ISSN 1977-0677

Official Journal

of the European Union

L 321

English edition

Legislation

Volume 59

29 November 2016

|

ISSN 1977-0677 |

||

|

Official Journal of the European Union |

L 321 |

|

|

||

|

English edition |

Legislation |

Volume 59 |

|

Contents |

|

II Non-legislative acts |

page |

|

|

|

INTERNATIONAL AGREEMENTS |

|

|

|

* |

||

|

|

|

||

|

|

* |

||

|

|

|

REGULATIONS |

|

|

|

* |

||

|

|

* |

||

|

|

|

DECISIONS |

|

|

|

* |

||

|

|

* |

||

|

|

* |

Commission Decision (EU) 2016/2084 of 10 June 2016 on State aid SA.38132 (2015/C) (ex 2014/NN) — additional PSO compensation for Arfea (notified under document C(2016) 3472) ( 1 ) |

|

|

|

* |

||

|

|

* |

|

|

|

|

|

(1) Text with EEA relevance |

|

EN |

Acts whose titles are printed in light type are those relating to day-to-day management of agricultural matters, and are generally valid for a limited period. The titles of all other Acts are printed in bold type and preceded by an asterisk. |

II Non-legislative acts

INTERNATIONAL AGREEMENTS

|

29.11.2016 |

EN |

Official Journal of the European Union |

L 321/1 |

COUNCIL DECISION (EU) 2016/2079

of 29 September 2016

on the signing, on behalf of the European Union, and provisional application of the Partnership Agreement on Relations and Cooperation between the European Union and its Member States, of the one part, and New Zealand, of the other part

THE COUNCIL OF THE EUROPEAN UNION,

Having regard to the Treaty on European Union, and in particular Article 37 thereof,

Having regard to the Treaty on the Functioning of the European Union, and in particular Article 207 and Article 212(1), in conjunction with Article 218(5) and the second subparagraph of Article 218(8) thereof,

Having regard to the joint proposal from the European Commission and the High Representative of the Union for Foreign Affairs and Security Policy,

Whereas:

|

(1) |

On 25 June 2012, the Council authorised the Commission and the High Representative of the Union for Foreign Affairs and Security Policy to open negotiations with New Zealand on a Framework Agreement to replace the Joint Declaration on relations and cooperation between the European Union and New Zealand of 21 September 2007. |

|

(2) |

The negotiations on the Partnership Agreement on Relations and Cooperation between the European Union and its Member States, of the one part, and New Zealand, of the other part (the ‘Agreement’) were successfully concluded on 30 July 2014. The Agreement reflects both the historically close relationship and increasingly strong links developing between the Parties, and their desire to further strengthen and extend their relations in an ambitious and innovative way. |

|

(3) |

Article 58 of the Agreement provides that the Union and New Zealand may apply provisionally certain provisions of the Agreement, determined mutually by the two Parties, pending its entry into force. |

|

(4) |

The Agreement should therefore be signed on behalf of the Union and some of its provisions should be applied on a provisional basis, pending the completion of the procedures necessary for its conclusion, |

HAS ADOPTED THIS DECISION:

Article 1

The signing on behalf of the Union of the Partnership Agreement on Relations and Cooperation between the European Union and its Member States, of the one part, and New Zealand, of the other part, is hereby authorised, subject to the conclusion of the Agreement.

The text of the Agreement is attached to this Decision.

Article 2

Pending its entry into force, in accordance with Article 58 of the Agreement and subject to the notifications provided for therein, the following provisions of the Agreement shall be applied provisionally between the Union and New Zealand, but only to the extent that they cover matters falling within the Union's competence, including matters falling within the Union's competence to define and implement a common foreign and security policy (1):

|

— |

Article 3 (Dialogue), |

|

— |

Article 4 (Cooperation in regional and international organisations), |

|

— |

Article 5 (Political dialogue), |

|

— |

Article 53 (Joint Committee), with the exception of points (g) and (h) of paragraph 3 thereof, and |

|

— |

Title X (Final provisions), with the exception of Article 57 and Article 58(1) and (3), to the extent necessary for the purpose of ensuring the provisional application of the provisions of the Agreement referred to in this Article. |

Article 3

The President of the Council is hereby authorised to designate the person(s) empowered to sign the Agreement on behalf of the Union.

Article 4

This Decision shall enter into force on the day following that of its adoption.

Done at Brussels, 29 September 2016.

For the Council

The President

P. ŽIGA

(1) The date from which the provisions of the Agreement referred to in Article 2 will be applied provisionally, will be published in the Official Journal of the European Union by the General Secretariat of the Council.

|

29.11.2016 |

EN |

Official Journal of the European Union |

L 321/3 |

PARTNERSHIP AGREEMENT

on Relations and Cooperation between the European Union and its Member States, of the one part, and New Zealand, of the other part

The EUROPEAN UNION, hereinafter referred to as ‘the Union’,

and

THE KINGDOM OF BELGIUM,

THE REPUBLIC OF BULGARIA,

THE CZECH REPUBLIC,

THE KINGDOM OF DENMARK,

THE FEDERAL REPUBLIC OF GERMANY,

THE REPUBLIC OF ESTONIA,

IRELAND,

THE HELLENIC REPUBLIC,

THE KINGDOM OF SPAIN,

THE FRENCH REPUBLIC,

THE REPUBLIC OF CROATIA,

THE ITALIAN REPUBLIC,

THE REPUBLIC OF CYPRUS,

THE REPUBLIC OF LATVIA,

THE REPUBLIC OF LITHUANIA,

THE GRAND DUCHY OF LUXEMBOURG,

HUNGARY,

THE REPUBLIC OF MALTA,

THE KINGDOM OF THE NETHERLANDS,

THE REPUBLIC OF AUSTRIA,

THE REPUBLIC OF POLAND,

THE PORTUGUESE REPUBLIC,

ROMANIA,

THE REPUBLIC OF SLOVENIA,

THE SLOVAK REPUBLIC,

THE REPUBLIC OF FINLAND,

THE KINGDOM OF SWEDEN,

THE UNITED KINGDOM OF GREAT BRITAIN AND NORTHERN IRELAND,

Member States of the European Union, hereinafter referred to as the ‘Member States’,

of the one part, and

NEW ZEALAND,

of the other part,

hereinafter referred to as ‘the Parties’,

CONSIDERING their shared values and close historical, political, economic and cultural ties,

WELCOMING the progress made in developing their mutually beneficial relationship since the adoption of the Joint Declaration on Relations and Cooperation between the European Union and New Zealand on 21 September 2007,

REAFFIRMING their commitment to the purposes and principles of the Charter of the United Nations (‘UN Charter’) and to strengthening the role of the United Nations (‘UN’),

REAFFIRMING their commitment to democratic principles and human rights as laid down in the Universal Declaration of Human Rights and other relevant international human rights instruments as well as to the principles of the rule of law and good governance,

ACKNOWLEDGING the New Zealand Government's particular commitment to the principles of the Treaty of Waitangi,

EMPHASISING the comprehensive nature of their relationship and the importance of providing a coherent framework to promote the development of this relationship,

EXPRESSING their common will to elevate their relations into a strengthened partnership,

CONFIRMING their desire to intensify and develop their political dialogue and cooperation,

DETERMINED to consolidate, deepen and diversify cooperation in areas of mutual interest, at the bilateral, regional and global levels and for their mutual benefit,

RECOGNISING the need for enhanced cooperation in the fields of justice, freedom and security,

RECOGNISING their desire to promote sustainable development in its economic, social and environmental dimensions,

FURTHER RECOGNISING their common interest in promoting mutual understanding and strong people-to-people links, including through tourism, reciprocal arrangements that enable young people to visit other countries and take up work and study options, and other short-term visits,

REAFFIRMING their strong commitment to promote economic growth, global economic governance, financial stability and effective multilateralism,

REAFFIRMING their commitment to cooperating in promoting international peace and security,

BUILDING ON the agreements concluded between the Union and New Zealand, notably in relation to crisis management, science and technology, air services, conformity assessment procedures and sanitary measures,

NOTING that in case the Parties decided, within the framework of this Agreement, to enter into specific agreements in the area of freedom, security and justice which were to be concluded by the Union pursuant to Title V of Part Three of the Treaty on the Functioning of the European Union, the provisions of such future agreements would not bind the United Kingdom and/or Ireland unless the Union, simultaneously with the United Kingdom and/or Ireland as regards their respective previous bilateral relations, notifies New Zealand that the United Kingdom and/or Ireland has/have become bound by such agreements as part of the Union in accordance with Protocol No 21 on the position of the United Kingdom and Ireland in respect of the area of freedom, security and justice annexed to the Treaty on European Union and the Treaty on the Functioning of the European Union. Likewise, any subsequent Union internal measures which were to be adopted pursuant to the above mentioned Title V to implement this Agreement would not bind the United Kingdom and/or Ireland unless they have notified their wish to take part or accept such measures in accordance with Protocol No 21. Also noting that such future agreements or such subsequent Union internal measures would fall within Protocol No 22 on the position of Denmark annexed to those Treaties,

HAVE AGREED AS FOLLOWS:

TITLE I

GENERAL PROVISIONS

Article 1

Purpose of the Agreement

The purpose of this Agreement is to establish a strengthened partnership between the Parties and to deepen and enhance cooperation on issues of mutual interest, reflecting shared values and common principles, including through the intensification of high-level dialogue.

Article 2

Basis of cooperation

1. The Parties reaffirm their commitment to democratic principles, human rights and fundamental freedoms, and the rule of law and good governance.

Respect for democratic principles and human rights and fundamental freedoms as laid down in the Universal Declaration of Human Rights and other relevant international human rights instruments, and for the principle of the rule of law, underpins the domestic and international policies of the Parties and constitutes an essential element of this Agreement.

2. The Parties reaffirm their commitment to the UN Charter and the shared values expressed therein.

3. The Parties reaffirm their commitment to promoting sustainable development and growth in all its dimensions, contributing to the attainment of internationally agreed development goals and cooperating to address global environmental challenges, including climate change.

4. The Parties emphasise their shared commitment to the comprehensive nature of their bilateral relationship and to broadening and deepening this relationship including through the conclusion of specific agreements or arrangements.

5. The implementation of this Agreement shall be based on the principles of dialogue, mutual respect, equal partnership, consensus and respect for international law.

Article 3

Dialogue

1. The Parties agree to enhance their regular dialogue in all areas covered by this Agreement with a view to fulfilling its purpose.

2. Dialogue between the Parties shall take place through contacts, exchanges and consultations at any level, particularly in the following forms:

|

(a) |

meetings at leaders level, which shall be held regularly whenever the Parties deem it necessary; |

|

(b) |

consultations and visits at ministerial level, which shall be held on such occasions and at such locations as determined by the Parties; |

|

(c) |

consultations at the level of foreign ministers, which shall be held regularly, where possible annually; |

|

(d) |

meetings at the level of senior officials for consultations on issues of mutual interest or briefings and cooperation on major domestic or international developments; |

|

(e) |

sectoral dialogues on issues of common interest; and |

|

(f) |

exchanges of delegations between European Parliament and the New Zealand Parliament. |

Article 4

Cooperation in regional and international organisations

The Parties undertake to cooperate by exchanging views on policy issues of mutual interest, and, where appropriate, sharing information on positions in regional and international fora and organisations.

TITLE II

POLITICAL DIALOGUE AND COOPERATION ON FOREIGN POLICY AND SECURITY MATTERS

Article 5

Political dialogue

The Parties agree to enhance their regular political dialogue at all levels, especially with a view to discussing matters of common concern covered by this Title and strengthening their common approach to international issues. The Parties agree that for the purposes of this Title the term ‘political dialogue’ shall mean exchanges and consultations, whether formal or informal, at any level of government.

Article 6

Commitment to democratic principles, human rights and the rule of law

In the interests of advancing the Parties' shared commitment to democratic principles, human rights and the rule of law, the Parties agree to:

|

(a) |

promote core principles regarding democratic values, human rights and the rule of law, including in multilateral fora; and |

|

(b) |

collaborate on and coordinate, where appropriate, in the practical advancement of democratic principles, human rights and the rule of law, including in third countries. |

Article 7

Crisis management

The Parties reaffirm their commitment to promoting international peace and security including, inter alia, through the Agreement between New Zealand and the European Union establishing a framework for the participation of New Zealand in European Union crisis management operations, signed in Brussels on 18 April 2012.

Article 8

Countering the proliferation of weapons of mass destruction

1. The Parties consider that the proliferation of weapons of mass destruction (‘WMD’) and their means of delivery, both to state and non-state actors, represents one of the most serious threats to international peace and security. The Parties reaffirm their commitment to comply with and fully implement at the national level their existing obligations under international disarmament and non-proliferation treaties and agreements and other relevant international obligations. The Parties agree to cooperate and to contribute to countering the proliferation of WMD and their means of delivery. The Parties agree that this provision constitutes an essential element of this Agreement.

2. The Parties furthermore agree to cooperate and to contribute to preventing the proliferation of WMD and their means of delivery by:

|

(a) |

taking steps, as appropriate, to sign, ratify, or accede to, and fully implement all other relevant international instruments; |

|

(b) |

maintaining an effective system of national export controls, controlling the export as well as transit of WMD-related goods, including a WMD end-use control on dual-use technologies and containing effective sanctions for breaches of export controls. |

3. The Parties agree to establish a regular political dialogue on those issues.

Article 9

Small arms and light weapons

1. The Parties recognise that the illicit manufacture, transfer and circulation of small arms and light weapons (‘SALW’), including their ammunition, and their excessive accumulation, poor management, inadequately secured stockpiles and uncontrolled spread continue to pose a serious threat to international peace and security.

2. The Parties reaffirm their commitment to observing and fully implementing their respective obligations to deal with the illicit trade in SALW, including their ammunition, under existing international agreements and UN Security Council (‘UNSC’) resolutions, as well as their commitments within the framework of other international instruments applicable in this area, such as the UN Programme of Action to Prevent, Combat and Eradicate the Illicit Trade in Small Arms and Light Weapons in All Its Aspects.

3. The Parties undertake to cooperate and to ensure coordination and complementarity in their efforts to deal with the illicit trade in SALW, including their ammunition, at global, regional, sub-regional and national levels and agree to establish a regular political dialogue on those issues.

Article 10

International Criminal Court

1. The Parties reaffirm that the most serious crimes of concern to the international community as a whole should not go unpunished and that their prosecution should be ensured by measures at either the domestic or the international level, including through the International Criminal Court.

2. In promoting the strengthening of peace and international justice, the Parties reaffirm their determination to:

|

(a) |

take steps to implement the Rome Statute of the International Criminal Court (‘Rome Statute’) and, as appropriate, related instruments; |

|

(b) |

share experience with regional partners in the adoption of legal adjustments required to allow for the ratification and implementation of the Rome Statute; and |

|

(c) |

cooperate to further the goal of the universality and integrity of the Rome Statute. |

Article 11

Cooperation in combating terrorism

1. The Parties reaffirm the importance of the fight against terrorism in full respect for the rule of law, international law, in particular the UN Charter and relevant UNSC resolutions, human rights law, refugee law and international humanitarian law.

2. Within this framework and taking into account the UN Global Counter-Terrorism Strategy, contained in UN General Assembly Resolution 60/288 of 8 September 2006, the Parties agree to cooperate in the prevention and suppression of terrorism, in particular, as follows:

|

(a) |

in the framework of the full implementation of UNSC Resolutions 1267, 1373 and 1540 and other applicable UN resolutions and international instruments; |

|

(b) |

by exchanging information on terrorist groups and their support networks in accordance with applicable international and national law; |

|

(c) |

by exchanging views on:

|

|

(d) |

by cooperating so as to deepen the international consensus on the fight against terrorism and its normative framework and by working towards an agreement on the Comprehensive Convention on International Terrorism as soon as possible so as to complement the existing UN counter-terrorism instruments; and |

|

(e) |

by promoting cooperation among UN Member States to effectively implement the UN Global Counter-Terrorism Strategy by all appropriate means. |

3. The Parties reaffirm their commitment to the international standards established by the Financial Action Task Force (‘FATF’) to combat the financing of terrorism.

4. The Parties reaffirm their commitment to work together to provide counter-terrorism capacity-building assistance to other states that require resources and expertise to prevent and respond to terrorist activity, including in the context of the Global Counter-Terrorism Forum (GCTF).

TITLE III

COOPERATION ON GLOBAL DEVELOPMENT AND HUMANITARIAN AID

Article 12

Development

1. The Parties reaffirm their commitment to supporting sustainable development in developing countries in order to reduce poverty and contribute to a more secure, equitable and prosperous world.

2. The Parties recognise the value of working together to ensure development activities have greater impact, reach and influence, including in the Pacific.

3. To this end the Parties agree to:

|

(a) |

exchange views and, where appropriate, coordinate positions on development issues in regional and international fora to promote inclusive and sustainable growth for human development; and |

|

(b) |

exchange information on their respective development programmes and, where appropriate, coordinate engagement in-country to increase their impact on sustainable development and poverty eradication. |

Article 13

Humanitarian aid

The Parties reaffirm their common commitment to humanitarian aid and shall endeavour to offer coordinated responses as appropriate.

TITLE IV

COOPERATION ON ECONOMIC AND TRADE MATTERS

Article 14

Dialogue on economic, trade and investment matters

1. The Parties are committed to dialogue and cooperation in economic and trade and investment related areas in order to facilitate bilateral trade and investment flows. At the same time, recognising the importance of pursuing this through a rule-based multilateral trading system, the Parties affirm their commitment to working together within the World Trade Organization (‘WTO’) to achieve further trade liberalisation.

2. The Parties agree to promote the exchange of information and the sharing of experiences on their respective macroeconomic policies and trends, including the exchange of information on the coordination of economic policies in the context of regional economic cooperation and integration.

3. The Parties shall pursue substantive dialogue aimed at promoting trade in goods, including agriculture and other primary commodities, raw materials, manufactured goods and high value-added products. The Parties recognise that a transparent, market-based approach is the best way to create an environment favourable to investment in the production of, and trade in such products and to foster their efficient allocation and use.

4. The Parties shall pursue substantive dialogue aimed at promoting bilateral trade in services and exchanging information and experiences on their respective supervisory environments. The Parties also agree to strengthen cooperation with a view to improving accounting, auditing, supervisory and regulatory systems for banking, insurance and other parts of the financial sector.

5. The Parties shall encourage the development of an attractive and stable environment for two-way investment through dialogue aimed at enhancing their mutual understanding and cooperation on investment issues, exploring mechanisms to facilitate investment flows and fostering stable, transparent and open rules for investors.

6. The Parties shall keep each other informed concerning the development of bilateral and international trade, investment and trade-related aspects of other policies, including their policy approaches to free trade agreements (‘FTAs’) and respective FTA agendas and regulatory issues, with a potential impact on bilateral trade and investment.

7. Such dialogue and cooperation on trade and investment will be pursued through, inter alia:

|

(a) |

an annual trade policy dialogue at the level of senior officials, complemented by ministerial meetings on trade, when determined by the Parties; |

|

(b) |

an annual agricultural trade dialogue; and |

|

(c) |

other sectoral exchanges, when determined by the Parties. |

8. The Parties undertake to cooperate on securing the conditions for and promoting increased trade and investment between them, including through the negotiation of new agreements, where feasible.

Article 15

Sanitary and phytosanitary issues

1. The Parties agree to strengthen cooperation on sanitary and phytosanitary (‘SPS’) issues within the framework of the WTO Agreement on the Application of Sanitary and Phytosanitary Measures and the Codex Alimentarius Commission, the World Organisation for Animal Health (‘OIE’) and the relevant international and regional organisations operating within the framework of the International Plant Protection Convention (‘IPPC’). Such cooperation shall aim to enhance the mutual understanding of each other's SPS measures and to facilitate trade between the Parties, and may include:

|

(a) |

the sharing of information; |

|

(b) |

applying import requirements to the entire territory of the other Party; |

|

(c) |

carrying out verification of all or part of the other Party's authorities' inspection and certification systems in accordance with the relevant international standards of the Codex Alimentarius, OIE and IPPC on the assessment of such systems; and |

|

(d) |

recognising pest-free and disease-free areas and areas of low pest or disease prevalence. |

2. For that purpose, the Parties commit to making full use of existing instruments such as the Agreement between the European Community and New Zealand on sanitary measures applicable to trade in live animals and animal products, signed in Brussels on 17 December 1996, and to cooperate in an appropriate bilateral forum on other SPS issues not covered by that Agreement.

Article 16

Animal welfare

The Parties also reaffirm the importance of maintaining their mutual understanding and cooperation on animal welfare matters, and will continue to share information and cooperate within the Animal Welfare Cooperation Forum of the European Commission and the competent authorities of New Zealand and to work closely together in the OIE on these matters.

Article 17

Technical barriers to trade

1. The Parties share the view that greater compatibility of standards, technical regulations and conformity assessment procedures is a key element in facilitating trade in goods.

2. The Parties recognise their mutual interest in reducing technical barriers to trade and to this end agree to cooperate within the framework of the WTO Agreement on Technical Barriers to Trade and through the Agreement on mutual recognition in relation to conformity assessment between the European Community and New Zealand, signed in Wellington on 25 June 1998.

Article 18

Competition policy

The Parties reaffirm their commitment to promoting competition in economic activities through their respective competition laws and regulations. The Parties agree to share information on competition policy and related issues and to enhance cooperation between their competition authorities.

Article 19

Government procurement

1. The Parties reaffirm their commitment to open and transparent government procurement frameworks which, consistent with their international obligations, promote value for money, competitive markets, and non-discriminatory purchasing practices and thus enhance trade between the Parties.

2. The Parties agree to further strengthen their consultation, cooperation and exchanges of experience and best practices in the area of government procurement on issues of mutual interest, including on their respective regulatory frameworks.

3. The Parties agree to explore ways to further promote access to each other's government procurement markets and exchange views on measures and practices which could adversely affect procurement trade between them.

Article 20

Raw materials

1. The Parties will enhance cooperation on issues relating to raw materials through bilateral dialogue or within relevant plurilateral settings or international institutions, at the request of either Party. In particular, this cooperation shall in particular aim at removing barriers to trade in raw materials, strengthening a rules-based global framework for trade in raw materials and promoting transparency in global markets for raw materials.

2. Topics for cooperation may include, inter alia:

|

(a) |

questions of supply and demand, bilateral trade and investment issues as well as issues of interest stemming from international trade; |

|

(b) |

tariff and non-tariff barriers for raw-material goods, related services and investments; |

|

(c) |

the parties' respective regulatory frameworks; and |

|

(d) |

best practices in relation to sustainable development of the mining industry, including minerals policy, land-use planning and permitting procedures. |

Article 21

Intellectual property

1. The Parties reaffirm the importance of their rights and obligations in relation to intellectual property rights, including copyright and related rights, trademarks, geographical indications, designs and patents, and their enforcement, in accordance with the highest international standards that the Parties adhere to.

2. The Parties agree to exchange information and share experiences on intellectual property issues including:

|

(a) |

the practice, promotion, dissemination, streamlining, management, harmonisation, protection and effective implementation of intellectual property rights; |

|

(b) |

the prevention of infringements of intellectual property rights; |

|

(c) |

the fight against counterfeiting and piracy, through the appropriate forms of cooperation; and |

|

(d) |

the functioning of bodies in charge of the protection and enforcement of intellectual property rights. |

3. The Parties agree to exchange information and promote dialogue on the protection of genetic resources, traditional knowledge and folklore.

Article 22

Customs

1. The Parties shall enhance cooperation on customs matters, including trade facilitation, with a view to further simplifying and harmonising customs procedures and promoting joint action in the context of relevant international initiatives.

2. Without prejudice to other forms of cooperation provided for under this Agreement, the Parties shall consider the possibility of concluding instruments on customs cooperation and mutual administrative assistance in customs matters.

Article 23

Cooperation on taxation matters

1. With a view to strengthening and developing economic activities while taking into account the need to develop an appropriate regulatory framework, the Parties recognise and commit themselves to implementing the principles of good governance in the area of tax, i.e. transparency, exchange of information and fair tax competition.

2. To that effect, in accordance with their respective competences, the Parties will work to improve international cooperation in the area of tax, facilitate the collection of legitimate tax revenues and develop measures for the effective implementation of the principles of good governance referred to in paragraph 1.

Article 24

Transparency

The Parties recognise the importance of transparency and due process in the administration of their trade-related laws and regulations, and to this end the Parties reaffirm their commitments as set out in WTO Agreements, including Article X of the General Agreement on Tariffs and Trade 1994 and Article III of the General Agreement on Trade in Services.

Article 25

Trade and sustainable development

1. The Parties recognise the contribution to the goal of sustainable development that can be made by promoting mutually supportive trade, environment and labour policies and reaffirm their commitment to promoting global and bilateral trade and investment in such a way as to contribute to that goal.

2. The Parties recognise the right of each Party to establish its own levels of domestic environmental and labour protection, and to adopt or modify its own relevant laws and policies, consistent with their commitment to internationally recognised standards and agreements.

3. The Parties recognise that it is inappropriate to encourage trade or investment by lowering or offering to lower the levels of protection afforded in domestic environmental or labour laws. The Parties recognise that it is also inappropriate to use environmental or labour laws, policies and practices for trade-protectionist purposes.

4. The Parties shall exchange information and share experience on their actions to promote coherence and mutual supportiveness between trade, social and environmental objectives, including on areas such as corporate social responsibility, environmental goods and services, climate-friendly products and technologies and sustainability assurance schemes, as well as on the other aspects set out in Title VIII, and shall strengthen dialogue and cooperation on sustainable development issues that may arise in the context of trade relations.

Article 26

Dialogue with civil society

The Parties shall encourage dialogue between governmental and non-governmental organisations, such as trade unions, employers, business associations, chambers of commerce and industry, with a view to promoting trade and investment in areas of mutual interest.

Article 27

Business cooperation

The Parties shall encourage stronger business-to-business links and enhance links between government and business through activities involving business, including in the context of the Asia-Europe Meeting (‘ASEM’).

In particular, this cooperation shall aim at improving the competitiveness of small and medium-sized enterprises.

Article 28

Tourism

Recognising the value of tourism in deepening mutual understanding and appreciation between the peoples of the Union and New Zealand and the economic benefits flowing from increased tourism, the Parties agree to cooperate with a view to increasing tourism in both directions between the Union and New Zealand.

TITLE V

COOPERATION ON JUSTICE, FREEDOM AND SECURITY

Article 29

Legal cooperation

1. The Parties agree to develop cooperation in civil and commercial matters, in particular as regards the negotiation, ratification and implementation of multilateral conventions on judicial cooperation in civil matters and, in particular, the Conventions of the Hague Conference on Private International Law in the field of international legal cooperation and litigation as well as the protection of children.

2. As regards judicial cooperation in criminal matters, the Parties shall continue engaging in matters of mutual legal assistance, in accordance with relevant international instruments.

This may include, where appropriate, accession to and implementation of relevant UN instruments. It may also include, where appropriate, support for relevant Council of Europe instruments and cooperation between relevant New Zealand authorities and Eurojust.

Article 30

Law-enforcement cooperation

The Parties agree to cooperate among law-enforcement authorities, agencies and services and to contribute to disrupting and dismantling transnational crime and terrorist threats common to the Parties. Cooperation among law-enforcement authorities, agencies and services may take the form of mutual assistance in investigations, the sharing of investigative techniques, joint education and training of law-enforcement personnel and any other type of joint activity and assistance as may be mutually determined by the Parties.

Article 31

Combating organised crime and corruption

1. The Parties reaffirm their commitment to cooperating on preventing and combating transnational organised, economic and financial crime, corruption, and counterfeiting and illegal transactions, through full compliance with their existing mutual international obligations in this area, including those on effective cooperation in the recovery of assets or funds derived from acts of corruption.

2. The Parties shall promote the implementation of the UN Convention against Transnational Organized Crime, adopted on 15 November 2000.

3. The Parties shall also promote the implementation of the UN Convention against Corruption, adopted on 31 October 2002, taking account of the principles of transparency and participation of civil society.

Article 32

Combating illicit drugs

1. Within their respective powers and competences, the Parties shall cooperate to ensure a balanced and integrated approach towards drug issues.

2. The Parties shall cooperate with a view to dismantling the transnational criminal networks involved in drug-trafficking through, inter alia, the exchange of information, training or the sharing of best practices, including special investigative techniques. A particular effort shall be made to combat the penetration of the licit economy by criminals.

Article 33

Combating cybercrime

1. The Parties shall strengthen cooperation to prevent and combat high-technology, cyber- and electronic crimes and the distribution of illegal content, including terrorist content and child sexual abuse material, via the internet, through exchanging information and practical experiences in compliance with their national legislation and international human rights obligations.

2. The Parties shall exchange information in the fields of the education and training of cybercrime investigators, the investigation of cybercrime, and digital forensic science.

Article 34

Combating money-laundering and the financing of terrorism

1. The Parties reaffirm the need to cooperate on preventing the use of their financial systems to launder the proceeds of all criminal activities including drug-trafficking and corruption and on combating the financing of terrorism. This cooperation extends to the recovery of assets or funds derived from criminal activities.

2. The Parties shall exchange relevant information within the framework of their respective legislation and implement appropriate measures to combat money-laundering and the financing of terrorism in accordance with standards adopted by relevant international bodies active in this area, such as the FATF.

Article 35

Migration and asylum

1. The Parties reaffirm their commitment to cooperating and exchanging views in the areas of migration, including irregular immigration, trafficking in human beings, asylum, integration, labour mobility and development, visas, document security, biometrics and border management.

2. The Parties agree to cooperate in order to prevent and control irregular immigration. To this end:

|

(a) |

New Zealand shall readmit any of its nationals irregularly present on the territory of a Member State, upon request by the latter and without further formalities; and |

|

(b) |

each Member State shall readmit any of its nationals irregularly present on the territory of New Zealand, upon request by the latter and without further formalities. |

Consistent with their international obligations, including under the Convention on International Civil Aviation, signed on 7 December 1944, the Member States and New Zealand will provide their nationals with appropriate identity documents for such purposes.

3. The Parties will, at the request of either Party, explore the possibility of concluding an agreement between New Zealand and the Union on readmission in accordance with Article 52(1) of this Agreement. This agreement will include consideration of appropriate arrangements for third-country nationals and stateless persons.

Article 36

Consular protection

1. New Zealand agrees that the diplomatic and consular authorities of any represented Member State may exercise consular protection in New Zealand on behalf of other Member States which do not have accessible permanent representation in New Zealand.

2. The Union and the Member States agree that the diplomatic and consular authorities of New Zealand may exercise consular protection on behalf of a third country and that third countries may exercise consular protection on behalf of New Zealand in the Union in places where New Zealand or the third country concerned do not have accessible permanent representation.

3. Paragraphs 1 and 2 are intended to dispense with any requirements for notification or consent which might otherwise apply.

4. The Parties agree to facilitate a dialogue on consular affairs between their respective competent authorities.

Article 37

Protection of personal data

1. The Parties agree to cooperate with a view to advancing their relationship following the European Commission's decision on the adequate protection of personal data by New Zealand, and to ensuring a high level of protection of personal data in accordance with relevant international instruments and standards, including the Organisation for Economic Cooperation and Development (‘OECD’) Guidelines on the Protection of Privacy and Transborder Flows of Personal Data.

2. Such cooperation may include, inter alia, the exchange of information and expertise. It may also include cooperation between regulatory counterparts in bodies such as the OECD's Working Party on Security and Privacy in the Digital Economy and the Global Privacy Enforcement Network.

TITLE VI

COOPERATION IN THE AREAS OF RESEARCH, INNOVATION AND THE INFORMATION SOCIETY

Article 38

Research and innovation

1. The Parties agree to strengthen their cooperation in the areas of research and innovation.

2. The Parties shall encourage, develop and facilitate cooperative activities in the areas of research and innovation for peaceful purposes, in support of or complementary to the Agreement on scientific and technological cooperation between the European Community and the Government of New Zealand, signed in Brussels on 16 July 2008.

Article 39

Information society

1. Recognising that information and communication technologies are key elements of modern life and of vital importance to economic and social development, the Parties agree to exchange views on their respective policies in this field.

2. Cooperation in this area may focus, inter alia, on:

|

(a) |

exchanging views on different aspects of the information society, in particular high-speed broadband rollout, electronic communications policies and regulation, including universal service, licensing and general authorisations, the protection of privacy and personal data, e-government and open government, internet security and the independence and efficiency of regulatory authorities; |

|

(b) |

the interconnection and interoperability of research networks and computing and scientific data infrastructures and services, including in a regional context; |

|

(c) |

the standardisation, certification and dissemination of new information and communication technologies; |

|

(d) |

security, trust and privacy aspects of information and communication technologies and services, including the promotion of online safety, the combating of misuses of information technology and all forms of electronic media, and the sharing of information; and |

|

(e) |

exchanging views on measures to address the issue of international mobile roaming costs. |

TITLE VII

COOPERATION IN THE AREA OF EDUCATION, CULTURE AND PEOPLE TO PEOPLE LINKS

Article 40

Education and training

1. The Parties acknowledge the crucial contribution of education and training to the creation of quality jobs and sustainable growth for knowledge-based economies, notably through the development of citizens who are not only prepared for informed and effective participation in democratic life, but who also have the capacity to solve problems and take up opportunities that result from the globally connected world of the 21st century. Consequently, the Parties recognise that they have a common interest in cooperating in the areas of education and training.

2. In accordance with their mutual interests and the aims of their policies on education, the Parties undertake to support jointly appropriate cooperative activities in the field of education and training. This cooperation will concern all education sectors and may include:

|

(a) |

cooperating on learning mobility of individuals through the promotion and facilitation of the exchange of students, researchers, academic and administrative staff of tertiary education institutions and teachers; |

|

(b) |

joint cooperation projects between education and training institutions in the Union and New Zealand with a view to promoting curriculum development, joint study programmes and degrees and staff and student mobility; |

|

(c) |

institutional cooperation, linkages and partnerships with a view to strengthening the educational element of the knowledge triangle and to promoting the exchange of experience and know-how; and |

|

(d) |

support for policy reform through studies, conferences, seminars, working groups, benchmarking exercises and the exchange of information and good practice, particularly in view of the Bologna and Copenhagen processes and the tools and principles in place that increase transparency and innovation in education. |

Article 41

Cultural, audiovisual and media cooperation

1. The Parties agree to promote closer cooperation in the cultural and creative sectors, in order to enhance, inter alia, mutual understanding and knowledge of their respective cultures.

2. The Parties shall endeavour to take appropriate measures to promote cultural exchanges and carry out joint initiatives in various cultural areas, using available cooperation instruments and frameworks.

3. The Parties shall endeavour to promote the mobility of culture professionals, works of art and other cultural objects between New Zealand and the Union and its Member States.

4. The Parties agree to explore, through policy dialogue, a range of ways in which cultural objects held outside their countries of origin can be made accessible to the communities in which those objects originated.

5. The Parties shall encourage intercultural dialogue between civil society organisations as well as individuals from both Parties.

6. The Parties agree to cooperate, notably through policy dialogue, in relevant international fora, in particular the United Nations Education, Science and Culture Organization (UNESCO), in order to pursue common objectives and to foster cultural diversity, including through the implementation of the UNESCO Convention on the Protection and Promotion of Diversity of Cultural Expressions.

7. The Parties shall encourage, support and facilitate exchanges, cooperation and dialogue between institutions and professionals in the audiovisual and media sectors.

Article 42

People-to-people links

Recognising the value of people-to-people links and their contribution to enhancing understanding between the Union and New Zealand, the Parties agree to encourage, foster and deepen such links as appropriate. Such links may include exchanges of officials and short-term internships for post-graduate students.

TITLE VIII

COOPERATION IN THE AREA OF SUSTAINABLE DEVELOPMENT, ENERGY AND TRANSPORT

Article 43

Environment and natural resources

1. The Parties agree to cooperate on environmental matters, including the sustainable management of natural resources. The aim of such cooperation is to promote environmental protection and to mainstream environmental considerations into relevant sectors of cooperation, including in an international and regional context.

2. The Parties agree that cooperation may be undertaken through modes such as dialogue, workshops, seminars, conferences, collaborative programmes and projects, the sharing of information such as best practices, and exchanges of experts, including at the bilateral or multilateral level. The topics and objectives for cooperation shall be jointly identified at the request of either Party.

Article 44

Health improvement, protection and regulation

1. The Parties agree to enhance cooperation in the field of health, including in the context of globalisation and demographic change. Efforts shall be made to promote cooperation and exchanges of information and experiences on:

|

(a) |

health protection; |

|

(b) |

communicable disease surveillance (such as influenza and acute disease outbreaks) and other activities within the scope of the International Health Regulations (2005), including preparedness actions against major cross-border threats, in particular preparedness planning and risk assessment; |

|

(c) |

cooperation on standards, and conformity assessment to manage regulation and risk from products (including pharmaceuticals and medical devices); |

|

(d) |

issues relating to the implementation of the World Health Organisation (‘WHO’) Framework Convention on Tobacco Control; and |

|

(e) |

issues relating to the implementation of the WHO Global Code of Practice on the International Recruitment of Health Personnel. |

2. The Parties reaffirm their commitments to respect, promote and effectively implement, as appropriate, internationally recognised health practices and standards.

3. The forms of cooperation may include, inter alia, specific programmes and projects, as mutually agreed, as well as dialogue, cooperation and initiatives on topics of common interest at the bilateral or multilateral level.

Article 45

Climate change

1. The Parties acknowledge climate change as a global and urgent concern that requires collective action consistent with the overall goal of keeping the increase in global average temperature below 2 degrees Celsius above pre-industrial levels. Within the scope of their respective competences and without prejudice to discussions in other fora, the Parties agree to cooperate in areas of joint interest, including but not limited to:

|

(a) |

the transition to economies with low greenhouse-gas emissions through nationally appropriate mitigation strategies and actions, including green growth strategies; |

|

(b) |

the design, implementation and operation of market-based mechanisms, and in particular of carbon-trading schemes; |

|

(c) |

public- and private-sector financing instruments for climate action; |

|

(d) |

low greenhouse-gas emission technology research, development and deployment; and |

|

(e) |

the monitoring of greenhouse gases and the analysis of their effects, including developing and implementing adaptation strategies as appropriate. |

2. Both Parties agree to further cooperate on international developments in this area and, in particular, on progress towards the adoption of a new post-2020 international agreement under the UN Framework Convention on Climate Change as well as on complementary cooperative initiatives that would help address the mitigation gap before 2020.

Article 46

Disaster risk management and civil protection

The Parties recognise the need to manage both domestic and global natural and man-made disaster risks. The Parties affirm their common commitment to improving prevention, mitigation, preparedness, response and recovery measures in order to increase the resilience of their societies and infrastructure, and to cooperate as appropriate, at the bilateral and multilateral political level to improve global disaster risk-management outcomes.

Article 47

Energy

The Parties recognise the importance of the energy sector, and the role of a well-functioning market in energy. The Parties acknowledge the significance of energy to sustainable development, economic growth and its contribution to the attainment of internationally agreed development goals, as well as the importance of cooperation to address global environmental challenges, in particular climate change. The Parties shall endeavour, within the scope of their respective competences, to enhance cooperation in this field with a view to:

|

(a) |

developing policies to increase energy security; |

|

(b) |

promoting global energy trade and investment; |

|

(c) |

improving competitiveness; |

|

(d) |

improving the functioning of global energy markets; |

|

(e) |

exchanging information and policy experiences through existing multilateral energy fora; |

|

(f) |

promoting the use of renewable energy sources as well as the development and uptake of clean, diverse and sustainable energy technologies, including renewable and low-emission energy technologies; |

|

(g) |

achieving rational use of energy with contributions from both the supply and demand sides by promoting energy efficiency in the energy production, transportation and distribution and the end-use of energy; |

|

(h) |

implementing their respective international commitments to rationalise and phase out over the medium term inefficient fossil-fuel subsidies that encourage wasteful consumption; and |

|

(i) |

sharing best practices in energy exploration and production. |

Article 48

Transport

1. The Parties shall cooperate in all relevant areas of transport policy, including integrated transport policy, with a view to improving the movement of goods and passengers, promoting maritime and aviation safety and security, promoting environmental protection and increasing the efficiency of their transport systems.

2. Cooperation and dialogue between the Parties in this area should aim to promote:

|

(a) |

the exchange of information on their respective policies and practices; |

|

(b) |

the strengthening of aviation relations between the Union and New Zealand with a view to:

|

|

(c) |

the goals of unrestricted access to the international maritime markets and trade based on fair competition on a commercial basis; and |

|

(d) |

mutual recognition of driving licences for land-based motor vehicles. |

Article 49

Agriculture, rural development and forestry

1. The Parties agree to encourage cooperation and dialogue in agriculture, rural development and forestry.

2. Areas in which activities could be considered include, but are not limited to, agricultural policy, rural development policy, the structure of land-based sectors and geographical indications.

3. The Parties agree to cooperate, at the national and international level, on sustainable forest management and related policies and regulations, including measures to combat illegal logging and related trade, as well as the promotion of good forest governance.

Article 50

Fisheries and maritime affairs

1. The Parties shall strengthen dialogue and cooperation on issues of common interest in the areas of fisheries and maritime affairs. The Parties shall aim to promote long-term conservation and sustainable management of marine living resources, the prevention and combat of illegal, unreported and unregulated fishing (‘IUU fishing’) and the implementation of an ecosystem-based approach to management.

2. The Parties may cooperate and exchange information with regard to the conservation of marine living resources through the regional fisheries management organisations (‘RFMOs’) and multilateral fora (the UN, the Food and Agriculture Organization of the United Nations). In particular, the Parties shall cooperate in order to:

|

(a) |

ensure, through effective management by the Western and Central Pacific Fisheries Commission, and based on the best available science, the long-term conservation and sustainable use of highly migratory fish stocks throughout their range in the western and central Pacific Ocean, including by giving full recognition, in accordance with the relevant UN Conventions and other international instruments, to the special requirements of Small Island Developing States and Territories and ensuring a transparent decision-making process; |

|

(b) |

ensure the conservation and rational use of marine living resources under the purview of the Commission for the Conservation of Antarctic Marine Living Resources, including efforts to combat IUU activities in the area to which the Convention on the Conservation of Antarctic Marine Living Resources applies; |

|

(c) |

ensure the adoption and implementation of effective conservation and management measures for the stocks under the purview of the South Pacific RFMO; and |

|

(d) |

facilitate accession to RFMOs where one Party is a Member and the other an acceding Party. |

3. The Parties shall cooperate to promote an integrated approach to maritime affairs at international level.

4. The Parties shall hold a regular biennial dialogue at the level of senior officials, in order to strengthen dialogue and cooperation as well as to exchange information and experience on fisheries policy and maritime affairs.

Article 51

Employment and social affairs

1. The Parties agree to enhance cooperation in the field of employment and social affairs, including in the context of the social dimension of globalisation and demographic change. Efforts shall be made to promote cooperation and the exchange of information and experience regarding employment and labour matters. Areas of cooperation may include employment policies, labour law, gender issues, non-discrimination in employment, social inclusion, social security and social protection policies, industrial relations, social dialogue, lifelong skills development, youth employment, health and safety in the workplace, corporate social responsibility and decent work.

2. The Parties reaffirm the need to support a process of globalisation which is beneficial to all and to promote full and productive employment and decent work as a key element of sustainable development and poverty reduction. In this context, the Parties recall the International Labour Organisation (‘ILO’) Declaration on Social Justice for a Fair Globalization.

3. The Parties reaffirm their commitment to respecting, promoting and effectively implementing internationally recognised labour principles and rights, as laid down in particular in the ILO Declaration on Fundamental Principles and Rights at Work.

4. The forms of cooperation may include, inter alia, specific programmes and projects, as mutually determined, as well as dialogue, cooperation and initiatives on topics of common interest at the bilateral or multilateral level.

TITLE IХ

INSTITUTIONAL FRAMEWORK

Article 52

Other agreements or arrangements

1. The Parties may complement this Agreement by concluding specific agreements or arrangements in any area of cooperation falling within its scope. Such specific agreements and arrangements concluded after the signature of this Agreement shall be an integral part of the overall bilateral relations as governed by this Agreement and shall form part of a common institutional framework. Existing agreements and arrangements between the Parties do not form part of the common institutional framework.

2. Nothing in this Agreement shall affect or prejudice the interpretation or application of other agreements between the Parties including those referred to in paragraph 1. In particular, the provisions of this Agreement shall not replace or affect in any way the dispute-settlement or termination provisions of other agreements between the Parties.

Article 53

Joint Committee

1. The Parties hereby establish a Joint Committee consisting of representatives of the Parties.

2. Consultations shall be held in the Joint Committee to facilitate the implementation and to further the general aims of this Agreement as well as to maintain overall coherence in relations between the Union and New Zealand.

3. The functions of the Joint Committee shall be to:

|

(a) |

promote the effective implementation of this Agreement; |

|

(b) |

monitor the development of the comprehensive relationship between the Parties; |

|

(c) |

request, as appropriate, information from committees or other bodies established under other specific agreements between the Parties that form part of the common institutional framework in accordance with Article 52(1), and consider any reports submitted by them; |

|

(d) |

exchange views and make suggestions on any issues of common interest, including future actions and the resources available to carry them out; |

|

(e) |

set priorities in relation to the purpose of this Agreement; |

|

(f) |

seek appropriate methods of forestalling problems which might arise in areas covered by this Agreement; |

|

(g) |

endeavour to resolve any dispute arising in the application or interpretation of this Agreement; |

|

(h) |

examine the information presented by a Party in accordance with Article 54; and |

|

(i) |

make recommendations and adopt decisions, where appropriate, to give effect to specific aspects of this Agreement. |

4. The Joint Committee shall operate by consensus. It shall adopt its own rules of procedure. It may set up subcommittees and working groups to deal with specific issues.

5. The Joint Committee shall normally meet once a year in the Union and New Zealand alternately, unless otherwise decided by both Parties. Special meetings of the Joint Committee shall be held at the request of either Party. The Joint Committee shall be co-chaired by the two sides. It shall normally meet at the level of senior officials.

Article 54

Modalities for implementation and dispute settlement

1. The Parties shall take any general or specific measures required to fulfil their obligations under this Agreement.

2. Without prejudice to the procedure described in paragraphs 3 to 8 of this Article, any dispute relating to the interpretation or application of this Agreement shall be resolved exclusively through consultations between the Parties within the Joint Committee. The Parties shall present the relevant information required for a thorough examination of the matter to the Joint Committee, with a view to resolving the dispute.

3. Reaffirming their strong and shared commitment to human rights and non-proliferation, the Parties agree that if either Party considers that the other Party has committed a particularly serious and substantial violation of any of the obligations described in Articles 2(1) and 8(1) as essential elements, which threatens international peace and security so as to require an immediate reaction, it shall immediately notify the other Party of this fact and the appropriate measure(s) it intends to take under this Agreement. The notifying Party shall advise the Joint Committee of the need to hold urgent consultations on the matter.

4. In addition, the particularly serious and substantial violation of the essential elements could serve as grounds for appropriate measures under the common institutional framework as referred to in Article 52(1).

5. The Joint Committee shall be a forum for dialogue and the Parties shall do their utmost to find an amicable solution in the unlikely event that a situation as described in paragraph 3 would arise. Where the Joint Committee is unable to reach a mutually acceptable solution within 15 days from the commencement of consultations, and no later than 30 days from the date of the notification described in paragraph 3, the matter shall be referred for consultations at the ministerial level, which shall be held for a further period of up to 15 days.

6. If no mutually acceptable solution has been found within 15 days from the commencement of consultations at the ministerial level, and no later than 45 days from the date of notification, the notifying Party may decide to take the appropriate measures notified in accordance with paragraph 3. In the Union, the decision to suspend would entail unanimity. In New Zealand, the decision to suspend would be taken by the Government of New Zealand in accordance with its laws and regulations.

7. For the purposes of this Article, ‘appropriate measures’ means the suspension in part, suspension in full or termination of this Agreement or, as the case may be, of another specific agreement that forms part of the common institutional framework as referred to in Article 52(1), pursuant to the relevant provisions of such agreement. Appropriate measures taken by a Party to suspend this Agreement in part, shall only apply to the provisions falling within Titles I to VIII. In the selection of appropriate measures, priority must be given to those which least disturb the relations between the Parties. These measures, which are subject to Article 52(2), shall be proportionate to the violation of obligations under this Agreement, and shall be in accordance with international law.

8. The Parties shall keep under constant review the development of the situation which prompted action under this Article. The Party taking the appropriate measures shall withdraw them as soon as warranted, and in any event as soon as the circumstances that gave rise to their application no longer exist.

TITLE Х

FINAL PROVISIONS

Article 55

Definitions

For the purposes of this Agreement, the term ‘the Parties’ means the Union or its Member States, or the Union and its Member States, in accordance with their respective competences, on the one hand, and New Zealand, on the other.

Article 56

Disclosure of information

1. Nothing in this Agreement shall cause prejudice to national laws and regulations or Union acts regarding public access to official documents.

2. Nothing in this Agreement shall be construed as requiring either Party to provide information, the disclosure of which it considers contrary to its essential security interests.

Article 57

Amendment

This Agreement may be amended by written agreement between the Parties. Such amendments shall enter into force on such date or dates as may be agreed by the Parties.

Article 58

Entry into force, duration and notification

1. This Agreement shall enter into force on the thirtieth day after the date on which the Parties have notified each other of the completion of their respective legal procedures necessary for that purpose.

2. Notwithstanding paragraph 1, New Zealand and the Union may provisionally apply mutually determined provisions of this Agreement pending its entry into force. Such provisional application shall commence on the thirtieth day after the date on which both New Zealand and the Union have notified each other of the completion of their respective internal procedures necessary for such provisional application.

3. This Agreement shall be valid indefinitely. Either Party may notify in writing the other Party of its intention to terminate this Agreement. The termination shall take effect six months after the date of the notification.

4. The notifications made in accordance with this Article shall be made to the General Secretariat of the Council of the European Union and to the Ministry of Foreign Affairs and Trade of New Zealand.

Article 59

Territorial application

This Agreement shall apply, on the one hand, to the territories in which the Treaty on European Union and the Treaty on the Functioning of the European Union apply and under the conditions laid down in those Treaties, and, on the other hand, to the territory of New Zealand, but shall not include Tokelau.

Article 60

Authentic texts

This Agreement is done in duplicate in the Bulgarian, Croatian, Czech, Danish, Dutch, English, Estonian, Finnish, French, German, Greek, Hungarian, Italian, Latvian, Lithuanian, Maltese, Polish, Portuguese, Romanian, Slovak, Slovenian, Spanish and Swedish languages, each text being equally authentic. In the event of any divergence between the texts of this Agreement the Parties shall refer the matter to the Joint Committee.

Съставено в Брюксел на пети октомври през две хиляди и шестнадесета година.

Hecho en Bruselas, el cinco de octubre de dos mil dieciséis.

V Bruselu dne pátého října dva tisíce šestnáct.

Udfærdiget i Bruxelles den femte oktober to tusind og seksten.

Geschehen zu Brüssel am fünften Oktober zweitausendsechzehn.

Kahe tuhande kuueteistkümnenda aasta oktoobrikuu viiendal päeval Brüsselis.

Έγινε στις Βρυξέλλες, στις πέντε Οκτωβρίου δύο χιλιάδες δεκαέξι.

Done at Brussels on the fifth day of October in the year two thousand and sixteen.

Fait à Bruxelles, le cinq octobre deux mille seize.

Sastavljeno u Bruxellesu petog listopada godine dvije tisuće šesnaeste.

Fatto a Bruxelles, addì cinque ottobre duemilasedici.

Briselē, divi tūkstoši sešpadsmitā gada piektajā oktobrī.

Priimta du tūkstančiai šešioliktų metų spalio penktą dieną Briuselyje.

Kelt Brüsszelben, a kétezer-tizenhatodik év október havának ötödik napján.

Magħmul fi Brussell, fil-ħames jum ta’ Ottubru fis-sena elfejn u sittax.

Gedaan te Brussel, vijf oktober tweeduizend zestien.

Sporządzono w Brukseli dnia piątego października roku dwa tysiące szesnastego.

Feito em Bruxelas, em cinco de outubro de dois mil e dezasseis.

Întocmit la Bruxelles la cinci octombrie două mii șaisprezece.

V Bruseli piateho októbra dvetisícšestnásť.

V Bruslju, dne petega oktobra leta dva tisoč šestnajst.

Tehty Brysselissä viidentenä päivänä lokakuuta vuonna kaksituhattakuusitoista.

Som skedde i Bryssel den femte oktober år tjugohundrasexton.

Voor het Koninkrijk België

Pour le Royaume de Belgique

Für das Königreich Belgien

Deze handtekening verbindt eveneens de Vlaamse Gemeenschap, de Franse Gemeenschap, de Duitstalige Gemeenschap, het Vlaamse Gewest, het Waalse Gewest en het Brussels Hoofdstedelijk Gewest.

Cette signature engage également la Communauté française, la Communauté flamande, la Communauté germanophone, la Région wallonne, la Région flamande et la Région de Bruxelles-Capitale.

Diese Unterschrift bindet zugleich die Deutschsprachige Gemeinschaft, die Flämische Gemeinschaft, die Französische Gemeinschaft, die Wallonische Region, die Flämische Region und die Region Brüssel-Hauptstadt.

За Република България

Za Českou republiku

For Kongeriget Danmark

Für die Bundesrepublik Deutschland

Eesti Vabariigi nimel

Thar cheann Na hÉireann

For Ireland

Για την Ελληνική Δημοκρατία

Por el Reino de España

Pour la République française

Za Republiku Hrvatsku

Per la Repubblica italiana

Για την Κυπριακή Δημοκρατία

Latvijas Republikas vārdā –

Lietuvos Respublikos vardu

Pour le Grand-Duché de Luxembourg

Magyarország részéről

Għar-Repubblika ta' Malta

Voor het Koninkrijk der Nederlanden

Für die Republik Österreich

W imieniu Rzeczypospolitej Polskiej

Pela República Portuguesa

Pentru România

Za Republiko Slovenijo

Za Slovenskú republiku

Suomen tasavallan puolesta

För Republiken Finland

För Konungariket Sverige

For the United Kingdom of Great Britain and Northern Ireland

За Европейския съюз

Por la Unión Europea

Za Evropskou unii

For Den Europæiske Union

Für die Europäische Union

Euroopa Liidu nimel

Για την Ευρωπαϊκή Ένωση

For the European Union

Pour l'Union européenne

Za Europsku uniju

Per l'Unione europea

Eiropas Savienības vārdā –

Europos Sąjungos vardu

Az Európai Unió részéről

Għall-Unjoni Ewropea

Voor de Europese Unie

W imieniu Unii Europejskiej

Pela União Europeia

Pentru Uniunea Europeană

Za Európsku úniu

Za Evropsko unijo

Euroopan unionin puolesta

För Europeiska unionen

For New Zealand

|

29.11.2016 |

EN |

Official Journal of the European Union |

L 321/31 |

Amendment to the Customs Convention on the International Transport of Goods Under the Cover of TIR Carnets (TIR Convention, 1975)

According to the UN Depositary Notification C.N.742.2016.TREATIES — XI.A.16 the following amendments to the TIR Convention enter into force on 1 January 2017 for all Contracting Parties:

|

|

Annex 6, new Explanatory Note 0.42 bis: Add a new Explanatory Note to Article 42 bis to read as follows:

|

|

|

Annex 2, Article 4, paragraph 2(i): For the existing text substitute:

|

|

|

Annex 2, Article 4, paragraph 2(iii): For the existing text substitute:

|

|

|

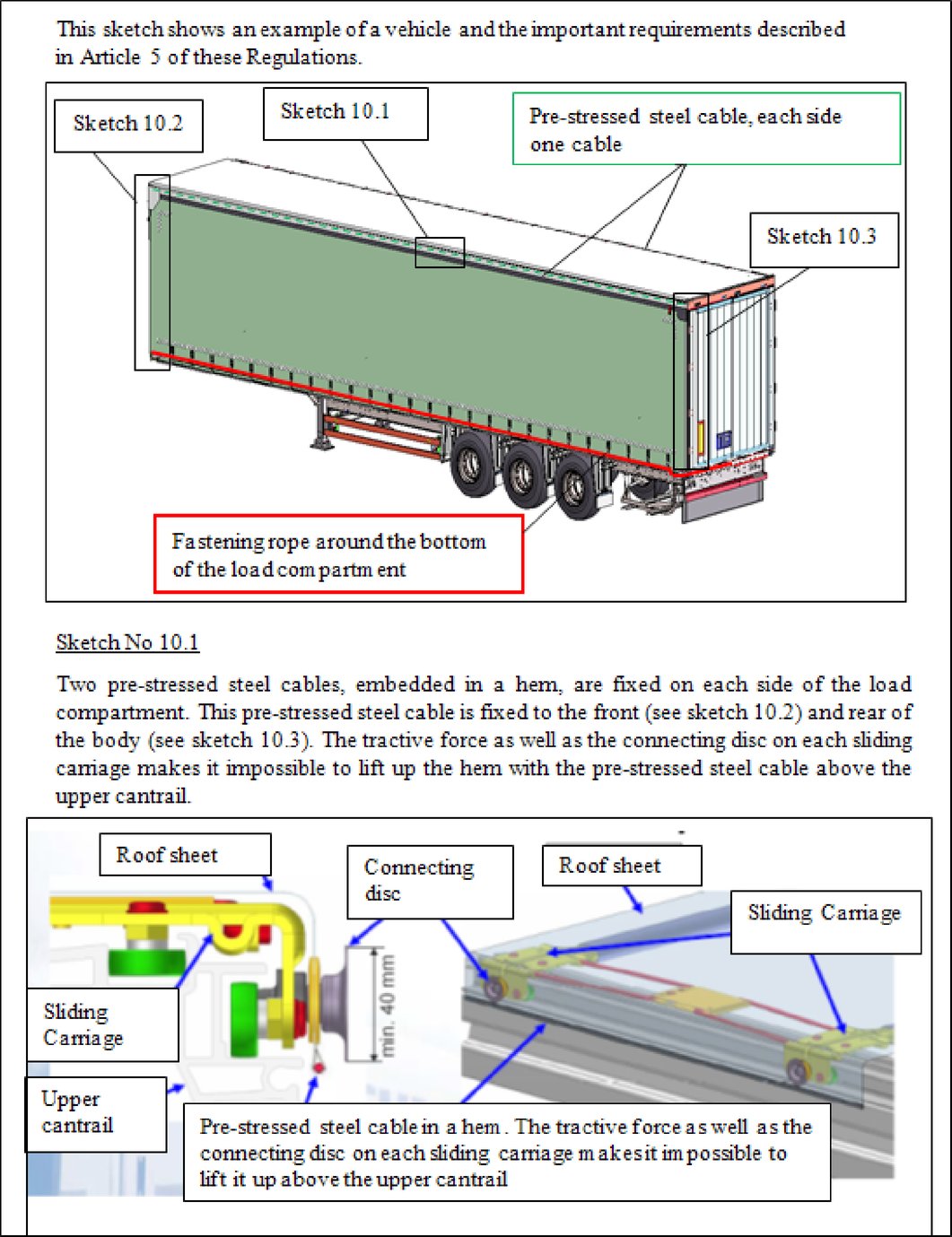

Annex 2, new Article 5: After the modified Article 4 insert: ‘Article 5 Vehicles with a sheeted sliding roof 1. Where applicable, the provisions of Articles 1, 2, 3 and 4 of these Regulations shall apply to vehicles with a sheeted sliding roof. In addition, these vehicles shall conform to the provisions of this Article. 2. The sheeted sliding roof shall fulfil the requirements set out in (i) to (iii) below.

An example of a possible system of construction is shown in sketch No 10, appended to these Regulations.’. |

|

|

Annex 2, Sketch No 9: For the existing Sketch No 9 substitute: ‘Sketch No 9 EXAMPLE OF A CONSTRUCTION OF A VEHICLE WITH SLIDING SHEETS

Sketch No 9 continued

Sketch No 9 continued:

|

|

|

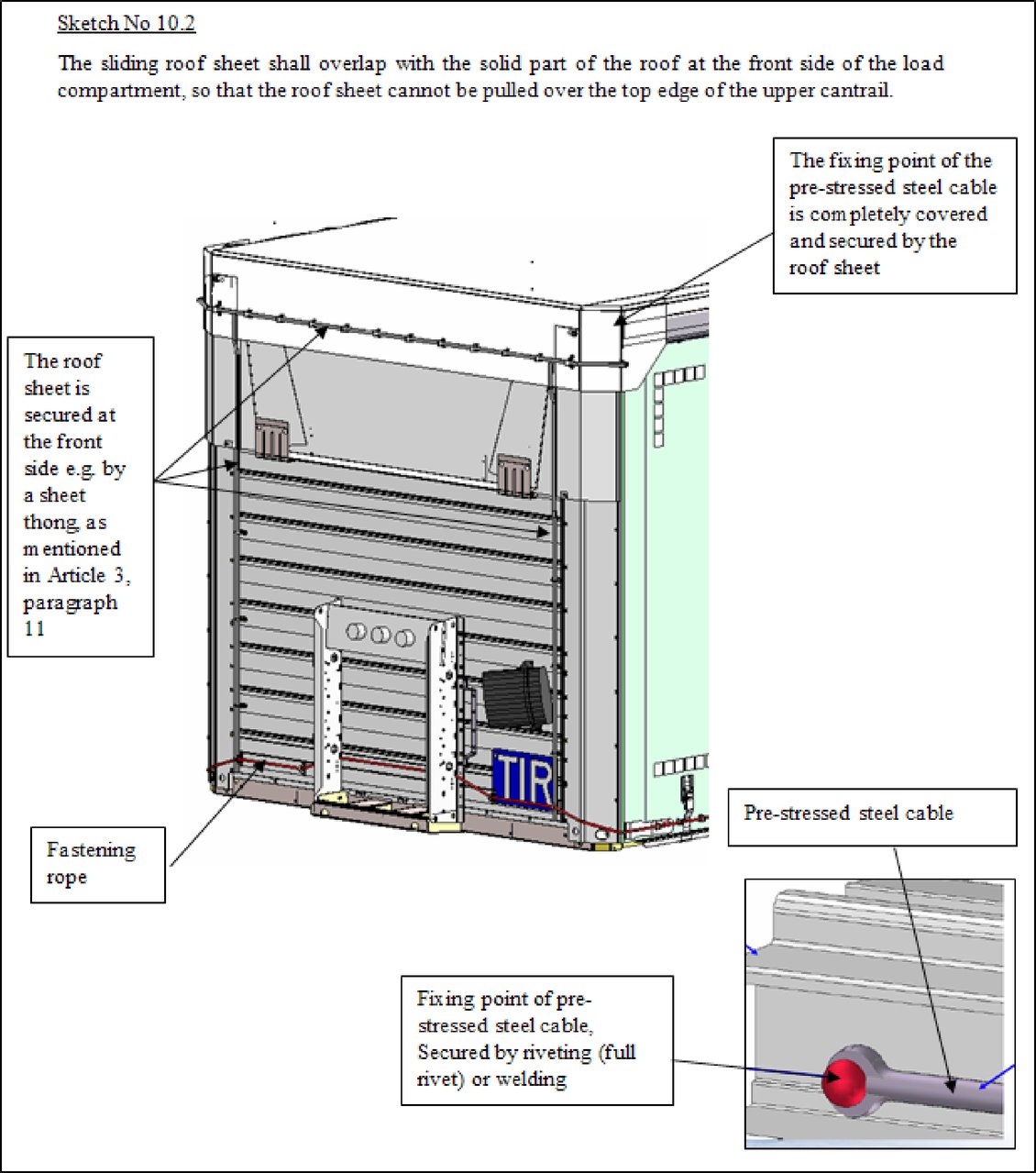

Annex 2, new Sketch No 10: After new Sketch No 9 insert: ‘Sketch No 10 EXAMPLE OF A CONSTRUCTION OF A VEHICLE WITH A SHEETED SLIDING ROOF

Sketch No 10 continued:

Sketch No 10 continued:

|

|

|

Annex 7, Part I, Article 5, paragraph 2(i): For the existing text substitute:

|

|

|

Annex 7, Part I, Article 5, paragraph 2(iii): For the existing text substitute:

|

|

|

Annex 7, Part I, new Article 6: After the modified Article 5 insert: ‘Article 6 Containers with a sheeted sliding roof 1. Where applicable, the provisions of Articles 1, 2, 3, 4 and 5 of these Regulations shall apply to containers with a sheeted sliding roof. In addition, these containers shall conform to the provisions of this Article. 2. The sheeted sliding roof shall fulfil the requirements set out in (i) to (iii) below.

An example of a possible system of construction is shown in sketch No 10, appended to these Regulations.’. |

|

|

Annex 7, Part I, Sketch No 9: For the existing Sketch No 9 substitute: ‘Sketch No 9 EXAMPLE OF A CONSTRUCTION OF A CONTAINER WITH SLIDING SHEETS

Sketch No 9 continued:

Sketch No 9 continued:

|

|

|

Annex 7, Part I, new Sketch No 10: After new Sketch No 9 insert: ‘Sketch No 10 EXAMPLE OF A CONSTRUCTION OF A CONTAINER WITH A SHEETED SLIDING ROOF

Sketch No 10 continued:

Sketch No 10 continued:

|

REGULATIONS

|

29.11.2016 |

EN |

Official Journal of the European Union |

L 321/45 |

COMMISSION IMPLEMENTING REGULATION (EU) 2016/2080

of 25 November 2016

opening the sale of skimmed milk powder by a tendering procedure

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Regulation (EU) No 1308/2013 of the European Parliament and of the Council of 17 December 2013 establishing a common organisation of the markets in agricultural products and repealing Council Regulations (EEC) No 922/72, (EEC) No 234/79, (EC) No 1037/2001 and (EC) No 1234/2007 (1),

Having regard to Commission Implementing Regulation (EU) 2016/1240 of 18 May 2016 laying down rules for the application of Regulation (EU) No 1308/2013 of the European Parliament and of the Council with regard to public intervention and aid for private storage (2), and in particular Article 28 and Article 31(1) thereof,

Whereas:

|

(1) |

Given the current situation on the skimmed milk powder market in terms of price recovery and the high level of intervention stocks it is appropriate to open the sale of skimmed milk powder from public intervention by a tendering procedure in accordance with Implementing Regulation (EU) 2016/1240. |

|

(2) |

In order to manage sales from intervention in an adequate way, it is necessary to specify the date before which the skimmed milk powder that is available for sale must have entered into public intervention. |

|

(3) |

Pursuant to Article 28(4)(b), (c) and (d) of Implementing Regulation (EU) 2016/1240, it is necessary to fix the periods for the submission of tenders, the minimum quantity for which a tender may be submitted and the amount of the security that has to be lodged when submitting a tender. |

|

(4) |

For the purposes of Article 31(1) of Implementing Regulation (EU) 2016/1240, it is necessary to lay down the time limits by which Member States are to notify the Commission of all admissible tenders. |

|

(5) |

In the interests of an efficient administration, Member States should make their notifications to the Commission in accordance with Commission Regulation (EC) No 792/2009 (3). |

|

(6) |

The Committee for the Common Organisation of the Agricultural Markets has not delivered an opinion within the time limit laid down by its chair, |

HAS ADOPTED THIS REGULATION:

Article 1

Scope

Sales by a tendering procedure of skimmed milk powder entered into storage before 1 November 2015 are open under the conditions provided for in Chapter III of Title II of Implementing Regulation (EU) 2016/1240.