ISSN 1977-091X

Official Journal

of the European Union

C 357

English edition

Information and Notices

Volume 59

29 September 2016

|

ISSN 1977-091X |

||

|

Official Journal of the European Union |

C 357 |

|

|

||

|

English edition |

Information and Notices |

Volume 59 |

|

Notice No |

Contents |

page |

|

|

II Information |

|

|

|

INFORMATION FROM EUROPEAN UNION INSTITUTIONS, BODIES, OFFICES AND AGENCIES |

|

|

|

European Commission |

|

|

2016/C 357/01 |

Non-opposition to a notified concentration (Case M.7893 — Plastic Omnium/Faurecia Exterior Automotive Business) ( 1 ) |

|

|

IV Notices |

|

|

|

NOTICES FROM EUROPEAN UNION INSTITUTIONS, BODIES, OFFICES AND AGENCIES |

|

|

|

Council |

|

|

2016/C 357/02 |

Council Conclusions on the Follow up of the Union Customs Code |

|

|

|

European Commission |

|

|

2016/C 357/03 |

||

|

2016/C 357/04 |

Explanatory Notes to the Combined Nomenclature of the European Union |

|

|

2016/C 357/05 |

||

|

2016/C 357/06 |

||

|

2016/C 357/07 |

Final Report of the Hearing Officer — Hutchison 3G UK/Telefónica UK (Case M.7612) |

|

|

2016/C 357/08 |

||

|

|

NOTICES CONCERNING THE EUROPEAN ECONOMIC AREA |

|

|

|

EFTA Surveillance Authority |

|

|

2016/C 357/09 |

|

|

V Announcements |

|

|

|

COURT PROCEEDINGS |

|

|

|

EFTA Court |

|

|

2016/C 357/10 |

||

|

2016/C 357/11 |

||

|

2016/C 357/12 |

||

|

2016/C 357/13 |

||

|

|

PROCEDURES RELATING TO THE IMPLEMENTATION OF COMPETITION POLICY |

|

|

|

European Commission |

|

|

2016/C 357/14 |

Prior notification of a concentration (Case M.8201 — Randstad Holding/Monster Worldwide) ( 1 ) |

|

|

2016/C 357/15 |

Prior notification of a concentration (Case M.8105 — Marmedsa/UECC/UECC Ibérica) — Candidate case for simplified procedure ( 1 ) |

|

|

2016/C 357/16 |

Prior notification of a concentration (Case M.8185 — Atlantia/EDF/ACA) — Candidate case for simplified procedure ( 1 ) |

|

|

|

|

|

(1) Text with EEA relevance |

|

EN |

|

II Information

INFORMATION FROM EUROPEAN UNION INSTITUTIONS, BODIES, OFFICES AND AGENCIES

European Commission

|

29.9.2016 |

EN |

Official Journal of the European Union |

C 357/1 |

Non-opposition to a notified concentration

(Case M.7893 — Plastic Omnium/Faurecia Exterior Automotive Business)

(Text with EEA relevance)

(2016/C 357/01)

On 11 July 2016, the Commission decided not to oppose the above notified concentration and to declare it compatible with the internal market. This decision is based on Article 6(1)(b) in conjunction with Article 6(2) of Council Regulation (EC) No 139/2004 (1). The full text of the decision is available only in English language and will be made public after it is cleared of any business secrets it may contain. It will be available:

|

— |

in the merger section of the Competition website of the Commission (http://ec.europa.eu/competition/mergers/cases/). This website provides various facilities to help locate individual merger decisions, including company, case number, date and sectoral indexes, |

|

— |

in electronic form on the EUR-Lex website (http://eur-lex.europa.eu/homepage.html?locale=en) under document number 32016M7893. EUR-Lex is the online access to the European law. |

IV Notices

NOTICES FROM EUROPEAN UNION INSTITUTIONS, BODIES, OFFICES AND AGENCIES

Council

|

29.9.2016 |

EN |

Official Journal of the European Union |

C 357/2 |

Council Conclusions on the Follow up of the Union Customs Code

(2016/C 357/02)

The Council,

ACKNOWLEDGING THAT:

|

— |

the Union Customs Code (UCC) is an important milestone in the history of the ongoing development of the Customs Union since 1968 as it reflects a major overhaul of existing EU customs legislation in order to achieve clearer customs procedures, better safety and security of EU citizens, and, through new IT systems, a stronger cooperation between the customs authorities and the Commission; |

|

— |

close cooperation between the Commission, the Council and the European Parliament, together with the input from trade, paved the way for the adoption of the basic legislative framework of the UCC on 9 October 2013; |

|

— |

intensive work has continued until recently, notably in completing the legislative framework through detailed implementing and delegated acts; |

|

— |

this ‘UCC package’ (1) has become applicable from the 1 May 2016 but further work is foreseen for a transitional period up until 2020 to refine and fully implement the new rules. |

STRESSING

|

— |

the importance of this transitional period to allow a pragmatic, business-friendly approach to implementation in which a constructive and supportive approach on behalf of the Commission is essential; |

|

— |

the importance that further work in this transitional period, in particular on IT-systems, is based on realistic costs and time planning, and explores ways to keep costs for customs and trade at a minimum, e.g. by adopting common IT solutions. |

EMPHASIZING the pivotal role of customs with regard to the movement of goods across EU borders, in particular, as set out in the UCC, for the protection of the revenue, the safety and the security of EU citizens, in fighting fraud and in maintaining a proper balance between controls and trade facilitation for legitimate trade.

UNDERLINING THE NEED:

|

— |

to look forward and continue work on further innovation of the ‘UCC package’ so as to deal effectively with the constantly changing environment in which customs work, such as changes in IT technology, management of the integral supply chain, trade flows, e-commerce, safety and security; |

|

— |

to continue work that effectively reflects the input and the needs of customs authorities and trade, and that takes into account the needs of the SME’s; |

|

— |

to continue work in developing further trade facilitation and simplification; |

|

— |

to continue the work based on a clear and realistic indication of both the costs and the time planning for the implementation of new rules by Member States and trade. |

INVITES COMMISSION AND MEMBER STATES

|

— |

to continue the work in keeping the ‘UCC package’ up to date, that is, modern, agile and able to cope with challenges for customs. This entails, but is not limited to:

|

|

— |

when considering further work, the following should be taken into account:

|

|

— |

to continue cooperation in a pro-active way on strategic topics at Council level, in order to obtain the maximum from the post-Lisbon institutional framework. This remains essential in securing a viable customs union. |

INVITES THE COMMISSION to ensure regular and adequate reporting at Council level on the progress made and the planning of further modernisation of the ‘UCC package’, taking into account the reporting that is already foreseen.

(1) Regulation (EU) No 952/2013 of the European Parliament and the Council of 9 October 2013, Commission Delegated Regulation (EU) 2015/2446 of 28 July 2015, Commission Delegated Regulation (EU) 2016/341 of 17 December 2015, Commission Implementing Regulation (EU) 2015/2447 of 24 November 2015 and Commission Implementing Decision (EU) 2016/578 of 11 April 2016.

European Commission

|

29.9.2016 |

EN |

Official Journal of the European Union |

C 357/4 |

Euro exchange rates (1)

28 September 2016

(2016/C 357/03)

1 euro =

|

|

Currency |

Exchange rate |

|

USD |

US dollar |

1,1225 |

|

JPY |

Japanese yen |

112,93 |

|

DKK |

Danish krone |

7,4511 |

|

GBP |

Pound sterling |

0,86208 |

|

SEK |

Swedish krona |

9,6165 |

|

CHF |

Swiss franc |

1,0891 |

|

ISK |

Iceland króna |

|

|

NOK |

Norwegian krone |

9,0888 |

|

BGN |

Bulgarian lev |

1,9558 |

|

CZK |

Czech koruna |

27,023 |

|

HUF |

Hungarian forint |

307,95 |

|

PLN |

Polish zloty |

4,2893 |

|

RON |

Romanian leu |

4,4506 |

|

TRY |

Turkish lira |

3,3438 |

|

AUD |

Australian dollar |

1,4637 |

|

CAD |

Canadian dollar |

1,4829 |

|

HKD |

Hong Kong dollar |

8,7041 |

|

NZD |

New Zealand dollar |

1,5459 |

|

SGD |

Singapore dollar |

1,5270 |

|

KRW |

South Korean won |

1 231,76 |

|

ZAR |

South African rand |

15,2492 |

|

CNY |

Chinese yuan renminbi |

7,4911 |

|

HRK |

Croatian kuna |

7,5160 |

|

IDR |

Indonesian rupiah |

14 533,57 |

|

MYR |

Malaysian ringgit |

4,6434 |

|

PHP |

Philippine peso |

54,189 |

|

RUB |

Russian rouble |

71,7039 |

|

THB |

Thai baht |

38,839 |

|

BRL |

Brazilian real |

3,6389 |

|

MXN |

Mexican peso |

21,8177 |

|

INR |

Indian rupee |

74,5915 |

(1) Source: reference exchange rate published by the ECB.

|

29.9.2016 |

EN |

Official Journal of the European Union |

C 357/5 |

Explanatory Notes to the Combined Nomenclature of the European Union

(2016/C 357/04)

Pursuant to Article 9(1)(a) of Council Regulation (EEC) No 2658/87 (1), the Explanatory Notes to the Combined Nomenclature of the European Union (1) are hereby amended as follows:

On page 138, Annex A of the Explanatory notes to Chapter 27 is replaced by the following text:

‘ANNEX A

METHOD OF DETERMINING THE CONTENT OF AROMATIC CONSTITUENTS IN PRODUCTS WITH A DISTILLATION END POINT EXCEEDING 315 °C

1. Scope

This test method covers the determination of the content of aromatic and non-aromatic constituents in mineral oils.

2. Definition

2.1. Aromatic constituents: the portion of the sample dissolved in the solvent and adsorbed on silica gel. The aromatic constituents may contain: aromatic hydrocarbons, condensed naphthenic-aromatics, aromatic olefins, asphaltenes, aromatic compounds containing sulphur, nitrogen, oxygen and polar aromatics.

2.2. Non-aromatic constituents: the portion of the sample which is not adsorbed on silica gel and which is eluted by the solvent (such as non-aromatic hydrocarbons).

3. Principle of the method

The sample, dissolved in n-pentane, is allowed to percolate through a special chromatography column packed with silica gel. The nonaromatic constituents, eluted with solvent, are collected subsequently and assayed by weighing after the solvent has evaporated.

Samples not dissolving in n-pentane should be dissolved in cyclohexane.

4. Apparatus and reagents

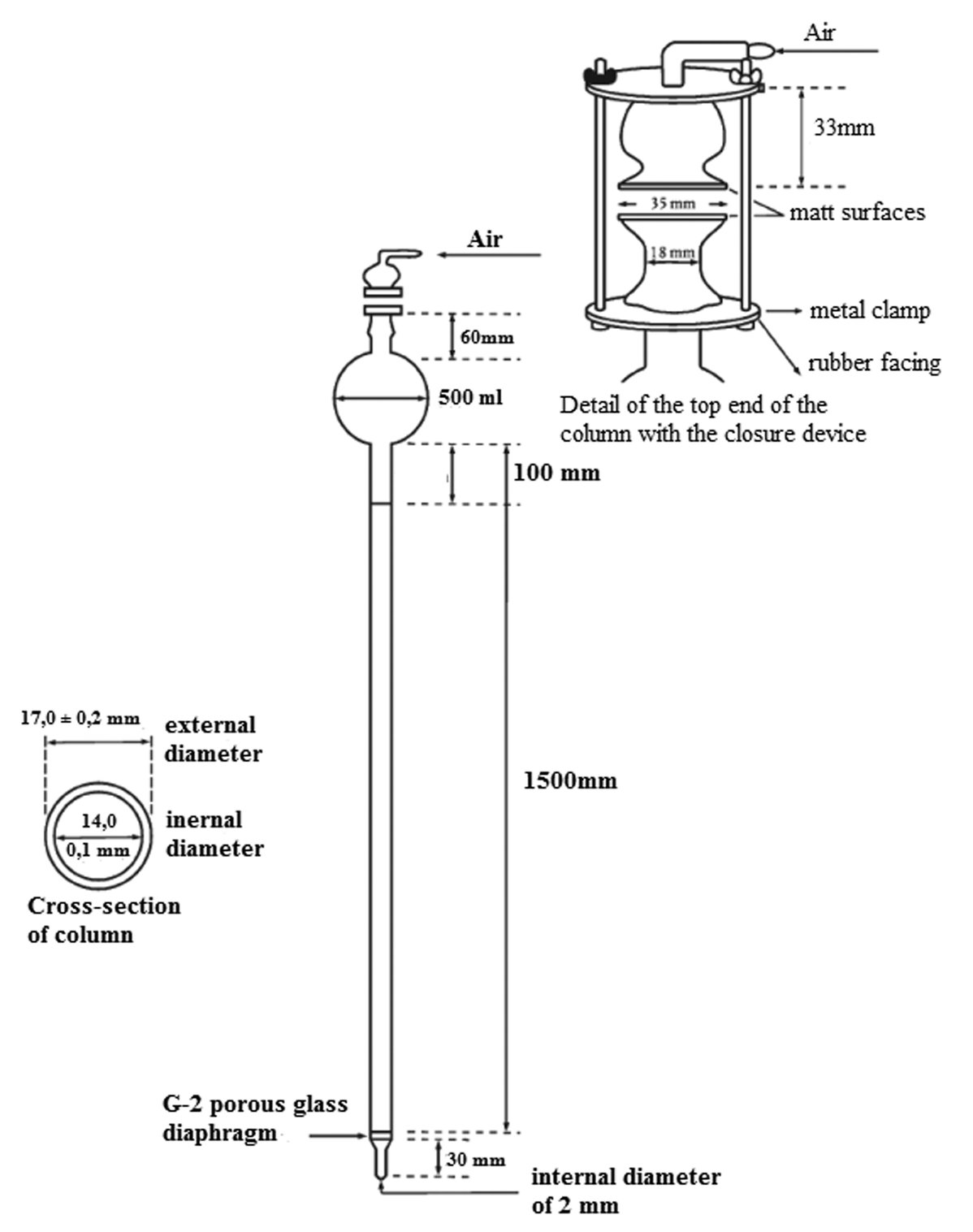

Chromatography column: this is a glass tube with the dimensions and shape shown in the accompanying sketch. The top aperture must be capable of being sealed by a glass joint having its ground flat face pressed against the top of the column by two rubber-covered metal clamps. The seal must be completely leak tight against an applied pressure of nitrogen or air.

Silica gel: fineness of 200 mesh or more. It must be activated for seven hours in an oven kept at 170 °C before use and placed in a desiccator to cool. After activation, the silica gel must be used within a few days.

Solvent I n-pentane: minimum 95 % pure, aromatic-free.

Solvent II cyclohexane: minimum 98 % pure, aromatic-free.

5. Procedure 1 (chromatography column 1)

Preparation of the sample solution: dissolve approximately 3,6 g (exactly weighed) of the sample in 10 ml of n-pentane (I). If the sample is insoluble in n-pentane, dissolve it in cyclohexane and the determination is performed using cyclohexane (II) instead of n-pentane (I).

Pack the chromatography column (chromatography column 1) with the previously activated silica gel, up to about 10 cm from the upper glass bulb, by carefully tamping the contents of the column with a vibrator so as not to leave any channels. Then insert a plug of glass wool in the top of the silica gel column.

Pre-moisten the silica gel with 180 ml of solvent (I) or (II), and apply a pressure of air or nitrogen from above until the upper surface of the liquid reaches the top of the silica gel.

Carefully release the pressure inside the column and pour over it approximately 3,6 g (exactly weighed expression with 2 decimals) of sample dissolved in 10 ml of solvent (I) or (II), then rinse out the beaker with another 10 ml of solvent (I) or (II), and pour this also over the column.

Apply the pressure progressively while allowing the liquid to flow in drops from the bottom capillary tube of the column at the approximate rate of 1 ml/min and collect this liquid in a 500 ml flask.

When the level of the liquid containing the substance to be separated falls to the surface of the silica gel, carefully remove the pressure once more and add 230 ml of solvent (I) or (II), re-apply the pressure immediately and bring down the level of the liquid to the surface of the silica gel while collecting the eluate in the same flask as before.

Before the level of the liquid containing the substance to be separated falls to the surface of the silica gel, check the eluate using FT-IR for the presence of aromatics. If the eluate contains only aliphatic hydrocarbons, add again 50 ml of solvent (I) or (II) after removing the pressure. Repeat this step if necessary.

Reduce the collected fraction to a small volume by evaporation in a vacuum oven at 35 °C or in a vacuum rotary evaporator or similar apparatus and then transfer it without loss into a tared beaker, using more solvent (I) or (II).

Evaporate the contents of the beaker in a vacuum oven at 35 °C to constant weight (W). The difference between the two last weights should not exceed 0,01 g. The time difference between the two weighings should be at least 30 minutes.

The percentage of non-aromatic constituents by weight (A) is given by the following formula:

|

A |

= |

W/W1*100 |

where W1 is the weight of the sample.

The difference from 100 is the percentage of aromatic constituents absorbed by the silica gel.

6. Accuracy of the method

|

Repeatability |

: |

5 %. |

|

Reproducibility |

: |

10 %. |

7. Procedure 2 (chromatography column 2)

Preparation of the sample solution: dissolve approximately 0,9 g (exactly weighed) of the sample in 2,5 ml of n-pentane (I). If the sample is insoluble in n-pentane, dissolve it in cyclohexane and the determination is performed using cyclohexane (II) instead of n-pentane (I).

Pack the chromatography column (chromatography column 2) with the previously activated silica gel, up to about 2,5 cm from the upper glass bulb, by carefully tamping the contents of the column with a vibrator so as not to leave any channels. Then insert a plug of glass wool in the top of the silica gel column.

Pre-moisten the silica gel with 45 ml of solvent (I) or (II), and apply a pressure of air or nitrogen from above until the upper surface of the liquid reaches the top of the silica gel.

Carefully release the pressure inside the column and pour over it approximately 0,9 g (exactly weighed expression with 2 decimals) of sample dissolved in 2,5 ml of solvent (I) or (II), then rinse out the beaker with another 2,5 ml of solvent (I) or (II), and pour this also over the column.

Apply the pressure progressively while allowing the liquid to flow in drops from the bottom capillary tube of the column at the approximate rate of 1 ml/min and collect this liquid in a 250 ml flask.

When the level of the liquid containing the substance to be separated falls to the surface of the silica gel, carefully remove the pressure once more and add 57,5 ml of solvent (I) or (II), re-apply the pressure immediately and bring down the level of the liquid to the surface of the silica gel while collecting the eluate in the same flask as before.

Before the level of the liquid containing the substance to be separated falls to the surface of the silica gel, check the eluate using FT-IR for the presence of aromatics. If the eluate contains only aliphatic hydrocarbons, add again 12,5 ml of solvent (I) or (II) after removing the pressure. Repeat this step if necessary.

Reduce the collected fraction to a small volume by evaporation in a vacuum oven at 35 °C or in a vacuum rotary evaporator or similar apparatus and then transfer it without loss into a tared beaker, using more solvent (I) or (II).

Evaporate the contents of the beaker in a vacuum oven at 35 °C to constant weight (W). The difference between the two last weights should not exceed 0,01 g. The time difference between the two weighings should be at least 30 minutes.

The percentage of non-aromatic constituents by weight (A) is given by the following formula:

|

A |

= |

W/W1*100 |

where W1 is the weight of the sample.

The difference from 100 is the percentage of aromatic constituents absorbed by the silica gel.

8. Accuracy of the method

|

Repeatability |

: |

5 %. |

|

Reproducibility |

: |

10 %. |

Chromatography column 1

Chromatography column 2

’

’

(1) Council Regulation (EEC) No 2658/87 of 23 July 1987 on the tariff and statistical nomenclature and on the Common Customs Tariff (OJ L 256, 7.9.1987, p. 1).

|

29.9.2016 |

EN |

Official Journal of the European Union |

C 357/9 |

COMMISSION IMPLEMENTING DECISION

of 28 September 2016

on the establishment of a work programme for the assessment of applications for the renewal of approvals of active substances expiring in 2019, 2020 and 2021 in accordance with Regulation (EC) No 1107/2009 of the European Parliament and of the Council

(2016/C 357/05)

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Regulation (EC) No 1107/2009 of the European Parliament and of the Council of 21 October 2009 concerning the placing of plant protection products on the market and repealing Council Directives 79/117/EEC and 91/414/EEC (1), and in particular Article 18 thereof,

Whereas:

|

(1) |

A large number of active substances deemed to have been approved in accordance with Regulation (EC) No 1107/2009 and listed in Part A of Annex to Regulation (EC) No 540/2011 (2) have an expiry date set between 1 January 2019 and 31 December 2021. Part B of the Annex to Commission Implementing Regulation (EU) No 686/2012 (3) lists those active substances and allocates to the Member States the evaluation of those active substances, naming for each active substance a rapporteur and a co-rapporteur Member State for the purposes of the renewal procedure. |

|

(2) |

In view of the time and resources necessary for completing the assessment of applications for the renewal of approvals for such a large number of active substances by the Member States and by the European Food Safety Authority, it is necessary to establish a work programme grouping together similar active substances setting priorities on the basis of safety concerns for human and animal health or the environment as provided for in Article 18 of Regulation (EC) No 1107/2009. |

|

(3) |

As reflected in recital 17 of Regulation (EC) No 1107/2009, low-risk substances should be identified and the placing on the market of plant protection products containing those substances should be facilitated. Moreover, in line with the objectives of Directive 2009/128/EC of the European Parliament and of the Council (4) the use of plant protection products having the least negative effects on human and animal health and on the environment should be promoted. The programme should therefore group together low-risk active substances in order to prioritise their assessment in view of a timely renewal of their approval. |

|

(4) |

In addition, the substances, for which, given their properties, it is expected that they may fail to satisfy the approval criteria set out listed in points 3.6.2 to 3.6.5 and point 3.7 of Annex II to Regulation (EC) No 1107/2009, should also be identified. The programme should group together those substances in order to prioritise their assessment |

|

(5) |

Given the available resources of the authorities conducting the assessment of applications for the renewal of approvals, it cannot be excluded that as a result of the prioritisation of the assessment of substances provided for by this Decision the approval of some other active substances may expire before a decision has been taken on the renewal of the approval of such substances. In such cases, the approval period of such active substances should be extended in due time in accordance with Article 17 of Regulation (EC) No 1107/2009. |

|

(6) |

In addition to providing for the grouping together of similar active substances based on priorities for their assessment, Article 18 of Regulation (EC) No 1107/2009 also provides that the work programme is to include specific elements. Commission Implementing Regulations (EU) No 844/2012 (5) and (EU) No 686/2012 are, respectively, implementing points (a) to (e) and point (f) of the second paragraph of Article 18 of Regulation (EC) No 1107/2009, |

HAS DECIDED AS FOLLOWS:

Sole Article

The work programme as set out in the Annex to this Decision is hereby adopted.

Done at Brussels, 28 September 2016.

For the Commission

Vytenis ANDRIUKAITIS

Member of the Commission

(1) OJ L 309, 24.11.2009, p. 1.

(2) OJ L 153, 11.6.2011, p. 1.

(3) Commission Implementing Regulation (EU) No 686/2012 of 26 July 2012 allocating to Member States, for the purposes of the renewal procedure, the evaluation of the active substances (OJ L 200, 27.7.2012, p. 5).

(4) Directive 2009/128/EC of the European Parliament and of the Council of 21 October 2009 establishing a framework for Community action to achieve the sustainable use of pesticides (OJ L 309, 24.11.2009, p. 71).

(5) Commission Implementing Regulation (EU) No 844/2012 of 18 September 2012 setting out the provisions necessary for the implementation of the renewal procedure for active substances, as provided for in Regulation (EC) No 1107/2009 of the European Parliament and of the Council concerning the placing of plant protection products on the market (OJ L 252, 19.9.2012, p. 26).

ANNEX

|

1. |

The work programme concerns active substances deemed to have been approved in accordance with Regulation (EC) No 1107/2009 which are listed in Part B of the Annex to Implementing Regulation (EU) No 686/2012. |

|

2. |

The priorities for the assessment of applications for the renewal of approvals of the active substances and grouping together similar active substances, as provided for in Article 18 of Regulation (EC) No 1107/2009, are as follows:

|

|

29.9.2016 |

EN |

Official Journal of the European Union |

C 357/12 |

Opinion of the Advisory Committee on Restrictive Agreements and dominant position given at its meeting of 27 April 2016 regarding a draft decision relating to Case M.7612 Hutchison 3G UK/Telefónica UK

Rapporteur: Sweden

(2016/C 357/06)

|

1. |

The Advisory Committee agrees with the Commission that the notified transaction constitutes a concentration within the meaning of Article 3(1)(b) of the Council Regulation (EC) No 139/2004 of 20 January 2004 on the control of concentrations between undertakings (1). |

|

2. |

The Advisory Committee agrees with the Commission that the notified transaction has an EU dimension pursuant to Article 1(2) of the Merger Regulation. |

Market definition

|

3. |

The Advisory Committee agrees with the Commission’s definitions of the relevant product and geographic markets in the draft Decision. |

|

4. |

In particular, the Advisory Committee agrees that the following markets should be distinguished:

|

Competitive assessment

|

5. |

The Advisory Committee agrees with the Commission’s assessment that the notified transaction is likely to give rise to non-coordinated horizontal effects that would significantly impede effective competition on the retail market for mobile telecommunications services in the United Kingdom mainly due to the removal of the important competitive constraints that O2 and Three exerted upon each other, together with a reduction of the competitive pressure on the remaining competitors. |

|

6. |

The Advisory Committee agrees with the Commission’s assessment that the notified transaction is likely to give rise to non-coordinated horizontal effects that would significantly impede effective competition on the retail market for mobile telecommunications services in the United Kingdom due to the reduced competitive pressure exercised by one or both of BT/EE and Vodafone and the overall reduced level of industry-wide network investments resulting from the merged entity’s network consolidation plans. |

|

7. |

The Advisory Committee agrees with the Commission’s assessment that the notified transaction is likely to give rise to non-coordinated horizontal effects that would significantly impede effective competition in the wholesale market for mobile network access and call origination services on public mobile networks in the United Kingdom mainly due to the removal of the important competitive constraints that O2 and Three exerted upon each other, together with a reduction of the competitive pressure on the remaining competitors. |

Remedy

|

8. |

The Advisory Committee agrees with the Commission that the commitments offered by the Notifying Party on 6 April 2016 pursuant to Article 8(2) of the Merger Regulation do not address the competition concerns identified by the Commission on the retail market for mobile telecommunications services in the United Kingdom. |

|

9. |

The Advisory Committee agrees with the Commission that the commitments offered by the Notifying Party on 6 April 2016 pursuant to Article 8(2) of the Merger Regulation do not address the competition concerns identified by the Commission on the wholesale market for access and call origination services on public mobile networks in the United Kingdom. |

|

10. |

The Advisory Committee agrees with the Commission’s conclusion that the notified transaction is likely to significantly impede effective competition in the internal market or in a substantial part of it. |

|

11. |

The Advisory Committee agrees with the Commission that the notified transaction must therefore be declared incompatible with the internal market in accordance with Articles 2(2) and 8(3) of the Merger Regulation. |

(1) OJ L 24, 29.1.2004, p. 1 (‘the Merger Regulation’)

|

29.9.2016 |

EN |

Official Journal of the European Union |

C 357/13 |

Final Report of the Hearing Officer (1)

Hutchison 3G UK/Telefónica UK

(Case M.7612)

(2016/C 357/07)

I. INTRODUCTION

|

1. |

On 11 September 2015, the European Commission (the ‘Commission’) received a notification of a proposed concentration pursuant to Article 4 of the Merger Regulation (2) by which CK Hutchison Holdings Limited (‘CKHH’), through its indirect subsidiary Hutchison 3G UK Investments Limited (the ‘Notifying Party’ or ‘Three’) (3) acquires within the meaning of Article 3(1)(b) of the Merger Regulation, sole control over Telefónica Europe Plc (‘O2’) (the ‘Transaction’). The Notifying Party and O2 will be referred to collectively as the ‘Parties’. |

II. PROCEDURE

|

2. |

The Commission’s first phase investigation raised serious doubts as to the compatibility of the Transaction with the internal market and the EEA Agreement. On 30 October 2015, the Commission initiated proceedings pursuant to Article 6(1)(c) of the Merger Regulation. The Notifying Party submitted written comments on 22 November 2015. |

Statement of Objections

|

3. |

On 4 February 2016, the Commission adopted a Statement of Objections (‘SO’) in which it took the preliminary view that the Transaction would, through non-coordinated and coordinated effects in the market for retail mobile telecommunications services in the United Kingdom, as well as through non-coordinated effects on the wholesale market for access and call origination on public mobile networks in the United Kingdom, significantly impede effective competition in a substantial part of the internal market within the meaning of Article 2 of the Merger Regulation. |

|

4. |

The Commission set a time limit of 25 February 2016 to reply to the SO. The Notifying Party replied to the SO on behalf of the Parties on 26 February 2016. In its reply, the Notifying Party requested a formal oral hearing. |

Access to the file

|

5. |

The Notifying Party received access to the file via CD-ROM on 4 February 2016. Additional access to the file was granted on 18 February, 29 February, 11 March, 23 March, 7 April, 15 April, 25 and 26 April 2016. |

Interested third persons and competent authorities of the Member States

Interested third persons

|

6. |

Upon their requests, I allowed Sky UK Limited (‘Sky’), Liberty Global Europe Ltd (‘Liberty Global’), Iliad S.A. (‘Iliad’), Vodafone Group Plc (‘Vodafone’), Talk Talk Telecom Group PLC (‘TalkTalk’), Tesco plc (‘Tesco’), BT Group plc (‘BT’), EE Limited (‘EE’, now ‘BT/EE’ (4)), Dixons Carphone plc (‘Dixons Carphone’), UK Broadband Networks Limited (‘UKBN’), Gamma Communications plc (‘Gamma’) and Wireless Infrastructure Group Limited (‘WIG’) to be heard as interested third persons in the current proceedings. |

|

7. |

All these interested third persons received a non-confidential version of the summary of the SO and were given the opportunity to make known their views. Except for WIG, all interested third persons requested to participate in the formal oral hearing requested by the Notifying Party. I acceded to the requests from each interested third person. |

|

8. |

A number of interested third persons have complained about the extensive redaction of the non-confidential version of the summary of the SO and their subsequent inability to comment fully on it and thus to properly exercise their rights in these proceedings. Vodafone and BT/EE have referred primarily to the SO sections concerning their respective network sharing agreements with the Parties. After the formal oral hearing, the Commission made available new, less redacted, versions of the SO and granted the interested third persons the opportunity to supplement their views. In the case of Vodafone and BT/EE, redactions of the SO sections concerning their respective network sharing agreements were significantly reduced. |

|

9. |

Upon its request, I admitted Arqiva Limited to the proceedings as an additional interested third person after the formal oral hearing. |

Competent authorities of the Member States

|

10. |

The national competition authorities of each Member State were invited to the oral hearing. Upon request, on the basis of Article 15(3) of the Merger Implementing Regulation, I also invited the UK Communications Regulator (‘Ofcom’) to the formal oral hearing as another competent authority of a Member State. |

Formal oral hearing

|

11. |

The formal oral hearing was held on 7 March 2016 and was attended by the Parties, as well as their external legal and economic advisers, the interested third persons Sky, Dixons Carphone, BT/EE, Vodafone, Tesco, Liberty Global, TalkTalk, Gamma, Iliad and UKBN, most of whom were assisted by external advisers, relevant Commission services, the competition authorities of 11 Member States (Belgium, Germany, Ireland, Spain, France, Italy, Latvia, the Netherlands, Finland, Sweden and the United Kingdom), and Ofcom (the United Kingdom). |

|

12. |

The Parties requested and were granted closed sessions for parts of their presentations. Among the interested third persons, Sky and Dixons Carphone requested and were granted closed sessions for their respective presentations, but only with respect to the other interested third persons. |

Letters of Facts

|

13. |

On 17 March 2016 and on 23 March 2016 the Commission addressed to the Notifying Party letters of facts where it pointed out additional evidence in the Commission’s file in support of the preliminary findings of the SO. The Notifying Party submitted written comments to the letter of facts of 17 March 2016 on 29 March 2016 and to the letter of facts of 23 March 2016 on 4 April 2016. |

Commitments

|

14. |

The Notifying Party submitted a first set of commitments on 2 March 2016. On 15 March 2016, the Notifying Party submitted a second set of commitments, which were market tested starting 18 March 2016. The Notifying Party submitted a final set of commitments on 6 April 2016. |

The draft decision

|

15. |

After having heard the Parties and in derogation of the SO, the Commission no longer takes the view in the draft decision that the Transaction would give rise to coordinated effects in the market for retail mobile telecommunications services in the United Kingdom. In the draft decision, the Commission confirms the view that the Transaction would significantly impede effective competition in a substantial part of the internal market within the meaning of Article 2(3) of the Merger Regulation, through non-coordinated effects in the market for retail mobile telecommunications services in the United Kingdom, as well as through non-coordinated effects on the wholesale market for access and call origination on public mobile networks in the United Kingdom. Pursuant to Article 8(3) of the Merger Regulation, the draft decision therefore declares the Transaction incompatible with the internal market. |

|

16. |

I have reviewed the draft decision pursuant to Article 16(1) of Decision 2011/695/EU and I conclude that it deals only with objections in respect of which the Parties have been afforded the opportunity of making known their views. |

III. CONCLUSION

|

17. |

Overall, I consider that the effective exercise of the procedural rights has been respected in this case. |

Brussels, 29 April 2016.

Joos STRAGIER

(1) Pursuant to Articles 16 and 17 of Decision 2011/695/EU of the President of the European Commission of 13 October 2011 on the function and terms of reference of the hearing officer in certain competition proceedings (OJ L 275, 20.10.2011, p. 29) (‘Decision 2011/695/EU’).

(2) Council Regulation (EC) No 139/2004 of 20 January 2004 on the control of concentrations between undertakings (the EC Merger Regulation) (OJ L 24, 29.1.2004, p. 1) (the ‘Merger Regulation’).

(3) On 9 March 2016, Hutchison 3G UK Investments Limited has changed the name of its legal entity to CK Telecoms UK Investments Limited, which is therefore the addressee of the decision.

(4) By the time of the oral hearing, BT had completed its acquisition of EE.

|

29.9.2016 |

EN |

Official Journal of the European Union |

C 357/15 |

Summary of Commission Decision

of 11 May 2016

declaring a concentration incompatible with the internal market

(Case M.7612 — Hutchison 3G UK/Telefónica UK)

(notified under document C(2016) 2796)

(Only the English version is authentic)

(2016/C 357/08)

On 11 May 2016 the Commission adopted a Decision in a merger case under Council Regulation (EC) No 139/2004 of 20 January 2004 on the control of concentrations between undertakings (1) , and in particular Article 8(3) of that Regulation. A non-confidential version of the full Decision, as the case may be in the form of a provisional version, can be found in the authentic language of the case on the website of the Directorate-General for Competition, at the following address: http://ec.europa.eu/comm/competition/index_en.html

I. THE PROCEDURE

|

(1) |

On 11 September 2015, the Commission received a notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertaking CK Hutchison Holdings Limited (‘CKHH’), through its indirect subsidiary Hutchison 3G UK Investments Limited (‘H3GI’ or the ‘Notifying Party’ (2)), acquires, within the meaning of Article 3(1)(b) of the Merger Regulation, control of the whole of the undertaking Telefónica Europe Plc (‘O2’), by way of purchase of its shares (the ‘Transaction’) (3). The Notifying Party and O2 are referred to collectively as the ‘Parties’. |

|

(2) |

After the phase I investigation the Commission concluded that the Transaction raises serious doubts as to its compatibility with the internal market and adopted a decision to initiate proceedings pursuant to Article 6(1)(c) of the Merger Regulation on 30 October 2015. Based on the phase II investigation which supplemented the findings of the phase I market investigation, the Commission issued a Statement of Objections on 4 February 2016. The Notifying Party submitted its written comments on the Statement of Objections on 26 February 2016. At the request of the Notifying Party, an oral hearing was held on 7 March 2016. The Notifying Party submitted commitments on 2 March 2016, on 15 March 2016 and on 6 April 2016. On 17 March 2016 and on 23 March 2016 the Commission addressed to the Notifying Parties letters where it pointed out additional evidence in the Commission's file in support of the preliminary findings of the Statement of Objections. On 29 March 2016 and 4 April 2016 the Notifying Party submitted written comments to the two Letters of Facts of 17 March 2016 and on 4 April 2016, respectively. The Advisory Committee discussed the draft of the Decision on 27 April 2016 and issued a favourable opinion. |

II. THE PARTIES AND THE CONCENTRATION

|

(3) |

H3GI is an indirect wholly owned subsidiary of CKHH. CKHH is a multinational group headquartered in Hong Kong and listed on the Hong Kong Stock Exchange Limited. CKHH has five core businesses: ports and related services, retail, infrastructure, energy, and telecommunications. CKHH's indirect wholly owned subsidiary, Hutchison 3G UK Limited (‘Three’) is a Mobile Network Operator (‘MNO’) in the United Kingdom. Three offers mobile telecommunications services such as voice, SMS, MMS, mobile internet, mobile broadband, roaming and call termination services. |

|

(4) |

O2 is also active in the United Kingdom and offers mobile telecommunications services such as voice, SMS, MMS, mobile internet, mobile broadband, roaming and call termination services. O2 belongs to Telefónica S.A. (‘Telefónica’), a holding company of a group of companies that operate fixed and mobile communication networks. |

|

(5) |

On 24 March 2015, H3GI, Hutchison 3G UK Holdings (CI) Limited (a parent company under the sole control of CKHH), and Telefónica SA entered into a Sale and Purchase Agreement under which H3GI acquires all of O2's shares. During the course of the proceedings the Notifying Party presented two alternative Transaction structures. Regardless of the structure under which the Transaction will be implemented, the Commission considers that the Transaction consists of an acquisition of sole control by H3GI (and ultimately by CKHH, which under both Transaction structures will continue to exercise sole control over Three) over O2 and accordingly constitutes a concentration within the meaning of Article 3(1)(b) Merger Regulation. |

III. EU DIMENSION

|

(6) |

The Transaction has an EU dimension within the meaning of Article 1 of the Merger Regulation. |

IV. REFERRAL

|

(7) |

On 4 December 2015, the Commission adopted a decision rejecting the United Kingdom's Referral Request. The Commission considers that the criteria for a referral provided for in Article 9(2)(a) of the Merger Regulation are fulfilled with regard to the Transaction. However, in exercising its discretion, the Commission does not consider it appropriate to refer the Transaction to the CMA for a number of reasons, including the need for the Commission to ensure a coherent and consistent approach when assessing mergers in the telecom sector in different Member States and its own significant previous expertise in assessing concentrations in the European mobile telecommunications markets. |

V. THE UNITED KINGDOM MOBILE TELECOMMUNICATIONS SECTOR

|

(8) |

The retail mobile telecommunications market in the United Kingdom is well functioning and very competitive at present. The United Kingdom is one of the most advanced countries in the European Union in terms of 4G technology roll-out and 4G services take-up. |

|

(9) |

Convergence of mobile and fixed communications is a trend in telecommunications towards removing differences between fixed and mobile networks. There are two aspects to convergence, one related to changes in technology and the other one to the ability of operators to offer bundles of mobile and fixed services. With respect to the latter, the Commission considers that the adoption of fixed-mobile bundles in the United Kingdom has been very limited and that it is unlikely to significantly increase in the near future. |

|

(10) |

There are four MNOs in the United Kingdom. Other than the Parties, these are EE (4) and Vodafone. All MNOs in the United Kingdom have rolled out their networks with another MNO. The network sharing arrangements in place are CTIL/Beacon between O2 and Vodafone, on the one hand, and MBNL between Three and BT/EE, on the other hand. These agreements have contributed to the competitiveness of the market. |

|

(11) |

The market in the United Kingdom is also characterised by a large number of mobile operators which do not own a network. These are the mobile virtual networks and branded resellers, together referred to as non-MNOs. |

|

(12) |

MNOs and non-MNOs sell mobile contracts to end customers directly through their own retail outlets, online or by telemarketing. They also sell mobile contracts indirectly through independent retailers (such as Dixons), with those retailers selling mobile subscriptions through their own retail stores, online and through telesales. Within independent retailers, a distinction can be drawn between independent specialist retailers, on the one hand, and generalist retailers and specialist electrical retailers, on the other hand. |

VI. RELEVANT MARKETS

|

(13) |

The Commission has raised objections as regards the effects of the Transaction with respect to the provision of retail mobile telecommunications services and wholesale services for access and call origination on public mobile telephone networks. Therefore, relevant product and geographic market for these services are defined as follows: |

a. Retail market for mobile telecommunications services

|

(14) |

The Commission considers that, in line with its decisional practice, mobile telecommunications services constitute a separate market from fixed telecommunications services. Further, the Commission considers that mobile services and over the top services (‘OTT’) are not substitutable as at the very least a mobile data connection is required to access OTT instant messaging and voice services. Given the very limited penetration of multiple-play offers with a mobile component in United Kingdom, for the purposes of the present case it is not necessary to define a separate product market for multiple-play offers including a mobile component. |

|

(15) |

As regards the market for the provision of mobile telecommunications services to end customers, consistent with its previous decisional practice, the Commission concludes that separate markets for the provision of retail mobile telecommunications services should not be identified according to: the type of technology (2G, 3G and 4G); the type of service (voice SMS/MMS and data); the type of contract (pre-paid and post-paid), and the type of end-customer (business and private). Pre-paid and post-paid services, as well as services to business and private customers are assessed as separate segments. |

|

(16) |

Further, in this case, the Commission has investigated the possible distinction between mobile services sold in contracts including the purchase of a handset (‘handset contracts’) and pure mobile subscriptions (‘SIM only contracts’), as well as a possible distinction by distribution channel (direct or indirect). These distinctions appear to be particularly relevant in the United Kingdom. The Commission considers that the definition of separate markets along these lines is not necessary as these distinctions constitute rather different segments within the same market. |

|

(17) |

In line with previous Commission decisions, and with the view of the Notifying Party, the Commission concludes that the relevant geographic market for the assessment of this case is national in scope, and corresponds to the territory of the United Kingdom. |

b. Wholesale market for access and call origination on public mobile networks

|

(18) |

In line with previous cases, the Commission concludes that the relevant product market for the assessment of the present case is the market for wholesale access and all origination on public mobile telephone networks. The Commission concludes that the geographic scope of the market is the territory of the United Kingdom. |

VII. COMPETITIVE ASSESSMENT

a. Retail market for mobile telecommunications services

(i) Horizontal non-coordinated effects arising from the elimination of important competitive constraints

|

(19) |

The Transaction would combine the operations of O2 and Three, respectively the first and the fourth players by subscribers (the second and the fourth by revenues) in the retail market for the provision of mobile telecommunications services in the United Kingdom, creating a market leader by number of subscribers and revenues and significantly increasing the level of market concentration. |

|

(20) |

Three is the latest network operator to have entered the market and has been the driver of competition since its entry, for example by changing the industry trend of restricting data usage and data price increases. Its recent and current market behaviour shows that it is the most aggressive and innovative player. Namely, it offers the most competitive prices in the direct channel, and offered 4G at no extra cost, forcing the industry to abandon strategies to sell 4G at a premium. It also offered such popular propositions as free international roaming and was the first to launch a voice over LTE (‘VoLTE’) service. Despite being a late entrant, Three managed to build out an excellent network as shown by independent surveys, network tests carried out by independent network performance firms, and data by the national regulator Ofcom. In particular its network was rated as the most reliable of the networks in the United Kingdom. |

|

(21) |

Absent the Transaction Three is likely to continue to compete strongly. Based on the available evidence in its file, the Commission considers it unlikely that Three's ability to compete will materially deteriorate in the next two to three years. In particular, as explained in Annex C (a summary of which is attached) it is unlikely to experience [capacity constraints]. Further, Three is financially sound […]. […] external analyses forecast a dynamically expanding business. |

|

(22) |

Therefore, pre-Transaction Three constitutes an important competitive force pursuant to paragraph 37 of the Horizontal Merger Guidelines, or in any event it exerts an important competitive constraint on that market, and that it is likely to continue exerting such a constraint absent the Transaction. |

|

(23) |

O2 has the strongest brand in the market and in the past seven years it has consistently achieved the highest customer satisfaction scores. Its success is due to its customer centric propositions, such as its transparent and flexible Refresh tariff, its popular loyalty programme, its customer friendly technology experts and its excellent customer service. It has also launched popular non-MNOs such as giffgaff and it owns 50 % of Tesco Mobile. Its popularity with customers and its brand image is a strong asset that exerts significant pressure on other competitors. As explained in Annex C (a summary of which is attached), the Commission considers that O2's ability to compete will […]. Further, it also has healthy finances and thus retains the ability to invest and grow. |

|

(24) |

The Commission therefore considers that pre-Transaction O2 exerts an important competitive constraint and that it is likely to continue exerting such a constraint absent the Transaction. |

|

(25) |

The Commission also notes that Three and O2 are the only mobile network operators in the United Kingdom whose market shares have been constantly growing over the last years and that they compete closely between each other and the other MNOs. |

|

(26) |

The Transaction would eliminate the competitive constraints that Three and O2 exercised on each other and on the other MNOs, which would result in significantly weakened competition on the retail market. In particular, based on the overall evidence in its file, it appears likely that the merged entity will compete less aggressively and would raise prices. It will be the largest MNO with little, if any incentive to be price aggressive. The Commission finds it likely that, given EE's and Vodafone's history and current strategy and positioning, they are likely to follow price increases by the merged entity. |

|

(27) |

In addition, as illustrated in Section VII.a.ii of this summary, the Commission also finds that the Transaction is likely to have a negative impact on the ability to compete of the remaining MNOs, which in turn would likely reduce those players' ability to compete on price and other parameters (innovation, network quality). Indeed, the Transaction will disrupt the existing well-functioning network sharing arrangements in the mobile market in the United Kingdom. |

|

(28) |

Given their limited ability to compete, in particular on data, and to innovate due to their dependence on MNOs, the Commission considers that non-MNOs will not be able to counterbalance the loss of competitive pressure resulting from the Transaction. Independent specialist retailers (Dixons), while generally succeed to improve on MNOs' offers, do not have the ability to compensate for the loss of competition among MNOs. |

|

(29) |

The Commission has also undertaken an in-depth quantitative assessment of the likely price effects of the elimination of competition in the retail market. Such quantitative assessment is carried out in detail in Annex A to the Decision (5). Absent the harm resulting from network sharing, the Commission considers that the Parties would have significant incentives to increase prices post-Transaction. […]. |

|

(30) |

The Commission considers that its quantitative analysis supports the conclusions reached by the qualitative market investigation. In the Commission's view, the Transaction is likely to generate a sizeable incentive to increase prices in the mobile market in the United Kingdom. Moreover, the Commission notes that the […] customers of Three and O2 are expected to face price increases that are significantly higher than average. |

(ii) Horizontal non-coordinated effects arising from network sharing

|

(31) |

As mentioned above, the four network operators have entered into two network sharing agreements: Vodafone and O2 in the CTIL/Beacon agreements and Three and BT/EE in the MBNL agreements. Today, the partners of each network sharing arrangements have an incentive to jointly develop the shared elements of their networks with a view to achieving a better network than the other MNOs and in particular than the MNOs in the other network sharing arrangement. |

|

(32) |

Post-Transaction, this healthy competitive dynamic would be lost. The merged entity would be part of both network sharing agreements and each of Vodafone and BT/EE would no longer have a fully committed network sharing partner in, respectively, CTIL/Beacon and MBNL. |

|

(33) |

In more detail, the Commission considers that the implementation of the network consolidation plans as presented to the Commission by the Notifying Party, following the reduction of competing MNOs, would significantly harm the competitive position of either one or both of the Parties' partners in the network sharing arrangements. |

|

(34) |

The Notifying Party submitted in particular two network consolidation plans, the ‘Preferred Plan’ and the ‘Alternative Plan’. |

|

(35) |

The Preferred Plan is likely to result in a significant impediment to BT/EE's ability to compete in the mobile telecommunications markets in the United Kingdom. |

|

(36) |

The Alternative Plan is likely to result in a significant impediment to BT/EE and Vodafone's ability to compete in the mobile telecommunications markets in the United Kingdom. It also harms to a lesser extent the competitive position of BT/EE. |

|

(37) |

Furthermore, the Commission notes that neither of these plans provide for a commitment of the merged entity to implement the network consolidation as presented to the Commission. Taking other possible integration scenarios into account, the Commission concludes that also in all other scenarios reviewed by the Commission the Transaction would harm the competitive position of either one or both of the Parties' partners in the network sharing arrangements. |

|

(38) |

Therefore, the Commission considers that the Transaction is likely to reduce the competitive pressure exerted by either one or both of the other MNOs that are partners of the Parties in the network sharing arrangements. |

|

(39) |

Besides, the network sharing situation resulting from the Transaction under the Alternative Plan is likely to lead to less industry-wide investments into network infrastructure, reducing the level of effective competition which would have prevailed in the absence of the Transaction. |

|

(40) |

The reduced competitive pressure and the less industry-wide investments into network infrastructure are likely to lead to a significant impediment of effective competition in an oligopolistic market featuring a limited number of players and high barriers to entry for this reason too. |

(iii) Countervailing factors

|

(41) |

The Commission considers, on the basis of its market investigation, that there are no countervailing buyer power or entry such as to offset the possible anticompetitive effects of the Transaction. |

(iv) Conclusion

|

(42) |

Since the horizontal non-coordinated effects described above cannot be offset by efficiencies (see Section VII.c of this summary), on the basis of the above, the Commission concludes that the Transaction would lead to a significant impediment of effective competition in the retail market for mobile telecommunications services in the United Kingdom. |

b. Wholesale market for access and call origination on public mobile networks

(i) Horizontal non-coordinated effects arising from the elimination of important competitive constraints

|

(43) |

In addition to the retail market, the Parties are active on the wholesale market for network access and call origination. On this market, MNOs provide hosting services to non-MNOs which in turn offer retail services to subscribers. |

|

(44) |

Currently all four MNOs offer wholesale access to non-MNOs. The largest wholesale host currently is EE, followed closely by O2. Both EE and O2 have market shares which are growing stably. Vodafone is the third largest host and its market share has been declining in the past three years. Three is the smallest wholesale access host. |

|

(45) |

Despite Three's relatively low historical market share, the Commission considers, on the basis of its market investigation, that Three is an important competitive force in the wholesale market. The Commission has conducted an analysis of share of recently contested customers by projected value. According to these, Three's share is [10-20] %. In addition, the Commission has found evidence that Three has significantly improved its position in the wholesale market. Three has been participating in a number of competitive processes including for the largest non-MNOs and has concluded contracts with non-MNOs with growth potential which will allow it to further grow in the future absent the Transaction. Moreover, Three's presence in the wholesale negotiations has a competitive impact even in situations where Three is not successful. The Commission considers, on the basis of its market investigation, that Three provides competitive wholesale rates for new technologies, such as 4G. The Commission considers on the basis of its market investigation, that Three has invested in both its network and its resources to be able to compete more effectively on this market. Finally, the Commission considers, on the basis of the market investigation, that both Three itself and the other market participants (including MNO competitors and non-MNO wholesale customers) consider Three as an important competitor. |

|

(46) |

On this basis, the Commission considers that Three constitutes an important competitive force, in accordance to paragraph 37 of the Horizontal Merger Guidelines. Absent the Transaction, Three would continue to grow in the wholesale market and exercise an important competitive constraint on O2 and the other MNOs. |

|

(47) |

In relation to O2, the Commission considers, on the basis of the market investigation, that O2 exercises an important competitive constraint on Three and the other MNOs pre-Transaction and that this would continue absent the Transaction. |

|

(48) |

Post-Transaction, the Commission considers that the reduction in the number of wholesale hosts would reduce the competitive position of non-MNOs. Also, the merged entity is likely to have lower incentives to host non-MNOs on commercially attractive terms than Three and O2 would have absent the merger. Finally, the reduction in competition on the wholesale market is unlikely to be offset by the remaining competitors on the market, BT/EE and Vodafone. |

(ii) Countervailing factors

|

(49) |

The Commission considers, on the basis of its market investigation, that there is no countervailing buyer power or entry such as to offset the possible anti-competitive effects of the Transaction. |

(iii) Conclusion

|

(50) |

Since the horizontal non-coordinated effects described above cannot be offset by efficiencies (see Section VII.c of this summary), on the basis of the above, the Commission concludes that the Transaction would lead to a significant impediment of effective competition in the wholesale services for access and call origination on public mobile telephone networks in the United Kingdom. |

c. Efficiencies

|

(51) |

According to the Notifying Party the Transaction will lead to significant network and scale efficiencies. The network efficiencies would arise as radio access network (‘RAN’) consolidation would lead to densification of sites, increased use of spectrum (by deploying the combined spectrum on a denser grid), and more efficient use of spectrum (in particular through ‘carrier aggregation’). These technical benefits would bring an increase in network capacity, network quality and speed compared to the sum of Three and O2 absent the Transaction. They would also lower network costs. These effects would benefit consumers as: (i) the merged entity would […]; (ii) reductions in incremental network costs would be passed on to consumers by the merged entity in terms of lower price; and (iii) the merged entity would exert greater competitive pressure on Vodafone and EE which would lead to lower prices by these rivals. Although these network efficiencies under Three's ‘Alternative Plan’ could not start to materialise before […], the Notifying Party submits that they nevertheless should be considered to satisfy the Commission's timeliness criterion as they are not subject to uncertainty. Moreover, the scale economies and fixed cost savings brought by the Transaction would facilitate the merged entity's ability to make future investments, in particular in spectrum. |

|

(52) |

As regards the timeliness of network efficiencies, the Commission considers that there remains significant uncertainty regarding the timing and the extent of network integration and investments and hence whether claimed efficiencies would be achieved. Moreover, the fact that network efficiencies are not claimed to materialise before […] gives rise to significant uncertainty relative to the situation where such efficiency claims would materialise earlier. Therefore, even if the network efficiencies claimed by the Notifying Party satisfied the three criteria of the Horizontal Merger Guidelines (which is not the case, as explained in the following paragraphs), the Commission considers that the weight that can be placed on such efficiency claims is limited. |

|

(53) |

Regarding the technical benefits from the consolidation of the two networks, the Commission notes that it appears plausible that the Transaction would allow to deploy the joint spectrum on a denser network compared to a stand-alone scenario. However, the extent could not be sufficiently verified with the information provided by the Notifying Party. The Parties would also have realistic alternatives to expand capacity on a stand-alone basis. Moreover, the Commission considers that any quality benefits from higher download speeds are likely limited. The Commission therefore concludes that the claimed technical benefits as well as associated cost and quality benefits do not satisfy the criteria of verifiability and merger specificity. |

|

(54) |

The Commission further considers that there is a duality between Notifying Party's arguments whereby (i) the merged entity would […]. In the Commission's view, both lines of reasoning are conceptually different aspect of one and the same effect. |

|

(55) |

[The Commission cannot verify the Notifying Party's arguments on this issue.] |

|

(56) |

Regarding the second argument, the Commission does not exclude that the transaction might to some extent reduce the incremental network costs of the merged entity relative to the Parties' absent the transaction. However, the Commission considers that the Notifying Party's claims of zero or reduced incremental network costs do not pass the tests of merger specificity and verifiability. The Commission rejects the claim that the merged entity would have zero incremental network costs, and it cannot verify the level of incremental network costs for the merged entity proposed by the Notifying Party because of the severe limitations in the modelling used and lack of necessary data provided by the Notifying Party. Moreover even if the claim that the merged entity would have zero incremental costs were verifiable and merger specific, the pass-through of such reductions to consumers would not be sufficient to offset the incentives to increase price and the Transaction would still be likely to lead to significant price increases. |

|

(57) |

The Commission also considers that the efficiencies claimed by the Notifying Party in relation to increased competitive pressure on EE and Vodafone through higher quality do not fulfil the three criteria of verifiability, merger specificity and benefit to consumers, as such efficiencies are largely based on assumptions and on arguments already dismissed by the Commission. |

|

(58) |

Finally, regarding the Notifying Party's claim that the scale economies and fixed cost savings would facilitate the merged entity's ability to make future investments and acquire more spectrum, the Commission considers that the efficiencies through fixed cost savings, even if they were verifiable and merger specific, would not benefit consumers. Furthermore, the Commission considers the alleged increased ability to acquire spectrum due to the Transaction is not verifiable and, in any event, the Notifying Party failed to show how such efficiency would benefit consumers. |

VIII. COMMITMENTS

a. Procedure and timing

|

(59) |

In order to address the competition concerns identified in the Statement of Objections, the Notifying Party submitted three sets of commitments: The Notifying Party submitted the first set on 2 March 2016 (the ‘First Commitments’). On 15 March 2016, the Notifying Party submitted revised commitments (the ‘Second Commitments’). The Commission launched a market test of the Second Commitments on 18 March 2016 (the ‘Market Test’), addressed to (1) current and potential future providers of mobile telecommunications services in the United Kingdom, providers of infrastructure services in the mobile telecommunications sector, as well as the associations MVNO Europe and iMVNOx; and (2) national telecommunications regulators, including Ofcom. In addition, the national competition authorities of the United Kingdom, Germany, and the Netherlands provided their views on the Second Commitments. Following the Market Test, the Notifying Party submitted another revised set of commitments on 6 April 2016 (the ‘Third Commitments’). |

b. Description of the Second Commitments

|

(60) |

The Second Commitments comprised the following components: (1) the New Entrant Operator (‘NEO’) Commitment; the (2) Tesco Mobile Commitment; (3) the Network Sharing Commitment; and (4) the Wholesale Market Commitment. |

(i) Tesco Mobile Commitment

|

(61) |

Under the Tesco Mobile Commitment Three commits, first, to divest its 50 % stake in Tesco Mobile. |

|

(62) |

Second, Three commits to offer a capacity based wholesale agreement to Tesco Mobile for a period of […] years. Three would make available up to […] % of capacity of the Network in return for a fixed annual fee to be agreed by Three and Tesco Mobile. Three would make the capacity available provided that Tesco Mobile has its own core network. Until Tesco does not have its own core network, Three commits to continue the wholesale access arrangements currently in place between O2 UK and Tesco Mobile. |

(ii) NEO Commitment

|

(63) |

Under the NEO Commitment Three commits, first, to divest a perpetual fractional network ownership interest, amounting to up to […] % of the capacity (‘Capacity Share’) in the Network to one or two NEOs. The minimum amount of capacity to be used by the NEO(s) varies over time. A NEO is prevented from reselling the capacity. |

|

(64) |

The NEO(s) will pay an agreed fixed price to Three in consideration for the network ownership interest entitling it/them to the use of the Capacity Share. In addition, the NEO(s) will pay, on an annual basis, a share corresponding to the percentage of their ownership interest of the running operating expenses, as well as ongoing capital maintenance and improvement costs incurred by Three for the Network plus a return on capital. |

|

(65) |

The NEO(s) will have non-discriminatory access to all elements of the Network and to all current and future radio technologies, features and services deployed in the Network. The NEO(s) will have to provide own core network(s). |

|

(66) |

The NEO(s) will be updated and consulted on Three's technology and network roadmap plans. Three will retain sole control over all decisions concerning the operation of the Network and investments in the Network. Three will discuss in good faith requests by the NEO(s) for network investments that are not part of the network roadmap. If no agreement can be reached on such investments, they will be implemented either entirely at the expense of the NEO(s) (if the investment can be technically separated on the Network for the NEO's own use) or with a capped financial contribution by Three (in return for a full right by Three to use such investment). |

|

(67) |

The ownership interest is non-transferrable for a period of […] years. After this period, it can be transferred, subject to a right of first refusal by Three. |

|

(68) |

The NEO can request that the ownership interest be provided to the NEO using air interface prioritisation such as 4G MOCN or equivalent functionality. |

|

(69) |

Second, Three commits to offer an option for the NEO(s) to exclusively use the capacity provided over a total of […] MHz spectrum in different spectrum bands currently owned by O2 UK (‘Target Spectrum Use Option’). The Target Spectrum Use Option would be available as of year […] following the acquisition of the network ownership interest and be subject to a number of conditions. |

|

(70) |

Third, Three commits to offer an option for the NEO(s) to acquire O2 UK (‘O2 UK Divestment Option’). The O2 UK Divestment Option can be exercised by the NEO(s) within […] following the divestment of the network ownership interest and is subject to a number of conditions. If the NEO(s) were to prefer to acquire a stake in Three instead, Three commits to discuss this request in good faith. |

|

(71) |

Finally, Three can decide whether to provide the network ownership interest to one or two NEOs. In case of two NEOs, the capacity share of one NEO would be at least […] %. The Target Spectrum Use Option and the O2 UK Divestment Option will have to be exercised by the NEO with the […] % ownership interest. Three can also decide to provide an ownership interest of only […] % provided that the capacity share made available to Tesco Mobile also amounts to […] % instead of […] %. |

(iii) The Network Sharing Commitment

|

(72) |

The fourth component is the Network Sharing Commitment by which Three commits, among others, to: (1) offer to EE a number of amendments to the MBNL agreements, including a fest-track dispute resolution, aimed at facilitating unilateral network investments, to agree on a new business plan with EE on the basis of the current business plan, and to waive rights for a casting vote following the change of control in EE on certain decisions; (2) complete the Beacon network within a given deadline, offer to Vodafone to re-enter into the active sharing agreements except for […] in case they are terminated by the merged entity, and to offer to Vodafone the partitioning of the transmission of 4G traffic according to certain rules; (3) to implement a certain network structure (a variation of the so-called ‘Preferred Plan’, whereby the merged entity would commit to the Beacon grid and use around […] additional MBNL sites), and (4) to enhance information barriers in relation to MBNL and Beacon. The business plan for MBNL and the active sharing agreement under Beacon would cover a time period up to […]. |

(iv) The Wholesale Market Commitment

|

(73) |

Under the Wholesale Market Commitment, with respect to MVNOs that already have an MVNO agreement with either Three or O2 UK, and such agreements do not yet include access to 4G services, Three commits to offer to include 4G services on the same rates as charged for 3G services (i.e., at no extra cost). |

|

(74) |

With respect to MVNOs which do not have an MVNO agreement with either Three or O2 UK, Three commits to offer wholesale access (including 4G) to such new MVNOs. The terms and conditions will be benchmarked against the average of those offered by Three and O2 UK as at the date of closing taking into account the size and type of the MVNO, type of products and services, volumes, prices, commercial/operational model and other relevant commercial terms. This Commitment shall continue for 10 years after closing or such earlier date on which H3GI ceases to offer such technology to its own end customers. |

c. Assessment of the Second Commitments

|

(75) |

Despite some interest in the NEO Commitment and the Tesco Mobile Commitment, the Market Test was negative on all elements of the Second Commitments. Based on the results of the Market Test, the Commission considered that the Second Commitments did not address the competition concerns identified. |

|

(76) |

As regards the Tesco Mobile Commitment, the Commission considered that it was uncertain if the divestment of O2's 50 % stake in Tesco Mobile would ever materialise. The capacity based wholesale agreement was not firmly committed but merely an offer and the Commission considered that it was uncertain whether Tesco Mobile would ultimately obtain wholesale access under that capacity based wholesale agreement. Even if that would have been the case, the Commission considered that the terms of the agreement as set out in the Second Commitments were unclear on a number of elements. Moreover, the […] % capacity offered on the O2 network were considered to be insufficient to allow Tesco Mobile to compete in the short, medium and long-term. Finally, the Commission did not agree with the Notifying Party's argument that the Tesco Mobile Commitment (even if taken together with the NEO Commitment), would reduce the predicted price increases (or eliminate them altogether. |

|

(77) |

Similarly, the Commission considered that the NEO Commitment was insufficient (even if taken together with the Tesco Mobile Commitment) to address the competition concerns identified on the retail market. In particular, a NEO would have been commercially and technically dependent on its host MNO. It would have had a cost structure that would not have allowed it to exercise a competitive constraint on other market participants, and in particular on MNOs and it would only have been able to differentiate its offerings, including in terms of quality, to a very limited extent. Also the growth potential of a NEO was questionable. Moreover, a number of elements of the NEO Commitment, including key commercial terms such as the annual costs to be borne by the NEO were not sufficiently clear. Finally, in addition to the Target Spectrum Use Option and the O2 UK Divestment Option, a number of other elements offered to the NEO(s) were equally optional and in light of the uncertainty of their implementation they could not be taken into account when assessing the adequacy of the Second Commitments. |

|

(78) |

The Network Sharing Commitment added to the numerous inconsistencies and uncertainties regarding network sharing instead of removing uncertainties. The Network Sharing Commitment was internally inconsistent with the Notifying Party's stated plans as it committed to implement a nationwide network grid based primarily on the Beacon network while at the same time it offered to divest the Beacon network […] after the merger. Furthermore, the Network Sharing Commitment did not address the uncertainty in relation to the post-merger network sharing situation as there was no guarantee (it was even unlikely) that either EE or Vodafone would accept the Notifying Party's offers it committed to make under that Commitment. |

|

(79) |

The proposed amendments of the MBNL agreements were insufficient to prevent harm to the competitive position of BT/EE following the merger. Half of the six proposed clarification or amendments merely reiterated existing contractual obligations. The removal of the casting vote of the managing director and the addition of a fast track dispute resolution mechanism are unable to address the competitive concerns. The statement that neither party of MBNL shall have the ability to delay or frustrate unilateral deployments of the other party by any means is too unsubstantiated and uncertain in its implementation. The fast-track dispute resolution mechanism will not help in maintaining the current ability of BT/EE to make unilateral investments. The vague description of the business plan offered by Three that mostly repeats existing obligations of Three is also insufficient to address the concerns raised by the transaction. |

|

(80) |