EUROPEAN COMMISSION

EUROPEAN COMMISSION

Strasbourg, 25.10.2016

COM(2016) 686 final

2016/0338(CNS)

Proposal for a

COUNCIL DIRECTIVE

on Double Taxation Dispute Resolution Mechanisms in the European Union

{SWD(2016) 343 final}

{SWD(2016) 344 final}

This document is an excerpt from the EUR-Lex website

Document 52016PC0686

Proposal for a COUNCIL DIRECTIVE on Double Taxation Dispute Resolution Mechanisms in the European Union

Proposal for a COUNCIL DIRECTIVE on Double Taxation Dispute Resolution Mechanisms in the European Union

Proposal for a COUNCIL DIRECTIVE on Double Taxation Dispute Resolution Mechanisms in the European Union

COM/2016/0686 final - 2016/0338 (CNS)

EUROPEAN COMMISSION

EUROPEAN COMMISSION

Strasbourg, 25.10.2016

COM(2016) 686 final

2016/0338(CNS)

Proposal for a

COUNCIL DIRECTIVE

on Double Taxation Dispute Resolution Mechanisms in the European Union

{SWD(2016) 343 final}

{SWD(2016) 344 final}

EXPLANATORY MEMORANDUM

1.CONTEXT OF THE PROPOSAL

•Reasons for and objectives of the proposal

From the first day of its mandate, this Commission has placed on top of its political agenda job creation, growth and investment. To achieve these overarching priorities the Commission has been, inter alia, pushing an ambitious reform agenda for a deeper and fairer internal market, as an essential foundation for building a stronger and more competitive EU economy.

These objectives translate, as regards taxation, in the need to build a fair and efficient corporate tax system in the EU.

To ensure the fairness of the tax systems, the Commission has made the fight against tax evasion and tax avoidance and aggressive tax planning a key priority and has pushed a very active reform agenda. In this context the Commission - in close cooperation with Member States and with the support of the European Parliament - is building a solid defence structure against tax evasion and avoidance in Europe, a robust response system against external threats to Member States' tax bases and a clear path towards fairer taxation for all EU citizens and businesses. At the same time, there is a need to ensure that tax systems are also efficient, so that they could support a stronger and more competitive economy. This should be done by creating a more favourable tax environment for businesses that reduces compliance costs and administrative burdens, and ensure tax certainty. In particular, the importance of tax certaintly in promoting investment and stimulating growth has been recently recognised by G20 leaders and has become the new global focus in the taxation area.

Fighting against tax avoidance and aggressive tax planning, both at EU and global level, must therefore go hand in hand with creating a competitive tax environment for businesses. They are the two sides of the same coin. A fair tax system is not only one that ensures that profits are actually taxed where they are generated but also one that ensures that profits are not taxed twice.

One of the main problems that businesses operating across border currently face is double taxation. There are already mechanisms in place that deal with the resolution of double taxation disputes. They are the Mutual Agreement Procedures (MAP) which are foreseen in Double Taxation Conventions (DTCs) entered into by Member States as well as in the Union Arbitration Convention 1 on the elimination of double taxation on the elimination of double taxation in connection with the adjustment of profits of associated enterprises. The Commission monitors the number of cases that are dealt with by Member States and the respective results on an annual basis. The analysis shows that there are cases that are prevented from entering existing mechanisms, that are not covered by the scope of the Union Arbitration Convention or DTCs, that get stuck without the taxpayer being informed about the reasons or that are not resolved at all.

Although the existing mechanisms work well in many cases, there is a need to make them work better regarding access for taxpayers to those mechanisms, coverage, timeliness and conclusiveness. Moreover, the traditional methods of resolving disputes no longer fully fit with the complexity and risks of the current global tax environment.

There is therefore a need to improve existing double taxation dispute resolution mechanisms in the EU with the aim to design a fair and efficient tax system that increases legal certainty. This is a key contribution to the creation of a fair tax system as well as ensuring that the EU internal market remains an attractive area for investment.

The proposed directive focusses on business and companies, the main stakeholders affected by double taxation situations. It builds on the existing Union Arbitration Convention, which already provides for a mandatory binding arbitration mechanism, but broadens its scope to areas which are not currently covered and adds targeted enforcement blocks to address the main identified shortcomings, as regards enforcement and effectiveness of this mechanism.

•Consistency with existing policy provisions in the policy area

The Commission’s Communication on an Action Plan for a Fair and Efficient Corporate Tax System in the EU, which was adopted on 17 June 2015 2 identified five key areas for action. One of these areas related to creating a better tax environment for business in the EU, with a view to foster growth and jobs in the Single Market. The Communication identified the proposal for a Common Consolidated Corporate Tax Base (CCCTB), which is planned to be adopted on the same day as this proposal, as a major step towards a better tax environment for business but recognised that, in the meantime, other initiatives should enhance the EU's tax environment for business.

This proposal complements the one on CCCTB. Since consolidation is only part of the second phase of the new approach to CCCTB, there would still be a need for effective dispute resolution mechanisms. Moreover, although a fully adopted CCCTB is designed to ensure that profits are taxed where they are generated, not all companies will be within the mandatory scope of the CCCTB. Therefore, it can be expected that even after a number of double taxation disputes will continue to arise, for which appropriate mechanisms need to be in place.

Furthermore, this proposal builds on existing policy provisions in the policy area, in particular the Union Arbitration Convention. The proposed Directive aims at broadening the scope and improving procedures and mechanisms in place without replacing them. This is a way to ensure that Member States on the one hand are provided with more detailed procedural provisions for the elimination of double taxation disputes but at the same time are left with sufficient flexibility to agree amongst them on a mechanism of their choice. The situation for the taxpayer is improved in several respects. According to the proposed Directive taxpayers get enhanced rights to enforce – subject to certain criteria - the setting up of resolution mechanisms, will be better informed about the procedure and can rely on the Member States being forced to achieve binding results.

•Consistency with other Union policies

This proposal falls within the ambit of the Commission’s initiatives for fairer and more effective taxation. It would contribute to the elimination of tax obstacles, which create distortions that impede the proper functioning of the internal market. It would therefore contribute to a deeper and fairer internal market.

2.LEGAL BASIS, SUBSIDIARITY AND PROPORTIONALITY

•Legal basis

Direct tax legislation falls within the ambit of Article 115 of the Treaty on the Functioning of the EU (TFEU). The clause stipulates that legal measures of approximation under that article shall be in the legal form of a Directive.

•Subsidiarity

This proposal complies with the principle of subsidiarity. The nature of the subject requires a common initiative across the internal market. The rules of this Directive aim to improve the effectiveness and efficiency of double taxation dispute resolution mechanisms as they create serious impediments to a well-functioning Internal Market. double taxation dispute resolution mechanisms are by nature bi- or multilateral procedures, requiring coordinated action between the Member States. Member States are inter-dependent when applying the double taxation dispute resolution mechanisms: even if relevant double taxation dispute resolution mechanisms are available, the shortcomings identified such as denials of access or length of the procedure will only be effectively solved if addressed and agreed mutually by the Member States.

Legal certainty and predictability at the level of the taxpayer can only be addressed through a common set of rules setting up a clear obligation of result, terms and conditions of the effective elimination of double taxation and ensuring implementation of the double taxation dispute resolution mechanisms decisions consistently throughout the EU. Furthermore, an EU initiative would add value, as compared to the existing national rules or bilateral treaties by offering a coordinated and flexible framework.

Such an approach is therefore in accordance with the principle of subsidiarity, as set out in Article 5 TFEU.

•Proportionality

The envisaged measure does not go beyond what is strictly necessary to achieve its objectives. It builds on the existing mechanisms and adds a limited number of rules to improve them. These rules are tailored to address the shortcomings identified. The Directive refers also to Alternative Dispute Resolution (ADR) mechanisms and recourse procedures that already exist in other areas. Finally, the Directive ensures the essential degree of coordination within the Union.

The objectives of this proposal can be achieved with minimal costs for businesses and Member States, while avoiding tax and compliance costs for companies as well as unnecessary administrative costs for Member States' tax administrations.

In light of this, the proposal does not go beyond what is necessary to achieve its objectives and is therefore compliant with the principle of proportionality.

•Choice of the instrument

The proposal is based on a Directive, the instrument available under the legal base of Article 115 TFEU.

3.RESULTS OF EX-POST EVALUATIONS, STAKEHOLDER CONSULTATIONS AND IMPACT ASSESSMENTS

•Stakeholder consultation

A public consultation was run from 17 February to 10 May 2016 by the European Commission asking for feedback on the status quo, objectives, possible kinds of action, and the options envisaged. In total 87 submissions were received.

The initiative received general support from business stakeholder groups and from a number of Member States who are primarily concerned about the negative impact of non-action at EU level. Non-governmental organisations, private individuals and other respondents to the consultation did not express a negative position but in contrast underlined the rather positive impact of other initiatives such as the CCCTB.

The vast majority of respondents considered that effective measures should be in place to ensure that double taxation is removed within the EU and that the existing mechanisms are not sufficient as regards the scope of mandatory binding dispute resolution, enforceability and efficiency. They considered that the current situation is detrimental to growth, creates barriers and prevents foreign investors from investing in the EU internal market. Respondents generally confirmed that there was a need for taking action in the EU and that this should build on the existing mechanisms. As regards the objectives, they should ensure the elimination of double taxation, be compatible with international developments and provide a stronger role for the taxpayer.

•Collection and use of expertise

The Commission services held a meeting of the European Joint Transfer Pricing Forum (EU JTPF) and the Platform for Tax Good Governance (EU Platform) respectively on 18 February 2016 and on 15 March 2016 3 to discuss the subject matter with relevant stakeholders and Member States. A synopsis report on all the consultation activities carried out by the European Commission to support this initiative is available on the web site of the European Commission. The initiative was also further discussed with Member States representatives on 26 July 2016.

•Impact assessment

The proposal is supported by an impact assessment which was reviewed by the Regulatory Scrutiny Board on 7 September 2016. The Board issued a positive opinion.

The proposal is based on the preferred option identified in the impact assessment, which is to set up a mandatory binding effective dispute resolution mechanism, i.e. a Mutual Agreement Procedure combined with an arbitration phase, with a clear time limit and an obligation of result for all Member States. The proposal applies to all taxpayers that are subject to one of the listed income taxes on business profits.

In terms of economic impact, the proposal will reduce the compliance and litigation burden for companies operating in the EU as regards their cross-border activities. It will also alleviate both external costs and internal administration costs related to the management of such disputes. It will facilitate the investment decisions within the EU by providing more certainty and predictability to investors, as regards the neutralisation of additional costs arising from double taxation. At the level of tax administrations, the proposal should reduce delays and procedure costs but also be a strong incentive to adjust the administration capacity and internal procedures optimally. It will therefore improve efficiency. It should have a positive effect on tax collection in the medium and long term, as it should boost growth and investment in the European Union but also improve confidence of the taxpayers in the tax system overall, thus stimulating voluntary compliance.

In terms of societal benefits, this initiative responds to the increased expectation from the public for a fair and effective tax system. It will ensure consistency in the treatment of double taxation disputes for cross-border transactions at the EU level and provide also for more transparency on how these disputed cases are solved.

•Fundamental rights

This Directive respects the fundamental rights and observes the principles recognised in particular by the Charter of Fundamental Rights of the European Union. In particular, this Directive seeks to ensure full respect of the right to a fair trial, by giving taxpayers access to their national competent court at the Dispute Resolution stage in case of denial of access or when the Member States fail to establish an Advisory Commission. It also safeguards the freedom to conduct a business.

4.BUDGETARY IMPLICATION

The impact of the proposal on the EU budget is presented in the financial statement accompanying the proposal and will be met within available resources.

5.OTHER ELEMENTS

•Implementation plans and monitoring, evaluation and reporting arrangements

The Commission will monitor the implementation of this Directive in cooperation with Member States. The relevant information will be gathered primarily by Member States.

The current monitoring of the Union Arbitration Convention at the level of the EU JTPF is proposed to be extended to all cases of double taxation disputes in cross-border situations covered by the new legal instrument and gathered on a yearly basis. The following information collected will enable the Commission to assess whether the objectives are met:

number of initiated/ closed/ pending cases across the EU

duration of dispute resolution mechanisms including the reasons for not adhering to the timelines foreseen

number of instances where access was denied by a Member State

amounts of tax involved in cases (in general and for those who go to arbitration)

number of instances of arbitration requested.

As statistical data is already collected and should continue to be collected on a yearly basis, it is expected that the costs of such activity would remain unchanged, for Member States and for the Commission.

Five years after the implementation of the instrument, the Commission will evaluate the situation as regards double taxation resolution in cross-border situations for companies in the EU with respect to the objectives and the overall impacts on companies and the internal market.

•Detailed explanation of the specific provisions of the proposal

The Directive builds to a large extent on the terms of the Convention on the elimination of double taxation in connection with the adjustments of profits of associated enterprises (90/436/EEC) 4 , the Union Arbitration Convention, which is part of the EU acquis. Once implemented the Directive will reinforce mandatory binding dispute resolution in the EU.

It would broaden the scope of dispute resolution mechanisms to all cross-border situations subject to double income tax imposed on business profits (Article 1). The objective of eliminating double taxation and the specific situations this should cover are restated in the same terms as in the Union Arbitration Convention. The proposed Directive however adds an explicit obligation of result for Member States as well as a clearly defined time-limit. On the other hand, situations which characterise double non-taxation or cases of fraud, wilful default or gross-negligence are excluded (Article 15).

In line with the Union Arbitration Convention the Directive allows for a Mutual Agreement Procedure (MAP), initiated by the complaint of the taxpayer, under which the Member States shall freely cooperate and reach an agreement on the double taxation dispute within 2 years (Article 4). If the MAP fails, it automatically leads to a dispute resolution procedure with the issuance of a final mandatory binding decision by the competent authorities of the Member States involved.

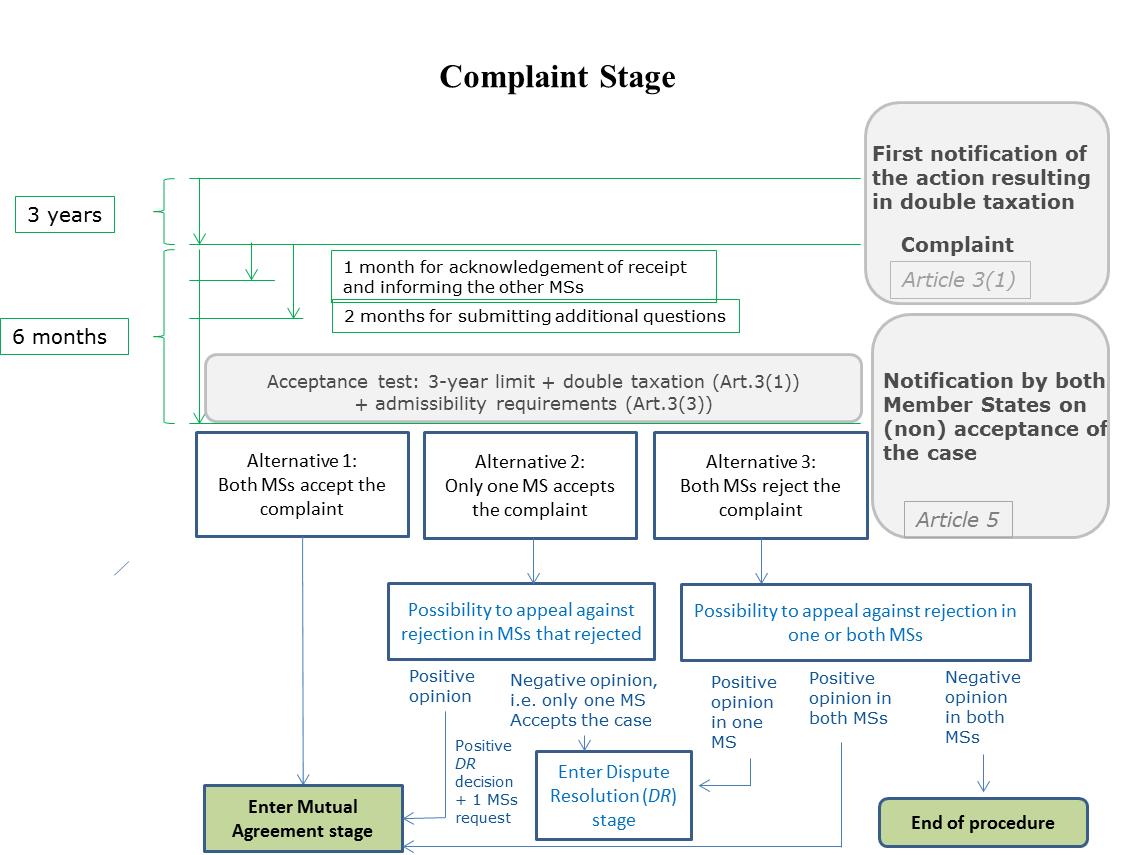

The diagram below summarises the three key procedural stages, the complaint, the MAP and the dispute resolution procedure:

Articles 3 to 5 provide formal rules to clarify the conditions under which a complaint shall be admissible to the MAP, i.e. the time frame for the complaint, the explanation of the double taxation situation by the taxpayer and the provision of the information in order to enable the competent authorities to examine the case and to consider its admissibility. They also strengthen the information provided to the taxpayer and sets obligations for the Member States to send notifications if a case is rejected or considered as not admissible.

The diagrams below summarise the different steps followed at the stage of the complaint and the connection with the two subsequent steps, i.e. the MAP or dispute resolution phase:

Articles 6 to 7 complement the initial MAP phase with an automatic arbitration procedure which foresees solving the dispute by way of arbitration within a timeline of fifteen months in case Member States failed to reach an agreement during the initial amicable phase. Situations where both Member States do not agree on admissibility of the taxpayer's case to the MAP phase can also be submitted to arbitration at an earlier stage, so as to solve this conflict on admissibility of the case (potential denial of access), provided that the taxpayer requests for it and establishes that it has renounced domestic remedies or that the recourse period for such remedies has expired. Under this supplemental arbitration procedure and according to Article 8 of the Directive, a panel of three to five independent persons (arbitrators) have to be appointed (one or two for each Member State plus one independent chairman), together with two representatives of each Member State. This ‘Advisory Commission’, issues a final opinion on eliminating the double taxation in the disputed case, which would be binding for Member States, unless they agree on an alternative solution to remove the double taxation (Article 13).

A default fast-track enforcement mechanism supervised by the competent national courts of each Member State involved is created in cases where the Advisory Commission is not set up within a certain time limit (Article 7). The taxpayer would have the possibility to refer to the national court in this case, to appoint the independent persons who would then chose the chairman. The independent persons and the chair will be chosen from a pre-established list maintained by the European Commission.

The following diagrams describe the dispute resolution phase as well as the new resolution process set up in case of denial of access at an early stage as a result of only one Member State denying the acceptance or the admissibility of the complaint with the other Member State accepting:

This enforcement and default appointment mechanism for the arbitration body is modelled on existing mechanisms in EU Member States according to which national courts appoint arbitrators when parties having entered into an arbitration agreement fail to do so. The national competent court which would be designated by the Member States would specifically address the cases corresponding to the shortcomings identified in the impact assessment, i.e. denial of access where Member States do not agree on the admissibility of the double taxation disputes, blocked and prolonged procedure exceeding two years.

Article 8 follows the requirements agreed in the Union Arbitration Convention regarding the setting up of an Advisory Commission and the terms and conditions under which the list of independent persons who can be members of the Advisory Commission is set up and maintained by the European Commission. Article 6 provides for the possibility for the competent authorities of the Member States concerned to agree and set up an alternative form of dispute resolution body, which can solve the case using other dispute resolution techniques, such as mediation, conciliation, expertise or any other appropriate and effective technique.

Article 10 provides a functioning framework for the Advisory Commission, the Rules of Functioning (RoF). These cover substantial aspects such as the description of the case, the definition of the underlying legal basis and questions to be addressed by the Advisory Commission and some key logistical and organisational aspects. These include the timeline, organisation of meetings and hearings, exchange of documents, working language and cost administration.

Article 12 reflects the Union Arbitration Convention and deals with information requirements and procedural aspects of the Advisory Commission.

Articles 13 and 14 follow the Union Arbitration Convention as regards the terms and conditions, including the constrained timeline, under which the Advisory Commission should issue its opinion, which should be the reference for the subsequent final and binding decision of the competent authorities. Specific obligations of the Member States regarding costs are provided for in Article 11 and reflect the provisions of the Union Arbitration Convention on these aspects.

The interaction with domestic judicial proceedings and appeals is dealt with in Article 15 in a way similar to the Union Arbitration Convention. It includes provisions on exceptional cases which should not fall within the scope of the procedure (i.e. cases of fraud, wilful default or gross-negligence are excluded).

Enhanced transparency is one of the objectives of the proposed Directive. Article 16 includes the provisions of the Union Arbitration Convention in this respect, according to which the competent authorities may publish the final arbitration decision and more detailed information, subject to agreement by the taxpayer.

Article 17 defines the role of the European Commission in the procedure, in particular as regards the maintaining of the list of independent persons according to Article 8(4).

Article 18 provides for the European Commission to adopt the practical arrangements necessary for the proper functioning of the procedures introduced by this Directive, with the assistance of a Committee on double taxation dispute resolution.

Article 19 empowers the European Commission to adopt legal acts as defined by Article 20 in order to update Annexes I and II to take account of new circumstances.

2016/0338 (CNS)

Proposal for a

COUNCIL DIRECTIVE

on Double Taxation Dispute Resolution Mechanisms in the European Union

THE COUNCIL OF THE EUROPEAN UNION,

Having regard to the Treaty on the Functioning of the European Union, and in particular Article 115 thereof,

Having regard to the proposal from the European Commission,

After transmission of the draft legislative act to the national parliaments,

Having regard to the opinion of the European Parliament 5 ,

Having regard to the opinion of the European Economic and Social Committee 6 ,

Acting in accordance with a special legislative procedure,

Whereas:

(1)Situations, in which different Member States tax the same income or capital twice can create serious tax obstacles for businesses operating cross border. They create an excessive tax burden for businesses and are likely to cause economic distortions and inefficiencies, as well as to have a negative impact on cross border investment and growth.

(2)For this reason, it is necessary that mechanisms available in the Union ensure the resolution of double taxation disputes and the effective elimination of the double taxation at stake.

(3)The currently existing mechanisms provided for in bilateral tax treaties do not achieve the provision of a full relief from double taxation in a timely manner in all cases. The existing Convention on the elimination of double taxation in connection with the adjustments of profits of associated enterprises (90/436/EEC) 7 ('the Union Arbitration Convention') has a limited scope as it is only applicable to transfer pricing disputes and attribution of profits to permanent establishments. The monitoring exercise carried out as part of the implementation of the Union Arbitration Convention has revealed some important shortcomings, in particular as regards access to the procedure and the length and the effective conclusion of the procedure.

(4)With a view to create a fairer tax environment, rules on transparency need to be enhanced and anti-avoidance measures need to be strengthened. At the same time in the spirit of a fair taxation system, it is necessary to ensure that taxpayers are not taxed twice on the same income and that mechanisms on dispute resolution are comprehensive, effective and sustainable. Improvements to double taxation dispute resolution mechanisms are also necessary to respond to a risk of increased number of double or multiple taxation disputes with potentially high amounts being at stake due to more regular and focused audit practices established by tax administrations.

(5)The introduction of an effective and efficient framework for resolution of tax disputes which ensures legal certainty and a business friendly environment for investments is therefore a crucial action in order to achieve a fair and efficient corporate tax system in the Union. The double taxation dispute resolution mechanisms should also create a harmonised and transparent framework for solving double taxation issues and as such provide benefits to all taxpayers.

(6)The elimination of double taxation should be achieved through a procedure under which, as a first step, the case is submitted to the tax authorities of the Member States concerned with a view to settling the dispute by Mutual Agreement Procedure. In the absence of such agreement within a certain time frame, the case should be submitted to an Advisory Commission or Alternative Dispute Resolution Commission, consisting both of representatives of the tax authorities concerned and of independent persons of standing. The tax authorities should take a final binding decision by reference to the opinion of an Advisory Commission or Alternative Dispute Resolution Commission.

(7)The improved double taxation dispute resolution mechanism should build on existing systems in the Union including the Union Arbitration Convention. However, the scope of this Directive should be wider than that of the Union Arbitration Convention, which is limited to disputes on transfer pricing and attribution of profits to permanent establishments only. This Directive should apply to all taxpayers that are subject to taxes on income from business profits as regards their cross-border transactions in the Union. In addition, the arbitration phase should be strengthened. In particular, it is necessary to provide for a time limit for the duration of the procedures to resolve double taxation disputes and to establish the terms and conditions of the dispute resolution procedure for the taxpayers.

(8)In order to ensure uniform conditions for the implementation of this Directive, implementing powers should be conferred on the Commission. Those powers should be exercised in accordance with Regulation (EU) No 182/2011 of the European Parliament and of the Council 8 .

(9)This Directive respects the fundamental rights and observes the principles recognised in particular by the Charter of Fundamental Rights of the European Union. In particular, this Directive seeks to ensure full respect for the right to a fair trial and the freedom to conduct a business.

(10)Since the objective of this Directive, to establish an effective and efficient procedure to resolve double taxation disputes in the context of the proper functioning of the internal market, cannot be sufficiently achieved by the Member States but can rather, by reason of the scale and effects of the action, be better achieved at Union level, the Union may adopt measures, in accordance with the principle of subsidiarity as set out in Article 5 of the Treaty on European Union. In accordance with the principle of proportionality as set out in that Article, this Directive does not go beyond what is necessary in order to achieve that objective.

(11)The Commission should review the application of this Directive after a period of five years and Member States should provide the Commission with appropriate input to support this review,

HAS ADOPTED THIS DIRECTIVE:

Article 1

Subject matter and scope

This Directive lays down rules on the mechanisms to resolve disputes between Member States on how to eliminate double taxation of income from business and the rights of the taxpayers in this context.

This Directive applies to all taxpayers that are subject to one of the taxes on income from business listed in Annex I, including permanent establishments situated in one or more Member State whose head office is either in a Member State or in a jurisdiction outside the Union.

This Directive does not apply to any income or capital within the scope of a tax exemption or to which a zero tax rate applies under national rules.

This Directive shall not preclude the application of national legislation or provisions of international agreements where it is necessary to prevent tax evasion, tax fraud or abuse.

Article 2

Definitions

For the purposes of this Directive, the following definitions shall apply:

1.'competent authority' means the authority of a Member State which has been designated as such by the Member State concerned;

2.'competent court' means the court of a Member State which has been designated by the Member State concerned;

3.'double taxation' means the imposition of taxes listed in Annex I to this Directive by two (or more) tax jurisdictions in respect of the same taxable income or capital by their national or judicial authorities when it gives rise to either (i) additional tax, (ii) increase in tax liabilities or (iii) cancellation or reduction of losses, which could be used to offset taxable profits;

4.'taxpayer' means any person or permanent establishment subject to income taxes listed in Annex I to this Directive.

Article 3

Complaint

1.Any taxpayer subject to double taxation shall be entitled to submit a complaint requesting the resolution of the double taxation to each of the competent authorities of the Member States concerned within three years from the receipt of the first notification of the action resulting in double taxation, whether or not it uses the remedies available in the national law of any of the Member States concerned. The taxpayer shall indicate in its complaint to each respective competent authority which other Member States are concerned.

2.The competent authorities shall acknowledge receipt of the complaint within one month from the receipt of the complaint. They shall also inform the competent authorities of the other Member States concerned on the receipt of the complaint.

3.The complaint is admissible if the taxpayer provides the competent authorities of each of the Member States concerned with the following information.

(a)name, address, tax identification number and other information necessary for identification of the taxpayer(s) who presented the complaint to the competent authorities and of any other taxpayer directly affected;

(b)tax periods concerned;

(c)details of the relevant facts and circumstances of the case (including details of structure of the transaction and of the relations between the taxpayer and the other parties to the relevant transactions) and more generally, the nature and date of the actions giving rise to the double taxation as well as the related amounts in the currencies of the Member States concerned, with a copy of any supporting documents;

(d)applicable national rules and double taxation treaties;

(e)the following information provided by the taxpayer who presented the complaint to the competent authorities with a copy of any supporting documents:

(i) an explanation of why the taxpayer considers that there is double taxation;

(ii) the details of any appeals and litigation initiated by the taxpayers regarding the relevant transactions and any court decisions concerning the case;

(iii) a commitment by the taxpayer to respond as completely and quickly as possible to all appropriate requests made by a competent authority and provide any documentation at the request of the competent authorities;

(iv) a copy of tax assessment notices, tax audit report or equivalent leading to alleged double taxation and of any other documents issued by the tax authorities with regard to the disputed double taxation.

(f)any specific additional information requested by the competent authorities.

4.The competent authorities of the Member States concerned may request the information referred to in point (f) of paragraph 3 within a period of two months from the receipt of the complaint.

5.The competent authorities of the Member States concerned shall take a decision on the acceptance and admissibility of the complaint of a taxpayer within six months of the receipt thereof. The competent authorities shall inform the taxpayers and the competent authorities of the other Member States of their decision.

Article 4

Decision accepting a complaint – Mutual Agreement Procedure

1.Where the competent authorities of the Member States concerned decide to accept the complaint according to Article 3(5), they shall endeavour to eliminate the double taxation by mutual agreement procedure within two years starting from the last notification of one of the Member States’ decision on the acceptance of the complaint.

The period of two years referred to in the first subparagraph may be extended by up to six months at the request of a competent authority of a Member State concerned, if the requesting competent authority provides justification it in writing. That extension shall be subject to the acceptance by taxpayers and the other competent authorities.

2.The double taxation shall be regarded as eliminated in either of the following cases:

(a)the income subject to double taxation is included in the computation of the taxable income in one Member State only;

(b)the tax chargeable on this income in one Member State is reduced by an amount equal to the tax chargeable on it in any other Member State concerned.

3.Once the competent authorities of the Member States have reached an agreement to eliminate the double taxation within the period provided for in paragraph 1, each competent authority of the Member States concerned shall transmit this agreement to the taxpayer as a decision which is binding on the authority and enforceable by the taxpayer, subject to the taxpayer renouncing the right to any domestic remedy. That decision shall be implemented irrespective of any time limits prescribed by the national law of the Member States concerned.

4.Where the competent authorities of the Member States concerned have not reached an agreement to eliminate the double taxation within the period provided for in paragraph 1, each competent authority of the Member States concerned shall inform the taxpayers indicating the reasons for the failure to reach agreement.

Article 5

Decision rejecting the complaint

1.The competent authorities of the Member States concerned may decide to reject the complaint where the complaint is inadmissible or there is no double taxation or the three-year period set forth in Article 3(1) is not respected.

2.Where the competent authorities of the Member States concerned have not taken a decision on the complaint within six months following receipt of a complaint by a taxpayer, the complaint shall be deemed to be rejected.

3.In case of rejection of the complaint, the taxpayer shall be entitled to appeal against the decision of the competent authorities of the Member States concerned in accordance with national rules.

Article 6

Dispute resolution by Advisory Commission

1.An Advisory Commission shall be set up by the competent authorities of the Member States concerned in accordance with Article 8 if the complaint is rejected under Article 5(1) by only one of the competent authorities of Member States concerned.

2.The Advisory Commission shall adopt a decision on the admissibility and acceptance of the complaint within six months from the date of notification of the last decision rejecting the complaint under Article 5(1) by the competent authorities of the Member States concerned. By default of any decision notified in the six month period, the complaint is deemed to be rejected.

Where the Advisory Commission confirms the existence of double taxation and the admissibility of the complaint, the mutual agreement procedure provided for in Article 4 shall be initiated at the request of one of the competent authorities. The competent authority concerned shall notify the Advisory Commission, the other competent authorities concerned and the taxpayers of that request. The period of two years provided for in Article 4(1) shall start from the date of the decision taken by the Advisory Commission on the acceptance and admissibility of the complaint.

Where none of the competent authorities request initiation of the mutual agreement procedure within thirty calendar days, the Advisory Commission shall provide an opinion on the elimination of the double taxation as provided for in Article 13(1).

3.The Advisory Commission shall be set up by competent authorities of the Member States concerned where they have failed to reach an agreement to eliminate the double taxation under the mutual agreement procedure within the time limit provided for in Article 4(1).

The Advisory Commission shall be set up in accordance with Article 8 and it shall deliver an opinion on the elimination of the double taxation in accordance with Article 13(1).

4.The Advisory Commission shall be set up no later than fifty calendar days after the end of the six-month period provided for in Article 3(5), if the Advisory Commission is set up in accordance with paragraph 1.

The Advisory Commission shall be set up no later than fifty calendar days after the end of the period provided for in Article 4(1) if the Advisory Commission is set up in accordance with paragraph 2.

Article 7

Appointments by national courts

1.If the Advisory Commission is not set up within the period provided for in Article 6(4), Member States shall provide that taxpayers may refer to a competent national court.

Where the competent authority of a Member State has failed to appoint at least one independent person of standing and its substitute, the taxpayer may request the competent court in that Member State to appoint an independent person and the substitute from the list referred to in Article 8(4).

If the competent authorities of all Member States concerned have failed to do so, the taxpayer may request the competent courts of each Member State to appoint the two independent persons of standing in accordance with the second and third subparagraphs. The thus appointed independent persons of standing shall appoint the chair by drawing lots from the list of the independent persons who qualify as chair according to Article 8(4).

Taxpayers shall submit their referral to appoint the independent persons of standing and their substitutes to each of their respective states of residence or establishment, if two taxpayers are involved or to the Member States whose competent authorities have failed to appoint at least one independent person of standing and its substitute, if only one taxpayer is involved.

2.Appointment of the independent persons and their substitutes according to paragraph 1 shall be referred to a competent court of a Member State only after the end of the fifty-day period referred to in Article 6(4) and within two weeks after the end of that period.

3.The competent court shall adopt a decision according to paragraph 1 and notify it to the applicant. The applicable procedure for the competent court to appoint the independent persons when the Member States fail to appoint them shall be the same as the one applicable under national rules in matters of civil and commercial arbitration when courts appoint arbitrators in cases where parties fail to agree in this respect. The competent court shall also inform the competent authorities having initially failed to set up the Advisory Commission. This Member State shall be entitled to appeal a decision of the court, provided they have the right to do so under their national law. In case of rejection, the applicant shall be entitled to appeal against the decision of the court in accordance with the national procedural rules.

Article 8

The Advisory Commission

1.The Advisory Commission referred to in Article 6 shall have the following composition:

(a)one chair;

(b)two representatives of each competent authority concerned;

(c)one or two independent persons of standing who shall be appointed by each competent authority from the list of persons referred to in paragraph 4.

The number of representatives referred to in point (b) of the first subparagraph may be reduced to one by agreement between the competent authorities.

Persons referred to in point (c) of the first subparagraph shall be appointed by each competent authority from the list of persons referred to in paragraph 4.

2.Following the appointment of the independent persons of standing a substitute shall be appointed for each of them according to the rules for the appointment of the independent persons in case where the independent persons are prevented from carrying out their duties.

3.When lots are drawn, each of the competent authorities may object to the appointment of any particular independent person of standing in any circumstance agreed in advance between the competent authorities concerned or in one of the following situations:

(a)where that person belongs to or is working on behalf of one of the tax administrations concerned;

(b)where that person has, or has had, a large holding in or is or has been an employee of or adviser to one or each of the taxpayers;

(c)where that person does not offer a sufficient guarantee of objectivity for the settlement of the dispute or disputes to be decided.

4.The list of independent persons of standing shall consist of all the independent persons nominated by the Member States. For this purpose, each Member State shall nominate five persons.

Independent persons of standing must be nationals of a Member State and resident within the Union. They must be competent and independent.

Member States shall notify to the Commission the names of the independent persons of standing they have nominated. Member States may specify in the notification which of the five persons they have nominated can be appointed as a chair. They shall also provide the Commission with complete and up-to-date information regarding their professional and academic background, competence, expertise and conflicts of interest. Member States shall inform the Commission of any changes to the list of independent persons without delay.

5.The representatives of each competent authority and independent persons of standing appointed in accordance with paragraph 1 shall elect a chair from the list of persons referred to in paragraph 4.

Article 9

The Alternative Dispute Resolution Commission

1.The competent authorities of the Member States concerned may agree to set up an Alternative Dispute Resolution Commission instead of the Advisory Commission to deliver an opinion on the elimination of the double taxation in accordance with Article 13.

2.The Alternative Dispute Resolution Commission may differ regarding its composition and form from the Advisory Commission and apply conciliation, mediation, expertise, adjudication or any other dispute resolution processes or techniques to solve the dispute.

3.The competent authorities of the Member States concerned shall agree on the Rules of Functioning according to Article 10.

4.Articles 11 to 15 shall apply to the Alternative Dispute Resolution Commission, except for the rules on majority set out in Article 13(3). The competent authorities of the Member States concerned can agree on different rules on majority in the Rules of Functioning of the Alternative Dispute Resolution Commission.

Article 10

Rules of Functioning

1.Member States shall provide that within the period of fifty calendar days as provided for in Article 6(4), each competent authority of the Member States concerned notifies the taxpayers on the following:

(a)Rules of Functioning for the Advisory Commission or Alternative Dispute Resolution Commission;

(b)a date at which the opinion on elimination of the double taxation will be adopted;

(c)reference to any applicable legal provisions in national law of the Member States and any applicable double tax conventions.

The date referred to in point (b) of the first subparagraph shall be set no later than 6 months after the setting up of the Advisory Commission or Alternative Dispute Resolution Commission.

2.The Rules of Functioning shall be signed between the competent authorities of the Member States involved in the dispute.

The Rules of Functioning shall provide in particular:

(a)the description and the characteristics of the disputed double taxation case;

(b)the terms of reference on which the competent authorities of the Member States agree as regards the questions to be resolved;

(c)the form, either an Advisory Commission or an Alternative Dispute Resolution Commission;

(d)the timeframe for the dispute resolution procedure;

(e)the composition of the Advisory Commission or Alternative Dispute Resolution Commission.

(f)the terms and conditions of participation of the taxpayers and third parties, exchanges of memoranda, information and evidence, the costs, the type of resolution process and any other relevant procedural or organisational aspects.

If the Advisory Commission is set up to deliver an opinion on the disputed rejection or admissibility of the complaint as provided for in Article 6(1), only the information referred to points (a), (d), (e) and (f) of the second subparagraph shall be set out in the Rules of Functioning.

3.In absence or incompleteness of notification of the Rules of Functioning to the taxpayers, the Member States shall provide that the independent persons and the chair shall complete the Rules of Functioning according to Annex II and send it to the taxpayer within two weeks from the expiry date of the fifty calendar days provided in Article 6(4). When the independent persons and the chair do not agree on the Rules of Functioning or do not notify them to the taxpayers, the taxpayers can refer to the competent court of their state of residence or establishment in order to draw all legal consequences and implement the Rules of Functioning.

Article 11

Cost of the procedure

The costs of the Advisory or Alternative Dispute Resolution Commission procedure, other than those incurred by the taxpayers, shall be shared equally between the Member States.

Article 12

Information, Evidence and Hearing

1.For the purposes of the procedure referred to in Article 6, the taxpayer(s) concerned may provide the Advisory Commission or Alternative Dispute Resolution Commission with any information, evidence or documents that may be relevant for the decision. The taxpayer(s) and the competent authorities of the Member States concerned shall provide any information, evidence or documents upon request by the Advisory Commission or Alternative Dispute Resolution Commission. However, the competent authorities of any such Member State may refuse to provide information to the Advisory Commission in any of the following cases:

(a)obtaining of the information requires carrying out administrative measures that are against national law

(b)information cannot be obtained under its national law;

(c)information concerns trade, business, industrial or professional secret or trade process;

(d) the disclosure of information is contrary to public policy.

2.Each of the taxpayers may, at its request, appear or be represented before the Advisory Commission or Alternative Dispute Resolution Commission. Each of the taxpayers shall appear or be represented before it upon request by the Advisory Commission or Alternative Dispute Resolution Commission.

3.In their capacity as members of the Advisory Commission or Alternative Dispute Resolution Commission, the independent persons of standing or any other member shall be subject to the obligation of professional secrecy under the conditions laid down by the national legislation of each of the Member States concerned. The Member States shall adopt appropriate provisions to sanction any breach of secrecy obligations.

Article 13

The Opinion of the Advisory Commission or Alternative Dispute Resolution Commission

1.The Advisory Commission or Alternative Dispute Resolution Commission shall deliver its opinion no later than six months after the date it was set up to the competent authorities of the Member States concerned.

2.The Advisory Commission or Alternative Dispute Resolution Commission when drawing up its opinion shall take into account the applicable national rules and double taxation treaties. In the absence of a double taxation treaty or agreement between the Member States concerned, the Advisory Commission or Alternative Dispute Resolution Commission, when drawing up its opinion, may refer to international practice in matters of taxation such as the latest OECD Model Tax Convention.

3.The Advisory Commission or Alternative Dispute Resolution Commission shall adopt its opinion by a simple majority of its members. Where majority cannot be reached, the vote of the chair shall determine the final opinion. The chair shall communicate the opinion of the Advisory Commission or Alternative Dispute Resolution Commission to the competent authorities.

Article 14

Final Decision

1.The competent authorities shall agree within six months of the notification of the opinion of the Advisory Commission or Alternative Dispute Resolution Commission on the elimination of the double taxation.

2.The competent authorities may take a decision, which deviates from the opinion of the Advisory Commission or Alternative Dispute Resolution Commission. If they fail to reach an agreement to eliminate the double taxation, they shall be bound by that opinion.

3.Member States shall provide that the final decision eliminating double taxation is transmitted by each competent authority to the taxpayers within thirty calendar days of its adoption. When he is not notified with the decision within the thirty calendar day period, the taxpayers may appeal in its Member State of residence or establishment in accordance with national rules.

4.The final decision shall be binding on the authority and enforceable by the taxpayer, subject to the taxpayer renouncing the right to any domestic remedy. It shall be implemented under national law of the Member States which as a result of the final decision will have to amend their initial taxation, irrespective of any time limits prescribed by the national law . Where the final decision has not been implemented, the taxpayers may refer to the national court of the Member State, which has failed to implement.

Article 15

Interaction with national proceedings and derogations

1.The fact that a decision causing double taxation taken by a Member State becomes final according to national law shall not prevent the taxpayers from having recourse to the procedures provided for in this Directive.

2.The submission of the dispute to the mutual agreement procedure or to the dispute resolution procedure shall not prevent a Member State from initiating or continuing judicial proceedings or proceedings for administrative and criminal penalties in relation to the same matters.

3.Taxpayers may have recourse to the remedies available to them under the national law of the Member States concerned. However, where the case has been submitted to a court or tribunal, the following dates shall be added to the date on which the judgment of the final court was given:

(a)six months referred to in Article 3(5);

(b)two years referred to in Article 4(1).

4.Where the national law of a Member State does not allow that a dispute resolution decision derogates from the decisions of their judicial bodies, the procedure under Articles 6(1) and 6(2) shall not be available to the taxpayer if judicial proceedings concerning the double taxation have been initiated. Nevertheless, if the taxpayer has initiated such judicial proceedings, the procedure would still be available if there has been no final decision and the taxpayer withdraws its action concerning the double taxation.

5.The submission of the case to the dispute resolution procedure according to Article 6 shall put an end to any other ongoing mutual agreement procedure or dispute resolution procedure on the same dispute in case the same Member States are concerned, with effect on the date of appointment of the Advisory Commission or Alternative Dispute Resolution Commission.

6.By way of derogation from Article 6, Member States concerned may deny access to the dispute resolution procedure in cases of tax fraud, wilful default and gross negligence.

Article 16

Publicity

1.The Advisory Commission and Alternative Dispute Resolution Commission shall issue its opinion in writing.

2.The competent authorities shall publish the final decision referred to in Article 14, subject to consent of each of the taxpayers concerned.

3.Where a taxpayer concerned does not consent to publishing the final decision in its entirety, the competent authorities shall publish an abstract of the final decision with description of the issue and subject matter, date, tax periods involved, legal basis, industry sector, short description of the final outcome.

The competent authorities shall send the information to be published in accordance with the first subparagraph to the taxpayers before its publication. Upon request by a taxpayer the competent authorities shall not publish information that concerns any trade, business, industrial or professional secret or trade process, or that is contrary to public policy.

4.The Commission shall establish standard forms for the communication of the information referred to in paragraphs 2 and 3 by means of implementing acts. Those implementing acts shall be adopted in accordance with the procedure referred to in Article 18(2).

5.The competent authorities shall notify the information to be published in accordance with paragraph 3 to the Commission without delay.

Article 17

Role of the Commission and Administrative support

1.The Commission shall make available online and keep up to date the list of the independent persons of standing referred to in Article 8(4), indicating which of those persons can be appointed as chair. That list shall contain only the names of those persons.

2.Member States shall inform the Commission of the measures taken in order to sanction any breach of secrecy obligation provided for in Article 12. The Commission shall inform the other Member States thereof.

3.The Commission shall maintain a central repository in which the information that is published in accordance with Articles 16(2) and (3) is archived and made available online.

Article 18

Committee procedure

1.The Commission shall be assisted by the Committee on double taxation dispute resolution. That Committee shall be a committee within the meaning of Regulation (EU) No 182/2011.

2.Where reference is made to this paragraph, Article 5 of Regulation (EU) 182/2011 shall apply.

Article 19

List of taxes and Rules of Functioning

The Commission shall be empowered to adopt delegated acts in accordance with Article 20 in relation to updating the list of taxes in accordance with Annex I and the Rules of Functioning in accordance with Annex II to amend them to take account of new circumstances.

Article 20

Exercise of delegated powers

1.The power to adopt delegated acts is conferred on the Commission subject to the conditions laid down in this Article.

2.The power to adopt delegated acts referred to in Article 19 shall be conferred on the Commission for an indeterminate period of time from the date referred to in Article 22.

3.The delegation of power referred to in Article 19 may be revoked at any time by the European Parliament or by the Council. A decision to revoke shall put an end to the delegation of the power specified in that decision. It shall take effect the day following the publication of that decision in the Official Journal of the European Union or at a later date specified therein. It shall not affect the validity of any delegated acts already in force.

4.As soon as it adopts a delegated act, the Commission shall notify it simultaneously to the European Parliament and to the Council.

5.A delegated act adopted pursuant to Article 19 shall enter into force only if no objection has been expressed either by the European Parliament or the Council within a period of two months of notification of that act to the European Parliament and the Council or if, before the expiry of that period, the European Parliament and the Council have both informed the Commission that they will not object. That period shall be extended by two months at the initiative of the European Parliament or the Council.

Article 21

Transposition

1.Member States shall bring into force the laws, regulations and administrative provisions necessary to comply with this Directive by 31 December 2017 at the latest. They shall forthwith communicate to the Commission the text of those provisions.

When Member States adopt those provisions, they shall contain a reference to this Directive or be accompanied by such a reference on the occasion of their official publication. Member States shall determine how such reference is to be made.

2.Member States shall communicate to the Commission the text of the main provisions of national law which they adopt in the field covered by this Directive.

Article 22

Entry into force

This Directive shall enter into force on the twentieth day following that of its publication in the Official Journal of the European Union.

Article 23

Addressees

This Directive is addressed to the Member States.

Done at Strasbourg,

For the Council

The President

LEGISLATIVE FINANCIAL STATEMENT

1.FRAMEWORK OF THE PROPOSAL/INITIATIVE

1.1.Title of the proposal/initiative

1.2.Policy area(s) concerned in the ABM/ABB structure

1.3.Nature of the proposal/initiative

1.4.Objective(s)

1.5.Grounds for the proposal/initiative

1.6.Duration and financial impact

1.7.Management mode(s) planned

2.MANAGEMENT MEASURES

2.1.Monitoring and reporting rules

2.2.Management and control system

2.3.Measures to prevent fraud and irregularities

3.ESTIMATED FINANCIAL IMPACT OF THE PROPOSAL/INITIATIVE

3.1.Heading(s) of the multiannual financial framework and expenditure budget line(s) affected

3.2.Estimated impact on expenditure

3.2.1.Summary of estimated impact on expenditure

3.2.2.Estimated impact on operational appropriations

3.2.3.Estimated impact on appropriations of an administrative nature

3.2.4.Compatibility with the current multiannual financial framework

3.2.5.Third-party contributions

3.3.Estimated impact on revenue

LEGISLATIVE FINANCIAL STATEMENT

1.FRAMEWORK OF THE PROPOSAL/INITIATIVE

1.1.Title of the proposal/initiative

Proposal for a Council Directive on improving Double Taxation Dispute Resolution Mechanisms (DTRMs) in the European Union

1.2.Policy area(s) concerned in the ABM/ABB structure 9

14

14.03

1.3.Nature of the proposal/initiative

☒ The proposal/initiative relates to a new action

◻ The proposal/initiative relates to a new action following a pilot project/preparatory action 10

◻ The proposal/initiative relates to the extension of an existing action

◻ The proposal/initiative relates to an action redirected towards a new action

1.4.Objective(s)

1.4.1.The Commission's multiannual strategic objective(s) targeted by the proposal/initiative

The Commission work programme for 2015 lists among its priorities that of A Fairer Approach to Taxation. Following up on this, one related area for action in the Commission work programme for 2016 is to improve Double Taxation Dispute Resolution Mechanism.

1.4.2.Specific objective(s) and ABM/ABB activity(ies) concerned

Specific objective No

To improve the effectiveness and efficiency of the DTDRM system in the Internal Market, with the view to ensuring effective resolution of double taxation disputes (see Impact Assessment prepared by the Commission Sevices as regards the proposal).

ABM/ABB activity(ies) concerned

ABB 3

1.4.3.Expected result(s) and impact

Specify the effects which the proposal/initiative should have on the beneficiaries/groups targeted.

An effective Double Taxation Dispute Resolution Mechanism will overall improve the EU business environment; boost investment, growth and jobs. Indeed, it will ensure more certainty and predictability for the business and companies and will therefore provide a more stable and certain basis for trade and taking investment decisions.

The tax revenues of the Member States will increase in the long term as a result of an increase in economic activity and tax collection. The actual elimination of double taxation through an effective dispute resolution will also increase Member States' level of compliance with their international obligations and reduce their administrative costs.

The trust of the public, citizens and taxpayers in general to the fairness and reliability of the tax systems will be strengthened.

1.4.4.Indicators of results and impact

Specify the indicators for monitoring implementation of the proposal/initiative.

The indicators for monitoring the implementation are detailed in the Impact Assessment (section 7).

1.5.Grounds for the proposal/initiative

1.5.1.Requirement(s) to be met in the short or long term

To protect the companies in cross border transactions against negative consequences of unresolved double and multiple taxation.

1.5.2.Added value of EU involvement

To ensure consistency and avoid mismatches through common rules and procedures in all Member States. Inconsistencies and gaps in the implementation by Member States would endanger the success of the whole project.

The EU added value is grounded in the fact that uniform and coordinated implementation is necessary for effectively improving dispute resolution. It is also necessary to address them consistently in the current context of a global fight against tax avoidance and evasion. The EU Transfer Pricing framework will be improved in terms of efficiency and enforceability when combined with the solution proposed.

1.5.3.Lessons learned from similar experiences in the past

Already in 1976, the Council had been submitted a proposal for on the elimination of double taxation in connection with the adjustment of transfer of profit between associated enterprises (arbitration procedure). This has led to the signature in 1990 of the Convention on the elimination of double taxation in connection with the adjustment of profits of associated enterprises (90/436/EEC).

1.5.4.Compatibility and possible synergy with other appropriate instruments

The proposal is part of a package that comprises several initiatives. Positive synergy effects may be derived from the interaction between measures within the package and with proposals which feature in the Transparency Package of March 2015 and the Action Plan of June 2015.

1.6.Duration and financial impact

◻ Proposal/initiative of limited duration

–◻ Proposal/initiative in effect from [DD/MM]YYYY to [DD/MM]YYYY

–◻ Financial impact from YYYY to YYYY

☒ Proposal/initiative of unlimited duration

–Implementation with a start-up period from YYYY to YYYY,

–followed by full-scale operation.

1.7.Management mode(s) planned 11

☒ Direct management by the Commission

–☒ by its departments, including by its staff in the Union delegations;

–◻ by the executive agencies

◻ Shared management with the Member States

◻ Indirect management by entrusting budget implementation tasks to:

–◻ third countries or the bodies they have designated;

–◻ international organisations and their agencies (to be specified);

–◻the EIB and the European Investment Fund;

–◻ bodies referred to in Articles 208 and 209 of the Financial Regulation;

–◻ public law bodies;

–◻ bodies governed by private law with a public service mission to the extent that they provide adequate financial guarantees;

–◻ bodies governed by the private law of a Member State that are entrusted with the implementation of a public-private partnership and that provide adequate financial guarantees;

–◻ persons entrusted with the implementation of specific actions in the CFSP pursuant to Title V of the TEU, and identified in the relevant basic act.

–If more than one management mode is indicated, please provide details in the ‘Comments’ section.

Comments

The proposal is of legislative nature. Some management mode and budget implementation tasks for the Commission relate to the following administration tasks:

- Administration, set up and maintenance of the list of independent persons appointed by the Member States

- Administration tasks related to the transparency aspects of the proposal and the facilitating of exchange of information between Member States

- Monitoring activities

2.MANAGEMENT MEASURES

2.1.Monitoring and reporting rules

Specify frequency and conditions.

None

2.2.Management and control system

2.2.1.Risk(s) identified

None

2.2.2.Information concerning the internal control system set up

None

2.2.3.Estimate of the costs and benefits of the controls and assessment of the expected level of risk of error

N/A

2.3.Measures to prevent fraud and irregularities

Specify existing or envisaged prevention and protection measures.

N/A

3.ESTIMATED FINANCIAL IMPACT OF THE PROPOSAL/INITIATIVE

3.1.Heading(s) of the multiannual financial framework and expenditure budget line(s) affected

Existing budget lines

In order of multiannual financial framework headings and budget lines.

|

Heading of multiannual financial framework |

Budget line |

Type of

|

Contribution |

|||

|

Number

|

Diff./Non-diff. 12 |

from EFTA countries 13 |

from candidate countries 14 |

from third countries |

within the meaning of Article 21(2)(b) of the Financial Regulation |

|

|

14.0301 |

Diff. |

NO |

NO |

NO |

NO |

|

New budget lines requested None

In order of multiannual financial framework headings and budget lines.

|

Heading of multiannual financial framework |

Budget line |

Type of

|

Contribution |

|||

|

Number

|

Diff./Non-diff. |

from EFTA countries |

from candidate countries |

from third countries |

within the meaning of Article 21(2)(b) of the Financial Regulation |

|

|

None |

YES/NO |

YES/NO |

YES/NO |

YES/NO |

||

3.2.Estimated impact on expenditure

[This section should be filled in using the spreadsheet on budget data of an administrative nature (second document in annex to this financial statement) and uploaded to CISNET for interservice consultation purposes.]

3.2.1.Summary of estimated impact on expenditure

EUR million (to three decimal places)

|

Heading of multiannual financial

|

Number |

1A Heading Competitiveness for Growth and jobs |

|

DG: <TAXUD> |

Year

|

Year

|

Year

|

Year

|

Enter as many years as necessary to show the duration of the impact (see point 1.6) |

TOTAL |

|||||

|

• Operational appropriations |

|||||||||||

|

Number of budget line |

Commitments |

(1) |

N/A |

||||||||

|

Payments |

(2) |

N/A |

|||||||||

|

Number of budget line |

Commitments |

(1a) |

|||||||||

|

Payments |

(2a) |

||||||||||

|

Appropriations of an administrative nature financed from the envelope of specific programmes 16 |

N/A |

||||||||||

|

Number of budget line |

(3) |

||||||||||

|

TOTAL appropriations

|

Commitments |

=1+1a +3 |

N/A |

||||||||

|

Payments |

=2+2a +3 |

N/A |

|||||||||

|

|

Commitments |

(4) |

N/A |

|||||||

|

Payments |

(5) |

N/A |

||||||||

|

• TOTAL appropriations of an administrative nature financed from the envelope for specific programmes |

(6) |

N/A |

||||||||

|

TOTAL appropriations

|

Commitments |

=4+ 6 |

N/A |

|||||||

|

Payments |

=5+ 6 |

N/A |

||||||||

If more than one heading is affected by the proposal / initiative:

|

• TOTAL operational appropriations |

Commitments |

(4) |

N/A |

|||||||

|

Payments |

(5) |

N/A |

||||||||

|

• TOTAL appropriations of an administrative nature financed from the envelope for specific programmes |

(6) |

N/A |

||||||||

|

TOTAL appropriations

|

Commitments |

=4+ 6 |

N/A |

|||||||

|

Payments |

=5+ 6 |

N/A |

||||||||

|

|

5 |

‘Administrative expenditure’ |

EUR million (to three decimal places)

|

Year

|

Year

|

Year

|

Year

|

Enter as many years as necessary to show the duration of the impact (see point 1.6) |

TOTAL |

|||||

|

DG: <TAXUD> |

||||||||||

|

• Human resources |

0.067 |

0.067 |

0.067 |

0.067 |

0.067 |

0.067 |

0.067 |

|||

|

• Other administrative expenditure |

0.030 |

0.030 |

0.030 |

0.030 |

0.030 |

0.030 |

0.030 |

|||

|

TOTAL DG <…….> |

Appropriations |

0.097 |

0.097 |

0.097 |

0.097 |

0.097 |

0.097 |

0.097 |

||

|

TOTAL appropriations

|

(Total commitments = Total payments) |

0.097 |

0.097 |

0.097 |

0.097 |

0.097 |

0.097 |

0.097 |

EUR million (to three decimal places)

|

Year

|

Year

|

Year

|

Year

|

Enter as many years as necessary to show the duration of the impact (see point 1.6) |

TOTAL |

|||||

|

TOTAL appropriations

|

Commitments |

0.097 |

0.097 |

0.097 |

0.097 |

0.097 |

0.097 |

0.097 |

||

|

Payments |

0.097 |

0.097 |

0.097 |

0.097 |

0.097 |

0.097 |

0.097 |

|||

3.2.2.Estimated impact on operational appropriations

–☒ The proposal/initiative does not require the use of operational appropriations

–◻ The proposal/initiative requires the use of operational appropriations, as explained below:

Commitment appropriations in EUR million (to three decimal places)

|

Indicate objectives and outputs ⇩ |

Year

|

Year

|

Year

|

Year

|

Enter as many years as necessary to show the duration of the impact (see point 1.6) |

TOTAL |

|||||||||||||

|

OUTPUTS |

|||||||||||||||||||

|

Type 18 |

Average cost |

No |

Cost |

No |

Cost |

No |

Cost |

No |

Cost |

No |

Cost |

No |

Cost |

No |

Cost |

Total No |

Total cost |

||

|

SPECIFIC OBJECTIVE No 1 19 … |

|||||||||||||||||||

|

- Output |

|||||||||||||||||||

|

- Output |

|||||||||||||||||||

|

- Output |

|||||||||||||||||||

|

Subtotal for specific objective No 1 |

|||||||||||||||||||

|

SPECIFIC OBJECTIVE No 2 ... |

|||||||||||||||||||

|

- Output |

|||||||||||||||||||

|

Subtotal for specific objective No 2 |

|||||||||||||||||||

|

TOTAL COST |

|||||||||||||||||||

3.2.3.Estimated impact on appropriations of an administrative nature

3.2.3.1.Summary

–◻ The proposal/initiative does not require the use of appropriations of an administrative nature

–☒ The proposal/initiative requires the use of appropriations of an administrative nature, as explained below:

EUR million (to three decimal places)

|

Year

|

Year

|

Year

|

Year

|

Enter as many years as necessary to show the duration of the impact (see point 1.6) |

TOTAL |

|

HEADING 5

|

||||||||

|

Human resources |

0.067 |

0.067 |

0.067 |

0.067 |

0.067 |

0.067 |

0.067 |

|

|

Other administrative expenditure |

0.030 |

0.030 |

0.030 |

0.030 |

0.030 |

0.030 |

0.030 |

|

|

Subtotal HEADING 5

|

0.097 |

0.097 |

0.097 |

0.097 |

0.097 |

0.097 |

0.097 |

|

Outside HEADING 5

21

|

||||||||

|

Human resources |

||||||||

|

Other expenditure

|

||||||||

|

Subtotal

|

|

TOTAL |

0.097 |

0.097 |

0.097 |

0.097 |

0.097 |

0.097 |

0.097 |

The appropriations required for human resources and other expenditure of an administrative nature will be met by appropriations from the DG that are already assigned to management of the action and/or have been redeployed within the DG, together if necessary with any additional allocation which may be granted to the managing DG under the annual allocation procedure and in the light of budgetary constraints.

3.2.3.2.Estimated requirements of human resources

–◻ The proposal/initiative does not require the use of human resources.

–☒ The proposal/initiative requires the use of human resources, as explained below:

Estimate to be expressed in full time equivalent units

|

Year

|

Year

|

Year N+2 |

Year N+3 |

Enter as many years as necessary to show the duration of the impact (see point 1.6) |

||||

|

• Establishment plan posts (officials and temporary staff) |

||||||||

|

XX 01 01 01 (Headquarters and Commission’s Representation Offices) |

0.5 |

0.5 |

0.5 |

0.5 |

0.5 |

0.5 |

0.5 |

|

|

XX 01 01 02 (Delegations) |

||||||||

|

XX 01 05 01 (Indirect research) |

||||||||

|

10 01 05 01 (Direct research) |

||||||||

|

• External staff (in Full Time Equivalent unit: FTE) 22 |

||||||||

|

XX 01 02 01 (AC, END, INT from the ‘global envelope’) |

||||||||

|

XX 01 02 02 (AC, AL, END, INT and JED in the delegations) |

||||||||

|

XX 01 04 yy 23 |

- at Headquarters |

|||||||

|

- in Delegations |

||||||||

|

XX 01 05 02 (AC, END, INT - Indirect research) |

||||||||

|

10 01 05 02 (AC, END, INT - Direct research) |

||||||||

|

Other budget lines (specify) |

||||||||

|

TOTAL |

||||||||