This document is an excerpt from the EUR-Lex website

Document 21987A0813(01)

Convention between the European Economic Community, the Republic of Austria, the Republic of Finland, the Republic of Iceland, the Kingdom of Norway, the Kingdom of Sweden and the Swiss Confederation, on a common transit procedure

Convention between the European Economic Community, the Republic of Austria, the Republic of Finland, the Republic of Iceland, the Kingdom of Norway, the Kingdom of Sweden and the Swiss Confederation, on a common transit procedure

Convention between the European Economic Community, the Republic of Austria, the Republic of Finland, the Republic of Iceland, the Kingdom of Norway, the Kingdom of Sweden and the Swiss Confederation, on a common transit procedure

OJ L 226, 13.8.1987, p. 2–117

(ES, DA, DE, EL, EN, FR, IT, NL, PT) This document has been published in a special edition(s)

(CS, ET, LV, LT, HU, MT, PL, SK, SL, BG, RO, HR)

In force: This act has been changed. Current consolidated version: 20/10/2022

In force: This act has been changed. Current consolidated version: 20/10/2022

ELI: http://data.europa.eu/eli/convention/1987/415/oj

|

13.8.1987 |

EN |

Official Journal of the European Communities |

L 226/2 |

CONVENTION ON A COMMON TRANSIT PROCEDURE

THE REPUBLIC OF AUSTRIA, THE REPUBLIC OF FINLAND, THE REPUBLIC OF ICELAND, THE KINGDOM OF NORWAY, THE KINGDOM OF SWEDEN, THE SWISS CONFEDERATION,

hereinafter called the EFTA countries,

THE EUROPEAN ECONOMIC COMMUNITY,

hereinafter called the Community,

CONSIDERING the Free Trade Agreements between the Community and each of the EFTA countries,

CONSIDERING the Joint Declaration calling for the creation of a European economic space, adopted by Ministers of the EFTA countries and the Member States of the Community and the Commission of the European Communities in Luxembourg on 9 April 1984, especially with regard to simplification of border formalities and rules of origin,

CONSIDERING the Convention on the simplification of formalities in trade in goods, concluded between the EFTA countries and the Community, introducing a single administrative document for use in such trade,

CONSIDERING that the use of this single document within the framework of a common transit procedure for the carriage of goods between the Community and the EFTA countries and between the EFTA countries themselves would lead to simplification,

CONSIDERING that the most appropriate way of achieving this aim would be to extend to those EFTA countries which do not apply it the transit procedure which currently applies to the carriage of goods within the Community, between the Community and Austria and Switzerland, and between Austria and Switzerland,

CONSIDERING also the Nordic transit order applied between Finland, Norway and Sweden,

HAVE DECIDED to conclude the following Convention:

General provisions

Article 1

1. This Convention lays down measures for the carriage of goods in transit between the Community and the EFTA countries as well as between the EFTA countries themselves, including, where applicable, goods transhipped, reconsigned or warehoused, by introducing a common transit procedure regardless of the kind and origin of the goods.

2. Without prejudice to the provisions of this Convention and in particular those concerning guarantees, goods circulating within the Community are deemed to be placed under the Community transit procedure.

3. Subject to the provisions of Articles 7 to 12 below, the rules governing the common transit procedure are set out in Appendices I and II to this Convention.

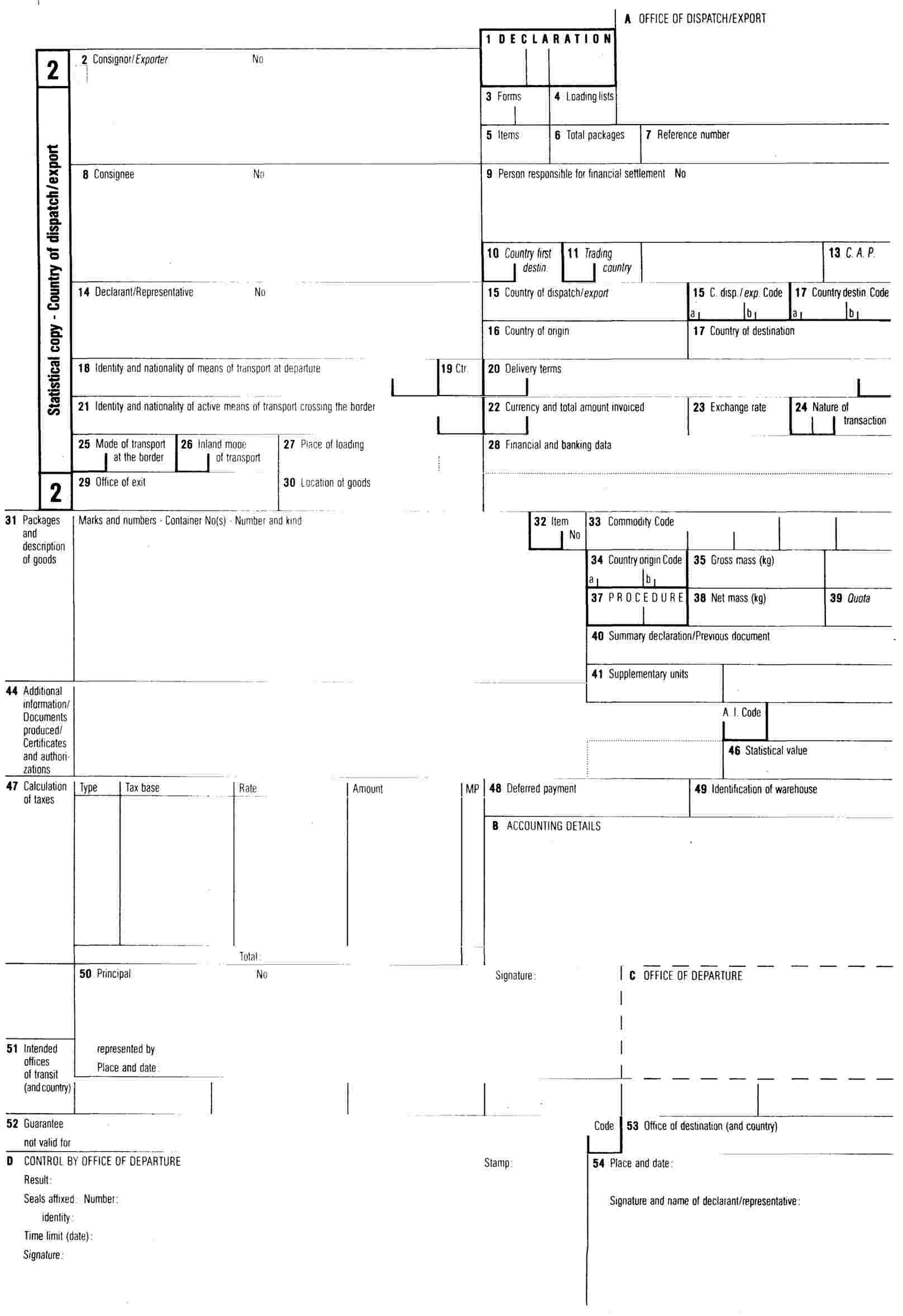

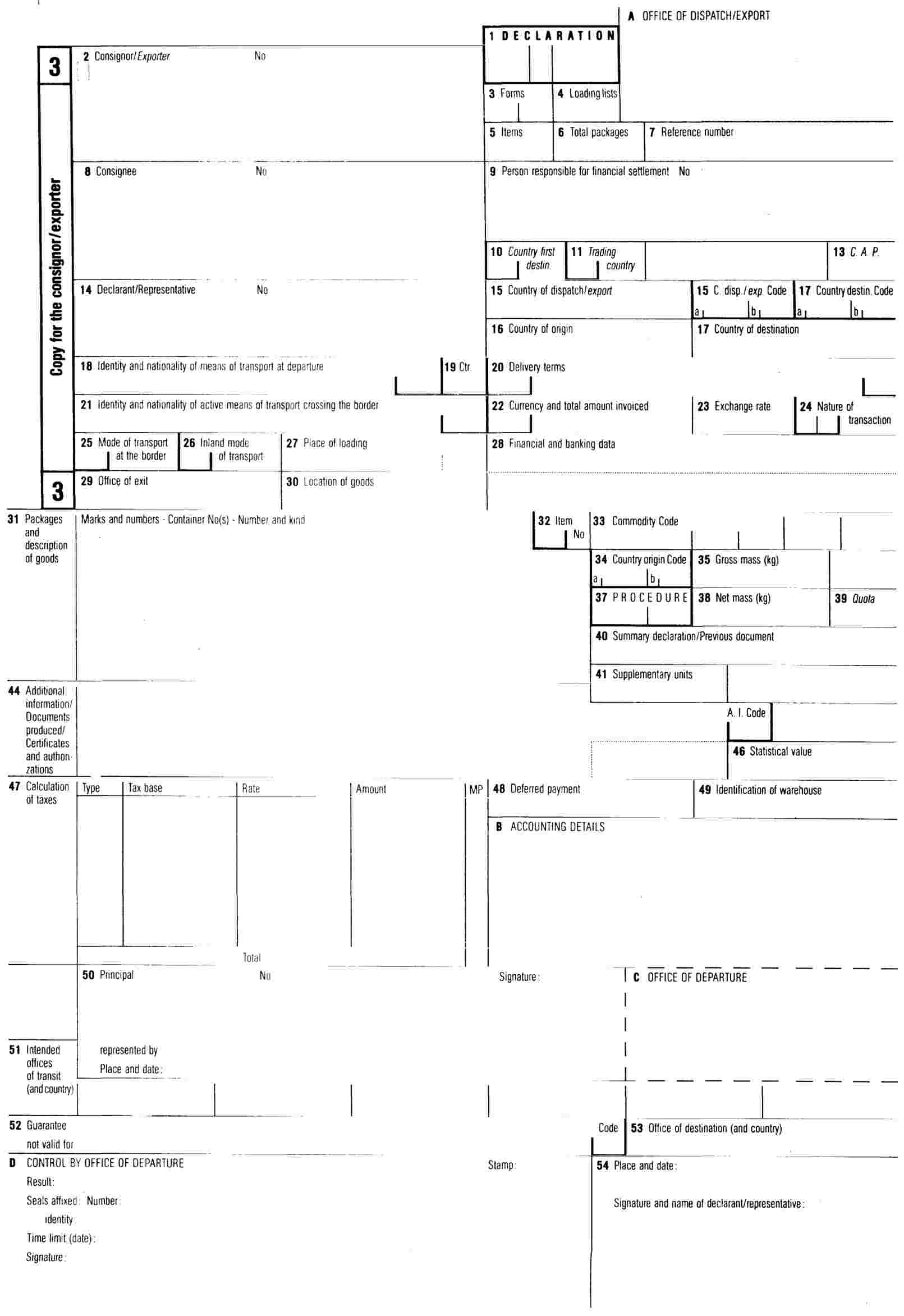

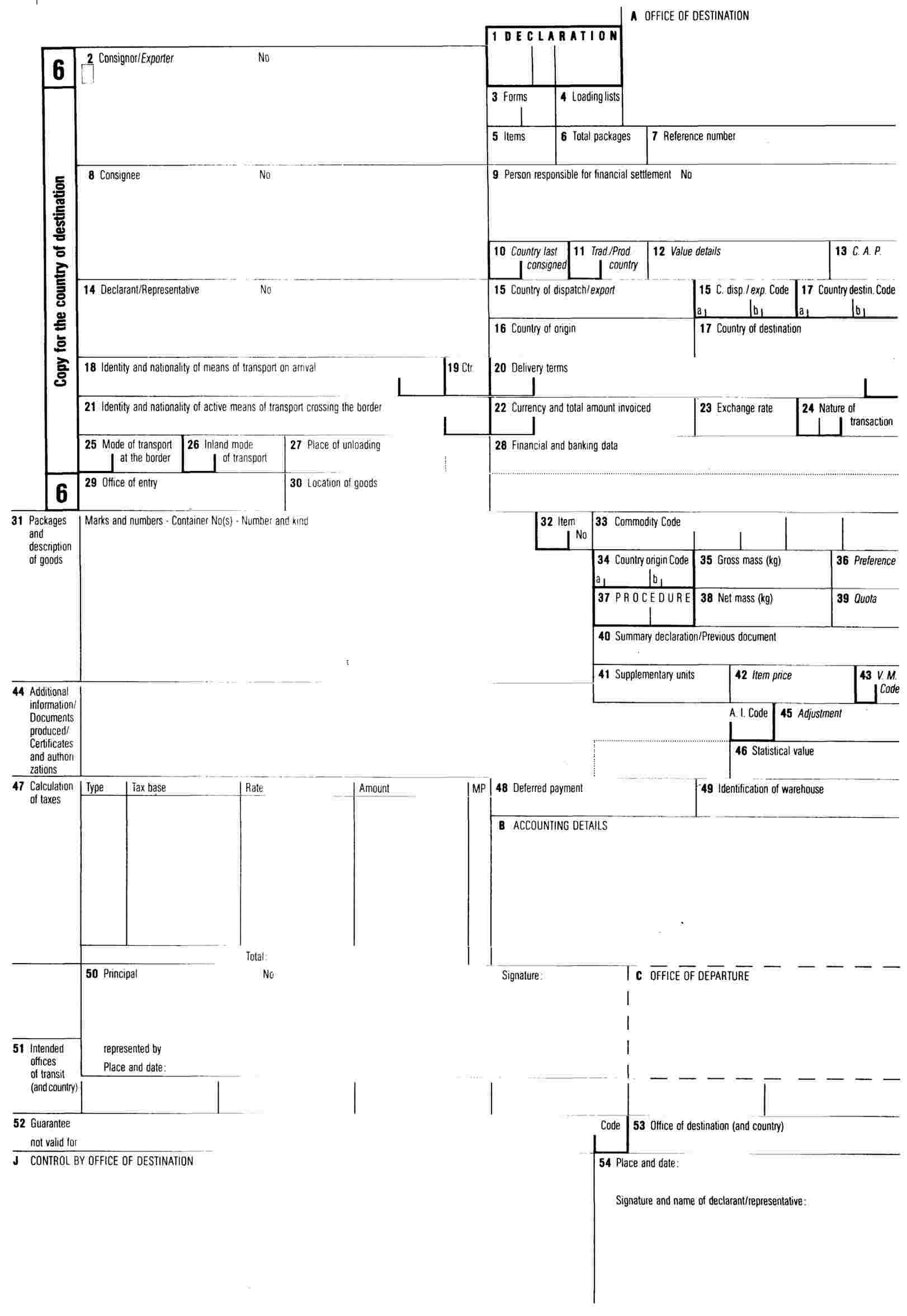

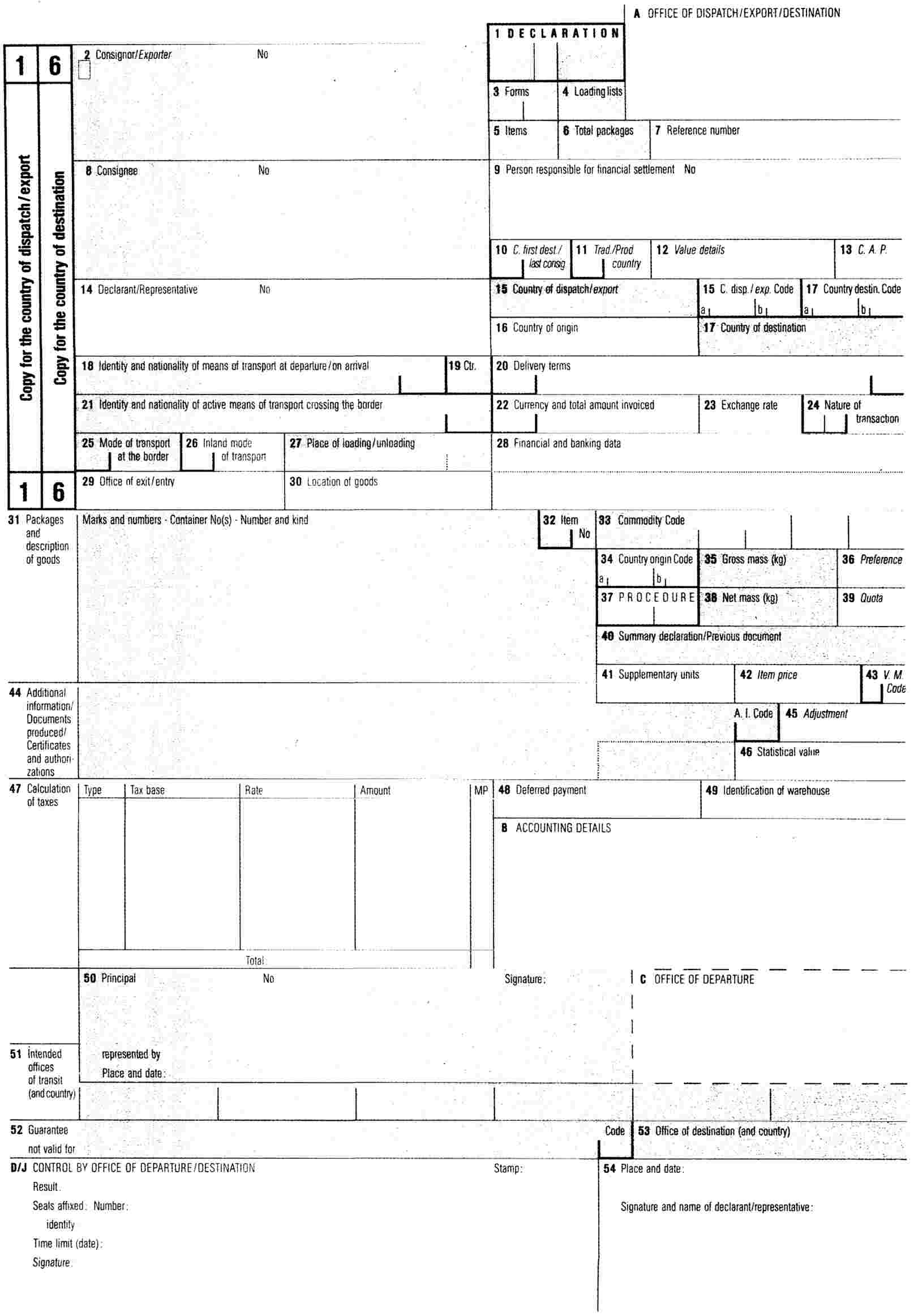

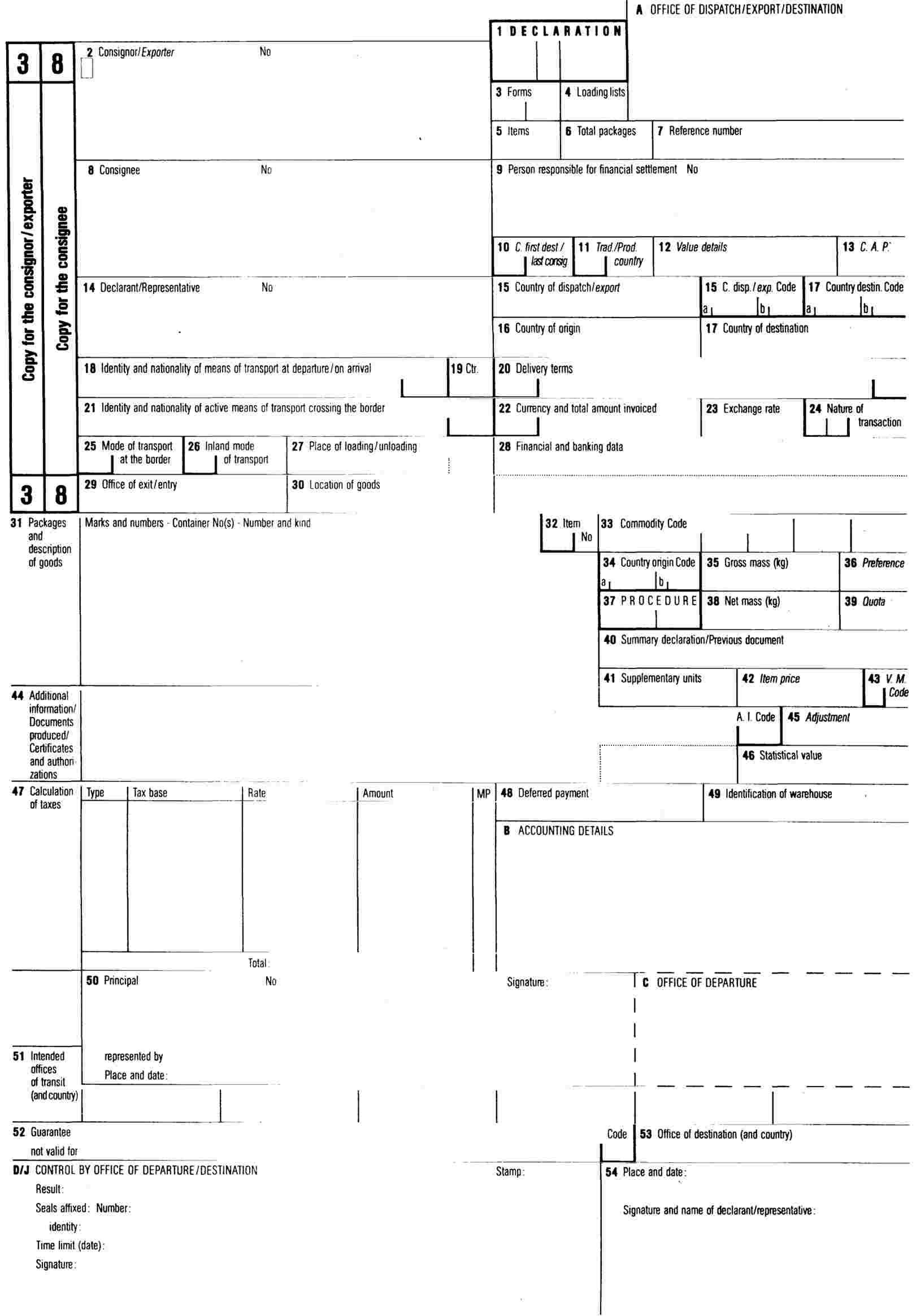

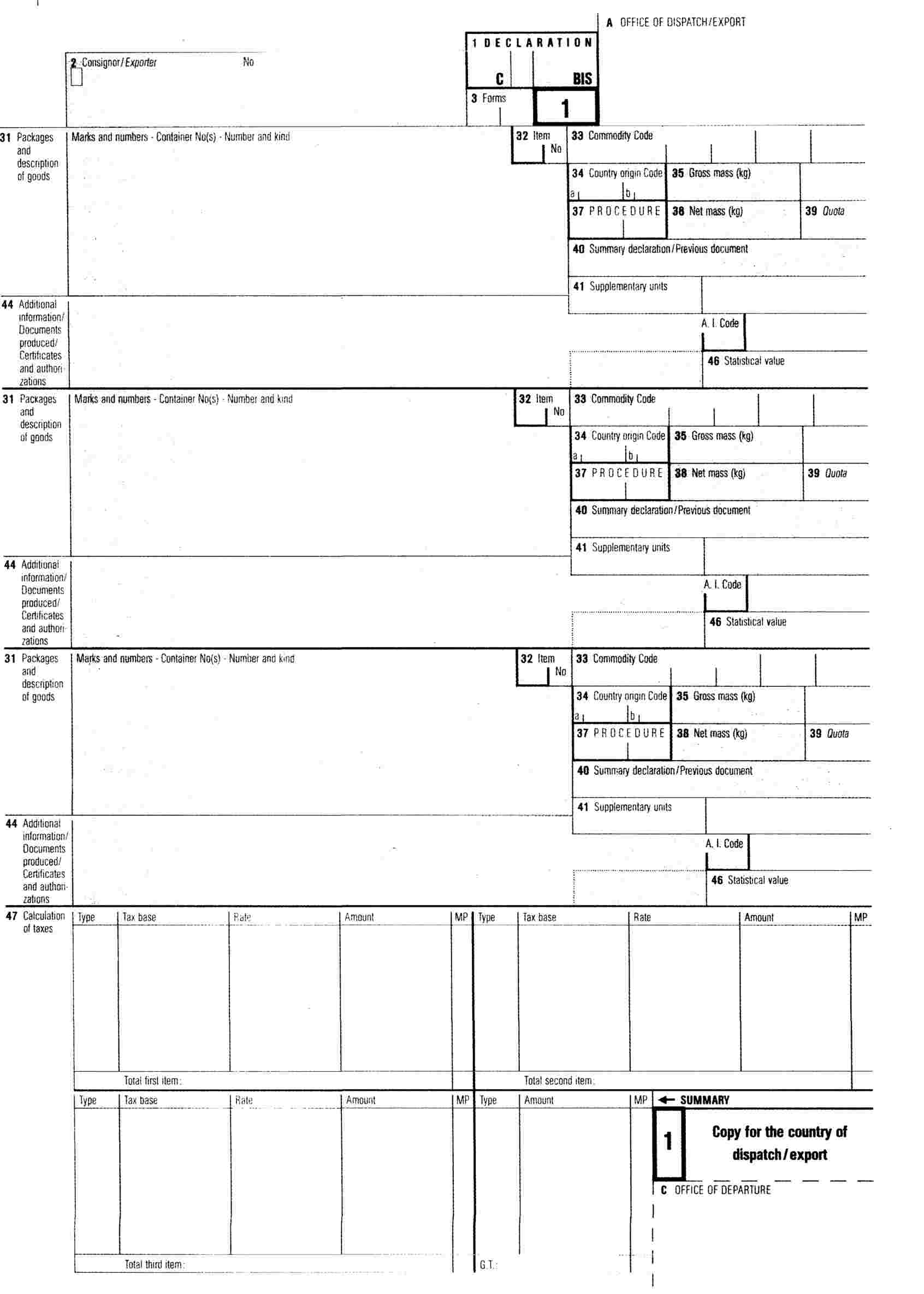

4. Transit declarations and transit documents for the purposes of the common transit procedure shall conform to and be made out in accordance with Appendix III.

Article 2

1. The common transit procedure shall hereinafter be described as the T 1 procedure or the T 2 procedure, as the case may be.

2. The T 1 procedure may be applied to any goods carried in accordance with Article 1, paragraph 1.

3. The T 2 procedure shall apply to goods carried in accordance with Article 1, paragraph 1:

|

(a) |

in the Community, only when the goods satisfy the conditions laid down in Articles 9 and 10 of the Treaty establishing the European Economic Community and have not been subject to customs export formalities for the grant of refunds for export to countries, not Member States of the Community, pursuant to the common agricultural policy or when the goods come under the Treaty establishing the European Coal and Steel Community and are, under the terms of that Treaty, in free circulation within the Community (Community goods); |

|

(b) |

in an EFTA country, only when the goods have arrived in that EFTA country under the T 2 procedure and are reconsigned under the special conditions laid down in Article 9 below. |

4. The special conditions laid down in this Convention in respect of placing goods under the T 2 procedure shall apply also to the issue of T 2 L documents certifying the Community status of goods and goods covered by a T 2 L document shall be treated in the same way as goods carried under the T 2 procedure, except that the T 2 L document need not accompany the goods.

Article 3

1. For the purposes of this Convention, the term:

|

(a) |

‘transit’ shall mean a customs procedure under which goods are carried, under customs control, from a customs office in one country to a customs office in the same or another country over at least one frontier; |

|

(b) |

‘country’, shall mean any EFTA country and any Member State of the Community; |

|

(c) |

‘third country’ shall mean any State which is neither an EFTA country nor a Member State of the Community. |

2. In the application of the rules laid down in this Convention for the T 1 or T 2 procedure, the EFTA countries, and the Community and its Member States, shall have the same rights and obligations.

Article 4

1. This Convention shall be without prejudice to the application of any other international agreement concerning a transit procedure, in particular the TIR procedure or the Rhine manifest, subject to any limitations to such application in respect of the carriage of goods from one point in the Community to another point in the Community and to any limitations to the issue of T 2 L documents certifying the Community status of goods.

2. This Convention shall be without prejudice also to:

|

(a) |

movements of goods under a temporary admission procedure; and |

|

(b) |

agreements concerning frontier traffic. |

Article 5

In the absence of an agreement between the Contracting Parties and a third country whereby goods moving between the Contracting Parties may be carried across that third country under the T 1 or T 2 procedure, such a procedure shall apply to goods carried across that third country only if the carriage across that country is effected under cover of a single transport document drawn up in the territory of a Contracting Party and the operation of that procedure is suspended in the territory of the third country.

Article 6

Provided that the implementation of any measures applicable to the goods is ensured, countries may, within the T 1 or T 2 procedure, introduce simplified procedures for certain types of traffic by means of bilateral or multilateral agreements. Such agreements shall be notified to the Commission of the European Communities which shall inform the other countries.

Implementation of the transit procedure

Article 7

1. Subject to any special provisions of this Convention, the competent customs offices of the EFTA countries are empowered to assume the functions of offices of departure, offices of transit, offices of destination and offices of guarantee.

2. The competent customs offices of the Member States of the Community shall be empowered to issue T 1 or T 2 documents for transit to an office of destination situated in an EFTA country. Subject to any special provisions of this Convention, they shall also be empowered to issue T 2 L documents for goods consigned to an EFTA country.

3. Where several consignments of goods are grouped together and loaded on a single means of transport, within the meaning of Article 16, paragraph 2, of Appendix I, and are dispatched as a groupage load by one principal in a single T 1 or T 2 operation, from one office of departure to one office of destination for delivery to one consignee, a Contracting Party may require that those consignments shall, save in exceptional, duly justified cases, be included in one single T 1 or T 2 declaration with the corresponding loading lists.

4. Notwithstanding the requirement for the Community status of goods to be certified where applicable, a person completing export formalities at the frontier customs office of a Contracting Party shall not be required to place the goods consigned under the T 1 or the T 2 procedure, irrespective of the customs procedure under which the goods will be placed at the neighbouring frontier customs office.

5. Notwithstanding the requirement for the Community status of goods to be certified where applicable, the frontier customs office of the Contracting Party where export formalities are completed may refuse to place the goods under the T 1 or T 2 procedure if that procedure is to end at the neighbouring frontier customs office.

Article 8

No addition, removal or substitution may be made in the case of goods forwarded under cover of a T 1 or T 2 document, in particular when consignments are split up, transhipped or bulked.

Article 9

1. Goods which are brought into an EFTA country under the T 2 procedure and may be reconsigned under that procedure shall remain at all times under the control of the customs authorities of that country to ensure that there is no change in their identity or state.

2. Where such goods are reconsigned from an EFTA country after having been placed, in that EFTA country, under a customs procedure other than a transit or a warehousing procedure, no T 2 procedure may be applied.

This provision shall, however, not apply to goods which are admitted temporarily to be shown at an exhibition, fair or similar public display and which have received no treatment other than that needed for their preservation in their original state or for splitting up consignments.

3. Where goods are reconsigned from an EFTA country after storage under a warehousing procedure, the T 2 procedure may be applied only on the following conditions:

|

— |

that the goods have not been warehoused over a period exceeding five years; however, as regards goods falling within Chapters 1 to 24 of the Nomenclature for the Classification of Goods in Customs Tariffs (International Convention on the Harmonized Commodity Description and Coding System of 14 June 1983), that period shall be limited to six months, |

|

— |

that the goods have been stored in special spaces and have received no treatment other than that needed for their preservation in their original state, or for splitting up consignments without replacing the packaging. |

|

— |

that any treatment has taken place under customs supervision. |

4. Any T 2 or T 2 L document issued by a customs office of an EFTA country shall bear a reference to the corresponding T 2 or T 2 L document under which the goods arrived in that EFTA country and shall include all special endorsements appearing thereon.

Article 10

1. Except where otherwise provided for in paragraph 2 below or in the Appendices, any T 1 or T 2 operation shall be covered by a guarantee valid for all countries involved in that operation.

2. The provisions of paragraph 1 shall not prejudice the right:

|

(a) |

of Contracting Parties to agree among themselves that the guarantee shall be waived for T 1 or T 2 operations involving only their territories; |

|

(b) |

of a Contracting Party not to require a guarantee for the part of a T 1 or T 2 operation between the office of departure and the first office of transit. |

3. For the purposes of the flat-rate guarantee as provided for in Appendices I and II to this Convention, the ECU means the total of the following amounts:

|

0,719 |

German mark, |

|

0,0878 |

Pound sterling, |

|

1,31 |

French franc, |

|

140 |

Italian lire, |

|

0,256 |

Dutch guilder, |

|

3,71 |

Belgian franc, |

|

0,14 |

Luxembourg franc, |

|

0,219 |

Danish krone, |

|

0,00871 |

Irish pound, |

|

1,15 |

Greek drachma. |

The value of the ECU in a given currency shall be equal to the sum of the exchange values in that currency of the amounts set out above.

Article 11

1. As a general rule, identification of the goods shall be ensured by sealing.

2. The following shall be sealed:

|

(a) |

the space containing the goods, when the means of transport has already been approved under other customs regulations or recognized by the office of departure as suitable for sealing; |

|

(b) |

each individual package in other cases. |

3. Means of transport may be recognized as suitable for sealing on condition that:

|

(a) |

seals can be simply and effectively affixed to them; |

|

(b) |

they are so constructed that no goods can be removed or introduced without leaving visible traces of tampering or without breaking the seals; |

|

(c) |

they contain no concealed spaces where goods may be hidden; |

|

(d) |

the spaces reserved for the load are readily accessible for customs inspection. |

4. The office of departure may dispense with sealing if, having regard to other possible measures for identification, the description of the goods in the T 1 or T 2 declaration or in the supplementary documents makes them readily identifiable.

Article 12

1. Until a procedure has been agreed for the exchange of statistical information to ensure that the EFTA countries and the Member States of the Community have the data necessary for the preparation of their transit statistics, an additional copy of the copy No 4 of the T 1 and T 2 documents shall be supplied for statistical purposes unless not required by a Contracting Party:

|

(a) |

to the first office of transit in each EFTA country; |

|

(b) |

to the first office of transit in the Community in the case of goods which are the subject of a T 1 or T 2 operation commencing in an EFTA country. |

2. However, the additional copy referred to above shall not be required when the goods are carried under the conditions laid down in Chapter I of Title IV of Appendix II.

3. The principal or his authorized representative shall, at the request of the national departments responsible for transit statistics, provide any information relating to T 1 or T2 documents necessary for the compilation of statistics.

Administrative assistance

Article 13

1. The customs authorities of the countries concerned shall furnish each other with any information at their disposal which is of importance in order to verify the proper application of this Convention.

2. Where necessary, the customs authorities of the countries concerned shall communicate to one another all findings, documents, reports, records of proceedings and information relating to transport operations carried out under the T 1 or T2 procedure as well as to irregularities or infringements in connection with such operations.

Furthermore, where necessary, they shall communicate to one another all findings relating to goods in respect of which mutual assistance is provided for and which have been subject to a customs warehousing procedure.

3. Where irregularities or infringements are suspected in connection with goods which have been brought into one country from another country or have passed through a country or have been stored under a warehousing procedure, the customs authorities of the countries concerned shall on request communicate to one another all information concerning:

|

a) |

the conditions under which those goods were carried:

|

|

b) |

the conditions of any warehousing of those goods where they arrived in the country to which the request is addressed under cover of a T2 or T2L document or where they were reconsigned from that country under cover of a T2 or T2L document. |

4. Any request made under paragraphs 1 to 3 shall specify the case or cases to which it refers.

5. If the customs authority of a country requests assistance which it would not be able to give if requested, it will draw attention to that fact in the request. Compliance with such a request will be within the discretion of the customs authority to whom the request is made.

6. Information obtained in accordance with paragraphs 1 to 3 shall be used solely for the purposes of this Convention and shall be accorded the same protection by a receiving country as is afforded to information of like nature under the national law of that country. Such information may be used for other purposes only with the written consent of the customs authority which furnished it and subject to any restrictions laid down by that authority.

The Joint Committee

Article 14

1. A Joint Committee is hereby established in which each Contracting Party to this Convention shall be represented.

2. The Joint Committee shall act by mutual agreement.

3. The Joint Committee shall meet whenever necessary but at least once a year. Any Contracting Party may request that a meeting be held.

4. The Joint Committee shall adopt its own rules of procedure which shall, inter alia, contain provisions for convening meetings and for the designation of the chairman and his term of office.

5. The Joint Committee may decide to set up any sub-committee or working party that can assist it in carrying out its duties.

Article 15

1. It shall be the responsibility of the Joint Committee to administer this Convention and ensure its proper implementation. For this purpose, it shall be regularly informed by the Contracting Parties on the experiences of the application of this Convention and make recommendations, and in the cases provided for in paragraph 3, it shall take decisions.

2. In particular it shall recommend:

|

(a) |

amendments to this Convention, other than those referred to in paragraph 3; |

|

(b) |

any other measure required for its application. |

3. It shall adopt by decision:

|

(a) |

amendments to the Appendices; |

|

(b) |

amendments of the definition of the ECU as set out in Article 10 (3); |

|

(c) |

other amendments to this Convention made necessary by amendments to the Appendices; |

|

(d) |

measures to be taken under Article 28 (2) of Appendix I; |

|

(e) |

transitional measures required in the case of the accession of new Member States to the Community. |

Such decisions shall be put into effect by the Contracting Parties in accordance with their own legislation.

4. If, in the Joint Committee, a representative of a Contracting Party has accepted a decision subject to the fulfilment of constitutional requirements, the decision shall enter into force, if no date is contained therein, on the first day of the second month after the lifting of the reservation is notified.

Miscellaneous and final provisions

Article 16

Each Contracting Party shall take appropriate measures to ensure that the provisions of this Convention are effectively and harmoniously applied, taking into account the need to reduce as far as possible the formalities imposed on operators and the need to achieve mutually satisfactory solutions of any difficulties arising out of the operation of those provisions.

Article 17

The Contracting Parties shall keep each other informed of the provisions which they adopt for the implementation of this Convention.

Article 18

The provisions of this Convention shall not preclude prohibitions or restrictions on the importation, exportation or transit of goods enacted by the Contracting Parties or by Member States of the Community and justified on grounds of public morality, public policy or public security, the protection of health and life of humans, animals or plants, the protection of national treasures possessing artistic, historical or archaeological value, or the protection of industrial or commercial property.

Article 19

The Appendices and the Additional Protocol to this Convention shall form an integral part thereof.

Article 20

1. This Convention shall apply, on the one hand, to the territories in which the Treaty establishing the European Economic Community is applied and under the conditions laid down in that Treaty and, on the other hand, to the territories of the EFTA countries.

2. This Convention shall also apply to the Principality of Liechtenstein for as long as that Principality remains bound to the Swiss Confederation by a customs union treaty.

Article 21

Any Contracting Party may withdraw from this Convention provided it gives 12 months' notice in writing to the depositary, which shall notify all other Contracting Parties.

Article 22

1. This Convention shall enter into force on 1 January 1988, provided that the Contracting Parties, before 1 November 1987, have deposited their instruments of acceptance with the Secretariat of the Council of the European Communities, which shall act as depositary.

2. If this Convention does not enter into force on 1 January 1988, it shall enter into force on the first day of the second month following the deposit of the last instrument of acceptance.

3. The depositary shall notify the date of the deposit of the instrument of acceptance of each Contracting Party and the date of the entry into force of this Convention.

Article 23

1. With the entry into force of this Convention, the Agreements of 30 November 1972 and 23 November 1972 on the application of the rules on Community transit, concluded by Austria and Switzerland respectively with the Community, as well as the Agreement of 12 July 1977 on the extension of the application of the rules on Community transit concluded by these countries and the Community, shall cease to apply.

2. The Agreements mentioned in paragraph 1 shall, however, continue to apply to T 1 or T2 operations started before the entry into force of this Convention.

3. The Nordic transit order applied between Finland, Norway and Sweden will be terminated as from the date of the entry into force of this Convention.

Article 24

This Convention, which is drawn up in a single copy in the Danish, Dutch, English, French, German, Greek, Italian, Portuguese, Spanish, Finnish, Icelandic, Norwegian and Swedish languages, all texts being equally authentic, shall be deposited in the archives of the Secretariat of the Council of the European Communities, which shall deliver a certified copy thereof to each Contracting Party.

Done at Interlaken, 20 May 1987.

APPENDIX I

TITLE I

GENERAL PROVISIONS

Article 1

1. The transit procedure laid down in this Convention shall be applicable to the carriage of goods in accordance with Article 1 (1), of the Convention.

2. It shall be the T 1 or T 2 procedure subject to Article 2 of the Convention.

Articles 2 to 10

(This Appendix does not contain Articles 2 to 10.)

Article 11

For the purposes of this Convention

|

(a) |

‘principal’ means: the person who, in person or through an authorized representative, requests permission, in a declaration in accordance with the required customs formalities, to carry out a transit operation and thereby makes himself responsible to the competent authorities for the execution of the operation in accordance with the rules; |

|

(b) |

‘means of transport’ means, in particular:

|

|

(c) |

‘office of departure’ means the customs office where the transit operation begins; |

|

(d) |

‘office of transit’ means:

|

|

(e) |

‘office of destination’ means the customs office where the goods must be produced to complete the transit operation; |

|

(f) |

‘office of guarantee’ means the customs office where a comprehensive guarantee is lodged; |

|

(g) |

‘internal frontier’ means a frontier common to two Contracting Parties. Goods loaded in a seaport of a Contracting Party and unloaded in a seaport of another Contracting Party shall be deemed to have crossed an internal frontier provided that the sea crossing is covered by a single transport document. Goods coming from a third country by sea and transhipped in a seaport of a Contracting Party with a view to unloading in a seaport of another Contracting Party shall be deemed not to have crossed an internal frontier. |

TITLE II

T 1 PROCEDURE

Article 12

1. Any goods that are to be carried under the T 1 procedure shall be the subject, in accordance with the conditions laid down in this Convention, of a T 1 declaration. A T 1 declaration means a declaration on a form corresponding to the specimen forms contained in Appendix III.

2. The T 1 form referred to in paragraph 1 may be supplemented, where appropriate, by one or more supplementary T 1 bis forms corresponding to the specimen supplementary forms contained in Appendix III.

3. The T 1 and T 1 bis forms shall be printed and completed in one of the official languages of the Contracting Parties which is acceptable to the competent authorities of the country of departure. Where necessary, the competent authorities of the country concerned in the T 1 operation may require translation into the official language or one of the official languages of that country.

4. The T 1 declaration shall be signed by the person who requests permission to effect a T 1 operation or by his authorized representative and at least three copies of it shall be produced at the office of departure.

5. The supplementary documents appended to the T 1 declaration shall form an integral part thereof.

6. The T 1 declaration shall be accompanied by the transport document.

The office of departure may dispense with production of this document at the time of completion of the customs formalities. However, the transport document must be produced whenever required by the customs authorities in the course of carriage.

7. Where the T 1 procedure in the country of departure succeeds another customs procedure, reference shall be made on the T 1 declaration to that procedure or to the corresponding customs documents.

Article 13

The principal shall be responsible for:

|

(a) |

the production of the goods intact at the office of destination within the prescribed time limit and with due observance of the measures adopted by the competent authorities to ensure identification; |

|

(b) |

the observance of the provisions relating to the T1 procedure and to transit in each of the countries in the territory of which carriage of the goods is effected. |

Article 14

1. Each country may, subject to conditions which it may prescribe, provide for the use of the T 1 document for national procedures.

2. The supplementary details included on the T 1 document for that purpose by a person other than the principal shall be the responsibility of the former, in accordance with the national provisions laid down by law, regulation or administrative action.

Article 15

(This Appendix does not contain an Article 15.)

Article 16

1. The same means of transport may be used for the loading of goods at more than one office of departure and for unloading at more than one office of destination.

2. Each T 1 declaration shall include only the goods loaded or to be loaded on a single means of transport for carriage from one office of departure to one office of destination.

For the purposes of the preceding subparagraph the following shall be regarded as constituting a single means of transport, on condition that the goods carried are to be dispatched together:

|

(a) |

a road vehicle accompanied by its trailer(s) or semi-trailer(s); |

|

(b) |

a line of coupled railway carriages or wagons; |

|

(c) |

boats constituting a single chain; |

|

(d) |

containers loaded on a means of transport within the meaning of this Article. |

Article 17

1. The office of departure shall register the T 1 declaration, prescribe the period within which the goods must be produced at the office of destination, and take such measures for identification as it considers necessary.

2. Having entered the necessary particulars on the T 1 declaration, the office of departure shall retain its copy and return the others to the principal or his representative.

Article 18

(This Appendix does not contain an Article 18.)

Article 19

1. The copies of the T 1 document delivered to the principal or to his representative by the office of departure must accompany the goods.

2. Goods shall be carried via the offices of transit mentioned in the T 1 document. If circumstances justify it, other offices of transit may be used.

3. For supervision purposes, each country may prescribe transit routes within its territory.

4. Each country shall provide the Commission of the European Communities with a list of customs offices authorized to deal with T 1 operations, stating at what hours they are open.

The Commission shall communicate this information to the other countries.

Article 20

Copies of the T 1 document shall be produced in each country as required by the customs authorities, who may satisfy themselves that the seals are unbroken. The goods shall not be inspected unless some irregularity is suspected which could result in abuse.

Article 21

The consignment as well as the copies of the T 1 document shall be produced at each office of transit.

Article 22

1. The carrier shall give each office of transit a transit advice note. The design of the transit advice note is laid down in Appendix II.

2. The offices of transit shall not inspect the goods unless some irregularity is suspected which could result in abuse.

3. If, in accordance with the provisions of Article 19 (2), goods are carried via an office of transit other than that mentioned in the T 1 document, that office shall without delay send the transit advice note to the office mentioned in that document.

Article 23

Where goods are loaded or unloaded at any intermediate office, copies of the Τ 1 document issued by the office(s) of departure must be produced.

Article 24

1. The goods described on a T 1 document may, without renewal of the declaration, be transferred to another means of transport under the supervision of the customs authorities of the country in whose territory the transfer is made. In such a case, the customs authorities shall record the relevant details on the T 1 document.

2. The customs authorities may, subject to such conditions as they shall determine, authorize such transfer without supervision. In such a case the carrier shall record the relevant details on the Τ 1 document and inform the next customs office at which the goods must be presented, so that the transfer is officially certified by the customs authorities.

Article 25

1. If seals are broken in the course of carriage without the carrier so intending, he shall, as soon as possible, request that a certified report be drawn up in the country in which the means of transport is located, by the customs authority if there is one nearby or, if not, by any other competent authority. The authority concerned shall, if possible, affix new seals.

2. In the event of an accident necessitating transfer to another means of transport the provisions of Article 24 shall apply.

If there is no customs authority nearby, any other approved authority may act in its place under the conditions laid down in Article 24 (1).

3. In the event of imminent danger necessitating immediate unloading of the whole or part of the load, the carrier may take action on his own initiative. He shall record such action on the T 1 document. The provisions of paragraph 1 shall apply in such case.

4. If, as a result of accidents or other incidents arising in the course of carriage, the carrier is not in a position to observe the time limit referred to in Article 17, he shall inform the competent authority referred to in paragraph 1 as soon as possible. That authority shall then record the relevant details on the Τ 1 document.

Article 26

1. The office of destination shall record on the copies of the Τ 1 document the details of controls and shall without delay send a copy to the office of departure and retain the other copy.

2. (This Article does not contain paragraph 2.)

3. Where the goods are produced at the office of destination after expiry of the time limit prescribed by the office of departure and where this failure to comply with the time limit is due to circumstances which are explained to the satisfaction of the office of destination and which are beyond the control of the carrier or the principal, the latter shall be deemed to have complied with the time limit prescribed.

4. Without prejudice to Articles 34 and 51 of Appendix II a T 1 operation may be terminated at an office other than that specified in the T 1 document, provided that both offices belong to the same Contracting Party. That office shall then become the office of destination.

If, exceptionally, it should prove necessary to produce the goods with the intention of terminating their transport at an office other than that specified in the Τ 1 document and the two offices belong to different Contracting Parties, the customs authorities at the office where the goods are produced may authorize the change in office of destination. The new office of destination shall enter in the ‘Control by office of destination’ box of the return copy of the Τ 1 document, in addition to the usual statements which it is obliged to enter, one of the following statements:

|

— |

Diferencias: mercancías presentadas en la aduana ... (nombre y país) |

|

— |

Forskelle: det toldsted, hvor varerne blev frembudt ... (navn og land) |

|

— |

Unstimmigkeiten: Zollstelle der Gestellung ... (Name und Land) |

|

— |

Διαφορές: εμπορεύματα προσκομισθέντα στο τελωνείο ... (όνομα και χώρα) |

|

— |

Differences: office where goods were presented ... (name and country) |

|

— |

Différences: marchandises présentées au bureau ... (nom et pays) |

|

— |

Differenze: ufficio al quale sono state presentate le merci ... (nome e paese) |

|

— |

Verschillen: kantoor waar de goederen zijn aangebracht ... (naam en land) |

|

— |

Diferenças: mercadorias apresentadas na estãncia ... (nome e país) |

|

— |

Muutos: toimipaikka, jossa tavarat esitetty ... (nimi ja maa) |

|

— |

Breying: Tollstjóraskrifstofa øar sem vörum var framvisad ... (Nafn og land) |

|

— |

Forskjell: det tollsted hvor varene ble fremlagt ... (navn og land) |

|

— |

Avvikelse: tullanstalt där varorna anmäldes ... (namn och land) |

However, no such change of office of destination shall be authorized in respect of a T 1 document bearing one of the following endorsements:

|

— |

Salida de la Comunidad sometida a restricciones |

|

— |

Udførsel fra Fællesskabet undergivet restriktioner |

|

— |

Ausgang aus der Gemeinschaft Beschränkungen unterworfen |

|

— |

Έξοδος από την Κοινότητα υποκείμενη σε περιορισμούς |

|

— |

Export from the Community subject to restrictions |

|

— |

Sortie de la Communauté soumise à des restrictions |

|

— |

Uscita dalla Comunità assoggettata a restrizioni |

|

— |

Verlaten van de Gemeenschap aan beperkingen onderworpen |

|

— |

Saída da Comunidade sujeita a restrições |

|

— |

Salida de la Comunidad sujeta a pago de derechos |

|

— |

Udførsel fra Fællesskabet betinget af afgiftsbetaling |

|

— |

Ausgang aus der Gemeinschaft Abgabenerhebung unterworfen |

|

— |

Έξοδος από την Κοινότητα υποκείμενη σε επιβάρυνση |

|

— |

Export from the Community subject to duty |

|

— |

Sortie de la Communauté soumise à imposition |

|

— |

Uscita dalla Comunità assoggettata a tassazione |

|

— |

Verlaten van de Gemeenschap aan belastingheffing onderworpen |

|

— |

Saída da Comunidade sujeita a pagamento de imposições |

The office of departure shall not discharge the Τ 1 document until all the obligations arising from the change in office of destination have been complied with. Where appropriate, it shall inform the guarantor of the non-discharge.

Article 27

1. In order to ensure collection of the duties and other charges which each country is authorized to charge in respect of goods passing through its territory in the course of a T 1 operation the principal shall furnish a guarantee, except as otherwise provided in this Appendix.

2. The guarantee may be comprehensive, covering a number of Τ 1 operations, or individual, covering a single Τ 1 operation.

3. Subject to the provisions of Article 33 (2), the guarantee shall consist of the joint and several guarantee of a natural or legal third person established in the country in which the guarantee is provided who is approved as guarantor by that country.

Article 28

1. The person standing as guarantor under the conditions referred to in Article 27 shall be responsible for designating, in each of the countries through which the goods will be carried in the course of a T 1 operation, a natural or legal third person who also will stand as guarantor for the principal.

Such guarantor must be established in the country in question and must undertake, jointly and severally with the principal, to pay the duties and other charges chargeable in that country.

2. The application of paragraph 1 shall be subject to a decision by the Joint Committee as a result of an examination of the conditions under which the Contracting Parties have been able to exercise their right of recovery in accordance with Article 36.

Article 29

1. The guarantee referred to in Article 27 (3), shall be in the form of one of the specimen guarantees shown as Specimen I or II annexed to this Appendix, as appropriate.

2. When the provisions laid down by national law, regulation or administrative action, or common practice so require, each country may allow the guarantee to be in a different form, on condition that it has the same legal effects as the documents shown as specimens.

Article 30

1. A comprehensive guarantee shall be lodged with an office of guarantee.

2. The office of guarantee shall determine the amount of the guarantee, accept the guarantor's undertaking and issue an authorization allowing the principal to carry out, within the limits of the guarantee, any Τ 1 operation irrespective of the office of departure.

3. Each person who has obtained authorization shall, subject to the conditions laid down by the competent authorities of the countries concerned, be issued with one or more copies of a certificate of guarantee. The design of the certificate of guarantee is laid down in Appendix II.

4. Reference to this certificate shall be made in each T 1 declaration.

Article 31

1. The office of guarantee may revoke the authorization if the conditions under which it was issued no longer exist.

2. Each country shall notify the Commission of the European Communities of any revocation of authorization.

The Commission shall communicate this information to the other countries.

Article 32

1. Each country may accept that the natural or legal third person standing as guarantor under the conditions laid down in Articles 27 and 28 guarantees, by a single guarantee and for a flat-rate amount of 7 000 ECU in respect of each declaration, payment of duties and other charges which may become chargeable in the course of a T 1 operation carried out under his responsibility, whoever the principal may be. If carriage of the goods presents increased risks, having regard in particular to the amount of duties and other charges to which they are liable in one or more countries, the flat-rate shall be fixed by the office of departure at a higher level.

The guarantee referred to in the first subparagraph shall conform to Specimen III annexed to this Appendix.

2. The exchange values in national currencies of the ECU to be applied under this Convention shall be calculated once a year.

3. The following is laid down in Appendix II:

|

(a) |

movements of goods which may give rise to an increase in the flat-rate amount, and the conditions under which such an increase shall apply; |

|

(b) |

the conditions under which the guarantee referred to in paragraph 1 shall apply to any particular T 1 operation; |

|

(c) |

the detailed rules for applying the exchange values in national currencies of the ECU. |

Article 33

1. An individual guarantee furnished for a single T 1 operation shall be lodged at the office of departure.

2. The guarantee may be a cash deposit. In such a case, the amount shall be fixed by the competent authorities of the countries concerned and the guarantee must be renewed at each office of transit within the meaning of the first indent of Article 11 (d).

Article 34

Without prejudice to national provisions prescribing other cases of exemption, the principal shall be exempted by the competent authorities of the countries concerned from payment of duties and other charges in the case of:

|

(a) |

goods which have been destroyed as a result of force majeure or unavoidable accident duly proven; or |

|

(b) |

officially recognized shortages arising from the nature of the goods. |

Article 35

The guarantor shall be released from his obligations towards the country through which goods were carried in the course of a T 1 operation when the T 1 document has been discharged at the office of departure.

When the guarantor has not been notified by the competent customs authorities of the country of departure of the non-discharge of the T 1 document, he shall likewise be released from his obligations upon expiry of a period of 12 months from the date of registration of the T 1 declaration.

Where, within the period provided for in the second subparagraph, the guarantor has been notified by the competent customs authorities of the non-discharge of the T 1 document, he must, in addition, be informed that he is or may be liable to pay the amounts for which he is liable in respect of the T 1 operation in question. This notification must reach the guarantor not later than three years after the date of registration of the T 1 declaration. Where no such notification has been made before the expiry of the aforementioned time limit, the guarantor shall likewise be released from his obligations.

Article 36

1. When it is found that, in the course of a T 1 operation, an offence or irregularity has been committed in a particular country, the recovery of duties or other charges which may be chargeable shall be effected by that country in accordance with its provisions laid down by law, regulation or administrative action, without prejudice to the institution of criminal proceedings.

2. If the place of the offence or irregularity cannot be determined, it shall be deemed to have been committed:

|

(a) |

when, in the course of a T 1 operation, the offence or irregularity is detected at an office of transit situated at an internal frontier: in the country which the means of transport or the goods have just left; |

|

(b) |

when, in the course of a T 1 operation, the offence or irregularity is detected at an office of transit within the meaning of the second indent of Article 11 (d): in the country to which that office belongs; |

|

(c) |

when, in the course of a T 1 operation, the offence or irregularity is detected in the territory of a country elsewhere than at an office of transit: in the country in which it is detected; |

|

(d) |

when the consignment has not been produced at the office of destination: in the last country which the means of transport or the goods are shown by the transit advice note to have entered; |

|

(e) |

when the offence or irregularity is detected after the T 1 operation has been concluded: in the country in which it is detected. |

Article 37

1. The T 1 documents issued in accordance with the rules, and the identification measures taken by the customs authorities of one country, shall have the same legal effects in other countries as the T 1 documents issued in accordance with the rules and the identification measures taken by the customs authorities of each of those countries.

2. The findings of the competent authorities of a country made when inspections are carried out under the T 1 procedure shall have the same force in other countries as findings of the competent authorities of each of those countries.

Article 38

(This Appendix does not contain an Article 38.)

TITLE III

T 2 PROCEDURE

Article 39

1. Any goods that are to be carried under the T 2 procedure shall be the subject, in accordance with the conditions laid down in this Convention, of a T 2 declaration to be entered on a form corresponding to the specimen forms contained in Appendix III.

The declaration referred to in subparagraph 1 shall bear the symbol ‘T 2’. In the event of use of supplementary forms, the symbol ‘T2 bis’ must be indicated on those forms.

2. The provisions of Title II shall apply mutatis mutandis to the T2 procedure.

Articles 40 and 41

(This Appendix does not contain Articles 40 and 41.)

TITLE IV

SPECIAL PROVISIONS APPLYING TO CERTAIN MODES OF TRANSPORT

Article 42

1. The railway authorities of the countries concerned shall be exempt from the requirement to furnish a guarantee.

2. The provisions of Articles 19 (2) and (3), Articles 21 and 22 shall not apply to the carnage of goods by rail.

3. For the purposes of applying Article 36 (2) (d), the records kept by the railway authorities shall be substituted for transit advice notes.

Article 43

1. No guarantee need be furnished for the carriage of goods on the Rhine and the Rhine waterways.

2. Each country may dispense with the furnishing of a guarantee in respect of the carriage of goods on other waterways situated in its territory. It shall forward details of the measures taken to that effect to the Commission of the European Communities which shall inform the other countries.

Article 44

1. Goods, the transport of which involves crossing an internal frontier within the meaning of the second subparagraph of Article 11 (g), need not be placed under the T 1 or T2 procedure before crossing the said frontier.

2. Paragraph 1 shall not apply when the carriage of goods by sea, under a single contract of carriage, is to be followed, beyond the port of unloading, by carriage by land or inland waterway under a transit procedure except when carriage beyond that port is to be effected under the Rhine Manifest procedure.

3. When goods have been placed under the T 1 or T2 procedure before crossing the internal frontier, the effect of that procedure shall be suspended during the crossing of the high seas.

4. No guarantee need be furnished for the carriage of goods by sea.

Article 45

1. The T1 or T2 procedure shall not be compulsory for the carriage of goods by air unless they are subject to measures entailing control of their use or destination.

2. In cases where a T1 or T2 procedure is used for carriage effected wholly or partly by air, no guarantee need be furnished to cover the air portion of the journey of goods carried by undertakings authorized to undertake such carriage by scheduled or non-scheduled services in countries concerned.

Article 46

1. The T1 or T2 procedure shall not be compulsory for the carriage of goods by pipeline.

2. In cases where such procedure is used for the carriage of goods by pipeline no guarantee need be furnished.

Article 47

(This Appendix does not contain an Article 47.)

TITLE V

SPECIAL PROVISIONS APPLYING TO POSTAL CONSIGNMENTS

Article 48

1. In derogation from the provisions of Article 1 the T1 or T2 procedure shall not apply to postal consignments (including postal packages).

2. (This Article does not contain paragraph 2.)

TITLE VI

SPECIAL PROVISIONS APPLYING TO GOODS CARRIED BY TRAVELLERS OR CONTAINED IN THEIR LUGGAGE

Article 49

1. The T1 or T2 procedure shall not be compulsory for the carriage of goods accompanying travellers or contained in their luggage, if the goods concerned are not intended for commercial use.

2. (This Article does not contain paragraph 2.)

Articles 50 to 61

(This Appendix does not contain Articles 50 to 61.)

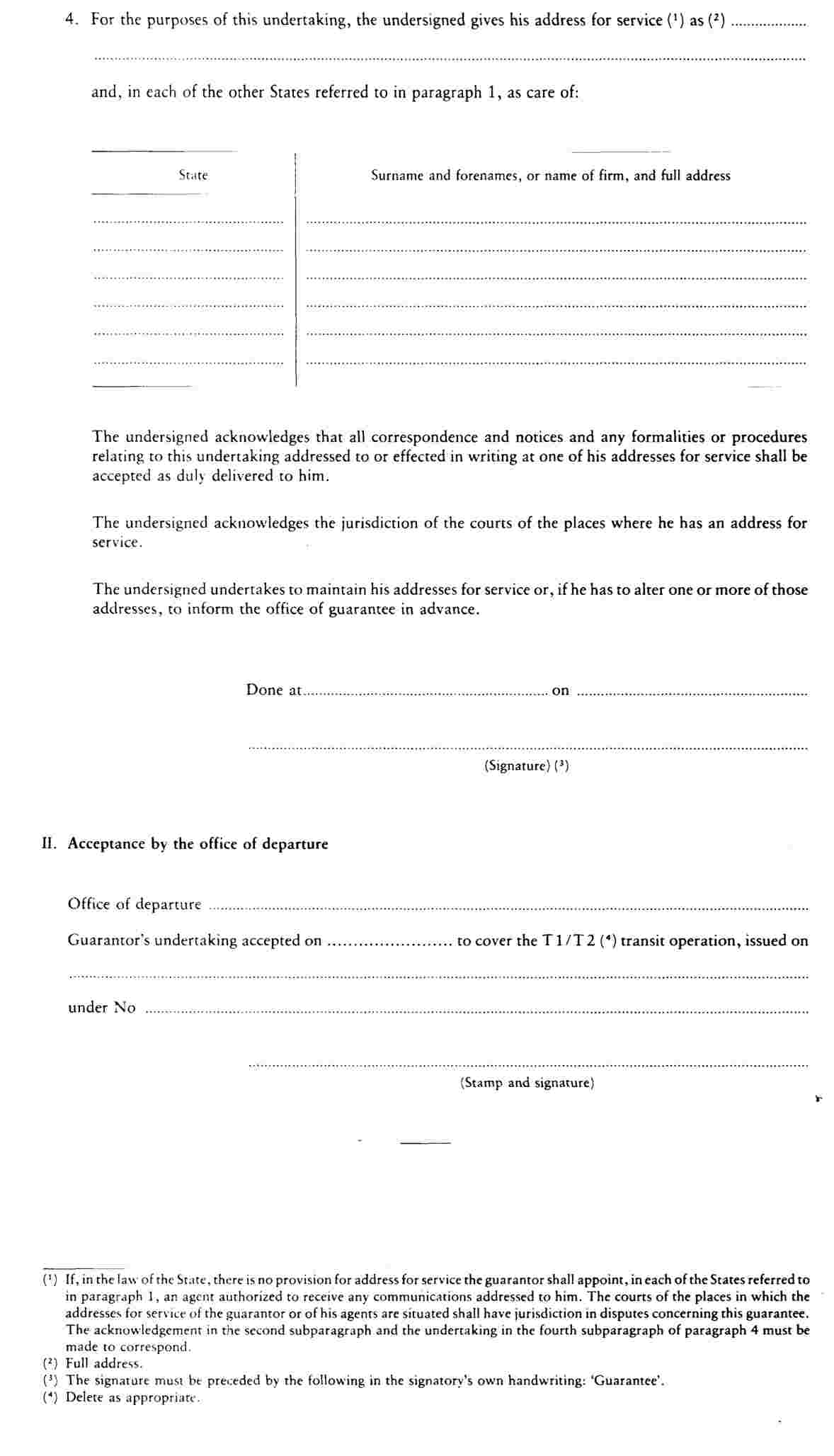

ANNEX

This Annex contains the specimens for the different guarantee systems applicable under the Common Transit Procedure and the Community Transit

SPECIMEN I

SPECIMEN II

SPECIMEN III

APPENDIX II

TITLE I

PROVISION RELATING TO FORMS AND THEIR USE IN PROCEDURE

CHAPTER I

FORMS

Enumeration of the forms

Article 1

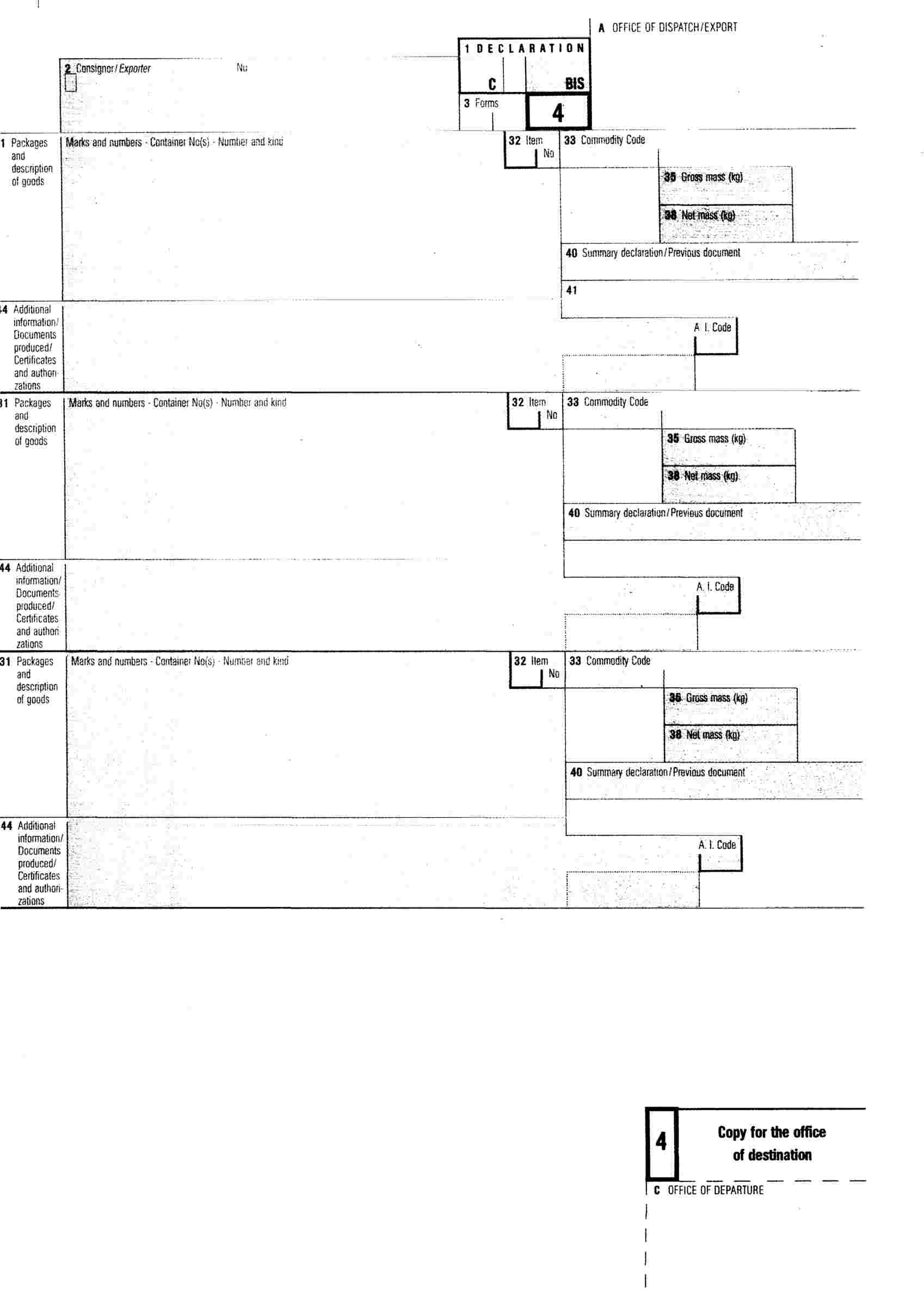

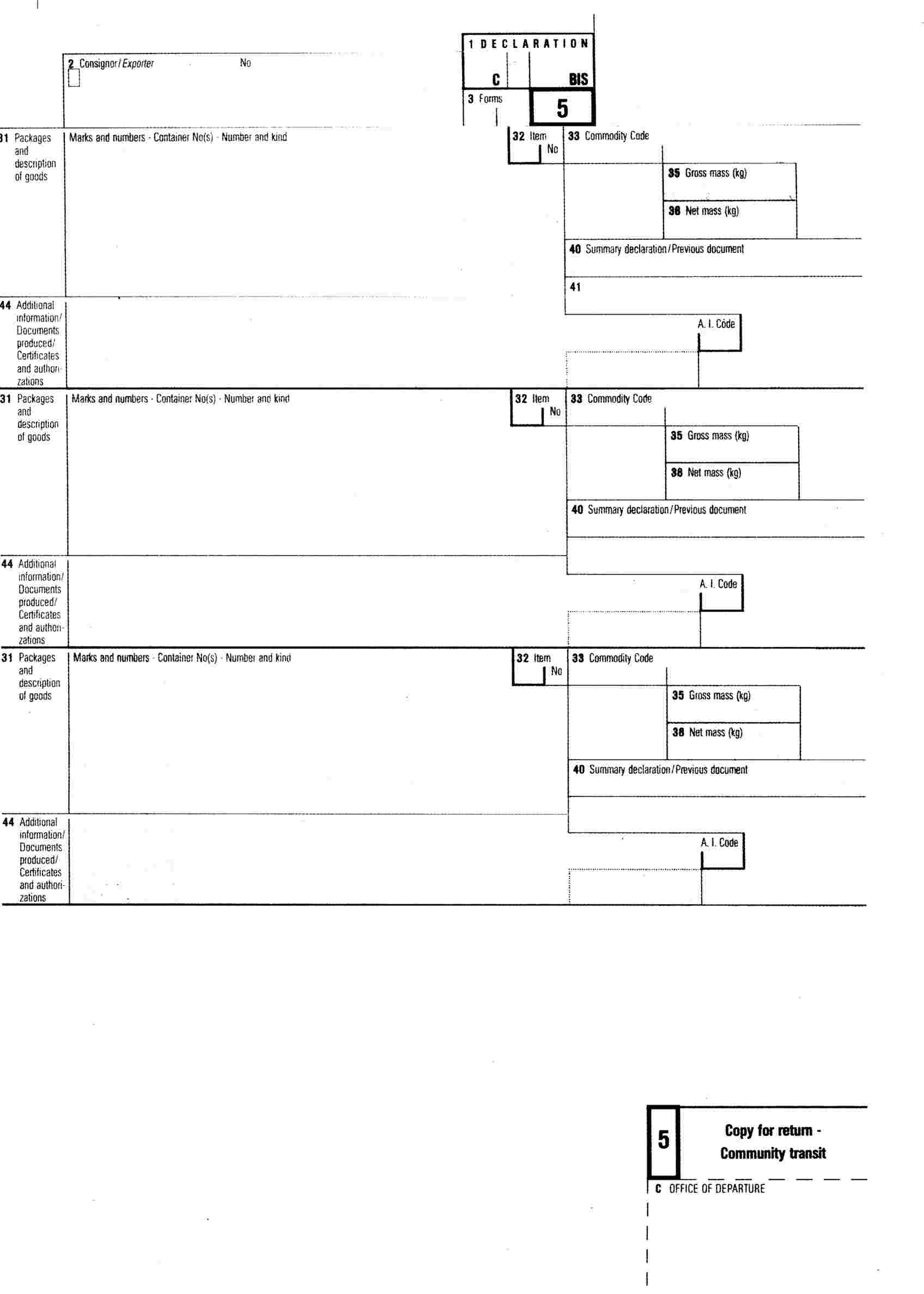

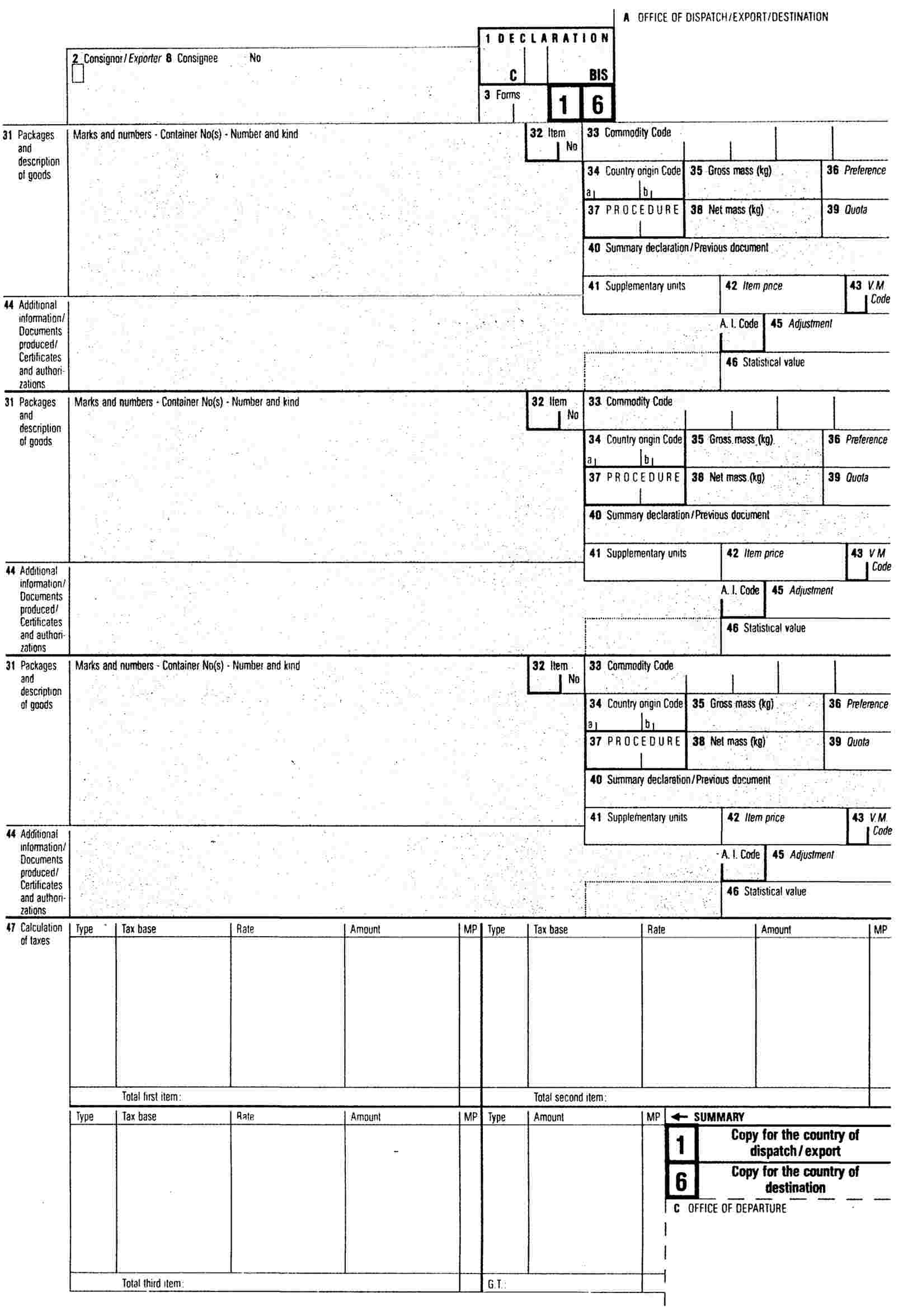

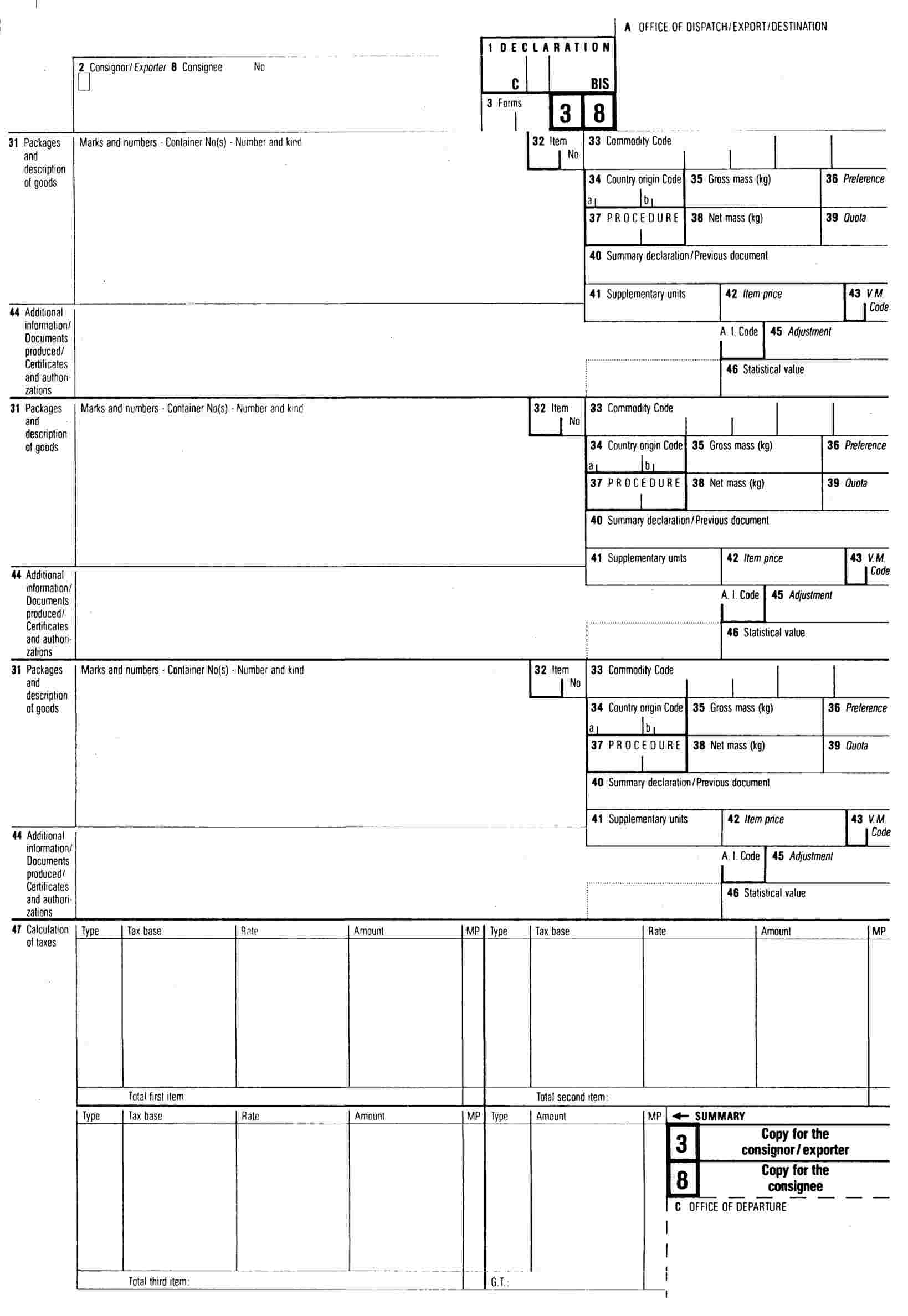

1. The forms on which T1 or T2 declarations are made shall conform to the specimens in Annexes I to IV to Appendix III.

Such declarations shall be drawn up in accordance with the rules laid down in this Convention.

2. Loading lists based on the specimen in Annex I to this Appendix may, subject to the conditions laid down in Articles 5 to 9 and Article 85, be used as the descriptive part of transit declarations. The use thereof shall be without prejudice to formalities for dispatch, export or for placing the goods under any procedure in the country of destination and the forms used for such formalities.

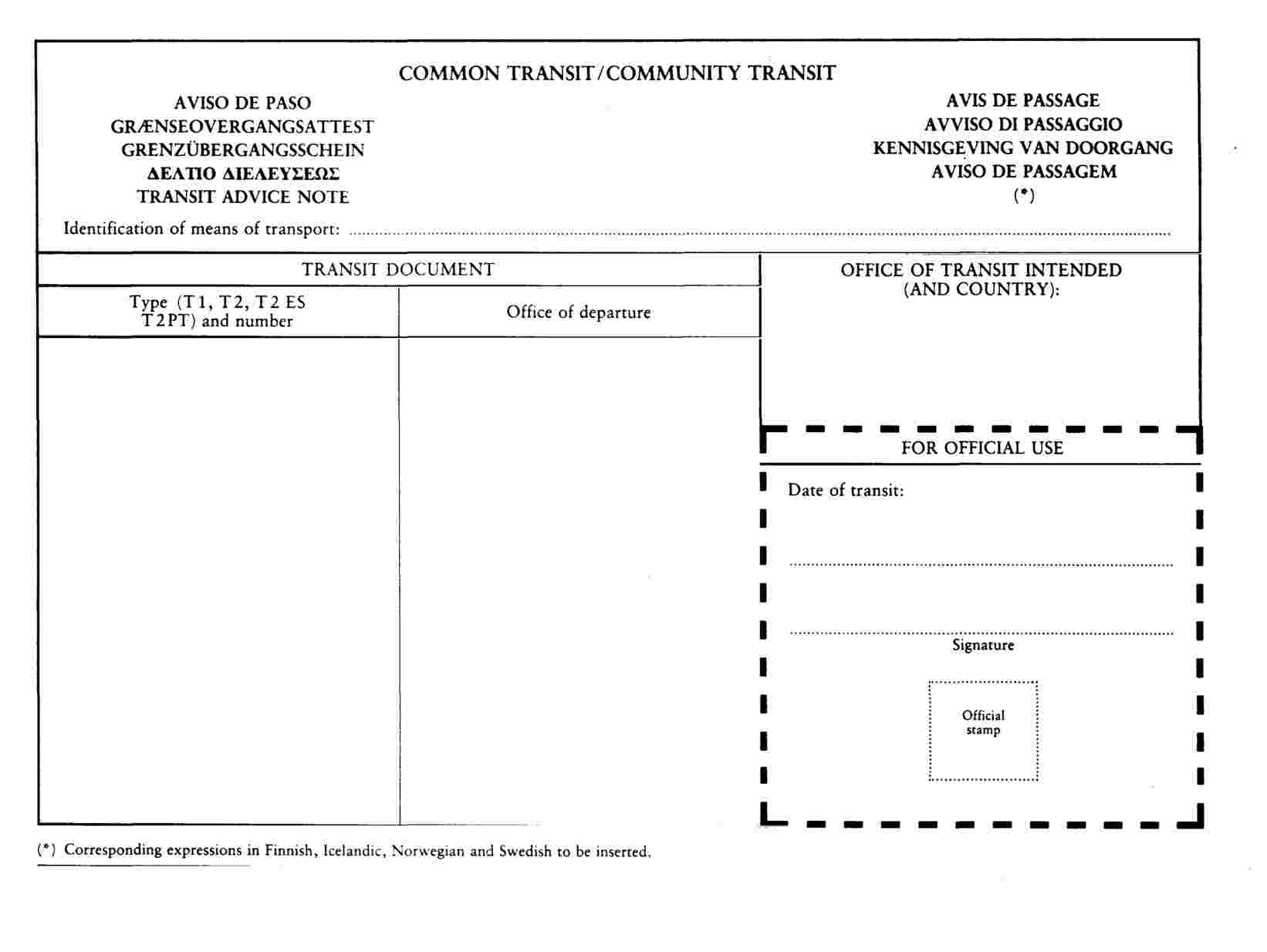

3. The form to be completed as the transit advice note for the purposes of Article 22 of Appendix I shall conform to the specimen in Annex II to this Appendix.

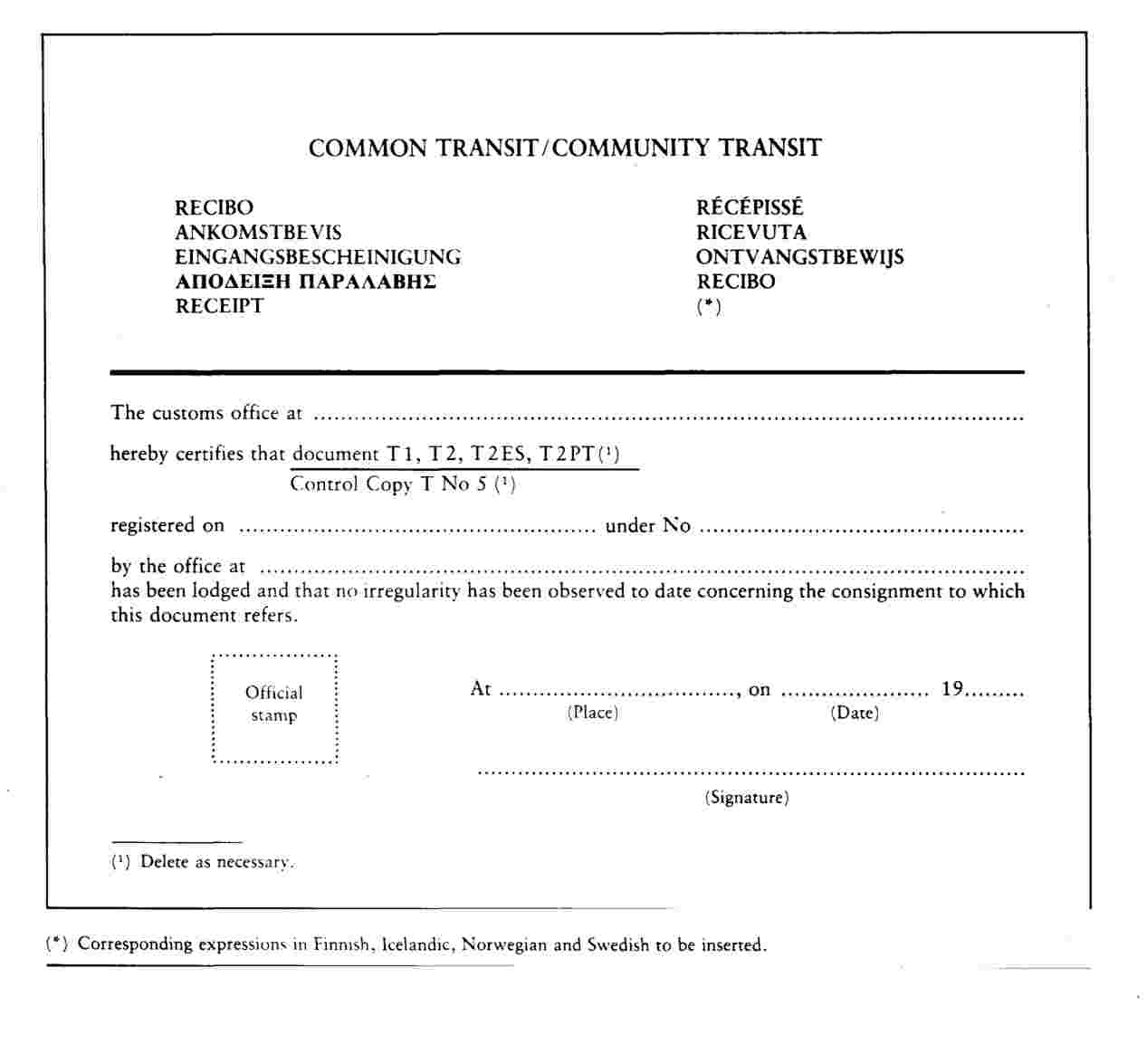

4. The form to be completed as the receipt, to certify that the T1 or T2 document and the relevant consignment have been produced at the office of destination, shall conform to the specimen in Annex HI to this Appendix. However, as regards the T1 or T2 document, the receipt on the back of the copy for return thereof may be used. The receipt shall be issued and used in accordance with Article 10.

5. The certificate of guarantee for which provision is made under Article 30 (3), of Appendix I shall conform to the specimen in Annex IV to this Appendix. The certificate shall be issued and used in acoordance with Articles 12 to 15.

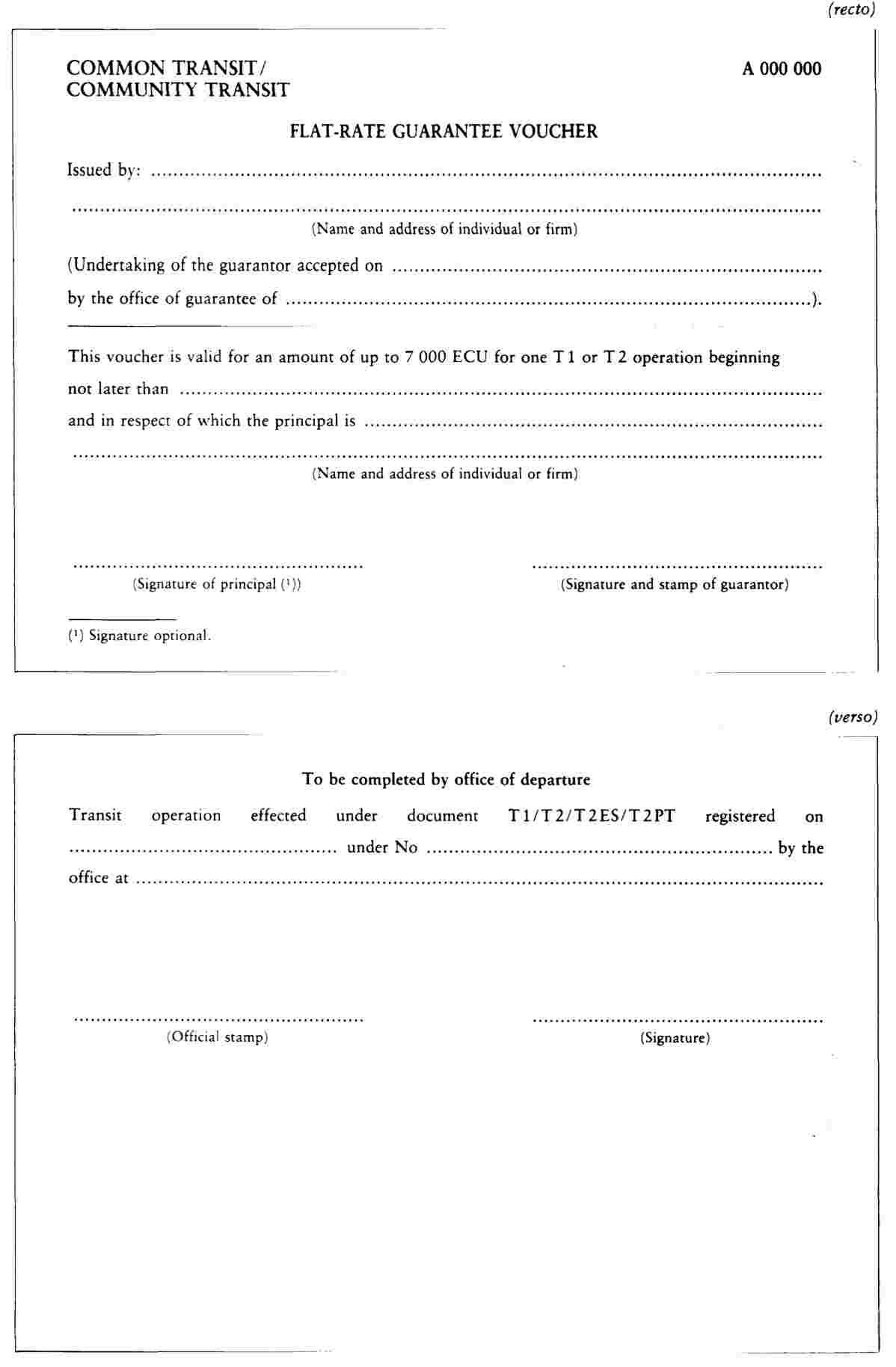

6. The flat-rate guarantee voucher shall conform to the specimen in Annex V to this Appendix. The entries on the back of this form may, however, be shown on the front above the particulars of the individual or firm issuing the voucher, the following entries remaining unchanged. The flat-rate guarantee voucher shall be issued and used in acoordance with Articles 16 to 19.

7. The document certifying the Community status of the goods — called ‘T2 L document’ — shall be drawn up on a form which conforms to copy 4 of the specimen contained in Annex I to Appendix III or to copy 4/5 of the specimen contained in Annex II to that Appendix.

That form shall be supplemented, where necessary by one or more forms which conform to copy 4 or to copy 4/5 of the specimen contained in Annexes III and IV respectively to Appendix III.

When, in the event of use of a computerized system for processing declarations which issues such declarations, the forms contained in Annexes III and IV respectively to Appendix III are not used as supplementary forms, the T2L document shall be supplemented by one or more forms which conform to copy 4 or to copy 4/5 of the specimen contained in Annexes I and II respectively to Appendix HI.

The person concerned shall enter the symbol ‘T2 L’, in the right-hand section in box 1 of the form conforming to copy 4 or to copy 4/5 of the specimen contained in Annexes I and II respectively to Appendix III. If supplementary forms are used, the person concerned shall enter the symbol ‘T2L’ in the right-hand section of box 1 of the form conforming to copy 4 or to copy 4 /5 of the specimen contained in Annexes I and III or II and IV, respectively, to Appendix III.

For the purposes of this Convention such document shall be referred to as a ‘T 2 L document’; it shall be issued and used in accordance with Title V of this Appendix.

Printing of the forms and their completion

Article 2

1. The paper used for the forms for loading lists, transit advice notes and receipts shall be dressed for writing purposes and weigh at least 40 g/m2; its strength shall be such that in normal use it does not easily tear or crease.

2. The paper used for the flat-rate guarantee voucher shall be free of mechanical pulp, dressed for writing purposes and weigh a least 55 g/m2. The paper shall have a red printed guilloche pattern background so as to reveal any falsification by mechanical or chemical means.

3. The paper used for the guarantee certificate form shall be free of mechanical pulp and weigh not less than 100 g/m2. It shall have a guilloche pattern background, printed in green on both sides, so as to reveal any falsification by mechanical or chemical means.

4. The paper referred to in paragraphs 1,2 and 3 shall be white, except for the loading lists referred to in Article 1 (2), for which the colour of the paper may be left to the choice of the user.

5. The sizes of the forms shall be:

|

(a) |

210 x 297 mm for the loading list, a tolerance in the length of - 5 or + 8 mm being allowed; |

|

(b) |

210 x 148 mm for the transit advice note and the guarantee certificate; |

|

(c) |

148 x 105 mm for the receipt and flat-rate guarantee voucher; |

6. The declarations and documents shall be drawn up in one of the official languages of the Contracting Parties which is acceptable to the competent authorities of the country of departure. This provision shall not apply to flat-rate guarantee vouchers.

The competent authorities of another country in which the declarations and the documents must be presented may, as necessary, require a translation into the language, or one of the official languages, of that country.

The language to be used for the guarantee certificate shall be designated by the competent authorities of the country responsible for the office of guarantee.

7. The flat-rate guarantee vouchers shall show the name and address of the printer or a mark enabling the printer to be identified. The flat-rate guarantee vouchers shall be serially numbered as a means of identification.

8. The Contracting Parties shall be responsible for the printing of the forms of the certificate of guarantee. Each certificate must be numbered for purposes of identification.

9. The forms of the certificate of guarantee and flat-rate guarantee vouchers shall be completed using a typewriter or a mechanical or similar process.

Loading lists, transit advice notes and receipts may be completed using a typewriter or a mechanical or similar process, or legibly in manuscript; in the latter case they shall be completed in ink and in block letters.

No erasures or alterations shall be made. Amendments shall be made by striking out the incorrect particulars and, where appropriate, adding those required. Any such amendments shall be initialled by the person making the amendment and authenticated by the competent authorities.

CHAPTER II

USE OF FORMS

T 1 and T 2 declarations

Mixed consignments

Article 3

1. The copies constituting the forms on which T 1 or T 2 declarations are made are described in the explanatory note contained in Annex VII to Appendix III, and shall be completed in accordance with that explanatory note.

Where any of the particulars to be given in those forms must appear in code form, the codes in question shall comply with the details given in Annex IX to Appendix III.

2. Where goods are to move under the T 1 procedure, the principal shall enter the symbol ‘T 1’ in the right-hand section of box 1 of a form which conforms to the specimen contained in Annexes I and II to Appendix III. Where supplementary forms are used, the principal shall enter the symbol ‘T 1 bis’ in the right-hand section of box 1 of one or more forms conforming to the specimen contained in Annexes III and IV to Appendix III.

When, in the event of use of a computerized system for processing declarations which issues such declarations, the supplementary forms used conform to the specimen contained in Annexes I or II to Appendix III the symbol ‘T 1 bis’ shall be entered in the right-hand section of box 1 of the said forms.

Where goods are to move under the T 2 procedure, the principal shall enter the symbol ‘T 2’ in the right-hand section of box 1 of a form which conforms to the specimen contained in Annexes I and II to Appendix III. Where supplementary forms are used, the principal shall enter the symbol ‘T 2 bis’ in the right-hand section of box 1 of one or more forms conforming to the specimen contained in Annexes III and IV to Appendix III.

When, in the event of use of a computerized system for processing declarations which issues such declarations, the supplementary forms used conform to the specimen contained in Annexes I or II to Appendix III, the symbol ‘T 2 bis’ shall be entered in the right-hand section of box 1 of the said forms.

3. In the case of consignments containing at the same time goods moving under the T 1 procedure and goods moving under the T 2 procedure, supplementary documents which conform to the specimen contained in Annexes III and IV or, where appropriate, Annexes I and II to Appendix III and which bear the symbols ‘T 1 bis’ or ‘T 2 bis’, respectively, may be attached to a single form which conforms to the specimen contained in Annexes I and II to Appendix III. In this case, the symbol ‘T’ shall be entered in the right-hand section in box 1 of the said form; the blank space following the symbol ‘T’ should be crossed out; in addition, the boxes 32 ‘Item No’, 33 ‘Commodity code’, 35 ‘Gross mass (kg)’, 38 ‘Net mass (kg)’ and 44 ‘Additional information /Documents produced /Certificates and authorizations’ shall be barred. A reference to the serial numbers of the supplementary documents bearing the symbol ‘T 1 bis’ and the supplementary documents bearing the symbol ‘T 2 bis’ shall be entered in the box 31 ‘Packages and description of goods’ of the form conforming to the specimen contained in Annexes I and II to Appendix III.

4. When one of the symbols referred to in paragraph 2 has been omitted from the right-hand section in box 1 of the form used or when, in the case of consignments containing at the same time goods moving under the T 1 procedure and goods moving under the T 2 procedure, the provisions of paragraph 3 and of Article 5, paragraph 7, have not been complied with, goods under cover of such documents shall be deemed to be moving under the T 1 procedure.

Production of the dispatch or export declaration with the transit declaration

Article 4

Without prejudice to any measures of simplification applicable, the customs document for the dispatch or redispatch of goods or the customs document for the exportation or re-exportation of goods or any document having equivalent effect shall be presented to the office of departure together with the transit declaration to which it relates.

For the purposes of the preceding subparagraph and without prejudice to Article 7 (3), of the Convention, the declaration of dispatch or redispatch or the export or re-export declaration on the one hand, and the transit declaration on the other, may be combined on a single form.

Loading Lists

Mixed consignments

Article 5

1. Where the principal uses loading lists for a consignment comprising two or more types of goods, the boxes 15 ‘Country of dispatch /export’, 32 ‘Item No’, 33 ‘Commodity code’, 35 ‘Gross mass (kg)’, 38 ‘Net mass (kg)’ and where necessary, 44 ‘Additional information /Documents produced /Certificates and authorizations’ of the form used for the purposes of transit shall be barred and the box 31 ‘Packages and description of goods’ of that form shall not be used to show the marks and numbers, number and kind of the packages and description of goods. In this case, supplementary forms must not be used.

2. The loading list referred to in Article 1 (2) means any commercial document which complies with the conditions laid down in Article 2 (1), (5) (a), (6), first and second subparagraphs, (9), second and third subparagraphs and Articles 6 and 7.

3. The loading list shall be produced in the same number of copies as the form used for transit purposes to which it relates and shall be signed by the person signing that form.

4. When the declaration is registered, the loading list must bear the same registration number as the form used for transit purposes to which it related. That number must be printed either by means of a stamp incorporating the name of the office of departure or by hand. In the latter case it must be accompanied by the office stamp.

The signature of an official of the office of departure shall be optional.

5. Where two or more loading lists accompany a single form used for transit purposes, each must bear a serial number allotted by the principal; the number of accompanying loading lists shall be shown in the box ‘Loading lists’ of the said form.

6. A declaration on a form which conforms to the specimen in Annexes I and II to Appendix III, bearing the symbol ‘T 1’ or ‘T 2’ in the right-hand space of box 1 and accompanied by one or more loading lists complying with the conditions laid down in Articles 6 to 9 shall, as appropriate, be treated as equivalent to a T 1 declaration or a T 2 declaration for the purposes of Article 12 or Article 39 of Appendix I.

7. In case of consignments contained at the same time goods moving under the T 1 procedure and goods moving under the T 2 procedure, separate loading lists must be completed and may be attached to a single form conforming to the specimen in Annexes I or II to Appendix III.

In that case, the symbol ‘T’ shall be entered in the right-hand space of box 1 of the said form. The blank space behind the symbol ‘T’ should be crossed out; in addition, the boxes 15 ‘Country of dispatch /export’, 32 ‘Item No’, 33 ‘Commodity code’, 35 ‘Gross mass (kg)’, 38 ‘Net mass (kg)’, and where necessary, 44 ‘Additional information /Documents produced /Certificates and authorizations’ shall be barred. A reference to the serial numbers of the loading lists relating to each of the two types of goods shall be entered in box 31 ‘Packages and description of goods’ of the form used.

Article 6

The loading list shall include:

|

(a) |

the heading ‘Loading list’; |

|

(b) |

a box, 70 x 55 mm, divided into a top part 70 x 15 mm for the insertion of the symbol ‘T’ followed by one of the endorsements referred to in Article 3, paragraph 2, and a lower part 70 x 40 mm for the references referred to in Article 5, paragraph 4; |

|

(c) |

columns, in the following order and headed as shown:

|

The width of the columns may be adapted as necessary, except that the width of the column headed ‘Reserved for customs’ shall be not less than 30 mm. Spaces not reserved for a particular purpose under subparagraphs (a) to (c) above may also be used.

Article 7

1. Only the front of the form may be used as a loading list.

2. Each item shown on the loading list must be preceded by a serial number.

3. (This Article does not contain paragraph 3.)

4. A horizontal line must be drawn after the last entry and the remaining unused spaces barred so that any subsequent addition is impossible.

Article 8

1. The customs authorities of each country may allow firms established in their country whose records are based on an electronic or automatic data-processing system to use loading lists as referred to in Article 1 (2), which, although not complying with all the conditions of Article 2(1), (5) (a) and (9), last two subparagraphs, and of Article 6, are designed and completed in such a way that they can be used without difficulty by the customs and statistical authorities in question.

2. For each item such loading lists must always include the number, kind and marks and numbers of packages, the description of goods, gross mass in kilograms and the country of dispatch/export.

Article 9

1. Where Articles 29 to 61 operate, Article 5, (2), and Articles 6, 7 and 8 shall apply to loading lists which accompany the International Consignment Note or the TR Transfer Note. In the former case, the number of such lists shall be shown in box 32 of the International Consignment Note; in the latter case, the number of such lists shall be shown in the box for particulars of accompanying documents of the TR Transfer Note.

In addition, the loading list must include the wagon number to which the International Consignment Note refers or, where appropriate, the number of the container containing the goods.

2. For operations beginning within the territory of the Contracting Parties comprising at the same time goods moving under the T1 procedure and goods moving under the T 2 procedure, separate loading lists shall be used; in the case of goods carried in large containers under cover of TR Transfer Notes, such separate lists shall be completed for each large container, which contains both categories of goods.

For transport operations beginning in the Community the serial numbers of the loading lists relating to goods moving under the T1 procedure shall be inserted, as appropriate:

|

(a) |

in box 25 of the International Consignment Note; |

|

(b) |

in the box reserved for the description of the goods of the TR Transfer Note. |

For transport operations beginning in an EFTA country, a reference to the serial numbers of the loading lists relating to the goods moving under the T2 procedure shall be inserted, as appropriate:

|

(a) |

in box 25 of the International Consignment Note; |

|

(b) |

in the box reserved for the description of the goods of the TR Transfer Note. |

3. In the circumstances referred to in paragraphs 1 and 2 and for the purposes of the procedures provided for in Articles 29 to 61, the loading lists accompanying the International Consignment Note or the TR Transfer Note shall form an integral part thereof and shall have the same legal effects.

The original of such loading lists shall bear the stamp of the station of dispatch.

Receipt

Article 10

1. Any person who delivers to the office of destination a T 1 or T 2 document together with the consignment to which that document relates may obtain a receipt on request.

2. The receipt shall first be completed by the person concerned and may contain other particulars relating to the consignment, except in the space reserved for customs, but the customs certification shall be valid only in respect of the particulars contained in that space.

Return of the documents

Article 11

Each country shall have the right to designate one or more central offices to which documents shall be returned by the competent customs office in the country of destination. Countries shall, after appointing such offices for that purpose, inform the Commission of the European Communities and specify the category of documents to be returned thereto. The Commission shall in turn notify the other countries.

TITLE II

PROVISIONS RELATING TO GUARANTEES

COMPREHENSIVE GUARANTEE

Certificate of guarantee

Article 12

1. The principal shall, on issue of the certificate of guarantee or at any time during the validity thereof, designate on his own responsibility on the reverse of the certificate, the person, or persons, authorized to sign T 1 or T 2 declarations on his behalf. The particulars shall include the surname and forename of each authorized person followed by the signature of that person. Each nomination of an authorized person must be acknowledged by the signature of the principal. The principal shall be entitled at his discretion to cross through the unused boxes.

2. The principal may at any time delete the name of an authorized person from the reverse of the certificate.

Article 13

Any person named on the reverse of a certificate of guarantee presented at an office of departure shall be considered the authorized agent of the principal.

Article 14

The period of validity of a certificate of guarantee may not exceed two years. However, this period may be extended by the office of guarantee for one further period not exceeding two years.

Article 15

If the guarantee is cancelled the principal shall be responsible for returning to the office of guarantee forthwith all the certificates of guarantee issued to him which are still valid.

Flat-rate guarantee

Article 16

1. When a natural or legal person proposes to stand surety under the conditions referred to in Articles 27 and 28 of and on the terms laid down in Article 32 (1), of Appendix I, the guarantee shall be given in the form as shown in Specimen III annexed to Appendix I.

2. Where national law, administrative practice or accepted usage so requires, each country may require the use of a different form of guarantee provided it has the same legal effect as the guarantee referred to in paragraph 1.

Article 17

1. The acceptance of the guarantee referred to in Article 16 by the customs office where it is given (hereinafter referred to as ‘the office of guarantee’) shall be the guarantor's athority to issue, under the terms of the guarantee, a flat-rate guarantee voucher or vouchers to persons who intend to act as principal in a T 1 or T 2 operation from an office of departure of their choice.

The guarantor may issue flat-rate guarantee vouchers:

|

— |

which are not valid for a T 1 or T 2 operation in respect of goods which are listed in Annex VII to this Appendix, and |

|

— |

which may be used in multiples of up to seven vouchers per means of transport as referred to in Article 16 (2), of Appendix I for goods other than those referred to in the previous indent. |

For this purpose the guarantor shall mark such flat-rate guarantee vouchers diagonally in capital letters with one of the following statements, adding a reference to this subparagraph:

|

— |

VALIDEZ LIMITADA |

|

— |

BEGRÆNSET GYLDIGHED |

|

— |

BESCHRÄNKTE GELTUNG |

|

— |

ΠΕΡΙΟΡΙΣΜΕΝΗ ΙΣΧΥ · |

|

— |

LIMITED VALIDITY |

|

— |

VALIDITÉ LIMITÉE |

|

— |

VALIDITÀ LIMITATA |

|

— |

BEPERKTE GELDIGHEID |

|

— |

VALIDADE LIMITADA |

|

— |

VOIMASSA RAJOITETUSTI |

|

— |

TAKMARKAD GILDISSVID |

|

— |

BEGRENSET GYLDIGHET |

|

— |

BEGRÄNSAD GILTIGHET |

The cancellation of a guarantee shall be notified forthwith to the other countries by the country in which the relevant office of guarantee is located.

2. The guarantor shall be liable up to an amount of 7 000 ECU in respect of each flat-rate guarantee voucher.

3. Without prejudice to the provisions in the second and third subparagraphs of paragraph 1 and in Article 18, the principal may carry out one T 1 or T 2 operation under each flat-rate guarantee voucher. The voucher shall be delivered to the office of departure, where it shall be retained.

Article 18

1. Except in the cases referred to in paragraphs 2 and 3, the office of departure may not require a guarantee in excess of the flat-rate amount of 7 000 ECU for each T 1 or T2 declaration, irrespective of the amount of the duties and other charges to which the goods covered by a particular declaration may be liable.

2. When, because of circumstances peculiar to it, a transport operation involves increased risks and the office of departure therefore considers that the guarantee of 7 000 ECU is clearly insufficient, it may exceptionally require a guarantee of greater amount in multiples of 7 000 ECU.

3. The carriage of goods listed in Annex VII to this Appendix shall give rise to an increase in the amount of the flat-rate guarantee when the quantitiy of goods carried exceeds the quantity corresponding to the flat-rate amount of 7 000 ECU.

In that case, the flat-rate amount shall be increased to the multiple of 7 000 ECU necessary to guarantee the quantity of goods to be dispatched.

4. The principal shall, in the cases referred to in paragraphs 2 and 3, deliver to the office of departure flat-rate guarantee vouchers corresponding to the required multiple of 7 000 ECU.

5. The exchange value in a national currency of the amounts expressed in ECU referred to in this Appendix shall be calculated by using the exchange rate in force on the first working day of the month of October, and shall be applied from 1 January of the following year.

If a rate is not available for a particular national currency the rate to be applied for that currency shall be that obtaining on the last day for which a rate was published.

The exchange value of the ECU to be used in applying the first subparagraph shall be that which was applicable on the date on which the T 1 or T 2 declaration covered by the flat-rate guarantee voucher or vouchers was registered.

Article 19

1. When the T 1 or T2 declaration includes other goods besides those shown in the list referred to in Article 18, paragraph 3, the flat-rate guarantee provisions shall be applied as if the two categories of goods were covered by separate declarations.

2. By way of derogation from paragraph 1, account shall not be taken of the presence of goods of either category if the quantity or value thereof is relatively insignificant.

TITLE III

Articles 20 to 27

(This Appendix does not contain Articles 20 to 27.)

TITLE IV

SIMPLIFIED PROCEDURES

Rules not affected by this Title

Article 28

This Title shall be without prejudice to obligations in respect of the formalities for dispatch, export or for placing the goods under any procedure in the country of destination.

CHAPTER I

TRANSIT PROCEDURE FOR THE CARRIAGE OF GOODS BY RAIL

General provisions relating to carriage by rail

Article 29

Formalities under the T 1 or T 2 procedure shall be simplified in accordance with Articles 30 to 43 and 59 to 61 for the carriage of goods by railway authorities under cover of an International Consignment Note (CIM) or International Express Parcels Consignment Note (TIEx).

Article 30

The International Consignment Note or the International Express Parcels Consignment Note shall be treated as equivalent to a T 1 or a T 2 declaration as the case may be.

Article 31

The railway authorities of each country shall make available to the customs authorities of their country for purposes of control the records held at their accounting offices.

Article 32

1. The railway authorities which accept the goods for carriage accompanied by an International Consignment Note or International Express Parcels Consignment Note shall be the principal as regards the T 1 or T2 procedure concerned.

2. The railway authorities of the country through whose territory the goods enter the territory of the Contracting Parties shall be the principal as regards the T 1 or T 2 procedure in respect of goods accepted for carriage by the railway authorities of a third country.

Article 33

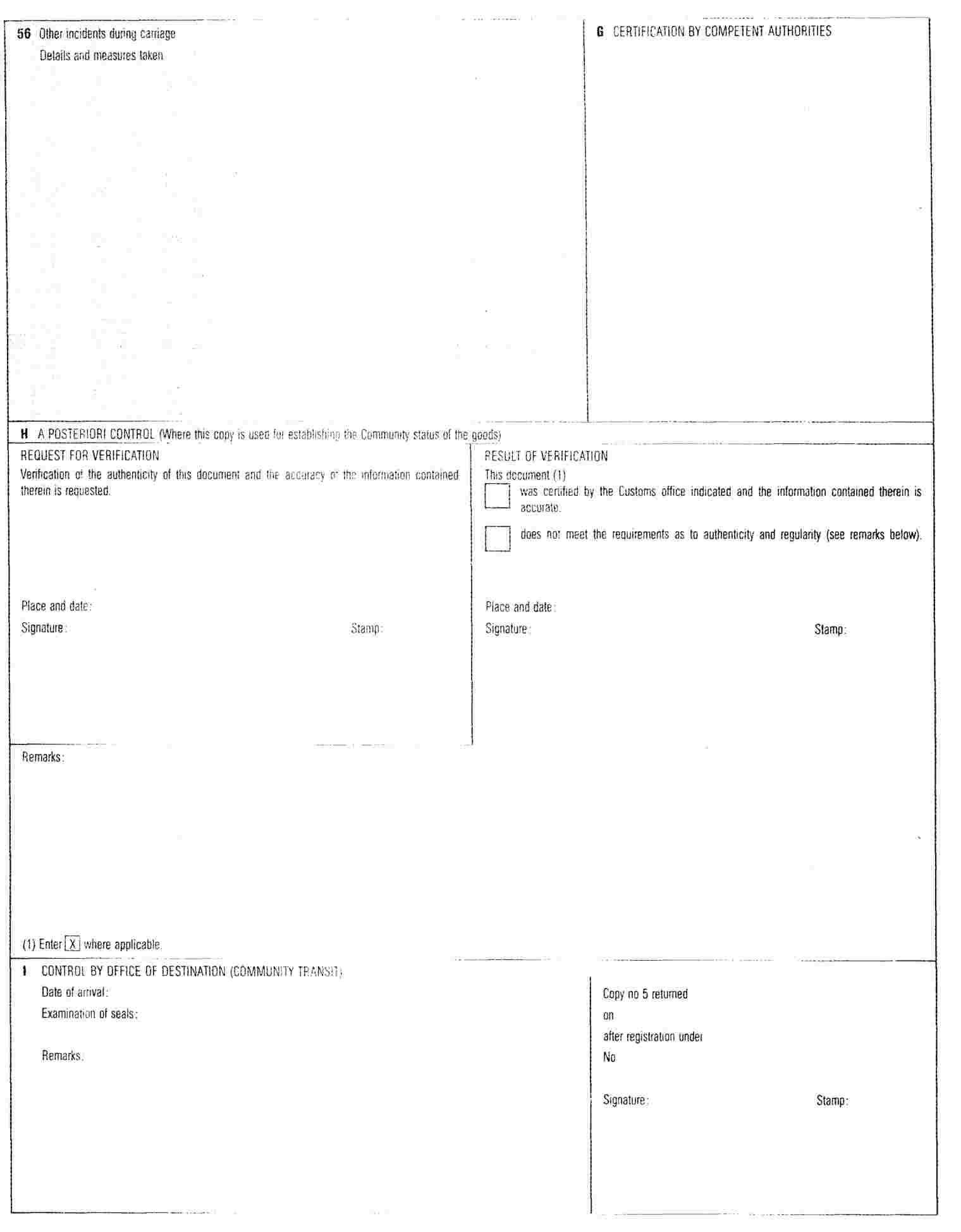

The railway authorities shall ensure that consignments carried under the T 1 or T 2 procedure are identified by labels bearing a pictogram, a specimen of which is shown in Annex VIII to this Appendix.

The labels shall be affixed to the International Consignment Note or to the International Express Parcels Consignment Note and to the relevant railway wagon in the case of a full load or in other cases, to the package or packages.

Article 34

When the contract of carriage is modified so that:

|

— |

a carriage operation which was to end outside the territory of a Contracting Party ends within the territory of that Contracting Party, |

|

— |

a carriage operation which was to end within the territory of a Contracting Party ends outside the territory of that Contracting Party, |

the railway authorities shall not carry out the modified contract except with the prior agreement of the office of departure.

When the contract of carriage is modified so that the carriage operation is ended within the country of departure, the modified contract shall be carried out subject to conditions to be determined by the customs authorities of that country.

In all other cases, the railway authorities may carry out the modified contract; they shall forthwith inform the office of departure of the modification made.

Movement of goods between Contracting Parties

Article 35

1. The International Consignment Note shall be produced at the office of departure in respect of a carriage which starts and is to end within the territory of the Contracting Parties.