EUROPEAN COMMISSION

EUROPEAN COMMISSION

Brussels,7.3.2018

SWD(2018) 208 final

COMMISSION STAFF WORKING DOCUMENT

Country Report France 2018

Including an In-Depth Review on the prevention and correction of macroeconomic imbalances

Accompanying the document

COMMUNICATION FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT, THE COUNCIL, THE EUROPEAN CENTRAL BANK AND THE EUROGROUP

2018 European Semester: Assessment of progress on structural reforms, prevention and correction of macroeconomic imbalances, and results of in-depth reviews under Regulation (EU) No 1176/2011

{COM(2018) 120 final}

Contents

Executive summary

1.Economic situation and outlook

2.Progress with country-specific recommendations

3.Summary of the main findings from the Macroeconomic Imbalance Procedure in-depth review

4.Reform priorities

4.1.Public finances and taxation

4.2.Labour market, education and social policies

4.3. Investment, competitiveness and business environment

4.4. Sectoral policies

Annex A: Overview table

Annex B: Macroeconomic Imbalance Procedure scoreboard

Annex C: Standard tables

References

LIST OF Tables

Table 1.1:Key economic, financial and social indicators – France

Table 2.1:Summary Table on 2017 country-specific recommendations assessment

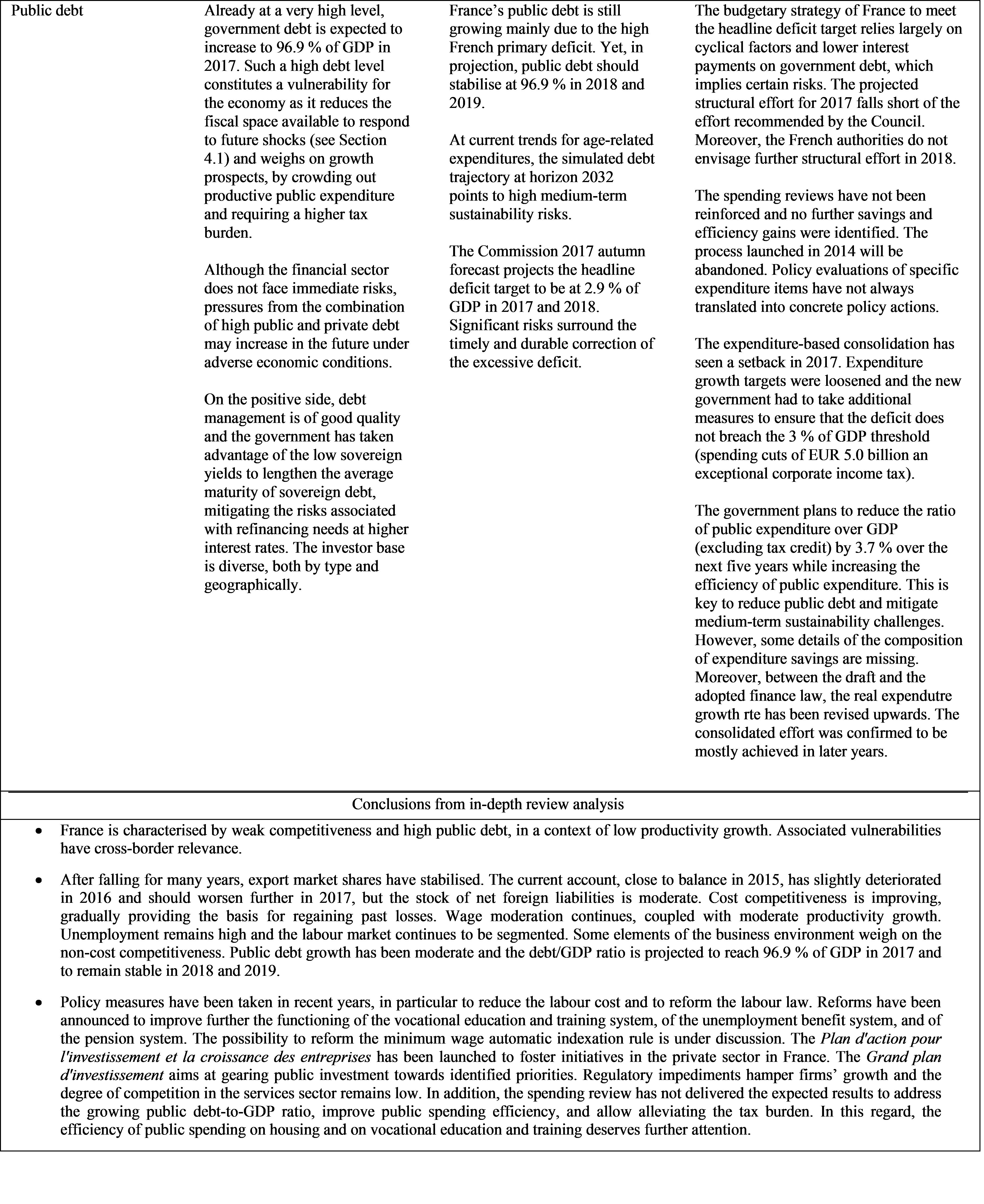

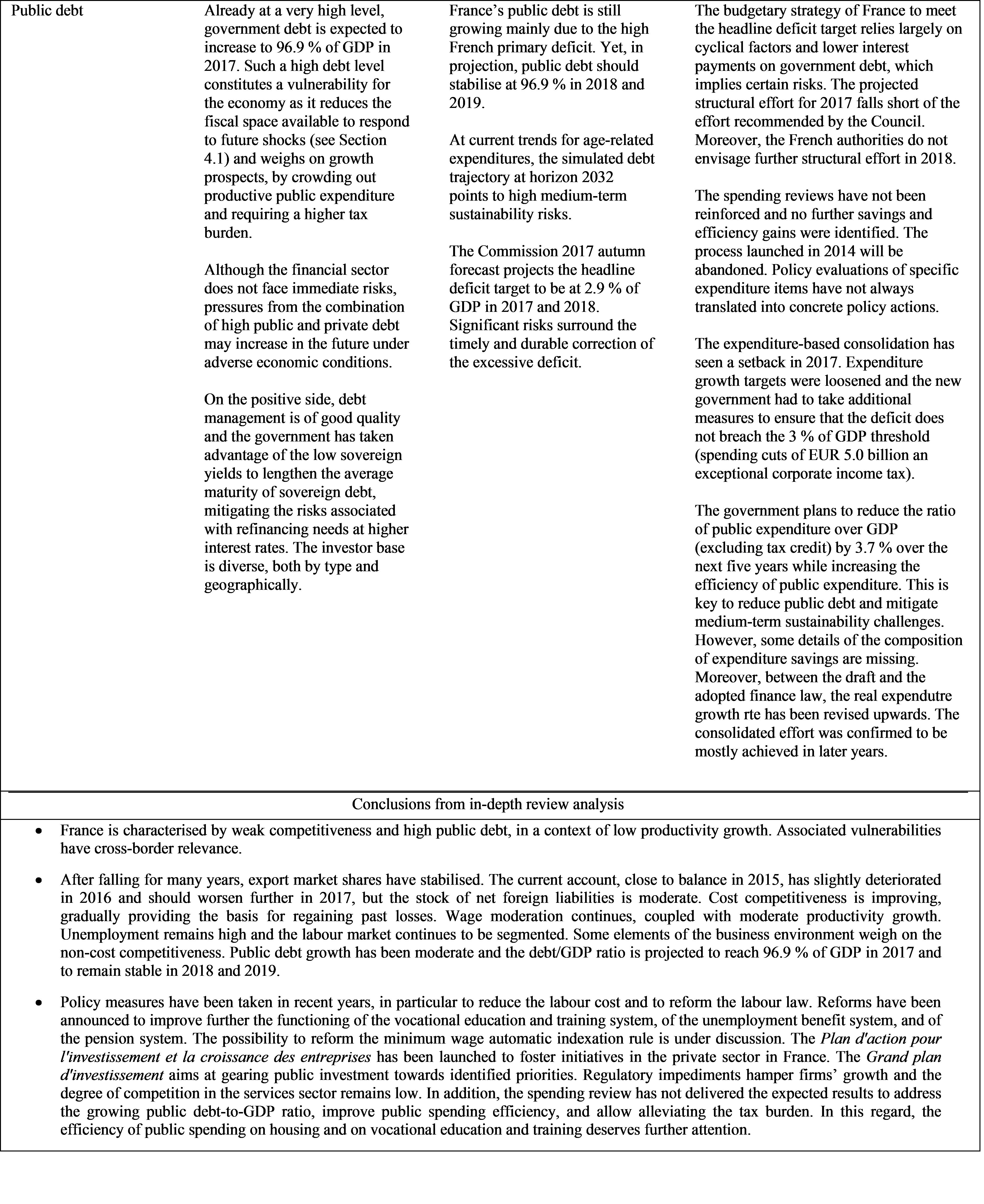

Table 3.1:MIP Assessment Matrix (*) – France 2018

Table 4.3.1:Stock of FDI: residents abroad (assets) and non-residents in the economy (liabilities)

Table 4.4.1:Modal share evolution - long distance

Table 4.4.2:Financial soundness indicators - all banks in France

Table B.1:The MIP scoreboard for France (AMR 2018)

Table C.1:Financial market indicators

Table C.2:Headline Social Scoreboard indicators

Table C.3:Labour market and education indicators

Table C.4:Social inclusion and health indicators

Table C.5:Product market performance and policy indicators

Table C.6:Green growth

LIST OF Graphs

Graph 1.1:

Contributions to GDP growth (2010-2019)

Graph 1.2:

Potential GDP growth breakdown in France

Graph 1.3:

Potential total factor productivity growth in selected euro area countries

Graph 1.4:

Evolution of import penetration in selected euro area countries

Graph 1.5:

Trade balance – France

Graph 1.6:

Household and non-financial corporation indebtedness

Graph 1.7:

France – non-financial corporation debt: gaps relative to benchmarks

Graph 2.1:

Overall multiannual implementation of 2011-2017 CSRs to date

Graph 3.1:

Decomposition of unit labour cost rate of change

Graph 3.2:

Effects of the crédit d’impôt pour la compétitivité et l’emploi transformation

Graph 4.1.1:

Contributions to the change in the public debt ratio in France

Graph 4.1.2:

Projections of French public debt under alternative scenarios

Graph 4.1.3:

Trends in real estate

Graph 4.1.4:

Other taxes on production (2016) – Top 10

Graph 4.1.5:

Tax structure as % GDP, 2015

Graph 4.2.1:

Unemployment rate in France and the EU

31

Graph 4.2.2:

Minimum wage (level and evolution) and employment for low-skilled workers

Graph 4.2.3:

Unemployment rate and potential additional labour force

Graph 4.2.4:

Percentage of low-skilled in total employment (September 2017)

Graph 4.3.1:

Export of goods in value - by sector evolution

Graph 4.3.2:

Export of goods in volume - performance

Graph 4.3.3:

Export of goods in value - by quality rank (as % of total exports)

Graph 4.3.4:

Service exports - France

Graph 4.3.5:

Participation of the French SMEs in the internal and world markets compared to the EU average

Graph 4.3.6:

Investment in selected Euro area Member States -expressed as a percentage of GDP

Graph 4.3.7:

Number of employees and number of firms - French manufacturing industry

Graph 4.3.8:

Performance in the Small Business Act report for 2017

Graph 4.4.1:

R&D intensity (2015)

Graph 4.4.2:

Economic structure (% of value added)

LIST OF Boxes

Box 2.1: Tangible results delivered through EU support to structural change in France

Box 3.1: Euro area spillovers

19

Box 4.2.1: Monitoring performance in the light of the European Pillar of Social Rights

32

Box 4.3.1: Investment challenges and reforms in France

Box 4.4.1: Policy highlights on environment and climate

Executive summary

The improved macroeconomic scenario is an asset for pursuing ambitious structural reforms, while improving the situation of public finances in France (

). After three years of moderate growth, economic activity in France has accelerated sharply in 2017. The government is undertaking important reform actions. A Grand Plan d'Investissement for the period 2018-2022 is on-going, as well as the implementation of adopted labour market reforms and additional measures to be launched, as regards the pension, unemployment benefit system, and vocational education and training. Meanwhile, challenges remain to improve public finances on a more sustainable basis, in particular while the high level of private debt is still a potential source of concern. These also include a comprehensive review of public finances, the simplification of the tax system and the increase in efficiency of the tax system. Improving access to the labour market for less qualified workers and people with a migrant background is also an issue. Reducing the administrative and regulatory burden and improving collaboration between public research and companies would contribute to increase the competitiveness of the French economy.

Economic activity has accelerated and is forecast to remain strong in the near future. GDP growth in France increased to 1.8 % in 2017 from 1.2 % in 2016. It was driven by strong private investment growth and in particular by a strong recovery in the housing market. According to the Commission 2018 winter forecast, GDP growth is expected to reach 2.0 % in 2018 and 1.8 % in 2019 as spare capacity in the economy is reabsorbed. Private consumption growth is set to recover somewhat, while investment growth is expected to remain strong. Moreover, the contribution of net exports is expected to improve in a context of sustained global demand.

The performance of French exports has stopped deteriorating. Export market shares have stabilised since 2012, led by more favourable developments in France’s main trade partners. The trade deficit is expected to have reached a trough in 2017, as imports remained more vigorous than exports and oil prices rebounded. External sustainability is not a concern for France in the short term, whilst the weak export performance continues to weigh on growth prospects.

In the long term, growth is expected to remain moderate. In line with an EU-wide trend, France’s potential growth has been eroded since the 2008 financial crisis. Yet, France’s potential growth increased to 1.0 % in 2016 and is expected to further accelerate, up to 1.3 % in 2019. Structural reforms have been planned and some have already been undertaken. They seek to address the economic challenges that limit potential growth.

Competitiveness is improving, although France has not fully regained previous losses. The growth of unit labour costs has recently recovered, in line with increased economic activity. Productivity growth remains subdued and prevents French competitiveness from recovering more quickly. Labour market and tax reforms are on-going. Additional measures have been launched to improve the competitiveness of the French economy, including product market reforms. The positive effect of these actions is likely to become more prominent in the medium term.

France’s public indebtedness is high. The general government deficit is expected to decline below the threshold value of 3 % of GDP in 2017. However, the adjustment of government spending is proving difficult despite the dampening effect of the low interest burden. Debt is expected to stabilise at 96.9 % of GDP over the forecast horizon (2017-2019). Despite the objective to reduce expenditure more than 3 pps of GDP by 2022, the identification and monitoring of structural savings are still unknown. In turn, targets for healthcare spending (ONDAM) and operational spending of local authorities (ODEDEL) are less demanding for 2018. As a result, it seems that France currently plans to ‘back load’ the envisaged consolidation effort by cutting spending in later years.

Unemployment continues to fall. The unemployment rate declined from 10.4 % in 2015 to 9.5 % in 2017 and is forecast to decrease further in the coming years, while the employment rate rose to 71 % in the third quarter 2017. Labour market conditions for younger, lower-skilled workers, and people with a migrant background (both first and second generations) remain more difficult.

Its large economy and integration with the rest of the euro area make France a source of potentially significant cross-border spillovers. Model simulations suggest that product and labour market reforms in France can yield positive long-term GDP effects for both France and the rest of the euro area.

Overall, France has made some progress in addressing the 2017 country-specific recommendations. Some progress has been made in improving access to the labour market for jobseekers, ensuring that minimum wage developments are consistent with job creation and competitiveness, and further reducing the regulatory burden for firms. Some progress has also been made on taxation by decreasing the statutory corporate income tax rate and reducing the cost of labour. Limited progress has been made in ensuring the sustainability of public finances and reviewing expenditure items. There has also been only limited progress in raising the efficiency of public support schemes for innovation and revising the system of vocational education and training. No progress has been made in continuing to lift barriers to competition in the services sector.

Regarding progress in reaching national targets under the Europe 2020 strategy, France is performing well in decreasing greenhouse gas emissions, improving energy efficiency, increasing tertiary education attainment and reducing early school leaving. More action is still needed to reduce poverty and increase the employment rate, R&D intensity, and the use of renewable energy.

France performs relatively well on the indicators of the Social Scoreboard supporting the European Pillar of Social Rights. Overall, the social protection system is effective and shows good results both in the fields of social protection and health. France also has a low gender employment gap, relatively low income inequality, and a high share of children in formal childcare. Some issues in the areas of educational inequalities and labour market segmentation merit attention. Recently, the number of people at risk of poverty and social exclusion has also been rising, even if it remains at a relatively low level.

The main findings of the in-depth review contained in this report, and the related policy challenges, are as follows:

·Cost competitiveness has improved in recent years. Wage growth remains moderate. No ad-hoc hike in the minimum wage has been decided since 2013. The possibility of reforming the minimum wage automatic indexation mechanism is under discussion. Tax measures have reduced labour costs. However, the competitiveness gap accumulated in previous years has not been closed yet.

·Other factors driving the competitiveness of French exports continue to be weak. France’s share of the global market has been more resilient for services than goods since 2008, especially for business services. The share of low-, middle- and top-quality goods in total French exports has slightly increased, while the share of high-quality goods has significantly decreased. The proportion of exporting SMEs is lower in France than in other Member States.

·The labour market situation continues to improve, yet challenges remain to be tackled, especially for some categories. The government has presented an ambitious reform agenda to the social partners. It includes the adopted reform of the labour law, as well as the announced reform of the systems for unemployment benefit, pensions, and vocational education and training, comprising apprenticeship. Remaining challenges concern the still high level of unemployment (especially for younger and lower-skilled people) and the segmentation of the labour market. The integration of disadvantaged groups in the labour market and their transition towards more stable forms of work can also be improved. This is particularly relevant for people with a migrant background.

·The French business environment is middle-ranking in comparison to major competitors. While investment remains dynamic with respect to the euro area, the government has announced measures to improve the business environment, as companies are still facing fast changing legislation, complex regulatory requirements and burdensome administrative procedures. Size-related regulatory thresholds continue to weigh on firms’ growth. Competition is still weak in several service sectors, notably in professional and business services. Lack of clarity and prioritisation about the French state’s objectives as shareholder in several large incumbent firms operating in sectors of major economic importance remains, including railways and energy. The new regulatory framework for the collaborative economy aims at taking into account the specificities of these services but holds back their development. France's low coverage with fast broadband also limits its ability to benefit from the digital economy.

·High public debt coupled with already high structural deficits could be a source of significant risk for public finances in the medium term. Short-term sustainability risks remain low. Long-term risks are also contained, notably due to pension indexation rules and favourable demographics compared to the rest of the EU. Still, sustainability challenges in the medium term remain high and call for significant consolidation in the coming years to bring down public debt. The debt burden for the private sector continues to increase. The combination of high public and private debt is an additional risk factor.

·A new expenditure-based consolidation strategy has been announced. The already very high tax burden leaves little margin for further tax increases, suggesting that further consolidation needs to be expenditure-based. A new spending review framework has been put forward, aiming to identify efficiency gains and to generate savings at all levels of the public administration. The concrete scope of this framework remains to be clarified and the framework has not yet been implemented. Reforms aiming at simplifying and improving the efficiency of spending are under consideration for pensions, healthcare, housing allowances and vocational training.

·The tax system has been reformed to address the high tax burden on companies and favour productive investment. While these reforms aim to improve the business environment, the tax system continues to be complex. In addition, it is characterised by relatively low levels of consumption and environmental taxes and a high level of taxes on production.

Other key structural issues analysed in this report, which point to particular challenges for France’s economy, are the following:

·Educational inequalities remain high and the vocational education and training system presents some weaknesses in matching labour market needs. New measures have been adopted to reduce educational inequalities linked to socioeconomic background. The system of initial vocational education and training does not sufficiently foster access to employment, despite undertaken reforms. Access to the continuous vocational training system is uneven for different categories of employed workers and unemployed.

·Social conditions in France are good overall. In general, the French social protection system appears effective in reducing poverty and exclusion and providing access to healthcare and childcare. Still, inequalities based on migration and socioeconomic background remain, especially in deprived urban areas. Some, mainly rural, areas face challenges in attracting physicians. Access to affordable housing can be challenging in urban areas.

·Innovation performance remains below that of EU innovation leaders. The efficiency of public support schemes can be further improved. It is to be seen if the results of evaluations will lead to a sufficient policy response improving the overall performance of the system. In addition, knowledge transfer between public research and companies remains a challenge; there is room to further promote such collaboration.

1.

Economic situation and outlook

GDP growth

After three years of moderate growth, economic activity in France has accelerated sharply. GDP growth increased to 1.8 % in 2017 (

), after registering 1.2 % in 2016. Economic activity has been driven by strong private investment. Household investment grew at a sustained pace, recovering strongly after several years of contraction. In addition, corporate investment held up remarkably well following the end of the over-amortisation scheme, a fiscal incentive for firms to invest. By contrast, private consumption slowed as higher inflation diminished the purchasing power of households. Moreover, net exports continued to weigh on growth, as exports were hampered by temporary factors while imports remained strong.

|

Graph 1.1:Contributions to GDP growth (2010-2019)

|

|

|

|

Source: Commission 2018 winter forecast

|

Growth is set to remain strong in the near future. Economic sentiment has continued to improve in recent months, with some confidence indicators approaching or even exceeding their pre-crisis peaks. Private consumption growth is set to recover somewhat in 2018, in line with increases in household purchasing power. Investment growth is expected to rise further in 2018 before cooling slightly in 2019. Household investment is set to remain strong, as indicated by the increase in new construction starts. Moreover, public investment is forecast to rebound in 2018 after several years of contraction. Finally, the contribution of net exports is expected to gradually improve in a context of sustained global demand. According to the 2018 winter forecast, GDP growth is expected to reach 2.0 % in 2018 and to slightly decelerate to 1.8 % in 2019 as spare capacity in the economy is reabsorbed (Graph 1.1).

The labour market situation continues to improve. The employment rate (for those aged between 20 and 64) gradually increased to 70 % in 2016, compared to the 71.1 % EU average, and continued to improve in 2017 in line with the EU trend. In parallel, the unemployment rate decreased from 10.4 % in 2015 to 10.1 % in 2016 and 9.5 % in 2017 (vs. 7.7 % in the EU and 9.1 % in the euro area) and it has continued to decrease in 2017. It is projected to decline further, supported by ongoing reforms. Youth unemployment has fallen from 24.6 % in 2016 to 22.6 % in 2017, but remained above the EU and euro area average (respectively 16.8 % and 18.9 % in 2016). The limited integration of young people into the labour market is also reflected in a stable NEET (not in education, employment or training) rate of 11.9 %. There is a decreasing number of school drop-outs in the 15-19 age group, while unemployment is still high in the 20-24 age group showing only first signs of improvement in 2017.

Wage growth remains subdued, reflecting the labour market slack, low inflation and weak productivity gains. Nominal compensation per employee increased by 1.0 % in 2016 and is set to accelerate only gradually. Minimum wage increases are expected to remain moderate. In line with wage developments, inflation is forecast to reach 1.5 % in 2018 and 2019, up from 1.2 % in 2017.

Potential risks to French growth come from outside the country, while domestic risks do not appear to be a cause for concern. Recent cost-competitiveness gains could help exporters to better absorb the euro’s appreciation than in the past. Moreover, higher corporate investment could help boost potential growth, leading to self-fulfilling higher growth expectations.

Potential growth

In the long term, growth is expected to remain moderate as potential growth has declined since the 2008 financial crisis. While averaging 1.8 % from 2000 to 2008, the annualised growth rate of potential GDP amounted to just 1.0 % between 2009 and 2017. The rate of growth is projected to recover gradually and to reach 1.3 % in 2019. A slowdown of potential GDP has been observed in most major euro area economies. In the case of France, this slowdown is attributable to a significant reduction in the contribution of total factor productivity (TFP) to growth, while capital accumulation and total hours worked remained relatively robust (Graph 1.2). In annualised terms, the decline in France’s TFP growth amounted to 0.4 pp. between the 2000-2008 period and the 2009-2017 period, and is more pronounced than that of Germany. As a result, potential TFP growth in France decoupled from Germany and is now lower than in Spain, although it remained higher than in Italy (Graph 1.3).

|

Graph 1.2:Potential GDP growth breakdown in France

|

|

|

|

Source: Commission 2017 autumn forecast

|

The deceleration in TFP growth prevents a faster improvement in French competitiveness. Wage increases have been moderate in recent years. However, the slowdown of labour productivity, largely due to a decline in TFP growth despite a continued increase in capital intensity, prevents a faster recovery of cost competitiveness (see Section 3).

The decline in long-term growth prospects also exacerbates the challenges associated with the high public debt. The deceleration of potential GDP makes it more difficult for France to bring down its public debt without greater fiscal consolidation efforts (see Section 4.1).

|

Graph 1.3:Potential total factor productivity growth in selected euro area countries

|

|

|

|

Source: Commission 2017 autumn forecast

|

Structural reforms are key to reinforcing the growth potential, in particular because they help to spur TFP growth (

). Increasing the quality of the labour input by helping the workforce acquire the right set of skills, adjusting the regulatory framework to encourage the growth of the relatively productive firms, and reducing the costs of firm exit by facilitating labour market transitions, contribute to productivity growth. The French labour market is characterised by limited mobility among sectors and regions, which may hamper resource reallocation and reduce TFP growth. Labour market segmentation may also have a negative effect on human capital accumulation (see Section 4.2). Inequality of opportunity, as evident through the strong dependence of educational outcomes on parental background, may be associated to suboptimal investment in human capital (see Section 4.2). TFP growth may also be hampered by burdensome regulations, including social and tax thresholds that are calculated on the basis of the number of employees a company has (see Section 4.4). The tax structure is not very growth-friendly (see Section 4.1).

Trade balance and current account

Export market shares have stabilised since 2012 (see Section 4.3). A number of temporary factors affected export growth in 2016. In particular, exports of refined petroleum products were hit by strikes in the refineries in the second quarter of 2016, while unfavourable weather conditions damaged agricultural crops, and the terrorist attacks hampered tourism exports. As a result, growth in French exports remained subdued in 2016 at 1.8 %, below both export market growth (2.8 %) and world trade (2.4 %). As these temporary factors fade, export growth is forecast to gradually recover.

|

Graph 1.4:Evolution of import penetration in selected euro area countries

|

|

|

|

Source: Commission 2017 autumn forecast

|

By contrast, import growth has proved robust. Imports have accounted for a growing share of GDP in volume. Above all, the increase in import penetration reflects general trends in world trade as a result of globalisation. However, import penetration has increased faster in France than in other major euro-area economies since 2010 (Graph 1.4). The strong import growth in France reflects to some extent the composition of demand in recent years, characterised by the fast growth of relatively import-intensive components of demand (

).

As a result of strong import growth, the trade balance started deteriorating again in 2016. After reaching −1.5 % of GDP in 2015, the trade balance stood at −1.9 % of GDP in 2016, and is expected to reach a trough at −2.4 % of GDP in 2017, according to the 2017 autumn forecast. The trade balance in the services sector deteriorated continuously since 2012, becoming negative in 2014. In addition, the trade balance in goods started deteriorating again in 2016, despite lower oil prices. Excluding energy products, the trade balance in goods has been deteriorating since 2014 (Graph 1.5).

|

Graph 1.5:Trade balance – France

|

|

|

|

Source: Insee

|

In line with developments in the trade balance, the current account deteriorated in 2016. According to balance of payment statistics, the current account balance reached −0.9 % in 2016, after registering −0.4 % in 2015. In cyclically-adjusted terms, France retained a sizeable current account deficit (

). The current account deficit is larger than the one required to stabilise the net international investment position (NIIP) over 10 years (this latter standing at −0.5 % of GDP), and larger than the current account 'norm' (

) explained by fundamentals (+0.2 % of GDP).

France's net borrowing has deteriorated as well to −2.5 % of GDP in 2016 and is expected to deteriorate further to −3.1 % in 2017. Net lending by households remains insufficient to fully finance net borrowing by the general government and by non-financial corporations. France is the only major EU economy in which non-financial corporations are net borrowers, while the net borrowing of the public sector is higher than the euro area average.

Private indebtedness

The level of consolidated private debt has steadily increased since 1998, reaching 146.9 % of GDP in 2016. Both household debt and non-financial corporation debt continued to grow at a relatively rapid pace throughout the crisis and in subsequent years (Graph 1.6). By contrast, in the rest of the euro area, private debt has been falling since 2009. While household debt is in line with the euro area average, the debt of French non-financial corporations exceeded the euro area average by 10.0 pps in 2016.

Increasing household indebtedness does not seem a source of concern in the near future. This is because of (i) the prevalence of fixed-rate loans, (ii) the particular French system of guarantees (granted by a bank or an insurer) that provides an additional safety net in case of default, (iii) the comparatively good credit profile of borrowers, (iv) the absence of any particular tax incentive to take up a housing loan, and (v) a history of low defaults even during the crisis (see Section 4.4).

High non-financial corporation debt, combined with still low profitability, is a potential source of concern for France, should this trend persist. This is underlined by the 15 December 2017 report

|

Graph 1.6:Household and non-financial corporation indebtedness

|

|

|

|

Source: Eurostat

|

of the Haut Conseil de stabilité financière whereby the institution commits to take additional prudential measures in case vulnerabilities and risks related to private debt justify it. At 89.7 % of GDP in 2016, non-financial corporation debt stood more than 10 pps above the fundamental benchmark obtained with regressions (Graph 1.7), and also above prudential threshold, and should be monitored (

). Non-financial corporations are expected to continue to rely on external financing since the investment-over-gross-savings ratio stands at quite high levels, substantially higher than before the crisis (126.4 % in 2016, compared with approximately 116 % in 2007 and 2008). However, risks tend to be mitigated by the fact that this growth in corporate debt seems to be mainly driven by the issuance of bonds by large corporations on the capital markets (INSEE, 2017b). As for the balance sheet structure of non-financial corporations in France, the proportion of short-term debt over total debt has decreased regularly since the start of the crisis, from 34.3 % in 2007 to 28.9 % in 2016, which limits the problem of short-term refinancing. At present, interest payments as a proportion of gross value added are relatively low. In 2016, they stood at 4.6 %, which is less than half the peak value of 11.2 % reached in 2008. In spite of this decreasing trend in recent years, interest payments as a proportion of gross value added remain substantially above the average value of 2.6 % in the 19 countries of the euro area.

|

Graph 1.7:France – non-financial corporation debt: gaps relative to benchmarks

|

|

|

|

Source: European Commission

|

Public finances

The reduction of the deficit below the 3 % of GDP reference value seems durable, but the structural deficit is projected to increase. According to the Commission 2017 autumn forecast, the general government deficit is expected to fall to 2.9 % of GDP in 2017, in part due to the additional consolidation measures of more than EUR 4 billion to offset previously detected state expenditure slippages. However, the final budgetary impact of AREVA’s (

) recapitalisation and the repeal of the 3 % tax on dividends, both pending a final decision by Eurostat, might compromise the reduction of the excessive deficit below the 3 % reference value. Based on the measures presented in the draft budgetary plan, the government deficit is expected to remain at 2.9 % of GDP in 2018. The structural balance, however, is projected to deteriorate by 0.4 % of GDP, which contrasts with the improvement required by the provisions of the preventive arm of the Stability and Growth Pact and the transitional debt rule. For 2019, at unchanged policies (

), the deficit is projected to increase to 3.0 % of GDP, which implies a structural deterioration of 0.3 % of GDP.

No reduction in the general government debt is foreseen over the forecast horizon. The public debt-to-GDP ratio reached 96.5 % of GDP in 2016, compared with 91.1 % for the euro area on average. This difference between France and the euro area average is expected to widen further in the coming years (see Section 4.1) as the French debt ratio is forecast to keep rising in 2017 to 96.9 % of GDP and remain at this level until 2019. This is mainly due to the projected deterioration of the structural deficit. Despite the lack of progress in public debt reduction, sovereign yields remain very low, driven by the expansionary monetary policy of the European Central Bank, and no refinancing issues have been detected.

Social developments

Despite recent labour market improvements, some groups of the population are still disadvantaged. Education levels are a determining factor for labour market performance. The unemployment rate of people without qualifications increased from 2015 to 2016 by 0.4 pp. to 18 %. It remained stable for graduates of upper-secondary education and decreased by 0.6 pp. to 5.7 % for graduates of higher education. Divergence in opportunities starts in school, as PISA results highlight a strong performance gap depending on socioeconomic background. People not born in the EU experience a large and increasing employment gap compared to those born in France (17.5 pps in 2016), and the children of those born outside the EU also struggle to overcome this gap.

The French labour market is also marked by entrenched segmentation. An increasing share of employees is on temporary contracts and is very unlikely to move to permanent contracts (the transition rate was at 13 % in 2016, one of the lowest in the EU). Compared to other countries, women occupy a relatively good position in the labour market compared to men, although women are more likely to be in part-time work than men (22.2 %).

Overall, France has relatively low levels of poverty, but the risk of social exclusion is increasing. The poverty rate remained stable in 2016 at 13.6 %, at 3.6 pps below the EU and euro area averages. The impact of social transfers on poverty reduction was 42.4 % in 2016, 9 pps above the EU average, although these social transfers are being reduced. The percentage of people at risk of poverty or social exclusion increased to 18.2 % in 2016, from 17.7 % in 2015, but is still below the average EU level of 23.5 %.

While income inequality in France is below the EU average, equality of opportunity deserves attention. Income inequality measured through the Gini index of disposable income was relatively unchanged in 2016 compared to the previous year at 29.3 % in 2016, below the EU average of 31 % in 2015. In 2016, the ratio of the average income of the bottom quintile to that of the first quintile was unchanged at 4.3 in 2016, below the EU average of 5.2 (

). This is the result of an effective tax and benefit system and comparatively low wage dispersion. However, educational outcomes are highly dependent on social background. Moreover, the risk of poverty for the children of low-skilled parents has been rising and is now above the EU average.

|

|

|

Table 1.1:Key economic, financial and social indicators – France

|

|

|

|

Source: Eurostat and ECB as of 30 Jan 2018, where available; European Commission for forecast figures (Winter forecast 2018 for real GDP and HICP, Autumn forecast 2017 otherwise) t

|

|

|

2.

Progress with country-specific recommendations

Progress in implementing the recommendations addressed to France in 2017 (

) has to be seen in a longer term perspective since the introduction of the European Semester in 2011. Looking at the multi-annual assessment of the implementation of the CSRs since these were first adopted, 72 % of all the CSRs addressed to France have recorded at least 'some progress'. 28 % of these CSRs recorded 'limited progress' or 'no progress' (see Figure 2.1). Substantial progress has been achieved in decreasing the cost of labour and reforming the labour law. Other areas where progress in implementing CSRs is more visible in addressing challenges relate to the long-term sustainability of public finances, skills and life-long learning, as well as the business environment.

|

Graph 2.1:Overall multiannual implementation of 2011-2017 CSRs to date

|

|

|

|

Source: European Commission

|

In terms of public finances, the general government deficit has decreased over time, while public debt is stabilising. The general government deficit decreased by 1.7 pp. between 2011 and 2016, from 5.1 % to 3.4 % of GDP. While initially relying more on tax increases, the consolidation strategy became increasingly reliant on declining interest payments, thanks to the prevailing low interest rates, and public investment cuts. A more systematic evaluation of public policies was pursued and reinforced by the introduction of annual spending reviews since 2014. However, the resulting savings and efficiency gains were limited due to a lack of appropriate follow-up and low political ownership. A ceiling to the growth rate of spending on healthcare and on operational spending at local authorities' level was introduced. While the former was systematically respected, the ceiling for local authorities is not binding and its respect has been ensured by cuts in local investment. Finally, the long-term financial sustainability of the complementary pension schemes was improved. Nonetheless, structural deficits remained high, hampering efforts to reduce public debt. Therefore, ensuring sound and sustainable public finances remains a challenge, especially in the medium term, given the age-related expenditure trajectory.

Recent reforms are expected to improve the functioning of the labour market over time. The labour law has been modified to encourage hiring on permanent contracts, notably by reducing legal uncertainty over individual dismissals. Flexibility has been increased at company level, thanks to the simplifications of rules on collective dismissals, the possibility to sign agreements at company level partially derogating from branch level provisions, and the creation of company-level agreements to modify wages and adapt working hours in case of economic difficulty. The most recent reforms aim to streamline social dialogue, simplifying its procedures and the entities involved. The training system has been reinforced and a compte personnel d'activité has been set up to allow all workers (including civil servants, unemployed and the self-employed) to access and manage all the rights acquired, both in terms of training and recognition of periods of hardship, throughout their career. The reforms that have been announced are expected to complement past policy actions. They will do this by reforming the unemployment benefit system and the vocational education and training system, and by harmonising the calculation rules for the different pension schemes.

Since 2011, efforts have been made to improve the business environment. A simplification programme was launched in 2013 to reduce red tape. New measures have recently been taken or announced to limit the proliferation of regulations and to improve relations between businesses and public authorities. An action plan is currently being drawn up to foster entrepreneurship and business growth. To develop activity in the services sector, the ‘Macron law’ in 2015 lifted restrictions in a number of services sectors such as the legal professions. No substantial measures have been adopted since then, although regulatory and administrative requirements still hamper the uptake of digital technologies in the services sector (European Commission, 2018c). A clarification of the French state’s objectives as shareholder, including in the railway and energy sectors, would complement the policy actions undertaken in this area. Lastly, some initiatives have been launched to further support public and private R&D activities but the efficiency of such measures cannot be assessed yet.

Some progress has been made to address the high tax burden faced by companies. Since 2011, substantial efforts have been made to reduce the tax burden on companies and decrease the cost of labour through the Tax Credit for Competitiveness and Employment (Crédit d'impôt pour la compétitivité et l'emploi - CICE) and the Responsibility and Solidarity Pact (Pacte de responsabilité et de solidarité). However, efforts to broaden the tax base on consumption and simplify the tax system and improve its efficiency have been limited.

Overall, France has made some progress (

) in addressing the 2017 country-specific recommendations. Public debt continued to increase in 2017 and remains high, although it is expected to stabilise over the forecast horizon. The government has launched a new strategy to increase efficiency in public expenditure Public Action 2022 (Action Publique 2022). However details of the new approach are not yet known nor are the potentially associated public expenditure savings. The reduction of public expenditure is meant to contribute to achieving the objective to reduce the deficit and to counterbalance cuts in public revenues, due to the reduced tax burden on companies and the additional reductions in the cost of labour in 2019. France is also conducting an important reform of capital taxation that is expected to increase efficiency and restore attractiveness (CSR 2). A reform of the vocational education and training system will be unveiled in 2018. Its aim is to improve the quality of training and the governance of the overall system. However, little progress has been made to benefit people with a migrant background. Despite only moderate nominal increase in the minimum wage, which followed its indexation rule since 2013, the employment rate of lower-skilled people has continued to decline. This highlights the need for a comprehensive strategy to address this issue (CSR 3). On the reduction of the regulatory burden for firms (CSR 4), a circular was adopted to limit the proliferation of regulations, better assess their impact on businesses, and avoid the ‘over-transposition’ of EU directives into French law. The French government has also presented a bill including a ‘right to make a mistake’ for entrepreneurs acting in good faith in their dealings with public authorities. More progress in lifting barriers to competition in the services sector is warranted. Assessments are being carried out on the efficiency of public support schemes for innovation, but it remains to be seen how they will be translated into action. An industry and innovation fund will be set up to support breakthrough innovation.

European Structural and Investment (ESI) Funds contribute in addressing key challenges to inclusive growth and convergence in France (see Box 2.1), notably by improving labour market access, focusing on the less qualified and the most vulnerable by reinforcing counselling schemes and addressing early-school leaving. ESI Funds boost vocational education and training for both employed and unemployed and support apprenticeship and employment opportunities for people further away from the labour market. ESI Funds also contribute to improving cooperation and networking between enterprises and public research institutions.

|

|

|

Table 2.1:Summary Table on 2017 country-specific recommendations assessment

|

|

|

|

Source: European Commission

|

|

|

|

Box 2.1: Tangible results delivered through EU support to structural change in France

France is a beneficiary of significant European Structural and Investment Funds (ESI Funds) support and can receive up to EUR 26.8 billion until 2020. This represents around 4 % of public investment (

I

) annually over the period 2014-2018. By 31 December 2017, an estimated EUR 11.4 billion (42 % (

II

) of the total) was allocated to projects on the ground. This has paved the way for over 5 000 enterprises to cooperate with research institutions; over 100 firms are being supported to introduce new products to the markets they operate in; 2 000 households have received access to broadband and more than 350 000 persons have benefitted from integrated urban development strategies.

ESI funds help address structural policy challenges and implement country specific recommendations. The European Social Fund (ESF) and the Youth Employment Initiative (YEI) support the improvement of labour market access, focusing on the less qualified and the most vulnerable, notably by co-financing reinforced counselling schemes, such as the 'Garantie jeunes' or 'Accompagnement global', by supporting measures to address early-school leaving. ESI Funds boost the offer of initial and continuous vocational education and training for both employees and for the unemployed, including by increasing support to apprenticeship or supporting measures which provide employment opportunities in specific social structures for people further away from the labour market. Over 1.5 million people had participated in actions financed by the ESF and the YEI within the national programmes, which include some 65 % of the available ESF/YEI funding for France, adding to the participants supported by the regional programmes. 62 % of youngsters so far supported by the YEI national programme were either employed (49 %) or in education or training (13 %) 6 months after their participation.

Various reforms were undertaken already as precondition for ESI Funds support (

III

). Smart Specialisation Strategies for research and innovation were developed to focus efforts on product specialisation with strong market potential. This has also helped improve cooperation between enterprises and public research institutions. ESI funds also support research infrastructures, which enable the pursuit of both research excellence and the development of local ecosystems for research and innovation that in turn create growth and jobs.

France is advancing the take up of the European Fund for Strategic Investments (EFSI). As of December 2017, overall financing volume of operations approved under the EFSI amounted to EUR 8.6 billion, which is expected to trigger total private and public investment of EUR 39.6 billion. More specifically, 79 projects involving France have been approved so far under the Infrastructure and Innovation Window (including 27 multi-country projects), amounting to EUR 7 billion in EIB financing under the EFSI. This is expected to trigger about EUR 30.4 billion in investments. Under the SME Window, 32 agreements with financial intermediaries have been approved so far. European Investment Fund financing enabled by the EFSI amounts to EUR 1.6 billion, which is expected to mobilise approximatively EUR 9 billion in total investment. Over 82 000 smaller companies or start-ups will benefit from this support. SMEs rank first in terms of operations and volume approved, followed by RDI, energy and digital.

Funding under Horizon 2020, the Connecting Europe Facility and other directly managed EU funds is additional to the ESI Funds. By the end of 2017, France has signed agreements for EUR 2 billion for projects under the Connecting Europe Facility.

https://cohesiondata.ec.europa.eu/countries/FR

|

3.

Summary of the main findings from the Macroeconomic Imbalance Procedure in-depth review

The in-depth review for the French economy is presented in this report. In spring 2017, France was identified as having excessive macroeconomic imbalances, in particular relating to weak competitiveness and high public debt, in a context of low productivity growth. The 2018 Alert Mechanism Report (European Commission, 2017h) concluded that a new in-depth review should be undertaken for France to assess developments relating to identified imbalances. Analyses relevant for the in-depth review can be found in following sections: sources of imbalances related to public debt are covered in Section 4.1; the situation of the labour market in Section 4.2 and the business environment in Section 4.3. Potential spillovers to the rest of the euro area are discussed in Box 3.1 (*).

Imbalances and their gravity

Competitiveness has stopped deteriorating, while the full impact of structural reforms has still to materialise. As analysed in Sections 1 and 4.3, the export performance of France has stabilised compared to the decline observed in the past. However, in terms of trade balance, both the trade balance in goods and in services deteriorated in 2016. The current account deficit reached −0.9 % of GDP (

), accompanied by a decrease in the cyclically adjusted current account balance by 0.3 pp. (

). It remains larger the deficit required to keep the Net International Investment Position (NIIP) in balance (−0.5 % of GDP) or the one explained by fundamentals (+0.2 % of GDP) (

). Labour cost growth continues to be moderate, but the decline in productivity growth prevents a faster recovery of France's competitiveness. The effects of labour and product market reforms recently announced or undertaken will take some time to materialise. Considerable improvements in the competitiveness of the French economy may thus be expected only in the medium term.

Growth in unit labour costs is recovering. Unit labour costs in non-agricultural market sectors have been growing since the third quarter of 2016. This is the result of increased gross wages per person, driven by the cyclical upswing, weak productivity growth, and the end of the ramp-up of measures to decrease the cost of labour (Graph 3.1). In real terms, unit labour costs increased by 0.3 % in 2016, after a decrease of 0.8 % in 2015. The construction and market services sectors are contributing the most to the overall unit labour cost dynamics, with an average annual growth rate equal to 2.7 % for the former and 1.1 % for the latter between 2008 and 2016. More precisely, unit labour costs in the construction sector have been increasing more quickly than the average for the sector in the euro area (1.3 %) or in other comparable Member States of the EU, such as Germany (2.0 %) and Italy (2.0 %).

Labour productivity growth remains subdued. Productivity growth fell from 0.8 % in 2015 to 0.5 % in 2016, in line with the data for the EU and the euro area. It remained slower than in Germany (0.6 %) and Spain (0.7 %), but faster than in Italy (−0.3 %). This deceleration is partially explained by the strong job creation observed over the year (Sections 1 and 4.2). It continued in 2017 as productivity growth is estimated to be only 0.3 %. In 2018 and beyond, labour productivity is forecast to progressively reach a growth level close to its trend rate due to a milder support from employment policies (e.g. reduction in the crédit d'impôt pour la compétitivité et l'emploi rate, end of the subsidy for new hires, and reduction in subsidised schemes). Nevertheless, the current trend productivity growth remains lower than prior to the crisis. The productivity gap between the most and the least productive companies has increased due to low levels of sectoral and geographical mobility in the factors of production (labour and capital) (Cette, Corde and Lecat, 2017; Berthou, 2016; Fontagné and Santoni, 2015).

|

Graph 3.1:Decomposition of unit labour cost rate of change

|

|

|

|

Source: European Commission

|

The high public debt-to-GDP ratio in France remains a major source of vulnerability that compounds the risks of weak competitiveness. Public debt grew further in 2017. High public debt weighs on growth prospects by crowding out productive public expenditure and requiring a high tax burden, also to service the interest on the debt. This is aggravated by the also high levels of private sector debt, in particular non-financial corporations' debt which stands above fundamental and prudential benchmarks (see Section 1), in a context of low productivity growth. High public indebtedness makes France vulnerable, as it limits its fiscal capacity to offset potential negative shocks to the economy. Moreover, in such a case, if the sustainability of public finances were put at stake, the depreciation of public debt portfolios held by financial institutions could also undermine their solvency ratios and their ability to give credit, thereby amplifying the negative effects of such shocks. Furthermore, high levels of public debt combined with projections of insufficient fiscal effort and the projected increase in pension and healthcare expenditure lead to high sustainability risks in the medium term. Given its size, such an imbalance might entail potentially negative effects on other EU countries.

The strong economic and financial integration of the French economy with the rest of the euro area make it a potential source of spillovers for several other Member States. France shows particularly strong trade linkages with neighbouring euro area countries and the UK. Financial and banking linkages between France and the rest of euro area are likewise important. Box 3.1 illustrates how structural reform measures in France can carry both domestic and cross-border positive effects. The simulations presented therein follow the spirit of the euro area recommendations (

), notably as for increasing productivity and growth potential.

Evolution, prospects and policy responses

Changes in the measures to reduce the cost of labour may have some effects in the short term and be relatively more favourable to lower-skilled workers. The transformation of the Tax Credit for Competitiveness and Employment (Crédit d'impôt pour la compétitivité et l'emploi - CICE) into a permanent reduction in employers’ social contributions, associated to further reductions in contribution for wages up to 1.6 times the minimum wage, is planned for 2019 (Section 4.1). This would have a positive impact on economic growth, investment and other macroeconomic variables over the short run, according to the combined simulations based on the European Commission’s EUROMOD and QUEST models (

). As shown in Figure 3.2, changes to this tax credit would increase GDP by 0.23 % in 2019 compared to the baseline. This rise in GDP would be accompanied by an equal increase in consumption and a smaller, but more persistent, increase in investment. The distributional effects of this reform, both in terms of wages and employment, would favour lower-skilled workers, because employers’ social contributions would become more progressive, making it cheaper to hire these workers.

Planned changes in corporate-income and capital taxation should lower the tax burden on companies and favour investment. The finance law for 2018 continues the previous government’s plan to reduce the corporate income tax rate. By 2022, this measure would represent a total of EUR 11 billion of tax cuts for companies and is expected to increase GDP by about 1.5 percentage points according to the authorities. In addition recent measures have also targeted capital taxation to reduce taxes on capital gains, dividends and interests to encourage investments in companies. A new flat rate of 30 % will apply on capital income and replace the current progressive system, which taxes capital income at a higher rate with targeted incentives or rebates related to the duration or the type of investment.

Recently adopted labour market reforms may also contribute to the competitiveness of the French economy. The new reform of the labour law began with the Enabling Act of August 2017. It strengthens the new type of collective agreement (accords de compétitivité), introduced by the Labour Act of 8 August 2016 to maintain or increase employment within a company. It allows to further review employees’ remuneration beyond working time conditions, allowing companies to dismiss employees that refuse such agreements on real and serious grounds. Moreover, the 2017 reform introduces binding ceilings for compensations awarded by labour courts (called prud'hommes in France) and allows for company-level agreements to prevail in the definition of wage bonuses. Reforms of vocational education and training under discussion could lead to productivity improvements through a workforce upskilling (Section 4.2).

New initiatives aim to improve the business environment for companies, but bottlenecks remain. A number of measures have been taken to reduce the regulatory burden weighing on businesses and to facilitate their relations with the public administration. The Plan d'action pour la croissance et la transformation des entreprises (PACTE) seeks to promote entrepreneurship and support the growth of businesses. The Grand plan d'investissement aims at gearing investments towards identified priorities. As for R&D policies, the ongoing evaluation of public funding schemes and programmes could lead to the adoption of measures to increase the efficiency of these schemes and programmes. In particular, the evaluation of public research-business collaboration paved the way to improve the collaboration between public research and companies. New programmes have also been announced to support research and innovation activities (e.g. Industry and Innovation Fund, Fonds pour l'industrie et l'innovation). However, complex regulatory and administrative requirements are preventing the growth of the digital and collaborative economy. The reduction of the regulatory burden and the clarification of the objectives characterising the French state as shareholder, including in the railway and energy sectors, remain key to improve the business environment for companies (Sections 4.3 and 4.4).

Public debt remains high, although it is set to stabilise in 2018. General government debt continued to increase in 2016, reaching 96.5 % of GDP. It is forecast to peak at 96.9 % in 2017. This stands in contrast to the rest of the euro area, where average debt levels are already declining (Section 4.1). High and increasing structural deficits are set to prevent the public debt ratio from decreasing. In recent years, low inflation and low interest rates have reduced the interest burden, which became the main contributor to fiscal consolidation. However, these benefits are expected to end 2019 as a result of the expected normalisation of interest rates and higher inflation, which impacts the rates of return of inflation-indexed bonds.

The current consolidation strategy puts the emphasis on containing public expenditure and on reaping efficiency gains. In the multiannual programming law for 2018-2022 the expenditure-to-GDP ratio excluding tax credits is set to decline by over 3 pps between 2017 and 2022. The government targets a very ambitious deceleration of the rate of expenditure growth compared to previous attempts. A new expenditure ceiling for state expenditure items under the control of the government has been introduced. There have also been reductions in the number of state-subsidised contracts and in social housing allowances. Additional savings have been made on the state wage bill by the reintroduction of one unpaid day in case of illness, a wage freeze for civil servants, and a reduction in the number of public sector employees. The multiannual programming law for 2018-2022 sets an operational expenditure growth target of 1.2 % for local authorities (Objectif d'évolution de la Dépense Locale) over that period. This programming law also plans for cuts in transfers from the state to local authorities to be replaced by a contract agreement between the State and local authorities. However, the effectiveness and timeliness of the mechanism foreseen to correct expenditure slippages is still to be proven. The annual spending reviews introduced in 2014 will be replaced with a broader Public Action 2022 initiative (Action Publique 2022), aiming at an ambitious and coordinated overhaul of all public policies. The roadmap of this initiative, including policies and evaluation methods, is expected for the first quarter of 2018.

|

Graph 3.2:Effects of the crédit d’impôt pour la compétitivité et l’emploi transformation

|

|

|

|

Source: European Commission

|

There are sustainability risks in the medium term, mainly due to the high structural deficit and debt ratio. Sustainability risks are low in the short term (see section 4.1). However, the high structural deficit and debt level create a significant sustainability gap in the medium term. This gap is aggravated by the projected increase in age-related expenditure over the next 15 years, as an ageing population requires more pension, health and social care expenditure. Public debt reduction is thus key to avert medium-term sustainability risks.

Overall assessment

French macroeconomic imbalances are due to high public debt and weak competitiveness in a context of low productivity growth. Competitiveness indicators have stabilised, due to moderate wage increases and measures to reduce the cost of labour. Yet, labour productivity growth remains low, preventing a faster recovery of competitiveness and weighing on long-term growth prospects. The trade account still shows a moderate deficit although export market shares losses have stopped since 2012. The already-high level of general government debt is set to peak in 2017 and is projected to remain unchanged in 2018. The high public debt ratio remains a major source of vulnerability, as it weighs on growth prospects and limits the stabilisation capacity of fiscal policy in the event of a downturn.

Reforms have gained momentum, but their full implementation remains crucial and further reforms are warranted to ensure a permanent reduction of macroeconomic imbalances. Action has been taken to improve the functioning of the labour market, to decrease the tax burden on companies and capital, and to evaluate some public schemes for innovation. Measures have also been taken to reduce the cost of labour, while reforms have been announced for vocational education and training, unemployment benefit system, pensions, and to support the growth of companies. Still, the segmentation of the labour market continues to prevent some categories of employees from improving their working conditions. A review of expenditure items that effectively leads to future expenditure savings remains warranted, along with further decreases in the complexity of the tax system and in unjustified regulatory barriers. There is also scope to increase competition in the services sectors and to raise the efficiency of policy schemes to support innovation.

|

|

|

|

|

Table 3.1:MIP Assessment Matrix (*) – France 2018

|

|

|

|

|

|

(Continued on the next page)

|

|

Table (continued)

|

|

|

|

|

|

Source: European Commission

|

|

|

4.

Reform priorities

4.1.

Public finances and taxation

General government debt sustainability (

)*

General government debt continued to increase in 2016 and 2017 and it is projected to only stop rising in 2018 and 2019. Public debt rose further to 96.5 % of GDP in 2016 and, according to the Commission 2017 autumn forecast, is projected to peak at 96.9 % of GDP in 2017 and to remain at this level in 2018 and 2019 (Graph 4.1.1). This trend implies a widening gap with respect to the euro area, where overall public debt is projected to decline by some 4 pps to 85.2 % of GDP between 2017 and 2019. The high projected French primary deficit explains most of this difference (see Section 1). The contribution of the declining interest burden to overall deficit reduction is projected to halt in 2019 as a result of higher inflation and expected normalisation of interest rates (see Section 3).

The short-term sustainability does not seem to be a cause of concern in spite of the high public debt ratio. Short-term sustainability is assessed by the indicator S0 (

).The short-term fiscal sub-index indicates high risk due to the high level of gross financing needs, of the primary deficit and of public debt. However, as the overall S0 indicator does not flag any significant risk, the identified short-term fiscal challenges are not acute enough to generate overall risks of fiscal stress. This low short-term risk is confirmed by the ‘AA stable’ rating given by the three major rating agencies to French government debt.

|

Graph 4.1.1:Contributions to the change in the public debt ratio in France

|

|

|

|

Source: European Commission 2017 autumn forecast

|

|

Graph 4.1.2:Projections of French public debt under alternative scenarios

|

|

|

|

Source: European Commission Debt Sustainability Monitor 2017

|

Sound debt management and the high rating of French debt reduce short-term risks. As French debt is denominated in euro there is no currency risk. Moreover, the average maturity of debt instruments was lengthened to more than 7.5 years in 2017 from 7 years in 2014, which has allowed France to secure low interest rates over the coming years. The investor base is diverse. Despite the recent slight decline, the high share of holdings by foreign investors of French debt (at close to 60 %, which is broadly evenly distributed between euro area and other countries), could be a source of vulnerability. However, investor appetite for French debt remains high.

Sustainability risks remain high in the medium term. According to the baseline scenario in the debt sustainability analysis, at unchanged policies, the public debt ratio in France is projected to keep rising to reach some 105.7 % of GDP in 2028. This increase in public debt stems from the projected high primary deficits aggravated by the increase in age-related expenditure, namely on pensions, health and long-term care. Until 2026, these pressures are offset only in part by a favourable snow-ball effect (e.g. the difference between the implicit interest rate on government debt and the nominal growth rate of the economy). This effect then fades out and subsequently turns negative when the rising interest rate burden outweighs the effect stemming from nominal growth. Based on the updated projections in the forthcoming 2018 Ageing Report the Commission's services have recalculated the sustainability indicators. The S1 sustainability indicator, which measures sustainability risks at horizon 2032, indicates a high medium-term risk. This indicator implies that a cumulative gradual improvement in the French structural primary balance of 5.1 pps of GDP, relative to the baseline scenario, would be required over 5 years to reduce the debt ratio to 60 % of GDP by 2032. Specifically, 2.8 pps of the required fiscal adjustment would be due to the debt ratio's distance from the 60 % reference value, 1.9 pp. to the unfavourable initial budgetary position (defined as the gap to the debt-stabilising primary balance) and the remaining 0.4 pp. to the projected increase in age-related public spending. Public debt projections are especially sensitive to interest rate and growth developments. Higher interest rates or lower projected annual GDP growth would lead to significantly higher debt ratios after 10 years (Graph 4.1.2).

However, sustainability risks appear contained in the long term as a result of the projected decline in age-related expenditure. The S2 indicator measures fiscal sustainability challenges in the long term under a baseline no-policy change scenario. In the case of France, the S2 indicator points to a relatively small required fiscal adjustment (0.7 pp. of GDP) to ensure that the debt ratio remains sustainable over the long term. This is primarily due to the projected fall in age-related spending as of the late 2030s (contribution of -1.6 pp. of GDP to S2), offset by the unfavourable initial budgetary position (2.3 pps of GDP). The projected decline in age-related expenditure is mostly driven by the envisaged decrease in public spending on pensions (-2.0 pps of GDP). This decline stems mainly from the indexation of public pensions to inflation as measured by consumer prices, which means that pensions would grow less quickly than wages on average. Notwithstanding the low S2 indicator, the implied fiscal adjustment might lead to debt stabilising at relatively high levels. This indicator should therefore be taken with some caution for high-debt countries, including France. Moreover, long-term risks could arise under more adverse scenarios involving lower total factor productivity growth or more dynamic healthcare and long-term care expenditures.

Improving the efficiency of spending on pensions, healthcare, housing and vocational training and apprenticeship

Pension system

The financial situation of the pension system is worsening in the medium term. At 14 % of GDP in 2016, pension expenditure in France is among the highest in the EU, where it stands at around 13 % of GDP. At 50.5 % in 2016, the benefit ratio, defined as the average pension as a share of the economy-wide average wage, is also above the EU average of 43.5 %. According to analysis carried out for the upcoming Pension Adequacy Report, the adequacy of the pension system is good, with a 40-year career at average wage replacement ratio of 0.68 (similar for women and men). Moreover, in 2016 the "at risk of poverty and social exclusion" (AROPE) of older people (aged 65 or over) was 10.0 % in France, while it averaged at 18.2 % in the EU. The average effective exit age from the labour market (expected at 61.8 years in 2017), which is low in an EU perspective, is projected to increase progressively to 64.5 in 2050 as a result of recent reforms. The French pension system is currently in a limited deficit amounting to around 0.2 % of GDP per year. According to the Ageing Working Group projections, pension expenditures are projected to increase slightly until 2032 and to start to decline thereafter, thanks to an only moderate increase in the old-age dependency ratio (by around 15 pps). No specific financial sustainability issues are foreseen for the pension system. However, the new set of projections released by the Conseil d'Orientation des Retraites (2017) show that, according to the prevailing rules, the system is not projected to return to balance until the late 2030s, instead of 2025 according to previous projections. This is due to the projected decline in the average contribution rate over the next decade, which would entail a fall in resources of the system by around 1 % of GDP. This led the Comité de Suivi des Retraites (2017) to issue a recommendation to the government to take the necessary measures to bring the pension system back to balance.

The reform that entered into force in July 2017 is a step towards simplification of the pension system. In July 2017, the LURA (Liquidation Unique de retraite de base des Régimes Alignés) reform entered into force. This reform consolidated into a single calculation the pension benefits of private sector workers that contributed to several basic schemes. The reference wage for this calculation is now the average of the 25 best years of wages (indexed to inflation) of a whole career. Moreover, only four quarters a year can be taken into account, which implies that individuals that contributed to several schemes simultaneously will get a lower pension than before this reform.

A comprehensive pension reform aimed at harmonising the calculation rules for the different pension schemes is on the agenda. Despite the recent reforms, and in particular the LURA agreement, the pension system remains extremely complex, consisting of more than 30 schemes, which include basic and mandatory complementary schemes. The government is considering introducing a system strengthening the link between contributions and benefits, according to which the amount of the pension at the age of retirement would be gauged based on the accumulated contributions over the whole career and the expected years of life at retirement for the different age groups. This would apply to the different schemes, although they could maintain different contribution rates. The details of the reform have not been defined yet and implementation is not foreseen before 2019. However, it is not year clear whether the reform will address the financial sustainability of pension regimes, as recommended by the Comité de suivi des Retraites.

Healthcare

Demographic changes, coupled with slowly increasing inflation and the cost of medical innovation require the well-performing French healthcare system to become more cost-effective. France spent 11.0 % of its GDP on health in 2016. This makes it — together with Sweden — the EU’s the second highest spender on health (OECD/European Observatory on Health Systems and Policies, 2017c).

Recent reforms and reforms currently underway have promoted efficiency gains. The share of generics in the pharmaceutical market has increased thanks to a series of measures implemented (

). However, at 30 % (2015), it is still far below the share in other big economies of the EU. The purchase of expensive medicines that could be replaced with cheaper generics remains an important challenge. Recent reforms to enhance cooperation between hospitals, strengthen primary care and improve integration of care have yet to show results. The financial situation of hospitals has worsened in 2017, according to the Fédération hospitalière de France while restructuring of hospitals is at a standstill (Cour des Comptes, 2017e). Another challenge for future sustainability remains France's low levels of spending and activity on prevention (OECD, 2017d). Prevention has therefore become a priority in ongoing reforms.

Housing policy

Public spending on housing in France amounts to around 2.0 % of GDP and targets both housing supply and demand. Resources allocated to housing policy have increased faster than GDP in the last two decades (+4.6 % annual average). Around EUR 19 billion — almost half of total annual spending on housing — is spent on rent subsidies in public housing or in the private sector. Housing policy also encompasses subsidised loans, tax incentives, rent control and regulation. The cost of providing housing benefits is expanding due to the indexation mechanism used to calculate these benefits and to the increase in the number of beneficiaries in the aftermath of the crisis. Indicators such as the number of new housing projects, the vacancy rate, the average size, age and condition of existing housing can be good indicators of the efficiency of the housing policy. Another good indicator of the efficiency of housing policy is the so-called ‘effort rate’ as measured by the ratio between housing expenditure minus allowances and net household income.

Despite housing allowances, the ‘effort rate’ of households is moderately on the rise. The efficiency of housing benefits has decreased over the last decade as shown by the increasing effort rate of households. This increasing effort rate can be explained by the indexation mechanism, the disconnection between the reference rent and real spending on housing or by the use of undifferentiated parameters for housing in the social and private sectors that are only partially reflective of the region/zone of location. Moreover, as housing benefits are proportionate with the level rents up to a certain ceiling and directly disbursed to the owners, they are believed to have an inflationary effect on rents (Fack, 2005 or Grislain-Letrémy and Trévien, 2014), thereby making access to housing more difficult. In an effort to limit the rise of rents in the private sector, the control of rents was introduced in 2015 in pilot cities of Paris and Lille but was abandoned in 2017 following an administrative justice ruling. The French government decided to appeal this decision in January 2018. The recent across the board cuts in housing benefits lower public spending on housing but do not address the increase in the effort rate for tenants. Nor do they address the discrepancy in the effort rates in the private and the social housing sectors. Finally, housing benefits do not address the main issue of the scarcity in housing supply.

The criteria for accessing social housing lead to suboptimal outcomes. Turnover of tenants in the social housing sector is low at between 10 and 15 years, compared to around 3 years in the private rental sector. The financial situation of social housing tenants is not periodically reassessed to verify if the tenants still qualify to such lower-cost housing (Cour des Comptes, 2017f). Since 70 % of the population can claim access to social housing, waiting lists are long (1.7 million people in 2014) and only some particular situations lead to priority treatment of files (Agence Nationale pour l'information sur le logement). As a consequence, housing supply remains locked in the hands of insiders and access is not always granted to those most in need. Students can claim housing benefits irrespective of their parents' revenues while no preference is given to lower-income families with young children. This is especially concerning as the housing conditions of young children can have a long lasting impact into later life.

The scarcity in housing supply is a challenge for housing policy. The real-estate market did not experience any sudden or significant price correction in the aftermath of the 2008 crisis. For aspiring owners, access to housing is increasingly difficult despite strong credit growth for house purchases and a pick-up in the construction sector as real estate prices remain high and overvalued (Philiponnet and Turrini, 2017) (see graph 4.1.3). Moreover, the conditions for tax credit schemes to facilitate home ownership are not always well defined and no proper analysis of their effectiveness has been done. Administrative appeals and building regulations and landowners not developing constructible land into housing are obstacles to increasing housing supply, notably in tense areas. Finally, the owner-tenant relationship is unbalanced with more legal protection given to the tenants. This leads to high vacancy rates in private housing (INSEE, 2016a).

Changes to the different elements of housing policy could help improve its efficiency. Spending less on housing benefits and reallocating the resources to housing supply instead could improve the housing situation. This is particularly the case for new social housing in areas with strong housing demand and insufficient housing supply. In addition, regular and more comprehensive assessments of the economic situation of tenants in social housing to better match housing need and existing supply could improve housing access for the most deprived at a lower cost.

|

Graph 4.1.3:Trends in real estate

|

|

|

|

Source: European Commission

|

Vocational training and apprenticeship

Vocational training and apprenticeship is a domain with a significant potential for contributing to long-lasting efficiency gains in public expenditure. Public spending in this area reached around EUR 24 billion in 2015 or about 1.2 % of GDP (Projet de loi de finances pour 2018), excluding direct expenditure by companies (

) and individual expenditure by households. Companies continued spending the most in this area, accounting for 33 % of the total, followed by the regions, the central government and other public administrations (e.g. Unedic, Pôle emploi) which accounted for about 20 %, 15 % and 10 %, respectively. A quarter of the overall expenditure was dedicated to training civil servants both at the central and local levels as well as in hospitals. Between 2011 and 2015 regions increased their share in the overall amount of public spending, in line with the progressive decentralisation of vocational training and apprenticeship policy completed by the reform of 2014 (

).