ISSN 1977-0677

Official Journal

of the European Union

L 271

English edition

Legislation

Volume 57

12 September 2014

|

ISSN 1977-0677 |

||

|

Official Journal of the European Union |

L 271 |

|

|

||

|

English edition |

Legislation |

Volume 57 |

|

Contents |

|

II Non-legislative acts |

page |

|

|

|

REGULATIONS |

|

|

|

* |

||

|

|

* |

||

|

|

* |

||

|

|

* |

||

|

|

* |

||

|

|

* |

||

|

|

|

||

|

|

|

DECISIONS |

|

|

|

* |

||

|

|

* |

||

|

|

|

2014/660/EU |

|

|

|

* |

||

|

|

|

RECOMMENDATIONS |

|

|

|

|

2014/661/EU |

|

|

|

* |

Commission Recommendation of 10 September 2014 on the monitoring of the presence of 2 and 3-monochloropropane-1,2-diol (2 and 3-MCPD), 2- and 3-MCPD fatty acid esters and glycidyl fatty acid esters in food ( 1 ) |

|

|

|

|

2014/662/EU |

|

|

|

* |

Commission Recommendation of 10 September 2014 on good practices to prevent and to reduce the presence of opium alkaloids in poppy seeds and poppy seed products ( 1 ) |

|

|

|

Corrigenda |

|

|

|

* |

|

|

|

|

|

(1) Text with EEA relevance |

|

EN |

Acts whose titles are printed in light type are those relating to day-to-day management of agricultural matters, and are generally valid for a limited period. The titles of all other Acts are printed in bold type and preceded by an asterisk. |

II Non-legislative acts

REGULATIONS

|

12.9.2014 |

EN |

Official Journal of the European Union |

L 271/1 |

COUNCIL REGULATION (EU) No 959/2014

of 8 September 2014

amending Regulation (EU) No 269/2014 concerning restrictive measures in respect of actions undermining or threatening the territorial integrity, sovereignty and independence of Ukraine

THE COUNCIL OF THE EUROPEAN UNION,

Having regard to the Treaty on the Functioning of the European Union, and in particular Article 215 thereof,

Having regard to Council Decision 2014/145/CFSP of 17 March 2014 concerning restrictive measures in respect of actions undermining or threatening the territorial integrity, sovereignty and independence of Ukraine (1),

Having regard to the joint proposal of the High Representative of the Union for Foreign Affairs and Security Policy and of the European Commission,

Whereas:

|

(1) |

Council Regulation (EU) No 269/2014 (2) gives effect to certain measures provided for in Decision 2014/145/CFSP and provides for the freezing of funds and economic resources of natural persons responsible for, actively supporting or implementing, actions or policies which undermine or threaten the territorial integrity, sovereignty and independence of Ukraine, or stability or security in Ukraine or which obstruct the work of international organisations in Ukraine, and natural or legal persons, entities or bodies associated with them; legal persons, entities or bodies supporting, materially or financially, actions which undermine or threaten the territorial integrity, sovereignty and independence of Ukraine; legal persons, entities or bodies in Crimea or Sevastopol whose ownership has been transferred contrary to Ukrainian law, or legal persons, entities or bodies which have benefitted from such a transfer; or natural or legal persons, entities or bodies actively supporting, materially or financially, or benefitting from, Russian decision-makers responsible for the annexation of Crimea or the destabilisation of Eastern Ukraine. |

|

(2) |

On 8 September 2014, the Council agreed to expand restrictive measures with a view to targeting individuals or entities conducting transactions with the separatist groups in the Donbass region of Ukraine. The Council adopted Decision 2014/658/CFSP (3) which amends Decision 2014/145/CFSP and provides for amended listing criteria to that end. |

|

(3) |

That measure falls within the scope of the Treaty and, therefore, in particular with a view to ensuring its uniform application in all Member States, regulatory action at the level of the Union is necessary in order to implement it. |

|

(4) |

Regulation (EU) No 269/2014 should therefore be amended accordingly. |

|

(5) |

In order to ensure that the measures provided for in this Regulation are effective, it should enter into force immediately, |

HAS ADOPTED THIS REGULATION:

Article 1

The following point is added to Article 3(1) of Regulation (EU) No 269/2014:

|

‘(e) |

natural or legal persons, entities or bodies conducting transactions with the separatist groups in the Donbass region of Ukraine.’ |

Article 2

This Regulation shall enter into force on the date of its publication in the Official Journal of the European Union.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 8 September 2014.

For the Council

The President

S. GOZI

(1) OJ L 78, 17.3.2014, p. 16.

(2) Council Regulation (EU) No 269/2014 of 17 March 2014 concerning restrictive measures in respect of actions undermining or threatening the territorial integrity, sovereignty and independence of Ukraine (OJ L 78, 17.3.2014, p. 6).

(3) Council Decision 2014/658/CFSP of 8 September 2014 amending Decision 2014/145/CFSP concerning restrictive measures in respect of actions undermining or threatening the territorial integrity, sovereignty and independence of Ukraine (see page 47 of this Official Journal).

|

12.9.2014 |

EN |

Official Journal of the European Union |

L 271/3 |

COUNCIL REGULATION (EU) No 960/2014

of 8 September 2014

amending Regulation (EU) No 833/2014 concerning restrictive measures in view of Russia's actions destabilising the situation in Ukraine

THE COUNCIL OF THE EUROPEAN UNION,

Having regard to the Treaty on the Functioning of the European Union, and in particular Article 215 thereof,

Having regard to Council Decision 2014/659/CFSP of 8 September 2014 amending Decision 2014/512/CFSP concerning restrictive measures in view of Russia's actions destabilising the situation in Ukraine (1),

Having regard to the joint proposal of the High Representative of the Union for Foreign Affairs and Security Policy and of the European Commission,

Whereas:

|

(1) |

Council Regulation (EU) No 833/2014 (2) gives effect to certain measures provided for in Council Decision 2014/512/CFSP (3). Those measures comprise restrictions on exports of dual-use goods and technology, restrictions on the provision of related services and on certain services related to the supply of arms and military equipment, restrictions on the sale, supply, transfer or export, directly or indirectly, of certain technologies for the oil industry in Russia in the form of a prior authorisation requirement, and restrictions on access to the capital market for certain financial institutions. |

|

(2) |

The Heads of State or Government of the European Union called for preparatory work on further targeted measures to be undertaken so that further steps could be taken without delay. |

|

(3) |

In view of the gravity of the situation, the Council considers it appropriate to take further restrictive measures in response to Russia's actions destabilising the situation in Ukraine. |

|

(4) |

In this context, it is appropriate to apply additional restrictions on exports of dual-use goods and technology, as laid down in Council Regulation (EC) No 428/2009 (4). |

|

(5) |

In addition, the provision of services for deep water oil exploration and production, arctic oil exploration and production or shale oil projects should be prohibited. |

|

(6) |

In order to put pressure on the Russian Government, it is also appropriate to apply further restrictions on access to the capital market for certain financial institutions, excluding Russia-based institutions with international status established by intergovernmental agreements with Russia as one of the shareholders; restrictions on legal persons, entities or bodies established in Russia in the defence sector, with the exception of those mainly active in the space and nuclear energy industry; and restrictions on legal persons, entities or bodies established in Russia whose main activities relate to the sale or transportation of crude oil or petroleum products. Financial services other than those referred to in Article 5 of Regulation (EU) No 833/2014, such as deposit services, payment services, insurance services, loans from the institutions referred to in Article 5(1) and (2) of that Regulation and derivatives used for hedging purposes in the energy market are not covered by these restrictions. Loans are only to be considered new loans if they are drawn after 12 September 2014. |

|

(7) |

These measures fall within the scope of the Treaty and, therefore, in particular with a view to ensuring its uniform application in all Member States, regulatory action at the level of the Union is necessary. |

|

(8) |

In order to ensure that the measures provided for in this Regulation are effective, it should enter into force immediately, |

HAS ADOPTED THIS REGULATION:

Article 1

Regulation (EU) No 833/2014 is amended as follows:

|

(1) |

In Article 1, points (e) and (f), are replaced by the following:

. |

|

(2) |

The following Article is inserted: ‘Article 2a 1. It shall be prohibited to sell, supply, transfer or export, directly or indirectly, dual-use goods and technology as included in Annex I to Regulation (EC) No 428/2009, whether or not originating in the Union, to natural or legal persons, entities or bodies in Russia as listed in Annex IV to this Regulation. 2. It shall be prohibited:

3. The prohibitions in paragraphs 1 and 2 shall be without prejudice to the execution of contracts or agreements concluded before 12 September 2014 and to the provision of assistance necessary to the maintenance and safety of existing capabilities within the EU. 4. The prohibitions in paragraphs 1 and 2 shall not apply to the sale, supply, transfer or export of dual use goods and technology intended for the aeronautics and space industry, or the related provision of technical and financial assistance, for non military use and for a non military end user, as well as for maintenance and safety of existing civil nuclear capabilities within the EU, for non military use and for a non military end user.’ . |

|

(3) |

The following Article is inserted: ‘Article 3a 1. It shall be prohibited to provide, directly or indirectly, the following associated services necessary for deep water oil exploration and production, arctic oil exploration and production, or shale oil projects in Russia:

2. The prohibitions in paragraph 1 shall be without prejudice to the execution of an obligation arising from a contract or a framework agreement concluded before 12 September 2014 or ancillary contracts necessary for the execution of such contracts. 3. The prohibition in paragraph 1 shall not apply where the services in question are necessary for the urgent prevention or mitigation of an event likely to have a serious and significant impact on human health and safety or the environment.’ . |

|

(4) |

In Article 4(1), point (b) is replaced by the following:

. |

|

(5) |

Article 5 is replaced by the following: ‘Article 5 1. It shall be prohibited to directly or indirectly purchase, sell, provide investment services for or assistance in the issuance of, or otherwise deal with transferable securities and money-market instruments with a maturity exceeding 90 days, issued after 1 August 2014 to 12 September 2014, or with a maturity exceeding 30 days, issued after 12 September 2014 by:

2. It shall be prohibited to directly or indirectly purchase, sell, provide investment services for or assistance in the issuance of, or otherwise deal with transferable securities and money-market instruments with a maturity exceeding 30 days, issued after 12 September 2014 by:

3. It shall be prohibited to directly or indirectly make or be part of any arrangement to make new loans or credit with a maturity exceeding 30 days to any legal person, entity or body referred to in paragraph 1 or 2, after 12 September 2014 except for loans or credit that have a specific and documented objective to provide financing for non-prohibited imports or exports of goods and non-financial services between the Union and Russia or for loans that have a specific and documented objective to provide emergency funding to meet solvency and liquidity criteria for legal persons established in the Union, whose proprietary rights are owned for more than 50 % by any entity referred to in Annex III.’ . |

|

(5a) |

Point (a) of Article 11(1) is replaced by the following:

. |

|

(6) |

Article 12 is replaced by the following: ‘Article 12 It shall be prohibited to participate, knowingly and intentionally, in activities the object or effect of which is to circumvent the prohibitions referred to in Articles 2, 2a, 3a, 4 or 5, including by acting as a substitute for the entities referred to in Article 5, or by using the exceptions in Article 5(3) to fund entities referred to in Article 5.’ . |

|

(7) |

Annex I to this Regulation is added as Annex IV. |

|

(8) |

Annex II to this Regulation is added as Annex V. |

|

(9) |

Annex III to this Regulation is added as Annex VI. |

Article 2

This Regulation shall enter into force on the date of its publication in the Official Journal of the European Union.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 8 September 2014.

For the Council

The President

S. GOZI

(1) See page 54 of this Official Journal.

(2) Council Regulation (EU) No 833/2014 of 31 July 2014 concerning restrictive measures in view of Russia's actions destabilising the situation in Ukraine (OJ L 229, 31.7.2014, p. 1).

(3) Council Decision 2014/512/CFSP of 31 July 2014 concerning restrictive measures in view of Russia's actions destabilising the situation in Ukraine (OJ L 229, 31.7.2014, p. 13).

(4) Council Regulation (EC) No 428/2009 of 5 May 2009 setting up a Community regime for the control of exports, transfer, brokering and transit of dual-use items (OJ L 134, 29.5.2009, p. 1).

ANNEX I

‘ANNEX IV

List of natural or legal persons, entities or bodies, referred to in Article 2a

|

|

JSC Sirius (optoelectronics for civil and military purposes) |

|

|

OJSC Stankoinstrument (mechanical engineering for civil and military purposes) |

|

|

OAO JSC Chemcomposite (materials for civil and military purposes) |

|

|

JSC Kalashnikov (small arms) |

|

|

JSC Tula Arms Plant (weapons systems) |

|

|

NPK Technologii Maschinostrojenija (ammunition) |

|

|

OAO Wysokototschnye Kompleksi (anti-aircraft and anti-tank systems) |

|

|

OAO Almaz Antey (state-owned enterprise; arms, ammunition, research) |

|

|

OAO NPO Bazalt (state-owned enterprise, production of machinery for the production of arms and ammunition)’ |

ANNEX II

‘ANNEX V

List of persons, entities and bodies referred to in Article 5(2)(a)

|

|

OPK OBORONPROM |

|

|

UNITED AIRCRAFT CORPORATION |

|

|

URALVAGONZAVOD’ |

ANNEX III

‘ANNEX VI

List of persons, entities and bodies referred to in Article 5(2)(b)

|

|

ROSNEFT |

|

|

TRANSNEFT |

|

|

GAZPROM NEFT’ |

|

12.9.2014 |

EN |

Official Journal of the European Union |

L 271/8 |

COUNCIL IMPLEMENTING REGULATION (EU) No 961/2014

of 8 September 2014

implementing Regulation (EU) No 269/2014 concerning restrictive measures in respect of actions undermining or threatening the territorial integrity, sovereignty and independence of Ukraine

THE COUNCIL OF THE EUROPEAN UNION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Council Regulation (EU) No 269/2014 of 17 March 2014 concerning restrictive measures in respect of actions undermining or threatening the territorial integrity, sovereignty and independence of Ukraine (1), and in particular Article 14(1) thereof,

Whereas:

|

(1) |

On17 March 2014, the Council adopted Regulation (EU) No 269/2014. |

|

(2) |

In view of the gravity of the situation, the Council considers that additional persons and entities should be added to the list of natural and legal persons, entities and bodies subject to restrictive measures as set out in Annex I to Regulation (EU) No 269/2014. |

|

(3) |

Annex I to Regulation (EU) No 269/2014 should therefore be amended accordingly, |

HAS ADOPTED THIS REGULATION:

Article 1

The persons and entities listed in the Annex to this Regulation shall be added to the list set out in Annex I to Regulation (EU) No 269/2014.

Article 2

This Regulation shall enter into force on the date of its publication in the Official Journal of the European Union.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 8 September 2014.

For the Council

The President

S. GOZI

ANNEX

List of persons and entities referred to in Article 1

|

|

Name |

Identifying information |

Reasons |

Date of listing |

|

1. |

Alexander ZAKHARCHENKO Александр Владимирович Захарченко |

Born in 1976 in Donetsk |

As of 7 August, he replaced Alexander Borodai as the so-called ‘Prime minister’ of the so-called ‘Donetsk People's Republic’. In taking on and acting in this capacity, Zakharchenko has supported actions and policies which undermine the territorial integrity, sovereignty and independence of Ukraine. |

12.9.2014 |

|

2. |

Vladimir KONONOV/aka ‘Tsar’

|

Born on 14.10.1974 in Gorsky |

As of 14 August, he replaced Igor Strelkov/Girkin, as the so-called ‘Defence minister’ of the so-called ‘Donetsk People's Republic’. He has reportedly commanded a division of separatist fighters in Donetsk since April and has promised to solve the strategic task of repelling Ukraine's military aggression. Konokov has therefore supported actions and policies which undermine the territorial integrity, sovereignty and independence of Ukraine. |

12.9.2014 |

|

3. |

Miroslav Vladimirovich RUDENKO Мирослав Владимирович Руденко |

21.1.1983 in Debalcevo |

Commander of the Donbass People's Militia. He has inter alia stated that they will continue their fighting in the rest of the country. Rudenko has therefore supported actions and policies which undermine the territorial integrity, sovereignty and independence of Ukraine. |

12.9.2014 |

|

4. |

Gennadiy Nikolaiovych TSYPKALOV Геннадий Николаевич Цыпкалов. |

Born on 6.21.1973 |

Replaced Marat Bashirov as so-called ‘Prime Minister’ of the so-called ‘Lugansk People's Republic’. Previously active in the militia Army of the Southeast. Tsyplakov has therefore supported actions and policies which undermine the territorial integrity, sovereignty and independence of Ukraine. |

12.9.2014 |

|

5. |

Andrey Yurevich PINCHUK Андрей Юрьевич ПИНЧУК |

|

‘State security minister’ of the so-called ‘Donetsk People's Republic’. Associated with Vladimir Antyufeyev, who is responsible for the separatist ‘governmental’ activities of the so called ‘government of the Donetsk People's Republic’. He has therefore supported actions and policies which undermine the territorial integrity, sovereignty and independence of Ukraine. |

12.9.2014 |

|

6. |

Oleg BEREZA Олег БЕРЕЗА |

|

‘Internal affairs minister’ of the so-called ‘Donetsk People's Republic’. Associated with Vladimir Antyufeyev, who is responsible for the separatist ‘governmental’ activities of the so called ‘Government of the Donetsk People's Republic’. He has therefore supported actions and policies which undermine the territorial integrity, sovereignty and independence of Ukraine. |

12.9.2014 |

|

7. |

Andrei Nikolaevich RODKIN Андрей Николаевич Родкин |

|

Moscow Representative of the so called ‘Donetsk People's Republic’. In his statements, he has inter alia talked about the militias' readiness to conduct a guerrilla war and their seizure of weapon systems from the Ukrainian armed forces. He has therefore supported actions and policies which undermine the territorial integrity, sovereignty and independence of Ukraine. |

12.9.2014 |

|

8. |

Aleksandr KARAMAN Александр караман |

|

‘Deputy Prime Minister for Social Issues’ of the so called ‘Donetsk People's Republic’. Associated with Vladimir Antyufeyev, who is responsible for the separatist ‘governmental’ activities of the so called ‘Government of the Donetsk People's Republic’. He has therefore supported actions and policies which undermine the territorial integrity, sovereignty and independence of Ukraine. Protégé of Russia's Deputy Prime Minister Dmitry Rogozin. |

12.9.2014 |

|

9. |

Georgiy L'vovich MURADOV Георгий Львович Мурадов |

Born on 19.11.1954 |

So called ‘Deputy Prime Minister’ of Crimea and Plenipotentiary Representative of Crimea to President Putin. Muradov has played an important role in consolidating Russian institutional control over Crimea since the illegal annexation. He has therefore supported actions and policies which undermine the territorial integrity, sovereignty and independence of Ukraine. |

12.9.2014 |

|

10. |

Mikhail Sergeyevich SHEREMET Михаил Сергеевич Шеремет |

Born on 23.5.1971 in Dzhankoy |

So called ‘First Deputy Prime Minister’ of Crimea. Sheremet played a key role in the organization and implementation of the 16 March referendum in Crimea on unification with Russia. At the time of the referendum, Sheremet reportedly commanded the pro-Moscow ‘self-defense forces’ in Crimea. He has therefore supported actions and policies which undermine the territorial integrity, sovereignty and independence of Ukraine. |

12.9.2014 |

|

11. |

Yuri Leonidovich VOROBIOV Юрий Леонидович Воробьев |

Born on 2.2.1948 in Krasnoyarsk |

Deputy Speaker of the Federation Council of the Russian Federation On 1 March 2014 Vorobiov publicly supported in the Federation Council the deployment of Russian forces in Ukraine. He subsequently voted in favour of the related decree. |

12.9.2014 |

|

12. |

Vladimir Volfovich ZHIRINOVSKY Владимир Вольфович Жириновски |

Born on 10.6.1964 in Eidelshtein, Kasakhstan |

Member of the Council of the State Duma; leader of the LDPR party. He actively supported the use of Russian Armed Forces in Ukraine and annexation of Crimea. He has actively called for the split of Ukraine. He signed on behalf of the LDPR party he chairs an agreement with the so-called, ‘Donetsk People's Republic’. |

12.9.2014 |

|

13. |

Vladimir Abdualiyevich VASILYEV

|

Born on 11.8.1949 in Klin |

Deputy Speaker of the State Duma. On 20 March 2014 he voted in favour of the draft Federal Constitutional Law ‘on the acceptance into the Russian Federation of the Republic of Crimea and the formation within the Russian Federation of new federal subjects- the republic of Crimea and the City of Federal Status Sevastopol’. |

12.9.2014 |

|

14. |

Viktor Petrovich VODOLATSKY Виктор Петрович Водолацкий |

Born on 19.8.1957 in Azov Region. |

Chairman (‘ataman’) of the Union of the Russian and Foreign Cossack Forces, and deputy of the State Duma. He supported the annexation of Crimea and admitted that Russian Cossacks were actively engaged in the Ukrainian conflict on the side of the Moscow-backed separatists. On 20 March 2014 he voted in favour of the draft Federal Constitutional Law ‘on the acceptance into the Russian Federation of the Republic of Crimea and the formation within the Russian Federation of new federal subjects- the republic of Crimea and the City of Federal Status Sevastopol’. |

12.9.2014 |

|

15. |

Leonid Ivanovich KALASHNIKOV Леонид Иванович Калашников |

Born on 6.8.1960 in Stepnoy Dvorets |

First deputy Chairman of the Committee on Foreign Affairs of the State Duma. On 20 March 2014 he voted in favour of the draft Federal Constitutional Law ‘on the acceptance into the Russian Federation of the Republic of Crimea and the formation within the Russian Federation of new federal subjects- the republic of Crimea and the City of Federal Status Sevastopol’. |

12.9.2014 |

|

16. |

Vladimir Stepanovich NIKITIN

|

Born on 5.4.1948 in Opochka |

First Deputy Chairman of the Committee on Relations with CIS Countries, Eurasian Integration and Links with Compatriots of the State Duma. On 20 March 2014 he voted in favour of the draft Federal Constitutional Law ‘on the acceptance into the Russian Federation of the Republic of Crimea and the formation within the Russian Federation of new federal subjects- the republic of Crimea and the City of Federal Status Sevastopol’. |

12.9.2014 |

|

17. |

Oleg Vladimirovich LEBEDEV Олег Владимирович Лебедев |

Born on 21.3.1964 in Orel/Rudny |

First Deputy Chairman of the Committee on Relations with CIS Countries, Eurasian Integration and Links with Compatriots of the State Duma. On 20 March 2014 he voted in favour of the draft Federal Constitutional Law ‘on the acceptance into the Russian Federation of the Republic of Crimea and the formation within the Russian Federation of new federal subjects- the republic of Crimea and the City of Federal Status Sevastopol’. |

12.9.2014 |

|

18. |

Ivan Ivanovich MELNIKOV Иван Иванович Мельников |

Born on 7.8.1950 in Bogoroditsk |

First Deputy Speaker, State Duma. On 20 March 2014 he voted in favour of the draft Federal Constitutional Law ‘on the acceptance into the Russian Federation of the Republic of Crimea and the formation within the Russian Federation of new federal subjects- the republic of Crimea and the City of Federal Status Sevastopol’. |

12.9.2014 |

|

19. |

Igor Vladimirovich LEBEDEV Игорь Владимирович Лебедев |

Born on 27.9.1972 in Moscow |

Deputy Speaker, State Duma. On 20 March 2014 he voted in favour of the draft Federal Constitutional Law ‘on the acceptance into the Russian Federation of the Republic of Crimea and the formation within the Russian Federation of new federal subjects- the republic of Crimea and the City of Federal Status Sevastopol’. |

12.9.2014 |

|

20. |

Nikolai Vladimirovich LEVICHEV Николай Владимирович Левичев |

Born on 28.5.1953 in Pushkin |

Deputy Speaker, State Duma. On 20 March 2014 he voted in favour of the draft Federal Constitutional Law ‘on the acceptance into the Russian Federation of the Republic of Crimea and the formation within the Russian Federation of new federal subjects- the republic of Crimea and the City of Federal Status Sevastopol’. |

12.9.2014 |

|

21. |

Svetlana Sergeevna ZHUROVA Светлана Сергеевна Журова |

Born on 7.1.1972 in Pavlov-on-the-Neva |

First Deputy Chairman of the Committee on Foreign Affairs, State Duma. On 20 March 2014 he voted in favour of the draft Federal Constitutional Law ‘on the acceptance into the Russian Federation of the Republic of Crimea and the formation within the Russian Federation of new federal subjects- the republic of Crimea and the City of Federal Status Sevastopol’. |

12.9.2014 |

|

22. |

Aleksey Vasilevich NAUMETS Алексей Васильевич Hаумец |

Born on 11.2.1968 |

Major-general of the Russian Army. He is the commander of the 76th airborne division which has been involved in the Russian military presence on the territory of Ukraine, notably during the illegal annexation of Crimea. |

12.9.2014 |

|

23. |

Sergey Viktorovich CHEMEZOV

|

Born on 20.8.1952 in Cheremkhovo |

Sergei Chemezov is one of President Putin's known close associate, both were KGB officers posted in Dresden and he is a member of the Supreme Council of ‘United Russia’. He is benefiting from his links with the Russian President by being promoted to senior positions in State-controlled firms. He chairs the Rostec conglomerate, the leading Russian state-controlled defence and industrial manufacturing corporation. Further to a decision of the Russian government, Technopromexport, a subsidiary of Rostec, is planning to build energy plants in Crimea thereby supporting its integration into the Russian Federation. Furthermore, Rosoboronexport, a subsidiary of Rostec, has supported the integration of Crimean defence companies into Russia's defence industry, thereby consolidating the illegal annexation of Crimea into the Russian Federation. |

12.9.2014 |

|

24. |

Alexander Mikhailovich BABAKOV Aлександр Михайлович Бабаков |

Born on 8.2.1963 in Chisinau |

State Duma Deputy, Chair of the State Duma Commission on Legislative Provisions for Development of the Military-Industrial Complex of the Russian Federation. He is a prominent member of ‘United Russia’ and a businessman with heavy investments in Ukraine and in Crimea. On the 20 March 2014 he voted in favour of the draft Federal Constitutional Law ‘on the acceptance into the Russian Federation of the Republic of Crimea and the formation within the Russian Federation of new federal subjects — the Republic of Crimea and the city of federal status of Sevastopol’. |

12.9.2014 |

|

12.9.2014 |

EN |

Official Journal of the European Union |

L 271/14 |

COMMISSION IMPLEMENTING REGULATION (EU) No 962/2014

of 29 August 2014

entering a name in the register of protected designations of origin and protected geographical indications (Pescabivona (PGI))

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Regulation (EU) No 1151/2012 of the European Parliament and of the Council of 21 November 2012 on quality schemes for agricultural products and foodstuffs (1), and in particular Article 52(2) thereof,

Whereas:

|

(1) |

Pursuant to Article 50(2)(a) of Regulation (EU) No 1151/2012, Italy's application to register the name ‘Pescabivona’ was published in the Official Journal of the European Union (2). |

|

(2) |

As no statement of opposition under Article 51 of Regulation (EU) No 1151/2012 has been received by the Commission, the name ‘Pescabivona’ should therefore be entered in the register, |

HAS ADOPTED THIS REGULATION:

Article 1

The name ‘Pescabivona’ (PGI) is hereby entered in the register.

The name specified in the first paragraph denotes a product in Class 1.6. Fruit, vegetables and cereals fresh or processed, as listed in Annex XI to Commission Implementing Regulation (EU) No 668/2014 (3).

Article 2

This Regulation shall enter into force on the twentieth day following that of its publication in the Official Journal of the European Union.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 29 August 2014.

For the Commission,

On behalf of the President,

Tonio BORG

Member of the Commission

(1) OJ L 343, 14.12.2012, p. 1.

(2) OJ C 103, 8.4.2014, p. 13.

(3) Commission Implementing Regulation (EU) No 668/2014 of 13 June 2014 laying down rules for the application of Regulation (EU) No 1151/2012 of the European Parliament and of the Council on quality schemes for agricultural products and foodstuffs (OJ L 179, 19.6.2014, p. 36).

|

12.9.2014 |

EN |

Official Journal of the European Union |

L 271/15 |

COMMISSION IMPLEMENTING REGULATION (EU) No 963/2014

of 29 August 2014

entering a name in the register of protected designations of origin and protected geographical indications [Zázrivské vojky (PGI)]

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Regulation (EU) No 1151/2012 of the European Parliament and of the Council of 21 November 2012 on quality schemes for agricultural products and foodstuffs (1), and in particular Article 52(2) thereof,

Whereas:

|

(1) |

Pursuant to Article 50(2)(a) of Regulation (EU) No 1151/2012, Slovakia's application to register the name ‘Zázrivské vojky’ was published in the Official Journal of the European Union (2). |

|

(2) |

As no statement of opposition under Article 51 of Regulation (EU) No 1151/2012 has been received by the Commission, the name ‘Zázrivské vojky’ should therefore be entered in the register, |

HAS ADOPTED THIS REGULATION:

Article 1

The name ‘Zázrivské vojky’ (PGI) is hereby entered in the register.

The name specified in the first paragraph denotes a product in Class 1.3. Cheeses, as listed in Annex XI to Commission Implementing Regulation (EU) No 668/2014 (3).

Article 2

This Regulation shall enter into force on the twentieth day following that of its publication in the Official Journal of the European Union.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 29 August 2014.

For the Commission,

On behalf of the President,

Tonio BORG

Member of the Commission

(1) OJ L 343, 14.12.2012, p. 1.

(2) OJ C 109, 11.4.2014, p. 27.

(3) Commission Implementing Regulation (EU) No 668/2014 of 13 June 2014 laying down rules for the application of Regulation (EU) No 1151/2012 of the European Parliament and of the Council on quality schemes for agricultural products and foodstuffs (OJ L 179, 19.6.2014, p. 36).

|

12.9.2014 |

EN |

Official Journal of the European Union |

L 271/16 |

COMMISSION IMPLEMENTING REGULATION (EU) No 964/2014

of 11 September 2014

laying down rules for the application of Regulation (EU) No 1303/2013 of the European Parliament and of the Council as regards standard terms and conditions for financial instruments

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Regulation (EU) No 1303/2013 of the European Parliament and of the Council of 17 December 2013 laying down common provisions on the European Regional Development Fund, the European Social Fund, the Cohesion Fund, the European Agricultural Fund for Rural Development and the European Maritime and Fisheries Fund and laying down general provisions on the European Regional Development Fund, the European Social Fund, the Cohesion Fund and the European Maritime and Fisheries Fund and repealing Council Regulation (EC) No 1083/2006 (1), and in particular the second subparagraph of Article 38(3) thereof,

Whereas:

|

(1) |

To facilitate the use of financial instruments set up at national, regional, transnational or cross-border level and managed by or under the responsibility of the managing authority in accordance with Article 38(3)(a) of Regulation (EU) No 1303/2013, rules on standard terms and conditions for certain financial instruments should be established. Those standard terms and conditions would make those instruments ready to use — the so-called off-the-shelf financial instruments. |

|

(2) |

To facilitate the use of financial instruments, the standard terms and conditions need to ensure compliance with state aid rules and facilitate the delivery of Union financial support of final recipients through a combination of financial instruments and grants. |

|

(3) |

The standard terms and conditions should not allow a finance provider, such as a public or private investor or a lender, a manager of the financial instrument, or a final recipient to receive any state aid which is incompatible with the internal market. The standard terms and conditions should take into account the relevant de minimis Regulations such as Commission Regulation (EU) No 1407/2013 (2) and Commission Regulation (EU) No 1408/2013 (3), Commission Regulation (EU) No 651/2014 (4), Commission Regulation (EU) No 702/2014 (5), the Guidelines on State aid to promote risk finance investments (6) and the Guidelines for State aid in the agricultural and forestry sectors and in rural areas 2014 to 2020 (7). |

|

(4) |

Given that the State aid rules do not apply to agricultural activities supported under the European Agricultural Fund for Rural Development, compliance with the standard terms and conditions should be voluntary. For other activities receiving support from the European Agricultural Fund for Rural Development, general State aid rules apply and therefore, the standard terms and conditions should be mandatory. |

|

(5) |

It is possible that undertakings in the fisheries sector, particularly small and medium-sized enterprises (SMEs), may benefit from financial instruments financed by a European Structural and Investment Fund. When such a benefit is funded by another European Structural and Investment Fund than the European Maritime and Fisheries Fund, the total amount of the aid granted through the financial instruments to all undertakings in the fisheries and aquaculture sector over three years should be below a cap of the annual fishery, aquaculture and processing turnover by Member State specified in Commission Regulation (EU) No 717/2014 (8). In addition Regulation (EU) No 702/2014 and the Guidelines for the examination of State aid to fisheries and aquaculture (9) should to be taken into account. |

|

(6) |

The standard terms and conditions should also include a minimum set of governance requirements to ensure proper management of the financial instruments in order to provide for more detailed rules than those included in the Regulation (EU) No 1303/2013. |

|

(7) |

In order to support SMEs growth in a difficult funding environment, a portfolio risk sharing loan (‘RS loan’) is an appropriate financial instrument. The RS loan provides new loans to SMEs with easier access to finance by providing financial intermediaries with funding contribution and credit risk sharing and thereby offering SMEs with more funds at preferential conditions in terms of interest rate reduction and/or collateral reduction. |

|

(8) |

Financing through the RS loan may be a particularly effective way of supporting SMEs in a context of limited availability of funding or relatively little risk appetite of the financial intermediaries for certain sectors or type of SMEs. In this context, the standard terms and conditions are an effective way to address such market failure. |

|

(9) |

In order to provide an incentive to financial intermediaries to increase lending to SMEs covered by Union funded guarantees, a capped portfolio guarantee is an appropriate financial instrument. |

|

(10) |

The capped portfolio guarantee should address the existing gap in the debt market for SMEs supporting new loans by providing credit risk protection (in the form of a first loss portfolio capped guarantee) with the aim to reduce the particular difficulties that SMEs face in accessing finance because of the lack of sufficient collateral in combination with the relatively high credit risk they represent. In order to achieve the expected impact, the Union contribution to the capped portfolio guarantee should, however, not replace equivalent guarantees received by the respective financial institutions for the same purpose under existing Union, national and regional financial instruments. In this context, the standard terms and conditions are an effective way to address such market failure. |

|

(11) |

In order to incentivize the energy saving potential arising from the renovation of residential buildings, a renovation loan is an appropriate financial instrument. |

|

(12) |

The renovation loan should target long term subsidised loan conditions and upfront technical support and funding of residential building owners to prepare and implement building renovation projects. It also assumes a financing market in which banking intermediaries are essentially the only source of funding, but where this funding is either too little (due to the risk appetite of the intermediary), too short term, too costly or otherwise inappropriate for the long term payback nature of the projects being financed. This, together with an inefficient system of identifying and procuring the works on behalf of multiple apartment owners without excluding the possibility to support individuals, constitutes a market failure. In this context, the standard terms and conditions are an effective way to address such market failure. |

|

(13) |

The measures provided for in this Regulation are in accordance with the opinion of the Coordination Committee for the European Structural and Investment Funds, |

HAS ADOPTED THIS REGULATION:

Article 1

Subject matter

This Regulation lays down rules concerning the standard terms and conditions for the following financial instruments:

|

(a) |

a portfolio risk sharing loan (RS Loan); |

|

(b) |

a capped portfolio guarantee; |

|

(c) |

a renovation loan. |

Article 2

Additional terms and conditions

Managing authorities may include other terms and conditions in addition to those to be included in the funding agreement in accordance with the terms and conditions for the selected financial instrument set out in this Regulation.

Article 3

Compliance with State aid rules under the standard terms and conditions

1. In case of financial instruments combined with grants for technical support to final recipients benefiting from one of the instruments, such grants shall not exceed 5 % of the ESI Funds contribution to the instrument and be subject to the conclusions of the ex-ante assessment justifying such grants referred to in Article 37 of Regulation (EU) No 1303/2013.

2. The body implementing the financial instrument (hereinafter ‘the financial intermediary’) shall manage the grant for technical support. The technical support shall not cover the activities which are covered by management cost and fees received to manage the financial instrument. The expenditure covered by the technical support may not constitute part of the investment to be financed by the loan under the relevant financial instrument.

Article 4

Governance under the standard terms and conditions

1. The managing authority or, if applicable, the fund of funds manager shall be represented in the supervisory committee or a similar type of governance structure of the financial instrument.

2. The managing authority shall not participate directly in individual investment decisions. In the case of a fund of funds, the managing authority shall exercise only its supervisory role at the level of the fund of funds without interfering in individual decisions by the fund of funds.

3. The financial instrument shall have a governance structure that allows for decisions concerning credit and risk diversification to be made transparently in line with relevant market practice.

4. The fund of funds manager and the financial intermediary shall have a governance structure that ensures impartiality and independence of the fund of funds manager or of the financial intermediary.

Article 5

Funding agreement under the standard terms and conditions

1. The managing authority shall conclude in writing a funding agreement for contributions from programmes to financial instrument, which shall contain the terms and conditions in accordance with Annex I.

2. The funding agreement shall contain as annexes:

|

(a) |

the ex-ante assessment required under Article 37 of Regulation (EU) No 1303/2013 justifying the financial instrument; |

|

(b) |

the business plan of the financial instrument including the investment strategy and a description of the investment, guarantee or lending policy; |

|

(c) |

the description of the instrument which must be aligned with the detailed standard terms and conditions of the instrument and which must fix the financial parameters of the financial instruments; |

|

(d) |

the monitoring and reporting templates. |

Article 6

RS Loan

1. The RS Loan shall take the form of a loan fund to be set up by a financial intermediary with contribution from the programme and contribution of at least 25 % of the loan fund from the financial intermediary. The loan fund shall finance a portfolio of newly originated loans, to the exclusion of the refinancing of existing loans.

2. The RS Loan shall comply with the terms and conditions set out in Annex II.

Article 7

Capped Portfolio Guarantee

1. The Capped Portfolio Guarantee shall provide credit risk coverage on a loan by loan basis up to a guarantee rate of maximum 80 %, for the creation of a portfolio of new loans to the small and medium-sized enterprises up to a maximum loss amount fixed by the guarantee cap rate which shall not exceed 25 % of the risk exposure at portfolio level.

2. The Capped Portfolio Guarantee shall comply with the terms and conditions set out in Annex III.

Article 8

Renovation Loan

1. The Renovation Loan shall take the form of a loan fund to be set up by a financial intermediary with contribution from the programme and contribution of at least 15 % of the loan fund from the financial intermediary. The loan fund shall finance a portfolio of newly originated loans, to the exclusion of the refinancing of existing loans.

2. Final recipients may be natural or legal persons or independent professionals, owning premises as well as administrators or other legal bodies acting on behalf and for the benefit of owners, implementing energy efficiency or renewable energies measures that are eligible under Regulation (EU) No 1303/2013 and programme support.

3. The Renovation Loan shall comply with the terms and conditions set out in Annex IV.

Article 9

This Regulation shall enter into force on the twentieth day following that of its publication in the Official Journal of the European Union.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 11 September 2014.

For the Commission

The President

José Manuel BARROSO

(1) OJ L 347, 20.12.2013, p. 320.

(2) Commission Regulation (EU) No 1407/2013 of 18 December 2013 on the application of Articles 107 and 108 of the Treaty on the Functioning of the European Union to de minimis aid (OJ L 352, 24.12.2013, p. 1).

(3) Commission Regulation (EU) No 1408/2013 of 18 December 2013 on the application of Articles 107 and 108 of the Treaty on the Functioning of the European Union to de minimis aid in the agriculture sector (OJ L 352, 24.12.2013, p. 9).

(4) Commission Regulation (EU) No 651/2014 of 17 June 2014 declaring certain categories of aid compatible with the internal market in application of Articles 107 and 108 of the Treaty (OJ L 187, 26.6.2014, p. 1).

(5) Commission Regulation (EU) No 702/2014 of 25 June 2014 declaring certain categories of aid in the agricultural and forestry sectors and in rural areas compatible with the internal market in application of Articles 107 and 108 of the Treaty on the Functioning of the European Union (OJ L 193, 1.7.2014, p. 1).

(6) Guidelines on State aid to promote risk finance investments (OJ C 19, 22.1.2014, p. 4).

(7) Guidelines for State aid in the agricultural and forestry sectors and in rural areas 2014 to 2020 (OJ C 204, 1.7.2014, p. 1).

(8) Commission Regulation (EU) No 717/2014 on the application of Articles 107 and 108 of the Treaty on the Functioning of the European Union to de minimis aid in fishery and aquaculture sector (OJ L 190, 28.6.2014, p. 45).

(9) Guidelines for the examination of State aid to fisheries and aquaculture (OJ C 84, 3.4.2008, p. 10).

ANNEX I

Annotated table of content of a funding agreement between a managing authority and a financial intermediary

Table of content:

|

(1) |

Preamble |

|

(2) |

Definitions |

|

(3) |

Scope and objective |

|

(4) |

Policy objectives and ex-ante assessment |

|

(5) |

Final recipients |

|

(6) |

Financial advantage and State aid |

|

(7) |

Investment, guarantee or lending policy |

|

(8) |

Activities and operations |

|

(9) |

Target results |

|

(10) |

Role and liability of the financial intermediary: risk and revenue sharing |

|

(11) |

Management and audit of the financial instrument |

|

(12) |

Programme contribution |

|

(13) |

Payments |

|

(14) |

Account management |

|

(15) |

Administrative costs |

|

(16) |

Duration and eligibility of expenditure at closure |

|

(17) |

Re-utilisation of resources paid by the managing authority (including interest yielded) |

|

(18) |

Capitalisation of interest rate subsidies, guarantee fee subsidies (if applicable) |

|

(19) |

Governance of the financial instrument |

|

(20) |

Conflicts of interest |

|

(21) |

Reporting and Monitoring |

|

(22) |

Evaluation |

|

(23) |

Visibility and transparency |

|

(24) |

Exclusivity |

|

(25) |

Settlement of disputes |

|

(26) |

Confidentiality |

|

(27) |

Amendment of the agreement and transfer of rights and obligations |

1. PREAMBLE

Name of the Country/Region

Identification of the Management Authority

Common Code for Identification (CCI) No of programme

Title of the related programme

Relevant section of the programme referring to the financial instrument

Name of the ESIF

Identification of the priority axis

Regions where the financial instrument shall be implemented (NUTS level or other)

Amount allocated to the financial instrument by the managing authority

Amount from ESIF

Amount from national public (programme public contribution)

Amount from national private (programme private contribution)

Amount from national public and private outside programme contribution

Expected starting date of the financial instrument

Completion date of the financial instrument

Contact information for communications between the parties

Purpose of the agreement

2. DEFINITIONS

3. SCOPE AND OBJECTIVE

The description of the financial instrument, including its investment strategy or policy, the type of support to be provided.

4. POLICY OBJECTIVES AND EX-ANTE ASSESSMENT

The criteria for eligibility for financial intermediaries if applicable as well as additional operational requirements transposing the policy objectives of the instrument, financial products to be offered, final recipients targeted, and envisaged combination with grants.

5. FINAL RECIPIENTS

Identification and eligibility of the final recipients (target group) of the financial instrument.

6. FINANCIAL ADVANTAGE AND STATE AID

Evaluation of the financial advantage by the programme public contribution and alignment with the State aid rules.

7. INVESTMENT, GUARANTEE OR LENDING POLICY

Provisions regarding investment, guarantee or lending policy especially regarding portfolio diversification (risk, sector, geographical zones, size) and existing portfolio of the financial intermediary.

8. ACTIVITIES AND OPERATIONS

Business plan or equivalent documents for the financial instrument to be implemented, including the expected leverage effect referred to in Article 37(2)(c) of Regulation (EU) No 1303/2013.

Definition of eligible activities

A clear definition of the activities assigned and the limits thereof, concerning in particular the modification of activities and the portfolio management (losses and default and recovery process).

9. TARGET RESULTS

Definition of the activities, results and impact indicators associated with base line measurements and expected targets.

The target results the financial instrument is expected to achieve as contribution to the specific objectives and results of the relevant priority or measure. List of indicators in accordance with the operational programme and Article 46 of Regulation (EU) No 1303/2013.

10. ROLE AND LIABILITY OF THE FINANCIAL INTERMEDIARY: RISK AND REVENUE SHARING

Identifications and Provisions on the liability of the financial intermediary and of other entities involved in the implementation of the financial instrument.

Explanation of risk valuation and risk and profit sharing of the different parties.

Provisions in line with Article 6 of Commission Delegated Regulation (EU) No 480/2014 (1) concerning role, liabilities and responsibility of bodies implementing financial instruments.

11. MANAGEMENT AND AUDIT OF THE FINANCIAL INSTRUMENT

Relevant provisions in line with Article 9 of Delegated Regulation (EU) No 480/2014 concerning management and control of financial instruments.

Provisions on the audit requirements, such as minimum requirements for documentation to be kept at the level of the financial intermediary (and at the level of the fund of funds), and requirements in relation to the maintenance of separate records for the different forms of support in compliance with Article 37(7) and (8) of Regulation (EU) No 1303/2013 (where applicable), including provisions and requirements regarding access to documents by audit authorities of the Member State, Commission auditors and the European Court of Auditors in order to ensure a clear audit trail in accordance with Article 40 of Regulation (EU) No 1303/2013.

Provisions in order for the audit authority to comply with guidance in relation with audit methodology, check list and availability of documents.

12. PROGRAMME CONTRIBUTION

Provisions in line with Article 38(10) of Regulation (EU) No 1303/2013 concerning the modalities of transfer and management of programme contributions.

Where appropriate, provisions on a framework of conditions for the contributions from the European Regional Development Fund, the European Social Fund, the Cohesion Fund, the European Agricultural Fund for Rural development and the Future Maritime and Fisheries Fund.

13. PAYMENTS

Requirements and procedures for managing payments in tranches, respecting the ceilings of Article 41 of Regulation (EU) No 1303/2013 and for the forecast of deal flows.

Conditions for a possible withdrawal of the programme public contribution to the financial instrument.

Rules concerning which supporting documents are required to justify the payments from the managing authority to the financial intermediary.

Conditions under which payments from the managing authority to the financial intermediary must be suspended or interrupted.

14. ACCOUNT MANAGEMENT

Details of the accounts. including if applicable requirements for fiduciary/separate accounting as set out in Article 38(6) of Regulation (EU) No 1303/2013.

Provisions explaining how the account of the financial instrument is managed. Including conditions governing the use of bank accounts: counterparty risks (if applicable), acceptable treasury operations, responsibilities of parties concerned, remedial actions in the event of excessive balances on fiduciary accounts, record keeping and reporting.

15. ADMINISTRATIVE COSTS

Provisions on the remuneration of the financial intermediary on the calculation and payment of management costs and fees to the financial intermediary and in accordance with Articles 12 and 13 of Delegated Regulation (EU) No 480/2014.

The provision must include the maximum rate applicable and the reference amounts for the calculation.

16. DURATION AND ELIGIBILITY OF EXPENDITURE AT CLOSURE

The date for the entry into force of the agreement.

The dates defining the implementing period of the financial instrument and the eligibility period.

Provisions on the possibility of extension, and termination of the programme public contribution to the financial intermediary for the financial instrument, including the conditions for early termination or withdrawal of programme contributions, exit strategies and the winding-up of financial instruments (including the fund of funds where applicable).

Provisions regarding the eligible expenditure at closure of the programme in accordance with Article 42 of Regulation (EU) No 1303/2013.

17. RE-UTILISATION OF RESOURCES PAID BY THE MANAGING AUTHORITY (INCLUDING INTEREST YIELDED)

Provisions on the re-utilisation of resources paid by the managing authority.

Requirements and procedures for managing interest and other gains attributable to support from ESIF in accordance with Article 43 of Regulation (EU) No 1303/2013.

Provisions regarding the re-use of resources attributable to the support of the ESI Funds until the end of the eligibility period in compliance with Article 44 of Regulation (EU) No 1303/2013.

Provisions regarding the use of resources attributable to the support of the ESI Funds following the end of the eligibility period in compliance with Article 45 of Regulation (EU) No 1303/2013.

18. CAPITALISATION OF INTEREST RATE SUBSIDIES, GUARANTEE FEE SUBSIDIES (IF APPLICABLE)

Provisions in line with Article 11 of the Delegated Regulation (EU) No 480/2014 referred to in Article 42(1) of Regulation (EU) No 1303/2013 concerning capitalisation of annual instalments for interest rate subsidies and guarantee fee subsidies.

19. GOVERNANCE OF THE FINANCIAL INSTRUMENT

Provisions describing an appropriate governance structure of the financial instrument to ensure that decisions concerning loans/guarantees/investments, divestments and risk diversification are implemented in accordance with the applicable legal requirements and market standards.

Provisions on the investment board of the financial instrument (role, independence, criteria).

20. CONFLICTS OF INTEREST

Clear procedures need to be established to deal with conflicts of interest.

21. REPORTING AND MONITORING

Provisions for monitoring of the implementation of investments and of deal flows including reporting by the financial intermediary to the fund of funds and/or the managing authority to ensure compliance with Article 46 of Regulation (EU) No 1303/2013 and State aid rules.

Rules on reporting to the managing authority on how the tasks are performed, reporting on results and irregularities and corrective measures taken.

22. EVALUATION

Conditions and arrangements for the evaluation of the financial instrument.

23. VISIBILITY AND TRANSPARENCY

Provisions on visibility of the funding provided by the union in line with the Annex XII to Regulation (EU) No 1303/2013.

Provisions guaranteeing access to information for final recipients.

24. EXCLUSIVITY

Provisions establishing under which conditions the fund of funds manager or the financial intermediary is allowed to start a new investment vehicle.

25. SETTLEMENT OF DISPUTES

Provisions on the settlement of disputes.

26. CONFIDENTIALITY

Provisions defining what elements of the financial instrument are covered by confidentiality clauses. Otherwise all other information is considered public.

Confidentiality obligations entered into as part of this agreement shall not prevent proper reporting to the investors, including those providing public funds.

27. AMENDMENT OF THE AGREEMENT AND TRANSFER OF RIGHTS AND OBLIGATIONS

Provisions defining the scope and conditions for possible amendment and termination of the agreement.

Provisions forbidding the financial intermediary to transfer any right or obligation without the prior authorisation of the managing authority.

|

ANNEX A |

: |

the ex-ante assessment required under Article 37 of Regulation (EU) No 1303/2013 justifying the financial instrument. |

|

ANNEX B |

: |

the business plan of the financial instrument including the investment strategy and a description of the investment, guarantee or lending policy. |

|

ANNEX C |

: |

the description of the instrument which must be aligned with the detailed standard terms and conditions of the instrument and which must fix the financial parameters of the financial instruments. |

|

ANNEX D |

: |

the monitoring and reporting templates. |

(1) Commission Delegated Regulation (EU) No 480/2014 of 3 March 2014 supplementing Regulation (EU) No 1303/2013 of the European Parliament and of the Council laying down common provisions on the European Regional Development Fund, the European Social Fund, the Cohesion Fund, the European Agricultural Fund for Rural Development and the European Maritime and Fisheries Fund and laying down general provisions on the European Regional Development Fund, the European Social Fund, the Cohesion Fund and the European Maritime and Fisheries Fund (OJ L 138, 13.5.2014, p. 5).

ANNEX II

Loan for SMEs based on a portfolio Risk Sharing loan model (RS loan)

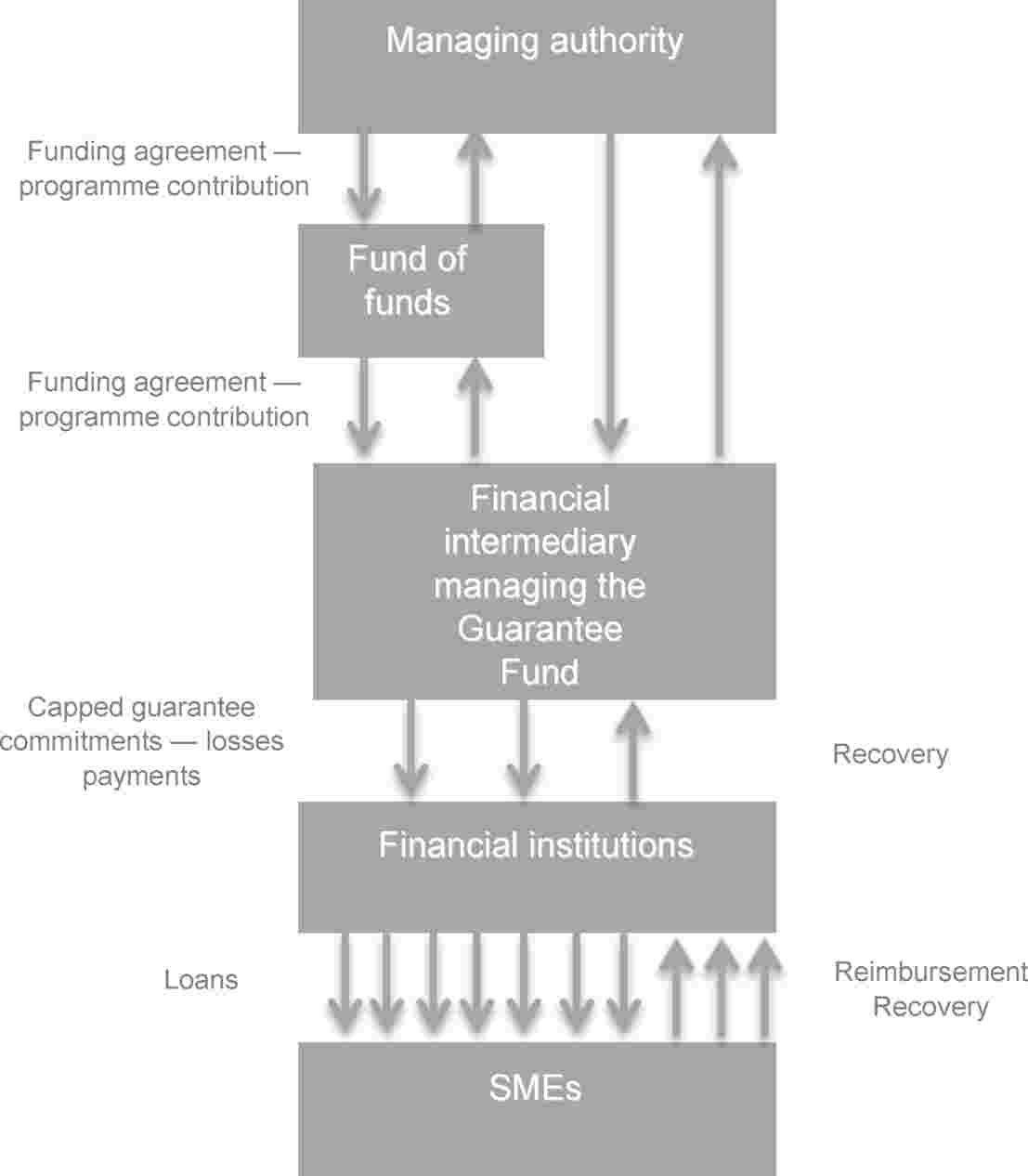

Schematic representation of the RS loan principle

|

Structure of the financial instrument |

The Risk Sharing loan (RS loan or financial instrument) shall take the form of a loan fund to be set up by a financial intermediary with contributions from the programme and the financial intermediary to finance a portfolio of newly originated loans, to the exclusion of the refinancing of existing loans. The Risk Sharing loan shall be made available in the framework of an operation which is part of the priority axis defined in the programme co-funded by the relevant ESIF and defined in the context of the ex-ante assessment required in Article 37 of Regulation (EU) No 1303/2013. |

||||||||||||||||||||

|

Aim of the instrument |

The aim of the instrument shall be to:

The contribution from the ESIF programme to the financial intermediary shall not crowd out financing available from other private investors or public investors. The ESIF programme shall provide funding to the financial intermediary in order to build up a portfolio of newly generated loans to SMEs, and in parallel, participate in the losses/defaults and recoveries on the SME loans in this portfolio on a loan by loan basis and in the same proportion as the programme contribution in the instrument. In the case of fund of funds structure, the fund of funds shall transfer the contribution from the ESIF programme to the financial intermediary. In addition to the ESIF programme contribution, the fund of funds may provide its own resources which are combined with the financial intermediary resources. The fund of funds shall in this case take the pro-rata part of the risk sharing between the different contributions in the portfolio of loans. State aid rules have to be respected if the resources provided by the fund of funds are State resources. |

||||||||||||||||||||

|

State aid implication |

The RS Loan shall be designed as a State aid free instrument, i.e. market-conform remuneration for the financial intermediary, full pass-on of financial advantage by the financial intermediary to the final recipients, and the financing provided to the final recipients are under the applicable de minimis Regulation. (a) Aid at the level of the financial intermediary and the fund of funds is excluded when:

(b) At the level of the SMEs: At the SMEs' level, the loan shall comply with the de minimis rules. For each loan inserted in the portfolio, the financial intermediary shall calculate the GGE by using the following calculation methodology: Calculation of the GGE = Nominal amount of the loan (EUR) × (Cost of funding (standard practice) + Cost of risk (standard practice) – Any fees charged by the managing authority on the programme contribution to the financial intermediary) × Weighted average life of the loan (Years) × Risk sharing rate. When the GGE is calculated with the above mentioned formula, for the purpose of the Risk Sharing loan, the requirement as foreseen in Article 4 of the de minimis Regulation (1) is considered to be met. There is no minimum collateral requirement. A verification mechanism shall ensure that the GGE calculated with the above mentioned formula is not below than the GGE calculated following the Article 4(3)(c) of the de minimis Regulation. The total amount of aid calculated with the GGE cannot be above EUR 200 000 over a 3 years fiscal period taking into account the cumulation rule for final recipients in the de minimis Regulation. Technical support grant or another grant provided to the final recipient shall be cumulated with the calculated GGE. Regarding SMEs in the fisheries and aquaculture sector, the aid shall comply with the relevant rules of the fisheries de minimis Regulation. For activities supported by the EAFRD, general rules apply. |

||||||||||||||||||||

|

Lending policy |

(a) Disbursement from the managing authority or fund of funds to the financial intermediary: Following the signature of a funding agreement between the managing authority and the fund of funds or the financial intermediary, the relevant managing authority transfers public contributions from the programme to the fund of funds or the financial intermediary which places such contributions in a dedicated Risk Sharing loan fund. The transfer shall be in tranches and respect the ceilings of the Article 41 of Regulation (EU) No 1303/2013. The target lending volume and range of interest rate shall be confirmed within the ex-ante assessment in accordance with Article 37 of Regulation (EU) No 1303/2013and shall be taken into account to determine the nature of the instrument (revolving or non-revolving instrument). (b) Origination of a portfolio of new loans: The financial intermediary shall be required to originate within a pre-determined limited period of time a portfolio of new eligible loans in addition to its current loan activities, partly funded from the disbursed funds under the programme at the risk-sharing rate agreed in the funding agreement. Eligible loans for SMEs (according to pre-defined eligibility criteria on a loan-by-loan and portfolio level) shall be automatically included in the Portfolio, by way of submitting inclusion notices at least on a quarterly basis. The financial intermediary shall implement a consistent lending policy, especially regarding portfolio diversification, enabling a sound credit portfolio management and risk diversification, while complying with the applicable industry standards and while remaining aligned with the managing authority's financial interests and policy objectives. The identification, selection, due diligence, documentation and execution of the loans to final recipients shall be performed by the financial intermediary in accordance with its standard procedures and in accordance with the principles set out in the relevant funding agreement. (c) Re-use of resources paid back to financial instrument: Resources paid back to the financial instrument shall be either reused within the same financial instrument (revolving within the same financial instrument) or after being paid back to the managing authority or the fund of funds they shall be used in accordance with Article 44 of Regulation (EU) No 1303/2013. When revolving within the same financial instrument, as a matter of principle, the amounts that are attributable to the support of the ESIF and that are reimbursed and/or recovered by the financial intermediary from loans to final recipients within the time framework for investments shall be made available for new use within the same financial instrument. This revolving approach as referred at Articles 44 and 45 of Regulation (EU) No 1303/2013 shall be included in the funding agreement. Alternatively, if the managing authority or the fund of funds is directly repaid, the repayments shall occur regularly mirroring (i) principal repayments (on a pro rata basis on the basis of the risk sharing rate) (ii) any recovered amounts and losses deductions (according to the risk sharing rate), of the SME loans and (iii) any interest rate payments. These resources have to be used in accordance with Articles 44 and 45 of Regulation (EU) No 1303/2013. (d) Loss recoveries: The financial intermediary shall take recovery actions in relation to each defaulted SME loan financed by the financial instrument in accordance with its internal guidelines and procedures. Amounts recovered (net of recovery and foreclosure costs, if any) by the financial intermediary shall be allocated pro-rata to the risk-sharing between the financial intermediary and the managing authority or the fund of funds. (e) Others: Interest and other gains generated by support from the ESI Funds to financial instrument shall be used as referred in Article 43 of Regulation (EU) No 1303/2013. |

||||||||||||||||||||

|

Pricing policy |

When proposing its pricing, the financial intermediary shall present a pricing policy and the methodology to ensure the full pass on of the financial advantage of the programme public contribution to the eligible SMEs. The pricing policy and the methodology shall include the following elements:

|

||||||||||||||||||||

|

Programme contribution to financial instrument: amount and rate (product details) |

The actual risk sharing rate, programme public contribution and interest rate on loans shall be based on the ex-ante assessment findings and shall be such as to ensure that the benefit to the final recipients complies with the de minimis rule. The size of the target portfolio Risk Sharing loan shall be confirmed within the ex-ante assessment justifying the support to the financial instrument (Article 37 of Regulation (EU) No 1303/2013) and take into account the revolving approach of the instrument (if applicable). The composition of the targeted portfolio of loans shall be defined in a way to ensure diversification of risk. The RS loan allocation and the risk-sharing rate must be set in order to fill the gap evaluated within the ex-ante assessment, but in any case must comply with the conditions laid down in this term sheet. The risk sharing rate agreed with the financial intermediary shall define for each eligible loan included in the portfolio, the portion of the eligible loan principal amount financed by the programme. The risk-sharing rate agreed with the financial intermediary determines the exposure of the losses which are to be covered by the financial intermediary and by the programme contribution accordingly. |

||||||||||||||||||||

|

Programme contribution to financial instrument (activities) |

The portfolio funded by the RS loan instrument shall include only newly originated loans provided to SMEs, to the exclusion of the refinancing of existing loans. The eligibility criteria for inclusion in the portfolio are determined pursuant to Union law (e.g. Regulation (EU) No 1303/2013 and Fund-specific rules), programme, national eligibility rules, and with the financial intermediary with the aim of reaching a large number of final recipients and achieving sufficient portfolio diversification. The financial intermediary shall have a reasonable estimation of the portfolio risk profile. These criteria shall reflect market conditions and practices in the relevant Member State or region. |

||||||||||||||||||||

|

Managing Authority's liability |

The managing authority's liability in relation to the financial instrument shall be as set out in Article 6 of Delegated Regulation (EU) No 480/2014. The losses covered are principal amounts due, payable and outstanding and standard interest (but excluding late payment fees and any other costs and expenses). |

||||||||||||||||||||

|

Duration |

The lending period of the financial instrument shall be set in order to ensure that the programme contribution as referred in Article 42 of Regulation (EU) No 1303/2013 is used for loans disbursed to final recipients no later than the 31 December 2023. The typical duration to create the portfolio of loans is recommended to be up to 4 years from the date of signature of the funding agreement (between the managing authority or fund of funds and the financial intermediary). |

||||||||||||||||||||

|

Lending and risk-sharing at financial intermediary level (alignment of interest) |

Alignment of interest between the managing authority and the financial intermediary shall be achieved through:

The expected risk-sharing rate shall be determined based on the ex-ante assessment findings justifying the support to the financial instrument. |

||||||||||||||||||||

|

Eligible Financial Intermediaries |

Public and private bodies established in a Member State which shall be legally authorised to provide loans to enterprises operating in the jurisdiction of the programme which contributes to the financial instrument. Such bodies are financial institutions, and, as appropriate, microfinance institutions or any other institution authorised to provide loans. |

||||||||||||||||||||

|

Final recipients eligibility |

The final recipients shall be eligible under EU and national law, the relevant programme and funding agreement. The following eligibility criteria shall be met at the date of the signature of the loan:

In addition, at the time of the investment and during the reimbursement of the loan, final recipients shall have a registered place of business in a Member State and the economic activity for which the loan was disbursed shall be located in the relevant Member State and Region/Jurisdiction of the ESIF programme. |

||||||||||||||||||||

|

Characteristics of the product for the final recipients |

The financial intermediary shall deliver to final recipients the loans that contribute to the objective of the programme and that are co-financed by the programme under the RS loan instrument. Their terms shall be grounded on the ex-ante assessment referred to in Article 37 of Regulation (EU) No 1303/2013. The loans shall be used exclusively for the following permitted purposes:

The following eligibility criteria shall be met at all times by the loans included in the portfolio:

|

||||||||||||||||||||

|

Reporting and targeted results |

Financial intermediaries shall provide the managing authority or fund of funds with at least quarterly information in a standardised form and scope. The report shall include all the relevant elements for the managing authority to fulfil the conditions of Article 46 of Regulation (EU) No 1303/2013. Member States shall also fulfil their reporting obligations pursuant to the de minimis Regulation. Indicators must be aligned with the specific objectives of the relevant priority of the ESIF programme financing the financial instrument and on the expected results of the ex-ante assessment. They shall be measured and reported at least quarterly for the RS loan instrument and aligned as a minimum with the regulation requirements. In addition to the common indicators of the priority axis of the ESIF programme (employment increase, number of SMEs, …) other indicators are:

|

||||||||||||||||||||

|

Evaluation of the economic benefit of the programme contribution |

The financial intermediary shall reduce the overall effective interest rate (and collateral policy where appropriate) charged to the final recipients under each eligible loan included in the portfolio reflecting the favourable funding and risk sharing conditions of the RS loan. The entire financial advantage of the programme public contribution to the instrument shall be transferred to the final recipients in the form of an interest rate reduction. The financial intermediary shall monitor and report on the GGE for final recipients as referred in the State aid section. This principle shall be reflected in the funding agreement between the managing authority or fund of funds and the financial intermediary. |

(1) Commission Regulation (EU) No 1407/2013 of 18 December 2013 on the application of Articles 107 and 108 of the Treaty on the Functioning of the European Union to de minimis aid (OJ L 352, 24.12.2013, p. 1).

(2) Commission Recommendation 2003/361/EC of 6 May 2003 concerning the definition of micro, small and medium-sized enterprises (notified under document number C(2003) 1422) (OJ L 124, 20.5.2003, p. 36).

(3) Enterprise with less than 250 employees and having a turnover of less than EUR 50 million or total assets less than EUR 43 million; also not belonging to a group exceeding such thresholds. According to the Commission Recommendation, ‘an enterprise is considered to be any entity engaged in an economic activity, irrespective of its legal form’.

(4) The following economic sectors are together referred to as the ‘restricted sectors’.

|

(a) |