ISSN 1977-091X

Official Journal

of the European Union

C 377

English edition

Information and Notices

Volume 58

13 November 2015

|

ISSN 1977-091X |

||

|

Official Journal of the European Union |

C 377 |

|

|

||

|

English edition |

Information and Notices |

Volume 58 |

|

Notice No |

Contents |

page |

|

|

IV Notices |

|

|

|

NOTICES FROM EUROPEAN UNION INSTITUTIONS, BODIES, OFFICES AND AGENCIES |

|

|

2015/C 377/01 |

||

|

2015/C 377/02 |

|

EN |

|

IV Notices

NOTICES FROM EUROPEAN UNION INSTITUTIONS, BODIES, OFFICES AND AGENCIES

|

13.11.2015 |

EN |

Official Journal of the European Union |

C 377/1 |

COMMUNICATION FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT, THE COUNCIL AND THE COURT OF AUDITORS

Consolidated annual accounts of the European Union 2014

(2015/C 377/01)

CONTENTS

| FINANCIAL STATEMENT DISCUSSION AND ANALYSIS | 2 |

| NOTE ACCOMPANYING THE CONSOLIDATED ACCOUNTS | 22 |

| CONSOLIDATED FINANCIAL STATEMENTS AND EXPLANATORY NOTES | 23 |

| BALANCE SHEET | 24 |

| STATEMENT OF FINANCIAL PERFORMANCE | 25 |

| CASH FLOW STATEMENT | 26 |

| STATEMENT OF CHANGES IN NET ASSETS | 27 |

| NOTES TO THE FINANCIAL STATEMENTS | 28 |

| AGGREGATED REPORTS ON THE IMPLEMENTATION OF THE BUDGET AND EXPLANATORY NOTES | 99 |

FINANCIAL STATEMENT DISCUSSION AND ANALYSIS

1. EU: INSTITUTIONAL GOVERNANCE AND OPERATIONS

The European Union (EU) is an economic and political partnership of 28 European Member States. It was established in 1993 by the Maastricht Treaty and succeeded the European Community, the European Coal and Steel Community (ECSC) and Euratom. The latest major amendment to the constitutional basis of the EU, the Treaty of Lisbon, entered into force on 1 December 2009.

The EU is based on the rule of law. This means that every action taken by the EU is founded on treaties that have been approved voluntarily and democratically by all EU Member States. It has a unique institutional set-up:

|

— |

European citizens elect directly the Members of the European Parliament (EP), |

|

— |

the EU’s broad priorities are set by the European Council, which brings together national and EU-level leaders, |

|

— |

Governments defend their country’s national interests in the Council of the European Union (the ‘Council’), |

|

— |

the interests of the EU as a whole are promoted by the European Commission (the ‘Commission’), whose President is elected by the EP and whose members are suggested for appointment by national governments by common accord with the President-elect and are subject, as a body, to a vote of consent by the EP. |

The EU has its own legal order which is separate from international law and forms an integral part of the legal systems of the Member States. The legal order of the EU is based on its own sources of law. Given the varied nature of these sources, a hierarchy had to be established among them. Primary legislation is at the top of the hierarchy and is represented by the Treaties. This is followed by international agreements concluded by the EU, general legal principles and secondary legislation, which is based on the Treaties.

Sources and hierarchy of EU law:

|

— |

Treaty on European Union (TEU); Treaty on the Functioning of the European Union (TFEU); Charter of Fundamental Rights of the European Union; other Treaties and Protocols, |

|

— |

international agreements, |

|

— |

general principles of Union law, |

|

— |

secondary legislation. |

The institutional governance of the EU consists of institutions, agencies and other EU bodies which are listed in note 10 of the notes to the financial statements. The main institutions in the sense of being responsible for drafting policies and taking decisions are the EP, the European Council, the Council and the Commission.

European Parliament

The EP is an important forum for political debate and decision-making at the EU level. The Members of the EP are directly elected by voters in all Member States to represent citizen’s interests with regard to EU lawmaking and to make sure other EU institutions are working democratically.

Over the years and with subsequent changes in European treaties, the EP has acquired substantial legislative and budgetary powers that allow it to set, together with the representatives of the governments of the Member States in the Council, the direction in which the European project is heading. In doing so, the EP has sought to promote democracy and human rights — not only in Europe, but also throughout the world.

The EP is on an equal footing with the Council in the annual budgetary procedure. It is involved in the budgetary process from the preparation stage, notably in laying down the general guidelines and the type of spending, right up to the adoption. It establishes the budget with the Council and monitors its implementation. The EP gives a discharge on the implementation of the EU budget on a recommendation from the Council. Finally, the EP has to provide its consent to the Multiannual Financial Framework (MFF) which ensures that EU expenditure develops in an orderly manner and within the limit of its own resources. The current President of the EP is Martin Schulz.

The European Council and the Council of the European Union

The European Council, formed by the Heads of State or Government of the Member States together with its President and the President of the Commission, provides the necessary impetus for the development of the EU and defines the general political directions and priorities. The current President of the European Council is Donald Tusk.

Jointly with the EP, the Council adopts EU legislation through regulations and directives and also makes decisions and non-binding recommendations. The Council consists of a representative of each Member State, at ministerial level, authorised to commit the government of that Member State by casting its vote. With the exception of the Foreign Affairs configuration, the Council is chaired by the representative of the Member State that holds the Union’s presidency on the basis of equal rotation every six months. A committee consisting of the permanent representatives of the Governments of the Member States (Coreper) prepares the Council’s work.

In its areas of competence, the Council takes its decisions by a qualified majority, except where the Treaties provide otherwise (e.g. unanimity or simple majority). The Council is one of the two branches (the other being the EP) of the budgetary authority which adopts the EU’s budget. The Council also adopts the decisions, pursuant to a special legislative procedure and acting unanimously, laying down the provisions applying to the own resources system and the MFF. In the latter case, the EP must give its consent by a majority of its Members. The latest MFF (2014-2020) was adopted by the Council in November 2013.

European Commission

The Commission is the EU’s executive body. It represents the interests of the EU as a whole (not the interests of individual countries).

The Commission’s main roles are to:

|

— |

propose legislation which is then adopted by the co-legislators, the EP and the Council, |

|

— |

enforce European law (where necessary with the help of the Court of Justice of the EU), |

|

— |

set objectives and priorities for action, outlined yearly in the Commission Work Programme and work towards delivering them, |

|

— |

manage and implement EU policies and the budget, |

|

— |

represent the Union outside Europe (negotiating trade agreements between the EU and other countries, for example). |

A new team of 28 Commissioners (one from each EU Member State) is appointed every five years. The candidate for President of the Commission is proposed to the EP by the European Council that decides by qualified majority and taking into account the elections to the EP. The Commission President is then elected by the EP by a majority of its component members (which corresponds to at least 376 out of 751 votes). Following this election, the President-elect selects the 27 other members of the Commission, on the basis of the suggestions made by Member States. The final list of Commissioners-designate has then to be agreed between the President-elect and the Council. The Commission as a whole needs the Parliament’s consent. Prior to this, Commissioners-designate are assessed by the various EP committees. The current Commission’s term of office runs until 31 October 2019. Its President is Jean-Claude Juncker.

The current Commission priorities are: (1) jobs, growth and investment; (2) Digital Single Market; (3) Energy Union and climate; (4) internal market; (5) economic and monetary union; (6) EU-US free trade; (7) justice and fundamental rights; (8) migration; (9) EU as a global actor; and (10) democratic change.

The staff of the Commission works in departments, known as Directorates-General (DGs) or services, each responsible for a particular policy area and headed by a Director-General. The DGs draft laws, but their proposals become official only once the College of Commissioners (28 Commissioners’ meeting) adopts them. The DGs also manage funding initiatives at EU level, and carry out public consultations and communication activities.

The Commission also administers a number of executive agencies, which help with the management of EU programmes.

2. INITIATIVES AND STRATEGIES OF THE COMMISSION

The new Commission that came into office in November 2014 has defined its work programme for 2015 and the new initiatives for the Commission until 2019. The work programme sets out the Commission’s plans and identifies actions which will make a positive difference for jobs, growth and investment in 2015. This programme focuses on a limited set of concrete new initiatives such as:

A new boost for jobs, growth and investment:

|

— |

EUR 315 billion investment offensive: The legislative follow-up to the plan announced at the end of 2014, unlocking public and private investments in the real economy over the next three years, |

|

— |

promoting labour integration and employability, and |

|

— |

reviewing the Europe 2020 strategy. |

Digital Single Market package:

|

— |

creating the conditions for a vibrant digital economy and society by complementing the telecommunications regulatory environment, |

|

— |

modernising copyright rules, |

|

— |

simplifying rules for consumers making online and digital purchases, |

|

— |

enhancing cyber-security, and |

|

— |

mainstreaming digitalisation. |

A resilient energy union with a forward-looking climate change policy:

|

— |

creation of the European Energy Union: To ensure energy supply security, further integrate national energy markets, reduce European energy demand and decarbonise the energy mix, and |

|

— |

multilateral response to climate change. |

A deeper and fairer internal market:

|

— |

an internal market strategy, |

|

— |

a labour mobility package, |

|

— |

capital markets union action plan, |

|

— |

a framework for financial institution resolution, and |

|

— |

an aviation package. |

A trade and investment strategy to boost jobs and growth

An area of justice and fundamental rights:

|

— |

EU accession to the European Convention on Human Rights, and |

|

— |

European agenda on security. |

A new policy on migration:

|

— |

developing a new approach on legal migration to make the EU an attractive destination for talent and skills, and |

|

— |

improving the management of migration into the EU through greater cooperation with third countries, solidarity among our Member States and fighting human trafficking. |

A stronger global actor:

|

— |

European Neighbourhood policy, and |

|

— |

post-2015 sustainable development goals. |

A fair taxation environment:

|

— |

an action plan on efforts to combat tax evasion and tax fraud, including measures at EU level in order to move to a system on the basis of which the country where profits are generated is also the country of taxation; including automatic exchange of information on tax rulings and stabilising corporate tax bases, and |

|

— |

compulsory exchange of information on tax rulings. |

A Union of democratic change:

|

— |

an EU agreement on better lawmaking; |

|

— |

a mandatory transparency register; and |

|

— |

review of the genetically modified organism decision-making process. |

Deeper Economic and Monetary Union: Continued efforts to promote economic stability and attract investors to Europe.

In preparing the work programme, the Commission examined around 450 proposals that were put forward to the EP and the Council, and is proposing to withdraw or amend 80 of them. Some are proposed for withdrawal because they do not match the new Commission’s priorities. In many cases, the Commission remains strongly committed to the objectives sought — but proposals are of no use if they are simply sitting dormant on a negotiating table or if they will be so watered down in negotiations that they can no longer achieve their original purpose. When that is the case, the Commission will propose new, better ways of achieving these objectives.

3. EU BUDGET: FROM PREPARATION TO DISCHARGE

3.1. Budget and funding

The MFF consists of headings with annual limits for commitment appropriations set for each. The sum of the ceilings of all headings gives the total ceiling of commitment appropriations. The EU Budget finances a wide range of policies and programmes throughout the EU. In accordance with the priorities set by the EP and the Council in the MFF, the Commission carries out specific programmes, activities and projects in the field. The direct link between the annual budget and the EU policies is ensured through activity-based budgeting (ABB). The activity-based budget nomenclature allows for clear identification of the policy areas of the EU and the total amount of resources allocated to each of these areas. The budget is prepared by the Commission and usually agreed in mid-December by the EP and the Council in accordance with the procedure of Article 314 TFEU. According to the principle of budget equilibrium, the total revenue must equal total expenditure for a given financial year.

The EU has two main categories of funding: Own resources revenues and sundry revenues. Own resources revenues make up the vast majority of EU funding and accrue automatically to the EU to enable it to finance its budget without the need for a subsequent decision by national authorities. The overall amount of own resources needed to finance the budget is determined by total expenditure less sundry revenue. The total amount of own resources cannot exceed 1,23 % of the gross national income (GNI) of the EU. Own resources can be divided into traditional own resources (such as custom levies), the own resource based on value added tax (VAT) and the resource based on gross national income (GNI). Sundry revenues arising from the activities of the EU (e.g. competition fines) normally represent less than 10 % of total revenue.

As a general principle the EU is not allowed to borrow money on capital markets or from financial institutions to finance its budget.

3.2. How the EU budget is managed and spent

Primary operational expenditure

The EU’s operational expenditure covers the various headings of the MFF and takes different forms, depending on how the money is paid out and managed. From 2014 onwards, the Commission classifies its expenditure as follows:

|

|

Direct management: this is where the budget is implemented directly by the Commission services. |

|

|

Indirect management: this refers to cases where the Commission confers tasks of implementation of the budget to bodies of EU law or national law, such as the EU agencies. |

|

|

Shared management: under this method, budget implementation tasks are delegated to Member States. About 80 % of the expenditure falls under this mode covering such areas as agricultural spending and structural actions. |

The different financial actors within the Commission

The College of Commissioners assumes collective political responsibility but in practice does not exercise itself the budget implementation powers vested in it. It delegates these tasks each year to individual civil servants accountable to the College, subject to the Financial Regulation (FR) and the Staff Regulations (SR). The staff concerned — generally Directors-General and Heads of Service — are known as ‘Authorising Officers by delegation’ or ‘AODs’. They in turn may further delegate budget implementation tasks to ‘Authorising Officers by sub-delegation’.

The responsibility of the Authorising Officers covers the entire management process, from determining what needs to be done to achieve the policy objectives set by the institution to managing the activities launched from both an operational and budgetary standpoint. Each Authorising Officer is required to prepare an Annual Activity Report (AAR) on the activities under her/his responsibility where she/he reports on policy results and on the reasonable assurance she/he may have that the resources assigned to the activities described in her/his report have been used for their intended purpose and in accordance with the principles of sound financial management, and that the control procedures put in place give the necessary guarantees concerning the legality and regularity of the underlying transactions. On the basis of Article 66 FR, the Commission transmits a summary report (synthesis report) on the individual AARs to the EP and the Council, by which the Commission takes overall political responsibility for the management of the EU budget in line with Article 317 TFEU. This report and the AAR are available at: http://ec.europa.eu/atwork/planning-and-preparing/synthesis-report/index_en.htm

The Accounting Officer executes payment and recovery orders drawn up by Authorising Officers and is responsible for managing the treasury, laying down accounting rules and methods, validating accounting systems, keeping the accounts and drawing up the institution’s annual accounts. Furthermore, the Accounting Officer is required to sign the annual accounts declaring that they present fairly, in all material aspects, the financial position, the results of the operations and the cash flows.

Committing to spend the EU budget

Before a legal commitment (for example a contract or grant agreement) can be entered into with a third party, there must be a budget line authorising the activity in question in the annual budget. There must also be sufficient funds on the budget line to cover the expenditure. If these conditions are met, the funds required must be reserved in the budget by means of a budgetary commitment made in the accounting system and only then a legal commitment can be made. No money can be spent from the EU budget unless and until the Authorising Officer has adopted a budgetary commitment.

Once approved, the budgetary commitment is recorded in the budgetary accounting system and the appropriations are consumed accordingly. This, however, has no effect on the financial statements (or general ledger) since no expense has yet been incurred.

Making a payment

The Commission is a participant in SWIFT (Society for Worldwide Interbank Financial Telecommunication) and makes more than 2 million payments a year. No payment can be made unless a budgetary commitment has already been approved by the Authorising Officer dealing with the operation in question.

Prefinancing is a payment intended to provide the beneficiary with a cash advance, i.e. a float. It may be split into a number of payments over a period defined in the particular legal commitment. If the beneficiary does not incur eligible expenditure he has the obligation to return the prefinancing advance to the EU. Thus prefinancing paid is not a definitive expense until the relevant conditions are met and so is recorded as an asset on the EU balance sheet when the initial payment is made.

Cost claims will be received by the relevant EU body so as to justify how the prefinancing amount was spent by the beneficiary in accordance with the legal commitment. The rhythm of receipt of these cost claims is variable depending on the type of action being funded and the conditions.

Eligibility criteria are defined in the basic act, in the calls for proposal, in other documents for grant beneficiaries and/or in the contractual clauses of the grant agreements or in the grant decision. After analysis, the eligible amounts are taken into expenses and the beneficiary is informed about any non-eligible amounts.

The FR and other applicable legislation, particularly concerning agriculture and cohesion policies, give the right to make checks on expenditure up to many years after it was incurred. Where errors, irregularities or fraud are detected, financial corrections or recoveries are applied (see note 6 of the notes to the financial statements).

3.3. Financial reporting and accountability

The consolidated annual accounts of the EU provide financial information on the activities of the institutions, agencies and other bodies of the EU from a budgetary and accrual accounting perspective. These accounts do not comprise the annual accounts of Member States.

The annual accounts of the EU consist of two separate but linked parts:

|

(a) |

the financial statements; and |

|

(b) |

the reports on implementation of the budget, which provide a detailed record of budget implementation. |

It is the responsibility of the Commission’s Accounting Officer to prepare the EU’s financial statements and ensure that they present fairly, in all material aspects, the financial position, the result of the operations and the cash flows of the EU.

In addition to the above annual accounts, ad hoc reports on specific areas such as the report on budgetary and financial management, on financial instruments, on guarantees given and on financial corrections are also prepared.

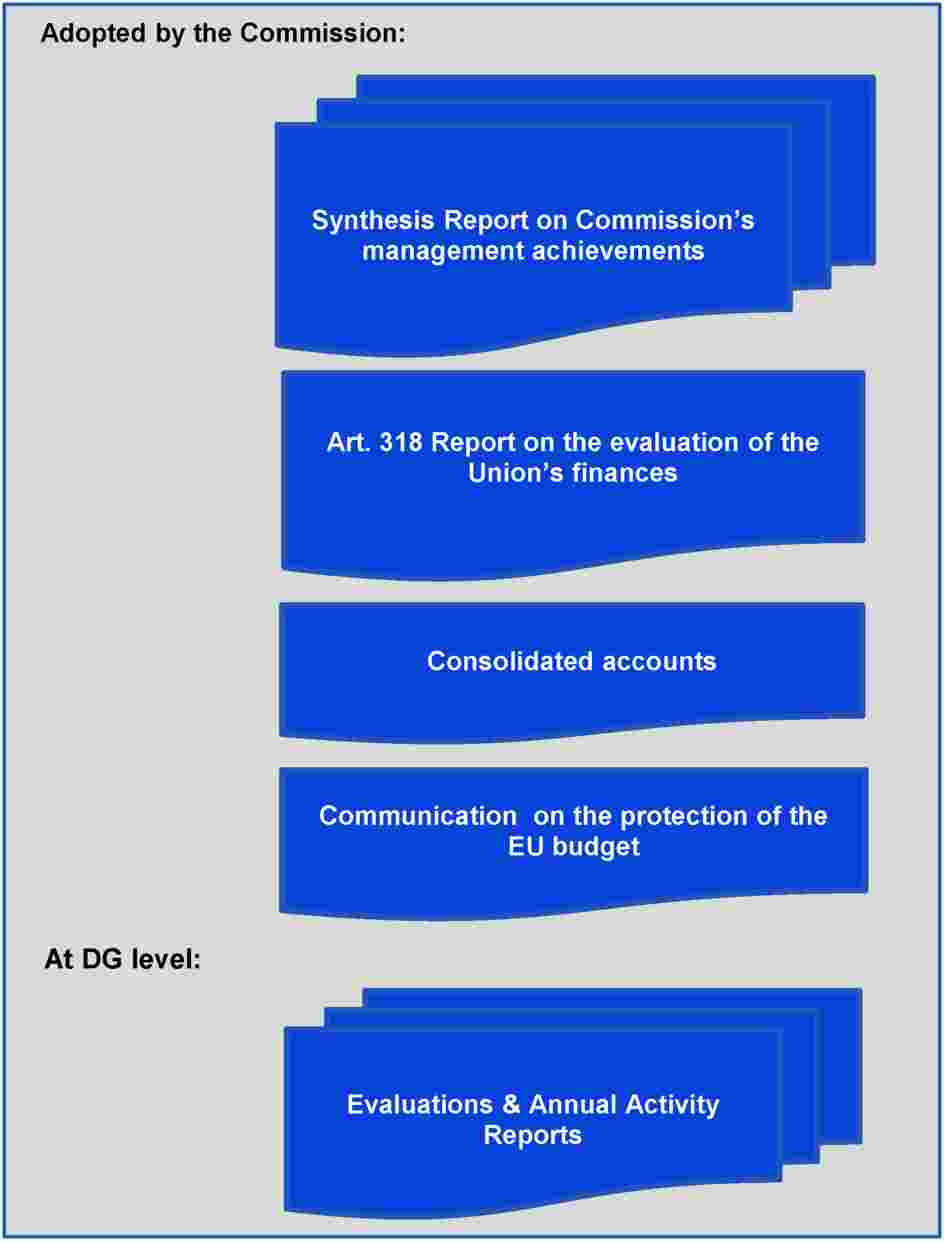

Reporting and accountability in the Commission:

3.4. Audit and discharge

Audit

The EU’s annual accounts and resource management are audited by the European Court of Auditors (the Court), its external auditor, which as part of its activities draws up for the EP and the Council:

|

(1) |

an annual report on the activities financed from the general budget; |

|

(2) |

an opinion, based on its audits and given in the annual report in the form of a statement of assurance, on: (i) the reliability of the accounts; and (ii) the legality and regularity of the underlying transactions involving both revenue collected from taxable persons and payments to final beneficiaries; and |

|

(3) |

special reports giving the findings of audits covering specific areas. |

Discharge

The final step of a budget life cycle is the discharge of the budget for a given financial year. The EP is the discharge authority within the EU. This means that following the audit and finalisation of the annual accounts it falls to the Council to recommend and then to the EP to give a discharge to the Commission and other EU bodies for implementing the EU budget for a given financial year. This decision is based on an examination of the annual accounts, the Commission’s synthesis report and annual evaluation report, the annual report, the audit opinion and special reports of the Court, and replies of the Commission to questions and further information requests.

The discharge represents the political aspect of the external control of budget implementation and is the decision by which the EP, acting on a Council recommendation, ‘releases’ the Commission (and other EU bodies) from its responsibility for management of a given budget by marking the end of that budget’s existence. This discharge procedure may produce three outcomes: the granting, postponement or the refusal of the discharge. Integral to the annual budgetary discharge procedure in the EP are the hearings with Commissioners who are questioned by the Members of the EP’s Budgetary Control Committee regarding the policy areas under their responsibility. The final discharge report including specific recommendations to the Commission for action is adopted in Plenary. The Council discharge recommendations are adopted by Ecofin. Both, the EP’s discharge report as well as the Council discharge recommendations are subject to an annual follow-up report in which the Commission outlines the concrete actions it has taken to implement the recommendations made.

4. CONSOLIDATED FINANCIAL STATEMENTS OF THE EU: FINANCIAL SITUATION 2014

4.1. General trends

Revenue

Five-year trend of revenue in EUR millions:

In 2014, GNI resource revenue decreased while other own resource revenue remained at a similar level and recovery of expenses (financial corrections and recoveries — see note 3.5 of the notes to the financial statements) nearly doubled from EUR 1,8 billion to EUR 3,4 billion — this was due to the advanced stage of closure of the 2000-2006 cohesion programming period and the related withdrawals of non-eligible expenditure made, as well as significant corrections imposed by the Commission in agricultural policy.

Expenses

The main expense items are transfer payments in the context of the European Agricultural Guarantee Fund (EAGF), the European Agricultural Fund for Rural Development (EAFRD) and other rural development instruments, European Regional Development Fund (ERDF) and Cohesion Fund (CF) and the European Social Fund (ESF). In the financial year 2014 these made up almost 70 % of total expenses.

Expenses were generally at a similar level to last year. Decreases were, however, noted for ERDF/Cohesion, which was due to the fact that expenses recognised in 2014 relate only to programming period 2007-2013 whereas no expenses have been booked yet for the current period 2014-2020 due to the slow start-up of programmes (implementation by Member States has only started in 2015).

The EU also recognises future payment obligations as expenses that are not yet shown in the cash-based budgetary accounts. The increased future payment obligations shown under payables for agriculture and rural development and future payment obligations for pension rights acquired by Commissioners, MEPs and staff generally lead to higher expenses and a negative economic result (these payments will be financed by future budgets and are not included yet in revenue).

Economic result

The economic result (deficit) of the period increased from EUR 4 365 million in 2013 to EUR 11 280 million in 2014. The main reason for this increase is the significant actuarial loss (net amount of EUR 9,2 billion) related to the pension and other employee benefits liability which occurred due to the decrease in interest rates. Such fluctuations must be expected due to the, internationally applied, accounting rules in place and the current economic environment. Should interest rates increase, a reverse impact would be expected.

Furthermore, as this is an actuarial estimate of the value of the total liability at one point in time, 31 December 2014, and is based on various assumptions valid at this time, this loss does not indicate actual charges to the EU budget, nor does it impact the amounts to be paid to pensioners from the EU budget in the immediate coming years. These payments are already estimated in the MFF 2014-2020 and will be implemented via the annual budgetary process.

Assets

The most significant items on the asset side of the balance sheet are financial assets (investments, loans, cash) and prefinancing amounts, which make up almost 85 % of the assets of the EU. The amount of loans remains stable at around EUR 60 billion (see note 4.3.2 below) whereas the amount of financial instruments financed from the EU budget increased by almost EUR 2 billion (see note 4.3.1 below). Included on the asset side under ‘Property, plant and equipment’ are assets concerning the Copernicus programme (EUR 1,5 billion) and Galileo assets under construction (EUR 1,5 billion).

In recent years, the EU institutions managed to keep the amounts held as cash and cash equivalents at year-end at a low level. The high cash balance of EUR 17,5 billion at 31 December 2014 is related to the budgetary procedure and due to own resources contributions related to VAT and GNI balances, received from Member States in December 2014 (see note 2.8.1 of the notes to the financial statements).

Cash and cash equivalents at year-end

EUR 163 billion assets and EUR 221 billion liabilities on the 2014 EU balance sheet

|

Asset |

Liabilities |

|

|

|

Liabilities

The liability side consists primarily of four key items: The pension and other employee benefits liabilities, financial liabilities, payables and accrued charges. The biggest change as compared to 2013 is the increase of the pension and other employee benefits liability from EUR 46,8 billion in 2013 to EUR 58,6 billion in 2014 due primarily to the significant decrease in interest rates (see above).

The excess of liabilities over assets does not mean that the EU institutions are in financial difficulties; rather it means that certain liabilities will be funded by future annual budgets. Many expenses are recognised under accrual accounting rules in 2014 although they may be actually paid in 2015 or later and funded using future budgets. The most significant amounts to be highlighted are the European Agricultural Guarantee Fund (EAGF) activities (paid in 2015) and the employee benefits (to be paid over the next 30-plus years).

4.2. Prefinancing

The Commission makes every effort to ensure that the levels of prefinancing are maintained at an appropriate level. A balance has to be struck between making sufficient controls and the timely recognition of expenditure. It should be noted that the level of prefinancing is significantly influenced by the MFF cycle — for example at the beginning of an MFF period one can expect large advances to be paid to Member States under cohesion policy.

The total prefinancing (excl. other advances to Member States) on the EU balance sheet amounts to EUR 45,2 billion, of which 99,8 % relates to Commission activities. Some 76 % of the Commission’s prefinancing is implemented via the shared management mode which means that the implementation of the budget is delegated to Member States (the Commission retains a supervisory role).

Commission prefinancing by management mode

The majority of expenditure under shared management mode covers agricultural spending and structural actions. The most significant prefinancing amounts relate to the European Regional Development Fund and Cohesion Fund (ERDF & CF), the European Agricultural Fund for Rural Development (EAFRD) and the European Social Fund (ESF).

Shared management spending by fund

4.3. Financial instruments

4.3.1. Financial instruments financed by the EU budget under direct and indirect management

The importance and volume of financial instruments for budget implementation increases from year to year. The basic concept behind this approach, in contrast to the traditional method of budget implementation by giving grants and subsidies, is that for each euro spent from the budget via financial instruments, the final beneficiary receives more than EUR 1 as financial support due to the leverage effect. This intelligent use of the EU budget aims at maximising the impact of the funds available.

Available for sale financial assets of financial instruments financed by the EU budget

In general, there are three main types of financial instruments used:

|

— |

equity instruments, |

|

— |

loan instruments, and |

|

— |

guarantee instruments. |

Details of the major instruments are given below:

Guarantee Fund for external actions (EUR 1 996 million of assets)

The Guarantee Fund for external actions covers loans guaranteed by the EU as a result of a Council decision, in particular European Investment Bank (EIB) lending operations outside the EU and loans under macro-financial assistance (MFA) and Euratom loans outside the EU. It is a long-term instrument (non-current part: EUR 1 489 million) managed by the EIB and intended to cover any defaulting loans guaranteed by the EU. The Fund is endowed by payments from the general budget of the EU (so as to reach 9 % of the capital value of the operations), the proceeds from interest on investments made from the Fund’s assets, and sums recovered from defaulting debtors for whom the Fund has had to activate its guarantee. Any yearly surplus arising shall be paid back as revenue for the EU budget.

The EU is required to include a guarantee reserve to cover loans to third countries. This reserve is intended to cover the requirements of the Guarantee Fund and, where necessary, activated guarantees exceeding the amount available in the Fund, so that these amounts may be charged to the budget. This reserve corresponds to the target amount of 9 % of the loans outstanding at year-end.

Risk-Sharing Finance Facility (EUR 961 million of assets)

The Risk-Sharing Finance Facility (RSFF) is managed by the EIB and the Commission’s investment portfolio is used to provision financial risk for loans and guarantees given by the EIB to eligible research projects. In total, a Commission budget of up to EUR 1 billion is foreseen for RSFF, of which up to EUR 800 million are from the ‘Cooperation’ programme and up to EUR 200 million from the ‘Capacities’ programme. The EIB has committed itself to provide the same amount. There will be no new budget contributions to RSFF under the 2014-2020 MFF. At 31 December 2014 the Commission had contributed, including also EFTA and third country contributions, EUR 856 million to the RSFF. In 2014, EUR 375 million of the EU contribution to the RSFF was transferred to its successor debt instrument under Horizon 2020. The amount disclosed as a contingent liability (note 5.2.1 of the notes to the financial statements) represents the estimated maximum loss at 31 December 2014 that the Commission would suffer in case of defaults on loans or guarantees given by the EIB within the framework of the RSFF. It should be noted that the Commission’s overall risk is limited to the amount it contributes to the Facility.

Horizon 2020 (EUR 643 million of assets)

Horizon 2020 is a new equity instrument under the 2014-2020 MFF. Seen as a means to drive economic growth and create jobs, Horizon 2020 has the political backing of Europe’s leaders and the Members of the EP. They agreed that research is an investment in the future and so put it at the heart of the EU’s blueprint for smart, sustainable and inclusive growth and jobs. By coupling research and innovation, Horizon 2020 is helping to achieve this with its emphasis on excellent science, industrial leadership and tackling societal challenges. The goal is to ensure Europe produces world-class science, removes barriers to innovation and makes it easier for the public and private sectors to work together in delivering innovation. Horizon 2020 is managed by the EIF.

ETF start-up (EUR 524 million of assets)

The European Technology Start-up Facility (ETF) covers the growth and employment programme, the multiannual programme for enterprise and entrepreneurship (MAP) and the competitiveness and innovation framework programme (CIP), under the trusteeship of the EIF, supporting the creation and financing of start-up SMEs by investing in suitable specialised venture capital funds.

Loan Guarantee instrument for TEN-T projects (EUR 235 million of assets)

The Loan Guarantee instrument for TEN-T projects (LGTT) issues guarantees so as to mitigate revenue risk in the early years of TEN-Transport projects. Specifically the guarantee would fully cover stand-by credit lines, which would only be drawn upon in cases where project cash flows were insufficient to service senior debt. The instrument is a joint financial product of the Commission and the EIB. The capital contribution to the LGTT instrument for the 2007-2013 financing period was initially set at EUR 1 billion, split evenly between the Commission and the EIB. The amending Regulation 670/2012 reallocated EUR 200 million to the Project Bond Initiative and another EUR 50 million to grant funding, so the total EU contribution still available to the instrument stands at EUR 250 million.

At 31 December 2014 the Commission had contributed EUR 212 million to the LGTT. The amount recognised as a contingent liability (note 5.2.1 of the notes to the financial statements), represents the estimated maximum loss at 31 December 2014 that the Commission would suffer in case of defaults on loans given by the EIB within the framework of the LGTT operations. It should be noted that the Commission’s overall risk is limited to the amount it contributes to the instrument.

Financial instruments (FI) by type

|

(EUR millions) |

|||

|

|

Total assets |

Total liabilities |

Guarantees given |

|

Loan/Equity/Technical assistance instruments: |

|

|

|

|

MEDA Instrument of economic and financial cooperation under the Euro-Mediterranean partnership |

290 |

(3) |

|

|

European Neighbourhood and Partnership Instrument (ENPI) |

167 |

(7) |

|

|

|

457 |

(9) |

|

|

Loan instruments: SME Support Loans |

19 |

— |

|

|

Equity instruments: |

|

|

|

|

The High Growth and Innovative SME Facility under Competitiveness & Innovation Framework Programme |

323 |

(0) |

|

|

COSME — Competitiveness of Enterprises and SME |

31 |

— |

|

|

European Fund for Southeast Europe (EFSE) |

118 |

— |

|

|

Enterprise Expansion Fund under the Western Balkan Enterprise Development and Innovation Facility |

10 |

0 |

|

|

Enterprise Innovation Fund (EIF) under the Western Balkan Enterprise Development and Innovation Facility |

21 |

0 |

|

|

European Technology Start up Facility 1998 (ETF) |

19 |

(0) |

|

|

Global Energy Efficiency and Renewable Energy Fund (GEEREF) |

72 |

— |

|

|

Multi Annual Framework Programme (MAP) Equity Facility |

183 |

(0) |

|

|

Marguerite Fund |

37 |

— |

|

|

European Progress Microfinance Facility (PMF) for employment and social inclusion |

60 |

— |

|

|

SE4F — Green for Growth Fund to the Eastern Neighbourhood Region |

52 |

— |

|

|

European Energy Efficiency Fund |

89 |

— |

|

|

Technology Transfer Pilot Projects |

2 |

(0) |

|

|

Microfinance Initiative for Asia Debt Fund |

10 |

— |

|

|

SANAD — MENA Fund for Micro-, Small and Medium Enterprises |

9 |

— |

|

|

|

1 035 |

(1) |

|

|

Guarantee instruments: |

|

|

|

|

SME Guarantee Facility under Competitiveness & Innovation Framework Programme (CIP SMEG) |

151 |

(259) |

— |

|

COSME LGF — Competitiveness of Enterprises and SME |

39 |

(1) |

(42) |

|

Horizon 2020 — EU Finance for Innovators |

478 |

(11) |

(98) |

|

Horizon 2020 — SME Guarantee |

165 |

(1) |

(267) |

|

Loan Guarantee Instrument for Ten-T Projects (LGTT) |

235 |

(3) |

(209) |

|

Guarantee Facility under the Western Balkan Enterprise Development and Innovation Facility |

21 |

(2) |

(10) |

|

Multi Annual Programme (MAP) for Enterprises |

26 |

(41) |

— |

|

Natural Capital Financing Facility |

3 |

— |

— |

|

Project Bond Instrument (PBI) |

149 |

(2) |

(138) |

|

Private Finance for Energy Efficiency Instrument (PF4EE) |

6 |

(0) |

— |

|

European Progress Microfinance Mandate (PMF TA) |

13 |

(9) |

— |

|

Risk Sharing Finance Facility (RSFF) |

961 |

(32) |

(883) |

|

SME Guarantee Facility |

60 |

(15) |

— |

|

|

2 309 |

(376) |

(1 647) |

|

Total |

3 820 |

(386) |

(1 647) |

|

Guarantee Fund for external actions |

1 996 |

(25) |

(19 198) |

4.3.2. Borrowing and lending activities managed by the Commission

The EU is empowered by the EU Treaty to adopt borrowing operations to mobilise the financial resources necessary to fulfil specific mandates. The Commission, acting on behalf of the EU, currently operates three main programmes, macro-financial assistance (MFA), balance-of-payments (BOP) assistance and the European Financial Stabilisation Mechanism (EFSM), under which it may grant loans and fund these by issuing debt instruments in the capital markets or with financial institutions.

EU borrowing and lending activities are non-budget operations. The capital required to fund the EU lending operations under the above programmes is raised on the capital markets or with financial institutions. The EU is not permitted to borrow to finance its ordinary budgetary expenses or a budget deficit. The size of the borrowings varies from private placements for amounts of up to EUR 500 million to benchmark-size bond issues (at least EUR 1 billion). In general funds raised are on-lent back-to-back to the beneficiary country, i.e. with the same coupon, maturity and amount. Notwithstanding the back-to-back methodology, the debt service of the funding instruments is a legal obligation of the EU, which will ensure that all payments are made fully and in a timely manner. The Commission has put procedures in place so as to ensure the repayment of borrowings even in case of a loan default. For each country programme, the EP, the Council and the Commission decisions determine the overall granted amount, the (maximum) number of instalments to be disbursed, and the maximum (average) maturity of the loan package. Subsequently, the Commission and the beneficiary country agree loan/funding parameters, including instalments and the payment of tranches. In addition, except for the first one, all instalments of the loan depend on compliance with strict conditions, with agreed terms and conditions similar to International Monetary Fund (IMF) support, in the context of a joint EU/IMF financial assistance, which is another factor influencing the timing of funding. This implies that the timing and maturities of issuances are dependent on the related EU lending activity. Funding is exclusively denominated in euro and the maturity spectrum is 3 to 30 years.

Borrowings of the EU constitute direct and unconditional obligations of the EU and are guaranteed by the 28 Member States. Borrowings undertaken to fund loans to countries outside the EU are covered by the Guarantee Fund for external actions. Should a beneficiary Member State default, the debt service will be drawn from the available treasury balance of the Commission, if possible. If that would not be possible, the Commission would draw the necessary funds from the Member States. EU Member States are legally obliged, according to the EU own resources legislation (Article 12 of Council Regulation 1150/2000), to make available sufficient funds to meet the EU’s obligations. Thus investors are only exposed to the credit risk of the EU, not to that of the beneficiary of loans funded. ‘Back-to-back’ lending ensures that the EU budget does not assume any interest rate or foreign exchange risk.

Balance of Payments

The BOP facility, a policy-based financial instrument, provides medium-term financial assistance to Member States of the EU. It enables the granting of loans to Member States which are experiencing, or are seriously threatened with, difficulties in their balance of payments or capital movements. Only Member States which have not adopted the euro may benefit from this facility. BOP assistance to Latvia was granted before the introduction of the euro on 1 January 2014. The maximum outstanding amount of loans granted under the instrument is limited to EUR 50 billion. Borrowings related to these BOP loans are guaranteed by the EU budget — thus at 31 December 2014, the budget is exposed to a maximum possible risk of EUR 8,6 billion regarding these loans (the EUR 8,4 billion below being the nominal value).

|

(EUR millions) |

||||

|

|

Hungary |

Latvia |

Romania |

Total |

|

Total loans granted |

6 500 |

3 100 |

8 400 |

18 000 |

|

Disbursed at 31.12.2013 |

5 500 |

2 900 |

5 000 |

13 400 |

|

Disbursed in 2014 |

— |

— |

— |

— |

|

Loans disbursed 31.12.2014 |

5 500 |

2 900 |

5 000 |

13 400 |

|

Loans repaid at 31.12.2014 |

(4 000) |

(1 000) |

— |

(5 000) |

|

Outstanding amount at 31.12.2014 |

1 500 |

1 900 |

5 000 |

8 400 |

A table showing the reimbursement schedule for these loans is given below.

Between November 2008 and May 2009, financial assistance amounting to EUR 14,6 billion was granted to Hungary, Latvia and Romania, of which EUR 13,4 billion had been disbursed by mid-2011. It should be noted that the BOP assistance programme for Hungary expired in November 2010 (with EUR 1 billion undrawn) and the first two repayments of EUR 2 billion in December 2011 and of another EUR 2 billion in November 2014 were received as scheduled. The BOP assistance programme for Latvia expired in January 2012 (with EUR 200 million undrawn) and the first two repayments of EUR 1 billion in April 2014 and EUR 1,2 billion in January 2015 were also received on time. The BOP first assistance programme for Romania expired in May 2012 with the full amount granted, EUR 5 billion, being disbursed. The first repayment of EUR 1,5 billion in January 2015 was received as scheduled.

In February 2011, Romania requested a follow-up precautionary financial assistance (PFA) programme under the BOP facility to support the relaunch of economic growth. On 12 May 2011 the Council decided to make available precautionary EU BOP assistance (PFA) for Romania of up to EUR 1,4 billion (Council Decision 2011/288/EU), however this expired at end-March 2013 without being used. Following Romania’s second request for PFA, the Council decided to provide new EU BOP PFA of up to EUR 2 billion, on 22 October 2013 (Council Decision 2013/531/EU), which will remain available for activation until 30 September 2015. If its activation is requested, this financial assistance shall be provided in the form of a loan with a maximum average maturity of eight years. As this PFA of EUR 2 billion is currently the single active programme under the BOP facility, it is the sole amount still available.

European Financial Stabilisation Mechanism

|

EUR millions |

|||

|

|

Ireland |

Portugal |

Total |

|

Total loans granted |

22 500 |

26 000 |

48 500 |

|

Disbursed at 31.12.2013 |

21 700 |

22 100 |

43 800 |

|

Disbursed in 2014 |

800 |

2 200 |

3 000 |

|

Loans disbursed at 31.12.2014 |

22 500 |

24 300 |

46 800 |

|

Loans repaid at 31.12.2014 |

— |

— |

— |

|

Loans outstanding at 31.12.2014 |

22 500 |

24 300 |

46 800 |

A table showing the reimbursement schedule for these loans is given below.

On 11 May 2010 the Council adopted the EFSM to preserve financial stability in Europe (Council Regulation (EU) no 407/2010). The mechanism based on Article 122(2) TFEU and enables the granting of financial assistance to a Member State in difficulties or seriously threatened with severe difficulties caused by exceptional circumstances beyond its control. The assistance may take the form of a loan or credit line. The Commission borrows funds on the capital markets or with financial institutions on behalf of the EU and lends these funds to the beneficiary Member State. For each country receiving a loan under the EFSM, a quarterly assessment of the fulfilment of the policy conditions attached to the loan is carried out before another instalment is disbursed.

The Ecofin Council conclusions of 9 May 2010 restrict the facility to EUR 60 billion but the legal limit is provided in Article 2(2) of the Council Regulation (EU) No 407/2010, which restricts the outstanding amount of loans or credit lines to the margin available under the own resources ceiling. Borrowings related to loans disbursed under the EFSM are guaranteed by the EU budget — thus at 31 December 2014, the budget is exposed to a maximum possible risk of EUR 47,5 billion regarding these loans (the EUR 46,8 billion above being the nominal value). As the borrowings under the EFSM are guaranteed by the EU budget, the EP scrutinises the Commission’s EFSM actions and exercises control in the context of the budget and discharge procedure. As both EFSM programmes have expired, no available amounts are disclosed in the table above.

The Council decided by Implementing Decision in December 2010 on a loan to Ireland of maximum EUR 22,5 billion, and in May 2011 on a loan to Portugal of maximum EUR 26 billion. The initial implementing decisions fixed interest with a margin to result in conditions similar to those of the IMF support. With the adoption of Council Implementing Decisions Nos 2011/682/EU and 2011/683/EU of 11 October 2011, the Council suppressed the interest margin retroactively and extended the maximum average maturity from 7,5 years to 12,5 years and the maturity of individual tranches up to 30 years. With the adoption of Council Implementing Decisions No 2013/313/EU and 2013/323/EU of 21 June 2013, the Council has further lengthened the maximum average maturity of the EFSM loans to Ireland and Portugal by 7 years to 19,5 years. The extension smoothes the debt redemption profile of both countries and lowers their refinancing needs in the post-programme period.

The last three instalments were disbursed in 2014: EUR 0,8 billion for Ireland and EUR 1,8 billion for Portugal in March 2014 and finally EUR 0,4 billion for Portugal in November 2014. EUR 1,7 billion of the financial assistance granted to Portugal has expired without being requested. There are currently no amounts available under EFSM.

The following table provides an overview of the planned reimbursement schedule in nominal value for outstanding EFSM and BOP loan amounts (in EUR billions) at the date of signature of these accounts:

|

Year |

BOP |

EFSM |

Total |

|||||

|

Hungary |

Latvia |

Romania |

Total |

Ireland |

Portugal |

Total |

||

|

2015 |

|

|

|

0 |

5,0 |

|

5,0 |

5,0 |

|

2016 |

1,5 |

|

|

1,5 |

|

4,75 |

4,75 |

6,25 |

|

2017 |

|

|

1,15 |

1,15 |

|

|

0 |

1,15 |

|

2018 |

|

|

1,35 |

1,35 |

3,9 |

0,6 |

4,5 |

5,85 |

|

2019 |

|

0,5 |

1,0 |

1,5 |

|

|

0 |

1,5 |

|

2021 |

|

|

|

0 |

3,0 |

6,75 |

9,75 |

9,75 |

|

2022 |

|

|

|

0 |

|

2,7 |

2,7 |

2,7 |

|

2024 |

|

|

|

0 |

0,8 |

1,8 |

2,6 |

2,6 |

|

2025 |

|

0,2 |

|

0,2 |

|

|

0 |

0,2 |

|

2026 |

|

|

|

0 |

2,0 |

2,0 |

4,0 |

4,0 |

|

2027 |

|

|

|

0 |

1,0 |

2,0 |

3,0 |

3,0 |

|

2028 |

|

|

|

0 |

2,3 |

|

2,3 |

2,3 |

|

2029 |

|

|

|

0 |

|

0,4 |

0,4 |

0,4 |

|

2032 |

|

|

|

0 |

3,0 |

|

3,0 |

3,0 |

|

2038 |

|

|

|

0 |

|

1,8 |

1,8 |

1,8 |

|

2042 |

|

|

|

0 |

1,5 |

1,5 |

3,0 |

3,0 |

|

Total |

1,5 |

0,7 |

3,5 |

5,7 |

22,5 |

24,3 |

46,8 |

52,5 |

Macro-financial assistance (MFA)

MFA is a policy-based financial instrument of untied and undesignated balance of payment and/or budget support to partner third-countries geographically close to the EU territory. It takes the form of medium/long term loans or grants or an appropriate combination of both and generally complements financing provided in the context of an IMF-supported adjustment and reform program. These loans are guaranteed by the Guarantee Fund for external actions (see note 2.4 of the financial statements).

4.3.3. Inter-governmental financial stability mechanisms outside the EU Treaty framework: European Financial Stability Facility and European Stability Mechanism

The European Financial Stability Facility (EFSF) was created by the Eurozone Member States with the mandate to safeguard financial stability in Europe by providing financial assistance to Eurozone Member States. The EFSF is not an EU body and is entirely separate from and not consolidated in the EU accounts. It is not guaranteed by the EU budget. Consequently it has no impact on the EU accounts, aside from the possible sanctions revenue described below. With the entry into force of the ESM (see below), the EFSF did not provide new financial assistance after 1 July 2013.

The Commission is responsible for negotiating the policy conditionality attached to the financial assistance and the monitoring of compliance with that conditionality. Regulation 1173/2011 of the Parliament and Council allows for the imposition of sanctions in the form of fines on Member States whose currency is the Euro. These fines, being 0,2 % of the Member State’s GDP in the preceding year, can be applied in cases where a Member State has not taken appropriate actions to correct an excessive budget deficit, or where there has been manipulation of statistics. Similarly, Regulation 1174/2011 on macroeconomic imbalances makes provision for an annual fine on a Eurozone Member State of 0,1 % of GDP in the cases where a Member State has not taken the requested corrective action or in case an insufficient corrective action plan has been submitted. Regulation 1177/2011 updated Regulation 1467/97 on speeding up and clarifying the implementation of the excessive deficit procedure. This updated Regulation also foresees the possibility of issuing fines to Eurozone Member States (equal to 0,2 % of GDP plus a variable component). Fines will transit through the EU Budget and then be transferred to the EFSF. This would mean that such amounts would appear as both a budget revenue and expense, thus having no impact on the overall budget result. Likewise they would have no impact on the economic result as presented in the EU financial statements.

The European Stability Mechanism (‘ESM’) is an intergovernmental organisation under public international law outside the EU Treaty framework. The ESM Treaty was signed by the then 17 euro area Member States and became operational in October 2012. The ESM has assumed the tasks fulfilled by the EFSM and the EFSF becoming the sole and permanent mechanism for responding to new requests for financial assistance to euro area Member States. Consequently, the EFSF and the EFSM no longer engage in new financing programmes or enter into new loan facility agreements. It must also be noted that the EU budget will not guarantee ESM borrowings. As this mechanism has its own legal personality and is funded directly by the euro area Member States, it is not an EU body and it has no impact on either the EU accounts or the EU budget, aside from the possible sanctions revenue described below.

Fines collected will pass through the EU budget and be transferred to the ESM once the EFSF is no longer operational. Furthermore, the Treaty on Stability, Coordination and Governance foresees penalty payments on any of the ‘Contracting Parties’ where that Member State has not taken necessary measures to address a breach of deficit criterion. Penalties imposed (which cannot exceed 0,1 % of GDP) will be payable to the ESM if applied to euro area Member States (thus with no impact on the EU budget result, as with the EFSF above), or to the EU budget for non-euro Member States. In the latter case, the sanction amount will be revenue for the EU budget and be reflected as such in its accounts.

5. ECONOMIC AND FINANCIAL CONTEXT OF EU BUDGET IMPLEMENTATION

Macro-economic environment

In the context of the sovereign debt crisis the economic growth in the EU Member States has slowed down from 2012 to 2013 and increased from 2013 to 2014. This general economic situation of Member States is reflected in the own resource revenue of the EU, which led to a slight increase of traditional own resources and VAT revenue. Since the GNI resource revenue is a residual component which is directly linked to the total level of payment appropriations adopted by the Budget Authority (and these appropriations have been reduced by Member States in the 2014-2020 MFF), the amount of GNI resource revenue decreased in 2014.

The reinforcement of the Stability and Growth Pact in the EU paves the way for sustainable public finances of the EU Member States concerned. The Fiscal pact aims at consolidating the public finances of the Member States and shall enable them to increase their GDP in the years to come.

The policy of the European Central Bank (ECB) of keeping interest rates at a low level supports the stabilisation of the Euro-area economy. The ECB contributes within its mandate to the increase of growth of the euro area.

Gross Domestic Product of EU-28 at market prices

GNI resource revenue

Unpaid payment claims

Due to the macro-economic environment in the EU, the pressure on the national budgets of Member States leads to pressure on the payment appropriations of the EU budget. This development has an immediate effect on the payment claims received from Member States and other beneficiaries. The total of unpaid payment claims at year-end has increased from EUR 24,3 billion in 2013 to EUR 25,8 billion in 2014. Although there will always be outstanding claims due to amounts submitted close to the year-end, the main reason for the exceptional amounts noted in recent years is the shortage of payment appropriations.

Unpaid payment claims must be financed by future budgets. With this in mind, in May 2015 the EP, the Council and the Commission have agreed on a payment plan to bring the EU budget back on a sustainable track. For the EU it is crucial to consider the long-term needs budgetary payment appropriations since it is these which are decided on by the Budgetary Authority and without these, no payments can be made or cash transferred. Once agreed, appropriations are automatically transformed into available cash of the EU through the monthly own resource collection process.

Within the Commission, short-term cash flow forecasting is done weekly (sometimes daily) to ensure that the immediate payment obligations of the EU can be met, respecting the limits of the payment appropriations available in the budget. This short term forecast is the basis used to estimate the amount of own resources to be called monthly from Member States. On the first working day of each month Member States must credit to the Commission’s own resource accounts one-twelfth of the total amount of the VAT and GNI-based resource entered in the Union’s budget. Depending on the Commission’s cash position, Member States may be asked in the first quarter of the year to bring forward, by one or two months, the VAT and GNI based resources. Those advances have to be deducted from calls for funds in later months, depending on the forecasted cash needs.

For the medium and long-term, the Commission monitors in detail the payment requirements of the EU as part of its regular activities. For example, this is required for the preparation of Commission proposals on the MFF, as part of the annual budget preparation and when preparing amending budgets. In the negotiation phase of the MFF, the models used and the assumptions underlying are monitored regularly and updated when necessary. The results of the model simulation are channelled into the budgetary negotiations establishing the MFF payment ceiling.

NOTE ACCOMPANYING THE CONSOLIDATED ACCOUNTS

The consolidated annual accounts of the European Union for the year 2014 have been prepared on the basis of the information presented by the institutions and bodies under Article 148(2) of the Financial Regulation applicable to the general budget of the European Union. I hereby declare that they were prepared in accordance with Title IX of this Financial Regulation and with the accounting principles, rules and methods set out in the notes to the financial statements.

I have obtained from the accounting officers of these institutions and bodies, who certified its reliability, all the information necessary for the production of the accounts that show the European Union’s assets and liabilities and the budgetary implementation.

I hereby certify that based on this information, and on such checks as I deemed necessary to sign off the accounts of the European Commission, I have a reasonable assurance that the accounts present fairly, in all material aspects, the financial position, the results of the operations and the cash flows of the European Union.

[signed]

Manfred KRAFF

Accounting Officer of the Commission

17 July 2015

CONSOLIDATED FINANCIAL STATEMENTS AND EXPLANATORY NOTES (1)

CONTENTS

| BALANCE SHEET | 24 |

| STATEMENT OF FINANCIAL PERFORMANCE | 25 |

| CASHFLOW STATEMENT | 26 |

| STATEMENT OF CHANGES IN NET ASSETS | 27 |

| NOTES TO THE FINANCIAL STATEMENTS | 28 |

|

1. |

SIGNIFICANT ACCOUNTING POLICIES | 28 |

|

2. |

NOTES TO THE BALANCE SHEET | 39 |

|

3. |

NOTES TO THE STATEMENT OF FINANCIAL PERFORMANCE | 61 |

|

4. |

NOTES TO THE CASHFLOW STATEMENT | 73 |

|

5. |

CONTINGENT ASSETS AND LIABILITIES AND OTHER SIGNIFICANT DISCLOSURES | 73 |

|

6. |

PROTECTION OF THE EU BUDGET | 77 |

|

7. |

FINANCIAL RISK MANAGEMENT | 83 |

|

8. |

RELATED PARTY DISCLOSURES | 94 |

|

9. |

EVENTS AFTER THE BALANCE SHEET DATE | 96 |

|

10. |

SCOPE OF CONSOLIDATION | 96 |

BALANCE SHEET

|

(EUR millions) |

|||

|

|

Note |

31.12.2014 |

31.12.2013 |

|

NON-CURRENT ASSETS |

|

|

|

|

Intangible assets |

2.1 |

282 |

237 |

|

Property, plant and equipment |

2.2 |

7 937 |

6 104 |

|

Investments accounted for using the equity method |

2.3 |

409 |

349 |

|

Financial assets |

2.4 |

56 438 |

59 844 |

|

Prefinancing |

2.5 |

18 358 |

38 072 |

|

Exchange receivables and non-exchange recoverables |

2.6 |

1 198 |

498 |

|

|

|

84 623 |

1 05 104 |

|

CURRENT ASSETS |

|

|

|

|

Financial assets |

2.4 |

11 811 |

5 571 |

|

Prefinancing |

2.5 |

34 237 |

21 367 |

|

Exchange receivables and non-exchange recoverables |

2.6 |

14 380 |

13 182 |

|

Inventories |

2.7 |

128 |

128 |

|

Cash and cash equivalents |

2.8 |

17 545 |

9 510 |

|

|

|

78 101 |

49 758 |

|

TOTAL ASSETS |

|

1 62 724 |

1 54 862 |

|

NON-CURRENT LIABILITIES |

|

|

|

|

Pension and other employee benefits |

2.9 |

(58 616) |

(46 818) |

|

Provisions |

2.10 |

(1 537) |

(1 323) |

|

Financial liabilities |

2.11 |

(51 851) |

(56 369) |

|

|

|

(1 12 005) |

(1 04 510) |

|

CURRENT LIABILITIES |

|

|

|

|

Provisions |

2.10 |

(745) |

(545) |

|

Financial liabilities |

2.11 |

(8 828) |

(3 163) |

|

Payables |

2.12 |

(43 180) |

(36 213) |

|

Accrued charges and deferred income |

2.13 |

(55 973) |

(56 282) |

|

|

|

(1 08 726) |

(96 204) |

|

TOTAL LIABILITIES |

|

(2 20 730) |

(2 00 714) |

|

NET ASSETS |

|

(58 006) |

(45 852) |

|

Reserves |

2.14 |

4 435 |

4 073 |

|

Amounts to be called from Member States (2) |

2.15 |

(62 441) |

(49 925) |

|

NET ASSETS |

|

(58 006) |

(45 852) |

STATEMENT OF FINANCIAL PERFORMANCE

|

(EUR millions) |

|||

|

|

Note |

2014 |

2013 (reclassified) (20) |

|

REVENUE |

|

|

|

|

Revenue from non-exchange transactions |

|

|

|

|

GNI resources |

3.1 |

1 04 688 |

1 10 194 |

|

Traditional own resources |

3.2 |

17 137 |

15 467 |

|

VAT resources |

3.3 |

17 462 |

14 019 |

|

Fines |

3.4 |

2 297 |

2 757 |

|

Recovery of expenses |

3.5 |

3 418 |

1 777 |

|

Other |

3.6 |

5 623 |

4 045 |

|

Total |

|

1 50 625 |

1 48 259 |

|

|

|

|

|

|

Revenue from exchange transactions |

|

|

|

|

Financial income |

3.7 |

2 298 |

1 991 |

|

Other |

3.8 |

1 066 |

1 443 |

|

Total |

|

3 364 |

3 434 |

|

|

|

1 53 989 |

1 51 693 |

|

EXPENSES (22) |

|

|

|

|

Implemented by Member States |

3.9 |

|

|

|

European Agricultural Guarantee Fund |

|

(44 465) |

(45 067) |

|

European Agricultural Fund for Rural Development and other rural development instruments |

|

(14 046) |

(13 585) |

|

European Regional Development Fund and Cohesion Fund |

|

(43 345) |

(47 767) |

|

European Social Fund |

|

(12 651) |

(12 126) |

|

Other |

|

(2 307) |

(1 525) |

|

Implemented by the Commission and executive agencies |

3.10 |

(15 311) |

(12 519) |

|

Implemented by other EU agencies and bodies |

3.11 |

(1 025) |

(656) |

|

Implemented by third countries and international organisations |

3.11 |

(2 770) |

(2 465) |

|

Implemented by other entities |

3.11 |

(1 799) |

(1 694) |

|

Staff and pension costs |

3.12 |

(9 662) |

(9 058) |

|

Changes in employee benefits actuarial assumptions |

3.13 |

(9 170) |

(2 033) |

|

Finance costs |

3.14 |

(2 926) |

(2 383) |

|

Share of net deficit of joint ventures and associates |

3.15 |

(640) |

(608) |

|

Other expenses |

3.16 |

(5 152) |

(4 572) |

|

|

|

(1 65 269) |

(1 56 058) |

|

ECONOMIC RESULT OF THE YEAR |

|

(11 280) |

(4 365) |

CASHFLOW STATEMENT

|

(EUR millions) |

|||

|

|

Note |

2014 |

2013 |

|

Economic result of the year |

|

(11 280) |

(4 365) |

|

Operating activities |

4.2 |

|

|

|

Amortisation |

|

61 |

48 |

|

Depreciation |

|

408 |

401 |

|

(Increase)/decrease in loans |

|

(1 298) |

20 |

|

(Increase)/decrease in prefinancing |

|

6 844 |

(1 695) |

|

(Increase)/decrease in exchange receivables and non-exchange recoverables |

|

(1 898) |

923 |

|

(Increase)/decrease in inventories |

|

— |

10 |

|

Increase/(decrease) in pension and employee benefits liability |

|

11 798 |

4 315 |

|

Increase/(decrease) in provisions |

|

414 |

(196) |

|

Increase/(decrease) in financial liabilities |

|

1 146 |

(330) |

|

Increase/(decrease) in payables |

|

6 967 |

14 655 |

|

Increase/(decrease) in accrued charges and deferred income |

|

(309) |

(12 154) |

|

Prior year budgetary surplus taken as non-cash revenue |

|

(1 005) |

(1 023) |

|

Other non-cash movements |

|

130 |

(50) |

|

Investing activities |

4.3 |

|

|

|

(Increase)/decrease in intangible assets and property, plant and equipment |

|

(2 347) |

(624) |

|

(Increase)/decrease in investments accounted for using the equity method |

|

(60) |

43 |

|

(Increase)/decrease in available for sale financial assets |

|

(1 536) |

(1 142) |

|

NET CASHFLOW |

|

8 035 |

(1 164) |

|

Net increase/(decrease) in cash and cash equivalents |

|

8 035 |

(1 164) |

|

Cash and cash equivalents at the beginning of the year |

2.8 |

9 510 |

10 674 |

|

Cash and cash equivalents at year-end |

2.8 |

17 545 |

9 510 |

STATEMENT OF CHANGES IN NET ASSETS

|

(EUR millions) |

|||||

|

|

Reserves (A) |

Amounts to be called from Member States (B) |

Net Assets =(A)+(B) |

||

|

|

Fair value reserve |

Other reserves |

Accumulated Surplus/(Deficit) |

Economic result of the year |

|

|

BALANCE AS AT 31.12.2012 |

150 |

3 911 |

(39 148) |

(5 329) |

(40 416) |

|

Movement in Guarantee Fund reserve |

— |

46 |

(46) |

— |

— |

|

Fair value movements |

(51) |

— |

— |

— |

(51) |

|

Other |

— |

12 |

(9) |

— |

3 |

|

Allocation of the 2012 economic result |

— |

5 |

(5 334) |

5 329 |

— |

|

2012 budget result credited to Member States |

— |

— |

(1 023) |

— |

(1 023) |

|

Economic result of the year |

— |

— |

— |

(4 365) |

(4 365) |

|

BALANCE AS AT 31.12.2013 |

99 |

3 974 |

(45 560) |

(4 365) |

(45 852) |

|

Movement in Guarantee Fund reserve |

— |

247 |

(247) |

— |

— |

|

Fair value movements |

139 |

— |

— |

— |

139 |

|

Other |

— |

(24) |

16 |

— |

(8) |

|

Allocation of the 2013 economic result |

— |

(0) |

(4 365) |

4 365 |

— |

|

2013 budget result credited to Member States |

— |

— |

(1 005) |

— |

(1 005) |

|

Economic result of the year |

— |

— |

— |

(11 280) |

(11 280) |

|

BALANCE AS AT 31.12.2014 |

238 |

4 197 |

(51 161) |

(11 280) |

(58 006) |

NOTES TO THE FINANCIAL STATEMENTS

1. SIGNIFICANT ACCOUNTING POLICIES

1.1. LEGAL BASIS AND ACCOUNTING RULES

The accounts of the EU are kept in accordance with Regulation (EU, Euratom) No 966/2012 of the European Parliament and of the Council of 25 October 2012 on the financial rules applicable to the general budget of the Union and repealing Council Regulation (EC, Euratom) No 1605/2002 (OJ L 298, 26.10.2012, p. 1) hereinafter referred to as the ‘Financial Regulation’ and Commission Delegated Regulation (EU) No 1268/2012 of 29 October 2012 (OJ L 362, 31.12.2012, p. 1) laying down detailed rules of application of this Financial Regulation.

In accordance with Article 143 of the Financial Regulation, the EU prepares its financial statements on the basis of accrual-based accounting rules that are based on International Public Sector Accounting Standards (IPSAS). These accounting rules, adopted by the Accounting Officer of the Commission, have to be applied by all the institutions and EU bodies falling within the scope of consolidation in order to establish a uniform set of rules for accounting, valuation and presentation of the accounts with a view to harmonising the process for drawing up the financial statements and consolidation. The accounts are kept in euros on the basis of the calendar year.

1.2. ACCOUNTING PRINCIPLES

The objective of the financial statements is to provide information about the financial position, performance and cash flows of an entity that is useful to a wide range of users. For the EU as a public sector entity, the objectives are more specifically to provide information useful for decision making, and to demonstrate the accountability of the entity for the resources entrusted to it. It is with these goals in mind that the present document has been drawn up.

The overall considerations (or accounting principles) to be followed when preparing the financial statements are laid down in EU accounting rule 2 and are the same as those described in IPSAS 1, that is: fair presentation, accrual basis, going concern, consistency of presentation, aggregation, offsetting and comparative information. The qualitative characteristics of financial reporting according to article 144 of the Financial Regulation are relevance, reliability, understandability and comparability.

Preparation of the financial statements in accordance with the above mentioned rules and principles requires management to make estimates that affect the reported amounts of certain items in the balance sheet and statement of financial performance, as well as the disclosures related to financial instruments and contingent assets and liabilities.

1.3. CONSOLIDATION

Scope of consolidation

The consolidated financial statements of the EU comprise all significant controlled entities (i.e. the EU institutions (including the Commission) and the EU agencies), associates and joint ventures, this being 52 controlled entities, 7 joint ventures and 1 associate. The complete list of consolidated entities can be found in note 10 of the EU accounts. In comparison with 2013, the scope of consolidation remains unchanged, noting that 1 associate has now been reclassified as a joint venture and following the amalgamation of 2 other associates the resulting entity has been classified as a joint venture.

Controlled entities

The decision to include an entity in the scope of consolidation is based on the control concept. Controlled entities are all entities over which the EU has, directly or indirectly, the power to govern the financial and operating policies so as to be able to benefit from these entities’ activities. This power must be presently exercisable. Controlled entities are fully consolidated. The consolidation begins at the first date on which control exists, and ends when such control no longer exists.

The most common indicators of control within the EU are: creation of the entity through founding treaties or secondary legislation, financing of the entity from the general budget, the existence of voting rights in the governing bodies, audit by the Court and discharge by the European Parliament. It is clear that an individual assessment for each entity needs to be made in order to decide whether one or all of the criteria listed above are sufficient to trigger control.