EUR-Lex Access to European Union law

This document is an excerpt from the EUR-Lex website

Document 52013XC0723(03)

Guidelines on regional State aid for 2014-2020 Text with EEA relevance

Smjernice za regionalne državne potpore za razdoblje 2014. – 2020. Tekst značajan za EGP

Smjernice za regionalne državne potpore za razdoblje 2014. – 2020. Tekst značajan za EGP

OJ C 209, 23.7.2013, p. 1–45

(BG, ES, CS, DA, DE, ET, EL, EN, FR, IT, LV, LT, HU, MT, NL, PL, PT, RO, SK, SL, FI, SV)

Special edition in Croatian: Chapter 08 Volume 006 P. 3 - 47

|

23.7.2013 |

EN |

Official Journal of the European Union |

C 209/1 |

Guidelines on regional State aid for 2014-2020

(Text with EEA relevance)

2013/C 209/01

INTRODUCTION

|

1. |

On the basis of Article 107(3)(a) and (c) of the Treaty on the Functioning of the European Union (TFEU), the Commission may consider compatible with the internal market State aid to promote the economic development of certain disadvantaged areas within the European Union (1). This kind of State aid is known as regional aid. |

|

2. |

In these guidelines, the Commission sets out the conditions under which regional aid may be considered to be compatible with the internal market and establishes the criteria for identifying the areas that fulfil the conditions of Article 107(3)(a) and (c) of the Treaty. |

|

3. |

The primary objective of State aid control in the field of regional aid is to allow aid for regional development while ensuring a level playing field between Member States, in particular by preventing subsidy races that may occur when they try to attract or retain businesses in disadvantaged areas of the Union, and to limit the effects of regional aid on trade and competition to the minimum necessary. |

|

4. |

The objective of geographical development distinguishes regional aid from other forms of aid, such as aid for research, development and innovation, employment, training, energy or for environmental protection, which pursue other objectives of common interest in accordance with Article 107(3) of the Treaty. In some circumstances higher aid intensities may be allowed for those other types of aid, whenever granted to undertakings established in disadvantaged areas, in recognition of the specific difficulties which they face in such areas (2). |

|

5. |

Regional aid can only play an effective role if it is used sparingly and proportionately and is concentrated on the most disadvantaged regions of the European Union (3). In particular, the permissible aid ceilings should reflect the relative seriousness of the problems affecting the development of the regions concerned. Furthermore, the advantages of the aid in terms of the development of a less-favoured region must outweigh the resulting distortions of competition (4). The weight given to the positive effects of the aid is likely to vary according to the applied derogation of Article 107(3) of the Treaty, so that a greater distortion of competition can be accepted in the case of the most disadvantaged regions covered by Article 107(3)(a) than in those covered by Article 107(3)(c) (5). |

|

6. |

Regional aid can further be effective in promoting the economic development of disadvantaged areas only if it is awarded to induce additional investment or economic activity in those areas. In certain very limited, well-identified cases, the obstacles that these particular areas may encounter in attracting or maintaining economic activity may be so severe or permanent that investment aid alone may not be sufficient to allow the development of that area. Only in such cases may regional investment aid be supplemented by regional operating aid not linked to an investment. |

|

7. |

In the Communication on State aid modernisation of 8 May 2012 (6), the Commission announced three objectives pursued through the modernisation of State aid control:

|

|

8. |

In particular, the Communication called for a common approach to the revision of the different guidelines and frameworks with a view to strengthening the internal market, promoting more effectiveness in public spending through a better contribution of State aid to the objectives of common interest, greater scrutiny of the incentive effect, limiting the aid to the minimum, and avoiding the potential negative effects of the aid on competition and trade. The compatibility conditions set out in these guidelines are based on those common assessment principles and are applicable to notified aid schemes and individual aid. |

1. SCOPE AND DEFINITIONS

1.1. Scope of regional aid

|

9. |

Regional aid to the steel (7) and synthetic fibres (8) sectors will not be considered to be compatible with the internal market. |

|

10. |

The Commission will apply the principles set out in these guidelines to regional aid in all sectors of economic activity (9), apart from the fisheries and aquaculture (10), agricultural (11) and the transport sector (12), which are subject to special rules laid down by specific legal instruments, which might derogate partially or totally from these guidelines. The Commission will apply these guidelines for processing and marketing of agricultural products into non-agricultural products. These guidelines apply to aid measures supporting activities outside the scope of Article 42 of the Treaty but covered by the Rural Development Regulation and are either co-financed by the European Agriculture Fund for Rural Development or are being granted as an additional national financing to such co-financed measures, unless sectoral rules provide for otherwise. |

|

11. |

These guidelines will not apply to State aid granted to airports (13) or in the energy sector (14). |

|

12. |

Regional investment aid to broadband networks may be considered compatible with the internal market if, in addition to the general conditions laid down in these guidelines, it complies also with the following specific conditions: (i) aid is granted only to areas where there is no network of the same category (either basic broadband or NGA) and where none is likely to be developed in the near future; (ii) the subsidised network operator offers active and passive wholesale access under fair and non-discriminatory conditions with the possibility of effective and full unbundling; (iii) aid should be allocated on the basis of a competitive selection process in accordance with paragraph 78(c) and (d) of the Broadband guidelines (15). |

|

13. |

Regional investment aid to research infrastructures (16) may be regarded to be compatible with the internal market if, in addition to the general conditions laid down in these guidelines the aid is made conditional on giving transparent and non-discriminatory access to this infrastructure. |

|

14. |

Large undertakings tend to be less affected than small and medium enterprises (SMEs) by regional handicaps for investing or maintaining economic activity in a less developed area. Firstly, large companies can more easily obtain capital and credit on global markets and are less constrained by the more limited offer of financial services in a particular disadvantaged region. Secondly, investments by large undertakings can produce economies of scale that reduce location-specific initial costs and, in many respects, are not tied to the region in which the investment takes place. Thirdly, large companies making investments usually possess considerable bargaining power vis-à-vis the authorities, which may lead to aid being awarded without need or due justification. Finally, large companies are more likely to be significant players on the market concerned and, consequently, the investment for which the aid is awarded may distort competition and trade on the internal market. |

|

15. |

Since regional aid to large undertakings for their investments is unlikely to have an incentive effect, it cannot be regarded to be compatible with the internal market under Article 107(3)(c) of the Treaty, unless it is granted for initial investments that create new economic activities in these areas (17), or for the diversification of existing establishments into new products or new process innovations. |

|

16. |

Regional aid aimed at reducing the current expenses of an undertaking constitutes operating aid and will not be regarded as compatible with the internal market, unless it is awarded to tackle specific or permanent handicaps faced by undertakings in disadvantaged regions. Operating aid may be considered compatible if it aims to reduce certain specific difficulties faced by SMEs in particularly disadvantaged areas falling within the scope of Article 107(3)(a) of the Treaty, or to compensate for additional costs to pursue an economic activity in an outermost regions or to prevent or reduce depopulation in very sparsely populated areas. |

|

17. |

Operating aid awarded to undertakings whose principal activity falls under Section K ‘Financial and insurance activities’ of the NACE Rev. 2 statistical classification of economic activities (18) or to undertakings that perform intra-group activities and whose principal activity falls under classes 70.10 ‘Activities of head offices’ or 70.22 ‘Business and other management consultancy activities’ of NACE Rev. 2 will not be considered to be compatible with the internal market. |

|

18. |

Regional aid may not be awarded to firms in difficulties, as defined for the purposes of these guidelines by the Community guidelines on State aid for rescuing and restructuring firms in difficulty (19), as amended or replaced. |

|

19. |

When assessing regional aid awarded to an undertaking which is subject to an outstanding recovery order following a previous Commission decision declaring an aid illegal and incompatible with the internal market, the Commission will take account of the amount of aid still to be recovered (20). |

1.2. Definitions

|

20. |

For the purposes of these guidelines, the following definitions apply:

|

2. NOTIFIABLE REGIONAL AID

|

21. |

In principle, Member States must notify regional aid pursuant to Article 108(3) (23) of the Treaty, with the exception of measures that fulfil the conditions laid down in a block exemption Regulation adopted by the Commission pursuant to Article 1 of Council Regulation (EC) No 994/98 of 7 May 1998 on the application of Articles 92 and 93 of the Treaty establishing the European Community to certain categories of horizontal State aid (Enabling Regulation) (24). |

|

22. |

The Commission will apply these guidelines to notified regional aid schemes and individual aid. |

|

23. |

Individual aid granted under a notified scheme remains subject to the notification obligation pursuant to Article 108(3) of the Treaty, if the aid from all sources exceeds the notification threshold (25) or if it is granted to a beneficiary that has closed down the same or similar activity in the EEA two years preceding the date of applying for aid or at the moment of aid application has the intention to close down such an activity within a period of two years after the investment to be subsidised is completed. |

|

24. |

Investment aid granted to a large undertaking to diversify an existing establishment in a ‘c’ area into new products, remains subject to the notification obligation pursuant to Article 108(3) of the Treaty. |

3. COMPATIBILITY ASSESSMENT OF REGIONAL AID

3.1. Common assessment principles

|

25. |

To assess whether a notified aid measure can be considered compatible with the internal market, the Commission generally analyses whether the design of the aid measure ensures that the positive impact of the aid towards an objective of common interest exceeds its potential negative effects on trade and competition. |

|

26. |

The Communication on State aid modernisation of 8 May 2012 called for the identification and definition of common principles applicable to the assessment of compatibility of all the aid measures carried out by the Commission. For this purpose, the Commission will consider an aid measure compatible with the Treaty only if it satisfies each of the following criteria:

|

|

27. |

The overall balance of certain categories of schemes may further be made subject to a requirement of ex post evaluation as described in Section 4 of these guidelines. In such cases, the Commission may limit the duration of those schemes (normally to four years or less) with a possibility to re-notify their prolongation afterwards. |

|

28. |

If a State aid measure or the conditions attached to it (including its financing method when the financing method forms an integral part of the State aid measure) entail a non-severable violation of EU law, the aid cannot be declared compatible with the internal market (26). |

|

29. |

In assessing the compatibility of any individual aid with the internal market, the Commission will take account of any proceedings concerning infringement to Article 101 or 102 of the Treaty which may concern the beneficiary of the aid and which may be relevant for its assessment under Article 107(3) of the Treaty (27). |

3.2. Contribution to a common objective

|

30. |

The primary objective of regional aid is to reduce the development gap between the different regions in the European Union. Through its equity or cohesion objective regional aid may contribute to the achievement of the Europe 2020 strategy delivering an inclusive and sustainable growth. |

3.2.1. Investment aid schemes

|

31. |

Regional aid schemes should form an integral part of a regional development strategy with clearly defined objectives and should be consistent with and contribute towards these objectives. |

|

32. |

This would be the case in particular for measures implemented in accordance with regional development strategies defined in the context of the European Regional Development Fund (ERDF), the European Social Fund, the Cohesion Fund, the European Agricultural Fund for Rural Development or the European Maritime and Fisheries Fund with a view to contributing towards the objectives of the Europe 2020 strategy. |

|

33. |

For aid schemes outside an operational programme financed from the cohesion policy funds, Member States should demonstrate that the measure is consistent and contributes to the development strategy of the area concerned. For this purpose, Member States can rely on evaluations of past State aid schemes, impact assessments made by the granting authorities, or expert opinions. To ensure that the aid scheme contributes to this development strategy, it must include a system that will enable the granting authorities to prioritise and select the investment projects according to the objectives of the scheme (for example, on the basis of a formal scoring approach) (28). |

|

34. |

Regional aid schemes may be put in place in ‘a’ areas to support initial investments of SMEs or of large undertakings. In ‘c’ areas schemes may be put in place to support initial investments of SMEs and initial investment in favour of new activity of large undertakings. |

|

35. |

When awarding aid to individual investment projects on the basis of a scheme, the granting authority must confirm that the selected project will contribute towards the objective of the scheme and thus towards the development strategy of the area concerned. For this purpose, Member State can rely on the information provided by the applicant for aid in the form annexed to these guidelines where the positive effects of the investment on the area concerned must be described (29). |

|

36. |

To ensure that the investment makes a real and sustained contribution to the development of the area concerned, the investment must be maintained in the area concerned for at least five years, or three years for SMEs, after its completion (30). |

|

37. |

If the aid is calculated on the basis of wage costs, the posts must be filled within three years of the completion of works. Each job created through the investment must be maintained within the area concerned for a period of five years from the date the post was first filled. For investments carried out by all SMEs, Member States may reduce this five-year period for the maintenance of an investment or jobs to a minimum of three years. |

|

38. |

To ensure that the investment is viable, the Member State must ensure that the beneficiary provides a financial contribution of at least 25 % (31) of the eligible costs, through its own resources or by external financing, in a form that is exempted of any public financial support (32). |

|

39. |

To avoid that State aid measures would lead to environmental harm, Member States must also ensure compliance with Union environmental legislation, including in particular the need to carry out an environmental impact assessment when required by law and ensure all relevant permits. |

3.2.2. Notified individual investment aid

|

40. |

To demonstrate the regional contribution of individual investment aid notified to the Commission, Member States may use a variety of indicators such as the ones mentioned below that can be both direct (for example. direct jobs created) and indirect (for example. local innovation):

|

|

41. |

Member States can also refer to the business plan of the aid beneficiary which could provide information on the number of jobs to be created, salaries to be paid (increase in household wealth as spill-over effect), volume of acquisition from local producers, turnover generated by the investment and benefiting the area possibly through additional tax revenues. |

|

42. |

For ad hoc aid (33), the Member State must demonstrate, in addition to the requirements laid down in paragraphs 35 to 39, that the project is coherent with and contributes towards the development strategy of the area concerned. |

3.2.3. Operating aid schemes

|

43. |

Operating aid schemes will promote the development of disadvantaged areas only if the challenges facing these areas are clearly identified in advance. The obstacles to attracting or maintaining economic activity may be so severe or permanent that investment aid alone is not sufficient to allow the development of those areas. |

|

44. |

As regards aid to reduce certain specific difficulties faced by SMEs in ‘a’ areas, the Member States concerned must demonstrate the existence and importance of those specific difficulties and must demonstrate that an operating aid scheme is needed as those specific difficulties cannot be overcome with investment aid. |

|

45. |

As regards operating aid to compensate certain additional costs in the outermost regions, the permanent handicaps which severely restrain the development of the outermost regions are set out in Article 349 of the Treaty and include remoteness, insularity, small size, difficult topography and climate, and economic dependence on a few products. The Member State concerned must however identify the specific additional costs related to these permanent handicaps that the operating aid scheme is intended to compensate. |

|

46. |

As regards operating aid to prevent or reduce depopulation in very sparsely populated areas, the Member State concerned must demonstrate the risk of depopulation of the relevant area in the absence of the operating aid. |

3.3. Need for State intervention

|

47. |

In order to assess whether State aid is necessary to achieve the objective of common interest, it is necessary first to diagnose the problem to be addressed. State aid should be targeted towards situations where aid can bring about a material improvement that the market cannot deliver itself. This holds especially in a context of scarce public resources. |

|

48. |

State aid measures can indeed, under certain conditions, correct market failures thereby contributing to the efficient functioning of markets and enhancing competitiveness. Furthermore, where markets provide efficient outcomes but these are deemed unsatisfactory from an equity or cohesion point of view, State aid may be used to obtain a more desirable, equitable market outcome. |

|

49. |

As regards aid granted for the development of areas included in the regional aid map in accordance with the rules developed in Section 5 of these guidelines, the Commission considers that the market is not delivering the expected cohesion objectives set out in the Treaty without state intervention. Therefore, aid granted in those areas should be considered compatible with the internal market pursuant to Article 107(3)(a) and (c) of the Treaty. |

3.4. Appropriateness of regional aid

|

50. |

The notified aid measure must be an appropriate policy instrument to address the policy objective concerned. An aid measure will not be considered compatible if other less distortive policy instruments or other less distortive types of aid instrument make it possible to achieve the same positive contribution to regional development. |

3.4.1. Appropriateness among alternative policy instruments

3.4.1.1.

|

51. |

Regional investment aid is not the only policy instrument available to Member States to support investment and job creation in disadvantaged regions. Member States can use other measures such as infrastructure development, enhancing the quality of education and training, or improvements in the business environment. |

|

52. |

Member States must indicate why regional aid is an appropriate instrument to tackle the common objective of equity or cohesion when introducing a scheme outside an operational programme financed from the cohesion policy funds. |

|

53. |

If a Member State decides to put in place a sectoral aid scheme outside an operational programme financed from the Union funds mentioned in paragraph 32 above, it must demonstrate the advantages of such an instrument compared to a multi-sectoral scheme or other policy options. |

|

54. |

The Commission will in particular take account of any impact assessments of the proposed aid scheme that the Member State may make available. Likewise, the results of ex post evaluations as described in Section 4 may be taken into account to assess the appropriateness of the proposed scheme. |

3.4.1.2.

|

55. |

For ad hoc aid, the Member State must demonstrate how the development of the area concerned is better ensured by such aid than by aid under a scheme or other types of measures. |

3.4.1.3.

|

56. |

The Member State must demonstrate that the aid is appropriate to achieve the objective of the scheme for the problems that the aid is intended to address. To demonstrate that the aid is appropriate, the Member State may calculate the aid amount ex ante as a fixed sum covering the expected additional costs over a given period, to incentivise undertakings to contain costs and develop their business in a more efficient manner over time (34). |

3.4.2. Appropriateness among different aid instruments

|

57. |

Regional aid can be awarded in various forms. The Member State should however ensure that the aid is awarded in the form that is likely to generate the least distortions of trade and competition. In this respect, if the aid is awarded in forms that provide a direct pecuniary advantage (for example, direct grants, exemptions or reductions in taxes, social security or other compulsory charges, or the supply of land, goods or services at favourable prices, etc.), the Member State must demonstrate why other potentially less distortive forms of aid such as repayable advances or forms of aid that are based on debt or equity instruments (for example, low-interest loans or interest rebates, state guarantees, the purchase of a share-holding or an alternative provision of capital on favourable terms) are not appropriate. |

|

58. |

For aid schemes implementing the objectives and priorities of operational programmes, the financing instrument chosen in this programme is considered to be an appropriate instrument. |

|

59. |

The results of ex post evaluations as described in Section 4 may be taken into account to assess the appropriateness of the proposed aid instrument. |

3.5. Incentive effect

|

60. |

Regional aid can only be found compatible with the internal market, if it has an incentive effect. An incentive effect is present when the aid changes the behaviour of an undertaking in a way it engages in additional activity contributing to the development of an area which it would not have engaged in without the aid or would only have engaged in such activity in a restricted or different manner or in another location. The aid must not subsidise the costs of an activity that an undertaking would have incurred in any event and must not compensate for the normal business risk of an economic activity. |

|

61. |

The existence of an incentive effect can be proven in two possible scenarios:

|

|

62. |

If the aid does not change the behaviour of the beneficiary by stimulating (additional) investment in the area concerned, it can be considered that the same investment would take place in the region even without the aid. Such aid lacks incentive effect to achieve the regional objective and cannot be approved as compatible with the internal market. |

|

63. |

However, for regional aid awarded through cohesion policy funds in ‘a’ regions to investments necessary to achieve standards set by Union law, the aid may be considered to have an incentive effect, if in absence of the aid, it would not have been sufficiently profitable for the beneficiary to make the investment in the area concerned, thereby leading to the closure of an existing establishment in that area. |

3.5.1. Investment aid schemes

|

64. |

Works on an individual investment can start only after submitting the application form for aid. |

|

65. |

If works begin before submitting the application form for aid, any aid awarded in respect of that individual investment will not be considered compatible with the internal market. |

|

66. |

Member States must introduce a standard application form for aid annexed to these guidelines (36). In the application form, SMEs and large companies must explain counterfactually what would have happened had they not received the aid indicating which of the scenarios described in paragraph 61 applies. |

|

67. |

In addition, large companies must submit documentary evidence in support of the counterfactual described in the application form. SMEs are not subject to such obligation. |

|

68. |

The granting authority must carry out a credibility check of the counterfactual and confirm that regional aid has the required incentive effect corresponding to one of the scenarios described in paragraph 61. A counterfactual is credible if it is genuine and relates to the decision-making factors prevalent at the time of the decision by the beneficiary regarding the investment. |

3.5.2. Notified individual investment aid

|

69. |

In addition to the requirements of paragraphs 64 to 67, for notified individual aid (37), the Member State must provide clear evidence that the aid effectively has an impact on the investment choice or the location choice (38). It must specify which scenario described in paragraph 61 applies. To allow a comprehensive assessment, the Member State must provide not only information concerning the aided project but also a comprehensive description of the counterfactual scenario, in which no aid is awarded to the beneficiary by any public authority in the EEA. |

|

70. |

In scenario 1, the Member State could prove the existence of the incentive effect of the aid by providing company documents that show that the investment would not be sufficiently profitable without the aid. |

|

71. |

In scenario 2, the Member State could prove the incentive effect of the aid by providing company documents showing that a comparison has been made between the costs and benefits of locating in the area concerned and those in alternative area(s). The Commission verifies whether such comparisons have a realistic basis. |

|

72. |

The Member States are, in particular, invited to rely on official board documents, risk assessments (including the assessment of location-specific risks), financial reports, internal business plans, expert opinions and other studies related to the investment project under assessment. Documents containing information on demand forecasts, cost forecasts, financial forecasts, documents that are submitted to an investment committee and that elaborate on various investment scenarios, or documents provided to the financial institutions could help the Member States to demonstrate the incentive effect. |

|

73. |

In this context, and in particular in scenario 1, the level of profitability can be evaluated by reference to methodologies which are standard practice in the particular industry concerned, and which may include methods to evaluate the net present value of the project (NPV) (39), the internal rate of return (IRR) (40) or the average return on capital employed (ROCE). The profitability of the project is to be compared with normal rates of return applied by the company in other investment projects of a similar kind. Where these rates are not available, the profitability of the project is to be compared with the cost of capital of the company as a whole or with the rates of return commonly observed in the industry concerned. |

|

74. |

If the aid does not change the behaviour of the beneficiary by stimulating (additional) investment in the area concerned, there is no positive effect for the region. Therefore, aid will not be considered compatible with the internal market in cases where it appears that the same investment would take place in the region even without the aid having been granted. |

3.5.3. Operating aid schemes

|

75. |

For operating aid schemes, the incentive effect of the aid will be considered to be present if it is likely that, in the absence of aid, the level of economic activity in the area or region concerned would be significantly reduced due to the problems that the aid is intended to address. |

|

76. |

The Commission will therefore consider that the aid induces additional economic activity in the areas or regions concerned, if the Member State has demonstrated the existence and substantial nature of those problems in the area concerned (see paragraphs 44 to 46). |

3.6. Proportionality of the aid amount (aid limited to the minimum)

|

77. |

In principle, the amount of the regional aid must be limited to the minimum needed to induce additional investment or activity in the area concerned. |

|

78. |

As a general rule, notified individual aid will be considered to be limited to the minimum, if the aid amount corresponds to the net extra costs of implementing the investment in the area concerned, compared to the counterfactual in the absence of aid. Likewise, in the case of investment aid granted to large undertakings under notified schemes, Member States must ensure that the aid amount is limited to the minimum on the basis of a ‘net-extra cost approach’. |

|

79. |

For scenario 1 situations (investment decisions) the aid amount should therefore not exceed the minimum necessary to render the project sufficiently profitable, for example to increase its IRR beyond the normal rates of return applied by the undertaking concerned in other investment projects of a similar kind or, when available, to increase its IRR beyond the cost of capital of the company as a whole or beyond the rates of return commonly observed in the industry concerned. |

|

80. |

In scenario 2 situations (location incentives), the aid amount should not exceed the difference between the net present value of the investment in the target area with the net present value in the alternative location. All relevant costs and benefits must be taken into account, including for example administrative costs, transport costs, training costs not covered by training aid and also wage differences. However, where the alternative location is in the EEA, subsidies granted in that other location are not to be taken into account. |

|

81. |

To ensure predictability and a level playing field, the Commission further applies maximum aid intensities (41) for investment aid. These maximum aid intensities serve a dual purpose. |

|

82. |

First, for notified schemes, these maximum aid intensities serve as safe harbours for SMEs: as long as the aid intensity remains below the maximum permissible, the criterion of ‘aid limited to the minimum’ is deemed to be fulfilled. |

|

83. |

Second, for all other cases, the maximum aid intensities are used as a cap to the net-extra costs approach described in paragraphs 79 and 80. |

|

84. |

The maximum aid intensities are modulated in function of three criteria:

|

|

85. |

Accordingly, higher aid intensities (and, potentially, higher resulting distortions of trade and competition) are allowed the less developed the target region is, and if the aid beneficiary is an SME. |

|

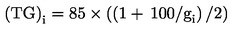

86. |

In view of the expected higher distortions of competition and trade, the maximum aid intensity for large investment projects must be scaled down using the mechanism as defined in paragraph 20(c). |

3.6.1. Investment aid schemes

|

87. |

For aid to SMEs, the increased maximum aid intensities described in Section 5.4 may be used. However, SMEs may not benefit from these increased intensities where the investment relates to a large investment project. |

|

88. |

For aid to large undertakings, the Member State must ensure that the aid amount corresponds to the net extra costs of implementing the investment in the area concerned, compared to the counterfactual in the absence of aid. The method explained in paragraphs 79 and 80 must be used together with maximum aid intensities as a cap. |

|

89. |

For aid to large investment projects, it must be ensured that the aid does not exceed the scaled down intensity. Where aid is awarded to a beneficiary for an investment that is considered to be part of a single investment project, the aid must be scaled down for the eligible costs exceeding EUR 50 million (42). |

|

90. |

The maximum aid intensity and aid amount per project must be calculated by the granting authority when awarding the aid. The aid intensity must be calculated on the basis of a gross grant equivalent either in relation to the total eligible costs of the investment or eligible wage costs declared by the aid beneficiary when applying for aid. |

|

91. |

If investment aid calculated on the basis of investment costs is combined with regional investment aid calculated on the basis of wage costs, the total aid must not exceed the highest aid amount resulting from either calculation up to the maximum permissible aid intensity for the area concerned. |

|

92. |

Investment aid may be awarded concurrently under several regional aid schemes or cumulated with ad hoc aid, provided that the total aid from all sources does not exceed the maximum permissible aid intensity per project that must be calculated in advance by the first granting authority. |

|

93. |

For an initial investment linked to European Territorial Cooperation (ETC) projects meeting the criteria of the Regulation laying down the specific provisions for the support of the European Regional Development Fund to the ETC cooperation goal (43), the aid intensity which applies to the area in which the initial investment is located will apply to all beneficiaries participating in the project. If the initial investment is located in two or more assisted areas, the maximum aid intensity for the initial investment will be the one applicable in the assisted area where the largest part of the eligible costs are incurred. Initial investments carried out by large undertakings in ‘c’ areas may only benefit from regional aid in the context of ETC projects if they are initial investments in favour of new activities or new products. |

3.6.1.1.

|

94. |

The assets acquired should be new, except for SMEs or in the case of acquisition of an establishment (44). |

|

95. |

For SMEs, up to 50 % of the costs of preparatory studies or consultancy costs linked to the investment may also be considered as eligible costs. |

|

96. |

For aid awarded for a fundamental change in the production process, the eligible costs must exceed the depreciation of the assets linked to the activity to be modernised in the course of the preceding three fiscal years. |

|

97. |

For aid awarded for a diversification of an existing establishment, the eligible costs must exceed by at least 200 % the book value of the assets that are reused, as registered in the fiscal year preceding the start of works. |

|

98. |

Costs related to the lease of tangible assets may be taken into account under the following conditions:

|

|

99. |

In the case of acquisition of an establishment only the costs of buying the assets from third parties unrelated to the buyer should be taken into consideration. The transaction must take place under market conditions. Where aid has already been granted for the acquisition of assets prior to their purchase, the costs of those assets should be deducted from the eligible costs related to the acquisition of an establishment. If the acquisition of an establishment is accompanied by an additional investment eligible for aid, the eligible costs of this latter investment should be added to the costs of purchase of the assets of the establishment. |

|

100. |

For large undertakings, costs of intangible assets are eligible only up to a limit of 50 % of the total eligible investment costs for the project. For SMEs, the full costs related to intangible assets may be taken into consideration. |

|

101. |

Intangible assets which are eligible for the calculation of the investments costs must remain associated with the assisted area concerned and must not be transferred to other regions. To this end, the intangible assets must fulfil the following conditions:

|

|

102. |

The intangible assets must be included in the assets of the undertaking receiving the aid and must remain associated with the project for which the aid is awarded for at least five years (three years for SMEs). |

3.6.1.2.

|

103. |

Regional aid may also be calculated by reference to the expected wage costs arising from job creation as a result of an initial investment. Aid can compensate only the wage costs of the person hired calculated over a period of two years and the resulting intensity cannot exceed the applicable aid intensity in the area concerned. |

3.6.2. Notified individual investment aid

|

104. |

For scenario 1 situations (investment decision) the Commission will verify whether the aid amount exceeds the minimum necessary to render the project sufficiently profitable, by using the method set out in paragraph 79. |

|

105. |

In scenario 2 situations (location decision), for a location incentive, the Commission will compare the net present value of the investment for the target area with the net present value of the investment in the alternative location, by using the method set out in paragraph 80. |

|

106. |

Calculations used for the analysis of the incentive effect can also be used to assess if the aid is proportionate. The Member State must demonstrate the proportionality on the basis of documentation such as that referred to in paragraph 72. |

|

107. |

The aid intensity must not exceed the permissible adjusted aid intensity. |

3.6.3. Operating aid schemes

|

108. |

The Member State must demonstrate that the level of the aid is proportionate to the problems that the aid is intended to address. |

|

109. |

In particular, the following conditions must be fulfilled:

|

|

110. |

As regards aid to compensate for certain additional costs in the outermost regions, the eligible costs must be fully attributable to one or several of the permanent handicaps referred to in Article 349 of the Treaty. Those additional costs must exclude transport costs and any additional costs that may be attributable to other factors and must be quantified in relation to the level of costs incurred by similar undertakings established in other regions of the Member State concerned. |

|

111. |

As regards aid to reduce certain specific difficulties faced by SMEs in ‘a’ areas, the level of the aid must be progressively reduced over the duration of the scheme (45). |

3.7. Avoidance of undue negative effects on competition and trade

|

112. |

For the aid to be compatible, the negative effects of the aid measure in terms of distortions of competition and impact on trade between Member States must be limited and outweighed by the positive effects in terms of contribution to the objective of common interest. Certain situations can be identified where the negative effects manifestly outweigh any positive effects, meaning that the aid cannot be found compatible with the internal market. |

3.7.1. General considerations

|

113. |

Two main potential distortions of competition and trade may be caused by regional aid. These are product market distortions and location effects. Both types may lead to allocative inefficiencies (undermining the economic performance of the internal market) and to distributional concerns (distribution of economic activity across regions). |

|

114. |

One potentially harmful effect of State aid is that it prevents the market mechanism from delivering efficient outcomes by rewarding the most efficient producers and putting pressure on the least inefficient to improve, restructure or exit the market. A substantial capacity expansion induced by State aid in an underperforming market might in particular unduly distort competition, as the creation or maintenance of overcapacity could lead to a squeeze on profit margins, a reduction of competitors’ investments or even the exit of competitors from the market. This might lead to a situation where competitors that would otherwise be able to stay on the market are forced out of the market. It may also prevent undertakings from entering or expanding in the market and it may weaken incentives for competitors to innovate. This results in inefficient market structures which are also harmful to consumers in the long run. Further, the availability of aid may induce complacent or unduly risky behaviour on the part of potential beneficiaries. The long term run effect on the overall performance of the sector is likely to be negative. |

|

115. |

Aid may also have distortive effects in terms of increasing or maintaining substantial market power on the part of the beneficiary. Even where aid does not strengthen substantial market power directly, it may do so indirectly, by discouraging the expansion of existing competitors or inducing their exit or discouraging the entry of new competitors. |

|

116. |

Apart from distortions on the product markets, regional aid by nature also affects the location of economic activity. Where one area attracts an investment due to the aid, another area loses out on that opportunity. These negative effects in the areas adversely affected by aid may be felt through lost economic activity and lost jobs including those at the level of subcontractors. It may also be felt in a loss of positive externalities (for example, clustering effect, knowledge spillovers, education and training, etc.). |

|

117. |

The geographical specificity of regional aid distinguishes it from other forms of horizontal aid. It is a particular characteristic of regional aid that it is intended to influence the choice made by investors about where to locate investment projects. When regional aid off-sets the additional costs stemming from the regional handicaps and supports additional investment in assisted areas without attracting it away from other assisted areas, it contributes not only to the development of the region, but also to cohesion and ultimately benefits the whole Union. With regard to the potential negative location effects of regional aid, these are already limited to a certain degree by regional aid maps, which define exhaustively the areas where regional aid may be granted, taking account of the equity and cohesion policy objectives, and the maximum permissible aid intensities. However, an understanding of what would have happened in the absence of the aid remains important to appraise the actual impact of the aid in the cohesion objective. |

3.7.2. Manifest negative effects

|

118. |

The Commission identifies a number of situations where the negative effects of the aid manifestly outweigh any positive effects, so that the aid cannot be declared compatible with the internal market. |

|

119. |

The Commission establishes maximum aid intensities. These constitute a basic requirement for compatibility, the aim of which is to prevent the use of State aid for projects where the ratio between aid amount and eligible costs is considered very high and particularly likely to be distortive. In general, the greater the positive effects to which the aided project is likely to give rise and the higher the likely need for aid, the higher the cap on aid intensity will be. |

|

120. |

For scenario 1 cases (investment decisions), where the creation of capacity by the project takes place in a market which is structurally in absolute decline, the Commission considers it to be a negative effect, which is unlikely to be compensated by any positive effect. |

|

121. |

In scenario 2 cases (location decisions), where without aid the investment would have been located in a region with a regional aid intensity which is higher or the same as the target region this will constitute a negative effect that is unlikely to be compensated by any positive effect because it runs counter to the very rationale of regional aid (46). |

|

122. |

Where the beneficiary closes down the same or a similar activity in another area in the EEA and relocates that activity to the target area, if there is a causal link between the aid and the relocation, this will constitute a negative effect that is unlikely to be compensated by any positive elements. |

|

123. |

When appraising notified measures, the Commission will request all necessary information to consider whether the State aid would result in a substantial loss of jobs in existing locations within the EEA. |

3.7.3. Investment aid schemes

|

124. |

Investment aid schemes must not lead to significant distortions of competition and trade. In particular, even where distortions may be considered limited at an individual level (provided all conditions for investment aid are fulfilled), on a cumulative basis schemes might still lead to high levels of distortions. Such distortions might concern the output markets by creating or aggravating a situation of overcapacity or creating, increasing or maintaining the substantial market power of some recipients in a way that will negatively affect dynamic incentives. Aid available under schemes might also lead to a significant loss of economic activity in other areas of the EEA. In case of a scheme focussing on certain sectors, the risk of such distortions is even more pronounced. |

|

125. |

Therefore, the Member State has to demonstrate that these negative effects will be limited to the minimum taking into account, for example, the size of the projects concerned, the individual and cumulative aid amounts, the expected beneficiaries as well as the characteristics of the targeted sectors. In order to enable the Commission to assess the likely negative effects, the Member State could submit any impact assessment at its disposal as well as ex-post evaluations carried out for similar predecessor schemes. |

|

126. |

When awarding aid under a scheme to individual projects, the granting authority must verify and confirm that the aid does not result in the manifest negative effects described in paragraph 121. This verification can be based on the information received from the beneficiary when applying for aid and on the declaration made in the standard application form for aid where the alternative location in absence of aid should be indicated. |

3.7.4. Notified individual investment aid

|

127. |

In appraising the negative effects of notified aid, the Commission distinguishes between the two counterfactual scenarios described in paragraphs 104 and 105 above. |

3.7.4.1.

|

128. |

In scenario 1 cases, the Commission places particular emphasis on the negative effects linked with the build-up of overcapacity in declining industries, the prevention of exit, and the notion of substantial market power. These negative effects are described below in paragraphs 129 to 138 and must be counterbalanced with the positive effects of the aid. However, if it is established that the aid would result in the manifest negative effects described in paragraph 120 the aid cannot be found compatible with the internal market because it is unlikely to be compensated by any positive element. |

|

129. |

In order to identify and assess the potential distortions of competition and trade, Member States should provide evidence permitting the Commission to identify the product markets concerned (that is to say, products affected by the change in behaviour of the aid beneficiary) and to identify the competitors and customers/consumers affected. |

|

130. |

The Commission will use various criteria to assess these potential distortions, such as market structure of the product concerned, performance of the market (declining or growing market), process for selection of the aid beneficiary, entry and exit barriers, product differentiation. |

|

131. |

A systematic reliance on State aid by an undertaking might indicate that the undertaking is not able to withstand competition on its own or that it enjoys undue advantages compared to its competitors. |

|

132. |

The Commission distinguishes two main sources of potential negative effects on product markets:

|

|

133. |

In order to evaluate whether the aid may serve to create or maintain inefficient market structures, the Commission will take into account the additional production capacity created by the project and whether the market is underperforming. |

|

134. |

Where the market in question is growing, there is normally less reason to be concerned that the aid will negatively affect dynamic incentives or will unduly impede exit or entry. |

|

135. |

More concern is warranted when markets are in decline. In this respect the Commission distinguishes between cases for which, from a long-term perspective, the relevant market is structurally in decline (that is to say, shows a negative growth rate), and cases for which the relevant market is in relative decline (that is to say, shows a positive growth rate, but does not exceed a benchmark growth rate). |

|

136. |

Underperformance of the market will normally be measured compared to the EEA GDP over the last three years before the start of the project (benchmark rate); it can also be established on the basis of projected growth rates in the coming three to five years. Indicators may include the foreseeable future growth of the market concerned and the resulting expected capacity utilisation rates, as well as the likely impact of the capacity increase on competitors through its effects on prices and profit margins. |

|

137. |

In certain cases, assessing the growth of the product market in the EEA may not be appropriate to entirely assess the effects of aid, in particular if the geographic market is worldwide. In such cases, the Commission will consider the effect of the aid on the market structures concerned, in particular, its potential to crowd out producers in the EEA. |

|

138. |

In order to evaluate the existence of substantial market power, the Commission will take into account the position of the beneficiary over a period of time before receiving the aid and the expected market position after finalising the investment. The Commission will take account of market shares of the beneficiary, as well as of market shares of its competitors and other relevant factors, including, for example the market structure by looking at the concentration in the market, possible barriers to entry (47), buyer power (48) and barriers to expansion or exit. |

3.7.4.2.

|

139. |

If the counterfactual analysis suggests that without the aid the investment would have gone ahead in another location (scenario 2) which belongs to the same geographical market considering the product concerned, and if the aid is proportional, possible outcomes in terms of overcapacity or substantial market power would in principle be the same regardless of the aid. In such cases, the positive effects of the aid are likely to outweigh the limited negative effects on competition. However, where the alternative location is in the EEA, the Commission is particularly concerned with negative effects linked with the alternative location and therefore if the aid results in the manifest negative effects described in paragraphs 121 and 122 the aid cannot be found compatible with the internal market because it is unlikely to be compensated by any positive element. |

3.7.5. Operating aid schemes

|

140. |

If the aid is necessary and proportional to achieve the common objective described in subsection 3.2.3, the negative effects of the aid are likely to be compensated by positive effects. However, in some cases, the aid may result in changes to the structure of the market or to the characteristics of a sector or industry which could significantly distort competition through barriers to market entry or exit, substitution effects, or displacement of trade flows. In those cases, the identified negative effects are unlikely to be compensated by any positive effects. |

3.8. Transparency

|

141. |

Member States must publish on a central website, or on a single website retrieving information from several websites (for example, regional websites), at least the following information on the notified State aid measures: the text of the notified aid scheme and its implementing provisions, granting authority, individual beneficiaries, aid amount per beneficiary, and aid intensity. These requirements apply to individual aid granted under notified schemes and as well as for ad hoc aid. Such information must be published after the granting decision has been taken, must be kept for at least 10 years and must be available for the general public without restrictions (49). |

4. EVALUATION

|

142. |

To further ensure that distortions of competition and trade are limited, the Commission may require that certain schemes be subject to a time limitation (of normally four years or less) and to the evaluation referred to in paragraph 27. |

|

143. |

Evaluations will be carried out for schemes where the potential distortions are particularly high, that is to say, that may restrict competition significantly, if their implementation is not reviewed in due time. |

|

144. |

Given the objectives of the evaluation and in order not to impose disproportionate burden on Member States in respect of smaller aid amounts, this obligation may be imposed only for aid schemes with large aid budgets, containing novel characteristics or when significant market, technology or regulatory changes are foreseen. The evaluation must be carried out by an expert independent from the State aid granting authority on the basis of a common methodology (50) and must be made public. The evaluation must be submitted to the Commission in sufficient time to allow for the assessment of the possible prolongation of the aid scheme and in any case upon expiry of the scheme. The precise scope and the methodology of this evaluation to be carried out will be defined in the decision approving the aid scheme. Any subsequent aid measure with a similar objective must take into account the results of the evaluation. |

5. REGIONAL AID MAPS

|

145. |

In this section, the Commission lays down the criteria for identifying the areas that fulfil the conditions of Article 107(3)(a) and (c) of the Treaty. The areas that fulfil these conditions and which a Member State wishes to designate as ‘a’ or ‘c’ areas must be identified in a regional aid map which must be notified to the Commission and approved by the Commission before regional aid can be awarded to undertakings located in the designated areas. The maps must also specify the maximum aid intensities applicable in these areas. |

5.1. Population coverage eligible for regional aid

|

146. |

Given that the award of regional State aid derogates from the general prohibition of State aid laid down in Article 107(1) of the Treaty, the Commission considers that the combined population of ‘a’ and ‘c’ areas in the Union must be lower than that of the non-designated areas. The total coverage of those designated areas should therefore be less than 50 % of the Union’s population. |

|

147. |

In the Guidelines on national regional aid for 2007-2013 (51) the overall coverage of the ‘a’ and ‘c’ areas was set at 42 % of the EU-25 population (45,5 % of the EU-27 population). The Commission considers that this initial level of overall population coverage should be adapted to reflect the current difficult economic situation of many Member States. |

|

148. |

Accordingly, the overall coverage ceiling of the ‘a’ and ‘c’ areas should be set at 46,53 % of the EU-27 population for the period 2014-2020 (52). |

5.2. The derogation in Article 107(3)(a)

|

149. |

Article 107(3)(a) of the Treaty provides that ‘aid to promote the economic development of areas where the standard of living is abnormally low or where there is serious underemployment, and of the regions referred to in Article 349, in view of their structural, economic and social situation’ may be considered to be compatible with the internal market. According to the Court of Justice, ‘the use of the words “abnormally” and “serious” in Article (107)(3)(a) shows that the exemption concerns only areas where the economic situation is extremely unfavourable in relation to the [Union] as a whole’ (53). |

|

150. |

The Commission considers that the conditions of Article 107(3)(a) of the Treaty are fulfilled in NUTS 2 regions (54) that have a gross domestic product (GDP) per capita below or equal to 75 % of the Union’s average (55). |

|

151. |

Accordingly, a Member State may designate the following areas as ‘a’ areas:

|

|

152. |

The eligible ‘a’ areas are set out by Member State in Annex I. |

5.3. The derogation in Article 107(3)(c)

|

153. |

Article 107(3)(c) of the Treaty provides that ‘aid to facilitate the development of certain economic activities or of certain economic areas, where such aid does not adversely affect trading conditions to an extent contrary to the common interest’ may be considered to be compatible with the internal market. According to the Court of Justice, ‘[t]he exemption in Article (107)(3)(c) […] permits the development of certain areas without being restricted by the economic conditions laid down in Article (107)(3)(a), provided such aid “does not adversely affect trading conditions to an extent contrary to the common interest” ’. That provision gives the Commission power to authorise aid intended to further the economic development of areas of a Member State which are disadvantaged in relation to the national average’ (58). |

|

154. |

The total coverage ceiling for ‘c’ areas in the Union (‘ “c” coverage’) is obtained by subtracting the population of the eligible ‘a’ areas in the Union from the overall coverage ceiling laid down in paragraph 148. |

|

155. |

There are two categories of ‘c’ areas:

|

5.3.1. Predefined ‘c’ areas

5.3.1.1.

|

156. |

The Commission considers that each Member State concerned must have sufficient ‘c’ coverage to be able to designate as ‘c’ areas the regions that were ‘a’ areas in the regional aid map during the period 2011-2013 (59). |

|

157. |

The Commission also considers that each Member State concerned must have sufficient ‘c’ coverage to be able to designate as ‘c’ areas the regions that have a low population density. |

|

158. |

Accordingly, the following areas will be considered as predefined ‘c’ areas:

|

|

159. |

The specific allocation of predefined ‘c’ coverage is set out by Member State in Annex I. This specific population allocation may only be used to designate predefined ‘c’ areas. |

5.3.1.2.

|

160. |

A Member State may designate as ‘c’ areas the predefined ‘c’ areas referred to in paragraph 158. |

|

161. |

For sparsely populated areas, a Member State should in principle designate NUTS 2 regions with less than 8 inhabitants per km2 or NUTS 3 regions with less than 12,5 inhabitants per km2. However, a Member State may designate parts of NUTS 3 regions with less than 12,5 inhabitants per km2 or other contiguous areas adjacent to those NUTS 3 regions, provided that the areas designated have less than 12,5 inhabitants per km2 and that their designation does not exceed the specific allocation of ‘c’ coverage referred to in paragraph 160. |

5.3.2. Non-predefined ‘c’ areas

5.3.2.1.

|

162. |

The total coverage ceiling for non-predefined ‘c’ areas in the Union is obtained by subtracting the population of the eligible ‘a’ areas and of the predefined ‘c’ areas from the overall coverage ceiling laid down in paragraph 148. The non-predefined ‘c’ coverage is allocated among the Member States by applying the method set out in Annex II. |

5.3.2.2.

|

163. |

To address the difficulties of Member States that have been particularly affected by the economic crisis, the Commission considers that the total coverage of each Member State that is benefitting from financial assistance under the facility providing medium-term financial assistance for non-euro-area Member States, as established by Council Regulation (EC) No 332/2002 (61), the European Financial Stability Facility (EFSF) (62), the European Financial Stabilisation Mechanism (EFSM) (63) or the European Stability Mechanism (ESM) (64) should not be reduced compared to the period 2007-2013. |

|

164. |

To ensure continuity in the regional aid maps and a minimum scope of action for all Member States, the Commission considers that each Member State should not lose more than half of its total coverage compared to the period 2007-2013 and that each Member State should have a minimum population coverage. |

|

165. |

Accordingly, by way of derogation from the overall coverage ceiling laid down in paragraph 148, the ‘c’ coverage for each Member State concerned is increased as necessary so that:

|

|

166. |

The non-predefined ‘c’ coverage, including the safety net and the minimum population coverage, is set out by Member State in Annex I. |

5.3.2.3.

|

167. |

The Commission considers that the criteria used by Member States for designating ‘c’ areas should reflect the diversity of situations in which the award of regional aid may be justified. The criteria should therefore address certain socioeconomic, geographical or structural problems likely to be encountered in ‘c’ areas and should provide sufficient safeguards that the award of regional State aid will not adversely affect trading conditions to an extent contrary to the common interest. |

|

168. |

Accordingly, a Member State may designate as ‘c’ areas the non-predefined ‘c’ areas defined on the basis of the following criteria:

|

|

169. |

For the purpose of applying the criteria set out in paragraph 168, the notion of contiguous areas refers to whole local administrative unit 2 (LAU 2) (73) areas or to a group of whole LAU 2 areas (74). A group of LAU 2 areas will be considered to form a contiguous area if each of those areas in the group shares an administrative border with another area in the group (75). |

|

170. |

Compliance with the population coverage allowed for each Member State will be determined on the basis of the most recent data on the total resident population of the areas concerned, as published by the national statistical office. |

5.4. Maximum aid intensities applicable to regional investment aid

|

171. |

The Commission considers that the maximum aid intensities applicable to regional investment aid must take into account the nature and scope of the disparities between the levels of development of the different regions in the Union. The aid intensities should therefore be higher in ‘a’ areas than in ‘c’ areas. |

5.4.1. Maximum aid intensities in ‘a’ areas

|

172. |

The aid intensity in ‘a’ areas must not exceed:

|

|

173. |

The maximum aid intensities laid down in paragraph 172 may be increased by up to 20 percentage points in outermost regions that have a GDP per capita below or equal to 75 % of the EU-27 average or by up to 10 percentage points in other outermost regions. |

5.4.2. Maximum aid intensities in ‘c’ areas

|

174. |

The aid intensity must not exceed:

|

|

175. |

In the former ‘a’ areas the aid intensity of 10 % GGE may be increased by up to 5 percentage points from 1 July 2014 to 31 December 2017. |

|

176. |

If a ‘c’ area is adjacent to an ‘a’ area, the maximum aid intensity in the NUTS 3 regions or parts of NUTS 3 regions within that ‘c’ area which are adjacent to the ‘a’ area may be increased as necessary so that the difference in aid intensity between the two areas does not exceed 15 percentage points. |

5.4.3. Increased aid intensities for SMEs

|

177. |

The maximum aid intensities laid down in subsections 5.4.1 and 5.4.2 may be increased by up to 20 percentage points for small enterprises or by up to 10 percentage points for medium-sized enterprises (76). |

5.5. Notification and declaration of compatibility

|

178. |

Following the publication of these guidelines in the Official Journal of the European Union, each Member State should notify to the Commission a single regional aid map applicable from 1 July 2014 to 31 December 2020. Each notification should include the information specified in the form in Annex III. |

|

179. |

The Commission will examine each notified regional aid map on the basis of these guidelines and will adopt a decision approving the regional aid map for the Member State concerned. Each regional aid map will be published in the Official Journal of the European Union and will constitute an integral part of these guidelines. |

5.6. Amendments

5.6.1. Population reserve

|

180. |

On its own initiative, a Member State may decide to establish a reserve of national population coverage consisting of the difference between the population coverage ceiling for that Member State, as allocated by the Commission (77), and the coverage used for the ‘a’ and ‘c’ areas designated in its regional aid map. |

|

181. |

If a Member State has decided to establish such a reserve, it may, at any time, use the reserve to add new ‘c’ areas in its map until its national coverage ceiling is reached. For this purpose, the Member State may refer to the most recent socioeconomic data provided by Eurostat or by its national statistical office or other recognised sources. The population of the ‘c’ areas concerned should be calculated on the basis of the population data used for establishing the initial map. |

|

182. |

The Member State must notify the Commission each time it intends to use its population reserve to add new ‘c’ areas prior to putting into effect such amendments. |

5.6.2. Mid-term review

|

183. |

The Commission will establish in June 2016 (78), whether any NUTS 2 region (79), which is not listed in Annex I to these guidelines as an ‘a’ area, has a GDP per capita below 75 % of the EU-28 average, and will publish a communication on the results of this analysis. The Commission will establish at that moment whether these identified areas may become eligible for regional aid under Article 107(3)(a) of the Treaty and the level of the aid intensity corresponding to their GDP per capita. If these identified areas are designated either as pre-defined ‘c’ areas or as non-predefined ‘c’ areas in the national regional aid map approved by the Commission in accordance with these guidelines, the percentage of the specific population allocation for ‘c’ areas indicated in Annex I will be adjusted accordingly. The Commission will publish the amendments to Annex I. A Member State may, within the limit of its adjusted specific allocation for ‘c’ areas (80), amend the list of ‘c’ areas contained in its regional aid map for the period from 1 January 2017 to 31 December 2020. These amendments may not exceed 50 % of each Member State’s adjusted ‘c’ coverage. |

|

184. |

For the purpose of amending the list of ‘c’ areas, the Member State may refer to data on GDP per capita and unemployment rate provided by Eurostat or by its national statistical office or other recognised sources, using the average of the last three years for which such data are available (at the moment of the notification of the amended map). The population of the ‘c’ areas concerned should be calculated on the basis of the population data used for establishing the initial map. |

|

185. |

The Member State must notify the amendments to its map resulting from the inclusion of additional ‘a’ areas and from the exchange of ‘c’ areas to the Commission prior to putting them into effect and by 1 September 2016 at the latest. |

6. APPLICABILITY OF REGIONAL AID RULES

|

186. |

The Commission extends the guidelines on national regional aid for 2007-2013 (81) and the Communication concerning the criteria for an in-depth assessment of regional aid to large investment projects (82) until 30 June 2014. |

|

187. |

The regional aid maps approved on the basis of the guidelines on national regional aid for 2007-2013 expire on 31 December 2013. The transition period of six months laid down in Article 44(3) of the general block exemption regulation (GBER) (83) therefore does not apply to regional aid schemes implemented under the GBER. To grant regional aid after 31 December 2013 on the basis of existing block exempted schemes, Member States are invited to notify the prolongation of the regional aid maps in due time to allow the Commission to approve a prolongation of those maps before 31 December 2013. In general, the schemes approved on the basis of the regional aid guidelines 2007-2013 expire at the end of 2013 as stated in the corresponding Commission decision. Any prolongation of such schemes must be notified to the Commission in due time. |

|

188. |

The Commission will apply the principles set out in these guidelines for assessing the compatibility of all regional aid intended to be awarded after 30 June 2014. Regional aid awarded unlawfully or regional aid intended to be awarded after 31 December 2013 and before 1 July 2014 will be assessed in accordance with the guidelines on national regional aid for 2007-2013. |

|

189. |

Since they must be consistent with the regional aid map, notifications of regional aid schemes or of aid measures intended to be awarded after 30 June 2014, cannot be considered complete until the Commission has adopted a decision approving the regional aid map for the Member State concerned in accordance with the arrangements described in subsection 5.5. Accordingly, the Commission will in principle not examine notifications of regional aid schemes which are intended to apply after 30 June 2014 or notifications of individual aid intended to be awarded after that date before it has adopted a decision approving the regional aid map for the Member State concerned. |

|

190. |

The Commission considers that the implementation of these guidelines will lead to substantial changes in the rules applicable to regional aid in the Union. Furthermore, in the light of the changed economic and social conditions in the Union, it appears necessary to review the continuing justification for and effectiveness of all regional aid schemes, including both investment aid and operating aid schemes. |

|

191. |

For these reasons, the Commission proposes the following appropriate measures to Member States pursuant to Article 108(1) of the Treaty:

|

7. REPORTING AND MONITORING

|

192. |

In accordance with Council Regulation (EC) No 659/1999 of 22 March 1999 laying down detailed rules for the application of Article 93 of the EC Treaty and Commission Regulation (EC) No 794/2004 of 21 April 2004 implementing Regulation (EC) No 659/1999, Member States must submit annual reports to the Commission. |

|

193. |

Member States shall transmit to the Commission information on each individual aid exceeding EUR 3 million granted under a scheme, in the format laid down in Annex VI, within 20 working days from the day on which the aid is granted. |

|

194. |

Member States must maintain detailed records regarding all aid measures. Such records must contain all information necessary to establish that the conditions regarding eligible costs and maximum aid intensities have been fulfilled. These records must be maintained for 10 years from the date of award of the aid and must be provided to the Commission upon request. |

8. REVISION

|

195. |

The Commission may decide to amend these guidelines at any time if this should be necessary for reasons associated with competition policy or to take account of other Union policies and international commitments or for any other justified reason. |

(1) Areas eligible for regional aid under Article 107(3)(a) of the Treaty, commonly referred to as ‘a’ areas, tend to be the more disadvantaged within the Union in terms of economic development. Areas eligible under Article 107(3)(c) of the Treaty, referred to as ‘c’ areas, also tend to be disadvantaged but to a lesser extent.

(2) Regional top-ups for aid granted for such purposes are therefore not considered as regional aid.

(3) Each MemberStatemay identify these areas in a regional aid map on the basis of the conditions laid down in Section 5.

(4) See in this respect Case 730/79, Philip Morris [1980], ECR 2671, paragraph 17 and in Case C-169/95, Spain v Commission [1997], ECR I-148, paragraph 20.

(5) See in this respect Case T-380/94, AIUFFASS and AKT v Commission [1996], ECR II-2169, paragraph 54.

(6) Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of regions EU State Aid Modernisation (SAM), COM/2012/0209 final.

(7) As defined in Annex IV.

(8) As defined in Annex IV.

(9) Following the expiry on 31 December 2013 of the Framework on State aid to shipbuilding (OJ C 364, 14.12.2011, p. 9.), regional aid to shipbuilding is also covered by these guidelines.

(10) As covered by Council Regulation (EC) No 104/2000 of 17 December 1999 on the common organisation of the markets in fishery and aquaculture products (OJ L 17, 21.1.2000, p. 22).

(11) State aid for the primary production, processing and marketing of agricultural products resulting in agricultural products listed in Annex I to the Treaty and forestry is subject to rules laid down in the Guidelines for State aid in the agricultural sector.

(12) Transport means transport of passengers by aircraft, maritime transport, road, railway and by inland waterway or freight transport services for hire or reward.

(13) Community guidelines on the application of Articles 92 and 93 of the EC Treaty and Article 61 of the EEA Agreement to State aid to the aviation sector (OJ C 350, 10.12.1994, p. 5.), Community guidelines on financing of airports and start-up aid to airlines departing from regional airports (OJ C 312, 9.12.2005, p. 1.) as amended or replaced.

(14) The Commission will assess the compatibility of State aid to the energy sector on the basis of the future energy and environmental aid guidelines, amending the current guidelines on State aid for environmental protection, where the specific handicaps of the assisted areas will be taken into account.

(15) Communication from the Commission, EU Guidelines for the application of State aid rules in relation to the rapid deployment of broadband networks (OJ C 25, 26.1.2013, p. 1).

(16) As defined in Council Regulation (EC) No 723/2009 of 25 June 2009 on the Community legal framework for a European Research Infrastructure Consortium (ERIC) (OJ L 206, 8.8.2009, p. 1).

(17) See, paragraph 20(i).