ISSN 1977-0677

Official Journal

of the European Union

L 332

English edition

Legislation

Volume 58

18 December 2015

|

ISSN 1977-0677 |

||

|

Official Journal of the European Union |

L 332 |

|

|

||

|

English edition |

Legislation |

Volume 58 |

|

Contents |

|

I Legislative acts |

page |

|

|

|

DIRECTIVES |

|

|

|

* |

|

|

|

Corrigenda |

|

|

|

* |

||

|

|

* |

|

|

|

|

|

(1) Text with EEA relevance |

|

EN |

Acts whose titles are printed in light type are those relating to day-to-day management of agricultural matters, and are generally valid for a limited period. The titles of all other Acts are printed in bold type and preceded by an asterisk. |

I Legislative acts

DIRECTIVES

|

18.12.2015 |

EN |

Official Journal of the European Union |

L 332/1 |

COUNCIL DIRECTIVE (EU) 2015/2376

of 8 December 2015

amending Directive 2011/16/EU as regards mandatory automatic exchange of information in the field of taxation

THE COUNCIL OF THE EUROPEAN UNION,

Having regard to the Treaty on the Functioning of the European Union, and in particular Article 115 thereof,

Having regard to the proposal from the European Commission,

After transmission of the draft legislative act to the national parliaments,

Having regard to the opinion of the European Parliament (1),

Having regard to the opinion of the European Economic and Social Committee (2),

Having regard to the opinion of the Committee of the Regions (3),

Acting in accordance with a special legislative procedure,

Whereas:

|

(1) |

The challenge posed by cross-border tax avoidance, aggressive tax planning and harmful tax competition has increased considerably and has become a major focus of concern within the Union and at global level. Tax base erosion is considerably reducing national tax revenues, which hinders Member States in applying growth-friendly tax policies. The issuance of advance tax rulings, which facilitate the consistent and transparent application of the law, is common practice, including in the Union. By providing certainty for business, clarification of tax law for taxpayers can encourage investment and compliance with the law and can therefore be conducive to the objective of further developing the single market in the Union on the basis of the principles and freedoms underlying the Treaties. However, rulings concerning tax-driven structures have, in certain cases, led to a low level of taxation of artificially high amounts of income in the country issuing, amending or renewing the advance ruling and left artificially low amounts of income to be taxed in any other countries involved. An increase in transparency is therefore urgently required. The tools and mechanisms established by Council Directive 2011/16/EU (4) need to be enhanced in order to achieve this. |

|

(2) |

The European Council, in its conclusions of 18 December 2014, underlined the urgent need to advance efforts in the fight against tax avoidance and aggressive tax planning, both at global and Union levels. Stressing the importance of transparency, the European Council welcomed the Commission's intention to submit a proposal on the automatic exchange of information on tax rulings in the Union. |

|

(3) |

Directive 2011/16/EU provides for the mandatory spontaneous exchange of information between Member States in five specific cases and within certain deadlines. The spontaneous exchange of information in cases where the competent authority of one Member State has grounds for supposing that there may be a loss of tax in another Member State already applies to tax rulings that a Member State issues, amends or renews to a specific taxpayer regarding the interpretation or application of tax provisions in the future and that have a cross-border dimension. |

|

(4) |

However, the efficient spontaneous exchange of information in respect of advance cross-border rulings and advance pricing arrangements is hindered by several important practical difficulties such as the discretion permitted to the issuing Member State to decide which other Member States should be informed. Therefore the information exchanged should, where appropriate, be accessible to all other Member States. |

|

(5) |

The scope of the automatic exchange of advance cross-border rulings and advance pricing arrangements, issued, amended or renewed to a particular person or group of persons upon which that person or group of persons is entitled to rely, should cover any material form (irrespective of their binding or non-binding character and the way they are issued). |

|

(6) |

For the purposes of legal certainty, Directive 2011/16/EU should be amended by including an appropriate definition of an advance cross-border ruling and advance pricing arrangement. The scope of these definitions should be sufficiently broad to cover a wide range of situations, including but not limited to the following types of advance cross-border rulings and advance pricing arrangements:

|

|

(7) |

Taxpayers are entitled to rely on advance cross-border rulings or advance pricing arrangements during, for example, taxation processes or tax audits under the condition that the facts on which the advance cross-border rulings or advance pricing arrangements are based have been accurately presented and that the taxpayers abide by the terms of the advance cross-border rulings or advance pricing arrangements. |

|

(8) |

Member States will exchange information irrespective of whether the taxpayer abides by the terms of the advance cross-border ruling or advance pricing arrangement. |

|

(9) |

The provision of information should not lead to the disclosure of a commercial, industrial or professional secret or of a commercial process, or disclosure of information which would be contrary to public policy. |

|

(10) |

In order to reap the benefits of the mandatory automatic exchange of advance cross-border rulings and advance pricing arrangements, the information should be communicated promptly after they are issued, amended or renewed, and regular intervals for the communication of the information should therefore be established. For the same reasons, it is also appropriate to provide for the mandatory automatic exchange of advance cross-border rulings and advance pricing arrangements that were issued, amended or renewed within a period beginning five years before the date of application of this Directive and which are still valid on 1 January 2014. However, particular persons or groups of persons with a group wide annual net turnover of less than EUR 40 000 000 could be excluded, under certain conditions, from such mandatory automatic exchange. |

|

(11) |

For reasons of legal certainty, it is appropriate, under a set of very strict conditions, to exclude from the mandatory automatic exchange bilateral or multilateral advance pricing arrangements with third countries following the framework of existing international treaties with those countries, where the provisions of those treaties do not permit disclosure of the information received under that treaty to a third party country. In these cases however, the information identified in paragraph 6 of Article 8a relating to the requests that lead to issuance of such bilateral or multilateral advance pricing arrangements should be exchanged instead. Therefore, in such cases, the information to be communicated should include the indicator that it is provided on the basis of such a request. |

|

(12) |

The mandatory automatic exchange of advance cross-border rulings and advance pricing arrangements should in each case include the communication of a defined set of basic information that would be accessible to all Member States. The Commission should be empowered to adopt practical arrangements necessary to standardise the communication of such information under the procedure laid down in Directive 2011/16/EU (which involves the Committee on Administrative Cooperation for Taxation) for establishing a standard form to be used for the exchange of information. That procedure should also be used in the adoption of further practical arrangements for the implementation of the information exchange, such as the specification of linguistic requirements that would be applicable to the exchange of information using that standard form. |

|

(13) |

In developing such a standard form for the mandatory automatic exchange of information, it is appropriate to take account of work performed at the OECD's Forum on Harmful Tax Practices, where a standard form for information exchange is being developed, in the context of the Action Plan on Base Erosion and Profit Shifting. It is also appropriate to work closely with the OECD, in a coordinated manner and not only in the area of the development of such a standard form for mandatory automatic exchange of information. The ultimate aim should be a global level playing field, where the Union should take a leading role by promoting that the scope of information on advance cross-border rulings and advance pricing arrangements to be exchanged automatically should be rather broad. |

|

(14) |

Member States should exchange basic information, and a limited set of basic information should also be communicated to the Commission. This should enable the Commission to monitor and evaluate the effective application of the mandatory automatic exchange of information on advance cross-border rulings and advance pricing arrangements at any time. The information received by the Commission should not, however, be used for any other purposes. Such communication would moreover not discharge a Member State from its obligations to notify any State aid to the Commission. |

|

(15) |

Feedback by the receiving Member State to the Member State sending the information is a necessary element of the operation of an effective system of automatic information exchange. It is therefore appropriate to underline that Member States' competent authorities should send, once a year, feedback on the automatic exchange of information to the other Member States concerned. In practice, this mandatory feedback should be done by arrangements agreed upon bilaterally. |

|

(16) |

Where necessary, following the stage of mandatory automatic exchange of information under this Directive, a Member State should be able to rely on Article 5 of Directive 2011/16/EU as regards the exchange of information on request to obtain additional information, including the full text of advance cross-border rulings or advance pricing arrangements, from the Member State having issued such rulings or arrangements. |

|

(17) |

It is appropriate to recall that Article 21(4) of Directive 2011/16/EU regulates the language and translation requirements applicable to requests for cooperation, including requests for notification, and attached documents. That rule should also be applicable in cases where Member States request additional information, following the stage of mandatory automatic exchange of basic information on advance cross-border rulings and advance pricing arrangements. |

|

(18) |

Member States should take all reasonable measures necessary to remove any obstacle that might hinder the effective and widest possible mandatory automatic exchange of information on advance cross-border rulings and advance pricing arrangements. |

|

(19) |

In order to enhance the efficient use of resources, facilitate the exchange of information and avoid the need for Member States each to make similar developments to their systems to store information, specific provision should be made for the establishment of a central directory, accessible to all Member States and the Commission, to which Member States would upload and store information, instead of exchanging that information by secured email. The practical arrangements necessary for the establishment of such a directory should be adopted by the Commission in accordance with the procedure referred to in Article 26(2) of Directive 2011/16/EU. |

|

(20) |

Having regard to the nature and extent of the changes introduced by Council Directive 2014/107/EU (5) and this Directive, the timeframe for the submission of information, statistics and reports provided for under Directive 2011/16/EU should be extended. Such an extension should ensure that the information to be provided can reflect the experience resulting from those changes. The extension should apply both to the statistics and other information to be submitted by Member States before 1 January 2018 and to the report and, if appropriate, the proposal to be submitted by the Commission before 1 January 2019. |

|

(21) |

The existing provisions regarding confidentiality should be amended to reflect the extension of mandatory automatic exchange of information to advance cross-border rulings and advance pricing arrangements. |

|

(22) |

This Directive respects the fundamental rights and observes the principles recognised in particular by the Charter of Fundamental Rights of the European Union. In particular, this Directive seeks to ensure full respect for the right to the protection of personal data and the freedom to conduct a business. |

|

(23) |

Since the objective of this Directive, namely the efficient administrative cooperation between Member States under conditions compatible with the proper functioning of the internal market, cannot be sufficiently achieved by the Member States but can rather, by reason of the uniformity and effectiveness required, be better achieved at Union level, the Union may adopt measures, in accordance with the principle of subsidiarity as set out in Article 5 of the Treaty on European Union. In accordance with the principle of proportionality, as set out in that Article, this Directive does not go beyond what is necessary in order to achieve that objective. |

|

(24) |

Directive 2011/16/EU should therefore be amended accordingly, |

HAS ADOPTED THIS DIRECTIVE:

Article 1

Directive 2011/16/EU is amended as follows:

|

(1) |

Article 3 is amended as follows:

|

|

(2) |

in Article 8, paragraphs 4 and 5 are deleted. |

|

(3) |

The following Articles are inserted: ‘Article 8a Scope and conditions of mandatory automatic exchange of information on advance cross-border rulings and advance pricing arrangements 1. The competent authority of a Member State, where an advance cross-border ruling or an advance pricing arrangement was issued, amended or renewed after 31 December 2016 shall, by automatic exchange, communicate information thereon to the competent authorities of all other Member States as well as to the European Commission, with the limitation of cases set out in paragraph 8 of this Article, in accordance with applicable practical arrangements adopted pursuant to Article 21. 2. The competent authority of a Member State shall, in accordance with applicable practical arrangements adopted pursuant to Article 21, also communicate information to the competent authorities of all other Member States as well as to the European Commission, with the limitation of cases set out in paragraph 8 of this Article, on advance cross-border rulings and advance pricing arrangements issued, amended or renewed within a period beginning five years before 1 January 2017. If advance cross-border rulings and advance pricing arrangements are issued, amended or renewed between 1 January 2012 and 31 December 2013, such communication shall take place under the condition that they were still valid on 1 January 2014. If advance cross-border rulings and advance pricing arrangements are issued, amended or renewed between 1 January 2014 and 31 December 2016, such communication shall take place irrespective of whether they are still valid. Member States may exclude from the communication referred to in this paragraph, information on advance cross-border rulings and advance pricing arrangements issued, amended or renewed before 1 April 2016 to a particular person or a group of persons, excluding those conducting mainly financial or investment activities, with a group-wide annual net turnover, as defined in point (5) of Article 2 of Directive 2013/34/EU of the European Parliament and of the Council (6), of less than EUR 40 000 000 (or the equivalent amount in any other currency) in the fiscal year preceding the date of issuance, amendment or renewal of those cross-border rulings and advance pricing arrangements. 3. Bilateral or multilateral advance pricing arrangements with third countries shall be excluded from the scope of automatic exchange of information under this Article where the international tax agreement under which the advance pricing arrangement was negotiated does not permit its disclosure to third parties. Such bilateral or multilateral advance pricing arrangements will be exchanged under Article 9, where the international tax agreement under which the advance pricing arrangement was negotiated permits its disclosure, and the competent authority of the third country gives permission for the information to be disclosed. However, where the bilateral or multilateral advance pricing arrangements would be excluded from the automatic exchange of information under the first sentence of the first subparagraph of this paragraph, the information identified in paragraph 6 of this Article referred to in the request that lead to issuance of such a bilateral or multilateral advance pricing arrangement shall instead be exchanged under paragraphs 1 and 2 of this Article. 4. Paragraphs 1 and 2 shall not apply in a case where an advance cross-border ruling exclusively concerns and involves the tax affairs of one or more natural persons. 5. The exchange of information shall take place as follows:

6. The information to be communicated by a Member State pursuant to paragraphs 1 and 2 of this Article shall include the following:

7. To facilitate the exchange of information referred to in paragraph 6 of this Article, the Commission shall adopt the practical arrangements necessary for the implementation of this Article, including measures to standardise the communication of the information set out in paragraph 6 of this Article, as part of the procedure for establishing the standard form provided for in Article 20(5). 8. Information as defined under points (a), (b), (h) and (k) of paragraph 6 of this Article shall not be communicated to the European Commission. 9. The competent authority of the Member States concerned, identified under paragraph 6(j), shall confirm, if possible by electronic means, the receipt of the information to the competent authority which provided the information without delay and in any event no later than seven working days. This measure shall be applicable until the directory referred to in Article 21(5) becomes operational. 10. Member States may, in accordance with Article 5, and having regard to Article 21(4), request additional information, including the full text of an advance cross-border ruling or an advance pricing arrangement. Article 8b Statistics on automatic exchanges 1. Before 1 January 2018, Member States shall provide the Commission on an annual basis with statistics on the volume of automatic exchanges under Articles 8 and 8a and, to the extent possible, with information on the administrative and other relevant costs and benefits relating to exchanges that have taken place and any potential changes, for both tax administrations and third parties. 2. Before 1 January 2019, the Commission shall submit a report that provides an overview and an assessment of the statistics and information received under paragraph 1 of this Article, on issues such as the administrative and other relevant costs and benefits of the automatic exchange of information, as well as practical aspects linked thereto. If appropriate, the Commission shall present a proposal to the Council regarding the categories and the conditions laid down in Article 8(1), including the condition that information concerning residents in other Member States has to be available, or the items referred to in Article 8(3a), or both. When examining a proposal presented by the Commission, the Council shall assess further strengthening of the efficiency and functioning of the automatic exchange of information and raising the standard thereof, with the aim of providing that:

(6) Directive 2013/34/EU of the European Parliament and of the Council of 26 June 2013 on the annual financial statements, consolidated financial statements and related reports of certain types of undertakings, amending Directive 2006/43/EC of the European Parliament and of the Council and repealing Council Directives 78/660/EEC and 83/349/EEC (OJ L 182, 29.6.2013, p. 19).’." |

|

(4) |

In Article 20, the following paragraph is added: ‘5. A standard form, including the linguistic arrangements, shall be adopted by the Commission in accordance with the procedure referred to in Article 26(2) before 1 January 2017. The automatic exchange of information on advance cross-border rulings and advance pricing arrangements pursuant to Article 8a shall be carried out using that standard form. This standard form shall not exceed the components for exchange of the information listed in Article 8a(6) and other relating fields linked to these components necessary to achieve the objectives of Article 8a. The linguistic arrangements referred to in the first subparagraph shall not preclude Member States from communicating the information referred to in Article 8a in any of the official and working languages of the Union. However, those linguistic arrangements may provide that the key elements of such information shall also be sent in another official and working language of the Union.’. |

|

(5) |

Article 21 is amended as follows:

|

|

(6) |

Article 23 is amended as follows:

|

|

(7) |

The following Article is inserted: ‘Article 23a Confidentiality of information 1. Information communicated to the Commission pursuant to this Directive shall be kept confidential by the Commission in accordance with the provisions applicable to Union authorities and may not be used for any purposes other than those required to determine whether and to what extent Member States comply with this Directive. 2. Information communicated to the Commission by a Member State under Article 23, as well as any report or document produced by the Commission using such information, may be transmitted to other Member States. Such transmitted information shall be covered by the obligation of official secrecy and enjoy the protection extended to similar information under the national law of the Member State which received it. Reports and documents produced by the Commission, referred to in the first subparagraph, may be used by the Member States only for analytical purposes, and shall not be published or made available to any other person or body without the express agreement of the Commission.’. |

|

(8) |

In Article 25, the following paragraph is inserted: ‘1a. Regulation (EC) No 45/2001 applies to any processing of personal data under this Directive by the Union institutions and bodies. However, for the purpose of the correct application of this Directive, the scope of the obligations and rights provided for in Article 11, Article 12(1), Articles 13 to 17 of Regulation (EC) No 45/2001 is restricted to the extent required in order to safeguard the interests referred to in point (b) of Article 20(1) of that Regulation.’. |

Article 2

1. Member States shall adopt and publish, by 31 December 2016, the laws, regulations and administrative provisions necessary to comply with this Directive. They shall forthwith communicate to the Commission the text of those measures.

They shall apply those measures from 1 January 2017.

When Member States adopt those measures, they shall contain a reference to this Directive or be accompanied by such a reference on the occasion of their official publication. Member States shall determine how such reference is to be made.

2. Member States shall communicate to the Commission the text of the main provisions of national law which they adopt in the field covered by this Directive.

Article 3

This Directive shall enter into force on the day of its publication in the Official Journal of the European Union.

Article 4

This Directive is addressed to the Member States.

Done at Brussels, 8 December 2015.

For the Council

The President

P. GRAMEGNA

(1) Opinion of 27 October 2015 (not yet published in the Official Journal).

(2) OJ C 332, 8.10.2015, p. 64.

(3) Opinion of 14 October 2015 (not yet published in the Official Journal).

(4) Council Directive 2011/16/EU of 15 February 2011 on administrative cooperation in the field of taxation and repealing Directive 77/799/EEC (OJ L 64, 11.3.2011, p. 1).

(5) Council Directive 2014/107/EU of 9 December 2014 amending Directive 2011/16/EU as regards mandatory automatic exchange of information in the field of taxation (OJ L 359, 16.12.2014, p. 1).

II Non-legislative acts

INTERNATIONAL AGREEMENTS

|

18.12.2015 |

EN |

Official Journal of the European Union |

L 332/11 |

COUNCIL DECISION (EU) 2015/2377

of 26 October 2015

on the signing, on behalf of the European Union, and provisional application of the Agreement between the European Union and the Republic of Palau on the short-stay visa waiver

THE COUNCIL OF THE EUROPEAN UNION,

Having regard to the Treaty on the Functioning of the European Union, and in particular point (a) of Article 77(2), in conjunction with Article 218(5), thereof,

Having regard to the proposal from the European Commission,

Whereas:

|

(1) |

Regulation (EU) No 509/2014 of the European Parliament and the Council (1) transferred the reference to the Republic of Palau from Annex I to Annex II of Council Regulation (EC) No 539/2001 (2). |

|

(2) |

That reference to the Republic of Palau is accompanied by a footnote indicating that the exemption from the visa requirement shall apply from the date of entry into force of an agreement on visa exemption to be concluded with the European Union. |

|

(3) |

On 9 October 2014, the Council adopted a decision authorising the Commission to open negotiations with the Republic of Palau for the conclusion of an agreement between the European Union and the Republic of Palau on the short-stay visa waiver (the ‘Agreement’). |

|

(4) |

Negotiations on the Agreement were opened on 17 December 2014 and were successfully finalised by the initialling thereof, by exchange of letters, on 27 May 2015 by the Republic of Palau and on 10 June 2015 by the Union. |

|

(5) |

The Agreement should be signed, and the declarations attached to the Agreement should be approved, on behalf of the Union. The Agreement should be applied on a provisional basis as from the day following the date of signature thereof, pending the completion of the procedures for its formal conclusion. |

|

(6) |

This Decision constitutes a development of the provisions of the Schengen acquis in which the United Kingdom does not take part, in accordance with Council Decision 2000/365/EC (3); the United Kingdom is therefore not taking part in the adoption of this Decision and is not bound by it or subject to its application. |

|

(7) |

This Decision constitutes a development of the provisions of the Schengen acquis in which Ireland does not take part, in accordance with Council Decision 2002/192/EC (4); Ireland is therefore not taking part in the adoption of this Decision and is not bound by it or subject to its application, |

HAS ADOPTED THIS DECISION:

Article 1

The signing on behalf of the Union of the Agreement between the European Union and the Republic of Palau on the short-stay visa waiver (the ‘Agreement’) is hereby authorised, subject to the conclusion of the said Agreement.

The text of the Agreement is attached to this Decision.

Article 2

The declarations attached to this Decision shall be approved on behalf of the Union.

Article 3

The President of the Council is hereby authorised to designate the person(s) empowered to sign the Agreement on behalf of the Union.

Article 4

The Agreement shall be applied on a provisional basis as from the day following the date of signature thereof (5), pending the completion of the procedures for its conclusion.

Article 5

This Decision shall enter into force on the day of its adoption.

Done at Luxembourg, 26 October 2015.

For the Council

The President

C. DIESCHBOURG

(1) Regulation (EU) No 509/2014 of the European Parliament and of the Council of 15 May 2014 amending Council Regulation (EC) No 539/2001 listing the third countries whose nationals must be in possession of visas when crossing the external borders and those whose nationals are exempt from that requirement (OJ L 149, 20.5.2014, p. 67).

(2) Council Regulation (EC) No 539/2001 of 15 March 2001 listing the third countries whose nationals must be in possession of visas when crossing the external borders and those whose nationals are exempt from that requirement (OJ L 81, 21.3.2001, p. 1).

(3) Council Decision 2000/365/EC of 29 May 2000 concerning the request of the United Kingdom of Great Britain and Northern Ireland to take part in some of the provisions of the Schengen acquis (OJ L 131, 1.6.2000, p. 43).

(4) Council Decision 2002/192/EC of 28 February 2002 concerning Ireland's request to take part in some of the provisions of the Schengen acquis (OJ L 64, 7.3.2002, p. 20).

(5) The date of signature of the Agreement will be published in the Official Journal of the European Union by the General Secretariat of the Council.

|

18.12.2015 |

EN |

Official Journal of the European Union |

L 332/13 |

AGREEMENT

between the European Union and the Republic of Palau on the short-stay visa waiver

THE EUROPEAN UNION, hereinafter referred to as ‘the Union’ or ‘the EU’, and

THE REPUBLIC OF PALAU, hereinafter referred to as ‘Palau’,

hereinafter referred to jointly as the ‘Contracting Parties’,

WITH A VIEW TO further developing friendly relations between the Contracting Parties and desiring to facilitate travel by ensuring visa-free entry and short stay for their citizens,

HAVING REGARD to Regulation (EU) No 509/2014 of the European Parliament and of the Council of 15 May 2014 amending Council Regulation (EC) No 539/2001 listing the third countries whose nationals must be in possession of visas when crossing the external borders and those whose nationals are exempt from that requirement (1) by, inter alia, transferring 19 third countries, including Palau, to the list of third countries whose nationals are exempt from the visa requirement for short stays in the Member States,

BEARING IN MIND that Article 1 of Regulation (EU) No 509/2014 states that for those 19 countries, the exemption from the visa requirement shall apply from the date of entry into force of an agreement on visa exemption to be concluded with the Union,

DESIRING to safeguard the principle of equal treatment of all EU citizens,

TAKING INTO ACCOUNT that persons travelling for the purpose of carrying out a paid activity during their short stay are not covered by this Agreement and therefore for that category the relevant rules of Union law and national law of the Member States and the national law of Palau on the visa obligation or exemption and on the access to employment continue to apply,

TAKING INTO ACCOUNT the Protocol on the position of the United Kingdom and Ireland in respect of the area of freedom, security and justice and the Protocol on the Schengen acquis integrated into the framework of the European Union, annexed to the Treaty on European Union and the Treaty on the Functioning of the European Union, and confirming that the provisions of this Agreement do not apply to the United Kingdom and Ireland,

HAVE AGREED AS FOLLOWS:

Article 1

Purpose

This Agreement provides for visa-free travel for the citizens of the Union and for the citizens of Palau when travelling to the territory of the other Contracting Party for a maximum period of 90 days in any 180-day period.

Article 2

Definitions

For the purpose of this Agreement:

|

(a) |

‘Member State’ shall mean any Member State of the Union, with the exception of the United Kingdom and Ireland; |

|

(b) |

‘a citizen of the Union’ shall mean a national of a Member State as defined in point (a); |

|

(c) |

‘a citizen of Palau’ shall mean any person who holds the citizenship of Palau; |

|

(d) |

‘Schengen area’ shall mean the area without internal borders comprising the territories of the Member States as defined in point (a) applying the Schengen acquis in full. |

Article 3

Scope of application

1. Citizens of the Union holding a valid ordinary, diplomatic, service, official or special passport issued by a Member State may enter and stay without a visa in the territory of Palau for the period of stay as defined in Article 4(1).

Citizens of Palau holding a valid ordinary, diplomatic, service, official or special passport issued by Palau may enter and stay without a visa in the territory of the Member States for the period of stay as defined in Article 4(2).

2. Paragraph 1 of this Article does not apply to persons travelling for the purpose of carrying out a paid activity.

For that category of persons, each Member State individually may decide to impose a visa requirement on the citizens of Palau or to withdraw it in accordance with Article 4(3) of Council Regulation (EC) No 539/2001 (2).

For that category of persons, Palau may decide on the visa requirement or the visa waiver for the citizens of each Member State individually in accordance with its national law.

3. The visa waiver provided for by this Agreement shall apply without prejudice to the laws of the Contracting Parties relating to the conditions of entry and short stay. The Member States and Palau reserve the right to refuse entry into and short stay in their territories if one or more of these conditions is not met.

4. The visa waiver applies regardless of the mode of transport used to cross the borders of the Contracting Parties.

5. Issues not covered by this Agreement shall be governed by Union law, the national law of the Member States and by the national law of Palau.

Article 4

Duration of stay

1. Citizens of the Union may stay in the territory of Palau for a maximum period of 90 days in any 180-day period.

2. Citizens of Palau may stay in the territory of the Member States fully applying the Schengen acquis for a maximum period of 90 days in any 180-day period. That period shall be calculated independently of any stay in a Member State which does not yet apply the Schengen acquis in full.

Citizens of Palau may stay for a maximum period of 90 days in any 180-day period in the territory of each of the Member States that do not yet apply the Schengen acquis in full, independently of the period of stay calculated for the territory of the Member States fully applying the Schengen acquis.

3. This Agreement does not affect the possibility for Palau and the Member States to extend the period of stay beyond 90 days in accordance with their respective national laws and Union law.

Article 5

Territorial application

1. As regards the French Republic, this Agreement shall apply only to the European territory of the French Republic.

2. As regards the Kingdom of the Netherlands, this Agreement shall apply only to the European territory of the Kingdom of the Netherlands.

Article 6

Joint Committee for the management of the Agreement

1. The Contracting Parties shall set up a Joint Committee of experts (hereinafter referred to as the ‘Committee’), composed of representatives of the Union and representatives of Palau. The Union shall be represented by the European Commission.

2. The Committee shall have, inter alia, the following tasks:

|

(a) |

monitoring the implementation of this Agreement; |

|

(b) |

suggesting amendments or additions to this Agreement; |

|

(c) |

settling disputes arising from the interpretation or application of this Agreement. |

3. The Committee shall be convened whenever necessary, at the request of one of the Contracting Parties.

4. The Committee shall establish its rules of procedure.

Article 7

Relationship of this Agreement to existing bilateral visa waiver agreements between the Member States and Palau

This Agreement shall take precedence over any bilateral agreements or arrangements concluded between individual Member States and Palau, in so far as they cover issues falling within the scope hereof.

Article 8

Final provisions

1. This Agreement shall be ratified or approved by the Contracting Parties in accordance with their respective internal procedures and shall enter into force on the first day of the second month following the date of the later of the two notifications by which the Contracting Parties notify each other that those procedures have been completed.

This Agreement shall be applied on a provisional basis as from the day following the date of signature hereof.

2. This Agreement is concluded for an indefinite period, unless terminated in accordance with paragraph 5.

3. This Agreement may be amended by written agreement of the Contracting Parties. Amendments shall enter into force after the Contracting Parties have notified each other of the completion of their internal procedures necessary for this purpose.

4. Each Contracting Party may suspend in whole or in part this Agreement, in particular, for reasons of public policy, the protection of national security or the protection of public health, illegal immigration or upon the reintroduction of the visa requirement by either Contracting Party. The decision on suspension shall be notified to the other Contracting Party not later than two months before its planned entry into force. A Contracting Party that has suspended the application of this Agreement shall immediately inform the other Contracting Party should the reasons for that suspension cease to exist and shall lift that suspension.

5. Each Contracting Party may terminate this Agreement by giving written notice to the other Party. This Agreement shall cease to be in force 90 days thereafter.

6. Palau may suspend or terminate this Agreement only in respect of all the Member States.

7. The Union may suspend or terminate this Agreement only in respect of all of its Member States.

Done in duplicate in the Bulgarian, Croatian, Czech, Danish, Dutch, English, Estonian, Finnish, French, German, Greek, Hungarian, Italian, Latvian, Lithuanian, Maltese, Polish, Portuguese, Romanian, Slovak, Slovenian, Spanish and Swedish languages, each text being equally authentic.

Съставено в Брюксел на седми декември две хиляди и петнадесета година.

Hecho en Bruselas, el siete de diciembre de dos mil quince.

V Bruselu dne sedmého prosince dva tisíce patnáct.

Udfærdiget i Bruxelles den syvende december to tusind og femten.

Geschehen zu Brüssel am siebten Dezember zweitausendfünfzehn.

Kahe tuhande viieteistkümnenda aasta detsembrikuu seitsmendal päeval Brüsselis.

Έγινε στις Βρυξέλλες, στις εφτά Δεκεμβρίου δύο χιλιάδες δεκαπέντε.

Done at Brussels on the seventh day of December in the year two thousand and fifteen.

Fait à Bruxelles, le sept décembre deux mille quinze.

Sastavljeno u Bruxellesu sedmog prosinca dvije tisuće petnaeste.

Fatto a Bruxelles, addì sette dicembre duemilaquindici.

Briselē, divi tūkstoši piecpadsmitā gada septītajā decembrī.

Priimta du tūkstančiai penkioliktų metų gruodžio septintą dieną Briuselyje.

Kelt Brüsszelben, a kétezer-tizenötödik év december havának hetedik napján.

Magħmul fi Brussell, fis-seba jum ta’ Diċembru fis-sena elfejn u ħmistax.

Gedaan te Brussel, de zevende december tweeduizend vijftien.

Sporządzono w Brukseli dnia siódmego grudnia roku dwa tysiące piętnastego.

Feito em Bruxelas, em sete de dezembro de dois mil e quinze.

Întocmit la Bruxelles la șapte decembrie două mii cincisprezece.

V Bruseli siedmeho decembra dvetisíctridsať.

V Bruslju, dne sedmega decembra leta dva tisoč petnajst.

Tehty Brysselissä seitsemäntenä päivänä joulukuuta vuonna kaksituhattaviisitoista.

Som skedde i Bryssel den sjunde december år tjugohundrafemton.

За Европейския съюз

Рог la Unión Europea

Za Evropskou unii

For Den Europæiske Union

Für die Europäische Union

Euroopa Liidu nimel

Για την Ευρωπαϊκή Ένωση

For the European Union

Pour l'Union européenne

Za Europsku uniju

Per l'Unione europea

Eiropas Savienības vārdā –

Europos Sąjungos vardu

Az Európai Unió részéről

Għall-Unjoni Ewropea

Voor de Europese Unie

W imieniu Unii Europejskiej

Pela União Europeia

Pentru Uniunea Europeană

Za Európsku úniu

Za Evropsko unijo

Euroopan unionin puolesta

För Europeiska unionen

За Република Палау

Por la República de Palaos

Za Republiku Palau

For Republikken Palau

Für die Republik Palau

Belau Vabariigi nimel

Για τη Δημοκρατία του Παλάου

For the Republic of Palau

Pour la République des Palaos

Za Republiku Palau

Per la Repubblica di Palau

Palau Republikas vārdā –

Palau Respublikos vardu

Palaui Köztársaság részéről

Għar-Repubblika ta' Palau

Voor de Republiek Palau

W imieniu Republiki Palau

Pela República de Palau

Pentru Republica Palau

Za Palauskú republiku

Za Republiko Palau

Palaun tasavallan puolesta

För Republiken Palau

(1) OJ L 149, 20.5.2014, p. 67.

(2) Council Regulation (EC) No 539/2001 of 15 March 2001 listing the third countries whose nationals must be in possession of visas when crossing the external borders and those whose nationals are exempt from that requirement (OJ L 81, 21.3.2001, p. 1).

JOINT DECLARATION WITH REGARD TO ICELAND, NORWAY, SWITZERLAND AND LIECHTENSTEIN

The Contracting Parties take note of the close relationship between the European Union and Norway, Iceland, Switzerland and Liechtenstein, particularly by virtue of the Agreements of 18 May 1999 and 26 October 2004 concerning the association of those countries with the implementation, application and development of the Schengen acquis.

In such circumstances it is desirable that the authorities of Norway, Iceland, Switzerland, and Liechtenstein, on the one hand, and Palau, on the other hand, conclude, without delay, bilateral agreements on the short-stay visa waiver in terms similar to those of this Agreement.

JOINT DECLARATION ON THE INTERPRETATION OF THE CATEGORY OF PERSONS TRAVELLING FOR THE PURPOSE OF CARRYING OUT A PAID ACTIVITY AS PROVIDED FOR IN ARTICLE 3(2) OF THIS AGREEMENT

Desiring to ensure a common interpretation, the Contracting Parties agree that, for the purposes of this Agreement, the category of persons carrying out a paid activity covers persons entering for the purpose of carrying out a gainful occupation or remunerated activity in the territory of the other Contracting Party as an employee or as a service provider.

This category should not cover:

|

— |

businesspersons, i.e. persons travelling for the purpose of business deliberations (without being employed in the country of the other Contracting Party), |

|

— |

sportspersons or artists performing an activity on an ad-hoc basis, |

|

— |

journalists sent by the media of their country of residence, and, |

|

— |

intra-corporate trainees. |

The implementation of this Declaration shall be monitored by the Joint Committee within its responsibility under Article 6 of this Agreement, which may propose modifications when, on the basis of the experiences of the Contracting Parties, it considers it necessary.

JOINT DECLARATION ON THE INTERPRETATION OF THE PERIOD OF 90 DAYS IN ANY 180-DAY PERIOD AS SET OUT IN ARTICLE 4 OF THIS AGREEMENT

The Contracting Parties understand that the maximum period of 90 days in any 180-day period as provided for by Article 4 of this Agreement means either a continuous visit or several consecutive visits, the total duration of which does not exceed 90 days in any 180-day period.

The notion of ‘any’ implies the application of a moving 180-day reference period, looking backwards at each day of the stay into the last 180-day period, in order to verify if the 90 days in any 180-day period requirement continues to be fulfilled. Inter alia, it means that an absence for an uninterrupted period of 90 days allows for a new stay for up to 90 days.

JOINT DECLARATION ON INFORMING CITIZENS ABOUT THE VISA WAIVER AGREEMENT

Recognising the importance of transparency for the citizens of the European Union and the citizens of Palau, the Contracting Parties agree to ensure full dissemination of information about the content and consequences of the visa waiver agreement and related issues, such as the entry conditions.

REGULATIONS

|

18.12.2015 |

EN |

Official Journal of the European Union |

L 332/19 |

COMMISSION IMPLEMENTING REGULATION (EU) 2015/2378

of 15 December 2015

laying down detailed rules for implementing certain provisions of Council Directive 2011/16/EU on administrative cooperation in the field of taxation and repealing Implementing Regulation (EU) No 1156/2012

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Council Directive 2011/16/EU of 15 February 2011 on administrative cooperation in the field of taxation and repealing Directive 77/799/EEC (1), and in particular Article 20(1), (3) and (4) and Article 21(1) thereof,

Whereas:

|

(1) |

Directive 2011/16/EU replaced Council Directive 77/799/EEC (2). A number of important adaptations of the rules concerning administrative cooperation in the field of taxation were made, in particular as regards the exchange of information between Member States with a view to enhancing the efficiency and the effectiveness of cross border exchange of information. |

|

(2) |

Council Directive 2014/107/EU (3) amended Directive 2011/16/EU to introduce the mandatory automatic exchange of financial account information and the relating set of reporting and due diligence rules. |

|

(3) |

In order to ensure the functioning of the new legal framework, Directive 2011/16/EU requires certain rules on the standard forms and computerised formats and the practical arrangements on the exchange of information between Member States to be adopted by means of implementing acts. Commission Implementing Regulation (EU) No 1156/2012 (4) provides detailed rules as regards the standard forms and the computerised formats to be used in relation to Directive 2011/16/EU. |

|

(4) |

Considering the changes to be made with a view of implementing Directive 2011/16/EU and in order to ease the readability of the implementing act, it is appropriate to repeal Implementing Regulation (EU) No 1156/2012 and to set out new consolidated rules. |

|

(5) |

In order to facilitate the exchange of information, Directive 2011/16/EU requires that such exchange of information under that Directive should take place using standard forms except for mandatory automatic exchange of information. |

|

(6) |

The standard forms to be used should contain a number of fields that are sufficiently diversified, so as to allow Member States to easily deal with all relevant cases, using the fields appropriate for each case. |

|

(7) |

For the purposes of the mandatory automatic exchange of information, Directive 2011/16/EU requires the Commission to adopt both the practical arrangements and the computerised format. With a view to ensuring the appropriateness and usability of the information exchanged and the efficiency of the exchange itself, detailed rules should be laid down in this regard. |

|

(8) |

The condition that the mandatory automatic exchange of information on the five categories of income and capital pursuant to Article 8(1) of Directive 2011/16/EU is subject to the availability of the information justifies that the corresponding computerised format is not specified beyond the level of the overall structure and classes of elements composing the computerised format, while the detailed elements exchanged under each of those classes remain subject to its availability in each Member State. |

|

(9) |

Taking into account that the information exchanged under Article 8(3a) of Directive 2011/16/EU is to be collected by Reporting Financial Institutions pursuant to the applicable reporting and due diligence rules laid down in Annexes I and II to Directive 2011/16/EU and that the exchange is accordingly not subject to the condition of the availability of the information, the computerised format to be used should, in contrast, be expanded to encompass the lowest level of detail and include each element, together with its relevant attributes, if any. |

|

(10) |

According to Directive 2011/16/EU, the information should, as far as possible, be provided by electronic means using the Common Communication Network (‘CCN’). Where necessary, the practical arrangements for the communication should be specified. Detailed rules should apply to the communication of reports, statements and other documents not consisting in the information exchanged itself but supporting it and, in the case of communication outside the CCN network and without prejudice to other bilaterally agreed arrangements, to the communication and identification of the information exchanged. |

|

(11) |

Laws, regulations and administrative provisions in the Member States necessary to comply with Article 8(3a) of Directive 2011/16/EU regarding the mandatory automatic exchange of financial account information are to apply from 1 January 2016. This Regulation should therefore apply from the same date. |

|

(12) |

The measures provided for in this Regulation are in accordance with the opinion of the Committee on Administrative Cooperation for Taxation, |

HAS ADOPTED THIS REGULATION:

Article 1

Standard forms for exchanges on request, spontaneous exchanges, notifications and feedback

1. In regard to the forms to be used, ‘field’ means a location in a form where information to be exchanged pursuant to Directive 2011/16/EU may be recorded.

2. The form to be used for requests for information and for administrative enquiries pursuant to Article 5 of Directive 2011/16/EU and their replies, acknowledgments, requests for additional background information, inability or refusal pursuant to Article 7 of that Directive shall comply with Annex I to this Regulation.

3. The form to be used for spontaneous information and its acknowledgment pursuant to Articles 9 and 10 of Directive 2011/16/EU shall comply with Annex II to this Regulation.

4. The form to be used for requests for administrative notification pursuant to Article 13(1) and 13(2) of Directive 2011/16/EU and their responses pursuant to Article 13(3) of that Directive shall comply with Annex III to this Regulation.

5. The form to be used for feedback information pursuant to Article 14(1) of Directive 2011/16/EU shall comply with Annex IV to this Regulation.

Article 2

Computerised formats for the mandatory automatic exchange of information

1. The computerised format to be used for the mandatory automatic exchange of information pursuant to Article 8(1) of Directive 2011/16/EU shall comply with Annex V to this Regulation.

2. The computerised format to be used for the mandatory automatic exchange of information pursuant to Article 8(3a) of Directive 2011/16/EU shall comply with Annex VI to this Regulation.

Article 3

Practical arrangements regarding the use of the CCN network

1. The reports, statements and other documents referred to in the information communicated pursuant to Directive 2011/16/EU may be sent using means of communication other than the CCN network.

2. Where the information referred to in Directive 2011/16/EU is not exchanged by electronic means using the CCN network, and unless otherwise agreed bilaterally, the information shall be provided under cover of a letter describing the information communicated and duly signed by the competent authority communicating the information.

Article 4

Repeal

Implementing Regulation (EU) No 1156/2012 is repealed with effect from 1 January 2016.

References made to the repealed Implementing Regulation shall be construed as references to this Regulation.

Article 5

Entry into force and application

This Regulation shall enter into force on the third day following that of its publication in the Official Journal of the European Union.

It shall apply from 1 January 2016.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 15 December 2015.

For the Commission

The President

Jean-Claude JUNCKER

(2) Council Directive 77/799/EEC of 19 December 1977 concerning mutual assistance by the competent authorities of the Member States in the field of direct taxation (OJ L 336, 27.12.1977, p. 15).

(3) Council Directive 2014/107/EU of 9 December 2014 amending Directive 2011/16/EU as regards mandatory automatic exchange of information in the field of taxation (OJ L 359, 16.12.2014, p. 1).

(4) Commission Implementing Regulation (EU) No 1156/2012 of 6 December 2012 laying down detailed rules for implementing certain provisions of Council Directive 2011/16/EU on administrative cooperation in the field of taxation (OJ L 335, 7.12.2012, p. 42).

ANNEX I

Form referred to in Article 1(2)

The form for requests for information and for administrative enquiries pursuant to Article 5 of Directive 2011/16/EU and their replies, acknowledgments, requests for additional background information, inability or refusal pursuant to Article 7 of Directive 2011/16/EU contains the following fields (1):

|

— |

Legal basis |

|

— |

Reference number |

|

— |

Date |

|

— |

Identity of the requesting and requested authorities |

|

— |

Identity of the person under examination or investigation |

|

— |

General case description and, if appropriate, specific background information likely to allow assessing the foreseeable relevance of the information requested to the administration and enforcement of the domestic laws of the Member States concerning the taxes referred to in Article 2 of Directive 2011/16/EU. |

|

— |

Tax purpose for which the information is sought |

|

— |

Period under investigation |

|

— |

Name and address of any person believed to be in possession of the requested information |

|

— |

Fulfilment of the legal requirement imposed by Article 16(1) of Directive 2011/16/EU |

|

— |

Fulfilment of the legal requirement imposed by Article 17(1) of Directive 2011/16/EU |

|

— |

Reasoned request for a specific administrative enquiry and reasons for refusal to undertake the requested specific administrative enquiry |

|

— |

Acknowledgement of the request for information |

|

— |

Request for additional background information |

|

— |

Reasons for inability or refusal to provide information |

|

— |

Reasons for a failure to respond by the relevant time limit and date by which the requested authority considers it might be able to respond. |

(1) However, only the fields actually filled in a given case need to appear in the form used in that case.

ANNEX II

Form referred to in Article 1(3)

The form for spontaneous information and its acknowledgment pursuant to Articles 9 and 10 respectively of Directive 2011/16/EU contains the following fields (1):

|

— |

Legal basis |

|

— |

Reference number |

|

— |

Date |

|

— |

Identity of the sending and receiving authorities |

|

— |

Identity of the person subject to the spontaneous exchange of information |

|

— |

Period covered by the spontaneous exchange of information |

|

— |

Fulfilment of the legal requirement imposed by Article 16(1) of Directive 2011/16/EU |

|

— |

Acknowledgement of the spontaneous information. |

(1) However, only the fields actually filled in a given case need to appear in the form used in that case.

ANNEX III

Form referred to in Article 1(4)

The form for request for notification pursuant to Article 13(1) and 13(2) of Directive 2011/16/EU and their responses pursuant to Article 13(3) of that Directive contains the following fields (1):

|

— |

Legal basis |

|

— |

Reference number |

|

— |

Date |

|

— |

Identity of the requesting and requested authorities |

|

— |

Name and address of the addressee of the instrument or decision |

|

— |

Other information which may facilitate the identification of the addressee |

|

— |

Subject of the instrument or decision |

|

— |

Response of the requested authority, in accordance with Article 13(3) of Directive 2011/16/EU, including the date of notification of the instrument or decision to the addressee. |

(1) However, only the fields actually filled in a given case need to appear in the form used in that case.

ANNEX IV

Form referred to in Article 1(5)

The form for feedback pursuant to Article 14(1) of Directive 2011/16/EU contains the following fields (1):

|

— |

Reference number |

|

— |

Date |

|

— |

Identity of the competent authority issuing the feedback |

|

— |

General feedback on the information provided |

|

— |

Results directly related to the information provided. |

(1) However, only the fields actually filled in a given case need to appear in the form used in that case.

ANNEX V

Computerised format referred to in Article 2(1)

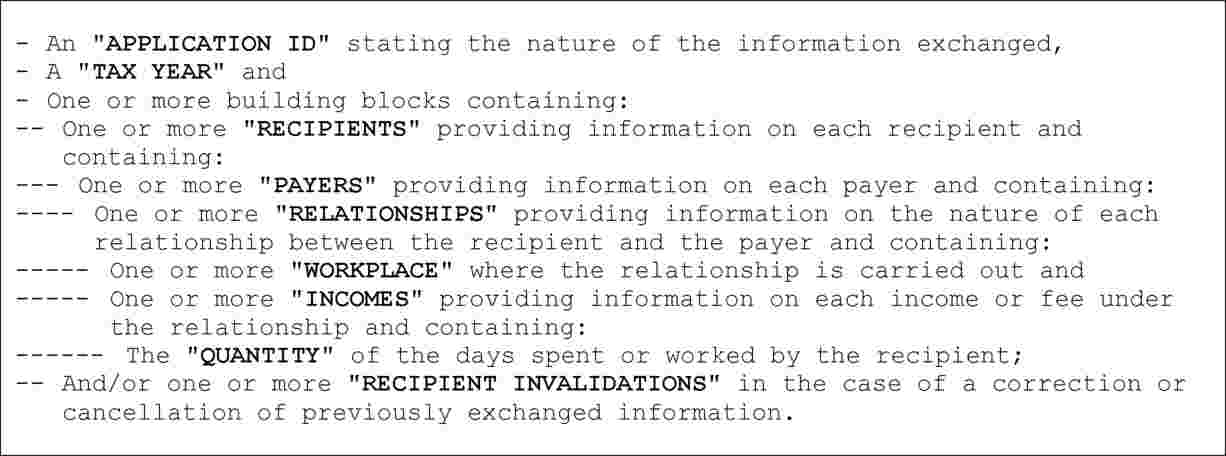

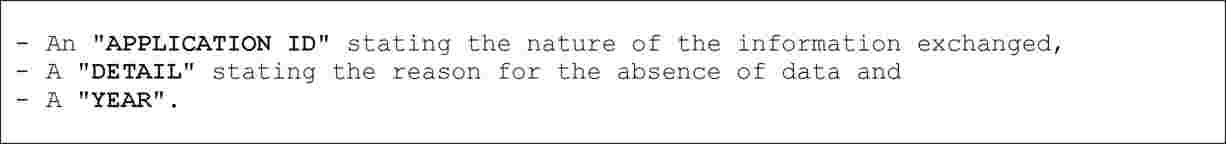

The computerised formats for the mandatory automatic exchange of information pursuant to Article 8(1) of Directive 2011/16/EU comply with the following tree structure and contains the following classes of elements (1):

|

(a) |

As regards the overall message:

|

|

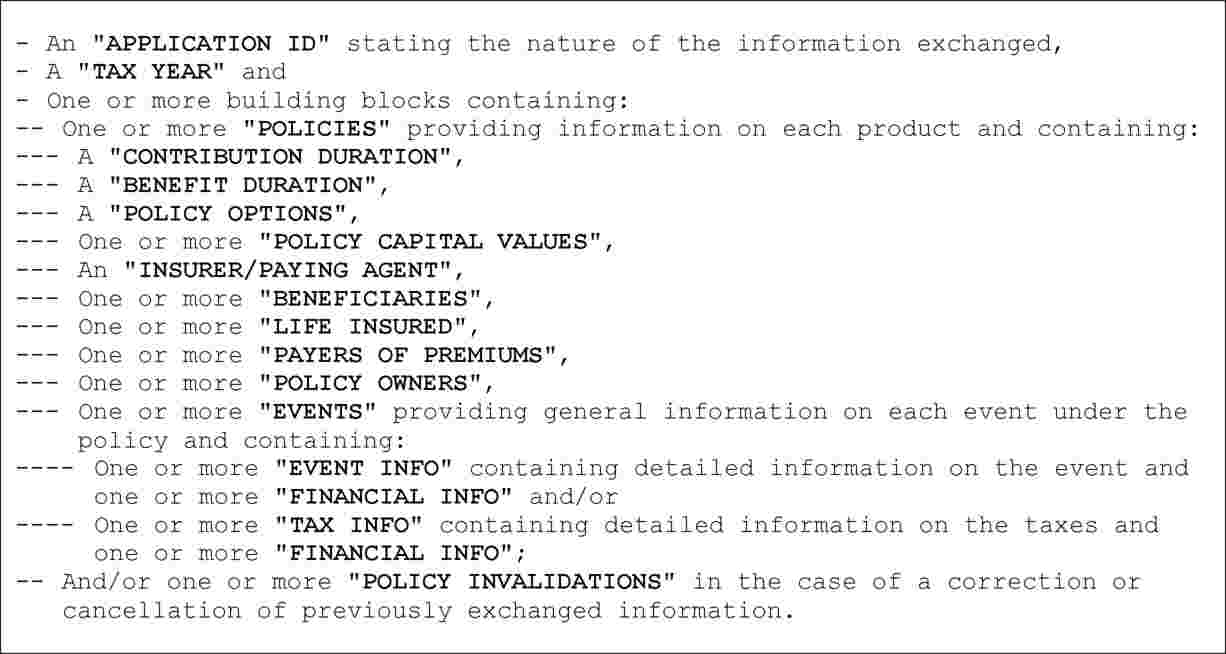

(b) |

As regards the body for communicating information on income from employment or director's fees:

|

|

(c) |

As regards the body for communicating information on pensions:

|

|

(d) |

As regards the body for communicating information on life insurance products:

|

|

(e) |

As regards the body for communicating information on ownership of and income from immovable property:

|

|

(f) |

As regards the body in case no information is to be communicated in relation to a specific category:

|

|

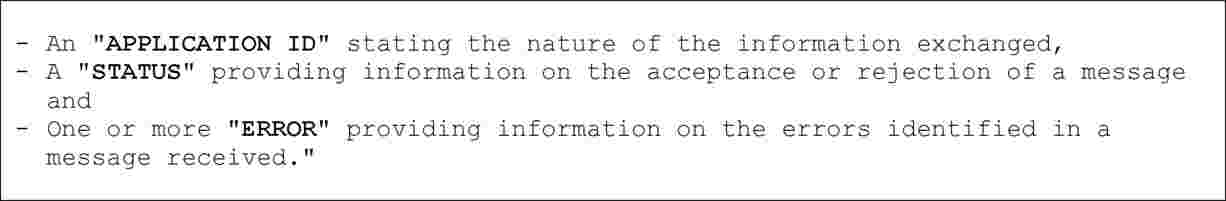

(g) |

As regards the body for an acknowledgement of receipt of the information for a specific category:

|

(1) However, only the classes of elements actually available and applicable in a given case need to appear in the computerised format used in that case.

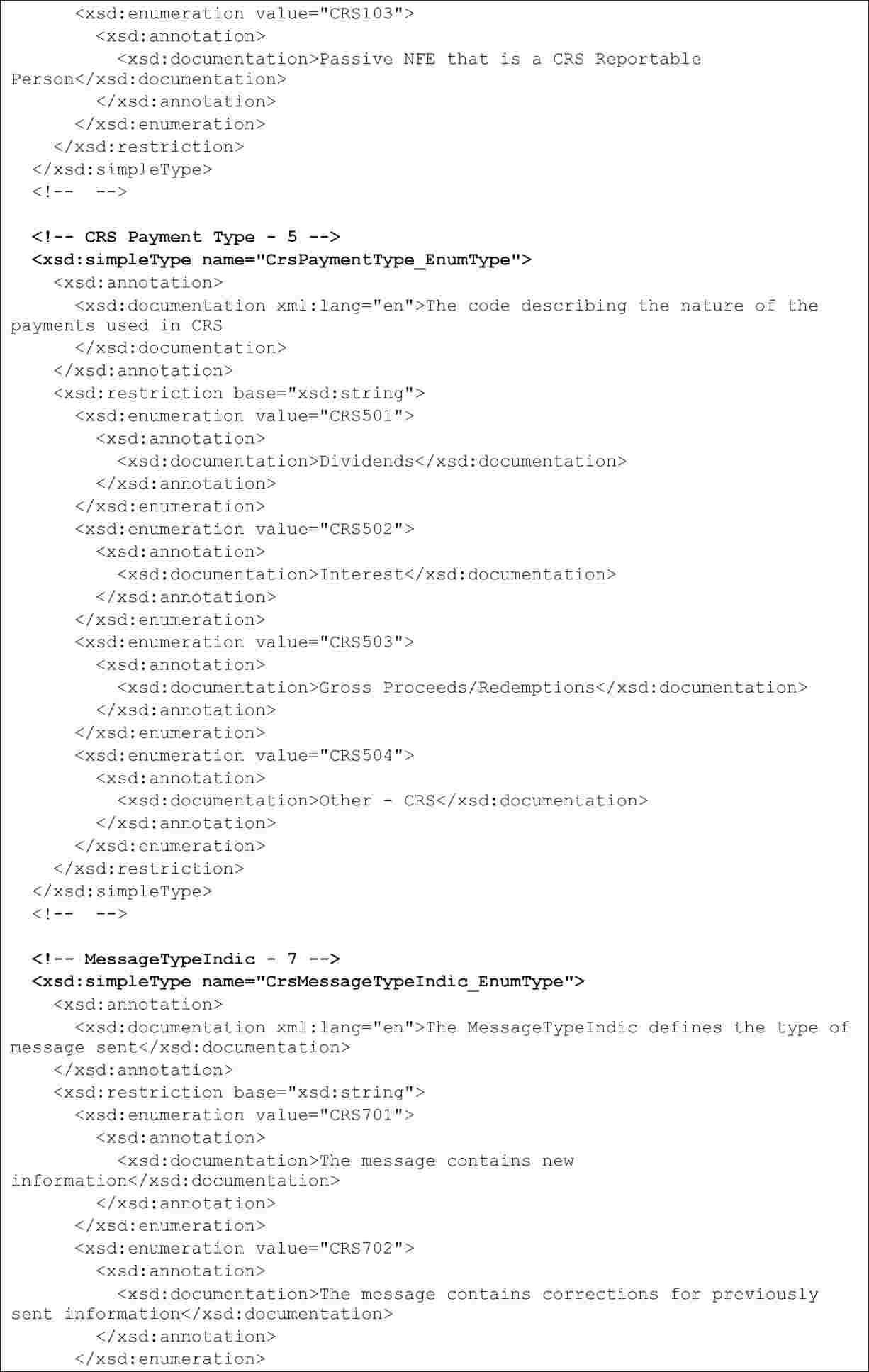

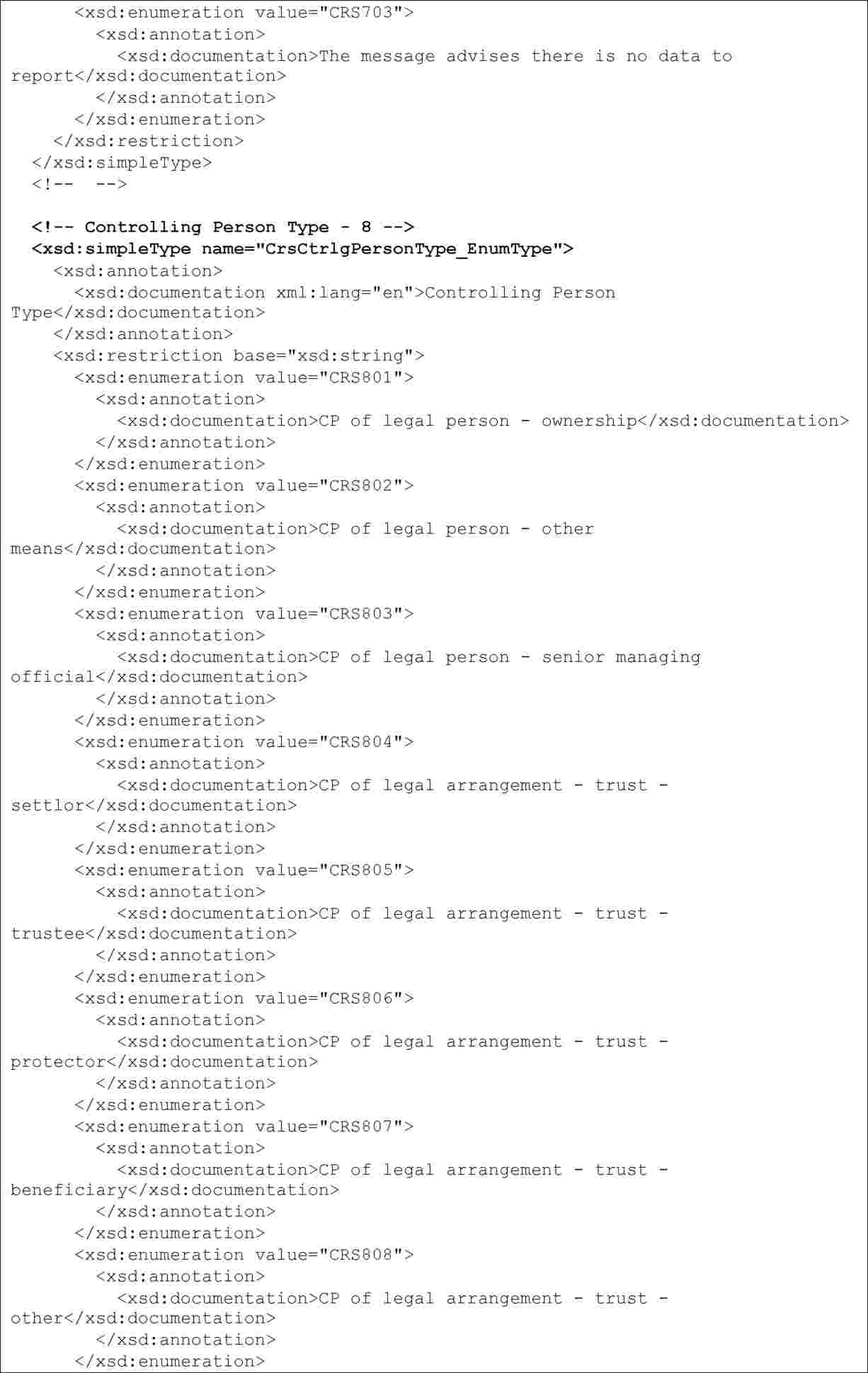

ANNEX VI

Computerised format referred to in Article 2(2)

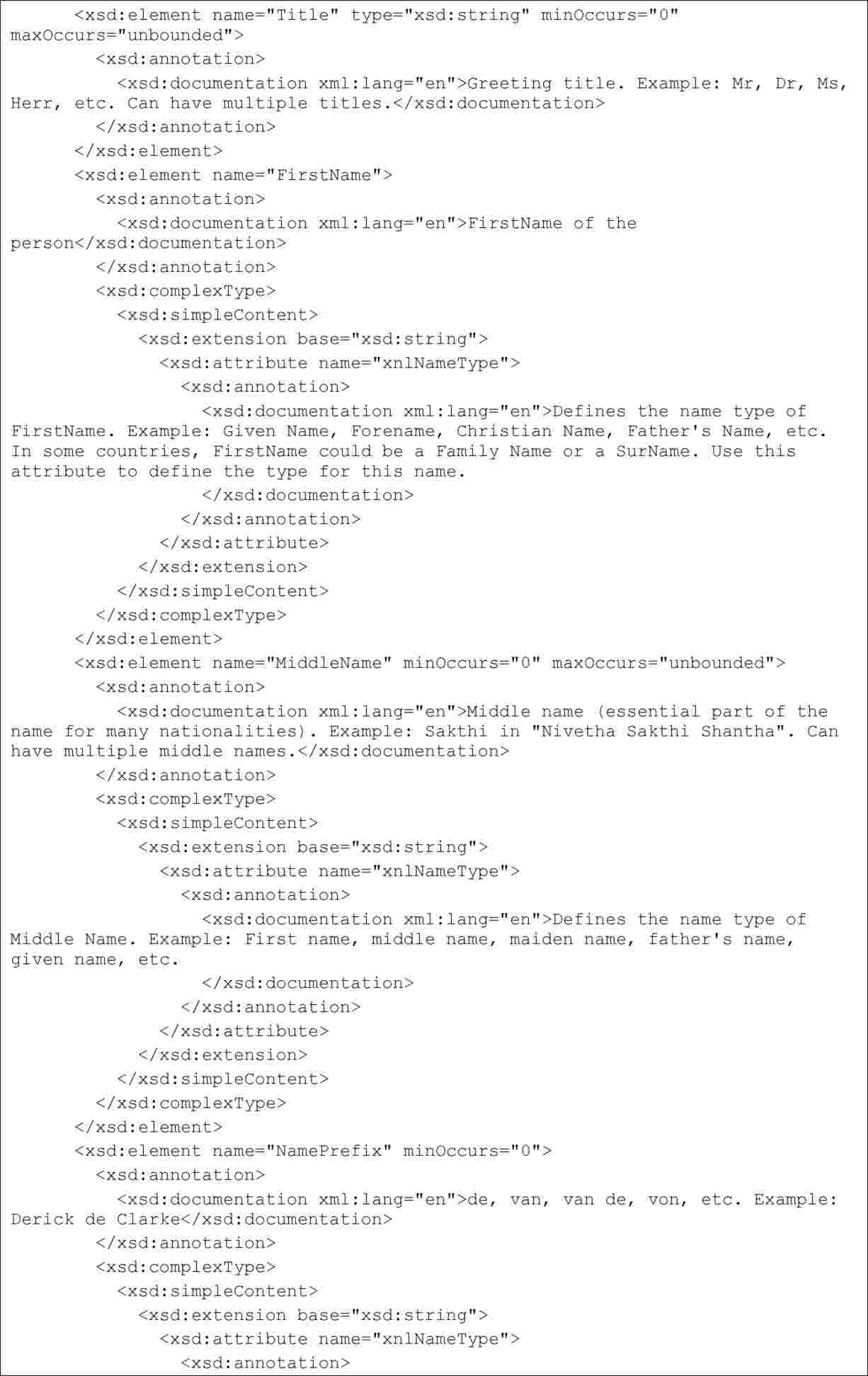

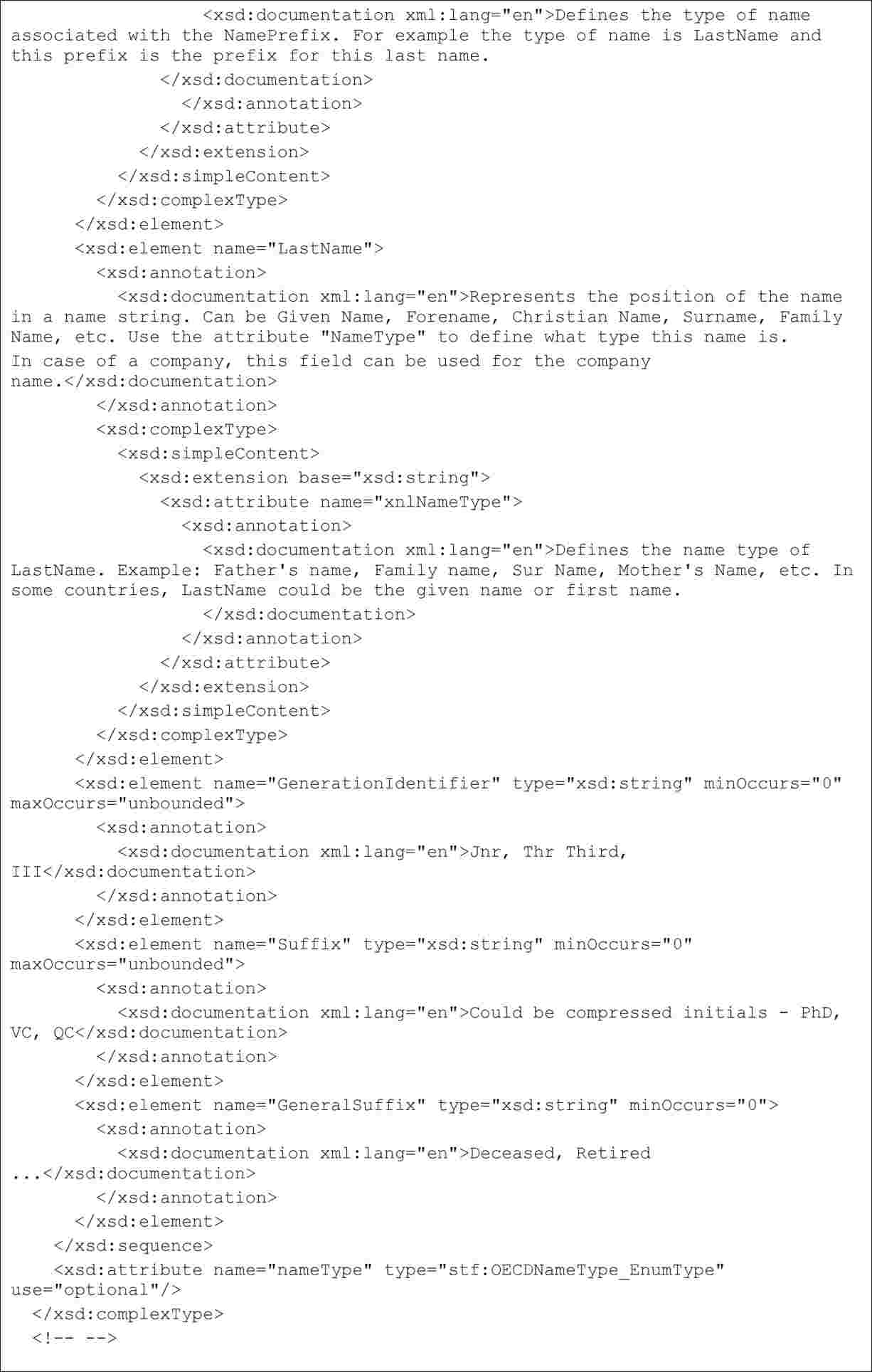

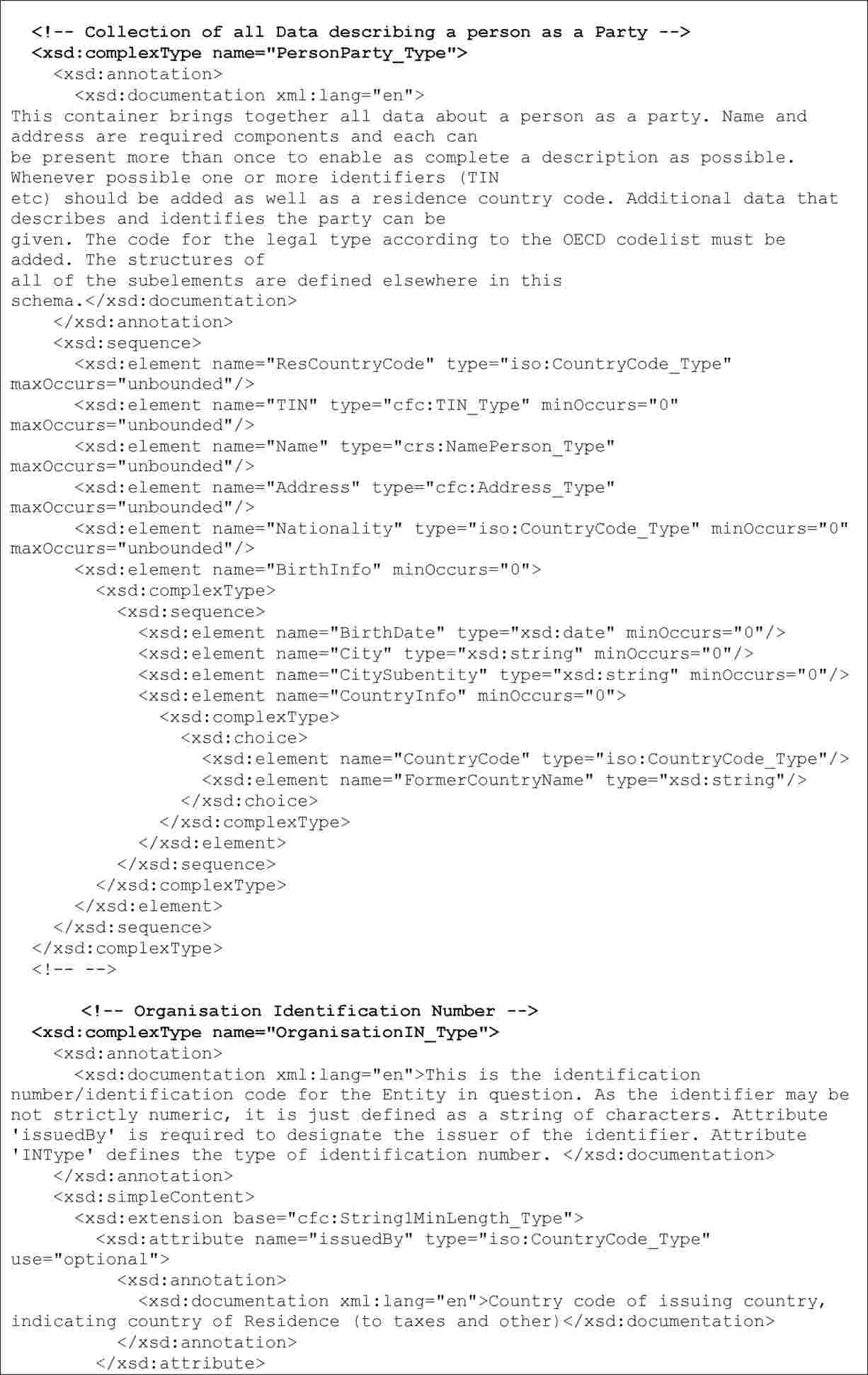

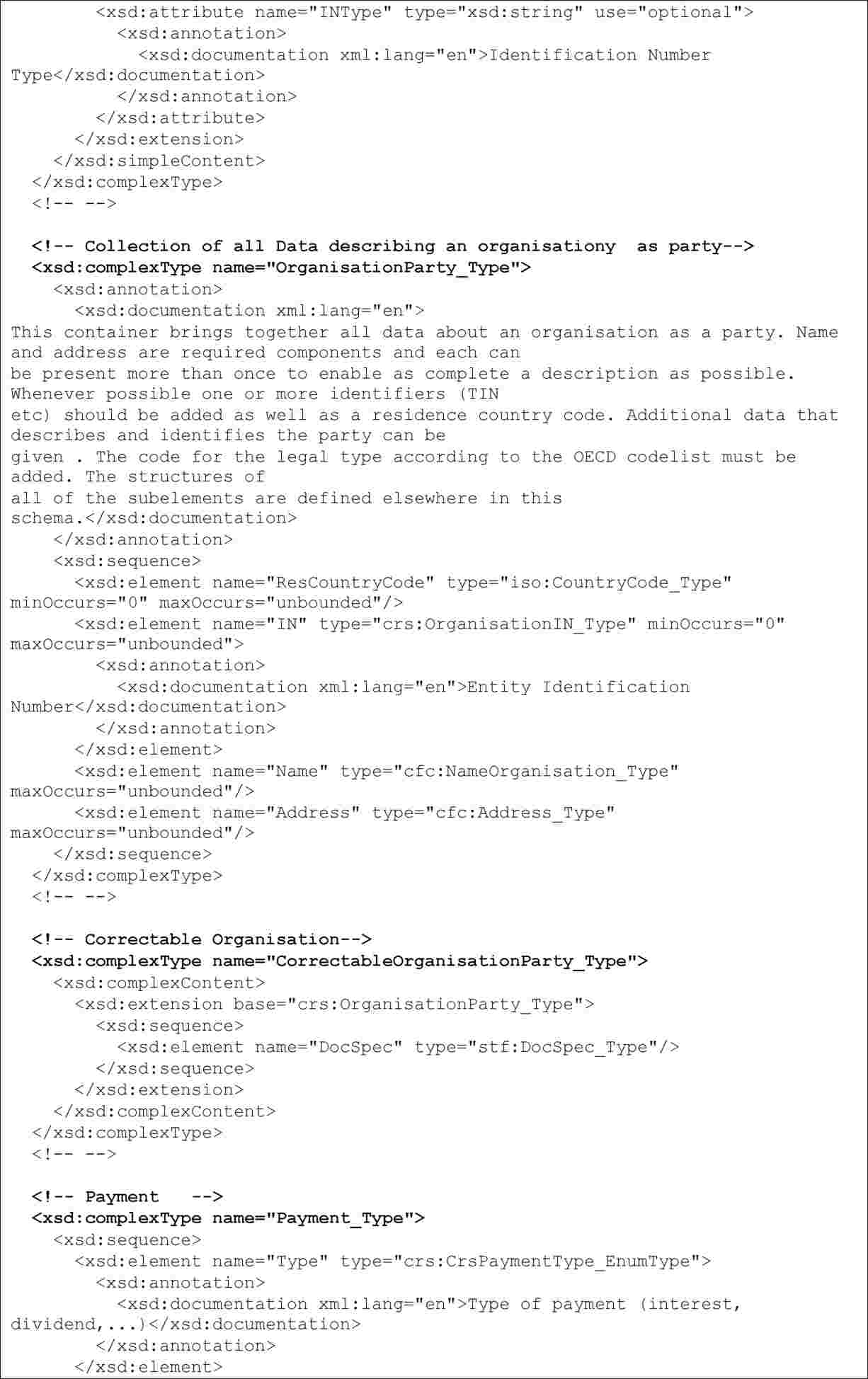

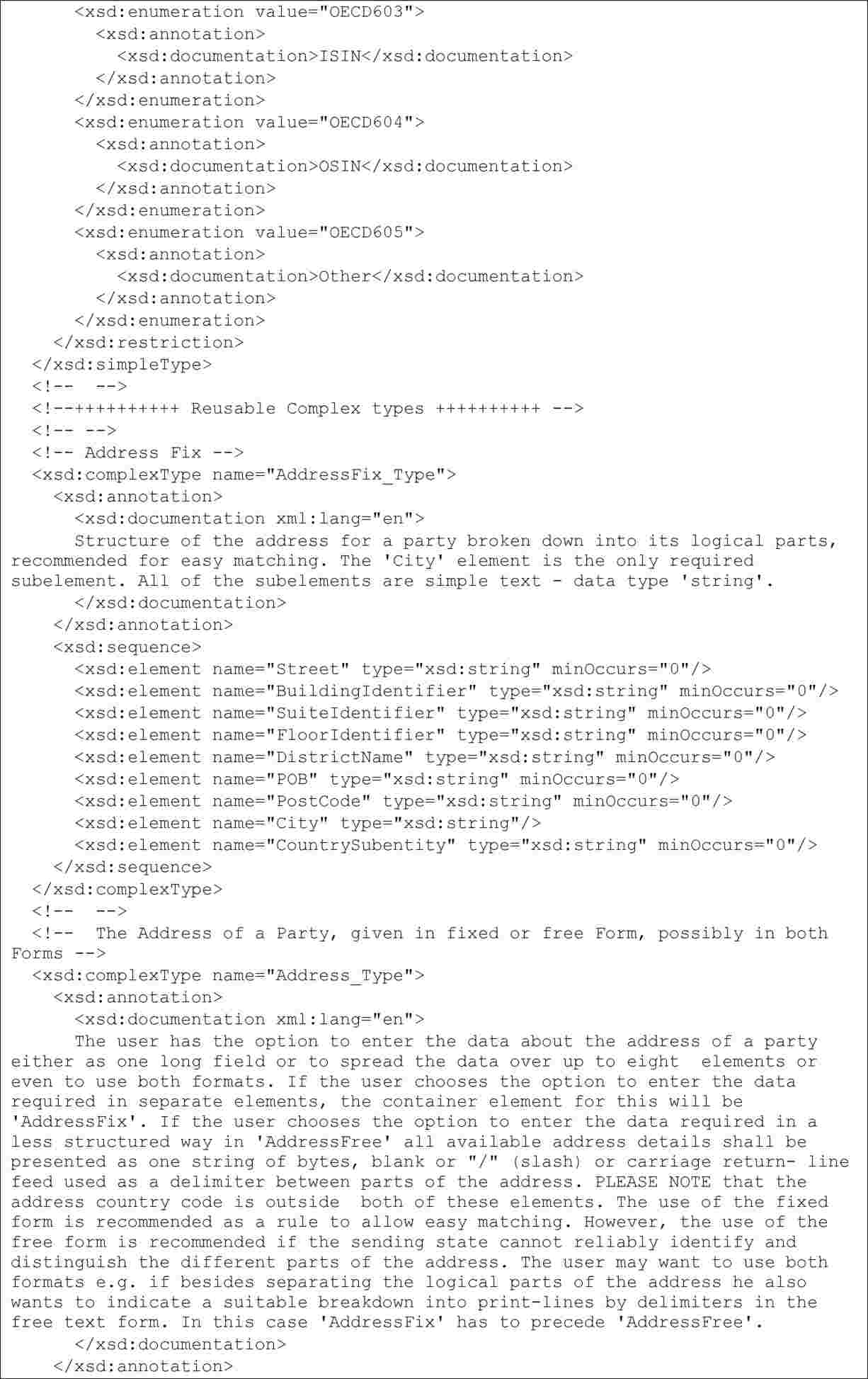

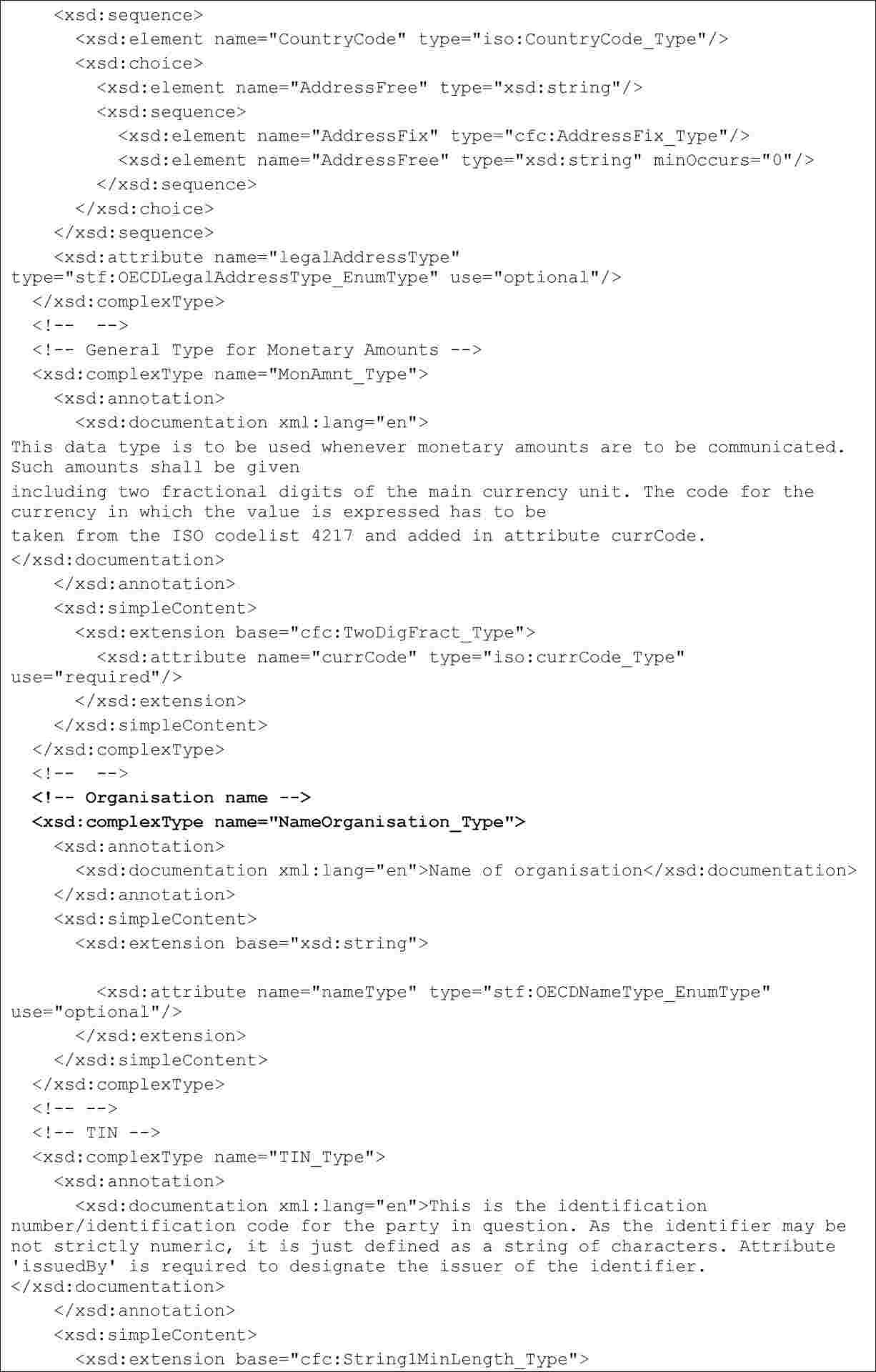

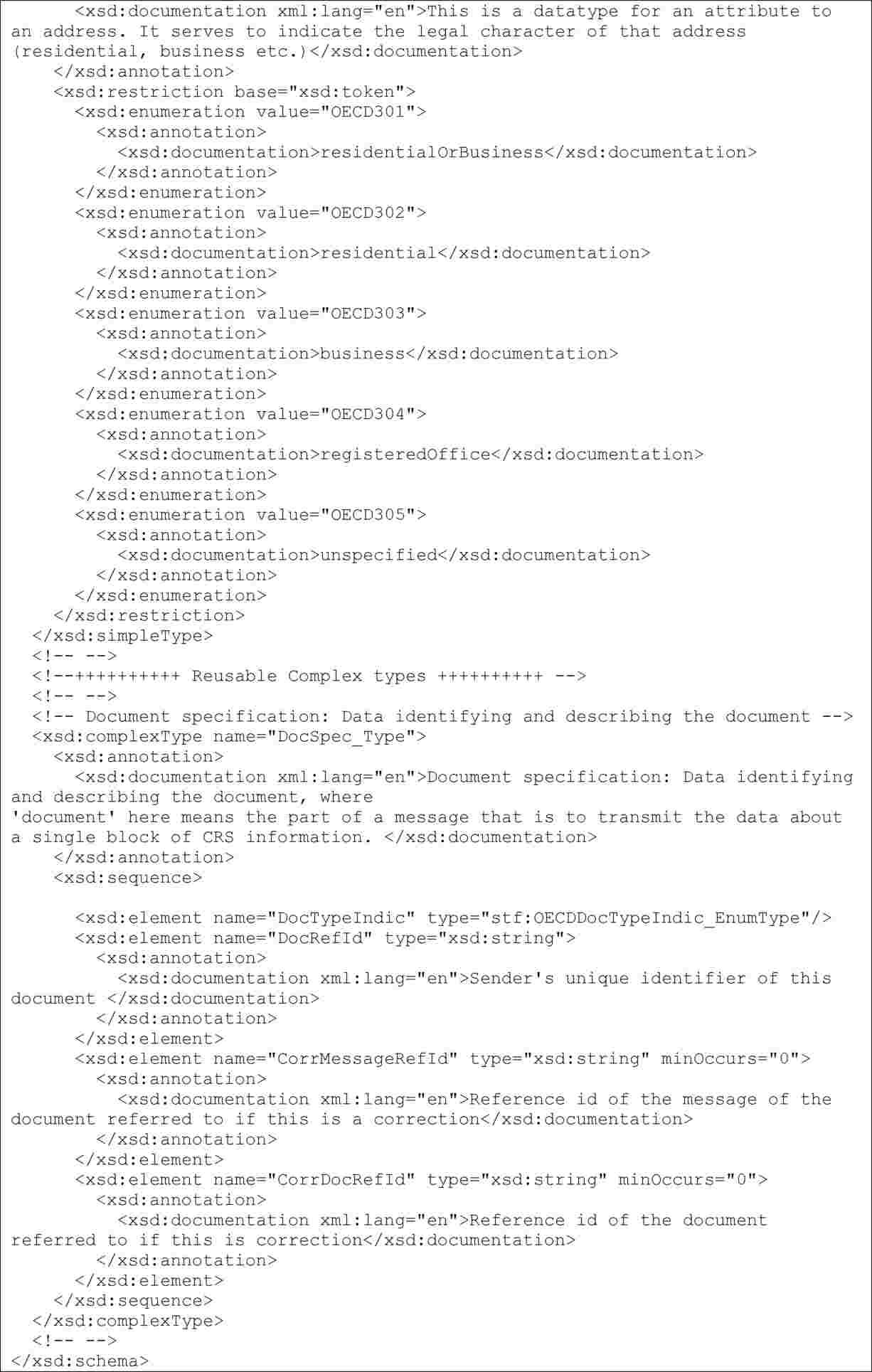

The computerised format for the mandatory automatic exchange of information pursuant to Article 8(3a) of Directive 2011/16/EU complies with the following tree structure and contains the following elements and attributes (1):

|

(a) |

As regards the overall message:

|

|

(b) |

As regards the types common to FATCA and CRS used in the message under point (a) above:

|

|

(c) |

As regards the common OECD types used in the message under point (a) above:

|

(1) However, only the elements and attributes actually applicable in a given case further to the performance of the reporting and due diligence rules included in Annexes I and II to Directive 2011/16/EU need to appear in the computerised format used in that case.

|

18.12.2015 |

EN |

Official Journal of the European Union |

L 332/46 |

COMMISSION IMPLEMENTING REGULATION (EU) 2015/2379

of 16 December 2015

derogating from Regulations (EC) Nos 2305/2003, 969/2006 and 1067/2008 and from Implementing Regulation (EU) 2015/2081, Regulation (EC) No 1964/2006 and Implementing Regulation (EU) No 480/2012 and Regulation (EC) No 1918/2006 as regards the dates for lodging import licence applications and issuing import licences in 2016 under tariff quotas for cereals, rice and olive oil, and derogating from Regulation (EC) No 951/2006 as regards the dates for issuing export licences in 2016 in the out-of-quota sugar and isoglucose sectors

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Council Regulation (EC) No 1095/96 of 18 June 1996 on the implementation of the concessions set out in Schedule CXL drawn up in the wake of the conclusion of the GATT XXIV.6 negotiations (1), and in particular Article 1 thereof,

Having regard to Regulation (EU) No 1308/2013 of the European Parliament and of the Council of 17 December 2013 establishing a common organisation of the markets in agricultural products and repealing Council Regulations (EEC) No 922/72, (EEC) No 234/79, (EC) No 1037/2001 and (EC) No 1234/2007 (2), and in particular Articles 20(n), 144(g) and 187(e) thereof,

Whereas:

|

(1) |

Commission Regulations (EC) Nos 2305/2003 (3), 969/2006 (4), 1067/2008 (5) and Commission Implementing Regulation (EU) 2015/2081 (6) lay down specific provisions on the lodging of import licence applications and the issuing of import licences for barley under quota 09.4126, maize under quota 09.4131 and common wheat of a quality other than high quality under quotas 09.4123, 09.4124, 09.4125 and 09.4133 and for certain cereals originating in Ukraine under quotas 09.4306, 09.4307 and 09.4308. |

|

(2) |

Commission Regulation (EC) No 1964/2006 (7) and Commission Implementing Regulation (EU) No 480/2012 (8) lay down specific provisions on the lodging of import licence applications and the issuing of import licences for rice originating in Bangladesh under quota 09.4517 and broken rice under quota 09.4079. |

|

(3) |

Commission Regulation (EC) No 1918/2006 (9) lays down specific provisions on the lodging of import licence applications and the issuing of import licences for olive oil originating in Tunisia under the quota available. |

|

(4) |

In view of the public holidays in 2016, derogations should be made, at certain times, from Regulations (EC) Nos 2305/2003, 969/2006, 1067/2008, Implementing Regulation (EU) 2015/2081, Regulation (EC) Nos 1964/2006, Implementing Regulation (EU) No 480/2012 and Regulation (EC) No 1918/2006 as regards the dates for lodging import licence applications and issuing import licences in order to ensure compliance with the quota volumes in question. |

|

(5) |

Under Article 7d(1) of Commission Regulation (EC) No 951/2006 (10), export licences for out-of-quota sugar and isoglucose are issued from the Friday following the week during which the licence applications were lodged, provided that no particular measures have since been taken by the Commission. |

|

(6) |

In view of the public holidays in 2016 and the resulting impact on the publication of the Official Journal of the European Union, the period between the lodging of applications and the day on which the licences are to be issued will be too short to ensure proper management of the market. That period should therefore be extended. |

|

(7) |

The measures provided for in this Regulation are in accordance with the opinion of the Committee for the Common Organisation of Agricultural Markets, |

HAS ADOPTED THIS REGULATION:

Article 1

Cereals

1. By way of derogation from the second subparagraph of Article 3(1) of Regulation (EC) No 2305/2003, for 2016, import licence applications for barley under quota 09.4126 may not be lodged before Monday 4 January 2016 or after 13.00 (Brussels time) on Friday 16 December 2016.

2. By way of derogation from the first subparagraph of Article 3(4) of Regulation (EC) No 2305/2003, for 2016, import licences for barley issued under quota 09.4126 and applied for during the periods referred to in Annex I to this Regulation shall be issued on the corresponding dates specified therein, subject to measures adopted pursuant to Article 7(2) of Commission Regulation (EC) No 1301/2006 (11).

3. By way of derogation from the second subparagraph of Article 4(1) of Regulation (EC) No 969/2006, for 2016, import licence applications for maize under quota 09.4131 may not be lodged before Monday 4 January 2016 or after 13.00 (Brussels time) on Friday 16 December 2016.

4. By way of derogation from the first subparagraph of Article 4(4) of Regulation (EC) No 969/2006, for 2016, import licences for maize issued under quota 09.4131 and applied for during the periods referred to in Annex I to this Regulation shall be issued on the corresponding dates specified therein, subject to measures adopted pursuant to Article 7(2) of Regulation (EC) No 1301/2006.

5. By way of derogation from the second subparagraph of Article 4(1) of Regulation (EC) No 1067/2008, for 2016, import licence applications for common wheat of a quality other than high quality under quotas 09.4123, 09.4124, 09.4125 and 09.4133 may not be lodged before Monday 4 January 2016 or after 13.00 (Brussels time) on Friday 16 December 2016.

6. By way of derogation from the first subparagraph of Article 4(4) of Regulation (EC) No 1067/2008, for 2016, import licences for common wheat issued under quotas 09.4123, 09.4124, 09.4125 and 09.4133 and applied for during the periods referred to in Annex I to this Regulation shall be issued on the corresponding dates specified therein, subject to measures adopted pursuant to Article 7(2) of Regulation (EC) No 1301/2006.

7. By way of derogation from the second subparagraph of Article 2(1) of Implementing Regulation (EU) 2015/2081, for 2016, import licence applications for cereals originating in Ukraine under quotas 09.4306, 09.4307 and 09.4308 may not be lodged before Monday 4 January 2016 or after 13.00 (Brussels time) on Friday 16 December 2016.

8. By way of derogation from Article 2(3) of Implementing Regulation (EU) 2015/2081, for 2016, import licences for cereals originating in Ukraine issued under quotas 09.4306, 09.4307 and 09.4308 and applied for during the periods referred to in Annex I to this Regulation shall be issued on the corresponding dates specified therein, subject to measures adopted pursuant to Article 7(2) of Regulation (EC) No 1301/2006.

Article 2

Rice

1. By way of derogation from the first subparagraph of Article 4(3) of Regulation (EC) No 1964/2006, for 2016, import licence applications for rice originating in Bangladesh under quota 09.4517 may not be lodged before Monday 4 January 2016 or after 13.00 (Brussels time) on Friday 9 December 2016.

2. By way of derogation from the third subparagraph of Article 2(1) of Implementing Regulation (EU) No 480/2012, for 2016, import licence applications for broken rice under quota 09.4079 may not be lodged before Monday 4 January 2016 or after 13.00 (Brussels time) on Friday 9 December 2016.

Article 3

Olive oil

1. By way of derogation from Article 3(1) of Regulation (EC) No 1918/2006, import licence applications for olive oil originating in Tunisia may not be lodged after Tuesday 13 December 2016.

2. By way of derogation from Article 3(3) of Regulation (EC) No 1918/2006, import licences for olive oil originating in Tunisia applied for during the periods referred to in Annex II to this Regulation shall be issued on the corresponding dates specified therein, subject to measures adopted pursuant to Article 7(2) of Regulation (EC) No 1301/2006.

Article 4

Out-of-quota sugar and isoglucose

By way of derogation from Article 7d(1) of Regulation (EC) No 951/2006, export licences for out-of-quota sugar and isoglucose for which applications are lodged during the periods referred to in Annex III to this Regulation shall be issued on the corresponding dates specified therein, taking account where applicable of the specific measures referred to in Article 9(1) and (2) of Regulation (EC) No 951/2006.

Article 5

Entry into force

This Regulation shall enter into force on the third day following that of its publication in the Official Journal of the European Union.

It shall expire on 10 January 2017.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 16 December 2015.

For the Commission,

On behalf of the President,

Jerzy PLEWA

Director-General for Agriculture and Rural Development

(1) OJ L 146, 20.6.1996, p. 1.

(2) OJ L 347, 20.12.2013, p. 671.

(3) Commission Regulation (EC) No 2305/2003 of 29 December 2003 opening and providing for the administration of a Community tariff quota for imports of barley from third countries (OJ L 342, 30.12.2003, p. 7).

(4) Commission Regulation (EC) No 969/2006 of 29 June 2006 opening and providing for the administration of a Community tariff quota for imports of maize from third countries (OJ L 176, 30.6.2006, p. 44).

(5) Commission Regulation (EC) No 1067/2008 of 30 October 2008 opening and providing for the administration of Community tariff quotas for common wheat of a quality other than high quality from third countries and derogating from Council Regulation (EC) No 1234/2007 (consolidated version) (OJ L 290, 31.10.2008, p. 3).

(6) Commission Implementing Regulation (EU) 2015/2081 of 18 November 2015 opening and providing for the administration of import tariff quotas for certain cereals originating in Ukraine (OJ L 302, 19.11.2015, p. 81).

(7) Commission Regulation (EC) No 1964/2006 of 22 December 2006 laying down detailed rules for the opening and administration of an import quota for rice originating in Bangladesh, pursuant to Council Regulation (EEC) No 3491/90 (OJ L 408, 30.12.2006, p. 19).

(8) Commission Implementing Regulation (EU) No 480/2012 of 7 June 2012 opening and providing for the management of a tariff quota for broken rice falling within CN code 1006 40 00 for the production of food preparations falling within CN code 1901 10 00 (OJ L 148, 8.6.2012, p. 1).

(9) Commission Regulation (EC) No 1918/2006 of 20 December 2006 opening and providing for the administration of tariff quotas for olive oil originating in Tunisia (OJ L 365, 21.12.2006, p. 84).

(10) Commission Regulation (EC) No 951/2006 of 30 June 2006 laying down detailed rules for the implementation of Council Regulation (EC) No 318/2006 as regards trade with third countries in the sugar sector (OJ L 178, 1.7.2006, p. 24).

(11) Commission Regulation (EC) No 1301/2006 of 31 August 2006 laying down common rules for the administration of import tariff quotas for agricultural products managed by a system of import licences (OJ L 238, 1.9.2006, p. 13).

ANNEX I

|

Periods for lodging cereal import licence applications |

Dates of issue |

|

Friday 18 March from 13.00 until Friday 25 March 2016 at 13.00, Brussels time |

The first working day from Monday 4 April 2016 |

|

Friday 21 October from 13.00 until Friday 28 October 2016 at 13.00, Brussels time |

The first working day from Monday 7 November 2016 |

ANNEX II

|

Periods for lodging olive oil import licence applications |

Dates of issue |

|

Monday 21 or Tuesday 22 March 2016 |

The first working day from Friday 1 April 2016 |

|

Monday 2 or Tuesday 3 May 2016 |

The first working day from Friday 13 May 2016 |

|

Monday 9 or Tuesday 10 May 2016 |

The first working day from Wednesday 18 May 2016 |

|

Monday 18 or Tuesday 19 July 2016 |

The first working day from Wednesday 27 July 2016 |

|

Monday 8 or Tuesday 9 August 2016 |

The first working day from Wednesday 17 August 2016 |

|

Monday 24 or Tuesday 25 October 2016 |

The first working day from Thursday 3 November 2016 |

ANNEX III

|

Periods for lodging export licence applications for out-of-quota sugar and isoglucose |

Dates of issue |

|

Monday 24 to Friday 28 October 2016 |

The first working day from Tuesday 8 November 2016 |

|

Monday 19 to Friday 23 December 2016 |

The first working day from Friday 6 January 2017 |

|

18.12.2015 |

EN |

Official Journal of the European Union |

L 332/50 |

COMMISSION IMPLEMENTING REGULATION (EU) 2015/2380

of 16 December 2015

amending Regulation (EC) No 1484/95 as regards fixing representative prices in the poultrymeat and egg sectors and for egg albumin

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Regulation (EU) No 1308/2013 of the European Parliament and of the Council of 17 December 2013 establishing a common organisation of the markets in agricultural products and repealing Council Regulations (EEC) No 922/72, (EEC) No 234/79, (EC) No 1037/2001 and (EC) No 1234/2007 (1), and in particular Article 183(b) thereof,

Having regard to Regulation (EU) No 510/2014 of the European Parliament and of the Council of 16 April 2014 laying down the trade arrangements applicable to certain goods resulting from the processing of agricultural products and repealing Council Regulations (EC) No 1216/2009 and (EC) No 614/2009 (2), and in particular Article 5(6)(a) thereof,

Whereas:

|

(1) |

Commission Regulation (EC) No 1484/95 (3) lays down detailed rules for implementing the system of additional import duties and fixes representative prices in the poultrymeat and egg sectors and for egg albumin. |

|

(2) |

Regular monitoring of the data used to determine representative prices for poultrymeat and egg products and for egg albumin shows that the representative import prices for certain products should be amended to take account of variations in price according to origin. |

|

(3) |

Regulation (EC) No 1484/95 should be amended accordingly. |

|

(4) |

Given the need to ensure that this measure applies as soon as possible after the updated data have been made available, this Regulation should enter into force on the day of its publication, |

HAS ADOPTED THIS REGULATION:

Article 1

Annex I to Regulation (EC) No 1484/95 is replaced by the text set out in the Annex to this Regulation.

Article 2

This Regulation shall enter into force on the day of its publication in the Official Journal of the European Union.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 16 December 2015.

For the Commission,

On behalf of the President,

Jerzy PLEWA

Director-General for Agriculture and Rural Development

(1) OJ L 347, 20.12.2013, p. 671.

(2) OJ L 150, 20.5.2014, p. 1.

(3) Commission Regulation (EC) No 1484/95 of 28 June 1995 laying down detailed rules for implementing the system of additional import duties and fixing representative prices in the poultrymeat and egg sectors and for egg albumin, and repealing Regulation (EEC) No 163/67 (OJ L 145, 29.6.1995, p. 47).

ANNEX

‘ANNEX I

|

CN code |

Description of goods |

Representative price (EUR/100 kg) |

Security under Article 3 (EUR/100 kg) |

Origin (1) |

|

0207 12 10 |

Fowls of the species Gallus domesticus, not cut in pieces, presented as “70 % chickens”, frozen |

130,1 |

0 |

AR |

|

0207 12 90 |

Fowls of the species Gallus domesticus, not cut in pieces, presented as “65 % chickens”, frozen |

154,5 145,7 |

0 0 |

AR BR |

|

0207 14 10 |

Fowls of the species Gallus domesticus, boneless cuts, frozen |

286,0 197,1 343,8 219,0 |

4 32 0 24 |

AR BR CL TH |

|

0207 27 10 |

Turkeys, boneless cuts, frozen |

329,9 244,7 |

0 16 |

BR CL |

|

0408 91 80 |

Eggs, not in shell, dried |

431,0 |

0 |

AR |

|

1602 32 11 |

Preparations of fowls of the species Gallus domesticus, uncooked |

225,1 |

19 |

BR |

(1) Nomenclature of countries laid down by Commission Regulation (EU) No 1106/2012 of 27 November 2012 implementing Regulation (EC) No 471/2009 of the European Parliament and of the Council on Community statistics relating to external trade with non-member countries, as regards the update of the nomenclature of countries and territories (OJ L 328, 28.11.2012, p. 7). The code “ZZ” represents “other origins”.’

|

18.12.2015 |

EN |

Official Journal of the European Union |

L 332/52 |

COMMISSION REGULATION (EU) 2015/2381

of 17 December 2015