ISSN 1977-091X

Official Journal

of the European Union

C 138

English edition

Information and Notices

Volume 57

8 May 2014

|

ISSN 1977-091X |

||

|

Official Journal of the European Union |

C 138 |

|

|

||

|

English edition |

Information and Notices |

Volume 57 |

|

Notice No |

Contents |

page |

|

|

IV Notices |

|

|

|

NOTICES FROM EUROPEAN UNION INSTITUTIONS, BODIES, OFFICES AND AGENCIES |

|

|

|

European Commission |

|

|

2014/C 138/01 |

||

|

2014/C 138/02 |

||

|

|

NOTICES FROM MEMBER STATES |

|

|

2014/C 138/03 |

||

|

|

NOTICES CONCERNING THE EUROPEAN ECONOMIC AREA |

|

|

|

EFTA Surveillance Authority |

|

|

2014/C 138/04 |

||

|

2014/C 138/05 |

||

|

2014/C 138/06 |

|

|

V Announcements |

|

|

|

COURT PROCEEDINGS |

|

|

|

EFTA Court |

|

|

2014/C 138/07 |

Action brought on 10 January 2014 by the EFTA Surveillance Authority against Iceland (Case E-1/14) |

|

|

2014/C 138/08 |

Action brought on 10 January 2014 by the EFTA Surveillance Authority against Iceland (Case E-2/14) |

|

|

2014/C 138/09 |

||

|

|

PROCEDURES RELATING TO THE IMPLEMENTATION OF THE COMMON COMMERCIAL POLICY |

|

|

|

European Commission |

|

|

2014/C 138/10 |

||

|

|

PROCEDURES RELATING TO THE IMPLEMENTATION OF COMPETITION POLICY |

|

|

|

European Commission |

|

|

2014/C 138/11 |

Prior notification of a concentration (Case M.7223 — Danish Crown/Sokolow) — Candidate case for simplified procedure ( 1 ) |

|

|

|

|

|

(1) Text with EEA relevance |

|

EN |

|

IV Notices

NOTICES FROM EUROPEAN UNION INSTITUTIONS, BODIES, OFFICES AND AGENCIES

European Commission

|

8.5.2014 |

EN |

Official Journal of the European Union |

C 138/1 |

Euro exchange rates (1)

7 May 2014

(2014/C 138/01)

1 euro =

|

|

Currency |

Exchange rate |

|

USD |

US dollar |

1,3927 |

|

JPY |

Japanese yen |

141,68 |

|

DKK |

Danish krone |

7,4641 |

|

GBP |

Pound sterling |

0,82070 |

|

SEK |

Swedish krona |

9,0497 |

|

CHF |

Swiss franc |

1,2186 |

|

ISK |

Iceland króna |

|

|

NOK |

Norwegian krone |

8,2235 |

|

BGN |

Bulgarian lev |

1,9558 |

|

CZK |

Czech koruna |

27,412 |

|

HUF |

Hungarian forint |

305,90 |

|

LTL |

Lithuanian litas |

3,4528 |

|

PLN |

Polish zloty |

4,1998 |

|

RON |

Romanian leu |

4,4295 |

|

TRY |

Turkish lira |

2,9133 |

|

AUD |

Australian dollar |

1,4909 |

|

CAD |

Canadian dollar |

1,5164 |

|

HKD |

Hong Kong dollar |

10,7957 |

|

NZD |

New Zealand dollar |

1,6035 |

|

SGD |

Singapore dollar |

1,7396 |

|

KRW |

South Korean won |

1 424,96 |

|

ZAR |

South African rand |

14,6360 |

|

CNY |

Chinese yuan renminbi |

8,6833 |

|

HRK |

Croatian kuna |

7,5863 |

|

IDR |

Indonesian rupiah |

16 120,38 |

|

MYR |

Malaysian ringgit |

4,5228 |

|

PHP |

Philippine peso |

61,711 |

|

RUB |

Russian rouble |

49,1860 |

|

THB |

Thai baht |

45,101 |

|

BRL |

Brazilian real |

3,1037 |

|

MXN |

Mexican peso |

18,1319 |

|

INR |

Indian rupee |

83,6525 |

(1) Source: reference exchange rate published by the ECB.

|

8.5.2014 |

EN |

Official Journal of the European Union |

C 138/2 |

COMMISSION DECISION

of 5 May 2014

on appointing eight members of the European Statistical Advisory Committee

(2014/C 138/02)

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Decision No 234/2008/EC of the European Parliament and of the Council of 11 March 2008 establishing the European Statistical Advisory Committee and repealing Council Decision 91/116/EEC (1), and in particular Article 4(1)(a) thereof,

After consultation of the Council,

After consultation of the European Parliament,

Whereas:

|

(1) |

The European Statistical Advisory Committee comprises 24 members. |

|

(2) |

According to Article 4(1) of the Decision No 234/2008/EC, 8 members shall be appointed by the Commission, after consulting the European Parliament and the Council. |

|

(3) |

Member States have provided the Commission with a list of candidates with well-established qualifications in the field of statistics. |

|

(4) |

In the appointment of these eight members, the Commission has endeavoured to ensure that they represent in equal measure, users, respondents and other stakeholders in Community statistics (including the scientific community, the social partners and civil society). |

|

(5) |

A reserve list is established to be used in case of resignations or unexpected unavailability of the appointed members. Selection from the reserve list shall endeavour to maintain the balance between user groups, |

HAS ADOPTED THIS DECISION:

Article 1

The persons named in the Annex are hereby appointed as members of the European Statistical Advisory Committee for a term of five years.

Article 2

This Decision shall enter into force on the day following that of its publication in the Official Journal of the European Union.

Done at Luxembourg, 5 May 2014.

For the Commission

The President

José Manuel BARROSO

(1) OJ L 73, 15.3.2008, p. 13.

ANNEX

Axel Börsch-Supan

Maria João Casanova de Araújo e Sá Valente Rosa

Tasos C. Christofides

Irena Kotowska

Frances Ruane

Lena Sommestad

Ineke Stoop

Ildefonso Villàn Criado

Reserve list

Asta Manninen

Audroné Jakaitiene

Mojca Bavdaž

Sotiris Nikas

Roxane Silbermann

NOTICES FROM MEMBER STATES

|

8.5.2014 |

EN |

Official Journal of the European Union |

C 138/4 |

VALUE ADDED TAX (VAT)

EXEMPT INVESTMENT GOLD

List of gold coins meeting the criteria established in Article 344(1), point (2) of Council Directive 2006/112/EC of 28 November 2006 (special scheme for investment gold)

Valid for the year 2014

(2014/C 138/03)

EXPLANATORY NOTE

|

(a) |

This list reflects the contributions sent by Member States to the Commission within the deadline set by Article 345 of Council Directive 2006/112/EC of 28 November 2006 on the common system of value added tax. |

|

(b) |

The coins included in this list are considered to fulfil the criteria of Article 344 and therefore will be treated as investment gold in those Member States. As a result their supply is exempt from VAT for the whole of the 2014 calendar year. |

|

(c) |

The exemption will apply to all issues of the given coin in this list, except to issues of coins with a purity lower than 900 thousandths fine. |

|

(d) |

However, if a coin does not appear in this list, its supply will still be exempt where the coin meets the criteria for the exemption laid down in the VAT Directive. |

|

(e) |

The list is in alphabetical order, by names of countries and denominations of coins. Within the same category of coins, the listing follows the increasing value of the currency. |

|

(f) |

In the list the denomination of the coins reflects the currency shown on the coins. However, where the currency on the coins is not shown in roman script, where possible, its denomination in the list is shown in parenthesis. |

|

COUNTRY OF ISSUE |

COINS |

|

AFGHANISTAN |

(20 AFGHANI) 10 000 AFGHANI (1/2 AMANI) (1 AMANI) (2 AMANI) (4 GRAMS) (8 GRAMS) 1 TILLA 2 TILLAS |

|

ALBANIA |

20 LEKE 50 LEKE 100 LEKE 200 LEKE 500 LEKE 10 FRANGA 20 FRANGA 50 FRANGA 100 FRANGA |

|

ALDERNEY |

5 POUNDS 25 POUNDS 1 000 POUNDS |

|

ANDORRA |

5 CENTIMES 1 DINER 5 DINERS 20 DINERS 50 DINERS 100 DINERS 250 DINERS 1 SOVEREIGN |

|

ANGUILLA |

5 DOLLARS 10 DOLLARS 20 DOLLARS 100 DOLLARS |

|

ARGENTINA |

1 ARGENTINO 5 PESOS 25 PESOS 50 PESOS |

|

ARMENIA |

100 DRAM 10 000 DRAM 25 000 DRAM 50 000 DRAM |

|

ARUBA |

10 FLORIN 25 FLORIN 50 FLORIN 100 FLORIN |

|

AUSTRALIA |

5 DOLLARS 15 DOLLARS 25 DOLLARS 50 DOLLARS 100 DOLLARS 150 DOLLARS 200 DOLLARS 250 DOLLARS 500 DOLLARS 1 000 DOLLARS 2 500 DOLLARS 3 000 DOLLARS 10 000 DOLLARS 1/2 SOVEREIGN (= 1/2 POUND) 1 SOVEREIGN (= 1 POUND) |

|

AUSTRIA |

10 CORONA (= 10 KRONEN) 100 CORONA (= 100 KRONEN) (4 DUCATS) 10 EURO 25 EURO 50 EURO 100 EURO 4 FLORIN = 10 FRANCS (= 4 GULDEN) 8 FLORIN = 20 FRANCS (= 8 GULDEN) 25 SCHILLING 100 SCHILLING 200 SCHILLING 200 SHILLING/10 EURO 500 SCHILLING 1 000 SCHILLING 2 000 SCHILLING |

|

BAHAMAS |

5 DOLLARS 10 DOLLARS 20 DOLLARS 25 DOLLARS 50 DOLLARS 100 DOLLARS 150 DOLLARS 200 DOLLARS 250 DOLLARS 2 500 DOLLARS |

|

BARBADOS |

10 DOLLARS 25 DOLLARS 50 DOLLARS 100 DOLLARS 200 DOLLARS 250 DOLLARS |

|

BELGIUM |

10 ECU 20 ECU 25 ECU 50 ECU 100 ECU 50 EURO GOLD 100 EURO 10 FRANCS 20 FRANCS 5 000 FRANCS |

|

BELIZE |

25 DOLLARS 50 DOLLARS 100 DOLLARS 250 DOLLARS 500 DOLLARS |

|

BERMUDA |

10 DOLLARS 25 DOLLARS 30 DOLLARS 50 DOLLARS 60 DOLLARS 100 DOLLARS 180 DOLLARS 200 DOLLARS 250 DOLLARS |

|

BHUTAN |

1 SERTUM 2 SERTUMS 5 SERTUMS |

|

BIAFRA |

1 POUND 2 POUNDS 5 POUNDS 10 POUNDS 25 POUNDS |

|

BOLIVIA |

4 000 PESOS BOLIVIANOS |

|

BOTSWANA |

5 PULA 150 PULA 10 THEBE |

|

BRAZIL |

300 CRUZEIROS (4 000 REIS) (5 000 REIS) (6 400 REIS) (10 000 REIS) (20 000 REIS) 20 REAIS |

|

BRITISH VIRGIN ISLANDS |

20 DOLLARS 100 DOLLARS 250 DOLLARS 500 DOLLARS |

|

BULGARIA |

(1 LEV) (5 LEVA) (10 LEVA) (20 LEVA) (100 LEVA) (125 LEVA) (1 000 LEVA) (10 000 LEVA) (20 000 LEVA) |

|

BURUNDI |

10 FRANCS 25 FRANCS 50 FRANCS 100 FRANCS |

|

CANADA |

1 DOLLAR 2 DOLLARS 5 DOLLARS 10 DOLLARS 20 DOLLARS 50 DOLLARS 100 DOLLARS 175 DOLLARS 200 DOLLARS 350 DOLLARS 1 SOVEREIGN |

|

CAYMAN ISLANDS |

25 DOLLARS 50 DOLLARS 100 DOLLARS 250 DOLLARS |

|

CHAD |

3 000 FRANCS 5 000 FRANCS 10 000 FRANCS 20 000 FRANCS |

|

CHILE |

2 PESOS 5 PESOS 10 PESOS 20 PESOS 50 PESOS 100 PESOS 200 PESOS 500 PESOS |

|

CHINA |

5/20 YUAN (1/20 oz) 10/50 YUAN (1/10 oz) 25/100 YUAN (1/4 oz) 50/200 YUAN (1/2 oz) 100/500 YUAN (1 oz) 5 (YUAN) 10 (YUAN) 20 (YUAN) 25 (YUAN) 50 (YUAN) 100 (YUAN) 150 (YUAN) 200 (YUAN) 250 (YUAN) 300 (YUAN) 400 (YUAN) 450 (YUAN) 500 (YUAN) 1 000 (YUAN) 2 000 (YUAN) 10 000 (YUAN) |

|

COLOMBIA |

1 PESO 2 PESOS 2 1/2 PESOS 5 PESOS 10 PESOS 20 PESOS 100 PESOS 200 PESOS 300 PESOS 500 PESOS 1 000 PESOS 1 500 PESOS 2 000 PESOS 15 000 PESOS |

|

CONGO |

10 FRANCS 20 FRANCS 25 FRANCS 50 FRANCS 100 FRANCS |

|

COOK ISLANDS |

5 DOLLARS 10 DOLLARS 20 DOLLARS 25 DOLLARS 100 DOLLARS 200 DOLLARS 250 DOLLARS |

|

COSTA RICA |

5 COLONES 10 COLONES 20 COLONES 50 COLONES 100 COLONES 200 COLONES 1 500 COLONES 5 000 COLONES 25 000 COLONES 100 000 COLONES |

|

CUBA |

4 PESOS 5 PESOS 10 PESOS 20 PESOS 50 PESOS 100 PESOS |

|

CYPRUS |

50 POUNDS |

|

CZECH REPUBLIC |

1 000 KORUN (1 000 CZK) 2 000 KORUN (2 000 CZK) 2 500 KORUN (2 500 CZK) 5 000 KORUN (5 000 CZK) 10 000 KORUN (10 000 CZK) |

|

CZECHOSLOVAKIA |

1 DUKÁT 2 DUKÁT 5 DUKÁT 10 DUKÁT |

|

DENMARK |

10 KRONER 20 KRONER 1 000 KRONER |

|

DOMINICAN REPUBLIC |

30 PESOS 100 PESOS 200 PESOS 250 PESOS |

|

ECUADOR |

1 CONDOR 10 SUCRES |

|

EL SALVADOR |

25 COLONES 50 COLONES 100 COLONES 200 COLONES 250 COLONES |

|

EQUATORIAL GUINEA |

250 PESETAS 500 PESETAS 750 PESETAS 1 000 PESETAS 5 000 PESETAS |

|

ETHIOPIA |

400 BIRR 600 BIRR 10 (DOLLARS) 20 (DOLLARS) 50 (DOLLARS) 100 (DOLLARS) 200 (DOLLARS) |

|

FIJI |

5 DOLLARS 10 DOLLARS 200 DOLLARS 250 DOLLARS |

|

FINLAND |

100 EURO 20 MARKKAA 1 000 MARKKAA 2 000 MARKKAA |

|

FRANCE |

1/4 EURO 10 EURO 20 EURO 50 EURO 100 EURO 200 EURO 250 EURO 500 EURO 1 000 EURO 5 000 EURO 5 FRANCS 10 FRANCS 20 FRANCS 40 FRANCS 50 FRANCS 100 FRANCS 500 FRANCS 655,97 FRANCS |

|

GABON |

10 FRANCS 25 FRANCS 50 FRANCS 100 FRANCS 1 000 FRANCS 3 000 FRANCS 5 000 FRANCS 10 000 FRANCS 20 000 FRANCS |

|

GAMBIA |

200 DALASIS 500 DALASIS 1 000 DALASIS |

|

GERMANY |

1 DM 20 EURO 100 EURO 200 EURO 5 MARK 10 MARK 20 MARK |

|

GIBRALTAR |

1/25 CROWN 1/10 CROWN 1/5 CROWN 1/2 CROWN 1 CROWN 2 CROWNS 50 PENCE 1 POUND 5 POUNDS 25 POUNDS 50 POUNDS 100 POUNDS 1/25 ROYAL 1/10 ROYAL 1/5 ROYAL 1/2 ROYAL 1 ROYAL |

|

GUATAMALA |

5 QUETZALES 10 QUETZALES 20 QUETZALES |

|

GUERNSEY |

1 POUND 5 POUNDS 10 POUNDS 25 POUNDS 50 POUNDS 100 POUNDS |

|

GUINEA |

1 000 FRANCS 2 000 FRANCS 5 000 FRANCS 10 000 FRANCS |

|

HAITI |

20 GOURDES 50 GOURDES 100 GOURDES 200 GOURDES 500 GOURDES 1 000 GOURDES |

|

HONDURAS |

200 LEMPIRAS 500 LEMPIRAS |

|

HONG KONG |

1 000 DOLLARS |

|

HUNGARY |

1 DUKAT 4 FORINT = 10 FRANCS 8 FORINT = 20 FRANCS 50 FORINT 100 FORINT 200 FORINT 500 FORINT 1 000 FORINT 5 000 FORINT 10 000 FORINT 20 000 FORINT 50 000 FORINT 100 000 FORINT 500 000 FORINT 10 KORONA 20 KORONA 100 KORONA |

|

ICELAND |

500 KRONUR 10 000 KRONUR |

|

INDIA |

1 MOHUR 15 RUPEES 1 SOVEREIGN |

|

INDONESIA |

2 000 RUPIAH 5 000 RUPIAH 10 000 RUPIAH 20 000 RUPIAH 25 000 RUPIAH 100 000 RUPIAH 200 000 RUPIAH |

|

IRAN |

(1/2 AZADI) (1 AZADI) (1/4 PAHLAVI) (1/2 PAHLAVI) (1 PAHLAVI) (2 1/2 PAHLAVI) (5 PAHLAVI) (10 PAHLAVI) 50 POUND 500 RIALS 750 RIALS 1 000 RIALS 2 000 RIALS |

|

IRAQ |

(5 DINARS) (50 DINARS) (100 DINARS) |

|

ISLE OF MAN |

1/20 ANGEL 1/10 ANGEL 1/4 ANGEL 1/2 ANGEL 1 ANGEL 5 ANGEL 10 ANGEL 15 ANGEL 20 ANGEL 1/25 CROWN 1/10 CROWN 1/5 CROWN 1/2 CROWN 1 CROWN 50 PENCE 1 POUND 2 POUNDS 5 POUNDS 50 POUNDS (1/2 SOVEREIGN) (1 SOVEREIGN) (2 SOVEREIGNS) (5 SOVEREIGNS) |

|

ISRAEL |

20 LIROT 50 LIROT 100 LIROT 200 LIROT 500 LIROT 1 000 LIROT 5 000 LIROT 5 NEW SHEQALIM 10 NEW SHEQALIM 20 NEW SHEQALIM 5 SHEQALIM 10 SHEQALIM 500 SHEQEL |

|

ITALY |

20 EURO 50 EURO 5 LIRE 10 LIRE 20 LIRE 40 LIRE 80 LIRE 100 LIRE |

|

IVORY COAST |

10 FRANCS 25 FRANCS 50 FRANCS 100 FRANCS |

|

JAMAICA |

100 DOLLARS 250 DOLLARS |

|

JERSEY |

1 POUND 2 POUNDS 5 POUNDS 10 POUNDS 20 POUNDS 25 POUNDS 50 POUNDS 100 POUNDS 1 SOVEREIGN |

|

JORDAN |

2 DINARS 5 DINARS 10 DINARS 25 DINARS 50 DINARS 60 DINARS |

|

KATANGA |

5 FRANCS |

|

KENYA |

100 SHILLINGS 250 SHILLINGS 500 SHILLINGS |

|

KIRIBATI |

150 DOLLARS |

|

LATVIA |

100 LATU |

|

LESOTHO |

1 LOTI 2 MALOTI 4 MALOTI 10 MALOTI 20 MALOTI 50 MALOTI 100 MALOTI 250 MALOTI 500 MALOTI |

|

LIBERIA |

12 DOLLARS 20 DOLLARS 25 DOLLARS 30 DOLLARS 50 DOLLARS 100 DOLLARS 200 DOLLARS 250 DOLLARS 500 DOLLARS 2 500 DOLLARS |

|

LITHUANIA |

10 LITŲ 50 LITŲ 100 LITŲ 500 LITŲ |

|

LUXEMBOURG |

5 EURO 10 EURO 20 EURO 20 FRANCS 40 FRANCS |

|

MACAU |

250 PATACAS 500 PATACAS 1 000 PATACAS 10 000 PATACAS |

|

MALAWI |

250 KWACHA |

|

MALAYSIA |

100 RINGGIT 200 RINGGIT 250 RINGGIT 500 RINGGIT |

|

MALI |

10 FRANCS 25 FRANCS 50 FRANCS 100 FRANCS |

|

MALTA |

15 EURO 50 EURO 5 (LIRI) 10 (LIRI) 20 (LIRI) 25 (LIRI) 50 (LIRI) 100 (LIRI) LM 25 |

|

MARSHALL ISLANDS |

20 DOLLARS 50 DOLLARS 200 DOLLARS |

|

MAURITIUS |

100 RUPEES 200 RUPEES 250 RUPEES 500 RUPEES 1 000 RUPEES |

|

MEXICO |

1/20 ONZA 1/10 ONZA 1/4 ONZA 1/2 ONZA 1 ONZA 2 PESOS 2 1/2 PESOS 5 PESOS 10 PESOS 20 PESOS 50 PESOS 250 PESOS 500 PESOS 1 000 PESOS 2 000 PESOS |

|

MONACO |

10 EURO 20 EURO 100 EURO 20 FRANCS 100 FRANCS 200 FRANCS |

|

MONGOLIA |

750 (TUGRIK) 1 000 (TUGRIK) |

|

NEPAL |

1 ASARPHI 1 000 RUPEES |

|

NETHERLANDS |

(2 DUKAAT) 10 EURO 20 EURO 50 EURO 1 GULDEN 5 GULDEN 10 GULDEN |

|

NETHERLANDS ANTILLES |

5 GULDEN 10 GULDEN 50 GULDEN 100 GULDEN 300 GULDEN |

|

NEW ZEALAND |

5 DOLLARS 10 DOLLARS 150 DOLLARS 1,56 grammes/1/20 ounce 3,11 grammes/1/10 ounce 7,77 grammes/1/4 ounce 15,56 grammes/1/2 ounce 31,1 grammes/1 ounce |

|

NICARAGUA |

50 CORDOBAS |

|

NIGER |

10 FRANCS 25 FRANCS 50 FRANCS 100 FRANCS |

|

NORWAY |

10 KRONER 20 KRONER 1 500 KRONER |

|

OMAN |

25 BAISA 50 BAISA 100 BAISA 1/4 OMANI RIAL 1/2 OMANI RIAL OMANI RIAl 5 OMANI RIALS 10 OMANI RIALS 15 OMANI RIALS 20 OMANI RIALS 25 OMANI RIALS 75 OMANI RIALS |

|

PAKISTAN |

3 000 RUPEES |

|

PANAMA |

100 BALBOAS 500 BALBOAS |

|

PAPUA NEW GUINEA |

100 KINA |

|

PERU |

1/5 LIBRA 1/2 LIBRA 1 LIBRA 5 SOLES 10 SOLES 20 SOLES 50 SOLES 100 SOLES |

|

PHILIPPINES |

1 000 PISO 1 500 PISO 5 000 PISO |

|

POLAND |

10 ZŁOTYCH 20 ZŁOTYCH 30 ZŁOTYCH 50 ZŁOTYCH (orzeł bielik) 50 ZŁOTYCH 100 ZŁOTYCH (orzeł bielik) 100 ZŁOTYCH (exception: 100 ZŁOTYCH ‘Beatyfikacja Jana Pawła II 1 V 2011’) 200 ZŁOTYCH (orzeł bielik) 200 ZŁOTYCH 500 ZŁOTYCH (orzeł bielik) 500 ZŁOTYCH 200 000 ZŁOTYCH 500 000 ZŁOTYCH |

|

PORTUGAL |

1 ESCUDO 100 ESCUDOS 200 ESCUDOS 500 ESCUDOS 5 EURO 8 EURO 10 000 REIS |

|

RHODESIA |

1 POUND 5 POUNDS 10 SHILLINGS |

|

ROMANIA |

12 1/2 LEI 20 LEI 25 LEI 50 LEI 100 LEI 500 LEI 1 000 LEI 2 000 LEI 5 000 LEI |

|

RUSSIA |

1 (CHERVONET) 5 (ROUBLES) 7 1/2 (ROUBLES) 10 (ROUBLES) 15 (ROUBLES) 25 (ROUBLES) 50 (ROUBLES) 100 (ROUBLES) 200 (ROUBLES) 1 000 (ROUBLES) 10 000 (ROUBLES) |

|

RWANDA |

10 FRANCS 25 FRANCS 50 FRANCS 100 FRANCS |

|

SAINT HELENA |

1/16 GUINEA 1/8 GUINEA 1/4 GUINEA 1/2 GUINEA 1 GUINEA 2 GUINEAS 5 GUINEAS 2 POUNDS 5 POUNDS 1/16 SOVEREIGN 1/8 SOVEREIGN 1/4 SOVEREIGN 1/2 SOVEREIGN SOVEREIGN |

|

SAN MARINO |

20 EURO 50 EURO 1 SCUDO 2 SCUDI 5 SCUDI 10 SCUDI |

|

SAUDI ARABIA |

1 GUINEA (= 1 SAUDI POUND) |

|

SENEGAL |

10 FRANCS 25 FRANCS 50 FRANCS 100 FRANCS 250 FRANCS 500 FRANCS 1 000 FRANCS 2 500 FRANCS |

|

SERBIA |

10 DINARA 20 DINARA |

|

SEYCHELLES |

1 000 RUPEES 1 500 RUPEES |

|

SIERRA LEONE |

20 DOLLARS 50 DOLLARS 100 DOLLARS 250 DOLLARS 500 DOLLARS 2 500 DOLLARS 1/4 GOLDE 1/2 GOLDE 1 GOLDE 5 GOLDE 10 GOLDE 1 LEONE |

|

SINGAPORE |

1 DOLLAR 2 DOLLARS 5 DOLLARS 10 DOLLARS 20 DOLLARS 25 DOLLARS 50 DOLLARS 100 DOLLARS 150 DOLLARS 250 DOLLARS 500 DOLLARS |

|

SLOVAK REPUBLIC |

100 EURO 5 000 KORUN (5 000 SKK) 10 000 KORUN (10 000 SKK) |

|

SLOVENIA |

100 EURO 5 000 TOLARS 20 000 TOLARS 25 000 TOLARS |

|

SOLOMON ISLANDS |

10 DOLLARS 25 DOLLARS 50 DOLLARS 100 DOLLARS |

|

SOMALIA |

20 SHILLINGS 50 SHILLINGS 100 SHILLINGS 200 SHILLINGS 500 SHILLINGS 1 500 SHILLINGS |

|

SOUTH AFRICA |

1/10 KRUGERRAND 1/4 KRUGERRAND 1/2 KRUGERRAND 1 KRUGERRAND 1/10 oz NATURA 1/4 oz NATURA 1/2 oz NATURA 1 oz NATURA 1/2 POND 1 POND 1/10 PROTEA 1 PROTEA 1 RAND 2 RAND 5 RAND 25 RAND 1/2 SOVEREIGN (= 1/2 POUND) 1 SOVEREIGN (= 1 POUND) |

|

SOUTH KOREA |

2 500 WON 20 000 WON 25 000 WON 30 000 WON 50 000 WON |

|

SPAIN |

2 (ESCUDOS) 10 (ESCUDOS) 20 EURO 100 EURO 200 EURO 400 EURO 10 PESETAS 20 PESETAS 25 PESETAS 5 000 PESETAS 10 000 PESETAS 20 000 PESETAS 40 000 PESETAS 80 000 PESETAS 100 (REALES) |

|

SUDAN |

25 POUNDS 50 POUNDS 100 POUNDS |

|

SURINAM |

20 DOLLARS 50 DOLLARS 100 GULDEN |

|

SWAZILAND |

2 EMALANGENI 5 EMALANGENI 10 EMALANGENI 20 EMALANGENI 25 EMALANGENI 50 EMALANGENI 100 EMALAGENI 250 EMALAGENI 1 LILANGENI |

|

SWEDEN |

5 KRONOR 10 KRONOR 20 KRONOR 1 000 KRONOR 2 000 KRONOR |

|

SWITZERLAND |

10 FRANCS 20 FRANCS 50 FRANCS 100 FRANCS |

|

SYRIA |

(1/2 POUND) (1 POUND) |

|

TANZANIA |

1 500 SHILINGI 2 000 SHILINGI |

|

THAILAND |

(150 BAHT) (300 BAHT) (400 BAHT) (600 BAHT) (800 BAHT) (1 500 BAHT) (2 500 BAHT) (3 000 BAHT) (4 000 BAHT) (5 000 BAHT) (6 000 BAHT) |

|

TONGA |

1/2 HAU 1 HAU 5 HAU 1/4 KOULA 1/2 KOULA 1 KOULA |

|

TRISTAN DA CUNHA |

1/16 GUINEA 1/8 GUINEA 1/4 GUINEA 1/2 GUINEA 1 GUINEA 2 GUINEAS 5 GUINEAS 2 POUNDS 5 POUNDS 1/16 SOVEREIGN 1/8 SOVEREIGN QUARTER SOVEREIGN HALF SOVEREIGN SOVEREIGN |

|

TUNISIA |

2 DINARS 5 DINARS 10 DINARS 20 DINARS 40 DINARS 75 DINARS 10 FRANCS 20 FRANCS 100 FRANCS 5 PIASTRES |

|

TURKEY |

(25 KURUSH) (= 25 PIASTRES) (50 KURUSH) (= 50 PIASTRES) (100 KURUSH) (= 100 PIASTRES) (250 KURUSH) (= 250 PIASTRES) (500 KURUSH) (= 500 PIASTRES) 1/2 LIRA 1 LIRA 500 LIRA 1 000 LIRA 10 000 LIRA 50 000 LIRA 100 000 LIRA 200 000 LIRA 1 000 000 LIRA 60 000 000 LIRA |

|

TURKS AND CAICOS ISLANDS |

100 CROWNS |

|

TUVALU |

50 DOLLARS |

|

UGANDA |

50 SHILLINGS 100 SHILLINGS 500 SHILLINGS 1 000 SHILLINGS |

|

UNITED ARAB EMIRATES |

(500 DIRHAMS) (750 DIRHAMS) (1 000 DIRHAMS) |

|

UNITED KINGDOM |

(1/3 GUINEA) (1/2 GUINEA) 50 PENCE 2 POUNDS 5 POUNDS 10 POUNDS 25 POUNDS 50 POUNDS 100 POUNDS QUARTER SOVEREIGN (1/2 SOVEREIGN) (= 1/2 POUND) (1 SOVEREIGN) (= 1 POUND) (2 SOVEREIGNS) (5 SOVEREIGNS) |

|

URUGUAY |

5 000 NUEVO PESOS 20 000 NUEVO PESOS 5 PESOS |

|

USA |

1 DOLLAR 2,5 DOLLARS 5 DOLLARS 10 DOLLARS (AMERICAN EAGLE) 20 DOLLARS 25 DOLLARS 50 DOLLARS 50 DOLLARS (AMERICAN BUFFALO) 50 DOLLARS (AMERICAN EAGLE) |

|

VATICAN |

20 EURO 50 EURO 10 LIRE GOLD 20 LIRE 100 LIRE GOLD |

|

VENEZUELA |

(10 BOLIVARES) (20 BOLIVARES) (100 BOLIVARES) 1 000 BOLIVARES 3 000 BOLIVARES 5 000 BOLIVARES 10 000 BOLIVARES 5 VENEZOLANOS |

|

WESTERN SAMOA |

50 TALA 100 TALA |

|

YUGOSLAVIA |

20 DINARA 100 DINARA 200 DINARA 500 DINARA 1 000 DINARA 1 500 DINARA 2 000 DINARA 2 500 DINARA 5 000 DINARA 1 DUCAT 4 DUCATS |

|

ZAIRE |

100 ZAIRES |

|

ZAMBIA |

250 KWACHA |

NOTICES CONCERNING THE EUROPEAN ECONOMIC AREA

EFTA Surveillance Authority

|

8.5.2014 |

EN |

Official Journal of the European Union |

C 138/26 |

Information communicated by the EFTA States regarding State aid granted under the Act referred to in point 1j of Annex XV to the EEA Agreement (Commission Regulation (EC) No 800/2008 declaring certain categories of aid compatible with the common market in application of Articles 87 and 88 of the Treaty (General Block Exemption Regulation)

(2014/C 138/04)

PART I

|

Aid reference |

GBER 1/14/EMP |

||||

|

EFTA State |

Norway |

||||

|

Granting authority |

Name |

Arbeids- og velferdsetaten (The Norwegian Labour and Welfare Administration) |

|||

|

|

Address |

|

|||

|

|

Webpage |

www.nav.no |

|||

|

Title of the aid measure |

Disability assistance in working life (Funksjonsassistanse i arbeidslivet) |

||||

|

National legal basis (Reference to the relevant national official publication) |

Forskrift 11. desember 2008 nr. 1320 om arbeidsrettede tiltak mv. (Reg. 1320/2008) |

||||

|

Web link to the full text of the aid measure |

http://lovdata.no/dokument/SF/forskrift/2008-12-11-1320 |

||||

|

Type of measure |

Scheme |

X |

|||

|

Amendment of an existing aid measure |

GBER 6/12/EMP |

EFTA Surveillance Authority aid number |

|||

|

|

Prolongation |

X |

|||

|

Duration |

Scheme |

Unlimited |

|||

|

Economic sector(s) concerned |

All economic sectors eligible to receive aid |

X |

|||

|

Type of beneficiary |

SME |

X |

|||

|

|

Large enterprises |

X |

|||

|

Budget |

Annual overall amount of the budget planned under the scheme |

Approx. NOK 36 millions |

|||

|

Aid instrument (Article 5) |

Grant |

X |

|||

PART II

|

General Objectives (list) |

Objectives (list) |

Maximum aid intensity in % or Maximum aid amount in NOK |

SME – bonuses in % |

|

Aid for disadvantaged and disabled workers (Articles 40-42) |

Aid for the recruitment of disadvantaged workers in the form of wage subsidies (Article 40) |

…% |

|

|

|

Aid for the employment of disabled workers in the form of wage subsidies (Article 41) |

…% |

|

|

|

Aid for compensating the additional costs of employing disabled workers (Article 42) |

Documented additional costs for the assistant, for one year at the time |

|

|

8.5.2014 |

EN |

Official Journal of the European Union |

C 138/28 |

State aid — Decision to raise no objections

(2014/C 138/05)

The EFTA Surveillance Authority raises no objections to the following state aid measure:

|

Date of adoption of the decision |

: |

12 February 2014 |

||||

|

Case number |

: |

74910 |

||||

|

Decision number |

: |

56/14/COL |

||||

|

EFTA State |

: |

Norway |

||||

|

Title |

: |

A prolongation and a budget increase of the Norwegian Bioenergy Scheme |

||||

|

Legal basis |

: |

Annual Agricultural Agreement and state budget approved by the Norwegian Parliament for 2014 |

||||

|

Objective |

: |

Environmental protection; Increasing supply of renewable energy for heating, and contributing to energy saving |

||||

|

Form of aid |

: |

Grants |

||||

|

Budget |

: |

NOK 60 million (Annual budget subject to parliamentary budget procedures) |

||||

|

Duration |

: |

2014 (until expiry of the current Environmental Guidelines) |

||||

|

Economic sectors |

: |

Energy |

||||

|

Name and address of the granting authority |

: |

|

The authentic text of the decision, from which all confidential information has been removed, can be found on the EFTA Surveillance Authority’s website:

http://www.eftasurv.int/state-aid/state-aid-register/

|

8.5.2014 |

EN |

Official Journal of the European Union |

C 138/29 |

State aid — Decision to close an existing aid case as a result of acceptance of appropriate measures by an EFTA State

(2014/C 138/06)

The EFTA Surveillance Authority has proposed appropriate measures, which were accepted by Norway, on the following state aid measure:

|

Date of adoption of the decision |

: |

12 February 2014 |

|

Decision number |

: |

55/14/COL |

|

Case number |

: |

70957 |

|

EFTA State |

: |

Norway |

|

Title |

: |

Financing of safety training courses by county schools |

|

Legal basis |

: |

The Education Act of 17 July 1998 No 61 |

|

Objective |

: |

n.a. |

|

Economic sectors |

: |

Education |

|

Other information |

: |

Based on measures undertaken and further commitments given by the Norwegian authorities to amend the current financing regime of safety training courses by county schools, the Authority’s concerns regarding the incompatibility of the county schools’ financing of safety training courses were dispelled and the investigation closed. |

The authentic text of the decision, from which all confidential information has been removed, can be found on the EFTA Surveillance Authority’s website:

http://www.eftasurv.int/state-aid/state-aid-register/

V Announcements

COURT PROCEEDINGS

EFTA Court

|

8.5.2014 |

EN |

Official Journal of the European Union |

C 138/30 |

Action brought on 10 January 2014 by the EFTA Surveillance Authority against Iceland

(Case E-1/14)

(2014/C 138/07)

An action against Iceland was brought before the EFTA Court on 10 January 2014 by the EFTA Surveillance Authority, represented by Xavier Lewis and Markus Schneider, acting as Agents of the EFTA Surveillance Authority, Rue Belliard 35, 1040 Brussels, Belgium.

The EFTA Surveillance Authority requests the EFTA Court to:

|

1. |

Declare that by failing to adopt, and/or to notify the EFTA Surveillance Authority forthwith of, all the measures necessary to implement the Act referred to at point 18a of Annex XIII to the Agreement on the European Economic Area (Directive 2006/38/EC of the European Parliament and of the Council of 17 May 2006 amending Directive 1999/62/EC on the charging of heavy goods vehicles for the use of certain infrastructures), as adapted to the Agreement by way of Protocol 1 thereto, within the time prescribed, Iceland has failed to fulfil its obligations under the Act and under Article 7 of the Agreement. |

|

2. |

Order Iceland to bear the costs of these proceedings. |

Legal and factual background and pleas in law adduced in support:

|

— |

The application addresses Iceland’s failure to comply, no later than 20 April 2013, with a reasoned opinion delivered by the EFTA Surveillance Authority on 20 February 2013, regarding that State’s failure to implement into its national legal order Directive 2006/38/EC of the European Parliament and of the Council of 17 May 2006 amending Directive 1999/62/EC on the charging of heavy goods vehicles for the use of certain infrastructures (‘the Act’), as referred to at point 18a of Annex XIII to the Agreement on the European Economic Area, and as adapted to that Agreement by way of Protocol 1 thereto. |

|

— |

The EFTA Surveillance Authority submits that Iceland has failed to fulfil its obligations under Article 2 of the Act and under Article 7 of the EEA Agreement, by failing to adopt, and/or to notify the EFTA Surveillance Authority of, all the measures necessary to implement the Act within the time prescribed. |

|

8.5.2014 |

EN |

Official Journal of the European Union |

C 138/31 |

Action brought on 10 January 2014 by the EFTA Surveillance Authority against Iceland

(Case E-2/14)

(2014/C 138/08)

An action against Iceland was brought before the EFTA Court on 10 January 2014 by the EFTA Surveillance Authority, represented by Xavier Lewis and Markus Schneider, acting as Agents of the EFTA Surveillance Authority, Rue Belliard 35, 1040 Brussels, Belgium.

The EFTA Surveillance Authority requests the EFTA Court to:

|

1. |

Declare that by failing to adopt, and/or to notify the EFTA Surveillance Authority forthwith of, the measures necessary to implement the Act referred to at point 56v of Annex XIII to the Agreement on the European Economic Area (Directive 2005/35/EC of the European Parliament and of the Council of 7 September 2005 on ship-source pollution and on the introduction of penalties for infringements), as adapted to the Agreement by way of Protocol 1 thereto and by Joint Committee Decision No 65/2009 of 29 May 2009, within the time prescribed, Iceland has failed to fulfil its obligations under the Act and under Article 7 of the Agreement. |

|

2. |

Order Iceland to bear the costs of these proceedings. |

Legal and factual background and pleas in law adduced in support:

|

— |

The application addresses Iceland’s failure to comply, no later than 12 August 2013, with a reasoned opinion delivered by the EFTA Surveillance Authority on 12 June 2013, regarding that State’s failure to implement into its national legal order Directive 2005/35/EC of the European Parliament and of the Council of 7 September 2005 on ship-source pollution and on the introduction of penalties for infringements (‘the Act’), as referred to at point 56v of Annex XIII to the Agreement on the European Economic Area, and as adapted to that Agreement by way of Protocol 1 thereto and by Joint Committee Decision No 65/2009 of 29 May 2009. |

|

— |

The EFTA Surveillance Authority submits that Iceland has failed to fulfil its obligations under Article 16 of the Act, as adapted, and under Article 7 of the EEA Agreement, by failing to adopt, and/or to notify the EFTA Surveillance Authority of, the measures necessary to implement the Act within the time prescribed. |

|

8.5.2014 |

EN |

Official Journal of the European Union |

C 138/32 |

Action brought on 10 January 2014 by the EFTA Surveillance Authority against the Kingdom of Norway

(Case E-3/14)

(2014/C 138/09)

An action against the Kingdom of Norway was brought before the EFTA Court on 10 January 2014 by the EFTA Surveillance Authority, represented by Xavier Lewis and Markus Schneider, acting as Agents of the EFTA Surveillance Authority, Rue Belliard 35, 1040 Brussels, Belgium.

The EFTA Surveillance Authority requests the EFTA Court to:

|

1. |

Declare that by failing to adopt, and/or to notify the EFTA Surveillance Authority forthwith of, the measures necessary to implement the Act referred to at point 65a of Annex XIII to the Agreement on the European Economic Area (Directive 2009/12/EC of the European Parliament and of the Council of 11 March 2009 on airport charges), as adapted to the Agreement by way of Protocol 1 thereto, within the time prescribed, Norway has failed to fulfil its obligations under the Act and under Article 7 of the Agreement. |

|

2. |

Order the Kingdom of Norway to bear the costs of these proceedings. |

Legal and factual background and pleas in law adduced in support:

|

— |

The application addresses Norway’s failure to comply, no later than 30 March 2013, with a reasoned opinion delivered by the EFTA Surveillance Authority on 30 January 2013 regarding that state’s failure to implement into its national legal order Directive 2009/12/EC of the European Parliament and of the Council of 11 March 2009 on airport charges (‘the Act’), as referred to at point 65a of Annex XIII to the Agreement on the European Economic Area, and as adapted to that Agreement by way of Protocol 1 thereto. |

|

— |

The EFTA Surveillance Authority submits that Norway has failed to fulfil its obligations under Article 13 of the Act and under Article 7 of the EEA Agreement, by failing to adopt, and/or to notify the Authority of, the measures necessary to implement the Act within the time prescribed. |

PROCEDURES RELATING TO THE IMPLEMENTATION OF THE COMMON COMMERCIAL POLICY

European Commission

|

8.5.2014 |

EN |

Official Journal of the European Union |

C 138/33 |

Notice of initiation of an expiry review of the anti-dumping measures applicable to imports of certain pre- and post-stressing wires and wire strands of non-alloy steel (PSC wires and strands) originating in the People’s Republic of China

(2014/C 138/10)

Following the publication of a notice of impending expiry (1) of the anti-dumping measures in force on the imports of certain PSC wires and strands originating in the People’s Republic of China, the European Commission (‘the Commission’) has received a request for review pursuant to Article 11(2) of Council Regulation (EC) No 1225/2009 of 30 November 2009 on protection against dumped imports from countries not members of the European Community (2) (‘the basic Regulation’).

1. Request for review

The request was lodged on 7 February 2014 by the European Stress Information Service (‘ESIS’) (‘the applicant’) on behalf of producers representing more than 25 % of the total Union production of certain PSC wires and strands.

2. Product under review

The product subject to this review is not plated or not coated wire of non-alloy steel, wire of non-alloy steel plated or coated with zinc and stranded wire of non-alloy steel whether or not plated or coated with not more than 18 wires, containing by weight 0,6 % or more of carbon, with a maximum cross-sectional dimension exceeding 3 mm, (‘the product under review’), currently falling within CN codes ex 7217 10 90, ex 7217 20 90, ex 7312 10 61, ex 7312 10 65 and ex 7312 10 69 and originating in the People’s Republic of China. Galvanised (but not with any further coating material) seven wire strands in which the diameter of the central wire is identical to or less than 3 % greater than the diameter of any of the 6 other wires, originating in the People’s Republic of China, which are not covered by the measures currently in force, are not subject to this review.

3. Existing measures

The measures currently in force are a definitive anti-dumping duty imposed by Council Regulation (EC) No 383/2009 (3) as last amended by Council Implementing Regulation (EU) No 986/2012 (4).

4. Grounds for the review

The request is based on the grounds that the expiry of the measures would be likely to result in recurrence of dumping and recurrence of injury to the Union industry.

4.1. Allegation of likelihood of recurrence of dumping

Since, in view of the provisions of Article 2(7) of the basic Regulation, the People’s Republic of China (‘the country concerned’) is considered to be a non-market economy country, the applicant established normal value for the imports from the People’s Republic of China on the basis of the price in a market economy third country, namely Turkey. The allegation of likelihood of recurrence of dumping is based on a comparison of the normal value thus established with the export price (at ex-works level) of the product under review when sold for export to a number of other third country markets, in view of the current absence of significant import volumes from the People’s Republic of China to the Union.

On the basis of the above comparison, which shows dumping, the applicant alleges that there is a likelihood of recurrence of dumping from the country concerned.

4.2. Allegation of likelihood of recurrence of injury

The applicant alleges the likelihood of recurrence of injury. In this respect the applicant has provided prima facie evidence that, should measures be allowed to lapse, the current import level of the product under review from the country concerned to the Union is likely to increase due to the existence of unused capacity of the manufacturing facilities of the exporting producers in the People’s Republic of China.

Furthermore, the applicant alleges that following the recent imposition of anti-dumping and/or anti-subsidy measures on imports of the product under review in the United States of America and Malaysia, it can be reasonably expected that a certain volume of the exports from the country concerned to these markets will be diverted to the EU market if measures are allowed to lapse.

The applicant finally alleges that the partial removal of injury has been mainly due to the existence of measures and that any recurrence of substantial imports at dumped prices from the country concerned would likely lead to a recurrence of injury to the Union industry should measures be allowed to lapse.

5. Procedure

Having determined, after having consulted the Committee established by Article 15(1) of the basic Regulation in accordance with Article 11(6) of the basic Regulation, that sufficient evidence exists to justify the initiation of an expiry review, the Commission hereby initiates a review in accordance with Article 11(2) of the basic Regulation.

The review will determine whether the expiry of the measures would be likely to lead to a continuation or recurrence of dumping of the product under review originating in the country concerned and a continuation or recurrence of injury to the Union industry.

5.1. Procedure for the determination of a likelihood of continuation or recurrence of dumping

Exporting producers (5) of the product under review from the country concerned, including those that did not cooperate in the investigation leading to the measures in force, are invited to participate in the Commission investigation.

5.1.1. Investigating exporting producers

In view of the potentially large number of exporting producers in the People’s Republic of China involved in this expiry review and in order to complete the investigation within the statutory time limits, the Commission may limit the exporting producers to be investigated to a reasonable number by selecting a sample (this process is also referred to as ‘sampling’). The sampling will be carried out in accordance with Article 17 of the basic Regulation.

In order to enable the Commission to decide whether sampling is necessary, and if so, to select a sample, all exporting producers, or representatives acting on their behalf, including the ones who did not cooperate in the investigation leading to the measures subject to the present review, are hereby requested to make themselves known to the Commission. These parties have to do so within 15 days of the date of publication of this notice in the Official Journal of the European Union, unless otherwise specified, by providing the Commission with the information on their company(ies) requested in Annex I to this notice.

In order to obtain the information it deems necessary for the selection of the sample of exporting producers, the Commission will also contact the authorities of the country concerned and may contact any known associations of exporting producers.

All interested parties wishing to submit any other relevant information regarding the selection of the sample, excluding the information requested above, must do so within 21 days of the publication of this notice in the Official Journal of the European Union, unless otherwise specified.

If a sample is necessary, the exporting producers may be selected based on the largest representative volume of exports to the Union which can reasonably be investigated within the time available. All known exporting producers, the authorities of the country concerned and associations of exporting producers will be notified by the Commission, via the authorities of the country concerned if appropriate, of the companies selected to be in the sample.

In order to obtain the information it deems necessary for its investigation with regard to exporting producers, the Commission will send questionnaires to the exporting producers selected to be in the sample, to any known association of exporting producers and to the authorities of the country concerned.

All exporting producers selected to be in the sample, any known association of exporting producers and the authorities of the country concerned will have to submit a completed questionnaire within 37 days from the date of notification of the sample selection, unless otherwise specified.

Without prejudice to the possible application of Article 18 of the basic Regulation, companies that have agreed to their possible inclusion in the sample but are not selected to be in the sample will be considered to be cooperating (‘non-sampled cooperating exporting producers).

5.1.2. Additional procedure with regard to exporting producers in the non-market economy country concerned

In accordance with Article 2(7)(a) of the basic Regulation, in the case of imports from the country concerned normal value will be determined on the basis of the price or constructed value in a market economy third country.

In the previous investigation Turkey was used as a market economy third country for the purpose of establishing normal value in respect of the country concerned. For the purpose of the current investigation, the Commission envisages using again Turkey. Interested parties are hereby invited to comment on the appropriateness of this choice within 10 days of the date of publication of this notice in the Official Journal of the European Union. According to the information available to the Commission, other market economy suppliers of the Union may be located, inter alia, in South Africa, India, Thailand, South Korea, Brazil and Russia. The Commission will examine whether there is production and sales of the product under review in those market economy third countries for which there are indications that production of the product under review is taking place.

5.1.3. Investigating unrelated importers (6) (7)

Unrelated importers of the product under review from the country concerned to the Union are invited to participate in this investigation.

In view of the potentially large number of unrelated importers involved in this expiry review and in order to complete the investigation within the statutory time limits, the Commission may limit to a reasonable number the unrelated importers that will be investigated by selecting a sample (this process is also referred to as ‘sampling’). The sampling will be carried out in accordance with Article 17 of the basic Regulation.

In order to enable the Commission to decide whether sampling is necessary and, if so, to select a sample, all unrelated importers, or representatives acting on their behalf, including the ones who did not cooperate in the investigation leading to the measures subject to the present review, are hereby requested to make themselves known to the Commission. These parties must do so within 15 days of the date of publication of this notice in the Official Journal of the European Union, unless otherwise specified, by providing the Commission with the information on their company(ies) requested in Annex II to this notice.

In order to obtain information it deems necessary for the selection of the sample of unrelated importers, the Commission may also contact any known associations of importers.

All interested parties wishing to submit any other relevant information regarding the selection of the sample, excluding the information requested above, must do so within 21 days of the publication of this notice in the Official Journal of the European Union, unless otherwise specified.

If a sample is necessary, the importers may be selected based on the largest representative volume of sales of the product under review in the Union which can reasonably be investigated within the time available. All known unrelated importers and associations of importers will be notified by the Commission of the companies selected to be in the sample.

In order to obtain the information it deems necessary for its investigation, the Commission will send questionnaires to the sampled unrelated importers and to any known association of importers. These parties must submit a completed questionnaire within 37 days from the date of the notification of the sample selection, unless otherwise specified.

5.2. Procedure for the determination of a likelihood of a continuation or recurrence of injury

In order to establish whether there is a likelihood of a continuation or recurrence of injury to the Union industry, Union producers of the product under review are invited to participate in the Commission investigation.

In view of the large number of Union producers involved in this expiry review and in order to complete the investigation within the statutory time limits, the Commission has decided to limit to a reasonable number the Union producers that will be investigated by selecting a sample (this process is also referred to as ‘sampling’). The sampling is carried out in accordance with Article 17 of the basic Regulation.

The Commission has provisionally selected a sample of Union producers. Details can be found in the file for inspection by interested parties. Interested parties are hereby invited to consult the file (for this they should contact the Commission using the contact details provided in section 5.6 below). Other Union producers, or representatives acting on their behalf, including Union producers who did not cooperate in the investigation leading to the measures in force, that consider that there are reasons why they should be included in the sample must contact the Commission within 15 days of the date of publication of this notice in the Official Journal of the European Union.

All interested parties wishing to submit any other relevant information regarding the selection of the sample must do so within 21 days of the publication of this notice in the Official Journal of the European Union, unless otherwise specified.

All known Union producers and/or associations of Union producers will be notified by the Commission of the companies finally selected to be in the sample.

In order to obtain the information it deems necessary for its investigation, the Commission will send questionnaires to the sampled Union producers and to any known associations of Union producers. These parties must submit a completed questionnaire within 37 days from the date of the notification of the sample selection, unless otherwise specified.

5.3. Procedure for the assessment of Union interest

Should the likelihood of continuation or recurrence of dumping and injury be confirmed, a decision will be reached, pursuant to Article 21 of the basic Regulation, as to whether maintaining the anti-dumping measures would not be against the Union interest. Union producers, importers and their representative associations, users and their representative associations, and representative consumer organisations are invited to make themselves known within 15 days of the date of publication of this notice in the Official Journal of the European Union, unless otherwise specified. In order to participate in the investigation, the representative consumer organisations have to demonstrate, within the same deadline, that there is an objective link between their activities and the product under review.

Parties that make themselves known within the above deadline may provide the Commission with information on the Union interest within 37 days of the date of publication of this notice in the Official Journal of the European Union, unless otherwise specified. This information may be provided either in a free format or by completing a questionnaire prepared by the Commission. In any case, information submitted pursuant to Article 21 of the basic Regulation will only be taken into account if supported by factual evidence at the time of submission.

5.4. Other written submissions

Subject to the provisions of this notice, all interested parties are hereby invited to make their views known, submit information and provide supporting evidence. Unless otherwise specified, this information and supporting evidence must reach the Commission within 37 days of the date of publication of this notice in the Official Journal of the European Union.

5.5. Possibility to be heard by the Commission investigation services

All interested parties may request to be heard by the Commission investigation services. Any request to be heard must be made in writing and must specify the reasons for the request. For hearings on issues pertaining to the initial stage of the investigation the request must be submitted within 15 days of the date of publication of this notice in the Official Journal of the European Union. Thereafter, a request to be heard must be submitted within the specific deadlines set by the Commission in its communication with the parties.

5.6. Instructions for making written submissions and sending completed questionnaires and correspondence

All written submissions, including the information requested in this notice, completed questionnaires and correspondence provided by interested parties for which confidential treatment is requested shall be labelled ‘Limited’ (8).

Interested parties providing ‘Limited’ information are required to furnish non-confidential summaries of it pursuant to Article 19(2) of the basic Regulation, which will be labelled ‘For inspection by interested parties’. These summaries must be sufficiently detailed to permit a reasonable understanding of the substance of the information submitted in confidence. If an interested party providing confidential information does not furnish a non-confidential summary of it in the requested format and quality, such information may be disregarded.

Interested parties are invited to make all submissions and requests by e-mail including scanned powers of attorney and certification sheets, with the exception of voluminous replies which shall be submitted on a CD-ROM or DVD by hand or by registered mail. By using e-mail, interested parties express their agreement with the rules applicable to electronic submissions contained in the document ‘CORRESPONDENCE WITH THE EUROPEAN COMMISSION IN TRADE DEFENCE CASES’ published on the website of the Directorate-General for Trade: http://trade.ec.europa.eu/doclib/docs/2011/june/tradoc_148003.pdf The interested parties must indicate their name, address, telephone and a valid e-mail address and they should ensure that the provided e-mail address is a functioning official business e-mail which is checked on a daily basis. Once contact details are provided, the Commission will communicate with interested parties by e-mail only, unless they explicitly request to receive all documents from the Commission by other means of communication or unless the nature of the document to be sent requires the use of a registered mail. For further rules and information concerning correspondence with the Commission including principles that apply to submissions by e-mail, interested parties should consult the communication instructions with interested parties referred to above.

Commission address for correspondence:

|

European Commission |

||||

|

Directorate-General for Trade |

||||

|

Directorate H |

||||

|

Office: N105 08/020 |

||||

|

1049 Bruxelles/Brussel |

||||

|

BELGIQUE/BELGIË |

||||

|

E-mail: |

||||

|

6. Non-cooperation

In cases where any interested party refuses access to or does not provide the necessary information within the time limits, or significantly impedes the investigation, findings, affirmative or negative, may be made on the basis of facts available, in accordance with Article 18 of the basic Regulation.

Where it is found that any interested party has supplied false or misleading information, the information may be disregarded and use may be made of facts available.

If an interested party does not cooperate or cooperates only partially and findings are therefore based on facts available in accordance with Article 18 of the basic Regulation, the result may be less favourable to that party than if it had cooperated.

Failure to give a computerised response shall not be deemed to constitute non-cooperation, provided that the interested party shows that presenting the response as requested would result in an unreasonable extra burden or unreasonable additional cost. The interested party should immediately contact the Commission.

7. Hearing Officer

Interested parties may request the intervention of the Hearing Officer for the Directorate-General for Trade. The Hearing Officer acts as an interface between the interested parties and the Commission investigation services. The Hearing Officer reviews requests for access to the file, disputes regarding the confidentiality of documents, requests for extension of time limits and requests by third parties to be heard. The Hearing Officer may organise a hearing with an individual interested party and mediate to ensure that the interested parties’ rights of defence are being fully exercised.

A request for a hearing with the Hearing Officer should be made in writing and should specify the reasons for the request. For hearings on issues pertaining to the initial stage of the investigation the request must be submitted within 15 days of the date of publication of this notice in the Official Journal of the European Union. Thereafter, a request to be heard must be submitted within specific deadlines set by the Commission in its communication with the parties.

The Hearing Officer will also provide opportunities for a hearing involving parties to take place which would allow different views to be presented and rebuttal arguments offered on issues pertaining, among other things, to the likelihood of a continuation or recurrence of dumping and injury and Union interest.

For further information and contact details interested parties may consult the Hearing Officer’s web pages on DG Trade’s website: http://ec.europa.eu/commission_2010-2014/degucht/contact/hearing-officer/

8. Schedule of the investigation

The investigation will be concluded, pursuant to Article 11(5) of the basic Regulation within 15 months of the date of the publication of this notice in the Official Journal of the European Union.

9. Possibility to request a review under Article 11(3) of the basic Regulation

As this expiry review is initiated in accordance with the provisions of Article 11(2) of the basic Regulation, the findings thereof will not lead to the existing measures being amended but will lead to those measures being repealed or maintained in accordance with Article 11(6) of the basic Regulation.

If any interested party considers that a review of the measures is warranted so as to allow for the possibility to amend the measures, that party may request a review pursuant to Article 11(3) of the basic Regulation.

Parties wishing to request such a review, which would be carried out independently of the expiry review mentioned in this notice, may contact the Commission at the address given above.

10. Processing of personal data

Any personal data collected in this investigation will be treated in accordance with Regulation (EC) No 45/2001 of the European Parliament and of the Council of 18 December 2000 on the protection of individuals with regard to the processing of personal data by the Community institutions and bodies and on the free movement of such data (9).

(1) OJ C 270, 19.9.2013, p. 12.

(2) OJ L 343, 22.12.2009, p. 51.

(3) OJ L 118, 13.5.2009, p. 1.

(4) OJ L 297, 26.10.2012, p. 1.

(5) An exporting producer is any company in the country concerned which produces and exports the product under review to the Union market, either directly or via third party, including any of its related companies involved in the production, domestic sales or exports of the product concerned.

(6) Only importers not related to exporting producers can be sampled. Importers that are related to exporting producers have to fill in Annex I to the questionnaire for these exporting producers. For the definition of a related party see footnotes 5 and 8 of the Annexes I and II to this Notice.

(7) The data provided by unrelated importers may also be used in relation to aspects of this investigation other than the determination of dumping.

(8) A ‘Limited’ document is a document which is considered confidential pursuant to Article 19 of Regulation (EC) No 1225/2009 and Article 6 of the WTO Agreement on Implementation of Article VI of the GATT 1994 (Anti-Dumping Agreement). It is also a document protected pursuant to Article 4 of Regulation (EC) No 1049/2001 of the European Parliament and of the Council (OJ L 145, 31.5.2001, p. 43).

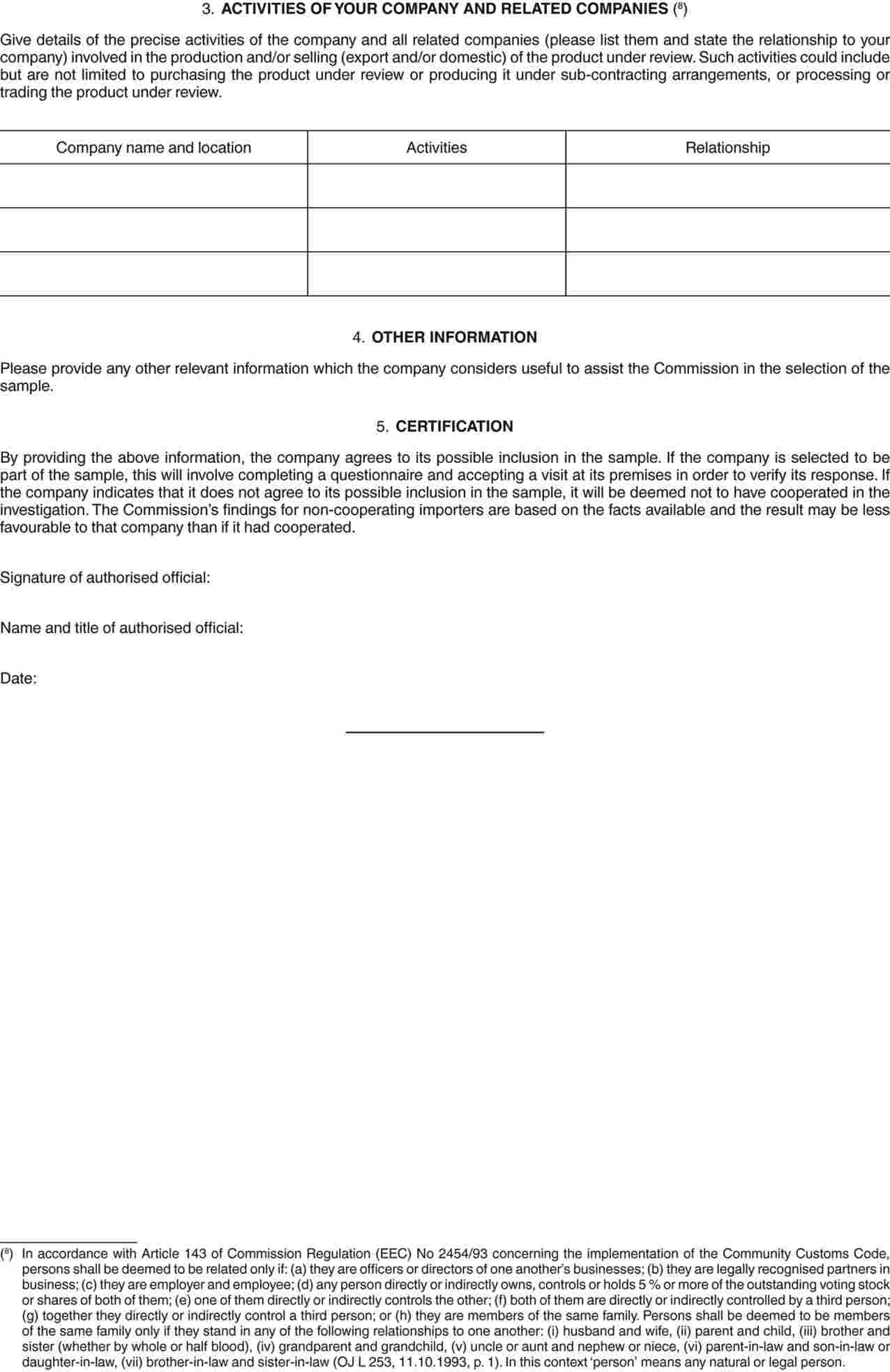

ANNEX I

ANNEX II

PROCEDURES RELATING TO THE IMPLEMENTATION OF COMPETITION POLICY

European Commission

|

8.5.2014 |

EN |

Official Journal of the European Union |

C 138/44 |

Prior notification of a concentration

(Case M.7223 — Danish Crown/Sokolow)

Candidate case for simplified procedure

(Text with EEA relevance)

(2014/C 138/11)

|

1. |

On 30 April 2014, the European Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 (1) by which the undertaking Danish Crown A/S (‘Danish Crown’, Denmark) acquires within the meaning of Article 3(1)(b) of the Merger Regulation sole control of the whole of the undertaking Sokolów SA (‘Sokolów’, Poland) by way of purchase of shares. Sokolów is currently jointly controlled by Danish Crown and the Finnish food company HKScan OYJ. |

|

2. |

The business activities of the undertakings concerned are: — for Danish Crown: vertically integrated food company which supplies live animals, including pigs and cattle, to slaughterhouses. Danish Crown is based in Denmark but has production facilities in several countries and activities worldwide, — for Sokolów: vertically integrated food company which is active in the slaughtering of live animals, including pigs and cattle, and in the processing of meat, including pig, beef and poultry. Sokolów has production facilities in Poland. |

|

3. |

On preliminary examination, the European Commission finds that the notified transaction could fall within the scope of the Merger Regulation. However, the final decision on this point is reserved. Pursuant to the Commission Notice on a simplified procedure for treatment of certain concentrations under the Council Regulation (EC) No 139/2004 (2) it should be noted that this case is a candidate for treatment under the procedure set out in the Notice. |

|

4. |

The European Commission invites interested third parties to submit their possible observations on the proposed operation to the European Commission. Observations must reach the European Commission not later than 10 days following the date of this publication. Observations can be sent to the European Commission by fax (+32 22964301), by e-mail to COMP-MERGER-REGISTRY@ec.europa.eu or by post, under reference number M.7223 — Danish Crown/Sokolow to the following address:

|

(1) OJ L 24, 29.1.2004, p. 1 (the ‘Merger Regulation’).

(2) OJ C 366, 14.12.2013, p. 5.