ISSN 1977-091X

Official Journal

of the European Union

C 348

English edition

Information and Notices

Volume 61

28 September 2018

|

ISSN 1977-091X |

||

|

Official Journal of the European Union |

C 348 |

|

|

||

|

English edition |

Information and Notices |

Volume 61 |

|

Contents |

page |

|

|

|

IV Notices |

|

|

|

NOTICES FROM EUROPEAN UNION INSTITUTIONS, BODIES, OFFICES AND AGENCIES |

|

|

|

European Commission |

|

|

2018/C 348/01 |

||

|

2018/C 348/02 |

|

EN |

|

IV Notices

NOTICES FROM EUROPEAN UNION INSTITUTIONS, BODIES, OFFICES AND AGENCIES

European Commission

|

28.9.2018 |

EN |

Official Journal of the European Union |

C 348/1 |

COMMUNICATION FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT, THE COUNCIL AND THE COURT OF AUDITORS

Consolidated annual accounts of the European Union 2017

(2018/C 348/01)

CONTENTS

| FOREWORD | 2 |

| EUROPEAN UNION POLITICAL FRAMEWORK, GOVERNANCE AND ACCOUNTABILITY | 4 |

| NOTE ACCOMPANYING THE CONSOLIDATED ACCOUNTS | 9 |

| HIGHLIGHTS OF THE FINANCIAL YEAR 2017 | 10 |

| CONSOLIDATED FINANCIAL STATEMENTS AND EXPLANATORY NOTES | 12 |

| BALANCE SHEET | 13 |

| STATEMENT OF FINANCIAL PERFORMANCE | 14 |

| CASHFLOW STATEMENT | 15 |

| STATEMENT OF CHANGES IN NET ASSETS | 16 |

| NOTES TO THE FINANCIAL STATEMENTS | 17 |

| FINANCIAL STATEMENT DISCUSSION AND ANALYSIS | 92 |

| BUDGETARY IMPLEMENTATION REPORTS AND EXPLANATORY NOTES | 109 |

| GLOSSARY | 166 |

| LIST OF ABBREVIATIONS | 170 |

FOREWORD

It is my pleasure to present the 2017 annual accounts of the European Union. They provide a complete overview of the EU finances and the implementation of the EU budget for the last year, including information on contingent liabilities, financial commitments and other obligations of the Union. Reflecting the multiannual nature of the Union's activities, they offer explanations of the key financial figures and their evolution. The consolidated annual accounts of the European Union are part of the Commission’s Integrated Financial Reporting Package and form an essential part of our highly developed system of financial accountability.

While 2016 was a year of doubt for the European project, not least with the decision of the United Kingdom to leave the Union, 2017 was a year of renewed hope and perspective.

The 60th anniversary of the Treaty of Rome provided the backdrop to a period of deep reflection on the future of Europe. We took the opportunity to reaffirm our commitment to the values of the Union and to define the priorities for the Union of 27.

In 2017, the European Union focused on making the economic recovery sustainable. Growth rates for the EU and the euro area beat expectations to reach a 10-year high of 2,4 %. Nevertheless, the EU had to tackle a series of challenges related to competitiveness, migration or security, and address some major natural disasters.

The EU budget is a unique asset for the Union that translates ambitions into tangible results on the ground. It complements national budgets by delivering European added value in areas where a coordinated response is the most efficient and effective way to deliver on our priorities.

2017 was the fourth year of the implementation of the current Multiannual Financial Framework; all the financial programmes are now fully operational. At the same time, with many unexpected challenges, the importance of a flexible approach to budget implementation was once more confirmed. The MFF mid-term revision has provided additional means to respond to unforeseen circumstances.

The 2017 adopted budget focused on two main policy priorities for Europe: supporting the ongoing recovery of the European economy and tackling the migration and refugee crisis. It ensured the implementation of the ongoing programmes on the one hand, and provided for financial support to address the new challenges on the other.

Nearly half of the funds — EUR 83,2 billion in commitments — stimulated growth, employment and competitiveness. This included funding for research and innovation under Horizon 2020, for education under Erasmus+, for small and medium sized enterprises under the COSME programme, and for infrastructure under the Connecting Europe Facility (CEF). Moreover, the European Fund for Strategic Investments (EFSI) provided for the implementation of the Investment Plan for Europe, and the convergence among Member States and among regions was fostered through the European Structural and Investment Funds (ESIF).

The European Fund for Strategic Investments has already triggered more than EUR 287 billion in new investment and has helped creating more than 300 000 jobs. In December 2017, the European Parliament and Council decided to increase and extend the fund to catalyse investments of up to EUR 500 billion by 2020. The EFSI guarantee fund, which the Commission established to provide a liquidity cushion to cover guarantee calls by the EIB group for its investments, has reached EUR 3,5 billion at end 2017.

EUR 54 billion was allocated to programmes aiming to strengthen economic, social and territorial cohesion, including the European Regional Development Fund, the Cohesion Fund, and the European Social Fund. The Youth Employment Initiative, which implementation accelerated in 2017, focuses on decreasing youth unemployment throughout the Union. By the end of 2017 the total eligible cost of operations selected for support reached nearly EUR 7 billion. Member States declare that 1,7 million young people have already benefitted from the assistance provided by the Initiative.

Moreover, the EU budget served as an instrument of solidarity with e.g. EUR 1,2 billion mobilised under the EU Solidarity Fund, the highest sum ever provided in a single instalment, following the earthquakes of 2016 and 2017 in the Italian regions of Abruzzo, Lazio, Marche and Umbria.

EUR 58,6 billion were devoted to the promotion of sustainable growth and the preservation of Europe's natural resources. Programmes included the pillars of the Common Agricultural Policy (CAP) of market support measures and rural development, fisheries, and activities in the fields of climate and environment under the Programme for the Environment and Climate Action (LIFE).

The EU budget also continued to underpin the comprehensive European response to the migration crisis and the management of Europe’s external borders. The Asylum, Migration and Integration Fund (AMIF) promoted the efficient management of migration flows and the development of a common Union approach to asylum and migration. The total of payments executed in 2017 amounted to EUR 576,2 million, almost a double of the 2016 figure. Financed by the EU budget, the European Border and Coast Guard Agency with its extended mandate has significantly strengthened its presence at the EU’s external borders with the aim of supporting the Member States in their border management activities and jointly implementing an integrated border management at EU level.

The EU budget also allowed the Union to play a strong role beyond Europe during a period of turbulence in Europe’s neighbourhood. Last but not least, it contributed to the response to global challenges such as climate change by integrating mitigation and adaptation actions into all major EU spending programmes, with the total budget contribution to climate mainstreaming estimated at 20,3 % for 2017.

An optimal performance of the Union’s budget has been a priority for the Juncker Commission from day one. We strongly support the increasing emphasis of the European Parliament, the Member States and the European Court of Auditors not only on how programmes are managed, but also on whether they are delivering results in the areas that really matter for Europe’s citizens.

The Commission will continue playing its role, along with the budgetary authority, to harness the potential of the EU budget to invest in growth, create jobs and tackle our common challenges.

Günther H. Oettinger

Commissioner for Budget and Human Resources, European Commission

EUROPEAN UNION POLITICAL FRAMEWORK, GOVERNANCE AND ACCOUNTABILITY

The European Union (EU) is a Union within which 28 (1) European countries (the Member States) confer competences to attain objectives they have in common. The Union is founded on the values of respect for human dignity, freedom, democracy, equality, the rule of law and respect for human rights, including the rights of persons belonging to minorities. These values are common to the Member States in a society in which pluralism, non-discrimination, tolerance, justice, solidarity and equality between women and men prevail.

1. POLITICAL FRAMEWORK

EU Treaties

The overarching objectives and principles that guide the Union and the European Institutions are defined in the Treaties. The Union and the EU institutions may only act within the limits of the competences conferred by the Treaties so as to attain the objectives set out therein and must do this in accordance with the principles (2) of subsidiarity and proportionality. To attain its objectives and carry out its policies, the Union provides itself with the necessary financial means. The Commission is responsible for implementing the objectives in cooperation with the Member States and in accordance with the principle of sound financial management.

The EU pursues the objectives established in the Treaty with a number of tools, one of which is the EU budget. Others are, for example, proposing legislation or pursuing policy strategies.

Europe 2020 strategy

The Europe 2020 strategy agreed in 2010 by the Heads of State or Government of EU Member States defines a 10 year jobs and growth strategy at EU level for the EU (3). The strategy put forward three mutually reinforcing priorities of smart, sustainable and inclusive growth with five EU headline targets. Its success depends on all the actors of the Union, acting collectively.

The EU budget is only one of the EU levers contributing to the delivery of the Europe 2020 objectives. A wide range of actions at national, EU and international levels are being mobilised to deliver concrete results in relation to the Europe 2020 strategy.

Commission political priorities

The Commission's political priorities are defined in the political guidelines set by the President of the Commission, providing a roadmap for the Commission's action that is fully consistent and compatible with Europe 2020 as the EU's long-term growth strategy.

10 PRIORITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

2030 Agenda for Sustainable Development (4)

Sustainable development has long been at the heart of the European project. The EU Treaties give recognition to its economic, social and environmental dimensions which should be addressed together. The EU is committed to development that meets the needs of the present without compromising the ability of future generations to meet their own needs. The EU budget plays an essential role in many sustainability challenges from youth unemployment to ageing populations, climate change, pollution, sustainable energy and migration. Under the current Commission sustainable development is mainstreamed in key cross-cutting projects as well as in sectoral policies and initiatives.

Multiannual Financial Framework and spending programmes

The policies supported by the EU budget are implemented in accordance with the Multiannual Financial Framework (MFF) and corresponding sectorial legislation defining spending programmes.

The Multiannual Financial Framework translates the EU’s political priorities into financial terms over a period long enough to be effective and to provide a coherent long-term vision for beneficiaries of EU funds and co-financing national authorities. It sets maximum annual amounts (ceilings) for EU expenditure as a whole and for the main categories of expenditure (headings). The sum of the ceilings of all headings gives the total ceiling of commitment appropriations. The Multiannual Financial Framework is adopted by unanimity indicating the agreement of all Member States to the objectives and the level of spending (maximum level of budget commitments and payments), with the consent of the European Parliament. The Commission is responsible for managing and implementing the EU budget and programmes adopted by the Parliament and the Council. Most of the actual implementation and spending (about 75 %) is done by national and local authorities but the Commission is responsible for supervising it. The Commission handles the budget under the watchful eye of the European Court of Auditors. Both institutions aim to ensure sound financial management.

Interinstitutional agreement

The Multiannual Financial Framework is complemented by the interinstitutional agreement (5) which is a political agreement between the European Parliament, the Council and the Commission. The purpose of this agreement, adopted in 2013 in accordance with Article 295 of the TFEU, is to implement budgetary discipline, improve the functioning of the annual budgetary procedure and cooperation between the institutions on budgetary matters as well as to ensure sound financial management.

Annual budget

The annual budget is prepared by the Commission and usually agreed by mid-December by the European Parliament and the Council, based on the procedure of Art. 314 TFEU. According to the principle of budget equilibrium, total revenue must equal total expenditure (payment appropriations) for a given financial year.

The main sources of funding of the EU are own resources revenues which are complemented by other revenues. There are three types of own resources: traditional own resources (such as custom duties and sugar levies), the own resource based on value added tax (VAT) and the own resource based on gross national income (GNI). Other revenues arising from the activities of the EU (e.g. competition fines) normally represent less than 10 % of total revenue. The overall amount of own resources needed to finance the budget is determined by total expenditure less other revenue. The total amount of own resources cannot exceed 1,20 % of the sum of gross national income (GNI) of the Member States.

The EU's operational expenditure covers the various headings of the Multiannual Financial Framework and takes different forms, depending on how the money is paid out and managed. The EU budget is implemented in three management modes:

Shared management: under this method of budget implementation, tasks are delegated to Member States. About 75 % of the expenditure falls under this management mode covering such areas as agricultural spending and structural actions.

Direct management: this is where the budget is implemented directly by the Commission services.

Indirect management: this refers to cases where the Commission confers tasks of implementation of the budget to third parties, such as the EU regulatory agencies or international organisations.

Financial Regulation

The Financial Regulation (FR) applicable to the general budget is a central act in the regulatory architecture of the EU’s finances defining EU financial rules applicable to the EU budget.

2. GOVERNANCE AND ACCOUNTABILITY IN THE EU

2.1. INSTITUTIONAL STRUCTURE

The organisational governance of the EU consists of institutions, agencies and other EU bodies which are listed in note 9 of the notes to the consolidated financial statements. The European Investment Bank (EIB) and the European Investment Fund (EIF) are not included in the scope of the Financial Regulation. The main institutions, in the sense of being responsible for drafting policies and taking decisions, are the European Parliament, the European Council, the Council and the Commission.

The Commission is the executive of the EU and promotes its general interest. It does this by proposing legislation; implementing EU policies; overseeing the correct implementation of the Treaties and European law; managing the EU budget; and by representing the Union outside Europe.

The Commission's internal functioning is based on a number of key principles underpinning good governance: clear roles and responsibilities, a strong commitment to performance management and compliance with the legal framework, clear accountability mechanisms, a high quality and inclusive regulatory framework, openness and transparency, and high standards of ethical behaviour.

2.2. THE COMMISSION'S GOVERNANCE STRUCTURE

The European Commission has a unique governance system, with a clear distinction between political and administrative oversight structures and well-defined lines of responsibility and financial accountability (6). The system is based on the Treaties and the structure has evolved to adapt to a changing environment and to remain in line with best practice as set out in relevant international standards (7).

|

— |

The College of Commissioners assumes collegial political responsibility for the work of the Commission. Operational implementation of the budget is delegated to Directors-General and Heads of Service who lead the administrative structure of the Commission (8). |

|

— |

The College delegates financial management tasks to the Directors-General or Heads of Service who thereby become Authorising Officers by Delegation (AOD). These tasks can further be delegated to Directors, Heads of Unit and others, who thereby become Authorising Officers by Sub-Delegation. The responsibility of the Authorising Officers covers the entire management process, from determining what needs to be done to achieve the policy objectives set by the institution to managing the activities from both an operational and budgetary standpoint. |

In the Commission, the roles and responsibilities in financial management are thus clearly defined and applied. This is a decentralised approach with clear responsibilities with the aim of creating an administrative culture that encourages civil servants to take responsibility for activities over which they have control and to give them control over the activities for which they are responsible.

Within the context of the Commission's Strategic Planning and Programming cycle, each authorising officer is required to prepare an ‘annual activity report’ (AAR) on the activities and policy achievements and results of the year where he/she declares that resources have been used based on the principles of sound financial management and that he/she has set in place control procedures which provide the necessary guarantee concerning the legality and regularity of the underlying transactions. At Commission level these results are adopted and published in an aggregated form in the Annual Management and Performance Report for the EU budget and sent to the European Parliament and the Council. This is the main instrument through which the College of Commissioners takes political responsibility for the management of the budget.

The Accounting Officer of the Commission is centrally responsible for the treasury management, recovery procedures, laying down accounting rules based on International Public Sector Accounting Standards and methods, validating accounting systems and the preparation of the Commission's and consolidated annual accounts of the EU. Furthermore, the Accounting Officer is required to sign the annual accounts declaring that they present fairly, in all material aspects, the financial position, the results of the operations and the cash flows. The annual accounts are adopted by the College of Commissioners. The Accounting Officer is an independent function and bears a major responsibility as regards financial reporting in the Commission. The Internal Auditor of the Commission is likewise a centralised and independent function and provides independent advice, opinions and recommendations on the quality and functioning of internal control systems inside the Commission, EU agencies and other autonomous bodies.

The Audit Progress Committee follows-up implementation of audits, in particular of the Internal Audit Service but also on the basis of European Court of Auditors audits, and assesses internal audit quality, so as to gain a more general view of the control systems of the Commission.

The Corporate Management Board plays a role in the corporate governance of the Commission by providing oversight and strategic orientations on major corporate management issues, including in relation to the management of financial and human resources. Chaired by the Secretary-General, it brings together on a regular basis Directors-General and Cabinets responsible for budget, human resources and IT to ensure that the necessary organisational and technical structures are in place in the Commission to deliver on the political priorities of the President in an efficient and effective manner.

2.3. PERFORMANCE FRAMEWORK

Implementing robust performance frameworks is essential for ensuring a strong focus on results, EU added value and sound management of EU programmes. The performance framework of the EU budget is highly specified, scoring higher than any Organisation for Economic Co-operation and Development (OECD) country in the standard index of performance budgeting frameworks. The EU budget performance framework reports on several types and levels of strategic goals, objectives and targets, including the Europe 2020 strategy and other political priorities. It must also take account of the complementarity and mainstreaming of policies and programmes and the key role of the Member States in implementing the EU Budget.

|

— |

Objectives, indicators and targets are strongly featured in the programmes' legal basis and every year the Commission reports on them through the Programme Statements that accompany the draft budget. They provide all of the key information that is necessary for careful programme scrutiny and performance measurement: this includes 7-year financial commitments; programme performance baselines (starting points for policy action); end-goals (to be achieved at the end of the multi-annual programming period); and intermediate milestones. |

|

— |

To ensure resources are allocated to priorities and that every action brings high performance and added value, the Commission implements its EU Budget Focused on Results initiative. Building on the 2014–2020 performance framework, it promotes a better balance between compliance and performance. |

|

— |

The Annual Management and Performance Report for the EU budget provides a comprehensive overview on the performance, management and protection of the EU budget. It explains how the EU budget supports the European Union’s political priorities, the results achieved with the EU budget, and the role the Commission plays in ensuring and promoting the highest standards of budgetary and financial management. |

|

— |

The European Court of Auditors takes a systematic and thorough approach to assessing the qualitative aspects of budgeting, including the performance dimension, as a normal part of its annual reporting and through special reports. |

All of these elements place the budget authority in a strong position to take performance into account as a significant factor in deciding on the next annual budget.

2.4. FINANCIAL REPORTING

The main element of EU financial reporting is the Integrated Financial Reporting Package of the EU which comprises the consolidated annual accounts of the EU, the Annual Management and Performance Report for the budget and the Report on the follow-up to the discharge. The Integrated Financial Reporting Package provides the public with a comprehensive view of the financial and operational situation of the EU each year.

The consolidated annual accounts of the EU provide financial information on the activities of the institutions, agencies and other bodies of the EU from both an accrual accounting and budgetary perspective. These accounts do not comprise the annual accounts of Member States.

The consolidated annual accounts of the EU consist of two separate but linked parts:

|

a) |

the consolidated financial statements; and |

|

b) |

the reports on implementation of the budget, which provide an aggregated record of budget implementation. |

In addition, the consolidated annual accounts of the EU are accompanied by a Financial Statement Discussion and Analysis (FSDA) which summarises significant changes and trends in the financial statements and explains significant risks and uncertainties the EU has faced and needs to address in future.

Reporting and Accountability in the Commission:

|

Integrated Financial Reporting Package |

Consolidated Annual Accounts of the EU Annual Management and Performance Report for the budget Report on the follow up to the discharge |

|

Other reports |

General Report on the activities of the EU Annual Activity Reports of the Directorates-General Report on Budgetary and Financial Management |

2.5. EXTERNAL AUDIT AND DISCHARGE PROCEDURE

External audit

The European Court of Auditors (the Court) is the external auditor of the EU institutions (and bodies). The Court's mission is to contribute to improving EU financial management, promote accountability and transparency, and act as the independent guardian of the financial interests of the citizens of the EU. The Court’s role as the EU’s independent external auditor is to check that EU funds are correctly accounted for, are raised and spent in accordance with the relevant rules and regulations and have achieved value for money.

The EU’s annual accounts and its sound financial management are audited by the Court, which, as part of its activities, draws up for the European Parliament and the Council:

|

(1) |

an annual report on the activities financed from the general budget, detailing its observations on the annual accounts and underlying transactions; |

|

(2) |

an opinion, based on its audits and given in the annual report in the form of a statement of assurance, on (i) the reliability of the accounts and (ii) the legality and regularity of the underlying transactions involving both revenue collected and payments to final beneficiaries; and |

|

(3) |

special reports covering specific areas. |

Discharge

The final step of a budget lifecycle is the discharge procedure for a given financial year. It represents the political dimension of the external control of budget implementation and is the decision by which the ‘Discharge Authority’ (i.e. the European Parliament, acting on a Council recommendation) ‘releases’ the Commission (and other EU bodies) from its responsibility for the management of a given budget. This decision is based on an examination of the EU consolidated annual accounts and a set of Commission reports (the Annual Management and Performance Report, the report on the follow-up to the previous year's discharge and the annual report to the discharge authority on internal audits carried out) as well as on the European Court of Auditors' Annual Report, audit opinion (the ‘Statement of Assurance’) and Special Reports. It also takes account of the Commission written replies to questions and further information requests as well as hearings of the Budget Commissioner and Commissioners responsible for the main spending areas before the European Parliament's Budgetary Control Committee (CONT).

The outcome of the discharge procedure may be threefold: granting, postponement or refusal of the discharge. The final discharge reports also include specific requests addressed to the Commission by both the European Parliament and the Council. These requests are subject to a follow up report in which the Commission outlines the concrete actions it has already taken or intends to take.

NOTE ACCOMPANYING THE CONSOLIDATED ACCOUNTS

The consolidated annual accounts of the European Union for the year 2017 have been prepared on the basis of the information presented by the institutions and bodies under Article 148(2) of the Financial Regulation applicable to the general budget of the European Union. I hereby declare that they were prepared in accordance with Title IX of this Financial Regulation and with the accounting principles, rules and methods set out in the notes to the financial statements.

I have obtained from the accounting officers of these institutions and bodies, who certified its reliability, all the information necessary for the production of the accounts that show the European Union's assets and liabilities and the budgetary implementation.

I hereby certify that based on this information, and on such checks as I deemed necessary to sign off the accounts of the European Commission, I have a reasonable assurance that the accounts present fairly, in all material aspects, the financial position, the results of the operations and the cashflows of the European Union.

[signed]

Rosa ALDEA BUSQUETS

Accounting Officer of the Commission

22 June 2018

HIGHLIGHTS OF THE FINANCIAL YEAR 2017

Implementation of the 2017 Union budget

The 2017 adopted budget focused on two main policy priorities for Europe: supporting the ongoing recovery of the European economy and addressing the security and humanitarian challenges in our neighbourhood. Increased funding went to investments in growth, jobs and competitiveness in the European Union as well as to securing the necessary resources to protect the external borders of the EU, to reinforce security inside and outside the Union, to provide support for the reception and integration of refugees, and to address the root causes of migration in the countries of origin and transit.

The implementation of the EU budget in 2017 totalled EUR 171,1 billion in commitment appropriations, and EUR 137,4 billion in payment appropriations.

Nearly half of the funds — EUR 83,3 billion in commitments — stimulated growth, employment and competitiveness. This included funding for research and innovation under Horizon 2020, education under Erasmus+, small and medium sized enterprises under the COSME programme, the Connecting Europe Facility (CEF), the guarantee fund for the European Fund for Strategic Investments (EFSI) which is the vehicle behind the Investment Plan for Europe, and to foster convergence among Member States and among regions through the European Structural and Investment Funds (ESIF). Moreover, the EU budget support to European farmers amounted to EUR 44,7 billion in payments.

The budget was also used to reinforce the external borders of the Union and address the refugee crisis and irregular migration by funding stronger tools to prevent migrant smuggling and address the long-term drivers of migration in cooperation with countries of origin and transit, stronger policies for legal migration, including resettlement for persons in need of protection, and instruments to support Member States with respect to the integration of refugees inside the EU.

The United Kingdom's withdrawal from the European Union

Background

On 23 June 2016 a majority of the citizens of the United Kingdom who voted in the referendum on membership of the European Union voted to leave the EU. On 29 March 2017 the United Kingdom formally notified the European Council of its intention to leave the EU and the European Atomic Energy Community (Euratom). In doing so it triggered Article 50 of the Treaty on European Union, which sets out the procedure for a Member State to withdraw from the Union.

The negotiation process

At a special meeting of the European Council on 29 April 2017 the leaders of the other 27 Member States adopted political guidelines on the orderly withdrawal of the United Kingdom from the EU. These defined the framework for the negotiations and set out the EU’s overall positions and principles. Four days later the Commission sent a Recommendation to the Council to open Article 50 negotiations with the United Kingdom, including draft negotiating directives.

On 22 May the Council adopted a Decision authorising the opening of negotiations with the United Kingdom and formally nominating the Commission as the EU’s negotiator. It also adopted the first set of negotiating directives. These provided for a clear structure and a united EU approach to the negotiations.

The EU is represented by Michel Barnier, who was appointed as Chief Negotiator by the European Commission. Within the European Commission, a Task Force under the authority of Michel Barnier coordinates the work on all of the strategic, operational, legal and financial issues related to the negotiations. The Commission reports back to the Council throughout the negotiations, and also keeps the European Parliament closely and regularly informed.

The first phase of negotiations

The first phase of the talks began on 19 June 2017. It set out to provide as much clarity and legal certainty as possible and to settle the disentanglement of the United Kingdom from the EU.

Six negotiating rounds were held during 2017. Negotiations focused on three priority issues: protecting citizens’ rights; the framework for addressing the unique circumstances in Ireland and Northern Ireland; and the financial settlement to ensure that both the EU and the United Kingdom respect their financial obligations undertaken before the withdrawal. In addition, the negotiations covered other separation issues.

On 8 December 2017 the European Commission recommended to the European Council to conclude that sufficient progress had been made in the first phase of the Article 50 negotiations with the United Kingdom. The Commission’s assessment was based on a Joint Report agreed by the negotiators of the Commission and the UK government. In this Joint Report, the UK agreed to pay all its obligations under the current Multiannual Financial Framework (MFF) and previous financial perspectives as if it were still a Member State, including its share of the Union's liabilities and contingent liabilities.

On 15 December the European Council confirmed that sufficient progress had been achieved, and the leaders adopted guidelines to move to the second phase of negotiations, on possible transitional arrangements and the future relationship between the EU and the United Kingdom.

The next phase of negotiations

On 20 December 2017 the European Commission sent a Recommendation to the Council to begin discussions on the next phase of negotiations, including draft negotiating directives. These supplement the negotiating directives from May 2017 and set out additional details on possible transitional arrangements.

The Recommendation also recalls the need to translate into legal terms the results of the first phase of the negotiations, as outlined in the Commission’s Communication and the Joint Report. In line with the European Council’s guidelines of 15 December, the additional negotiating directives on transitional arrangements were adopted on 29 January 2018.

On 19 March 2018 the Commission published a draft of the Withdrawal Agreement that outlined the progress made in the negotiation round with the UK of 16-19 March 2018. In the financial settlement part of the Withdrawal Agreement, the EU and the UK translated the progress achieved in the first phase of negotiations (presented in the Joint Report) into a legal text.

Following the publication of the draft Withdrawal Agreement, on 23 March 2018 the European Council issued further guidelines with a view to the opening of negotiations on the overall understanding of the framework for the future EU-UK relationship. Negotiations should be completed by autumn 2018 in order to allow enough time before 29 March 2019 for the Withdrawal Agreement to be concluded by the Council, after obtaining the consent of the European Parliament, and to be approved by the United Kingdom in accordance with its own procedures.

Financial settlement and the 2017 EU annual accounts

With regard to the financial settlement, it was stated in the Joint Report, confirmed by the publication of the draft Withdrawal Agreement on 19 March, that the UK would pay all its obligations under the current MFF and previous financial perspectives as if it were still a Member State. More specifically, the draft withdrawal agreement states that the United Kingdom shall in particular be liable to the Union for its share of:

|

— |

The budgetary commitments of the Union budget and of the budgets of the Union decentralised agencies outstanding on 31 December 2020 — see Article 133 of the Withdrawal Agreement; |

|

— |

The financing of the Union's liabilities incurred until 31 December 2020, with certain exceptions — see Article 135; |

|

— |

The contingent financial liabilities of the Union arising from financial operations decided/approved before the withdrawal date — see Article 136; and |

|

— |

The payments required to discharge the contingent liabilities of the Union that become due related to legal cases concerning financial interests of the Union (provided that the facts forming the subject matter of those cases occurred no later than 31 December 2020) — see Article 140. |

This is the most recent information available at the time of preparation of these accounts. Based on this current situation, there is no impact on the consolidated EU annual accounts at 31 December 2017 resulting from the withdrawal process.

It is also noted that the Commission has proposed on 2 May 2018 its proposal for the next MFF starting in 2021 which is prepared on the basis that the UK will no longer be a Member State.

CONSOLIDATED FINANCIAL STATEMENTS AND EXPLANATORY NOTES (1)

CONTENTS

| BALANCE SHEET | 13 |

| STATEMENT OF FINANCIAL PERFORMANCE | 14 |

| CASHFLOW STATEMENT | 15 |

| STATEMENT OF CHANGES IN NET ASSETS | 16 |

| NOTES TO THE FINANCIAL STATEMENTS | 17 |

|

1. |

SIGNIFICANT ACCOUNTING POLICIES | 17 |

|

2. |

NOTES TO THE BALANCE SHEET | 29 |

|

3. |

NOTES TO THE STATEMENT OF FINANCIAL PERFORMANCE | 58 |

|

4. |

CONTINGENT LIABILITIES AND ASSETS | 66 |

|

5. |

BUDGETARY AND LEGAL COMMITMENTS | 70 |

|

6. |

FINANCIAL RISK MANAGEMENT | 74 |

|

7. |

RELATED PARTY DISCLOSURES | 86 |

|

8. |

EVENTS AFTER THE BALANCE SHEET DATE | 88 |

|

9. |

SCOPE OF CONSOLIDATION | 88 |

BALANCE SHEET

|

EUR millions |

|||

|

|

Note |

31.12.2017 |

31.12.2016 |

|

NON-CURRENT ASSETS |

|

|

|

|

Intangible assets |

2.1 |

405 |

381 |

|

Property, plant and equipment |

2.2 |

10 745 |

10 068 |

|

Investments accounted for using the equity method |

2.3 |

581 |

528 |

|

Financial assets |

2.4 |

59 980 |

62 247 |

|

Pre-financing |

2.5 |

25 022 |

21 901 |

|

Exchange receivables and non-exchange recoverables |

2.6 |

611 |

717 |

|

|

|

97 344 |

95 842 |

|

CURRENT ASSETS |

|

|

|

|

Financial assets |

2.4 |

8 655 |

3 673 |

|

Pre-financing |

2.5 |

24 005 |

23 569 |

|

Exchange receivables and non-exchange recoverables |

2.6 |

11 755 |

10 905 |

|

Inventories |

2.7 |

295 |

165 |

|

Cash and cash equivalents |

2.8 |

24 111 |

28 585 |

|

|

|

68 821 |

66 897 |

|

TOTAL ASSETS |

|

166 165 |

162 739 |

|

NON-CURRENT LIABILITIES |

|

|

|

|

Pension and other employee benefits |

2.9 |

(73 122 ) |

(67 231 ) |

|

Provisions |

2.10 |

(2 880 ) |

(1 936 ) |

|

Financial liabilities |

2.11 |

(50 063 ) |

(55 067 ) |

|

|

|

(126 065 ) |

(124 234 ) |

|

CURRENT LIABILITIES |

|

|

|

|

Provisions |

2.10 |

(659) |

(675) |

|

Financial liabilities |

2.11 |

(6 850 ) |

(2 284 ) |

|

Payables |

2.12 |

(39 048 ) |

(40 005 ) |

|

Accrued charges and deferred income |

2.13 |

(63 902 ) |

(67 580 ) |

|

|

|

(110 459 ) |

(110 544 ) |

|

TOTAL LIABILITIES |

|

(236 524 ) |

(234 778 ) |

|

NET ASSETS |

|

(70 359 ) |

(72 040 ) |

|

Reserves |

2.14 |

4 876 |

4 841 |

|

Amounts to be called from Member States (2) |

2.15 |

(75 234 ) |

(76 881 ) |

|

NET ASSETS |

|

(70 359 ) |

(72 040 ) |

STATEMENT OF FINANCIAL PERFORMANCE

|

EUR millions |

|||

|

|

Note |

2017 |

2016 |

|

REVENUE |

|

|

|

|

Revenue from non-exchange transactions |

|

|

|

|

GNI resources |

3.1 |

78 620 |

95 578 |

|

Traditional own resources |

3.2 |

20 520 |

20 439 |

|

VAT resources |

3.3 |

16 947 |

15 859 |

|

Fines |

3.4 |

4 664 |

3 858 |

|

Recovery of expenses |

3.5 |

1 879 |

1 947 |

|

Other |

3.6 |

10 376 |

5 740 |

|

|

|

133 006 |

143 422 |

|

|

|

|

|

|

Revenue from exchange transactions |

|

|

|

|

Financial revenue |

3.7 |

1 845 |

1 769 |

|

Other |

3.8 |

1 332 |

998 |

|

|

|

3 177 |

2 767 |

|

Total Revenue |

|

136 183 |

146 189 |

|

EXPENSES |

|

|

|

|

Implemented by Member States |

3.9 |

|

|

|

European Agricultural Guarantee Fund |

|

(44 289 ) |

(44 152 ) |

|

European Agricultural Fund for Rural Development and other rural development instruments |

|

(11 359 ) |

(12 604 ) |

|

European Regional Development Fund and Cohesion Fund |

|

(17 650 ) |

(35 045 ) |

|

European Social Fund |

|

(7 353 ) |

(9 366 ) |

|

Other |

|

(1 253 ) |

(1 606 ) |

|

Implemented by the Commission, executive agencies and trust funds |

3.10 |

(15 738 ) |

(15 610 ) |

|

Implemented by other EU agencies and bodies |

3.11 |

(2 667 ) |

(2 547 ) |

|

Implemented by third countries and international organisations |

3.11 |

(4 115 ) |

(3 258 ) |

|

Implemented by other entities |

3.11 |

(1 478 ) |

(2 035 ) |

|

Staff and pension costs |

3.12 |

(10 002 ) |

(9 776 ) |

|

Changes in employee benefits actuarial assumptions |

3.13 |

(3 544 ) |

(1 068 ) |

|

Finance costs |

3.14 |

(1 896 ) |

(1 904 ) |

|

Other expenses |

3.15 |

(6 756 ) |

(5 486 ) |

|

Total Expenses |

|

(128 101 ) |

(144 456 ) |

|

ECONOMIC RESULT OF THE YEAR |

|

8 082 |

1 733 |

CASHFLOW STATEMENT

|

EUR millions |

||

|

|

2017 |

2016 |

|

Economic result of the year |

8 082 |

1 733 |

|

Operating activities |

|

|

|

Amortisation |

99 |

88 |

|

Depreciation |

888 |

575 |

|

(Increase)/decrease in loans |

497 |

1 774 |

|

(Increase)/decrease in pre-financing |

(3 557 ) |

(314) |

|

(Increase)/decrease in exchange receivables and non-exchange recoverables |

(745) |

(1 297 ) |

|

(Increase)/decrease in inventories |

(130) |

(26) |

|

Increase/(decrease) in pension and other employee benefits |

5 891 |

3 417 |

|

Increase/(decrease) in provisions |

928 |

581 |

|

Increase/(decrease) in financial liabilities |

(438) |

(2 351 ) |

|

Increase/(decrease) in payables |

(957) |

7 813 |

|

Increase/(decrease) in accrued charges and deferred income |

(3 678 ) |

(821) |

|

Prior year budgetary surplus taken as non-cash revenue |

(6 405 ) |

(1 349 ) |

|

Other non-cash movements |

3 |

18 |

|

Investing activities |

|

|

|

(Increase)/decrease in intangible assets and property, plant and equipment |

(1 687 ) |

(2 073 ) |

|

(Increase)/decrease in investments accounted for using the equity method |

(53) |

(31) |

|

(Increase)/decrease in available for sale financial assets |

(3 190 ) |

(822) |

|

(Increase)/decrease in financial assets at fair value through surplus or deficit |

(22) |

(0) |

|

NET CASHFLOW |

(4 474 ) |

6 914 |

|

Net increase/(decrease) in cash and cash equivalents |

(4 474 ) |

6 914 |

|

Cash and cash equivalents at the beginning of the year |

28 585 |

21 671 |

|

Cash and cash equivalents at year-end |

24 111 |

28 585 |

STATEMENT OF CHANGES IN NET ASSETS

|

EUR millions |

||||

|

|

Amounts to be called from Member States Accumulated Surplus/(Deficit) |

Other reserves |

Fair value reserve |

Net Assets |

|

BALANCE AS AT 31.12.2015 |

(77 124 ) |

4 390 |

292 |

(72 442 ) |

|

Movement in Guarantee Fund reserve |

(82) |

82 |

— |

— |

|

Fair value movements |

— |

— |

33 |

33 |

|

Other |

(59) |

44 |

— |

(15) |

|

2015 budget result credited to Member States |

(1 349 ) |

— |

— |

(1 349 ) |

|

Economic result of the year |

1 733 |

— |

— |

1 733 |

|

BALANCE AS AT 31.12.2016 |

(76 881 ) |

4 516 |

325 |

(72 040 ) |

|

Movement in Guarantee Fund reserve |

(20) |

20 |

— |

— |

|

Fair value movements |

— |

— |

(2) |

(2) |

|

Other |

(11) |

62 |

(46) |

5 |

|

2016 budget result credited to Member States |

(6 405 ) |

— |

— |

(6 405 ) |

|

Economic result of the year |

8 082 |

— |

— |

8 082 |

|

BALANCE AS AT 31.12.2017 |

(75 234 ) |

4 598 |

278 |

(70 359 ) |

NOTES TO THE FINANCIAL STATEMENTS

1. SIGNIFICANT ACCOUNTING POLICIES

1.1. LEGAL BASIS AND ACCOUNTING RULES

The accounts of the EU are kept in accordance with Regulation (EU, Euratom) No 966/2012 of the European Parliament and of the Council of 25 October 2012 on the financial rules applicable to the general budget of the Union and repealing Council Regulation (EC, Euratom) No 1605/2002 (OJ L 298, 26 October 2012, p. 1) hereinafter referred to as the ‘Financial Regulation’ and Commission Delegated Regulation (EU) No 1268/2012 of 29 October 2012 (OJ L 362, 31 December 2012, p. 1) laying down detailed rules of application of this Financial Regulation.

In accordance with article 143 of the Financial Regulation, the EU prepares its financial statements on the basis of accrual-based accounting rules that are based on International Public Sector Accounting Standards (IPSAS). These accounting rules, adopted by the Accounting Officer of the Commission, have to be applied by all the institutions and EU bodies falling within the scope of consolidation in order to establish a uniform set of rules for accounting, valuation and presentation of the accounts with a view to harmonising the process for drawing up the financial statements and consolidation.

Application of new and amended European Union accounting rules (EAR)

Amendments to EAR which are effective for annual periods beginning on or after 1 January 2017

The following amendments have been adopted by the Accounting Officer of the Commission:

|

— |

Amendments to EAR 1 ‘Financial Statements’; and |

|

— |

Amendments to EAR 14 ‘Accounting Policies, Changes in Accounting Estimates and Errors’. |

These amendments stem from the recent changes to IPSAS 1 ‘Presentation of Financial Statements’ and IPSAS 3 ‘Accounting Policies, Changes in Accounting Estimates and Errors’, proposing improvements to ensure consistency among IPSAS standards. Consequently, the related EARs have been updated and the main changes relate to the description of qualitative characteristics of financial reporting and updates to the hierarchy of sources to be used in the selection and application of accounting policies.

The adoption of these amendments has had no impact on the EU annual accounts 2017.

New and revised EARs adopted but not yet effective at 31 December 2017

The EU has not applied the following new and revised EARs, which have been adopted by the Accounting Officer of the Commission, but which are not yet effective:

|

— |

Revision to EAR 12 ‘Employee Benefits’ (effective for annual periods beginning on or after 1 January 2018): The EAR 12 has been revised in line with the new IPSAS 39 ‘Employee Benefits’. The main change is that any gain or loss resulting from changes in the actuarial assumptions is to be recognised directly in net assets, in contrast with the current requirement to recognise them in surplus or deficit. |

The EU is currently analysing the impact and practical consequences of applying this revised EAR. However, no significant impact is expected on the consolidated financial statements, except for the recognition of the actuarial assumptions in the net assets instead of the statement of financial performance.

|

— |

New EAR 20 ‘Public Sector Combinations’ (effective for annual periods beginning on or after 1 January 2019): The EAR 20, which is based on the IPSAS 40 ‘Public Sector Combinations’, establishes the classification of a public sector combination into two different types depending on whether the transaction takes place under common control or not: (i) amalgamation, in which the transaction is based on the carrying amounts of the entity combined with the EU; and (ii) acquisition, in which the transaction is based on the acquisition date fair values of the entity acquired by the EU. Both have distinct requirements and levels of disclosure, in order to provide a better understanding of its effects to users of the financial statements of the EU. |

The impact on the EU financial statements in the year of initial application will depend on whether in that period the EU would enter into a public sector combination transaction.

1.2. ACCOUNTING PRINCIPLES

The objective of financial statements is to provide information about the financial position, performance and cashflows of an entity that is useful to a wide range of users. For the EU as a public sector entity, the objectives are more specifically to provide information useful for decision making, and to demonstrate the accountability of the entity for the resources entrusted to it. It is with these goals in mind that the present document has been drawn up.

The overall considerations (or accounting principles) to be followed when preparing the financial statements are laid down in EU accounting rule 1 ‘Financial Statements’ and are the same as those described in IPSAS 1: fair presentation, accrual basis, going concern, consistency of presentation, materiality, aggregation, offsetting and comparative information. The qualitative characteristics of financial reporting are relevance, faithful representation (reliability), understandability, timeliness, comparability and verifiability.

1.3. CONSOLIDATION

Scope of consolidation

The consolidated financial statements of the EU comprise all significant controlled entities (i.e. the EU institutions (including the Commission) and the EU agencies), associates and joint ventures. The complete list of consolidated entities can be found in note 9 of the EU financial statements. It now comprises 52 controlled entities and 1 associate. Entities that fall under the consolidation scope, but which are immaterial to the EU consolidated financial statements as a whole, need not be consolidated or accounted for using equity method where to do so would result in excessive time or cost to the EU. Those entities are referred to as ‘Minor entities’ and are separately listed in note 9. In 2017, 7 entities have been classified as minor entities.

Controlled entities

The decision to include an entity in the scope of consolidation is based on the control concept. Controlled entities are all entities for which the EU is exposed, or has right, to variable benefits from its involvement and has the ability to affect the nature and amount of those benefits through its power over the other entity. This power must be presently exercisable and must relate to the relevant activities of the entity. Controlled entities are fully consolidated. The consolidation begins at the first date on which control exists, and ends when such control no longer exists.

The most common indicators of control within the EU are: creation of the entity through founding treaties or secondary legislation, financing of the entity from the EU budget, the existence of voting rights in the governing bodies, audit by the European Court of Auditors and discharge by the European Parliament. An individual assessment for each entity is made in order to decide whether one or all of the criteria listed above are sufficient to result in control.

Under this approach, the EU's institutions (except the European Central Bank) and agencies (excluding the agencies of the former 2nd pillar) are considered as under the exclusive control of the EU and are therefore included in the consolidation scope. Furthermore the European Coal and Steel Community (ECSC) in Liquidation is also considered as a controlled entity.

All material ‘inter-entity transactions and balances’ between EU controlled entities are eliminated, while unrealised gains and losses on such transactions are not material and so have not been eliminated.

Joint Arrangements

A joint arrangement is an agreement over which the EU and one or more parties have joint control. Joint control is contractually agreed sharing of control over an arrangement, which exists only when decisions about the relevant activities require the unanimous consent of parties sharing control. Joint agreements can be either joint operations or joint ventures. In case a joint arrangement is structured through a separate vehicle and parties to the joint arrangement have rights to the net assets of the arrangement, this joint arrangement classifies as a joint venture. Participations in joint ventures are accounted for using the equity method (see note 1.5.4). In case the parties have rights to the assets, and obligations for the liabilities, related to the arrangement, this joint arrangement is classified as a joint operation. In relation to its interest in joint operations, the EU recognises in its financial statements: its assets and liabilities, revenue and expense, as well as its share of assets, liabilities, revenue and expense held or incurred jointly.

Associates

Associates are entities over which the EU has, directly or indirectly, significant influence but not control. It is presumed that significant influence exists if the EU holds directly or indirectly 20 % or more of the voting rights. Participations in associates are accounted for using the equity method (see note 1.5.4).

Non-consolidated entities the funds of which are managed by the Commission

The funds of the Joint Sickness Insurance Scheme for staff of the EU, the European Development Fund and the Participants Guarantee Fund are managed by the Commission on their behalf. However, since these entities are not controlled by the EU, they are not consolidated in its financial statements.

1.4. BASIS OF PREPARATION

Financial statements are presented annually. The accounting year begins on 1 January and ends on 31 December.

1.4.1. Currency and basis for conversion

Functional and reporting currency

The financial statements are presented in millions of euros, unless stated otherwise, the euro being the EU's functional and reporting currency.

Transactions and balances

Foreign currency transactions are translated into euros using the exchange rates prevailing at the dates of the transactions. Foreign exchange gains and losses resulting from the settlement of foreign currency transactions and from the re-translation at year-end exchange rates of monetary assets and liabilities denominated in foreign currencies are recognised in the statement of financial performance. Translation differences on non-monetary financial instruments classified as available for sale financial assets are included in the fair value reserve.

Different conversion methods apply to property, plant and equipment and intangible assets, which retain their value in euros at the rate that applied at the date when they were purchased.

Year-end balances of monetary assets and liabilities denominated in foreign currencies are converted into euros on the basis of the European Central Bank (ECB) exchange rates applying on 31 December:

Euro exchange rates

|

Currency |

31.12.2017 |

31.12.2016 |

Currency |

31.12.2017 |

31.12.2016 |

|

BGN |

1,9558 |

1,9558 |

PLN |

4,177 |

4,4103 |

|

CZK |

25,5350 |

27,0210 |

RON |

4,6585 |

4,5390 |

|

DKK |

7,4449 |

7,4344 |

SEK |

9,8438 |

9,5525 |

|

GBP |

0,8872 |

0,8562 |

CHF |

1,1702 |

1,0739 |

|

HRK |

7,4400 |

7,5597 |

JPY |

135,01 |

123,4000 |

|

HUF |

310,3300 |

309,8300 |

USD |

1,1993 |

1,0541 |

1.4.2. Use of estimates

In accordance with IPSAS and generally accepted accounting principles, the financial statements necessarily include amounts based on estimates and assumptions by management based on the most reliable information available. Significant estimates include, but are not limited to: amounts for employee benefit liabilities, provisions, financial risk on inventories and accounts receivable, accrued revenue and charges, contingent assets and liabilities, degree of impairment of intangible assets and property, plant and equipment and amounts disclosed in the notes concerning financial instruments. Actual results could differ from those estimates. Changes in estimates are reflected in the period in which they become known.

1.5. BALANCE SHEET

1.5.1. Intangible assets

Acquired computer software licences are stated at historical cost less accumulated amortisation and impairment losses. The assets are amortised on a straight-line basis over their estimated useful lives (3-11 years). The estimated useful lives of intangible assets depend on their specific economic lifetime or legal lifetime determined by an agreement. Internally developed intangible assets are capitalised when the relevant criteria of the EU accounting rules are met and the expenses relate solely to the development phase of the asset. The costs capitalisable include all directly attributable costs necessary to create, produce, and prepare the asset to be capable of operating in the manner intended by management. Costs associated with research activities, non-capitalisable development costs and maintenance costs are recognised as expenses as incurred.

1.5.2. Property, plant and equipment

All property, plant and equipment are stated at historical cost less accumulated depreciation and impairment losses. Cost includes expenditure that is directly attributable to the acquisition, construction or transfer of the asset.

Subsequent costs are included in the asset’s carrying amount or recognised as a separate asset, as appropriate, only when it is probable that future economic benefits or service potential associated with the item will flow to the EU and its cost can be measured reliably. Repairs and maintenance costs are charged to the statement of financial performance during the financial period in which they are incurred.

Land and works of art are not depreciated as they are deemed to have an indefinite useful life. Assets under construction are not depreciated as these assets are not yet available for use. Depreciation on other assets is calculated using the straight-line method to allocate their cost less their residual values over their estimated useful lives, as follows:

|

Type of asset |

Straight line depreciation rate |

|

Buildings |

4 % to 10 % |

|

Space assets |

8 % to 25 % |

|

Plant and equipment |

10 % to 25 % |

|

Furniture and vehicles |

10 % to 25 % |

|

Computer hardware |

25 % to 33 % |

|

Other |

10 % to 33 % |

Gains or losses on disposals are determined by comparing proceeds less selling expenses with the carrying amount of the disposed asset and are included in the statement of financial performance.

Leases

Leases of tangible assets, where the EU has substantially all the risks and rewards of ownership, are classified as finance leases. Finance leases are capitalised at the inception of the lease’s commencement at the lower of the fair value of the leased asset and the present value of the minimum lease payments. The interest element of the finance lease payment is charged to expenditure over the period of the lease at a constant periodic rate in relation to the balance outstanding. The rental obligations, net of finance charges, are included in financial liabilities (non-current and current). The interest element of the finance cost is charged to the statement of financial performance over the lease period so as to produce a constant periodic interest rate on the remaining balance of the liability for each period. The assets held under finance leases are depreciated over the shorter of the asset's useful life and the lease term.

Leases where the lessor retains a significant portion of the risks and rewards inherent to ownership are classified as operating leases. Operating lease payments are recognised as an expense in the statement of financial performance on a straight-line basis over the lease term.

1.5.3. Impairment of non-financial assets

Assets that have an indefinite useful life are not subject to amortisation/depreciation and are tested annually for impairment. Assets that are subject to amortisation/depreciation are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. An impairment loss is recognised for the amount by which the asset’s carrying amount exceeds its recoverable (service) amount. The recoverable (service) amount is the higher of an asset’s fair value less costs to sell and its value in use.

Intangible assets and property, plant and equipment residual values and useful lives are reviewed, and adjusted if appropriate, at least once per year. An asset’s carrying amount is written down immediately to its recoverable (service) amount if the asset’s carrying amount is greater than its estimated recoverable (service) amount. If the reasons for impairments recognised in previous years no longer apply, the impairment losses are reversed accordingly.

1.5.4. Investments accounted for using the equity method

Participations in associates and joint ventures

Investments accounted for using the equity method are initially recognised at cost. The EU's interest in these investments is recognised in the statement of financial performance, and its share in the movements in reserves is recognised in the fair value reserve in net assets. The initial cost together with all movements (further contributions, share of economic results and reserve movements, impairments, and dividends) give the book value of the investment in the financial statements at the balance sheet date. Distributions received from the investment reduce the carrying amount of the asset.

If the EU's share of deficits of an investment accounted for using the equity method equals or exceeds its interest in the investment, the EU discontinues recognising its share of further losses (‘unrecognised losses’). After the EU's interest is reduced to zero, additional losses are provided for and a liability is recognised, only to the extent that the EU has incurred legal or constructive obligation or made payments on behalf of the entity.

If there are indications of impairment, a write-down to the lower recoverable amount is necessary. The recoverable amount is determined as described under note 1.5.3. If the reason for impairment ceases to apply at a later date, the impairment loss is reversed to the carrying amount that would have been determined had no impairment loss been recognised.

In cases where the EU holds 20 % or more of an investment capital fund, it does not seek to exert significant influence. Such funds are therefore treated as financial instruments and categorised as available for sale financial assets.

Associates and joint ventures classified as minor entities are not accounted for under the equity method. EU contributions to those entities are accounted for as an expense of the period.

1.5.5. Financial assets

Classification

The EU classifies their financial assets in the following categories: financial assets at fair value through surplus or deficit; loans and receivables; held-to-maturity investments; and available for sale financial assets. The classification of financial instruments is determined at initial recognition and re-evaluated at each balance sheet date.

(i) Financial assets at fair value through surplus or deficit

A financial asset is classified in this category if acquired principally for the purpose of selling in the short term. Derivatives are also categorised in this category. Assets in this category are classified as current assets if they are expected to be realised within 12 months of the balance sheet date.

(ii) Loans and receivables

Loans and receivables are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market. They arise when the EU provides money, goods or services directly to a debtor with no intention of trading the receivable, or in case the EU is subrogated to the rights of the original lender following a payment made by the EU under a guarantee contract. Payments due within 12 months of the balance sheet date are classified as current assets. Payments due after 12 months from the balance sheet date are classified as non-current assets. Loans and receivables include term deposits with the original maturity above three months.

(iii) Held-to-maturity investments

Held-to-maturity investments are non-derivative financial assets with fixed or determinable payments and fixed maturities that the EU has the positive intention and ability to hold to maturity. During this financial year, the EU did not hold any investments in this category.

(iv) Available for sale financial assets

Available for sale financial assets are non-derivatives that are either designated in this category or not classified in any of the other categories. They are classified as either current or non-current assets, depending on the period of time the EU expects to hold them. Investments in entities that are neither consolidated nor accounted for using the equity method and other equity-type investments (e.g. Risk Capital Operations) are also classified as available for sale financial assets.

Initial recognition and measurement

Purchases and sales of financial assets at fair value through surplus or deficit, held-to-maturity and available for sale are recognised on trade-date — the date on which the EU commits to purchase or sell the asset. Cash equivalents and loans are recognised when cash is advanced to the borrowers. Financial instruments are initially recognised at fair value. For all financial assets not carried at fair value through surplus or deficit transactions costs are added to the fair value at initial recognition. Financial assets carried at fair value through surplus or deficit are initially recognised at fair value and transaction costs are expensed in the statement of financial performance.

The fair value of a financial asset on initial recognition is normally the transaction price (i.e. the fair value of the consideration received), unless the fair value of that instrument is evidenced by comparison with other observable current market transactions in the same instrument or based on a valuation technique whose variables include only data from observable markets (e.g. in case of some derivative contracts). However, when a long-term loan that carries no interest or an interest below market conditions is granted, its fair value can be estimated as the present value of all future cash receipts discounted using the prevailing market rate of interest for a similar instrument with a similar credit rating.

Loans granted are measured at their nominal amount, which is considered to be the fair value of the loan. The reasoning for this is as follows:

|

— |

The ‘market environment’ for EU lending is very specific and different from the capital market used to issue commercial or government bonds. As lenders in these markets have the opportunity to choose alternative investments, the opportunity possibility is factored into market prices. However, this opportunity for alternative investments does not exist for the EU which is not allowed to invest money on the capital markets; it only borrows funds for the purpose of lending at the same rate. This means that there is no alternative lending or investment option available to the EU for the sums borrowed. Thus, there is no opportunity cost and therefore no basis of comparison with market rates. In fact, the EU lending operation itself represents the market. Essentially, since the opportunity cost ‘option’ is not applicable, the market price does not fairly reflect the substance of the EU lending transactions. Therefore, it is not appropriate to determine the fair value of EU lending with reference to commercial or government bonds. |

|

— |

Furthermore as there is no active market or similar transactions to compare with, the interest rate to be used by the EU for fair valuing its lending operations under the EFSM, BOP and other such loans, should be the interest rate charged. |

|

— |

In addition, for these loans, there are compensating effects between loans and borrowings due to their back-to-back character. Thus, the effective interest for the loan equals the effective interest rate for the related borrowings. The transaction costs incurred by the EU and then recharged to the beneficiary of the loan are directly recognised in the statement of financial performance. |

Financial instruments are derecognised when the rights to receive cashflows from the investments have expired or the EU has transferred substantially all risks and rewards of ownership to another party.

Subsequent measurement

|

a) |

Financial assets at fair value through surplus or deficit are subsequently carried at fair value. Gains and losses arising from changes in the fair value of the ‘financial instruments at fair value through surplus or deficit’ category are included in the statement of financial performance in the period in which they arise. |

|

b) |

Loans and receivables are carried at amortised cost using the effective interest method. In the case of loans granted on borrowed funds, the same effective interest rate is applied to both the loans and borrowings since these loans have the characteristics of ‘back-to-back operations’ and the differences between the loan and the borrowing conditions and amounts are not material. The transaction costs incurred by the EU and then recharged to the beneficiary of the loan are directly recognised in the statement of financial performance. |

|

c) |

Held to maturity assets are carried at amortised cost using the effective interest method. The EU currently holds no held to maturity investments. |

|

d) |

Available for sale financial assets are subsequently carried at fair value. Gains and losses arising from changes in the fair value of available for sale financial assets are recognised in the fair value reserve, except for translation differences on monetary assets which are recognised in the statement of financial performance. When assets classified as available for sale financial assets are derecognised or impaired, the cumulative fair value adjustments previously recognised in the fair value reserve are recognised in the statement of financial performance. Interest on available for sale financial assets calculated using the effective interest method is recognised in the statement of financial performance. Dividends on available for sale equity instruments are recognised when the EU's right to receive payment is established. |

The fair values of quoted investments in active markets are based on current bid prices. If the market for a financial asset is not active (and for unlisted securities and over-the–counter derivatives), the EU establishes a fair value by using valuation techniques. These include the use of recent arm’s length transactions, reference to other instruments that are substantially the same, discounted cashflow analysis, option pricing models and other valuation techniques commonly used by market participants.

Investments in Venture Capital Funds, classified as available for sale financial assets, which do not have a quoted market price in an active market are valued at the attributable net asset value, which is considered as an equivalent of their fair value.

In cases where the fair value of investments in equity instruments that do not have a quoted market price in an active market cannot be reliably measured, these investments are valued at cost less impairment losses.

Impairment of financial assets

The EU assesses at each balance sheet date whether there is objective evidence that a financial asset is impaired. A financial asset is impaired and impairment losses are incurred if, and only if, there is objective evidence of impairment as a result of one or more events that occurred after the initial recognition of the asset and that loss event (or events) has an impact on the estimated future cashflows of the financial asset that can be reliably estimated.

(a) Assets carried at amortised cost

If there is objective evidence that an impairment loss on loans and receivables or held-to-maturity investments carried at amortised cost has been incurred, the amount of the loss is measured as the difference between the asset’s carrying amount and the present value of estimated future cashflows (excluding future credit losses that have not been incurred) discounted at the financial asset’s original effective interest rate. The carrying amount of the asset is reduced and the amount of the loss is recognised in the statement of financial performance. If a loan or held-to-maturity investment has a variable interest rate, the discount rate for measuring any impairment loss is the current effective interest rate determined under the contract. The calculation of the present value of the estimated future cashflows of a collateralised financial asset reflects the cashflows that may result from foreclosure less costs for obtaining and selling the collateral, whether or not foreclosure is probable. If, in a subsequent period, the amount of the impairment loss decreases and the decrease can be related objectively to an event occurring after the impairment was recognised, the previously recognised impairment loss is reversed through the statement of financial performance.

(b) Assets carried at fair value

In the case of equity investments classified as available for sale financial assets, a significant or permanent (prolonged) decline in the fair value of the security below its cost is considered in determining whether the securities are impaired. If any such evidence exists for available for sale financial assets, the cumulative loss — measured as the difference between the acquisition cost and the current fair value, less any impairment loss on that financial asset previously recognised in the statement of financial performance — is removed from reserves and recognised in the statement of financial performance. Impairment losses recognised in the statement of financial performance on equity instruments are not reversed through the statement of financial performance. If, in a subsequent period, the fair value of a debt instrument classified as available for sale financial asset increases and the increase can be objectively related to an event occurring after the impairment loss was recognised, the impairment loss is reversed through the statement of financial performance.

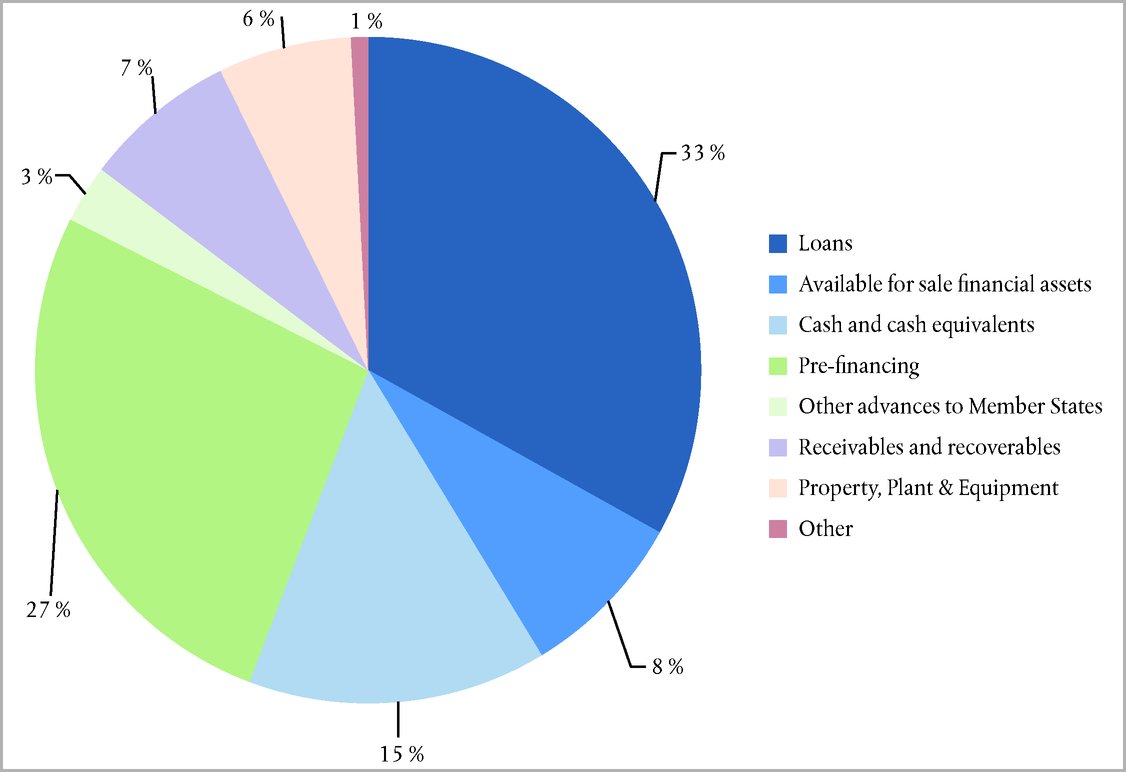

1.5.6. Inventories