EUROPEAN COMMISSION

EUROPEAN COMMISSION

Brussels, 15.7.2015

SWD(2015) 142 final

COMMISSION STAFF WORKING DOCUMENT

Investment perspectives in electricity markets

Accompanying the document

COMMUNICATION FROM THE COMMISSION TOT HE EUROPEAN PARLIAMENT, THE COUNCIL, THE EUROPEAN ECONOMIC AND SOCIAL COMMITTEE AND THE COMMITTEE OF THE REGIONS

Launching the public consultation process on a new energy market design

{COM(2015) 340 final}

COUNTRIES

AT

Austria

BE

Belgium

BG

Bulgaria

CY

Cyprus

CZ

Czech Republic

DE

Germany

DK

Denmark

EE

Estonia

EL

Greece

ES

Spain

FI

Finland

FR

France

HR

Croatia

HU

Hungary

IE

Ireland

IT

Italy

LT

Lithuania

LU

Luxembourg

LV

Latvia

MT

Malta

NL

Netherlands

NO

Norway

PL

Poland

PT

Portugal

RO

Romania

SE

Sweden

SI

Slovenia

SK

Slovakia

UK

United Kingdom

US

United States

UNITS

GWh

Gigawatt hour

kWh

Kilowatt hour

Mtoe

Million tonnes of oil equivalent

MWh

Megawatt-hour

tCO2

Tons of carbon dioxide emissions

TWh

Terawatt-hour

OTHERS

CAPEX

Capital Expenditure

ECM

Error correction model

EEX

European Energy Exchange

EIA

Energy Information Administration

ENTSO

European network of transmission system operator

ETS

Emissions trading scheme

EU

European Union

EUA

European Union allowances

EUR

Euro

FiT

Feed-in tariff

GDP

Gross Domestic product

GHG

Greenhouse gas

HHI

Herfindahl-Hirschman index

HICP

Harmonized index of consumer prices

IEA

International Energy Agency

LCOE

Levelised Cost of Electricity

LRMC

Long run marginal cost

MS

Member State

OCGT

Open-Cycle Gas Turbine

OECD

Organization for Economic Cooperation and Development

OPEX

Operating expenditure

RES

Renewable energy sources

VOLL

Value of Lost Load

Executive Summary

Part I:Investments in electricity markets: evolution and drivers

Introduction

1.Investments in electricity generation: recent trends

1.1.Investment trends in electricity generation

1.2.Public support

1.3.Price evolution: electricity, carbon and commodity prices

1.4.Concluding remarks

2.Investment in electricity: assessing the drivers in renewables and conventional technologies

2.1.public support and investment

2.2.Market driven Investments

2.3.Concluding remarks

Part II:Investment needs and price signal: perspectives

Introduction

1.Price signal in electricity markets and market framework in member States

1.1.Price signal to investors

1.2.Market Frameworks in Member States

1.3.Concluding remarks

2.The transition to low carbon economies and investment needs

2.1.The case for investments in electricity markets

2.2.The ongoing transformation of European electricity markets

2.3.Concluding remarks

Part III:Reconciling markets with investment signal: which market arrangements?

Introduction

1.The economics of the transition to low carbon economies

1.1.The economics of low carbon technologies

1.2.Investment criterion in low carbon technologies in a changing electricity system

1.3.Concluding remarks

2.Market arrangements through the energy transition

2.1.Current trends

2.2.Challenges for investments and options in power systems under decarbonisation (transition phase)

2.3.Challenges for investments and options under decarbonised power systems (decarbonised phase)

2.4.Concluding remarks

References

Glossary

Annexes

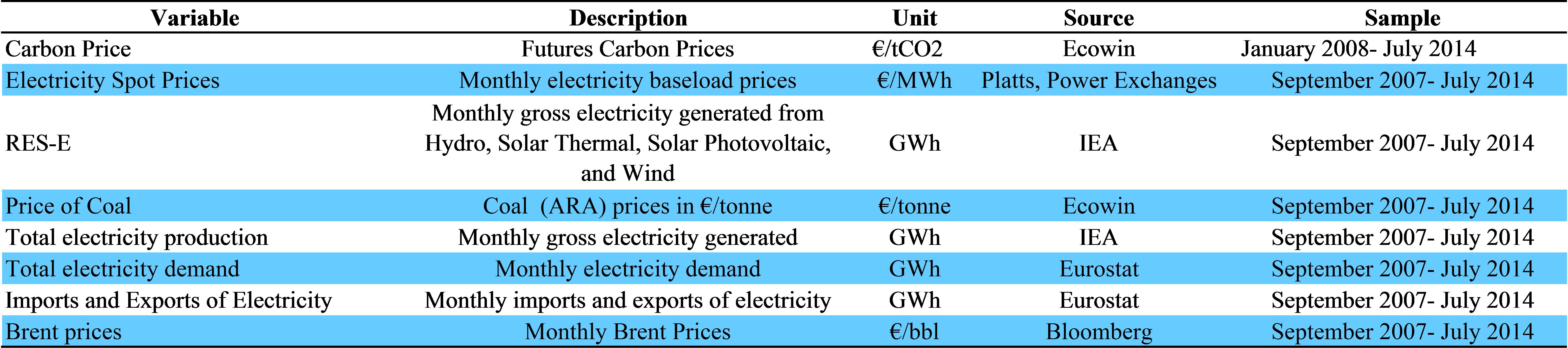

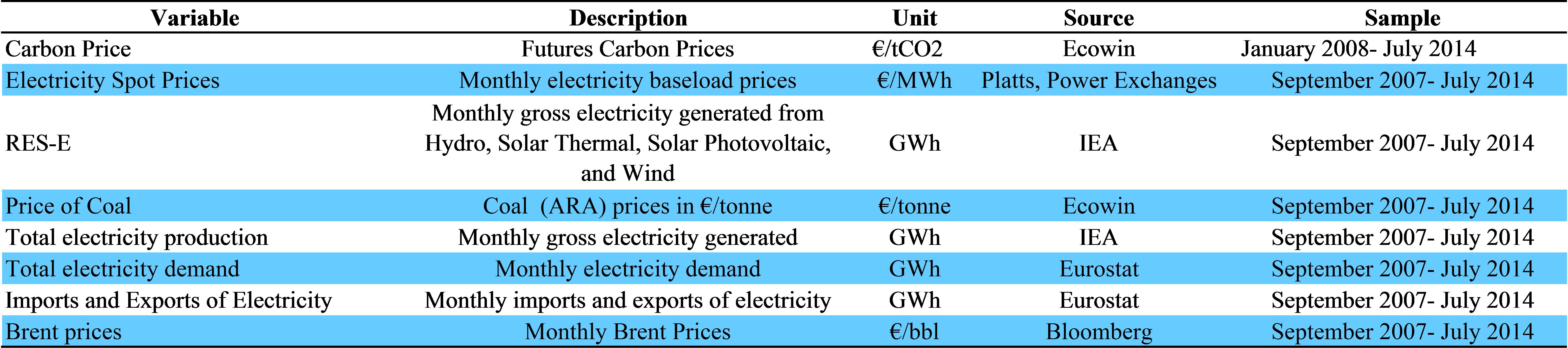

A.1.Investment drivers: variables description

A.2.Power price drivers methodology and data description

A2.1.Methdology

A2.2.Data description

A.3.The transition to low carbon technologies: impact on the merit order curve

A.4.Methodology to calculate the annualized capital expenditure

LIST OF Tables

I.2.1.Results of the electricity investments drivers

II.1.1.Electricity Regional Initiatives

II.1.2.Electricity market characteristics at Member State-level

II.2.1.Electricity cost structure

III.2.1.Dispersion* in the EU electricity sector: price and market support

A1.1.Investment model

A2.1.Panel unit root test results

A2.2.Pedroni and Kao residual co-integration test results

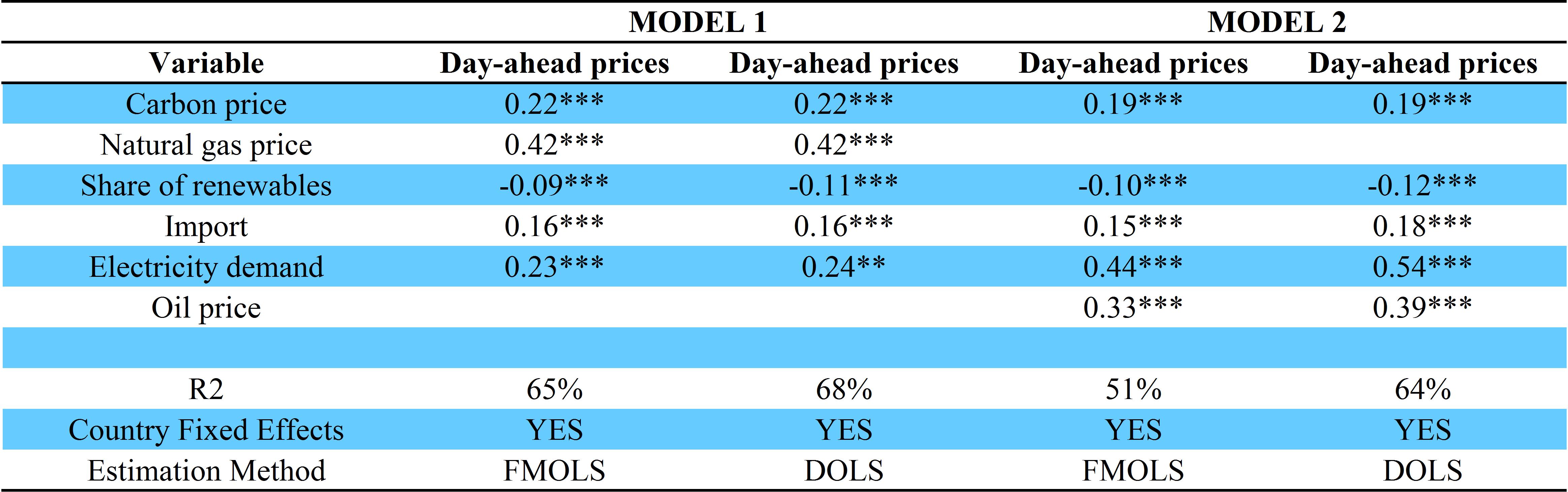

A2.3.Panel FMOLS and DOLS long-run estimates (in logs)

A2.4.Short run causality (Variables in first differences)

A2.5.Long run causality (Variables in levels)

A2.6.Data description – Power price drivers

LIST OF Graphs

I.1.1.Evolution of installed generation capacity

I.1.2.Installed generation capacity - EU28

I.1.3.Net change in installed generation capacity 2004-2008

I.1.4.Net change in installed generation capacity 2009-2013

I.1.5.Total support to the energy sector

I.1.6.Components of total support

I.1.7.Average domestic and industrial retail electricity price, wholesale price and crude oil price evolution 2007-2013

I.1.8.EU: retail price change and the contribution of the price components 2009-2013

I.1.9.Electricity wholesale price

I.1.10.Energy commodities and CO2 prices

I.2.1.Support per electricity produced

I.2.2.RES share and support evolution

I.2.3.Investment decision

II.1.1.A generic merit-order curve and the effect of increased low marginal cost technologies

II.1.2.Taxonomy of capacity mechanisms

II.2.1.Ranges for EU28 - Net Power Capacity Investment (in GWe - aggregate 2011-2030)

II.2.2.Annual Investment Expenditures in billion of euro - 2010 (2011-2030)

II.2.3.EU28 - Electricity consumption (in TWh) - Final electricity demand in TWh*

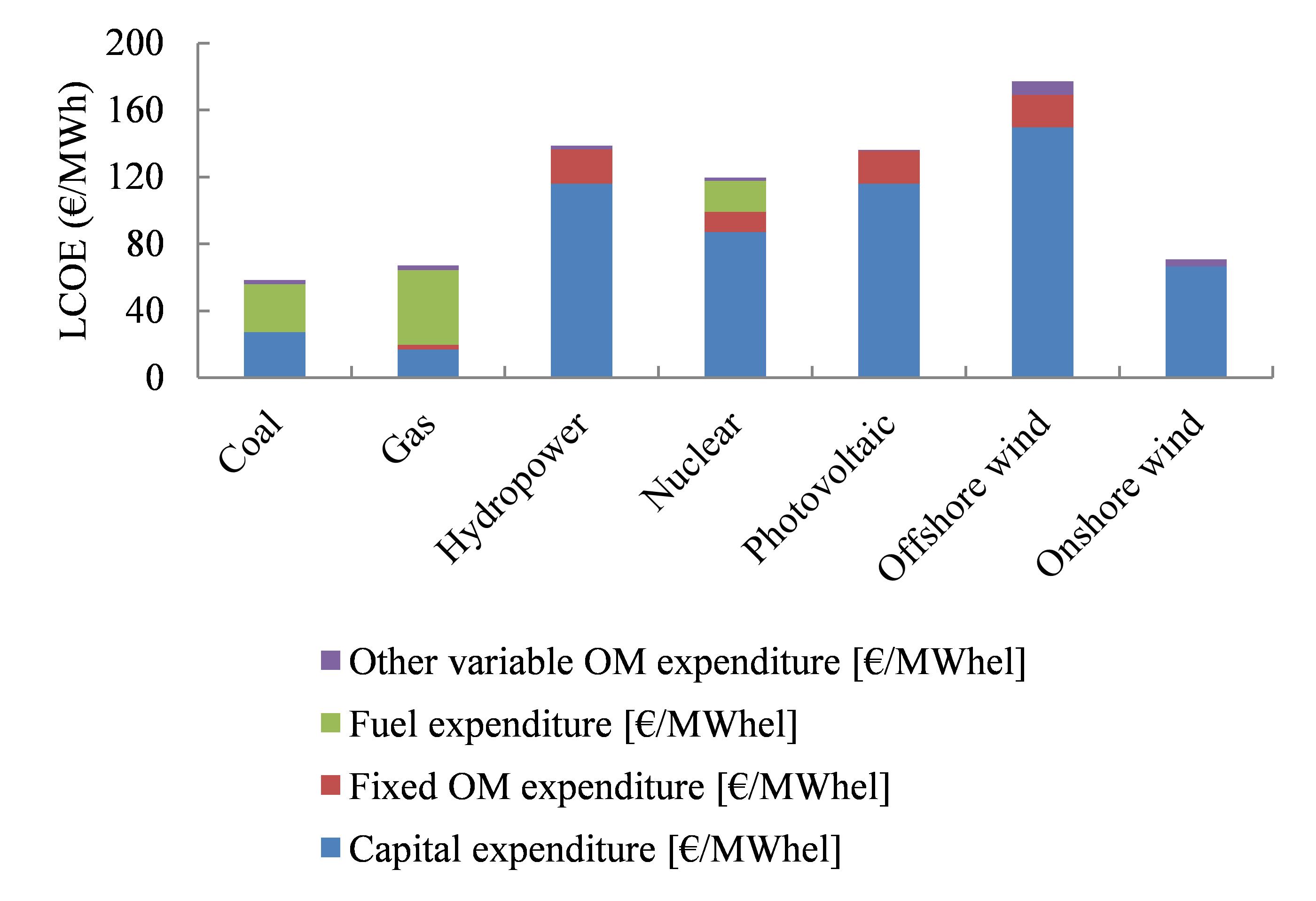

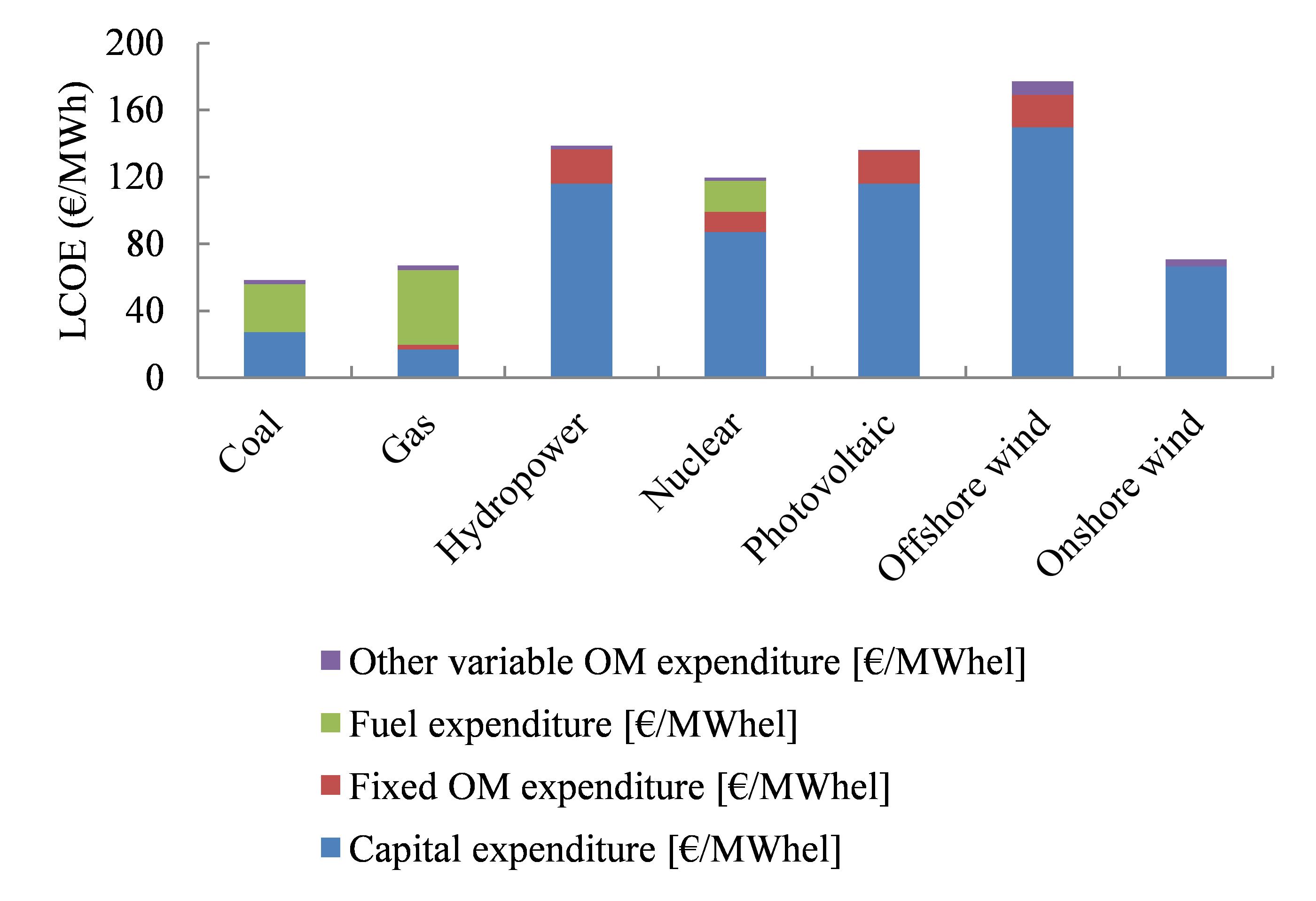

II.2.4.Levelised costs of fossil fuel and low carbon technologies

III.1.1.Generic merit order curve under no capacity constraints

III.1.2.Generic merit order curve under scarce capacity

III.1.3.Impact of demand response on the load duration curve

III.1.4.Short-run impact of demand response on the sudden changes of power outputs

III.1.5.Cost development of an entrant and an incumbent technology

III.1.6.Estimated mark-ups for low carbon technologies with Open gas Cycle Turbine as a marginal producer

III.2.1.Estimated mark-ups in EUR/tCO2 for low carbon technologies under a marginal price regime

III.2.2.Degree of harmonisation of national market intervention

III.2.3.Cost structure of the technology mix under conventional power system

III.2.4.Cost structure of the technology mix under the decarbonised phase

A3.1.Merit-order curves under the conventional phase (stage 1)

A3.2.Merit-order curves under the transition phase (stage 2) when technologies 0 are operating

A3.3.Merit-order curves under the transition phase (stage 2) when technologies 0 are not operating

A3.4.Merit-order curves under the decarbonised phases (stage 3)

LIST OF Boxes

I.1.1.Electricity Markets and Policy Context11

I.1.2.Electricity wholesale price drivers16

I.2.1.Investment drivers: relevant literature22

I.2.2.Methodology and data25

II.1.1.Wholesale electricity markets33

III.1.1.Price developments and market adjustment through the energy transition53

III.1.2.Quantifying the investment criterion59

III.2.1.Reforms in the Emission Trading Scheme67

III.2.2.Low carbon technologies and market designs: the experience in South and Central America71

The EU has confirmed its intention to decarbonise its economies

The decarbonisation of EU economies is at the core of the EU’s agenda for climate change and energy. The Climate and Energy Package adopted in late 2008 targets require the EU’s Member States to cut their greenhouse gas emissions by 20 %, to produce 20 % of their energy from renewable sources, and to reduce their gross primary energy consumption by 20 %. In 2009, this agenda was complemented by the aspirational goal of reducing greenhouse gas emissions by 80-95 % by 2050. These ambitions were reaffirmed in October 2014, when Member States agreed to set targets for 2030 of 40 % for domestic greenhouse gas emissions reduction, at least 27 % for the share of renewable energy and at least -27 % for energy consumption.

The substantial investment in low-carbon technologies that will be needed to achieve these goals will have to be supported by an economic and institutional framework capable of facilitating this transition. The power sector is likely to play a central role in the energy transition. First, it has been the main sector experiencing decarbonisation since the last decade and its challenges still remain high. Second, in the near future, the power sector is expected to support the economy in reducing its dependence on fossil fuels, notably in the transport and heating and cooling sectors. For this reason, the cost effective promotion of private and public investments in this sector will be crucial so that consumers can reap the benefits of this strategy. This report provides analysis of the key challenges for investments in the electricity generation sector and reviews how to improve the current market arrangements or to introduce possible new ones that that could improve the current and future investment framework.

Investment in new generation capacity is increasing…

Investment in the EU’s electricity generation sector has not been affected by the economic crisis and has even been accelerating since 2009. Between 2004 and 2012, capacity increased by 30 % in the EU, in comparison to just 10 % in the US. As a result the share of renewable energy in the EU’s electricity mix has continued to rise since 2008.

… in a context of increasing public support

As with investments in other sectors of the economy, investments in electricity generation are in general driven by market conditions. They can, however, benefit from various forms of public support, provided these are in line with EU state aid rules. Public support may have different objectives, such as security of supply, environmental concerns or social inclusion. With the increasing production of renewable electricity, the support to these new technologies rose to € 40 bn in 2012, financed mostly by end-user consumers through levies on retail electricity prices. As a result, retail prices have increased for households and, to a certain extent, industries.

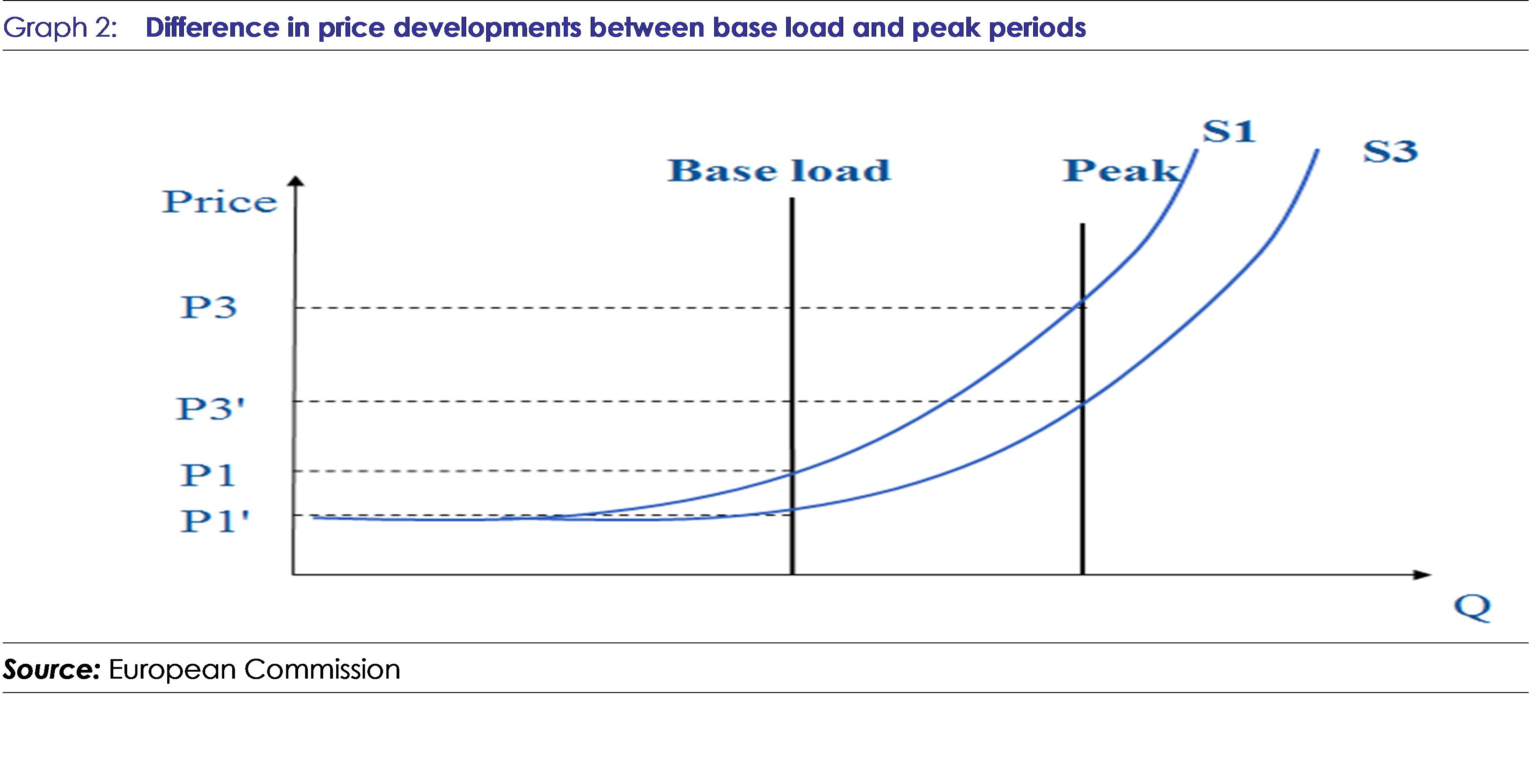

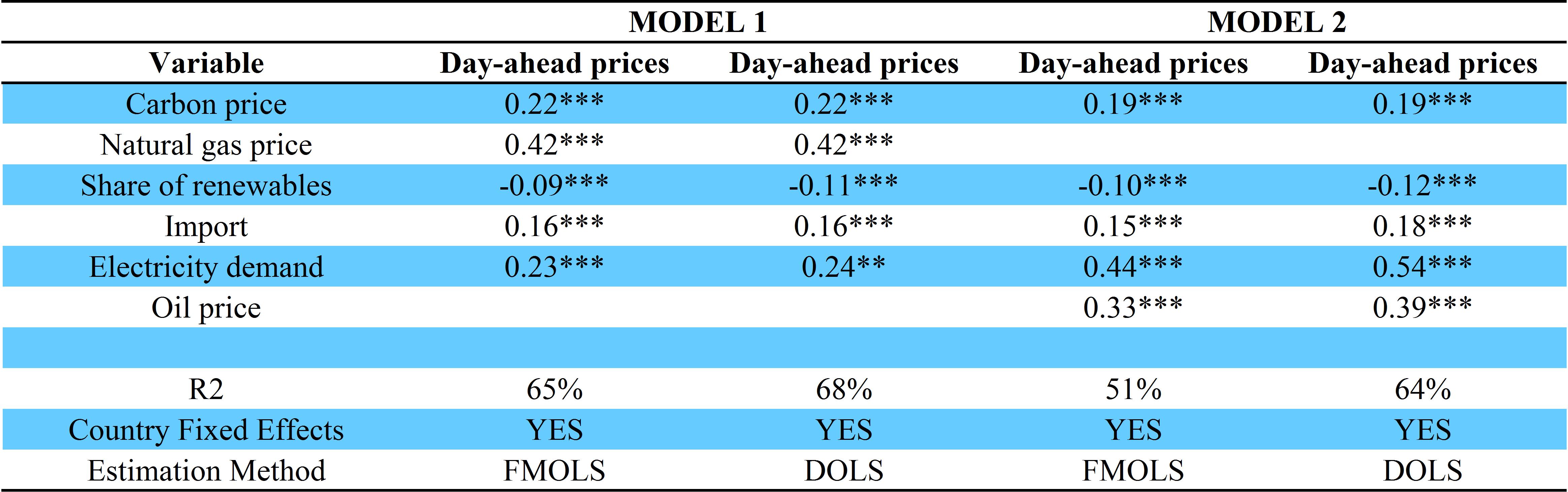

… and a weakening investment price signal

By contrast, the opposite trend was observed on wholesale markets. Market prices for fossil fuels have decreased since oil prices peaked in 2008. Despite a rebound in 2009-2010, oil prices have been declining since 2011. Wholesale power prices have followed the same evolution, lowering the expected profits of investors. Moreover, due to the sharp decline in the price of CO2 emission allowances, the use of high carbon emitting power plants and the investment in them has only been discouraged to a certain extent. An empirical analysis of the drivers of wholesale electricity prices shows the importance of electricity demand, as the main determinant of prices. This confirms that the economic crisis, by lowering electricity demand, has played a major role in depressing wholesale electricity prices. However, the results also suggest that renewable energy production had a downward impact on wholesale prices as their market penetration has grown, which could be interpreted as an indication of structural changes on the market.

… wholesale electricity prices still matter for competitive technologies

The investment framework has also undergone considerable changes. On the one hand, investments in maturing, clean technologies have taken place thanks to public support, which reduced the capital and operating costs and the risks for investors. On the other hand, investment in conventional technologies has been influenced by fundamental factors that matter for investors. The report includes an empirical analysis of investment drivers in conventional technologies. The results confirm the importance of the price signal as a trigger for investments in mature energy technologies, but also points to the influence of macroeconomic factors such as interest rates, competition and a favourable business environment.

Today, in wholesale electricity markets, power prices are set by the bid of the marginal unit. This is achieved mostly within day-ahead markets as currently other markets such as intra-day markets are not sufficiently developed. Under the assumption of perfect competition, bids represent the marginal costs of the plant to supply energy. But the role of the market price signal varies across market frameworks. In energy-only markets, the stability of the system in terms of new investments in capacity is achieved through price signals. When electricity demand is higher, prices increase to signal scarcity. This increases the profits of generators and gives them the incentive to invest. In other market frameworks, the energy market can be complemented by a capacity mechanism. In such markets, generators get revenues from electricity trading (energy market), but also get remunerated for their available capacity in the market.

… but the rising penetration of low-carbon technologies is changing investment conditions

The rising penetration of low-carbon technologies represents a challenge for the electricity sector under the current market arrangements. As their share of production increases, electricity markets will increasingly be dominated by units with low operating costs but high initial capital costs. The risk is that under current market arrangements and without further integrating existing markets, wholesale market price may prove too low to trigger the necessary investments in generation capacity. In such a situation, it needs to be evaluated if generators would require some additional forms of remuneration, which would have to be borne by consumers or tax payers and would need to stand in proportion to the benefits provided.

According to Commission estimates, the power sector will require up to EUR 90 billion of investment a year until 2030, of which EUR 50 billion are needed in energy generation and EUR 40 billion are needed in power grids. The high investments needs and the changing investment environment call for a reflection on the effectiveness of current market arrangements to drive investments.

The transition to a low-carbon economy impacts both capacity and prices

This report contributes to the current debate on market design by discussing the consequences of decarbonisation in a competitive market environment and by providing an analytical framework to understand the transition to a low-carbon economy. The analysis aims to describe the consequences of decarbonisation on the investment environment under current market arrangements. On this basis, the analysis identifies possible challenges that the EU could face during and after its transition to a low-carbon economy. Today, the transition is still ongoing, but markets will soon face a larger share of low carbon technologies. Investments in electricity generation are long-term by nature and investors need to assess their future profitability before deciding to invest today. The challenges of the transition phase will differ during its different stages of completion and therefore need to be well understood in order to be successfully addressed.

Under current market arrangements, the rising penetration of low-carbon technologies is likely to put pressure on wholesale market revenues during the transition phase. This may make it difficult to achieve the necessary levels of investment, and non-competitive low carbon technologies may still require some form of support. At the same time, the market is likely to face overcapacity, which will need to be addressed in order to reduce the costs of the transition. Once decarbonisation has be achieved, the issue of market revenues may become even more salient, as the cost structure of the technology mix based on low variable costs and high fixed costs could challenge the ability of market prices, formed today mostly on day-ahead markets, to allow investor to recoup their costs. As a result there could be a risk that investors may not be able recoup their investments under the current forms of market arrangements (especially in view of the existence of price caps, market fragmentation and imperfect competition).

… as a result, market arrangements may need to evolve

The report explores further possible avenues to tackle the investment challenges identified in the analysis and brought about by the transition. The central objective of any market arrangement should be to minimise public support in order to make the penetration of low-carbon technologies cost effective for end-consumers and society at large. Therefore, the report reviews how the existing market arrangements can be improved and which ones could be deployed for the transition phase. The aim of such arrangements would be to deepen market integration, make effective use of the carbon price signal, ensure the phasing out of high CO2 emitting technologies in the short run and reinforce the spot price signal.

In the long run, the challenge will be to put in place market arrangements that provide sufficient revenues for investments to take place without any form of State intervention. Given the investment challenges that successful decarbonisation may create, there is a need to start reflecting on the most suitable market arrangements for the transition phase and on the type of market arrangements that Europe will need once it has reached its decarbonisation goals.

This part describes the changing pattern of electricity investments over the past decade. EU electricity markets have been reshaped by regulatory reforms starting in the 1990s, and by the decarbonisation agenda and the adoption of targets to reduce greenhouse gas emissions and increase the share of renewables in energy consumption.

Chapter one describes the recent evolutions of investments in electricity markets. Investment in electricity generation in the EU has been steadily increasing over the last fifteen years. This trend has been driven by the energy and climate change policy agenda and has led to a significant increase in the proportion of electricity generated from renewables. Such an evolution would not have been possible without any forms of public support at production, demand or investment level. The last section highlights the divergent path of retail and wholesale electricity prices. Retail prices for both households and industries have risen largely. Wholesale prices, by contrast, have fallen in recent years due to a number of factors including lower commodity prices, the economic slowdown and higher production from renewables.

Chapter two discusses and analyses the investment drivers in electricity markets. First the analysis focuses on renewable technologies as investments in these new technologies were mostly driven by the policy agenda and the resulting public support. By contrast, investments in conventional technologies were mostly driven by macro-economic and energy specific factors. The econometric analysis carried out in this chapter shows that the price signal matters for these mature technologies along with other economy-wide factors such as demand, competition and financial conditions.

The electricity generation sector is experiencing a transformation driven by the EU policy climate and energy agenda. Generation technologies are changing in response to climate change policy as well as to security of supply concerns. At the same time, the reform of the sector through market opening is putting competitive pressure on utilities to improve the efficiency of their operations.

This chapter focuses on the electricity sector and describes the recent evolution of investment in electricity markets. Section 1 analyses the evolution of installed capacity over the period 2004 – 2013 in the Member States. Section 2 describes the increase in public support to electricity over the period. Section 3 looks at the electricity price evolution in relation to coal, oil and CO2 prices. Section 4 concludes.

1.1.Investment trends in electricity generation

Investments in power generation in the EU have continued to expand over the last 15 years. The evolution of capacity in the EU followed a steady increasing trend. Compared to the US, where the increasing trend was interrupted by a break between 1998 and 2000, growth of capacity in the EU followed a more stable and faster increasing trend, which accelerated starting in 2009 (Graph I.1.1).

|

Graph I.1.1:Evolution of installed generation capacity

|

|

|

|

Source: OECD and Eurostat

|

Generation capacity in the EU increased sharply from 2009 onwards due to the addition of new renewables technologies on the already existing capacity. The composition of the capacity mix progressively changed: nuclear capacity started declining in recent years (2010-2013) due to phasing out decisions in some Member States. Conventional capacity showed a decline in 2012-2013 (Graph I.1.2).

|

Graph I.1.2:Installed generation capacity - EU28

|

|

|

|

Source: Eurostat

|

Investment in electricity generation capacity in the post-crisis period was of greater magnitude than pre-crisis. During the period 2004-2008, generation capacity modestly increased in some Member States (Graph I.1.3). For example, 25 GW were added in Spain and 17 GW in Germany. Between 2008 and 2012, instead, a period which coincided with the development of renewables, capacity additions were much more significant, with 35 GW of additional capacity in Spain and 51 GW in Germany. The same evolution can be observed in other Member States, like Italy, Portugal, Greece, Romania, the United-Kingdom, France, Netherlands, Czech Republic, Poland, Sweden, and Denmark. This phenomenon was mainly driven by the increase in renewable installed capacity, accompanied by a more modest increase of conventional technologies.

At the same time, Member States are not following the same investment trends. Between 2009 and 2013, a majority of Member States (Germany, Italy, France, Romania, Spain, Greece, the United Kingdom, Belgium, Austria, Poland, Czech Republic, Bulgaria, Portugal, Slovakia and Ireland) increased their overall generation capacity, while for the rest there was little change in generation capacity and for some even a decrease (notably Sweden)(). With respect to investment in low carbon technologies, in Germany, Italy, France, Romania, Spain and the United Kingdom, renewable capacity increased quite substantially, whereas in the Netherlands additions in conventional capacity were larger than in renewables. France stands out as a country where conventional capacity decreased in the period 2004-2008 whereas there were additions in conventional generation in 2009-2013. In Germany, instead, where renewables increased significantly during 2009-2013, additional conventional capacity was built also due to the phasing-out of nuclear power plants (Graph I.1.4).

|

Graph I.1.3:Net change in installed generation capacity 2004-2008

|

|

|

|

Source: Eurostat, Energy Statistics

|

|

Graph I.1.4:Net change in installed generation capacity 2009-2013

|

|

|

|

Source: Eurostat, Energy Statistics

|

1.2.Public support

The expansion of capacity of the period 2008-2012 was accompanied by policy efforts, in the form of increased public support to the sector. Public support is a type of state intervention, which can take the form of direct transfer of funds, targeted tax allowances and exemptions, investment tax deductions, loan guarantees, price support, price caps, and price guarantees. Arguably, public support to energy has always been used to reach some policy objectives such as energy independence, social inclusion, environmental goals, or competitiveness exposure of energy intensive industries. More recently, the development of the new low carbon technologies and the need to secure a new investment path has triggered new forms of support to deployment.

The total amount of public support to the electricity sector increased over the period 2008-2012 from EUR36 to EUR63 billion (). Public support increased both for fossil fuel and renewable technologies, even though the latter accounted for most of the increment: support to renewables grew by 93% compared to 39% for fossil fuels (Graph I.1.5).

|

Graph I.1.5:Total support to the energy sector

|

|

|

|

Source: Own calculations based on ECOFYS, 2014

|

Support to production constitutes the main share of total support (around 45%). It includes, among others, exemptions from fuel taxes, feed-in tariffs and premia, tradable certificates for renewable energy quotas, and support to decommissioning. The increase in support to production can be explained by the increase of renewable technologies in the fuel mix. This new renewable capacity was mainly installed with the support of feed-in schemes. In the majority of Member States, most of this support has been financed by consumers through levies or surcharges, while in a few cases it has been financed through general taxation ().

Support to energy demand accounts for 30% of total support. It is granted to the demand side rather than to generators and is mainly constituted by energy and VAT tax exemptions, price guarantees (in the form of social tariffs for electricity set below a reference price or the provision of fossil fuel below costs as inputs to electricity generation), and interruptible load schemes, by which payments are provided to electricity consumers that agree to be switched off remotely where the system requires it.

In comparison, the other forms of support were smaller. Support to investment follows support to demand with a share of approximately 14%; support to energy savings has a share of 8%. Support to R&D was very low compared to the support granted to all other sectors (support to production, to investment, to energy saving and to energy demand) up until 2012, when it hit 6% of the total ().

|

Graph I.1.6:Components of total support

|

|

|

|

Source: ECOFYS, 2014

|

1.3.Price evolution: electricity, carbon and commodity prices

Trends in electricity should be interpreted in the wider context of the macro economic framework in the energy sector, which have an impact both in the retail and wholesale market.

|

|

|

|

|

|

|

|

|

(Continued on the next page)

|

|

Box (continued)

|

|

|

|

|

|

|

|

(Continued on the next page)

|

|

Box (continued)

|

|

|

|

|

|

|

|

|

1.3.1.Electricity retail price evolution

In the recent period, electricity retail prices have experienced an increase () compared to wholesale prices. This divergence is the result of the increase of renewable capacity and of public support, which has been mostly financed by consumers through levies on electricity retail prices. The increasing trend can be observed for both household and industry retail price throughout the whole EU, even though there are considerable differences in the price level between the two types of consumers across groups of Member States.

In countries with regulated retail prices, the retail tariffs are higher than in countries without regulated prices. Whereas the two groups of countries showed different levels of retail prices already in 2007, through 2012 the increase in countries with regulated prices was higher than in countries without regulated prices(). In addition, the gap between the household and industry retail price level is higher for the former than for the latter.

|

Graph I.1.7:Average domestic and industrial retail electricity price, wholesale price and crude oil price evolution 2007-2013

|

|

|

|

Source: Eurostat

|

Taxes and levies () have been the main contributor to retail price increase for households and industrial consumers. Indeed, the increase of the taxes and levies component has been particularly pronounced and on average it contributed by more than 2% to the annual increases of retail prices in the 2009-2013 period (). During the same period, a similar trend, but relatively lower, was observed for the network component. For both categories of consumers, the average annual contribution of this component to the retail prices increases was around 0.6%. In contrast, the contribution of the energy component to the retail price evolution, presented a diverging pattern between the two consumer categories for the period. In particular, the energy component put downward pressure on retail prices for households in first two years of the analysis, which then shifted to upward pressure. For industrial consumers, in contrast, it contributed to lowering retail price increases throughout the period. On average, this component decreased annually by 1.1% for industrial consumers, while for households it increased by 0.9%.

|

Graph I.1.8:EU: retail price change and the contribution of the price components 2009-2013

|

|

|

|

Source: Eurostat and own calculations

|

1.3.2. Wholesale electricity and energy commodity prices evolution

Electricity wholesale prices have been declining after 2011. After the price spike in 2008, due to the influence of oil prices, wholesale electricity price on the German market (EEX) experienced a drop of 10% between 2009 and 2014. On the French market (Powernext) and the Nordic market (Nord Pool), prices decreased by 5% and 15% respectively, in the same period. The drop in wholesale prices is the result of many different factors, among which the evolution of energy commodity prices such as coal, gas and oil prices. They are, among other things, drivers of wholesale prices because they are the inputs for most of the conventional electricity production (see box I.1.2).

|

Graph I.1.9:Electricity wholesale price

|

|

|

|

Source: Bloomberg, Platts

|

Coal, gas and oil prices followed similar decreasing paths starting from 2011. After a rebound in 2010, oil price started to decline from 2011, and experienced a sharp drop in 2014-2015. Gas and coal follow a trajectory which is similar in shape, even though the peak point for coal is 2011 while for gas it is 2013. In the period 2011-2015, gas prices dropped by 10%, while coal by 17% (Graph I.1.10).

By contrast, since 2009 the carbon price has decreased sharply. Carbon price plays a role on the wholesale electricity market in that it adjusts the relative costs of conventional and low carbon technologies and may incentivise investment in the latter. CO2 price followed a rapid and overall decreasing path: between 2008 and 2015, it dropped by 68% from 22.3EUR/tCO2 to 7.0EUR/tCO2. Such low levels have very little if not negligible effects on the relative costs of technologies and therefore can be assumed to have had a limited effect on short-term production choices. Fuel switching decisions for existing plants are mainly influenced by the relative costs of energy inputs (gas and coal). In the longer term, though, CO2 pricing is expected to play a strong role in the investment decision (see Box III.2.1).

|

Graph I.1.10:Energy commodities and CO2 prices

|

|

|

|

Source: Bloomberg, Platts

|

Other important factors contributing to lower wholesale prices are weak demand for electricity due to the economic crisis and the increasing renewable generation share. Investments in renewable generation, mostly driven by public support, and made in a situation of lower demand, contributed to lowering prices on the wholesale market. An econometric analysis of the drivers of wholesale prices confirms the upward impact of demand and commodity prices on prices, while an increasing share of renewable tend to lower prices (see box I.2.2).

|

|

|

|

|

|

|

|

|

(Continued on the next page)

|

|

Box (continued)

|

|

|

|

|

|

|

|

|

1.4.Concluding remarks

Investment in electricity generation has been resilient to the crisis but its composition has changed. The expansion of renewable sources was much more pronounced than for conventional ones, a development which became more evident after 2009.

Public support has increased both for fossil fuel and renewable technologies, even though renewables accounted for most of the increment. Its composition across types of support remained relatively stable, with the major share going to support for electricity production, followed by support to demand, to investment, and to energy efficiency.

While electricity retail prices have risen in the recent period, wholesale price have decreased. The main factor contributing to rising retail prices are taxes and levies, but network costs have also increased. Rising levies reflect, among other things, the need for financing support schemes to renewable production. Wholesale prices have, in contrast, fallen due to lower demand for electricity as well as lower prices on fossil fuels and carbon. The increasing share of renewable generation in a situation of lower demand has also contributed to lower prices.

Electricity is a sector in which investments are determined by macroeconomic conditions, but are also highly influenced by policies. Investments respond to macroeconomic conditions: general economic growth, demand evolution and financial conditions determine the general economic environment in which investment decisions are taken. Investments in the electricity sector are subject to a group of energy- specific factors which influence the decision to invest and the magnitude of the investment: the generation mix of the country, the wholesale prices, () as well as indicators about the supply side of the market such as the reserve margin and the capacity factor of the electricity system. In addition to this, policies can have a sizeable impact on investment decisions for example when they support some technology groups in order to achieve specific objectives.

This chapter explores both sets of investment drivers. Section 1 describes the different forms of support granted to renewable technologies and compares them to what is received by conventional ones. Section 2 develops an econometric model to understand the drivers of investment in conventional technologies. Section 3 concludes.

2.1.public support and investment

Public support for renewables has been justified by the need to promote low carbon technologies at early stages of development. These technologies would otherwise not be able to compete on the market due to higher costs. New renewable electricity production in Europe has been deployed mainly thanks to subsidies and priority of dispatch. Most renewable technologies remain too expensive and uncompetitive in relation to the market prices of today, even though certain are gradually becoming more mature: according to the IEA (), increased investment in research, development and demonstration (RD&D) in emerging technologies, particularly ocean and enhanced geothermal, is needed to enhance competitiveness.

For this reason, renewable technologies have received the highest level of support per MWh. In the EU28, the average support per MWh for the 2008-2012 period was around 64 EUR/MWh, starting at 54 EUR/MWh in 2008 reaching 62 EUR/MWh in 2012 () with a peak of 70 EUR/MWh in 2010. The support level increased by 27% between 2008 and 2010, reflecting the implementation of the EU renewable energy policy as agreed in 2009 (Graph I.2.1). By contrast, support to conventional technologies has been much more limited, which can be explained by their level of maturity. Public support to these technologies has slightly increased between 2008 and 2012 ().

In most Member States, support schemes and instruments have limited the risk exposure of producers, hence of investors. In 2012, seventeen Member States applied feed-in tariffs. This is an instrument which drastically reduces the risk for the producer as it provides a fixed remuneration for the renewable electricity produced. Feed-in-tariffs have proved to be very effective in promoting renewable electricity deployment, but this type of support also runs the risk of being very costly. Feed-in-premiums is another variant, which is a more market-based instrument that was used by nine Member States in 2012. It provides a premium in addition to the wholesale electricity price so that the producer is at least partly exposed to the price risk. Quota obligation systems were used in eight Member States. This implies the creation of a market for green certificates, which provides the generators with an additional remuneration source on top of the price received for the electricity produced from renewable sources. Here, the producer is exposed to both the electricity and the certificate price risk. Finally, both investment grants and fiscal incentives were used by ten Member States respectively in 2012.

|

Graph I.2.1:Support per electricity produced

|

|

|

|

Source: Own calculations based on Eurostat, Energy Statistics and ECOFYS 2014

|

Support given to renewables decreased from 2010, due to the slowdown in economic activity caused by the economic crisis but also due to reforms of support systems aimed at reducing their costs. The crisis has reduced demand and deteriorated the general investment climate. The high cost of the renewable support system induced Member States to undertake reforms to make them more cost-efficient. This development was underpinned by the economic crisis, which forced Member States to enact reforms aiming to improve the efficiency of spending. The rising cost of support to renewables has been one contributing factor behind the emergence of tariff deficits in several EU Member States (). A tariff deficit can be defined as a shortfall of revenues in the electricity system, which arises when the tariffs for the regulated component of the retail electricity price is set below the corresponding costs borne by the energy companies. Costs related to the support to renewables have been contributing to the tariff deficits in Spain, Portugal, France and Greece, and for temporary imbalances in the system in Germany and Italy. All these countries have undertaken reforms since 2012 to reduce and contain these costs and make them more market-oriented (). In some cases (i.e. Spain, Portugal, Greece etc.) these reforms were imposed retroactively, which impacted the remuneration of past investments.

Reforms to support schemes have not yet translated into a slowdown of investment in renewables, (expressed as share in total capacity) according to current data.. The share of renewables in the EU has been on an increasing trend since 2008, whereas production support started its decrease in 2010. This apparently counter-intuitive fact can be explained by considering that, despite having been revised, support schemes appear to be still enough to sustain investment, probably thanks to the reduction in their costs through learning. An additional aspect is that investment responds with a lag to the change in support schemes, hence the effect the reduced support is not visible in 2012 data. Finally, it is important to stress that, whereas the data presented are European averages, the specific situation in Member States might differ substantially.

|

Graph I.2.2:RES share and support evolution

|

|

|

|

Source: Eurostat and ECOFYS 2014

|

2.2.Market driven Investments

While renewables were developed heavily relying on public support, conventional () generation was affected by energy policy through the induced changing market conditions. EU policies are affecting the shape of the electricity market in different ways. Market liberalization introduced competition in the generation segment of the value chain; renewable obligations are reducing the residual demand that conventional technologies face; the EU emission trading scheme (ETS) is increasing the costs of production of conventional technologies in line with their carbon intensity.

2.2.1.The investment framework for conventional technologies

The factors that determine the investment decision in the power sector can be grouped into three main categories, i.e. macro-economic, competition and energy-specific. In order to understand their role, it is useful to provide a discussion of the assumptions to their contribution, which will be used to construct a model to analyse market driven investment in the recent past.

Macroeconomic conditions influence the decision to invest in electricity generation. They refer to economy-wide factors that influence the financial risk arising from the financing of investment as well as the policy objectives and institutional factors under the control of policy-makers (IEA, 2003). As such, the business environment, the cost of capital and access to finance are likely to impact the profitability of projects and ultimately the decision to invest. Moreover, given the role of electricity in the economy, economic growth is an important driver of electricity investments as it stimulates electricity consumption, hence the need to build additional generation capacity ().

Another important factor which influences the attractiveness of the market is the competition intensity and potential barriers to entry. By nature, the electricity sector displays high sunk costs and needs large capital investments, which may provide an advantage to incumbents. In general, electricity markets are concentrated, which is a consequence of the characteristics of the sector, but may also give the opportunity to adopt a strategic behaviour to limit new entries in the market (e.g. excess capacity and pricing strategies).

Finally energy-specific conditions are likely to attract investors if profit prospects are high and uncertainty is low (). Energy-specific conditions refer to those factors characterising the electricity system such as the wholesale price, () the reserve margin, the capacity factor and the generation mix. But they also include the economic conditions under which generators operate, i.e. the remuneration of their capacity or the price signal. Finally, the policy framework and the extent to which clean technologies are supported, influence the decision to invest in conventional technologies.

Graph I.2.3 summarises the main factors () influencing the investment decision in electricity markets.

|

Graph I.2.3:Investment decision

|

|

|

|

Source: European Commission

|

2.2.2.Hypotheses

The following macroeconomic factors are assumed to play a role in investment decision:

Macroeconomic factors

Higher electricity demand leads to higher investment in power generation

Economic growth is normally accompanied by higher investments. () In electricity markets, demand is strongly correlated with economic growth, mainly because increased business activity implies higher electricity consumption (). Hence it can be seen as a sign of an expanding market that businesses will want to exploit by increasing their investments in installed capacity. This indicates that demand is positively correlated with investment. In the future electricity demand is expected to be decoupled from economic growth, as a result of energy efficiency policies, so far it appears that it parallels economic growth.

Investments are negatively associated with interest rates

Power plants are capital-intensive investments, for which the cost of financing plays a substantial part. Interest rates are used in the economic literature as an indication of the cost of capital: it is expected that higher interest rates have a negative effect on investments as they make investments more expensive.

A stable and transparent policy environment reduces investment risk and contributes positively to new investments

Quality of regulation is an important factor in determining the investment environment. Good regulation that removes barriers to entry generally induces new entry and investment. Better regulation also induces investments when it is able to reduce the level of economic rents in a specific sector (see Box I.2.2). Because of the long time horizon, economies of scale and scope and the regulatory and political risks, investment will be especially sensitive to a country's institutional environment. It is expected that the better the policy environment in terms of commitment and transparency, the better the business environment and the more attractive the investment.

|

|

|

|

|

|

|

|

|

(Continued on the next page)

|

|

Box (continued)

|

|

|

|

|

|

|

|

|

Competition and Energy-specific factors

The following competition and energy-specific factors are analysed:

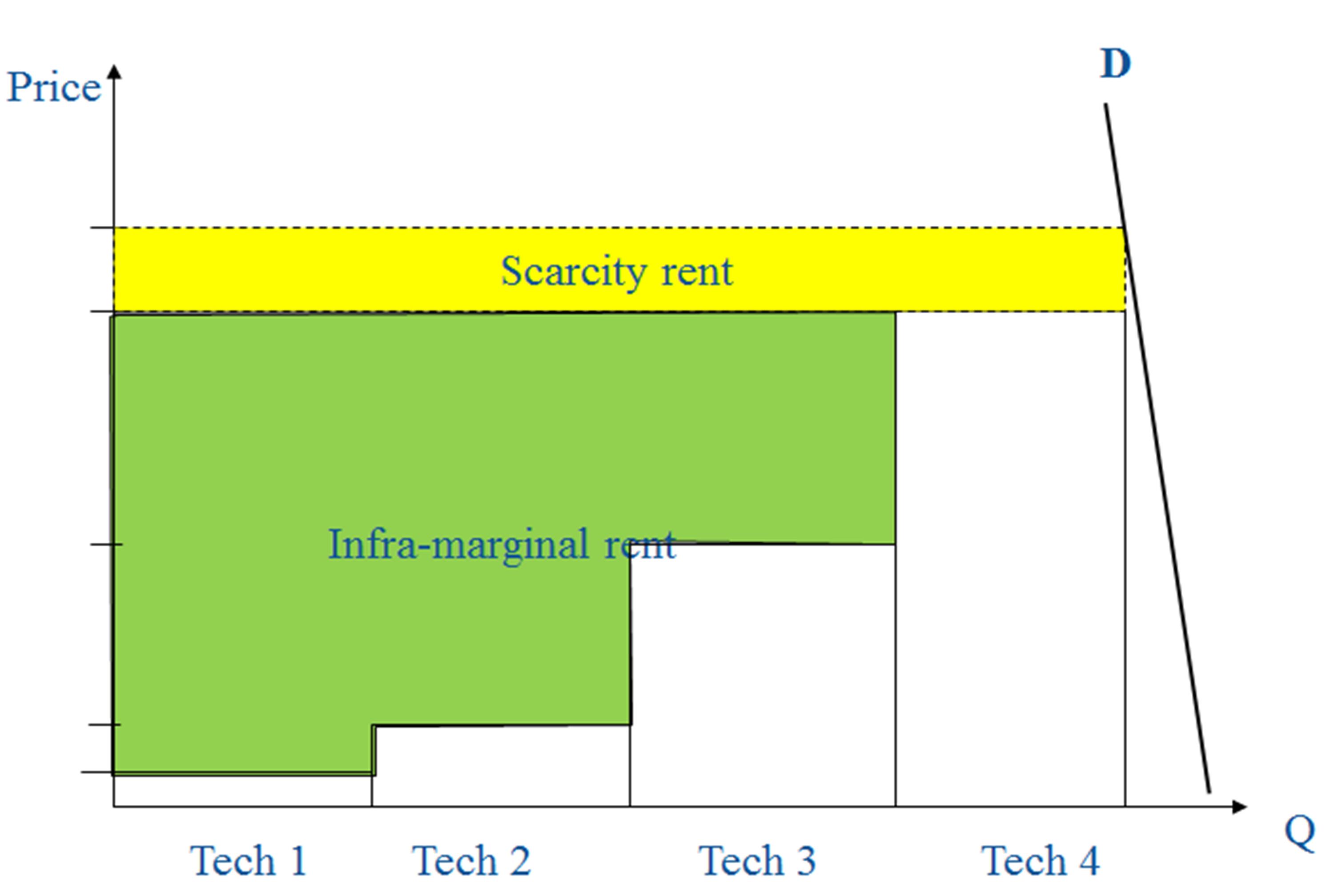

Electricity wholesale price as a signalling device for investment

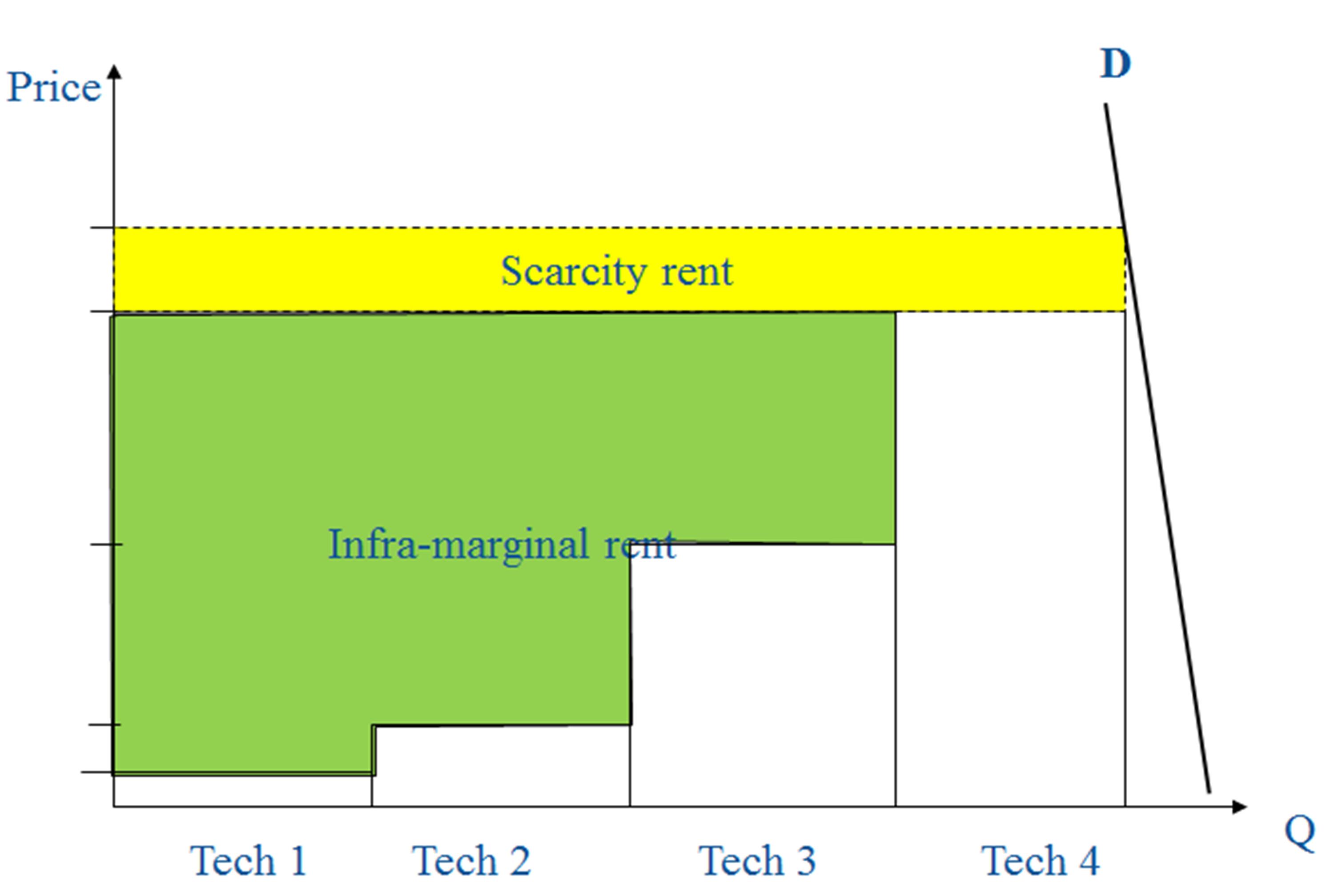

In a market, where the only commodity is energy (energy-only market) and there is no extra trade in capacity or other products, the primary income source for recovery of capital costs is the infra-marginal rent generated by the difference between the clearing price and the generators' marginal costs. According to the theory of spot pricing, the optimal capacity stock is such that the price resulting from scarcity is high enough to repay the capital costs of the marginal generators when demand exceeds supply (). Therefore, when prices are high, the system signals the need for new investment; hence, it is expected that higher prices are positively correlated with investment.

Highly concentrated markets create significant barriers to entry that may impede new investment or expansion in electricity generation

Concentrated markets are likely to suffer from abuse of market dominance, by which the incumbent firms enjoy the ability to unilaterally raise prices by providing a less-than-optimal capacity. It is therefore expected that the market concentration, as captured by HHI, CR3, etc. indexes, has a negative impact on investments.

Overcapacity reduces the motive for new investments

The reserve margin indicator is defined as the ratio between total available generation and the maximum level of electricity demand, at the time at which that demand occurs (). It can be interpreted as an indicator of overcapacity in the sense that a high value implies that there is a large amount of available generation to meet peak demand. On the other hand, if the indicator is low, it means that available capacity is small compared to maximum demand. Hence, it is expected that incentives to invest in market-oriented power plants are higher the lower the reserve margin.

Penetration of renewable technologies induce lower incentives for new investments in conventional power plants

Renewable penetration reduces the residual demand for conventional generation, therefore reducing the size of the market they can bid on. Penetration of renewable was incentivised by support schemes, which are assumed to make investment in such technologies more attractive to investors (for example, because of more stable and higher returns) and hence to divert resources from conventional to low-carbon investment. It is expected that a higher renewable share decreases the scope for investment in conventional technologies because they increase their risk profile. In fact, the presence of renewables makes the revenue stream for conventional power plants very uncertain, whereas in their absence, conventional power plants will be operating a more predictable number of hours over the year.

Additional revenues from capacity mechanisms increase the incentives for new investments

In energy only markets price caps may not allow power producers to receive the full amount of scarcity rents and to be able to recoup the fixed cost of their investment. The presence of capacity mechanisms, which act as complementary source of revenues, helps to mitigate price uncertainty and volatility caused by weather conditions and intermittent generation by providing additional sources of revenues to producers than the energy only market (). Capacity mechanisms can be seen as a factor that competes with spot prices for the role as a signal for investment needs; this is because if all the capacity is procured though capacity mechanisms, scarcity prices that reflect a structural lack of capacity will never appear on the spot market. For this reason, the analysis includes a dummy variable for the presence of capacity mechanisms to capture the effect on investment.

|

|

|

|

|

|

|

|

|

(Continued on the next page)

|

|

Box (continued)

|

|

|

|

|

|

|

|

|

2.2.3.Results

Table I.2.1 presents the estimation results of four distinct Tobit models based on the EU-28 Member States for the period 2005-2012. The difference between the four specification models is the choice of the variables included in the analysis. The consistency of the coefficients in terms of statistical significance and their size between the various specifications, indicate that the results are robust (). In addition, in order to reflect the time effect on investment, the model includes lags. ()

Electricity wholesale prices are a key driver of investment in power generation. The positive and statistically significant sign of the electricity wholesale price changes indicates that the observation of increasing prices stimulates investment in the near future. This finding confirms that investors in power plants react to high prices as a signal for higher expected returns, compared to other investment opportunities.

Increasing demand for electricity creates the need for new generating capacity. What matters for new investment in power generation is the growth in electricity demand in the course of time, rather than its level in comparison to other countries. Under an increasing demand pattern, investors are faced with less uncertainty on load factors for their plants, when and how often they will run, and the prices that could be achieved when they do run, as higher demand is associated with higher wholesale prices. Thus, it increases the expectations for higher profitability of the investment as the anticipation for the growth of the electricity demand is optimistic.

The cost of financing is of considerable importance to investments in power plants. As expected, the statistical significance and the negative sign of the coefficient of the interest rates imply that a rise in interest rates has a sizable negative effect on capital expenditures in power plants. In particular, the market interest rate is considered to be a key building block in the firm’s user cost of capital, which, combined with the resulting stream of expected cash flows, constitute the primary determinants of whether and how much to invest.

Tight reserve margins trigger investment in power plants. The negative correlation between the reserve margin and the new additions in electricity installed capacity implies that, under conditions of high reserve margins investments are not attractive. The reason is that a high reserve margin is an indication of excess capacity, which means that the probability for a new investment to recover its capital plus a fair return on the assets is relatively limited.

Competitive markets reflect a good business environment and create incentives for investment in power generation. A competitive environment provides a steady and reliable business environment for new investments in electricity markets. The coefficient of the accumulated shares of the three larger electricity producers that was used as proxy of the degree of competition indicates that new additions in installed capacity are negatively correlated with concentrated market structures.

However, in order for competition to deliver its anticipated benefits, the market also requires governments to commit to policy and regulatory authorities to ensure transparency and optimal monitoring of the functioning of the electricity markets. Although in all specifications the proxy that was used in order to capture the quality of regulation had the expected sign, it was not statistically significant. ()

|

|

|

Table I.2.1:Results of the electricity investments drivers

|

|

|

|

Source: Commission Services

|

|

|

Higher penetration of renewables in total installed capacity is associated with lower investments in conventional generation technologies. The negative and statistically significant coefficient of the share of renewables in the total installed capacity implies that renewables replace over the years larger and larger part of the electricity supply curve.

The coefficient of the dummy variable for the presence of capacity markets was statistically insignificant though it presented the expected sign, The insignificance of this coefficient may be explained by the fact that most of the capacity mechanism incentives were introduced mainly over the recent years. This implies that other factors played a crucial role in the period of the analysis.

2.3.Concluding remarks

Investment in renewables was driven by public support, which was much higher than the support granted to nuclear and fossil fuels. Public support started decreasing in 2010 as a response to fiscal consolidation and to the increasingly heavy burden on public finances.

Market fundamentals were important drivers of investments in conventional technologies, mainly represented by the wholesale electricity price, financial conditions, demand and the level of competition on the market. The relevance of wholesale price for investment signals the remuneration investors can expect from the market. Similarly, the impact of financial conditions and demand captures the effects of the economic slowdown brought about by the recent economic crisis. Finally, the level of competition on the market explains the influence of the market structure.

In the future, in a world of competitive electricity technologies, the price signal as well as the macro-economic framework will matter for investors, hence the importance of market functioning and price formation.

Both the macro-economic framework and the energy market design play an important role in driving investments in electricity generation. This part looks at price formation in electricity wholesale markets and presents the main characteristics of the sector. It also assesses the challenges posed by the increasing penetration of low carbon technologies.

Chapter one describes the marginal pricing principle of wholesale electricity markets and discusses the different types of market design to keep the system reliable, i.e. energy-only market or capacity mechanism. It also presents the different market frameworks in place in Member States. Efforts to integrate energy markets in the EU are relatively recent but are showing signs of progress. Still the design of electricity markets varies considerably across the EU.

Chapter two discusses the investment needs to meet the decarbonisation policy agenda. Substantial investment will be required in the electricity sector both because of the sector's own need to reduce emissions, but also because demand is expected to rise from other sectors of the economy seeking to lower their emissions. The chapter also analyses the ongoing transformation of electricity markets induced by low carbon technologies. It discusses how the ongoing transformation contributes to changing the framework for investors, which points to the need to have the right market framework.

Prices are a key drivers of investment decisions as they influence potential remuneration to investors. In well-functioning competitive markets, high prices are expected to signal the need for additional investment. For investors, it is important that prices are above the long run marginal costs so that producers can recover their fixed costs.

This chapter describes the main characteristics of electricity markets. Section 1 focuses on the price formation mechanism in today's electricity markets. Section 2 looks at market features in Member States. Section 3 concludes.

1.1.Price signal to investors

1.1.1.Remuneration in the electricity market

Expected remuneration is the key signal for investment because it represents the profitability of the undertaking. For electricity producers, remuneration can come from different sources, which also differ according to the market design (section 1.1.2). Generators can be remunerated for the energy they deliver from bilateral contracts and/or from the wholesale market; they can be remunerated from balancing services they provide; or, if such markets exist, they can get remuneration for the availability of production capacity that they offer (refer to Box II.1.1 for a more detailed description). All such products contribute to the final remuneration of generators.

The spot price on the wholesale market is used as a reference price for all other markets where energy is traded, forward markets or bilateral agreements. In a market which is not distorted by external interventions, the variability of the spot price plays a role in signalling the need of investment in new resources. Where interventions are in place which protect some technologies from exposure to prices (for example remuneration from pre-determined schemes rather than from the market price), distortions might appear that weaken the price signal.

In general, the spot price on the wholesale market corresponds to the price set on the day-ahead market. Generators bid on the day-ahead market and then refine their positions during intraday trade. Both markets are linked and participants get revenues from both intraday and day-ahead markets (see box II.1.1).

1.1.2.Marginal cost pricing

Electricity prices on the spot market are based on the bid of the marginal unit (). The typical electricity supply curve is a piecewise linear function. Each step represents a type of generation source, with the quantity of electricity that can be supplied at the quoted price. Cheaper generation is dispatched first in the market, so that the supply function is upward sloping: demand is first met with lower cost energy, and higher cost generation is called in progressively with increased quantity. The equilibrium price (the 'spot price') is the price of the marginal generation source needed to meet demand. Simplifying, it can be said that this is the price that all generators receive. The supply curve obtained by aggregation of the different bids is also known as merit-order curve. All bids below the clearing price are in the merit whereas all bids above the clearing price are out of merit.

.

|

|

|

|

|

|

|

|

|

(Continued on the next page)

|

|

Box (continued)

|

|

|

|

|

|

|

|

(Continued on the next page)

|

|

Box (continued)

|

|

|

|

|

|

|

|

|

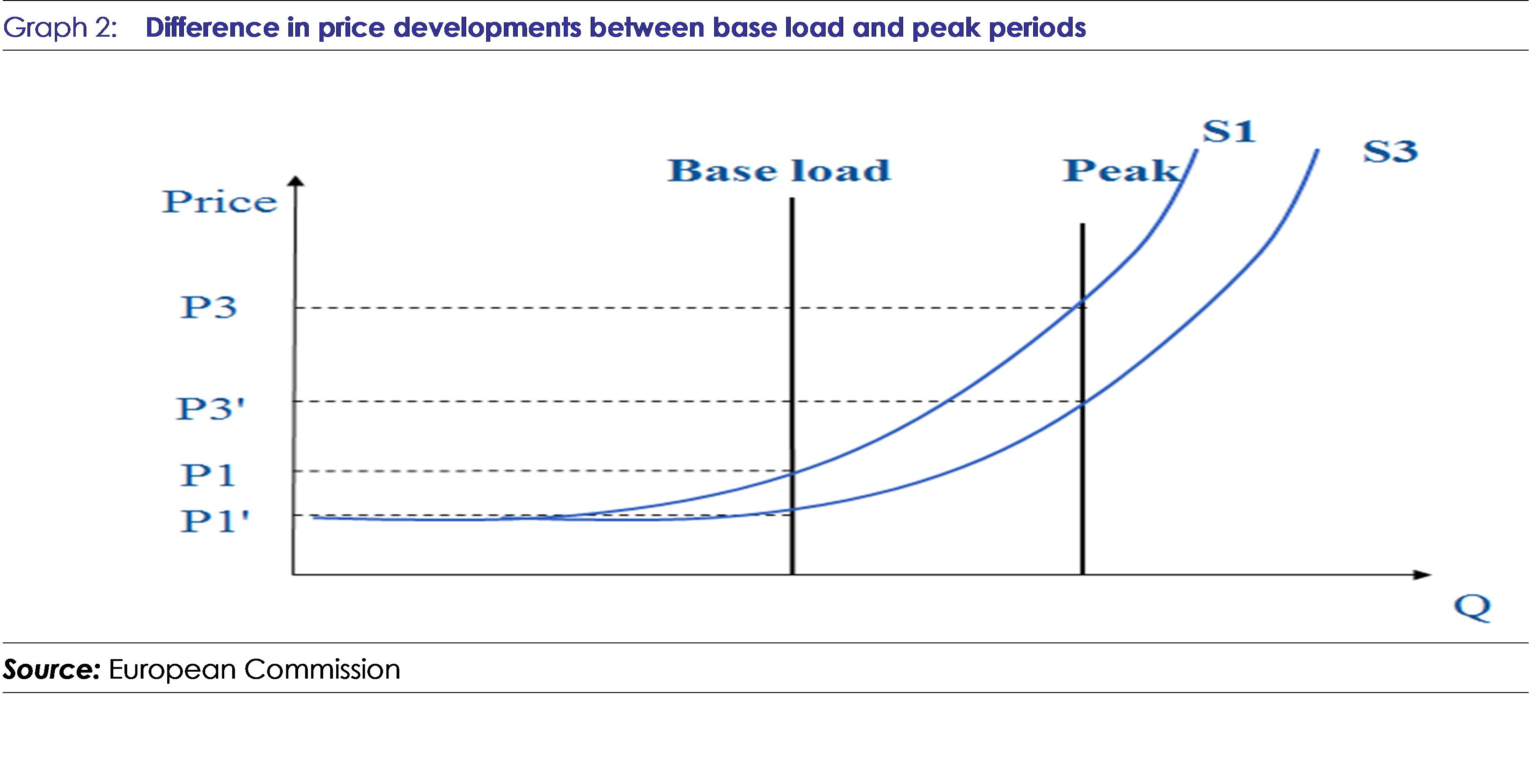

Graph II.1.1 shows a generic merit-order curve with six generation technologies: renewables, nuclear, lignite, hard coal, natural gas and oil. They are ordered left to right on the basis of their marginal costs from the cheapest to the most expensive. Demand intersects the merit-order curve at a point in the supply served by hard coal plants. The price is set by the bid of the last hard coal plant in the merit. This means that all other generation units with lower bids earn an infra-marginal rent equal to the difference between their bid and the bid of the hard coal plant (that is the spot price). Under the assumption of perfect competition in the market, bids represent the marginal costs of the plant to supply energy.

|

Graph II.1.1:A generic merit-order curve and the effect of increased low marginal cost technologies

|

|

|

|

Source: AGORA Energiewende

|

With such a mechanism, a well-functioning and competitive power market produces electricity at the lowest cost for each hour of the day. The equilibrium price reflects both: (i) the cost of producing one kWh of electricity from the most expensive source needed to meet the demand; and (ii) the price that consumers are willing to pay for the final kWh required to meet the demand.

1.1.3.Economic approach to the equilibrium of the electricity system

The characteristics of electricity production make the reality of electricity markets complex. First, storability of electricity is currently limited, which means that the electricity produced is consumed instantaneously. Any oversupply of electricity would be lost at the moment it is produced. Second, demand is still rather inelastic (although important improvements in demand response are foreseen in the near future), and prices can reach very high levels within a short period if demand is not met. By contrast, when demand is low, a large part of capacity remains idle, hence not remunerated by the market. The task of ensuring a sufficient level of supply to meet demand at all moments is a challenging one, not only for the daily dispatching, but also in a long term perspective. The electricity system needs to be able to invest in capacity ahead of demand developments in order to make sure that enough production capacity is available when needed.

For this reason, an important aspect of market design is the need to keep the system reliable. Different market designs exist, which can be classified under two main categories based on the products traded: in an energy only market, the only product is the power produced, whereas in the presence of a capacity market, the availability of power plants is an additional product.

In an energy-only market, the signal for investment relies on high prices that materialise in moments of excess demand (these are called scarcity prices and moments of excess demand are scarcity scenarios): whenever there is a scarcity scenario, prices are allowed to rise so that generators start earning 'scarcity rents' that are high enough to cover their fixed costs of capital and induce new investment/new entry in the market. The problem with this approach is that it may lead to high price volatility, which increases the investment risk associated to the electricity market and the uncertainty – especially for peaking plants, but also for variables renewable plants() – to recuperate their investments; the possibility for prices to reach very high levels may also be used strategically by market players to abuse market power. For these and other reasons, wholesale electricity prices are usually capped. Finally, potentially variable and high prices might not be desirable if they expose consumers, both households and industry, to unsustainable high prices; nonetheless, long term contracts could be devised for customers not willing to be exposed to price volatility.

Alternatively, the market can be designed as an energy market complemented by a capacity mechanism. Markets designed in this way involve the trade of two products: scheduled energy (and services) and the ability to deliver power at some point in time (that is: "generation capacity"). For the trade of electricity, these markets make use of the same wholesale market design as energy-only markets. The difference is that they complement it with a capacity mechanism. Capacity mechanisms are tools to remunerate capacity for the simple fact of being available if needed. They can be price-based, hence setting a price for capacity availability; or they can be quantity based, in which case the required volume is determined at the outset and it is left to the market to set the appropriate price. All the relative costs associated with capacity mechanisms should be borne by consumers.

The Commission distinguishes six categories of capacity mechanisms () which are split between targeted and market-wide mechanisms. Targeted mechanisms focus on the additional capacity expected on top of what the market will provide. Market-wide mechanisms provide support to the majority of capacity providers in the market. Both targeted and market wide mechanisms can be further split between volume-based and price-based intervention. Volume-based mechanisms are: tender, reserve, central buyer, de-centralised obligation; while price based mechanisms are: capacity payment and targeted capacity payment.

|

Graph II.1.2:Taxonomy of capacity mechanisms

|

|

|

|

Source: European Commission

|

1.2.Market Frameworks in Member States

Historically energy policy in the Member States was managed at national level, whereas only relatively recently efforts have been made to steer the architecture of the different energy systems towards an integrated design.

|

|

|

Table II.1.1:Electricity Regional Initiatives

|

|

|

|

Source: European Commission

|

|

|

1.2.1.EU integration

Market integration has improved thanks to the Electricity Regional Initiatives (ERI), launched in 2006, aimed to create seven regional electricity markets in Europe, as an interim step towards the Internal Electricity Market. Each region brings together regulators, companies, Member States, the European Commission and other interested parties to focus on developing and implementing solutions to improve the way in which regional energy markets develop. An overall monitoring process at EU level ensures that progress towards a single EU market is not hampered, and that there is convergence and coherence across the regions.

A similar harmonisation effort started in 2014 with respect to support schemes. Investment in renewables was achieved mainly through support schemes that were national in scope (chapter I.2). In 2014 the new Guidelines for state aid for environmental protection and energy () set the path towards harmonisation of support schemes across Europe.

Market coupling has also improved. On 24 February 2015, for the first time, day-ahead power markets were linked from Finland to Portugal and Slovenia, accounting for about 2,800 TWh of yearly consumption and encompassing nineteen power systems. The EU has also agreed to achieve an interconnection level of at least 10 % of their installed electricity production capacity for all Member States by 2020. This target has been proposed to be extended to 15% by 2030. () In addition, regional cooperation is being pursued, for instance, to reinforce cross-border network infrastructures such as in the North Sea area (through the North Seas Countries' Offshore Grid Initiative), in the Baltic region (through the Baltic Energy Market Interconnection Plan - BEMIP) and in the Pentalateral Energy Forum between Germany, Belgium, France, Luxembourg, the Netherlands and Austria.

|

|

|

Table II.1.2:Electricity market characteristics at Member State-level

|

|

|

|

Source: ACER 2013

|

|

|

1.2.2.Member States

In terms of market design, most Member States employ a power exchange (), where trade through the market is optional (see table III.1.2). Greece, Ireland, Portugal and Spain have adopted a power pool, where all transactions must go through the market. In Bulgaria, Cyprus, and Luxemburg there is no wholesale market and transactions are either agreed on a bilateral basis (over the counter) or are managed by the central authority.

Member States differ also in the choice of reliance on an energy-only or a capacity market. Currently, most of the active capacity mechanisms aim to ensure the firmness and adequacy of the overall capacity of the market to meet demand. Some Member States purely rely on an energy-only market (Austria, Bulgaria, Czech Republic, Estonia, Latvia, Lithuania, Netherlands, Romania, Slovakia and Slovenia) whereas others made the choice to accompany the energy-only market by some form of capacity mechanism (see section 1.1.3).

Different forms of capacity mechanisms have been implemented in several European countries while others are discussing their implementation. Belgium, Sweden, Finland, and Germany operate strategic reserves (). Ireland, Italy, Portugal and Spain practice capacity payments. France plans to implement a capacity obligation scheme supported by certification of capacity. Denmark plans to implement a strategic reserve. Greece has a capacity obligations scheme since 2005 (). The United Kingdom has opted for a centralized, market wide capacity auction. Other Member States are supporting new investments through tenders for new capacity. Various Member States are considering new capacity mechanisms. ().

Support schemes are evolving. Even though a big part of investment in renewables is driven by support schemes, evolution towards market-based allocations and/or pricing can be observed in some Member States. To tackle the problem of revenue uncertainty in electricity generation and a consequent difficulty in getting private sector investment, the United Kingdom passed the Energy Act 2013 to implement Electricity Market Reform (EMR) which implements legally-binding Contracts for Difference. Through a Contract for Difference the electricity generator is paid the difference between the price reflecting the cost of investing in a particular low carbon technology – and the ‘reference price’– a measure of the average market price for electricity in the British market. In addition, the scope of the schemes is changing from renewable-targeted (a type of action which is more technology-specific) to low-carbon (a requirement which is instead emission reduction- specific). In Spain, feed-in tariffs and feed-in premia were replaced by investment support schemes () based on which renewable producers must submit offers to the market operator. If the revenues collected from the market are not sufficient to cover their costs plus a fair return, then a subsidy will be given in €/MW on a yearly basis in order to ensure that the predetermined level of profitability () will be achieved.

The presence or not of a price-cap on the wholesale market is one additional source of heterogeneity across Member States. For instance, price caps have been set in the French and German power exchange at +/-3000 EUR/MWh, which means that the price cannot exceed these limits. Nord Pool Spot has a range of -200 EUR/MWh to +2,000 EUR/MWh (), (). The Irish power exchange SEM has a price cap of 1 000 EUR/MWh. In the Iberian power market OMEL bids are allowed between 0 and 180 EUR/MWh (). Possibly, also other Member States implement price caps.

1.3.Concluding remarks

Power price formation is based on the bid of the marginal unit required to meet demand, which in a competitive market will correspond to its marginal cost. For each technology, the difference between the market price and its costs, i.e. the inframarginal-rent, allows investors to breakeven. Some additional revenue can also be realised on the balancing market.

The role of the price is different across market frameworks. In energy only markets, the stability of the system in terms of investments in capacity is achieved through electricity prices. When demand is in excess, prices increase to signal scarcity on the market. The high scarcity price enables the generators to cover their fixed capital costs and provide an incentive to invest so that the capacity will be able to meet market demand. In other market frameworks, the energy market is complemented by a capacity mechanism to incentivise investment to make the capacity available to meet the demand (often targeting a long term reliability standards).

Although EU wholesale markets have been progressively harmonised, market framework still differ across Member States in terms of electricity traded via various markets (day-ahead, intra-day, balancing markets), implementation of capacity mechanisms and other forms of price regulation, e.g. price caps.

The decarbonisation agenda of the European Union requires large investments to take place in the next future. At the same time, the liberalisation of the electricity market has enhanced the role of spot markets in providing the signal for investment. However, the penetration of low carbon technologies is challenging the functioning of the market and changing the investment landscape.

The objective of this chapter is to reflect on the evolution of key features for investment in electricity markets. Section 1 assesses investment needs in electricity generation; Section 2 describes the ongoing transformation of electricity markets and the potential impact on power prices. Section 3 concludes.

2.1.The case for investments in electricity markets

The transition to a low-carbon and energy-secure economy requires mobilisation of significant investments in Europe. The Impact Assessment of the energy efficiency review and its contribution to energy security and the 2030 Framework for climate and energy policy estimated the investment needs related both to the achievement of the 2030 targets and the modernization and transformation of the energy system in the EU Member States (). These projections show that EUR 90 billion of investments are needed annually up to 2030 in the power sector, of which EUR 50 billion for energy generation and EUR 40 billion related to power grids. This is driven by the need to modernise the EU's ageing energy infrastructure (for generation as well as transmission and distribution), as a response to security of supply issues, and due to energy and climate policy ambitions.

Significant investments in renewable power capacity will be needed up to 2030 under decarbonisation. Graph II.2.1 presents the ranges of net capacity investment in the period 2011-2030 for the different scenarios of the Impact Assessment of the energy efficiency review and its contribution to energy security and the 2030 Framework for climate and energy policy. These investment numbers include lifetime extensions of existing plants, refurbishments and replacement investments on existing sites.

|

Graph II.2.1:Ranges for EU28 - Net Power Capacity Investment (in GWe - aggregate 2011-2030)

|

|

|

|

Source: European Commission (2014 f)

|

In addition to the investment needs for the power sector, substantial investments are also required in other sectors of the economy, i.e. transport (energy efficiency, electrification), buildings (energy efficiency, innovation) and industry (energy efficiency, innovation). Total investment needs are estimated at EUR 850 billion annually up to 2030.

|

Graph II.2.2:Annual Investment Expenditures in billion of euro - 2010 (2011-2030)

|

|

|

|

Source: European Commission (2014 f)

|

Decarbonisation of the rest of the economy is expected to lead to higher demand for the generation electricity sector. Electricity consumption is still largely driven by GDP growth although energy efficiency improvements have contributed to decouple energy performance from economic growth. Electricity consumption decreased starting in 2008 due to the impact of the economic crisis and the subsequent sluggish recovery, as well as to energy intensity improvements. At the end of 2012, total electricity consumption was still 2.3% lower than in 2008, whereas analysts were expecting an average annual growth rate of about 2% () at the time. In the future, the energy efficiency improvement in the rest of the economy is expected to increase the demand for electricity. According to the Energy Roadmap 2050 (), the electricity share in the final energy consumption is expected to double compared to 2005 in the decarbonisation scenarios () reaching 36% - 39% of final energy demand in 2050. This reflects the increasing role played by electricity in decarbonising final demand sectors such as heating and services and in particular transport.

|

|

|

Table II.2.1:Electricity cost structure

|

|

|

|

Source: Own calculations based on Impact Assessment accompanying the document Energy Roadmap 2050, part 2, Table 31.

|

|

|

|

Graph II.2.3:EU28 - Electricity consumption (in TWh) - Final electricity demand in TWh*

|

|

|

|

Source: European Commission

|

Electricity demand in the transport sector in 2050 increases by almost a factor eight compared to 2005 under the different scenarios of the Impact Assessment of the energy efficiency review and its contribution to energy security and the 2030 Framework for climate and energy policy. This is mainly due to the electrification of road transport, in particular private cars. About 80% of private passenger transport activity is foreseen to be carried out with electrified (plug-in or pure electric) vehicles by 2050. Compared to transport, the electricity demand of households and the tertiary sector is expanding more modestly by 2050, yet markedly, mainly driven by the electrification of heating and cooling. This new usage of electricity overcomes the improvements achieved by 2050 in energy efficiency of appliances as well as the increased thermal integrity in the residential and service sectors and more rational use of energy in all sectors. By contrast, industrial electricity demand remains quite stable by 2050 compared to 2005.

2.2.The ongoing transformation of European electricity markets

2.2.1.Changing cost structure: high capital costs technologies