ISSN 1725-2423

Official Journal

of the European Union

C 16

English edition

Information and Notices

Volume 52

22 January 2009

|

ISSN 1725-2423 |

||

|

Official Journal of the European Union |

C 16 |

|

|

||

|

English edition |

Information and Notices |

Volume 52 |

|

Notice No |

Contents |

page |

|

|

II Information |

|

|

|

INFORMATION FROM EUROPEAN UNION INSTITUTIONS AND BODIES |

|

|

|

Commission |

|

|

2009/C 016/01 |

||

|

|

European Central Bank |

|

|

2009/C 016/02 |

||

|

|

IV Notices |

|

|

|

NOTICES FROM EUROPEAN UNION INSTITUTIONS AND BODIES |

|

|

|

Commission |

|

|

2009/C 016/03 |

||

|

|

NOTICES FROM MEMBER STATES |

|

|

2009/C 016/04 |

Commission notice pursuant to Article 16(4) of Regulation (EC) No 1008/2008 of the European Parliament and of the Council on common rules for the operation of air services in the Community — Public service obligations in respect of scheduled air services ( 1 ) |

|

|

2009/C 016/05 |

Commission communication pursuant to Article 17(5) of Regulation (EC) No 1008/2008 of the European Parliament and of the Council on common rules for the operation of air services in the Community — Invitation to tender in respect of the operation of scheduled air services in accordance with public service obligations ( 1 ) |

|

|

|

NOTICES CONCERNING THE EUROPEAN ECONOMIC AREA |

|

|

|

EFTA Surveillance Authority |

|

|

2009/C 016/06 |

||

|

|

V Announcements |

|

|

|

ADMINISTRATIVE PROCEDURES |

|

|

|

Commission |

|

|

2009/C 016/07 |

||

|

|

PROCEDURES RELATING TO THE IMPLEMENTATION OF THE COMPETITION POLICY |

|

|

|

Commission |

|

|

2009/C 016/08 |

Prior notification of a concentration (Case COMP/M.5436 — Citi Infrastructure Partners, L.P./Itínere Infraestructuras S.A.) — Candidate case for simplified procedure ( 1 ) |

|

|

|

OTHER ACTS |

|

|

|

Commission |

|

|

2009/C 016/09 |

||

|

|

|

|

|

(1) Text with EEA relevance |

|

EN |

|

II Information

INFORMATION FROM EUROPEAN UNION INSTITUTIONS AND BODIES

Commission

|

22.1.2009 |

EN |

Official Journal of the European Union |

C 16/1 |

Communication from the Commission — Temporary Community framework for State aid measures to support access to finance in the current financial and economic crisis

(2009/C 16/01)

1. THE FINANCIAL CRISIS, ITS IMPACT ON THE REAL ECONOMY AND THE NEED FOR TEMPORARY MEASURES

1.1. The financial crisis and its impact on the real economy

On 26 November 2008, the Commission adopted the Communication ‘A European Economic Recovery Plan’ (1) (‘the Recovery Plan’) to drive Europe's recovery from the current financial crisis. The Recovery Plan is based on two mutually reinforcing main elements. Firstly, short-term measures to boost demand, save jobs and help restore confidence and, secondly, ‘smart investment’ to yield higher growth and sustainable prosperity in the longer term. The Recovery Plan will intensify and accelerate reforms already underway under the Lisbon Strategy.

In this context, the challenge for the Community is avoiding public intervention which would undermine the objective of less and better targeted State aid. Nevertheless, under certain conditions, there is a need for new temporary State aid.

The Recovery Plan also includes further initiatives to apply State aid rules in a way that achieves maximum flexibility for tackling the crisis while maintaining a level playing field and avoiding undue restrictions of competition. This Communication gives details of a number of additional temporary openings for Member States to grant State aid.

First, the financial crisis has a hard impact on the banking sector in the Community. The Council has stressed that, although public intervention has to be decided at national level, this needs to be done within a coordinated framework and on the basis of a number of common Community principles (2). The Commission reacted immediately with various measures including the adoption of the Communication on the application of State aid rules to measures taken in relation to financial institutions in the context of the current global financial crisis (3) and of a number of decisions authorising rescue aid to financial institutions.

Sufficient and affordable access to finance is a precondition for investment, growth and job creation by the private sector. Member States need to use the leverage they have acquired as a result of providing substantial financial support to the banking sector to ensure that this support does not lead merely to an improvement in the financial situation of the banks without any benefit to the economy at large. Support for the financial sector should therefore be well targeted to guarantee that banks resume their normal lending activities. The Commission will take this into account when reviewing State aid to banks.

While the situation on financial markets appears to be improving, the full impact of the financial crisis on the real economy is now being felt. A very serious downturn is affecting the wider economy and hitting households, businesses and jobs. In particular, as a consequence of the crisis on financial markets, banks are deleveraging and becoming much more risk-averse than in previous years, leading to a credit squeeze. This financial crisis could trigger credit rationing, a drop in demand and recession.

Such difficulties could affect not only weak companies without solvency buffers, but also healthy companies which will find themselves facing a sudden shortage or even unavailability of credit. This will be particularly true for small and medium-sized undertakings (‘SMEs’), which in any event face greater difficulties with access to finance than larger companies. This situation could not only seriously affect the economic situation of many healthy companies and their employees in the short and medium term but also have longer-lasting negative effects since all Community investments in the future — in particular, towards sustainable growth and other objectives of the Lisbon Strategy — could be delayed or even abandoned.

1.2. The need for close European coordination of national aid measures

In the current financial situation, Member States could be tempted to go it alone and, in particular, to wage a subsidy race to support their companies. Past experience shows that individual action of this kind cannot be effective and could seriously damage the internal market. When granting support, taking fully into consideration the current specific economic situation, it is crucial to ensure a level playing field for European companies and to avoid Member States engaging in subsidy races which would be unsustainable and detrimental to the Community as a whole. Competition policy is there to ensure this.

1.3. The need for temporary State aid measures

While State aid is no miracle cure to the current difficulties, well targeted public support for companies could be a helpful component in the overall effort both to unblock lending to companies and to encourage continued investment in a low-carbon future.

The temporary additional measures provided for in this Communication pursue two objectives: first, in the light of the exceptional and transitory financing problems linked to the banking crisis, to unblock bank lending to companies and thereby guarantee continuity in their access to finance. As borne out by the recently adopted Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions ‘Think Small First’ — A ‘Small Business Act’ for Europe of 25 June 2008 (4), SMEs are particularly important for the whole economy in Europe and improving their financial situation will also have positive effects for large companies, thereby supporting overall economic growth and modernisation in the longer term.

The second objective is to encourage companies to continue investing in the future, in particular in a sustainable growth economy. There could indeed possibly be dramatic consequences if, as a result of the current crisis, the significant progress that has been achieved in the environmental field were to be halted or even reversed. For this reason, it is necessary to provide temporary support to companies for investing in environmental projects (which could, inter alia, give a technological edge to Community industry), thereby combining urgent and necessary financial support with long-term benefits for Europe.

This Communication first recalls the manifold opportunities for public support which are already at the disposal of Member States under existing State aid rules, before setting out additional State aid measures that Member States may grant temporarily in order to remedy the difficulties which some companies are currently encountering with access to finance and to promote investment pursuing environmental objectives.

The Commission considers that the proposed aid instruments are the most appropriate ones to achieve those objectives.

2. GENERAL ECONOMIC POLICY MEASURES

The Recovery Plan was adopted in response to the current economic situation. Given the scale of the crisis, the Community needs a coordinated approach, big enough and bold enough to restore consumer and business confidence.

The strategic aims of the Recovery Plan are to:

|

— |

swiftly stimulate demand and boost consumer confidence, |

|

— |

lessen the human cost of the economic downturn and its impact on the most vulnerable. Many workers and their families are or will be hit by the crisis. Action can be taken to help stem the loss of jobs and then to help people return rapidly to the labour market, rather than face long-term unemployment, |

|

— |

help Europe to prepare to capitalise when growth returns, so that the European economy is in tune with the demands for competitiveness and sustainability and the needs of the future, as outlined in the Lisbon Strategy. That means supporting innovation, building a knowledge economy and speeding up the shift towards a low-carbon and resource-efficient economy. |

To achieve those objectives, Member States already have at their disposal a number of instruments which are not considered State aid. For instance, some companies may be experiencing even more acute difficulties with access to finance than others, thereby delaying or even scuppering the financing necessary for their growth and for seeing through investments envisaged. For this purpose, Member States could adopt a series of general policy measures, applicable to all companies on their territories and, consequently, falling outside the State aid rules, with the aim of temporarily alleviating financing problems in the short and medium term. For example, payment deadlines for social security and similar charges, or even taxes could be extended or measures for employees could be introduced. If such measures are open to all undertakings, in principle they do not constitute State aid.

Member States may also grant financial support directly to consumers, for instance for scrapping old products and/or buying green products. If such aid is granted without discrimination based on the origin of the product, it does not constitute State aid.

Moreover, general Community programmes, like the Competitiveness and Innovation Framework Programme (2007 to 2013) established by Decision No 1639/2006/EC of the European Parliament and of the Council of 24 October 2006 (5) and the Seventh Framework Programme of the European Community for research, technological development and demonstration activities (2007-2013) established by Decision No 1982/2006/EC of the European Parliament and of the Council of 18 December 2006 (6) may be used to best effect to deliver support to SMEs, but also to large undertakings. This is fully in line with other European initiatives, such as the European Investment Bank's decision to mobilise EUR 30 billion to support European SMEs and its commitment to step up its ability to intervene in infrastructure projects.

3. STATE AID POSSIBLE UNDER EXISTING INSTRUMENTS

Over the last few years, the Commission has significantly modernised the State aid rules in order to encourage Member States to target public support better on sustainable investments, thus contributing to the Lisbon Strategy. In this context, particular emphasis has been given to SMEs, accompanied by more openings for granting State aid. In addition, the State aid rules have been greatly simplified and streamlined by Commission Regulation (EC) No 800/2008 of 6 August 2008 declaring certain categories of aid compatible with the common market in application of Articles 87 and 88 of the Treaty (General block exemption Regulation) (7) (‘the GBER’) which now offers Member States a wide panoply of aid measures with minimum administrative burden. In the current economic situation, the following existing State aid instruments are of particular importance:

Commission Regulation (EC) No 1998/2006 of 15 December 2006 on the application of Articles 87 and 88 of the Treaty to de minimis aid (8) (‘the de minimis Regulation’) specifies that support measures worth up to EUR 200 000 per company over any three-year period do not constitute State aid within the meaning of the Treaty. The same Regulation also states that guarantees of up to EUR 1,5 million do not exceed the de minimis threshold and therefore do not constitute aid. Consequently, Member States can grant such guarantees without calculation of the corresponding aid equivalent and without administrative burdens.

The GBER forms a central element of the State aid rules by simplifying the State aid procedure for certain important aid measures and fostering redirection of State aid to priority Community objectives. All previously existing block exemptions, along with new areas (innovation, environment, research and development for large companies and risk capital measures for SMEs), have been brought under a single instrument. In all the cases covered by the GBER, Member States can grant aid without prior notification to the Commission. Therefore, the speed of the process lies fully in the hands of Member States. The GBER is particularly important for SMEs, in that it provides for special rules on investment and employment aid exclusively for SMEs. In addition, all the 26 measures covered are open to SMEs, allowing Member States to accompany SMEs during the different stages in their development, assisting them in areas ranging from access to finance to research and development, innovation, training, employment, environmental measures, etc.

New Community guidelines on State aid for environmental protection (9) were adopted as part of the Energy and Climate Change Package at the beginning of 2008. Under those guidelines, Member States may grant State aid, inter alia, as follows:

|

— |

aid for companies which improve their environmental performance beyond Community standards, or in the absence of Community standards, of up to 70 % of the extra investment costs (up to 80 % in the field of eco-innovation) for small undertakings and of up to 100 % of the extra investment costs if the aid is granted following a genuinely competitive bidding process, even for large companies; aid for early adaptation to future Community standards and aid for environmental studies is also allowed, |

|

— |

in the field of renewable energies and cogeneration, Member States may grant operating aid to cover all extra production costs, |

|

— |

in order to attain environmental targets for energy saving and for reductions in greenhouse gas emissions, Member States may grant aid enabling undertakings to achieve energy savings and aid for renewable energy sources and cogeneration of up to 80 % of the extra investment costs for small undertakings and of up to 100 % of the extra investment costs if the aid is granted following a genuinely competitive bidding process. |

In December 2006, the Commission adopted a new Community framework for State aid for research and development and innovation (10). That text contains new provisions on innovation, specially targeted at SMEs and also corresponding to better targeting of aid on job and growth creation along the lines set out in the Lisbon Strategy. In particular Member States may grant State aid, inter alia, as follows:

|

— |

aid for R & D projects, in particular aid for fundamental research, of up to 100 % of the eligible costs and aid for industrial research of up to 80 % for small enterprises, |

|

— |

aid for young innovative enterprises of up to EUR 1 million and even more in assisted regions, aid for innovation clusters, aid for innovation advisory services and aid for innovation support services, |

|

— |

aid for the loan of highly qualified personnel, aid for technical feasibility studies, aid for process and organisational innovation in services and aid for industrial property rights costs for SMEs. |

Training is another key element for competitiveness. It is critically important to maintain investment in training, even at a time of rising unemployment, in order to develop new skills. Under the GBER, Member States may grant both general and specific training aid to companies totalling up to 80 % of the eligible costs.

In 2008, the Commission adopted a new Notice on the application of Articles 87 and 88 of the EC Treaty to State aid in the form of guarantees (11), which specifies the conditions under which public guarantees for loans do not constitute State aid. In accordance with that Notice, guarantees are not considered State aid, in particular, when a market price is paid for them. Besides clarifying the conditions which determine whether or not aid in the form of guarantees is present, the Notice also introduces, for the first time, specific safe-harbour premiums for SMEs, allowing easier but safe use of guarantees in order to foster the financing of SMEs.

New Community guidelines on State aid to promote risk capital investments in small and medium-sized enterprises (12) were adopted by the Commission in July 2006. They are aimed at innovative and fast-growing SMEs — a key focus of the Lisbon Strategy. The Commission put in place a new safe-harbour threshold of EUR 1,5 million per target SME, a 50 % increase. Beneath that ceiling the Commission accepts that, as a rule, alternative means of funding from financial markets are lacking (that is to say, that a market failure exists). In addition, aid for risk capital has been included in the GBER.

In disadvantaged regions, Member States can grant investment aid for setting up a new establishment, extending an existing establishment or diversifying into new products under the Guidelines on national regional aid for 2007-2013 (13), which have applied since January 2007.

The Guidelines on national regional aid for 2007-2013 also introduce a new form of aid to provide incentives to support business start-ups and the early-stage development of small enterprises in assisted areas.

Under the existing Community guidelines on State aid for rescuing and restructuring firms in difficulty (14), Member States can also grant aid to companies requiring public support. For that purpose, Member States may notify rescue and/or restructuring aid schemes for SMEs.

On the basis of the existing State aid possible, the Commission has already authorised a large number of schemes that Member States may use to respond to the current financial situation.

4. APPLICABILITY OF ARTICLE 87(3)(b)

4.1. General principles

Pursuant to Article 87(3)(b) of the Treaty the Commission may declare compatible with the common market aid ‘to remedy a serious disturbance in the economy of a Member State’. In this context, the Court of First Instance of the European Communities has ruled that the disturbance must affect the whole of the economy of the Member State concerned, and not merely that of one of its regions or parts of its territory. This, moreover, is in line with the need to interpret strictly any derogating provision such as Article 87(3)(b) of the Treaty (15).

This strict interpretation has been consistently applied by the Commission (16) in its decision-making.

In this context, the Commission considers that, beyond emergency support for the financial system, the current global crisis requires exceptional policy responses.

All Member States will be affected by this crisis, albeit in different ways and to different degrees, and it is likely that unemployment will increase, demand fall and fiscal positions deteriorate.

In the light of the seriousness of the current financial crisis and its impact on the overall economy of the Member States, the Commission considers that certain categories of State aid are justified, for a limited period, to remedy those difficulties and that they may be declared compatible with the common market on the basis of Article 87(3)(b) of the Treaty.

4.2. Compatible limited amount of aid

4.2.1. Existing framework

Article 2 of the de minimis Regulation, states that:

‘Aid measures shall be deemed not to meet all the criteria of Article 87(1) of the Treaty and shall therefore be exempt from the notification requirement of Article 88(3) of the Treaty, if they fulfil the conditions laid down in paragraphs 2 to 5 of this Article.

The total de minimis aid granted to any one undertaking shall not exceed EUR 200 000 over any period of three fiscal years. The total de minimis aid granted to any one undertaking active in the road transport sector shall not exceed EUR 100 000 over any period of three fiscal years. These ceilings shall apply irrespective of the form of the de minimis aid or the objective pursued and regardless of whether the aid granted by the Member State is financed entirely or partly by resources of Community origin. The period shall be determined by reference to the fiscal years used by the undertaking in the Member State concerned.’

4.2.2. New measure

The financial crisis is affecting not only structurally weak companies but also companies which will find themselves facing a sudden shortage or even unavailability of credit. An improvement in the financial situation of those companies will have positive effects for the whole European economy.

Therefore, in view of the current economic situation, it is considered necessary to temporarily allow the granting of a limited amount of aid that will nevertheless fall within the scope of Article 87(1) of the Treaty, since it exceeds the threshold indicated in the de minimis Regulation.

The Commission will consider such State aid compatible with the common market on the basis of Article 87(3)(b) of the Treaty, provided all the following conditions are met:

|

(a) |

the aid does not exceed a cash grant of EUR 500 000 per undertaking; all figures used must be gross, that is, before any deduction of tax or other charge; where aid is awarded in a form other than a grant, the aid amount is the gross grant equivalent of the aid; |

|

(b) |

the aid is granted in the form of a scheme; |

|

(c) |

the aid is granted to firms which were not in difficulty (17) on 1 July 2008; it may be granted to firms that were not in difficulty at that date but entered in difficulty thereafter as a result of the global financial and economic crisis; |

|

(d) |

the aid scheme does not apply to firms active in the fisheries sector; |

|

(e) |

the aid is not export aid or aid favouring domestic over imported products; |

|

(f) |

the aid is granted no later than 31 December 2010; |

|

(g) |

prior to granting the aid, the Member State obtains a declaration from the undertaking concerned, in written or electronic form, about any other de minimis aid and aid pursuant to this measure received during the current fiscal year and checks that the aid will not raise the total amount of aid received by the undertaking during the period from 1 January 2008 to 31 December 2010, to a level above the ceiling of EUR 500 000; |

|

(h) |

the aid scheme does not apply to undertakings active in the primary production of agricultural products (18); it may apply to undertakings active in the processing and marketing of agricultural products (19) unless the amount of the aid is fixed on the basis of the price or quantity of such products purchased from primary producers or put on the market by the undertakings concerned, or the aid is conditional on being partly or entirely passed on to primary producers. |

4.3. Aid in the form of guarantees

4.3.1. Existing framework

The Commission Notice on the application of Articles 87 and 88 of the EC Treaty to State aid in the form of guarantees is intended to give Member States detailed guidance about the principles on which the Commission intends to base its interpretation of Articles 87 and 88 and application thereof to State guarantees. In particular, the Notice specifies the conditions under which State aid can be considered not to be present. It does not provide compatibility criteria for assessment of guarantees.

4.3.2. New measure

In order further to encourage access to finance and to reduce the current high risk aversion on the part of banks, subsidised loan guarantees for a limited period can be an appropriate and well targeted solution to give firms easier access to finance.

The Commission will consider such State aid compatible with the common market on the basis of Article 87(3)(b) of the Treaty, provided all the following conditions are met:

|

(a) |

for SMEs, Member States grant a reduction of up to 25 % of the annual premium to be paid for new guarantees granted in accordance with the safe-harbour provisions of the Commission Notice on the application of Articles 87 and 88 of the EC Treaty to State aid in the form of guarantees (20); |

|

(b) |

for large companies, Member States also grant a reduction of up to 15 % of the annual premium for new guarantees calculated on the basis of the same safe-harbour provisions; |

|

(c) |

when the aid element in guarantee schemes is calculated through methodologies already accepted by the Commission following their notification under a regulation adopted by the Commission in the field of State aid (21), Member States may also grant a similar reduction of up to 25 % of the annual premium to be paid for new guarantees for SMEs and up to 15 % for large companies; |

|

(d) |

the maximum loan does not exceed the total annual wage bill of the beneficiary (including social charges as well as the cost of personnel working on the company site but formally in the payroll of subcontractors) for 2008. In the case of companies created on or after 1 January 2008, the maximum loan must not exceed the estimated annual wage bill for the first two years in operation; |

|

(e) |

guarantees are granted until 31 December 2010 at the latest; |

|

(f) |

the guarantee does not exceed 90 % of the loan; |

|

(g) |

the guarantee may relate to both investment and working capital loans; |

|

(h) |

the reduction of the guarantee premium is applied during a maximum period of 2 years following the granting of the guarantee; |

|

(i) |

the aid is granted to firms which were not in difficulty (22) on 1 July 2008; it may be granted to firms that were not in difficulty at that date but entered in difficulty thereafter as a result of the global financial and economic crisis |

4.4. Aid in the form of subsidised interest rate

4.4.1. Existing framework

The Commission Communication on the revision of the method for setting the reference and discount rates (23) establishes a method for calculation of the reference rate, based on the one-year inter-bank offered rate (IBOR) increased by margins ranging from 60 to 1 000 base points, depending on the creditworthiness of the company and the level of collateral offered. If Member States apply that method, the interest rate does not contain State aid.

4.4.2. New measure

Companies may have difficulties in finding finance in the current market circumstances. Therefore the Commission will accept that public or private loans are granted at an interest rate which is at least equal to the central bank overnight rate plus a premium equal to the difference between the average one year interbank rate and the average of the central bank overnight rate over the period from 1 January 2007 to 30 June 2008, plus the credit risk premium corresponding to the risk profile of the recipient, as stipulated by the Commission Communication on the revision of the method for setting the reference and discount rates.

The aid element contained in the difference between this interest rate and the reference rate defined by the Commission Communication on the revision of the method for setting the reference and discount rates will be considered, on a temporary basis, to be compatible with the Treaty on the basis of Article 87(3)(b), provided the following conditions are met:

|

(a) |

this method applies to all contracts concluded on 31 December 2010 at the latest; it may cover loans of any duration; the reduced interest rates may be applied for interest payments before 31 December 2012 (24); an interest rate at least equal to the rate defined in the reference and discount rate Communication must apply to loans after that date; |

|

(b) |

the aid is granted to firms which were not in difficulty on 1 July 2008 (22); it may be granted to firms that were not in difficulty at that date but entered in difficulty thereafter as a result of the global financial and economic crisis. |

4.5. Aid for the production of green products

4.5.1. Existing framework

The Commission Communication on the revision of the method for setting the reference and discount rates establishes a method for calculation of the reference rate, based on the one-year inter-bank offered rate (IBOR) increased by margins ranging from 60 to 1 000 base points, depending on the creditworthiness of the company and the level of collateral offered. If Member States apply that method, the interest rate does not contain State aid.

4.5.2. New measure

Because of the current financial crisis, companies are also finding it more difficult to gain access to finance for production of more environmentally friendly products. Aid in the form of guarantees may not be sufficient to finance costly projects aiming at increasing environmental protection by adapting earlier to future standards not yet in force or by going beyond such standards.

The Commission considers that environmental goals should remain a priority despite the financial crisis. Production of more environmentally friendly, including energy-efficient, products, is in the Community's interest and it is important that the financial crisis should not impede that objective.

Therefore, additional measures in the form of subsidised loans could encourage production of ‘green products’. However, subsidised loans may cause serious distortions of competition and should be strictly limited to specific situations and targeted investment.

The Commission considers that, for a limited period, Member States should be given the possibility of granting aid in the form of an interest-rate reduction.

On the basis of Article 87(3)(b) of the Treaty, the Commission will consider compatible with the common market any interest-rate subsidy for investment loans that meets all the following conditions:

|

(a) |

the aid relates to investment loans for financing projects consisting of production of new products which significantly improve environmental protection; |

|

(b) |

the aid is necessary for launching a new project; in the case of existing projects, aid may be granted if it becomes necessary, due to the new economic situation, in order to pursue the project; |

|

(c) |

the aid is granted only for projects consisting of production of products involving early adaptation to or going beyond future Community product standards (25) which increase the level of environmental protection and are not yet in force; |

|

(d) |

for products involving early adaptation to or going beyond future Community environmental standards, the investment starts on 31 December 2010 at the latest with the objective of putting the product on the market at least two years before the standard enters into force; |

|

(e) |

loans may cover the costs of investment in tangible and intangible assets (26) with the exception of loans for investments which account for production capacities of more than 3 % on product markets (27) where the average annual growth rate, over the last five years before the start of the investment, of the apparent consumption on the EEA market, measured in value data, remained below the average annual growth rate of the European Economic Area's GDP over the same five year reference period; |

|

(f) |

the loans are granted on 31 December 2010 at the latest; |

|

(g) |

for calculation of the aid, the starting point should be the individual rate of the beneficiary as calculated on the basis of the methodology contained in point 4.4.2 of this Communication. On the basis of that methodology, the company may benefit from an interest-rate reduction of:

|

|

(h) |

the subsidised interest rate applies during a maximum period of 2 years following the granting of loan; |

|

(i) |

the reduction in the interest rate may be applied to loans granted by the State or public finance institutions and to loans granted by private financial institutions. Non-discrimination between public and private entities should be ensured; |

|

(j) |

the aid is granted to firms which were not in difficulty (22) on 1 July 2008; it may be granted to firms that were not in difficulty at that date but entered in difficulty thereafter as a result of the global financial and economic crisis; |

|

(k) |

Member States ensure that the aid is not directly or indirectly transferred to financial entities. |

4.6. Risk capital measures

4.6.1. Existing framework

The Community guidelines on State aid to promote risk capital investments in small and medium-sized enterprises set out the conditions under which State aid supporting risk capital investment may be considered compatible with the common market in accordance with Article 87(3) of the Treaty.

Based on the experience gained from applying the guidelines on State aid to promote risk capital investments in small and medium-sized enterprises, the Commission considers that there is no general risk capital market failure in the Community. It does, however, accept that there are market gaps for some types of investment at certain stages of enterprises' development which are the result of imperfect matching of supply of and demand for risk capital and can generally be described as an equity gap.

Point 4.3 of the guidelines states that for tranches of finance not exceeding EUR 1,5 million per target SME over each period of twelve months, under certain conditions market failure is presumed and does not need to be demonstrated by Member States.

Point 5.1(a) of the same guidelines states that ‘The Commission is aware of the constant fluctuation of the risk capital market and of the equity gap over time, as well as of the different degree by which enterprises are affected by the market failure depending on their size, on their stage of business development, and on their economic sector. Therefore, the Commission is prepared to consider declaring risk capital measures providing for investment tranches exceeding the threshold of EUR 1,5 million per enterprise per year compatible with the common market, provided the necessary evidence of the market failure is submitted.’

4.6.2. Temporary adaptation of the existing rules

The turmoil on the financial market has had a negative effect on the risk capital market for early growth SMEs by tightening the availability of risk capital. Due to the currently greatly increased risk perception associated with risk capital linked with uncertainties resulting from possibly lower yield expectations, investors are currently tending to invest in safer assets the risks of which are easier to assess as compared to those associated with risk capital investments. Furthermore the illiquid nature of risk capital investments has proven to be a further disincentive for investors. There is evidence that the resulting restricted liquidity under current market circumstances has widened the equity gap for SMEs. It is therefore considered appropriate to temporarily raise the safe-harbour threshold for risk capital investments to meet the increased equity gap and to temporarily lower the percentage of minimum private investor participation to 30 % also in the case of measures targeting SMEs in non-assisted areas.

Accordingly, on the basis of Article 87(3)(b) of the Treaty, certain limits set out in the Community guidelines on State aid to promote risk capital investments in small and medium-sized enterprises are temporarily adapted until 31 December 2010 as follows:

|

(a) |

for the purposes of point 4.3.1, the maximum permitted tranches of finance are increased to EUR 2,5 million, from EUR 1,5 million per target SME over each period of twelve months; |

|

(b) |

for the purposes of point 4.3.4, the minimum amount of funding to be provided by private investors is 30 % both in and outside assisted areas; |

|

(c) |

other conditions laid down in the guidelines remain applicable; |

|

(d) |

this temporary adaptation of the guidelines does not apply to risk capital measures covered by the GBER; |

|

(e) |

Member States may adapt approved schemes to reflect the temporary adaptation of the guidelines. |

4.7. Cumulation

The aid ceilings fixed under this Communication will be applied regardless of whether the support for the aided project is financed entirely from State resources or partly financed by the Community.

The temporary aid measures foreseen by this Communication may not be cumulated with aid falling within the scope of the de minimis Regulation for the same eligible costs. If the undertaking has already received de minimis aid prior to the entry into force of this temporary framework the sum of the aid received under the measures covered by point 4.2 of this Communication and the de minimis aid received must not exceed EUR 500 000 between 1 January 2008 and 31 December 2010. The amount of de minimis aid received from 1 January 2008 must be deducted from the amount of compatible aid granted for the same purpose under points 4.3, 4.4, 4.5 or 4.6.

The temporary aid measures may be cumulated with other compatible aid or with other forms of Community financing provided that the maximum aid intensities indicated in the relevant guidelines or block exemptions Regulations are respected.

5. SIMPLIFICATION MEASURES

5.1. Short-term export credit insurance

The Communication from the Commission to Member States pursuant to Article 93(1) of the EC Treaty applying Articles 92 and 93 of the Treaty to short-term export-credit insurance (28) stipulates that marketable risks cannot be covered by export-credit insurance with the support of Member States. Marketable risks are commercial and political risks on public and non-public debtors established in countries listed in the Annex to that Communication, with a maximum risk period of less than two years. Risks concerning debtors established in the Member States and eight further members of the Organisation for Economic Co-operation and Development are considered marketable.

The Commission considers that, as a consequence of the current financial crisis, a lack of insurance or reinsurance capacity does not exist in every Member State, but it cannot be excluded that, in certain countries cover for marketable risks could be temporarily unavailable.

Point 4.4 of the Communication states that: ‘In such circumstances, those temporarily non-marketable risks may be taken on to the account of a public or publicly supported export-credit insurer for non-marketable risks insured for the account of or with the guarantee of the State. The insurer should, as far as possible, align its premium rates for such risks with the rates charged elsewhere by private export-credit insurers for the type of risk in question.

Any Member State intending to use that escape clause should immediately notify the Commission of its draft decision. That notification should contain a market report demonstrating the unavailability of cover for the risks in the private insurance market by producing evidence thereof from two large, well-known international private export-credit insurers as well as a national credit insurer, thus justifying the use of the escape clause. It should, moreover, contain a description of the conditions which the public or publicly supported export-credit insurer intends to apply in respect of such risks.

Within two months of the receipt of such notification, the Commission will examine whether the use of the escape clause is in conformity with the above conditions and compatible with the Treaty.

If the Commission finds that the conditions for the use of the escape clause are fulfilled, its decision on compatibility is limited to two years from the date of the decision, provided that the market conditions justifying the use of the escape clause do not change during that period.

Furthermore, the Commission may, in consultation with the other Member States, revise the conditions for the use of the escape clause; it may also decide to discontinue it or replace it with another appropriate system.’

Those provisions, applicable to large companies and SMEs, are an appropriate instrument in the current economic situation if Member States consider that cover is unavailable on the private insurance market for certain marketable credit risks and/or for certain buyers of risk protection.

In this context, in order to speed up the procedure for Member States, the Commission considers that, until 31 December 2010, Member States may demonstrate the lack of market by providing sufficient evidence of the unavailability of cover for the risk in the private insurance market. Use of the escape clause will in any case be considered justified if:

|

— |

a large well-known international private export credits insurer and a national credit insurer produce evidence of the unavailability of such cover, or |

|

— |

at least four well-established exporters in the Member State produce evidence of refusal of cover from insurers for specific operations. |

The Commission, in close cooperation with the Member States concerned, will ensure swift adoption of decisions concerning the application of the escape clause.

5.2. Simplification of procedures

State aid measures referred to in this Communication must be notified to the Commission. Beyond the substantive measures set out in this Communication, the Commission is committed to ensuring the swift authorisation of aid measures that address the current crisis in accordance with this Communication provided close cooperation and full information is provided by the Member States concerned.

This commitment will complement the on-going process, whereby the Commission is currently drafting a number of improvements to its general State aid procedures, particularly to allow quicker and more effective decision-making in close cooperation with Member States. This general simplification package should, in particular, enshrine joint commitments by the Commission and Member States to more streamlined and predictable procedures at each step of a State aid investigation and allow faster approval of straightforward cases.

6. MONITORING AND REPORTING

Council Regulation (EC) No 659/1999 of 22 March 1999 laying down detailed rules for the application of Article 93 of the EC Treaty (29) and Commission Regulation (EC) No 794/2004 of 21 April 2004 implementing Council Regulation (EC) No 659/1999 laying down detailed rules for the application of Article 93 of the EC Treaty (30) require Member States to submit annual reports to the Commission.

By 31 July 2009, Member States must provide the Commission with a list of schemes put in place on the basis of this Communication.

Member States must ensure that detailed records regarding the granting of aid provided for by this Communication are maintained. Such records, which must contain all information necessary to establish that the necessary conditions have been observed, must be maintained for 10 years and be provided to the Commission upon request. In particular, Member States must have obtained information demonstrating that the aid beneficiaries under the measures provided for in points 4.2, 4.3, 4.4 and 4.5 were not companies in difficulty on 1 July 2008.

In addition, a report on the measures put in place on the basis of this Communication should be provided to the Commission by Member States by 31 October 2009. In particular, the report should provide elements indicating the need for the Commission to maintain the measures provided for by this Communication after 31 December 2009, as well as detailed information on the environmental benefits of the subsidised loans. Member States must provide this information for any subsequent year during which this Communication is applied, before 31 October of each year.

The Commission may request additional information regarding the aid granted, to check whether the conditions laid down in the Commission decision approving the aid measure have been met.

7. FINAL PROVISIONS

The Commission applies this Communication from 17 December 2008, the date on which it agreed in principle its content, having regard to the financial and economic context which required immediate action. This Communication is justified by the current exceptional and transitory financing problems related to the banking crisis and will not be applied after 31 December 2010. After consulting Member States, the Commission may review it before that date on the basis of important competition policy or economic considerations. Where this would be helpful, the Commission may also provide further clarifications of its approach to particular issues.

The Commission applies the provisions of this Communication to all notified risk capital measures on which it must take a decision after 17 December 2008, even if the measures were notified prior to that date.

In accordance with the Commission notice on the determination of the applicable rules for the assessment of unlawful State aid (31), the Commission applies the following in respect of non-notified aid:

|

(a) |

this Communication, if the aid was granted after 17 December 2008; |

|

(b) |

the guidelines applicable when the aid was granted in all other cases. |

The Commission, in close cooperation with the Member States concerned, ensures swift adoption of decisions upon complete notification of measures covered by this Communication. Member States should inform the Commission of their intentions and notify plans to introduce such measures as early and comprehensively as possible.

The Commission wishes to recall that any procedural improvement depends entirely on submission of clear and complete notifications.

(1) Communication from the Commission to the European Council, COM(2008) 800.

(2) Conclusions of the ECOFIN Council of 7 October 2008.

(3) OJ C 270, 25.10.2008, p. 8.

(4) COM(2008) 394 final.

(5) OJ L 310, 9.11.2006, p. 15.

(6) OJ L 412, 30.12.2006, p. 1.

(8) OJ L 379, 28.12.2006, p. 5.

(10) OJ C 323, 30.12.2006, p. 1.

(11) OJ C 155, 20.6.2008, p. 10.

(12) OJ C 194, 18.8.2006, p. 2.

(13) OJ C 54, 4.3.2006, p. 13.

(14) OJ C 244, 1.10.2004, p. 2.

(15) Joined Cases T-132/96 and T-143/96 Freistaat Sachsen and Volkswagen AG v Commission [1999] ECR II-3663, paragraph 167.

(16) Commission Decision 98/490/EC in Case C 47/96 Crédit Lyonnais (OJ L 221, 8.8.1998, p. 28), point 10.1; Commission Decision 2005/345/EC in Case C 28/02 Bankgesellschaft Berlin (OJ L 116, 4.5.2005, p. 1), points 153 et seq.; and Commission Decision 2008/263/EC in Case C 50/06 BAWAG (OJ L 83, 26.3.2008, p. 7), point 166. See Commission Decision in Case NN 70/07 Northern Rock (OJ C 43, 16.2.2008, p. 1), Commission Decision in Case NN 25/08 Rescue aid to WestLB (OJ C 189, 26.7.2008, p. 3) and Commission Decision of 4 June 2008 in Case C 9/08 SachsenLB, not yet published.

(17) For the purposes of this Communication ‘firm in difficulty’ means:

|

— |

for large companies, a firm in difficulty as defined in point 2.1 of the Community guidelines on State aid for rescuing and restructuring firms in difficulty, |

|

— |

for SMEs, a firm in difficulty as defined in Article 1(7) of the GBER. |

(18) As defined in Article 2(2) of Commission Regulation (EC) No 1857/2006 of 15 December 2006 on the application of Articles 87 and 88 of the Treaty to State aid to small and medium-sized enterprises active in the production of agricultural products and amending Regulation (EC) No 70/2001 (OJ L 358, 16.12.2006, p. 3).

(19) As defined in Article 2(3) and 2(4) of Regulation (EC) No 1857/2006.

(20) This includes the possibility that for SMEs which do not have a credit history or a rating based on a balance sheet approach, such as certain special purpose companies or start-up companies, Member States grant a reduction up to 25 % on the specific safe-harbour premium set at 3,8 % in the Notice.

(21) Such as the GBER or Regulation (EC) No 1628/2006 or Regulation (EC) No 1857/2006, provided that the approved methodology explicitly addresses the type of guarantees and the type of underlying transactions at stake.

(22) See footnote 17.

(23) OJ C 14, 19.1.2008, p. 6.

(24) Member States who want to use this facility have to publish the daily overnight rates online and have to make them available to the Commission.

(25) Future Community product standard means a mandatory Community standard setting environmental levels to be attained for products sold in the Community which has been adopted but is not yet in force.

(26) As defined in point 70 of the Community guidelines on State aid for environmental protection.

(27) As defined in point 69 of the Guidelines on national regional aid for 2007-2013.

(28) OJ C 281, 17.9.1997, p. 4.

(29) OJ L 83, 27.3.1999, p. 1.

(30) OJ L 140, 30.4.2004, p. 1.

(31) OJ C 119, 22.5.2002, p. 22.

European Central Bank

|

22.1.2009 |

EN |

Official Journal of the European Union |

C 16/10 |

AGREEMENT

of 8 December 2008

between the European Central Bank and the national central banks of the Member States outside the euro area amending the Agreement of 16 March 2006 between the European Central Bank and the national central banks of the Member States outside the euro area laying down the operating procedures for an exchange rate mechanism in stage three of economic and monetary union

(2009/C 16/02)

|

1. |

and |

|

2. |

European Central Bank (ECB) |

(hereinafter the ‘Parties’)

Whereas:

|

1. |

The European Council in its Resolution of 16 June 1997 (hereinafter the ‘Resolution’) agreed to set up an exchange rate mechanism (hereinafter the ‘ERM II’) when the third stage of economic and monetary union began on 1 January 1999. |

|

2. |

Under the terms of the Resolution, ERM II is designed to help ensure that non-euro area Member States participating in ERM II orient their policies to stability, foster convergence and thereby help the non-euro area Member States in their efforts to adopt the euro. |

|

3. |

Slovakia, as a Member State with a derogation, has participated in ERM II since 2 November 2005. Národná banka Slovenska is a party to the Agreement of 16 March 2006 between the European Central Bank and the national central banks of the Member States outside the euro area laying down the operating procedures for an exchange rate mechanism in stage three of economic and monetary union (1), as amended by the Agreement of 21 December 2006 (2) and by the Agreement of 14 December 2007 (3) (hereinafter collectively referred to as the ‘ERM II Central Bank Agreement’). |

|

4. |

Pursuant to Article 1 of Council Decision 2008/608/EC of 8 July 2008 in accordance with Article 122(2) of the Treaty on the adoption by Slovakia of the single currency on 1 January 2009 (4) the derogation in favour of Slovakia referred to in Article 4 of the 2003 Act of Accession is abrogated with effect from 1 January 2009. The euro will be Slovakia's currency from 1 January 2009 and Národná banka Slovenska should no longer be party to the ERM II Central Bank Agreement from that date. |

|

5. |

The current arrangements for ERM II intervention at the margins are provided for in the ERM II Central Bank Agreement. |

|

6. |

The current arrangements for ERM II interventions require further updating and revising in order to take into account the imposition of a new criterion on counterparties eligible to conduct interventions at the margins and to refine an existing eligibility criterion. |

|

7. |

It is therefore necessary to amend the ERM II Central Bank Agreement to take account of the abrogation of the derogation in favour of Slovakia and changes to the eligibility criteria for ERM II intervention at the margins, |

HAVE AGREED AS FOLLOWS:

Article 1

Amendment to the ERM II Central Bank Agreement in view of the abrogation of Slovakia's derogation

Národná banka Slovenska shall no longer be party to the ERM II Central Bank Agreement from 1 January 2009.

Article 2

Replacement of Annexes I and II to the ERM II Central Bank Agreement

2.1. Annex I to the ERM II Central Bank Agreement is replaced by the text set out in Annex I to this Agreement.

2.2. Annex II to the ERM II Central Bank Agreement is replaced by the text set out in Annex II to this Agreement.

Article 3

Final provisions

3.1. This Agreement amends the ERM II Central Bank Agreement with effect from 1 January 2009.

3.2. This Agreement shall be drawn up in English and duly signed by the Parties' duly authorised representatives. The ECB, which shall retain the original Agreement, shall send a certified copy of the original Agreement to each euro area and non-euro area national central bank. The Agreement shall be published in the Official Journal of the European Union.

Done at Frankfurt am Main, on 8 December 2008.

For

Българска народна банка (Bulgarian National Bank)

For

Česká národní banka

For

Danmarks Nationalbank

For

Eesti Pank

For

Latvijas Banka

For

Lietuvos bankas

For

the Magyar Nemzeti Bank

For

Narodowy Bank Polski

For

Banca Națională a României

For

Národná banka Slovenska

For

Sveriges Riksbank

For

the Bank of England

For

the European Central Bank

(1) OJ C 73, 25.3.2006, p. 21.

(3) OJ C 319, 29.12.2007, p. 7.

(4) OJ L 195, 24.7.2008, p. 24.

ANNEX I

‘ANNEX I

QUOTATION CONVENTION FOR CURRENCIES PARTICIPATING IN ERM II AND THE PAYMENT AFTER PAYMENT PROCEDURE IN THE EVENT OF INTERVENTION AT THE MARGINS

A. Quotation convention

For all the currencies of the non-euro area Member States participating in ERM II, the exchange rate for the bilateral central rate vis-à-vis the euro shall be quoted using the euro as the base currency. The exchange rate shall be expressed as the value of E1 using six significant digits for all currencies.

The same convention shall be applied for quoting the upper and lower intervention rates vis-à-vis the euro of the currencies of the non-euro area Member States participating in ERM II. The intervention rates shall be determined by adding or subtracting the agreed bandwidth, expressed as a percentage, to or from the bilateral central rates. The resulting rates shall be rounded to six significant digits.

B. Payment after payment procedure

A payment after payment procedure shall be applied by both the ECB and the euro area national central banks (NCBs) in the event of intervention at the margins. The non-euro area NCBs participating in ERM II shall apply the payment after payment procedure when acting as correspondents of the euro area NCBs and the ECB in accordance with this Annex; the non-euro area NCBs participating in ERM II may, at their discretion, adopt the same payment after payment procedure when settling intervention at the margins that such NCBs have carried out on their own behalf.

(i) General principles

|

— |

The payment after payment procedure shall be applied when intervention at the margins in ERM II takes place between the euro and the currencies of the non-euro area Member States participating in ERM II. |

|

— |

To be eligible for intervention at the margins in ERM II, counterparties shall be required to keep an account with the NCB concerned and to maintain a SWIFT address. Counterparties shall, as an additional eligibility criterion, also be required to provide the NCB concerned in advance with their standard settlement instructions in the ERM II currencies and any further updates to these instructions. Eligible counterparties may be requested to provide the ECB or NCBs with contact details as specified by the ECB and the NCBs concerned from time to time. |

|

— |

Counterparties eligible for intervention at the margins in ERM II may also conduct such intervention directly with the ECB, provided that they also have the status of eligible counterparties for executing foreign exchange transactions with the ECB pursuant to Guideline ECB/2008/5 of 20 June 2008 on the management of the foreign reserve assets of the European Central Bank by the national central banks and the legal documentation for operations involving such assets (1). |

|

— |

The non-euro area NCBs participating in ERM II shall act as the correspondents of the euro area NCBs and the ECB. |

|

— |

When intervention at the margins takes place, the NCB concerned or the ECB shall release its payment for a given transaction only after receiving confirmation from its correspondent that the amount due has been credited to its account. Counterparties shall be required to pay in due time so as to enable the NCBs and the ECB to fulfil their respective payment obligations. Consequently, counterparties shall be required to pay before a predefined deadline. |

(ii) Deadline for the receipt of funds from counterparties

Counterparties shall pay intervention amounts at the latest by 1 p.m. CET on value date.’

ANNEX II

‘ANNEX II

CEILINGS ON ACCESS TO THE VERY SHORT-TERM FINANCING FACILITY REFERRED TO IN ARTICLES 8, 10 AND 11 OF THE ERM II CENTRAL BANK AGREEMENT

with effect from 1 January 2009

|

(EUR million) |

|

|

Central banks party to this Agreement |

Ceilings (1) |

|

Българска народна банка (Bulgarian National Bank) |

520 |

|

Česká národní banka |

690 |

|

Danmarks Nationalbank |

700 |

|

Eesti Pank |

310 |

|

Latvijas Banka |

340 |

|

Lietuvos bankas |

380 |

|

Magyar Nemzeti Bank |

670 |

|

Narodowy Bank Polski |

1 750 |

|

Banca Națională a României |

1 000 |

|

Sveriges Riksbank |

940 |

|

Bank of England |

4 700 |

|

European Central Bank |

nil |

|

Euro area national central banks |

Ceilings |

|

Nationale Bank van België/Banque Nationale de Belgique |

nil |

|

Deutsche Bundesbank |

nil |

|

Central Bank and Financial Services Authority of Ireland |

nil |

|

Bank of Greece |

nil |

|

Banco de España |

nil |

|

Banque de France |

nil |

|

Banca d'Italia |

nil |

|

Central Bank of Cyprus |

nil |

|

Banque centrale du Luxembourg |

nil |

|

Central Bank of Malta |

nil |

|

De Nederlandsche Bank |

nil |

|

Oesterreichische Nationalbank |

nil |

|

Banco de Portugal |

nil |

|

Banka Slovenije |

nil |

|

Národná banka Slovenska |

nil |

|

Suomen Pankki |

nil’ |

(1) The amounts indicated are notional for central banks which do not participate in ERM II.

IV Notices

NOTICES FROM EUROPEAN UNION INSTITUTIONS AND BODIES

Commission

|

22.1.2009 |

EN |

Official Journal of the European Union |

C 16/16 |

Euro exchange rates (1)

21 January 2009

(2009/C 16/03)

1 euro=

|

|

Currency |

Exchange rate |

|

USD |

US dollar |

1,2910 |

|

JPY |

Japanese yen |

116,11 |

|

DKK |

Danish krone |

7,4507 |

|

GBP |

Pound sterling |

0,93860 |

|

SEK |

Swedish krona |

10,7680 |

|

CHF |

Swiss franc |

1,4764 |

|

ISK |

Iceland króna |

|

|

NOK |

Norwegian krone |

9,0555 |

|

BGN |

Bulgarian lev |

1,9558 |

|

CZK |

Czech koruna |

27,584 |

|

EEK |

Estonian kroon |

15,6466 |

|

HUF |

Hungarian forint |

284,58 |

|

LTL |

Lithuanian litas |

3,4528 |

|

LVL |

Latvian lats |

0,7028 |

|

PLN |

Polish zloty |

4,3465 |

|

RON |

Romanian leu |

4,3148 |

|

TRY |

Turkish lira |

2,1455 |

|

AUD |

Australian dollar |

1,9937 |

|

CAD |

Canadian dollar |

1,6345 |

|

HKD |

Hong Kong dollar |

10,0167 |

|

NZD |

New Zealand dollar |

2,4882 |

|

SGD |

Singapore dollar |

1,9418 |

|

KRW |

South Korean won |

1 775,03 |

|

ZAR |

South African rand |

13,2043 |

|

CNY |

Chinese yuan renminbi |

8,8276 |

|

HRK |

Croatian kuna |

7,4200 |

|

IDR |

Indonesian rupiah |

14 459,20 |

|

MYR |

Malaysian ringgit |

4,6689 |

|

PHP |

Philippine peso |

61,320 |

|

RUB |

Russian rouble |

42,4185 |

|

THB |

Thai baht |

45,114 |

|

BRL |

Brazilian real |

3,0597 |

|

MXN |

Mexican peso |

18,0095 |

|

INR |

Indian rupee |

63,5300 |

Source: reference exchange rate published by the ECB.

NOTICES FROM MEMBER STATES

|

22.1.2009 |

EN |

Official Journal of the European Union |

C 16/17 |

Commission notice pursuant to Article 16(4) of Regulation (EC) No 1008/2008 of the European Parliament and of the Council on common rules for the operation of air services in the Community

Public service obligations in respect of scheduled air services

(Text with EEA relevance)

(2009/C 16/04)

|

Member State |

Italy |

|||||||

|

Route concerned |

Cuneo Levaldigi — Rome Fiumicino |

|||||||

|

Date of entry into force of the public service obligations |

180 days from the publication of this notice |

|||||||

|

Address where the text and any relevant information and/or documentation relating to the public service obligations can be obtained free of charge |

|

|

22.1.2009 |

EN |

Official Journal of the European Union |

C 16/18 |

Commission communication pursuant to Article 17(5) of Regulation (EC) No 1008/2008 of the European Parliament and of the Council on common rules for the operation of air services in the Community

Invitation to tender in respect of the operation of scheduled air services in accordance with public service obligations

(Text with EEA relevance)

(2009/C 16/05)

|

Member State |

France |

|||||||

|

Concerned route |

Lorient (Lann Bihoué) — Lyon (Saint-Exupéry) |

|||||||

|

Period of validity of the contract |

1 August 2009-31 July 2013 |

|||||||

|

Deadline for submission of tenders |

Submission of applications: 26 March 2009 (at 12.00 a.m.) Submission of tenders (subsequent procedure): 4 May 2009 (at 12.00 a.m.) |

|||||||

|

Address where the text of the invitation to tender and any relevant information and/or documentation related to the pubic tender and the public service obligation can be obtained free of charge |

|

NOTICES CONCERNING THE EUROPEAN ECONOMIC AREA

EFTA Surveillance Authority

|

22.1.2009 |

EN |

Official Journal of the European Union |

C 16/19 |

Communication from Iceland pursuant to Directive 94/22/EC of the European Parliament and of the Council on the conditions for granting and using authorizations for the prospection, exploration and production of hydrocarbons

Announcement of the first Licensing Round 2009 — Continental Shelf between Iceland and Jan Mayen ‘The Dreki Area’

(2009/C 16/06)

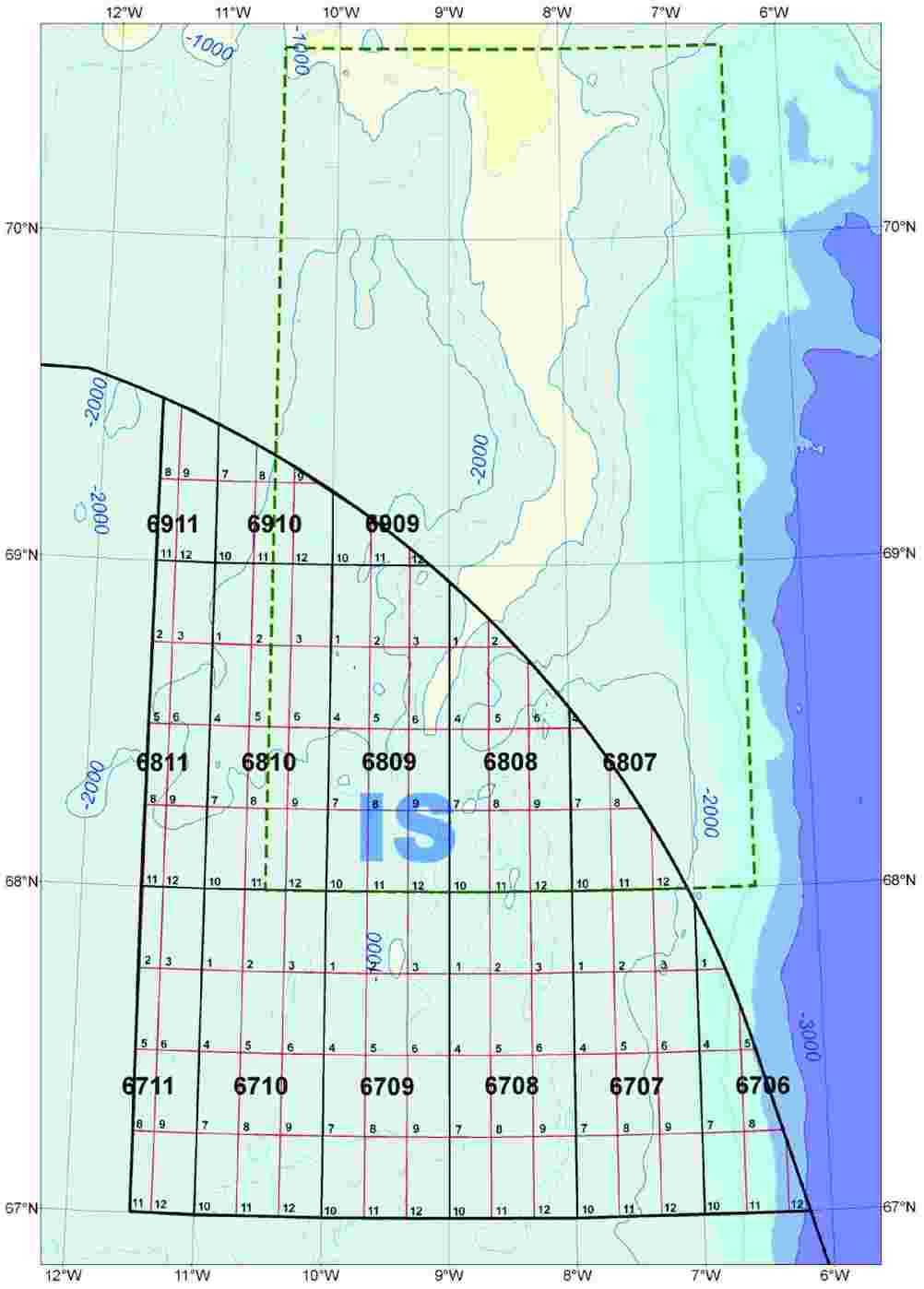

The National Energy Authority of Iceland (NEA), by the authority of the Ministry of Industry, Energy and Tourism, hereby announces an invitation to interested parties to submit applications for hydrocarbon exploration and production licenses on ‘The Dreki Area’ in accordance with Article 3(2)(a) of Directive 94/22/EC of the European Parliament and of the Council of 30 May 1994 on the conditions for granting and using authorizations for the prospection, exploration and production of hydrocarbons.

The Licensing round is organized by the NEA in accordance with and shall be subject to the provisions of Act No 13 of 13 March 2001 (Government Gazette (Stjórnartíðindi), 16 May 2001) on Prospection, Exploration and Production of Hydrocarbons (the Hydrocarbons Act), with subsequent amendments, as well as such rules and regulations (the Hydrocarbons Regulations) issued by the Ministry of Industry, Energy and Tourism in accordance with the Hydrocarbons Act.

The National Energy Authority is the competent authority for the granting of authorisations. The criteria, conditions, and requirements referred to in Articles 5(1), 5(2) and 6(2) of Directive 94/22/EC are set out in the above-mentioned legal instruments.

In addition to the Hydrocarbons Act and the Hydrocarbons Regulations, the Agreement of 22 October 1981 between Norway and Iceland on the Continental Shelf Between Iceland and Jan Mayen, the Agreement between Norway and Iceland concerning transboundary hydrocarbon deposits of 3 November 2008 and the Agreed Minutes of the same date concerning the Right of Participation pursuant to Articles 5 and 6 of the Agreement from 1981, apply to the relevant parts of the area offered for the licensing.

Applications for exploration and production licenses may be submitted for the following blocks or parts of blocks in ‘The Dreki Area’.

IS6706/1 (part), 4 (part), 5 (part), 7, 8 (part), 10, 11 (part), 12 (part)

IS6707/1, 2, 3 (part), 4, 5, 6, 7, 8, 9, 10, 11, 12

IS6708/1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12

IS6709/1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12

IS6710/1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12

IS6711/2 (part), 3, 5 (part), 6, 8 (part), 9, 11 (part), 12

IS6807/4 (part), 7 (part), 8 (part), 10, 11 (part), 12 (part)

IS6808/1 (part), 2 (part), 4, 5 (part), 6 (part), 7, 8, 9, 10, 11, 12

IS6809/1, 2, 3 (part), 4, 5, 6, 7, 8, 9, 10, 11, 12

IS6810/1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12

IS6811/2 (part), 3, 5 (part), 6, 8 (part), 9, 11 (part), 12

IS6909/10 (part), 11 (part), 12 (part)

IS6910/7 (part), 8 (part), 9 (part), 10, 11, 12 (part)

IS6911/8 (part), 9 (part), 11 (part), 12

Individual applications for licenses may cover one or more of the blocks or part of blocks, up to a maximum of 800 km2. The number of licenses on offer is up to five (5) as a maximum. Applicants are encouraged to nominate a secondary area in case of an area of first choice overlapping with other applications.

Applicants for hydrocarbon exploration and production licenses shall be submitted to the NEA:

|

The National Energy Authority (NEA) |

|

Grensasvegi 9 |

|

108 — Reykjavik |

|

Iceland |

|

Website: www.nea.is |

|

Tel. (354) 569 60 00 |

|

Fax (354) 568 88 96 |

Full details and all the relevant documents, including lists and maps of the area on offer and guidance about licenses, the terms which those licenses will include, and how to apply, are available on the following web address:

http://www.nea.is/licencinground2009

or by contacting the NEA at the address above.

The award of exploration and production licenses in the first Licensing Round 2009 on ‘The Dreki Area’ is planned to take place before the end of October 2009.

Closing date of the Licensing Round — Continental Shelf between Iceland and Jan Mayen ‘The Dreki Area’ is: 15 May 2009.

Northern Dreki Area on the Icelandic Continental Shelf between Iceland and Jan Mayen. The boundary of the Agreement Area from 1981 (as referred to in paragraph 4) between Iceland and Norway shown by green, dashed line.

V Announcements

ADMINISTRATIVE PROCEDURES

Commission

|

22.1.2009 |

EN |

Official Journal of the European Union |

C 16/22 |

Call for proposals under the work programme ‘People’ of the 7th EC Framework Programme for Research, Technological Development and Demonstration Activities

(2009/C 16/07)

Notice is hereby given of the launch of a call for proposals under the work programme ‘People’ of the 7th Framework Programme of the European Community for Research, Technological Development and Demonstration Activities (2007 to 2013).

Proposals are invited for the following call concerning trans-national operation of the EURAXESS Services Network. The call deadline and budget are given in the call text, which is published on the CORDIS website.

People Specific Programme:

|

Call Identifier |

: |

FP7-PEOPLE-2009-EURAXESS |

This call for proposals relates to the work programme adopted by Commission Decision C(2008) 4483 of 22 August 2008.

Information on the modalities of the call, the work programme, and the guidance for applicants on how to submit proposals is available through the CORDIS website: http://cordis.europa.eu/fp7/calls/

PROCEDURES RELATING TO THE IMPLEMENTATION OF THE COMPETITION POLICY

Commission

|

22.1.2009 |

EN |

Official Journal of the European Union |

C 16/23 |

Prior notification of a concentration

(Case COMP/M.5436 — Citi Infrastructure Partners, L.P./Itínere Infraestructuras S.A.)

Candidate case for simplified procedure

(Text with EEA relevance)

(2009/C 16/08)

|

1. |

On 14 January 2009, the Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 (1) by which the undertaking Citi Infrastructure Partners, L.P., belonging to Citigroup (United States of America) would acquire within the meaning of Article 3(1)(b) of the Council Regulation control of part of the undertaking Itínere Infraestructuras S.A. (Spain) by means of a public purchase offer. |

|

2. |

The business activities of the undertakings concerned are:

|

|

3. |

On preliminary examination, the Commission finds that the notified transaction could fall within the scope of Regulation (EC) No 139/2004. However, the final decision on this point is reserved. Pursuant to the Commission Notice on a simplified procedure for treatment of certain concentrations under Council Regulation (EC) No 139/2004 (2), it should be noted that this case is a candidate for treatment under the procedure set out in the Notice. |

|

4. |

The Commission invites interested third parties to submit any observations on the proposed operation to the Commission. Observations must reach the Commission not later than 10 days following the date of this publication. Observations can be sent to the Commission by fax ((32-2) 296 43 01 or 296 72 44) or by post, under reference number COMP/M.5436 — Citi Infrastructure Partners, L.P./Itínere Infraestructuras S.A., to the following address:

|

OTHER ACTS

Commission

|

22.1.2009 |

EN |

Official Journal of the European Union |

C 16/24 |

The SESAR Joint Undertaking

(2009/C 16/09)

The SESAR Joint Undertaking (Council Regulations (EC) No 219/2007 and (EC) No 1361/2008) has launched the final phase of its first exercise for accession to membership. The final offers from the 15 selected candidate members must be submitted by 16 February 2009. For detailed information on the SESAR Joint Undertaking, its activities and possible forms of participation please visit its webpage: www.sesarju.eu