ISSN 1977-0677

Official Journal

of the European Union

L 196

English edition

Legislation

Volume 65

25 July 2022

|

ISSN 1977-0677 |

||

|

Official Journal of the European Union |

L 196 |

|

|

||

|

English edition |

Legislation |

Volume 65 |

|

|

|

|

|

(1) Text with EEA relevance. |

|

EN |

Acts whose titles are printed in light type are those relating to day-to-day management of agricultural matters, and are generally valid for a limited period. The titles of all other Acts are printed in bold type and preceded by an asterisk. |

II Non-legislative acts

REGULATIONS

|

25.7.2022 |

EN |

Official Journal of the European Union |

L 196/1 |

COMMISSION DELEGATED REGULATION (EU) 2022/1288

of 6 April 2022

supplementing Regulation (EU) 2019/2088 of the European Parliament and of the Council with regard to regulatory technical standards specifying the details of the content and presentation of the information in relation to the principle of ‘do no significant harm’, specifying the content, methodologies and presentation of information in relation to sustainability indicators and adverse sustainability impacts, and the content and presentation of the information in relation to the promotion of environmental or social characteristics and sustainable investment objectives in pre-contractual documents, on websites and in periodic reports

(Text with EEA relevance)

THE EUROPEAN COMMISSION,

Having regard to Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector (1), and in particular Article 2a(3), Article 4(6), third subparagraph, Article 4(7), second subparagraph, Article 8(3), fourth subparagraph, Article 8(4), fourth subparagraph, Article 9(5), fourth subparagraph, Article 9(6), fourth subparagraph, Article 10(2), fourth subparagraph, Article 11(4), fourth subparagraph and Article 11(5), fourth subparagraph thereof,

Whereas:

|

(1) |

Sustainability-related disclosures in the financial services sector should be sufficiently clear, concise, and prominent to enable end investors to take informed decisions. To that end, end investors should have access to reliable data that they can use and analyse in a timely and efficient manner. The information provided in such disclosures should therefore be reviewed and revised in accordance with the Directives, Regulations and national provisions referred to in Article 6(3) and Article 11(2) of Regulation (EU) 2019/2088. In addition, rules should be laid down concerning the publication of that information on websites, where such publication is required by Regulation (EU) 2019/2088. |

|

(2) |

The content and presentation of sustainability-related disclosures relating to financial products that reference a basket of indexes should provide end investors with a comprehensive view of the features of such financial products. It is therefore necessary that sustainability-related disclosures concerning an index that is designated as a reference benchmark and is made up of a basket of indexes, covers both the basket and each index in that basket. |

|

(3) |

For end investors that have an interest in the sustainability performance of financial market participants and financial advisers, it is essential that information provided by financial market participants about the principal adverse impacts of their investment decisions on sustainability factors, and by financial advisers about principal adverse impacts of their investment advice or insurance advice on sustainability factors, is comprehensive. Such information should therefore cover both direct and indirect investments in assets. |

|

(4) |

It is necessary to ensure that the information disclosed can be easily compared and that the indicators of principal adverse impacts of investment decisions on sustainability factors can be easily understood. Such comparability and comprehensibility would be improved by making a distinction between, on the one hand, indicators of adverse impacts that always lead to principal adverse impacts, and, on the other hand, additional indicators of adverse impacts on sustainability factors that are principal for the financial market participants. It is, however, important to ensure that adverse impacts of investment decisions on climate, or on other environment-related sustainability factors, are considered as important as adverse impacts of investment decisions on social, employee, human rights, anti-corruption or anti-bribery sustainability factors. The additional indicators of principal adverse impacts should therefore relate to at least one of each of those factors. To ensure coherence with other sustainability-related disclosures, the indicators of principal adverse impacts should use standardised metrics, where relevant, and be based on the indicators used in Commission Delegated Regulation (EU) 2020/1818 (2) and Commission Delegated Regulation (EU) 2021/2139 (3). |

|

(5) |

To further strengthen the comparability of the information to be disclosed, the information on principal adverse impacts should relate to reference periods that run from 1 January until 31 December of the preceding year, and should be published by 30 June each year as a common date. It is possible, however, that the portfolios of investments of financial market participants change regularly within such reference periods. The determination of principal adverse impacts should therefore be undertaken on at least four specific dates during such reference period and the average result should be disclosed on an annual basis. To ensure that end investors can compare how financial market participants have considered the principal adverse impacts over time, financial market participants should provide a historical year-by-year comparison of their reports for at least the five previous reference periods, where available. |

|

(6) |

Financial market participants that consider principal adverse impacts for the first time in a given calendar year should be treated appropriately, while it should also be ensured that end investors receive sufficient information before taking their investment decisions. Such financial market participants should therefore disclose information about the actions they plan or the targets they set for the subsequent reference period to avoid or reduce any principal adverse impacts identified. For the same reason, they should also disclose information about their policies to identify and prioritise principal adverse impacts on sustainability factors and the international standards they will apply in that subsequent reference period. |

|

(7) |

End investors should, irrespective of the Member State they reside in, be able to compare the disclosed principal adverse impacts on sustainability factors. Financial market participants should therefore provide a summary of their disclosures in both a language that is customary in the sphere of international finance and in one of the official languages of the Member States in which the financial products of those financial market participants are made available. |

|

(8) |

Financial advisers use information on principal adverse impacts on sustainability factors that is provided by financial market participants. Information provided by financial advisers on whether and how they take into account principal adverse impacts on sustainability factors within their investment or insurance advice should therefore clearly describe how the information from financial market participants is processed and integrated in their investment or insurance advice. In particular, financial advisers that rely on criteria or thresholds concerning principal adverse impacts on sustainability factors that are used to select, or advise on, financial products, should publish those criteria or thresholds. |

|

(9) |

The carbon footprint metrics are not yet fully developed. Financial market participants that, in accordance with Article 4(2), point (d), of Regulation (EU) 2019/2088, refer in their entity-level disclosures to the degree of alignment of their financial products with the objectives of the Paris Agreement adopted under the United Nations Framework Convention on Climate Change, should therefore base such disclosures on forward-looking climate scenarios. |

|

(10) |

One way in which financial products can promote environmental or social characteristics is to take into account principal adverse impacts of investment decisions. Financial products that have sustainable investment as their objective must, as part of the disclosures made with regard to the ‘do no significant harm’ principle, also consider sustainability indicators in relation to the adverse impacts referred to in Article 4(6) and (7) of Regulation (EU) 2019/2088. For those reasons, financial market participants should indicate, as part of their sustainability disclosures, how they consider, for those financial products, the principal adverse impacts of their investment decisions on sustainability factors. |

|

(11) |

Article 10(1), second subparagraph, of Regulation (EU) 2019/2088 requires financial market participants that make available financial products that promote environmental or social characteristics to disclose those characteristics without misleading end investors. That implies that financial market participants should not disclose on sustainability, including through product categorisation, in a way that does not reflect the way in which the financial product effectively promotes those environmental or social characteristics. Financial market participants should therefore only disclose those criteria for the selection of underlying assets that are binding on the investment decision-making process, and not criteria that they may ignore or override at their discretion. |

|

(12) |

Financial products that promote environmental or social characteristics can be used to invest in a wide range of underlying assets, some of which may not themselves qualify as sustainable investments or contribute to the specific environmental or social characteristics promoted by the financial product. Examples of such investments are hedging instruments, unscreened investments for diversification purposes, investments for which data are lacking or cash held as ancillary liquidity. Financial market participants making available such financial products should therefore be fully transparent about the allocation of the underlying investments to those categories of investments. |

|

(13) |

Financial products can promote environmental or social characteristics in a myriad of ways, including in a pre-contractual or periodic document, in their product name or in any marketing communication about their investment strategy, financial product standards, labels they adhere to, or applicable conditions for automatic enrolment. To ensure comparability and comprehensibility of the promoted environmental or social characteristics, financial market participants that make available financial products that promote environmental or social characteristics should confirm the information about the promotion of environmental or social characteristics in annexes to the documents or information referred to in Article 6(3) and Article 11(2) of Regulation (EU) 2019/2088 on pre-contractual and periodic disclosures. |

|

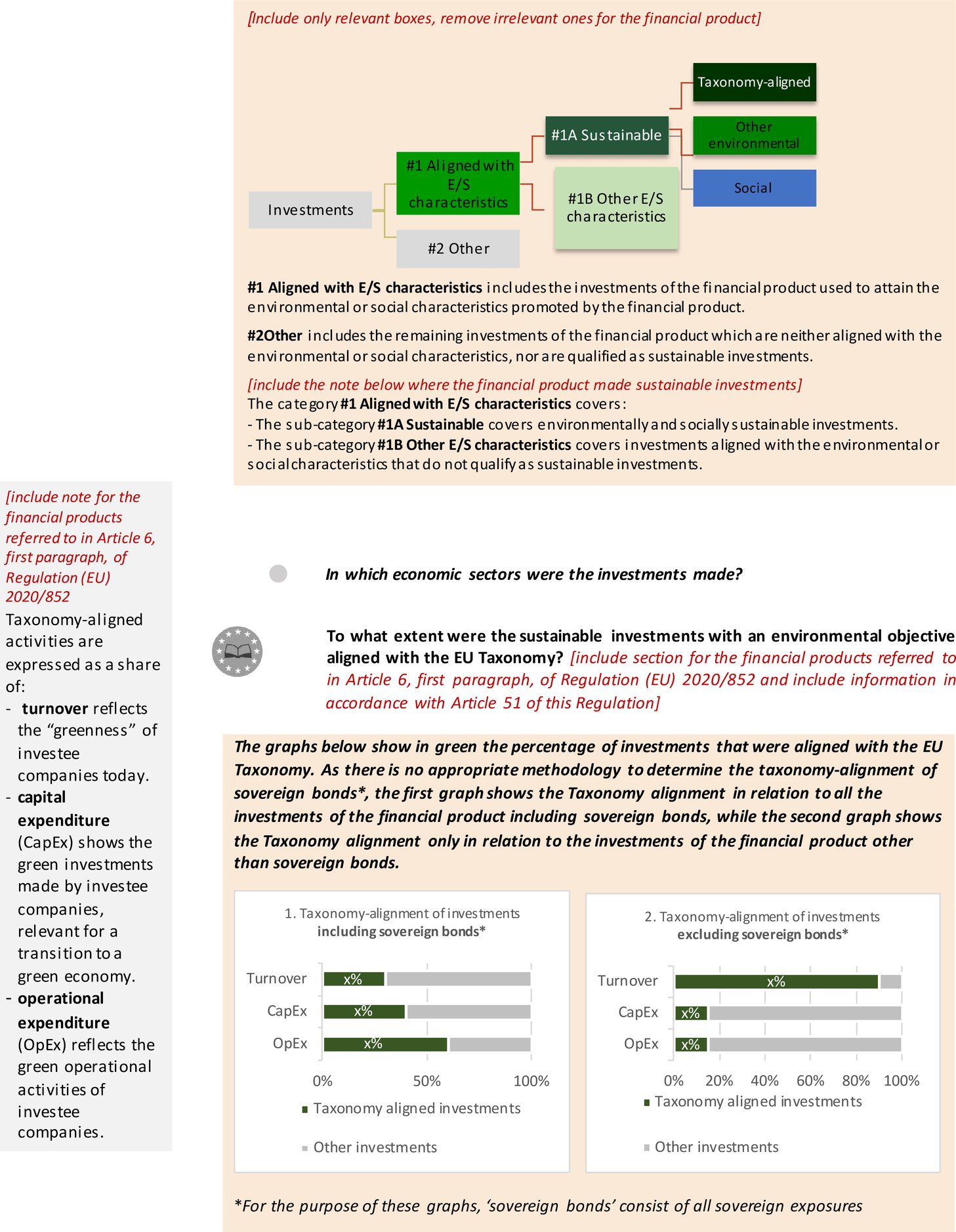

(14) |

Financial products that promote environmental or social characteristics have various degrees of sustainability-related ambition. Therefore, where those financial products pursue sustainable investment in part, financial market participants should confirm that fact in the annexes to the documents or information referred to in Article 6(3) and Article 11(2) of Regulation (EU) 2019/2088 on pre-contractual and periodic disclosures to ensure that end investors are able to understand the different degrees of sustainability and take informed investment decisions in terms of sustainability. |

|

(15) |

While financial products that have sustainable investment as their objective should make sustainable investments only, such products can to some extent make other investments where they are required to do so under sector specific rules. It is therefore appropriate to require disclosures on the amount and purpose of any other investments so that it can be verified whether those investments do not prevent the financial product from attaining its sustainable investment objective. |

|

(16) |

Many financial products rely on exclusion strategies based on environmental or social criteria. End investors should be provided with the information necessary to assess the effects of such criteria on investment decisions, and the effects of such exclusion strategies on the composition of the resulting portfolio. Market practice demonstrates that some exclusion strategies are showcased as effective, while in fact those exclusion strategies actually lead to the exclusion of only a limited number of investments, or are based on exclusions required by law. It is therefore necessary to address concerns about ‘greenwashing’, that is, in particular, the practice of gaining an unfair competitive advantage by recommending a financial product as environmentally friendly or sustainable, when in fact that financial product does not meet basic environmental or other sustainability-related standards. To prevent mis-selling and greenwashing, and to provide end investors with a better understanding of the effects of the exclusion strategies applied by certain financial products, financial market participants should confirm any commitment in terms of excluded investments, in particular as binding elements of the investment strategy, in information on asset allocation and in the information on sustainability indicators used to measure the effects of such strategies. |

|

(17) |

Regulation (EU) 2019/2088 aims to reduce information asymmetries in principal-agent relationships concerning the promotion of environmental or social characteristics and sustainable investment objectives. To that end, that Regulation requires financial market participants to make pre-contractual and website disclosures to end investors when they act as agents of those end investors. For that requirement to be fully effective, financial market participants should monitor throughout the lifecycle of a financial product how that product complies with the disclosed environmental or social characteristics, or with the sustainable investment objective. Financial market participants should therefore explain, as part of their website disclosures, the internal or external control mechanisms put in place to monitor such compliance on a continuous basis. |

|

(18) |

Regulation (EU) 2019/2088 specifies that the assessment of good governance practices forms an integral part of financial products that promote environmental or social characteristics, or that have sustainable investment as their objective. Therefore, financial market participants that make available financial products that promote environmental or social characteristics or that have a sustainable investment objective should disclose information on their policies to assess good governance practices of investee companies. |

|

(19) |

Article 8(1), point (b), of Regulation (EU) 2019/2088 requires financial market participants that make available financial products that promote environmental or social characteristics and that use a designated index as a reference benchmark to disclose whether and how that index is consistent with those characteristics. In contrast, Article 9(1) of Regulation (EU) 2019/2088 requires financial market participants that make available financial products that have sustainable investment as their objective and that use a designated index as a reference benchmark to disclose how that index is aligned with that investment objective and why and how that designated index differs from a broad market index. For such financial products, financial market participants should thus clearly demonstrate that the design of the designated index is appropriate to deliver the stated sustainable investment objective and that the strategy of the financial product ensures that the financial product is continuously aligned with that index. Therefore, methodological disclosures should be made at index level for such financial products. |

|

(20) |

Financial market participants can use various investment methods to ensure that the financial products that they make available meet the environmental or social characteristics, or attain the sustainable investment objective. Financial market participants can directly invest in securities issued by investee companies or make indirect investments. Financial market participants should be transparent about which share of their investments is held directly and which share is held indirectly. In particular, financial market participants should explain how the use of derivatives is compatible with the environmental or social characteristics that the financial product promotes or with the objective of sustainable investment. |

|

(21) |

To ensure clarity to end investors, pre-contractual information about financial products that promote environmental or social characteristics should make clear, by way of a statement, that such products do not have sustainable investment as an objective. For the same purpose, and to ensure a level-playing field with financial products that have sustainable investment as their objective, pre-contractual, website and periodic information about products that promote environmental or social characteristics should also mention the proportion of the sustainable investments. |

|

(22) |

Article 2, point (17), of Regulation (EU) 2019/2088 defines a sustainable investment as an investment in an economic activity that contributes to an environmental or social objective, or an investment in human capital or economically or socially disadvantaged communities, provided that such investments do not significantly harm any of those objectives and that the investee companies follow good governance practices. The ‘do not significant harm’ principle is particularly important for financial products that have sustainable investment as their objective as compliance with that principle is a necessary criterion to assess whether an investment delivers the sustainable investment objective. That principle is, however, also relevant for financial products that promote environmental or social characteristics where those financial products make sustainable investments, as financial market participants should disclose the proportion of sustainable investments made. Financial market participants that make available financial products that promote environmental or social characteristics which partly make sustainable investments or financial products that have sustainable investment as their objective should thus provide information relating to the ‘do not significant harm’ principle. The principle of ‘do not significant harm’ is linked to the disclosures of principal adverse impacts of investment decisions on sustainability factors. For that reason, financial product disclosures about the ‘do not significant harm’ principle should explain how the indicators for adverse impacts have been taken into account. Furthermore, as those disclosures are closely linked to Regulation (EU) 2020/852 of the European Parliament and of the Council (4), it is appropriate to require additional information on the alignment of the investments with the minimum safeguards set out in that Regulation. |

|

(23) |

To enable end investors to better understand the investment strategies offered, financial market participants should use website sustainability-related disclosures to expand on topics disclosed in a concise way in pre-contractual documents and to provide further information relevant to those end investors. Before a contract is concluded, financial market participants should inform end investors about the fact that more product-specific, detailed information can be found on the website and provide them with a hyperlink to that information. |

|

(24) |

The website product disclosure should provide additional details about the investment strategy used for the financial product concerned, including the policy to assess good governance of investee companies, and the methodologies used to measure whether the financial product meets the environmental or social characteristics or attains sustainable investment objectives. Moreover, financial market participants should publish on their website a clear, succinct and understandable summary of the information provided as part of the periodic reporting. |

|

(25) |

With respect to the content of the periodic disclosures required by Article 11 of Regulation (EU) 2019/2088, financial market participants should disclose a minimum set of standardised and comparable quantitative and qualitative indicators that demonstrate how each financial product meets the environmental or social characteristics that it promotes or the sustainable investment objective that it aims to attain. Those indicators should be relevant to the design and investment strategy of the financial product as described in the pre-contractual information of the financial product. In particular, to ensure consistency between pre-contractual disclosures and periodic disclosures, financial market participants should report in their periodic disclosures on the specific sustainability indicators mentioned in the pre-contractual information and that are used to measure how the environmental or social characteristics are met or the sustainable investment objective is attained. |

|

(26) |

It is necessary to ensure that end investors have a clear overview of the investments of the financial product. Financial market participants should therefore provide in the periodic reports required by Article 11 of Regulation (EU) 2019/2088 information on the impacts of the fifteen top investments of the financial product. Those top investments should be selected on the basis of the investments accounting for the greatest proportion of investments over the course of the period covered by the periodic report, calculated at appropriate intervals to be representative of that period. However, where less than fifteen investments account for half of the investments of the financial product, financial market participants should provide information on those investments only. Moreover, to ensure adequate comparability over time, financial market participants should provide a historical year-by-year comparison of their periodic reports for at least the five previous periods, provided periodic reports for those periods are available. |

|

(27) |

Financial market participants making available financial products that use a reference benchmark to meet environmental or social characteristics, or to attain the sustainable investment objective, should be transparent on how well the financial product is able to stay in line with the designated reference benchmark when aiming to meet or to attain that characteristic or objective. For that reason, and to foster consistency with the environmental, social and governance (ESG) disclosures required at benchmark level by Regulation (EU) 2016/1011 of the European Parliament and Council (5), financial market participants should compare in their periodic reports the performance of the financial product concerned with that of the designated reference benchmark for all those sustainability indicators that are relevant to substantiate that the designated benchmark is aligned with the environmental or social characteristics of the financial product or its sustainable investment objective. That comparison should also enable end investors to clearly determine to what extent the financial product performs in a sustainable manner compared to the performance of a mainstream product. |

|

(28) |

It is necessary to ensure that end investors are able to benefit from the sustainability-related disclosures in relation to an offer for a financial product from a financial market participant from another Member State. Financial market participants should therefore provide a summary of the information provided in those sustainability-related disclosures in a language that is customary in the sphere of international finance. Where a financial product is made available outside of the Member State where the financial market participant is established, a summary of that information should also be provided in one of the official languages of the Member State where the financial product is made available. |

|

(29) |

It is necessary to ensure comparability of the principal adverse impacts statement, the pre-contractual disclosures and the periodic disclosures required by Regulation (EU) 2019/2088, and to ensure that such information is easily comprehensible to end investors. It is therefore appropriate to set out standard templates for the presentation of that information. For the same reason, the templates should contain summary explanations of key terms used in those templates. |

|

(30) |

Certain financial products may offer a range of underlying investment options to end investors. It is necessary to ensure that end investors are informed about the potential sustainability performance of such products, and that financial market participants are required to provide information on those options that promote environmental or social characteristics or have sustainable investment as their objective. That information should make clear that for financial products that promote environmental or social characteristics, the extent to which those products meet those characteristics is subject to the proportion of options selected by the end investor that promote those characteristics and the period of time in which the end investor invests in those options. The information provided should also make clear that for financial products that have sustainable investment as their objective, all of the underlying investment options must have sustainable investment as their objective. There are financial products that offer a range of underlying investment options to end investors, with one or more of the underlying investment options qualifying as financial products that promote environmental or social characteristics. To provide full transparency, it is important to ensure that information about those financial products also covers those options. There are also financial products where one or more of the underlying investment options are financial products that have sustainable investment as their objective. In that case also, the information about those products should cover those options. There are also financial products with one or more of the underlying investment options that have sustainable investment as their objective, but where those options are not financial products as defined in Article 2, point (12), of Regulation (EU) 2019/2088. Since those options are within an overall financial product within the scope of Regulation (EU) 2019/2088 and have sustainable investment as their objective, it is appropriate to require minimum information to be provided on their sustainable investment objective. |

|

(31) |

Pre-contractual disclosures for financial products that offer a range of underlying investment options should provide an appropriate level of sustainability-related information on the financial product overall. End investors should be provided with a summary list of the sustainability-related underlying investment options and a clear indication of where sustainability-related information about those options can be found. That list should ensure that the underlying investment options are appropriately categorised in terms of the objective of sustainable investment and the promotion of environmental or social characteristics. |

|

(32) |

Including the sustainability-related information directly in the form of annexes to the pre-contractual disclosures referred to in Regulation (EU) 2019/2088 may prevent an end investor from receiving a clear and concise disclosure because the financial product may offer a large range of underlying investment options and a corresponding number of annexes of information. In such cases, it should be allowed that such information is provided through a reference to other disclosures made pursuant to Directives, Regulations or national law. Similarly, for periodic disclosures relating to financial products that offer a range of underlying investment options, the periodic information should only relate to the investment options invested in, because the investment options actually invested in govern the extent to which the financial product meets the environmental or social characteristics that it promotes or attains its sustainable investment objective. |

|

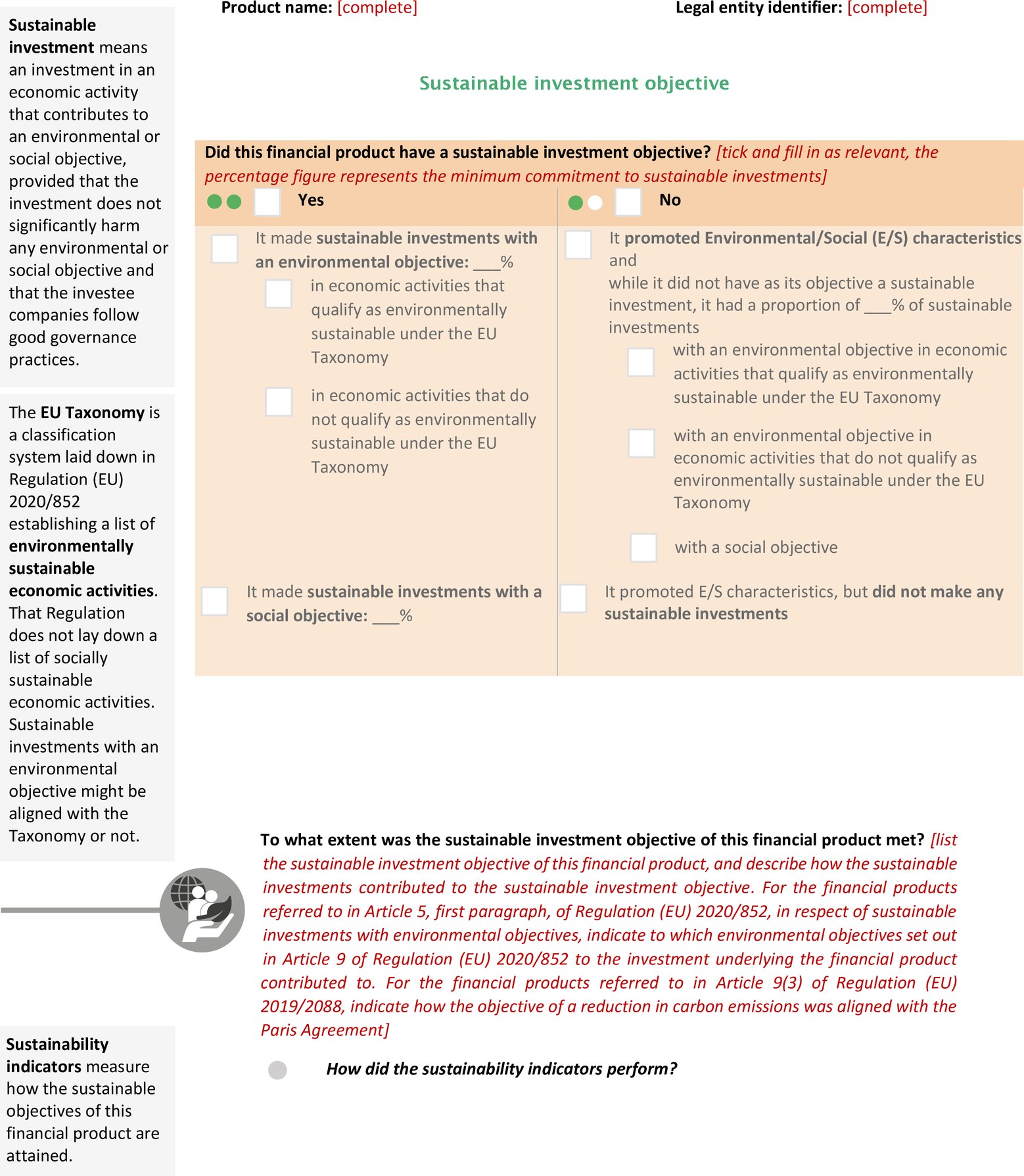

(33) |

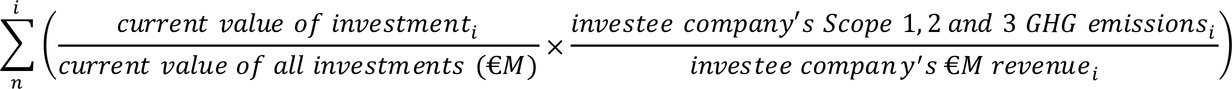

Regulation (EU) 2020/852 amended Regulation (EU) 2019/2088 by requiring financial market participants to include within the pre-contractual and periodic disclosures of financial products that have sustainable investment as their objective and invest in an economic activity that contributes to an environmental objective within the meaning of Article 2, point (17), of that Regulation, information on the environmental objective as set out in Regulation (EU) 2020/852, and a description of how and to what extent the investments underlying the financial product are in environmentally sustainable economic activities as referred to in Article 3 of that Regulation. In addition, Regulation (EU) 2019/2088 now also requires financial market participants to include within the pre-contractual and periodic disclosures of financial products that promote environmental characteristics information required for financial products that have sustainable investment as their objective and invest in an economic activity that contributes to an environmental objective within the meaning of that Regulation. It is necessary to enable end investors to easily compare the degrees of financial products’ investments in environmentally sustainable economic activities. Financial market participants should therefore, for the purposes of Article 6(1) and 2, and Article 11(2) of Regulation (EU) 2019/2088, include in the annexes to the documents or information referred to in Article 6(3) and Article 11(2) of that Regulation (EU) graphical representations of such investments on the basis of a standardised metric, with the numerator consisting of the market value of investments in environmentally sustainable economic activities and the denominator consisting of the market value of all investments. In order to provide reliable information to end investors, the numerator should include the market value of the investments in investee companies that represents the proportion of environmentally sustainable economic activities of those investee companies, and the proceeds of debt securities where the debt securities terms require those proceeds to be used for environmentally sustainable economic activities. To capture all investments that can finance environmentally sustainable economic activities, it should be possible to include into the numerator infrastructure assets, real estate assets, securitisation assets and investments in other financial products as referred to in Article 5, first paragraph, and Article 6, first paragraph, of Regulation (EU) 2020/852. Due to the lack of reliable methodologies to determine to what extent exposures achieved through derivatives are exposures to environmentally sustainable economic activities, such exposures should not be included in the numerator. The denominator should consist of the market value of all investments. |

|

(34) |

There is currently no appropriate methodology to calculate to what extent exposures to central governments, central banks and supranational issuers (‘sovereign exposures’) are exposures to environmentally sustainable economic activities. In order to increase awareness of end investors, it is appropriate to calculate and graphically represent the extent of investments in environmentally sustainable economic activities in two ways. The first way is to allow the inclusion in the numerator of investments in debt securities issued by central governments, central banks and supranational issuers where the debt securities’ terms require the proceeds to be used for environmentally sustainable economic activities and the inclusion in the denominator of investments in debt securities issued by central governments, central banks and supranational issuers, regardless of the use of proceeds. To further inform investment decisions of end investors, financial market participants should explain why certain sovereign exposures are not in environmentally sustainable economic activities, including where that is the case due to the lack of appropriate methodologies to calculate to what extent those exposures are exposures to environmentally sustainable economic activities. The second way is to exclude sovereign exposures from the numerator and from the denominator, thus further enhancing comparability among financial products and allowing end investors to assess to what extent financial products invest in environmentally sustainable economic activities without the inclusion of sovereign exposures. |

|

(35) |

Financial market participants should be able to rely on third party data providers where undertakings have not yet complied with the obligation, laid down in Article 8 of Regulation (EU) 2020/852, to disclose information on how and to what extent their activities are associated with economic activities that qualify as environmentally sustainable under Articles 3 and 9 of that Regulation. For the assessment of investments in investee companies that are not subject to the disclosures required by Article 8 of Regulation (EU) 2020/852, financial market participants should assess and use the publicly reported data. Only where such data are not available, financial market participants should be allowed to use data that have been obtained either directly from investee companies, or from third parties, in each case provided that the data made available under such disclosures are equivalent to the data made available under the disclosures made in accordance with that Article 8. |

|

(36) |

It is necessary to ensure that financial products consistently disclose information on the degree to which investments in investee companies that are non-financial undertakings, are investments in environmentally sustainable economic activities under Articles 3 and 9 of Regulation (EU) 2020/852. To that end, financial market participants should select either the proportion of the turnover, capital expenditure or operating expenditure to calculate the key performance indicator per financial product to measure that degree, and they should disclose that selection in the annexes to the documents or information referred to in Article 6(3) of Regulation (EU) 2019/2088. To ensure comparability among financial products and for ease of comprehension by end investors, the key performance indicator should by default be turnover. Capital expenditure or operating expenditure should only be used where the features of the financial product justify such use, in particular where capital expenditure or operating expenditure are more representative for the degree to which those financial products invest in environmentally sustainable economic activities, and provided such use is explained. For investee companies that are financial undertakings, as defined in Article 1, point (8), of Commission Delegated Regulation (EU) 2021/2178 (6), the comparability should be achieved by requiring the use of the same key performance indicator for the same type of financial undertaking. For insurance undertakings and reinsurance undertakings that carry out non-life underwriting activities, it should be possible to combine both the investment and underwriting key performance indicators into a single key performance indicator. To promote transparency to end investors, it is necessary to require that the periodic disclosures of how and to what extent the investments underlying the financial product are made in environmentally sustainable economic activities provide a comparison with the targeted proportions of investments in those economic activities featured in the pre-contractual disclosures. To ensure comparability and transparency, the periodic disclosures should indicate to what degree the investments were made in those economic activities by turnover, capital expenditure and operational expenditure. |

|

(37) |

The provisions of this Regulation are closely linked to each other, since they all deal with the information that must be provided by financial market participants and financial advisers in relation to sustainability-related disclosures in the financial services sector required under Regulation (EU) 2019/2088. To ensure coherence between those provisions, which should enter into force at the same time, and to facilitate a comprehensive view by financial market participants and financial advisers of their obligations under that Regulation, it is appropriate to include all the regulatory technical standards required by Article 2a(3), Article 4(6), third subparagraph, Article 4(7), second subparagraph, Article 8(3), fourth subparagraph, Article 8(4), fourth subparagraph, Article 9(5), fourth subparagraph, Article 9(6), fourth subparagraph, Article 10(2), fourth subparagraph, Article 11(4), fourth subparagraph, and Article 11(5), fourth subparagraph, into a single Regulation. |

|

(38) |

This Regulation is based on the draft regulatory technical standards submitted to the Commission by the European Banking Authority, the European Insurance and Occupational Pensions Authority and the European Securities and Markets Authority (European Supervisory Authorities). |

|

(39) |

The Joint Committee of the European Supervisory Authorities referred to in Article 54 of Regulation (EU) No 1093/2010 of the European Parliament and of the Council (7), in Article 54 of Regulation (EU) No 1094/2010 of the European Parliament and of the Council (8) and in Article 54 of Regulation (EU) No 1095/2010 of the European Parliament and of the Council (9) has conducted open public consultations on the draft regulatory technical standards on which this Regulation is based, analysed the potential related costs and benefits and requested the advice of the Baking Stakeholder Group established in accordance with Article 37 of Regulation (EU) No 1093/2010, the Insurance and Reinsurance Stakeholder Group established in accordance with Article 37 of Regulation (EU) No 1094/2010, and the Securities and Markets Stakeholder Group established in accordance with Article 37 of Regulation (EU) No 1095/2010. |

|

(40) |

It is necessary to enable financial market participants and financial advisers to adapt to the requirements laid down in this Delegated Regulation. Its date of application should therefore be deferred to 1 January 2023. It is, however, necessary to require financial market participants that have considered principal adverse impacts of investment decisions on sustainability factors as referred to in Article 4(1), point (a), of Regulation (EU) 2019/2088, or as required by Article 4(3) or (4) of that Regulation, by 31 December 2022, to publish the first time the information on those impacts on their websites in separate sections titled ‘Statement on principal adverse impacts of investment decisions on sustainability factors’ by 30 June 2023 for the period of 1 January 2022 until 31 December 2022, |

HAS ADOPTED THIS REGULATION:

CHAPTER I

DEFINITIONS AND GENERAL PROVISIONS

Article 1

Definitions

For the purposes of this Regulation, the following definitions apply:

|

(1) |

‘financial undertaking’ means an AIFM as defined in Article 4(1), point (b), of Directive 2011/61/EU of the European Parliament and of the Council (10), a management company as defined in Article 2(1), point (b), of Directive 2009/65/EC of the European Parliament and of the Council (11), an investment company authorised in accordance with Articles 27, 28 and 29 of Directive 2009/65/EC that has not designated for its management a management company authorised in accordance with Articles 6, 7 and 8 of that Directive, a credit institution as defined in Article 4(1), point (1), of Regulation (EU) No 575/2013 of the European Parliament and of the Council (12), an investment firm as defined in Article 4(1), point (2), of Regulation (EU) No 575/2013, an insurance undertaking as defined in Article 13, point (1), of Directive 2009/138/EC of the European Parliament and of the Council (13), a reinsurance undertaking as defined in Article 13, point (4), of Directive 2009/138/EC, or any third country entity that carries out similar activities, is subject to the laws of a third country and is supervised by a third-country supervisory authority; |

|

(2) |

‘non-financial undertaking’ means an undertaking that is not a financial undertaking as defined in point (1); |

|

(3) |

‘sovereign exposure’ means an exposure to central governments, central banks and supranational issuers; |

|

(4) |

‘environmentally sustainable economic activity’ means an economic activity that complies with the requirements laid down in Article 3 of Regulation (EU) 2020/852; |

|

(5) |

‘transitional economic activity’ means an economic activity that complies with the requirements laid down in Article 10(2) of Regulation (EU) 2020/852; |

|

(6) |

‘enabling economic activity’ means an economic activity that complies with the requirements laid down in Article 16 of Regulation (EU) 2020/852. |

Article 2

General principles for the presentation of information

1. Financial market participants and financial advisers shall provide the information required by this Regulation free of charge and in a manner that is easily accessible, non-discriminatory, prominent, simple, concise, comprehensible, fair, clear and not misleading. Financial market participants and financial advisers shall present and lay out the information required by this Regulation in a way that is easy to read, use characters of readable size and use a style that facilitates its understanding. Financial market participants may adapt size and font type of characters and colours used in the templates set out in Annexes I to V to this Regulation.

2. Financial market participants and financial advisers shall provide the information required by this Regulation in a searchable electronic format, unless otherwise required by the sectoral legislation referred to in Article 6(3) and Article 11(2) of Regulation (EU) 2019/2088.

3. Financial market participants and financial advisers shall keep the information published on their websites in accordance with this Regulation up to date. They shall clearly mention the date of publication of the information and the date of any update. Where that information is presented as a downloadable file, financial market participants and financial advisers shall indicate the version history in the file name.

4. Financial market participants and financial advisers shall provide, where available, legal entity identifiers (LEIs) and international securities identification numbers (ISINs) when referring to entities or financial products in the information provided in accordance with this Regulation.

Article 3

Reference benchmarks with basket indexes

Where an index designated as a reference benchmark is made up of a basket of indexes, financial market participants and financial advisers shall provide the information relating to that index in respect of that basket and of each index in that basket.

CHAPTER II

TRANSPARENCY ABOUT ADVERSE IMPACTS ON SUSTAINABILITY FACTORS

SECTION 1

Financial market participants

Article 4

Statement by financial market participants that they do consider principal adverse impacts of their investment decisions on sustainability factors

1. By 30 June each year, the financial market participants referred to in Article 4(1), point (a), of Regulation (EU) 2019/2088, or Article 4(3) or Article 4(4) of that Regulation, shall publish on their website, in a separate section titled: ‘Statement on principal adverse impacts of investment decisions on sustainability factors’, the information referred to in Article 4(1), point (a), of Regulation (EU) 2019/2088, in Article 4(2), (3) and (4) of that Regulation, and in Articles 4 to 10 of this Regulation. That information shall cover the period of 1 January until 31 December of the preceding year, and shall be published in the section ‘Sustainability-related disclosures’ referred to in Article 23 of this Regulation.

2. Financial market participants shall publish the statement referred to in paragraph 1 in the format of the template set out in Table 1 of Annex I.

3. By way of derogation from paragraph 1, for financial market participants that publish the statement referred to in Article 4(1), point (a), of Regulation (EU) 2019/2088, or Article 4(3) or Article 4(4) of that Regulation for the first time, the information referred to in paragraph 1 shall cover the period from the date on which the principal adverse impacts of investment decisions on sustainability factors were first considered until 31 December of that year. Those financial market participants shall publish the information in the statement referred to in paragraph 1 by 30 June of the following year.

Article 5

Summary section

In the summary section in Table 1 of Annex I, financial market participants shall include all of the following:

|

(a) |

the name of the financial market participant to which the adverse sustainability impacts statement relates; |

|

(b) |

the fact that principal adverse impacts on sustainability factors are considered; |

|

(c) |

the reference period of the statement; |

|

(d) |

a summary of the principal adverse impacts. |

The summary section in Table 1 of Annex I shall be drafted in all of the following languages:

|

(a) |

one of the official languages of the home Member State of the financial market participant and, where different, in an additional language customary in the sphere of international finance; |

|

(b) |

where a financial product of the financial market participant is made available in a host Member State, one of the official languages of that host Member State. |

The summary section shall be of a maximum length of two sides of A4-sized paper when printed.

Article 6

Description of the principal adverse impacts of investment decisions on sustainability factors

1. In the section ‘Description of the principal adverse impacts on sustainability factors’ in Table 1 of Annex I, financial market participants shall complete all the fields that relate to the indicators related to principal adverse impacts of their investment decisions on sustainability factors, and they shall add all of the following:

|

(a) |

information on one or more additional climate and other environment-related indicators, as set out in Table 2 of Annex I; |

|

(b) |

information on one or more additional indicators for social and employee matters, respect for human rights, anti-corruption and anti-bribery matters, as set out in Table 3 of Annex I; |

|

(c) |

information on any other indicators used to identify and assess additional principal adverse impacts on a sustainability factor. |

2. In the section ‘Description of the principal adverse impacts on sustainability factors’ in Table 1 of Annex I, financial market participants shall describe the actions taken during the period from 1 January to 31 December of the preceding year and actions planned or targets set for the subsequent period from 1 January to 31 December to avoid or reduce the principal adverse impacts identified.

3. Financial market participants shall include in the columns ‘Impact’ in the section ‘Description of the principal adverse impacts on sustainability factors’ in Table 1 of Annex I a figure on impact as the average of impacts on 31 March, 30 June, 30 September and 31 December of each period from 1 January to 31 December.

Article 7

Description of policies to identify and prioritise principal adverse impacts of investment decisions on sustainability factors

1. In the section ‘Description of policies to identify and prioritise principal adverse impacts on sustainability factors’ in Table 1 of Annex I, financial market participants shall describe their policies to identify and prioritise principal adverse impacts on sustainability factors and how those policies are kept up to date and applied, including all of the following:

|

(a) |

the date on which the governing body of the financial market participant approved those policies; |

|

(b) |

how the responsibility for the implementation of those policies within organisational strategies and procedures is allocated; |

|

(c) |

the methodologies to select the indicators referred to in Article 6(1), points (a), (b) and (c), and to identify and assess the principal adverse impacts referred to in Article 6(1), and in particular an explanation of how those methodologies take into account the probability of occurrence and the severity of those principal adverse impacts, including their potentially irremediable character; |

|

(d) |

any associated margin of error within the methodologies referred to in point (c) of this paragraph, with an explanation of that margin; |

|

(e) |

the data sources used. |

2. Where information relating to any of the indicators used is not readily available, financial market participants shall include in the section ‘Description of policies to identify and prioritise principal adverse impacts on sustainability factors’ in Table 1 of Annex I details of the best efforts used to obtain the information either directly from investee companies, or by carrying out additional research, cooperating with third party data providers or external experts or making reasonable assumptions.

Article 8

Engagement policies section

1. In the section ‘Engagement policies’ in Table 1 of Annex I, financial market participants shall provide all of the following information:

|

(a) |

where applicable, brief summaries of the engagement policies referred to in Article 3g of Directive 2007/36/EC of the European Parliament and of the Council (14); |

|

(b) |

brief summaries of any other engagement policies to reduce principal adverse impacts. |

2. The brief summaries referred to in paragraph 1 shall describe all of the following:

|

(a) |

the indicators for adverse impacts considered in the engagement policies referred to in paragraph 1; |

|

(b) |

how those engagement policies will be adapted where there is no reduction of the principal adverse impacts over more than one period reported on. |

Article 9

References to international standards section

1. In the section ‘References to international standards’ in Table 1 of Annex I, financial market participants shall describe whether and to what extent they adhere to responsible business conduct codes and internationally recognised standards for due diligence and reporting and, where relevant, the degree of their alignment with the objectives of the Paris Agreement.

2. The description referred to in paragraph 1 shall contain information about all of the following:

|

(a) |

the indicators used to consider the principal adverse impacts on sustainability factors referred to in Article 6(1) that measure the adherence or alignment referred to in paragraph 1; |

|

(b) |

the methodology and data used to measure the adherence or alignment referred to in paragraph 1, including a description of the scope of coverage, data sources, and how the methodology used forecasts the principal adverse impacts of investee companies; |

|

(c) |

whether a forward-looking climate scenario is used, and, if so, the name and provider of that scenario and when it was designed; |

|

(d) |

where no forward-looking climate scenario is used, an explanation of why the financial market participant does consider forward-looking climate scenarios to be irrelevant. |

Article 10

Historical comparison

Financial market participants that have described the adverse impacts on sustainability factors for a period preceding the period for which information is to be disclosed in accordance with Article 6 shall provide in the section ‘Description of principal adverse impacts on sustainability factors’ in Table 1 of Annex I a historical comparison of the period reported on with the previous period reported on and, subsequently, with every previous period reported on up to the last five previous periods.

SECTION 2

Financial advisers

Article 11

Statement by financial advisers that they do consider in their insurance or investment advice principal adverse impacts on sustainability factors

1. The financial advisers referred to in Article 2, point (11), points (a) and (b), of Regulation (EU) 2019/2088 that apply Article 4(5), point (a), of that Regulation shall publish the information referred to in Article 4(5), point (a), of that Regulation in a separate section of their website titled, ‘Statement on principal adverse impacts of insurance advice on sustainability factors’.

2. The financial advisers referred to in Article 2, point (11), points (c) to (f), of Regulation (EU) 2019/2088 and apply Article 4(5), point (a), of that Regulation shall publish the information referred to in Article 4(5), point (a), of that Regulation in a separate section of their websites titled, ‘Statement on principal adverse impacts of investment advice on sustainability factors’.

3. The statement and information referred to in paragraphs 1 and 2 shall contain details on the process used by financial advisers to select the financial products they advise on, including all of the following:

|

(a) |

how the financial advisers use the information published by financial market participants pursuant to this Regulation; |

|

(b) |

whether the financial advisers rank and select financial products based on the indicators listed in Table 1 of Annex I and any additional indicators and, where applicable, a description of the ranking and selection methodology used; |

|

(c) |

any criteria or thresholds based on the principal adverse impacts listed in Table 1 of Annex I that are used to select, or advise on, financial products. |

SECTION 3

Statement by financial market participants that they do not consider adverse impacts of investment decisions on sustainability factors, and statement by financial advisers that they do not consider adverse impacts of investment decisions on sustainability factors in their investment or insurance advice

Article 12

Statement by financial market participants that they do not consider adverse impacts of their investments decisions on sustainability factors

1. Financial market participants referred to in Article 4(1), point (b), of Regulation (EU) 2019/2088 shall publish the information referred to in Article 4(1), point (b), of that Regulation in a separate section of their website titled ‘No consideration of adverse impacts of investment decisions on sustainability factors’.

2. The statement referred to in paragraph 1 shall contain all of the following:

|

(a) |

a prominent statement that the financial market participant does not consider any adverse impacts of its investment decisions on sustainability factors; |

|

(b) |

the reasons why the financial market participant does not consider any adverse impacts of its investment decisions on sustainability factors and, where relevant, information on whether the financial market participant intends to consider such adverse impacts by reference to the indicators listed in Table 1 of Annex I, and if so, when. |

Article 13

Statement by financial advisers that they do not consider adverse impacts of investment decisions on sustainability factors in their investment or insurance advice

1. The financial advisers referred to in Article 2, point (11), points (a) and (b), of Regulation (EU) 2019/2088 that apply Article 4(5), point (b), of that Regulation shall publish the information referred to in Article 4(5), point (b), of that Regulation in a separate section of their website titled ‘No consideration of adverse impacts of insurance advice on sustainability factors’.

2. The financial advisers referred to in Article 2, point (11), points (c) to (f), of Regulation (EU) 2019/2088 that apply Article 4(5), point (b), of that Regulation shall publish the information referred to in Article 4(5), point (b), of that Regulation in a separate section of their website titled ‘No consideration of adverse impacts of investment advice on sustainability factors’.

3. The statement and information referred to in paragraphs 1 and 2 shall contain all of the following:

|

(a) |

a prominent statement that the financial adviser does not consider any adverse impacts of investment decisions on sustainability factors in its investment or insurance advice; |

|

(b) |

the reasons why the financial adviser does not consider any adverse impacts of investment decisions on sustainability factors in its investment or insurance advice and, where relevant, information on whether the financial adviser intends to consider such adverse impacts by reference to the indicators listed in Table 1 of Annex I, and if so, when. |

CHAPTER III

PRE-CONTRACTUAL PRODUCT DISCLOSURE

SECTION 1

Promotion of environmental or social characteristics

Article 14

Presentation by financial market participants of the pre-contractual information to be disclosed pursuant to Article 8(1), (2) and (2a) of Regulation (EU) 2019/2088

1. Financial market participants shall present the information to be disclosed pursuant to Article 8(1), (2) and (2a) of Regulation (EU) 2019/2088 in the format of the template set out in Annex II to this Regulation. That information shall be attached as an annex to the documents or the information referred to in Article 6(3) of Regulation (EU) 2019/2088.

2. Financial market participants shall include in the main body of the documents or information referred to in Article 6(3) of Regulation (EU) 2019/2088 a prominent statement that information about the environmental or social characteristics is available in the annex to those documents or that information.

3. Financial market participants shall provide at the beginning of the annex to the documents or the information referred to in Article 6(3) of Regulation (EU) 2019/2088 all of the following information:

|

(a) |

whether the financial product intends to make any sustainable investments; |

|

(b) |

whether the financial product promotes environmental or social characteristics, without having as its objective a sustainable investment. |

Article 15

Sustainable investment information in the asset allocation section for financial products that promote environmental characteristics

1. For the financial products referred to in Article 6, first subparagraph, of Regulation (EU) 2020/852, financial market participants shall provide, in the section ‘To what minimum extent are sustainable investments with an environmental objective aligned with the EU Taxonomy?’ in the template set out in Annex II, all of the following:

|

(a) |

a graphical representation in the form of a pie chart of:

|

|

(b) |

a description of the investments underlying the financial products that are in environmentally sustainable economic activities, including whether the compliance of those investments with the requirements laid down in Article 3 of Regulation (EU) 2020/852 will be subject to an assurance provided by one or more auditors or a review by one or more third parties and, if so, the name or the names of the auditor or third party; |

|

(c) |

where the financial products invest in economic activities other than environmentally sustainable economic activities, a clear explanation of the reasons for doing so; |

|

(d) |

where the financial products have sovereign exposures and the financial market participant cannot assess the extent to which those exposures contribute to environmentally sustainable economic activities, a narrative explanation of the proportion in total investments of investments that consist of those exposures. |

2. For the purposes of paragraph 1, point (a), financial market participants shall use:

|

(a) |

the same key performance indicator for the aggregated investments in non-financial undertakings; |

|

(b) |

the same key performance indicator for the aggregated investments in the same type of financial undertakings. |

For insurance and reinsurance undertakings that carry out non-life underwriting activities, the key performance indicator may combine the investment and the underwriting key performance indicators in accordance with Article 6 of Delegated Regulation (EU) 2021/2178.

3. For the purposes paragraph 1, point (b), the description shall include all of the following:

|

(a) |

in respect of investee companies that are non-financial undertakings, whether the degree to which the investments are in environmentally sustainable economic activities is measured by turnover, or whether, due to the features of the financial product, the financial market participant has decided that a more representative calculation is given when that degree is measured by capital expenditure or operating expenditure and the reason for that decision, including an explanation of why that decision is appropriate for investors in the financial product; |

|

(b) |

where information about the degree to which the investments are in environmentally sustainable economic activities is not readily available from public disclosures by investee companies, details of whether the financial market participant obtained equivalent information directly from investee companies or from third party providers; |

|

(c) |

a breakdown of the minimum proportions of investments in the transitional economic activities and in the enabling economic activities, in each case expressed as a percentage of all investments of the financial product. |

Article 16

Sustainable investment information in the asset allocation section for financial products that promote social characteristics

For financial products that promote environmental or social characteristics and that include a commitment in sustainable investments with a social objective, financial market participants shall include in the section ‘What is the asset allocation planned for this financial product?’ in the template set out in Annex II the minimum share of those sustainable investments.

Article 17

Calculation of the degree to which investments are in environmentally sustainable economic activities

1. The degree to which investments are in environmentally sustainable economic activities shall be calculated in accordance with the following formula:

where ‘investments of the financial product in environmentally sustainable economic activities’ shall be the sum of the market values of the following investments of the financial product:

|

(a) |

for debt securities and equities of investee companies, where a proportion of activities of those investee companies is associated with environmentally sustainable economic activities, the market value of that proportion of those debt securities or equities; |

|

(b) |

for debt securities other than those referred to in point (a), where a proportion of the proceeds is required by the terms of those debt securities to be used exclusively on environmentally sustainable economic activities, the market value of that proportion; |

|

(c) |

for bonds issued under Union legislation on environmentally sustainable bonds, the market value of those bonds; |

|

(d) |

for investments in real estate assets which qualify as environmentally sustainable economic activities, the market value of those investments; |

|

(e) |

for investments in infrastructure assets which qualify as environmentally sustainable economic activities, the market value of those investments; |

|

(f) |

for investments in securitisation positions as defined in Article 2, point (19), of Regulation (EU) 2017/2402 of the European Parliament and of the Council (15) with underlying exposures in environmentally sustainable economic activities, the market value of the proportion of those exposures; |

|

(g) |

for investments in financial products as referred to in Article 5, first paragraph, and Article 6, first paragraph, of Regulation (EU) 2020/852, the market value of the proportion of those financial products representing the degree to which investments are in environmentally sustainable economic activities, as calculated in accordance with this Article. The degree to which investments are into environmentally sustainable economic activities shall be calculated by applying the methodology used to calculate net short positions laid down in Article 3(4) and (5) of Regulation (EU) No 236/2012 of the European Parliament and of the Council (16). |

2. For the purposes of paragraph 1, point (a), the proportion of activities of investee companies associated with environmentally sustainable economic activities shall be calculated on the basis of the most appropriate key performance indicators for the investments of the financial product using the following information:

|

(a) |

for the investee companies referred to in Article 8(1) and (2) of Regulation (EU) 2020/852, the disclosures made by those investee companies in accordance with that Article; |

|

(b) |

for other investee companies, equivalent information obtained by the financial market participant directly from investee companies or from third party providers. |

3. For the disclosures referred to in Article 15(1), point (a), and Article 19(1), point (a), in the case of investee companies that are non-financial undertakings that are subject to the obligation to publish non-financial information pursuant to Delegated Regulation (EU) 2021/2178 and other non-financial undertakings that are not subject to that obligation, the calculation referred to in paragraph 2 shall use turnover as the same type of key performance indicator for all non-financial undertakings.

4. By way of derogation from paragraph 3, where, due to the features of the financial product, capital expenditure or operating expenditure gives a more representative calculation of the degree to which an investment is into environmentally sustainable economic activities, the calculation may use the most appropriate of those two key performance indicators. In the case of investee companies that are financial undertakings subject to Article 8(1) of Regulation (EU) 2020/852 and for other financial undertakings that are not subject to that obligation, the calculation referred to in paragraph 2 shall use the key performance indicators referred to in Section 1.1, points (b) to (e), of Annex III to Delegated Regulation (EU) 2021/2178.

5. For the disclosures referred to in Article 15(1), point (a)(ii), Article 19(1), point (a)(ii), Article 55(1), point (b)(iii) and Article 62(1), point (b)(iii), paragraphs 1 to 4 of this Article shall apply, except that the sovereign exposures shall be excluded from the calculation of the numerator and of the denominator of the formula contained in paragraph 1.

SECTION 2

Sustainable investment as objective

Article 18

Presentation by financial market participants of pre-contractual information for financial products to be disclosed pursuant to Article 9, paragraphs 1 to 4a, of Regulation (EU) 2019/2088

1. Financial market participants shall present the information to be disclosed pursuant to Article 9(1) to (4a) of Regulation (EU) 2019/2088 and this Section in an annex to the document or the information referred to in Article 6(3) of Regulation (EU) 2019/2088. They shall present that information in the format of the template set out in Annex III to this Regulation.

2. Financial market participants shall include in the main body of the document or the information referred to in Article 6(3) of Regulation (EU) 2019/2088 a prominent statement that information about sustainable investment is available in the annex.

3. Financial market participants shall include at the beginning of the annex to the document or the information referred to in Article 6(3) of Regulation (EU) 2019/2088 a statement that the financial product has sustainable investment as its objective.

Article 19

Sustainable investment information for financial products with the objective of sustainable investment

1. For the financial products referred to in Article 5, first paragraph, of Regulation (EU) 2020/852, financial market participants shall include in the section ‘What is the asset allocation and the minimum share of sustainable investments?’ in the template set out in Annex III all of the following information:

|

(a) |

a graphical representation in the form of a pie chart:

|

|

(b) |

a description in accordance with Article 15(1), point (b), of this Regulation; |

|

(c) |

where the financial products invest in economic activities that contribute to an environmental objective and the economic activities are not environmentally sustainable economic activities, a clear explanation of the reasons for doing so; |

|

(d) |

where the financial products have sovereign exposures and the financial market participant cannot assess the extent to which those exposures contribute to environmentally sustainable economic activities, a narrative explanation of the proportion in total investments of investments that consist of those exposures. |

2. For the purposes of paragraph 1, point (a), financial market participants shall apply Article 15(2).

3. For the purposes of paragraph 1, point (b), financial market participants shall apply Article 15(3).

4. For financial products that invest in an economic activity that contributes to a social objective, financial market participants shall include in the section ‘What is the asset allocation and the minimum share of sustainable investments?’ in the template set out in Annex III the minimum share of those investments.

SECTION 3

Financial products with investment options

Article 20

Financial products with one or more underlying investment options that qualify those financial products as financial products that promote environmental or social characteristics

1. By way of derogation from Articles 14 to 17, where a financial product offers investment options to the investor and one or more of those investment options qualify that financial product as a financial product that promotes environmental or social characteristics, financial market participants shall insert in the main body of the document or information referred to in Article 6(3) of Regulation (EU) 2019/2088 a prominent statement confirming all of the following:

|

(a) |

that the financial product promotes environmental or social characteristics; |

|

(b) |

that those environmental or social characteristics will only be met where the financial product invests in at least one of the investment options mentioned in the list referred to in paragraph 2, point (a), of this Article and that at least one of those options is kept during the holding period of the financial product; |

|

(c) |

that further information about those characteristics is available in the Annexes referred to in paragraph 3 of this Article or, where relevant, through the references referred to in paragraph 5 of this Article. |

2. The prominent statement referred to in paragraph 1 shall be accompanied by all of the following:

|

(a) |

a list of the investment options referred to in paragraph 3, presented in accordance with the categories of investment options referred to in points (a), (b) and (c) of that paragraph; |

|

(b) |

the proportions of investment options within each of the categories referred to in paragraph 3, points (a), (b) and (c), relative to the total number of investment options offered by the financial product. |

3. Financial market participants shall provide all of the following information in annexes to the document or information referred to in Article 6(3) of Regulation (EU) 2019/2088 for the following categories of investment options:

|

(a) |

for each investment option that qualifies as a financial product that promotes environmental or social characteristics, the information referred to in Articles 14 to 17 of this Regulation; |

|

(b) |

for each investment option that qualifies as a financial product that has sustainable investment as its objective, the information referred to in Articles 18 and 19 of this Regulation; |

|

(c) |

for each investment option that has sustainable investment as its objective and is not a financial product, information on the objective of sustainable investment. |

4. Financial market participants shall present the information referred to in paragraph 3, point (a), in the form of the template set out in Annex II and the information referred to in paragraph 3, point (b), in the form of the template set out in Annex III.

5. By way of derogation from paragraph 3, where a financial product offers a range of investment options to the investor such that the information about those investment options cannot be provided in annexes to the document or information referred to in Article 6(3) of Regulation (EU) 2019/2088 in a clear and concise manner due to the number of annexes required, financial market participants may provide the information referred to in paragraph 3 of this Article by including in the main body of the document or information referred to in Article 6(3) of Regulation (EU) 2019/2088 references to the annexes to the disclosures required by the directives, regulations and national provisions referred to in that paragraph where that information can be found.

Article 21

Financial products with underlying investment options that all have sustainable investment as their objective

1. By way of derogation from Articles 18 and 19, where a financial product offers investment options to the investor and those investment options all have sustainable investment as their objectives, financial market participants shall confirm in a prominent statement in the main body of the document or information referred to in Article 6(3) of Regulation (EU) 2019/2088 that the financial product has as its objective sustainable investment and that the information related to that objective is available in the annexes to the document or information referred to in Article 6(3) of Regulation (EU) 2019/2088 or, where relevant, through the references referred to in paragraph 5 of this Article.

2. The prominent statement referred to in paragraph 1 shall be accompanied by all of the following:

|

(a) |

a list of the investment options referred to in paragraph 3 presented in accordance with the categories of investment options referred to in points (a) and (b) of that paragraph; |

|

(b) |

the proportions of each of the categories of investment options referred to in paragraph 3, points (a) and (b), within each of those categories relative to the total number of investment options offered by the financial product. |

3. Financial market participants shall provide all of the following information in annexes to the document or information referred to in Article 6(3) of Regulation (EU) 2019/2088 for the following categories of investment options:

|

(a) |

for each investment option that qualifies as a financial product that has sustainable investment as its objective, the information referred to in Articles 18 and 19 of this Regulation; |

|

(b) |

for each investment option that has sustainable investment as its objective and is not a financial product, the information on the objective of sustainable investment. |

4. Financial market participants shall present the information referred to in paragraph 3, point (a), in accordance with the template set out in Annex III.

5. By way of derogation from paragraph 3, where a financial product offers a range of investment options to the investor such that the information relating to those investment options cannot be provided in annexes to the document or information referred to in Article 6(3) of Regulation (EU) 2019/2088 in a clear and concise manner due to the number of annexes required, financial market participants may provide the information referred to in paragraph 3 of this Article by including in the main body of the document or information referred to in Article 6(3) of Regulation (EU) 2019/2088 references to the annexes of the applicable disclosures required by directives, regulations and national provisions referred to in that paragraph where that information can be found.

Article 22

Information on underlying investment options that have sustainable investment as their objective and are not themselves financial products

The information on the objective of the sustainable investments referred to in Article 20(3), point (c), and Article 21(3), point (b), shall contain all of the following:

|

(a) |

a description of the sustainable investment objective; |

|