ISSN 1977-0677

Official Journal

of the European Union

L 153

English edition

Legislation

Volume 61

15 June 2018

|

ISSN 1977-0677 |

||

|

Official Journal of the European Union |

L 153 |

|

|

||

|

English edition |

Legislation |

Volume 61 |

|

Contents |

|

II Non-legislative acts |

page |

|

|

|

DECISIONS |

|

|

|

* |

Commission Decision (EU) 2018/859 of 4 October 2017 on State aid SA.38944 (2014/C) (ex 2014/NN) implemented by Luxembourg to Amazon (notified under document C(2017) 6740) ( 1) |

|

|

|

* |

Commission Decision (EU) 2018/860 of 7 February 2018 on the Aid Scheme SA.45852 — 2017/C (ex 2017/N) which Germany is planning to implement for Capacity Reserve (notified under document C(2018) 612) ( 1) |

|

|

|

|

GUIDELINES |

|

|

|

* |

||

|

|

|

ACTS ADOPTED BY BODIES CREATED BY INTERNATIONAL AGREEMENTS |

|

|

|

* |

|

|

|

|

|

(1) Text with EEA relevance. |

|

EN |

Acts whose titles are printed in light type are those relating to day-to-day management of agricultural matters, and are generally valid for a limited period. The titles of all other Acts are printed in bold type and preceded by an asterisk. |

II Non-legislative acts

DECISIONS

|

15.6.2018 |

EN |

Official Journal of the European Union |

L 153/1 |

COMMISSION DECISION (EU) 2018/859

of 4 October 2017

on State aid SA.38944 (2014/C) (ex 2014/NN) implemented by Luxembourg to Amazon

(notified under document C(2017) 6740)

(Only the French text is authentic)

(Text with EEA relevance)

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union, and in particular the first subparagraph of Article 108(2) thereof,

Having regard to the Agreement on the European Economic Area, and in particular Article 62(1)(a) thereof,

Having called on interested parties to submit their comments pursuant to the provisions cited above (1) and having regard to their comments,

Whereas:

1. PROCEDURE

|

(1) |

By letter of 24 June 2014, the Commission sent a request for information to Luxembourg regarding its tax ruling practice in relation to Amazon. In that letter, the Commission requested Luxembourg to confirm that Amazon is liable to taxation in Luxembourg and to specify the extent of the activities of the Amazon group benefiting from a tax reduction under the taxation regime for intellectual property. In addition, the Commission requested all tax rulings addressed to the Amazon group that were still in force. By email of 18 July 2014, Luxembourg requested an extension of the deadline to respond to the Commission's letter of 24 June 2014, which it was granted (2). |

|

(2) |

On 4 August 2014, Luxembourg transmitted its reply to the Commission's request of 24 June 2014, to which it annexed, inter alia, a letter dated 6 November 2003 addressed to Amazon.com, Inc. (‘the contested tax ruling’) from the Administration des contributions directes (‘the Luxembourg tax administration’), a letter dated 23 October 2003 from Amazon.com, Inc. and a letter dated 31 October 2003 prepared by [Advisor 1] (*1) on behalf of Amazon.com, Inc. to the Luxembourg tax administration in which a request for a ruling was made (collectively referred to as ‘the ruling request’), and the annual financial reports of Amazon EU Société à responsabilité limitée (‘LuxOpCo’) (3), Amazon Europe Holding Technologies SCS (‘LuxSCS’) (4), Amazon Services Europe Société à responsabilité limitée (‘ASE’), Amazon Media EU Société à responsabilité limitée (‘AMEU’) and other Amazon Luxembourg group entities. |

|

(3) |

On 7 October 2014, the Commission adopted a decision to open the formal investigation procedure in accordance with Article 108(2) of the Treaty in respect of the contested tax ruling on the ground that it harboured serious doubts as to the compatibility of that measure with the internal market (‘the Opening Decision’) (5). In that decision, Luxembourg was requested to provide additional information on the contested tax ruling (6). By letters of 3 and 5 November 2014, Luxembourg requested an extension of the deadline to reply to the Opening Decision. |

|

(4) |

By letter of 21 November 2014, Luxembourg submitted its comments to the Opening Decision. That submission included, inter alia, a transfer pricing report prepared by [Advisor 2] on behalf of Amazon (‘the TP Report’), which had not been previously submitted to the Commission. |

|

(5) |

On 6 February 2015, the Opening Decision was published in the Official Journal of the European Union (7). Interested parties were invited to submit their comments on that decision. |

|

(6) |

By letter of 13 February 2015, the Commission sent an additional request for information to Luxembourg. In that letter, the Commission also asked Luxembourg to agree that it could contact Amazon directly to obtain the requested information if that information was not in Luxembourg's possession. On 24 February 2015, Luxembourg requested an extension of deadline to reply to the Commission's request for information. |

|

(7) |

By letter of 5 March 2015, Amazon submitted its observations on the Opening Decision. Comments on the Opening Decision were also submitted by the following third parties: Oxfam on 14 January 2015, the Bundesarbeitskammer on 4 February 2015, Fedil on 27 February 2015, the Booksellers Association (‘BA’) on 3 March 2015, le Syndicat de la librairie française (‘SLF’) on 4 March 2015, the European and International Booksellers Federation (‘EIBF’) on 4 March 2015, ATOZ S.A. on 5 March 2015, the Computer and Communications Industry Association (‘CCIA’) on 5 March 2015 and the European Policy Information Center (‘EPICENTER’) on 5 March 2015. In addition, the Federation of European Publishers (‘FEP’) on 5 March 2015 and le Syndicat des Distributeurs de Loisirs Culturels (‘SDLC’) on 5 March 2015 expressed their support of the EIBF's position. |

|

(8) |

On 12 March 2015, a telephone conference took place between the Commission and Luxembourg in which the latter assured the former that it would be able to provide a complete reply to the Commission's request for information of 13 February 2015 by 17 March 2015. |

|

(9) |

By letter of 17 March 2015, Luxembourg partially replied to the Commission's request for information of 13 February 2015. It further explained that outstanding information, in particular that concerning certain contractual relationships between Amazon entities in Luxembourg and third parties, was not in its possession. |

|

(10) |

On 19 March 2015, the Commission transmitted the comments of third parties on the Opening Decision to Luxembourg. |

|

(11) |

By email of 19 March 2015, Amazon submitted the amended and restated cost sharing agreement (‘CSA’) as entered into between LuxSCS and two Amazon group entities in the United States on 1 January 2005, as again amended and restated on 2 July 2009 (effective from 5 January 2009) and amended with effect of 1 January 2014 (8). |

|

(12) |

By email exchanges of 18, 19 and 20 March 2015, the Commission indicated to Luxembourg that its reply of 17 March 2015 to the Commission's request for information of 13 February 2015 was incomplete and it posed further questions for clarification. |

|

(13) |

On 20 March 2015, Luxembourg agreed that the Commission could address its questions directly to Amazon. On 26 March 2015, the Commission informed Luxembourg that, in accordance with Article 6(a) of Council Regulation (EC) No 659/1999 of 22 March 1999 (9), it had identified the formal investigation procedure on the contested tax ruling as ineffective to date. On that basis, and with the authorisation of Luxembourg (10), the Commission, in accordance with Article 6(a)(6) of Regulation (EC) No 659/1999, sent a request to Amazon on 26 March 2015 (the ‘MIT request’) to provide it with all agreements concluded by Amazon since 2000 pursuant to which Amazon's intellectual property (‘IP’) rights were licensed or otherwise made available (‘the IP agreements’), as well as any cost sharing and/or buy-in agreements concluded between LuxSCS and other Amazon group entities. Amazon was also requested to provide information on the activities of LuxSCS, the financial accounts of Amazon subsidiaries based outside Luxembourg, and to explain or reconcile certain financial data. Finally, information on the recent changes in the legal structure of the Amazon group in Luxembourg was requested. |

|

(14) |

By letter of 20 April 2015, Luxembourg requested the Commission to explain the purpose of a meeting the latter had held with Oxfam and Eurodad, of which Luxembourg had not been informed. It also submitted a request not to publish the decision to send the MIT request. |

|

(15) |

On 4 May 2015, Amazon partially replied to the Commission's request for information of 26 March 2015. Amazon also confirmed that its structure in Luxembourg had changed in 2014 and that a new ruling was granted by Luxembourg on that basis, but explained that the change was irrelevant for the purposes of the Commission's investigation. |

|

(16) |

On 8 May 2015, a meeting was held between the Commission, Luxembourg and Amazon. By letter of 12 June 2015, Amazon submitted further comments following that meeting. Amazon also submitted a list of IP agreements, referred to by Amazon as the ‘M.com Agreements’, pursuant to which Amazon made IP related to its platform technology available to unrelated third parties. |

|

(17) |

By letter of 13 May 2015, Luxembourg submitted its observations on the third party comments on the Opening Decision. |

|

(18) |

By letter of 3 July 2015, the Commission reminded Amazon to provide certain outstanding information, in particular on the IP agreements, and asked for additional information. |

|

(19) |

By letter of 10 July 2015 (again submitted on 23 July 2015), Luxembourg submitted a statement concerning the non-retroactive application of a final negative decision of the Commission. |

|

(20) |

By letters of 24 and 31 July 2015, Amazon provided a partial reply to the Commission's request of 3 July 2015, including information on the M.com Agreements. On the basis of those replies, Amazon considered the information request concerning the IP agreements to have been fully replied to, since according to Amazon no other IP agreements concluded by Amazon were comparable to the Intellectual Property License Agreement concluded between LuxSCS and LuxOpCo as of 30 April 2006 (the ‘License Agreement’) (11). Amazon also requested an extension of the deadline to submit the other information requested by the Commission. |

|

(21) |

By letter of 31 July 2015, the Commission reminded Amazon to provide all requested information, in particular complete information on all IP agreements concluded by Amazon since 2000. It also requested Amazon to provide the new ruling granted to it by Luxembourg in 2014, to which a reference was made in Luxembourg's letter of 4 August 2014 and Amazon's letter of 4 May 2015. |

|

(22) |

By letter of 21 August 2015, Amazon replied to the Commission's request, except for the submission of information on the remaining IP agreements. |

|

(23) |

On 8 September 2015, a meeting took place between the Commission and Amazon of which Luxembourg was informed. Following that meeting, the Commission reminded Amazon by email of 8 September 2015 about the outstanding request for information concerning the IP agreements. |

|

(24) |

By email of 14 September 2015, Amazon explained that no other agreements exist pursuant to which the same intellectual property as that covered the License Agreement was or will be made available to related or unrelated parties. At the same time, Amazon informed the Commission that it was preparing a list of intra-group IP agreements, regardless of whether they relate to the EU or intellectual property covered by the License Agreement between LuxSCS and LuxOpCo. That list was submitted to the Commission on 17 September 2015. |

|

(25) |

By email of 23 September 2015, Amazon submitted a list of agreements by means of which intellectual property was licensed in from or licensed out to third parties. |

|

(26) |

By email of 29 September 2015, the Commission reminded Amazon to submit the IP agreements as requested by the Commission on 26 March and 3 July 2015 on the basis of the lists provided by Amazon on 17 and 23 September 2015. In addition, the Commission requested further information from Amazon concerning the cost sharing reports and LuxOpCo's customers per website. |

|

(27) |

By e-mails of 30 September and 1, 2, 12, 13, 20 and 27 October 2015, Amazon submitted information. |

|

(28) |

On 28 October 2015, a meeting took place between the Commission, Luxembourg and Amazon. |

|

(29) |

By email of 20 November 2015, the Commission reminded Amazon about the scope of its request for information of 26 March 2015 regarding Amazon's internal and external IP agreements and requested Amazon to submit additional information. |

|

(30) |

During a meeting on 27 November 2015, a company which requested its name not to be revealed (‘Company X’) provided the Commission with market information in relation to the Commission's investigation. In a conference call on 15 January 2016, Company X provided additional information on the e-commerce business in Europe. By email of 25 January 2016 regarding the minutes of the conference call, Company X provided additional information. |

|

(31) |

On 30 November 2016, Amazon submitted additional information. |

|

(32) |

By email of 1 December 2015, Amazon requested an extension to reply to the Commission's request for information dated 20 November 2015. |

|

(33) |

On 4 December 2015, Amazon submitted the information requested by the Commission in its email of 20 November 2015 and asked for an extension of deadline for the remaining responses. |

|

(34) |

By letters of 10 and 28 December 2015, Luxembourg submitted its observations following the meeting of 28 October 2015. |

|

(35) |

By email of 11 December 2015, the Commission reminded Amazon about the outstanding replies from its information request of 20 November 2015 and sent a further request for information with additional questions to Amazon. |

|

(36) |

On 18 December 2015, Amazon provided further responses to the Commission's request for information of 20 November 2015. |

|

(37) |

By email of 18 December 2015, the Commission invited Luxembourg to submit its observations and comments on the information submitted by Amazon to the Commission by that point of the investigation. |

|

(38) |

On 12 and 15 January 2016, Amazon submitted partial responses to the Commission's information request of 11 December 2015 and asked for an extension of deadline for the outstanding information. |

|

(39) |

On 18 January 2016, Amazon submitted further information. |

|

(40) |

By email of 19 January 2016, the Commission informed Amazon that certain replies to questions of previous requests for information were still outstanding. In addition, the Commission requested clarification and further information. |

|

(41) |

On 22 January 2016, Amazon partially replied to the Commission's request for information of 19 December 2015. On 28 January 2016, Amazon submitted a partial reply to the Commission's request for information of 11 December 2015. By letters of 5, 15, 19 and 24 February 2016, Amazon submitted partial replies to the Commission's request for information of 19 January 2016. |

|

(42) |

On 26 February 2016, the Commission sent a reminder to Amazon requesting it to reply to outstanding questions concerning the requests for information of 20 November 2015, 11 and 18 December 2015 and 19 January 2016. |

|

(43) |

On 4 and 21 March 2016, Amazon submitted partial replies to the Commission's request for information of 11 December 2015. |

|

(44) |

By email of 11 March 2016, Amazon submitted a partial reply to the Commission's request for information of 26 February 2016. |

|

(45) |

By email of 22 March 2016, Amazon submitted a partial reply to the Commission's requests for information of 19 January 2016 and 26 February 2016. |

|

(46) |

By email of 8 March 2016, Amazon agreed to waive confidentiality claims previously made vis-à-vis Luxembourg in a letter of 22 January 2016 for certain information submitted and committed to share this information with Luxembourg. |

|

(47) |

On 14 March 2016, Amazon confirmed to have shared its latest submission to the Commission with Luxembourg. |

|

(48) |

On 1 April 2016, the Commission requested Company X to agree that certain market information provided by it would be shared with Luxembourg. On 5 April 2016, Company X provided its agreement. |

|

(49) |

On 8 April 2016, the Commission inquired with Amazon about the information that Amazon had shared with Luxembourg by that point of the investigation. The Commission also informed Amazon that certain information of the Commission's request for information of 11 February 2015 was still outstanding. In addition, the Commission addressed a request for further clarification and information to Amazon. |

|

(50) |

By email of 11 April 2016, Amazon confirmed what information it had shared with Luxembourg. |

|

(51) |

By letter of 18 April 2016, the Commission inquired with Luxembourg what information had been shared with it by Amazon and invited Luxembourg to submit its comments on those submissions. The Commission further recalled its email of 18 December 2015, by which it had invited Luxembourg to comment on Amazon's submissions. Finally, the Commission shared the market information as agreed with Company X with Luxembourg and asked Luxembourg for its comments. |

|

(52) |

On 22 April 2016, Amazon submitted a partial reply to the Commission's request for information of 8 April 2016 and requested an extension of the deadline for the remaining replies. |

|

(53) |

By letter of 2 May 2016 (again submitted on 10 May 2016), Luxembourg confirmed receipt of the information submitted by Amazon by that point of the investigation and submitted its observations on Amazon's submissions. As regards the market information of Company X, Luxembourg informed the Commission that it had shared that information with Amazon, since Amazon would be in a better position to comment. |

|

(54) |

By email of 2 May 2016, Amazon submitted a partial reply and acknowledged the outstanding replies to questions raised in the Commission's request for information dated 8 April 2016, as mentioned in the letter of 22 April 2016. |

|

(55) |

By email of 17 May 2016, the Commission clarified the scope of the information it previously requested from Amazon and recalled that certain information was still outstanding from its requests for information of 11 December 2015 and 8 April 2016. |

|

(56) |

By email of 24 May 2016, Amazon submitted its reply to the Commission's email of 17 May 2016. |

|

(57) |

On 26 May 2016, a meeting between the Commission, Luxembourg and Amazon took place. During that meeting and in the draft minutes thereof, the Commission raised further questions to Amazon. By letter of 20 June 2016, Amazon replied to those questions. |

|

(58) |

By letter of 21 June 2016, Amazon submitted its comments to the market information of Company X. It also requested access to the complete submission of Company X and the disclosure of its identity. |

|

(59) |

On 7 July 2016, the Commission provided its comments to the amended minutes of the meeting of 26 May 2016 to Amazon. In addition, the Commission requested further information from Amazon. |

|

(60) |

By email of 22 July 2016, Amazon submitted a partial reply to the Commission's request for information of 7 July 2016. In its reply, Amazon informed the Commission about the protective order covering documents used in US Tax Court proceedings. Therefore, Amazon suggested submitting redacted documents, since these were available to Amazon. |

|

(61) |

By email of 27 July 2016, the Commission reminded Amazon about outstanding information following its request for information of 7 July 2016 and accepted to receive temporarily documents from the US Tax Court proceedings in a redacted version. In addition, the Commission requested further clarification and information from Amazon. |

|

(62) |

By email of 29 July 2016, Amazon submitted a partial reply to the Commission's request for information of 7 July 2016 and requested an extension of the deadline to reply to the remaining questions. By letter of 12 August 2016, Amazon submitted a partial reply to the Commission's request for information of 7 July 2016 and 27 July 2016. |

|

(63) |

By email of 19 August 2016, the Commission requested further clarification and information from Amazon concerning Amazon's replies to the request for information of 7 July 2016. |

|

(64) |

By email of 19 August 2016, and again by letter of 22 August 2016, the Commission sent a request for information to Amazon asking for the entire redacted documents of the US Tax Court proceedings. |

|

(65) |

On 26 August 2016, Amazon submitted a partial reply to the Commission's request for information of 7 July 2016 and requested an extension of the deadline to complete its reply. |

|

(66) |

By email of 30 August 2016, Amazon informed the Commission about its successful application concerning access to the documents used in the US Tax Court proceedings and announced the upcoming submission of unredacted documents. |

|

(67) |

On 9 September 2016, Amazon submitted a partial reply to the Commission's request for information dated 19 August 2016. |

|

(68) |

On 30 September 2016, Amazon submitted the unredacted documents as produced in the US Tax Court proceedings, as requested by the Commission on 22 August 2016. |

|

(69) |

By e-mails of 7 and 19 December 2016, the Commission asked Amazon for additional information concerning the US Tax Court proceedings. On 20 December 2016, Amazon submitted its reply. |

|

(70) |

On 21 December 2016, the Commission sent a request for information to Amazon to which Amazon submitted a partial reply on 20 January 2017. By email of 2 February 2017, the Commission sent Amazon further clarifications concerning its request for information of 21 December 2017. On 6, 8 and 27 February and 6 March 2017, Amazon submitted further information and partial replies to the Commission. By email of 13 March 2017, the Commission reminded Amazon to submit outstanding information. |

|

(71) |

On 14 March 2017, the Commission sent a request for information to Amazon. |

|

(72) |

By email of 24 March 2017, Amazon submitted the opinion of the US Tax Court of 23 March 2017 to the Commission. |

|

(73) |

By email of 27 March 2017, the Commission requested further information from Amazon concerning the US Tax Court's opinion. |

|

(74) |

On 28 March 2017, Amazon replied to the Commission requesting more time to answer due to the ongoing post-trial procedures in the US. |

|

(75) |

By email of 4 April 2017, Amazon submitted a partial reply to the Commission's request for information of 14 March 2017. |

|

(76) |

By email of 7 April 2017, the Commission informed Luxembourg and Amazon that it was obliged to decline Amazon's request to grant full access to the submissions of Company X. |

|

(77) |

On 11 April 2017, Amazon submitted another partial reply to the Commission's request for information of 14 March 2017 and requested an extension of the deadline for some remaining parts of its reply. |

|

(78) |

By email of 12 April 2017, Amazon submitted a partial reply to the Commission. |

|

(79) |

On 17 April 2017, Amazon submitted further information concerning the post-trial procedure in the US. |

|

(80) |

On 18 May 2017, Amazon sent another partial reply and thus completed its reply to the Commission's request for information of 14 March 2017. |

|

(81) |

By email of 19 May 2017, the Commission sent a request for information to Amazon. |

|

(82) |

On 29 May 2017, Amazon submitted further information to the Commission. |

|

(83) |

By email of 7 June 2017, Amazon submitted its reply to the Commission's request for information of 19 May 2017. |

|

(84) |

By email of 14 June 2017, the Commission requested Amazon to confirm that all information submitted by Amazon to the Commission in 2016 and 2017 had also been shared with Luxembourg and invited Luxembourg to submit its observations on the information submitted to the Commission by Amazon at that point of the investigation. On 19 June 2017, Amazon confirmed to have shared all information submitted to the Commission in 2016 and 2017 with Luxembourg. By email of 21 June 2017, Luxembourg confirmed to have received all documents that were submitted to the Commission by Amazon in 2016 and 2017 and that Luxembourg had no further comments in relation to Amazon's submissions to the Commission in 2016 and 2017 except for Amazon's submissions of 30 September 2016 and 20 January 2017. |

|

(85) |

On 22 June 2017, a meeting was held between the Commission, Luxembourg and Amazon. |

|

(86) |

On 6 July 2017, Luxembourg submitted its comments to submissions made by Amazon on 30 September 2016 and 20 January 2017. |

|

(87) |

On 6 July 2017, the Commission sent a request for information to Amazon to which Amazon replied on 10 and 27 July, and 4 and 7 August 2017. |

|

(88) |

By email of 9 August 2017, the Commission sent a request for information to Amazon. On 7 September 2017, Amazon submitted its reply. |

|

(89) |

On 12 September 2017, Luxembourg confirmed by email that it had no further comments to Amazon's submissions of 10 and 27 July, 4 and 7 August and 7 September 2017. |

2. FACTUAL AND LEGAL BACKGROUND

2.1. DESCRIPTION OF THE BENEFICIARY OF THE CONTESTED TAX RULING

2.1.1. THE AMAZON GROUP

|

(90) |

The Amazon group consists of Amazon.com, Inc. and all companies directly or indirectly controlled by Amazon.com, Inc. (collectively referred to as ‘Amazon’ or the ‘Amazon group’). Amazon is headquartered in Seattle, Washington, United States of America. |

|

(91) |

Amazon operates retail and service businesses. |

|

(92) |

Amazon's retail business consists of selling a range of merchandise to customers through its websites, such as books, DVDs, videos, electronic consumer goods, computers, kitchen equipment and housewares, tools, hardware, mobile phones, etc. and content, such as digital music, E-books, games etc., which Amazon purchases for resale from suppliers (12). Amazon fulfils customer orders in several ways, including through its own North American and International fulfilment centres and networks and through co-sourced and outsourced fulfilment arrangements in certain countries and through digital delivery (13). |

|

(93) |

Amazon's service business includes its activities in third party programmes (the ‘Third-Party Seller Programs’), such as Marketplace and Merchants@Amazon, through which Amazon allows other (smaller) businesses and individuals (Marketplace) and medium and large retail sellers (Merchants@Amazon) to offer their products for sale on Amazon's websites. The products of the third party merchants are integrated into Amazon's websites. In return, the participating businesses and individuals pay fees to Amazon (14). Those third-party businesses and sellers can also choose to send Amazon their inventory, which Amazon stores at its fulfilment centres (15), lists on all its websites, and picks, packs and delivers to the client's address (the ‘Fulfilment by Amazon’ business) (16). |

|

(94) |

Amazon also generates revenue through other marketing and promotional services, such as online advertising and co-branded credit card agreements. Amazon previously offered its e-commerce services, features and technologies to operate other businesses' websites selling its products under the Amazon brand name and URL under its ‘Merchant.com’ programme. Under its ‘Syndicated Stores’ programme, Amazon previously offered its e-commerce services, features and technologies to operate other businesses' websites selling its products under another business name and URL (17). Both programmes have since been phased out (18). |

|

(95) |

Finally, Amazon manufactures and sells hardware products, such as Amazon Kindle, Amazon Fire and Amazon Echo devices. |

|

(96) |

Amazon operates thirteen global web sites, including www.amazon.com and six European web sites: www.amazon.de, www.amazon.co.uk, www.amazon.fr, www.amazon.it and www.amazon.es (‘the EU websites’) and www.amazon.nl (19). Amazon's operations are organised in three segments: North America, International, and Amazon Web Services (‘AWS’) (20). |

|

(97) |

The North America segment's sales primarily consist of retail sales of consumer products (including by third-party sellers) and subscriptions through North America-focused websites such as www.amazon.com, www.amazon.ca, and www.amazon.com.mx. That segment also includes export sales from those websites. |

|

(98) |

The International segment's sales primarily consist of retail sales of consumer products (including by third-party sellers) and subscriptions through international websites such as www.amazon.com.au, www.amazon.com.br, www.amazon.cn, www.amazon.in, www.amazon.co.jp, the EU websites and www.amazon.nl. That segment also includes export sales from these international websites (including export sales from these sites to customers in the U.S., Mexico, and Canada), but excludes export sales from Amazon's North American websites. |

|

(99) |

The AWS segment consists of global sales of computer, storage, database, and other service offerings for start-ups, enterprises, government agencies, and academic institutions. Through AWS, Amazon provides access to technology infrastructure for different types of business. |

|

(100) |

In 2016, Amazon generated worldwide net sales of approximately USD 136 billion and net income of USD 2,37 billion. Globally, 91 % of Amazon's revenue comes from its retail business. 59 % of net sales come from the North America segment, 32 % from the International segment, and 9 % from the AWS segment. In 2016, Amazon had 314 400 full- and part-time employees (21). |

2.1.2. AMAZON'S EUROPEAN OPERATIONS

|

(101) |

Prior to May 2006, Amazon operated its European websites through a wholly-owned US subsidiary of Amazon.com, Inc.: Amazon.com International Sales, Inc. (‘AIS’). AIS functioned as principal for the retail business on Amazon's European websites (at that time: www.amazon.de, www.amazon.co.uk, and www.amazon.fr), whereas another US group company, Amazon International Marketplace, Inc. (‘AIM’), functioned as principal for the service business on those websites. AIM was, in turn, the sole shareholder of ASE, incorporated in 2003, which acted as the service commission agent for the service business on the European websites. Finally, wholly-owned Amazon entities incorporated in the UK, Germany and France (‘EU Local Affiliates’) (22) performed certain services with respect to the European websites, e.g. costumer referral services (23). |

|

(102) |

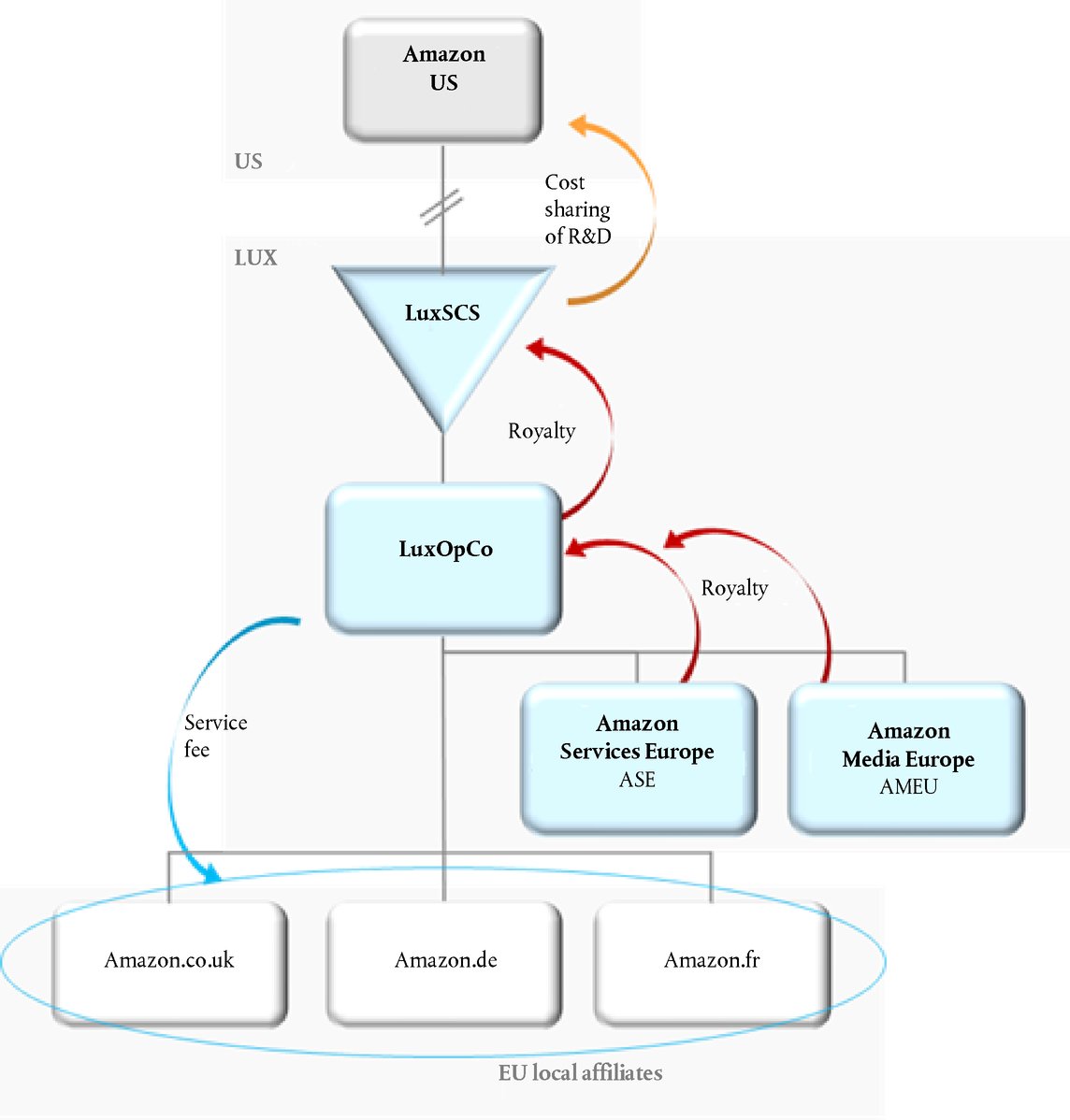

As of May 2006, the restructuring of Amazon's European operations as described in the ruling request (the ‘2006 restructuring’) became effective. During financial years covering 1 May 2006 to 30 June 2014 (‘the relevant period’), the structure reflected in Figure 1 was in place. In July 2014, Amazon restructured its European operations (the ‘2014 restructuring’). The 2014 restructuring and Amazon's European operations as carried out after the 2014 restructuring are not within the scope of this Decision. Figure 1 Structure of Amazon's European Entities 2006-2014

Cost sharing of R&D Royalty Royalty Service fee Amazon.de Amazon.fr Amazon.co.uk Amazon Media Europe AMEU Amazon Services Europe ASE LuxOpCo LuxSCS EU local affiliates LUX US Amazon US |

2.1.2.1. LuxSCS

|

(103) |

LuxSCS is a Luxembourg limited partnership (Société en Commandite Simple). While the ownership structure changed throughout the relevant period, the partners of LuxSCS were always US-resident companies (24). On incorporation in 2004, LuxSCS's partners were Amazon Europe Holding, Inc. (general partner); Amazon.com International Sales, Inc. and Amazon.com International Marketplace, Inc. In May 2006, ACI Holdings, Inc. and Amazon.com, Inc. replaced Amazon.com International Marketplace, Inc. as partners of LuxSCS. Since September 2009, Amazon Europe Holding, Inc. (general partner), Amazon.com International Sales, Inc. and Amazon.com, Inc. were the partners in LuxSCS (25). |

|

(104) |

During the relevant period, LuxSCS was expected to function solely as an intangibles holding company for Amazon's European operations, for which LuxOpCo was responsible as the principal operator (26). As described by Amazon in a letter dated 20 April 2006 to the Luxembourg tax administration, LuxSCS's activities were limited to ‘the mere holding’ of the Intangibles and the shares in LuxOpCo. The ‘limited number of legal agreements’ concluded by LuxSCS was the ones ‘necessary for the Luxembourg structure to operate’. LuxSCS would only receive passive income (royalties and interests) from its subsidiaries (27). LuxSCS also provided intercompany loans to LuxOpCo and other group companies (28). LuxSCS had no physical presence or employees during the relevant period. |

|

(105) |

In 2005, LuxSCS entered into License and Assignment Agreements For Pre-existing Intellectual Property (the ‘Buy-In Agreement’) with Amazon Technologies, Inc. (‘ATI’) (29) and the CSA as concluded with two Amazon group entities based in the U.S.: A9.com, Inc. (‘A9’) and ATI (30). LuxSCS also entered into an Intellectual Property Assignment and License Agreement with Amazon.co.uk Ltd, Amazon.fr SARL, and Amazon.de GmbH, under which LuxSCS received the trademarks and IP rights to the European websites which had been owned by those EU Local Affiliates until 30 April 2006 (31). |

|

(106) |

By means of the Buy-In Agreement and the CSA, LuxSCS obtained the right to exploit and sublicense certain Amazon IP and derivative works thereof (‘the Intangibles’) (32) as held and further developed by A9, ATI and LuxSCS itself (33). LuxSCS obtained those rights to exploit the Intangibles for the purpose of operating the European websites and any other purpose within the European territory (34). In return, LuxSCS had to pay Buy-in Payments (specified in Table 11) and its annual share of the costs relating to the CSA development program (specified in Table 12) (35). According to the CSA, LuxSCS had to use its best efforts to prevent infringements of the Intangibles licensed to it by A9 and ATI (36). Furthermore, as specified in the 2009 amended and restated CSA, LuxSCS was to undertake the functions and risks set out in Exhibit B to the CSA (37). |

|

(107) |

According to the CSA, the Intangibles consisted of (i) ‘any and all intellectual property rights throughout the world’, as owned or otherwise held by ATI and LuxSCS as well as certain intellectual property rights held by A9 (38), (ii) all such IP licensed, transferred or assigned to those parties, and (iii) derivative works thereof as assigned to any of the parties pursuant to the CSA. The Intangibles essentially include three categories of intellectual property, which is hereinafter referred to as (i) ‘Technology’ (39), (ii) ‘Customer Data’ (40), and (iii) ‘Trademarks’ (41). The Intangibles do not include internet domain names (42). |

2.1.2.2. LuxOpCo and its subsidiaries

|

(108) |

During the relevant period, LuxOpCo was a wholly-owned subsidiary of LuxSCS (43). As part of the 2006 restructuring, it was expected to take over the roles of ASI and AIM (44). It was also expected to further develop and improve the software-based business model underlying Amazon's European retail and service business (45). As expected, during this period LuxOpCo functioned as the headquarters of the Amazon group in Europe and the principal operator of Amazon's European online retail and service business as carried out through the EU websites (46). LuxOpCo would further manage the strategic decision-making related to the retail and services businesses carried out through the EU websites, along with the management of key physical components of the retail business (47). It was expected to set the strategies and guidelines regarding which products would be featured and sold on the EU websites, the pricing and merchandising strategies for the products sold or service offerings, and certain website promotions and advertising programmes offered on the EU websites. It would also be responsible for strategic decisions relating to the selection of third-party merchants and product categories, and for marketing towards third parties. Finally, it would manage all aspects of the order fulfilment business (48). |

|

(109) |

During the relevant period, LuxOpCo recorded revenue in its accounts both from product sales and from order fulfilment services. It purchased goods for resale from vendors located in various jurisdictions which were, in turn, shipped to end customers who made purchases on the EU websites. LuxOpCo was the seller of record (49) of Amazon inventory on the EU websites, held title to the inventory, and bore the risk of any loss in that respect (50). LuxOpCo was also responsible for the goods shipped by third-party businesses and individuals directly to the fulfilment centres (51). |

|

(110) |

LuxOpCo also performed treasury management functions (52) and held (either directly or indirectly) the shares in ASE, AMEU and the EU Local Affiliates which performed various intra-group services in support of LuxOpCo's business. |

|

(111) |

During the relevant period, ASE and AMEU, both Luxembourg resident companies, formed a fiscal unity with LuxOpCo for Luxembourg tax purposes in which LuxOpCo operated as the parent of the unity (53). Under Luxembourg tax law, those domestic companies were therefore not treated as separate entities, but paid their taxes on a consolidated basis, i.e. as if they were one single taxpayer (54). |

|

(112) |

After the 2006 restructuring, ASE was expected to continue to act as a service provider to LuxOpCo (55). During the relevant period, it operated Amazon's EU third-party seller business, ‘Marketplace’. Marketplace offers small businesses and sellers the possibility to make their goods available through the EU websites. It also allowed them to send their inventory to Amazon, which was stored at Amazon's fulfilment centres and which Amazon picked, packed and delivered anywhere in Europe. During the relevant period, AMEU operated Amazon's EU digital business (in which, for instance, MP3s and eBooks are sold). |

|

(113) |

In 2013 and 2014, the consolidated net turnover of LuxOpCo amounted to EUR 13 612 449 784 and EUR 15 463 362 589, respectively. During the financial year 2013, LuxOpCo employed on average 523 full time employees (‘FTEs’), ASE 63 FTEs and AMEU 5 FTEs. The employees of LuxOpCo, ASE and AMEU included strategic management posts that manage and coordinate the entirety of Amazon's European operations (56). |

|

(114) |

After the 2006 restructuring, the EU Local Affiliates were expected to continue to provide the same services to LuxOpCo with respect to the EU websites as they had previously provided to AIS and AIM (57). Accordingly, during the relevant period the EU Local Affiliates provided customer referral services with respect to the EU websites by performing costumer and merchant services, support services (such as marketing support localisation and adaption support, research and development (‘R & D support’) as well as fulfilment services (58). The EU Local Affiliates developed local content for use on the EU websites and supported the management of merchandise for the online retail stores, as required by LuxOpCo. Customer service support entailed providing pre-sale and after-sale customer support service via email, telephone, chat or other means of communication, as required by LuxOpCo, to meet customer requirements. The support services included general and administrative support. Finally, the EU Local Affiliates also supported the soliciting of the operators of other local websites to promote the EU websites to their customers (the so-called ‘Associates Programme’). |

|

(115) |

Services provided by the EU Local Affiliates to LuxOpCo were provided pursuant to the ‘Service Agreements’ concluded between each of the affiliates and LuxOpCo as of 1 May 2006 (59). The EU Local Affiliates acted in their own name when providing these services for LuxOpCo, but they did not assume any risks either for the sales or for the inventories (60). Pursuant to the Service Agreements, the EU Local Affiliates were remunerated by LuxOpCo on a cost plus basis (61), reflecting the EU Local Affiliates' role relative to LuxOpCo (62). In practice, the costs incurred by the EU Local Affiliates in performing the services rendered for LuxOpCo were invoiced to LuxOpCo with an additional mark-up ranging from 3 % to 8 %. In 2013, the EU Local Affiliates recorded the following turnovers: Amazon.co.uk Ltd: GBP [400-500] million; Amazon Logistik GmbH: EUR [100-200] million; Amazon.de GmbH: EUR [90-100] million; Amazon.fr Logistique SAS: EUR [100-200] million; and Amazon.fr SARL: EUR [50-60] million. |

2.1.2.3. The License Agreement

|

(116) |

With effect from 30 April 2006, LuxOpCo entered into the License Agreement with LuxSCS. Under that agreement, LuxOpCo irrevocably obtained the exclusive right to develop, enhance, and exploit the Intangibles for the purpose of operating the EU websites and any other purpose within the European Country (63) geographic territory (64) in return for a royalty payment (the ‘License Fee’) (65). Any IP created by or further developed by LuxOpCo on the basis of or as a result of access to the Intangibles (66) is assigned to LuxSCS (67). LuxOpCo was required to act on its own initiative and risk to protect and maintain the Intangibles (68). The License Agreement also provided for corporate services to be provided by LuxOpCo for the benefit of LuxSCS without any separate remuneration to LuxOpCo (69). LuxOpCo further agreed to take over all risks associated with all the activities to be performed by it under the License Agreement (70). If LuxOpCo acquired any IP to be used for the same purpose as the Intangibles from third parties, LuxOpCo was required to license this IP to LuxSCS on a royalty-free basis (71). |

|

(117) |

LuxOpCo, ASE, AMEU and EU Local Affiliates used the Intangibles to carry out their business activities (72). |

|

(118) |

Under the License Agreement, LuxOpCo had the right to sub-license the Intangibles to affiliated companies (73). As of 30 April 2006, LuxOpCo concluded an ‘Intellectual Property License Agreement’ with both ASE and AMEU, under which ASE and AMEU were irrevocably granted non-exclusive licenses to the Intangibles. To a very large extent, both those agreements mirrored the License Agreement between LuxOpCo and LuxSCS. Under those agreements, a royalty payable by ASE and AMEU to LuxOpCo was set in exactly the same manner as the royalty payable by LuxOpCo to LuxSCS under the License Agreement. |

|

(119) |

Pursuant to the Service Agreements, the EU Local Affiliates were entitled to use the Intangibles as well as other intangible property and trademarks owned or otherwise held by LuxOpCo to the extent necessary for the provision of their services to LuxOpCo. All goodwill from such use solely accrued for the benefit of LuxOpCo (74). All intellectual property rights and derivative works thereof as developed or acquired by the EU Local Affiliates during the provision of those services remained the property of LuxOpCo (75). |

|

(120) |

The License Agreement was in effect for the life of all the licensed Intangibles (76), and could only be terminated in the event of a change of control or substantial encumbrance (77) or in the event of one of the parties failed to cure for failure of its performance under that agreement (78). Accordingly, LuxSCS had no possibility to unilaterally terminate the License Agreement. The License Agreement was amended in January 2010, with effect from 1 January 2009 (79). That amendment concerned the definition of ‘EU Operating Profit’ used for the purpose of calculating the License Fee (80). |

2.2. THE CONTESTED MEASURE

2.2.1. THE CONTESTED TAX RULING

|

(121) |

The contested tax ruling is a one-sentence letter dated 6 November 2003 from the Luxembourg tax administration to Amazon.com, Inc. which states the following: ‘After having made myself acquainted with the letter of october [sic] 31, 2003, directed to me by [Advisor 1] just as with your letter of octobre [sic] 23, 2003 and dealing with your position regarding Luxembourg tax treatment within the framework of your future activities, I am pleased to inform you that I may approve the contents of the two letters.’ |

|

(122) |

Following a delay in the implementation of the restructuring of Amazon's European operations, Amazon sought confirmation from the Luxembourg tax administration of the continued validity of the contested tax ruling by letter of 5 December 2004, which the latter confirmed by letter of 23 December 2004 (81). The contested tax ruling, initially concluded for five years, was prolonged in 2010 and effectively used until June 2014 (82). |

2.2.2. THE LETTER OF 31 OCTOBER 2003

|

(123) |

In its letter of 31 October 2003 to the Luxembourg tax administration (‘Amazon's letter of 31 October 2003’), Amazon sought confirmation of the tax treatment of LuxSCS, its US-based partners and dividends received by LuxOpCo under that structure. That letter explains that LuxSCS, as a Société en Commandite Simple, is not deemed to have a separate tax personality from that of its partners and, as a result, it is not subject to corporate income tax or net wealth tax in Luxembourg. |

|

(124) |

Notwithstanding the tax transparency of LuxSCS, LuxSCS or its US-based partners could still be taxed in Luxembourg if their activities were deemed to be carried out through a permanent establishment in Luxembourg. The letter therefore further explains that neither LuxSCS nor its partners could be considered to have a tangible presence in Luxembourg (offices, employees etc.) so that, in the absence of a fixed place of business, LuxSCS would not be deemed to have a separate personality from its partners nor to carry out a commercial activity in Luxembourg (83). Nor could its partners be regarded as having a permanent establishment in Luxembourg. |

2.2.3. THE LETTER OF 23 OCTOBER 2003

|

(125) |

In its letter of 23 October 2003 to the Luxembourg tax administration (‘Amazon's letter of 23 October 2003’), Amazon requested a tax ruling confirming the treatment of LuxOpCo for Luxembourg corporate income tax purposes (84). That letter explains Amazon's envisaged business structure in Europe and seeks confirmation that the transfer pricing arrangement for the License Agreement described therein results in ‘an appropriate and acceptable profit’ for LuxOpCo ‘with respect to the transfer pricing policy and Articles 56 and 164(3) of the LITL’. |

|

(126) |

That letter refers to an ‘economic analysis’ attached thereto, which sets out ‘the functions and risks that LuxOpCo was anticipated to undertake, as well as the nature and extent of the Intangibles that are anticipated to be the subject of the Intangibles License’ concluded between LuxSCS and LuxOpCo. On the basis of that analysis, a transfer pricing arrangement was proposed under which the level of the annual royalty (referred to in the letter as the ‘License Fee’) that LuxOpCo would be required to pay to LuxSCS for the use of the Intangibles was established. |

|

(127) |

Pursuant to that arrangement, the annual royalty would be equal to a percentage of all revenue (the ‘Royalty Rate’) received by LuxOpCo in connection with its operation of the EU websites. As further set out in that letter, the License Fee and the Royalty Rate would be calculated by use of the following method (85):

|

|

(128) |

For the purpose of the Royalty Rate Computation the following definitions apply (86):

|

2.2.4. THE TRANSFER PRICING REPORT

|

(129) |

In response to the Opening Decision, Luxembourg submitted the TP Report (87). Luxembourg claims that the TP Report is the ‘economic analysis’ to which reference is made in Amazon's letter of 23 October 2003. The TP Report was drawn up by reference to the Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations prepared by the Organisation for Economic Cooperation and Development.(‘OECD TP Guidelines’) (88). |

2.2.4.1. Functional analysis

|

(130) |

Section 3 of the TP Report provides a functional analysis of LuxSCS and LuxOpCo. |

|

(131) |

According to that functional analysis, LuxSCS's principal activities will be limited to those of an intangible holding company and a participant in the ongoing development of the Intangibles through the CSA (89). LuxSCS will also license the Intangibles to LuxOpCo, subject to the License Agreement, and will receive royalty payments pursuant to that agreement. |

|

(132) |

As regards LuxOpCo, the TP Report explains that ‘[t]hrough its staff of full-time management employees, LuxOpCo will manage the strategic decision-making related to the EU Web Sites' Retail and Services Businesses, and will also manage the key physical components of the Retail Business’ (90). According to Amazon's letter of 23 October 2003, LuxOpCo was expected to have ‘in total, at least 25 to 30 full-time employees, including certain key pan-European management with responsibility for strategic decision-making in connection with the EU Web sites’ (91), with the remaining full-time employees (approximately 20) to function in areas such as marketing, technology and accounts payable. |

|

(133) |

The TP Report further explains that ‘[f]ollowing the restructuring, it is anticipated that LuxOpCo's principal activities will be focused on the exploitation of Amazon's software platform in an effort to continually develop and improve the software-based business model underlying the Retail Business and Service Business offered through the EU Websites. […] (*2) As part of this effort, LuxOpCo's management will work to identify opportunities to improve and enhance the Retail and Service Businesses through the exploitation of new and improved platform features and functionality as they are developed. As both a retailer and service provider, LuxOpCo will strive to provide the optimal costumer experience in all areas including fulfilment, payment, processing, merchandising decisions and monitoring of third-party seller performance […]’ (92). |

|

(134) |

In its role as retailer, LuxOpCo was expected to take merchandising and pricing decisions, and to manage all aspects of the order fulfilment process (93). As the operator of the service business, LuxOpCo would also be ‘responsible for strategic decisions relating to the selection of third-party merchants and product categories, and for marketing to and negotiations with third-party merchants’ (94). For the purpose of operating the EU websites, LuxOpCo was to use the Intangibles which it licensed from LuxSCS. LuxOpCo was expected to hold legal title to all inventory (95). LuxOpCo would assume all risks associated with holding inventory and selling products through the EU websites (96). According to Amazon's letter of 23 October 2003, LuxOpCo was to own and use the Luxembourg-based transaction processing servers to complete the processing of, and authorise payments for, customer and third-party seller transactions, including payments to third-party merchants (97). |

|

(135) |

LuxOpCo was to contract with ASE, which would act as a service commission agent in its own name but for the benefit of LuxOpCo, in connection with Amazon's third-party seller programs in Europe. ASE's services would primarily consist of certain order processing services associated with the service business. |

|

(136) |

The EU Local Affiliates located in Germany, France and the UK were to provide various services with respect to the EU websites, including certain customer referral and support, marketing and fulfilment services (98). |

|

(137) |

According to Amazon's management forecasts submitted for the purpose of the TP Report, LuxOpCo was expected to expand its revenues in the course of its operations from approximately EUR 3,2 billion in 2005 to approximately EUR 8,3 billion in 2010 and incur the following costs: the cost of goods as a percent of revenue was projected on average at approximately 77,5 %, leading to a gross margin of about 22,5 %. Following the 2006 restructuring, LuxOpCo was to assume the on-going costs associated with the management and operation of the Amazon platform in Europe, including payment and collection processing expenses, bad debt expenses, certain system support expenses, as well as the cost of salaries of the management, technology and other personnel working to support the Amazon platform operations in the region (99). The assumptions underlying the management forecast were neither disclosed nor reviewed in the TP Report (100). |

2.2.4.2. Selection of the most appropriate transfer pricing method

|

(138) |

Section 5 of the TP Report deals with the selection of the most appropriate transfer pricing method for determining the arm's length nature of the Royalty Rate. |

|

(139) |

To determine the remuneration attributable to LuxOpCo and the arm's length level of the royalty to be paid by LuxOpCo to LuxSCS under the License Agreement, the TP Report proposes alternative transfer pricing arrangements: one based on the comparable uncontrolled price (‘CUP’) method and another based on the residual profit split method (101). |

2.2.4.3. Transfer pricing assessment based on the CUP method

|

(140) |

Section 6.1 of the TP Report calculates an arm's length range for royalty on the basis of the CUP method. |

|

(141) |

First of all, searches were performed for comparable transactions in Amazon's own internal database of license agreements and an external agency was commissioned to conduct a search for license agreements involving intangible assets similar to those of Amazon. The transactions identified as a result of the searches were not considered sufficiently comparable and were therefore rejected for the purpose of the CUP analysis. |

|

(142) |

Next, the TP Report identified as relevant the following agreements entered into by Amazon since 2000 with third-party retailers under which Amazon made its technology platform available to those retailers: the Strategic Alliance Agreement between Rocket.zeta, Inc., Amazon.com, Inc., target.direct LLC and Target Corporation (the ‘Target Agreement’) (102), the Strategic Alliance Agreement between Rock-Bound, Inc. and ToysRUs.com LLC (the ‘ToysRUs Agreement’); the Product Listing Agreement between Amazon.com Payments, Inc and Circuit City Stores, Inc. (the ‘Circuit City Agreement’); the Mirror Site Hosting Agreement between Frontier.zeta, Inc. and Borders Online LLC (the ‘Borders Agreement’); and the Mirror Site Hosting Agreement between Amazon.com International Sales, Inc. and Waterstone's Bookseller Ltd (the ‘Waterstones Agreement’). Amazon refers to these agreements as the ‘M.com Agreements’. Upon review of those agreements, the TP Report concludes that the [A] Agreement provides a comparable arrangement to the extent that the rest of the contracts ‘did not include the provision of the eCommerce technology platform’ (103). |

|

(143) |

Pursuant to the [A] Agreement, Amazon agreed to create, develop, host and maintain a new [A] website and a [A] store on Amazon websites, which were to replace [A]'s existing e-commerce website. The functionalities to be included in the [A] website would be substantially equivalent to those generally incorporated in the Amazon websites. In return, [A] was to pay Amazon compensation consisting of, among others, set-up fees (104), base fees (105), and sales commissions (106). |

|

(144) |

To make that compensation comparable to the License Fee (referred to in the TP Report as the ‘Royalty Rate’), the set-up fees were amortized and allocated to each of the four periods referred to in the agreement and, together with the annual basic fee, they were converted into a percentage of sales (ranging from 3,4 % to 7,2 %). Since the commission fee included in the [A] Agreement ranged from 4 % to 5 % of sales, the TP Report's first conclusion was that the implied royalty rate in the [A] Agreement ranged from 8,4 % to 11,7 % of sales. However, [A] had also committed to pay Amazon certain fees to compensate for both excess order capacity and excess inventory level. Those fees, referred to in the agreement, were also converted into a percentage of sales, ranging from 1,2 % to 0,7 %. Therefore, the arm's length range for the Royalty Rate was initially calculated to be between 9,6 % and 12,6 % of sales. |

|

(145) |

Finally, since the [A] Agreement did not provide [A] with access to Amazon's customer data, the TP Report included an adjustment to align the CUP with the fact that LuxSCS granted LuxOpCo access to Amazon's customer data. Accordingly, using the information available in the [B] Agreement, an upward adjustment of 1 % was proposed, resulting in an arm's length range for the Royalty Rate between 10,6 % and 13,6 % of LuxOpCo's sales. |

2.2.4.4. Transfer pricing assessment based on the residual profit split method

|

(146) |

Section 6.2 of the TP Report calculates an arm's length range for the License Fee (referred to in the TP Report as the ‘Royalty Rate’) on the basis of the residual profit split method. In its application of that method, the TP Report estimated the return associated with LuxOpCo's ‘routine functions in its role as the European operating company’ (107) based on the mark-up on costs to be incurred by LuxOpCo (108). |

|

(147) |

To determine an arm's length range for that mark-up, the TP Report conducted a search to identify comparable companies generally identified as engaged in the management and operation of software-based business. A comparable companies search in the Amadeus database (109) using selection criteria related to geographic region (110), keyword search in business descriptions (111) and industry classification of the search combined with manual screening identified seven companies considered comparable to Amazon (112). |

|

(148) |

On that basis, the TP Report defined a ‘net cost plus mark-up’ as the profit level indicator for testing the arm's length remuneration attributable to the anticipated functions of LuxOpCo, which was defined as operating income divided by the sum of cost of goods and operating expenses (113). Based on data concerning the seven comparables, the following three-year average (1999-2001) interquartiles range was presented: lower quartile was 2,3 %, median was 4,2 %, and upper quartile was 6,7 %. The table presenting the results indicates that the figures are percentages of net sales (114). |

|

(149) |

As a result, a mark-up of [4-6] % was selected and applied to the operating expenses of LuxOpCo to determine ‘the relevant routine return attributable to LuxOpCo's functions’ (115). That return was subsequently deducted from LuxOpCo's operating profit. The resulting difference between that return and LuxOpCo's recorded profit, the residual profit, was considered by the TP Report to be wholly attributable to the use of the Intangibles licensed from LuxSCS. |

|

(150) |

Finally, the TP Report divided each of the projected annual residual profits by the projected net sales of LuxOpCo to obtain an indication of the Royalty Rate. On that basis, the TP Report concluded that ‘a Royalty Rate in a range of 10,1 to 12,3 percent of net revenues to be charged by LuxSCS to LuxOpCo would be consistent with the arm's length standard under the OECD Guidelines’ (116). |

|

(151) |

The calculations made in the TP Report, are summarised and illustrated in Table 1 (117). Columns 1 and 3 have been added by the Commission to explain those calculations: Table 1 Calculation in the TP Report, cf. p. 32 of the TP report (Column 1 and 3 added by the Commission)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2.2.4.5. Reconciliation of the two transfer pricing arrangements

|

(152) |

Summarising the transfer pricing analyses of the License Agreement using the CUP method and the residual profit split method, the TP Report considered that the results converge and indicated that an arm's length range for the Royalty Rate from LuxOpCo to LuxSCS under that agreement is 10,1 % to 12,3 % of LuxOpCo's sales. |

|

(153) |

The TP Report then concludes that ‘while it is reasonable to conclude that a Royalty Rate chosen from within the range of royalty rates implied by both these methods would be consistent with the arm's length principle, there may be minor differences in the precise future Intangibles transferred under the [A] agreement that would account for the slight differences in results under the two methods. […] it is reasonable to conclude […] that the residual profit split analysis is less likely to produce biased estimates, and accordingly, may be considered to be a more reliable measure of the arm's length Royalty Rate’ (118). |

2.2.5. CONSEQUENCES OF THE CONTESTED TAX RULING

|

(154) |

By the contested tax ruling, the Luxembourg tax administration endorsed the contents of Amazon's letters of 23 and 31 October 2003. In particular, it accepted that the transfer pricing arrangement for the purposes of determining the level of the annual royalty to be paid by LuxOpCo to LuxSCS under the License Agreement, which in turn determined LuxOpCo's annual taxable income in Luxembourg, was at arm's length. That arrangement is summarised in Figure 2: Figure 2 Structure of Amazon's European Entities 2006-2014 incl. arrangement for royalty payment

Taxable profit of LuxOpCo agreed in the contested ruling Recorded profit in excess of taxable profit agreed in the contested roling is paid by LuxOpCo to LuxSCS in the form of a royalty 0,45 % on sales [4-6] % on OpEx 0,55 % on sales Amazon.com, Inc. US LUX LuxSCS Royalty Amazon EU Sàrl LuxOpCo EU Sales invoiced and recorded in Luxembourg EU Subsidiaries Amazon.co.uk Amazon.fr Amazon.de |

|

(155) |

The contested tax ruling was relied upon by LuxOpCo during the relevant period to determine its annual corporate income tax liability in Luxembourg for the purpose of filing its annual tax declarations. The contested tax ruling was also relied upon by LuxSCS and its US-based partners in that it confirms that neither LuxSCS nor its partners are subject to Luxembourg corporate income tax, municipal business tax or, for the latter, tax on their partnership interest in LuxSCS (119). |

|

(156) |

Table 2 illustrates the implications of the contested tax ruling for the calculation of LuxOpCo's taxable base in Luxembourg and the level of the royalty payment (the License Fee) to LuxSCS since 2006. The Commission recalls that LuxOpCo operates as the parent entity in the fiscal unity formed with ASE and AMEU, and that those companies are accordingly treated as one single tax payer for Luxembourg tax purposes. Accordingly, Table 2 is drawn up on a consolidated basis, and no distinction is made between LuxOpCo, ASE and AMEU in the following parts of this Decision. Table 2 Calculation of LuxOpCo's taxable base and royalty payments 2006-2013

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(157) |

According to the calculation of the License Fee to LuxSCS (120), the cost base used to determine LuxOpCo's taxable basis for Luxembourg tax purposes are its operating expenses and the costs incurred by the EU Local Affiliates which are subsequently reimbursed by LuxOpCo (specified in Table 2 as ‘LuxOpCo — Intercompany’). The costs of goods sold and certain other costs, referred to as ‘expenses excluded from the mark-up (Mngt and RSU)’ in Table 2, are excluded from the calculation of LuxOpCo's taxable profit. The latter category of expenses comprises the following costs: (i) as from 2008, charges by US affiliates of Amazon.com, Inc. for support services (121), which were not foreseen at the time of the contested tax ruling; (ii) beginning in 2010, Amazon.com, Inc. charged LuxOpCo for the shares awarded as stock compensation to employees of LuxOpCo and certain of its direct and indirect European subsidiaries (122). Amazon claims that those charges did not change the functions and risks of LuxOpCo. |

|

(158) |

The application of the [4-6] % mark-up on the sum of LuxOpCo's operating expenses and intercompany expenses produces the Estimated Total Return To Lux Fiscal Unity Group. This result is then tested against the ceiling and the floor criteria (0,55 % and 0,45 % of revenues respectively). In cases where the Estimated Total Return was higher than 0,55 % of the revenues (as in years 2006, 2007, 2011, 2012 and 2013), the application of the ceiling was determinant for assessing LuxOpCo's taxable income in Luxembourg, referred to in Table 2 as the ‘Luxembourg consolidated Profit – per Ceiling/Floor and Return’. |

|

(159) |

Finally, the Luxembourg consolidated Profit (referred to as the LuxOpCo return in the ruling request) is subtracted from the operating profit (referred to as the ‘EU Operating profit’ in the ruling request) to determine the License Fee due to LuxSCS. |

2.3. ADDITIONAL INFORMATION SUBMITTED IN THE COURSE OF THE FORMAL INVESTIGATION

|

(160) |

During the course of the investigation, Amazon provided information on the European online retail market, on its business model in general and on its European operations in particular, on the IP licensing agreements it concluded with unrelated entities, and on its new corporate and tax structure in Luxembourg with effect from June 2014. That information complements the information already presented in Sections 2.1 and 2.2. |

2.3.1. INFORMATION ON THE EUROPEAN ONLINE RETAIL MARKET

|

(161) |

The European online retail market was the subject of a report commissioned by Amazon from [Advisor 3], a consultancy company, which contains an analysis of the economic trends of the e-commerce sector in Europe (‘the [Advisor 3] Report’) (123). The [Advisor 3] Report describes ‘online retail’ as the online sales of physical goods by online retailers, i.e. operators purchasing goods, holding them in their inventory and selling them online (124). |

|

(162) |

According to that report, the activities of online retailers are more similar to the activities of physical retailers, than to that of digital service providers (125). The main difference between physical retailers and online retailers lies in the product distribution channel used (126). The study also indicates that online retailers are structurally less profitable than digital service providers, since online retailers have an essentially variable costs basis. The costs structure of digital service providers is more fixed than that of retailers, which allows for economies of scale and higher margins once a company has reached a critical size (127). For retailers, be it physical or online, the impact of economies of scale on the profitability is limited, since the vast majority of costs are variable. Changes in the cost of goods sold, discounts and logistics costs, which are a major share of the total costs, are strongly linked to business volumes (128). This factor, together with the intense competition characteristic to the online retail sector, resulted in negative average EBIT margins on the European online retail market. In the period 2006-2013, the relation of the average EBIT margin to sales was – 0,5 %. |

|

(163) |

The [Advisor 3] report's analysis of the market dynamics in the five most populated countries in Europe (129) shows that ‘the online retail segment experienced a strong growth and was subject to intense competition between 2006 and 2013’ (130). In particular, ‘[t]he intensity of competition required online retailers to invest heavily to sustain the market segment growth and keep up with the competition, thus putting margins under pressure when not pushing them into negative territory. Online retailers were willing to sacrifice short-term profitability, with the hope that investments undertaken would generate profit in the long run’ (131). The report concludes that in order to succeed on competitive European retail markets, it is necessary to consider the specific local features of these markets (132). |

2.3.2. INFORMATION ON AMAZON'S BUSINESS MODEL

2.3.2.1. The ‘three pillars’ of Amazon's retail business model

|

(164) |

According to Amazon (133), the key drivers of its retail business are selection (product/merchandise offerings (134)), price, and convenience (easy-to-use functionality, fast and reliable fulfilment, timely customer service, feature-rich and authoritative content, as well as a secure transaction environment) (135), whereby selection comes first, then price, and then convenience (136). These key drivers are referred to by Amazon as the ‘three pillars’ (137), and are traditional retail objectives (138). According to Amazon, executing the three pillars is critical and requires uniqueness and innovation in product offering, technology, business line, geography etc. (139), depending mainly on human intervention. The three pillars must be adapted to each local market where Amazon operates (140). |

|

(165) |

Selection: According to Amazon, selection is one of the key drivers of its success. Amazon employees define it as offering customers everything they may want to buy, which requires identification of customers' tastes and buying preferences in a given market, recruiting relevant suppliers and ensuring that the products are in stock (141). According to Amazon, there is a tightly linked correlation between selection and revenue (142). Amazon strives to have the widest selection possible and to continuously grow the number of products offered (143). Amazon continuously expands its selection, because the broader the selection, the better the customer experience (144). |

|

(166) |

Since preferences are local and category and vendor preferences differ by geography (145), selection is also local, as tastes and cultures are locally different (146). This can be seen from comparing Amazon's top selling items, which are different in each country (147). The goal and main responsibility on country level is to build a business mainly focused on physical retail and to create a relevant selection for the customer (148). The creation of such a relevant selection happens through personal negotiation (humans with humans) (149). |

|

(167) |

Within Amazon, selection is created in three ways: (i) through the acquisition of companies, (ii) partnerships with suppliers, and (iii) third-party programmes, such as Marketplace. For instance, Amazon started its tool business in the US by acquiring an existing company that already sold tools to access the existing vendor relationships and the selection that Amazon wanted to add to its retail business (150). Partnering with suppliers requires specific market know-how and building trust with suppliers (151). Once a partnership is established with a supplier, local vendor managers have to maintain that relationship, respecting the conditions of the suppliers and knowing the local market. Amazon's Marketplace offers other retailers the use of Amazon's platform for their e-commerce business, even if they are direct competitors of Amazon. Amazon created the technical account management (‘TAM’), which is the contact point for technical questions of Marketplace sellers after their launch on the Amazon websites. Amazon also developed its technology to allow self-service sign up for potential sellers on the Marketplace and, by 2010/2012, self-service sign up became more important for Amazon's Marketplace business (152). |

|

(168) |

Price: According to Amazon, price is its second most important business driver. Amazon endeavours to keep prices as low as possible (153). While manual pricing was predominantly used at Amazon until 2009 (154), prices have since been set by a pricing algorithm. |

|

(169) |

Convenience: According to Amazon, its third business driver is convenience. Convenience consists of several goals aimed at facilitating and improving the customer experience, such as (i) helping customers find what they are searching for, while ensuring complete product information for the customer, and (ii) delivering purchased products as quickly and accurately as possible (155). |

2.3.2.2. Online marketing efforts

|

(170) |

In addition to selection, price and convenience, Amazon's online marketing efforts are a key driver to bring traffic to Amazon websites and increase retail sales (156). |

|

(171) |

Prior to 2003, Amazon cooperated with international advertising agencies to support its marketing efforts. This changed in 2003, when Amazon started to pursue its own online marketing efforts. One of Amazon's main online marketing tools is its ‘Associates Program’ (157), which is a key traffic driving initiative (158). Amazon developed the Associates Program to establish marketing partnerships with so-called ‘associated websites’ that advertise Amazon or its products to channel internet traffic to Amazon websites (159). |

|

(172) |

Once the technology for the Associates Program was developed, it had to be integrated in each country with local associate websites. Consequently, the implementation of the Associates Program could only be done locally (160). Therefore, Amazon's Associates Program team was split in a ‘software team’ and a ‘recruitment team’ (i.e. a business development team). While the software team was based entirely in Seattle, the recruitment teams were established locally in countries where Amazon operated a website (161), such as Germany, the UK, and Japan (162). |

|

(173) |

The selection of the most relevant local partner websites (websites that advertise Amazon products) for the Associates Program, which would subsequently increase traffic to Amazon's websites, requires local market know-how (163). Therefore, the network of associated websites is created by local Amazon teams. This includes recruiting the local websites (including the EU websites), establishing the association fee, and controlling instances of fraud. This process starts with large players like Google and goes down to special interest websites with few visitors. All agreements are negotiated locally, because local conditions have to be considered for search engine optimisation, even with global websites such as Google (164). |

2.3.2.3. Technology

|

(174) |

Amazon describes itself as a technology company which ‘approaches retail as an engineering problem’ (165). Thus, technology is an important part of Amazon's business. Technology allows Amazon to provide competitive prices, target suggestions for items to particular costumers, process payments, manage inventory and ship products to customers. Technology is also necessary to support the scale of the business, since Amazon's business strategy relies on constant expansion (166). |

|

(175) |

Amazon's technology is not static, but is continuously developed and improved. If Amazon did not update and maintain its technology, Amazon would not be able to provide the ‘comprehensive e-tail experience that underpins its commercial success’ (167). In addition to maintaining and improving the existing technology, Amazon's teams develop software that supports new functionalities that are added over the years (168). As stated by Amazon, this is vital to its business since ‘[…] constant software development and innovation is indispensable to prevent Amazon's technology from becoming obsolete and the failure of its business operations’ (169). Amazon strives to be reliable, available, fast and flexible in its operations (170). |

|

(176) |