ISSN 1977-1053

Euroopan unionin

virallinen lehti

C 406

Suomenkielinen laitos

Tiedonantoja ja ilmoituksia

59. vuosikerta

4. marraskuuta 2016

|

ISSN 1977-1053 |

||

|

Euroopan unionin virallinen lehti |

C 406 |

|

|

||

|

Suomenkielinen laitos |

Tiedonantoja ja ilmoituksia |

59. vuosikerta |

|

Ilmoitusnumero |

Sisältö |

Sivu |

|

|

II Tiedonannot |

|

|

|

EUROOPAN UNIONIN TOIMIELINTEN, ELINTEN, TOIMISTOJEN JA VIRASTOJEN TIEDONANNOT |

|

|

|

Euroopan komissio |

|

|

2016/C 406/01 |

Euroopan unionin toiminnasta tehdyn sopimuksen 107 ja 108 artiklan mukaisen valtiontuen hyväksyminen — Tapaukset, joita komissio ei vastusta ( 1 ) |

|

|

2016/C 406/02 |

Euroopan unionin toiminnasta tehdyn sopimuksen 107 ja 108 artiklan mukaisen valtiontuen hyväksyminen — Tapaukset, joita komissio ei vastusta ( 2 ) |

|

|

V Ilmoitukset |

|

|

|

KILPAILUPOLITIIKAN TOTEUTTAMISEEN LIITTYVÄT MENETTELYT |

|

|

|

Euroopan komissio |

|

|

2016/C 406/03 |

Valtiontuki – Saksa — Valtiontuki SA.42393 (2016/C) (ex 2015/N) Yhteistuotantotuen uudistus Saksassa — Kehotus huomautusten esittämiseen Euroopan unionin toiminnasta tehdyn sopimuksen 108 artiklan 2 kohdan mukaisesti ( 1 ) |

|

|

2016/C 406/04 |

Valtiontuki – Puola — Valtiontuki SA.44351 (2016/C) (ex 2016/NN) – Puolan vähittäiskauppavero — Kehotus huomautusten esittämiseen Euroopan unionin toiminnasta tehdyn sopimuksen 108 artiklan 2 kohdan mukaisesti ( 1 ) |

|

|

2016/C 406/05 |

|

|

|

|

|

(1) ETA:n kannalta merkityksellinen teksti |

|

|

(2) ETA:n kannalta merkityksellinen teksti perustamissopimuksen liitteeseen I kuuluvia tuotteita lukuun ottamatta |

|

FI |

|

II Tiedonannot

EUROOPAN UNIONIN TOIMIELINTEN, ELINTEN, TOIMISTOJEN JA VIRASTOJEN TIEDONANNOT

Euroopan komissio

|

4.11.2016 |

FI |

Euroopan unionin virallinen lehti |

C 406/1 |

Euroopan unionin toiminnasta tehdyn sopimuksen 107 ja 108 artiklan mukaisen valtiontuen hyväksyminen

Tapaukset, joita komissio ei vastusta

(ETA:n kannalta merkityksellinen teksti)

(2016/C 406/01)

|

Päätöksen tekopäivä |

13.04.2015 |

|||

|

Tuen numero |

SA.38085 (2013/N) |

|||

|

Jäsenvaltio |

Italia |

|||

|

Alue |

— |

107 artiklan 3 kohdan c alakohta |

||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

Regime di imposizione sulla base del tonnelaggio per il trasporto marittimo |

|||

|

Oikeusperusta |

Riferimento legislativo – Titolo II, Capo VI del T.U.I.R., di cui al D.P.R. 22 dicembre 1986, n. 917 come modificato dal decreto legislativo 12 dicembre 2003, n. 344 |

|||

|

Toimenpidetyyppi |

Ohjelma |

— |

||

|

Tarkoitus |

Alakohtainen kehitys |

|||

|

Tuen muoto |

Veropohjan alennus |

|||

|

Talousarvio |

Kokonaistalousarvio: EUR 135 (miljoonaa) Vuotuinen talousarvio: EUR 13,5 (miljoonaa) |

|||

|

Tuen intensiteetti |

% |

|||

|

Kesto |

01.01.2014 – 31.12.2023 |

|||

|

Toimiala |

Meri- ja rannikkovesiliikenteen henkilökuljetus, Meri- ja rannikkovesiliikenteen tavarakuljetus |

|||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||

|

Muita tietoja |

— |

|||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

19.01.2016 |

|||

|

Tuen numero |

SA.38757 (2015/NN) |

|||

|

Jäsenvaltio |

Ruotsi |

|||

|

Alue |

VAESTERBOTTENS LAEN |

— |

||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

SGEI-stöd till Skellefteå Airport |

|||

|

Oikeusperusta |

Förordnande av tjänst av allmänt ekonomiskt intresse |

|||

|

Toimenpidetyyppi |

tapauskohtaiselle tuelle |

Skellefteå City Airport AB |

||

|

Tarkoitus |

Yleistä taloudellista etua koskevat palvelut |

|||

|

Tuen muoto |

Suora avustus |

|||

|

Talousarvio |

— |

|||

|

Tuen intensiteetti |

% |

|||

|

Kesto |

01.01.2014 – 31.12.2023 |

|||

|

Toimiala |

Matkustajalentoliikenne |

|||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||

|

Muita tietoja |

— |

|||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

22.01.2015 |

|||

|

Tuen numero |

SA.38796 (2014/N) |

|||

|

Jäsenvaltio |

Yhdistynyt kuningaskunta |

|||

|

Alue |

— |

— |

||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

Investment Contract for Teesside Renewable Energy Project Dedicated Biomass with Combined Heat and Power |

|||

|

Oikeusperusta |

Energy Act 2013 |

|||

|

Toimenpidetyyppi |

Yksittäinen tuki |

MGT Teesside Limited |

||

|

Tarkoitus |

Ympäristönsuojelu, Energian säästö |

|||

|

Tuen muoto |

Suora avustus |

|||

|

Talousarvio |

Kokonaistalousarvio: GBP 1 100 (miljoonaa) |

|||

|

Tuen intensiteetti |

100 % |

|||

|

Kesto |

01.08.2018 – 01.08.2033 |

|||

|

Toimiala |

Sähkön tuotanto |

|||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||

|

Muita tietoja |

— |

|||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

19.01.2016 |

|||||

|

Tuen numero |

SA.38892 (2015/NN) |

|||||

|

Jäsenvaltio |

Ruotsi |

|||||

|

Alue |

VAESTERNORRLANDS LAEN |

— |

||||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

SGEI-stöd till Sundsvall Timrå Airport |

|||||

|

Oikeusperusta |

Förordnande av tjänst av allmänt ekonomiskt intresse |

|||||

|

Toimenpidetyyppi |

tapauskohtaiselle tuelle |

Sundsvall Timrå Airport |

||||

|

Tarkoitus |

Yleistä taloudellista etua koskevat palvelut |

|||||

|

Tuen muoto |

Suora avustus |

|||||

|

Talousarvio |

— |

|||||

|

Tuen intensiteetti |

100 % |

|||||

|

Kesto |

01.01.2014 – 31.12.2023 |

|||||

|

Toimiala |

Matkustajalentoliikenne |

|||||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||||

|

Muita tietoja |

— |

|||||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

09.08.2016 |

||||

|

Tuen numero |

SA.38920 (2016/NN) |

||||

|

Jäsenvaltio |

Portugali |

||||

|

Alue |

— |

— |

|||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

Concessao do Apoio Mínimo à Santa Casa da Misericordia de Tomar (SCMT) |

||||

|

Oikeusperusta |

Regulamento Específico ”Reabilitação Urbana” |

||||

|

Toimenpidetyyppi |

Yksittäinen tuki |

Santa Casa da Misericordia de Tomar |

|||

|

Tarkoitus |

— |

||||

|

Tuen muoto |

Suora avustus |

||||

|

Talousarvio |

Kokonaistalousarvio: EUR 1,872 (miljoonaa) |

||||

|

Tuen intensiteetti |

% |

||||

|

Kesto |

— |

||||

|

Toimiala |

TERVEYS- JA SOSIAALIPALVELUT |

||||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

||||

|

Muita tietoja |

— |

||||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

14.08.2015 |

|||

|

Tuen numero |

SA.39457 (2015/N) |

|||

|

Jäsenvaltio |

Yhdistynyt kuningaskunta |

|||

|

Alue |

— |

— |

||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

Reation Engines Ltd, SABRE design project |

|||

|

Oikeusperusta |

Science and Technology Act 1965 |

|||

|

Toimenpidetyyppi |

Yksittäinen tuki |

Reaction Engines Limited |

||

|

Tarkoitus |

Tutkimus- ja kehitystyö |

|||

|

Tuen muoto |

Suora avustus |

|||

|

Talousarvio |

Kokonaistalousarvio: GBP 50 (miljoonaa) |

|||

|

Tuen intensiteetti |

42 % |

|||

|

Kesto |

01.04.2015 lähtien |

|||

|

Toimiala |

Ilma- ja avaruusalusten ja niihin liittyvien koneiden valmistus |

|||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||

|

Muita tietoja |

— |

|||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

01.07.2015 |

|||

|

Tuen numero |

SA.40098 (2015/N) |

|||

|

Jäsenvaltio |

Suomi |

|||

|

Alue |

— |

— |

||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

Evaluation plan – Aid scheme for funding of research and development projects |

|||

|

Oikeusperusta |

Valtioneuvoston asetus tutkimus-, kehittämis- ja innovaatiotoiminnan rahoituksesta (1444/2014) Valtioneuvoston asetus tutkimus-, kehittämis- ja innovaatiotoiminnan rahoituksesta (1444/2014); Valtionavustuslaki (688/2001); Laki valtion lainanannosta sekä valtiontakauksesta ja valtiontakuusta (449/1988); Laki yritystuen yleisistä ehdoista (786/1997) Please see attached the submitted GBER-form ”Tukiohjelma tutkimus- ja kehittämishankkeisiin (Tekes)” for more details. |

|||

|

Toimenpidetyyppi |

Ohjelma |

— |

||

|

Tarkoitus |

Tutkimus- ja kehitystyö |

|||

|

Tuen muoto |

Suora avustus, Laina / Takaisinmaksettavat ennakot |

|||

|

Talousarvio |

Kokonaistalousarvio: EUR 2 000 (miljoonaa) Vuotuinen talousarvio: EUR 400 (miljoonaa) |

|||

|

Tuen intensiteetti |

75 % |

|||

|

Kesto |

01.01.2015 – 31.12.2020 |

|||

|

Toimiala |

Kaikki tukikelpoiset toimialat |

|||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||

|

Muita tietoja |

— |

|||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

14.07.2016 |

|||

|

Tuen numero |

SA.40680 (2016/N) |

|||

|

Jäsenvaltio |

Saksa |

|||

|

Alue |

BREMERHAVEN, KRFR.ST. |

107 artiklan 3 kohdan c alakohta |

||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

Offshore-Terminal Bremerhaven |

|||

|

Oikeusperusta |

§ § 23, 24 der Haushaltsordnung der Freien Hansestadt Bremen (Landeshaushaltsordung) und dazu erlassene Verwaltungsvorschriften |

|||

|

Toimenpidetyyppi |

tapauskohtaiselle tuelle |

Landessondervermögen Fischereihafen |

||

|

Tarkoitus |

Alakohtainen kehitys |

|||

|

Tuen muoto |

Suora avustus |

|||

|

Talousarvio |

Kokonaistalousarvio: EUR 155,3 (miljoonaa) |

|||

|

Tuen intensiteetti |

0 % |

|||

|

Kesto |

— |

|||

|

Toimiala |

Meri- ja rannikkovesiliikenteen tavarakuljetus |

|||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||

|

Muita tietoja |

— |

|||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

10.12.2015 |

|||

|

Tuen numero |

SA.40713 (2015/N) |

|||

|

Jäsenvaltio |

Ranska |

|||

|

Alue |

— |

— |

||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

Soutien au développement des installations produisant de l'électricité à partir de la combustion ou de l'explosion du gaz de mine |

|||

|

Oikeusperusta |

Code de l'énergie, Articles L314-1 (6o) et L121-7; Décret no 2000-1196 du 6 décembre 2000 fixant par catégorie d'installations les limites de puissance des installations pouvant bénéficier de l'obligation d'achat d'électricité, Article 3-1; Décret 2001-410 du 10 mai 2001 relatif aux conditions d'achat de l’électricité produite par des producteurs bénéficiant de l'obligation d’achat; Arrêté (…) fixant les conditions d'achat de l'électricité produite par les installations utilisant l'énergie dégagée par la combustion ou l'explosion du gaz de mines |

|||

|

Toimenpidetyyppi |

Ohjelma |

— |

||

|

Tarkoitus |

Ympäristönsuojelu, Energian säästö |

|||

|

Tuen muoto |

Suora avustus |

|||

|

Talousarvio |

Kokonaistalousarvio: EUR 22,8 (miljoonaa) Vuotuinen talousarvio: EUR 1,5 (miljoonaa) |

|||

|

Tuen intensiteetti |

100 % |

|||

|

Kesto |

saakka 01.01.2020 |

|||

|

Toimiala |

Sähkön tuotanto |

|||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||

|

Muita tietoja |

— |

|||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

03.08.2016 |

|||||||

|

Tuen numero |

SA.41342 (2016/N) |

|||||||

|

Jäsenvaltio |

Saksa |

|||||||

|

Alue |

DAHME-SPREEWALD, BRANDENBURG |

— |

||||||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

Flughafen Berlin Brandenburg |

|||||||

|

Oikeusperusta |

Gesellschafterbeschluss vom 17. April 2015 (TOP 3): 1,107 Mrd. EUR Hybridkapital Gesellschafterbeschluss vom 16. Oktober 2015 (TOP 3): Aufnahme verbürgter Darlehen bis zur Höhe von 2,5 Mrd. EUR zur Refinanzierung des Konsortialkredits und zur Ausfinanzierung des FBB-Businessplans |

|||||||

|

Toimenpidetyyppi |

Yksittäinen tuki |

Flughafen Berlin Brandenburg GmbH |

||||||

|

Tarkoitus |

Muu, Aluekehitys, Ympäristönsuojelu |

|||||||

|

Tuen muoto |

Takaus, Muut pääomatuen muodot – subordinate shareholder loan (quasi-equity); shareholder guarantee |

|||||||

|

Talousarvio |

Kokonaistalousarvio: EUR 1 107 (miljoonaa) |

|||||||

|

Tuen intensiteetti |

Toimenpide ei ole tukea |

|||||||

|

Kesto |

— |

|||||||

|

Toimiala |

Ilmaliikenne |

|||||||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||||||

|

Muita tietoja |

— |

|||||||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

24.08.2015 |

|||

|

Tuen numero |

SA.41471 (2015/N) |

|||

|

Jäsenvaltio |

Puola |

|||

|

Alue |

Poland |

— |

||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

Warunki i tryb udzielania pomocy publicznej i pomocy de minimis za pośrednictwem Narodowego Centrum Badań i Rozwoju |

|||

|

Oikeusperusta |

Art. 33 ust. 2 ustawy z dnia 30 kwietnia 2010 r. o Narodowym Centrum Badań i Rozwoju (Dz.U. z 2014 r. poz. 1788 oraz z 2015 r. poz. 249.). Rozporządzenie Ministra Nauki i Szkolnictwa Wyższego z dnia 25 lutego 2015 r. w sprawie warunków i trybu udzielania pomocy publicznej i pomocy de minimis za pośrednictwem Narodowego Centrum Badań i Rozwoju (Dz.U. z 2015 r., poz. 299). |

|||

|

Toimenpidetyyppi |

Ohjelma |

— |

||

|

Tarkoitus |

Kalastus- ja vesiviljelyalan tutkimus- ja kehitystyöhön myönnettävä tuki (30 artikla), Pk-yrityksille myönnettävä investointituki (17 artikla), Riskirahoitustuki (21 artikla), Käynnistystuki (22 artikla), Pk-yrityksille myönnettävä tuki – esiselvityskustannuksiin myönnettävä tuki (24 artikla), Perustutkimus (25 artiklan 2 kohdan a alakohta), Teollinen tutkimus (25 artiklan 2 kohdan b alakohta), Kokeellinen kehittäminen (25 artiklan 2 kohdan c alakohta), Toteutettavuustutkimukset (25 artiklan 2 kohdan d alakohta), Pk-yrityksille myönnettävä innovaatiotuki (28 artikla) |

|||

|

Tuen muoto |

Avustus/Korkotuki, Takaus (tarvittaessa viittaus komission päätökseen(10)), Laina / Takaisinmaksettavat ennakot, Riskirahoitus |

|||

|

Talousarvio |

Kokonaistalousarvio: PLN 22 649 (miljoonaa) Vuotuinen talousarvio: PLN 3 640,625 (miljoonaa) |

|||

|

Tuen intensiteetti |

100 % |

|||

|

Kesto |

05.03.2015 – 30.06.2021 |

|||

|

Toimiala |

Kaikki tukikelpoiset toimialat |

|||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||

|

Muita tietoja |

— |

|||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

18.04.2016 |

|||

|

Tuen numero |

SA.42476 (2015/N) |

|||

|

Jäsenvaltio |

Alankomaat |

|||

|

Alue |

NEDERLAND |

— |

||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

Betuweroute – Compensatie spoorvervoer tijdens bouwwerkzaamheden 2016-2020 |

|||

|

Oikeusperusta |

Artikel 3(1)(a) van de Kaderwet subsidies I en M, artikel 2(1) van het Kaderbesluit subsidies I en M. |

|||

|

Toimenpidetyyppi |

Ohjelma |

— |

||

|

Tarkoitus |

Alakohtainen kehitys |

|||

|

Tuen muoto |

Muu |

|||

|

Talousarvio |

Kokonaistalousarvio: EUR 13,2 (miljoonaa) |

|||

|

Tuen intensiteetti |

15 % |

|||

|

Kesto |

01.01.2016 – 31.12.2020 |

|||

|

Toimiala |

Rautateiden tavaraliikenne |

|||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||

|

Muita tietoja |

— |

|||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

29.08.2016 |

|||

|

Tuen numero |

SA.43168 (2015/N) |

|||

|

Jäsenvaltio |

Kreikka |

|||

|

Alue |

ATTIKI |

— |

||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

Κρατική εγγύηση για το δάνειο της ΕΤΕπ προς τη ΔΕΗ (Έργα σε μη διασυνδεδεμένα νησιά) |

|||

|

Oikeusperusta |

ΝΟΜΟΣ 2322/1995 (ΦΕΚ A 143) |

|||

|

Toimenpidetyyppi |

Yksittäinen tuki |

PUBLIC POWER CORPORATION (PPC) |

||

|

Tarkoitus |

Yleistä taloudellista etua koskevat palvelut |

|||

|

Tuen muoto |

Takaus |

|||

|

Talousarvio |

— |

|||

|

Tuen intensiteetti |

0 % |

|||

|

Kesto |

— |

|||

|

Toimiala |

Sähkön tuotanto |

|||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||

|

Muita tietoja |

— |

|||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

04.08.2016 |

|||||

|

Tuen numero |

SA.43575 (2015/N) |

|||||

|

Jäsenvaltio |

Latvia |

|||||

|

Alue |

Riga, Latvia |

— |

||||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

Aid for the construction of cultural and sport center ”Daugavas stadions” |

|||||

|

Oikeusperusta |

Cabinet of Ministers Order No. 78 from 16 February 2015”Government’s Action Plan for the implementation of the Declaration of Cabinet of Ministers led by Laimdota Straujuma” http://likumi.lv//ta/id/272247?&search=on Cabinet of Ministers Session Protocol No. 38 from 11 August 2015 http://likumi.lv/ta/id/275917-ministru-kabineta-sedes-protokols |

|||||

|

Toimenpidetyyppi |

Yksittäinen tuki |

State owned limited liability company (VSIA) |

||||

|

Tarkoitus |

Alakohtainen kehitys, Kulttuuri |

|||||

|

Tuen muoto |

Suora avustus, Muu |

|||||

|

Talousarvio |

Kokonaistalousarvio: EUR 38,18 (miljoonaa) |

|||||

|

Tuen intensiteetti |

96,12 % |

|||||

|

Kesto |

— |

|||||

|

Toimiala |

Urheilulaitosten toiminta |

|||||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||||

|

Muita tietoja |

— |

|||||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

22.08.2016 |

|

|

Tuen numero |

SA.43666 (2015/N) |

|

|

Jäsenvaltio |

Saksa |

|

|

Alue |

— |

— |

|

Nimike (ja/tai tuensaajayrityksen nimi) |

Begrenzung der KWKG-Umlage für Schienenbahnen Annexverfahren zu SA.42393 (2015/N), Novelle des KWKG (Kraft-Wärme-Kopplungsgesetz) |

|

|

Oikeusperusta |

Kraft-Wärme-Kopplungsgesetz (derzeit im parlamentarischen Verfahren) |

|

|

Toimenpidetyyppi |

Ohjelma |

— |

|

Tarkoitus |

Ympäristönsuojelu |

|

|

Tuen muoto |

Muu – The measure foresees a reduction of the costs of railways with regard to the surcharge that is recovered in order to support co-generated electricity. The aid for co-generated electricity is financed by a surcharge for all consumers of electricity. According to § 26 Absatz 3 KWKG-E for railways this surcharge cannot be more than 0,04 ct/kWh per consumption point. |

|

|

Talousarvio |

— |

|

|

Tuen intensiteetti |

% |

|

|

Kesto |

01.01.2016 – 31.12.2020 |

|

|

Toimiala |

Rautateiden henkilöliikenne; kaukoliikenne |

|

|

Tuen myöntävän viranomaisen nimi ja osoite |

Directly by the grid operator on proof by the railway undertaking that the legal prerequisites are fulfilled. |

|

|

Muita tietoja |

— |

|

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

01.08.2016 |

|||

|

Tuen numero |

SA.43724 (2015/N) |

|||

|

Jäsenvaltio |

Ruotsi |

|||

|

Alue |

VAESTERBOTTENS LAEN |

— |

||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

Hillskär – investeringar i infrastruktur för effektiv samordning av transportslag vid Kvarken Ports |

|||

|

Oikeusperusta |

Förordning (2014:1383) om förvaltning av EU:s strukturfonder. |

|||

|

Toimenpidetyyppi |

tapauskohtaiselle tuelle |

Umeå Hamn AB |

||

|

Tarkoitus |

Alakohtainen kehitys, Aluekehitys |

|||

|

Tuen muoto |

Suora avustus |

|||

|

Talousarvio |

Kokonaistalousarvio: SEK 62 (miljoonaa) |

|||

|

Tuen intensiteetti |

% |

|||

|

Kesto |

— |

|||

|

Toimiala |

Meri- ja rannikkovesiliikenteen tavarakuljetus |

|||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||

|

Muita tietoja |

— |

|||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

04.02.2016 |

|||

|

Tuen numero |

SA.43861 (2015/N) |

|||

|

Jäsenvaltio |

Yhdistynyt kuningaskunta |

|||

|

Alue |

UNITED KINGDOM |

— |

||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

UK Electricity Demand Reduction (EDR) Pilot (formerly pre-notified under SA.40956) |

|||

|

Oikeusperusta |

Aid granted under the EDR Pilot would be pursuant to section 43 of the UK Energy Act 2013 |

|||

|

Toimenpidetyyppi |

Ohjelma |

— |

||

|

Tarkoitus |

Energian säästö |

|||

|

Tuen muoto |

Suora avustus |

|||

|

Talousarvio |

Kokonaistalousarvio: GBP 6 (miljoonaa) |

|||

|

Tuen intensiteetti |

100 % |

|||

|

Kesto |

21.01.2016 – 31.01.2019 |

|||

|

Toimiala |

Kaikki tukikelpoiset toimialat |

|||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||

|

Muita tietoja |

— |

|||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

09.08.2016 |

|||||||

|

Tuen numero |

SA.43983 (2015/N) |

|||||||

|

Jäsenvaltio |

Saksa |

|||||||

|

Alue |

DEUTSCHLAND, BAYERN, OBERFRANKEN, BAYREUTH, LANDKR. |

— |

||||||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

BLSV-Sportcamp Nordbayern |

|||||||

|

Oikeusperusta |

Gesetz über die Feststellung des Haushaltsplans des Freistaates Bayern für die Haushaltsjahre 2015 und 2016 (Haushaltsgesetz 2015/2016 – HG 2015/2016) vom 17. Dezember 2014, Kapitel 03 03 Titel 893 01-7 Haushaltsordnung des Freistaates Bayern (Bayerische Haushaltsordnung – BayHO) Verwaltungsvorschriften zu Art. 44 der Bayerischen Haushaltsordnung (VV-BayHO) Satzung der Oberfrankenstiftung vom 18.11.2010 Baugesetzbuch |

|||||||

|

Toimenpidetyyppi |

Yksittäinen tuki |

Bayerischer Landes-Sportverband e.V. (BLSV) |

||||||

|

Tarkoitus |

— |

|||||||

|

Tuen muoto |

Suora avustus, Avustus/Korkotuki |

|||||||

|

Talousarvio |

Kokonaistalousarvio: EUR 20,76 (miljoonaa) |

|||||||

|

Tuen intensiteetti |

87,34 % |

|||||||

|

Kesto |

— |

|||||||

|

Toimiala |

Kaikki tukikelpoiset toimialat |

|||||||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||||||

|

Muita tietoja |

— |

|||||||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

13.06.2016 |

|||

|

Tuen numero |

SA.44881 (2016/N) |

|||

|

Jäsenvaltio |

Saksa |

|||

|

Alue |

— |

— |

||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

Thüringen: Fischerei Altenburger Land, Herrn Stefan Schröer |

|||

|

Oikeusperusta |

§ § 23 und 44 Thüringer Landeshaushaltsordnung, zuletzt geändert durch Artikel 9 des Gesetztes vom 31. Januar 2015, GVBl. 22,23 Gesetz zur Errichtung eines Sondervermögens ”Aufbauhilfe” und zur Änderung weiterer Gesetze (Aufbauhilfefonds- Errichtungsgesetz, AufbHG) vom 15. Juli 2013, BGBl. I, S. 2401; Verordnung über die Verteilung und Verwendung der Mittel des Fonds ”Aufbauhilfe” (Aufbauhilfeverordnung-AufbhV) vom 16. August 2013, BGBl. I S. 3233; Thüringer Gesetz zur Errichtung eines Sondervermögens ”Aufbauhilfefond Thüringen” zur Beseitigung der vom Hochwasser 2013 verursachten Schäden (Thüringer Aufbauhilfefondsgesetz) vom 12. Juli 2013; GVBl S. 162; Thüringer Verordnung über die Verteilung der Mittel des Aufbauhilfefonds Thüringen und die Durchführung des Aufbauhilfefondsgesetzes; ThürAufbhfVO vom 17. September 2013, GVBL. S. 288 |

|||

|

Toimenpidetyyppi |

Yksittäinen tuki |

Stefan Schröer, Fischerei Altenburger Land |

||

|

Tarkoitus |

Luonnonmullistusten aiheuttaman tuhon korvaaminen |

|||

|

Tuen muoto |

— |

|||

|

Talousarvio |

Kokonaistalousarvio: EUR 0,5753 (miljoonaa) |

|||

|

Tuen intensiteetti |

80 % |

|||

|

Kesto |

— |

|||

|

Toimiala |

MAATALOUS; METSÄTALOUS JA KALATALOUS |

|||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||

|

Muita tietoja |

— |

|||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

23.09.2016 |

|||

|

Tuen numero |

SA.45184 (2016/N) |

|||

|

Jäsenvaltio |

Italia |

|||

|

Alue |

BASILICATA, PUGLIA, CAMPANIA, CALABRIA, SICILIA, ABRUZZO, MOLISE, SARDEGNA |

107 artiklan 3 kohdan a alakohta, 107 artiklan 3 kohdan c alakohta |

||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

Piano di valutazione – Credito di imposta alle imprese che effettuano l’acquisizione di beni strumentali nuovi destinati a strutture produttive ubicate nelle zone assistite delle regioni Campania, Puglia, Basilicata, Calabria e Sicilia ammissibili alle deroghe ex art. 107 par. 3 lett. a) del TFUE e nelle zone assistite delle regioni Molise, Sardegna, Abruzzo, ammissibili alle deroghe previste dall’art. 107 par. 3 lett. c) del TFUE come individuate dalla Carta degli aiuti a finalità regionale 2014 – 2020 6424 final del 16.09.2014 |

|||

|

Oikeusperusta |

L. 28.12.2015 n. 208 (Disposizioni per la formazione del bilancio annuale e pluriennale dello Stato – legge di stabilità 2016), art. 1 commi da 98 a 106, pubblicata in Gazzetta Ufficiale n. 302 del 30.12.2015 Comunicazione per la fruizione del credito d'imposta per gli investimenti nel Mezzogiorno, Agenzia delle Entrate, Roma, 24.3.2016 |

|||

|

Toimenpidetyyppi |

Ohjelma |

— |

||

|

Tarkoitus |

Alueellinen tuki – investointituki (14 artikla) – Järjestelmä |

|||

|

Tuen muoto |

Veroetuus tai verovapautus |

|||

|

Talousarvio |

Vuotuinen talousarvio: EUR 617 (miljoonaa) |

|||

|

Tuen intensiteetti |

0 % |

|||

|

Kesto |

01.01.2016 – 31.12.2019 |

|||

|

Toimiala |

Kaikki tukikelpoiset toimialat |

|||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||

|

Muita tietoja |

— |

|||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

01.07.2016 |

|||

|

Tuen numero |

SA.45575 (2016/N) |

|||

|

Jäsenvaltio |

Puola |

|||

|

Alue |

— |

— |

||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

Fourteenth prolongation of the Polish bank guarantee scheme – H2 2016 |

|||

|

Oikeusperusta |

Ustawa z dnia 12 lutego 2009 r. o udzielaniu przez Skarb Panstwa wsparcia instytucjom finansowym (Dz. U. Nr 39, poz. 308 ze zm.) |

|||

|

Toimenpidetyyppi |

Ohjelma |

— |

||

|

Tarkoitus |

Vakavien taloushäiriöiden korjaaminen |

|||

|

Tuen muoto |

Takaus |

|||

|

Talousarvio |

Kokonaistalousarvio: PLN 160 000 (miljoonaa) |

|||

|

Tuen intensiteetti |

— |

|||

|

Kesto |

01.07.2016 – 31.12.2016 |

|||

|

Toimiala |

RAHOITUS- JA VAKUUTUSTOIMINTA |

|||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||

|

Muita tietoja |

— |

|||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

Päätöksen tekopäivä |

23.09.2016 |

|||

|

Tuen numero |

SA.46199 (2016/N) |

|||

|

Jäsenvaltio |

Italia |

|||

|

Alue |

SARDEGNA |

107 artiklan 3 kohdan a alakohta |

||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

Revisione di medio termine della Carta degli aiuti a finalità regionale 2014-2020 |

|||

|

Oikeusperusta |

N.A. |

|||

|

Toimenpidetyyppi |

Ohjelma |

— |

||

|

Tarkoitus |

Aluekehitys (mukaan lukien alueellinen yhteistyö) |

|||

|

Tuen muoto |

Muu – Tutte le forme di aiuto sono ammissibili. |

|||

|

Talousarvio |

— |

|||

|

Tuen intensiteetti |

25 % |

|||

|

Kesto |

01.01.2017 – 31.12.2020 |

|||

|

Toimiala |

Kaikki tukikelpoiset toimialat |

|||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||

|

Muita tietoja |

— |

|||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

|

4.11.2016 |

FI |

Euroopan unionin virallinen lehti |

C 406/20 |

Euroopan unionin toiminnasta tehdyn sopimuksen 107 ja 108 artiklan mukaisen valtiontuen hyväksyminen

Tapaukset, joita komissio ei vastusta

(ETA:n kannalta merkityksellinen teksti perustamissopimuksen liitteeseen I kuuluvia tuotteita lukuun ottamatta)

(2016/C 406/02)

|

Päätöksen tekopäivä |

28.09.2016 |

|||||||

|

Tuen numero |

SA.45613 (2016/N) |

|||||||

|

Jäsenvaltio |

Viro |

|||||||

|

Alue |

— |

— |

||||||

|

Nimike (ja/tai tuensaajayrityksen nimi) |

Sigade Aafrika katku likvideerimiskulude katmine ja kahjude hüvitamine suurettevõtjatele 2 |

|||||||

|

Oikeusperusta |

|

|||||||

|

Toimenpidetyyppi |

Ohjelma |

— |

||||||

|

Tarkoitus |

Eläintautien tai kasvintuhoojien ennaltaehkäisystä ja hävittämisestä aiheutuneisiin kustannuksiin tarkoitettu tuki sekä eläintautien tai kasvintuhoojien aiheuttamien vahinkojen korvaamiseen tarkoitettu tuki |

|||||||

|

Tuen muoto |

Suora avustus, Tuetut palvelut |

|||||||

|

Talousarvio |

Kokonaistalousarvio: EUR 20 (miljoonaa) |

|||||||

|

Tuen intensiteetti |

100 % |

|||||||

|

Kesto |

saakka 31.12.2020 |

|||||||

|

Toimiala |

Sikojen kasvatus |

|||||||

|

Tuen myöntävän viranomaisen nimi ja osoite |

|

|||||||

|

Muita tietoja |

— |

|||||||

Päätöksen koko teksti, josta on poistettu luottamukselliset tiedot, on saatavissa todistusvoimaisella kielellä Internet-osoitteesta:

http://ec.europa.eu/competition/elojade/isef/index.cfm.

V Ilmoitukset

KILPAILUPOLITIIKAN TOTEUTTAMISEEN LIITTYVÄT MENETTELYT

Euroopan komissio

|

4.11.2016 |

FI |

Euroopan unionin virallinen lehti |

C 406/21 |

VALTIONTUKI – SAKSA

Valtiontuki SA.42393 (2016/C) (ex 2015/N)

Yhteistuotantotuen uudistus Saksassa

Kehotus huomautusten esittämiseen Euroopan unionin toiminnasta tehdyn sopimuksen 108 artiklan 2 kohdan mukaisesti

(ETA:n kannalta merkityksellinen teksti)

(2016/C 406/03)

Komissio ilmoitti 24. lokakuuta 2016 päivätyllä, tätä tiivistelmää seuraavilla sivuilla todistusvoimaisella kielellä toistetulla kirjeellä Saksalle päätöksestään aloittaa Euroopan unionin toiminnasta tehdyn sopimuksen 108 artiklan 2 kohdassa tarkoitettu menettely, joka koskee edellä mainittua tukea.

Komissio on päättänyt olla vastustamatta eräitä muita tukitoimenpiteitä, kuten tätä tiivistelmää seuraavassa kirjeessä selostetaan.

Asianomaiset voivat esittää huomautuksensa tukipiteestä, jota koskevan menettelyn komissio aloittaa, kuukauden kuluessa tämän tiivistelmän ja sitä seuraavan kirjeen julkaisemisesta. Huomautukset on lähetettävä osoitteeseen:

|

European Commission |

|

Directorate-General Competition |

|

State Aid Greffe |

|

B-1049 Bruxelles/Brussel |

|

Faksi: + 32 22961242 |

|

Stateaidgreffe@ec.europa.eu |

Huomautukset toimitetaan Saksalle. Huomautusten esittäjä voi pyytää kirjallisesti henkilöllisyytensä luottamuksellista käsittelyä. Tämä pyyntö on perusteltava.

MENETTELY

Saksan viranomaiset ilmoittivat komissiolle 28. elokuuta 2015 yhdistetystä lämmön- ja sähköntuotannosta annetun lain (KWKG 2016) uudistamista koskevasta säädösluonnoksesta. Se hyväksyttiin 21. joulukuuta 2015, ja se tuli voimaan 1. tammikuuta 2016.

Saksa ilmoitti toimenpiteestä oikeusvarmuuden vuoksi. Se katsoo, että toimenpidettä ei rahoiteta valtion varoista, koska sitä ei rahoiteta suoraan valtion talousarviosta vaan verkonhaltijoiden sähkön kulutuksesta keräämillä maksuilla.

EHDOTETUN TOIMENPITEEN KUVAUS

Ilmoitetussa Saksan tukijärjestelmässä tukea maksetaan sähkön ja lämmön yhteistuotantolaitosten haltijoille. Tukijärjestelmä koskee lisäksi kaukolämpö- ja kaukojäähdytysverkkojen rakentamista ja laajentamista sekä lämpö- ja kylmyysvarastojen rakentamista ja jälkiasentamista.

Toimenpide rahoitetaan sähkönkulutuksesta kerättävillä maksuilla (”CHP-lisämaksu”), joiden keräyksestä vastaavat verkonhaltijat verkkomaksujen ohessa.

Siirtoverkonhaltijat laskevat vuosittain CHP-lisämaksun määrän yhdenmukaisella taksalla kulutettua kilowattituntia kohti (0,445 eurosenttiä/kWh vuonna 2016). KWKG-laissa kuitenkin säädetään, että CHP-lisämaksu on enintään 0,04 eurosenttiä/kWh niiden kuluttajien osalta, joiden vuosikulutus on suurempi kuin 1 GWh (”B-luokan kuluttajat”), ja enintään 0,03 eurosenttiä/kWh niiden kuluttajien osalta, jotka toimivat valmistusteollisuuden alalla, kuluttavat enemmän kuin 1 GWh ja joiden sähkökustannukset ovat suuremmat kuin neljä prosenttia niiden liikevaihdosta (”C-luokan kuluttajat”).

ARVIOINTI

Koska CHP-lisämaksu on rajoitettu B- ja C-luokan kuluttajien osalta 0,04 ja 0,03 eurosenttiin kilowattitunnilta, KWKG-lailla vähennetään näihin luokkiin kuuluvien yritysten rasitetta verrattuna alentamattomiin maksuihin. Kyseessä on siis valikoiva etu. C-luokkaan voidaan luokitella ainoastaan valmistusteollisuutta. B-luokkaan voidaan periaatteessa luokitella minkä tahansa alan yrityksiä, mutta luokittelu suosii suurempia yrityksiä, koska kulutuksen on oltava yli 1 Gwh vuodessa, ja se suosii joka tapauksessa sellaisten alojen yrityksiä, joilla sähkönkulutus on perinteisesti suurta.

Etu rahoitetaan valtion varoista. Komissio katsoo, että CHP-lisämaksusta muodostuu valtion hallinnassa olevia varoja. Kuten 19. joulukuuta 2013 annettuun tuomioon johtaneessa asiassa Association Vent de Colère (1)!, valtio on luonut CHP-lisämaksua koskevan lain nojalla järjestelmän, jossa verkonhaltijoille korvataan sähkönkuluttajilta perittävän CHP-lisämaksun avulla kokonaan kulut, joita niille aiheutuu siitä, että ne tukevat sähkön ja lämmön yhteistuotantolaitosten sähköntuotantoa sekä varastojen ja kaukolämpö- ja kaukojäähdytysverkkojen rakentamista. Myös CHP-lisämaksun alennukset rahoitetaan valtion varoista, koska ne aiheuttavat valtiolle lisärasitteen. Kaikki CHP-lisämaksun alennukset nimittäin vähentävät kyseisiltä kuluttajaluokilta (B- ja C-luokka) kerättävien maksujen määrää. Näin ollen ne aiheuttavat tulojen menetystä, joka on katettava korottamalla muilta kuluttajilta (eli A-luokan kuluttajilta) kerättävän CHP-lisämaksun määrää.

CHP-lisämaksun alennukset voivat vääristää samalla alalla toimivien yritysten välistä kilpailua, koska niitä eivät saa kaikki yritykset, ja ne ovat myös omiaan vaikuttamaan jäsenvaltioiden väliseen kauppaan ja kilpailuun muiden jäsenvaltioiden yritysten kanssa. Alennuksista hyötyvät todennäköisesti juuri sellaiset alat, kuten kemianteollisuus, paperiteollisuus, autonvalmistus ja muu autoteollisuus, jotka kilpailevat muissa jäsenvaltioissa sijaitsevien yritysten kanssa.

CHP-lisämaksun alennukset eivät kuulu valtiontuesta ympäristönsuojelulle ja energia-alalle vuosiksi 2014–2020 annettujen suuntaviivojen (2) soveltamisalaan. Nämä suuntaviivat koskevat valtiontukia alennuksina maksuista, joilla rahoitetaan uusiutuvista energialähteistä tuotetun energian tukemista, mutta eivät alennuksia maksuista, joilla rahoitetaan yhteistuotannon tai muiden energiatehokkuustoimenpiteiden tukemista. Komissio voi kuitenkin todeta tukitoimenpiteen SEUT-sopimuksen 107 artiklan 3 kohdan c alakohdan mukaisesti sisämarkkinoille soveltuvaksi, jos se on välttämätön ja oikeasuhteinen ja jos sen myönteiset vaikutukset yhteisen tavoitteen saavuttamiseen ylittävät sen kielteiset vaikutukset kilpailuun ja kauppaan.

Voitaisiin väittää, että CHP-lisämaksun alennukset edistävät yhteistä tavoitetta, jos tuella itsessään pyritään saavuttamaan yhteisen edun mukainen tavoite ja sitä tarvitaan tavoitteen saavuttamiseksi ja jos alennukset ovat tarpeen, jotta voidaan turvata kyseisen yhteisen edun mukaisen tavoitteen saavuttamiseksi toteutettavan toimenpiteen rahoitus.

Komissio on todennut, että CHP-lisämaksulla rahoitettavat tukitoimenpiteet (esimerkiksi sähkön ja lämmön yhteistuotantolaitosten, kaukolämpö- ja kaukojäähdytysverkkojen sekä lämmön ja kylmyyden varastoinnin edistäminen) soveltuvat sisämarkkinoille.

Voitaisiin lisäksi väittää, että näitä tukitoimenpiteitä on asianmukaista rahoittaa kulutukseen perustuvalla maksulla, koska tuetut toimenpiteet ja energian kulutus liittyvät läheisesti toisiinsa ja myös siksi, että kulutukseen perustuva maksu tarjoaa suhteellisen vakaan rahoituslähteen eikä heikennä talousarvion kurinalaisuutta. Viimeksi mainittu näkökohta on tärkeä, kun otetaan huomioon unionin energiatehokkuustavoitteet. Tältä osin jäsenvaltiot ovat velvollisia arvioimaan mahdollisuuksiaan energiatehokkuustoimenpiteiden toteuttamiseen, mukaan lukien sähkön ja lämmön yhteistuotantolaitokset ja kaukolämmitys, ja hyödyntämään havaittua potentiaaliaan. Havaitun potentiaalin hyödyntämiseen saatetaan tarvita merkittävää rahoitusta, jolloin jäsenvaltioiden tarve kyetä rahoittamaan näitä toimenpiteitä kulutukseen perustuvilla maksuilla kasvaa.

Tässä mielessä voidaan väittää, että alennukset ovat asianmukainen väline, jolla voidaan saavuttaa energiatehokkuuden edistämisen tavoite, jos voidaan osoittaa, että alennusten puuttuminen vaarantaisi kulutukseen perustuvan maksun ja siten tukijärjestelmän rahoittamisen ja viime kädessä itse tukijärjestelmän. Näin olisi kuitenkin vain siinä tapauksessa, jos osoitettaisiin, että maksulla rahoitettava tuki olisi ilman alennuksia vaarassa, koska täysimääräisen maksun maksaminen johtaisi siihen, että merkittävä määrä yrityksiä siirtyisi muualle tai joutuisi konkurssiin. Vaikka alennukset voitaisiin osoittaa välttämättömiksi, niiden on myös oltava oikeassa suhteessa tavoitteeseen ja rajoituttava vähimmäismäärään, joka on välttämätön tuen rahoittamisen turvaamiseksi.

Saksan toimittamat tiedot tästä asiasta ovat edelleen vähäisiä. Se on ilmoittanut, ettei sillä ole mitään konkreettisia tietoja eri edunsaajista tai aloista, joita asia koskee. Se on kuitenkin olettanut, että edunsaajat ovat usein yrityksiä, joilla on myös oikeus uusiutuvista energialähteistä tuotetun sähkön tukemiseksi kerättävän ns. EEG-lisämaksun alennukseen, mutta se ei ole perustellut tätä väitettä. Kriteerit alennuksen saamiseen CHP-lisämaksusta näyttävät laajemmilta kuin EEG-lisämaksun osalta.

Saksa ei myöskään ole esittänyt seikkoja, jotka osoittaisivat, että alennukset on rajattu välttämättömään vähimmäismäärään. Erityisesti vaikuttaa siltä, että kyseiset alennukset ovat suurempia kuin EEG-lisämaksun alennukset.

Tämän vuoksi komissiolla on epäilyksiä tuen kannustavasta vaikutuksesta ja oikeasuhteisuudesta. Koska tuen kannustavaa vaikutusta ja oikeasuhteisuutta ei ole vielä osoitettu, komissio epäilee tässä vaiheessa, että tukitoimenpiteessä ei ole varmistettu, että kilpailun vääristymä sen johdosta, että jotkut yritykset on vapautettu osasta tavanomaisia toimintakustannuksia, olisi rajallinen ja toimenpiteen kokonaisvaikutus olisi myönteinen.

Neuvoston asetuksen (EU) 2015/1589 16 artiklan mukaan kaikki sääntöjenvastainen tuki voidaan periä takaisin tuensaajalta.

KIRJEEN TEKSTI

1. PROCEDURE: NOTIFICATION, CORRESPONDENCE, DEADLINE ETC.

|

(1) |

On 28 August 2015, further to pre-notification contacts, the German authorities notified to the Commission the draft bill on the Reform of the Combined Heat and Power Generation Act (Heat and Power Cogeneration Act, hereinafter: KWKG or KWKG 2016), which was then adopted into law on 21 December 2015. It replaces the Combined Heat and Power Generation Act enacted on 1 April 2002. |

|

(2) |

As at the time of the notification, the draft law was still under discussion in Germany; Germany submitted updated versions of the draft law and additional explanations to the notification on 31 August, 18 September, 21 September and 28 September 2015. On 29 September 2015 it also submitted a draft evaluation plan that was updated on 14 June 2016. |

|

(3) |

The Commission sent requests for information on 9 and 28 October, 13 November, 10 December 2015, 4 February, 19 May, 20 July, 30 August and 21 September 2016. |

|

(4) |

Replies were submitted on 12 November, 24 November and 17 December 2015, on 3 March and 30 May, in August and September 2016. The latest information was submitted on 28 September 2016. |

|

(5) |

On 4 August 2016, Germany waived its right under Article 342 TFEU in conjunction with Article 3 of Council Regulation (EEC) No 1/1958 (3) to have the decision adopted in German and agreed that the decision be adopted and notified in English. |

|

(6) |

Germany has notified the measure for legal certainty. It considers that the measure is not financed from State resources. It has indicated that the arguments put forward in the EEG 2012 (4) and EEG 2014 (5) State aid cases as well as in the EEG 2012 Court case (6) are valid for the CHP file as well, without however enumerating them. It has briefly pointed to the similarities with the EEG support: support based on a guaranteed feed-in tariff that is covered by a levy on electricity consumption and raised by network operators. It considers that such system does not qualify as financed from State resources. |

2. DETAILED DESCRIPTION OF THE MEASURE

2.1. Overall objectives

|

(7) |

The KWKG aims at improving the energy efficiency of energy production in Germany by increasing the net electricity production from combined heat and power generation (‘CHP’) installations to 110 TWh/year by 2020 and to 120 TWh/year by 2025, as compared to the current yearly production of 96 TWh. |

|

(8) |

The KWKG also aims at ensuring cohesion between support for CHP and the goals of the energy transition (Energiewende). The KWKG therefore also supports new heat/cooling storage facilities or retrofitted storage facilities, as they increase the flexibility of cogeneration facilities, and focuses on installations that can reduce CO2 emissions in the electricity sector. CHP installations are expected to contribute to an additional reduction of 4 million tonnes of CO2 emissions (7) by 2020 in the electricity sector as in Germany electricity from cogeneration installations displaces separated production of electricity by coal-fired power plants. In addition, new coal-fired and lignite-fired CHP installations are not supported and support under the KWKG is essentially directed at gas-fired CHP installations as they have lower CO2 emissions. Bio-energy CHP installations are in theory also eligible for support under the KWKG but in practice they ask for support under the Renewable Energy Sources Act (EEG) under which support levels are higher. |

|

(9) |

Under the KWKG, aid can also be granted for the construction or expansion of heating/cooling networks. Support to the latter is viewed as a complement to CHP-support, given that using CHP installations in connection with district heating increases the energy efficiency of the system. |

|

(10) |

The district heating sector is expected to be the largest contributor to the aims of the KWKG; however, Germany has indicated that CHP installations used by the service sector and by the industry are also needed to achieve the objectives of the KWKG (8). |

|

(11) |

The reform of the KWKG is based on a cost-benefit analysis concluded in 2014 (9) in line with Article 14 of the Energy Efficiency Directive (10). The cost-benefit analysis identified potential for new CHP installations in Germany but showed that under current market conditions new CHP installations could not be constructed without aid at least until 2020. |

|

(12) |

The cost-benefit analysis also showed that depreciated gas-fired plants used for district heating could still technically be operated but could not generate sufficient revenue from the market alone under current market conditions. District heating companies typically operate both CHP installations and heat boilers to cover the heat demand. The companies are equipped with software that continuously verifies which combination of those installations will deliver the heat at the lowest cost. When electricity prices are low, production costs of CHP installations are higher than production costs of heat boilers; in those cases the heat boilers are used by preference to CHP installations for the heat production. While the average price for base-load electricity on the exchange was still around 50 €/MWh in 2010, it fell to 25 €/MWh in 2016 (11). Under those deteriorated economic conditions, existing gas-fired CHP installations in the district heating sector are under the threat of being closed and replaced by separate production installations (12). |

|

(13) |

In order to maintain the current production level of 15 TWh/year of existing installations in the district heating sector and possibly bring it back to a previous level of 20 to 22 TWh/year, Germany intends to grant support to existing gas-fired CHP installations in the district heating sector until 2019. |

2.2. The different support measures involved

2.2.1. CHP-support

|

(14) |

Under the KWKG, support is granted to new, modernised and retrofitted highly efficient CHP installations. It is open to various cogeneration technologies (including gas and steam turbines, Organic Rankine Cycle and fuel cells). |

|

(15) |

CHP installations qualify as highly efficient if they comply with the high-efficiency criteria of Directive 2012/27/EU (13) (§ 2(8) KWKG). |

|

(16) |

The CHP installation can be fired by biogas, biomass, natural gas, oil, waste and waste heat. The support level does not vary depending on the type of fuel used. As gas-fired CHP installations are the main focus of the KWKG 2016, the support level has been set by reference to typical costs of gas-fired CHP installations. Germany indicated in this connection that CHP installations using bio-energy were in practice supported under the EEG given that renewable support was higher than CHP-support. As to oil-fired CHP installations, Germany indicated that production costs for those installations are higher than for gas-fired CHP installations given that oil prices are significantly higher than gas prices (57 €/MWh for light oil compared to 23-24 €/MWh for natural gas). Concerning CHP installations burning waste, Germany explained that waste-fired CHP installations cannot use the most efficient CHP technology (GuD) but can only use steam processes, also the amount of electricity used by the CHP installation itself is higher than for gas-fired CHP installations (among others because it needs electricity to filter the waste gases). As a result, investment costs per installed kW are around 10 times higher for waste-fired CHP installations than for gas-fired CHP installations. Germany further indicated that waste incineration businesses were as a rule subject to public procurement. Competition to obtain the waste incineration concession is generally high. As a result the support for the CHP installation would also be integrated into the bid and any overcompensation can be excluded. |

|

(17) |

The support is paid as a premium (the ‘CHP-support’) on top of the market price by the network operator to which the installation is connected. Operators of CHP installations with an electrical capacity of more than 100 kW have to sell their electricity on the market or consume it themselves. Operators of smaller CHP installations have the choice to sell the electricity on the market, consume it themselves or ask the network operator to buy it at an agreed price. If no agreement is reached, the purchase price will be the average price for base-load electricity on the EEX exchange of the previous trimester. In this respect, Germany has communicated that it intends to amend this section of the KWKG so that in the future price agreements will no longer be allowed and the purchase price will in all cases be the above mentioned average price. |

|

(18) |

Operators of CHP installations are subject to balancing responsibilities like any other generator. Those responsibilities are laid down in the Electricity Grid Access Ordinance (Stromnetzzugangsverordnung — StromNZV (14)). |

|

(19) |

The support is paid in principle for CHP electricity injected into the public grid for 30 000 full load hours as of the moment the installation entered into operation. When the installation has an electrical capacity below or equal to 50 kW the support is granted for 60 000 full load hours. |

|

(20) |

Germany has explained that according to normal accounting rules the usual depreciation period of CHP installations is 20 years. CHP installations operate between 3 000 and 8 000 full load hours per year, depending on the size of the installation and the sector concerned. 30 000 or 60 000 full load hours would thus be reached at the latest after 10 or 20 years in the case of an installation running only during 3 000 full load hours/year. |

|

(21) |

The level of the subsidy is determined on the basis of the rates described in Table 1. Table 1 CHP-support for CHP electricity injected into the grid

|

|

(22) |

For two categories of operators support is also paid for the auto-consumed part of the electricity. Those are on the one hand operators of small CHP plants with an electrical capacity of up to 100 kW and on the other hand operators of CHP installations who qualify as electro-intensive users (EIU) eligible for a reduced EEG-surcharge under the EEG. In the latter case, the installation generally has a capacity above 100 kW. The CHP-support for those two categories is determined based on the rates described under Table 2. Table 2 CHP-support for auto-consumption

|

|

(23) |

Support is also paid to operators supplying CHP electricity to third parties but using a private network (industrial parks) if the supplied customer bears the full EEG-surcharge (§ 6(4)(3) KWKG). This also covers the situation of an operator (the ‘Kontraktor’) supplying electricity to third parties from an installation located on the premises of the client. In that case, the installation could be providing energy to a single client and the Kontraktor is in charge of the construction, operation and maintenance of the installation. The CHP-support for that category of operators is calculated using the rates described in Table 3. Table 3 CHP-support for ‘Kontraktoren’

|

|

(24) |

Modernised installations are existing CHP plants where old system parts relevant to determine the efficiency of the installation are replaced with new components. If the cost of such a modernisation exceeds 25 % or 50 % of a complete new construction of the cogeneration plant, this modernised plant is eligible for support under the KWKG (§ 8(3) KWKG 2016) respectively for 15 000 (when modernisation costs exceed 25 % of a complete new construction of the cogeneration plant) or 30 000 full-load hours (when modernisation costs exceed 50 % of a complete new construction of the cogeneration plant). The modernised CHP plants must provide sufficient evidence that they are more efficient than the old plants. Modernisation is eligible for support only if the existing system has reached a certain age (5 or 10 years respectively). The CHP-support is determined on the basis of the rates described in Table 1 above. |

|

(25) |

Germany has explained that modernised CHP installations face higher operating costs than new CHP installations. Due to continuous technological progress, new installations will require less repair and maintenance costs and consume less fuel than modernised installations. Given that capital costs represent only 20 to 25 % of total production costs of a CHP installation, once the modernisation costs reach a certain level (i.e. 50 % of the costs of a new investment), the difference in capital costs compared to a new installation is outbalanced by additional operating costs of the modernised installation. For that reason, modernised installations are entitled to the same level of subsidy as new installations when modernisation costs represent more than 50 % of the investment costs of a new installation. |

|

(26) |

Retrofitted installations are un-combined installations which are converted into CHP installations. They are eligible for support under § 8(4) KWKG 2016 if the costs of the retrofitting correspond to at least 10 % of a new CHP installation with the same capacity. Depending on whether the costs of the retrofitting exceed 10 %, 25 % or 50 % of a new CHP installation with the same capacity, the aid will be granted for 10 000, 15 000 or 30 000 full-load hours. |

|

(27) |

An additional premium of 0.3 € cent/kWh is granted under § 7(5) of the KWKG 2016 for CHP facilities subject to the Greenhouse Gas Emission Trading Law (TEHG) as they face higher costs compared to CHP installations not subject to the ETS system (‘§ 7(5) premium’). The § 7(5) premium has been established based on current and projected costs of CO2 allowances, typical emission factor of CHP installation and has also taken account of the fact that CHP installations partially benefit from free allowances under Article 10a (4) of the ETS Directive (15). In addition, in order to incentivize CHP plant owners to replace their existing coal-fired or lignite-fired plant with a gas-fired installation, a bonus of 0,6 € cents/kWh over the entire funding period (fuel switch bonus) is provided to operators for the part of the cogeneration electricity capacity of the installation that is replacing an existing coal-fired or lignite-fired CHP installation. The operator must demonstrate that the coal-fired or lignite-fired CHP installation has been closed within 12 months after the new installation started operation but at the earliest after 1 January 2016, he must also demonstrate that he owns both installations or that they are feeding the same heating network. |

|

(28) |

In order to minimise the administrative burden for micro-cogeneration units, owners of CHP in the power range of up to 2 kW can receive their support payments as a flat one-time payment. This corresponds to a subsidy of 4 € cent/kWh multiplied by 60 000 full load hours. |

|

(29) |

Operators of existing (depreciated) high-efficiency gas-fired CHP plants with an electrical CHP capacity of more than 2 MW can obtain a support of 1.5 € cents/kWh if i) the CHP electricity is injected into the public grid, ii) the installation was in general used for public supply and iii) the electricity is not supported anymore under the EEG or under other provisions of the KWKG. The support is limited in time (31 December 2019) and full-load hours (up to 16 000). |

|

(30) |

Germany has estimated that the support to existing installations will increase the number of operating hours of the installations concerned. Per installation, the increase in the number of annual operating hours can vary between 300 and 1 000 hours. In some cases, the support will also prevent that the installation is closed altogether. Germany submitted the example of an installation which without support would be able to operate under economically acceptable conditions for 37 hours in 2016 and 3 hours in 2017. With a support of 1.5 € cent/kWh, it would be able to increase its operating hours to 751 in 2016 and 553 in 2017 allowing for the operation of the installation to be maintained. |

|

(31) |

When the value of hour contracts is null or negative on the EPEX Spot SE exchange in Paris (price zone Germany/Austria), no premium will be paid out for the CHP electricity produced during those hours (§ 7(8) KWKG). The electricity generated during this period is not taken into account for the calculation of the number of full load hours during which support can be granted. |

|

(32) |

Aid for CHP installations can be cumulated with investment aid. However, in that case, the cumulation of the investment aid and the operating aid can never exceed the difference between the levelized cost of electricity produced in the CHP installation and the market price for the electricity. When the support is granted to beneficiaries selected in a tender (see section 2.7.2 below) and is cumulated with investment aid, Germany committed to deducting the investment aid from the operating aid in line with point 151, read in conjunction with point 129 of the Guidelines on State aid for environmental protection and energy 2014-2020 (16) (‘EEAG’). |

2.2.2. Storage of heat and cooling

|

(33) |

§ § 22-25 of the KWKG 2016 provide for investment support for the building of new or retrofitting of heat or cooling storage facilities. |

|

(34) |

While aid under the KWKG 2016 can also be granted when the owner of the storage and the CHP installations are different, Germany has indicated that storage facilities generally belong to the owner of the CHP installation to which it is connected. Storage facilities hence do no generate revenues. In addition, the increased flexibility of the CHP installation connected to the storage facility does not yield enough additional revenues for the CHP installation to trigger the investment into the storage facility. |

|

(35) |

Germany, however, would like to generalise the use of heat/cooling storage facilities in connection to CHP installations. Germany views those storage facilities as key elements to increase the energy efficiency and integration of CHP installations into the electricity market. As the heat/cold can be stored more easily than electricity (in the form of warm/cold water), CHP installations connected to storage facilities can adapt their production to produce in particular at times of higher electricity demand instead of cogenerating the electricity when there is heat demand but not necessarily electricity demand. A later heat requirement can then be covered from the storage facility. This flexibility allows CHP installations to run for an increased number of operating hours. Indeed, when electricity prices are too low, the heat demand is by preference produced from heat boilers and the CHP installation is not used or its production is reduced. The flexibility induced by the storage facility has therefore a direct environmental impact: the increased operation of CHP installations displaces separate production in heat boilers. In addition, in Germany, CHP electricity produced at times of high electricity demand displaces coal-fired electricity generation and thus significantly reduces CO2 emissions linked to electricity production. Finally, the induced flexibility also improves the integration of CHP installations into the electricity market as the electricity will be produced more in line with electricity demand. |

|

(36) |

In addition, storage facilities can also be filled with waste heat and renewable heat. As this type of heat is not necessarily produced when it is needed, the storage facility will increase the use of waste heat and renewable heat and reduce the need for heat only boilers. |

|

(37) |

Storage facilities are eligible for aid if the storage facility is mainly filled with heat produced by a CHP installation that is connected to the public electricity grid. Industrial waste heat and renewable heat are assimilated to CHP heat provided that the CHP heat still corresponds to at least 25 % of the stored heat. The storage facility must have a capacity of at least 1 m3 of water equivalent or 0.3 m3 per kW installed electrical capacity. |

|

(38) |

The aid amounts to 250 €/m3 water equivalent of the storage volume when the storage volume does not exceed 50 m3 water equivalent. This results in a maximum aid amount for small storage facilities of EUR 12 500. If it exceeds 50 m3 water equivalent, the aid is limited to 30 % of the eligible investment costs. In total the aid may not exceed EUR 10 million per project. |

|

(39) |

Eligible costs are all costs related to the construction of the storage facility and resulting from services and goods delivered by third parties. Not eligible are: administrative fees, internal costs for the construction and planning, imputed costs (‘kalkulatorische Kosten’), costs related to insurances, financing and land acquisition. |

|

(40) |

Germany has submitted an example of a concrete project for […] (*1) a heat storage installation. Its capacity would amount to […]m3 and project costs are estimated to amount to EUR […] million. The example shows that the aid makes it possible to increase the internal rate of return of the project from […]% to […]%. With only […]% projected internal rate of return the project would not have been implemented. |

|

(41) |

Aid for storage facilities under the KWKG 2016 can be cumulated with aid from local authorities, the Länder or other federal aid schemes. It is in principle deducted from the aid granted under the KWKG 2016 except if cumulation has been explicitly authorised. In that case Germany has committed to verifying that the cumulated aid would not exceed the aid intensity authorised under Annex 1 of the EEAG for cogeneration installations (17). |

2.2.3. District heating/cooling networks

|

(42) |

Under § § 18-21 KWKG 2016 support is granted for the construction and expansion of energy-efficient district heating/cooling networks (i.e. networks for the public supply of heat and/or cooling). |

|

(43) |

Those networks are eligible for support if they are fed with at least 60 % of a combination of cogenerated heat, industrial waste heat and/or renewable heat. In this case, the share of cogenerated heat must in any event correspond to at least 25 % of the transported heat. For networks which are fed with CHP heat which is not combined with industrial waste heat or renewable heat, Germany has committed to granting investment aid only if at least 75 % of the heat injected into the district heating network is produced by CHP installations. The aid is granted according to the aid intensities described in Table 4 below. Table 4 aid intensities for district heating/cooling networks

|

|

(44) |

Eligible costs are all costs related to the construction or expansion of the network and resulting from services and goods delivered by third parties. Not eligible are: administrative fees, internal costs for the construction and planning, imputed costs (‘kalkulatorische Kosten’), costs related to insurances, financing and land acquisition. |

|

(45) |

Germany has explained that for district heating/cooling networks the funding gap corresponds to between 30 % and 40 % of the investment costs, depending on the diameter of the pipes. It has submitted a detailed funding gap calculation for an average district heating system (town of 150 000 inhabitants, diameter >100 mm and aid amount of 30 % of investment costs, all values discounted with rate of 8 %). Table 5 below summarises the results of the funding gap calculation. Table 5 Summary of funding gap calculation for average district heating system

|

|

(46) |

In case of additional aid at local, regional or federal level, Germany has committed to verifying that the cumulated aid would not exceed the funding gap authorised under the EEAG, i.e. the difference between the positive and the negative cash flows over the lifetime of the investment, discounted to their current value (typically using the cost of capital) (see Point 19(32) EEAG). |

2.3. Production costs

|

(47) |

Germany has submitted Levelized Cost Of Electricity (LCOE) calculations for the production of cogenerated electricity in a series of representative installations for the district heating sector (one 10 MW, one 20 MW, one 100 MW, one 200 MW and one 450 MW installation) and 23 representative CHP installations used by households (single family houses or multiple family houses), service providers (retail, schools, hospitals, hotels) and the industry (construction of machines, car manufacturing, car repair, paper and chemistry sector). Germany has also provided LCOE calculations for CHP installations used by so-called contractors who operate a CHP installation to provide heat and power to a limited number of consumers (industry parks, for instance) as well as LCOE calculations for existing CHP installations. Finally they have also provided LCOE calculations for installations benefitting from the § 7(5) premium and the fuel switch bonus. All calculations concern gas-fired CHP installations. |

|

(48) |

Germany has calculated the LCOE based on the following formula:

Where:

|

|

(49) |

For each calculation, Germany has also provided: the type of CHP installation used, the number of full load hours, the rate at which the installation is used for self-consumption (18), the sector concerned, the typical investment costs, the energy conversion efficiency rate, the heat and electricity outputs, and the fixed and variable operating costs. For the variable operating costs, Germany has further submitted the projected gas prices, electricity prices (both electricity price obtained when the electricity is injected into the grid and electricity price that is saved when the electricity generated is self-consumed), and the compensation for avoided network fees (19). The LCOE calculations also take into account reduced energy taxes and costs of CO2 emission allowances, where the installation is under the obligation to buy CO2 emmission allowances, and heat revenues. As far as heat revenues are concerned, Germany has taken the heat price into account for the district heating sector and the avoided heating costs for the other operators, since they would have had to buy or produce the heat in a boiler, had they not cogenerated it. The heat price obtained in the district heating sector has been computed based on the observation that the district heating sector needs to provide heat at the least cost possible as it has to compete with decentralized heat production. A CHP installation feeding heat into the grid is in competition essentially with gas boilers, other CHP installations and sometimes also incineration facilities or industrial heat. The heat price then corresponds to the marginal costs of the cheapest plant that is able to produce the demanded heat. For the purpose of determining the heat price taken into account for the LCOE calculations, Germany assumed that the heat demand would be covered 50 % by gas boilers and 50 % by CHP installations. |

|

(50) |

The tables below represent the assumptions used in terms of consumption, gas and electricity prices. Table 6 Typical consumption in the sectors examined by Germany

Table 7 Retail prices of gas to customers per category of consumer and consumption levels by 2050, real, gross calorific value, excluding VAT, duties and taxes in € cents 2013/kWh

Table 8 Electricity prices for households, commercial customers and industrial customers in € cents 2013/kWh

Table 9 Forecasted evolution of fuel and energy prices 2008-2020, nominal (source EEX 2014, Prognos 2014 from the CHP cost-benefit analysis).

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

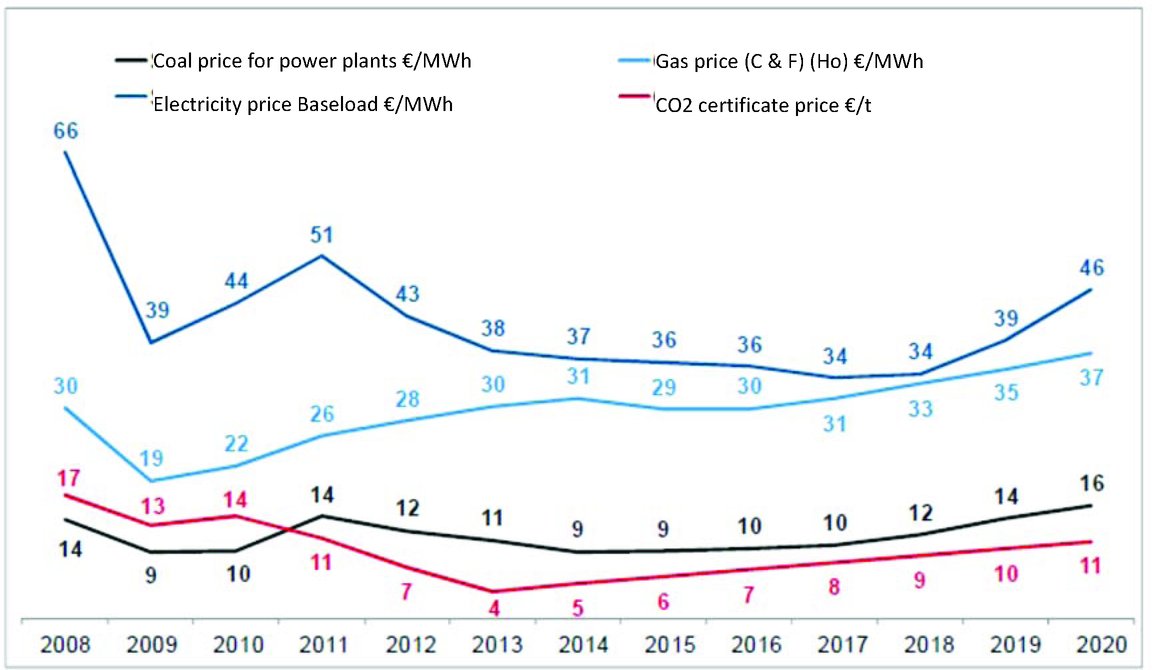

(51) |

Germany has indicated that since Prognos made those forecasts for the purposes of the CHP cost-benefit analysis on the basis of which the reform was designed, the market situation has slightly changed, with electricity base-load prices (forward market, 2016-2019) having dropped to 28-29 €/MWh, the natural gas prices having also dropped to 23-24 €/MWh (Ho) at the end of 2015 but CO2 certificate prices having increased to 8.5 €/t. Germany noted that the drop in natural gas prices was more than compensated by the drop in electricity prices and the increase in CO2 emission certificate prices. |

|

(52) |

The following tables recap the resulting LCOE calculations. They include the rate of return of the investment taking into account the support under the KWKG when the installation is eligible for such support. They also contain a comparison with the average market price (average obtained from the market price of the energy injected into the grid and the market price of the electricity that would have had to be paid if the autoconsumed electricity had been purchased from a supplier) and with the support level. Table 10 Housing, up to 100 kWel, calculation over 10 year period (2016-2025) with a discount rate of 10 % per year — in € cents/kWh

Table 11 Trade and services, outside the BesAR, up to 100 kWel, 10 year period (2016 to 2025) with a discount rate of 20 % per year — in € cents/kWh

Table 12 Non electro-intensive industry (not eligible under BesAR, more than 100 kWel, 15 year period (2016-2030) up to 10 MWel and 20 year depreciation period (2016-2035) if more than 10 MWel; 30 % per year discount rate — in € cents/kWh