ISSN 1977-0677

Official Journal

of the European Union

L 179

English edition

Legislation

Volume 62

3 July 2019

|

ISSN 1977-0677 |

||

|

Official Journal of the European Union |

L 179 |

|

|

||

|

English edition |

Legislation |

Volume 62 |

|

|

|

|

|

(1) Text with EEA relevance. |

|

EN |

Acts whose titles are printed in light type are those relating to day-to-day management of agricultural matters, and are generally valid for a limited period. The titles of all other Acts are printed in bold type and preceded by an asterisk. |

II Non-legislative acts

REGULATIONS

|

3.7.2019 |

EN |

Official Journal of the European Union |

L 179/1 |

COMMISSION IMPLEMENTING REGULATION (EU) 2019/1129

of 2 July 2019

amending Implementing Regulation (EU) No 79/2012 laying down detailed rules for implementing certain provisions of Council Regulation (EU) No 904/2010 concerning administrative cooperation and combating fraud in the field of value added tax

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Council Regulation (EU) No 904/2010 of 7 October 2010 on administrative cooperation and combating fraud in the field of value added tax (1), and in particular Article 17(2) and (3), Article 21(3) and Article 21a(3) thereof,

Whereas:

|

(1) |

Article 17(1)(f) and Article 21(2a) of Regulation (EU) No 904/2010 require Member States to store information on VAT exempted importations collected by them under Article 143(2) of Council Directive 2006/112/EC (2) and to grant other Member States automated access to that information, with a view to helping Member States identify discrepancies in VAT reporting and potential VAT frauds. |

|

(2) |

Information on such VAT exempted importations is already collected by national customs authorities under Regulation (EU) No 952/2013 of the European Parliament and of the Council (3) and forwarded to the Commission using the electronic system referred to in Article 56(1) of Commission Implementing Regulation (EU) 2015/2447 (4). The storage of and automated access to information on VAT exempted importations required by Article 17(1)(f) and Article 21(2a) of Regulation (EU) No 904/2010 should take place using that same electronic system for the sake of efficiency. In order to guarantee uniform implementation of those Articles of Regulation (EU) No 904/2010, it is necessary to specify the data elements of customs information collected under Regulation (EU) No 952/2013 that correspond to the information referred to in Article 17(1)(f) of Regulation (EU) No 904/2010. |

|

(3) |

The technical details concerning the automated enquiry of the information referred to in Article 17(1)(f) of Regulation (EU) No 904/2010 should allow for national tax authorities and Eurofisc liaison officials to have automated access to the electronic system referred to in Article 56(1) of Implementing Regulation (EU) 2015/2447. |

|

(4) |

Article 21a of Regulation (EU) No 904/2010 grants Eurofisc liaison officials automated access to certain vehicle registration information. Automated enquiry of that information should be conducted via a version of the European Vehicle and Driving Licence Information System (EUCARIS) especially designed for the purposes of Article 21a of that Regulation. In the context of VAT, Eurofisc liaison officials should be in a position to request precise identification data relating to vehicles and their owners and holders. To this end, the data as well as the means that will be used to retrieve the data from the system should be specified. It is also necessary to define the availability and reliability of the system, how exchanges will be secured, and which communication network will be used. |

|

(5) |

At national level, incoming requests to access vehicle registration data for VAT purposes will usually be processed by each Member State's national vehicle registration authorities. Nevertheless, Member States should be free to decide to entrust that responsibility to another authority if they wish. As regards outgoing requests, Member States should again be free to decide whether to entrust responsibility for the processing of such requests to their national vehicle registration authorities or to another authority, such as their tax authorities. |

|

(6) |

Article 21(2)(e) and (2a)(d) and Article 21a(2) of Regulation (EU) No 904/2010 lay down the conditions under which access to certain information is to be granted. In order to implement those conditions, Member States should be required to allocate a unique personal user identification to each of their Eurofisc liaison officials and to make a list of those personal user identifications available to the other Member States and to the Commission. They should also make sure that each automated outgoing request for information sent out by their Eurofisc liaison officials contains the Eurofisc liaison official's personal user identification. |

|

(7) |

Articles 17(1)(f), 21(2a) and 21a of Regulation (EU) No 904/2010 are to apply from 1 January 2020, in accordance with Article 3 of Council Regulation (EU) 2018/1541 (5). Application of the measures provided for in this Regulation should therefore apply from 1 January 2020 too. |

|

(8) |

The measures provided for in this Regulation are in accordance with the opinion of the Standing Committee on Administrative Cooperation, |

HAS ADOPTED THIS REGULATION:

Article 1

Commission Implementing Regulation (EU) No 79/2012 (6) is amended as follows:

|

(1) |

Article 1 is replaced by the following: ‘Article 1 Subject matter This Regulation lays down detailed rules for implementing Articles 14, 17(1)(f), 21(2)(e), 21(2a)(d), 21a(1) and (2), 32, 48, 49 and Article 51(1) of Regulation (EU) No 904/2010.’; |

|

(2) |

the following Articles are inserted: ‘Article 5a Exchange of customs information 1. The storage of and automated access by competent authorities to the information referred to in Article 17(1)(f) of Regulation (EU) No 904/2010 shall take place using the electronic system referred to in Article 56(1) of Commission Implementing Regulation (EU) 2015/2447 (*1). 2. Automated access pursuant to Article 21(2a) of Regulation (EU) No 904/2010 shall be granted at the level of the goods item of a customs declaration as provided for in Section 3 of Chapter 2, and Column H1 of Section 1 of Chapter 3, in Title I of Annex B to Commission Delegated Regulation (EU) 2015/2446 (*2). 3. Each goods item shall be identified by the following information as required in accordance with Article 226 of Implementing Regulation (EU) 2015/2447:

4. Annex VII to this Regulation sets out which piece of information referred to in Article 17(1)(f) of Regulation (EU) No 904/2010 corresponds to which data element of the customs system as defined in Annex B to Implementing Regulation (EU) 2015/2447. Article 5b Exchange of vehicle registration information 1. Automated enquiry of the information referred to in Article 21a(1) of Regulation (EU) No 904/2010 (“vehicle registration data”) shall be conducted using a version of the European Vehicle and Driving Licence Information System (EUCARIS) software application especially designed for the purposes of Article 21a of that Regulation, and amended versions of that software. Automated enquiry of vehicle registration data shall take place within a decentralised structure. The vehicle registration data exchanged via the EUCARIS system shall be transmitted in encrypted form. The specific version of the software application developed by the EUCARIS nominated party for operation for the automated enquiry of vehicle registration data for the purposes of Article 21a of Regulation (EU) No 904/2010 shall be separate from other versions of that software application available in EUCARIS. Automated enquiries shall be conducted in compliance with the requirements for data security and technical conditions of the data exchange referred to in points 2 and 3 of Chapter 3 of the Annex to Council Decision 2008/616/JHA (*3). The data elements of the vehicle registration data to be exchanged and the types of enquiry that are permitted shall be as specified in Annex VIII to this Regulation. 2. Automated access to vehicle registration data shall take place using the Trans European Services for Telematics between Administrations (TESTA) communications network and further developments thereof. 3. Member States shall take all necessary measures to ensure that automated enquiry of and automated access to vehicle registration data is possible 24 hours a day and seven days a week. In the event of a technical fault, the Member States' national contact points shall immediately inform each other with the support of the EUCARIS nominated party for operations, if needed. Automated data exchange shall be re-established as quickly as possible. 4. Each Member State shall designate one national authority as a national contact point responsible within that Member State for processing incoming requests for vehicle registration data for VAT purposes provided for in Article 21a of Regulation (EU) No 904/2010 and one for processing outgoing requests. The same authority may be responsible for processing both exchanges. It shall inform the other Member States and the Commission thereof. Article 5c Identification of Eurofisc Liaison Officials accessing information collated by the customs authorities, the recapitulative statements collected pursuant to Chapter 6 of Title XI of Directive 2006/112/EC and vehicle registration data To enable a Member State to identify a Eurofisc liaison official accessing information provided by that Member State under the conditions set out in Article 21(2)(e) or (2a)(d) or Article 21a(2) of Regulation (EU) No 904/2010, the following arrangements shall be implemented:

(*1) Commission Implementing Regulation (EU) 2015/2447 of 24 November 2015 laying down detailed rules for implementing certain provisions of Regulation (EU) No 952/2013 of the European Parliament and of the Council laying down the Union Customs Code (OJ L 343, 29.12.2015, p. 558)." (*2) Commission Delegated Regulation (EU) 2015/2446 of 28 July 2015 supplementing Regulation (EU) No 952/2013 of the European Parliament and of the Council as regards detailed rules concerning certain provisions of the Union Customs Code (OJ L 343, 29.12.2015, p. 1)." (*3) Council Decision 2008/616/JHA of 23 June 2008 on the implementation of Decision 2008/615/JHA on the stepping up of cross-border cooperation, particularly in combating terrorism and cross-border crime (OJ L 210, 6.8.2008, p. 12).’;" |

|

(3) |

in the Annexes, the Annexes set out in the Annex to this Regulation are added. |

Article 2

This Regulation shall enter into force on the twentieth day following that of its publication in the Official Journal of the European Union.

It shall apply from 1 January 2020.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 2 July 2019.

For the Commission

The President

Jean-Claude JUNCKER

(1) OJ L 268, 12.10.2010, p. 1.

(2) Council Directive 2006/112/EC of 28 November 2006 on the common system of value added tax (OJ L 347, 11.12.2006, p. 1).

(3) Regulation (EU) No 952/2013 of the European Parliament and of the Council of 9 October 2013 laying down the Union Customs Code (OJ L 269, 10.10.2013, p. 1).

(4) Commission Implementing Regulation (EU) 2015/2447 of 24 November 2015 laying down detailed rules for implementing certain provisions of Regulation (EU) No 952/2013 of the European Parliament and of the Council laying down the Union Customs Code (OJ L 343, 29.12.2015, p. 558).

(5) Council Regulation (EU) 2018/1541 of 2 October 2018 amending Regulations (EU) No 904/2010 and (EU) 2017/2454 as regards measures to strengthen administrative cooperation in the field of value added tax (OJ L 259, 16.10.2018, p. 1).

(6) Commission Implementing Regulation (EU) No 79/2012 of 31 January 2012 laying down detailed rules for implementing certain provisions of Council Regulation (EU) No 904/2010 concerning administrative cooperation and combating fraud in the field of value added tax (OJ L 29, 1.2.2012, p. 13).

ANNEX

‘ANNEX VII

Common data-set and technical details for the storage of and automated access to customs information

The table sets out which piece of information referred to in Article 17(1)(f) of Regulation (EU) No 904/2010 corresponds to which data element exchanged through the electronic system referred to in Article 56(1) of Implementing Regulation (EU) 2015/2447.

|

Piece of information referred to in Article 17(1)(f) of Regulation (EU) No 904/2010 |

Data element order number provided for in Implementing Regulation (EU) 2015/2447 |

Data element name and additional information provided for in Implementing Regulation (EU) 2015/2447 |

|

VAT identification number of the importer in the country of importation |

3/40 FR1 |

Additional fiscal references identification No (Party: Importer) |

|

VAT identification number of the tax representative of the importer in the country of importation |

3/40 FR3 |

Additional fiscal references identification No (Party: Tax Representative) |

|

VAT identification number of the customer in another Member State |

3/40 FR2 |

Additional fiscal references identification No (Party: Customer) |

|

Country of origin |

5/15 or 5/16 |

Country of origin or Country of preferential origin |

|

Country of destination |

5/8 |

Country of destination |

|

Commodity code |

6/14 |

Commodity code — Combined nomenclature code. |

|

Total amount |

4/4 B00 |

Tax base (*1) |

|

Item price |

8/6 |

Statistical value |

|

Net weight |

6/1 |

Net mass (kg) |

The currency of the information stored in the electronic system referred to in Article 56(1) of Implementing Regulation (EU) 2015/2447 is euro. The exchange rate between the currency of the Member State of importation and euro will be provided by the system automatically.

ANNEX VIII

Common data-set and technical details for automated enquiry of vehicle registration data

1. OBLIGATION

Each data element reported under section 4 of this Annex shall be communicated when the information is available in a Member State's national vehicle register.

2. VEHICLE/OWNER/HOLDER SEARCH

There are five different ways to search for vehicle registration data:

|

(1) |

by Chassis Number (VIN), Reference Date and Time (optional), |

|

(2) |

by Licence Plate Number, Vehicle Chassis Number (VIN) (optional), Reference Date and Time (optional), |

|

(3) |

by Vehicle Holder, date of birth (optional), Reference Date and Time (optional), |

|

(4) |

by Vehicle Owner, date of birth (optional), Reference Date and Time (optional), |

|

(5) |

by VAT number of the holder/owner of the vehicle, Reference Date and Time (optional). |

Without prejudice to the obligation set out in section 1 of this Annex, the Member States may decide not to make all these search modes available if, in the case of outgoing requests, they deem that one or more of them do not meet their Eurofisc liaison officials' needs or, in the case of incoming requests, the information requested is not available in that Member State's national vehicle register.

3. TYPES OF QUERIES

Based on the data set defined in section 4 of this Annex, and the type of search provided for in section 2, seven different types of queries can be submitted:

|

(1) |

Vehicle-owner/holder inquiry: Requesting a limited set of vehicle information plus the owner and/or holder of the vehicle based on the country-code and Licence Plate Number or Vehicle Chassis Number (VIN), and reference date/time. In case the inquiry is made by Vehicle Chassis Number, it is possible to broadcast the request to several or all connected countries. |

|

(2) |

Extended vehicle-owner/holder inquiry: Requesting an extended set of technical vehicle data, registration data and the owner and holder of the vehicle based on the country-code and Licence Plate Number or Vehicle Chassis Number (VIN), and reference date/time. In case the inquiry is made by VIN, it is possible to broadcast the request to several or all connected countries. |

|

(3) |

Vehicle-owner/holder history inquiry: Requesting the list of all past owners/holders of a vehicle whichever the countries where the vehicle was previously registered by the provision of a Vehicle Chassis Number (VIN), without a reference date/time. It is possible to broadcast the request to several or all connected countries. |

|

(4) |

Vehicles by owner/holder Inquiry: Requesting all vehicles, with a limited set of identifying data, registered on the name of a given natural person based on the first name, last name, date of birth (optional) or ID (optional) of the owner/holder or of a given legal person based on the company's registration name. |

|

(5) |

Vehicle by VAT number inquiry: Requesting all vehicles, with a limited set of identifying data, registered on the name of a given natural person or a given legal person based on the VAT number. |

|

(6) |

A batch version of the abovementioned queries 1, 2, 3, 4, and 5 containing several cases. A batch will always be sent to one specific country |

|

(7) |

A hit/no hit inquiry containing several Vehicle Chassis Number (VINs) sent out to several countries. In reply, the requesting Member State will receive a series of tables (a table per responding Member State) with an indication of which VINs were found/not found. This function will only be available in batch mode. |

Normally, the actual Date and Time is used to make a query, but it is possible to conduct a search with a Reference Date and Time in the past. When a query is made with a Reference Date and Time in the past and historical information is not available in the register of the specific Member State because no such information is registered at all, the actual information can be returned with an indication that the information is actual information

Without prejudice to the obligation set out in section 1 of this Annex, the Member States may decide not to make all these query modes available if, in the case of outgoing requests, they deem that one or more of them do not meet their Eurofisc liaison officials' needs or, in the case of incoming requests, the information requested is not available in that Member State's national vehicle register.

4. DATA SET

|

Data relating to the holder of the vehicle |

|

|

Registration holder's (company) name |

separate fields will be used for surname, infixes, titles, etc., and the name in printable format will be communicated |

|

First name |

separate fields for first name(s) and initials will be used, and the name in printable format will be communicated |

|

Address |

separate fields will be used for Street, House number and Annex, Zip code, Place of residence, Country of residence, etc., and the Address in printable format will be communicated |

|

Date of birth |

|

|

Legal entity |

individual, association, company, firm, etc. |

|

ID number |

an identifier that uniquely identifies the person or the company. |

|

Type of ID number |

the type of ID Number (e.g. passport number). |

|

VAT number |

|

|

Start date holdership |

start date of the holdership of the car. This date will often be the same as printed under (I) on the registration certificate of the vehicle |

|

End date holdership |

end data of the holdership of the car |

|

Data relating to the owner of the vehicle |

|

|

Owner's (company) name |

separate fields will be used for surname, infixes, titles, etc., and the name in printable format will be communicated |

|

First name |

separate fields for first name(s) and initials will be used, and the name in printable format will be communicated |

|

Address |

separate fields will be used for Street, House number and Annex, Zip code, Place of residence, Country of residence, etc., and the Address in printable format will be communicated |

|

Date of birth |

|

|

Legal entity |

individual, association, company, firm, etc. |

|

ID number |

an identifier that uniquely identifies the person or the company. |

|

Type of ID number |

the type of ID Number (e.g. passport number). |

|

VAT number |

|

|

Start date ownership |

start date of the ownership of the car. This date will often be the same as printed under (I) on the registration certificate of the vehicle |

|

End date ownership |

end date of the ownership of the car |

|

Data relating to vehicles |

|

|

Licence Plate number |

|

|

Chassis number/VIN |

|

|

Country of registration |

|

|

Make |

(D.1) e.g. Ford, Opel, Renault, etc. |

|

Commercial type of vehicle |

(D.3) e.g. Focus, Astra, Megane |

|

Nature of the vehicle/EU category code |

e.g. moped, motorbike, car, etc. |

|

Colour |

|

|

Mileage |

|

|

Mass |

Mass of the vehicle in service |

|

Date of first registration |

date of first registration of the vehicle somewhere in the world |

|

Start date (actual) registration |

date of the registration to which the specific certificate of the vehicle refers |

|

End date registration |

end date of the registration to which the specific certificate of the vehicle refers. It is possible that this date indicates the period of validity as printed on the document if not unlimited (document abbreviation = H). |

|

Status |

Scrapped, stolen, exported, etc. |

|

Start date status |

|

|

End date Status |

|

(*1) When Union code entered for data element No 4/3 (Calculation of Taxes – Tax type) is B00

|

3.7.2019 |

EN |

Official Journal of the European Union |

L 179/9 |

COMMISSION IMPLEMENTING REGULATION (EU) 2019/1130

of 2 July 2019

on the uniform conditions for the harmonised application of territorial typologies pursuant to Regulation (EC) No 1059/2003 of the European Parliament and of the Council

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Regulation (EC) No 1059/2003 of the European Parliament and of the Council of 26 May 2003 on the establishment of a common classification of territorial units for statistics (NUTS) (1), and in particular Article 4b(5) thereof,

Whereas:

|

(1) |

Regulation (EC) No 1059/2003 constitutes the legal framework for the regional classification of the Union in order to enable the collection, compilation and dissemination of harmonised regional statistics. |

|

(2) |

Article 4b of Regulation (EC) No 1059/2003 empowers the Commission to establish at Union level uniform conditions for the harmonised application of the territorial typologies referred to in that Article. |

|

(3) |

Those conditions should describe the method for assigning the typologies to individual local administrative units (LAUs) and Nomenclature of Territorial Units for Statistics (NUTS) level 3 regions. |

|

(4) |

When applying the uniform conditions, it is important to take account of geographical, socioeconomic, historical, cultural and environmental circumstances. |

|

(5) |

The measures provided for in this Regulation are in accordance with the opinion of the European Statistical System Committee, |

HAS ADOPTED THIS REGULATION:

Article 1

The uniform conditions for the harmonised application of the grid-based typology and the LAU-level and NUTS level 3 typologies shall be those set out in the Annex.

Article 2

This Regulation shall enter into force on the twentieth day following that of its publication in the Official Journal of the European Union.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 2 July 2019.

For the Commission

The President

Jean-Claude JUNCKER

ANNEX

1.

The uniform conditions for the harmonised application of the grid-based typology shall be the following:|

Element as established in Regulation (EC) No 1059/2003 |

Labels |

Conditions |

|

|

Grid-based typology |

‘Rural grid cells’ or ‘Low density grid cells’ |

1 km2 grid cells with density below 300 inhabitants/km2 and other cells outside urban clusters. |

|

|

‘Urban clusters’ or ‘Moderate density clusters’ |

|

Contiguous (including diagonals) 1 km2 grid cells with a density of at least 300 inhabitants/km2, and a minimum of 5 000 inhabitants in the cluster. |

|

|

‘Urban centres’ or ‘High density clusters’ |

Contiguous (without diagonals) 1 km2 grid cells within the ‘urban cluster’ with a density of at least 1 500 inhabitants/km2 and a minimum of 50 000 inhabitants in the cluster after gap filling. |

||

2.

The uniform conditions for the harmonised application of the typologies at LAU level shall be the following:|

Element as established in Regulation (EC) No 1059/2003 |

Labels |

Conditions |

|

|

Degree of urbanisation (DEGURBA) |

‘Urban areas’ |

‘Cities’ or ‘Densely populated areas’ |

LAU level territorial units where at least 50 % of the population lives in urban centres. |

|

‘Towns and suburbs’ or ‘Intermediate density areas’ |

LAU level territorial units where less than 50 % of the population lives in rural grid cells and less than 50 % lives in urban centres. |

||

|

‘Rural areas’ or ‘Thinly populated areas’ |

LAU level territorial units where at least 50 % of the population lives in rural grid cells. |

||

|

Functional urban areas |

‘Functional urban areas’ |

‘Cities’ |

LAU level territorial units defined as ‘Cities’ or ‘Densely populated areas’ |

|

‘Commuting zone’ |

LAU level territorial units from which at least 15 % of the employed population commutes to the city, whereby enclaves are included and exclaves are excluded. |

||

|

Coastal areas |

‘Coastal areas’ |

LAU level territorial units that border the sea or that have at least 50 % of their surface within a distance of 10 km from the sea. Enclaves (non-coastal LAUs surrounded by adjacent coastal LAUs) are added. |

|

|

‘Non-coastal areas’ |

LAU level territorial units that are not ‘Coastal areas’ i.e. that do not border the sea and have less than 50 % of their surface within a distance of 10 km from the sea. |

||

3.

The uniform conditions for the harmonised application of the typologies at NUTS level 3 shall be the following:|

Element as established in Regulation (EC) No 1059/2003 |

Labels |

Conditions |

|

Urban-rural typology |

‘Predominantly urban regions’ |

NUTS level 3 regions where at least 80 % of the population live in urban clusters. |

|

‘Intermediate regions’ |

NUTS level 3 regions where more than 50 % but less than 80 % of the population live in urban clusters. |

|

|

‘Predominantly rural regions’ |

NUTS level 3 regions where at least 50 % of the population live in rural grid cells. |

|

|

Metropolitan typology |

‘Metropolitan regions’ |

A single or an aggregation of NUTS level 3 region(s) in which at least 50 % of the population live in functional urban areas of at least 250 000 inhabitants. |

|

‘Non-metropolitan regions’ |

NUTS level 3 regions that are not ‘Metropolitan regions’. |

|

|

Coastal typology |

‘Coastal regions’ |

NUTS level 3 regions that border the sea, or those in which at least 50 % of the population live within 50 km from the coastline, as well as the NUTS level 3 region of Hamburg (Germany). |

|

‘Non-coastal regions’ |

NUTS level 3 regions that are not ‘Coastal regions’. |

|

3.7.2019 |

EN |

Official Journal of the European Union |

L 179/12 |

COMMISSION IMPLEMENTING REGULATION (EU) 2019/1131

of 2 July 2019

establishing a customs tool in order to implement Article 14a of Regulation (EU) 2016/1036 of the European Parliament and of the Council and Article 24a of Regulation (EU) 2016/1037 of the European Parliament and of the Council

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union

Having regard to Regulation (EU) 2016/1036 of the European Parliament and of the Council of 8 June 2016 on protection against dumped imports from countries not members of the European Union (1), and in particular Article 14a(1) thereof,

Having regard to Regulation (EU) 2016/1037 of the European Parliament and of the Council of 8 June 2016 on protection against subsidised imports from countries not members of the European Union (2), and in particular Article 24a(1) thereof,

Whereas:

|

(1) |

Regulation (EU) 2016/1036 and Regulation (EU) 2016/1037 make it possible to apply and collect anti-dumping and/or countervailing duty on certain goods in the continental shelf of a Member State or the exclusive economic zone declared by a Member State pursuant to the United Nations Convention on the Law of the Sea (3). |

|

(2) |

If the product concerned is brought to an artificial island, a fixed or floating installation or any other structure in the continental shelf or in the exclusive economic zone of a Member State of the Union from the customs territory of the Union, Regulation (EU) No 952/2013 of the European Parliament and of the Council (4) requires in that case that a re-export declaration, a re-export notification or an exit summary declaration be used to declare such product before its departure. To ensure that the information necessary to determine whether the payment of anti-dumping and/or countervailing duty is due is available to the customs authorities or to fulfil the registration and reporting obligations under Article 14(5), (5a) and (6) of Regulation (EU) 2016/1036 and Article 24(5), (5a) and (6) of Regulation (EU) 2016/1037, the recipient should be required to lodge a receipt declaration at the competent customs authority of the Member State where the re-export declaration was accepted or where the re-export notification or the exit summary declaration was registered within 30 days of the receipt of the product concerned on an artificial island, a fixed or floating installation or any other structure in the continental shelf or in the exclusive economic zone. |

|

(3) |

If the product concerned is brought to an artificial island, a fixed or floating installation or any other structure in the continental shelf or in the exclusive economic zone of a Member State of the Union directly from outside the customs territory of the Union, it is not possible to make use of the instruments provided for in Regulation (EU) No 952/2013. To ensure that the information necessary to determine whether the payment of anti-dumping and/or countervailing duty is due is available to the customs authorities or to fulfil the registration and reporting obligations under Article 14(5), (5a) and (6) of Regulation (EU) 2016/1036 and Article 24(5), (5a) and (6) of Regulation (EU) 2016/1037, the product concerned should be declared by means of a receipt declaration lodged by the recipient within 30 days of the receipt of the product concerned on an artificial island, a fixed or floating installation or any other structure in the continental shelf or in the exclusive economic zone. As the Member State to which the continental shelf or exclusive economic zone belongs is best placed to carry out controls, the declaration should be lodged at the competent customs authority of that Member State. |

|

(4) |

In order to simplify the controls to be carried out by the customs authorities under this Regulation, the concept of the debtor should as a general rule be limited to the holders of licences permitting commercial operation in the continental shelf and exclusive economic zone of the Member States who receive the products concerned in an artificial island, a fixed or floating installation or any other structure in that continental shelf or that exclusive economic zone, regardless of the place from which the product concerned is brought. However, in specific situations, persons other than holders of licences may also be debtors. |

|

(5) |

With regard to cases where the product concerned is placed under the inward processing procedure prior to being delivered to an artificial island, a fixed or floating installation or any other structure in the continental shelf or in the exclusive economic zone of a Member State of the Union, special rule is necessary to avoid possible circumvention of anti-dumping and/or countervailing duty. |

|

(6) |

In order to allow for the effective operation of the framework set out in this Regulation, the relevant procedures already laid down in Regulation (EU) No 952/2013 as regards the calculation, notification, recovery, repayment, remission and extinguishment of the customs debt and the provision of a guarantee should apply insofar as they are relevant under this Regulation. |

|

(7) |

As the provisions on customs control contained in Regulation (EU) No 952/2013 do not apply outside the customs territory of the Union, it is necessary to establish specific rules as regards customs controls in this Regulation. |

|

(8) |

In order to give customs authorities sufficient time to prepare for the processing of receipt declarations, the application of the provisions of this Regulation should be deferred. |

|

(9) |

The measures provided for in this Regulation are in accordance with the opinion of the Committee referred to in Article 15(1) of Regulation (EU) 2016/1036 and Article 25(1) of Regulation (EU) 2016/1037, |

HAS ADOPTED THIS REGULATION:

Article 1

Subject matter

This Regulation lays down the conditions for the levying of anti-dumping and/or countervailing duty on products brought to an artificial island, a fixed or floating installation or any other structure in the continental shelf or the exclusive economic zone of a Member State, as well as procedures relating to the notification and declaration of such products and the payment of such duty, where those products are the subject of any of the following:

|

(a) |

a notice of initiation of an anti-dumping or anti-subsidy investigation; |

|

(b) |

a Commission Implementing Regulation making imports subject to registration; |

|

(c) |

a Commission Implementing Regulation imposing a provisional or definitive anti-dumping or countervailing duty. |

Article 2

Definitions

For the purposes of this Regulation, the following definitions shall apply:

|

(1) |

‘customs authorities’ means the customs administrations of the Member States responsible for applying this Regulation and the customs legislation as defined in Article 5(2) of Regulation (EU) No 952/2013; |

|

(2) |

‘continental shelf’ means the continental shelf as defined in the United Nations Convention on the Law of the Sea; |

|

(3) |

‘exclusive economic zone’ means the exclusive economic zone as defined in the United Nations Convention on the Law of the Sea and which has been declared as exclusive economic zone by a Member State pursuant to the United Nations Convention on the Law of the Sea; |

|

(4) |

‘product concerned’ means goods that are the subject of any of the following:

|

|

(5) |

‘receipt declaration’ means the act whereby the recipient indicates, in the prescribed form and manner, the receipt of the products concerned on an artificial island, a fixed or floating installation or any other structure in the continental shelf or in the exclusive economic zone of a Member State containing data elements which are needed for the collection of the payable amount of antidumping duty and/or countervailing duty or for reporting and/or registration in accordance with an act referred to in point(a) or (b) of Article 1; |

|

(6) |

‘debt’ means the obligation of a person to pay the amount of anti-dumping and/or countervailing duty which applies to the product concerned; |

|

(7) |

‘recipient’ means the person who is the holder of a licence or an authorisation to carry out business activities in the continental shelf or in the exclusive economic zone of a Member State and receives or has arranged for the receipt of the product concerned on an artificial island, a fixed or floating installation or any other structure in that continental shelf or in that exclusive economic zone; |

|

(8) |

‘debtor’ means any person liable for a debt. |

Article 3

Lodging of a receipt declaration

1. The receipt of a product concerned on an artificial island, a fixed or floating installation or any other structure in the continental shelf or in the exclusive economic zone of a Member State shall be declared by the recipient by means of a receipt declaration.

2. The receipt declaration shall be lodged without delay and at the latest within 30 days of receipt of the product concerned using electronic data-processing techniques at the following customs authorities:

|

(a) |

where the product concerned is brought from the customs territory of the Union, at the customs authority of the Member State where the re-export declaration is accepted or the re-export notification or the exit summary declaration is registered; |

|

(b) |

where the product concerned is not brought from the customs territory of the Union, at the customs authority of the Member State to which the continental shelf or exclusive economic zone belongs. |

3. The receipt declaration shall contain the data elements set out in Part I of the Annex and shall be accompanied by the documents supporting those data elements.

4. The customs authority may allow the receipt declaration to be lodged by means other than electronic data-processing techniques. In that case, the recipient shall lodge the paper form set out in Part II of the Annex in an original and one copy together with the documents supporting the data elements provided in the form. The original shall be kept by the customs authority. The copy shall be returned by the customs authority to the recipient after it has registered the receipt declaration and acknowledged its receipt.

5. Member States shall use the information in the receipt declaration to fulfil their registration obligations under Article 14(5) and (5a) of Regulation (EU) 2016/1036 and Article 24(5) and (5a) of Regulation (EU) 2016/1037 as well as their reporting obligations to the Commission under Article 14(6) of Council Regulation (EU) 2016/1036 and Article 24(6) of Council Regulation (EU) 2016/1037.

Article 4

Debt

1. The following shall give rise to a debt:

|

(a) |

lodging a re-export declaration, a re-export notification or an exit summary declaration for the product concerned, including a processed product resulting from the product concerned under the inward processing procedure as referred to in Regulation (EU) No 952/2013, to be brought to an artificial island, a fixed or floating installation or any other structure in the continental shelf or the exclusive economic zone of a Member State from the customs territory of the Union; |

|

(b) |

the receipt of the product concerned brought from outside the customs territory of the Union at an artificial island, a fixed or floating installation or any other structure in the continental shelf or the exclusive economic zone of a Member State. |

2. In the cases referred to in paragraph 1(a), the debt shall be incurred at the time of acceptance of the re-export declaration or of the registration of the re-export notification or exit summary declaration.

In the cases referred to in paragraph 1(b), the debt shall be incurred at the time of receipt of the products concerned.

3. The debtor shall be the recipient.

Where the re-export declaration, the re-export notification, the exit summary declaration referred to in paragraph 1(a) or the receipt declaration referred to in paragraph 4 is drawn up on the basis of information which leads to all or part of the anti-dumping and/or countervailing duty not being collected, the person who provided the information required to draw up the declaration or notification and who knew, or who ought reasonably to have known, that such information was false shall also be a debtor.

Where several persons are liable for payment of the amount of anti-dumping duty and/or countervailing duty corresponding to one debt, they shall be jointly and severally liable for payment of that amount.

4. The recipient shall, without delay and at the latest within 30 days of receipt of the product concerned, lodge a receipt declaration. Paragraphs 2, 3 and 4 of Article 3 shall apply.

5. For the purposes of the application of paragraph 1(a), the re-export declaration, re-export notification or exit summary declaration shall provide the information about the continental shelf or exclusive economic zone of the Member State to which the product concerned is to be brought by using the relevant additional reference code as defined in data element 2/3 in point 2 of Title II of Annex B of Commission Implementing Regulation (EU) 2015/2447 (5).

6. A debt shall be incurred at the place where the receipt declaration is lodged or, where it has not been lodged in accordance with Article 3(2) or Article 4(4), at the place it ought to have been lodged.

Article 5

Calculation of the amount of anti-dumping and/or countervailing duty

1. The amount of anti-dumping and/or countervailing duty payable shall be determined mutatis mutandis on the basis of those rules of Regulation (EU) No 952/2013 for the calculation of import duty payable which were applicable to the product concerned at the time at which the debt in respect of the product concerned was incurred.

2. Where a product concerned which has been placed under the inward processing procedure as referred to in Regulation (EU) No 952/2013, the calculation of the debt concerning the processed products resulting from the product concerned which are re-exported with destination continental shelf or exclusive economic zone of a Member State shall be determined on the basis of the tariff classification, customs value, quantity, nature and origin of the product concerned placed under the inward processing procedure at the time of acceptance of the customs declaration relating to the product concerned.

Article 6

Notification, recovery, payment, repayment, remission and extinguishment of debt and provision of a guarantee

For the purposes of notification, recovery, payment, repayment, remission and extinguishment of debt and the provision of a guarantee, the relevant provisions of Chapters 2, 3 and 4 of Title III of Regulation (EU) No 952/2013 shall apply mutatis mutandis.

Article 7

Controls by customs authorities

1. The customs authorities may examine the product concerned and/or take samples where it is still possible for them to do so, verify the accuracy and completeness of the information given in the re-export declaration, re-export notification, exit summary declaration or receipt declaration and verify the existence, authenticity, accuracy and validity of any supporting document.

2. The customs authorities may examine the accounts of the debtor and other records relating to the operations in respect of the product concerned or to prior or subsequent commercial operations involving those products.

3. Where evidence exists that a person did not comply with one of the obligations laid down in this Regulation, the customs authorities may examine the accounts of that person and other records relating to the operations in respect of the product concerned or to prior or subsequent commercial operations involving those products.

4. The controls and examinations referred to in paragraphs 1, 2 and 3 may be carried out at the premises of the holder of the goods or of the holder's representative, or of any other person directly or indirectly involved in those operations in a business capacity, or of any other person in possession of those documents and data for business purposes.

Article 8

Keeping of documents and other information and charges and costs

Article 51 of Regulation (EU) No 952/2013 shall apply mutatis mutandis with respect to the keeping of documents and other information.

Article 52 of Regulation (EU) No 952/2013 shall apply mutatis mutandis with respect to charges and costs.

Article 9

Entry into force and application

This Regulation shall enter into force on the twentieth day following that of its publication in the Official Journal of the European Union.

It shall apply from four months from the date of publication.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 2 July 2019.

For the Commission

The President

Jean-Claude JUNCKER

(1) OJ L 176, 30.6.2016, p. 21.

(2) OJ L 176, 30.6.2016, p. 55.

(3) OJ L 179, 23.6.1998, p. 3.

(4) Regulation (EU) No 952/2013 of the European Parliament and of the Council of 9 October 2013 laying down the Union Customs Code (OJ L 269, 10.10.2013, p. 1).

(5) Commission Implementing Regulation (EU) 2015/2447 of 24 November 2015 laying down detailed rules for implementing certain provisions of Regulation (EU) No 952/2013 of the European Parliament and of the Council laying down the Union Customs Code (OJ L 343, 29.12.2015, p. 558).

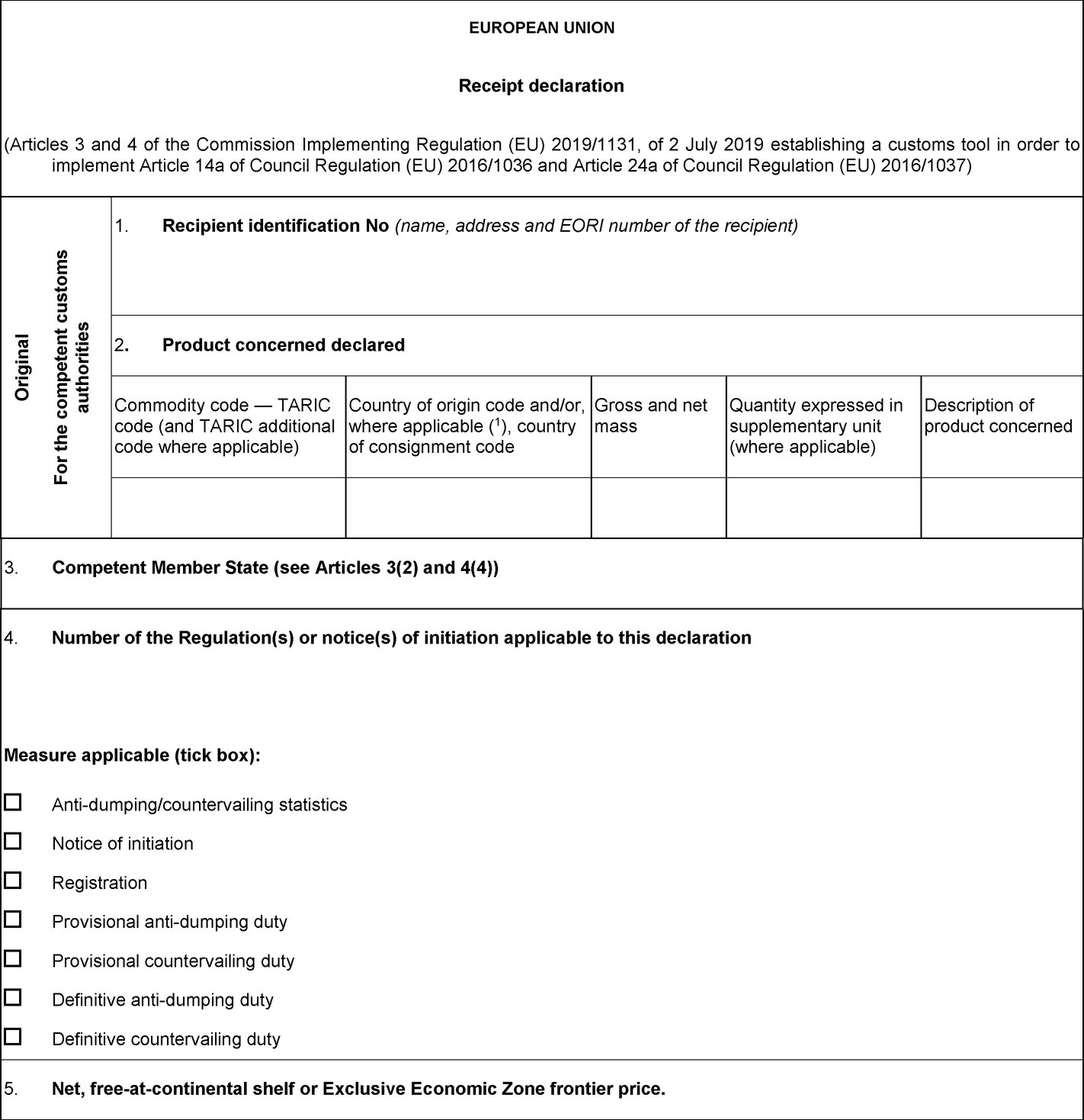

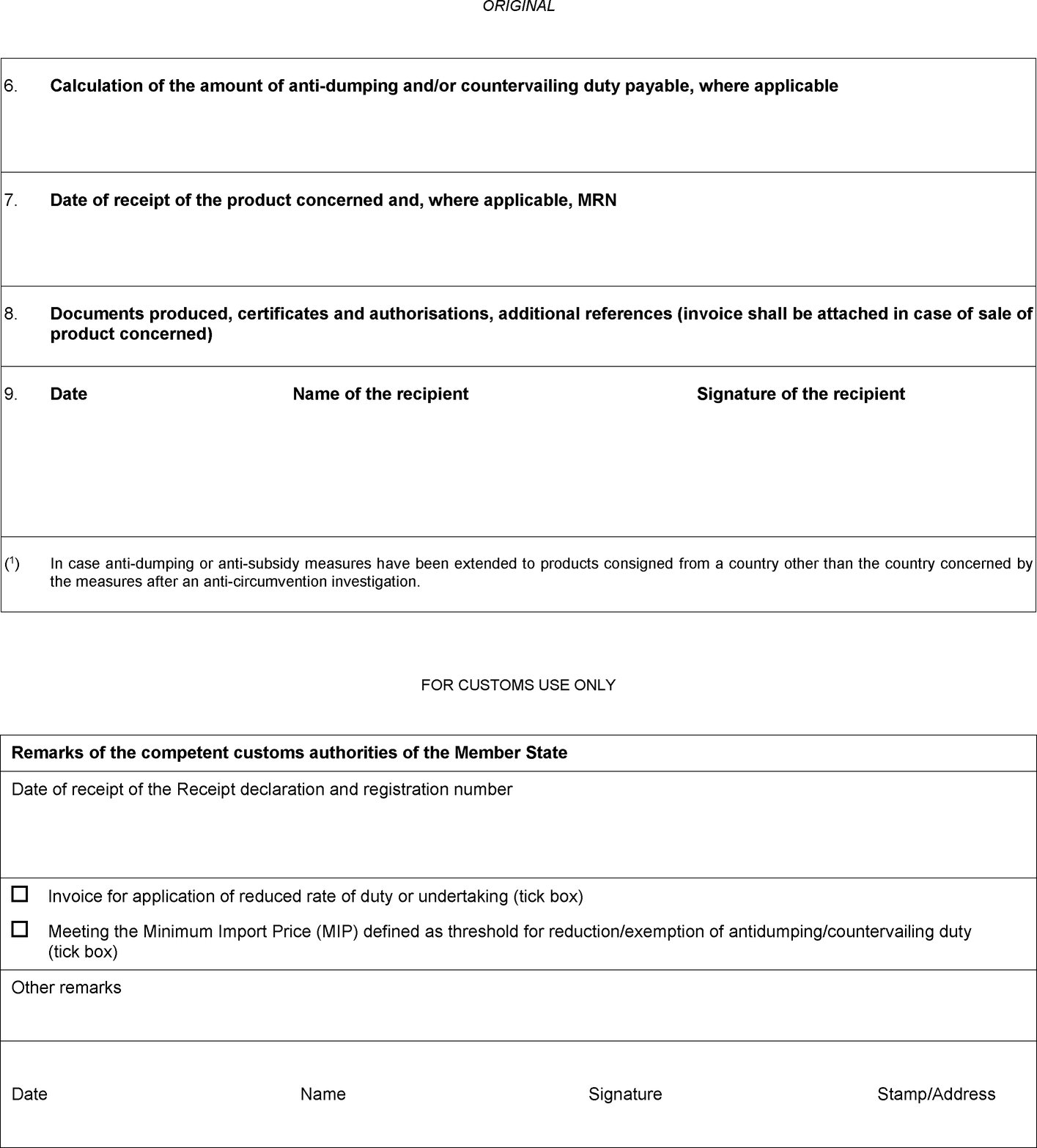

ANNEX

RECEIPT DECLARATION

PART I

Data elements

The recipient shall lodge electronically the receipt declaration which shall contain the following data elements:

|

(1) |

Name, address and EORI number of the recipient |

|

(2) |

Description of product concerned declared, commodity code — TARIC code and TARIC additional code (where applicable), gross and net mass, quantity expressed in supplementary unit (where applicable), country of origin code and/or, where applicable, country of consignment code (1) |

|

(3) |

Competent Member State (see Articles 3(2) and 4(4)) |

|

(4) |

Number of the Regulation(s) or Notice(s) of initiation applicable to this declaration Measure applicable:

|

|

(5) |

Net, free-at-continental shelf or Exclusive Economic Zone frontier price. |

|

(6) |

Calculation of the amount of provisional and/or definitive anti-dumping and/or countervailing duty, where applicable |

|

(7) |

Date of receipt of the product concerned and, where applicable, MRN |

|

(8) |

Documents produced, certificates and authorisations, additional references (invoice shall be attached in case of sale of product concerned) |

|

(9) |

Date, name and signature of the recipient |

The customs authorities may allow that these data elements may be provided without using electronic data-processing techniques. In this case, the recipient shall use the following paper form ‘Receipt declaration’.

PART II

Form

Text of image

Text of image

Text of image

Text of image

Note:

The text on the copy of the receipt declaration shall be:

‘Copy

For the recipient’.

(1) In case anti-dumping or anti-subsidy measures have been extended to products consigned from a country other than the country concerned by the measures after an anti-circumvention investigation.

|

3.7.2019 |

EN |

Official Journal of the European Union |

L 179/20 |

COMMISSION IMPLEMENTING REGULATION (EU) 2019/1132

of 2 July 2019

providing temporary exceptional adjustment aid to farmers in the beef and veal sector in Ireland

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Regulation (EU) No 1308/2013 of the European Parliament and of the Council 17 December 2013 establishing a common organisation of the markets in agricultural products and repealing Council Regulations (EEC) No 922/72, (EEC) No 234/79, (EC) No 1037/2001 and (EC) No 1234/2007 (1), and in particular Article 221(1) thereof,

Whereas:

|

(1) |

The beef and veal sector has traditionally been the most fragile agri-food sector due to a number of factors, in particular restricted market access to third-country markets and falling domestic consumption. Additional new challenges emerge from concerns over the sector's contribution to greenhouse gas emissions |

|

(2) |

The structure of the beef and veal industry makes it vulnerable, mainly due to its long life-cycle and high costs linked to extensive production. These factors have been aggravated by the prospect of the United Kingdom leaving the Union and uncertainties linked to the future United Kingdom's customs tariff once it withdraws from the Union. The United Kingdom is a premium market for beef and veal that is critical for the sustainability of the entire Union beef and veal sector. In parallel, the sector is confronted with demands of trade partners for increased market access to the Union. |

|

(3) |

Those problems are more acute in the case of the Irish beef and veal sector. The latter is concentrated in small-scale holdings in the poorer regions of the country where alternative types of production are limited. After years of stagnating beef prices in Ireland, gross margins have fallen in the past year by 11 to 19 %, with suckler cow farms suffering the biggest losses. |

|

(4) |

Ireland's beef and veal sector is both large and hugely dependent on exports. Five of every 6 tonnes of beef produced is exported and almost 50 % of these exports are to the United Kingdom. Uncertainty around the withdrawal of the United Kingdom is putting downward pressure on prices, deteriorating further the situation of beef producers in Ireland. This actually happened in the months preceding earlier announced dates for the withdrawal of the United Kingdom. |

|

(5) |

Market adjustment is particularly slow in Ireland's extensive beef production system where animals are typically slaughtered at a later age, between 18 and 30 months of age. This particular production system is suited to the requirements of the United Kingdom's beef market. Efforts to open new markets continue to be hampered by third-country restrictions related to outdated animal health requirements in particular. |

|

(6) |

In the light of the abovementioned specific problems faced by Irish producers, it is in the interest of the market stability of the Union beef and veal sector to adopt measures that reinforce the resilience of Irish beef. In conjunction with the need to avoid that downward price pressure on Irish beef spills over to other Member States, those problems constitute specific problems within the meaning of Article 221 of Regulation (EU) No 1308/2013. Those specific problems cannot be addressed by measures taken pursuant to Article 219 or 220 of that Regulation. On the one hand, they are not specifically linked to a significant market disturbance or threat thereof. On the other hand, the measures provided for in this Regulation are not taken in a context of combatting the spread of a disease. |

|

(7) |

In addition, available instruments under the common agricultural policy such as public intervention and private storage aid are not adequate measures to address the needs of the Irish beef and veal sector. It is therefore appropriate to provide Ireland with a financial grant to support farmers in that sector engaging in actions enhancing their resilience and sustainability, including the adjustment of production to markets with requirements other than the United Kingdom. |

|

(8) |

The Union aid made available to Ireland should take into account the main features of its beef and veal sector, including its share of specialised beef farmers and its vulnerability to disruption of exports. |

|

(9) |

Ireland should design measures aimed at production reduction and restructuring of its beef and veal sector to protect its long-term viability, based on one or more of the following activities: fostering environmental and economic sustainability, developing new markets and enhancing beef and veal quality. |

|

(10) |

Ireland should distribute the aid through measures on the basis of objective and non-discriminatory criteria, while ensuring that farmers in the beef and veal sector are the ultimate beneficiaries of the aid, and avoiding any market and competition distortion. |

|

(11) |

As the amount allocated to Ireland would compensate only a part of the actual cost for farmers in the beef and veal sector, Ireland should be allowed to grant additional support to those farmers, under the same conditions of objectiveness, non-discrimination and non-distortion of competition. |

|

(12) |

In order to give Ireland the flexibility to distribute the aid as circumstances require, Ireland should be allowed to cumulate it with other support financed by the European Agricultural Guarantee Fund and the European Agricultural Fund for Rural Development. |

|

(13) |

In accordance with Article 221 of Regulation (EU) No 1308/2013, this Regulation should be limited to a period of maximum 12 months starting from its date of entry into force. Payments made by Ireland to the beneficiaries after that period should not be eligible for Union financing. |

|

(14) |

In order to ensure transparency, monitoring and proper administration of the amounts available, Ireland should provide the Commission with certain information, including, in particular, information on the concrete measures to be taken, the criteria used to distribute the aid and the measures taken to avoid distortion of competition in the market concerned. |

|

(15) |

In order to ensure that farmers receive aid as soon as possible, Ireland should be enabled to implement this Regulation without delay. Therefore, this Regulation should apply from the day following that of its publication. |

|

(16) |

The measures provided for in this Regulation are in accordance with the opinion of the Committee for the Common Organisation of the Agricultural Markets, |

HAS ADOPTED THIS REGULATION:

Article 1

1. Union aid of a total amount of EUR 50 000 000 shall be available to Ireland to provide exceptional adjustment aid to farmers in the beef and veal sector subject to the conditions set out in paragraphs 2 to 5.

2. Ireland shall use the amount available for measures referred to in paragraph 3. The measures shall be taken on the basis of objective and non-discriminatory criteria, provided that the resulting payments do not cause distortion of competition.

3. The measures taken by Ireland shall be aimed at reducing production or restructuring the beef and veal sector and one or more of the following objectives:

|

(a) |

implementation of quality schemes in the beef and veal sector or projects aiming at promoting quality and value added; |

|

(b) |

boosting market diversification; |

|

(c) |

protecting and improving the farmers' environmental, climate and economic sustainability. |

4. Ireland shall ensure that, if farmers in the beef and veal sector are not the direct beneficiaries of the payments of the Union aid, the economic benefit of the Union aid is passed on to them in full.

5. Ireland's expenditure in relation to the payments for the measures referred to in paragraph 3 shall only be eligible for Union aid if those payments have been made by 31 May 2020 at the latest.

6. Measures under this Regulation may be cumulated with other support financed by the European Agricultural Guarantee Fund and the European Agricultural Fund for Rural Development.

Article 2

Ireland may grant additional national support for the measures taken under Article 1 up to a maximum of 100 % of the amount set out in Article 1, on the basis of objective and non-discriminatory criteria, provided that the resulting payments do not cause distortion of competition.

Ireland shall pay the additional support by 31 May 2020 at the latest.

Article 3

Ireland shall notify the Commission of the following:

|

(a) |

without delay and no later than 31 July 2019:

|

|

(b) |

no later than 31 July 2020, the total amounts paid per measure (when applicable, broken down by Union aid and additional support), and the number and type of beneficiaries and the assessment of the effectiveness of the measure. |

Article 4

This Regulation shall enter into force on the day following that of its publication in the Official Journal of the European Union.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 2 July 2019.

For the Commission

The President

Jean-Claude JUNCKER

DECISIONS

|

3.7.2019 |

EN |

Official Journal of the European Union |

L 179/23 |

COUNCIL DECISION (EU) 2019/1133

of 25 June 2019

on the position to be taken on behalf of the European Union in the International Partnership for Energy Efficiency Cooperation (IPEEC) with regard to the extension of the Terms of Reference for the IPEEC for the period from 24 May until 31 December 2019

THE COUNCIL OF THE EUROPEAN UNION,

Having regard to the Treaty on the Functioning of the European Union, and in particular Article 194(2), in conjunction with Article 218(9) thereof,

Having regard to the proposal from the European Commission,

Whereas:

|

(1) |

The Terms of Reference for the International Partnership for Energy Efficiency Cooperation (IPEEC) (‘the Agreement’) were signed in Rome by 12 States including four Member States of the European Community on 24 May 2009 and were concluded by the European Community by Council Decision 2009/954/EC (1). |

|

(2) |

Pursuant to point 7.1 of the Agreement, the Members of the IPEEC may decide to extend the duration of the Agreement. The Policy Committee, being IPEEC's plenary body composed of high-level representatives of all its Members, and being entrusted to govern the overall framework and policies of the IPEEC, is the appropriate body within which the IPEEC Members can decide on an extension of the duration of the Agreement. |

|

(3) |

The IPEEC Members, except for the Union, approved the extension of the Terms of Reference for the IPEEC for the period from 24 May until 31 December 2019 at the Policy Committee meeting on 21 February 2019. |

|

(4) |

It is appropriate to establish the position on the extension of the Terms of Reference for the IPEEC to be taken on the Union's behalf, as the extension of the terms of reference would be binding on the Union. |

|

(5) |

The IPEEC Members are considering the possibility of combining the current activities of IPEEC and the energy efficiency activities of the International Energy Agency (IEA) into an energy efficiency hub in order to achieve synergies in that area. The short-term extension of the Terms of Reference for the IPEEC aims to allow for the necessary time, as an interim measure, to set up the energy efficiency hub while ensuring that IPEEC's activities continue and are transferred to the new energy efficiency hub without interruption. |

|

(6) |

Operationally, an extension until 31 December 2019 takes into account the continued implementation of IPEEC's work programme and of core services to the IPEEC Members. This includes energy efficiency work under the G20, which this year will include events scheduled after the end of IPEEC's current mandate on 24 May 2019. The availability of funds to cover activities during the extension period is also considered, as the IPEEC Secretariat is currently receiving contributions for the full 2019 calendar year and activities, remaining staff and possible resources could be transferred to the new energy efficiency hub. |

|

(7) |

A short-term extension of the Terms of Reference for the IPEEC is therefore important to avoid an abrupt termination of IPEEC's activities on 24 May 2019. In accordance with point 3.4 of the Terms of Reference for the IPEEC, the final decision on the extension is to be adopted by consensus of the IPEEC Members, and following the Policy Committee meeting of 21 February 2019, a Council decision on the Union's position is necessary, |

HAS ADOPTED THIS DECISION:

Article 1

The position to be taken on the Union's behalf in the International Partnership for Energy Efficiency Cooperation (IPEEC) with regard to the extension of the Terms of Reference for the IPEEC for the period from 24 May until 31 December 2019 shall be the following:

|

(a) |

to approve the extension of the Terms of Reference of the IPEEC for the period from 24 May until 31 December 2019; |

|

(b) |

to agree with the International Energy Agency (IEA) Governing Board decision to continue hosting the IPEEC Secretariat at the IEA until 31 December 2019 on the basis of the Memorandum concerning the Hosting by the IEA of the Secretariat to the IPEEC; |

|

(c) |

to endorse the administrative transfer of the IPEEC to a new energy efficiency hub, in particular in relation to the transfer of Task Groups, funds and the IPEEC Secretariat staff. |

Article 2

This Decision shall enter into force on the date of its adoption.

Done at Luxembourg, 25 June 2019.

For the Council

The President

A. ANTON

(1) Council Decision 2009/954/EC of 30 November 2009 on the signing and conclusion of the ‘Terms of Reference for the International Partnership for Energy Efficiency Cooperation’ (IPEEC) and the ‘Memorandum concerning the hosting by the International Energy Agency of the Secretariat to the International Partnership for Energy Efficiency Cooperation’ by the European Community (OJ L 330, 16.12.2009, p. 37).

|

3.7.2019 |

EN |

Official Journal of the European Union |

L 179/25 |

COMMISSION DECISION (EU) 2019/1134

of 1 July 2019

amending Decision 2009/300/EC and Decision (EU) 2015/2099, as regards the period of validity of the ecological criteria for the award of the EU Ecolabel to certain products, and of the related assessment and verification requirements

(notified under document C(2019) 4626)

(Text with EEA relevance)

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Regulation (EC) No 66/2010 of the European Parliament and of the Council of 25 November 2009 on the EU Ecolabel (1), and in particular Article 8(2) thereof,

After consulting the European Union Ecolabelling Board,

Whereas:

|

(1) |

The validity of the ecological criteria for the award of the EU Ecolabel for televisions, and of the related assessment and verification requirements, set out in Commission Decision 2009/300/EC (2) expires on 31 December 2019. |

|

(2) |

The validity of the ecological criteria for the award of the EU Ecolabel for growing media, soil improvers and mulch, and of the related assessment and verification requirements, set out in Commission Decision (EU) 2015/2099 (3) expires on 18 November 2019. |

|

(3) |

The EU Ecolabel criteria for televisions laid down in Decision 2009/300/EC refer, as regards energy savings, to the energy labelling and eco-design requirements for televisions laid down in Commission Regulation (EC) No 642/2009 (4) and in Commission Delegated Regulation (EU) No 1062/2010 (5) both of which are currently under review in the light of technological progress. |

|

(4) |

In line with the conclusions of the EU Ecolabel Fitness check (REFIT) of 30 June 2017 (6), the Commission, together with the EU Ecolabelling Board, has been assessing the relevance of each product group before proposing its prolongation, suggesting solutions to improve synergies across product groups and to increase the uptake of EU Ecolabel, and ensuring that, during the revision process, appropriate attention is paid to the coherence between relevant EU policies, legislation and scientific evidence. Additional public stakeholders consultations have also been carried out. |

|

(5) |

For Decision (EU) 2015/2099, this assessment confirmed the relevance and appropriateness of the current ecological criteria and of the related assessment and verification requirements. |

|

(6) |

For Decision 2009/300/EC, this assessment should further reflect on the relevance and appropriateness of the criteria, pending adoption of the proposed new energy labelling and eco-design requirements for televisions, including the proposals for additional requirements in support of the Waste Electrical and Electronic Equipment Directive and broader circular economy objectives. |

|

(7) |

In those circumstances, in order to allow sufficient time for finalizing the assessment and potential revision or discontinuation of the current ecological criteria for televisions, the period of validity of the existing criteria for televisions and related assessment and verification requirements, should be prolonged until 31 December 2020. |

|

(8) |

To give stability to the market, increase the uptake of the EU Ecolabel and allow current licence holders to maintain the benefits of the EU Ecolabel on their awarded products, the period of validity of the current criteria for growing media, soil improvers and mulch and of the related assessment and verification requirements, should be prolonged until 30 June 2022. |

|

(9) |

It is therefore appropriate to prolong the period of validity of the ecological criteria for the product groups ‘televisions’ and ‘growing media, soil improvers and mulch’ and of the related assessment and verification requirements. |

|

(10) |

Decision 2009/300/EC and Decision (EU) 2015/2099 should be amended accordingly. |

|

(11) |

The measures provided for in this Decision are in accordance with the opinion of the Committee set up by Article 16 of Regulation (EC) No 66/2010, |

HAS ADOPTED THIS DECISION:

Article 1

Article 3 of Decision 2009/300/EC is replaced by the following:

‘Article 3

The ecological criteria for the product group “televisions” and the related assessment and verification requirements shall be valid until 31 December 2020.’.

Article 2

Article 4 of Decision (EU) 2015/2099 is replaced by the following:

‘Article 4

The ecological criteria for the product group “growing media, soil improvers and mulch”, and the related assessment and verification requirements, shall be valid until 30 June 2022.’.

Article 3

This Decision is addressed to the Member States.

Done at Brussels, 1 July 2019.

For the Commission

Karmenu VELLA

Member of the Commission

(2) Commission Decision 2009/300/EC of 12 March 2009 establishing the revised ecological criteria for the award of the Community Eco-label to televisions (OJ L 82, 28.3.2009, p. 3)

(3) Commission Decision (EU) 2015/2099 of 18 November 2015 establishing the ecological criteria for the award of the EU Ecolabel for growing media, soil improvers and mulch (OJ L 303, 20.11.2015, p. 75).

(4) Commission Regulation (EC) No 642/2009 of 22 July 2009 implementing Directive 2005/32/EC of the European Parliament and of the Council with regard to ecodesign requirements for televisions (OJ L 191, 23.7.2009, p. 42).

(5) Commission Delegated Regulation (EU) No 1062/2010 of 28 September 2010 supplementing Directive 2010/30/EU of the European Parliament and of the Council with regard to energy labelling of televisions (OJ L 314, 30.11.2010, p. 64).

(6) Report from the Commission to the European Parliament and the Council on the review of implementation of Regulation (EC) No 1221/2009 of the European Parliament and of the Council on 25 November 2009 on the voluntary participation by organisations in a Community eco-management and audit scheme (EMAS) and the Regulation (EC) No 66/2010 of the parliament and of the Council of 25 November 2009 on the EU Ecolabel