EUROPEAN COMMISSION

EUROPEAN COMMISSION

Brussels, 14.9.2018

SWD(2018) 405 final

COMMISSION STAFF WORKING DOCUMENT

Accompanying the document

REPORT FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT AND THE COUNCIL

11th FINANCIAL REPORT FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT AND THE COUNCIL on the

EUROPEAN AGRICULTURAL GUARANTEE FUND

2017 FINANCIAL YEAR

{COM(2018) 628 final}

TABLE OF CONTENTS

1.BUDGET PROCEDURE

1.1.Financial Framework 2014-2020

1.2.Draft Budget 2017 and Amending Letter 1/2017

1.3.Adoption of the 2017 budget

1.4.Revenue assigned to the EAGF

2.CASH POSITION AND MANAGEMENT OF APPROPRIATIONS

2.1.Management of appropriations

2.1.1.Appropriations available for the 2017 financial year

2.1.2.Expenditure section of the EU budget in relation to EAGF

2.1.3.Assigned revenue section of the EU budget in relation to EAGF

2.1.4.Execution of appropriations available for the 2017 financial year

2.1.5.Assigned revenue received under shared management

2.1.6.Budget execution

2.1.7.Budget execution of voted appropriations - Expenditure under direct management made by the Commission

2.1.8.Budget execution - Expenditure under direct management made by the Commission - Automatic carryover from 2016

2.2.Monthly payments

2.2.1.Monthly payments to Member States under shared management

2.2.1.1.Monthly payments on the provision for expenditure

2.2.1.2.Decisions on monthly payments for 2017

2.2.1.3.Reductions and suspensions of monthly payments

2.2.2.Direct management expenditure by the Commission

3.THE IMPLEMENTATION OF THE 2017 EAGF BUDGET

3.1.The uptake of the EAGF budget appropriations

3.2.Comments on the implementation of 2017 EAGF budget

3.2.1.Chapter 05 02: Interventions in agricultural markets

3.2.1.1.Introduction

3.2.1.2.Article 05 02 08: Fruits and vegetables

3.2.1.3.Article 05 02 09: Products of the wine-growing sector

3.2.1.4.Article 05 02 10: Promotion

3.2.1.5.Article 05 02 12: Milk and milk products

3.2.1.6.Article 05 02 13: Beef and veal

3.2.1.7.Article 05 02 14: Sheepmeat and goatmeat

3.2.1.8.Article 05 02 15: Pigmeat, eggs and poultry, bee-keeping and other animal products

3.2.1.9.Article 05 02 15: School schemes

3.2.2.Chapter 05 03: Direct payments

3.2.2.1.Article 05 03 01: Decoupled direct payments

3.2.2.2.Article 05 03 02: Other direct payments

3.2.2.3.Article 05 03 03: Additional amounts of aid

3.2.2.4.Article 05 03 09: Reimbursement of direct payments in relation to financial discipline

3.2.2.5.Article 05 03 10: Reserve for crises in the agricultural sector

3.2.3.Chapter 05 04: Rural Development

3.2.4.Chapter 05 07: Audit of agricultural expenditure

3.2.4.1.Article 05 07 01: Control of agricultural expenditure

3.2.4.2.Article 05 07 02: Settlement of disputes

3.2.5.Chapter 05 08: Policy strategy and coordination

3.2.5.1.Article 05 08 01: Farm accountancy data network (FADN)

3.2.5.2.Article 05 08 02: Surveys on the structure of agricultural holdings

3.2.5.3.Article 05 08 03: Restructuring of systems for agricultural surveys

3.2.5.4.Article 05 08 06: Enhancing public awareness of the common agricultural policy

3.2.5.5.Article 05 08 09: EAGF – Operational technical assistance

4.IMPLEMENTATION OF REVENUE ASSIGNED TO EAGF

5.CONTROL MEASURES

5.1.Introduction

5.2.Integrated Administration and Control System (IACS)

5.3.Market measures

5.4.Application of Chapter III of Title V Regulation (EU) No 1306/2013 (ex-post scrutiny)

6.CLEARANCE OF ACCOUNTS

6.1.Conformity clearance

6.1.1.Introduction

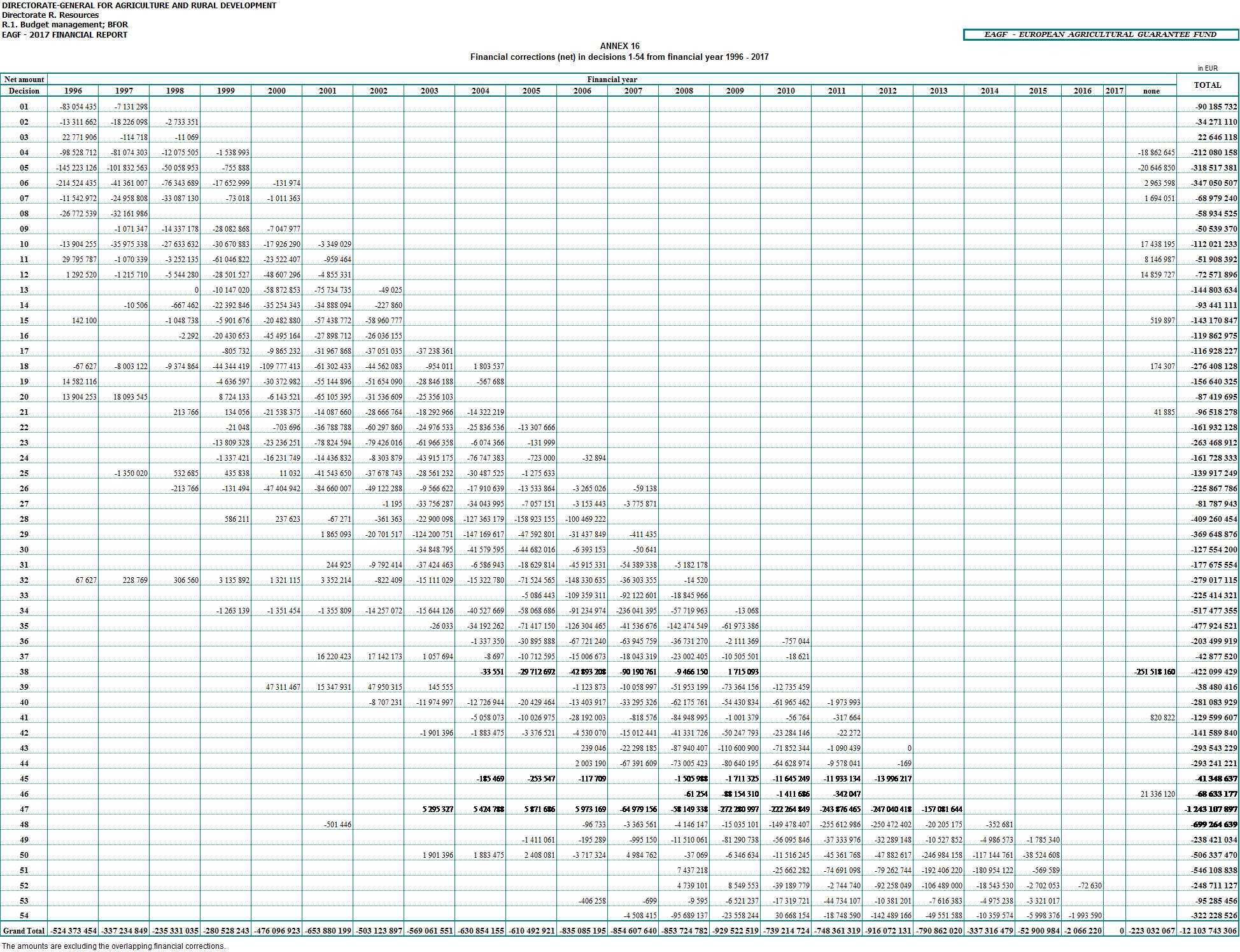

6.1.2.Audits and decisions adopted in 2017

6.1.2.1.Audits

6.1.2.2.Conformity decisions

6.2.Financial clearance

6.2.1.Introduction

6.2.2.Decisions

6.2.2.1.Financial clearance decision for the financial year 2013

6.2.2.2.Financial clearance decision for the financial year 2014

6.2.2.3.Financial clearance decision for the financial year 2015

6.2.2.4.Financial clearance decision for the financial year 2016

6.3.Appeals brought before the Court of Justice against clearance decisions

6.3.1.Judgments handed down

6.3.2.New appeals

6.3.3.Appeals pending

7.RELATIONS WITH PARLIAMENT AND WITH THE EUROPEAN COURT OF AUDITORS

7.1.Relations with Parliament

7.2.Relations with the European Court of Auditors

7.2.1.Mission of the European Court of Auditors

7.2.2.Annual Report for financial year 2016

7.2.3.Special Reports by the Court of Auditors

8.ANNEXES

1.BUDGET PROCEDURE

1.1.Financial Framework 2014-2020

CAP expenditure is funded within the financial framework for 2014-2020 as provided for in Council Regulation (EU) No 1311/2013

. Specifically, CAP expenditure is part of the ceiling fixed for Heading 2 - Sustainable growth: natural resources. Within that overall ceiling, a specific sub-ceiling has been fixed for market related expenditure and direct payments financed by the European Agricultural Guarantee Fund (EAGF).

The ceiling for market related expenditure and direct payments had to be adjusted following the transfer of certain amounts of direct payments to rural development (financed by the European Agricultural Fund for Rural Development - EAFRD) for the years 2015-2020 (flexibility between CAP pillars and reduction of direct payments), the transfer of the aids for cotton in Greece, the unspent amounts by Germany and Sweden and the voluntary adjustment of the United Kingdom as well as the transfer from rural development (EAFRD) for the years 2015-2020 to direct payments (flexibility). Therefore, on the basis of Commission Implementing Regulation (EU) No 367/2014

setting the net balance available for expenditure of the EAGF, the CAP amounts included in heading 2 of the financial framework (2014-2020) are:

(in EUR million current prices)

|

Heading 2*

|

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

2020

|

|

Total

of which:

- Market related expenditure and direct payments, a), b), c), d), f)

|

49 857

43 778.1

|

64 692

44 189.8

|

64 262

43 950.2

|

60 191

44 145.7

|

60 267

44 162.4

|

60 344

43 880.3

|

60 421

43 887.5

|

|

- Rural development a), b), c), d), e), f)

|

5 298.9

|

18 183.7

|

18 683.7

|

14 371.2

|

14 381.0

|

14 690.6

|

14 709.0

|

|

*) Sustainable growth: natural resources; There are small rounding differences between the net balance available for EAGF expenditure and the EAGF sub-ceiling under the MFF 2014-2020.

a) After transfer of EUR 622 million between EAGF and EAFRD for the financial year 2015 on the basis of Articles 136a(1) of Regulation (EC) No 73/2009 and article 14(1) of Regulation (EU) No 1307/2013;

|

|

b) After transfer of EUR 51.6 million between EAGF and EAFRD for the financial year 2015 for unspent amounts transferred each year for financial years 2014 and 2015 (SE and DE) on the basis of Articles 136 and 136b of Regulation (EC) No 73/2009;

|

|

c) After transfer of EUR 4 million between EAGF and EAFRD for the financial years 2014-2020 from the cotton sector (EL) on the basis of Article 66(1) of Regulation (EU) No 1307/2013;

d) After transfer of EUR 499.4 million between EAFRD and EAGF for the financial year 2015 on the basis of Articles 136a(2) of Regulation (EC) No 73/2009 and article 14(2) of Regulation (EU) No 1307/2013;

e) The EAFRD amounts reflect the re-programming carried out in 2015, transferring unused allocations for the year 2014 to 2015 and 2016 in accordance with article 19 of Regulation (EU) No 1311/2013;

f) After transfer of additional EUR 735.9 million from EAGF to EAFRD for the financial years 2019 and 2020 on the basis of Article 14(2) of Regulation (EU) No 1307/2013.

|

1.2.Draft Budget 2017 and Amending Letter 1/2017

The Draft Budget 2017 was adopted by the Commission and proposed to the Budgetary Authority on 18 July 2016. The commitment appropriations proposed for the EAGF totalled EUR 42 937.6 million.

The Council adopted its position on the Draft Budget 2017 on 12 September 2016, reducing the commitment appropriations for the EAGF by EUR 177.1 million. The European Parliament adopted its position on 26 October 2016, increasing the commitment appropriations for the EAGF by EUR 600.0 million compared to the Draft Budget.

On 17 October 2016 the Commission adopted Amending Letter (AL) No 1 to the Draft Budget 2017 increasing the needs in commitments by EUR 527.0 million compared to the Draft Budget. However, these additional needs were fully compensated by increased assigned revenue, expected to be available in 2017. As a result, the requested commitment appropriations for the EAGF in the AL remained unchanged compared to the Draft Budget.

1.3.Adoption of the 2017 budget

The Conciliation Committee, composed of members of the European Parliament and of the Council, agreed on a Joint Text on 28 November 2016. Finally, the 2017 budget was declared as adopted by the European Parliament on 1 December 2016. The budget's total commitment appropriations for the EAGF amounted to EUR 42 612.6 million and its payment appropriations amounted to EUR 42 563.0 million.

The difference between commitment and payment appropriations is due to the fact, that for certain measures, which are directly implemented by the Commission, differentiated appropriations are used. These measures relate mainly to the promotion of agricultural products, to policy strategy and coordination measures for agriculture.

Specifically, of the voted EAGF commitment appropriations for policy area 05 amounting to EUR 42 612.6 million: EUR 2 806.8 million were foreseen for interventions in agricultural markets under chapter 05 02, EUR 39 661.7 million were foreseen for direct payments under chapter 05 03, EUR 85.3 million were foreseen for audit of agricultural expenditure under chapter 05 07 and EUR 48.6 million for policy strategy and coordination under chapter 05 08.

Further details are provided in annex 1.

Subsequently, in the course of the financial year 2017, the EAGF's appropriations for articles 05 01 04 (support expenditure) and 05 08 09 (operational technical assistance) were reduced by respectively EUR 0.9 million and EUR 1.0 million through Amending Budget No 6.

1.4.Revenue assigned to the EAGF

In accordance with Article 43 of Regulation (EC) No 1306/2013 on the financing of the Common Agricultural Policy

, revenue originating from financial corrections under accounting or conformity clearance decisions, from irregularities and from the milk levy are designated as revenue assigned to the financing of EAGF expenditure. According to these rules, assigned revenue can be used to cover the financing of any EAGF expenditure. If a part of this revenue is not used, then this part will be automatically carried forward to the following budget year.

At the time of establishing the 2017 budget, an estimate of the revenue was made both for the amount expected to be collected in the course of the 2017 budget year as well as of the amount which was expected to be carried over from the budget year 2016 into 2017. This estimate amounted to EUR 2 732 million and it was taken into consideration when the Budgetary Authority adopted the 2017 budget. In particular:

–revenue from the conformity clearance corrections and from irregularities was estimated at EUR 1 278 million and EUR 152 million respectively while there were no longer receipts from the milk levy estimated. Thus, the total amount of assigned revenue expected to be collected in the course of the 2017 budget year was estimated at EUR 1 430 million;

–The amount of assigned revenue expected to be carried over from the budget year 2016 into 2017 was estimated at EUR 1 302 million.

In the 2017 budget, this initially estimated revenue of EUR 2 732 million was assigned to two schemes, i.e.:

–EUR 400 million for the operational funds for producer organisations in the fruits and vegetables sector;

–EUR 2 332 million for the basic payment scheme (direct payments).

For the aforementioned schemes, the sum of the voted appropriations by the Budgetary Authority and the assigned revenue corresponds to a total estimate of available appropriations of:

–EUR 855 million for the operational funds for producer organisations in the fruits and vegetables sector;

–EUR 17 628 million for the basic payment scheme (direct payments).

2.CASH POSITION AND MANAGEMENT OF APPROPRIATIONS

2.1.Management of appropriations

2.1.1.Appropriations available for the 2017 financial year

|

In EUR

|

|

Expenditure section of

budget (1)

|

Commitment appropriations

|

Payment appropriations

|

Revenue section of budget (AR) (2)

|

Forecasts

|

|

1. Initial appropriations for EAGF of which

|

42 612 572 079.00

|

42 562 967 974.00

|

1. Clearance decisions

|

1 278 000 000.00

|

|

1a. Appropriations under shared management

|

42 490 000 000.00

|

42 490 000 000.00

|

2. Irregularities

|

152 000 000.00

|

|

1b. Appropriations under direct management

|

122 572 079.00

|

72 967 974.00

|

3. Super levy from milk producers

|

-

|

|

2. Amending Budget

|

-1 900 000.00

|

-1 900 000.00

|

Total forecast of AR

|

1 430 000 000.00

|

|

3. Transfer to / out of EAGF in the year

|

|

-2 640 390.66

|

|

|

|

4. Final appropriations for EAGF of which

|

42 610 672 079.00

|

42 558 427 583.34

|

|

|

|

4a. Appropriations under shared management

|

42 489 315 000.00

|

42 489 315 000.00

|

|

|

|

4b. Appropriations under direct management

|

121 357 079.00

|

69 112 583.34

|

|

|

|

(1)

Appropriations entered in the 2017 budget after deducting the expected assigned revenue to be collected in 2017 and the one carried over from 2016 to 2017 in accordance with Article 14 of Regulation (EU, EURATOM) No 966/2012. Concerns only fresh appropriations (C1 plus C4), i.e. without any carry-over amounts (C2 credits for reimbursing the unused agricultural crisis reserve 2016 and C5 assigned revenue from EAGF surplus).

(2)

AR: Assigned revenue to be collected. There are no amounts of revenue entered on the revenue line (p.m.), but the forecast amount is indicated in the budget remarks.

|

2.1.2.Expenditure section of the EU budget in relation to EAGF

The initial commitment appropriations for 2017 totalled EUR 42 612 572 079. This was a net amount after deducting the expected assigned revenue to be collected in 2017 and the one carried over from 2016 to 2017. The initial payment appropriations amounted to EUR 42 562 967 974.

In financial year 2017, there was an Amending Budget for commitment and payment appropriations, transfers of payment appropriations to EAGF and transfers of payment appropriations out of EAGF. The commitment and payment appropriations finally available to the EAGF, after the Amending Budget and the transfers, amounted to EUR 42 610 672 079.00 and EUR 42 558 427 583.34 respectively.

Part of the appropriations coming from assigned revenue received in 2016 was not used in that financial year and it was automatically carried over to 2017. The amount of these appropriations totalled EUR 1 304 013 128.90. Also appropriations for an amount of EUR 433 080 989 were made available for the reimbursement of direct payments in relation to financial discipline following Commission Decision C(2017)771 relating to the non-automatic carryover of appropriations from the 2016 budget to the 2017 budget.

2.1.3.Assigned revenue section of the EU budget in relation to EAGF

For more details, please see point 1.4.

2.1.4.Execution of appropriations available for the 2017 financial year

|

|

|

In EUR

|

|

|

Execution of commitment appropriations

|

Execution of payment appropriations

|

|

Shared management (1)

|

44 639 387 611.79

|

|

44 639 387 611.79

|

|

|

Expenditure under direct management

|

119 428 161.33

|

|

58 396 372.68

|

|

|

Total

|

44 758 815 773.12

|

|

44 697 783 984.47

|

|

(1) Committed amounts. Commitments and payments less assigned revenue of EUR 1 482 465 754.02 (see point 4 and annex 6) received for shared management: EUR 43 156 921 857.77.

For the financial year 2017, the actual amount of commitment appropriations used amounted to EUR 44 758 815 773.12 while that for payment appropriations amounted to EUR 44 697 783 984.47.

The amount paid out (EUR 43 153 914 666.63) under shared management was less than EUR 43 156 921 857.77 due to suspended amounts for Poland (see 2.2.1.3.b).

2.1.5.Assigned revenue received under shared management

|

In EUR

|

|

Assigned revenue

|

|

Forecasted revenue

|

1 430 000 000.00

|

|

Revenue received

|

1 482 465 754.02

|

|

Difference

|

52 465 754.02

|

For details, please see points 1.4 and 4.

2.1.6.Budget execution

|

|

In EUR

|

Expenditure under shared management (1)

|

|

|

Final appropriations (C1)

|

Non automatic carry over of 2016 C1 appropriations (C2)

|

Assigned revenue appropriations (C4)

|

Carry over of assigned revenue appropriations (C5) from 2016

|

|

Appropriations

|

42 489 315 000.00

|

433 080 989.00

|

1 482 465 754.02

|

1 304 013 128.90

|

|

Execution (2)

|

42 030 621 233.69

|

425 579 559.54

|

879 173 689.66

|

1 304 013 128.90

|

|

Appropriations cancelled

|

8 193 766.31

|

7 501 429.46

|

-

|

0.00

|

|

Carry over to 2018

|

450 500 000.00

|

0.00

|

603 292 064.36

|

-

|

(1) Commitment appropriations = Payment appropriations

(2) Including suspended amounts (see 2.2.1.3)

Appropriations available for the financing of the measures under shared management with Member States (excluding expenditure under direct management by the Commission) amounted to EUR 42 489 million compared to actual expenditure of EUR 42 031 million. In order to make it available for the reimbursement of direct payments in relation with financial discipline, an amount of EUR 450.5 million was carried over to budget year 2018 with Commission Decision C(2018)776 of 7 February 2018 on non-automatic carryover of appropriations from the 2017 budget to the 2018 budget.

The 2017 appropriations coming from assigned revenue amounted to EUR 1 482.5 million of which an amount of EUR 77.5 million was used in chapter 05 02 and an amount of EUR 801.7 million was used in chapter 05 03. The remaining amount of EUR 603.3 million was automatically carried over to budget year 2018.

Part of the appropriations coming from assigned revenue received in 2016 was not used in financial year 2016 and was automatically carried forward to 2017. These appropriations amounted to EUR 1 304 million and had to be used in accordance with Article 14 of the Financial Regulation within that year. All these appropriations carried over from the previous financial year were fully used in 2017 in accordance with the Financial Regulation.

2.1.7.Budget execution of voted appropriations - Expenditure under direct management made by the Commission

|

In EUR

|

|

Expenditure under direct management

|

Commitment appropriations

|

Payment appropriations

|

Carry over to 2018 (2)

|

|

Appropriations (C1) (1)

|

121 357 079.00

|

69 112 583.34

|

-

|

|

Execution (C1)

|

119 428 161.33

|

47 177 737.98

|

17 671 686.06

|

|

Appropriations cancelled

|

1 928 917.67

|

4 263 159.30

|

-

|

|

(1) C1 denotes the budget's voted appropriations. This amount includes transfers from ''shared management'' for an amount of EUR 685 000.00 for commitment and payment appropriations, transfers ''out'' of EAGF for a total amount of EUR -2 986 000.00 for payment appropriations, transfers to EAGF for a total amount of EUR 345 609.34 for payment appropriations and an Amending Budget of EUR -1 900 000.00 for commitment and payment appropriations.

(2) Carry over to 2018 only for non-differentiated appropriations.

|

The available commitment appropriations for expenditure under direct management in the 2017 budget were EUR 121.4 million. An amount of EUR 119.4 million was committed in 2017. The balance of these appropriations, EUR 1.9 million, was cancelled.

The majority of EAGF commitment appropriations for expenditure under direct management made by the Commission are differentiated appropriations.

The automatic carry over to 2018, which relates only to non-differentiated appropriations, amounts to EUR 17.7 million.

For details, please see annexes 3 and 4.

2.1.8.Budget execution - Expenditure under direct management made by the Commission - Automatic carryover from 2016

|

In EUR

|

|

Carry over from 2016 to 2017

|

Commitments

|

De-commitments

|

Payments

|

Cancelled appropriations

|

|

Carried over appropriations

|

11 825 279.19

|

606 644.48

|

11 218 634.70

|

0.01

|

The automatic carry over from 2016 to 2017 only concerned expenditure under direct management for non-differentiated appropriations. As indicated in the table above, an amount of EUR 11.8 million was carried over from 2016 to 2017. In 2017 an amount of EUR 0.6 million from this carry over was de-committed. The payments made amounted to EUR 11.2 million.

For details, please see annex 4.

2.2.Monthly payments

2.2.1.Monthly payments to Member States under shared management

2.2.1.1.Monthly payments on the provision for expenditure

Article 18(1) of Regulation (EU) No 1306/2013 states that "monthly payments shall be made by the Commission for expenditure effected by Member States' accredited paying agencies during the reference month". Monthly payments shall be made to each Member State at the latest on the third working day of the second month following that in which the expenditure is incurred.

The monthly payments are a reimbursement of net expenditure (after deduction of revenue) which has been already carried out and are made available on the basis of the monthly declarations forwarded by the Member States

. The monthly booking of expenditure and revenue is subject to checks and corrections on the basis of these declarations. Moreover, these payments will become final following the Commission's verifications under the accounting clearance of accounts procedure.

Payments made by the Member States from 16 October 2016 to 15 October 2017 are covered by the system for monthly payments.

For financial year 2017, the total net amount of monthly payments decided, after the deduction of clearance and other corrections, was EUR 43 156 921 857.77. Taking into account the suspended amounts (see below 2.2.1.3.b) only EUR 43 153 914 666.63 was paid out.

2.2.1.2.Decisions on monthly payments for 2017

For the financial year 2017, the Commission adopted twelve decisions on monthly payments. Furthermore, an additional monthly payment decision, adjusting those already granted for the total expenditure chargeable to the year, was adopted in December 2017. For details, please see annex 2.

2.2.1.3.Reductions and suspensions of monthly payments

a.Reductions of the monthly payments

In 2017, reductions for a net amount of EUR 279.7 million were made to the monthly payments effected to the Member States. The categories of corrections are detailed in the following points:

–reductions of the monthly payments as a result of the non-compliance with the payment deadlines

Pursuant to Article 40 of Regulation (EU) No 1306/2013, certain Member States did not always respect the payment deadlines fixed by the Union legislation for the payment of aids to beneficiaries.

The payment deadlines ensure an equal treatment between the beneficiaries in all Member States and avoid the situation in which delays of payments would result in aids no longer having the intended economic effect. In addition, the deadlines help budgetary discipline by ensuring that the expenditure which falls in each budget year is more easily forecast.

As a result of non-respecting the set payment deadlines, the Commission decided reductions for a total amount of EUR 274.2 million.

–reductions of the monthly payments as a result of overspending the financial ceilings

For some aid measures financed by the EAGF, financial ceilings are determined in the sectoral regulations. Expenditure exceeding these ceilings is considered as "non eligible expenditure" and has to be corrected.

These corrections lead to reductions of the monthly payments. As a result of overspending these financial ceilings, the Commission made financial corrections for a total amount of EUR 0.9 million.

–reductions of the monthly payments as a result of non-eligibility

For some measures expenditure paid after the deadline is not eligible and the Commission made financial corrections for a total amount of EUR 4.5 million.

b.

Suspensions of the monthly payments

Following Commission Decision C(2016)2050 of 7 April 2016, the Commission has suspended for Poland the monthly payments for expenditure effected in 2017 for a total amount of EUR 3 007 191.14.

Following Commission Decision C(2016)4287 of 12 July 2016, the Commission has suspended for France the monthly payments for expenditure effected in 2017 for a total amount of EUR 4 844 104.81, but this amount is in the same year reimbursed to France.

2.2.2.Direct management expenditure by the Commission

In certain cases, the Commission makes payments directly for certain measures. These concern payments for actions for instance related to controls, to promotion actions and to information actions on the agricultural policy.

For details, please see annexes 3 and 4.

3.THE IMPLEMENTATION OF THE 2017 EAGF BUDGET

3.1.The uptake of the EAGF budget appropriations

The implementation of the budget amounted to EUR 44 758.8 million

. This expenditure was funded by the budget's initial appropriations and by using the revenue assigned to policy area 05-Agriculture and Rural Development, composed of the entire amount of EUR 1 304.0 million carried over from 2016 and of a part of the assigned revenue collected in 2017 amounting to EUR 879.2 million out of a total EUR 1 482.5 million.

Within policy area 05-Agriculture and Rural Development, the expenditure for market measures amounted to EUR 3 001.1 million and for direct payments to

EUR 41 551.2 million.

For details of the budget's implementation by policy area, please see annex 5.

Annex 9 presents a breakdown of the expenditure on market measures, direct payments and audit of agricultural expenditure by item, by fund source and by Member State.

3.2.Comments on the implementation of 2017 EAGF budget

A brief commentary on the implementation of the 2017 EAGF budget's appropriations as well as on the use of the assigned revenue available in 2017 is presented hereafter based on details appearing in the attached tables:

–Annex 5: Analysis of the execution of the 2017 EAGF budget. The expenditure incurred for each budget item appears in column 6. Columns 1, 2, 3 and 4 indicate, respectively, the source and amount of funding which originates either from voted appropriations or from transfers of assigned revenue and of voted appropriations from other items of the budget;

–Annex 6: Assigned revenue (C4) collected and used in 2017;

–Annex 7: Assigned revenue (C5) carried over from 2016 and used in 2017;

–Annex 9: Expenditure by Member State, by fund source and by item.

This presentation is made at the level of chapter, article and item of the agricultural budget.

3.2.1.Chapter 05 02: Interventions in agricultural markets

3.2.1.1.Introduction

Total payments for this chapter in 2017 amounted to EUR 3 001.1 million and they were funded by the voted appropriations amounting to EUR 2 805.0 million and by assigned revenue amounting to EUR 196.2 million. The latter was used to cover the expenditure incurred in the fruits and vegetables sector (for details, see point 3.2.1.2). In items where the needs exceeded the budgetary appropriations, the additional expenditure was covered through transfers from other items of the budget. For the market measures where the budget's appropriations were under-spent, the resulting available appropriations were transferred to other budget lines within the EAGF to cover additional expenditure as needed.

Annex 5 presents these details at the level of each budget item. In case the execution was close to the foreseen level in the 2017 budget, no further remarks are made.

3.2.1.2.Article 05 02 08: Fruits and vegetables

The 2017 budget foresaw total available appropriations amounting to EUR 1 061.5 million to cover the needs of all the measures for this sector. The Budgetary Authority voted appropriations of EUR 661.5 million as it took into account the estimated revenue assigned to this sector which amounted to EUR 400 million. Moreover, EUR 137.8 million was transferred from other budget lines within the same chapter. The expenditure incurred by Member States in 2017 amounted to EUR 995.4 million. The balance of the unused assigned revenue of EUR 203.8 million was carried over to the budget year 2018 to cover the needs of that year.

In particular, the total needs in the 2017 budget for the operational funds for producer organisations were estimated at EUR 855 million. The expenditure incurred by Member States amounted to EUR 822.0 million and it was funded by voted appropriations amounting to EUR 455.0 million, by transfers of appropriations of EUR 170.8 million and by assigned revenue of EUR 196.2 million. This expenditure was lower than the 2017 budget’s forecasted needs both because of the lower expenditure incurred for the temporary exceptional measures for producers that are members of producer organisations and of the lower expenditure for the National Financial Assistance.

Furthermore, compared to the forecasted needs in the 2017 budget, lower expenditure was incurred by Member States for the aid to producer groups for preliminary recognition amounting to EUR 16.3 million as this scheme is phasing out. Expenditure was also lower for the school fruit scheme amounting to EUR 117.1 million, particularly for payments related to the 2016/2017 school year.

Finally, the forecasted needs in the 2017 budget for other measures, including the temporary exceptional measures for producers who are not members of producer organisations in view of the prolongation of the Russian ban on imports amounted to EUR 54.5 million. However Member States incurred expenditure amounting to EUR 40.0 million only.

3.2.1.3.Article 05 02 09: Products of the wine-growing sector

The 2017 budget foresaw total available appropriations amounting to EUR 1 076 million to cover the needs of all the measures for this sector. The under-execution of EUR 64.2 million, compared to the forecasted 2017 budget needs, was due to the lower expenditure incurred by some Member States for the promotion, restructuring and investment components of their national wine programmes.

3.2.1.4.Article 05 02 10: Promotion

As regards promotion measures-payments by Member States, the under-execution of EUR 13.2 million compared to the forecasted 2017 budget needs was due to the lower expenditure incurred by some Member States for their promotion programmes which are approved by the Commission compared to the expenditure foreseen in the 2017 budget for these programmes.

As regards direct payments made by the European Union, the Commission committed appropriations for the total amount foreseen (EUR 52.5 million) in the 2017 budget for these payments.

3.2.1.5.Article 05 02 12: Milk and milk products

The 2017 budget foresaw total available appropriations amounting to EUR 607.7 million to cover the needs of all the measures for this sector. Expenditure incurred by Member States in 2017 amounted to EUR 468.0 million. All the schemes funded under this article were under-implemented compared to the estimated needs foreseen in the 2017 budget.

In particular, the 2017 needs for storage measures for skimmed milk powder (SMP) were estimated at EUR 19.0 million and the expenditure incurred amounted to EUR 16.6 million. For public storage, total purchases of 30 647 tonnes were made, and the expenditure incurred for technical and financial costs amounted to EUR 9.6 million. Furthermore, expenditure amounting to EUR 7.0 million was incurred for the private storage of SMP, with lower intake than initially foreseen.

In addition, the 2017 needs for storage measures for butter were estimated at EUR 9.0 million while the expenditure incurred amounted to EUR 7.0 million due to lower intake than initially foreseen.

For the school milk scheme, Member States incurred expenditure amounting to EUR 64.2 million which was lower than the forecasted 2017 needs of EUR 75 million because of lower expenditure for a part of the 2016/2017 school year.

Finally, the 2017 needs for other measures were estimated at EUR 504.7 million. Expenditure incurred amounted to EUR 380.2 million. Of the EUR 150 million budgeted for the milk production reduction scheme, EUR 108.8 million were spent. The full EUR 350 million for the exceptional adjustment aid for the dairy and other livestock sectors had been budgeted under item 05 02 12 99 – Other measures (milk and milk products). However, Member States had the option to use this aid for all livestock sectors. Member States declared EUR 268.9 million of expenditure for this scheme under the milk sector, while they also used a part of this aid for farmers in other livestock sectors. Budget transfers were made to cover the expenditure declared in the other articles, i.e. EUR 23.6 million for beef and veal, EUR 3.5 million for sheep- and goatmeat and EUR 26.9 million for pigmeat.

3.2.1.6.Article 05 02 13: Beef and veal

The 2017 budget foresaw no appropriations while the expenditure incurred by Member States in 2017 amounted to EUR 23.6 million. The over-execution in this article is the mirror picture of the under-implementation in milk and milk products resulting from the application of the targeted aid for the livestock sectors. The expenditure declared for this sector was covered via transfers from appropriations available for this measure in article 05 02 12.

3.2.1.7.Article 05 02 14: Sheepmeat and goatmeat

The 2017 budget foresaw no appropriations while the expenditure incurred by Member States in 2017 amounted to EUR 3.5 million. The over-execution in this article is the mirror picture of the under-implementation in milk and milk products resulting from the application of the targeted aid for the livestock sectors. The expenditure declared for this sector was covered via transfers from appropriations available for this measure in article 05 02 12.

3.2.1.8.Article 05 02 15: Pigmeat, eggs and poultry, bee-keeping and other animal products

The 2017 budget foresaw total available appropriations amounting to EUR 34.0 million to cover the needs of all the measures for this sector. However, the expenditure incurred by Member States in 2017 amounted to EUR 90.7 million and it was funded both by the voted appropriations and by transfers of appropriations amounting to EUR 56.7 million from other budget lines within the same chapter.

For 2017 there were no needs for private storage of pigmeat foreseen, but nevertheless the expenditure incurred amounted to EUR 1.4 million for the remainder of previous schemes.

The expenditure incurred for specific aid for beekeeping amounted to EUR 32.5 million compared to forecasted needs of EUR 34.0 million included in the 2017 budget. This difference is due to a lower uptake of the measure than initially foreseen, which could be explained by the fact that 2017 is the first year of the new 3 year programming period.

An amount of EUR 26.9 million was also paid for the exceptional adjustment aid for pigmeat, initially budgeted under Article 05 02 12 as explained above.

Under item 05 02 15 France declared expenditure for the exceptional support measures for poultry (EUR 29.9 million), which was not foreseen in Budget 2017.

3.2.1.9.Article 05 02 15: School schemes

As only from school year 2017/2018 the previously separate school fruit and school milk schemes have been merged, the 2017 budget foresaw only a small amount (EUR 0.2 million) and no expenditure was declared.

3.2.2.Chapter 05 03: Direct payments

Financial year 2017 was the second year of implementation of all the schemes under the reformed structure of direct payments as decided in the 2013 CAP reform. Total payments for this chapter of the 2017 budget amounted to EUR 41 551.2 million. This includes an amount of EUR 425.6 million paid for the reimbursement of direct payments to farmers in relation to financial discipline, financed from EUR 433.1 million carried over from 2016 (for details, see point 3.2.2.4). The rest of the payments made, EUR 41 125.6 million, was funded by voted appropriations amounting to EUR 39 138.5 million and by assigned revenue amounting to EUR 1 987.0 million. The latter was used to cover the expenditure incurred for the basic payment scheme (for details, see point 3.2.2.1). The unused voted appropriations amounted to EUR 523.2 million as evidenced by the difference between the voted appropriations of EUR 39 138.5 million used for the reimbursement to Member States and the initial voted appropriations of EUR 39 661.7 million included in the 2017 budget. These unused voted appropriations were decreased by a transfer of voted appropriations of EUR 66.8 million to other parts of the EAGF budget. Moreover, the unused amount of the crisis reserve (EUR 450.5 million), which was established from the proposed financial discipline in 2017, was transferred to budget article 05 03 09 so that the amount of the effectively applied financial discipline (EUR 450.5 million) could be carried over to 2018 for the reimbursement to the Member States concerned (see point 3.2.2.5). The remaining balance of assigned revenue collected in 2017 amounted to EUR 399.4 million and was carried over to 2018. In items where the needs exceeded the budget’s voted appropriations, the additional expenditure was covered through transfers of voted appropriations from other items of the budget or of assigned revenue. Equally, for direct payments where the budget's appropriations were under-spent, the resulting available appropriations were transferred to other budget lines within the EAGF in order to cover additional expenditure as needed.

Annex 5 presents these details at the level of each budget item.

3.2.2.1.Article 05 03 01: Decoupled direct payments

The main schemes funded by this article's appropriations are the single area payment scheme (SAPS), the basic payment scheme (BPS), the payment for agricultural practices beneficial for the climate and the environment, the redistributive payment and the payment for young farmers. All aid schemes in this article are paid independently of production but on certain conditions, e.g. the respect of cross-compliance. The 2017 budgetary needs for decoupled direct payments amounted to EUR 35 523.8 million for which the Budgetary Authority voted appropriations amounting to EUR 33 191.8 million after taking into consideration assigned revenue amounting to EUR 2 332.0 million. The expenditure incurred by Member States for all schemes in this article amounted to EUR 35 366.2 million, thus exceeding the voted appropriations by EUR 2 174.4 million. This latter amount of expenditure declared was covered by assigned revenue. The expenditure incurred by Member States for decoupled direct payments corresponded to 99.6 % of the needs foreseen in the 2017 budget for these schemes.

As regards the BPS, the 2017 budgetary needs were estimated at EUR 17 628.0 million. In order to cover these needs, the Budgetary Authority voted appropriations amounting to EUR 15 296.0 million after taking into account the revenue of EUR 2 332.0 million assigned to this scheme. The expenditure declared by Member States for this scheme was around EUR 17 540.2 million and covered 99.5% of the estimated needs.

As regards SAPS, the appropriations in the 2017 budget amounted to EUR 4 101.0 million and Member States incurred payments amounting to EUR 4 068.1 million, thus covering 99.2% of the estimated needs.

As regards the payment for agricultural practices beneficial for the climate and the environment, the so-called greening, the expenditure incurred by Member States amounted to EUR 11 767.1 million whereas appropriations in the 2017 budget were at EUR 11 696.0 million giving an execution rate of 100.6%.

The needs for the redistributive payment amounted to EUR 1 609.0 million and the expenditure declared by Member States was EUR 1 615.7 million or 100.4% of the budgeted needs.

For the payment for young farmers, needs were estimated at EUR 441.0 million in the 2017 budget. Expenditure amounted to EUR 352.8 million being only 80.0% of the needs. For following years, several Member States have adjusted their ceiling for the scheme which should reduce the underexecution noted in financial year 2017.

The remaining lines covered mostly smaller amounts, including also the residual payments for the schemes which expired further to the 2013 reform.

3.2.2.2.Article 05 03 02: Other direct payments

The appropriations of this article covered expenditure for "other direct payments". This includes schemes for which there may still be a link between the payment and the production, under well defined conditions and within clear limits. As a consequence of the 2013 reform, schemes added under this Article were the voluntary coupled support and the small farmers scheme and a number of lines only covered relatively minor residual payments for expired schemes.

The Commission had estimated that appropriations amounting to EUR 6 019.3 million were needed for this Article in 2017. Member States incurred expenditure amounting to EUR 5 759.4 million hence lower than the appropriations entered in the budget.

For the crop-specific payment for cotton, needs were estimated at EUR 246.0 million in the 2017 budget. Expenditure was EUR 233.8 million, i.e. 95.0% of the needs.

The execution for the POSEI-EU support programmes was very close to the needs (EUR 411.0 million) foreseen in the 2017 budget.

For the voluntary coupled support scheme, needs were estimated at EUR 3 988.0 million in the 2017 budget. Expenditure was EUR 3 898.8 million, i.e. 97.8% of the needs.

For the small farmers scheme, needs were estimated at EUR 1 347.0 million in the 2017 budget. Expenditure was EUR 1 201.1 million, i.e. 89.2% of the needs.

As regards item 05 03 02 99 – Other (direct payments), the 2017 budget included appropriations of EUR 2.5 million intended to cover expenditure and corrections for older schemes which were not covered under other budget items of the coupled direct payments sector. There was a negative expenditure of around EUR – 2.1 million and in order to cover the funding needs of other items of the 2017 budget, appropriations amounting to EUR 4.5 million were transferred out of this budget item.

3.2.2.3.Article 05 03 03: Additional amounts of aid

While appropriations foreseen in the 2017 budget for this article amounted to EUR 0.1 million, Member States incurred insignificant expenditure and thus under-executed the budget’s appropriations by almost a similar amount.

3.2.2.4.Article 05 03 09: Reimbursement of direct payments in relation to financial discipline

No appropriations are allocated to this article by the Budgetary Authority. This article serves the purpose of collecting the non-committed voted appropriations including in particular the appropriations of the unused crisis reserve in order to be carried over into budget year N+1 and finance the reimbursement of the financial discipline applied to direct payments in respect of calendar year N

.

Each year, if applicable, a Commission Implementing Regulation sets the amounts that each Member State has to reimburse to farmers and, in accordance with Article 169(3) of Regulation (EU, Euratom) No 966/2012, determines that the expenditure in relation to this reimbursement shall only be eligible for Union financing if the amounts have been paid to the beneficiaries before 16 October of the financial year to which the appropriations are carried over. From the amount of EUR 433.1 million, corresponding to the financial discipline applied during financial year 2016 and which was carried over to budget 2017 for reimbursement, Member States reimbursed EUR 425.6 million. The difference of EUR 7.5 million reverted to the 2017 budget for its return to Member States via an Amending Budget in the following budget year.

For financial year 2018, Commission Implementing Regulation (EU) 2017/2197

sets the amount of reimbursement at EUR 433.3 million instead of EUR 450.5 million as the relevant amount in the case of Romania not was known at the moment of adopting the regulation. This amount corresponds to the amount of financial discipline effectively applied for claim year 2017 and this amount was carried over into the 2018 budget.

3.2.2.5.Article 05 03 10: Reserve for crises in the agricultural sector

The appropriations of this article are intended to cover expenditure for measures which have to be taken in order to cope with major crises affecting agricultural production or distribution. The crisis reserve is established by applying, at the beginning of each year, a reduction to the direct payments through the financial discipline mechanism in accordance with Articles 25 and 26 of Regulation (EU) No 1306/2013 as well as Article 8 of Regulation (EU) No 1307/2013

. This reserve shall be set up with an annual amount of EUR 400 million (in 2011 prices). For the budget year 2017, the equivalent amount of the crisis reserve in current prices was EUR 450.5 million. The reserve was not used in financial year 2017.

For the 2016 claim year, the financial discipline was calculated exclusively for the constitution of the crisis reserve of EUR 450.5 million. However, by the end of the financial year, non-committed voted appropriations corresponding to the amount of financial discipline effectively applied for claim year 2016 (taking into account the unused amount of the crisis reserve) was transferred to budget article 05 03 09 in order to be carried over to the next financial year and, in this way, fund the reimbursement of financial discipline imposed on farmers in the calendar year 2017 (please see point 3.2.2.4).

3.2.3.Chapter 05 04: Rural Development

For Article 05 04 01 – Completion of Rural Development financed by the EAGGF-Guarantee section – Programming period 2000 to 2006, the final net amount recovered was EUR 0.5 million.

3.2.4.Chapter 05 07: Audit of agricultural expenditure

3.2.4.1.Article 05 07 01: Control of agricultural expenditure

This article involves the measures taken in order to reinforce the means of on-the-spot controls and to improve the systems of verification so as to limit the risk of fraud and irregularities to detriment of the Union budget. It also includes the expenditure to finance possible accounting and conformity corrections in favour of Member States.

The European Union directly funded the purchase of satellite images within the framework of the Integrated Administration and Control System (IACS) for an amount of EUR 11.3 million, thus taking up all of the appropriations foreseen in the 2017 budget.

There were much higher than expected corrections in favour of the Member States following conformity clearance of accounts (EUR 125.3 million instead of EUR 25.0 million foreseen in the Budget). This over execution was partly offset by lower than expected corrections in favour of Member States following accounting clearance of accounts (EUR 14.8 million instead of EUR 20.0 million foreseen in the Budget).

3.2.4.2.Article 05 07 02: Settlement of disputes

The appropriations in this article are intended to cover expenditure for which the Commission could be held liable by decision of a court of justice, including the cost of settling claims for damages and interest. The 2017 budget foresaw appropriations amounting to EUR 29.0 million, however no expenditure was declared. Therefore, these appropriations were transferred to other items of the 2017 budget.

3.2.5.Chapter 05 08: Policy strategy and coordination

3.2.5.1.Article 05 08 01: Farm accountancy data network (FADN)

Appropriations committed for data collection on farm holdings under this network amounted to EUR 14.7 million, while the 2017 budget foresaw appropriations amounting to EUR 18.0 million.

3.2.5.2.Article 05 08 02: Surveys on the structure of agricultural holdings

Almost all appropriations were committed for the farm structure surveys.

3.2.5.3.Article 05 08 03: Restructuring of systems for agricultural surveys

Appropriations committed for the restructuring of systems of agricultural surveys amounted to EUR 13.7 million, while the 2017 budget foresaw appropriations amounting to EUR 16.1 million.

3.2.5.4.Article 05 08 06: Enhancing public awareness of the common agricultural policy

Appropriations committed for actions, fairs and publications aimed at enhancing public awareness of the CAP, including actions under Corporate Communication amounted to around EUR 16.3 million, while the 2017 budget foresaw only appropriations amounting to EUR 8.0 million, later on reinforced by a transfer of appropriations of EUR 8.4 million.

3.2.5.5.Article 05 08 09: EAGF – Operational technical assistance

Appropriations committed for operational technical assistance for the EAGF amounted to approximately EUR 2.1 million, while the 2017 budget foresaw appropriations amounting to EUR 6.3 million. EUR 1.0 million of the voted appropriations was reallocated outside EAGF through Amending Budget No 6.

4.IMPLEMENTATION OF REVENUE ASSIGNED TO EAGF

The assigned revenue actually carried over from 2016 into 2017, amounted to EUR 1 304.0 million and was entirely used in financing expenditure of the 2017 budget year in accordance with article 14 of the Financial Regulation. As presented in annex 7, this amount covered expenditure of EUR 118.7 million for the operational funds for producer organisations in the fruits and vegetables sector and of EUR 1 185.3 million for the basic payment scheme.

As regards the assigned revenue collected in 2017, annex 6 shows that this revenue amounted to EUR 1 482.5 million and it originated from:

–the corrections of the conformity clearance procedure, EUR 1 348.0 million;

–the receipts from irregularities, EUR 130.7 million;

–the milk levy collections, EUR 3.7 million.

The assigned revenue collected in 2017 was used to cover expenditure incurred for the following measures:

–EUR 77.5 million for the operational funds for producer organisations in the fruits and vegetables sector;

–EUR 801.7 million for the basic payment scheme (BPS) (direct payments).

The balance of the assigned revenue collected in 2017 amounting to EUR 603.3 million was automatically carried over into the 2018 budget in order to fund budgetary needs of that year.

5.CONTROL MEASURES

5.1.Introduction

In accordance with the EU legislation and as in previous years, 2017 agricultural expenditure was submitted to a comprehensive system of control measures.

This system includes, on the one hand, all the necessary building blocks to guarantee a sound administration of the expenditure at Member States’ level and, on the other hand, allows the Commission to counter the risk of financial losses as a result of any deficiencies in the set-up and operation of those building blocks through the clearance of accounts procedure.

Member States have to ensure that the transactions are carried out and executed correctly, to prevent and deal with irregularities and to recover amounts unduly paid.

In complement to this general obligation, there is a system of controls and dissuasive sanctions of final beneficiaries which reflects the specific features of the regime and the risk involved in its administration.

The controls are carried out by the paying agencies or by delegated bodies operating under their supervision and effective, dissuasive and proportionate sanctions are imposed if the controls reveal non-compliance with EU rules. The system generally provides for exhaustive administrative controls of 100% of the aid applications, cross-checks with other databases where this is considered appropriate as well as pre-payment on-the-spot controls of a sample of transactions ranging between 1% and 100%, depending on the risk associated with the regime in question.

In addition, for most regimes which are not subject to the Integrated Administration and Control System (IACS), on top of the primary and secondary control levels, ex-post controls must be carried out.

5.2.Integrated Administration and Control System (IACS)

Regulation (EU) No 1306/2013, Regulation (EU) No 1307/2013, Commission Delegated Regulation (EU) No 639/2014

and Commission Delegated Regulation (EU) No 640/2014

contain the rules on the IACS.

A fully operational IACS consists of: a computerised database, an identification system for agricultural parcels and farmers claiming aid, a system for identification and registration of payment entitlements, aid applications and integrated controls system (claim processing, on-the-spot checks and sanctioning mechanisms) and a system for identifying and registering animals where applicable. The IACS is fully automated.

This system foresees a 100% administrative control covering the eligibility of the claim, complemented by administrative cross-controls with standing databases ensuring that only areas or animals that fulfil all eligible requirements are paid the premium and by a minimum 5% of on-the-spot checks to check the existence and eligibility of the area or the animals claimed.

For the financial year 2017, the IACS covered 93% of the EAGF expenditure. Furthermore, the relevant components of the IACS are applicable to the rural development measures, which are based on area or number of animals. Such measures include, inter alia, agri-environment and animal welfare measures, less-favoured areas and areas with environmental restrictions and afforestation of agricultural land. For financial year 2017, 61% of payments made under the EAFRD were also covered.

The Commission services verify the effectiveness of Member States' IACS and homogenous implementation by means of both on-the-spot auditing and general supervision based on annually supplied financial and statistical data. It has been established already for some years now that the IACS provides an excellent and cost effective means of ensuring the proper use of EU funds.

5.3.Market measures

Market interventions, for example storage aid or aid to producer organisations, are not covered by IACS but they are governed by specific rules as regards controls and sanctions which are set out in horizontal and sector-based regulations.

Aids are paid on the basis of claims, often involving the lodging of administrative and/or end-use securities, which are systematically (100%) checked administratively for completeness and correctness. The more financially important aid schemes are also subject to regular accounting controls performed in situ on commercial and financial documents.

5.4.Application of Chapter III of Title V Regulation (EU) No 1306/2013 (ex-post scrutiny)

An ex-post control system is provided for under Regulation (EU) No 1306/2013 in Title V, Chapter III. It provides for an ex-post control system which is a complement to the sectoral control systems described above. The system constitutes an extra layer of control which contributes to the assurance that transactions have been carried out in conformity with the rules or otherwise allows recovering the unduly paid amounts.

The ex-post scrutiny is to be carried out by a body in the Member State, which is independent of the departments within the paying agency responsible for the pre-payment controls and the payments. It covers a wide range of CAP subsidies including sector schemes for fruit and vegetables, wine and POSEI aids. In fact, the ex-post scrutiny covers all aids paid to beneficiaries from EAGF (except payments covered by IACS and those excluded by Article 14 of Regulation (EU) No 907/2014).

In 2017, the review of the implementation of scrutiny was integrated in the framework of certain conformity audit missions. Member States scrutiny services completed ex-post controls in respect of undertakings to which payments were made in financial year 2015. The annual reports in respect of the respective scrutiny period (July 2015-June 2016) shows that Member States completed more than 90% of the planned scrutinies. The regulation also foresees Member States providing mutual assistance in the performance of scrutinies. In the 2016/2017 scrutiny period, around 40 such requests were fulfilled.

6.CLEARANCE OF ACCOUNTS

6.1.Conformity clearance

6.1.1.Introduction

It is primarily the Member States' responsibility to check that transactions are carried out and executed correctly via a system of control and dissuasive sanctions. Where Member States fail to meet this requirement, the Commission applies financial corrections to protect the financial interests of the EU.

The conformity clearance relates to the legality and regularity of transactions. It is designed to exclude expenditure from EU financing which has not been effected in compliance with EU rules, thus shielding the EU budget from expenditure that should not be charged to it (financial corrections). In contrast, it is not a mechanism by which irregular payments to beneficiaries are recovered, which according to the principle of shared management is the sole responsibility of Member States.

Financial corrections are determined on the basis of the nature and gravity of the infringement and the financial damage caused to the EU. Where possible, the amount is calculated on the basis of the loss actually caused or on the basis of an extrapolation. Where this is not possible, flat-rates are used which take account of the severity of the deficiencies in the national control systems in order to reflect the financial risk for the EU.

Where undue payments are or can be identified as a result of the conformity clearance procedures, Member States are required to follow them up by recovery actions against the final beneficiaries. However, even where this is not possible because the financial corrections only relate to deficiencies in the Member States' management and control systems, financial corrections are an important means to improve these systems and thus to prevent or detect and recover irregular payments to final beneficiaries. The conformity clearance, thereby, contributes to the legality and regularity of the transactions at the level of the final beneficiaries.

6.1.2.Audits and decisions adopted in 2017

6.1.2.1.Audits

The following table presents an overview of the conformity audits with missions and their coverage in respect of financial year 2017, broken down per Activity Based Budgeting (ABB):

|

Financial Year 2017

|

ABB 02

|

ABB 03

|

ABB 04(1)

|

Total(2)

|

|

Number of conformity audits with missions carried out(3)

|

28

|

25

|

38

|

128

|

|

(1) concerns only EAFRD.

(2) The total figure includes 106 conformity audits, of which 87 audits targeted the 3 ABBs areas (audits targeting more than one ABBs are counted only once) and 19 other conformity audits (12 audits on cross compliance, 2 audits on entitlements and 5 IT audits). In addition to the conformity audits, 22 other audit missions not subject to conformity clearance procedure have been carried out (1 audit on IPARD, 2 audits on debt managagement and irregularities, 1 financial audit, 17 audits on the Certification Bodies as regards legality and regularity and 1 pre-accession audit).

(3) if an audit covers more than one ABB, it is allocated to all ABBs covered by that audit. However, these audits are counted only once in the total.

|

6.1.2.2.Conformity decisions

Three conformity clearance decisions having an impact on the financial year 2017 were adopted involving financial corrections in a number of sectors. These decisions had an overall financial impact for EAGF by excluding from EU financing a total of EUR 666 million:

·Decision 2016/2018/EU of 15 November 2016 – 52nd Decision, financial impact of EUR 248.71 million;

·Decision 2017/264/EU of 14 February 2017 – 53rd Decision, financial impact of EUR 95.29 million;

·Decision 2017/1144/EU of 26 June 2017 – 54th Decision, financial impact of EUR 322.23 million.

For the decisions 52 (2016/2018/EU) and 54 (2017/1144/EU) due to the relative magnitude of corrections compared to certain Member State’s GDP, the Commission decided that corrections amounting to EUR 434.97 million could be paid in 3 equal annual instalments. In addition, financial corrections for Greece in decisions 53 and 54 are included in the deferral decision (C(2015)4122 of 22 June 2015) amounting to EUR 1.04 million for EAGF.

The breakdown of financial impact according to sectors is as follows (in EUR):

|

Sector

|

Decision 52

|

Decision 53

|

Decision 54

|

|

Area aids / Arable crops

|

-51 387 714.51

|

-4 702 457.84

|

76 640 002.44

|

|

Export Refunds

|

|

|

-120 901 216.61

|

|

Financial Audit

|

-3 607 008.90

|

-4 193 911.45

|

-180 953 644.82

|

|

Fruit and vegetables

|

-140 115 955.50

|

-70 254 964.01

|

-5 680 843.51

|

|

Intervention storage

|

-1 851 180.41

|

-9 463 483.62

|

|

|

Irregularities

|

-46 848 823.39

|

-1 983 005.04

|

-88 841 383.00

|

|

Milk Products

|

|

|

-2 428 230.45

|

|

POSEI

|

-660 202.73

|

-583 198.56

|

|

|

Specific support (Art.68 of Reg.73/2009)

|

-3 184 313.41

|

-4 104 435.06

|

|

|

Wine

|

-1 055 927.93

|

|

-63 210.21

|

|

Grand Total

|

-248 711 126.78

|

-95 285 455.58

|

-322 228 526.16

|

Under Regulation (EU) No 1306/2013, an automatic clearing mechanism is applied to irregular payments not recovered 4 years after the establishment of the irregularity, or 8 years after the establishment of the irregularity when the recovery is challenged in national courts. The financial consequences of non recovery are shared by the Member State concerned and the EU on a 50% - 50% basis. Even after the application of this mechanism, Member States are, however, obliged to pursue their recovery procedures and, if they fail to do so with the necessary diligence, the Commission may decide to charge the entire outstanding amounts to the Member States concerned.

Regarding financial year 2017, Member States reported the information about recovery cases by 15 February 2018. The Member States recovered during financial year 2017 around EUR 154.7 million for EAGF. Recovered amounts were EUR 93.2 million for EAFRD and EUR 0.6 million for Transitional Rural Development Instrument (TRDI). The outstanding amount still to be recovered from beneficiaries at the end of that financial year 2017 was EUR 1 080.7 million for EAGF, EUR 500.19 million for EAFRD and EUR 25.5 million for TRDI. The financial consequences to the Member States for non recovery of EAGF cases dating from 2011 or 2007 account to EUR 7.4 million. During financial year 2017, around EUR 17.6 million was borne at 100% by the EU budget for EAGF cases reported irrecoverable.

6.2.Financial clearance

6.2.1.Introduction

The financial clearance covers the completeness, accuracy and veracity of paying agencies' accounts, the internal control systems set up by these paying agencies and the legality and regularity of the expenditure for which reimbursement has been requested from the Commission. Within this framework, Directorate-General for Agriculture and Rural Development (DG AGRI) pays particular attention to the certifying bodies’ conclusions and recommendations (where weaknesses are found), following their reviews of the paying agencies’ compliance with the accreditation criteria. As part of this review, DG AGRI also covers aspects relating to conformity issues and protecting the financial interests of the EU as regards advances paid, securities obtained and intervention stocks.

The Commission adopts an annual clearance of accounts decision clearing the paying agencies' annual accounts on the basis of the certificates and reports from the certifying bodies, but without prejudice to any subsequent decisions to recover expenditure which proves not to have been in accordance with the EU rules. As from financial year 2014, these accounts are received by the Commission by 15 February of the year following the financial year in question. The Commission decides whether the accounts of each paying agency are cleared and adopts its clearance decision by 31 May of the year following the financial year in question. The accounts not cleared by 31 May are cleared later in a future decision, once assurance on the completeness, accuracy and veracity of the accounts is obtained.

6.2.2.Decisions

6.2.2.1.Financial clearance decision for the financial year 2013

On 29 April 2014, the Commission adopted a Decision clearing the annual accounts of 76 paying agencies in respect of EAGF expenditure. With this decision, expenditure amounting to EUR 40 628.5 million was cleared. The accounts of BIRB (Belgium), OPEKEPE (Greece) and PIAA (Romania) were disjoined.

On 16 November 2016, the Commission adopted Decision C(2016) 7229 clearing the annual accounts of BIRB (Belgium). This decision cleared EUR 15 million.

On 6 April 2017, the Commission adopted Decision C(2017)2176 where the accounts of OPEKEPE (Greece) and PIAA (Romania) were cleared for a total amount of EUR 3 515 million.

6.2.2.2.Financial clearance decision for the financial year 2014

On 28 May 2015, the Commission adopted a Decision clearing the annual accounts of 74 paying agencies in respect of EAGF expenditure. With this decision, expenditure amounting to EUR 39 561 million was cleared. The accounts of five paying agencies (Hamburg and Mecklenburg-Vorpommern (Germany), OPEKEPE (Greece), SAISA (Italy) and PIAA (Romania)) were disjoined.

With Commission Decision C(2016) 7237 adopted on 16 November 2016, the accounts of the German Paying Agencies "Hamburg" and "Mecklenburg-Vorpommern", and the Romanian Paying Agency "PIAA" were cleared. This decision cleared EUR 1 716 million.

The accounts of OPEKEPE (Greece) and SAISA (Italy) amounting to EUR 2 077 million were cleared by the Commission Decision C(2017)2509 adopted on 25 April 2017.

6.2.2.3.Financial clearance decision for the financial year 2015

On 30 May 2016, the Commission adopted a Decision (2016/941) clearing the annual accounts of all paying agencies, except for the paying agencies State Fund Agriculture (Bulgaria), France Agrimer (France) and AGEA (Italy). This decision cleared EUR 40 111 million. The accounts of the disjoined paying agencies will be cleared in a later decision (amount involved EUR 3 307 million).

6.2.2.4.Financial clearance decision for the financial year 2016

On 29 May 2017, the Commission adopted a Decision (2017/927) clearing the annual accounts of all paying agencies, except for the paying agencies Zollamt Salzburg (Austria), State Fund Agriculture (Bulgaria), Cyprus Agricultural Payments Organization (Cyprus), Danish AgriFish Agency(Denmark), FranceAgriMer (France), Agenzia per le Erogazioni in Agricoltura (Italy) and Agriculture and Rural Payments Agency (Malta). This decision cleared EUR 37 384 million. The accounts of the disjoined paying agencies will be cleared in a later decision (relevant amount EUR 4 326 million).

6.3.Appeals brought before the Court of Justice against clearance decisions

6.3.1.Judgments handed down

In the financial year 2017, the Court handed down 10 judgments in appeals brought by the Member States against conformity clearance decisions.

In financial year 2017, the Court partially annulled:

|

Case Number

|

MS

|

Date of Judgment

|

Challenged Decision

|

Lodging Date

|

|

T-112/15

|

EL

|

30/03/2017

|

46

|

2/03/2015

|

|

T-143/15

|

ES

|

20/07/2017

|

47

|

30/03/2015

|

In financial year 2017, the Court annulled:

|

Case Number

|

MS

|

Date of Judgment

|

Challenged Decision

|

Lodging Date

|

|

T-145/15

|

RO

|

16/02/2017

|

47

|

29/03/2015

|

In financial year 2017, the Court rejected appeals brought in the following cases:

|

Case Number

|

MS

|

Date of Judgment

|

Challenged Decision

|

Lodging Date

|

|

T-141/15

|

CZ

|

20/10/2016

|

47

|

27/03/2015

|

|

T-501/15

|

NL

|

29/03/2017

|

48

|

31/08/2015

|

|

C-279/16P

|

ES

|

15/06/2017

|

45

|

19/05/2016

|

|

T-27/16

|

UK

|

29/06/2017

|

49

|

25/01/2016

|

|

T-157/15

|

EE

|

12/07/2017

|

47

|

30/03/2015

|

|

T-287/16

|

BE

|

20/07/2017

|

50

|

30/05/2016

|

|

T-261/16

|

PT

|

21/09/2017

|

50

|

25/05/2016

|

6.3.2.New appeals

In the financial year 2017, 15 new appeals were brought by the Member States against clearance decisions:

|

Case Number

|

MS

|

Lodging Date

|

Challenged Decision

|

|

C-4/17P

|

CZ

|

04/01/2017

|

47

|

|

T-31/17

|

PT

|

20/01/2017

|

52

|

|

T-49/17

|

ES

|

27/01/2017

|

52

|

|

T-51/17

|

PL

|

27/01/2017

|

52

|

|

T-239/17

|

DE

|

19/04/2017

|

53

|

|

T-233/17

|

PT

|

20/04/2017

|

53

|

|

T-237/17

|

ES

|

24/04/2017

|

53

|

|

T-241/17

|

PL

|

02/06/2017

|

53

|

|

C-341/17P

|

EL

|

14/07/2017

|

46

|

|

T-474/17

|

PT

|

01/08/2017

|

54

|

|

T-480/17

|

EL

|

03/08/2017

|

54

|

|

T-602/17

|

ES

|

04/09/2017

|

54

|

|

T-598/17

|

IT

|

05/09/2017

|

54

|

|

T-609/17

|

FR

|

06/09/2017

|

54

|

|

C-587/17P

|

BE

|

11/10/2017

|

50

|

6.3.3.Appeals pending

The situation as at 15 October 2017 with regard to appeals pending together with the amounts concerned is shown in annex 15.

7.RELATIONS WITH PARLIAMENT AND WITH THE EUROPEAN COURT OF AUDITORS

7.1.Relations with Parliament

The European Parliament is, together with the Council, part of the EU’s Budgetary Authority. It is, thus, one of the most important discussion partners of the Commission on budgetary matters and, therefore, on the EAGF.

Three EP committees are involved in the discussions and the preparation for the plenary on agricultural budgetary matters. These are the Committee on Agriculture and Rural Development, the Committee on Budgets and the Committee on Budgetary Control.

Since 2014 the Committee on Agriculture and Rural Development provides an opinion on the discharge procedure to the Committee on Budgetary Control.

The Committee on Budgetary Control monitored the correct implementation of the budget and drafted the opinion proposing to the Parliament to grant the discharge and making recommendations to the Commission or Member States.

The European Parliament granted discharge to the Commission, in respect to the implementation of the general budget of the European Union for the 2015 financial year, by a vote in plenary on a Parliamentary Decision which took place on 27 April 2017.

The same procedure applied in relation with financial year 2016 and the discharge was granted to the Commission by a vote in plenary on a Parliamentary Decision which took place on 18 April 2018.

7.2.Relations with the European Court of Auditors

7.2.1.Mission of the European Court of Auditors

The European Court of Auditors is the external auditor of the European Union. Articles 285 to 287 of the Treaty on the Functioning of the European Union provide that the Court shall audit the Union finances with a view to improving financial management and reporting on the use of public funds. The Court of Auditors should provide the European Parliament and the Council with a statement of assurance as to the reliability of the accounts and the legality and regularity of the underlying transactions. This statement, which can be complemented by specific assessments for various policy areas, is of prime importance to the European Parliament in its deliberations on granting discharge to the Commission for the implementation of the budget.

As part of its work, the Court carries out numerous audits within the Commission services. Court officials frequently visit the Directorate-General for Agriculture and Rural Development to gather facts and figures needed for the Court's opinions, as well as for its annual and special reports. In the light of these investigations the Court frequently makes suggestions and recommendations to the Commission on how to improve its financial management and make supervisory and control systems more effective.

7.2.2.Annual Report for financial year 2016

Every year the Court of Auditors publishes its Annual report on the implementation of the EU budget in which it gives a statement of assurance on the reliability of the consolidated accounts of the EU as well as on the legality and regularity of transactions. This is supplemented with specific assessments of each major area of EU activity. The report is published along with the Institutions' replies and is presented to the European Parliament after the summer break of year N+1.

In line with International Audit Standards, contradictory meetings take place between the auditor (the Court of Auditors) and the auditee (the Commission and the other Institutions and bodies) before the report is published. In these meetings, the Court's findings and conclusions are discussed to ensure agreement on the underlying facts or existing interpretation of legislation. The wording of the auditee's replies is also discussed.

In the Annual report for financial year 2016, the activities relevant for the Directorate-General for Agriculture and Rural development are considered under one single chapter, Chapter 7 – Natural Resources. However, transactions financed under the EAGF are assessed separately from those financed under the EAFRD which are considered along with other policies (environment, climate action and fisheries).