ISSN 1977-0677

Official Journal

of the European Union

L 305

English edition

Legislation

Volume 63

21 September 2020

|

ISSN 1977-0677 |

||

|

Official Journal of the European Union |

L 305 |

|

|

||

|

English edition |

Legislation |

Volume 63 |

|

|

|

|

|

(1) Text with EEA relevance. |

|

EN |

Acts whose titles are printed in light type are those relating to day-to-day management of agricultural matters, and are generally valid for a limited period. The titles of all other Acts are printed in bold type and preceded by an asterisk. |

II Non-legislative acts

REGULATIONS

|

21.9.2020 |

EN |

Official Journal of the European Union |

L 305/1 |

COMMISSION DELEGATED REGULATION (EU) 2020/1302

of 14 July 2020

supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to fees charged by the European Securities and Markets Authority to central counterparties established in third countries

(Text with EEA relevance)

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories (1), and in particular Article 25d(3) thereof,

Whereas:

|

(1) |

Article 25d of Regulation (EU) No 648/2012 requires that the European Securities and Markets Authority (‘ESMA’) charge third-country central counterparties (‘CCPs’) fees associated with applications for recognition under Article 25 of that Regulation and annual fees associated with the performance of its tasks in accordance with that Regulation in relation to recognised third-country CCPs. Article 25d(2) of Regulation (EU) No 648/2012 requires that such fees be proportionate to the turnover of the CCP concerned and cover all costs incurred by ESMA for the recognition and the performance of its tasks in relation to third-country CCP in accordance with that Regulation. |

|

(2) |

Fees associated with applications for recognition (‘recognition fees’) should be charged to third-country CCPs to cover ESMA’s costs for processing applications for recognition, including costs for verifying that applications are complete, requesting additional information, drafting of decisions and costs relating to the assessment of the systemic importance of third-country CCPs (‘tiering’). For CCPs that are systemically important or likely to become systemically important for the financial stability of the Union or of one or more of its Member States and that are recognised by ESMA in accordance with Article 25(2b) of Regulation (EU) No 648/2012 (‘Tier 2 CCPs’), additional costs are incurred by ESMA. These additional costs are incurred by ESMA when assessing compliance with the recognition conditions set out in Article 25(2b) of Regulation (EU) No 648/2012 and whether, by complying with the applicable third-country legal framework, a CCP may be deemed to satisfy compliance with the requirements set out in Article 16 and Titles IV and V of Regulation (EU) No 648/2012 (‘comparable compliance’). The costs associated with applications made by Tier 2 CCPs will therefore be higher than those associated with applications made by third-country CCPs that are not deemed to be systemically important or likely to become systemically important for the financial stability of the Union or of one or more of its Member States (‘Tier 1 CCPs’). |

|

(3) |

While a basic recognition fee should be charged to all third-country CCPs applying for recognition under Article 25 of Regulation (EU) No 648/2012, an additional fee should be charged to Tier 2 CCPs to cover the additional cost incurred by ESMA as part of the application process. The additional recognition fee should also be charged to already recognised CCPs the first time that ESMA determines whether they are to be classified as Tier 2 CCPs following the review of their systemic importance under Article 25(5) or Article 89(3c) of Regulation (EU) No 648/2012. |

|

(4) |

Annual fees are also to be charged to recognised third-country CCPs to cover ESMA’s costs for the performance of its tasks under Regulation (EU) No 648/2012 in relation to such CCPs. For both Tier 1 and Tier 2 CCPs, those tasks include the periodic review of the systemic importance of CCPs pursuant to Article 25(5) of Regulation (EU) No 648/2012, the implementation and maintenance of cooperation arrangements with third-country authorities and the monitoring of regulatory and supervisory developments in third countries. For Tier 2 CCPs, ESMA is also required to supervise on an ongoing basis compliance by those CCPs with the requirements set out in Article 16 and Titles IV and V of Regulation (EU) No 648/2012, including through comparable compliance, where granted. It is therefore appropriate that different annual fees apply to Tier 1 and Tier 2 CCPs. |

|

(5) |

The recognition and annual fees laid down in this Regulation should cover the costs that ESMA expects to incur when processing applications for recognition on the basis of its experience in performing tasks in relation to third-country CCPs and other supervised entities as well as on the basis of its expected costs as stated in its annual activity-based budget. |

|

(6) |

The tasks performed by ESMA under Regulation (EU) No 648/2012 in relation to recognised Tier 1 CCPs will largely be the same for each Tier 1 CCP independently of their size. It is therefore appropriate that the costs incurred by ESMA in relation to recognised Tier 1 CCPs are covered by levying an annual fee of the same amount on each recognised Tier 1 CCP. In relation to recognised Tier 2 CCPs, in order to ensure a fair allocation of fees which, at the same time, reflects the actual administrative effort required by ESMA for the performance of its tasks with respect to each Tier 2 CCP, annual fees should also take account of the turnover of the Tier 2 CCP. |

|

(7) |

Annual fees charged to third-country CCPs for the first year in which they are recognised pursuant to Article 25 of Regulation (EU) No 648/2012 should be proportionate to the part of that year during which ESMA performs tasks in accordance with that Regulation in relation to those CCPs. The same principle should apply for the year in which a CCP that is recognised as a Tier 1 CCP, is classified for the first time as a Tier 2 CCP pursuant to Article 25(5) of that Regulation. |

|

(8) |

To ensure the timely funding of the costs incurred by ESMA in relation to applications for recognition made pursuant to Article 25 of Regulation (EU) No 648/2012, recognition fees should be paid to ESMA before the processing of applications for recognition or the assessment of whether Tier 2 CCPs comply with the recognition requirements set out in Article 25(2b) of Regulation (EU) No 648/2012. In order to ensure the timely funding of the costs incurred by ESMA in the performance of its tasks in relation to recognised third-country CCPs, annual fees should be paid in the beginning of the calendar year to which they relate. Annual fees in the first year of recognition should be paid soon after the adoption of recognition decisions. |

|

(9) |

In order to discourage repeated or unfounded applications, recognition fees should not be reimbursed in the case where an applicant withdraws its application. As the administrative work required in the case of an application for recognition that is refused is the same as that required in the case of an application that is accepted, recognition fees should not be reimbursed if recognition is refused. |

|

(10) |

Any costs incurred by ESMA after the entry into force of Regulation (EU) 2019/2099 of the European Parliament and of the Council (2) in respect of third-country CCPs that have already been recognised in accordance with Article 25 of Regulation (EU) No 648/2012 prior to 22 September 2020 should be covered by fees. Such third-country CCPs should therefore be required to pay an interim annual fee for 2020 and each subsequent year until the review of their systemic importance pursuant to Article 89(3c) of Regulation (EU) No 648/2012 has been carried out. |

|

(11) |

This Delegated Regulation should enter into force as a matter of urgency to ensure that ESMA is funded in a timely and appropriate manner following the entry into force of Regulation (EU) 2019/2099, |

HAS ADOPTED THIS REGULATION:

CHAPTER I

FEES

Article 1

Recognition fees

1. A CCP established in a third country that applies for recognition in accordance with Article 25 of Regulation (EU) No 648/2012 shall pay a basic recognition fee of EUR 50 000.

2. A CCP established in a third country shall pay an additional recognition fee of EUR 360 000 where ESMA determines that, in accordance with Article 25(2a) of Regulation (EU) No 648/2012, that CCP is systemically important or likely to become systemically important for the financial stability of the Union or of one or more of its Member States (‘Tier 2 CCP’). A Tier 2 CCP shall pay the additional recognition fee in any of the following cases:

|

(a) |

the CCP applies for recognition; |

|

(b) |

the CCP, where already recognised pursuant to Article 25(2) of Regulation (EU) No 648/2012, is determined to be a Tier 2 CCP following the review carried out by ESMA in accordance with Article 25(5) of that Regulation. |

Article 2

Annual fees

1. A recognised CCP shall pay an annual fee.

2. Where a CCP is recognised by ESMA in accordance with Article 25(2) of Regulation (EU) No 648/2012 (‘Tier 1 CCP’), the annual fee for each Tier 1 CCP for a given year (n) shall be the total annual fee divided in equal parts between all Tier 1 CCPs recognised on 31 December of the previous year (n-1).

For the purposes of the first subparagraph, the total annual fee for a given year (n) shall be the estimate of expenditure relating to the tasks to be performed by ESMA with regard to all recognised Tier 1 CCPs under Regulation (EU) No 648/2012 as included in ESMA’s budget for that year.

3. Where a CCP is recognised by ESMA in accordance with Article 25(2b) of Regulation (EU) No 648/2012 (‘Tier 2 CCP’), the annual fee for a given year (n) shall be the total annual fee divided between all Tier 2 CCPs recognised on 31 December of the previous year (n-1) and multiplied by the applicable weight determined pursuant to Article 4 of this Regulation.

For the purposes of the first subparagraph, the total annual fee for a given year (n) shall be the estimate of expenditure relating to the tasks to be performed by ESMA with regard to all recognised Tier 2 CCPs under Regulation (EU) No 648/2012 as included in ESMA’s budget for that year.

Article 3

Annual fees in year of recognition

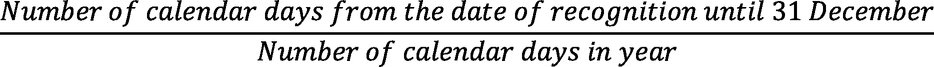

1. For the year in which a third-country CCP is recognised by ESMA in accordance with Article 25 of Regulation (EU) No 648/2012, the annual fee shall be calculated as follows:

|

(a) |

where ESMA recognises a CCP as a Tier 1 CCP, the annual fee shall be determined as the proportion of the basic recognition fee laid down in Article 1(1) of this Regulation calculated in accordance with the following ratio:

|

|

(b) |

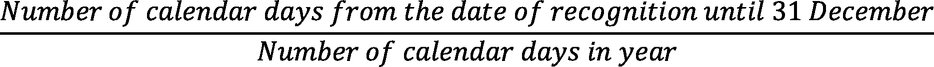

where ESMA recognises a CCP as a Tier 2 CCP, the annual fee shall be determined as the proportion of the additional recognition fee laid down in Article 1(2) of this Regulation calculated in accordance with the following ratio:

|

2. Where a CCP has paid an interim annual fee in accordance with Article 9 for the year in which that CCP is recognised as a Tier 1 CCP, the annual fee calculated in accordance with paragraph 1(a) shall not be charged.

3. Where a CCP has paid an interim annual fee in accordance with Article 9 or an annual fee in accordance with Article 2(2) for the year in which that CCP is recognised as a Tier 2 CCP, the amount of that fee shall be deducted from the fee to be paid in accordance with paragraph 1(b).

Article 4

Applicable turnover for Tier 2 CCPs

1. The relevant turnover of a Tier 2 CCP shall be its worldwide revenues accrued from provision of clearing services (membership fees and clearing fees net of transaction costs) during the CCP’s most recent financial year.

Tier 2 CCPs shall provide ESMA, on an annual basis, with audited figures confirming its worldwide revenues accrued from the provision of the clearing services referred to in the first subparagraph. The audited figures shall be submitted to ESMA no later than 30 September each year. The documents containing audited figures shall be provided in a language customary in the sphere of financial services.

If the revenues referred to in the first subparagraph are reported in another currency than euro, ESMA shall convert them into euro using the average euro foreign exchange rate applicable to the period during which the revenues were recorded. For that purpose, the euro foreign exchange reference rate published by the European Central Bank shall be used.

2. On the basis of the turnover determined in accordance with paragraph 1 for a given year (n), the CCP shall be deemed to belong to one of the following groups:

|

(a) |

Group 1: annual turnover below EUR 600 million; |

|

(b) |

Group 2: annual turnover of EUR 600 million or above. |

A Tier 2 CCP in Group 1 shall be attributed the turnover weight 1.

A Tier 2 CCP in Group 2 shall be attributed the turnover weight 1,2.

3. The total turnover weight of all recognised Tier 2 CCPs for a given year (n) shall be the sum of the turnover weights determined in accordance with paragraph 2 of all Tier 2 CCPs recognised by ESMA on the 31 December of the previous year (n-1).

4. For the purpose of Article 2(3), the applicable weight of a Tier 2 CCP for a given year (n) shall be its turnover weight determined in accordance with paragraph 2 divided by the total turnover weight of all recognised Tier 2 CCPs determined in accordance with paragraph 3.

CHAPTER II

PAYMENT CONDITIONS

Article 5

General payment modalities

1. All fees shall be paid in euro.

2. Any late payment shall incur the default interest laid down in Article 99 of Regulation (EU, Euratom) 2018/1046 of the European Parliament and of the Council (3).

3. Communications between ESMA and third-country CCPs shall take place by electronic means.

Article 6

Payment of recognition fees

1. The basic recognition fee provided for in Article 1(1) of this Regulation shall be paid when the CCP submits its application for recognition.

By way of derogation from the first subparagraph, where the Commission has not adopted an implementing act in accordance with Article 25(6) of Regulation (EU) No 648/2012 for the third country in which the CCP is established when the CCP applies for recognition, the basic recognition fee shall be paid at the latest on the day that such an implementing act enters into force.

2. The date by which the additional recognition fee provided for in Article 1(2) of this Regulation is to be paid shall be set in a debit note sent by ESMA to the CCP following ESMA’s request to the CCP to submit additional information for the assessment of the CCP’s compliance with the requirements laid down in Article 25(2b) of Regulation (EU) No 648/2012. The payment date shall provide the CCP with at least 30 calendar days to pay, from the day on which ESMA sent the debit note to the CCP.

3. Recognition fees shall not be reimbursed.

Article 7

Payment of annual fees

1. The annual fees provided for in Article 2 for a given year (n) shall be paid at the latest on 31 March of the year (n).

ESMA shall send debit notes to all recognised third-country CCPs specifying the amount of the annual fee at the latest on 1 March of year (n).

2. The amount of the annual fee provided for in Article 3 in the year of recognition as well as the date by which the annual fee is to be paid, shall be stated in a debit note sent by ESMA to the CCP. The payment date shall provide the CCP with at least 30 calendar days to pay, from the day on which ESMA sent the debit note to the CCP.

3. Annual fees paid by a CCP shall not be reimbursed.

CHAPTER III

TRANSITIONAL AND FINAL PROVISIONS

Article 8

Applications for recognition already submitted

1. Where a third-country CCP has submitted an application for recognition before 22 September 2020, and ESMA has not yet adopted a decision to recognise or to refuse recognition of that CCP, the CCP shall pay the recognition fee provided for in Article 1(1) 22 October 2020.

2. By way of derogation from paragraph 1, where ESMA has suspended the processing of a third-country CCP’s application for recognition before 22 September 2020, the CCP shall pay the recognition fee provided for in Article 1(1) within the payment date stated in the debit note sent by ESMA to the CCP, following the notification that the processing of its application is no longer suspended. The payment date shall provide the CCP with at least 30 calendar days to pay, from the day on which ESMA sent the debit note to the CCP.

Article 9

Interim annual fee for CCPs already recognised

1. A third-country CCP that is recognised by ESMA in accordance with Article 25 of Regulation (EU) No 648/2012 at the time this Regulation enters into force shall pay an interim annual fee of EUR 50 000 for 2020 and each subsequent year until the review of its systemic importance pursuant to Article 89(3c) of Regulation (EU) No 648/2012 has been carried out and it has been recognised in accordance with either Article 25(2) or Article 25(2b) of that Regulation or such recognition has not been granted.

2. The interim annual fee for 2020 shall be paid within 30 calendar days from the entry into force of this Regulation. Interim annual fees for another year (n) shall be paid at the latest on 31 March of the year (n).

Article 10

Entry into force

This Regulation shall enter into force on the day following that of its publication in the Official Journal of the European Union.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 14 July 2020.

For the Commission

The President

Ursula VON DER LEYEN

(1) OJ L 201, 27.7.2012, p. 1.

(2) Regulation (EU) 2019/2099 of the European Parliament and of the Council of 23 October 2019 amending Regulation (EU) No 648/2012 as regards the procedures and authorities involved for the authorisation of CCPs and requirements for the recognition of third-country CCPs (OJ L 322, 12.12.2019, p. 1).

(3) Regulation (EU, Euratom) 2018/1046 of the European Parliament and of the Council of 18 July 2018 on the financial rules applicable to the general budget of the Union, amending Regulations (EU) No 1296/2013, (EU) No 1301/2013, (EU) No 1303/2013, (EU) No 1304/2013, (EU) No 1309/2013, (EU) No 1316/2013, (EU) No 223/2014, (EU) No 283/2014, and Decision No 541/2014/EU and repealing Regulation (EU, Euratom) No 966/2012 (OJ L 193, 30.7.2018, p. 1).

|

21.9.2020 |

EN |

Official Journal of the European Union |

L 305/7 |

COMMISSION DELEGATED REGULATION (EU) 2020/1303

of 14 July 2020

supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to the criteria that ESMA should take into account to determine whether a central counterparty established in a third country is systemically important or likely to become systemically important for the financial stability of the Union or of one or more of its Member States

(Text with EEA relevance)

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories (1), and in particular the second subparagraph of Article 25(2a) thereof,

Whereas:

|

(1) |

When assessing the degree of systemic risk that a third-country CCP presents to the financial stability of the Union or of one or more of its Member States, ESMA should consider a range of objective quantitative and qualitative considerations that justify its decision to recognise a third-country CCP as a Tier 1 or a Tier 2 CCP. It should also take into account any conditions under which the Commission may have adopted its equivalence decision. In particular, when assessing the risk profile of a third-country CCP, ESMA must consider objective and transparent quantitative activity indicators with regard to the business conducted with respect to clearing participants established in the Union or denominated in Union currencies, at the time of the assessment. While ESMA must consider the business conducted by the CCP in a holistic manner, its assessment should reflect the risk that a particular CCP could bring to the financial stability of the Union. |

|

(2) |

In specifying the criteria that ESMA is to take into account when determining the tier of a third-country CCP, the nature of the transactions cleared by the CCP, including their complexity, risk profile and average maturity, as well as the transparency and liquidity of the markets concerned and the degree to which the CCP’s clearing activities are denominated in euro or other Union currencies should be considered. In this regard, specific features concerning certain products, such as agricultural products, listed and executed on regulated markets in third countries, which relate to markets that largely serve domestic non-financial counterparties in that third country who manage their commercial risks through those contracts, may pose a negligible risk to clearing members and trading venues in the Union as they have a low degree of systemic interconnectedness with the rest of the financial system. |

|

(3) |

The countries where the CCP operates, the extent of the services it provides, the characteristics of the financial instruments it clears as well as the volumes cleared are objective indicators of the complexity of the CCP’s business. When taking into account the criterion set out in point (a) of Article 25(2a) of Regulation (EU) No 648/2012, ESMA should therefore consider the ownership, business and corporate structure of the CCP, as well as the range, nature and complexity of clearing services offered by the CCP and the extent to which those services are of importance to clearing members and clients (‘clearing participants’) established in the Union. While the systemic importance of a CCP should be assessed in a holistic way, ESMA should take specific account of the proportion of the business of the CCP conducted in Union currencies, as well as the proportion of the business of the CCP originated from clearing participants established in the Union. For a CCP more likely to be of systemic importance to the Union it is important that ESMA assesses the structure and ownership of the group of which the CCP might be part in order to determine whether the interests of the Union are at risk. Additionally, the depth, liquidity and transparency of the markets served by such a CCP should also be assessed so that ESMA can better grasp the risk to clearing members established in the Union in the conduct of a default management auction. |

|

(4) |

The capital of the CCP and the financial resources committed by clearing participants as well as the type and nature of the collateral that they provide, are essential elements to be considered when assessing the capacity of a CCP to withstand any adverse development. When taking into account the criterion set out in point (b) of Article 25(2a) of Regulation (EU) No 648/2012, ESMA should therefore have an overview of the financial resources available to the CCP in case of a default or a non-default event. ESMA should also consider the secured, unsecured, committed, uncommitted, funded or unfunded nature of these resources as well as the means used by the CCP to provide legal certainty and confidence as to the settlement of the payments it effects and the collateral it has to deal with. Finally, ESMA should consider the existence, nature and effect of a recovery and resolution framework for CCPs in the jurisdiction the CCP applying for recognition operates. Such recovery and resolution frameworks should be assessed against internationally agreed guidance and key attributes. When looking at settlement and liquidity risk, ESMA should pay particular attention for those CCPs that are likely to be systemic on how securely those CCP access liquidity as well as the liquidity strains on Union currencies. While the safety of payments and settlements might be reinforced through the use of distributed ledger technology or other recent technologies, ESMA should pay attention to the additional risk it may bring to the CCP, in particular cyber risk. |

|

(5) |

The nature of the conditions imposed by a CCP in order for clearing participants to access its services and the interlinkages between those clearing participants have repercussions on the way a CCP may be affected by an adverse event in relation to those participants. Therefore, when taking into account the criterion set out in point (c) of Article 25(2a) of Regulation (EU) No 648/2012, ESMA should determine to the extent possible the identity of clearing participants to the CCP, in particular where that CCP provides services to clearing participants established in the Union. ESMA should also determine the relevant market share or relative importance of clearing participants or groups of clearing participants in that CCP. Insofar as necessary to assess the impact it might have on the clearing membership structure, ESMA should assess the conditions and options under which the CCP provides access to its clearing services. With respect to a CCP that is likely to be systemic to the Union, ESMA should assess whether the legal and prudential requirements that a CCP imposes on its clearing members are sufficiently stringent. |

|

(6) |

In the event of a disruption to a CCP, clearing participants may have to rely, whether directly or indirectly, on the provision by other CCPs of similar or identical services. In order to assess the relative importance of the CCP applying for recognition, ESMA should therefore, when taking into account the criterion set out in point (d) of Article 25(2a) of Regulation (EU) No 648/2012, determine whether clearing participants may substitute some or all of the clearing services provided by that CCP with services provided by other CCPs, in particular where those alternative CCPs are authorised or recognised in the Union. Where clearing members and clients established in the Union can only clear certain products subject to a clearing obligation in one third-country CCP, the systemic importance of that CCP should be considered with acute attention by ESMA. |

|

(7) |

CCPs may be connected in many ways to other financial infrastructures such as other CCPs or central securities depositaries. A disruption those connections may adversely affect the good functioning of the CCP. Therefore, when taking into account the criterion set out in point (e) of Article 25(2a) of Regulation (EU) No 648/2012, ESMA should assess the extent to which the CCP is connected with other financial market infrastructures or financial institutions in a way that could impact the financial stability of the Union or of one or more of its Member States. In doing this ESMA should give particular attention to those connections and interdependencies with entities located in the Union. Finally, ESMA should identify and assess the nature of the services outsourced by the CCP and the risk such arrangements might pose to the CCP in case they were to be interrupted or impaired in any way. |

|

(8) |

Where, as determined using objective quantitative indicators, the exposure of clearing members and clients established in the Union to a CCP is significant, ESMA should assess additional elements for each criterion. The more of those indicators are met by a CCP, the greater the likelihood that ESMA concludes that that CCP is of systemic importance for the financial stability of the Union or of one or more of its Member States. |

|

(9) |

This Delegated Regulation should enter into force as a matter of urgency to ensure the fastest operationalisation of Regulation (EU) 2019/2099 (2) of the European Parliament and of the Council, |

HAS ADOPTED THIS REGULATION:

Article 1

The nature, size and complexity of the CCP’s business

1. When taking into account the criterion set out in point (a) of Article 25(2a) of Regulation (EU) No 648/2012, ESMA shall assess the following elements:

|

(a) |

the countries where the CCP provides or intends to provide services; |

|

(b) |

the extent to which the CCP provides other services in addition to clearing services; |

|

(c) |

the type of financial instruments cleared or to be cleared by the CCP; |

|

(d) |

whether the financial instruments cleared or to be cleared by the CCP are subject to the clearing obligation under Article 4 of Regulation (EU) No 648/2012; |

|

(e) |

the average values cleared by the CCP over one year, at the following levels:

|

|

(f) |

whether the CCP has completed an assessment of its risk profile based on internationally agreed standards or otherwise, the methodology used and the result of the assessment. |

2. For the purposes of point (e) of paragraph 1, ESMA shall assess the following values separately:

|

(a) |

for securities transactions (including securities financing transactions according to Regulation (EU) 2015/2365 of the European Parliament and of the Council) (3), the value of open positions or open interest; |

|

(b) |

for derivative transactions traded on a regulated market within the meaning of Directive 2014/65/EU of the European Parliament and of the Council (4), the value of open interest or turnover; |

|

(c) |

for over-the-counter (OTC) derivatives transactions, the gross and net notional outstanding amount. |

Those values shall be assessed per currency and per asset class.

3. Where any of the indicators referred to in Article 6 applies, ESMA, in addition to the elements listed in paragraph 1 of this Article, shall also assess the following elements:

|

(a) |

the ownership structure of the CCP; |

|

(b) |

where the CCP belongs to the same group as another financial market infrastructure, such as another CCP or central securities depository, the corporate structure of the group to which the CCP belongs; |

|

(c) |

whether the CCP provides clearing services to clients or indirect clients established in the Union through clearing members established outside of the Union; |

|

(d) |

the nature, depth and liquidity of the markets served and the level of available information on the adequate pricing data to market participants and any generally accepted and reliable pricing sources; |

|

(e) |

whether quotes, pre-trade bid and offer prices and depths of trading interests are made public; |

|

(f) |

whether post-trade price, volume and time of the transactions executed or concluded, on and off the markets served by the CCP are made public. |

Article 2

The effect of failure of or a disruption to a CCP

1. When taking into account the criterion set out in point (b) of Article 25(2a) of Regulation (EU) No 648/2012, ESMA shall assess the following elements:

|

(a) |

the capital, including retained earnings and reserves, of the CCP; |

|

(b) |

the type and amount of collateral accepted and held by the CCP, the haircuts applied, the corresponding haircut methodology, the currencies in which the collateral is denominated and the extent to which the collateral is provided by entities established in the Union or that are part of a group subject to consolidated supervision in the Union; |

|

(c) |

the maximum amount of margins collected by the CCP on a single day during a period of 365 days preceding ESMA’s assessment; |

|

(d) |

the maximum amount of margins collected by the CCP on a single day during a period of 365 days preceding ESMA’s assessment from each clearing member that is an entity established in the Union or an entity part of a group subject to consolidated supervision in the Union, per asset class or segregated default fund where applicable; |

|

(e) |

where applicable for each default fund of the CCP, the maximum default fund contributions required and held by the CCP on a single day during a period of 365 days preceding ESMA’s assessment; |

|

(f) |

where applicable for each default fund of the CCP, the maximum default fund contributions required and held by the CCP on a single day during a period of 365 days preceding ESMA’s assessment from each clearing member that is an entity established in the Union or an entity part of a group subject to consolidated supervision in the Union; |

|

(g) |

the estimated largest payment obligation on a single day in total and in each Union currency that would be caused by the default of any one or two largest single clearing members (and their affiliates) in extreme but plausible market conditions; |

|

(h) |

the total amount and for each Union currency of liquid financial resources to the CCP’s benefit separated by type of resources, including cash deposits, committed or uncommitted resources; |

|

(i) |

the amount of total liquid financial resources committed to the CCP by entities established in the Union or that are part of a group subject to consolidated supervision in the Union. |

2. Where any of the indicators referred to in Article 6 applies, ESMA, in addition to the elements listed in paragraph 1 of this Article, shall also assess the following elements:

|

(a) |

the identity of the liquidity providers established in the Union or which are part of a group subject to consolidated supervision in the Union; |

|

(b) |

the average and peak aggregate daily values of incoming and outgoing Union currency payments; |

|

(c) |

the extent to which central bank money is used for settlement and payment or whether other entities are used for settlement or payment; |

|

(d) |

the extent to which the CCP applies technologies such as distributed ledger technology in its settlement/payment process; |

|

(e) |

the recovery plan of the CCP; |

|

(f) |

the resolution regime applicable to the CCP; |

|

(g) |

whether a crisis management group has been established for that CCP. |

Article 3

The CCP’s clearing membership structure

1. When taking into account the criterion set out in point (c) of Article 25(2a) of Regulation (EU) No 648/2012 ESMA shall assess the following:

|

(a) |

the clearing membership and, where the information is available, whether and which clients or indirect clients, established in the Union or that are part of a group subject to consolidated supervision in the Union are using the clearing services of the CCP; and |

|

(b) |

the different options available to access the clearing services of the CCP (including different membership and direct access models for clients), any conditions for granting, denying or terminating access. |

2. Where any of the indicators referred to in Article 6 applies, ESMA, in addition to the elements listed in paragraph 1 of this Article, shall specifically assess any legal or prudential requirements imposed by the CCP on clearing members to access its clearing services.

Article 4

Alternative clearing services provided by other CCPs

1. When taking into account the criterion set out in point (d) of Article 25(2a) of Regulation (EU) No 648/2012, ESMA shall assess whether clearing members and clients established in the Union may access some or all of the clearing services provided by a CCP through other CCPs and whether those CCPs are authorised or recognised under Articles 14 and 25 of that Regulation.

2. Where any of the indicators referred to in Article 6 applies, ESMA, in addition to the elements listed in paragraph 1 of this Article, shall also assess whether the services provided by the CCP relate to a class of derivatives subject to the clearing obligation under Article 4 of Regulation (EU) No 648/2012.

Article 5

The CCP’s relationship, interdependencies, or other interactions

1. When taking into account the criterion set out in point (e) of Article 25(2a) of Regulation (EU) No 648/2012, ESMA shall assess the scope of functions, services or activities that have been outsourced by the CCP.

2. Where any of the indicators referred to in Article 6 applies, ESMA, in addition to the elements listed in paragraph 1 of this Article, shall also assess the following elements:

|

(a) |

the possible effects that the inability of the provider of outsourced functions, services or activities to comply with its obligations under the outsourcing arrangements would have on the Union or one or more of its Members States; |

|

(b) |

whether the CCP serves trading venues established in the Union; |

|

(c) |

whether the CCP has interoperability arrangements or cross-margining agreements with CCPs established in the Union, or links with or participation in other financial market infrastructures located in the Union, such as Central Securities Depositaries or payment systems. |

Article 6

Indicators of minimum exposure of clearing members and clients established in the Union to the CCP

1. The indicators for the purpose of Articles 1 to 5 are the following:

|

(a) |

the maximum open interest of securities transactions, including securities financing transactions, or exchange traded derivatives denominated in Union currencies cleared by the CCP over a period of one year prior to the assessment or intended to be cleared by the CCP over a period of one year following the assessment is more than EUR 1 000 billion; |

|

(b) |

the maximum notional outstanding of OTC derivatives transactions denominated in Union currencies cleared by the CCP over a period of one year prior to the assessment or intended to be cleared by the CCP over a period of one year following the assessment is more than EUR 1 000 billion; |

|

(c) |

the average aggregated margin requirement and default fund contributions for accounts held at the CCP by clearing members that are entities established in the Union or part of a group subject to consolidated supervision in the Union, calculated by the CCP on a net basis at clearing member account level over a period of two years prior to the assessment is more than EUR 25 billion; |

|

(d) |

the estimated largest payment obligation committed by entities established in the Union or part of a group subject to consolidated supervision in the Union and computed over a period of one year prior to the assessment, that would result from the default of at least the two largest single clearing members and their affiliates, in extreme but plausible market conditions is more than EUR 3 billion. |

For the purposes of point (d), the payment obligation shall aggregate the commitments in all currencies of the Union converted into EUR as necessary.

2. ESMA may only determine, based on the criteria specified in Articles 1 to 5, that a third-country CCP is a Tier 2 CCP where at least one of the indicators in paragraph 1 is met.

Article 7

Entry into force

This Regulation shall enter into force on the day following that of its publication in the Official Journal of the European Union.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 14 July 2020.

For the Commission

The President

Ursula VON DER LEYEN

(1) OJ L 201, 27.7.2012, p. 1.

(2) Regulation (EU) 2019/2099 of the European Parliament and of the Council of 23 October 2019 amending Regulation (EU) No 648/2012 as regards the procedures and authorities involved for the authorisation of CCPs and requirements for the recognition of third-country CCPs (OJ L 322, 12.12.2019, p. 1).

(3) Regulation (EU) 2015/2365 of the European Parliament and of the Council of 25 November 2015 on transparency of securities financing transactions and of reuse and amending Regulation (EU) No 648/2012 (OJ L 337, 23.12.2015, p. 1).

(4) Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (OJ L 173, 12.6.2014, p. 349).

|

21.9.2020 |

EN |

Official Journal of the European Union |

L 305/13 |

COMMISSION DELEGATED REGULATION (EU) 2020/1304

of 14 July 2020

supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to the minimum elements to be assessed by ESMA when assessing third-country CCPs’ requests for comparable compliance and the modalities and conditions of that assessment

(Text with EEA relevance)

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories (1), and in particular Article 25a(3) thereof,

Whereas:

|

(1) |

According to Article 25a of Regulation (EU) No 648/2012, a third-country central counterparty (CCP) that is systemically important or likely to become systemically important for the financial stability of the Union or one or more of its Member States (Tier 2 CCP) may request the European Securities and Markets Authority (ESMA) to assess whether that Tier 2 CCP’s compliance with the applicable third-country framework may be deemed to satisfy compliance with the requirements set out in Article 16 and in Titles IV and V of Regulation (EU) No 648/2012 (comparable compliance), and to adopt a decision accordingly. |

|

(2) |

Comparable compliance preserves the financial stability of the Union and ensures a level-playing field between Tier 2 CCPs and CCPs authorised in the Union while reducing administrative and regulatory burdens for those Tier 2 CCPs. The assessment of comparable compliance should, therefore, verify whether a Tier 2 CCP’s compliance with the third-country framework effectively satisfies compliance with any or all requirements set out in Article 16, Title IV and V of Regulation (EU) No 648/2012. This Regulation should therefore indicate the elements to be assessed by ESMA when assessing a Tier 2 CCP’s request for comparable compliance. When conducting that assessment, ESMA should also consider that CCP’s compliance with any requirements in delegated or implementing acts that further specify those elements, including those requirements related to margin requirements, liquidity risk controls, and collateral requirements. |

|

(3) |

In its assessment of whether compliance with the applicable third-country framework satisfies compliance with the requirements set out in Article 16, Title IV and V of Regulation (EU) No 648/2012, ESMA might also consider the recommendations developed by the Committee on Payments and Market Infrastructures and the International Organization of Securities Commissions. |

|

(4) |

ESMA should conduct a detailed assessment to determine whether to grant a Tier 2 CCP comparable compliance for Title IV of Regulation (EU) No 648/2012. Any potential refusal of comparable compliance with respect to that Title IV might impact the equivalence assessment conducted by the Commission pursuant to Article 25(6) of that Regulation. ESMA should therefore inform the Commission where it intends not to grant comparable compliance with respect to that Title. |

|

(5) |

Where a Tier 2 CCP has entered into an interoperability arrangement with a CCP authorised under Article 14 of Regulation (EU) No 648/2012, that arrangement constitutes a direct link and, therefore, a direct channel of contagion, to a CCP in the Union. For such arrangements, ESMA should conduct a detailed assessment to determine whether to grant comparable compliance for Title V of that Regulation. An interoperability arrangement between a Tier 2 CCP and another third-country CCP does not constitute a direct link to a CCP in the Union but might, under certain circumstances, function as an indirect channel of contagion. For such arrangements, ESMA should only conduct a detailed assessment where the impact of that arrangement on the financial stability of the Union or one or more of its Member States justifies it. |

|

(6) |

Since one of the objectives of comparable compliance is to reduce administrative and regulatory burden for Tier 2 CCPs, comparable compliance should not be refused only because a Tier 2 CCP applies, under the applicable third-country framework, exemptions that are comparable to those set out in paragraphs 4 and 5 of Article 1 of Regulation (EU) No 648/2012. The assessment of comparable compliance should also take into account the extent to which not granting it may result in the impossibility for the Tier 2 CCP to comply with both Union and third-country requirements at the same time. |

|

(7) |

ESMA’s decision on whether to grant comparable compliance should be based on the assessment conducted at the time of the adoption of that decision. In order for ESMA to reassess its decision whenever relevant developments, including changes to a CCP’s internal rules and procedures occur, the Tier 2 CCP should notify ESMA of any such developments. |

|

(8) |

Regulation (EU) 2019/2099 of the European Parliament and of the Council (2), which inserted Article 25a into Regulation (EU) No 648/2012, started to apply on 1 January 2020. To ensure that that article is fully operational, this Regulation should enter into force as a matter of urgency, |

HAS ADOPTED THIS REGULATION:

Article 1

Procedure for submitting a request for comparable compliance

1. The reasoned request referred to in Article 25a(1) of Regulation (EU) No 648/2012 shall be submitted either within the deadline set by ESMA in the notification informing the third-country CCP that it is not considered to be a Tier 1 CCP or at any moment after a third-country CCP has been recognised by ESMA as a Tier 2 CCP in accordance with Article 25(2b).

The Tier 2 CCP shall inform its competent authority of the submission referred to in the first subparagraph.

2. The reasoned request referred to in paragraph 1 shall specify:

|

(a) |

the requirements for which the Tier 2 CCP requests comparable compliance; |

|

(b) |

the reasons why the Tier 2 CCP’s compliance with the applicable third-country framework satisfies compliance with the relevant requirements set out in Article 16 and Titles IV and V of Regulation (EU) No 648/2012; |

|

(c) |

the way in which the Tier 2 CCP complies with any conditions set out for the application of the implementing act referred to in Article 25(6) of Regulation (EU) No 648/2012. |

For the purposes of point (b), the Tier 2 CCP shall provide, where relevant, the evidence referred to in Article 5.

3. The Tier 2 CCP shall, at ESMA’s request, include in the reasoned request referred to in paragraph 1:

|

(a) |

a statement from its competent authority confirming that the Tier 2 CCP is of good repute and standing; |

|

(b) |

where necessary, with regard to the requirements set out in Article 16 and Title V of Regulation (EU) No 648/2012, a translation of the relevant applicable third-country framework into a language commonly used in finance. |

4. ESMA shall assess, within 30 working days of receipt of a reasoned request submitted in accordance with paragraph 1, whether that reasoned request is complete. ESMA shall set a deadline by which the Tier 2 CCP has to provide additional information where the request is incomplete.

5. ESMA shall decide whether to grant comparable compliance for the requirements included in the reasoned request within 90 working days from the receipt of a complete reasoned request submitted in accordance with paragraph 4 of this Article.

ESMA may postpone that decision where the reasoned request or the additional information referred to in paragraph 4 are not submitted in time and the assessment of that request could, as a result, delay ESMA’s decision on the recognition of the third-country CCP or the review of its recognition.

6. A Tier 2 CCP for which ESMA has not granted comparable compliance for one or more requirements may not submit a new reasoned request as referred to in paragraph 1 regarding those requirements, unless there has been a relevant change to the applicable third-country framework or to the way in which that CCP complies with that framework.

Article 2

Comparable compliance with respect to Article 16 of Regulation (EU) No 648/2012

1. ESMA shall grant comparable compliance with respect to Article 16(1) of Regulation (EU) No 648/2012 where a Tier 2 CCP’s capital, including retained earnings and reserves, has a permanent and available initial capital which corresponds to at least EUR 7,5 million.

2. ESMA shall grant comparable compliance with respect to Article 16(2) of Regulation (EU) No 648/2012 where a Tier 2 CCP’s capital, including retained earnings and reserves, is at all times higher than or equal to the sum of:

|

(a) |

the CCP’s capital requirements for winding down or restructuring its activities; |

|

(b) |

the CCP’s capital requirements for operational and legal risks; |

|

(c) |

the CCP’s capital requirements for credit, counterparty and market risks that are not already covered by the specific financial resources referred to in Articles 41 to 44 of Regulation (EU) No 648/2012 or comparable specific financial resources required by the CCP’s home jurisdiction’s legal order; |

|

(d) |

the CCP’s capital requirements for business risk. |

For the purposes of the first subparagraph, ESMA shall calculate the capital requirements in accordance with the specific capital requirements set out in the applicable third-country framework, or, where that framework does not provide for any of those capital requirements, in accordance with the relevant requirements set out in Articles 2 to 5 of Commission Delegated Regulation (EU) No 152/2013 (3).

Article 3

Comparable compliance with respect to Title IV of Regulation (EU) No 648/2012

1. ESMA shall grant comparable compliance with respect to the requirements set out in Title IV of Regulation (EU) No 648/2012 where:

|

(a) |

the Tier 2 CCP complies with the requirements referred to in the implementing act referred to in Article 25(6) of that Regulation, if any; |

|

(b) |

the Tier 2 CCP complies with all relevant elements set out in Annex I to this Regulation. |

2. Before ESMA adopts a decision not to grant comparable compliance, it shall:

|

(a) |

verify its understanding of the applicable third-country framework and the way in which the Tier 2 CCP complies with it with that CCP’s competent authority, |

|

(b) |

inform the Commission thereof. |

Article 4

Comparable compliance with respect to Title V of Regulation (EU) No 648/2012

1. Where a Tier 2 CCP has entered into an interoperability arrangement with a CCP authorised under Article 14 of Regulation (EU) No 648/2012, ESMA shall grant comparable compliance with respect to the requirements set out in Title V of that Regulation where the Tier 2 CCP complies with all relevant elements set out in Annex II to this Regulation.

2. Where a Tier 2 CCP has entered into an interoperability arrangement with a third-country CCP, ESMA shall grant comparable compliance with respect to the requirements set out in Title V of Regulation (EU) No 648/2012 unless the impact of that arrangement on the financial stability of the Union or one or more of its Member States justifies assessing whether to grant comparable compliance in accordance with paragraph 1.

Article 5

Exemptions and incompatible requirements

1. ESMA shall not refuse comparable compliance with respect to the requirements set out in Article 16 and Titles IV and V of Regulation (EU) No 648/2012 for the mere reason that the Tier 2 CCP applies an exemption under the applicable third-country framework which is comparable to any of those set out in paragraphs 4 and 5 of Article 1 of that Regulation. The Tier 2 CCP shall provide evidence that the Union and third-country exemption are comparable.

2. Where complying with a specific requirement set out in Article 16 or Titles IV or V of Regulation (EU) No 648/2012 implies a breach of the applicable third-country framework, ESMA shall grant comparable compliance with respect to that requirement only where the Tier 2 CCP provides evidence that:

|

(a) |

it is impossible to comply with that requirement without breaching a mandatory provision of the applicable third-country framework; |

|

(b) |

the applicable third-country framework effectively achieves the same objectives as Article 16 and Titles IV and V of Regulation (EU) No 648/2012; |

|

(c) |

it complies with the applicable third-country framework. |

Article 6

Changes to the applicable third-country framework

A Tier 2 CCP that has been granted comparable compliance shall notify ESMA of any change to its applicable third-country framework and to its internal rules and procedures. ESMA shall inform the Commission of those notifications.

Article 7

Entry into force

This Regulation shall enter into force on the day following that of its publication in the Official Journal of the European Union.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 14 July 2020.

For the Commission

The President

Ursula VON DER LEYEN

(1) OJ L 201, 27.7.2012, p. 1.

(2) Regulation (EU) 2019/2099 of the European Parliament and of the Council of 23 October 2019 amending Regulation (EU) No 648/2012 as regards the procedures and authorities involved for the authorisation of CCPs and requirements for the recognition of third-country CCPs (OJ L 322, 12.12.2019, p. 1).

(3) Commission Delegated Regulation (EU) No 152/2013 of 19 December 2012 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards on capital requirements for central counterparties (OJ L 52, 23.2.2013, p. 37).

ANNEX I

ELEMENTS REFERRED TO IN ARTICLE 3(1)

|

Provision of Union law |

Elements referred to in Article 3(1) |

||||||||||||||||

|

Chapter 1: Organisational requirements |

|||||||||||||||||

|

General provisions Article 26(1) of Regulation (EU) No 648/2012 |

The third-country CCP has:

|

||||||||||||||||

|

Article 26(2) of Regulation (EU) No 648/2012 |

The third-country CCP has established policies and procedures which are sufficiently effective so as to ensure compliance with the relevant third-country framework, including compliance with that framework by its managers and employees. |

||||||||||||||||

|

Article 26(3) and (4) of Regulation (EU) No 648/2012 |

The third-country CCP:

|

||||||||||||||||

|

Article 26(5) of Regulation (EU) No 648/2012 |

The third-country CCP implements and maintains a remuneration policy which promotes sound and effective risk management and which does not create incentives to relax risk standards. |

||||||||||||||||

|

Paragraphs 6, 7 and 8 of Article 26 of Regulation (EU) No 648/2012 |

The third-country CCP:

|

||||||||||||||||

|

Senior management and the board Article 27(1) of Regulation (EU) No 648/2012 |

The senior management of a third-country CCP is of sufficiently good repute and has sufficient experience to ensure the sound and prudent management of the CCP. |

||||||||||||||||

|

Paragraphs 2 and 3 of Article 27 of Regulation (EU) No 648/2012 |

The third-country CCP has a board with a sufficient number of independent members that have clear roles and responsibilities, an adequate representation of clearing members and clients, and mechanisms to address any potential conflicts of interest within the CCP to ensure sound and prudent management of the CCP. |

||||||||||||||||

|

Risk Committee Article 28 of Regulation (EU) No 648/2012 |

The third-country CCP:

|

||||||||||||||||

|

Record Keeping Article 29(1) of Regulation (EU) No 648/2012 |

The third-country CCP maintains, for a period of at least 10 years, all the records on the services and activity provided so as to enable its competent authority to monitor its compliance with the relevant third-country framework. |

||||||||||||||||

|

Article 29(2) of Regulation (EU) No 648/2012 |

The third-country CCP maintains, for a period of at least 10 years following the termination of a contract, all information on all contracts it has processed to enable the identification of the original terms of a transaction before clearing by that CCP. |

||||||||||||||||

|

Article 29(3) of Regulation (EU) No 648/2012 |

The third-country CCP makes available to any relevant third-country authority, upon request, the records on the services and activity provided, the information on all contracts it has processed and all information on the positions of cleared contracts, irrespective of the venue where the transactions were executed. |

||||||||||||||||

|

Shareholders and members with qualifying holdings Article 30(1) of Regulation (EU) No 648/2012 |

The third-country CCP informs its competent authority of the identities of the shareholders or members that have qualifying holdings and of the amounts of those holdings. |

||||||||||||||||

|

Paragraphs 2 and 4 of Article 30 of Regulation (EU) No 648/2012 |

The shareholders or members that have qualifying holdings in a third-country CCP:

|

||||||||||||||||

|

Article 30(3) of Regulation (EU) No 648/2012 |

Close links between the third-country CCP and other natural or legal persons do not prevent the effective exercise of the supervisory functions of the competent authority of the third country. |

||||||||||||||||

|

Article 30(5) of Regulation (EU) No 648/2012 |

The laws, regulations or administrative provisions of a third country governing one or more natural or legal persons with which the CCP has close links, or difficulties involved in their enforcement, do not prevent the effective exercise of the supervisory functions of the competent authority. |

||||||||||||||||

|

Article 31(1) of Regulation (EU) No 648/2012 |

The third-country CCP notifies its competent authority of any changes to its management and the third-country framework ensures that appropriate measures are taken where the conduct of a member of the board of a third-country CCP is likely to be prejudicial to the sound and prudent management of the CCP.,. |

||||||||||||||||

|

Conflict of Interest Article 33(1) of Regulation (EU) No 648/2012 |

The third-country CCP maintains and operates effective arrangements to identify, manage and resolve any potential conflicts of interest between itself, including its managers, employees, or any person with direct or indirect control or close links, and its clearing members or their clients known to the CCP. |

||||||||||||||||

|

Article 33(2) of Regulation (EU) No 648/2012 |

Where the arrangements of the third-country CCP to manage conflicts of interest are not sufficient to ensure, with reasonable confidence, that risks of damage to the interests of a clearing member or client are prevented, , that CCP discloses to clearing members and, where clients are known to that CCP, to those clients, the general nature or sources of conflicts of interest before accepting new transactions from those clearing members. |

||||||||||||||||

|

Article 33(3) of Regulation (EU) No 648/2012 |

Where the third-country CCP is a parent undertaking or a subsidiary, , that CCP’s arrangements to manage conflicts of interest take into account any circumstances of which the CCP is or should be aware which may give rise to a conflict of interest due to the structure and business activities of other undertakings of which it is a parent or a subsidiary. |

||||||||||||||||

|

Article 33(5) of Regulation (EU) No 648/2012 |

The third-country CCP takes all reasonable steps to prevent any misuse of information held in its systems and prevents the use of that information for other business activities. |

||||||||||||||||

|

Business Continuity Article 34(1) of Regulation (EU) No 648/2012 |

The third-country CCP implements and maintains an adequate business continuity policy and disaster recovery plan aimed at ensuring the preservation of its functions, the timely recovery of operations and the fulfilment of the CCP’s obligations, including the recovery of all transactions at the time of disruption to enable the CCP to continue to operate with certainty and to complete settlement on the scheduled date. |

||||||||||||||||

|

Article 34(2) of Regulation (EU) No 648/2012 |

The third-country CCP implements and maintains an adequate procedure ensuring the timely and orderly settlement or transfer of the assets and positions of clients and clearing members in the event of a withdrawal of authorisation. |

||||||||||||||||

|

Outsourcing Article 35 of Regulation (EU) No 648/2012 |

When outsourcing operational functions, services or activities, the third-country CCP ensures that, at all times:

|

||||||||||||||||

|

Chapter 2: Conduct of business rules |

|||||||||||||||||

|

General provisions Article 36(1) of Regulation (EU) No 648/2012 |

The third-country CCP, when providing services to its clearing members, and where relevant, to their clients, acts fairly and professionally in accordance with the best interests of such clearing members and clients and sound risk management. |

||||||||||||||||

|

Article 36(2) of Regulation (EU) No 648/2012 |

The third-country CCP has accessible, transparent and fair rules for the prompt handling of complaints. |

||||||||||||||||

|

Participation requirements Paragraphs 1 and 2 of Article 37 of Regulation (EU) No 648/2012 |

The third-country CCP establishes categories of admissible clearing members and non-discriminatory, transparent and objective admission criteria to ensure fair and open access to the CCP and sufficient financial resources and operational capacity of clearing members, enabling the CCP to control the risk it is exposed to, and monitors on an ongoing basis that those criteria are met. |

||||||||||||||||

|

Article 37(3) of Regulation (EU) No 648/2012 |

The third-country CCP’s rules for clearing members enables it to gather relevant basic information to identify, monitor and manage relevant concentrations of risk relating to the provision of services to clients. |

||||||||||||||||

|

Paragraphs 4 and 5 of Article 37 of Regulation (EU) No 648/2012 |

The third-country CCP has objective and transparent procedures for the suspension and orderly exit of clearing members that no longer meet the admission criteria and can only deny access to clearing members meeting the admission criteria where duly justified in writing and based on a comprehensive risk analysis. |

||||||||||||||||

|

Article 37(6) of Regulation (EU) No 648/2012 |

Specific additional obligations on clearing members, such as the participation in auctions of a defaulting clearing member’s position, are proportional to the risk brought by the clearing member and do not restrict participation to certain categories of clearing members. |

||||||||||||||||

|

Transparency Article 38(1) of Regulation (EU) No 648/2012 |

The third-country CCP publicly discloses the prices and fees associated with each service provided, including discounts and rebates and the conditions to benefit from those reductions, and allows its clearing members and, where relevant, their clients, separate access to the specific services provided. |

||||||||||||||||

|

Article 38(2) of Regulation (EU) No 648/2012 |

The third-country CCP discloses to clearing members and clients the risks associated with the services provided. |

||||||||||||||||

|

Article 38(3) of Regulation (EU) No 648/2012 |

The third-country CCP discloses to its clearing members the price information used to calculate its end-of-day exposures to its clearing members, and publicly discloses the volumes of the cleared transactions for each class of instruments cleared by the CCP on an aggregated basis. |

||||||||||||||||

|

Article 38(4) of Regulation (EU) No 648/2012 |

The third-country CCP publicly discloses the operational and technical requirements relating to the communication protocols covering content and message formats it uses to interact with third parties, including the operational and technical requirements related to access of trading venues to the CCP. |

||||||||||||||||

|

Paragraphs 6 and 7 of Article 38 of Regulation (EU) No 648/2012 |

The third-country CCP provides its clearing members with information on the initial margin models it uses, explaining how the models operate and describing the key assumptions and limitations of those models. |

||||||||||||||||

|

Segregation and Portability Article 39 of Regulation (EU) No 648/2012 |

The third-country CCP keeps separate records and accounts for each clearing member, segregates the assets and positions of the clearing member from the assets and positions of the clients of the clearing member, and provides sufficient protection for the assets and positions of each clearing member and each client, as well as a choice of segregation of positions and assets and of options of portability to each client, including individual client segregation. |

||||||||||||||||

|

Chapter 3: Prudential requirements |

|||||||||||||||||

|

Exposure management Article 40 of Regulation (EU) No 648/2012 |

The third-country CCP maintains appropriate policies and mechanisms to manage, on a near to real time basis, intra-day exposures to sudden changes in market conditions and in positions. |

||||||||||||||||

|

Margin requirements Article 41(1) of Regulation (EU) No 648/2012 |

The third-country CCP imposes, calls and collects margins to limit its credit exposures from its clearing members and, where relevant, from CCPs with which it has interoperability arrangements, and that CCP regularly monitors and, if necessary, revises the level of its margins to reflect current market conditions taking into account any potentially procyclical effects of such revisions. Such margins shall be sufficient:

Those margins ensure that a CCP fully collateralises its exposures with all its clearing members, and, where relevant, with CCPs with which it has interoperability arrangements, at least on a daily basis. |

||||||||||||||||

|

Article 41(2) of Regulation (EU) No 648/2012 |

The third-country CCP applies models and parameters in setting its margin requirements that capture the risk characteristics of the products cleared and take into account the interval between margin collections, market liquidity and the possibility of changes over the duration of the transaction. |

||||||||||||||||

|

Article 41(3) of Regulation (EU) No 648/2012 |

The third-country CCP calls and collects margins on an intraday basis, at least when predefined thresholds are exceeded. |

||||||||||||||||

|

Article 41(4) of Regulation (EU) No 648/2012 |

The third-country CCP calculates, calls and collects margins that are adequate to cover the risk stemming from the positions registered in each account with respect to specific financial instruments, or to a portfolio of financial instruments provided that the methodology used is prudent and robust. |

||||||||||||||||

|

Default Fund and Other Financial Resources Paragraphs 1 and 4 of Article 42 of Regulation (EU) No 648/2012 |

The third-country CCP:

|

||||||||||||||||

|

Article 42(2) of Regulation (EU) No 648/2012 |

The third-country CCP establishes the minimum size of contributions to the default fund and the criteria to calculate the contributions of the single clearing members. The contributions are proportional to the exposures of each clearing member. |

||||||||||||||||

|

Articles 42(3) and 43(2) of Regulation (EU) No 648/2012 |

The third-country CCP develops scenarios of extreme but plausible market conditions, including the most volatile periods that have been experienced by the markets for which that CCP provides its services, and a range of potential future scenarios, taking into account sudden sales of financial resources and rapid reductions in market liquidity, and the default fund of that CCP enables it, at all times, to withstand the default of at least the two clearing members to which it has the largest exposures under extreme but plausible market conditions. |

||||||||||||||||

|

Article 43(1) of Regulation (EU) No 648/2012 |

The default fund of the third-country CCP maintains sufficient pre-funded available financial resources to cover potential losses that exceed the losses to be covered by margins. Those pre-funded available financial resources include dedicated resources of the CCP, are freely available to the CCP and are not used to meet capital requirements. |

||||||||||||||||

|

Article 43(3) of Regulation (EU) No 648/2012 |

The third-country CCP ensures that the exposures of the clearing members toward that CCP are limited. |

||||||||||||||||

|

Liquidity risk controls Article 44(1) of Regulation (EU) No 648/2012 |

The third-country CCP:

|

||||||||||||||||

|

Default waterfall Paragraphs 1 and 2 of Article 45 of Regulation (EU) No 648/2012 |

The third-country CCP uses the margins posted by a defaulting clearing member prior to other financial resources in covering losses and thereafter, where the margins posted by that clearing member are not sufficient to cover the losses incurred by the CCP, the default fund contribution of that clearing member to cover those losses. |

||||||||||||||||

|

Paragraphs 3 and 4 of Article 45 of Regulation (EU) No 648/2012 |

The third-country CCP:

|

||||||||||||||||

|

Collateral requirements Article 46 of Regulation (EU) No 648/2012 |

The third-country CCP accepts only highly liquid collateral with minimal credit and market risk to cover its initial and ongoing exposure to its clearing members, and applies adequate haircuts to asset values that reflect the potential for their value to decline over the interval between their last revaluation and the time by which they can reasonably be assumed to be liquidated, taking into account the liquidity risk following the default of a market participant and the concentration risk on certain assets that may result in establishing the acceptable collateral and the relevant haircuts. |

||||||||||||||||

|

Investment Policy Article 47(1) of Regulation (EU) No 648/2012 |

The third-country CCP invests its financial resources only in cash or in highly liquid financial instruments with minimal market and credit risk, and its investments are capable of being liquidated rapidly with minimal adverse price effect. |

||||||||||||||||

|

Article 47(3) of Regulation (EU) No 648/2012 |

The third-country CCP deposits financial instruments posted as margins or as default fund contributions with, where available, operators of securities settlement systems that ensure the full protection of those financial instruments, or with other authorised financial institutions using alternative highly secure arrangements. |

||||||||||||||||

|

Article 47(4) of Regulation (EU) No 648/2012 |

Cash deposits of the third-country CCP are performed through highly secure arrangements with authorised financial institutions or, alternatively, through the use of the standing deposit facilities of central banks or other comparable means provided for by central banks. |

||||||||||||||||

|

Article 47(5) of Regulation (EU) No 648/2012 |

When depositing assets with a third party, the third-country CCP:

|

||||||||||||||||

|

Article 47(6) of Regulation (EU) No 648/2012 |

The third-country CCP does not invest its capital or the sums arising from margins, default fund contributions, liquidity or other financial resources, in its own securities or those of its parent undertaking or its subsidiary. |

||||||||||||||||

|

Article 47(7) of Regulation (EU) No 648/2012 |

The third-country CCP takes into account its overall credit risk exposures to individual obligors in making its investment decisions and ensures that its overall risk exposure to any individual obligor remains within acceptable concentration limits. |

||||||||||||||||

|

Default procedures Article 48(1) of Regulation (EU) No 648/2012 |

The third-country CCP has procedures in place to be followed where a clearing member does not comply with the participation requirements of the CCP or when that clearing member is declared in default either by the CCP or by a third party. |

||||||||||||||||

|

Article 48(2) of Regulation (EU) No 648/2012 |

The third-country CCP takes prompt action to contain losses and liquidity pressures resulting from defaults and ensures that the closing out of any clearing member’s positions does not disrupt its operations or expose the non-defaulting clearing members to losses that they cannot anticipate or control. |

||||||||||||||||

|

Article 48(3) of Regulation (EU) No 648/2012 |

The third-country framework ensures that the third-country CCP promptly informs its competent authority before the default procedure is declared or triggered. |

||||||||||||||||

|

Article 48(4) of Regulation (EU) No 648/2012 |

The third-country CCP verifies that its default procedures are enforceable. |

||||||||||||||||

|

Paragraphs 5, 6 and 7 of Article 48 of Regulation (EU) No 648/2012 |

The third-country CCP:

|

||||||||||||||||

|

Review of models, stress testing and back testing Article 49(1) of Regulation (EU) No 648/2012 |

The third-country CCP:

|

||||||||||||||||

|

Article 49(2) of Regulation (EU) No 648/2012 |

The third-country CCP regularly tests the key aspects of its default procedures and takes all reasonable steps to ensure that all clearing members understand them and have appropriate arrangements in place to respond to a default event. |

||||||||||||||||

|

Article 49(3) of Regulation (EU) No 648/2012 |

The third-country CCP publicly discloses key information on its risk-management model and assumptions adopted to perform the stress tests on the models and parameters adopted to calculate its margin requirements, default fund contributions, collateral requirements and other risk control mechanisms. |

||||||||||||||||

|

Settlement Article 50(1) of Regulation (EU) No 648/2012 |

The third-country CCP uses, where practical and available, central bank money to settle its transactions or, where central bank money is not used, takes steps to strictly limit cash settlement risks. |

||||||||||||||||

|

Article 50(2) of Regulation (EU) No 648/2012 |

The third-country CCP clearly states its obligations with respect to deliveries of financial instruments including whether it has an obligation to make or receive delivery of a financial instrument or whether it indemnifies participants for losses incurred in the delivery process. |

||||||||||||||||

|

Article 50(3) of Regulation (EU) No 648/2012 |

Where the third-country CCP has an obligation to make or receive deliveries of financial instruments, that CCP eliminates principal risk through the use of delivery-versus-payment mechanisms to the extent possible. |

||||||||||||||||

|

Chapter 4: Calculations and reporting for the purposes of Regulation (EU) No 575/2013of the European Parliament and of the Council (1) |

|||||||||||||||||

|

Calculations and reporting Articles 50a to 50d of Regulation (EU) No 648/2012 |

The third-country CCP applies reporting requirements on capital requirements calculations in accordance with the respective third-country framework applicable to rules on accounting and capital requirements. |

||||||||||||||||

(1) Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012 (OJ L 176, 27.6.2013, p. 1).

ANNEX II

ELEMENTS REFERRED TO IN ARTICLE 4(1)

|

Provision of Union law |

Elements referred to in Article 4(1) |

||||||||||

|