EUROPEAN COMMISSION

EUROPEAN COMMISSION

Brussels, 14.7.2021

SWD(2021) 631 final

COMMISSION STAFF WORKING DOCUMENT

IMPACT ASSESSMENT

Accompanying the

Proposal for a Regulation of the European Parliament and of the Council

on the deployment of alternative fuels infrastructure, and repealing Directive 2014/94/EU of the European Parliament and of the Council

{COM(2021) 559 final} - {SEC(2021) 560 final} - {SWD(2021) 632 final} - {SWD(2021) 637 final} - {SWD(2021) 638 final}

Table of contents

1.Introduction: Political and legal context

1.1.Political context

1.2.Legal context

1.3.Policy context

1.4.Evaluation of the existing Directive

2.Problem definition

2.1.What are the problems and their implications?

2.1.1.Lack of ambition and coherence in MS infrastructure planning leading to insufficient and unevenly distributed infrastructure

2.1.2.Interoperability issues persist in terms of physical connections and communication standards

2.1.3.Publicly accessible infrastructure does not fully correspond to user needs

2.2.What are the problem drivers?

2.2.1.Lack of binding provisions leads to different ambitions by Member States

2.2.2.Setting of targets by Member states not consistent with market developments and GHG reduction ambition

2.2.3.Implementation fails to consider necessary requirements/standards for ensuring full interoperability

2.2.4.Lack of user information about and at refuelling and recharging points

2.2.5.No uniform ad hoc payment method available at all recharging points

2.3.How will the problem evolve?

2.3.1.Lack of ambition and coherence in MS infrastructure planning leading to insufficient and unevenly distributed infrastructure

2.3.2.Interoperability issues persist in terms of physical connections and communication standards

2.3.3.Publicly accessible infrastructure does not fully correspond to user needs

3.Why should the EU act?

3.1.Legal basis

3.2.Subsidiarity: Necessity of EU action

3.3.Subsidiarity: Added value of EU action

4.Objectives: What is to be achieved?

4.1.General objectives

4.2.Specific objectives

5.What are the available policy options?

5.1.What is the baseline from which options are assessed?

5.2.Policy measures and policy options

5.2.1.Discarded policy measures

5.2.2.Retained policy measures and policy options overview

5.3.Description of policy options

5.3.1.Policy option 1

5.3.2.Policy Option 2

5.3.3.Policy Option 3

5.4.Discarded Policy Options

6.What are the impacts of the policy options?

6.1.Economic impacts

6.1.1.Impact on alternative fuels vehicles and infrastructure markets

6.1.2.Administrative burden for public authorities

6.1.3.Infrastructure costs

6.1.4.Costs and benefits on vehicle and vessel manufacturers

6.1.5.Impacts on SMEs / professional vehicle users and businesses

6.1.6.Functioning of the internal market and competition

6.1.7.Impact on innovation and industry competitiveness

6.2.Social impacts

6.2.1.Impacts on households and consumers

6.2.2.Impacts on employment and social skills

6.2.3.Impact on persons with disabilities and those with reduced mobility

6.2.4.Impact on public health

6.3.Environmental impacts

6.3.1.CO2 emission reduction

6.3.2.Air pollutants emission reduction

7.How do the options compare?

7.1.Effectiveness

7.2.Efficiency

7.3.Coherence

7.4.Proportionality and subsidiarity

7.5.Summary of comparison of options, including stakeholder views

7.6.Infrastructure needs depending on the level of stringency of CO2 standards for LDVs

7.7.Sensitivity analysis on sufficiency and share of fast chargers

7.8.Sensitivity analysis on the requirements for HDVs charging points

8.Preferred option

8.1.Context

8.2.Identifying the preferred option

8.3.REFIT (simplification and improved efficiency)

9.How will actual impacts be monitored and evaluated?

Annex 1: Procedural information

Annex 2: Stakeholder consultation

Annex 3: Who is affected and how?

Annex 4: Analytical methods

Annex 5: Methodology for the definition of policy options and measures

Glossary

|

Term or acronym

|

Meaning or definition

|

|

ACEA

|

European Automobile Manufacturers Association

|

|

AFI

|

Alternative Fuels Infrastructure

|

|

AFID

|

Alternative Fuels Infrastructure Directive 2014/94/EU

|

|

AFV

|

Alternatively Fuelled Vehicle

|

|

BEV

|

Battery Electric Vehicle

|

|

CNG

|

Compressed Natural Gas

|

|

EMSP

|

Electric Mobility Service Provider

|

|

ESR

|

Effort Sharing Regulation

|

|

ETS

|

EU Emission Trading System

|

|

EV

|

Electric Vehicle: covers BEV, FCEV and PHEV

|

|

FCEV

|

Fuel Cell Electric Vehicle

|

|

FQD

|

Fuel Quality Directive 98/70/EC

|

|

GDP

|

Gross Domestic Product

|

|

GHG

|

Greenhouse gas(es)

|

|

HDV

|

Heavy-Duty Vehicles, i.e. lorries, buses and coaches (vehicles of more than 3.5 tons)

|

|

HEV

|

(Not Off-Vehicle Charging) Hybrid Electric Vehicle (so not including PHEV)

|

|

ESO

|

European Standardisation Organisations

|

|

FEGP

|

Fixed Electrical Ground Power

|

|

ICEV

|

Internal Combustion Engine Vehicle

|

|

IEA

|

International Energy Agency

|

|

LCA

|

Life-Cycle Assessment

|

|

LCV

|

Light Commercial Vehicle(s): van(s)

|

|

LDV

|

Light-Duty Vehicle(s), i.e. passenger car(s) and light commercial vehicle(s) (van(s))

|

|

LPG

|

Liquefied Petroleum Gas

|

|

LNG

|

Liquefied Natural Gas

|

|

NEDC

|

New European Driving Cycle

|

|

NGO

|

Non-Governmental Organisation

|

|

NIR

|

National Implementation Report

|

|

NOx

|

Nitrogen oxides (nitric oxide (NO) and nitrogen dioxide (NO2))

|

|

NPF

|

National Policy Framework

|

|

OPS

|

Onshore Power Supply

|

|

PHEV

|

Plug-in Hybrid Electric Vehicle

|

|

PM

|

Particulate matter

|

|

RED II

|

Renewable Energy Directive (EU) 2018/2001

|

|

STF

|

Sustainable Transport Forum

|

|

WLTP

|

Worldwide Harmonised Light Vehicles Test Procedure

|

1.Introduction: Political and legal context

1.1.Political context

The European Green Deal

puts climate action at its core, by setting an EU climate neutrality objective by 2050. The Commission proposal for a European Climate Law turns this commitment into a legally binding target and also proposes a new colletive , net greenhouse gas emissions reduction target of at least 55% below 1990 levels by 2030 for the Union. The European Parliament and the Council have found a provisional political agreement on the European Climate Law setting into law the objective of a climate-neutral EU by 2050 and of the collective net greenhouse gas emission reuction target of at least 55% by 2030.

The Commission’s Communication on a Sustainable and Smart Mobility Strategy confirms the ambition of the European Green Deal to achieve a 90% reduction in the transport sector emissions by 2050 and sets out various milestones to show the sectors path towards achieving this objective. Those include among others the ambition to have at least 30 million zero-emission cars and 80,000 zero-emission lorries in operation by 2030 and that by 2050 nearly all cars, vans, buses as well as new heavy-duty vehicles will be zero-emission. This is also in line with the Zero Pollution ambition set up by the European Green Deal.

A comprehensive and easy to use network of recharging and refuelling infrastructure is a prerequisite to enable the widespread uptake of zero- and low-emission vehicles. Such an achievement is also of central relevance to the recovery of the European economy after the COVID pandemic – in particular of the automotive sector – and reflected accordingly in the Annual Growth Strategy 2021 under the ‘recharge and refuel’ flagship initiative.

This impact assessment addresses the needs, options and benefits for revising Directive 20014/94/EU on the deployment of alternative fuels infrastructure (AFID, in the following: the Directive) in order to ensure the necessary deployment of interoperable and user-friendly public accessible infrastructure for recharging and refuelling zero- and low-emission vehicles.

This initiative forms part of the overall effort to bring the Union on track to climate-neutrality, deliver on the long-term climate, environmental and energy objectives and build back better in terms of economic recovery, among other. It is part of a package of initiatives adopted under the “Fit for 55” package approach of the Commission in 2021. It is particularly complementary to the legislative proposal for setting new CO2 emission performance standards for cars and vans post 2020 – together both policy initiatives create a coherent approach to vehicle and infrastructure market take up.

1.2.Legal context

The Directive establishes a common framework of measures for the deployment of publicly accessible alternative fuels infrastructure. Building-up such publicly accessible infrastructure to enable the uptake of zero- and low-emission vehicles shall reduce oil dependence and mitigate environmental impacts specifically of road and waterborne transport. While it covers a range of fuels, including electricity, hydrogen, biofuels, natural gas and synthetic and paraffinic fuels, it particularly defines certain minimum requirements for fuels that require distinct infrastructure (electricity, gas, hydrogen).

The directive obliges Member States to develop National Policy Frameworks (NPFs) that shall enable to develop the market for alternative fuels and the infrastructure to support them. Member States have to assess the current state and future prospects, set targets for deploying the infrastructure and the measures necessary to meet them (electricity and natural gas for both roads and ports whereas hydrogen is voluntary). There is no common methodology for informing the development of NPFs. Member States have to ensure by certain dates a coverage of the TEN-T core network with appropriate recharging and refuelling infrastructure (“appropriate” not being defined). The directive also norms certain user information (e.g. on comparison of alternative fuels unit prices, on fuel labelling). Member States report every three years on the implementation of their NPFs.

Member States are required to support the commercial development of infrastructure, whereas public financing should support the development of infrastructure in early stage of market development and cases of market failure. This is further clarified by the revised Electricity Directive that bans Distribution System Operators to own and operate recharging points unless there is proof that no private operator is willing to do so.

The directive equally norms common technical specifications in its Annex II. Some of those technical specifications have been supplemented by means of delegated acts under the directive, following the implementation of a standardisation requests that the Commission had mandated to the European Standardisation Organisations (ESOs).

The Directive also addresses to some extent the role and responsibility of operators of recharging and refuelling points accessible to the public, for example with respect to a general obligation for price transparency, non-discrimination and the obligation to offer ad hoc payment solutions (users to charge without entering into a contract with the operator).

1.3.Policy context

The common scenarios underpinning the Climate Target Plan and the Sustainable and Smart Mobility Strategy showed at least 30 million zero-emission cars and 80,000 zero-emission lorries in operation by 2030 and also showed that by 2050 nearly all cars, vans, buses as well as new heavy-duty vehicles will be zero-emission while also the other transport modes need to shift towards zero emission fuels. The directive aims at ensuring that sufficient publicly accessible recharging and refuelling infrastructure is in place for all modes to ensure that the low and zero emission vehicles and vessels coming into the market are supported by a sufficient number and full geographic coverage of interoperable infrastructure.

The directive is an important complement to other policy instruments that address European policy objectives on climate change, transport, energy and environment. As the main policy instrument for alternative fuels infrastructure it interacts with a broad range of different policy instruments, many of which are also revised under the “Fit for 55” package. They include:

·CO2 emission performance standards: The regulations on EU emission standards for cars and vans and heavy duty vehicles set emission standards for vehicle manufacturers fleets. They provide a strong push for deployment of zero- and low-emission vehicles, creating demand for alternative fuels infrastructure. The Impact Assessment of the revision of the CO2 standards for cars and vans will provide an analysis on the numbers of zero- and low-emission vehicles needed to contribute to the increase in overall climate ambition by 2030. The revision of the directive enables this uptake by providing sufficient infrastructure.

·Energy and fuels policy: the Renewable Energy Directive

and the Refuel Aviation and FuelEU Maritime initiatives set obligations on the supply of, or demand for, renewable and low carbon transport fuels. The Fuel Quality Directive

addresses the reduction of the GHG emission intensity of road transport fuels. The CO2 emission standards for cars and vans and trucks address newly registered vehicles and ensure the increased supply and affordability on the market of new efficient and zero-emission vehicles. Fuels related legislation provides incentives for the use of low-carbon and renewable transport fuels in the existing vehicle fleet. Those are complementary instruments aiming at the reduction of transport emissions and creating demand for alternative fuels infrastructure in line with the EU Strategy for Energy System Integration.

·Related infrastructure policy: the Energy Performance of Buildings Directive

(EPBD) addresses private recharging infrastructure by stipulating requirements for roll-out of recharging infrastructure in buildings. The EPBD is complemented by flanking action in the context of the strategy “a renovation wave for Europe”

. AFID and EPBD are required to work together to provide a sufficient level of recharging infrastructure; the relationship of public and private recharging infrastructure has been thoroughly addressed in this Impact Assessment. The Regulation on the Guidelines for the Trans-European Transport Network enables at present the rollout of alternative fuels infrastructure as part of the deployment of innovation and new technology actions in form of individual projects on the TEN-T network corridors, which are established by that Regulation. Those projects have grown in scale over the years, leading to a substantive, but far from complete equipment of the TEN-T with alternative fuels infrastructure. This initiative and the initiative for the revision of the Regulation on the TEN-T guidelines are fully complementary. This initiative establishes concrete requirements for the deployment of recharging and refuelling infrastructure along the TEN-T core and comprehensive network, in urban nodes and in TEN-T ports and airports. Those requirements will be referenced in the proposal for the revision of the TEN-T regulation, so that there is a coherent policy framework

·Other policies set incentives for low- and zero-emission vehicles and vessels and their recharging and refuelling infrastructure, by internalising the climate and environmental externalities (the Eurovignette Directive

, the Emission Trading System and the EU Energy Taxation Directive

, currently under revision), by boosting vehicle demand through public procurement (the Clean Vehicles Directive

) and by setting new requirements for electric vehicle batteries (proposal for a Batteries Regulation). The pollutant emission standards, Euro 6 for cars and vans

and Euro VI for buses and lorries

require that all vehicles, including those fuelled with alternative fuels, do not emit, on the roads, more than the prescribed emission limits.

·The EU’s 2021-2027 long-term budget, together with NextGenerationEU, supports accelerated investment in alternative fuels infrastructure through Member States’ recovery plans under the Recovery and Resilience Facility (RRF). That support can be complemented by extended financing under the Connecting Europe Facility but also the InvestEU instrument and the European Structural and Investment Funds. Horizon Europe will address research and development strand, particularly through the 2Zero and Batteries Partnerships and the Fuel Cell and Hydrogen Joint Undertaking.

This Directive is fully complementary and delivers additional value added to these instruments. It is the main policy instrument to set the overall requirements for technical interoperability of alternative fuels infrastructure, related consumer information and rollout of publicly accessible infrastructure. In light of the above, the revision of this Directive sits within the broader context of the ‘Fit for 55% package’. The interactions between this impact assessment and particularly the impact assessment supporting the revision of the CO2 emission standards are most relevant, but furthermore also with the Renewable Energy Directive, the Energy Efficiency in Buildings Directive, the Energy Taxation Directive, the EU ETS, the FuelEU maritime and RefuelEU aviation and the revision of the TEN-T regulation. This impact assessment is therefore building on the analytical work of the Climate Target Plan, which takes into account the interaction and combination of the various policies. The interactions are further explored and assessed in the next sections.

1.4.Evaluation of the existing Directive

A REFIT ex-post evaluation showed that the Alternative Fuels Infrastructure Directive has supported the development of policies and measures for the roll-out of alternative fuels infrastructure in Member States, particularly through the requirement to develop National Policy Frameworks (NPFs) (see Annex 10). Despite the great differences in ambition and supportive policy measures across Member States, those policy frameworks have started to help building a medium-term perspective on infrastructure for electricity, natural gas and hydrogen until 2030 in all Member States.

However, shortcomings of the current policy framework have also been pointed out and the key objective of the Directive, namely to ensure a coherent market development in the EU, has not been met. Shortcomings arise in particular in the following three areas that are further addressed in chapter 2:

·The uptake of alternatively fuelled vehicles and deployment of corresponding infrastructure is not coherent across Member States. It has not led to a complete network of infrastructure allowing seamless travel across the EU. This is in particular the case for electric recharging points and hydrogen refuelling stations as well as with respect to on-shore power supply (OPS) and LNG infrastructure in ports. Furthermore, infrastructure for zero emission heavy-duty vehicles (HDV) is largely missing across the EU. The overall ambition for the deployment is not sufficient to meet the EU’s GHG reduction target of 55% by 2030 and the 2050 climate neutrality objective in view of the necessary significant increase of zero and low-emission light and heavy duty vehicles as well as vessels.

·While standards have been developed and prescribed to ensure interoperability between the vehicles and infrastructure, new technologies are emerging requiring further common technical specifications to ensure interoperability. In this context, and while alignment with electricity market legislation has been ensured, for the mass uptake of electric vehicles in the future, further provisions may be required to fully enable smart recharging through appropriate standards.

·User aspects have already been addressed to a certain extent in the Directive but this has not lead to full user information, uniform and easy to use payment methods and full price transparency across the EU.

The evaluation concluded that six years after the adoption of the Directive, the overall European market for alternative fuels infrastructure is still in a rather early development phase, though markets in some parts of the Union are maturing. The development of infrastructure has, however, largely kept pace with the development of the vehicle fleets that show different trends (see Annex 6 for further detail). In view of the overall relevance of ensuring sufficient infrastructure to support the needed uptake of vehicles and vessels, the evaluation recommended to retain the legislation but to revise it. The results of the ex-post evaluation are reflected in this impact assessment.

Table 1: Links between conclusions of the ex-post evaluation and the impact assessment

|

Main ex post evaluation conclusions

|

Impact Assessment

|

|

Conclusions on relevance

|

|

The issues and challenges identified at the time of the adoption as well as the general and specific objectives of the Directive are still applicable.

|

The impact assessment further develops the general and specific objectives of the directive

|

|

Conclusions on effectiveness

|

|

The directive has had a positive but relatively limited contribution towards the uptake of AFV and AFI but there is an expected positive, more sizeable contribution for the future when more AFV will come into the market. However, the directive is not effective in providing an evenly distributed infrastructure across the EU and does not address all transport modes, e.g. electric recharging and hydrogen refuelling infrastructure for HDV

|

Policy measures are defined to enlarge the scope and further strengthen investments in AFI in line with the needed contribution to the EGD objectives for all transport modes

|

|

The implementation appears to have only partly succeeded in developing a clear and consistent policy framework

|

Policy measures are defined to further strengthen the development of a fully consistent policy framework

|

|

There are positive contribution of the Directive on promoting interoperability, but impact is constrained due to ongoing issues in ensuring harmonised payment and consumer information and transparency.

|

Policy measures are defined to continue developing standards and to harmonise payment and consumer information and transparency

|

|

Conclusions on efficiency

|

|

The costs appear proportionate in relation to the benefits. Cost for the development of the NPFs and the NIRs required in the context of the implementation of the AFID were limited. No conclusions can be drawn on the efficient use of Member States’ budgets on implementing national policies and infrastructure deployment targets

|

The NPFs will be maintained as a policy instrument in the policy options.

|

|

Conclusions on coherence and coordination

|

|

The directive is internally coherent but does not fully reflect the recent policy developments set by the EGD and the 2030 CTP, considerably increasing the climate ambition and establishing 2030 climate target of at least 55% as well as 2050 climate neutrality objective. This requires large scale rollout of recharging and refuelling infrastructure reflecting recent market developments, e.g. in respect to fast recharging points.

|

The IA identifies new market developments, and reflects those in the different policy options. Full alignment shall be ensured with other initiatives under the ‘Fit for 55’ package in terms of baseline scenario, the impact of measures envisaged and their effects on vehicle fleet development.

|

|

Conclusions on EU added Value

|

|

EU level intervention brought some benefits which would not have been possible with action at national or local level alone. There is an increased need for EU action in order to deliver on the current policy objectives, to overcome the current fragmentation of the market to meet wider European Green Deal goals, and to define the timeframe for deployment.

|

EU action continues to be needed to deliver on the policy objectives.

|

2.Problem definition

Without further EU level intervention, lack of recharging and refuelling infrastructure is likely to become a barrier to the pervasive market growth in vehicles and vessels that is needed to meet the increased climate ambition of the EU for 2030. The ambition in target setting and support measures for infrastructure rollout varies greatly between Member States, as described in detail in section 2.1. Moreover, ease and transparency of use of recharging and refuelling infrastructure is a prerequisite for user acceptance and final successful vehicle and vessel uptake. Current market practice do not always guarantee this ease of use and problems of interoperability persist. At present, customers are confronted by a myriad of approaches to information on availability and accessibility of infrastructure, diverging use conditions and not fully interoperable services. Without further policy intervention, users of vehicles and vessels will continue to face an infrastructure that is not easy and transparent to use across borders in the EU. The underlying drivers, problems and implications that are relevant for the revision of the Directive are presented in the figure below:

Figure 1: Overview of drivers, problems and implications

2.1.What are the problems and their implications?

2.1.1.Lack of ambition and coherence in MS infrastructure planning leading to insufficient and unevenly distributed infrastructure

As already noted in chapter 1, there are significant differences in the level of ambition, targets set, and comprehensiveness of the measures adopted among Member States to support the rollout of alternative fuels infrastructure. `76.5% of respondents to the OPC on this question (232 out of 303) confirmed this problem analysis.

With respect to electric recharging points for road LDV the overall deployment figures match the demand from vehicles at an overall, average EU level. However, large differences in the pace of infrastructure roll-out among Member States clearly have impacts on cross-border continuity and will in some Member States also severely limit the uptake of low- and zero-emission vehicles. At present, more than 70% of all publicly accessible recharging points are located in just three Member States: The Netherlands, Germany and France. The uneven geographical distribution is likely to persist and may even intensify, as the Commission assessment of national implementation reports under the Directive in conjunction with the evaluation shows (see chapter 2.3.1, Annex 10).

Figure 2: Amount of recharging points per Member State in 2020

This discrepancy between Member States is not only evident in total numbers but also relative to the number of registered vehicles. While for example the Netherlands already have 7 recharging points deployed per 1,000 registered cars and vans, in 16 Member States less then 0.5 recharging points are installed per regsiered car/van.

Figure 3: Number of Recharging points per 1000 cars and vans, 2020

Furthermore, for electric LDV, there is an increasing gap between the growth rates for vehicle registrations and infrastructure deployment. The strong increase in new battery electric and plug in hybrid vehicle (cars and vans) registrations in 2019 (+50%) and 2020 (+52%) was not nearly met by the increase in publicly accessible recharging infrastructure (+38% and +30% respectively). While the deployment of faster recharging technology can help to address part of the increased vehicle uptake, a continued gap increase would imply a serious risk that infrastructure deployment will not go hand in hand with electric vehicle uptake in the years to come, which is expected to accelerate due to more stringent CO2 emission standards. This in turn risks to restrict the growth in electric vehicle uptake in particular post 2030.

With respect to other fuels in road transport, hydrogen infrastructure for fuel-cell hydrogen LDV is only addressed by half of the Member States in their NPFs leading to an incoherent development across the EU with huge gaps within the road network not allowing for seamless travel across the EU. For CNG and LNG, refuelling networks are developed across the EU albeit with huge differences among Member States. However, the envisaged density of refuelling stations for LNG (every 400 km along the TEN-T core network) and CNG (every 150 km along the core network) has been largely achieved in most Member States (see Annex 6 for further information).

Furthermore, there is currently no coherent approach towards the deployment of electric recharging and hydrogen refuelling infrastructure for HDV across Member States. This means that there is no network of recharging or refuelling infrastructure across the EU, which is problematic since an increased uptake of zero emission trucks is necessary for manufacturers to meet their obligation under the CO2 emission performance standards by 2025 already.

With respect to ports the existing legal provisions oblige Member States to ensure an appropriate number of LNG refuelling points to allow for circulation along the TEN-T core corridor by 2025 for maritime and 2030 for inland waterways. However, the present rate of growth in the network, that will also support the increasing replacement of LNG by biogas and synthetic gaseous e-fuels, appears to be slow. Furthermore, the development of OPS is only taking place in a small number of EU ports. There is a risk that deployment will continue to happen in a limited and uncoordinated manner. The Sustainable and Smart Mobility Strategy notes that zero-emission sea-going ships should be market-ready by 2030. A non-coordinated approach is likely to not lead to effective identification of needs and preparation of adequate rollout strategies for infrastructure.

Efforts have to be undertaken to decarbonise the aviation sector. Electricity supply for stationary aircraft is a low hanging fruit, but is not yet ensured throughout the EU and in particular not for outfield positions. Work has started on the development of zero-emission aircraft, including large-scale aircraft, where the Sustainable and Smart Mobility Strategy sets the milestone of having such aircraft market ready by 2035. The sector has to equally prepare for the built up of related infrastructure, but a non-coordinated approach is likely to lead to insufficient action. In the rail sector, an increasing number of projects deploy battery electric and hydrogen trains to decarbonise train operations on tracks that can’t be electrified. Again the absence of a strategic coordination in Member States risks not to lead to an effective approach.

2.1.2.Interoperability issues persist in terms of physical connections and communication standards

Common technical specifications help ensure full interoperability of physical connections and communication exchange between vehicle, infrastructure and user. The Directive and subsequent delegated regulations, supported by a standardisation request to European Standardisation Organisations (ESOs), has mandated various European standards. Those relate to the physical connection between the vehicle and the infrastructure for electricity recharging, natural gas refuelling and hydrogen refuelling for light duty road transport vehicles as well as electric recharging and hydrogen and natural gas refuelling in waterborne transport.

At present, requirements under the Directive focus exclusively on electro-technical issues, such as plugs, outlets and electrical safety specifications, but do not recognise the particular needs of trucks infrastructure. Furthermore, the Directive has not focused on minimum requirements for appropriate communication interfaces and data models, which is particularly relevant for electric mobility. In the Open Public Consultation (OPC), 69% (222 out of 324) of respondents noted that further mandatory technical requirements (standards) are needed to ensure full interoperability of infrastructure and services, whereas only 11% (36 out of 324) thought this was not the case.

The lack of common technical specifications for communication exchange have strong implications on the interoperability and transparent exchange of information among users and the different market actors within the electro-mobility ecosystem. Without further requirements, there will not be a smooth exchange of information on billing, charging session information, reservation, authorization, parking spot information and compatibility with smart charging and vehicle to grid functionalities, as many market operators will take forward their own approaches. With respect to the integration of electric vehicles into the electricity system, the current provisions of the Directive ensure alignment of the rules between recharging infrastructure and the electricity markets, clearly assigning all rights of the final customer in the electricity market to the CPOs. However, future mass vehicle uptake risk putting additional stress to the electricity system especially if the additional electricity demand incurs at peak times. The Impact Assessment for CO2 emission performance standards shows that by 2030 cars and vans would represent around 2% of the EU’s electricity consumption that would increase to 10% by 2040 and to 11% by 2050. From an overall network perspective, management of additional electricity demand of that magnitude over the next decades appears to be feasible. However, if this demand would occur at times when the network is already operating at the maximum, grid capacity problems in particular in the distribution grid, could arise when electric vehicles will have reached a significant share in the overall vehicle fleet. To enable smart recharging and thereby help to avoid capacity problems, common communication standards between the recharging point and the electricity grid are required.

Additional technical specifications and standardization work becomes also necessary to ensure full interoperability of the hydrogen refueling ecosystem for heavy duty road transport, including liquid hydrogen refueling. Concerning maritime transport and inland navigation, new standards are required to facilitate and consolidate the entry on the market of alternative fuels, especially in relation to fuel supply for electricity, hydrogen, advanced biofuel, methanol and ammonia bunkering, as well as communication exchange between vessel and infrastructure. Also for OPS further standards may be required considering the variety of ships at berth with different power demand.

The absence of common technical specifications in the areas addressed above risk that many recharging and refuelling services cannot develop in a competitive manner and instead proprietary solutions will develop. This will be detrimental to the internal mobility market, affecting directly consumers, infrastructure operators and service providers and vehicle manufacturers. In consequence, a lack of standardisation risks to harm the uptake of zero- and low-emission vehicles.

2.1.3.Publicly accessible infrastructure does not fully correspond to user needs

The evaluation concluded that there are still gaps and limitations in terms of ensuring access to adequate and relevant consumer information. Consumers cannot easily identify where, how and at what price they can recharge or refuel their vehicles, especially when travelling cross border. In the OPC, 80% (119 of 148) of respondents noted to have often or sometimes problems in finding alternative fuels infrastructure. While the Directive requires that information on the geographic location of the refuelling and recharging points is shared by the operators of the infrastructure, it does not impose quality requirements for those data nor does it specify where such information needs to be displayed. As a consequence, and despite the increasing availability of online platforms and digital applications, there is still no open data framework in place to provide real-time information to users, primarily for electro-mobility, but also for other alternative fuels infrastructure.

The Directive also requires charge-point operators to charge prices for public recharging that are reasonable, easily and clearly comparable, transparent and non-discriminatory. However, the evaluation and OPC revealed that often there is limited information available to the user on the price he will eventually have to pay for a recharging session. In the OPC, only 31% of respondents (37 out of 121) felt well informed on a regular basis. This problem was corroborated in the targeted consultations: prices are often not clearly displayed at a recharging point and are often also not accessible through apps. In addition, many different price components exist, including possible hidden fees that only appear at the stage of billing. This results in difficulties for users to compare end user prices. This lack of price transparency does not allow informed consumer choices and is detrimental to competition in the recharging services market.

Furthermore, the Directive sets provisions on ad hoc payment to ensure that no user gets stranded due to difficulties of payment. However, because the Directive does not set clear provisions for a common unified ad hoc payment method (such as credit/debit bank card payment), different ad hoc payment options using different technological solutions emerged, making it difficult for users to actually pay for a recharging service, e.g. by requiring pre-registration or the purchase of pre-payment cards.. In the OPC, 65% of respondents (72 out of 113) confirmed this problem. This issue may also incur in the future for other refuelling infrastructure, e.g. hydrogen, once private users will purchase hydrogen cars/vans and will depend on publicly accessible refuelling stations.

The OPC identified a clear need to change provisions on interoperability and user information, which will particularly facilitate cross-border trips: 79% of respondents to the OPC (255 out of 324) noted this to be very important or important.

All those aspects make it more difficult and cumbersome to travel across the EU and sometimes even within a Member State with an electric vehicle. Such negative user experiences can refrain other consumers from buying alternative fuels vehicles and thereby become a barrier for their uptake. Moreover, this market fragmentation can be detrimental to competition, can imply higher costs for the different market actors and can aggravate innovative service development.

This problem ultimately affects consumers. It also affects infrastructure services providers and entities that operate in the market of supplying infrastructure data to consumers.

2.2.What are the problem drivers?

2.2.1.Lack of binding provisions leads to different ambitions by Member States

Transport network coverage for road transport

The Directive requires each Member State to adopt a national policy framework (NPF) for the development of the alternative fuels market in the transport sector and the deployment of its relevant infrastructure. In particular, the NPFs have to comprise national targets and objectives for the deployment of alternatives fuels infrastructure, taking into account national, regional and union-wide demand. However, there is no clear and explicit link with reaching greenhouse gas reductions, which has become essential under the European Green Deal. In addition, Member States had to provide the necessary measures to reach national targets and the objectives set out in the NPFs. However, Member States are free to set their own targets and are not bound by any methodology to determine the need for infrastructure.

In its 2017 assessment of the NPFs (including in its 2019 update) and in its Assessment of the National Implementation Reports (NIR) in 2021 which informed the overall evaluation of the Directive, the Commission concluded that the NPFs and NIRs are not fully coherent from an EU-wide perspective in terms of the priorities they set. Member States’ ambition with regard to the uptake of alternative fuels and their targets for infrastructure varied significantly in the absence of a common methodology to set targets. For example, the share projected by Member States for electric cars and vans in the total fleet for 2030 varies between less than 1% for Cyprus and Greece and up to 45% in the case of Luxembourg. For 2020, 10 Member States planned to have less than 1000 recharging points installed and 16 less than 2000 and large parts of the TEN-T core network do not have recharging points installed every 60 km as recommended. In conclusion, a coherent network of infrastructure has not developed across the EU, even if the last two years saw considerable increase in overall investment. In the OPC, a majority of respondents noted for most of the different use cases of alternative fuels infrastructure that NPFs were not a fully adequate tool to solely rely on (see annex 2 for detailed breakdown).

Transport network coverage for waterborne transport

The Directive requires that LNG vessels can circulate along the TEN-T core network by 2025 (maritime) and 2030 (inland waterways) respectively without setting a clearer mandate as to which ports need to be equipped with LNG bunkering facilities. The directive equally requires that each NPF assesses the need for shore-side electricity – at sea and inland ports – and that this be installed, unless there is no demand or costs are disproportionate.

The assessment of the application of this Directive identified that plans to deploy LNG in maritime and inland ports for 2025 varied greatly between a few countries with high ambition (e.g. Spain, with a target of 42 maritime ports and Italy with a target of 12 maritime ports and 20 inland ports) and most others were there was no or little consideration of bunkering facilities for LNG.

With respect to shore side electricity, the evaluation found that 23 Member States assessed the need for shore-side electricity supply for inland waterway vessels and seagoing ships in their NPFs. Following their assessment, BE decided to increase on-shore power supply (OPS) in all ports, EL aimed to install supply at tourist ports and major maritime ports, while EE, FR, MT, and RO all established specific targets either for the year 2025 or 2030. Furthermore, AT, BG and SI noted the need for further studies to be carried out to better understand the benefits. The other Member States either did not specifically address the issue or concluded that it is not economically viable to install OPS supply considering the current market demand and as such no objectives were set.

For the shipping sector it can therefore be concluded that the legally binding provisions for LNG under the current Directive will ensure that a sufficient network will develop on the TEN-T core network, which is of particular relevance to sea ports. However, the lack of clear provisions with respect to OPS makes it unlikely that a coherent network of OPS develops in TEN-T core maritime and inland waterway ports in the timeframe foreseen by this Directive and corresponding to the expected increase following the ambition of the refuel EU maritime initiative.

Scope

The Directive currently defines a number of specific fuels as alternative fuels. However, since the adoption of the Directive, some technology advancements have taken place. The 2020 update of the Commission’s Report on advanced alternative fuels lists, for example, road electrification technologies, electrification/hybridisation of aircrafts used for short-distance and training flights, use of new fuel technologies in waterborne transport (e.g. advanced biofuels, ammonia, methanol, hydrogen as well as electricity for inland waterways and short sea shipping/ferries) or development of hydrogen fuel cell powertrains in rail transport. Moreover, while the scope of the Directive does not exclude recharging and refuelling stations for heavy-duty vehicles, it was formulated with a primary focus on light-duty vehicles. The inclusion of hydrogen into the NPFs has been voluntary and only half of the Member States addressed hydrogen. As a result of this approach and of rapid technology development in this segment, the Directive is currently not fully adjusted to cater for the infrastructure requirements of battery- and fuel-cell electric powertrains in the heavy-duty road sector, which is the focus, in particular, of the Hydrogen strategy.

Furthermore, questions have been raised whether the current scope diverts resources away from the infrastructure for zero-emission vehicles by including of natural gas as an alternative fuel. The use of fossil fuels is regarded to not contribute to overall emission reduction, but delay the necessary transition to zero-emission mobility. 55% of respondents the OPC (165 out of 268) asked for the exclusion of natural gas and thereby of CNG and LNG infrastructure from the scope of the directive, with strong presence of environmental NGOs, the electricity sector, electric mobility industry representatives and citizens. However, 45% (133 out of 298) of respondents, in particular representatives from the gas industry, biogas and biofuel producers, waterborne transport industry and parts of the automotive industry argued that LNG is still indispensable for maritime transport, as also noted under the FuelEU maritime initiative, and for long-distance road haul due to a lack of market-ready alternatives. Furthermore, biogas and e-gases use the same refuelling infrastructure as natural gas. Fossil natural gas can therefore be increasingly blended and phased out with low-carbon and renewable fuels (biogas and renewable synthetic e-gas) and thus fully contribute to the climate-neutrality objective.

2.2.2.Setting of targets by Member states not consistent with market developments and GHG reduction ambition

The Commission’s 2017 assessment of Member State NPFs and the 2021 assessment on the NIRs identified that in many Member States, projections on the uptake of alternative fuelled vehicles were rather low and consequently the infrastructure targets risk to be insufficient to support the expected growth in alternatively-fuelled vehicles. Since national policy frameworks were adopted (by end 2016), the EU has committed to reduce the EU’s greenhouse gas emission by 2030 by at least 55%, compared to the previous 40% reduction target. This has a major impact on the required uptake of sustainable alternative fuels, vehicles and infrastructure. In order to achieve these ambitious targets, the uptake of low and zero-emission vehicles and the related infrastructure needs to accelerate significantly in all market segments of light-duty and heavy-duty vehicles. Efforts will need to be considerably greater than the efforts reported by Member States under the Directive. This does not only relate to road transport but equally to other transport modes such as waterborne transport and aviation.

56% of OPC respondents (160 out of 288) noted that NPFs are not the right instrument and 31% (89 out of 288) noted that they are only partially sufficient in view of the increased policy ambition for 2030. Of those who responded to the question who should set mandatory deployment targets, 53% (142 out of 268) favoured direct EU legislation, whereas 38% (102 out of 268) considered the national level, but following a common methodology.

Furthermore, recommendations for using specific metrics to determine sufficient infrastructure are no longer adequate. The Directive recommends to have 1 recharging point per 10 electric vehicles. This recommendation on the number of recharging points per vehicle does not reflect variations in market requirements. The Sustainable Transport Forum of the Commission reviewed the recommendations and concluded that they should be elaborated further, including consideration of the larger demand for alternatively-fuelled vehicles, the increased vehicle ranges and different power levels of recharging points and their locations; e.g. a 350 kW recharging point can serve a considerably higher number of vehicles per day than a normal charger of 7 kW.

2.2.3.Implementation fails to consider necessary requirements/standards for ensuring full interoperability

The Directive sets common technical specifications for physical connectors. With the latest set of technical specifications added by means of Commission Delegated Regulation (EU) 2019/1745 those technical specifications set under the Directive have proven to be highly relevant.

However, new needs for technical specifications under the Directive have emerged as described in chapter 2.1.2 that are currently not foreseen under annex II of the Directive. These concern particularly the interoperability and transparent exchange of information among the different players within the electric vehicle charging system and standards for recharging heavy-duty vehicles and refuelling liquid and gaseous hydrogen. In addition, maritime transport, inland navigation and aviation will also benefit from further common technical specifications to facilitate and consolidate the entry on the market of alternative fuels, especially in relation to fuel supply for electricity and hydrogen as well as hydrogen based fuels.

In line with the Commission’s Strategy for Smart Energy System Integrationthe cost-efficient integration of an increased number of electric vehicles in the electricity system must be ensured. However, the Directive does currently not require common communication standards between the recharging point and the electricity grid that is a prerequisite for the development of smart and bidirectional recharging services in an open and competitive market.

Without a clear, updated legislative mandate to develop such standards at the EU level, there is a risk that such standards will not develop in a timely manner and hence delay market uptake of emerging technologies and services. In the OPC 78% of respondents (216 out of 278) noted it very important or important to revise the related provision of the Directive.

2.2.4.Lack of user information about and at refuelling and recharging points

Location and availability of recharging and refuelling points

A key issue for consumers is the concern that it may not be possible to find a suitable refuelling/recharging station before running out of fuel/electricity. Contributing to this, particularly on long-distance journeys on highways, is the lack of information on the distance to the next suitable recharging/refuelling station. Although the AFID requires that ‘the data indicating the geographic location of the refuelling and recharging points accessible to the public of alternative fuels covered by this Directive are accessible on an open and non-discriminatory basis to all users’, it does not specify where such information needs to be displayed. Furthermore, the evaluation also found out that action by some Member States (individually and on basis of EU funded activities) should be expected to contribute towards improving the availability and quality of information, but that this will not ensure consistent data provision and access to data across the EU network. 70% of respondents to the OPC (231 out of 324) agreed that users should get information on locations based on coherent requirements.

Digital Connectivity

A prerequisite for providing such location data, but in particular dynamic data on the availability on recharging points and on prices through digital means, is that recharging/refuelling points are digitally connected. The ability to manage contract-based payments for electric charging at other stations (i.e. when roaming) also requires stations to be digitally connected. According to estimates, by 2019 around 45% of the 1.3 million public, semi-public and private recharging points across Europe were digitally connected; by 2024 it is expected that over 60% of the recharging points will be digitally connected.

In the OPC, 90% of respondents (244 out of 269) agreed that information, including based on dynamic data, should be made available to the user by digital means. In the OPC, 62% (200 out of 324) noted that consumers should have real-time access to reliable information about the location and availability of recharging points, which requires digital connectivity of infrastructure.

Information on pricing and billing

An additional key feature to ensure user acceptance is that prices are clearly communicated before the recharging session. The Directive already requires that prices charged by the operators at publicly accessible recharging points are reasonable, easily and clearly comparable, transparent and non-discriminatory. However, no detailed provisions regulate the way prices need to be displayed.

Despite these legal requirements, 30% of respondents to the OPC (80 out of 276) noted to never or seldom have full information about prices charged, 28% (76 out of 276) noted this to be sometimes the case and 33% (92 out of 276) did not know, whereas only 11% (29 out of 276) noted that they always had full information. This confirms a practical problem with the current implementation. 67% (187 out of 278) supported a harmonisation of the display of prices at the EU level.

Moreover, for contract-based charging – which is not currently addressed in the provisions of the Directive - the actual invoiced amount often included extra charges, such as roaming charges that are not communicated beforehand to the consumer.

2.2.5.No uniform ad hoc payment method available at all recharging points

The Directive requires that users must be able to recharge their electric vehicle at any publicly accessible recharging point on an ad hoc basis, i.e. without needing to enter into a long-term contract with the operator or energy supplier. This requirement has been implemented in very diverse ways across the EU. Charge point operators developed individual solutions varying between Member States, and even within Member States. Ad hoc solutions offered at recharging points include credit card payments, pre-paid cards or payments through charge point operators’ specific apps that need to be downloaded by the user. The use of some of these payments solutions is extremely cumbersome and may even not allow for spontaneous ad hoc charging at some charging points (.e.g. when a prepaid card is required).

According to a recent assessment, many charge point operators do not provide a user friendly ad hoc charging possibility to drivers. Instead, to be able to easily use a publicly accessible recharging station, a driver must sign up for a contract with its operator. A recent overview of various aspects on price transparency in four Member States

found that ad-hoc payment systems are not widely used or offered in the Netherlands, but it is more common to use dedicated cards or web-based apps. The report concluded that ad-hoc payment is better developed in Germany and Austria but less so in France. Still, a test of 53 recharging points in Germany conducted by the German automotive club ADAC in May 2018 found that ad hoc charging was not possible in 23% of recharging cases in one of the most advanced markets in the EU. Only 8% of respondents to the OPC (9 out of 113) noted that they never faced difficulties when trying to pay. Similarly, representatives of the hydrogen sector also noted challenges with regard to uniform payment options.

2.3.How will the problem evolve?

2.3.1.Lack of ambition and coherence in MS infrastructure planning leading to insufficient and unevenly distributed infrastructure

As outlined in chapter 2.1.1 the trend towards an uneven distribution of recharging infrastructure for road transport is likely to continue and even to intensify. While there has been continuous development of AFI across the EU, progress has been very uneven across Member States, both in terms of planning and actual deployment of AFI. Deployment has been fragmented resulting in some well served hotspots but also large gaps in coverage leading to a network that is not sufficiently dense and widely spread to remove concerns around AFI availability. Furthermore, there are also indications that the roll out of AFI is not consistent with market and technological developments, as planning and deployment occurs at a different and mostly slower pace than markets for vehicles.

In the absence of an intervention, these problems and limitation are likely to continue to exist, with rapid developments in vehicle uptake not accompanied by an effective deployment of the needed AFI in a coherent manner throughout the EU. Those expected developments can be best demonstrated by comparing the Member States target setting as per their NPFs and NIRs.

Based on these targets as reported by 17 Member States it can be concluded that the problem of incoherent development in recharging infrastructure will continue to grow. For example, in Germany and Luxembourg there will be more than 20 recharging points for 1000 registered cars/vans, while other Member States will have very little recharging infrastructure with less than 2 recharging points serving 1000 cars/vans. Such a disparity in infrastructure development will not allow for easy cross-border travel. It also risks to limit the uptake of zero-emission vehicles in those Member States that provide only very little infrastructure. This is likely to undermine the accelerated uptake of vehicles to meet the increased 2030 climate ambition.

Figure 4: Targeted number of recharging points per 1000 registered cars/vans 2030, based on NIR targets of Member States

Source: National Implementation Reports, Assessment Report on the National Implementation Reports.

In conclusion, the planned AFI deployment by Member States under their NPFs and NIRs is not ambitious enough to align with the infrastructure needs induced by other policies (as outlined in the European Green Deal, the 2030 Climate Target Plan and the Smart and Sustainable Mobility Strategy). However, all policies need to contribute together to the ultimate goal of achieving necessary substantive emission reductions from the transport sector.

Such shortcomings are equally to be expected in other road transport segments. For example, only a limited number of Member States plan for hydrogen infrastructure. It will not allow for the development of a coherent network across the EU. The same goes for the heavy-duty segment, which is currently not specifically addressed in the Directive nor in most Member States’ NPFs. Besides generally requiring faster recharging and refuelling, the heavy-duty segment’s needs and use cases differ significantly from those of light-duty vehicles, and in particular of personal cars. Different use cases and related recharging/refuelling needs can be defined in relation to e.g. urban delivery, regional distribution, planned and unplanned long-haul freight transport. Furthermore, the need to integrate recharging and refuelling times in the logistics and operational planning – including by coordinating them with mandatory driver breaks as well as loading/unloading times at logistics hubs and/or at destination – will play a factor in defining the way the infrastructure is used; interactions with requirements for safe and secure parking places needs also to be taken into account. Confidence in the possibility to recharge and refuel seamlessly across borders is a crucial pre-condition for the deployment of alternative fuels in the long-haul transport sector. Without a clear European policy framework in this area it is very unlikely that a sufficiently dense European network particularly of electric charging and hydrogen refuelling stations will develop that allows the deployment of an appropriate share of low- and zero-emission vehicles into the heavy duty segment.

In contrast, the network of CNG and LNG refuelling stations across the EU’s road network is already existent and largely mature. Punctual re-enforcements are needed to accommodate the expected uptake in particular of LNG HDV. However, CNG and LNG vehicles can only contribute to the necessary emission reductions if natural gas will be gradually decarbonised and finally fully replaced by biogas and renewable low-carbon e-gases. Such decarbonisation of fuels pathways can be ensured through the existing refuelling infrastructure that can accommodate gaseous drop-in biofuels and renewable low carbon synthetic fuels needed to contribute to climate objectives.

What concerns other transport modes, it is unlikely that the On Shore Power Supply (OPS) will develop in EU ports without strengthening of the legislative requirements as only a few Member states currently plan to do so. This is in contrast to the clearly described ambition in the European Green Deal to oblige docked ships to use shore-side electricity and the FuelEU maritime initiative that aims to ensure that all containerships, cruise ships and Ro-Pax ships are equipped with OPS by 2030. Similarly from the NPFs it is not obvious that the current provisions in the Directive can ensure that alternative power trains in the shipping sector and their corresponding fuels infrastructure in ports will develop. For the maritime sector, the FuelEU maritime initiative will lead to increased demand for alternative fuels, including LNG as a short-term available fuel alternative, while zero-emission sea-going vessels are targeted for 2030.

In the absence of any provisions on aviation it is unlikely that electricity supply for all stationary aircrafts will become available. Increase demand for sustainable aviation fuels as required by the RefuelEU aviation initiative can be met by existing infrastructure. However, in the absence of any provision it is unlikely that a coherent strategic planning for the development of needed infrastructure needed for large-scale zero-emission aircraft will develop.

2.3.2.Interoperability issues persist in terms of physical connections and communication standards

As described in previous chapters, common technical specifications have been mandated in particular for physical connections through the Directive. However, as discussed in section 2.2.3, several issues still remain and new needs have emerged. While improvements will continue to take place, there is a real possibility of moving towards a fragmented ecosystem, where multiple standards will compete for a long time to become dominant, generating additional costs to operators and users. The lack of interoperability of both physical connections and communication standards could strongly prevent the progress towards a wider use of alternatively-fuelled vehicles, conditioning user aceptance. In particular:

·Interoperability and exchange of information among the different players within the electric vehicle charging ecosystem would continue to grow, however, identification and authentication of users, as well as payment methods and smart recharging solutions could develop under multiple different solutions at different paces across the EU, but not at the speed required and without the information transparency expected from users. Additionally, mass market development is likely to be affected due to user reluctancy. Certain areas of the charging ecosystems would not reach an agreement to common technical specifications, being ruled out by proprietary solutions, continuing and further deepening a plethora of non-user-friendly approaches in consequence.

·Standards for recharging HDV and refuelling HDV with liquid and gaseous hydrogen are required, but would develop at lower pace and would have less market impact if not transposed into European law.

·In addition, maritime transport and inland navigation would witness slower adoption of common technical specifications and hence a slower entry on the market of alternative fuels, especially in relation to supply of electricity and hydrogen as well as hydrogen based fuels.

2.3.3.Publicly accessible infrastructure does not fully correspond to user needs

Ever since alternatively-fuelled vehicles started gaining traction in the market, issues regarding availability of adequate consumer information have existed. With different industry players using different ways of communicating information to consumers, the problem is likely to continue to exist if there is no action to ensure a harmonised way of and a minimum set of data to be communicated by the recharging and refuelling point operator to consumers.

With respect to the lack of user information about and at recharging and refuelling points, the evaluation of the Directive found that some progress should be expected to continue to contribute towards improving the availability and quality of information (see Annex 10). Work under the Programme Support Action "Data collection related to recharging/refuelling points for alternative fuels and the unique identification codes related to e-Mobility actors" is of relevance here. However, withouth further policy intervention, the evolution will likely be limited to single Member States and not ensure consistent access to such information across the EU transport network. It is likely that important limitations in terms of the availability of information on the location of AFI infrastructure would remain, whereas other essential variables not included in the Directive would not become available. It could also become more problematic to make data accessible through the National (or Common) Access Points (NAPs) as established in the Directive 2010/40/EU on Intelligent Transport Systems.

Also without further harmonisation on EU level, individual companies will decide on the way to present prices to consumers. Such bottom-up approach would not lead to truly transparent prices across the EU.

Lack of information or filtered information on alternative fuels infrastructure locations, availability and prices, will hamper the development of a truly competitive alternative fuels services market. Only with full upfront information on their different recharging and refuelling options can consumers identify the recharging or refuelling point that best meets their needs, allowing markets to develop as competitive markets.

With respect to ad hoc payment method that has to be available at all recharging points, it is expected that without further harmonisation, individual charge point operators will continue to provide individual ad hoc payment solutions that will continue to pose problems of accessibility and understanding for consumers especially when travelling across borders.

3.Why should the EU act?

3.1.Legal basis

To ensure the correct functioning of the internal market the Treaty on the Functioning of the EU (TFEU) establishes the EU’s prerogative to makes provisions for the Common Transport Policy, Title VI (Articles 90-91) and for the trans-European networks, Title XVI (Articles 170-171). With this legal framework in mind, EU action allows better coordination for even and widespread deployment of AFI, instead of relying on the uncoordinated action of individual Member States only. This coordinated approach helps facilitating travel across the EU for consumers and transport operators. It also helps to remove lack of alternative fuels infrastructure as a potential barrier, encouraging the vehicle industry to commit to vehicle production knowing the infrastructure is in place.

3.2.Subsidiarity: Necessity of EU action

At the time of the development of the AFID, the impact assessment (European Commission, 2013) identified an EU initiative in this field as necessary - Member States did not have the instruments to achieve pan-European coordination (among vehicle manufacturers, infrastructure providers, national authorities and final users) in terms of technical specifications of infrastructure and timing of investments, and AF technology standards were not common EU-wide, thereby discouraging potential industry players, and leading to the fragmentation of the internal market.

According to the Directive itself, establishing a common framework of measures and promoting a broad market development of AFs for different transport modes and fuel types “cannot be sufficiently achieved by the Member States individually, but can rather, by reason of the need for action to meet the demand for a critical mass of alternatively fuelled vehicles and for cost-efficient developments by European industry, and to allow Union-wide mobility of alternatively fuelled vehicles, be better achieved at Union level”. Subsequent documents have provided further justification of the ongoing need and added value for action at EU level. According to the Commission’s Clean transport good practice examples published in 2016, EU intervention in the case of AFI was justified by the fact that the build-up of a European AFI “allows for free movement of goods and persons, with vehicles running on alternative fuels across the whole EU” and “facilitates the development of a single EU market for alternative fuels and vehicles which will permit the industry to benefit from economies of scale”.

3.3.Subsidiarity: Added value of EU action

The evaluation of this Directive, in conjunction with the assessment of national implementation reports of Member States under this Directive, also underlined the EU added value of the intervention in the sector, in terms of its effectiveness, efficiency and synergies that it brings. The evaluation showed that the development of a common EU framework for alternative fuels infrastructure has contributed towards avoiding the fragmentation of measures in relation to the promotion of AFIs, and thereby supporting Member States in the development of the AFI network, creating a level playing field within the industry and facilitating the free circulation of AFVs throughout the EU. All Member States have seen an increase in the level of AFI that, despite the gaps, suggest a relatively more coherent network with fewer gaps that what would have been the case in the absence of EU level intervention. Through encouraging interoperability, relevant technical standards and setting of targets on similar timescales, EU level action has provided some cost savings and better value for money by facilitating economies of scale, avoiding duplication of effort and resources, and providing funding investments for infrastructure. The implementation of the Directive (and its supporting activities) have facilitated cooperation and information exchange on alternative fuels between the relevant industry and public actors which would otherwise likely not exist.

Without EU intervention it would be very unlikely that a coherent and complete network of fully interoperable alternative fuels infrastructure develops across all Member States that will ensure that travelling across the EU with an alternatively fuelled vehicle is possible. This in turn is a prerequisite for the uptake of such vehicles across the EU which is vitally important for the EU to meet its GHG reduction ambition.

4.Objectives: What is to be achieved?

4.1.General objectives

The general objectives of this initiative are to contribute to achieving climate neutrality by 2050 (i.e. achieve net zero GHG emissions by 2050) and to contribute to the reduction of air pollution. To this end, and in line with the 2030 Climate Target Plan, the objective is to reach at least 55% net greenhouse gas emission reductions by 2030 compared to 1990 and the environmental goals of European Green Deal. This requires a coherent policy architecture for GHG reduction in transport, including the provision of sufficient and user friendly alternative fuels infrastructure as a prerequisite for the uptake of alternatively fuelled vehicles.

In particular, the transition to a climate-neutral economy requires a robust policy framework in the area of alternative fuels, in particular addressing renewable and low-carbon fuels, with the main aim of supporting the deployment of zero-emission vehicles, and infrastructure for all transport modes that must be open to future innovations. This initiative seeks to ensure the availability and usability of a dense, wide-spread network of alternative fuel infrastructure throughout the EU. All users of alternatively-fuelled vehicle/vessel/aircraft shall circulate at ease across the EU, enabled by key infrastructure such as motorways, ports and airports.

4.2.Specific objectives

This initiative is designed to effectively address the existing barriers that hamper the further deployment of a dense network of interoperable infrastructure. The specific objectives (SOs) and their correspondence with the problem drivers are presented in

Figure

5

.

Figure 5: Correspondence between the specific objectives and the problem drivers

SO1: Ensuring sufficient infrastructure to support the required uptake of alternatively fuelled vehicles across all modes and in all MS to meet the EU’s climate objective. It is essential to increase the number of recharging and refuelling points across Member States and across modes to ensure that sufficient infrastructure is available for the expected rapid uptake of alternatively fuelled vehicles and vessels in all Member States required to meet the EU’s 2030 climate ambition and 90% GHG emission reduction from transport by 2050.

SO2: Ensuring full interoperability of the infrastructure. Interoperability relates to both, physical interfaces and communication protocols as a prerequisite to provide assurance to investors about investments in recharging and refuelling infrastructure across all modes. Furthermore for road transport, it ensures that services – including smart and bidirectional recharging - can develop in a competitive manner.

SO3: Ensuring full user information and adequate payment options. Sufficient and accurate information for consumers, including information on location, accessibility, prices, payments and compatibility of fuels and recharging infrastructure are a prerequisite for users to purchase alternatively fuelled vehicles. They guarantee certainty and transparency about the use case; users know that they can use the vehicle without hassle and without surprises anywhere in the EU. Adequate payment options are highly relevant in this context – they ensure that users do not get stranded in front of recharging or refuelling points and always have a common and easy to use payment option at hand.

5.What are the available policy options?

5.1.What is the baseline from which options are assessed?

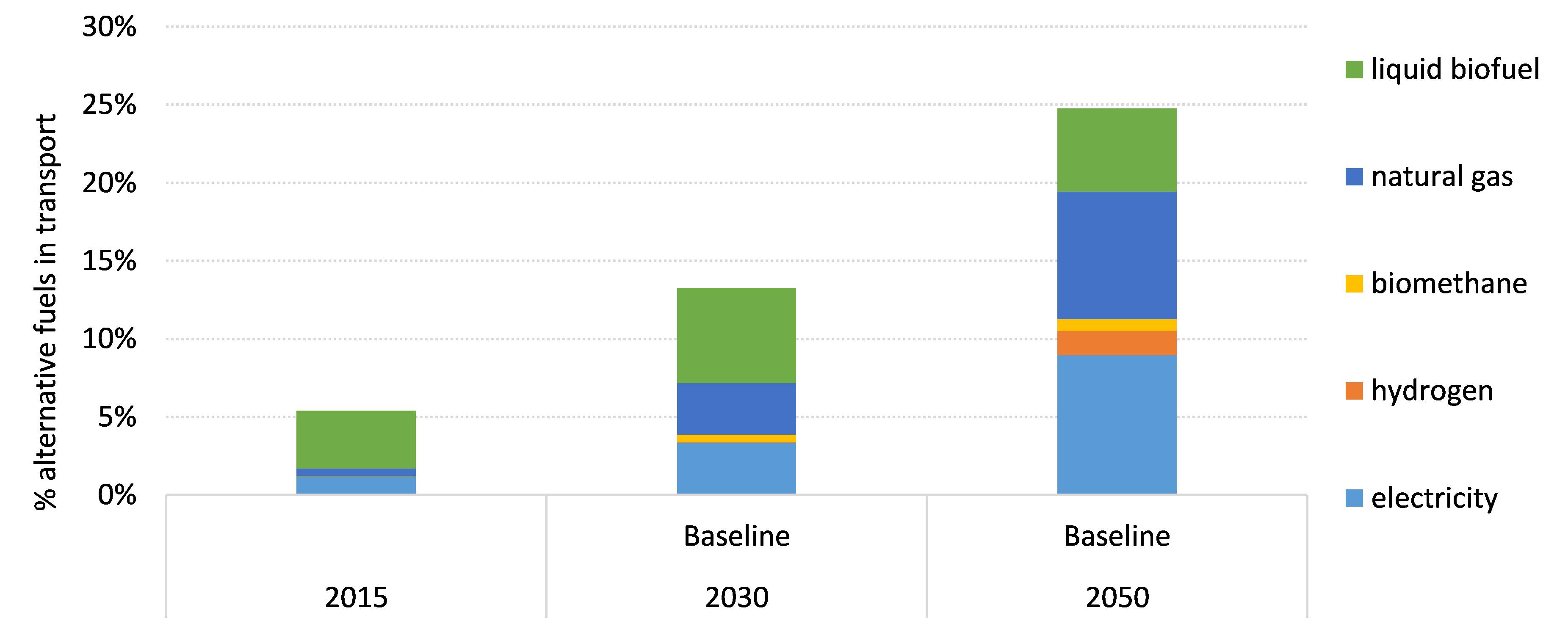

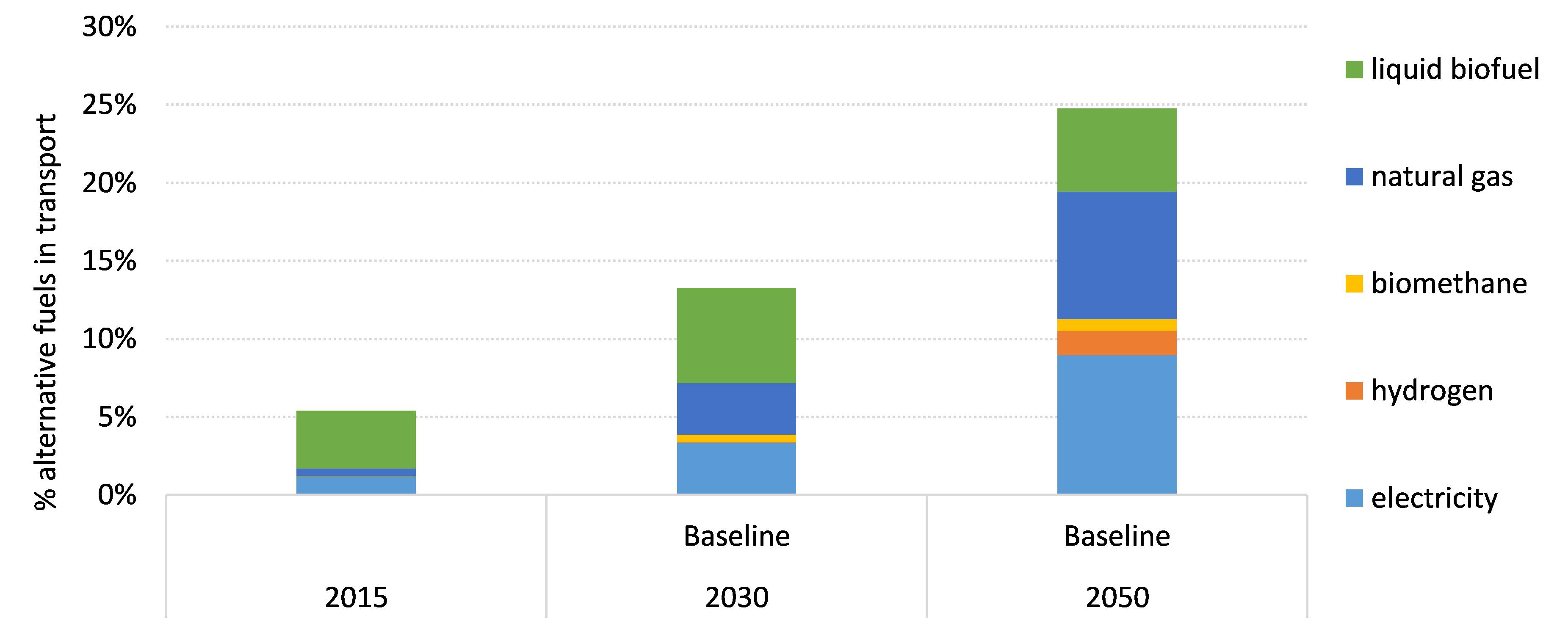

The EU Reference Scenario 2020 (REF2020) is the common starting point for the impact assessments for all the initiatives of the “Fit for 55” package and for this reason it is also used as a baseline for this impact assessment. The EU Reference scenario 2020 reflects the agreed 2030 EU climate and energy targets, the main policy tools at EU level to implement these targets as well as the aggregate ambition and, to the extent possible, the range of foreseen national policies and measures of the final National Energy and Climate Plans (NECPs) that Member States submitted in 2019 according to the Governance Regulation. The EU Reference scenario 2020 also takes into account the impacts of the COVID-19 pandemic that had a significant impact on the transport sector. More detailed information about the preparation process, assumptions and results are included in the Reference scenario publication. The most relevant information for this impact assessment is also presented in Annex 4.

The Reference scenario projects that EU level policies like CO2 standards for vehicles, together with the national contributions put forward in the NECPs and national incentives for the uptake of electric vehicles would result in an uptake of around 44 million electric light duty vehicles (30 million battery electric and 14 plug-in hybrid vehicles) by 2030. It shows that emissions from transport including intra-EU aviation and intra-EU maritime would go down by around 17% by 2030 relative to 2015 (or by 11% when all intra-EU and extra-EU aviation and maritime emissions are considered). The REF2020 scenario models the impacts of targets and policies already adopted, but not the revised EU climate ambition for 2030 or the target of net-zero emissions by 2050. Post-2030, there are no additional policies driving the decarbonisation. However, several of the measures in place today will continue to deliver emissions reductions in the long term. By 2050, the CO2 emissions from transport including intra-EU aviation and intra-EU maritime are projected to be 39% lower relative to 2015 (27% lower when all intra-EU and extra-EU aviation and maritime emissions are considered).