, whereas it had been operating only in parts of the country before. |

|

(8) |

The founding of Landsvirkjun in 1965 may be traced back to the Icelandic government's growing interest in increasing the utilization of hydroelectric energy resources by attracting foreign investors for the energy-intensive industry in Iceland. This happened following the interest of the Swiss aluminium producer Alusuisse in building an aluminium plant in Iceland; the Straumsvík Aluminium Plant, later purchased by Rio Tinto Alcan Iceland. |

|

(9) |

Landsvirkjun is by far the largest electricity producer in Iceland with an output of 12 842 gigawatt hours (GWh) in 2013, which according to the company's own estimates, represents approximately 71 % of Iceland's overall electricity production. The company produces electricity from hydro (96 %) and geothermal (4 %) sources and operates 16 power stations (15). |

|

(10) |

Landsvirkjun is currently governed by the provisions of the Landsvirkjun Act. According to Article 1(1) of the Act, the legal form of the company is a public partnership with joint liability. The owners are responsible for Landsvirkjun's liabilities as further stipulated in the Landsvirkjun Act. Unlimited State guarantee for of all Landsvirkjun's liabilities was in place until 2011, when a State guarantee on new financial obligations was made subject to an approval by the State and an appropriate premium, whereas it was subject to limited premium before (16). Unlimited guarantee is retained for all liabilities entered into before the entering into force of Act No 21/2011, amending the Landsvirkjun Act. |

|

(11) |

As of 1 January 2007, the State Treasury took over the ownership shares of the Town of Akureyri and the City of Reykjavík in Landsvirkjun. The company remained a partnership company with joint liability of the owners. Landsvirkjun is now jointly owned by the State Treasury (99,9 %) and Eignarhlutir ehf. (0,1 %). The latter is a limited liability company wholly owned by the State Treasury. The state's interests are controlled by the Ministry of Finance and Economic Affairs. |

|

(12) |

According to the Landsvirkjun Act, the company shall be financially independent. It is foreseen that Landsvirkjun shall pay dividends to its owners, determined on the basis of the performance of the company and the profits carried forward from preceding years. |

|

(13) |

Landsvirkjun's board of directors is composed of five members and an equal number of alternate members, all appointed by the Minister of Finance and Economic Affairs. The board adopts their own Rules of Procedure and according to the information provided by the Icelandic authorities the board functions like any other independent board of directors of a company engaging in competitive business operations (17). |

2.2.3. Landsnet

|

(14) |

Following the liberalization of the electricity sector the Electricity Act No 65/2003 (‘the Electricity Act’) was adopted in 2003 and on 1 January 2005 Landsvirkjun's Transmission Division became Landsnet hf., a limited liability company, owned by the Icelandic Treasury, and later a subsidiary of Landsvirkjun (18). Landsnet owns and operates the Icelandic transmission system. |

|

(15) |

According to Article 8 of the Electricity Act, a sole company shall be entrusted with the transmission of electricity in Iceland and the balancing of the electricity. According to the Act, the majority stakeholders in the transmission system operator (‘the TSO’) shall be the State and/or entities or companies solely owned by the State. Act No 75/2004 on Landsnet (‘the Landsnet Act’) established Landsnet as the sole TSO in Iceland. According to the Landsnet Act the company's board of directors is appointed directly by the Minister (of Industry and Commerce) and the board shall operate independently from other companies operating in the field of generation, sale or distribution of electricity. At the outset, the Icelandic Treasury was the sole owner of the shares in Landsnet and subsequently the shares were transferred to state owned utilities in Iceland in exchange for their transmission system assets, which became part of Landsnet's assets. |

2.3. The Power Contract and the Transmission Agreement

2.3.1. The characteristics of the electricity market in Iceland

|

(16) |

The Icelandic electricity system is an isolated one; no interconnection exists. There have been discussions about an interconnector between Iceland and the UK on a long term horizon, but this is preliminary and no decision has been taken (19). |

|

(17) |

As described above, Iceland has attracted energy-intensive users since the creation of Landsvirkjun and its hydroelectric energy resources. The total generation of electricity in Iceland in 2013 was 18 116 GWh, out of which Landsvirkjun generated around 71 %. Landsvirkjun is only active on the wholesale market for electricity, where its competitors are Orka náttúrunnar (Our Nature – ON) and HS Orka. Landsvirkjun's customers are composed of seven energy-intensive users representing purchase of 85 % of the company's output, and six distribution companies, purchasing 13 %, whereas Landsnet, the TSO, purchases 2 % for electricity losses. The sale of the electricity is made through directly-negotiated contracts and the energy-intensive users are connected to the transmission system directly. |

|

(18) |

The following chart demonstrates the share of consumption between the energy-intensive users (aluminium, ferrosilicon and aluminium foil industry), 80 %, public services, other industrial users and households, 20 %, in 2011 in Iceland.

|

2.3.2. Background on the utilization of geothermal energy in the Lake Mývatn area and transmission facilities

|

(19) |

According to information provided to the Authority in the context of Decision No 111/14/COL (20) the Icelandic authorities, including six municipalities (21) in the North-East of Iceland, have since the beginning of this century made an effort to attract investors to establish an energy-intensive project in Þingeyjarsýsla county, utilising the geothermal resources of the region. A letter of intent was signed between the Icelandic Government and four local municipalities on 25 May 2011, stating that the energy in the area shall be used for industrial development in the region, as described further below in paragraph (24). Landsvirkjun currently operates two geothermal power plants in the Lake Mývatn area: Krafla with 60 MW and Bjarnarflag with 3 MW. The third geothermal area, Þeistareykir, is located between Lake Mývatn and the town of Húsavík, where the PCC Plant is envisaged at a Greenfield site named Bakki. See Figure 2.

|

|

(20) |

Þeistareykir ehf. was established as a limited liability company in 1998, to engage in research and preparation work in relation to a proposed power plant at Þeistareykir. Landsvirkjun initially became a shareholder in Þeistareykir ehf. in 2005, acquiring a share of 31,97 %. Other shareholders were smaller local power companies and two small municipalities. During 2009 to 2012, Landsvirkjun bought the remaining shares in the company, becoming the sole owner on 1 April 2012. The merger of Þeistareykir ehf. and Landsvirkjun became effective as of 1 July 2013, by an authorization granted by the Parliament, and provided for in Act No 127/2013, amending the Landsvirkjun Act. |

|

(21) |

In 2005, Landsvirkjun initiated a comprehensive exploration program with the aim to develop up to 400 MW of electricity in the geothermal areas close to Lake Mývatn, consisting of Þeistareykir, Bjarnarflag and Krafla. |

|

(22) |

In 2006, the international aluminium company Alcoa signed a Memorandum of Understanding (‘MoU’) with the Icelandic Government and the municipality of Norðurþing, where Bakki is located, on a feasibility study for an aluminium plant at Bakki using 400 MW of power. MoUs were also signed by Landsvirkjun and Landsnet. The Memorandum between Landsvirkjun and Alcoa expired in 2008 and in 2011 Alcoa officially abandoned the plan for its aluminium plant at Bakki (22). |

|

(23) |

The environmental impact assessment for a 200 MW power plant at Þeistareykir was completed 24 November 2010 (23). |

|

(24) |

On 25 May 2011, the Icelandic Government and the municipalities of Norðurþing, Skútustaðahreppur, Þingeyjarsveit and Tjörneshreppur signed a letter of intent on the cooperation regarding the use of geothermal rights in the county of Þingeyjarsýsla for industrial development. The letter of intent stipulates that the parties are to work jointly on utilising the energy resources in the region and building infrastructure with the objective of achieving extensive economic development in the region. In the course of 2011, steps were taken between PCC and Norðurþing municipality as regards the new silicon metal plant to be constructed by PCC (24). On 8 February 2013 the Icelandic Government and the municipality of Norðurþing, the Harbour Fund of Norðurþing and PCC signed a joint declaration on a silicon metal plant to be constructed at Bakki. In particular, in subsection IV of the joint declaration the parties commit to progress to the signature of the following contracts:

|

|

(25) |

The owner of the land at Þeistareykir is the municipality of Þingeyjarsveit. Landsvirkjun leases the site (3 480 hectares) from the municipality. Licence for the operation of a 100 MW geothermal power station was issued on 28 March 2014 by the National Energy Authority (‘the NEA’). Since the capacity of the area is not known, Landsvirkjun aims at harnessing the geothermal power of the area in steps and to initially construct a 45 MW station (25). To that end, Landsvirkjun tendered out the purchase of 45 MW turbines on 25 March 2014 with an option for additional 45 MW turbines. |

|

(26) |

The Þeistareykir Power Station project will be further described below, in subsection 2.3.4. |

|

(27) |

Currently, the Bakki area is not connected to the grid and the use of geothermal energy has not started at Þeistareykir. The amount of steam harnessed so far in the Þeistareykir area from seven wells is enough to generate 45–50 MW of electricity. The Þeistareykir area does not enjoy a connection to the grid (26). Landsnet will connect the planned industrial site at Bakki and the new power station at Þeistareykir to the national grid at Krafla with a new power line: from the current transmission system at Krafla through Þeistareykir and to Bakki with adequate transmission capacity to supply electricity to PCC and other future users at Bakki (27), see Figure 3.

|

2.3.3. The Power Contract

|

(28) |

As referred to above, the Authority was informed about a power purchase agreement in the context of Decision No 111/14/COL, but this initial contract was not notified to the Authority. The Authority has been provided with some, however limited, information about the negotiation and exact terms of the initial power contract, signed on 28 June 2012 (‘the 2012 Power Contract’). Landsvirkjun has explained that negotiations started in early 2011, however the 2012 Power Contract never became legally binding since PCC did not fulfil the conditions precedent before an extended deadline. |

|

(29) |

Landsvirkjun put forward a new offer during the summer of 2013. The negotiations were handled on behalf of Landsvirkjun by a committee of three members, led by the company's Executive Vice President for Marketing and Business Development. The negotiations were discussed by the board of directors at several meetings during January to March 2014 and the Power Contract was approved by the board of directors on 14 March 2014. The Power Contract was signed on 17 March 2014 and it has a duration of 15 years from 1 May 2017. |

|

(30) |

The Power Contract has certain conditions precedent that were to be fulfilled on or before 30 May 2014. On 22 August 2014, Landsvirkjun informed the Authority that the deadline had initially been prolonged until 4 August 2014 and the parties were still in discussions, but the conditions had not yet been fulfilled and the Authority would be updated on the process. On 23 September 2014, Landsvirkjun informed the Authority that the conditions were not fulfilled and the parties had not reached an agreement on a new deadline. The Authority understands that the contract's conditions has not yet been fulfilled. |

|

(31) |

According to an internal memorandum presented to the board of directors in Landsvirkjun on 6 March 2014 (28) the prices in the Power Contract are […] (29). |

|

(32) |

According to the Power Contract, Landsvirkjun will provide electricity for PCC's new plant to be constructed in Bakki (‘the Plant’). The production capacity of the Plant will be 33 000 tons of silicon metal per annum. The Plant is expected to start production in May 2017 and will require, in steps, 52–58 MW of power (mean per hour), which will be provided exclusively by Landsvirkjun. The Power Contract provides for the sale of 52 MW of power from […], 56 MW from […], and 58 MW from […]. Annual energy delivery is expected to start at […] GWh and then gradually increase to […] GWh per annum during the course of the Power Contract. |

|

(33) |

The Power Contract has a ‘Take-or-Pay’ obligation, which means that PCC must pay for a fixed amount of energy per calendar year regardless of whether the actual consumption is less; this amounts to approximately 75 % of the entire contract power. |

|

(34) |

According to calculations provided by Landsvirkjun, the NPV of the Power Contract (net of investment costs) in the base case is USD […] million (30). |

|

(35) |

The Power Contract has a pricing formula linked to the US consumer price index (CPI) and the price of silicon metal. The base contract price starts at USD […] per megawatt hour (MWh) on […] until […], after which it will gradually increase up to USD […], which will be the price as of […] until its expiry in 2032. This contract price does not include the cost of transmission, which will be paid by PCC to Landsnet. The contract has a minimum price estimated to USD […] per MWh during the contract period, and a ceiling, […] % of the Nordpool system spot price of electricity calculated in EUR. According to internal documents, Landsvirkjun considers it likely that the company will only receive the CPI indexed minimum price (31). |

|

(36) |

Landsvirkjun has estimated that the average real price throughout the duration of the Power Contract will be USD […] (2013 prices) per MWh (excluding transmission costs) and has submitted that this is among the highest prices Landsvirkjun has in current contracts with energy-intensive users and […]. Landsvirkjun has explained that USD 20 per MWh (also excluding transmission cost) was the average price in its existing contracts with energy-intensive users in 2013 (32). |

2.3.4. The Þeistareykir Power Station

|

(37) |

The planned 45 MW power plant at Þeistareykir will be referred to in this Decision as ‘the Power Station’, if not otherwise stated. |

|

(38) |

The majority of the contract power in the Power Contract entered into with PCC is not existing capacity in Landsvirkjun's current generation system and investment in generation capacity is therefore needed to provide the power. For the purposes of providing the power, Landsvirkjun plans to build a geothermal power station at Þeistareykir. As described above, the new Power Station to be built at Þeistareykir will have the capacity of 45–50 MW of power from seven wells that have already been drilled. Surplus capacity available in Landsvirkjun's generation system will be provided for the remaining 8–13 MW needed for the Plant (33). According to information provided by Landsvirkjun, the Power Station would not be constructed at this point in time if it was not necessary for providing the electricity needed for the PCC Plant, rather the Power Station would be constructed at a later stage (34). |

|

(39) |

According to information provided by Landsvirkjun (35), the construction of a 45 MW power plant at Þeistareykir is necessary to ensure reliable delivery of the contract power to PCC within the timeframe envisaged in the Power Contract. The total capacity of the geothermal area at Þeistareykir is not well known, and therefore it is envisaged that the area will be harnessed in steps. The first step is the 45 MW needed to provide PCC with enough electricity for operation. The 45 MW Power Station at Þeistareykir will have a generation capacity of 357 GWh, which would increase the total electricity capacity of Landsvirkjun by 3 %. |

|

(40) |

The Power Contract is the first that Landsvirkjun enters into with an energy-intensive user where the power will not be generated mainly by hydropower facilities. The Power Station will be the first geothermal power station initially constructed by Landsvirkjun. Landsvirkjun currently owns and operates two geothermal stations, both in the vicinity of Þeistareykir; Bjarnarflag 3 MW, built in 1969 by a company that later merged with Landsvirkjun; and Krafla 60 MW, initially built as a 30 MW station in 1974-8 by the Icelandic State, taken over by Landsvirkjun in 1985 and expanded in 1996-9 to 60 MW. |

|

(41) |

Landsvirkjun has provided a breakdown of the estimated capital expenditures (CAPEX) related to the Power Station (45 MW), demonstrated in the table below in thousands of USD, and a comparison of an option to build a 90 MW power plant on the site (36).

|

|

(42) |

Landsvirkjun has explained that accrued costs, not taken into account in the above breakdown, are (i) development cost, and (ii) takeover cost of Þeistareykir ehf. as a mark-up cost. They have explained that the total accrued cost is USD […] million (37). Hereof the takeover cost of Þeistareykir ehf. is USD […] million. Landsvirkjun has explained the breakdown of the accrued cost as follows ([…]) (38):

|

|

(43) |

Landsvirkjun has submitted tables which show the result of […]-year NPV calculations, including the abovementioned CAPEX and taking into account both the estimated revenues from the Power Contract and a […] % increase in the estimated price for the last […] years (after the Power Contract expires). Calculations are performed for both a 45 MW and a 90 MW case. For each case, the NPV calculations are performed both with and without including the accrued costs, and testing the sensitivity of the analysis by adjusting CAPEX +/- […] % and with cost of capital (discount) rates ranging from […] % to […] %. |

|

(44) |

The results show that when excluding the accrued costs, both the 45 MW and 90 MW case are profitable, even in scenarios with higher than expected CAPEX and discount rates (also benefitting from the lower power costs deriving from the current surplus capacity (8 - 13 MW)) (39). When accrued costs are included, neither business case is profitable under the most likely scenario, and only in the event that the CAPEX and/or the cost of capital is lower than the most likely scenario, is the investment profitable for Landsvirkjun.

|

2.3.5. Transmission network charges in Iceland

|

(45) |

In Iceland, transmission network charges are established by Landsnet. However, the charges have to be authorized by the regulator, i.e. Orkustofnun, the NEA. |

|

(46) |

Article 12a of the Electricity Act and Article 15 of Regulation (EC) No 1040/2005 on the implementation of the Electricity Act, as amended (‘the Electricity Regulation’) set out principles governing the establishment of transmission network charges (out-feed):

|

2.3.6. The Transmission Agreement

|

(47) |

For the purposes of transmitting the contract power, Landsnet and PCC entered into the Transmission Agreement on 7 February 2014. This agreement concerns the connection of the Plant to the transmission system; the transmission of the power purchased by PCC from Landsvirkjun; and the transformation of the purchased power from the transmission voltage to 33 and 11 kV, to enable the in-feed of 52–58 MW power. The Icelandic authorities have explained that 45 MW thereof will be supplied by Landsvirkjun's planned Power Station at Þeistareykir and the rest from other power plants connected to the transmission system. The Transmission Agreement has conditions precedent which have not been fulfilled, according to information provided by the Icelandic authorities (40). |

|

(48) |

For this purpose, Landsnet will design and construct certain transmission facilities required to accommodate the provision of electric transmission service to the Plant. In particular, this entails the construction of a new power line from Þeistareykir Power Station to the planned industrial site at Bakki and from Þeistareykir Power Station to the national grid at Krafla power plant (see Figure 3). According to information provided by Landsvirkjun, the transmission line is designed and constructed with adequate transmission capacity to supply electricity to PCC and to other future users at Bakki, at 220 kV (41). In the context of this case, the Authority has not been provided with information as to potential energy-intensive users at Bakki other than PCC. |

|

(49) |

The Icelandic authorities have provided information as to the transmission constructions foreseen by Landsnet which are necessary for supplying the power from the Power Station to the planned industrial site at Bakki (42):

The Icelandic authorities have explained that the cost for the above are estimated at ISK […] million (no breakdown has been provided). However, PCC would only need a 132 kV power line (as opposed to a 220 kV line) and therefore the Icelandic authorities have submitted that approximately ISK […] million (no breakdown has been provided) would be needed for the purposes of connecting the industrial site at Bakki to Þeistareykir Power Station if only PCC's requirements were taken into account, and not those of potential future customers at the planned industrial site at Bakki (43). |

|

(50) |

In addition, the Icelandic authorities have provided the following information regarding the necessary transmission construction foreseen by Landsnet, from the substation at Bakki to the PCC Plant:

The Icelandic authorities have submitted that the cost of the above is estimated at approximately ISK […] million (no breakdown has been provided) (44). |

|

(51) |

According to Article 10.1 of the Transmission Agreement, the fees are the following:

Moreover, reference is made to a customer-specific investment cost in Annex 5 to the Transmission Agreement. |

2.3.6.1. The Transmission Charge

|

(52) |

The Icelandic authorities have explained that the Transmission Charge for energy-intensive users is, according to a tariff approved by the NEA on the basis of the Electricity Act (45), a combination of:

Article 10.1 of the Transmission Agreement refers to a sample of an invoice attached in Annex 1 to the Agreement. |

2.3.6.2. The Step-down Surcharge

|

(53) |

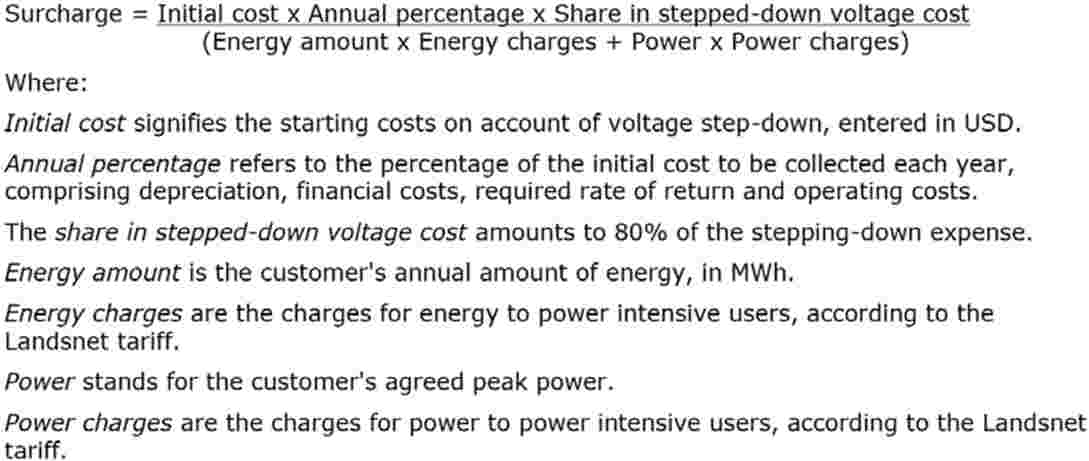

The Step-down Surcharge is an additional fee, added to the Capacity Charge and the Energy Charge and is, according the Transmission Agreement, meant to compensate for the actual cost of stepping down the electricity for PCC as an energy-intensive user. The Step-down Surcharge is calculated on the basis of the actual step-down costs according to a formula in Section B.9 of a grid code issued by Landsnet on 15 February 2011, version 1.0 (‘the Grid Code’), on Terms for Delivering Electricity to Power Intensive Users at Voltages below 132 kV (46), which is referred to in Article 10.1 of the Transmission Agreement. Article 10.1 of the Agreement further refers to its Annex 5, according to which the actual costs of the equipment (the step-down transformers) in the case of PCC is estimated at ISK […] million (47) (equivalent to EUR […] million). The calculation of the actual Step-down Surcharge in the case of PCC has not been provided. The formula applied to calculate the Step-down Surcharge according to the Transmission Agreement is the one provided for in Article 4.2 of Section B.9 of the Grid Code:

Annex 5, referred to at Article 10.1 of the Transmission Agreement, contains the following diagram:

|

2.4. The scope of this Decision

|

(54) |

In this Decision, the Authority will assess the terms of the Power Contract and the aspects of the Transmission Agreement concerning the Step-down Surcharge and the System Contribution. It therefore falls outside the scope of this Decision to assess whether there is potential state aid involved in any other elements of the Transmission Agreement and to what extent the transmission tariff might entail state aid, apart from the Step-down Surcharge and the System Contribution. |

3. Comments by the Icelandic authorities and Landsvirkjun

|

(55) |

The Icelandic authorities and Landsvirkjun are of the view that the notified Power Contract does not entail state aid and have submitted their arguments to that end. The Icelandic authorities notified the Power Contract for legal certainty, and they did not address the question of compatibility of the measure in their notification or subsequent submissions. |

|

(56) |

The Icelandic authorities submit that the Power Contract between Landsvirkjun and PCC was negotiated on normal market terms and provides an acceptable rate of return to Landsvirkjun, and that it hence does not confer an advantage on PCC. In particular, the Icelandic authorities have in this regard put forward arguments pertaining to the presence of an advantage. They submit that the Power Contract yields an acceptable return and that its terms fall within the margin of discretion which a public company enjoys in running its business (48). The Icelandic authorities have submitted that this is demonstrated by (i) a comparison with other contracts with energy-intensive users; (ii) the determination of price and the presence of business risk; (iii) its duration and potential for adjustment to market developments; and (iv) the profitability of investments made by Landsvirkjun. The arguments have to some extent been further developed in Landsvirkjun's submissions, in particular as regards the profitability. The profitability calculations submitted are discussed in subsection 2.3.4 above. Furthermore, it is submitted that the following factors must be taken into account: (i) that the power price is high compared to existing power contracts with energy-intensive users; (ii) the duration of the Power Contract is shorter than in existing power contracts with energy-intensive users; and (iii) there is the possibility of getting higher prices from the Plant and its extension in the future, and to get higher prices from other energy-intensive users (49). The Icelandic authorities have not put forward their view or elaborated on whether there is state aid involved in the Transmission Agreement. |

|

(57) |

With duration of 15 years, the Power Contract is shorter in duration than many of the power contracts that are currently being executed by Landsvirkjun, where a duration of 20 years and more was common. However, Landsvirkjun has for some time aimed at shortening the contract periods in new power contracts towards no longer than 15 to 18 years, which would facilitate the adjusting of the price for contract electricity to the price developments in more liquid electric power markets than that of Iceland. |

|

(58) |

The Icelandic authorities do not contend that the Power Contract is not imputable to the State, and refer to the Authority's previous decisions on Landsvirkjun's contracts in this regard (50). Landsvirkjun mainly argues that the Power Contract does not involve an advantage for PCC, but it also contends that it is a standalone business contract between two independent companies. Landsvirkjun has put forward information and arguments as to the limited involvement of Landsvirkjun's owners, i.e. the Icelandic state in the actual negotiation process (51). The State was informed of the progress of discussions between Landsvirkjun and PCC while the negotiations were in progress, but according to Landsvirkjun, no formal approval was obtained from them, neither with regard to the methodology used or individual substantive provisions of the Power Contract (52). In essence, Landsvirkjun seems to argue that the State did not exert any direct influence on the contract or the negotiations, and that therefore the measure is not imputable to the State. |

II. ASSESSMENT

1. The presence of state aid

1.1. State aid within the meaning of Article 61(1) EEA Agreement

|

(59) |

Article 61(1) of the EEA Agreement reads as follows: ‘Save as otherwise provided in this Agreement, any aid granted by EC Member States, EFTA States or through State resources in any form whatsoever which distorts or threatens to distort competition by favouring certain undertakings or the production of certain goods shall, in so far as it affects trade between Contracting Parties, be incompatible with the functioning of this Agreement.’ |

|

(60) |

Accordingly, a measure constitutes state aid within the meaning of Article 61(1) of the EEA Agreement if the following conditions are cumulatively fulfilled: the measure (i) is granted by the State or through state resources; (ii) confers an economic advantage on the beneficiary; (iii) is selective; (iv) it is liable to effect trade between Contracting Parties and distort competition (53). |

1.2. State resources and imputability

1.2.1. The Power Contract

|

(61) |

To be qualified as state aid, an advantage must be granted by the State or through state resources. The advantage can also be granted through a public undertaking provided there is imputability to the State (54). |

|

(62) |

The European Court of Justice (‘CJEU’) held, in paragraphs 37-39, of Stardust Marine (55) that: ‘[…] Article 87(1) EC covers all the financial means by which the public authorities may actually support undertakings, irrespective of whether or not those means are permanent assets of the public sector. Therefore, even if the sums corresponding to the measure in question are not permanently held by the Treasury, the fact that they constantly remain under public control, and therefore available to the competent national authorities, is sufficient for them to be categorised as State resources. […] The State is perfectly capable, by exercising its dominant influence over such undertakings, of directing the use of their resources in order, as occasion arises, to finance specific advantages in favour of other undertakings. […] the position of a public undertaking cannot be compared with that of a private undertaking. Through its public undertakings, the State may pursue objectives other than commercial ones, […].’ |

|

(63) |

As a consequence, the CJEU acknowledges that the resources of public-sector companies could constitute State resources. However, in this judgment, the CJEU clarified that the mere fact that the company gives out public funds does not suffice to establish the presence of State aid. According to the Court, the decisive elements in this assessment are, on the one hand, whether the State is in a position to control the public undertaking and exercise a dominant influence over its operations and, on the other hand, whether it actually does exercise this right of control over the undertaking paying out the funds in the specific case. If there are no indications of such involvement, the financial support of a public undertaking cannot be imputable to the State. The CJEU underlines that: ‘Even if the State is in a position to control a public undertaking and to exercise a dominant influence over its operations, actual exercise of that control in a particular case cannot be automatically presumed. […], the mere fact that a public undertaking is under State control is not sufficient for measures taken by that undertaking […], to be imputed to the State. […]’ (56) |

|

(64) |

At the same time the Court clarified, in paragraph 53, that: ‘[…] it cannot be demanded that it be demonstrated, on the basis of a precise inquiry, that in the particular case the public authorities incited the public undertaking to take the aid measures in question. […]’ (57) |

|

(65) |

As a consequence, imputability to the State may be inferred from a set of indicators arising from the circumstances of the case and the context in which the measure was taken, and the assessment has to be done on a case-by-case basis. The judgment also contains a non-exhaustive list of such indicators, including the legal status of the undertaking (in the sense of it being subject to public law or ordinary company law); any other indicator showing, in the particular case, an involvement by the public authorities in the adoption of a measure or the unlikelihood of them not being involved, having regard also to the compass of the measure, its content or the conditions which it contains. |

|

(66) |

In his opinion in the Stardust Marine case, Advocate General Jacobs also provided a similar non-exhaustive list of possible indicators, including ‘a general practice of using the undertaking in question for ends other than commercial ones or of influencing its decisions’ or ‘circumstantial evidence such as press releases’ (58). |

|

(67) |

This list of indicators and the Court's general formulation, according to which the public authorities must be regarded as having been involved ‘in one way or another’, seems to suggest that different kinds of conduct (active or passive) of the public authorities could suggest the imputability of the measure. Likewise ‘the unlikelihood of [the public authorities] not being involved having regard also to the compass of the measure, its content or the conditions which it contains’ (59) shows that imputability could be established merely on the basis of some characteristics of the measure at stake, i.e. when they are such as to render unlikely the non-involvement of the State. |

|

(68) |

Based on these principles, the Authority has assessed whether the Power Contract is imputable to the Icelandic authorities and not to Landsvirkjun itself, acting as an autonomous entity. |

|

(69) |

The Authority refers, on the one hand, to the facts described in paragraphs (10) to (13) above. Landsvirkjun is owned by the State Treasury, directly and indirectly. Since 2007, the Ministry of Finance and Economic Affairs appoints all the members of the board. As described in paragraph (13) above, the board adopts its own Rules of Procedure and it functions like any other independent board of directors of a company engaging in competitive business operations. |

|

(70) |

Furthermore, the Authority also acknowledges that the unlimited State guarantee enjoyed by Landsvirkjun was removed in 2011, therefore placing the company in the same playing field as its competitors. |

|

(71) |

As a consequence, it seems to the Authority that the Icelandic authorities are undertaking different measures to ensure that Landsvirkjun acts on the market under the same conditions as its competitors, being autonomous in its decision-making process. |

|

(72) |

The market in which Landsvirkjun is active (power generation) is also open to competition. |

|

(73) |

However, against this general background on the functioning of Landsvirkjun, the Authority cannot exclude, at this stage of the procedure, that the conclusion of the notified Power Contract is imputable to the State due to the reasons described below. |

|

(74) |

In the past the company may seem to have been used by the State to attract foreign investment as a vehicle for job creation and economic development by means of offering power contracts of long duration (60). But more importantly, this seems to be the case when the Power Contract was signed. The Authority notes that in 2013, the Minister of Industry claimed that it was a matter of urgency to increase investments in Iceland and projects such as the PCC Plant were already on ‘Landsvirkjun's desk’. The Minister did not refer to the contract as a market investor contract signed by Landsvirkjun itself but as a project with ‘huge impact on the society in the Northeast in terms of job creation and the more general positive economic impact’ (61). At the time when this declaration was made, the conditions of the 2012 Power Contract had not been fulfilled and it had expired. Only a few months later the Power Contract under assessment in this case was signed. The Authority acknowledges that this declaration is made by the Minister of Industry and not by the shareholder of the company, the State Treasury, or by the Minister of Finance, who appoints the board members of Landsvirkjun. However, all those entities are part of the Icelandic Government and therefore this declaration could be understood as ‘circumstantial evidence’ of the State's imputability as argued by AG Jacobs in his Opinion on the Stardust Marine case. |

|

(75) |

The letter of intent signed between the Icelandic Government and four local municipalities on 25 May 2011 (see paragraph (24) above) seems to go in the same direction, stating that the energy in the area shall be used for industrial development in the region. At this stage of the procedure, the Authority is of the opinion that this letter of intent must be understood as a compromise on behalf of the Icelandic Government (owner of Landsvirkjun) to ensure that a power contract would be signed. |

|

(76) |

Arguably, this kind of a declaration would be what AG Jacobs thought of when he mentioned ‘a general practice of using the undertaking for ends other than commercial ones’ in his opinion referred to above. |

|

(77) |

Moreover, the Authority must also take note of the joint declaration signed on 8 February 2013, in which the Icelandic Government and the municipality of Norðurþing, the Harbour Fund of Norðurþing and PCC committed to progress to the signature of different contracts; including the Power Contract (see paragraph (24) above). The Authority underlines that this joint declaration was not signed by Landsvirkjun but by the Icelandic Government and the local municipality. |

|

(78) |

Taking this scenario into account, the Authority cannot exclude the possibility that Landsvirkjun signed the Power Contract following implicit instructions from the public authorities and the commitments already taken to ensure the signature of the Power Contract, which appears to be inseparable from the other agreements mentioned in the joint declaration of 8 February 2013. It seems to the Authority that the Power Contract might have been entered into at the instigation of the Icelandic public authorities. |

|

(79) |

Furthermore, a prudent owner of a limited liability company – as the State was in Stardust Marine, and is in fact in most cases of public ownership in companies – would in all likelihood already closely monitor the negotiation and conclusion of contracts of such economic significance as the contract at hand, which in itself may indicate imputability to the State. |

|

(80) |

Overall, the Authority is therefore, in light of the legal status of Landsvirkjun, the possible use of Landsvirkjun as a tool to attract foreign investment as a vehicle for job creation and economic development, and the general circumstances described above, unable to exclude that the measure is imputable to the State, and that it entails State resources if and to the extent it confers an advantage on PCC. |

|

(81) |

In light of the above, it may appear to be not exclusively business decisions made by Landsvirkjun that motivate the choice of options. Rather, policy decisions of the Icelandic authorities would appear to have been considered, and transpire in internal documents of Landsvirkjun, which refer to factors possibly influencing the decision, such as the socioeconomic development of Húsavík town and surroundings in terms of job creation, the local community's claim, supported by the government, that the natural resources in the area will be used for the industrial development at Bakki, and the likely negative effect on Norðurþing municipality's aspirations, would the Power Contract not be concluded (62). The internal documents which have been provided do not dispel the doubts which the Authority has on the strictly commercial motives behind the Power Contract. |

|

(82) |

Against this background, the Icelandic authorities are specifically invited to comment on the issue of imputability. |

1.2.2. The Transmission Agreement

|

(83) |

For measures to be categorized as aid within the meaning of Article 61(1) of the EEA Agreement, they must be granted directly or indirectly through State resources. This means that both advantages which are granted directly by the State and those granted by a public or private body designated or established by the State are included in the concept of State resources within the meaning of Article 61(1) (63). The fact that a measure granting an advantage is not financed directly by the State, but by a public or private body established or appointed by the State to administer the measure, does not exclude that it is financed through State resources (64). A measure adopted by a public authority and favouring certain undertakings or products does not lose the character of a gratuitous advantage by the fact that it is wholly or partially financed by contributions imposed by the public authority and levied on the undertakings concerned (65). As the General Court recalled in France v Commission (66), the relevant criterion in order to assess whether the resources are public, whatever their initial origin, is that of the degree of intervention of the public authority in the definition of the measure in question and their methods of financing. The fact that the advantage is not financed directly from the State budget is not sufficient to exclude that State resources are involved. In Essent the CJEU assessed a system which provided that the operators of the Dutch electricity network collect a surcharge from private electricity clients and pass on the proceeds of that charge to a joint subsidiary of the four electricity generators, in order to compensate for stranded costs. The Court found that the Dutch system involved State resources (67). |

|

(84) |

Landsnet hf., the transmission system operator, is majority owned by the state owned Landsvirkjun and other owners are all state owned utilities, as described above in subsection I.2.2.3. This already suggests state imputability. Moreover, the degree of supervision that the public authorities exercise over the management of Landsnet is substantial; the Minister of Industry and Commerce directly appoints the board of directors, according to the Landsnet Act. A certain level of supervision exercised by the public authorities on the undertaking is one of the indicators listed by the CJEU in the Stardust Marine case to conclude on the imputability of the measure to the State. |

|

(85) |

Furthermore, Landsnet's tariffs are approved by and monitored by the regulatory authority, the NEA, which also decides the company's revenue cap according the Electricity Act, and its Grid Code is de facto signed on behalf of the Minister of Industry and Commerce. The Icelandic State is therefore strictly monitoring the TSO in their administration of the revenues from the transmission tariff. |

|

(86) |

Moreover, according to the information provided in this particular case, the State is involved in discussions on the decision of the possible System Contribution to be applied in the case at hand, and the State controls Landsvirkjun, the mother company of Landsnet, which is also involved in the decision on the System Contribution in this case. Finally, according to internal documents of Landsvirkjun (68), it appears to have entered into a formal or informal arrangement with Landsnet […] for the new investment of Landsnet in connecting the Power Station to the grid, and also for connecting the PCC Plant to the grid, and thereby influencing the actual decision on the possible System Contribution […], see discussion below in subsection 1.3.2. (69) |

|

(87) |

According to the information at hand, the Icelandic authorities remain involved in the calculation of the Step-down Surcharge and the possible System Contribution of PCC. It appears that a potential exemption or reduction of the statutory established charges results in a decreased amount collected by Landsnet from PCC and therefore implies a renouncement of State resources. |

|

(88) |

Based on the above and the information available at this stage, the Authority comes to the preliminary conclusion that the system of transmission fees in Iceland constitutes State resources imputable to the State. Hence, an exemption from or a reduced Step-down Surcharge and System Contribution implies a renouncement of State resources. |

1.3. Selective economic advantage

1.3.1. The Power Contract

|

(89) |

The Authority observes that the issue is to examine whether a private investor operating in a market economy would have chosen to enter into a long term bilateral contract for the same price and on the same terms as in the agreement under assessment (70). |

|

(90) |

The arguments by the Icelandic authorities in relation to the economic advantage which Landsvirkjun may have conferred on PCC by concluding the Power Contract on terms which were more beneficial to PCC than could have been reasonably expected, are essentially aimed at demonstrating that the contract was concluded on market terms, i.e. by comparing price and duration with contracts with energy-intensive users in the past and referring to the profitability and the business risk related to the investment needed. Thus, according to their arguments, PCC does not derive any undue advantage from the Power Contract. For the reasons set out below, the information submitted is not such as to dispel the Authority's doubts. |

|

(91) |

When governments make financial transactions and investments, the CJEU has stated that in order to confirm whether a state measure constitutes aid, it is necessary to establish whether the recipient undertaking receives an economic advantage, which it would not have obtained under normal conditions (71). In doing so, the Authority has to apply the market economy operator (MEO) test (72), which in essence provides that state aid is granted whenever a state makes funds available to an undertaking which in the normal course of events would not be provided by a private investor applying ordinary commercial criteria and disregarding other considerations of a social, political or philanthropic nature (73). |

|

(92) |

The measures at hand – a power contract, with a publicly owned company as a seller, could thus entail an element of state aid if its terms are such that they would not have been acceptable to a private market investor and that the sale of electricity could not have been expected to be sufficiently profitable for a private operator. |

|

(93) |

Whilst the Authority fully recognises the right for public companies such as Landsvirkjun to operate on the market on commercial terms, it nevertheless must consider carefully whether similar agreements would have been concluded by a private market operator (74). Moreover, the Authority must base its assessment of the price and terms of the Power Contract between Landsvirkjun and PCC on the information available at the time of the conclusion of the contract. |

|

(94) |

Ordinarily, when a sale by a public company or a public authority is assessed, the market price for the good under assessment can be used as a relevant benchmark. In the case at hand, however, a market price is not readily available, given the peculiarities of the Icelandic electricity market. A large majority of all electricity is sold to a few customers, which all have concluded long term agreements with the domestic power providers at different points in time. Furthermore, the Icelandic market is isolated from the rest of the world, as currently no power can be transmitted across the border. The abundant potential to produce electricity in Iceland and this isolation are assumed to be the main reasons for the differences in the price of electricity in Iceland and elsewhere in the EEA. |

|

(95) |

For the reasons set out above, the Authority must in the case at hand rely on an assessment of the profitability of the investment needed to provide PCC with the contract power in order to establish whether a private market economy operator would have concluded the contract on the same terms. In the case at hand, the profitability of the investment and operation of the Þeistareykir Power Station is therefore at the center of the assessment. |

|

(96) |

Since market data is not available and market conditions cannot be empirically established by reference to ‘pari passu’ transactions or an open, transparent non-discriminatory and unconditional tender procedure, and since benchmarking (comparable transactions carried out by comparable private operators in comparable situations) is not an available method for establishing whether the transaction was in line with market conditions, determination of the return on the investment in the Power Station by calculating the NPV and/or internal rate of return (IRR) on the project are generally-accepted standard methodologies that can be used for establishing whether the transaction was in line with market conditions. |

|

(97) |

For making the assessment, the Authority must base its methodology on available objective, verifiable and reliable data (75). This data must be sufficiently detailed, reflecting the economic situation at the time at which the terms of the Power Contract were decided, taking into account the level of risk and future expectations (76). |

|

(98) |

Landsvirkjun has provided profitability calculations with and without already accrued costs (77). They demonstrate that building a 45 MW power station would not be profitable, taking into account the already accrued costs, by the estimated income generated by the Power Contract, as calculated by Landsvirkjun. Landsvirkjun has presented a base case with CAPEX of USD […] million and a discount rate (cost of capital) of […] %. Given these assumptions and the income generated by the Power Contract, the investment in the Power Station would not be profitable when the accrued costs are taken into account. |

|

(99) |

Even if calculated on the basis of a potential 90 MW power plant to be built at Þeistareykir, Landsvirkjun's own calculations demonstrate that the Power Contract would not be profitable with the average real price of […] USD per MWh (2013 prices) over the duration of the contract and the overall interval of […] to […] USD per MWh in real terms and […] to […] USD per MWh in nominal terms, if already accrued costs were included (78). |

|

(100) |

Accrued costs are in Landsvirkjun's profitability calculations divided into (i) geothermal drilling, exploration, engineering and consultant service, project supervision and other; and (ii) cost related to the takeover of Þeistareykir ehf. ([…] million USD). When presenting profitability calculations with the accrued costs, Landsvirkjun has divided the costs related to the takeover of Þeistareykir ehf. into four parts, where each of them is attributed to each 45 MW step in a total of 180 MW, which Landsvirkjun considers to be the overall capacity of the Þeistareykir area. It is demonstrated in Landsvirkjun's own internal documents as well as the documents prepared in the context of the case at hand (79) that with the accrued costs, as demonstrated in Figure 5, with the attribution of ¼ of the takeover costs of Þeistareykir ehf. (i.e. […] million USD per 45 MW unit) to the 45 MW scenario, the Power Station is not profitable, taking into account the revenues expected to be generated by the Power Contract. Internal documents have not dispelled the doubts the Authority has regarding the profitability of the Power Contract (80). |

|

(101) |

Landsvirkjun contends that ‘[p]rofitability calculations at this point from Landsvirkjun's point of view discard accrued cost and consider it sunk, while the overall profitability of the project includes accrued cost’ (81). The Authority questions Landsvirkjun's submission that exploration and drilling costs should not be taken into account when calculating the profitability of the Power Contract. Exploration and drilling of wells is part of the Þeistareykir Power Plant project, and indeed, Landsvirkjun appears to have the option to sell the right to harness the seven wells already drilled, and therefore the exploration and drilling is not a sunk cost that a normal market operator would not take into account when making business decisions. The Authority observes that the drilling of the wells is a considerable share of the capital cost of a geothermal power plant. |

|

(102) |

Of particular relevance in this respect is the fact that the wells at Þeistareykir were, according to information available to the Authority, drilled as production wells, that is, they were envisaged as production wells already from the beginning, at the time when they were drilled as exploratory wells (82). Therefore, only a relatively small additional cost of drilling is envisaged for the 45 MW Power Station, as demonstrated by the breakdown of the cost provided by Landsvirkjun, where the cost of geothermal drilling is estimated at […] USD, whereas the 90 MW station scenario estimates […] million USD in geothermal drilling (83). |

|

(103) |

It appears that Landsvirkjun does not have the option under the Power Contract to delay the start of delivery of the power and provide the energy by means of a different source than that generated by the planned Power Station, should the construction of the Power Station be delayed. At this point in time, the contract power, 52–58 MW, is not available in Landsvirkjun's generation system. The power company must construct a new power station for the purposes of delivering the contract power. The Authority understands that Landsvirkjun would not be able to provide the contract power by constructing a new plant in a different region, due to the limited possibilities to transmit additional power to the North-East region from other regions. In contrast, according to Landsvirkjun's own assessment, such limitations in terms of transmission capacity would not be present were it to provide power from the Power Station to potential customers in the South-West of Iceland (84). However, the Authority understands that Landsvirkjun would not at this point in time construct the envisaged Power Station without the Plant being constructed at Bakki, but rather at a later point in time. As demonstrated by Landsvirkjun's internal documents, since the PCC Plant will be located in the North-East of Iceland, the only possible way to provide the energy within the time frame envisaged in the agreements entered into between the Icelandic authorities and PCC is to generate it in the new facility to be built at Þeistareykir (85). |

|

(104) |

Moreover, the Power Contract does not contain any conditions related to the Þeistareykir Power Station. This means that Landsvirkjun bears the risk if the costs of constructing the Power Station increase, or if its construction is delayed. |

|

(105) |

The Authority also takes note of the fact that in the profitability calculations presented, Landsvirkjun appears not to have included any required return on the accrued costs. Moreover, the company appears not to have included any cost related to connecting the Power Station to the transmission system, which may be an unrealistic assumption as demonstrated by the facts involving the Transmission Agreement, assessed below. |

|

(106) |

For the above reasons, the Authority concludes that it has doubts as to whether the Power Contract was concluded on market terms. |

|

(107) |

The Authority invites the Icelandic authorities to shed more light on the motives behind the Power Contract, or the choices made by the parties in the contract, in light of the lack of profitability of the Power Contract and the business risk. Moreover, the Icelandic authorities are invited to shed light on all cost factors, including the (potential) costs which may not to have been included in the cost calculation provided, such as the costs of connecting the Power Station to the grid and costs that Landsvirkjun may have to take on as regards the System Contribution according to the Electricity Act, accrued costs, remuneration for the use of land and natural resources, possible maintenance/reinjection wells, and the possible construction of equipment for reducing the emission of H2S (hydrogen sulphide) into the atmosphere, according to requirements of Regulation (EC) No 514/2010 on the level of H2S in the atmosphere. |

1.3.2. The Transmission Agreement

|

(108) |

As a preliminary point, the Authority observes that transmission tariffs are one of the key elements of the EEA internal electricity market. Directive 2003/54/EC concerning common rules for the internal market in electricity (86) provides that national regulators shall ensure non-discriminatory and cost-reflective transmission tariffs (87), but the system of allocating costs to transmission uses is not regulated by the internal market legislation, and different tariff schemes coexist in the EEA. An overview of the transmission tariffs in Europe can be found in a recent ENTSO-E synthesis, according to which infrastructure is the main component of the Icelandic transmission tariff and (energy-intensive) grid users pay for the infrastructure connecting their installation to the transmission grid based on actual cost (not socialized via the tariff) (88). This is in line with the information provided by the Icelandic authorities in the case at hand, in which it has been explained that Article 12a of the Electricity Act provides that for connecting new energy-intensive users in Iceland: (i) Step-down Surcharge shall be charged in case the electricity is delivered at voltage below 132 kV, for covering the extra costs of the stepping-down (see Article 12a(7) of the Electricity Act); and (ii) System Contribution (connection fee) shall be charged for necessary additional costs resulting from the connection (see Article 12a(10) of the Electricity Act, and also Article 15(11) of the Electricity Regulation) (89). |

|

(109) |

The Authority observes that the issue is to examine whether PCC will receive an economic advantage in the form of preferential transmission charges via the Transmission Agreement in the form of exemptions from costs that normally would be borne by the company in its normal course of business. The Authority recalls that the system of transmission charges in Iceland was outlined and the Transmission Agreement was described in subsections I.2.3.5 and I.2.3.6 above. A part of the charges in the case at hand appear at this stage to deviate from the statutory rules and general principles in Iceland; that is the Step-down Surcharge and the System Contribution. This will be addressed below. |

|

(110) |

The Authority observes that the information made available to it appears to indicate, at the outset, that the connection of the PCC Plant at Bakki would be a part of an overall plan to connect the envisaged power plant(s) at Þeistareykir to the planned industrial site at Bakki. This is described in a memorandum dated 13 February 2013, enclosed as Annex VII to the bill of law adopted by the Parliament as the PCC Act, entering into force on 12 April 2013, authorizing the State to enter into an investment agreement with PCC entailing regional investment aid (90), approved by the Authority by Decision No 111/14/COL. The memorandum describes that Landsnet has for some time prepared the construction of 220 kV power lines to connect the national grid at the power plant at Krafla to the envisaged industrial site at Bakki through the envisaged Þeistareykir Power Station. It states that at the outset Landsnet will be operating one power line at 132 kV voltage (91) for the purposes of providing the envisaged PCC Plant with power. |

1.3.2.1. The Step-down Surcharge

|

(111) |

As describe above, the Step-down Surcharge is established by statutory rules and is intended to compensate for the actual extra costs related to the stepping-down of the electricity from 220 kV or 132 kV to the lower delivery voltage requested by the energy-intensive user (92). |

|

(112) |

The Transmission Agreement describes at Article 10.1 that a Step-down Surcharge will be charged for having the contract power delivered at a 33 kV and 11 kV voltage, as further laid down in the Grid Code B.9 and in Annex 5 to the Transmission Agreement. |

|

(113) |

The Icelandic authorities have explained that the estimated actual cost of stepping down the electricity is approximately ISK […] million (EUR […] million). In Annex 5 of the Transmission Agreement the estimated actual equipment cost is ISK […] million and breakdown of the equipment cost as a basis for the Step-down Surcharge is as follows:

Figure 9. Source: Transmission Agreement |

|

(114) |

The Icelandic authorities have referred to Article 13 of the Electricity Act as regards the permission for Landsnet to deliver electricity to energy-intensive users at 132 kV voltages or below. The Authority notes that the relevant provision of Article 13 was added to the Electricity Act in 2011 by Act No 19/2011, providing for an exemption for Landsnet to deliver electricity to energy-intensive users at a voltage below 132 kV. Article 13 belongs to the Electricity Act's chapter on the distribution system and it contains a general rule granting a monopoly to distribution system operators (DSOs) to distribute electricity within their geographical area of operation, and, with the amendment in 2011, the exemption for the TSO to deliver electricity within the DSO's monopoly area to energy-intensive users at a voltage below 132 kV. The provision is not relevant for assessing whether state aid is involved in the Step-down Surcharge in this case. |

|

(115) |

Furthermore, the Icelandic authorities have referred to the Step-down Surcharge as established in Landsnet's Grid Code B.9. The Authority observes that the legal basis for the Step-down Surcharge appears to be in Article 12a(7) of the Electricity Act, which reads: ‘The transmission system operator may deliver electricity to energy-intensive users at a voltage of 66 kV or below, provided the extra costs are covered by a special surcharge.’ (93) |

|

(116) |

The Icelandic authorities have confirmed that the Step-down Surcharge is intended to cover the actual cost of stepping down the electricity from 220 kV or 132 kV to the delivery voltage requested (94). |

|

(117) |

On this basis, it is the Authority's understanding at this stage that the Step-down Surcharge is intended to fully cover the extra costs of the stepping-down to the voltage level requested by the energy-intensive customer. The Icelandic authorities have submitted a formula (see also subsection I.2.3.6.2 above) applied in the case of PCC, for calculating a surcharge on the Capacity Charge (per year) and Energy Charge (per kWh) parts of the Transmission Charge for energy-intensive users. The Authority observes that the formula appears to take into account only an 80 % share of the total actual expenses related to the stepping-down (95). The Authority has not been provided with any justification, other than a reference to Landsnet's Grid Code B.9, where the formula is provided, and the contention that ‘the same approaches shall be applied as those pertaining to the income possibility curve of power intensive users, for instance in relation to depreciation, operating expenses and return rates’ (96). The Authority recalls that the statutory rule appears to prescribe the full coverage of the cost of stepping down, and that no information has been put forward in the context of this case as to any confirmed or potential other users at Bakki, which could possibly justify a reduced cost coverage by PCC. The Icelandic authorities are invited to put forward any information pertaining to the issue of cost coverage of the Step-down Surcharge in the case of PCC, to explain how this is in line with the statutory rule in Article 12a(7) of the Electricity Act, to provide calculations, and to clarify the extent to which they may consider the Step-down Surcharge not to entail state aid in favour of PCC. |

1.3.2.2. The System Contribution

|

(118) |

The Icelandic authorities have explained that the general Transmission Charge for energy-intensive users does not include a fee for connecting new customers to the transmission grid. They have explained that according to statutory rules the connection of new customers shall not result in increased cost for the existing customers. Furthermore, the Icelandic authorities have explained that the payment (the System Contribution) shall be established on the basis of the necessary costs of connection (97). |

|

(119) |