Notice of initiation of an anti-subsidy proceeding concerning imports of certain woven and/or stitched glass fibre fabrics originating in the People's Republic of China and Egypt

(2019/C 167/07)

The European Commission (‘the Commission’) has received a complaint under Article 10 of Regulation (EU) 2016/1037 of the European Parliament and of the Council of 8 June 2016 on protection against subsidised imports from countries not members of the European Union (1) (‘the basic Regulation’), alleging that imports of certain woven and/or stitched glass fibre fabrics, originating in the People's Republic of China and Egypt, are being subsidised and are thereby causing injury (2) to the Union industry.

1. Complaint

The complaint was lodged on 1 April 2019 by Tech-Fab Europe (‘the complainant’) on behalf of producers representing more than 25 % of the total Union production of certain woven and/or stitched glass fibre fabrics.

An open version of the complaint and the analysis of the degree of support by Union producers for the complaint are available in the file for inspection by interested parties. Section 5.6 of this Notice provides information about access to the file for interested parties.

2. Product under investigation

The product subject to this investigation is fabrics of woven and/or stitched continuous filament glass fibre rovings or yarns, excluding products which are impregnated or pre-impregnated (pre-preg), and excluding open mesh fabrics with cells with a size of more than 1,8 mm in both length and width and weighing more than 35 g/m2 (‘the product under investigation’).

All interested parties wishing to submit information on the product scope must do so within 10 days of the date of publication of this Notice (3).

3. Allegation of subsidisation

The product allegedly being subsidised is the product under investigation, originating in the People's Republic of China and Egypt (‘the countries concerned’), currently falling within CN codes ex 7019 39 00, ex 7019 40 00, ex 7019 59 00 and ex 7019 90 00 (TARIC codes 7019390080, 7019400080, 7019590080 and 7019900080). The CN and TARIC codes are given for information.

3.1

The People's Republic of China

The Commission considers that the complaint includes sufficient evidence that the producers of the product under investigation from the People's Republic of China have benefitted from a number of subsidies granted by the government of the People's Republic of China.

The alleged subsidy practices consist, inter alia, of (i) direct transfer of funds, (ii) government revenue forgone or not collected and (iii) government provision of goods or services for less than adequate remuneration. The complaint contained evidence, for example, of preferential loans and provision of credit lines by State-owned banks, export credit subsidy programmes, export guarantees and insurances and grant programmes; tax reductions for High and New Technology Enterprises, tax offset for research and development, accelerated depreciation of equipment used by High-Tech enterprises for High-Tech development and production, dividend exemption between qualified resident enterprises, withholding tax reduction for dividends from foreign-invested Chinese enterprises to their non-Chinese parent companies, land use tax exemptions and export tax rebate; and government provision of land and power for less than adequate remuneration.

The complainant further alleges that the above measures amount to subsidies because they involve a financial contribution from the Government of China or other regional and local governments (including public bodies) and confer a benefit to the exporting producers of the product under investigation. They are alleged to be limited to certain enterprises or industry or group of enterprises and/or contingent upon export performance and are therefore specific and countervailable. On that basis, the alleged subsidy amounts appear to be significant for the People's Republic of China.

The Commission reserves the right to investigate other relevant subsidy practices which may be revealed during the course of the investigation.

3.2

Egypt

The Commission considers that the complaint includes sufficient evidence that the producers of the product under investigation from Egypt have benefitted from a number of subsidies granted by the government of the Egypt.

The alleged subsidy practices consist, inter alia, of (i) direct transfer of funds, (ii) government revenue forgone or not collected and (iii) government provision of goods or services for less than adequate remuneration. The complaint contained evidence, for example, of preferential policy loans, and tax benefits under Egyptian laws, import duty exemption on the import of raw materials and production equipment.

The complainant further alleges that the above measures amount to subsidies because they involve a financial contribution from the Government of Egypt (including public bodies) and confer a benefit to the exporting producers of the product under investigation. They are alleged to be limited to certain enterprises or industry or group of enterprises and/or contingent upon export performance and are therefore specific and countervailable. On that basis, the alleged subsidy amounts appear to be significant for Egypt.

Moreover, the complainant alleges that some of the subsidies are directly granted by the Government of Egypt, and some indirectly by the Government of China, but via the Government of Egypt. According to the complaint, the only Egyptian exporting producer, which is situated in a special economic zone (the China-Egypt Suez Economic and Trade Cooperation Zone), is Chinese-owned. The complaint contains evidence of the cooperation agreements between the Chinese and the Egyptian governments as well as of loans from Chinese State-owned or State-controlled entities to Egyptian State-owned banks. In view of the objectives of these agreements and loans, the complainant argues that such loans benefit the Chinese-owned exporting producer in Egypt.

In view of Articles 10(2) and 10(3) of the basic Regulation, the Commission prepared a memorandum on sufficiency of evidence containing the Commission's assessment on all the evidence at the disposal of the Commission concerning the People's Republic of China and Egypt and on the basis of which the Commission initiates the investigation. That memorandum can be found in the file for inspection by interested parties.

The Commission reserves the right to investigate other relevant subsidies which may be revealed during the course of the investigation.

4. Allegations of injury and causation

The complainant has provided evidence that imports of the product under investigation from the countries concerned have increased overall in absolute terms and have increased in terms of market share.

The evidence provided by the complainant shows that the volume and the prices of the imported product under investigation have had, among other consequences, a negative impact on the quantities sold by the Union industry, resulting in substantial adverse effects on the financial situation, the employment situation and the overall performance of the Union industry.

5. Procedure

Having determined, after informing the Member States, that the complaint was lodged by or on behalf of the Union industry and that there is sufficient evidence to justify the initiation of a proceeding, the Commission hereby initiates an investigation pursuant to Article 10 of the basic Regulation.

The investigation will determine whether the product under investigation originating in the countries concerned is being subsidised and whether these subsidised imports have caused or threaten to cause material injury to the Union industry.

If the conclusions are affirmative, the investigation will examine whether the imposition of measures would not be against the Union interest.

The Government of China and the Government of Egypt have been invited for consultations.

Regulation (EU) 2018/825 of the European Parliament and of the Council (4), which entered into force on 8 June 2018, (TDI Modernisation package) introduced a number of changes to the timetable and deadlines previously applicable in anti-subsidy proceedings. In particular, the Commission needs to provide information on the planned imposition of provisional duties 3 weeks before the imposition of provisional measures. The time-limits for interested parties to come forward, in particular at the early stage of investigations, are shortened. Therefore, the Commission invites interested parties to respect the procedural steps and deadlines provided in this Notice as well as in further communications from the Commission.

5.1.

Investigation period and period considered

The investigation of subsidisation and injury will cover the period from 1 January 2018 to 31 December 2018 (‘the investigation period’). The examination of trends relevant for the assessment of injury will cover the period from 1 January 2015 to the end of the investigation period (‘the period considered’).

5.2.

Comments on the complaint and the initiation of the investigation

All interested parties wishing to comment on the complaint (including matters pertaining to injury and causality) or any aspects regarding the initiation of the investigation (including the degree of support for the complaint) must do so within 37 days of the date of publication of this Notice.

Any request for a hearing with regard to the initiation of the investigation must be submitted within 15 days of the date of publication of this Notice.

5.3.

Procedure for the determination of subsidisation

Exporting producers (5) of the product under investigation from the countries concerned are invited to participate in the Commission investigation. Other parties from which the Commission will seek relevant information to determine the existence and amount of countervailable subsidies conferred upon the product under investigation are also invited to cooperate with the Commission to the fullest extent possible.

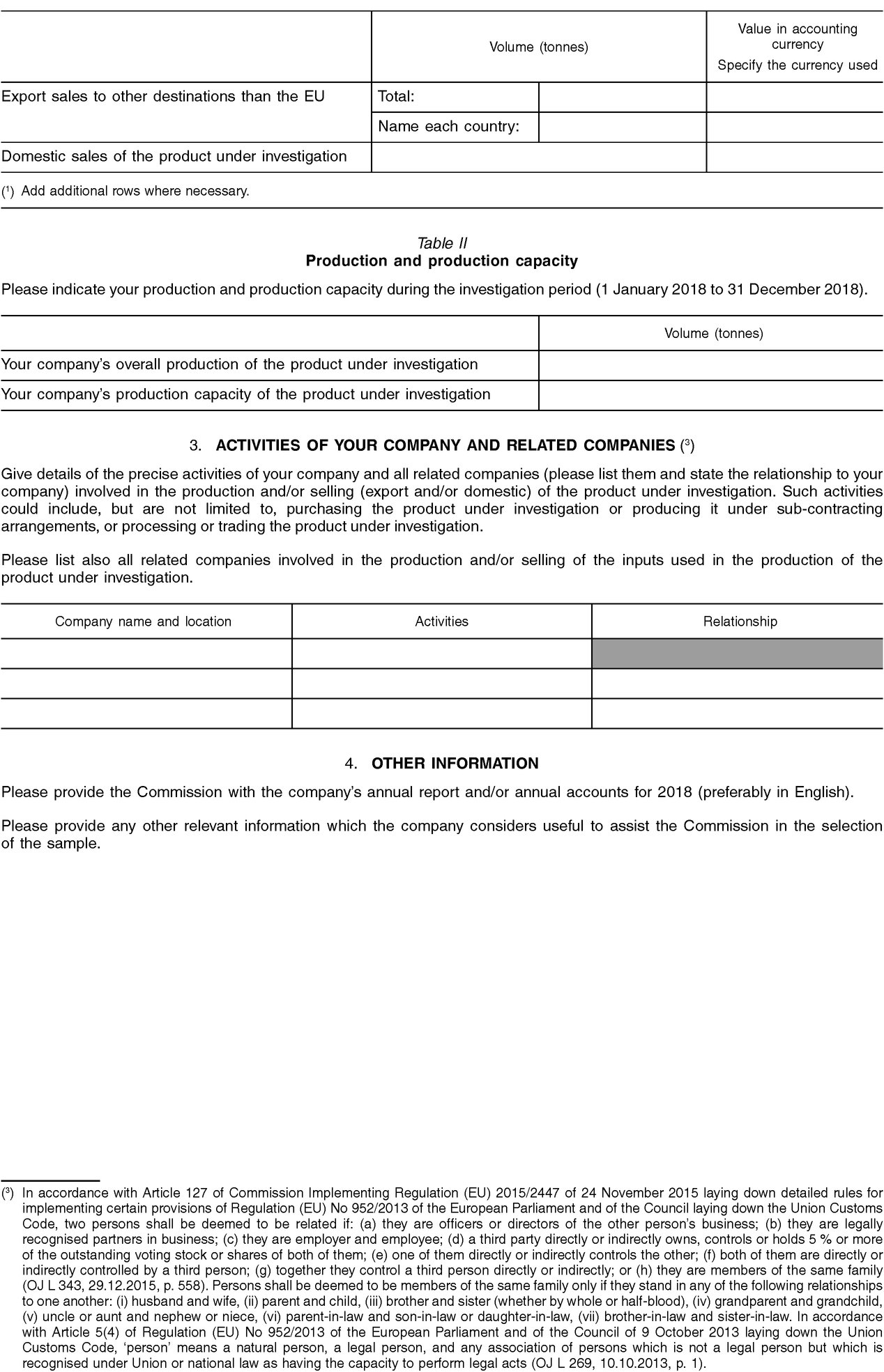

5.3.1. Investigating exporting producers

5.3.1.1. Procedure for selecting exporting producers to be investigated in the People's Republic of China

(a) Sampling

In view of the potentially large number of exporting producers in the People's Republic of China involved in this proceeding and in order to complete the investigation within the statutory time limits, the Commission may limit the exporting producers to be investigated to a reasonable number by selecting a sample (this process is also referred to as ‘sampling’). The sampling will be carried out in accordance with Article 27 of the basic Regulation.

In order to enable the Commission to decide whether sampling is necessary, and if so, to select a sample, all exporting producers, or representatives acting on their behalf, are hereby requested to provide the Commission with information on their companies requested in Annex I to this Notice within 7 days of the date of publication of this Notice.

In order to obtain information it deems necessary for the selection of the sample of exporting producers, the Commission has also contacted the authorities of the People's Republic of China and may contact any known associations of exporting producers.

If a sample is necessary, the exporting producers may be selected based on the largest representative volume of exports to the Union which can reasonably be investigated within the time available. All known exporting producers, the authorities of the People's Republic of China and associations of exporting producers will be notified by the Commission, via the authorities of the People's Republic of China if appropriate, of the companies selected to be in the sample.

In order to obtain information it deems necessary for its investigation with regard to exporting producers, the Commission will send questionnaires to the exporting producers selected to be in the sample, to any known associations of exporting producers, and to the authorities of the People's Republic of China.

Once the Commission has received the necessary information to select a sample of exporting producers, it will inform the parties concerned of its decision whether they are included in the sample. The sampled exporting producers will have to submit a completed questionnaire within 30 days from the date of notification of the decision of their inclusion in the sample, unless otherwise specified.

The Commission will add a note reflecting the sample selection to the file for inspection by interested parties. Any comment on the sample selection must be received within 3 days of the date of notification of the sample decision.

A copy of the questionnaire for exporting producers is available in the file for inspection by interested parties and on DG Trade's website: http://trade.ec.europa.eu/tdi/case_details.cfm?id=2398

The questionnaire will also be made available to any known association of exporting producers, and to the authorities of the People's Republic of China.

Without prejudice to the possible application of Article 28 of the basic Regulation, exporting producers that have filled in Annex I within the specified deadline and agreed to be included in the sample but are not selected as part of the sample will be considered to be cooperating (‘non-sampled cooperating exporting producers’). Without prejudice to section 5.3.1(b) below, the countervailing duty that may be applied to imports from non-sampled cooperating exporting producers will not exceed the weighted average amounts of subsidisation established for the exporting producers in the sample (6).

(b) Individual amount of countervailable subsidisation for companies not included in the sample

Pursuant to Article 27(3) of the basic Regulation, non-sampled cooperating exporting producers may request the Commission to establish their individual subsidy amount. Exporting producers wishing to claim an individual subsidy amount must fill in the questionnaire and return it duly completed within 30 days of the date of notification of the sample selection, unless otherwise specified. A copy of the questionnaire for exporting producers is available in the file for inspection by interested parties and on DG Trade's website http://trade.ec.europa.eu/tdi/case_details.cfm?id=2398

The Commission will examine whether non-sampled cooperating exporting producers can be granted an individual subsidy amount in accordance with Article 27(3) of the basic Regulation.

However, non-sampled cooperating exporting producers claiming an individual subsidy amount should be aware that the Commission may nonetheless decide not to determine their individual subsidy amount if, for instance, the number of non-sampled cooperating exporting producers is so large that such determination would be unduly burdensome and would prevent the timely completion of the investigation.

5.3.1.2. Procedure for selecting exporting producers to be investigated in Egypt

All exporting producers and associations of exporting producers in Egypt are invited to contact the Commission, preferably by email, immediately but no later than 7 days after the publication of this Notice, in order to make themselves known and request a questionnaire.

In order to obtain information it deems necessary for its investigation with regard to exporting producers, the Commission will send questionnaires to the exporting producers, to any known associations of exporting producers, and to the authorities of the Egypt.

Exporting producers in Egypt have to fill in a questionnaire within 37 days from the date of publication of this Notice. The questionnaire will also be made available to any known association of exporting producers, and to the authorities of Egypt.

A copy of the above-captioned questionnaire for exporting producers is available in the file for inspection by interested parties and on DG Trade's website (http://trade.ec.europa.eu/tdi/case_details.cfm?id=2398).

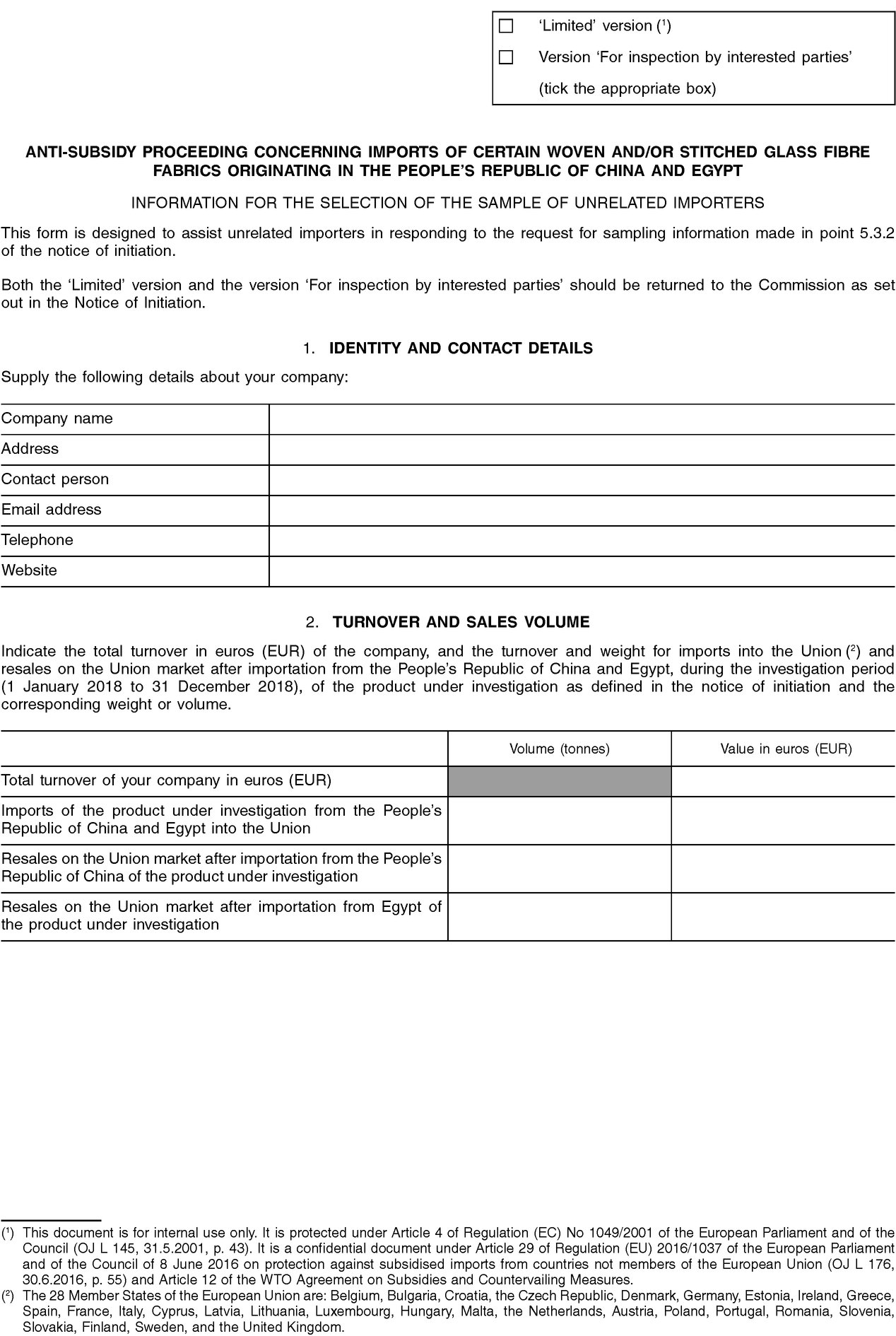

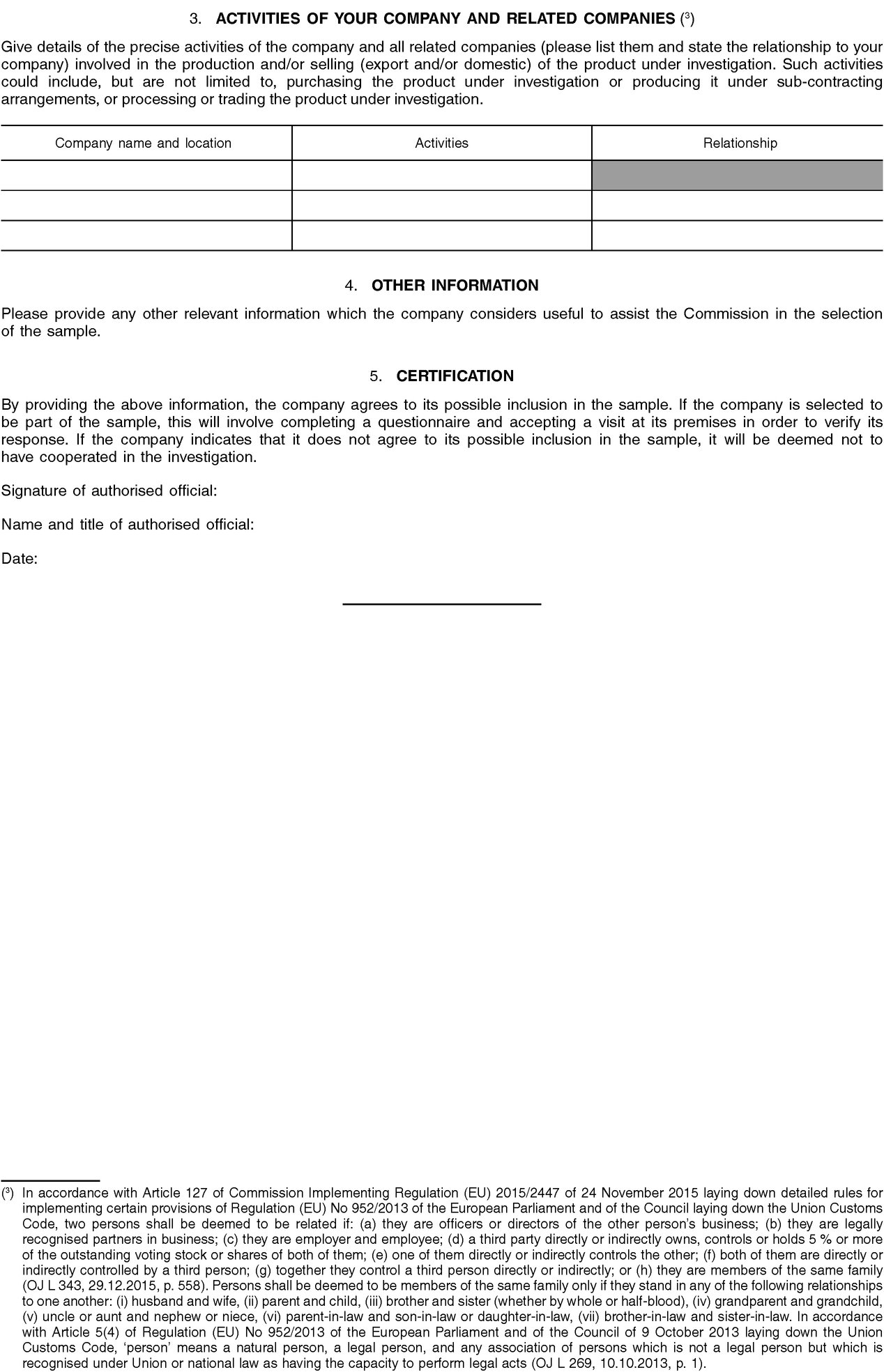

5.3.2. Investigating unrelated importers (7) (8)

Unrelated importers of the product under investigation from the countries concerned to the Union are invited to participate in this investigation.

In view of the potentially large number of unrelated importers involved in this proceeding and in order to complete the investigation within the statutory time limits, the Commission may limit to a reasonable number the unrelated importers that will be investigated by selecting a sample (this process is also referred to as ‘sampling’). The sampling will be carried out in accordance with Article 27 of the basic Regulation.

In order to enable the Commission to decide whether sampling is necessary and, if so, to select a sample, all unrelated importers, or representatives acting on their behalf, are hereby requested to provide the Commission with the information on their companies requested in Annex II to this Notice within 7 days of the date of publication of this Notice.

In order to obtain information it deems necessary for the selection of the sample of unrelated importers, the Commission may also contact any known associations of importers.

If a sample is necessary, the importers may be selected based on the largest representative volume of sales of the product under investigation in the Union which can reasonably be investigated within the time available.

Once the Commission has received the necessary information to select a sample, it will inform the parties concerned of its decision on the sample of importers. The Commission will also add a note reflecting the sample selection to the file for inspection by interested parties. Any comment on the sample selection must be received within 3 days of the date of notification of the sample decision.

In order to obtain information it deems necessary for its investigation, the Commission will make questionnaires available to the sampled unrelated importers. Those parties must submit a completed questionnaire within 30 days from the date of the notification of the decision about the sample, unless otherwise specified.

A copy of the questionnaire for importers is available in the file for inspection by interested parties and on DG Trade's website http://trade.ec.europa.eu/tdi/case_details.cfm?id=2398

5.4.

Procedure for the determination of injury and investigating Union producers

A determination of injury is based on positive evidence and involves an objective examination of the volume of the subsidised imports, their effect on prices on the Union market and the consequent impact of those imports on the Union industry. In order to establish whether the Union industry is injured, Union producers of the product under investigation are invited to participate in the Commission investigation.

In view of the large number of Union producers concerned and in order to complete the investigation within the statutory time-limits, the Commission has decided to limit to a reasonable number the Union producers that will be investigated by selecting a sample (this process is also referred to as ‘sampling’). The sampling is carried out in accordance with Article 27 of the basic Regulation.

The Commission has provisionally selected a sample of Union producers. Details can be found in the file for inspection by interested parties. Interested parties are hereby invited to comment on the provisional sample. In addition, other Union producers, or representatives acting on their behalf, that consider that there are reasons why they should be included in the sample must contact the Commission within 7 days of the date of publication of this Notice. All comments regarding the provisional sample must be received within 7 days of the date of publication of this Notice, unless otherwise specified.

All known Union producers and/or associations of Union producers will be notified by the Commission of the companies finally selected to be in the sample.

The sampled Union producers will have to submit a completed questionnaire within 30 days from the date of notification of the decision of their inclusion in the sample, unless otherwise specified.

A copy of the questionnaire for Union producers is available in the file for inspection by interested parties and on DG Trade's website http://trade.ec.europa.eu/tdi/case_details.cfm?id=2398

5.5.

Procedure for the assessment of Union interest

Should the existence of subsidisation and injury caused thereby be established, a decision will be reached, pursuant to Article 31 of the basic Regulation, as to whether the adoption of anti-subsidy measures would not be against the Union interest. Union producers, importers and their representative associations, users and their representative associations, representative consumer organisations and trade unions are invited to provide the Commission with information on the Union interest.

Information concerning the assessment of Union interest must be provided within 37 days of the date of publication of this Notice unless otherwise specified. This information may be provided either in a free format or by completing a questionnaire prepared by the Commission. A copy of the questionnaires, including the questionnaire for users of the product under investigation, is available in the file for inspection by interested parties and on DG Trade's website http://trade.ec.europa.eu/tdi/case_details.cfm?id=2398. In any case, the information submitted will only be taken into account if supported by factual evidence at the time of submission.

5.6.

Interested parties

In order to participate in the investigation interested parties, such as exporting producers, Union producers, importers and their representative associations, users and their representative associations, trade unions and representative consumer organisations first have to demonstrate that there is an objective link between their activities and the product under investigation.

Exporting producers, Union producers, importers and representative associations who made information available in accordance to the procedures described in sections 5.3, 5.4 and 5.5 above will be considered as interested parties if there is an objective link between their activities and the product under investigation.

Other parties will only be able to participate in the investigation as interested party from the moment they make themselves known, and provided that there is an objective link between their activities and the product under investigation. Being considered as an interested party is without prejudice to the application of Article 28 of the basic Regulation.

Access to the file available for inspection for interested parties is made via TRON.tdi at the following address: https://webgate.ec.europa.eu/tron/TDI. Please follow the instructions on that page to get access.

5.7.

Possibility to be heard by the Commission investigation services

All interested parties may request to be heard by the Commission's investigation services.

Any request to be heard must be made in writing and must specify the reasons for the request as well as a summary of what the interested party wishes to discuss during the hearing. The hearing will be limited to the issues set out by the interested parties in writing beforehand.

The timeframe for hearings is as follows:

|

—

|

For any hearings to take place before the imposition of provisional measures, a request should be made within 15 days from the date of publication of this Notice and the hearing will normally take place within 60 days of the date of publication of this Notice.

|

|

—

|

After the provisional stage, a request should be made within 5 days from the date of the provisional disclosure or of the information document, and the hearing will normally take place within 15 days from the date of notification of the disclosure or the date of the information document.

|

|

—

|

At definitive stage, a request should be made within 3 days from the date of the final disclosure, and the hearing will normally take place within the period granted to comment on the final disclosure. If there is an additional final disclosure, a request should be made immediately upon receipt of this additional final disclosure, and the hearing will normally take place within the deadline to provide comments on this disclosure.

|

The outlined timeframe is without prejudice to the right of the Commission services to accept hearings outside the timeframe in duly justified cases and to the right of the Commission to deny hearings in duly justified cases. Where the Commission services refuse a hearing request, the party concerned will be informed of the reasons for such refusal.

In principle, hearings will not be used to present factual information which is not yet on file. Nevertheless, in the interest of good administration and to enable Commission services to progress with the investigation, interested parties may be directed to provide new factual information after a hearing.

5.8.

Instructions for making written submissions and sending completed questionnaires and correspondence

Information submitted to the Commission for the purpose of trade defence investigations shall be free from copyrights. Interested parties, before submitting to the Commission information and/or data which is subject to third party copyrights, must request specific permission to the copyright holder explicitly allowing a) the Commission to use the information and data for the purpose of this trade defence proceeding and b) to provide the information and/or data to interested parties to this investigation in a form that allows them to exercise their rights of defence.

All written submissions, including the information requested in this Notice, completed questionnaires and correspondence provided by interested parties for which confidential treatment is requested shall be labelled ‘Limited’ (9). Parties submitting information in the course of this investigation are invited to reason their request for confidential treatment.

Parties providing ‘Limited’ information are required to furnish non-confidential summaries of it pursuant to Article 29(2) of the basic Regulation, which will be labelled ‘For inspection by interested parties’. Those summaries should be sufficiently detailed to permit a reasonable understanding of the substance of the information submitted in confidence.

If a party providing confidential information fails to show good cause for a confidential treatment request or does not furnish a non-confidential summary of it in the requested format and quality, the Commission may disregard such information unless it can be satisfactorily demonstrated from appropriate sources that the information is correct.

Interested parties are invited to make all submissions and requests via TRON.tdi (https://webgate.ec.europa.eu/tron/TDI), including scanned powers of attorney and certification sheets, with the exception of voluminous replies, which shall be submitted on a CD-ROM or DVD by hand or by registered mail. By using TRON.tdi or email, interested parties express their agreement with the rules applicable to electronic submissions contained in the document ‘CORRESPONDENCE WITH THE EUROPEAN COMMISSION IN TRADE DEFENCE CASES’ published on the website of the Directorate-General for Trade: http://trade.ec.europa.eu/doclib/docs/2011/june/tradoc_148003.pdf

The interested parties must indicate their name, address, telephone and a valid email address and they should ensure that the provided email address is a functioning official business email which is checked on a daily basis. Once contact details are provided, the Commission will communicate with interested parties by TRON.tdi or email only, unless they explicitly request to receive all documents from the Commission by another means of communication or unless the nature of the document to be sent requires the use of a registered mail. For further rules and information concerning correspondence with the Commission, including principles that apply to submissions via TRON.tdi and by email, interested parties should consult the communication instructions with interested parties referred to above.

Commission address for correspondence:

|

European Commission

|

|

Directorate-General for Trade

|

|

Directorate H

|

|

Office: CHAR 04/039

|

|

1049 Bruxelles/Brussel

|

|

BELGIQUE/BELGIË

|

|

TRON.tdi

|

:

|

https://webgate.ec.europa.eu/tron/tdi

|

|

Email

|

:

|

TRADE-AS656-GFF-SUBSIDY@ec.europa.eu

TRADE-AS656-GFF-INJURY@ec.europa.eu

|

|

6. Schedule of the investigation

The investigation will be concluded, pursuant to Article 11(9) of the basic Regulation within normally 12 months, but not more than 13 months of the date of the publication of this Notice. In accordance with Article 12(1) of the basic Regulation, provisional measures may be imposed normally not later than 9 months from the publication of this Notice.

In accordance with Article 29a of the basic Regulation, the Commission will provide information on the planned imposition of provisional duties 3 weeks before the imposition of provisional measures. Interested parties may request this information in writing within 4 months of the publication of this notice. Interested parties will be given 3 working days to comment in writing on the accuracy of the calculations.

In cases where the Commission intends not to impose provisional duties but to continue the investigation, interested parties will be informed in writing of the non-imposition of duties 3 weeks before the expiry of the deadline under Article 12(1) of the basic Regulation.

Interested parties will be given in principle 15 days to comment in writing on the provisional findings or on the information document, and 10 days to comment in writing on the definitive findings, unless otherwise specified. Where applicable, additional final disclosures will specify the deadline for interested parties to comment in writing.

7. Submission of information

As a rule, interested parties may only submit information in the timeframes specified in sections 5 and 6 of this Notice. The submission of any other information not covered by those sections should respect the following timetable:

|

—

|

Any information for the stage of provisional findings should be submitted within 70 days from the date of publication of this Notice, unless otherwise specified.

|

|

—

|

Unless otherwise specified, interested parties should not submit new factual information after the deadline to comment on the provisional disclosure or the information document at provisional stage. Beyond such deadline, interested parties may only submit new factual information provided that such parties can demonstrate that such new factual information is necessary to rebut factual allegations made by other interested parties and provided that such new factual information can be verified within the time available to complete the investigation in a timely manner.

|

|

—

|

In order to complete the investigation within the mandatory deadlines, the Commission will not accept submissions from interested parties after the deadline to provide comments on the final disclosure or, if applicable, after the deadline to provide comments on the additional final disclosure.

|

8. Possibility to comment on other parties' submissions

In order to guarantee the rights of defence, interested parties should have the possibility to comment on information submitted by other interested parties. When doing so, interested parties may only address issues raised in the other interested parties' submissions and may not raise new issues.

Such comments should be made according to the following timeframe:

|

—

|

Any comment on information submitted by other interested parties before the imposition of provisional measures should be made at the latest within 75 days from the date of publication of this Notice, unless otherwise specified.

|

|

—

|

Comments on the information provided by other interested parties in reaction to the disclosure of the provisional findings or of the information document should be submitted within 7 days from the deadline to comment on the provisional findings or on the information document, unless otherwise specified.

|

|

—

|

Comments on the information provided by other interested parties in reaction to the disclosure of the definitive findings should be submitted within 3 days from the deadline to comment on the definitive findings, unless otherwise specified. If there is an additional final disclosure, comments on the information provided by other interested parties in reaction to this further disclosure should be made within 1 day from the deadline to comment on this further disclosure, unless otherwise specified.

|

The outlined timeframe is without prejudice to the Commission's right to request additional information from interested parties in duly justified cases.

9. Extension to time-limits specified in this Notice

Any extension to the time-limits provided for in this Notice can only be requested in exceptional circumstances and will only be granted if duly justified.

Extensions to the deadline to reply to questionnaires may be granted, if duly justified, and will be normally limited to 3 additional days. As a rule, such extensions will not exceed 7 days. Regarding time-limits for the submission of other information specified in this Notice, extensions will be limited to 3 days unless exceptional circumstances are demonstrated.

10. Non-cooperation

In cases where any interested party refuses access to or does not provide the necessary information within the time-limits, or significantly impedes the investigation, provisional or final findings, affirmative or negative, may be made on the basis of facts available, in accordance with Article 28 of the basic Regulation.

Where it is found that any interested party has supplied false or misleading information, the information may be disregarded and use may be made of facts available.

If an interested party does not cooperate or cooperates only partially and findings are therefore based on facts available in accordance with Article 28 of the basic Regulation, the result may be less favourable to that party than if it had cooperated.

Failure to give a computerised response shall not be deemed to constitute non-cooperation, provided that the interested party shows that presenting the response as requested would result in an unreasonable extra burden or unreasonable additional cost. The interested party should immediately contact the Commission.

11. Hearing Officer

Interested parties may request the intervention of the Hearing Officer for trade proceedings. The Hearing Officer reviews requests for access to the file, disputes regarding the confidentiality of documents, requests for extension of time limits and any other request concerning the rights of defence of interested parties and third parties as may arise during the proceeding.

The Hearing Officer may organise hearings and mediate between the interested party/-ies and Commissions services to ensure that the interested parties' rights of defence are being fully exercised. A request for a hearing with the Hearing Officer should be made in writing and should specify the reasons for the request. The Hearing Officer will examine the reasons for the requests. These hearings should only take place if the issues have not been settled with the Commission services in the due course.

Any request must be submitted in good time and expeditiously so as not to jeopardise the orderly conduct of proceedings. To that effect, interested parties should request the intervention of the Hearing Officer at the earliest possible time following the occurrence of the event justifying such intervention. In principle, the timeframes set out in section 5.7 to request hearings with the Commission services apply mutatis mutandis to requests for hearings with the Hearing Officer. Where hearing requests are submitted outside the relevant timeframes, the Hearing Officer will also examine the reasons for such late requests, the nature of the issues raised and the impact of those issues on the rights of defence, having due regard to the interests of good administration and the timely completion of the investigation.

For further information and contact details interested parties may consult the Hearing Officer's web pages on DG Trade's website: http://ec.europa.eu/trade/trade-policy-and-you/contacts/hearing-officer/

12. Processing of personal data

Any personal data collected in this investigation will be treated in accordance with Regulation (EU) 2018/1725 of the European Parliament and of the Council (10).

A data protection notice that informs all individuals of the processing of personal data in the framework of Commission's trade defence activities is available on DG Trade's website: http://trade.ec.europa.eu/doclib/html/157639.htm

(1) OJ L 176, 30.6.2016, p. 55.

(2) The general term ‘injury’ refers to material injury as well as to threat of material injury or material retardation of the establishment of an industry as set out in Article 2(d) of the basic Regulation.

(3) References to the publication of this Notice mean publication of this Notice in the Official Journal of the European Union.

(4) Regulation (EU) 2018/825 of the European Parliament and of the Council of 30 May 2018 amending Regulation (EU) 2016/1036 on protection against dumped imports from countries not members of the European Union and Regulation (EU) 2016/1037 on protection against subsidised imports from countries not members of the European Union (OJ L 143, 7.6.2018, p. 1).

(5) An exporting producer is any company in the countries concerned which produces and exports the product under investigation to the Union market, either directly or via a third party, including any of its related companies involved in the production, domestic sales or exports of the product under investigation.

(6) Under Article 15(3) of the basic Regulation, any zero and de minimis amounts of countervailable subsidies and amounts of countervailable subsidies established in the circumstances referred to in Article 28 of the basic Regulation shall be disregarded.

(7) This section covers only importers not related to exporting producers. Importers that are related to exporting producers have to fill in Annex I to this Notice for these exporting producers. In accordance with Article 127 of Commission Implementing Regulation (EU) 2015/2447 of 24 November 2015 laying down detailed rules for implementing certain provisions of Regulation (EU) No 952/2013 of the European Parliament and of the Council laying down the Union Customs Code, two persons shall be deemed to be related if: (a) they are officers or directors of the other person's business; (b) they are legally recognised partners in business; (c) they are employer and employee; (d) a third party directly or indirectly owns, controls or holds 5 % or more of the outstanding voting stock or shares of both of them; (e) one of them directly or indirectly controls the other; (f) both of them are directly or indirectly controlled by a third person; (g) together they control a third person directly or indirectly; or (h) they are members of the same family (OJ L 343, 29.12.2015, p. 558). Persons shall be deemed to be members of the same family only if they stand in any of the following relationships to one another: (i) husband and wife, (ii) parent and child, (iii) brother and sister (whether by whole or half blood), (iv) grandparent and grandchild, (v) uncle or aunt and nephew or niece, (vi) parent-in-law and son-in-law or daughter-in-law, (vii) brother-in-law and sister-in-law. In accordance with Article 5(4) of Regulation (EU) No 952/2013 of the European Parliament and of the Council of 9 October 2013 laying down the Union Customs Code, ‘person’ means a natural person, a legal person, and any association of persons which is not a legal person but which is recognised under Union or national law as having the capacity to perform legal acts (OJ L 269, 10.10.2013, p. 1).

(8) The data provided by unrelated importers may also be used in relation to aspects of this investigation other than the determination of the subsidisation.

(9) A ‘Limited’ document is a document which is considered confidential pursuant to Article 29 of the basic Regulation and Article 6 of the WTO Agreement on Implementation of Article VI of the GATT 1994 (Anti-Subsidy Agreement). It is also a document protected pursuant to Article 4 of Regulation (EC) No 1049/2001 of the European Parliament and of the Council (OJ L 145, 31.5.2001, p. 43).

(10) Regulation (EU) 2018/1725 of the European Parliament and of the Council of 23 October 2018 on the protection of natural persons with regard to the processing of personal data by the Union institutions, bodies, offices and agencies and on the free movement of such data, and repealing Regulation (EC) No 45/2001 and Decision No 1247/2002/EC (OJ L 295, 21.11.2018, p. 39).