EUR-Lex Access to European Union law

This document is an excerpt from the EUR-Lex website

Document 31998R0075

Commission Regulation (EC) No 75/98 of 12 January 1998 amending Regulation (EEC) No 2454/93 laying down provisions for the implementation of Council Regulation (EEC) No 2913/92 establishing the Community Customs Code (Text with EEA relevance)

Commission Regulation (EC) No 75/98 of 12 January 1998 amending Regulation (EEC) No 2454/93 laying down provisions for the implementation of Council Regulation (EEC) No 2913/92 establishing the Community Customs Code (Text with EEA relevance)

Commission Regulation (EC) No 75/98 of 12 January 1998 amending Regulation (EEC) No 2454/93 laying down provisions for the implementation of Council Regulation (EEC) No 2913/92 establishing the Community Customs Code (Text with EEA relevance)

OJ L 7, 13.1.1998, p. 3–24

(ES, DA, DE, EL, EN, FR, IT, NL, PT, FI, SV)

Special edition in Czech: Chapter 02 Volume 008 P. 404 - 426

Special edition in Estonian: Chapter 02 Volume 008 P. 404 - 426

Special edition in Latvian: Chapter 02 Volume 008 P. 404 - 426

Special edition in Lithuanian: Chapter 02 Volume 008 P. 404 - 426

Special edition in Hungarian Chapter 02 Volume 008 P. 404 - 426

Special edition in Maltese: Chapter 02 Volume 008 P. 404 - 426

Special edition in Polish: Chapter 02 Volume 008 P. 404 - 426

Special edition in Slovak: Chapter 02 Volume 008 P. 404 - 426

Special edition in Slovene: Chapter 02 Volume 008 P. 404 - 426

Special edition in Bulgarian: Chapter 02 Volume 010 P. 185 - 207

Special edition in Romanian: Chapter 02 Volume 010 P. 185 - 207

Special edition in Croatian: Chapter 02 Volume 013 P. 198 - 219

No longer in force, Date of end of validity: 30/04/2016; Implicitly repealed by 32016R0481

No longer in force, Date of end of validity: 30/04/2016; Implicitly repealed by 32016R0481

|

13.1.1998 |

EN |

Official Journal of the European Communities |

L 7/3 |

COMMISSION REGULATION (EC) No 75/98

of 12 January 1998

amending Regulation (EEC) No 2454/93 laying down provisions for the implementation of Council Regulation (EEC) No 2913/92 establishing the Community Customs Code

(Text with EEA relevance)

THE COMMISSION OF THE EUROPEAN COMMUNITIES,

Having regard to the Treaty establishing the European Community,

Having regard to Council Regulation (EEC) No 2913/92 of 12 October 1992 establishing the Community Customs Code (1), as last amended by European Parliament and Council Regulation (EC) No 82/97 (2), and in particular Article 249 thereof,

Whereas it is appropriate to insert in Commission Regulation (EEC) No 2454/93 (3), as last amended by Regulation (EC) No 1427/97 (4), a definition of the term ‘EFTA countries’, as used in the context of the Community transit rules; whereas account should therefore be taken of the fact that countries other than the original Community and EFTA States have acceded to the Convention of 20 May 1987 on a common transit procedure (5), hereinafter referred to as ‘the Convention’;

Whereas the provisions on transit and proof of the Community status of goods carried by sea needs to be amended to simplify the tasks both of economic operators and of customs administrations;

Whereas the provisions on transit and proof of the Community status of goods carried by sea are inadequate because of the particular features of sea transport which have no counterpart in other types of transport; whereas it is consequently impossible under the current provisions to guarantee collection of customs debt and other charges on goods;

Whereas the Community transit procedure, which is obligatory for carriage by sea of non-Community goods, is almost impossible to apply in practice because of those features;

Whereas a guarantee is needed to ensure collection of customs debt and other charges where goods are carried under these transit rules, by sea, by regular shipping services;

Whereas it is necessary to establish a way of identifying goods consigned to or from a part of the customs territory of the Community where the provisions of Council Directive 77/388/EEC (6), as last amended by Directive 96/95/EC (7), do not apply; whereas such goods should be identified by means of a T2LF document or, where they are carried under the internal Community transit procedure, by means of a specific entry in the T2 declaration form;

Whereas Community goods consigned from one point to another in the customs territory of the Community, which are carried entirely by sea or air through the territory of one or more countries which have acceded to the Convention, should not be required to move under the Community's internal transit rules solely because they are carried through the territory of those countries;

Whereas experience has shown that it is advisable to restrict the ban on the use of the comprehensive guarantee within the Community transit regime to a limited period;

Whereas, for the purpose of simplifying administrative procedures, it would seem advisable to harmonize several of the forms used in the Community procedure and common transit procedure, and to combine in a single list the lists of certain sensitive goods contained in Annexes 52 and 56 to Regulation (EEC) No 2454/93;

Whereas the extension of the Community transit procedure to Andorra and San Marino requires some changes to the forms;

Whereas the transition period for trade between the Community as constituted on 31 December 1985, on the one hand, and Spain and Portugal on the other, and trade between those two Member States, ended on 31 December 1995, with the result that documents and procedures are no longer needed to identify goods so traded; whereas Commission Regulation (EEC) No 409/86 (8), as amended by Regulation (EEC) No 3716/91 (9), should therefore be repealed;

Whereas Article 188 of Regulation (EEC) No 2913/92, hereinafter referred to as ‘the Code’, grants import tariff reductions on fisheries products caught by Community vessels in the territorial waters of a third country; whereas a certificate in the form of a standard model incorporating all the necessary declarations needed in support of the declaration for release for free circulation would be the best way to deal with those products;

Whereas a simple obligation on the part of the Member States to keep at the disposal of the Commission the lists of cases referred to in Articles 870 and 889(2) of Regulation (EEC) No 2454/93 is sufficient not only to allow checks carried out in the framework of own resources controls to be carried out properly but also to protect the financial interests of the Community; whereas it is therefore convenient, with a view to simplifying the obligations of the Member States, to put an end to the obligation to send these lists to the Commission;

Whereas the codes established by Regulation (EEC) No 2454/93 do not cover returned goods within the meaning of Article 185 of the Code or goods from third countries released for free circulation in a country with which the Community has concluded a customs union agreement before being redispatched to the Community; whereas, therefore, those categories should be included in the list of codes;

Whereas the provisions of this Regulation are in accordance with the opinion of the Customs Code Committee,

HAS ADOPTED THIS REGULATION:

Article 1

Regulation (EEC) No 2454/93 is hereby amended as follows:

|

1. |

in Article 309, the following point (f) is added:

|

|

2. |

Article 311 is amended as follows:

|

|

3. |

the title of Part II, Title II, Chapter 3 is replaced by the following: ‘Customs status of goods’; |

|

4. |

Article 313 is replaced by the following: ‘Article 313 1. Subject to Article 180 of the Code and the exceptions listed in paragraph 2 of this Article, all goods in the customs territory of the Community shall be deemed to be Community goods, unless it is established that they do not have Community status. 2. The following shall not be deemed to be Community goods unless it is established in accordance with Articles 314 to 323 that they do have Community status:

By way of derogation from this provision and in accordance with Article 38(5) of the Code, goods brought into the customs territory of the Community shall be deemed to be Community goods unless it is established that they do not have Community status:

|

|

5. |

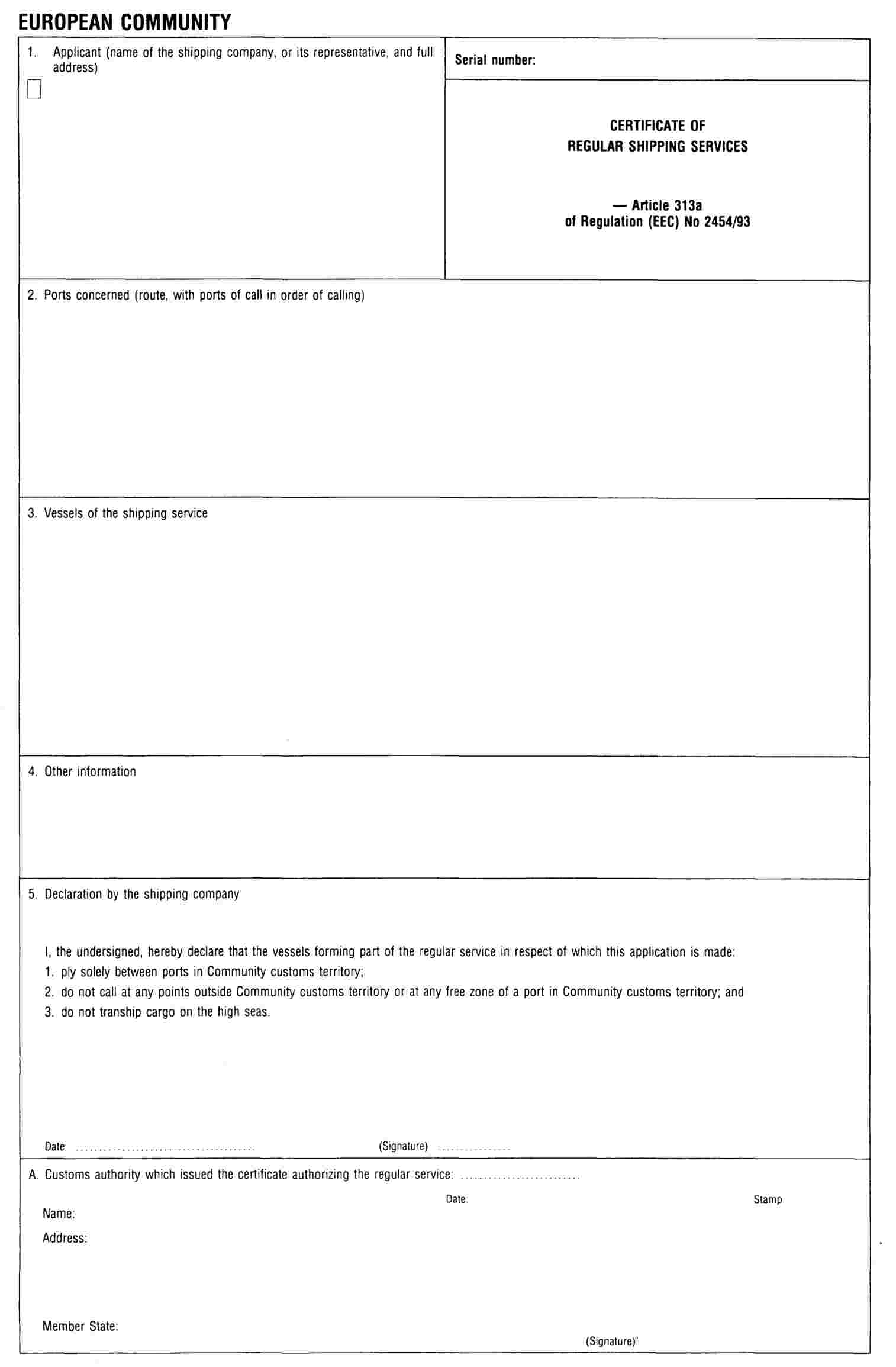

the following Articles 313a and 313b are inserted: ‘Article 313a 1. A regular shipping service means a regular service which carries goods in vessels that ply only between ports situated in the customs territory of the Community and may not come from, go to or call at any points outside this territory or in a free zone of a port in this territory. 2. The customs authorities may require proof that the provisions on authorized shipping services have been observed. Where the customs authorities establish that the provisions on authorized shipping services have not been observed, they shall immediately inform all the customs authorities concerned. Article 313b 1. Where a shipping company makes an application, the customs authorities of a Member State in whose territory the company is established or represented may, with the agreement of the customs authorities of the other Member States concerned, authorize the establishment of a regular shipping service. 2. The application shall contain the following details:

3. Authorisation shall be granted only to shipping companies which:

4. When they receive an application for authorisation, the customs authorities of the Member State to whom the application has been made (the authorising authorities) shall notify the customs authorities of the other Member States in whose territories the intended ports of call of the regular shipping service are situated (the corresponding authorities). The corresponding authorities shall acknowledge receipt of the application. Within 60 days of receipt of such notification, the corresponding authorities shall signify their agreement or refusal. Where a Member State refuses an application, it shall state the reasons. Where no reply is received, the authorising authority shall issue an authorisation which shall be accepted by the other Member States concerned. The authorising authorities shall issue an authorisation certificate, in one or more copies as required and conforming to the model set out in Annex 42 A, and shall inform the corresponding authorities of the other Member States concerned. Each authorisation certificate shall bear a serial number by which it can be identified. All copies of each certificate shall bear the same number. 5. Once a regular shipping service has been authorised, the shipping company concerned shall be required to use it. The shipping company shall communicate any withdrawal or change in the characteristics of the authorised service to the authorising authorities. 6. Where an authorisation is withdrawn, or a regular shipping service ceases operations, the authorising authorities shall notify the corresponding authorities of the Member States concerned. The authorising authorities shall also notify the corresponding authorities of any changes to a regular shipping service, using the procedure provided for in paragraph 4. 7. When a vessel of the type referred to in Article 313a(l) is forced by circumstances beyond its control to tranship at sea or temporarily put into a third-country port or a free zone of a port in the customs territory of the Community, the shipping company shall immediately inform the customs authorities of the subsequent ports of call along the vessel's scheduled route.’; |

|

6. |

Article 314 is replaced by the following: ‘Article 314 1. Where goods are not deemed to be Community goods within the meaning of Article 313, their Community status may not be established under paragraph 2 unless:

2. Proof that the goods have Community status may be established solely:

3. The documents or rules referred to in paragraph 2 shall not be used in respect of goods for which the export formalities have been completed or which have been placed under the inward processing procedure (drawback system). 4. Where the documents or rules referred to in paragraph 2 are used for Community goods with packaging not having Community status, the document certifying Community status shall be endorsed with one of the following phrases:

|

|

7. |

Article 315 is amended as follows:

|

|

8. |

Article 317 is amended as follows:

|

|

9. |

the following Article 317a is inserted: ‘Article 317a 1. Proof of the Community status of goods shall be furnished, in accordance with the conditions set out below, by the production of the shipping company's manifest relating to the goods. 2. The manifest shall include at least the following information:

The manifest shall further include, for each consignment:

3. At the shipping company's request, the manifest, duly completed and signed by the company, shall be authenticated by the customs authorities of the Member State of departure. Such authentication shall include the name and the stamp of the office of departure, the signature of the competent official and the date of authentication.’; |

|

10. |

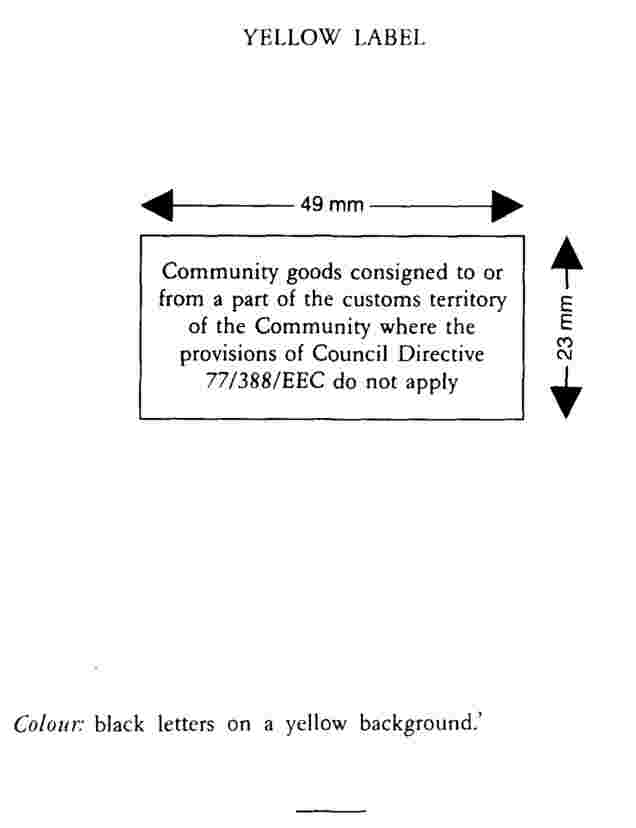

the following Article 323a is inserted: ‘Article 323a: 1. Where pursuant to Article 91(2)(f) the Code, non-Community goods are carried from one point to another in the customs territory of the Community by post (including parcel post), the customs authorities of the Member State of dispatch shall be required to affix on the packaging and accompanying documents a label of the type shown in Annex 42, or have a label of this type so affixed. 2. Where Community goods are carried by post (including parcel post) to or from a part of the customs territory of the Community where Directive 77/388/EEC does not apply, the customs authorities of the Member State of dispatch shall be required to affix on the packaging and accompanying documents a label of the type shown in Annex 42 B, or have a label of this type so affixed.’; |

|

11. |

Article 362(2) and (3) are replaced by the following: ‘2. The maximum period for which use of the comprehensive guarantee shall be prohibited in respect of any goods shall be 12 months, unless the Commission decides to extend the period in accordance with the Committee procedure.’; |

|

12. |

Article 376(1) (b) is replaced by the following:

|

|

13. |

in Article 381 the following paragraph la is inserted: ‘1a. Where a T2 declaration is required for goods of the type referred to in Article 31 l(c), the letter “F” shall be entered after the symbol “T2” in the third subdivision of box 1 of the form, the model for which is shown in Annexes 31 to 34.’; |

|

14. |

Article 389 is replaced by the following: ‘Article 389 Without prejudice to the application of Article 317(4), the customs authorities of each Member State may authorise any person, hereinafter referred to as the “authorised consignor”, who satisfies the requirements laid down in Article 390 and proposes to establish the Community status of goods by means of a T2L document in accordance with Article 315(1) or by means of one of the documents stipulated in Articles 317 and 317a, hereinafter referred to as “commercial documents”, to use such documents without having to present them for authentication to the customs authorities of the Member State of departure.’; |

|

15. |

Article 419(2) is replaced by the following: ‘2. The office of departure shall clearly enter in the box reserved for customs on sheets 1, 2 and 3 of the CIM consignment note:

The symbol “T2” or “T2F” shall be authenticated by the application of the stamp of the office of departure.’; |

|

16. |

Article 434(2), (3) and (4) are replaced by the following: ‘2. The office of departure shall clearly enter in the box reserved for customs on sheets 1, 2, 3A and 3B of the TR transfer note:

The symbol “T2” or “T2F” shall be authenticated by the application of the stamp of the office of departure. 3. The office of departure shall enter in the box reserved for customs on sheets 1, 2, 3A and 3B of the TR transfer note separate references for the container(s) depending on which type of goods they contain and the symbol “T1”, “T2” or “T2F”, as appropriate, wherever a TR transfer note covers:

4. In cases covered by paragraph 3, where lists of large containers are used, separate lists shall be made out for each category of container and the serial number or numbers of the list or lists concerned shall be entered in the box reserved for customs on sheets 1, 2, 3A and 3B of the TR transfer note. The symbol “T1”, “T2” or “T2F”, as appropriate to the category of container used, shall be entered alongside the serial number(s) of the list(s)’; |

|

17. |

Article 444 is amended as follows:

|

|

18. |

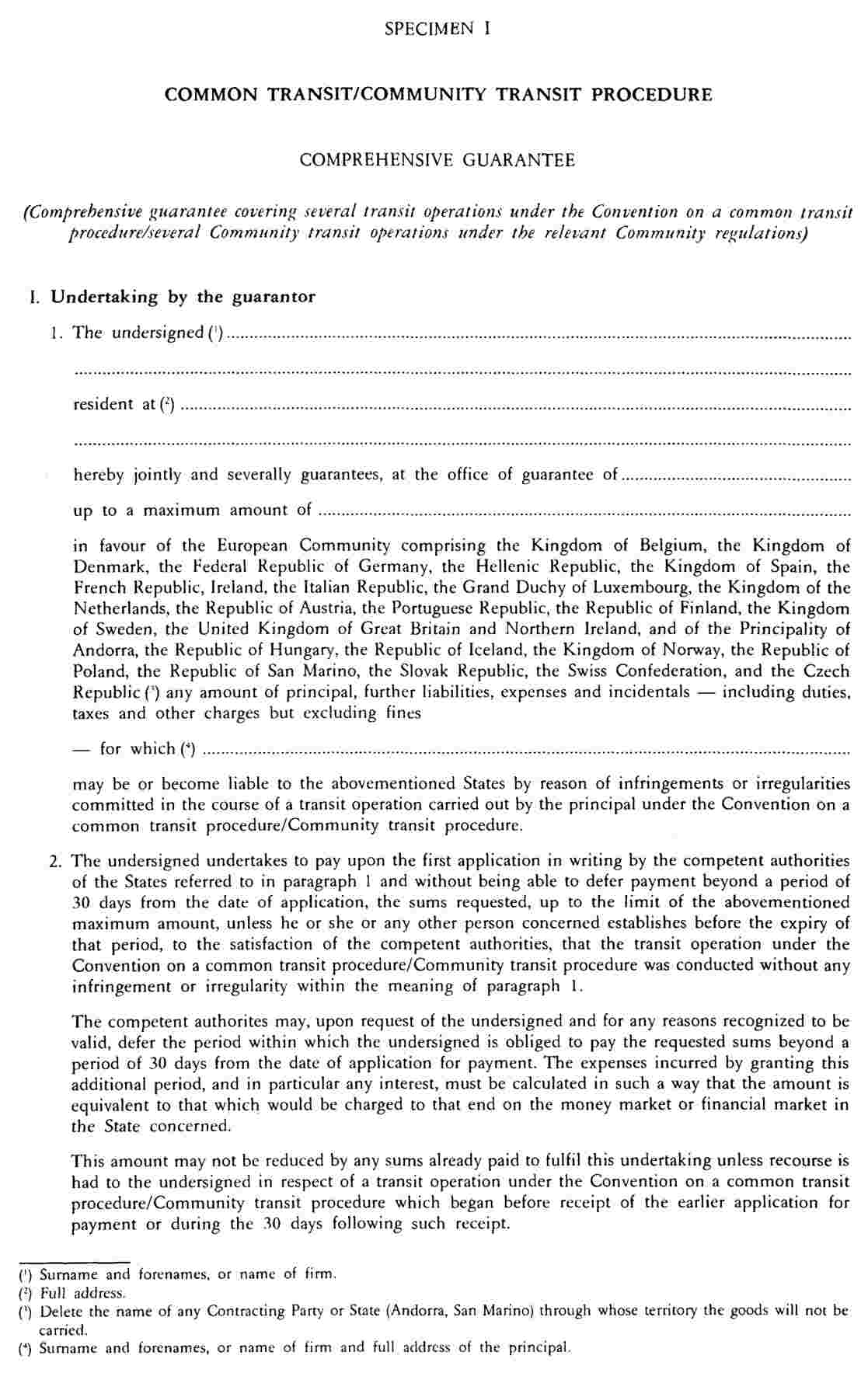

Articles 446 and 447 are replaced by the following: ‘Article 446 Use of the Community transit procedure shall be compulsory for goods carried by sea only where they are carried by a regular shipping service authorized in accordance with Article 313a. Article 447 1. In the case of goods placed under the transit procedure provided for in Article 446, a guarantee shall be furnished to secure the payment of the customs debt and other charges likely to arise in respect of the goods. 2. It shall not be necessary to furnish a guarantee for the procedures referred to in Article 448.’; |

|

19. |

Article 448 is amended as follows:

|

|

20. |

Article 449 is deleted; |

|

21. |

the title of Part III is replaced by the following: ‘Privileged operations TITLE I RETURNED GOODS’; |

|

22. |

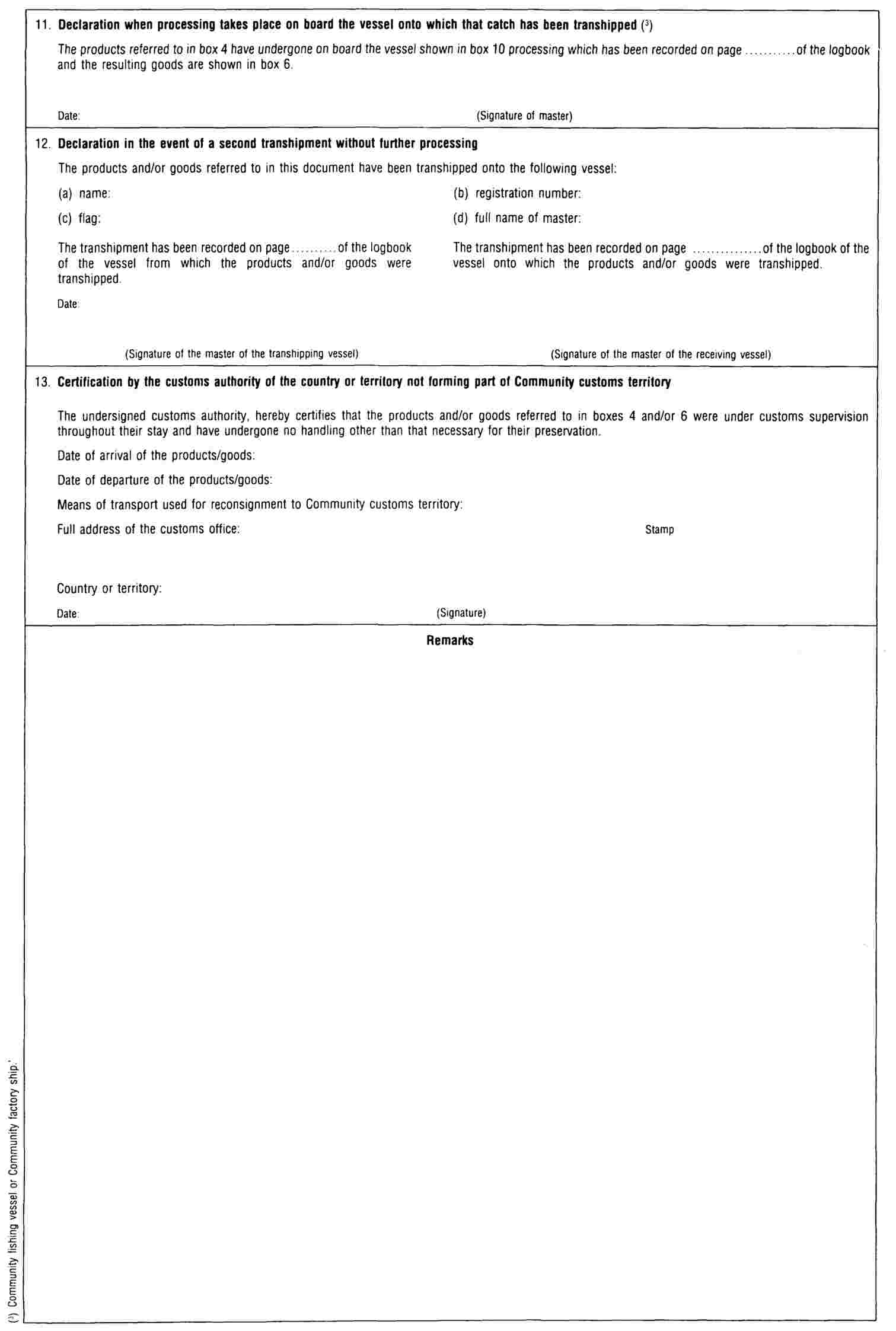

the following text is added after Article 856: ‘TITLE II PRODUCTS OF SEA-FISHING AND OTHER PRODUCTS TAKEN FROM THE TERRITORIAL SEA OF A THIRD COUNTRY BY COMMUNITY FISHING VESSELS Article 856a 1. Exemption from import duties for the products referred to in Article 188 of the Code shall be subject to the presentation of a certificate in support of the declaration for release for free circulation relating to those products. 2. For products to be released for free circulation in the Community, in the situations referred to in Article 329(a) to (d), the master of the Community vessel making the catch shall complete boxes 3, 4 and 5 and, if need be, box 9, of the certificate. If the catch has been processed on board, the master of the vessel shall also complete boxes 6, 7 and 8. Articles 330, 331 and 332 shall apply to completion of the corresponding boxes on the certificate. When the declaration is made for release for free circulation of these products, the declarant shall complete boxes 1 and 2 of the certificate. 3. The certificate must conform to the model set out in Annex 110a and be drawn up in accordance with paragraph 2. 4. Where the products are declared for release for free circulation at the port where they were unloaded from the Community fishing vessel which made the catch, the derogation referred to in Article 326(2) shall apply mutatis mutandis. 5. For the purposes of paragraphs 1 to 4, the meaning of “Community fishing vessel” and “Community factory vessel” shall be as defined in Article 325(1) while “products” shall be taken to mean those products and goods referred to in Articles 326 to 332, where reference is made to those provisions. 6. In order to ensure that paragraphs 1 to 5 are complied with, the Member State administrations shall accord each other mutual assistance in checking that certificates are authentic and the particulars in them accurate.’; |

|

23. |

Article 870 is replaced by the following: ‘Article 870 Each Member State shall keep at the disposal of the Commission a list of the cases in which the provisions of Article 869(a), (b) or (c) have been applied.’; |

|

24. |

Article 889(2) is replaced by the following: ‘2. Each Member State shall keep at the disposal of the Commission a list of the cases in which the provisions of the second subparagraph of paragraph 1 have been applied.’; |

|

25. |

Annex 37 is amended in accordance with Annex I hereto; |

|

26. |

Annex 38 is amended in accordance with Annex II hereto; |

|

27. |

Annex 42 A, as shown in Annex III to this Regulation, is inserted; |

|

28. |

Annex 42 B, as shown in Annex IV to this Regulation, is inserted; |

|

29. |

In Annexes 46, 47 and 54 the symbols ‘T2ES’ and ‘T2PT’ are replaced by the symbol ‘T2F’; |

|

30. |

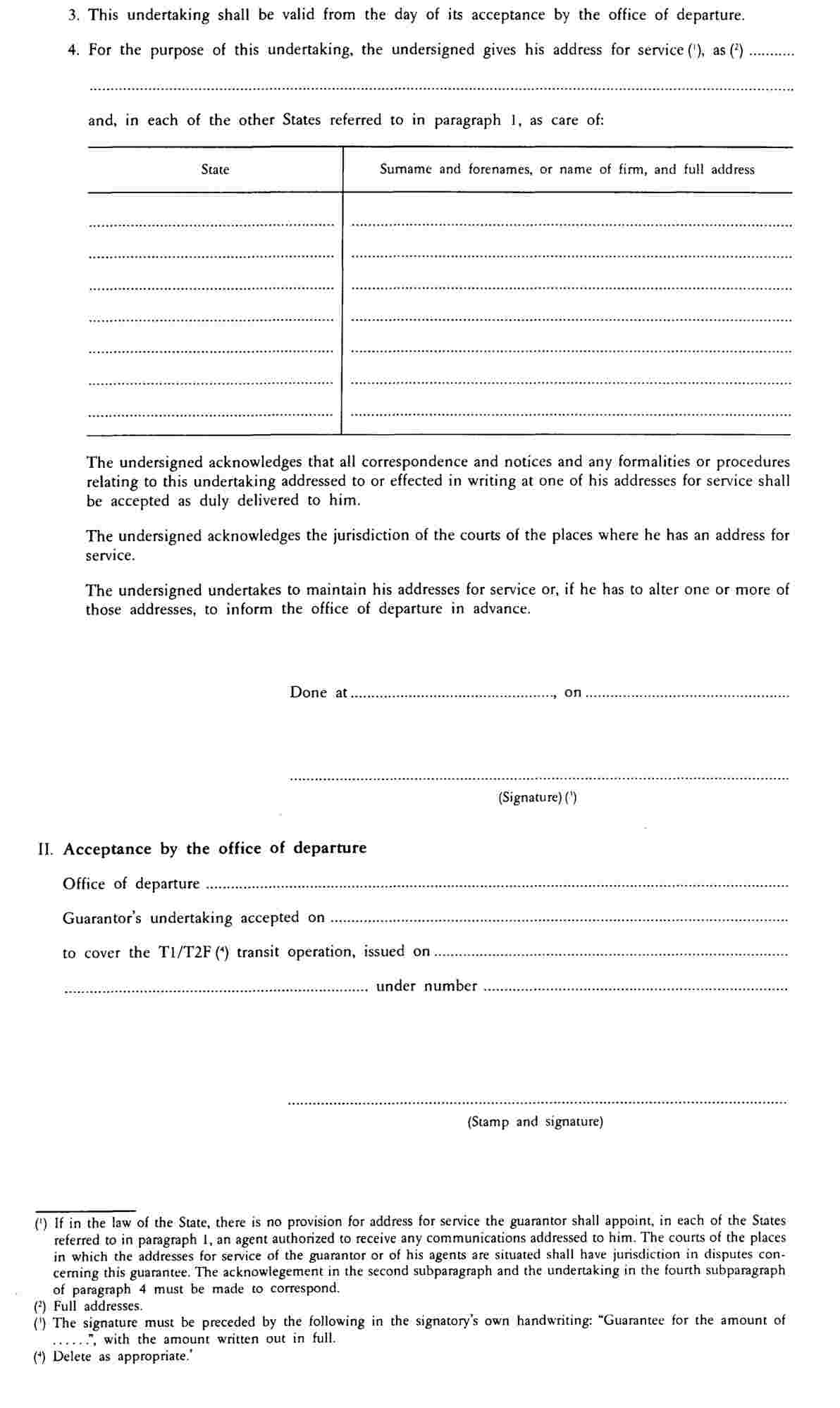

Annexes 48, 49, 50 and 51 are replaced by Annexes V, VI, VII and VIII hereto respectively; |

|

31. |

Annex 52 (list of goods which, when transported, give rise to an increase in the flat-rate guarantee) is replaced by Annex IX hereto; |

|

32. |

Annex 56 (list of goods presenting increased risks to which the guarantee waiver does not apply) is deleted; |

|

33. |

Annex 110a, as shown in Annex X to this Regulation, is inserted. |

Article 2

Regulation (EEC) No 409/86 is hereby repealed.

Article 3

The forms referred to in points 29 and 30 of Article 1 which were in use prior to the date of entry into force of this Regulation, may continue to be used, subject to the appropriate changes being entered, until stocks run out or until 31 December 1999 at the latest.

Article 4

Point 11 of Article 1 shall also apply to Decisions taken pursuant to Article 362(1) of Regulation (EEC) No 2454/93 which remain applicable at the date of the entry into force of this Regulation.

Article 5

This Regulation shall enter into force on the seventh day following its publication in the Official Journal of the European Communities.

Points 12, 26 (in respect of points 2 and 3 of Annex II), 31 and 32 of Article 1 shall apply from 1 February 1998.

Points 2 to 10, 13 to 20, 25, 26 (in respect of point 1 of Annex II), and 27, 28 and 29 of Article 1 shall apply from 1 July 1998.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 12 January 1998.

For the Commission

Mario MONTI

Member of the Commission

(1) OJ L 302, 19. 10. 1992, p. 1.

(2) OJ L 17, 21. 1. 1997, p. 1.

(3) OJ L 253, 11. 10. 1993, p. 1.

(4) OJ L 196, 24. 7. 1997, p. 31.

(5) OJ L 226, 13. 8. 1987, p. 2.

(6) OJ L 145, 13. 6. 1977, p. 1.

(7) OJ L 338, 28. 12. 1996, p. 89.

(8) OJ L 46, 25. 2. 1986, p. 5.

(9) OJ L 351, 20. 12. 1991, p. 21.

ANNEX I

In Title II A 1 of Annex 37, the third paragraph shall be replaced by the following:

‘In the third subdivision, enter “T1”, “T2” or “T2F” where the Community transit procedure is used, or “T2L” or “T2LF” where the Community transit procedure is not used but the Community status of goods must be proved.’

ANNEX II

Annex 38 shall be amended as follows:

|

1. |

The third subdivision of box 1, shall be replaced by following: ‘This subdivision must be completed only where the form is to be used for the purposes of the Community transit procedure or as a document proving the Community status of goods. The following marks shall be used as shown below:

|

|

2. |

A footnote (1) shall be added to the wording relating to code 3 in the list of first digits of codes for box 36 so that it reads as follows:

(1) Where this is used to establish the originating status." |

|

3. |

The following shall also be added to the list of codes for box 36:

|

ANNEX III

‘Annex 42 A

ANNEX IV

‘ANNEX 42 B

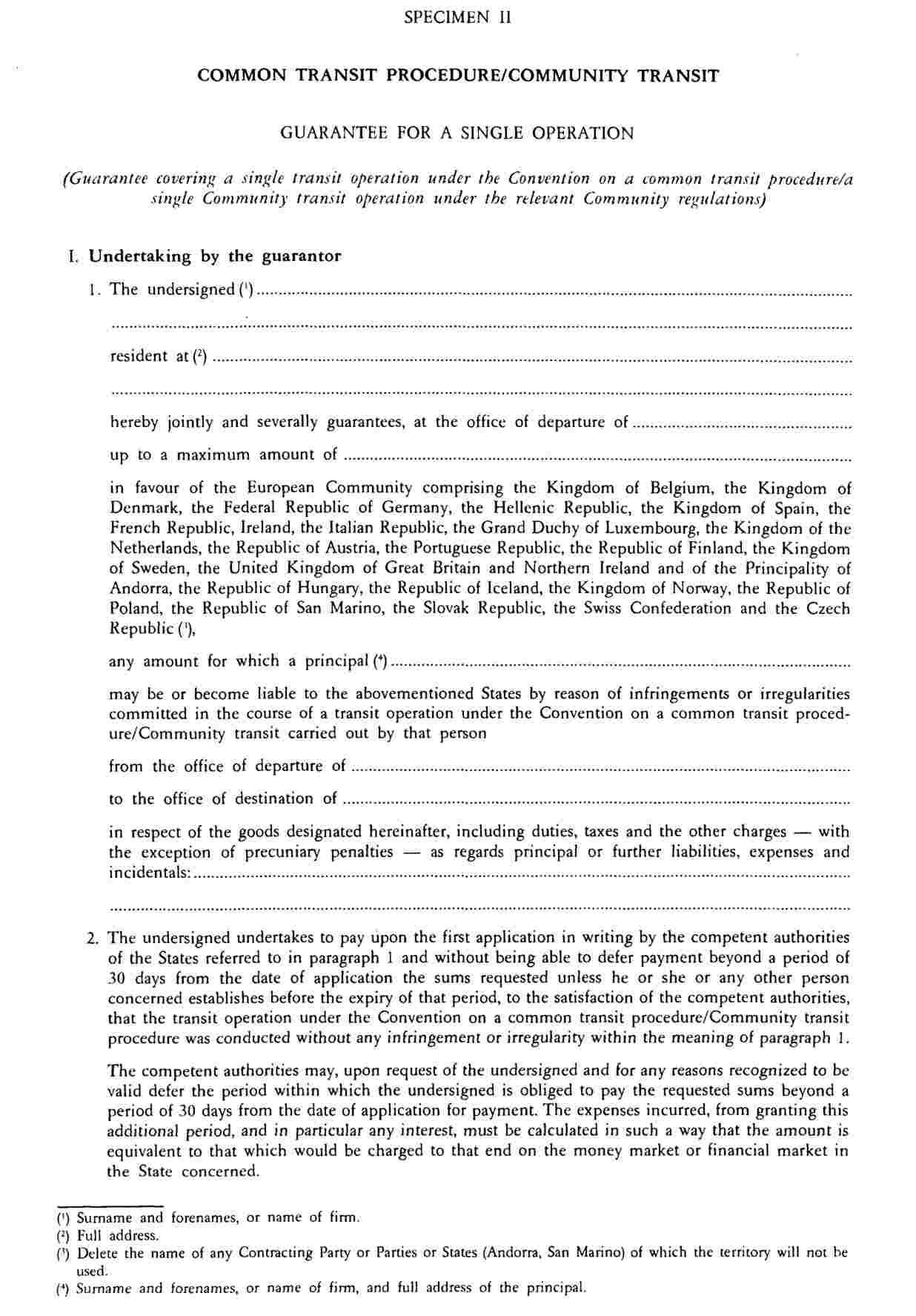

ANNEX V

‘ANNEX 48

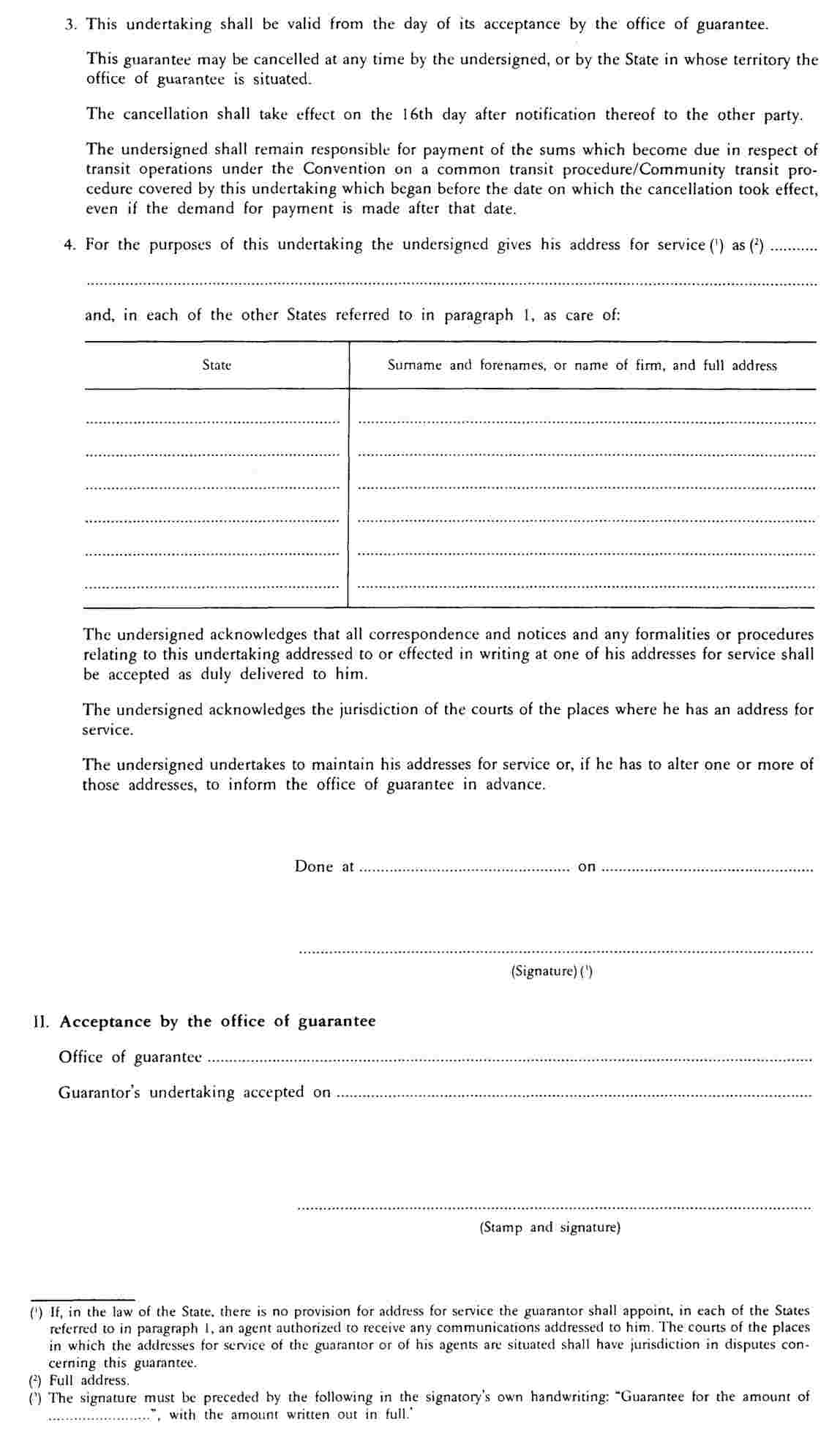

ANNEX VI

‘ANNEX 49

ANNEX VII

‘ANNEX 50

ANNEX VIII

‘ANNEX 51

TC 31 — CERTIFICATE OF GUARANTEE

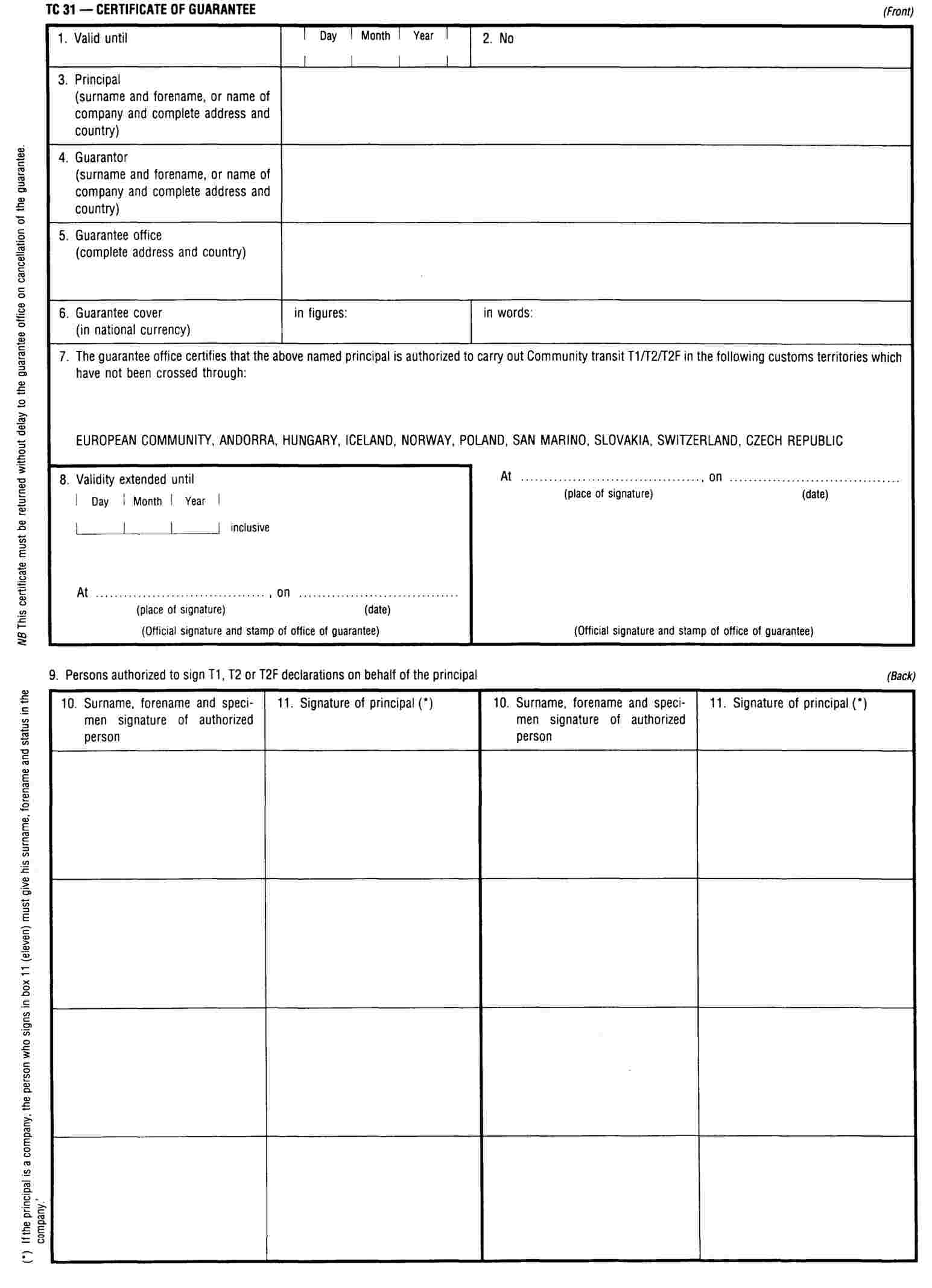

ANNEX IX

‘ANNEX52

LIST OF GOODS WHICH, WHEN TRANSPORTED, GIVE RISE TO AN INCREASE IN THE FLAT-RATE GUARANTEE

LIST OF GOODS PRESENTING INCREASED RISKS TO WHICH THE GUARANTEE WAIVER DOES NOT APPLY

|

HS code |

Description |

Quantity corresponding to the standard amount of ECU 7 000 |

|

1 |

2 |

3 |

|

01.02 |

Live bovine animals |

4 000 kg |

|

02.02 |

Meat of bovine animals, frozen |

3 000 kg |

|

04.02 |

Milk and cream, concentrated or containing added sugar or other sweetening matter |

5 000 kg |

|

ex 04.05 |

Butter and other fats and oils derived from milk |

3 000 kg |

|

08.03 |

Bananas, including plantains, fresh or dried |

8 000 kg |

|

17.01 |

Cane or beet sugar and chemically pure sucrose, in solid form |

7 000 kg |

|

2207.10 |

Undenatured ethyl alcohol of an alcoholic strength by volume of 80 % vol or higher |

3 hl |

|

ex 22.08 |

Spirits, liqueurs and other spirituous beverages |

5 hl |

|

2402.20 |

Cigarettes |

35 000 items’ |

ANNEX X

‘Annex 110 A