|

18.10.2017

|

EN

|

Official Journal of the European Union

|

C 350/5

|

Commission Interpretative Communication on the Acquisition of Farmland and European Union Law

(2017/C 350/05)

Some Member States' laws grant protection to agricultural land. Given that it is a scarce and special asset, acquisition of agricultural land is often subject to certain conditions and restrictions. Such national land laws, which exist in several EU Member States, pursue various objectives, from keeping farmland in agricultural use to curbing land concentration. Their common characteristic is that they have the objective of avoiding excessive land speculation. Some of the concerns underlying these laws, in particular land concentration and speculation, have recently gained higher profile on the political agenda. On 27 April 2017, the European Parliament adopted a report on farmland concentration and access to land for farmers (1).

The acquisition of farmland falls within the remit of EU law. Intra-EU investors enjoy the fundamental freedoms, first and foremost the free movement of capital and the freedom of establishment. These freedoms are integral parts of the internal market where goods, persons, services and capital can circulate freely. The internal market also extends to agriculture (2). The Commission has recently stressed that the Common Agricultural Policy (CAP) strives to contribute to its ten priorities which include a deeper and fairer internal market (3). At the same time, EU law also recognises the specific nature of agricultural land. The Treaties allow restrictions on foreign investments in farmland where they are proportionate to protect legitimate public interests such as preventing excessive land speculation, preserving agricultural communities or sustaining and developing viable agriculture. This is evident from the jurisprudence of the Court of Justice of the European Union (CJEU). Contrasting to the other fundamental freedoms under the Treaty, the free movement of capital — with its possible legitimate restrictions as established by the CJEU — also extends to investors from third countries. This interpretative Communication thus covers intra-EU as well as extra-EU acquisitions of farm land.

This Commission Interpretative Communication refers to the benefits and challenges of foreign (4) investment in agricultural land (1). It further outlines the applicable EU law (2) as well as the related jurisprudence of the CJEU (3). Finally, the Communication draws some general conclusions from the jurisprudence on how to achieve legitimate public interests in conformity with EU law (4). The Communication thus aims at informing the debate on foreign investment in farmland, assisting Member States that are in the process of adjusting their legislation or may wish to do so at a later stage, as well as helping to promote the wider dissemination of best practices in this complex area. At the same time, it responds to the European Parliament's request to publish guidance on how to regulate agricultural land markets in conformity with EU law (5).

1. Acquisition of agricultural land in the EU

a) The need to regulate agricultural land markets

Agricultural land is a special asset. In 2012, the United Nations called upon the States to ensure responsible governance of land tenure. To this end, the Foods and Agriculture Organisation of the United Nations (FAO) issued ‘Voluntary Guidelines’ on the governance of land tenure (6). The guidelines highlight the central importance of land ‘for the realisation of human rights, food security, poverty eradication, sustainable livelihoods, social stability, housing security, rural development, and social and economic growth’ (7). Accounting for almost half of the EU territory, agricultural land is exposed to pressure from non-agricultural uses as well as, in some periods, increasing demand for food, energy and biomass. Every year in Europe, soils covering an area larger than the city of Berlin are lost to urban sprawl and transport infrastructure (8).

Some national constitutions (9) and many national land laws grant special protection to agricultural land. Especially in recent times, the protection of agricultural land ranks high on the political agenda of a number of countries. Since 2013, and in particular following expiry of the transitional periods granted by the Accession Treaties (10), Hungary, Slovakia, Latvia, Lithuania, Bulgaria, Romania and Poland have adopted land laws to address undesired developments in their land markets.

Today, the need to regulate agricultural land markets could be particularly urgent in those countries which have undergone comprehensive land reforms in recent years (11). Restitution and privatisation of state-owned land have taken place or are still underway in some Member States (12). Moreover, farmland prices in those Member States are still low compared to other Member States (see Figure 1 in annex), despite the increase seen over the last decade (see Figure 2 in annex) (13). Against this background, farmers have voiced concerns about possible interest in farmland by other investors.

Regulations on land sales generally aim to preserve the agricultural characteristics of the assets, the proper cultivation of the land, the viability of existing farms and safeguards against land speculation. To this end, such regulations often require administrative authorisation of land sales and empower the competent authorities or bodies to object to a sale that goes against the objectives of the regulation. This can often be the case when the land is to be sold to a non-farmer where a local farmer in need of land is interested in it. The competent authorities can also intervene if they consider that the sale price is disproportionate to the value of the land. Some regulations on land sales grant pre-emption rights to the public authorities or bodies so they can resell the land to another buyer or rent it out in line with the agricultural policy. Another regulatory approach to address local land consolidation is to grant pre-emption rights to certain categories of interested parties, such as the tenant or the owner of the property neighbouring the land for sale (14).

b) Foreign investment, though increasing, is still low

In Europe, foreign investment in agricultural land appears limited in size. Especially in the EU-15 (15), inbound investment into farmland has remained exceptional (16). The interest of foreign investors has focused more on central and eastern European countries where, as from 1989, agriculture has undergone a remarkable transition from State farms or cooperatives to private farming in market economies.

It is difficult to obtain reliable data on foreign investment specifically in agricultural land. Information gathered by the Commission based on the Land Matrix database (17) shows that, for example, since 2004 foreign investors have acquired rights to use or control around 68 000 ha in Bulgaria, 8 000 ha in Lithuania and 84 000 ha in Romania. These estimated acquisitions represent a share of total arable land of 1,3 % in Bulgaria, 2,3 % in Lithuania and 0,4 % in Romania (18). The situation does not appear to be substantially different in other central and eastern European countries. To the extent they are available, official statistics from Hungary and Poland or studies covering Slovakia and Latvia suggest that foreigners own or control around 1 % of the utilised arable land (19).

However, the interest of foreign investors in farmland seems to be rising. It appears that the global financial crisis, in particular, had effects on investment in farmland. Seeking alternatives at a time of turmoil in financial markets, financial investors have put capital into agricultural land (20). In the same period, food security concerns along with biofuel and biogas programmes have contributed to increasing the interest of investors (21).

c) The acquisition of agricultural land on the political agenda

Concerns around foreign investments in agricultural land are not new. However, the recent rise in investments in farmland has increased the worries in some Member States. First, foreign investors have sometimes been perceived as crowding out local farmers. Second and more recently, there is concern that the (shrinking) areas of cultivable land have become vulnerable to speculators or unscrupulous investors. Fears have been voiced about increasing land concentration and speculation and the negative impact this has on food security, employment, the environment, soil quality and rural development (22). Some critics question the benefits of foreign acquisitions in the EU and claim that large international investment funds and companies deprive small and poor farmers of land resources and disrupt rural development (23).

Those concerns have also been taken up by the European Institutions. On 21 January 2015, the Economic and Social Committee (EESC) issued its Opinion on ‘Land grabbing — a warning for Europe and a threat to family farming’ (24). It identified the free movement of capital as a driver for land acquisitions which it considers ‘land grabbing’.

The European Parliament has also shown an interest in the topic. It requested a study on the ‘Extent of farmland grabbing in the EU’ which was published in May 2015 (25). On 27 April 2017, the Parliament adopted a ‘Report on the state of play of farmland concentration in the EU: how to facilitate the access to land for farmers’ (26). The report points to the degree of farmland concentration in the hands of a few agricultural and non-agricultural undertakings and the inherent risks such as difficult access to farmland for farmers (especially small-scale and family farmers). Accordingly, the Parliament calls for better monitoring of developments on land sales markets. In particular, it calls on the Commission to monitor all relevant policy areas, namely agriculture, finance and investment, ‘to see whether they promote or counteract the concentration of agricultural land in the EU’. The Parliament also calls on the Commission ‘to publish a clear and comprehensive set of criteria’ that ‘make it clear to the Member States which land market regulation measures are permitted’ under European Union law.

In terms of the wider policy agenda, other policies are perceived as a potential influencing factor. Answers to the recent public consultation on the simplification and modernisation of the CAP highlighted a number of issues including administrative requirements, land regulations and in particular the high prices of farmland in some Member States as a major concern for farmers. In addition, concerns have been previously expressed around the different levels of direct payments between the Member States which may not have always ensured a level playing field as regards access to farmland. The difference in direct payments has been addressed in the last Multiannual Financial Framework (MFF 2014-2020) via the so-called external convergence of direct payments and it may be an issue that will attract again attention.

In addition, other EU measures may be relevant in the context of the acquisition of farmland. Directive (EU) 2015/849 of the European Parliament and of the Council (27) that entered into application recently. The Directive aims at increasing transparency about whom really owns companies and trusts that might also mitigate concerns currently addressed by restrictions on acquisition of farmland in some countries, where authorities fear that transfers of shares between legal entities that own farmland may be used to circumvent conditions imposed on acquirers. The recent Commission proposal to amend this Directive will further increase transparency.

Finally, as regards third country investors, the recent Commission proposal for a framework for screening of foreign direct investments has the objective of providing legal certainty for Member States that have in place or want to establish mechanisms to screen direct investment from third countries, in view of the Union's exclusive competence in the area of the common commercial policy, which includes foreign direct investment (28). The proposal establishes a framework for the Member States, and in certain cases the Commission, to review direct investments from third countries in the European Union, while allowing Member States to take into account their individual situations and national circumstances with a view to protecting essential interests for reasons of public order or security. The new rules enable Member States to adopt or maintain appropriate review mechanisms for foreign direct investment, provided that certain conditions laid down in the Regulation are met (29).

d) The benefits of foreign investment in properly regulated land markets

In its research, the FAO concludes that, globally, foreign agricultural investments benefit national economies, local communities and the agricultural sector when national institutions and rules give proper incentives to all market players (30). Within Europe, foreign investments have also been an important source of much needed capital, technology and knowledge and have helped to improve agricultural productivity and product quality (31).

The free movement of capital is crucial for boosting cross-border investments and access to finance by local businesses. It is noteworthy that farms often have difficulty finding the finances for necessary investments. Like other small firms, small agricultural firms face credit constraints and there are indications that agriculture is under-capitalised in many countries (32).

The beneficial effects of foreign investments have been demonstrated by multiple studies commissioned by the Commission reviewing the transitional periods (33) as well as by external studies (34). To the extent that foreign investment has been allowed (for example, through renting land, establishment, legal entities or investment in the food industry) it has been proven to stimulate productivity gains in the agricultural sector (35). Therefore, it seems fair to conclude that foreign investments can add value to underutilised land and put abandoned land back into cultivation. Such investment can further improve market access for farmers as well as working conditions for farm workers. Finally, foreign investment can increase the export potential for farm products.

e) The Commission's legal action on recent land laws in some Member States

The recent amendments to legislation in Hungary, Slovakia, Latvia, Lithuania, Bulgaria and Romania coincide with the end of the transitional periods during which the Accession Treaties allowed them to restrict EU investors from buying agricultural land.

The new laws lifted the restrictions referred to in the Accession Treaties. At the same time, they introduced some restrictions which have as their declared objective the curbing of land concentration and speculation, to keep farmland in good and efficient agricultural use, to preserve a rural population, to address land fragmentation or to promote viable, medium-sized farms. To this end, the laws in question subject the acquisition of land to certain conditions. These include prior administrative approval and in particular requirements such as the acquirer of agricultural land farms the land himself, holds qualifications in farming, and has been residing or doing business in the given country. Furthermore, the new laws favour certain categories of acquirers (such as tenants, neighbouring farmers or locals) or prohibit selling to legal persons.

The Commission recognises the validity of the above-mentioned objectives as such. Having examined the new laws, however, it was concerned that some of their provisions infringe fundamental EU principles, namely the free movement of capital. In particular, in the Commission's view they discriminate, not formally but in their practical effects, against nationals from other EU countries or impose other disproportionate restrictions that would negatively affect investment. For this reason, in 2015, the Commission initiated infringement procedures against Bulgaria, Hungary, Lithuania, Latvia and Slovakia (36). Given that none of these countries was able to dispel the concerns raised, on 26 May 2016, the Commission advanced the procedures to the second and last step before a possible referral to the CJEU (37).

2. Applicable EU law

There is no secondary European legislation addressing the acquisition of agricultural land. The Member States have jurisdiction and discretion to regulate their land markets. In doing so however, they must respect the basic Treaty principles, first and foremost the fundamental freedoms and non-discrimination on grounds of nationality.

a) The free movement of capital and freedom of establishment

The right to acquire, use or dispose of agricultural land falls under the free movement of capital principles set out in Articles 63 et seq. of the Treaty on the Functioning of the European Union (TFEU) (38). These Treaty provisions bestow enforceable rights upon both the investor and the recipient of the investment. As a rule, all restrictions on the movement of capital between Member States but also between Member States and third countries are prohibited. The CJEU has interpreted the term restriction to mean all measures which limit investments or which are liable to hinder, deter or make them less attractive (39).

When investment in farmland serves agricultural entrepreneurial activities, it may also be covered by the freedom of establishment: Article 49 TFEU prohibits all restrictions on the establishment of nationals (legal or physical persons) of a Member State in the territory of another Member State for the pursuit of a self-employed economic activity such as farming.

An essential element inherent in all fundamental freedoms is the principle of non-discrimination on grounds of nationality. It prohibits both direct and indirect discrimination (covert forms of discrimination). The latter refers to national provisions related to the exercise of fundamental freedoms which do not explicitly discriminate on grounds of nationality but which lead in fact to an equivalent result.

Article 345 TFEU states that the ‘Treaties shall in no way prejudice the rules in Member States governing the system of property ownership’. National rules governing the acquisition or use of agricultural real estate do concern property rights but Article 345 TFEU does not preclude the fundamental freedoms or other basic Treaty principles from applying. The CJEU, in settled case law, rejected a broad reading of Article 345 TFEU. For example, in the Konle judgment concerning the acquisition of real estate, the Court clarified with respect to that Article which then was Article 222: ‘… although the system of property ownership continues to be a matter for each Member State under Article 222 of the Treaty, that provision does not have the effect of exempting such a system from the fundamental rules of the Treaty’ (40). As a result, Article 345 TFEU preserves the competence of Member States to take decisions concerning the system of property ownership, but subject to the requirements of EU law.

b) Restrictions on fundamental freedoms and possible justifications

Generally, national measures liable to hinder the exercise of fundamental freedoms can only be permitted if a number of conditions are fulfilled: the measures are not discriminatory, they are justified by an overriding public interest, they are suited to attaining the objective sought and they do not go beyond what is necessary to achieve that objective and cannot be replaced by less restrictive alternative means (principle of proportionality, see in more detail below 3b). Moreover, national measures must comply with other general principles of EU law such as legal certainty.

As for the free movement of capital in particular, Article 65 TFEU provides that this freedom is without prejudice to certain rights of Member States. These include the right to apply specific national tax provisions, to take precautions and supervisory measures especially in the fields of taxation and the prudential supervision of financial institutions. Moreover, and of more general importance, Article 65(1)(b) TFEU preserves the right of Member States ‘to take measures which are justified on grounds of public policy or public security’.

Different considerations apply to the movement of capital to and from third countries. The CJEU stressed that it ‘takes place in a different legal context’ from that which occurs within the Union. Consequently, under the Treaty additional justifications may be acceptable in the case of third country restrictions (41). Justifications may also be interpreted more broadly (42). Moreover, and in practice more importantly, any restrictions existing before the liberalisation of capital movements are grandfathered under Article 64(1) TFEU. The relevant date is 31 December 1993 for all Member States except Bulgaria, Estonia and Hungary (31 December 1999) and Croatia (31 December 2002). This means that restrictions in place before these dates affecting third country nationals cannot be challenged on the basis of the principle of the free movement of capital under the Treaty.

c) Charter of Fundamental Rights of the European Union (CFR)

Finally, other provisions of EU law might come into play in the process of acquiring, using or disposing of agricultural land, for example the right to property (Article 17 CFR), the freedom to choose an occupation (Article 15 CFR) and the freedom to conduct a business, including the freedom of contract (Article 16 CFR).

d) The principle of legal certainty

In addition, the principles of legal certainty and of legitimate expectations must also be complied with. These principles require in particular that rules involving negative consequences for individuals should be clear and precise and their application predictable for those subject to them (43). The right to rely on the principle of the protection of legitimate expectations extends to any person in a situation where a public authority has caused him to entertain expectations which are justified (44). Finally, fundamental rights must be respected.

3. The CJEU's approach to agricultural land

Some national land laws restricting the free movement of capital have been challenged before national courts which turned to the CJEU for a correct interpretation of EU law. Consequently, the CJEU has already had the opportunity to spell out in preliminary rulings how EU law impacts on cross-border investments in farmland.

a) Agricultural policy objectives that may justify restrictions on fundamental freedoms

The CJEU has recognised the specific nature of agricultural land. In its rulings on the acquisition of agricultural real estate, it has recognised a number of public policy objectives that can in principle justify restrictions to investment in agricultural land such as:

|

—

|

to increase the size of land holdings so that they can be exploited on an economic basis, to prevent land speculation (45),

|

|

—

|

to preserve agricultural communities, maintain a distribution of land ownership which allows the development of viable farms and management of green spaces and the countryside, encourage a reasonable use of the available land by resisting pressure on land, prevent natural disasters, and sustain and develop viable agriculture on the basis of social and land planning considerations (which entails keeping land intended for agriculture in such use and continuing to make use of it under appropriate conditions) (46),

|

|

—

|

to preserve a traditional form of farming of agricultural land by means of owner-occupancy and ensure that agricultural property be occupied and farmed predominantly by the owners, preserve a permanent agricultural community, and encourage a reasonable use of the available land by resisting pressure on land (47),

|

|

—

|

to maintain, for town and country planning or regional planning purposes and in the general interest, a permanent population and an economic activity independent of the tourist sector in certain regions (48),

|

|

—

|

to preserve the national territory within the areas designated as being of military importance and protect military interests from being exposed to real, specific and serious risks (49).

|

On several occasions, the CJEU has stressed that the objectives in question are consistent with the objectives of the CAP under Article 39 TFEU. This provision aims, among other things, to ensure a fair standard of living for the agricultural community and which takes account of the particular nature of agricultural activity (e.g. social structure, structural and natural disparities between the various agricultural regions). It is important to note that the CJEU has established its jurisprudence on a case-by-case basis, always judging the measures in the context of the specific circumstances of each case. In line with well-established case law, exceptions to fundamental freedoms have to be interpreted narrowly. In any case, purely economic ends cannot justify derogations from fundamental freedoms.

b) Compliance with the principle of proportionality

While the CJEU has, in this field, accepted several policy objectives to be legitimate, it has exercised an in-depth scrutiny when it comes to the proportionality of the national measures restricting fundamental freedoms. When assessing the proportionality, all the factual and legal circumstances of the case should be taken into account, both from the perspective of the exercise of the fundamental freedoms by the sellers and potential buyers, and with regard to the public interest pursued. The principle of proportionality requires that the restrictive provisions are suitable for achieving the intended objective, including the fact that they must serve the legitimate public objective in a consistent and systematic manner (50). They are also not to go beyond what is necessary to achieve the public interest. Finally, a restrictive measure is not proportionate if there is a possible alternative measure which could pursue the public interest at stake in a manner that is less restrictive to the free movement of capital or the freedom of establishment (51).

It is for the national authorities to demonstrate that their legislation is consistent with the principle of proportionality. This means that the legislation must be suitable and necessary in order to achieve the declared objective, and that that objective could not be achieved by prohibitions or restrictions that are less extensive, or that are less disruptive of trade within the European Union (52). In that regard, the reasons which may be invoked by a Member State as justification must be backed up with appropriate evidence or an analysis of the appropriateness and proportionality of the restrictive measure (53).

4. Conclusions on the regulation of the acquisition of agricultural land

This Commission Interpretative Communication has referred to the various needs and forms of regulations of agricultural land. Many of them have existed for many years, others are more recent. This last chapter discusses some of the features which are to be found in laws regulating the land markets and which require special attention. It draws some conclusions from the jurisprudence which could provide guidance to Member States on how to regulate the agricultural land markets in conformity with EU law and in a way which balances the need to attract capital into rural areas with the pursuit of legitimate policy objectives.

a) Prior authorisation

It can be inferred from the jurisprudence that subjecting the transfer of agricultural land to prior administrative approval restricts the free movement of capital but can still be justified under EU law under certain circumstances. The CJEU has recognised that any supervision after the transfer of agricultural land has occurred would not prevent a transfer that was contrary to the pursued agricultural objective. Alternatives to prior authorisation schemes were likely to offer less legal certainty to the land transaction. For instance, action taken afterwards, such as annulation of the transfer, would undermine the legal certainty which is of fundamental importance to any system of land transfer (54). On that basis, schemes involving prior authorisation could therefore be acceptable in some circumstances.

In particular, the CJEU has also stressed that a scheme of prior authorisation must not grant discretionary powers that can lead to arbitrary use and decisions by the competent authorities. It cannot, in the CJEU's words, ‘render legitimate discretionary conduct on the part of the national authorities that is liable to negate the effectiveness’ of EU law. Therefore, for such a scheme to be compatible with EU law, ‘it must be based on objective, non-discriminatory criteria known in advance, in such a way as adequately to circumscribe the exercise of the national authorities' discretion.’ (55). The criteria must be precise (56). Furthermore, all persons affected must have access to legal redress (57).

With respect to a prior authorisation scheme under which authorisation could be granted under ‘other special circumstances’, the CJEU has found that such criteria for the authorisation were too vague and did not enable individuals to become familiar with the extent of their rights and obligations resulting from the free movement of capital principles (58). Similarly, the CJEU considered that it is disproportionate to impose, as a condition for the acquisition, the obligation of having a ‘sufficient connection with the commune’, which the law in question in this case defined as meaning that the acquirer ‘has established a professional, family, social or economic connection to the commune as a result of a significant circumstance of long duration’ (59).

b) Pre-emption rights (rights of first refusal) in favour of farmers

The CJEU's jurisprudence suggests that pre-emption rights in favour of certain categories of buyers (such as tenant farmers) can under certain circumstances be justified on the grounds of agricultural policy objectives. In the Ospelt case (60), the CJEU examined a scheme of prior authorisation of the acquisition of farmland. The CJEU examined the proportionality of measures prohibiting the acquisition by non-farmers with the objective of maintaining a viable farming community and keeping the land in agricultural use.

It considered whether there were measures which were less restrictive to the free movement of capital than a ban on acquisition by non-farmers. In this particular context, the CJEU concluded that mechanisms could be put in place giving a right of first refusal to tenants. If the latter did not acquire the property, non-farmers could be authorised to acquire farmland on the condition of giving a commitment to keep the land in agricultural use.

Therefore, if the objective is to promote the acquisition of land by farmers, pre-emption rights in favour of tenant farmers or farmers more generally could be considered as a proportionate restriction on free movement of capital in as far as they are less restrictive than a prohibition of acquisition by non-farmers.

c) Price controls

State interventions to prevent excessive farmland prices may under certain circumstances be justified under EU law. This applies, in particular, to rules allowing national authorities to prohibit the sale of land if the price can be considered under objective criteria to be excessively speculative.

Whereas it is not automatic that a price regulation would restrict foreign investments in farmland, in the light of the definition given by the CJEU, limitations to the parties' freedom to set the prices are usually qualified as restrictions (61). Indeed, both the cross-border investor and the recipient of an investment are in principle hindered in their freedom if they are unable to freely set the price according to the rule of offer and demand. However, a restriction to price freedom can under certain circumstances be justified (62). The prevention of unreasonable (excessively speculative) prices, be they far too high or too low, appears to be a legitimate justification in light of the agricultural policy purposes recognised by the CJEU. Price regulations which are based on objective, non-discriminatory, precise and well-tailored criteria can be suitable to curb excessive land speculation or to save professional farmers from purchase costs which could endanger the profitability of their farms. At the same time, they could also prove necessary if it appears that they do not go beyond what is necessary to curb excessive speculation or to maintain the viability of farming. It then needs to be verified whether there are no less onerous measures to prevent unreasonable prices than price controls. The proportionality of a national law on price regulation has to be determined in the light of all the factual and legal circumstances of the specific case. The case in favour of proportionality is likely to be stronger with regard to markets which are vulnerable to excessive speculation, such as some agricultural land markets.

The findings on price controls are confirmed by the CJEU's jurisprudence on State aid in the context of the privatisation of farmland. The CJEU found that the sale of public land at a price lower than its market value might constitute State aid (63). The reason is that such a sale confers an advantage on the purchaser and, at the same time, entails a loss of income, hence a reduction of the State budget. Therefore, in order to avoid the grant of State aid and thus to comply with Article 107 TFEU, the privatisation of farmland must be conducted at a price which is as close as possible to its market value. To this end, the method for valuing the land must include an updated mechanism which takes account of recent market developments (for example, sharply rising prices) (64).

In a more recent judgment, the CJEU further developed this jurisprudence. It provided some clarifications about the market value at which publicly owned land must be sold. In the case at issue, the competent authority, relying on a provision of national law, did not approve the sale of a plot of land to the highest bidder in a public tender on the ground that its bid was grossly disproportionate to the value of the land. The CJEU accepted that the sale to the highest bidder does not necessarily result in a price which reflects the market value, hence the highest bid could be disproportionate. This could be the case where that bid is distinctly higher than any other price offered or expert estimations (65). It referred to the detailed discussion of the Advocate General on how to assess the market value (66). The CJEU concluded that a price regulation which prohibits the sale of publicly owned land to the highest bidder cannot be classified as State aid provided that its application results in a price as close as possible to the market value of the land (67).

d) Self-farming obligation

While the CJEU has acknowledged the need to ensure predominant owner-occupancy of arable land as a legitimate public objective (68), its existing jurisprudence does not accept a general self-farming requirement for the acquisition of agricultural land as a proportionate measure. In the Ospelt judgment, the CJEU addressed a particular national restriction on the acquisition of farmland with the aim of keeping land in agricultural use. Under the law in question, acquisition of farmland was authorised only if, among other conditions, the acquirer committed to farm it himself (69). In the case at issue, the authorisation was refused despite the fact that the acquirer (a legal person) agreed to continue leasing the agricultural plots to the same farmers as before. The CJEU found that the self-farming obligation as a requirement to acquire agricultural land was disproportionate because that condition reduced the possibility of leasing the land to farmers who did not have their own resources to acquire land. The objective pursued could be achieved by less restrictive measures, namely by making the acquisition conditional on the assurance by the acquirer that the land would be kept in agricultural use (70).

In addition to possible legal objections in view of the free movement of capital, the self-farming obligation would also appear to encroach on fundamental rights. If the acquirer of agricultural land has to agree to farm the land in person, this will affect his capacity to carry out other professional activities and thus his freedom to conduct a business (Article 16 CFR). The same could be true for his right to pursue a freely chosen or accepted occupation (Article 15 CFR).

e) Qualifications in farming

Subjecting the acquisition to the condition that the acquirer possesses specific qualifications in agriculture constitutes a restriction which raises doubts as to its proportionality.

First, it does not appear necessary that the acquirer himself possess appropriate qualifications as long as he can give assurances that the land will be properly farmed (71).

Second and more importantly, it appears that the qualification requirement in general goes beyond what is necessary to ensure proper cultivation of the land or high agricultural productivity and quality. In fact, in none of the Member States is ‘farmer’ a regulated profession within the meaning that it legally requires specific qualifications (72). Thus, it cannot be concluded that an effective agricultural sector presupposes obligatory professional qualifications. Against this background, the specific qualification requirement for the acquisition of land needs special justification in any national legislation in the absence of which it would appear to be an unjustified and disproportionate restriction on the free movement of capital. To come to a different conclusion, Member States would need to demonstrate why certain qualifications are required for the acquisition of land, while farming activities are generally allowed without any formal attestation of competence. These considerations do not call in question that a successful and sustainable agriculture necessitates adequate vocational training.

f) Residence requirements

On several occasions, the CJEU has had to pass judgments on national rules requiring that the purchaser of farmland resides on or near the land in question. In an early preliminary ruling when the free movement of capital provisions in the Treaty were not yet directly applicable, the CJEU stated that, under narrow conditions, such a requirement is compatible with the freedom of establishment (73). However, it is clear from more recent jurisprudence that residence requirements are incompatible with free movement of capital principles.

In Ospelt, the CJEU ruled out the lawfulness of any condition that the acquirer has to reside on the land (74). Four years later, in 2007, the CJEU considered as disproportionate the requirement that the acquirer takes up his fixed residence on the property which is the object of the sale. The CJEU found that such a residence requirement is particularly restrictive, given that it not only affects free movement of capital and freedom of establishment but also the right of the acquirer to choose his residence freely (75).

In this case, one of the reasons behind the idea of imposing a requirement to take up fixed residence on the property was to discourage property speculation. The CJEU discussed in detail various justifications for such a requirement and dismissed them all. It concluded that, to reduce land speculation, measures less detrimental to the free movement of capital and fundamental rights than residence requirements have to be considered. The CJEU gave the examples of a higher tax on resale of land occurring shortly after acquisition, or the requirement of a substantial minimum duration for leases of agricultural land (76).

On the obligation to take up residence on the land to be acquired, the same applies to a requirement to being a resident in the country or the municipality to which the land belongs. In fact, any residence requirement amounts to an indirect discrimination on grounds of nationality. The CJEU has indeed consistently held that national rules ‘under which a distinction is drawn on the basis of residence in that non-residents are denied certain benefits which are, conversely, granted to persons residing within the national territory, are liable to operate mainly to the detriment of nationals of other Member States. Non-residents are in the majority of cases foreigners’ (77). In this context, it should be noted that any requirement of having knowledge of the language of the country concerned would meet very similar objections.

g) Prohibition on selling to legal persons

A national rule prohibiting the sale of farmland to legal persons is a restriction on the free movement of capital and, where applicable, the freedom of establishment. It can be concluded from the CJEU's jurisprudence that such a restriction is unlikely to be justified. Indeed, when examining a condition that the acquirer farms the land himself, the CJEU found that such a restriction has the effect of precluding legal persons from acquiring farmland. In that case, the CJEU questioned whether this was necessary to achieve the objective of the law in question, namely keeping farmland in agricultural use. When the object of a legal person is farming, the prohibition on selling to legal persons is an obstacle to transactions which do not in themselves affect the agricultural use (78). It can be concluded from the CJEU's considerations that such a prohibition is not justified because it is not necessary to achieve the claimed objective. In this context, the CJEU also referred to examples of less restrictive measures, in particular making the transfer to a legal person subject to the obligation that the land will be let on a long lease (79).

h) Acquisition caps

Upper limits on the size of land ownership which can be acquired or held are restrictions to the free movement of capital as they limit investors' decisions to acquire agricultural land. Whereas they could be justified for specific policy objectives, their proportionality may be questionable, depending on the national circumstances. Some acquisition caps seem to run counter to some objectives which the CJEU has recognised as being in the overriding public interest, namely to increase the size of land holdings so that they can be exploited on an economic basis, or to allow the development of viable farms. From another point of view, given that farmland is a limited resource, some other acquisition caps seem to be suitable to prevent excessive land ownership concentration to support family farming and the development of medium-sized farms. It would then need to be examined whether they do not go beyond what is necessary and whether they can be replaced by less restrictive alternative means. The actual justification and proportionality of such caps therefore need to be examined in each national context, in light of all factual and legal circumstances of the case.

The Commission has so far taken note of two types of acquisition cap measures in national legislations. Some Member States require a specific permit from a regulator for acquisitions above a certain size. Other Member States have introduced or confirmed absolute caps that had been already in place.

If justified by a legitimate reason of public interest (such as the aim to achieve a more balanced ownership structure) and compliant with EU fundamental rights and general principles of EU law such as non-discrimination and proportionality, national acquisition caps might be considered compatible with EU law. The assessment will also heavily depend on whether the national rules are based on objective and well-defined criteria and whether the means of judicial redress for the individuals concerned are provided for.

i) Privileges in favour of local acquirers

Pre-emption rights and other privileges in favour of local buyers require particular attention and attentive scrutiny. Privileges for locals could amount to privileging the own nationals of a Member State. Thus, they could constitute a covert discrimination on grounds of nationality prohibited by Article 63 (as well as by Article 49) TFEU, as they privilege, even if not formally, but in their practical effects their own nationals. In fact, it can hardly be contested that the large majority of local buyers are nationals of the Member State concerned and, therefore, foreigners are far less likely to enjoy the privilege granted to locals than nationals of the country concerned (80). Moreover and in any event, even if they were considered to be indistinctly applicable, such measures would still restrict the free movement of capital, and where applicable, the freedom of establishment because they are liable to hinder or make less attractive investments in farmland by non-locals (81).

To be compatible with free movement of capital principles, privileges for local acquirers, like other restrictions, have to pursue, in a proportionate manner, legitimate objectives in the public interest. It cannot be excluded that Member States invoke public objectives which the CJEU has recognised as legitimate, such as increasing the size of land holdings to develop viable farms in local communities, or preserving a permanent agricultural community. At this level, the condition is that the privileges have to reflect the socioeconomic aspects of the intended objectives. This could be the case if pre-emption rights are granted to local farmers to address land ownership fragmentation, for instance, or if other special rights are given to locals to accommodate concerns resulting from their geographical situation (for example, less developed regions).

Privileges for locals which are not necessary to achieve the objective pursued are obviously not justified (82). This follows especially from the CJEU's jurisprudence in Libert. In this case, the CJEU examined the proportionality of a national rule whereby the land in a given municipality could be acquired only under the following conditions: first, the requirement that a person to whom the immovable property is to be transferred has been resident in the target municipality or a neighbouring municipality for at least six consecutive years prior to the transfer; second, the prospective buyer or tenant must, at the date of the transfer, carry out activities in the municipality in question which occupy on average at least half a working week; third, the prospective buyer or tenant has a professional, family, social or economic connection with the municipality in question as a result of a significant circumstance of long duration. The CJEU considered this national rule to be disproportionate. It explained that none of those conditions directly reflects the socioeconomic aspects relating to the objective put forward by the Member State of protecting exclusively the less affluent local population on the property market. The conditions of the law may be met not only by the less affluent local population but also by other persons with sufficient resources who, consequently, have no specific need for social protection on the property market. Those conditions thus go beyond what is necessary to attain the objective pursued. In addition, it should be noted that less restrictive measures other than those set out in the national rule in question had to be considered (83).

j) Condition of reciprocity

Member States may not make the acquisition of farmland by EU citizens of another Member State conditional on its own nationals being permitted to acquire farmland in the country of origin of the EU citizen of the other Member State. The requirement of reciprocity has long been rejected by the CJEU as incompatible with the principles of EU law. The obligation to comply with EU law does not depend on compliance by other Member States (84). In case of infringement of EU law by a Member State, any other Member State has the right to bring the infringing Member State before the CJEU (Article 259 TFEU). Moreover, the Commission as guardian of the Treaty monitors Member State compliance with EU law and is empowered to pursue infringement procedures, if necessary bringing infringing Member States before the CJEU.

5. Final remarks

It is clear from the above that, under EU law, Member States can take into account legitimate policy concerns. They can define a suitable policy for their agricultural land markets. The CJEU has recognised numerous agricultural policy objectives that may justify restrictions on fundamental freedoms. The main condition is that the objectives are clearly set out and that the instruments chosen are proportionate to these objectives in the sense that they do not go beyond what is necessary and that they are not discriminatory.

The Commission, as the guardian of the Treaties, has the duty to ensure that national measures are in conformity with EU law. The Commission services remain available to assist Member State authorities in ensuring that national legislative measures are in line with EU law. As a first step, a meeting with experts from Member States is planned for November 2017 to present and discuss this Communication. These contacts can be helpful for the Member States for a good understanding and correct interpretation of EU law. They can also help the Commission services to better understand specific circumstances that may be present in each country. In addition, the Commission intends to continue assisting Member States in the exchange of best practices on the regulation of agricultural land markets.

(1) See European Parliament ‘Report on the state of play of farmland concentration in the EU: how to facilitate the access to land for farmers’, 2016/2141(INI).

(2) See Article 38(1) of the Treaty on the Functioning of the European Union.

(3) IP/17/187 of 2 February 2017; https://ec.europa.eu/commission/priorities_en

(4) The term ‘foreign investors’ used in this Communication refers to intra-EU and, to the extent that the free movement of capital applies, also to third country investors (see chapter 2 a). It is recalled that from a practical point of view, most acquisitions of EU agricultural land take place in an intra-EU context.

(5) See European Parliament ‘Report on the state of play of farmland concentration in the EU: how to facilitate the access to land for farmers’, 2016/2141(INI), para 37.

(6) ‘Voluntary Guidelines on the Responsible Governance of Tenure of Land, Fisheries and Forests in the Context of National Food Security’.

(7) See point 2.4.1 of the Voluntary Guidelines. The crucial importance of land for food security, given that its supply is finite, is also highlighted in: Opinion of the European Economic and Social Committee of 21 January 2015 on Land grabbing — a warning for Europe and a threat to family farming (own-initiative opinion), point 6.3.

(8) http://ec.europa.eu/agriculture/events/2015/outlook-conference/brochure-land_en.pdf

(9) For example, according to Article 21(1) of the Bulgarian Constitution ‘[l]and is a fundamental national treasure under the particular protection of the State and society’.

(10) The Accession Treaties provided for transitional derogations from the principle of the free movement of capital in relation to the acquisition of agricultural land. Acceding Member States were allowed to maintain during the transition period their national regimes, which prohibited the acquisition of lands by nationals from other EU Member States or EEA countries. These derogations expired on 1 January 2014 for Bulgaria and Romania, on 1 May 2014 for Hungary, Latvia, Lithuania, Slovakia and on 1 May 2016 for Poland (Croatia's derogation will expire in 2020 with the possibility for Croatia to request a three year extension).

(11) This is highlighted, for example, by the Committee on Agriculture of the Hungarian National Assembly in its Own initiative opinion of 26 May 2015 on the inquiry it launched into the laws governing the use and ownership of agricultural land in the new Member States: http://ec.europa.eu/dgs/secretariat_general/relations/relations_other/npo/hungary/unsolicited_en.htm

(12) M.H. Orbison, Land reform in Central and Eastern Europe after 1989 and its outcome in the form of farm structures and land fragmentation, 2013 http://www.fao.org/docrep/017/aq097e/aq097e.pdf

(13) P. Ciaian, D. Drabik, J. Falkowski, d'A. Kancs, Market Impacts of new Land Market Regulations in Eastern EU States, JRC Technical Reports, 2016.

(14) See also: J. Swinnen, K. van Herck, L. Vranken, The Diversity of Land Markets and Regulations in Europe, and (some of) its Causes, The Journal of Development Studies, 2016, Vol. 52, No 2, 186-205.

(15) The countries which formed the European Union until 2004: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal, Spain, Sweden and the United Kingdom.

(16) There are, for example, reports about recent Chinese investment in some French farms and vineyards: R. Levesque, Chinese purchases in the Berry, in: La Revue foncière, May-June, 2016, p. 10.

(17) An initiative of the International Land Coalition (ILC): www.landmatrix.org

(18) European Commission Staff Working Document, The Movement of Capital and the Freedom of Payments, 5 March 2015, SWD (2015) 58 final, p. 21. However, it has to be borne in mind that data is not always readily available, and thus the existing estimates vary significantly. For example, it has also been reported that foreign ownership of agricultural land in Romania has increased by 57 % between 2010 and 2013 and represents in Romania around 7 % of the total agricultural area in 2013: P. Ciaian, D. Drabik, J. Falkowski, d'A. Kancs, Market Impacts of new Land Market Regulations in Eastern EU States, JRC Technical Reports, 2016, p. 10.

(19) European Parliament, Directorate-General for Internal Policies, Extent of Farmland Grabbing in the EU, Study, 2015, pp. 19-20.

(20) Some examples are given in: European Parliament, Directorate-General for Internal Policies, Extent of Farmland Grabbing in the EU, Study, 2015, p. 23 (for example, investments made by the Dutch Rabobank Group in Poland and Romania; the Italian insurance company Generali in Romania, Germany's Allianz in Bulgaria, the Belgian banking and insurance group KBC in Eastern Germany and Lithuania).

(21) The financial and economic crisis' impact on agriculture remains ambiguous. While the crisis was felt in agricultural income in 2009, it recovered quickly to close the gap further with the average gross wage in the economy. At the same time there was a temporary slowdown in labour outflow from agriculture, and even stagnation or an increase in some Member States.

(22) Maria Heubuch, The Greens/EFA, European Parliament (Publisher), Land Rush. The Sellout of Europe's Farmland, 2016; Friends of the Earth, Farming Money. How European Banks and private finance benefit from food speculation and land grabs, 2012 http://www.foeeurope.org/sites/default/files/publications/farming_money_foee_jan2012.pdf

(23) Franco, J.C. and Borras, S.M. (eds.) (2013), Land concentration, land grabbing and people's struggles in Europe, Amsterdam, Transnational Institute; Van der Ploeg, JD, Franco J.C. & Borras S.M. (2015) Land concentration and land grabbing in Europe: a preliminary analysis, Canadian Journal of Development Studies/Revue canadienne d'études du développement, 36:2, 147-162; Ecoruralis (2016) ‘Land Issues and Access to Land.’ http://www.ecoruralis.ro/web/en/Programs_and_Activities/Land_Issues_and_Access_to_Lan%20d/ (accessed in 2016).

(24) Opinion of the European Economic and Social Committee of 21.1.2015 on Land grabbing — a warning for Europe and a threat to family farming (own-initiative opinion), points 1.9 and 1.12.

(25) European Parliament, Directorate-General for Internal Policies, Extent of Farmland Grabbing in the EU, Study, 2015, pp. 17, 24, 25.

(26) See European Parliament ‘Report on the state of play of farmland concentration in the EU: how to facilitate the access to land for farmers’, 2016/2141(INI).

(27) Directive (EU) 2015/849 of the European Parliament and of the Council of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing, amending Regulation (EU) No 648/2012 of the European Parliament and of the Council, and repealing Directive 2005/60/EC of the European Parliament and of the Council and Commission Directive 2006/70/EC (OJ L 141, 5.6.2015, p. 73).

(28) Pursuant to Article 3(1)(e) and Article 207(1) TFEU.

(29) http://europa.eu/rapid/press-release_IP-17-3183_en.htm

(30) http://www.fao.org/investment-in-agriculture/en/. See also: OECD, Policy Framework for Investment in Agriculture, 2013.

(31) Report from the Commission to the Council, Review of the transitional measures regarding the acquisition of agricultural real estate foreseen in the Accession Treaty 2005, 14.12.2010, p. 2; Report from the Commission to the Council, Review of the transitional measures regarding the acquisition of agricultural real estate set out in the 2003 Accession Treaty, 16.7.2008, p. 7; European Commission press release http://europa.eu/rapid/press-release_IP-10-1750_en.htm?locale=en; European Commission press memo http://europa.eu/rapid/press-release_MEMO-11-244_en.htm?locale=en

(32) Kristina Hedman Jansson, Ewa Rabinowicz, Carl Johan Lagerkvist, The Institutional Framework for Agricultural Credit Markets in the EU, in: Johan Swinnen and Louise Knops (ed.), Land, Labour and Capital Markets in European Agriculture, Centre for European Policy Studies, 2013, p. 254; Sami Myyrä, Agricultural Credit in the EU, in: Johan Swinnen and Louise Knops (see quote before), p. 260. Capital market imperfections relevant for farmers have been identified and discussed by: Centre for European Policy Studies (CEPS) and Centre for Institutions and Economic Performance (LICOS) University of Leuven: Review of the Transitional Restrictions Maintained by Member States on the Acquisition of Agricultural Real Estate, Final Report 2007, pp. 13-17; Centre for European Policy Studies (CEPS): Review of the transitional restrictions maintained by Bulgaria and Romania with regard to the acquisition of agricultural real estate, Final Report, October 2010, pp. 19-23.

(33) See Centre for European Policy Studies (CEPS) and Centre for Institutions and Economic Performance (LICOS) University of Leuven: Review of the Transitional Restrictions Maintained by Member States on the Acquisition of Agricultural Real Estate, Final Report 2007, executive summary, p. ii; Centre for European Policy Studies (CEPS): Review of the transitional restrictions maintained by Bulgaria and Romania with regard to the acquisition of agricultural real estate, Final Report, October 2010, executive summary.

(34) See for example: J.F.M. Swinnen, L. Vranken, Reforms and agricultural productivity in Central and Eastern Europe and the Former Soviet Republics: 1989-2005, Journal of Productivity Analysis, June 2010, volume 33, Issue 3, pp 241-258, chapters 2 and 7 (concluding remarks); L. Dries, E. Germenji, N. Noev, J.F.M. Swinnen, Farmers, Vertical Coordination, and the Restructuring of Dairy Supply Chains in Central and Eastern Europe, in World Development, 2009, Vol. 37, No 11, p. 1755; L. Dries/J.F.M. Swinnen, Foreign Direct Investment, Vertical Integration. And Local Suppliers: Evidence from the Polish Dairy Sector, in: World Development, 2004, Vol. 32, No 9, pp. 1525 et seq., 1541.

(35) J. Swinnen, K. van Herck, L. Vranken, The Diversity of Land Markets and Regulations in Europe, and (some of) its Causes, The Journal of Development Studies, 2016, Vol. 52, No 2, 202.

(36) See: IP/15/4673 of 23 March 2015 and IP/15/4877 of 29 April 2015.

(37) See: IP/16/1827 of 26 May 2016.

(38) This has been confirmed by several rulings of the CJEU, see for example case C-370/05, Festersen, n 21-23, case C-452/01, Ospelt, n 24.

(39) As to the definition of restrictions of capital movements: CJEU, Case C-112/05, Volkswagen, n 19; CJEU, Joined Cases C-197/11 and 203/11 Libert, n 44; CJEU, Case C-315/02, Lenz, n 21.

(40) CJEU, Case C-302/97, Konle, n 38. See also C-367/98, Commission v Portugal, n 48; Case C-463/00, Commission v Spain (‘golden shares’), n 56. See also Cases C-163/99, C-98/01, Commission v UK (‘golden share in BAA’); C-452/01, Ospelt, n 24; C-174/04, Commission v Italy (‘suspension of voting rights in privatised undertakings’); joined cases C-463/04 and 464/04, Federconsumatori; C-244/11, Commission v Greece (‘golden shares in strategic public limited companies’), 15 and 16. See also AG Roemer's opinion of 27 April 1966 in joined cases 56/64 and 58/64, Consten and Grundig, ECR page 352 (366); Case C-105/12, Essent, n. 36.

(41) CJEU, cases C-101/05, Skatteverket, n 36; C-446/04, Test Claimants in the FII Group Litigation, n 171.

(42) See, for example, Case C-446/04, FII Group.

(43) CJEU, Case C-17/03, VEMW, n 80.

(44) CJEU, Joined Cases C-182/03 and C-217/03, Forum 187, n 147.

(45) Case C-182/83 Fearon, n 3.

(46) Case C-452/01 Ospelt, n 39, 43.

(47) Case C-370/05 Festersen, n 27, 28.

(48) Case C-302/97 Konle, n 40; joint Cases C-519/99 to C-524/99 and C-526/99 to C-540/99 Reisch, n 34.

(49) Case C-423/98 Albore, n 18, 22.

(50) See CJEU, Case C-243/01, Gambelli, n 67; Case C-169/07, Hartlauer, n 55 and case law cited in the ruling.

(51) As to the principle of proportionality, see in particular: CJEU, Case C-543/08, Commission v Portugal, n 83.

(52) CJEU, Case C-333/14, Scotch Whiskey, n 53.

(53) CJEU, Case C-333/14, Scotch Whiskey, n 54.

(54) See e.g. Case C-452/01, Ospelt n 43-45. In other cases, the CJEU came to a different result: in Reisch, for example, the Court held that the obligation of prior authorisation at issue in that case could be replaced by a system of prior declaration, so that it was disproportionate: Joined cases C-515/99, Reisch et al., n 37-38 and case law cited therein. It should be noted in this context that an obligation of declaration usually constitutes a restriction, which needs to be justified and be in conformity with the principles of proportionality and legal certainty and the fundamental rights, see for example Reisch, cit., n 32; Case C-213/04, Burtscher, n 43.

(55) See, for example, Case C-567/07, Woningstichting Sint Servatius, n 35.

(56) Case C-201/15, AGET Iraklis, n 99-101.

(57) See CJEU, Case C-54/99, Eglise de Scientologie, n 17; C-205/99, Analir, n 38.

(58) Case C-370/05, Festersen, n 43.

(59) Joint Cases C-197/11 and C-203/11, Eric Libert, n 57-59. See also the CJEU's doubts in: Case C-567/07, Woningstichting Sint Servatius, n 37 and 38 with respect to the criteria ‘in the interests of public housing’.

(60) Case C-452/01, Ospelt n 52.

(61) As to the definition of restrictions of capital movements: CJEU, Case C-112/05, Volkswagen, n 19; Joined Cases C-197/11 and 203/11 Libert, n 44; Case C-315/02, Lenz, n 21. National rules restricting the parties' freedom to set prices in their transactions have also been considered to be restrictions in the field of freedom of establishment and free provisions of services (see, for example, Case C-327/12, SOA, n 58; joined Cases C-94/04 and C-202/04, Cipolla and others, n 60). As regards free movement of goods, see CJEU, Case 82/77, van Tiggele, n 21; 231/83, Cullet, n 29; C-531/07, Fachverband der Buch- und Medienwirtschaft v LIBRO, n 2; C-333/14, Scotch Whisky Association, n 32 where the CJEU held with respect to the freedom of establishment that ‘the fact that the legislation at issue in the main proceedings prevents the lower cost price of imported products being reflected in the selling price to the consumer means, by itself, that that legislation is capable of hindering the access to the United Kingdom market of alcoholic drinks that are lawfully marketed in Member States other than the United Kingdom of Great Britain and Northern Ireland, and constitutes therefore a measure having an effect equivalent to a quantitative restriction within the meaning of Article 34 TFEU’.

(62) See case law cited above as well as CJEU, Case C-577/11, DKV Belgium SA, where the CJEU held the Belgian price regulation of insurance premiums in the health sector to be a justified and proportionate restriction. The CJEU emphasised, inter alia, that one of the characteristics of hospitalisation insurance resides in the fact that the probability of insurers increases with the age of the insured parties (n 43); the CJEU considered thus that a system of premium rate increase such as set out in the Belgian law at issue in that case provides for a guarantee that the insured party, precisely at an age when it needs that insurance will not be faced by a sharp, unexpected increase in his insurance premium rates (n 49).

(63) As a general rule, the presence of State aid can be ruled out if the sale of publicly-owned land takes place in accordance with normal market conditions. This can be ensured if the sale is carried out following a competitive, transparent, non-discriminatory and unconditional tender procedure, allowing all interested and qualified bidders to participate in the process, in line with the principles of the TFEU on public procurement (see points 89 et seq. of the Commission Notice on the notion of State aid as referred to in Article 107(1) of the Treaty on the Functioning of the European Union (OJ C 262, 19.7.2016, p. 1) and the relevant case-law mentioned therein). Otherwise, in order to avoid State aid and thus to comply with Article 107 TFEU, other methods must be used to ensure that the privatisation of farmland is be conducted at a price which corresponds to the price that a private vendor would have accepted under normal market conditions.

(64) CJEU, Case C-239/09, Seydaland Vereinigte Agrarbetriebe, n 35, 43, 54.

(65) Case C-39/14, BVVG Bodenverwertungs- und -verwaltungs GmbH, n 39, 40.

(66) Opinion of Advocate General Cruz Villalón delivered on 17 March 2015 on Case C-39/14, n 69-79.

(67) Case C-39/14, BVVG Bodenverwertungs- und -verwaltungs GmbH, n 55.

(68) Case C-370/05 Festersen, n 27, 28.

(69) Some other conditions applied, in particular related to qualifications in farming (see Case C-452/01, Ospelt n 13).

(70) Case C-452/01, Ospelt n 49-53.

(71) Following the line of reasoning in Ospelt, Case C-452/01, Ospelt n 49-53.

(72) See http://ec.europa.eu/internal_market/qualifications/regprof/index.cfm

(73) Case C-182/83, Fearon, para 9-11.

(74) Case C-452/01, Ospelt n 54.

(75) Case C-370/05, Festersen, n 35, 40. The right to move and reside freely within the territory of the Member States is a fundamental right under Protocol No 4 to the Convention for the Protection of Human Rights and Fundamental Freedoms, signed in Rome on 4 November 1950 and also by Article 45 of the Charter of Fundamental Rights of the European Union.

(76) Case C-370/05, Festersen, n 39.

(77) Case C-279/93, Finanzamt Köln-Altstadt v Schumacker, n 28; C-513/03, van Hilten-van der Heijden, n 44; C-370/05 Festersen, n 25; In case C-11/07, Eckelkamp, n 46 (higher tax on non-residents).

(78) Case C-452/01, Ospelt n 51.

(79) Case C-452/01, Ospelt n 52.

(80) See to this effect: CJEU, Case C-279/93, Finanzamt Köln-Altstadt v Schumacker, n 28; C-513/03, van Hilten-van der Heijden, n 44; C-370/05 Festersen, n 25; C-11/07, Eckelkamp, n 46 (higher tax on non-residents).

(81) On the definition of restrictions of capital movements: CJEU, Case C-112/05, Volkswagen, n 19; Joined Cases C-197/11 and 203/11 Libert, n 44; Case C-315/02, Lenz, n 21.

(82) The CJEU, for example, dismissed special rights for acquirers with ‘a sufficient connection with the commune’ in the sense of a long-term ‘professional, family, social or economic connection’, which has been granted to protect the less affluent local population on the property market. The CJEU explained this by noting that such conditions may be met not only by the less affluent local population but also by other persons with sufficient resources who have no specific need for social protection of the property market (Joint Cases C-197/11 and C-203/11, Eric Libert, n 54-56).

(83) Joint Cases C-197/11 and C-203/11, Eric Libert, n 54-56.

(84) Cases C-118/07, Commission v Finland, n 48; C-266/03, Commission v Luxembourg, n 35: ‘a Member State cannot … plead the principle of reciprocity and rely on a possible infringement of the Treaty by another Member State in order to justify its own default’.

ANNEX

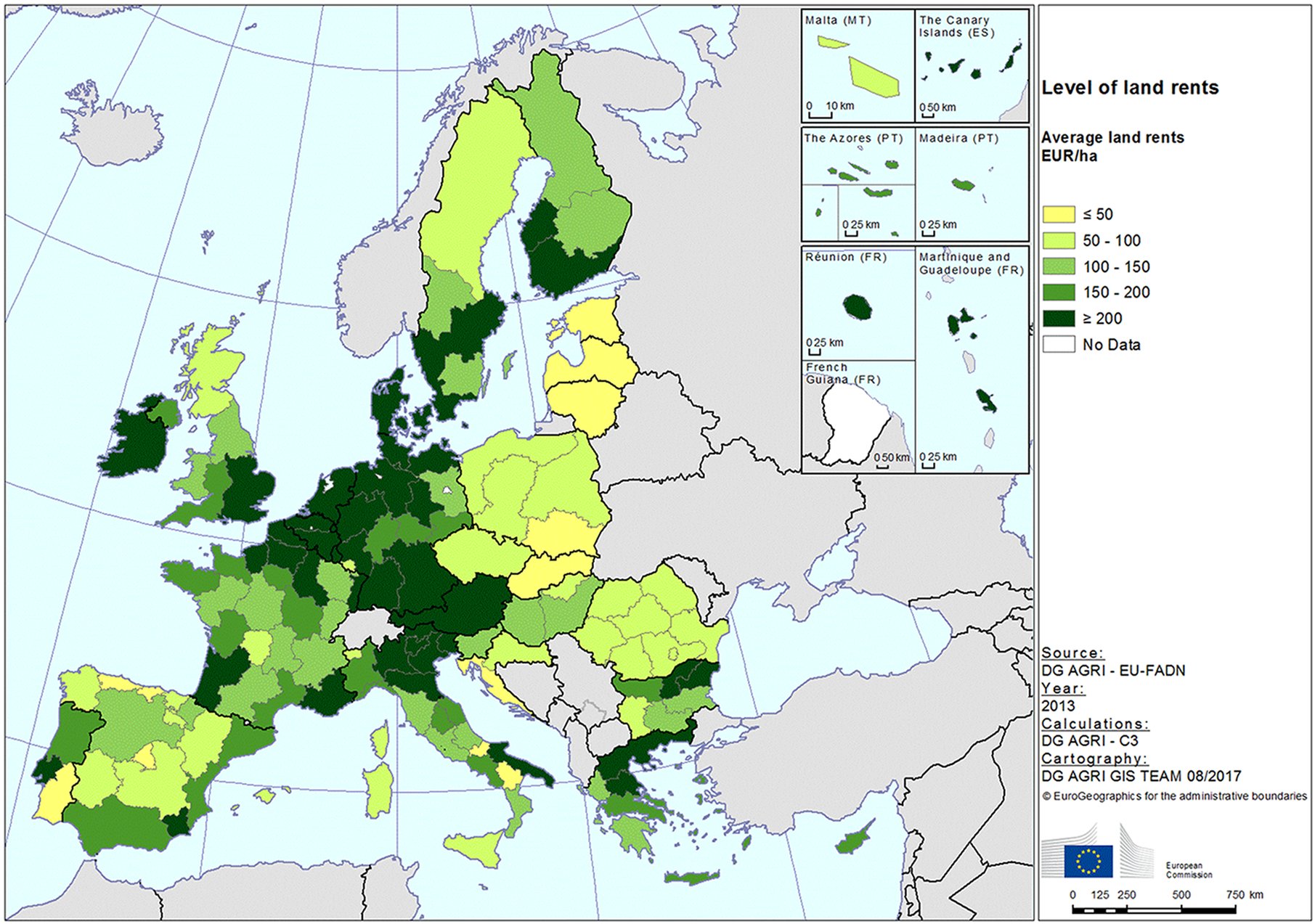

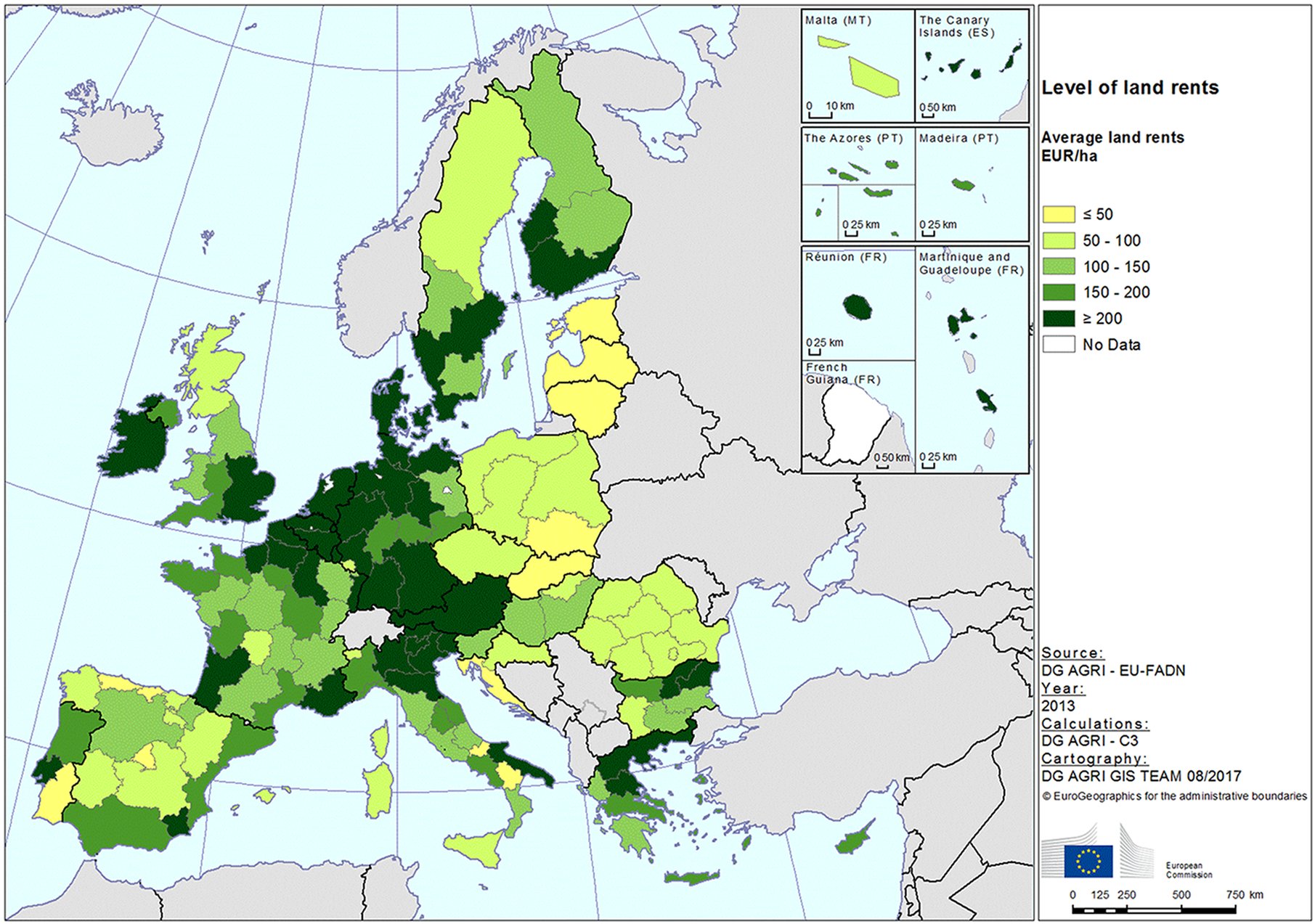

Figure 1

Level of land rents as indicator for land prices

(1)

Figure 2

Long-term developments in the land value/ha (Average in EUR)

(2)

(1) The annual rent which farmers have to pay for one hectare of land is typically considered the best proxy for the cost of land. The map shows that the level of land rents varies markedly across EU regions, due not only to supply and demand factors but also to differences in overall price levels (purchasing power) among countries and in the regulatory environment. In 2013, the highest average land rent per ha was in the Canary Islands and the Netherlands (approximately EUR 1 300 and EUR 780, respectively). Land rents were also very high in the Hamburg region (EUR 670) and in Denmark (EUR 610). On the other hand, rents were particularly low in Latvia and Estonia (below EUR 30 per ha) and in many regions with unfavourable conditions for intensive agricultural production — EU-FADN, the Farm Accountancy Data Network, which is referred to in Figures 1 and 2, collects annual data on the value of farm assets (including land) and rents for a sample of 87 000 market-oriented farms across the EU. Eurostat’s annual collection of national data on land prices and rents is currently under construction.

(2) ‘land value’ is measured according to the closing valuation of land; ‘ha’ is expressed according to the land in owner occupation); ‘EU-N 10’ means the ten countries which acceeded to the Union in 2004 (Cyprus, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Malta, Poland, Slovakia, and Slovenia); ‘EU-N 2’ the countries which acceeded in 2007 (Bulgaria and Romania).