EUROPEAN COMMISSION

EUROPEAN COMMISSION

Brussels, 14.10.2020

SWD(2020) 951 final

COMMISSION STAFF WORKING DOCUMENT

Accompanying the document

REPORT FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT, THE COUNCIL, THE EUROPEAN ECONOMIC AND SOCIAL COMMITTEE AND THE COMMITTEE OF THE REGIONS

Energy prices and costs in Europe

{COM(2020) 951 final}

Contents

Introduction

1

Electricity prices

1.1.1

Evolution of wholesale electricity prices

1.1.2

Factors impacting the evolution of wholesale prices

1.1.3

International comparisons

1.2

Retail electricity prices

1.2.1

Household electricity prices

1.2.2

Industrial electricity prices

1.2.3

International comparisons

2

Gas prices

2.1

Wholesale gas prices

2.1.1

Evolution of wholesale gas prices

2.1.2

Factors impacting the evolution of wholesale gas prices

2.1.3

International comparison

2.2

Retail gas prices

2.2.1

Industrial Natural Gas Prices

2.2.2

International comparisons

3

Oil and oil product prices

3.1

Crude oil prices

3.2

Wholesale prices of oil products

3.3

Retail prices of oil products

3.3.1

Methodology

3.3.2

General findings

3.3.3

Gasoline

3.3.4

Diesel

3.3.5

Heating oil

3.3.6

Gasoline vs diesel

3.3.7

International comparison

4

The EU energy bill

4.1

Introduction

4.2

Methodology

4.3

Drivers

4.4

Import bill calculation

5

Household energy expenditure and energy poverty

5.1

Energy products’ expenditure in household budgets

5.1.1

Energy expenditure (excluding transport) in households

5.1.2

Energy expenditure (excluding transport) in households with low income

5.1.3

Energy expenditure (excluding transport) in households with middle income

5.1.4

Share of energy in the household expenditure by income and Member States

5.1.5

Energy expenditures in the transport sector

5.1.6

Change in energy expenditures in the Member States (2008-2018)

6

Industry energy costs

6.1

Energy costs and their impact at macroeconomic level

6.2

Energy costs for industry

6.3

Exploring energy intensities

6.4

Energy costs drivers

6.4.1

Drivers of energy costs

6.4.2

Impact of energy costs on total production costs

6.5

International comparisons

6.5.1

Energy costs vs other G20 countries

6.5.2

Energy intensity of EU sectors vs other G20

6.5.3

Industrial electricity prices: EU vs G20 countries

6.5.4

Industrial gas prices: EU vs G20 countries

6.6

Overview of selected Energy Intensive Industries

7

The role of energy for government revenues and inflation

7.1

Government revenues from the energy sector

7.1.1

Energy taxes

7.1.2

Excise duties

7.1.3

Value added tax (VAT)

7.1.4

Tax revenues from oil products

7.1.5

Energy taxes, prices and incentives

8

Realised prices and profitability in the power market

8.1

Introduction

8.2

Methodology

8.3

Realised prices and business cases of key technologies

8.3.1

Solar PV

8.3.2

Wind onshore

8.3.3

Wind offshore

8.3.4

Gas fired power generation

8.3.5

Coal fired power generation

8.3.6

Nuclear Energy

ANNEX – COUNTRY FACTSHEETS

CoNTENT AND METHODOLOGY…………………………………………………………………………………………………………………..…254

Austria

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Belgium

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Bulgaria

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Croatia

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Cyprus

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Czechia

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Denmark

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Estonia

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Finland

Prices (2019 and recent evolution)

Energy costs for households, industry and services

France

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Germany

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Greece

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Hungary

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Ireland

Prices (2019 and recent evolution)

Energy costs for households, industry and services

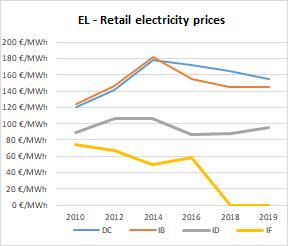

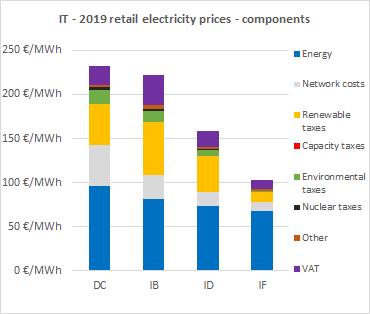

Italy

Prices (2019 and recent evolution)

Energy costs for households, industry and services

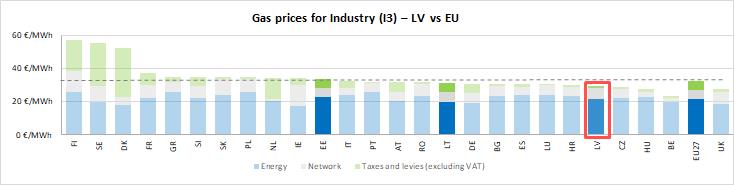

Latvia

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Lithuania

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Luxembourg

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Malta

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Netherlands

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Poland

Prices in 2019

Energy costs for households, industry and services

Portugal

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Romania

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Slovakia

Prices (2019 and recent evolution)

Energy costs for households, industry and services

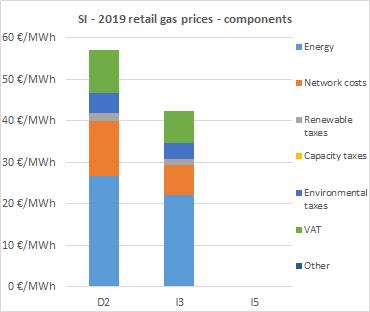

Slovenia

Prices (2019 and recent evolution)

Energy costs for households, industry and services

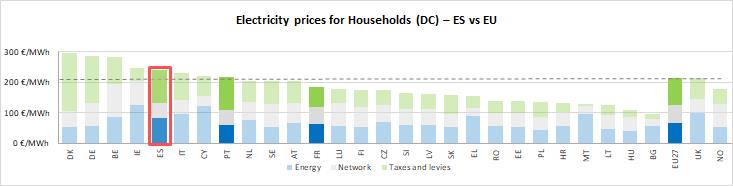

Spain

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Sweden

Prices (2019 and recent evolution)

Energy costs for households, industry and services

United Kingdom

Prices (2019 and recent evolution)

Energy costs for households, industry and services

Norway

Prices (2019 and recent evolution)

List of Figures

Figure 1 - Evolution of monthly average wholesale day-ahead baseload electricity prices in Europe, showing the European Power Benchmark and the range of minimum and maximum prices across the markets

Figure 2 – Price convergence on day-ahead markets in selected regions as percentage of hours in a given year

Figure 3 – Monthly evolution of spot and forward wholesale electricity prices and the energy component of retail prices in Europe since 2017

Figure 4 - Regional market prices in the North-Western Europe coupled area

Figure 5 - The Central Eastern Europe average wholesale price and the EPB benchmark

Figure 6 - Regional market prices in Italy and South Eastern Europe

Figure 7 - Electricity consumption, population and economic growth in the EU27

Figure 8 - Electricity generation mix in the EU27

Figure 9 - Monthly electricity generation in the EU27 and the shares of renewables and fossil fuels

Figure 10 - Monthly coal, natural gas and carbon price indexes, compared to the 2008 average price and the share of renewable energy (right hand scale)

Figure 11 - Net electricity flow positions of individual European regions

Figure 12 - Comparison of wholesale electricity prices in the EU with global trade partners

Figure 13 - Comparison of wholesale electricity prices in the EU with global trade partners

Figure 14 - Evolution and composition of the EU household price (DC band)

Figure 15 – Evolution of taxes, fees, levies and charges for EU households since 2010 (DC)

Figure 16 - Composition of the taxes and levies component of household electricity prices in 2019 (DC band)

Figure 17 - Breakdown of household electricity prices (DC band)

Figure 18 - Household prices in 2019 (DC band)

Figure 19 – Difference between the energy component of household retail prices and average day-ahead baseload prices in individual markets in 2019 (DC band)

Figure 20 - Composition of hosehold prices in 2019 (DC band)

Figure 21 - Household prices in 2019 (most representative band)

Figure 22 - Evolution and composition of the average retail electricity price for representative households in EU27 capitals (DC band)

Figure 23 - Evolution and composition of the EU27 industrial retail prices (ID band)

Figure 24 - Industrial retail electricity prices in 2019 (ID band)

Figure 25 – Relative composition of industrial retail electricity prices in 2019 (ID band)

Figure 26 – Comparison of taxes and levies between 2017 and 2019 (ID band)

Figure 27 - Composition of taxes and levies in 2019 (ID band)

Figure 28 - Evolution and composition of the EU27 industrial retail prices (IF band)

Figure 29 - Industrial retail electricity prices in 2019 (IF band)

Figure 30 – Relative composition of industrial retail electricity prices in 2019 (IF band)

Figure 31 - Difference between household retail electricity prices and electricity wholesale prices 2008-2019, EUR2018/MWh

Figure 32 - Difference between industrial retail electricity prices and electricity wholesale prices, EU27 and other G20 countries, 2008-2019, EUR2018/MWh

Figure 33 - Selected wholesale gas prices in Europe

Figure 34 - The difference between the Platts North West Europe Gas Contract Indicator (GCI) and the Dutch hub price (TTF)

Figure 35 - Price formation in Europe

Figure 36 – The role of different price formation methods in different regions of the world

Figure 37 - Daily day-ahead prices at selected gas hubs from 2008 to mid-2018

Figure 38 - The monthly average price of oil (Brent) and oil-indexed gas contracts (Platts GCI)

Figure 39 - Daily spot prices of oil (Brent) and gas (at the Dutch TTF hub)

Figure 40 - Daily change of spot prices of oil (Brent) and gas (at the Dutch TTF hub), between 2008 and 2020

Figure 41 - The monthly average price of oil (Brent) and gas (at the Dutch TTF hub), measured in €/MWh

Figure 42 – Daily residential natural gas consumption and daily average temperatures in some EU countries

Figure 43 – LNG imports and its share in the EU-27 total gas imports and consumption

Figure 44 – Main extra-EU import sources of LNG

Figure 45 – Main EU LNG importer countries in 2019

Figure 46 - Comparison of European, US and Japanese wholesale gas prices

Figure 47 - The ratio of European, US and Japanese wholesale gas prices

Figure 48 - Gas wholesale prices in the EU (weighted average), China, Japan and the US

Figure 49 - Gas wholesale prices in the EU (weighted average) and selected markets

Figure 50 - Composition of the EU household gas price (DC)

Figure 51 - Household gas prices in 2019

Figure 52 - Composition of household gas prices in 2019

Figure 53 – Change in the composition of EU taxes on household gas prices in between 2017 and 2019 and the composition in 2019

Figure 54 - Composition of EU prices for small (I3) industrial gas consumers

Figure 55 - Composition of EU prices for large (I5) industrial gas consumers

Figure 56 - Median (I3) and large (I5) industrial gas prices in 2019

Figure 57 - Composition of median (I3) and large (I5) industrial gas prices in 2019

Figure 58 - Composition of the tax structure of the EU retail gas prices for median (I3) and large (I5) consumers

Figure 59 – Household gas retail prices in the EU, Japan, US and China

Figure 60 - Household retail natural gas prices in the EU27 and in some G20 trading partners

Figure 61 - Retail industrial natural gas prices in the EU and its major G20 trading partners

Figure 62 - The Brent crude oil price from 2000 to mid-2020

Figure 63 - Crude oil (Brent) and European wholesale gasoline, diesel and heating oil prices from 2008 to mid-2018

Figure 64 - Crack spreads of gasoline, diesel and heating oil from 2008 to mid-2018

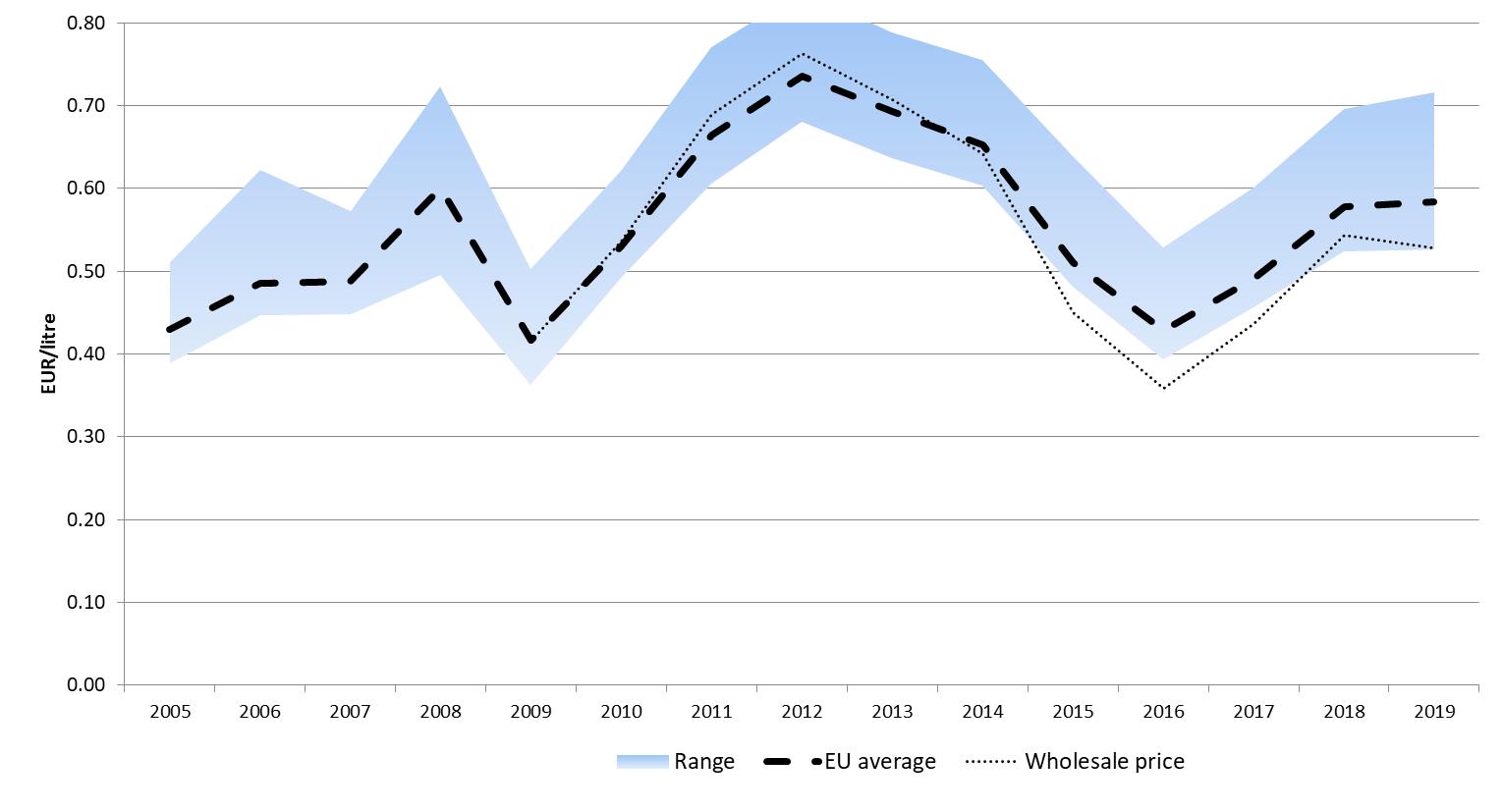

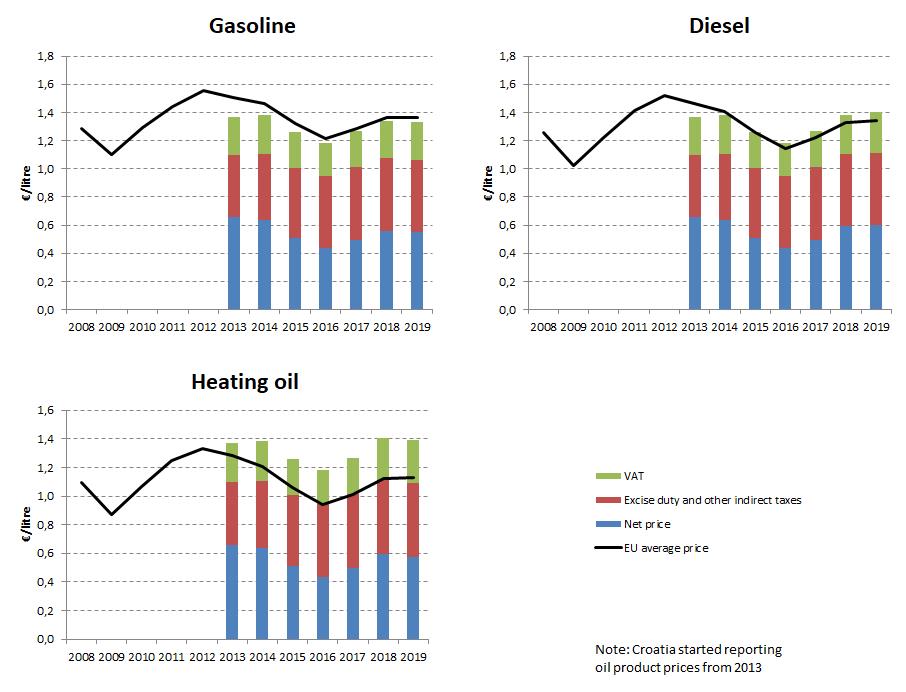

Figure 65 - Average retail price of oil products in the EU

Figure 66 - Average excise duty rates for oil products in the EU (EUR/litre)

Figure 67 - Average retail price of oil products in the EU, without taxes

Figure 68 - The retail price of gasoline in the EU

Figure 69 - The retail price of gasoline in the EU, without taxes

Figure 70 - The excise duty rate of gasoline in the EU

Figure 71 - Average retail price of gasoline in the EU by price component

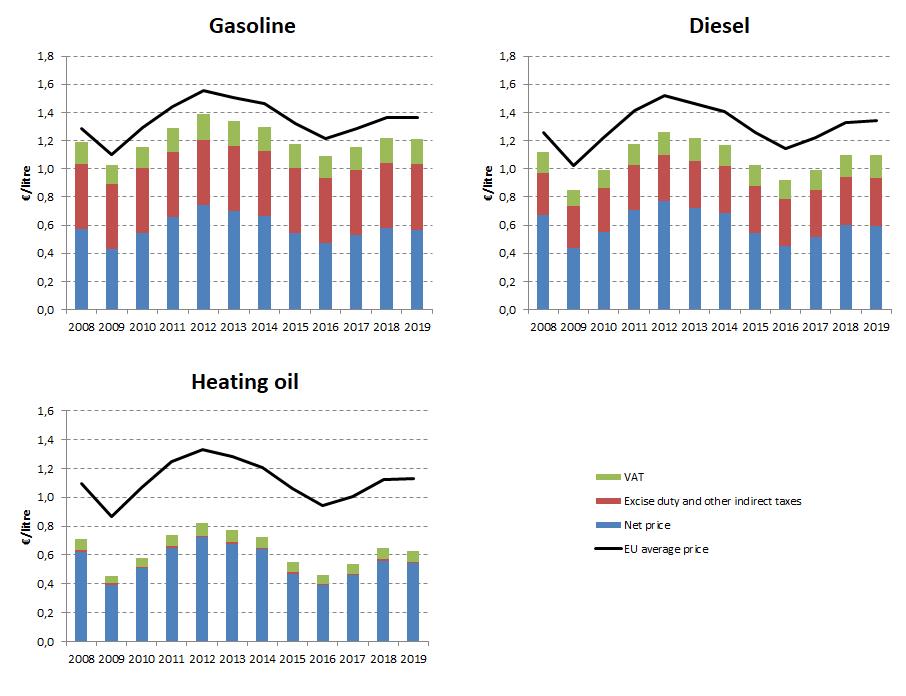

Figure 72 - Average retail price of gasoline in the first half of 2018 by Member State and price component

Figure 73 - The retail price of diesel in the EU

Figure 74 - The retail price of diesel in the EU, without taxes

Figure 75 - The exercise duty rate of diesel in the EU

Figure 76 - Average retail price of diesel in the EU by price component

Figure 77 - Average retail price of diesel in the first half of 2018 by Member State and price component

Figure 78 - The retail price of heating oil in the EU

Figure 79 - The retail price of heating oil in the EU, without taxes

Figure 80 - The exercise duty rate of heating oil in the EU

Figure 81 - Average retail price of heating oil in the EU by price component

Figure 82 - Average retail price of heating oil in the first half of 2018 by Member State and price component

Figure 83 - Average retail price of gasoline and diesel in the EU, with taxes (EUR per litre)

Figure 84 - Average retail price of gasoline and diesel in the EU, without taxes (EUR per litre)

Figure 85 - Average excise duty rates for gasoline and diesel in the EU (EUR per litre)

Figure 86 - The difference between the average excise duty rate on gasoline and diesel

Figure 87 - Excise duty rates in individual Member States in 2005 (blue) and 2019 (red)

Figure 88 - the change of the difference between the gasoline and diesel excise duty rates between 2005 and the first half of 2019

Figure 89 - Excise duty rates for motor fuels in Belgium

Figure 90 – Gross Inland Consumption of selected alternative fuels

Figure 91 – Total (all sectors) Final Energy Consumption of selected alternative fuels

Figure 92 – Industry’s Final Energy Consumption of selected alternative fuels

Figure 93 – Transport’s Final Energy Consumption of selected alternative fuels

Figure 94 – Household’s (and other sectors) Final Energy Consumption of selected alternative fuels

Figure 95 - International comparison of prices of ethanol

Figure 96 - International comparison of wholesale prices of biodiesel

Figure 97 – International comparison of retail prices of LPG

Figure 98 - Biogas in electricity and heat generation and biogas blending for natural gas

Figure 99: Electricity prices for households in €/MWh (2019)

Figure 100 - Representative sample of EV public charging prices in €/MWh

Figure 101 - EV fast and superfast public charging prices in Tesla network (€/MWh).

Figure 102 - International comparison of retail gasoline prices

Figure 103 - International comparison of retail gasoline prices

Figure 104 - International comparison of retail diesel prices

Figure 105 - International comparison of retail diesel prices

Figure 106 - EU import dependency by fuel

Figure 107 - EU net imports of energy in 2018 (mtoe)

Figure 108 - EU net imports

Figure 109 - Comparison of European oil, gas and coal prices

Figure 110 - The USD/EUR exchange rate since 2013

Figure 111 - The estimated EU import bill

Figure 112 - Shares of consumer goods groups in household expenditure in Member States

Figure 113 - Energy share in the total households’ expenditure by income decile in 2018

Figure 114 - Share of fuels in final energy consumption in the residential sector by EU Member State (2017)

Figure 115 - Share of end-use energy consumption in the residential sector by EU Member State (2018)

Figure 116 – Energy products expediture for the poorest households and the energy share in total household consumption expenditure by EU Member State

Figure 117 - Share of expenditure on household energy products and share of energy in total expenditure for the poorest households by EU Member State

Figure 118 - Energy product expenditure for lower-middle income households and the energy share in household expenditure by EU Member State

Figure 119 - Share of expenditure on household energy products and share of energy in total expenditure for lower-middle income households by EU Member State

Figure 120 – Energy product expenditure for middle income households and the energy share in household expenditure by EU Member State

Figure 121 - Share of expenditure on household energy products and share of energy in total expenditure for middle income households by EU Member State

Figure 122- Ratio of homes not adequately warm for households below the 60% of the median income and the share of energy products in expenditure for the lower-middle income households

Figure 123 - Germany, France, Ireland, Belgium, Netherlands, Luxembourg and Austria - Share of energy in final household expenditure per income deciles

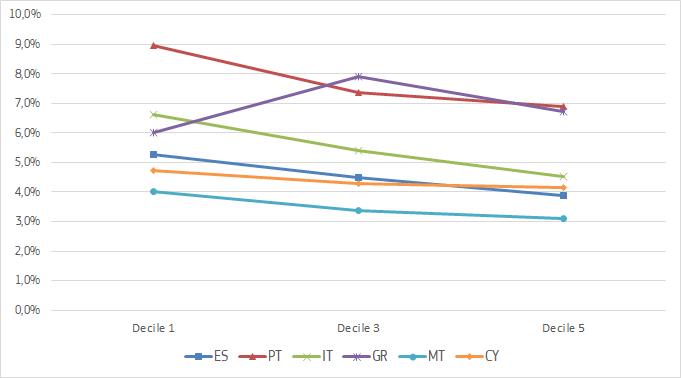

Figure 124 - South European countries: Spain, Portugal, Italy, Greece, Malta and Cyprus - Share of energy in final household expenditure per income deciles

Figure 125 - Poland, Czechia, Slovakia and Hungary - Share of energy in final household expenditure per income deciles

Figure 126 - Nordic and Baltic countries: Sweden, Finland, Denmark, Estonia, Latvia, Lithuania - Share of energy in final household expenditure per income deciles

Figure 127 - South East Europe: Croatia, Slovenia, Romania and Bulgaria - Share of energy in final household expenditure per income deciles

Figure 128 - Expenditures on transport energy products for the poorest households by EU Member State, and energy transport share in household expenditure

Figure 129 - Share of expenditure on transport energy products and share of transport energy in total expenditure for the poorest income households by EU Member State

Figure 130 - Expenditures on transport energy products for middle income households by EU Member State, and energy transport share in household expenditure

Figure 131 - Share of expenditure on household transport energy products and share of transport energy in total expenditure for middle income households by EU Member State

Figure 132 - Proportion of households whose share of energy expenditure in income is more than twice the national median share (2M)

Figure 133 - Share of households whose absolute energy expenditure is below half the national median (M/2, hidden energy poverty).

Figure 134 - Arrears on utility bills for EU average households and expenditures on household energy (electricity, gas, heating, etc.) for the poorest, lower-middle and middle income households by EU Member State

Figure 135 - Expenditures on household energy (electricity, gas, heating, etc.) and transport energy (petrol, diesel, etc.) for the poorest, lower-middle and middle income households by EU Member State

Figure 136- Evolution of energy costs shares in production value, industry and services

Figure 137: Evolution of energy costs shares in production value for Manufacturing

Figure 138 - Breakdown of the energy consumption per energy carrier, EU, 2008-2017 averages

Figure 139 - Energy costs shares in total production costs in manufacturing sectors, 2008-2017

Figure 140 - Energy costs shares in total production costs in non-manufacturing sectors 2010-2017

Figure 141 - Gross Operating Surplus in manufacturing sectors (average 2008-2015)

Figure 142 - Gross Operating Surplus in manufacturing in the EU and Member States, 2008-2015

Figure 143 – Gross Operating Surplus shares of value added in manufacturing, EU vs G20

Figure 144 - Gross Operating Surplus shares of value added in non-manufacturing, EU vs G20

Figure 145 - Energy intensity (consumption/value added in nominal terms) for the most energy-intensive manufacturing sectors (average of available countries)

Figure 146 - Energy intensity (consumption/value added in nominal terms) for non- manufacturing sectors (average of available countries)

Figure 147 - Drivers of energy costs of the total of sectors

Figure 148 - Changes in gross output and energy consumption in high energy-intensity sectors, 2010-2017

Figure 149 - Changes in gross output and energy consumption in low energy-intensity sectors, 2010-2017

Figure 150- Decomposition of output effect in EU, UK, US and China

Figure 151 - International comparision of energy costs shares for selected highly energy-intensive sectors

Figure 152 - Energy costs shares in production value for manufacturing sectors, 2008-2017

Figure 153 - Energy intensity international comparisons for the most energy-intensive manufacturing sectors

Figure 154 - Energy intensity international comparisons for other manufacturing sectors

Figure 155 – Retail electricity prices for industry: EU vs China, Japan & US, 2008-2019

Figure 156 - Retail electricity prices for industry: EU vs other G20, 2007-2019

Figure 157 – Retail electricity indexes prices for industry: EU vs Argentina, Australia & India, 2008-2019

Figure 158 - Range of retail electricity prices for industry in the EU

Figure 159 - Box plot of EU27 industrial retail electricity prices 2008-2019

Figure 160 - EU27 industrial retail electricity prices 2008-2019, individual Member States lines visible, outliers named

Figure 161 - Retail gas prices for industry: EU vs China, Japan and the US, 2008-2019

Figure 162 - Retail gas prices for industry: EU vs other non-EU G20 countries, 2008-2019

Figure 163 - Max-min range of retail gas prices for industry in the EU, 2008-2019

Figure 164 - Box plot of industrial gas prices, 2008-2019

Figure 165 - EU27 industrial retail natural gas prices 2008-2019, Member States lines visible, outliers named

Figure 166 - Electricity prices vs energy intensity by sector (based on plant’s data)

Figure 167 – Gas prices vs energy intensity by sector (based on plant’s data)

Figure 168 - Energy taxes in the EU-28

Figure 169 - Energy taxes as a percentage of tax revenue and of GDP in 2018

Figure 170 - Energy taxes by economic activity

Figure 171 – Average energy tax for 1 toe of gross inland energy consumption in the EU-28

Figure 172 – Average energy tax for 1 toe of gross inland energy consumption in 2018

Figure 173 - Excise duty revenues from energy consumption

Figure 174 - Exercise duty revenues from energy consumption, adjusted for inflation (in 2015 euros)

Figure 175 - The share of excise duty revenues by energy product

Figure 176 - The share of excise duty revenues by energy product, 2018

Figure 177 - The average standard VAT rate in the EU

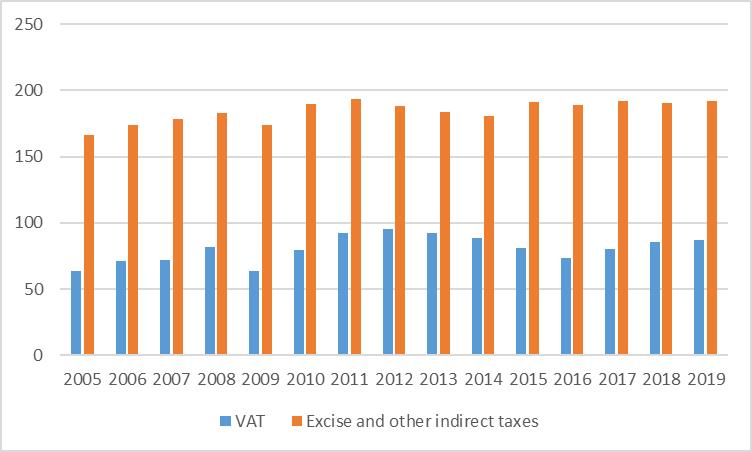

Figure 178 - Estimated tax revenue from gasoline, diesel and heating oil, EUR bn

Figure 179 - Realised electricity price in EUR/MWh for solar PV

Figure 180 - Realised electricity price as percentage of baseload price for solar PV

Figure 181 – Realised electricity price in EUR/MWh for wind onshore

Figure 182 - CAPEX for wind onshore in EUR/kW

Figure 183 - Realised electricity price per as percentage of baseload price for wind offshore

Figure 184 – CAPEX for wind offshore for selected countries

Figure 185 – Realised price for gas-fired power

Figure 186 – Revenue for gas fired generation by installed MW

Figure 187 - Realised price for coal-fired power

List of Tables

Table 1 - Key figures on the evolution and drivers of retail electricity prices between 2010 and 2019

Table 2 - The ratio and the difference of European, US and Japanese wholesale gas prices

Table 3 - Key figures on the evolution and drivers of retail gas prices between 2010 and 2019

Table 4 - Estimated average gas import prices by supplier (€/MWh)

Table 5 - EU crude oil import bill in 2013-2018

Table 6 - EU gas import bill in 2013-2018

Table 7 - EU hard coal import bill in 2013-2018

Table 8 – Summary Table: Evolution of energy, affordable warmth and transport share 2008-2018

Table 9 - Timely evolution of energy expenditure shares (%) 2008-2018

Table 10 – Timely evolution of transport energy expenditure shares (%) 2008-2018

Table 11 - Coverage of manufacturing sectors

Table 12 - Coverage of other sectors, excluding manufacturing

Table 13 - Energy costs shares in total production costs for manufacturing and non-manufacturing sectors, 2010-2017

Table 14 – Drivers of energy costs shares in total production costs, manufacturing and non-manufacturing sectors (EU avrg)

Table 15 – Categorisation of sectors according to the energy and production costs dynamics, 2010 -2017

Table 16 - Sector scope of the EU27 decomposition analysis

Table 17 - Sector scope of the G20 decomposition analysis

Table 18 - Decomposition of energy cost drivers by sectors in the EU between 2010 and 2017

Table 19- Decomposition of energy cost drivers for G20 countries over the period (2010-2016)

Table 20 - Decomposition of output drivers for the EU27 and main G20 trade partners, 2010-2017

Table 21- Structure intensity effect for EU27 for Manufacturing sub sectors at 2 digit level

Table 22- Drivers of total production costs in manufacturing sectors, EU27, 2010-2017

Table 23 - Changes in retail industrial electricity prices compared to EU prices, constant 2018 EUR/MWh

Table 24 - Factors in observed industrial retail electricity price changes per country, nominal prices per MWh

Table 25 - Changes in the industry retail natural gas price differential compared to EU prices between 2008-2019 (constant 2018 euros per MWh)

Table 26 - Factors in observed industrial retail natural gas price changes per country, nominal prices, per MWh

Table 27 - Plants participating in the study

Table 28 Energy prices & costs in selected EU energy-intensive sectors – simple average EU, 2018.

Table 29 - Exposure of EU selected energy-intensive industris to international trade – 2017/2018

Table 30 – Comparison of retail prices and taxes of different energy carriers (2019)

Table 31 –Maximum profitability observed for Solar PV

Table 32 – Maximum profitability observed for wind onshore

Table 33 – Maximum profitabvility observed for wind offshore

Introduction

This edition of the energy prices and costs report comes at an appropriate time alongside with the State of the Energy Report (SoEUR). The profound changes entailed by the energy transition require ample social and political support. Energy prices and energy costs (prices multiplied by consumption) should drive the markets’ transformation to achieve a carbon neutral economy while keeping energy affordable for citizens and businesses. In these difficult moments created by the COVID crisis, it is essential to ensure a fair energy transition that complements our efforts for recovery, provides a level playing field for our industry and keeps energy affordable for households. A successful energy transition towards the climate neutrality by 2050 as foreseen by the European Green Deal will require affordable energy while at the same time triggering investments in technologies needed for further decarbonisation. With the Clean energy for all Europeans package now under implementation and several Green Deal initiatives related to energy, taxation and climate policies being prepared, monitoring energy prices and costs helps to understand better the effects of our existing policies and provide useful insights for the preparation of the forthcoming proposals.

The evidence provided by the energy prices and costs report will serve to assess the implementation of our recent actions and initiatives..

The work and analyses presented in the report were impacted by important political, economic and societal events in recent years.

First, following the confirmation of exit of the United Kingdom from the EU, this report focuses now on the EU-27. Although, in various occasions statistics of UK are provided, the focus of the analysis and comprehensive approach is systematically applied to current 27 Member States. This significantly affects the direct comparability of the results of this report with previous ones.

Second, as for many aspects of our societies and lives, the COVID pandemic has required changes in the approach of this report which usually focused on analyses of ‘historical’ trends in data. While the available historical data covers until 2018 and in some cases 2019, given the COVID pandemic severe impact on energy prices and costs, where possible, the latest figures were included in the report to provide the most recent picture. That said, the COVID pandemic has also affected the quality and comprehensiveness of some of the collected data. Not all Member States were able to fully respond to our call to supply updates on household energy expenditure and less industrial sectors than foreseen participated in the specific collection of data at plant level which provides precious insights on the energy prices paid and the importance of energy costs for the most energy intensive industrial segments. Compared to the two previous editions of this report in 2016 and 20181, the COVID pandemic has in some cases limited the reporting ability in particular by the industry and this is reflected in somewhat reduced international comparisons and comprehensiveness of the assessment of energy prices and costs’ importance for some highly energy intensive sectors.

Part I of the report (Energy Prices, comprising Chapters 1-3) looks at the developments on wholesale and retail energy prices for electricity, gas and oil products between 2008 and 2019-20. On retail prices, the European Commission analyses the cost elements driving them up (or down). It presents the currently most extensive available breakdown of components affecting prices, in particular for taxes and levies, merging the very detailed ad hoc data collections done in the context of the preparation of past reports with the recently available new electricity and gas price statistics collected by Eurostat. Insights on the evolution, composition and drivers of retail prices together with international comparisons of the prices for petroleum, gas and electricity products are also provided in this Part of the report.

The impact of the energy costs on the economy, the industry and households, is addressed in in Part II (Energy costs, Chapters 4-6) of the report. Chapter 4 analyses the latest developments of EU’s energy import bill and the reasons behind them. Chapter 5 looks at the evolution of households’ energy expenditure, what drives it and to which extent it is affecting households’ budgets across income levels and energy poverty. Chapter 6 focuses on the evolution and impact of energy expenditure (energy costs) on the European industry. An assessment of the costs is made for manufacturing, agriculture and services sectors (more than 40 sectors are analysed) putting emphasis on the most energy intensive industries. There is an assessment of sectors’ energy costs shares, energy intensities and energy prices and, where possible under the limited available data, comparisons with international EU-trade partners. The analysis in this chapter benefits from the results of aggregated statistical data and the results of studies that collected data at plant level.

Part III (Chapter 7) looks at the taxes imposed on energy products and assesses their importance for government's budgets and their impact on the prices of these products.

In Part IV of the report (Chapter 8), the collected ‘realised’ prices of different generation technologies in the power market are analysed together with other sources of revenues and costs in order to map the profitability of these technologies. A sensitivity analysis of the profitability is also undertaken considering certain scenarios which include future evolution of key inputs (oil prices, carbon price) and other conditions.

Finally, the Annex of this report presents factsheets of the Member States with detailed information about their energy prices and costs.

PART I

ENERGY PRICES

1Electricity prices

1.1Wholesale electricity prices

Main findings

¾Over the last twelve years, wholesale electricity prices in Europe have generally moved in cycles, following developments in coal and gas markets. The current cycle began in 2016, when electricity prices bottomed out, and reached its peak at the end of 2018, when the European Power Benchmark (EPB) climbed above 60 €/MWh on a monthly basis. Since then, wholesale electricity prices have been on a declining trajectory on the back of falling fuel costs, weakening demand and rising renewable penetration. All these trends were magnified since the imposition of social distancing measures induced by the coronavirus pandemic. Electricity prices in many markets reached all-time lows during the lockdown period in the spring of 2020.

¾Price convergence across European wholesale markets also displays a cyclical nature. Whereas electricity prices on the continent were getting closer to each other in the period between 2015 and 2018, the opposite has been true ever since. The coronavirus pandemic has exacerbated the trend and drove differences in prices among and within regions to record levels. This was caused by the fact that electricity prices have been falling to a different degree, depending on the severity of the demand shock, weather conditions and the structure of the local power mix. Overall price convergence has remained low, which underlines the potential and opportunities for further investment in strengthening network capacities both among and within Member States.

¾The coronavirus pandemic has pushed spot electricity prices to record lows, but has had only a passing effect on long-term electricity prices. Since a significant part of electricity for final consumption is bought by traders year-ahead or even longer before the delivery, there is uncertainty whether the trend of falling retail prices observed in 2020 can be sustained in 2021.

¾In 2019, as widespread coal-to-gas switching progressed on the continent, wholesale power prices began to be influenced more by the developments in the gas market. Rising correlation between gas and electricity prices has been observed in markets where fuel switching has been particularly strong, such as the Netherlands, Germany, Greece, Portugal and Spain. This trend continued in 2020 and is expected to strengthen in the years ahead as coal capacities across Europe are retired in an accelerated fashion.

¾CO2 prices were rising steadily since 2018, culminating in the middle of 2019 at 30 €/t, the highest level since 2008. Unlike during the last major economic crisis in 2008-2009, the carbon market showed resilience in the face of the coronavirus pandemic. The effect of more expensive emission allowances on wholesale power prices has so far been blunted by declining fuel prices, weakening power demand and rising renewable generation. However, in regions with greater reliance on fossil fuels, pricier carbon exerted much stronger upward pressure on electricity prices.

¾Falling costs of renewable technologies and higher carbon prices have triggered a wave of investment in renewable capacities capable of competing with other participants in wholesale markets without any public support. This should be beneficial for consumers as it reduces budgetary needs sourced from renewable taxes imposed on electricity consumption.

1.1.1Evolution of wholesale electricity prices

Since 2008, day-ahead electricity prices in European wholesale markets have developed in cycles, influenced by costs of input fuels (coal and gas) and carbon allowances and by the changing structure of the power mix. The first cycle of the examined period started in the aftermath of the financial crisis in 2008-2009 when energy prices collapsed. The recovery lasted until 2011 and was followed by a prolonged downward path, stretching out to early 2016 when prices sank to levels not seen in more than a decade. A turnaround ensued quickly, however, driven by growing consumption and rising fuel and carbon prices, the effect of which was occasionally reinforced by supply restrictions during high-demand winter periods. This trend culminated in late 2018 on the back of peaking coal and gas prices. At the beginning of 2019, wholesale electricity prices fell abruptly and started to follow a downward trajectory again. This time, slowing economic activity, which curbed consumption, combined with falling fuel costs and rising renewable penetration to drive wholesale prices down. The coronavirus pandemic accentuated all these factors. Widespread lockdown measures imposed since March 2020 drastically reduced power demand, sent coal and gas prices to extreme lows and significantly raised the presence of renewables in the power mix. As a result, average European wholesale prices on the spot market reached an all-time low in April 2020 and began to recover only slowly in the following months.

The next chart (

Figure 1

) shows the evolution of the European Power Benchmark (EPB) and the range of minimum and maximum monthly wholesale electricity prices since 2008. The EPB is a weighted average of day-ahead prices in nine representative markets, serving as a general European benchmark. After averaging 43 €/MWh in 2017, the EPB rose to 52 €/MWh in 2018 and climbed back to 43 €/MWh in 2019. In the first half of 2020, it reached 24 €/MWh, its lowest level on record.

Figure 1 - Evolution of monthly average wholesale day-ahead baseload electricity prices in Europe, showing the European Power Benchmark and the range of minimum and maximum prices across the markets

Source: Platts, European power exchanges

Price convergence across European markets also displays a cyclical nature. Whereas wholesale prices on the continent were getting closer to each other in the period between 2015 and 2018, the opposite has been true ever since. The coronavirus pandemic has exacerbated the trend and drove differences in prices among and within regions to record levels. This was caused by the fact that prices were falling to a different degree, depending on the severity of the demand shock, general weather conditions and the structure of the local power mix. The sharpest declines occurred in the Nordic region where ample hydro reservoirs and rising wind generation reduced daily averages to single digits. Markets in Eastern and South Eastern Europe, on the other hand, experienced a more measured reaction as their lignite-oriented power mixes grappled with resilient carbon prices. As a general observation, it can be noted that rising wholesale prices tend to bring about greater convergence and vice versa.

Figure 2

illustrates in greater detail the degree of price convergence in day-ahead markets within selected European regions expressed in percentages of hours in a given year. The price convergence provides an indication of the level of market integration. Its longer-term drivers are market coupling initiatives or the expansion of transmission infrastructure. In the short term, fluctuations in convergence may also be caused by factors not necessarily related to the level of market integration, such as changes in the amount of cross-zonal capacity designated by grid operators for commercial purposes.

European electricity markets saw mixed developments in terms of convergence between 2018 and 2019. In Central Western Europe, where flow based market coupling has been applied since 2015, the number of occurrences of full price convergence (when the difference between hourly prices in all bidding zones falls within 1 €/MWh) increased noticeably in 2019 compared to the previous year (from 36% to 46% of hours). The decreasing divergence occurred despite the splitting of the DE-LU-AT bidding zone, which came into effect in October 2018 and which increased the number zones in the region from four to five. This could be explained by the fact that full price convergence between the partitioned zones of DE-LU and AT turned out to be relatively high, at 72% of hours in 2019. A considerable increase in full price convergence occurred also within the Baltic region and between Croatia and Slovenia where hourly prices were nearly identical more than 90% of the time in 2019. Price convergence also rose on the British Isles, following the implementation of market coupling between Great Britain and the Irish Integrated Single Electricity Market in October 2018. A new 1 GW interconnector linking Great Britain and the continent since January 2019 contributed to the rise in price convergence between France and Great Britain. On the other hand, decreases in price convergence were observed in Central and Eastern Europe, the Nordic region and between Spain and France in 2019. Overall levels of price convergence in Europe remain relatively low, which underlines the potential for further investment in strengthening network capacities both among and within Member States.

Figure 2 – Price convergence on day-ahead markets in selected regions as percentage of hours in a given year

Source: ENTSO-E, OTE, Nord Pool, Platts. The numbers in brackets refer to the number of bidding zones included. The CWE region comprises of BE, FR, NL and DE-LU-AT zones until October 2018, and separate DE-LU and AT zones since then. The CEE region includes CZ, SK, HU, RO bidding zones which are coupled. The Baltic region includes EE, LV, LT bidding zones. The Nordic region includes 12 bidding zones of Norway, Sweden, Finland and Denmark.

In order to obtain a comprehensive picture of how European wholesale electricity prices have developed since 2017, a consumption-weighted baseload benchmark (EP5) of 5 most advanced markets offering up to a 3-year visibility into the future was created and compared to a day-ahead (spot) equivalent. As shown in

Figure 3

, since the beginning of 2019, markets have been expecting power prices in the future to be higher than in the spot market, a situation which favours buying electricity closer to the time of delivery. The gap between the spot and year-ahead benchmarks has grown to almost 20 €/MWh during the coronavirus pandemic due to low demand, a high presence of renewables in the grid and abundance of cheap gas. The spot benchmark reached its all-time low in April.

The segment of prices for future delivery (forward prices), which are an important indicator for the future development of retail prices, experienced a remarkable shift. Until the end of 2019 the market expected wholesale prices to generally decline going into the future on the back of higher renewable penetration. But those expectations have reversed since then. The further one goes into the future, the higher the prices should climb, with the biggest jump apparent between year-ahead (2021) and two-year-ahead (2022) delivery periods. This is consistent with expectations of economic recovery in the years ahead.

Figure 3 – Monthly evolution of spot and forward wholesale electricity prices and the energy component of retail prices in Europe since 2017

Source: Platts, Vaasaett. The average energy component of household retail prices is weighted using population figures of EU27 capitals.

In 2017 and in the first half of 2018, forward prices generally followed their spot peers and rose considerably on the back of rising carbon and fuel costs. Afterwards, a period of relative stability ensued which lasted until the end of 2019. Forward prices decreased measurably before and especially during the lockdown period in 2020, when the number of known unknowns surrounding the coronavirus grew exponentially. However, forward prices recovered nearly all their losses by the end of July 2020 on the back of quickly rising carbon prices which offset the effect of lower fuel costs (mainly gas) expected in the future. Thus, the pandemic has pushed spot electricity prices to record lows on the one hand, but has had only a passing effect on long-term prices on the other.

Figure 3

illustrates that the interplay between spot and forward prices is not always straightforward. Additionally, since a significant part of electricity for final consumption is bought on the forward market by traders year-ahead of the delivery or even longer, forward wholesale prices play a vital role in determining the energy component of retail prices for households and industry. That is why a decrease in wholesale prices is channelled into retail prices with some delay and usually in a non-linear fashion. The delayed transmission effect helps explain why retail prices rose between 2017 and 2019 despite the fall in spot wholesale prices observed since 2019. A significant part of electricity destined for consumption in 2019 was bought at elevated price levels in 2018.

Given the fact that forward electricity prices have been much less affected by the coronavirus crisis, there is uncertainty whether the trend of falling retail prices observed in 2020 can be sustained in 2021.

According to data from Vaasaett, the average energy component of household retail prices in EU27 capitals started to decline measurably in April 2020 and this trend continued in May and June. The decline could be explained by falling spot prices in the wake of the pandemic.

Figure 4

shows the regional wholesale electricity prices in the North Western Europe (NWE) market coupling area, including Central Western Europe (Germany, France, Austria and the Benelux), Great Britain, the Nordic markets (Norway, Sweden, Denmark, Finland and the Baltic States) and the Iberian market (Spain and Portugal). Nordic markets have generally kept the lowest wholesale prices in Europe thanks to the prominent role of hydro power and rising wind generation in the region. However, Central Western Europe (CWE) moved closer to Nordic levels since 2018 on the back of rapidly rising renewable penetration and a solid performance of local nuclear capacities. During periods of exceptionally high wind generation in springtime, CWE prices went even below their Nord Pool peers.

Prices in the Iberian region kept their usual premium over the EPB during most of 2018 and 2019, but moved closer to the benchmark in 2020 due to significantly expanded renewable capacities, improved hydro generation and the covid-related demand shock. The British market generally displayed the highest prices since 2018, partly due to a carbon levy that puts additional costs on the local generators.

A warm and windy winter of 2019/2020 and restrictions on economic and social activity imposed in response to the spreading coronavirus put wholesale prices in the observed markets on a steep downward path in 2020. The most significant declines occurred in the Nordic markets where ample hydro reservoirs exacerbated the supply overhang.

Figure 4 - Regional market prices in the North-Western Europe coupled area

Source: Platts, European power exchanges

In the Central and Eastern Europe region (CEE – Poland, Czechia, Slovakia, Hungary, Romania, Croatia and Slovenia), prices followed the EPB closely in 2018, but disconnected afterwards as higher carbon prices imposed additional costs on local coal and lignite generators which constitute a large portion of the power mix. The average premium over the EPB reached 10 €/MWh since March 2020 (see

Figure 5

). In the face of the decreased competitiveness of local power plants, the region also began to rely more on imports from Germany and Nordic markets.

Four CEE day-ahead markets (Czechia, Slovakia, Hungary and Romania) are coupled, but overall price convergence within the area remains lower compared to the CWE region (see

Figure 2

). The Polish market is coupled with Sweden (and thus with the NWE region). Croatia and Slovenia are not coupled with the rest of the CEE region.

Figure 5 - The Central Eastern Europe average wholesale price and the EPB benchmark

Source: Platts, European power exchanges

Italy and Greece traditionally display higher wholesale electricity prices compared to the EPB due to the heavy presence of fossil fuels in their power mix and due to a relatively high reliance on imports (

Figure 6

). Since 2019, Greek prices have been consistently the highest of the group as increased carbon costs have challenged the economic viability of the domestic lignite fleet. The market has experienced a broad coal-to-gas switch that partially mitigated the impact of more expensive emission allowances. Italy has traditionally been a net electricity importer, as the cost of import (mainly from the CWE region) is competitive to domestic, primarily gas-fired power generation. Increased renewable penetration and the particularly pronounced covid-related demand shock brought Italian wholesale prices unusually close to the European benchmark in 2020.

Bulgarian wholesale prices shifted from a discount compared to the EBP in 2018 to a sizeable premium in 2019, as headwinds stemming from higher carbon prices impacted the generation costs of local lignite capacities. Bulgaria is normally a net electricity exporter, but its net outflows have been diminishing lately.

Figure 6 - Regional market prices in Italy and South Eastern Europe

Source: Platts, European power exchanges

1.1.2 Factors impacting the evolution of wholesale prices

Wholesale electricity prices are determined by market forces. In this section, we look at factors influencing both the demand and supply side.

On the demand side of the electricity market, residential consumption tends to be driven up by rising number of households, proliferation of electric appliances or the electrification of heating, while energy efficiency measures such as installing LED lightbulbs push electricity demand lower. Average temperatures play an important role too. In the case of businesses, the consumption of electricity is mainly influenced by two similarly countervailing factors: the level of economic activity and energy efficiency measures.

The next chart (

Figure 7

) assesses the relation between electricity consumption, economic activity and population trends. By the end of 2019, the gross domestic product in the EU27 was up by more than 14% and its population rose by 1.4% compared to 2010, yet electricity consumption decreased by 2% in the meantime. The decoupling of economic and population growth from electricity consumption points to the strengthening effect of efficiency measures over the last decade. In the last few years, the trend of exceptionally warm winters also contributed to the stagnation of electricity consumption, which is to some extent influenced by temperature conditions, especially in certain Member States.

Figure 7 - Electricity consumption, population and economic growth in the EU27

Source: Eurostat

On the supply side, the costs of the marginal generation technology (including imports as a competing alternative) in the merit order of a particular market determine wholesale prices. Therefore, the structure of the power mix and its changes can give some clues about price trends. The next chart (

Figure 8

) illustrates these changes in the EU27 electricity mix between 2010 and 2019. The share of fossil fuels (lignite, coal, gas and oil) decreased significantly (from 46% in 2010 to 37% in 2019). The role of coal has diminished in particular, falling from 24% to 16% over the last 10 years. At the same time the share of renewables (including wind, solar, hydro and biomass) increased from 23% to 35%. The share of nuclear-powered generation, meanwhile, decreased from 29% to 26%.

Figure 8 - Electricity generation mix in the EU27

Source: Eurostat. Based on gross generation data. 2019 series are estimates calculated from net generation data

Within renewables, the share of hydro power fluctuated between 11% and 14% depending on meteorological conditions. The increasing importance of renewable energy in the EU27 generation mix was driven mainly by wind power, whose share went up from 5% to 13% between 2010 and 2019, and to a smaller extent by solar PV installations, which emerged from a barely visible presence to capture 4% of the electricity mix in 2019.

Figure 9

offers a more detailed look at the generation mix which underwent considerable changes in the last three years. Two main trends shaped the developments. First was a large-scale switch from coal to gas which gathered strength in the course of 2019 across many markets and which was propelled by falling gas prices and elevated CO2 prices beneficial for less carbon-intensive technologies. Second, rapidly expanding wind and solar capacities together with favourable weather conditions measurably boosted renewable penetration. The coronavirus pandemic magnified both trends. Reduced power demand from the industrial and commercial sector coupled with rising renewable generation significantly restricted the space for coal-fired power plants in the merit order. Additional headwinds for coal came from record low gas prices and the resilience of the carbon market. This combination resulted in a 30% decline in coal generation in the EU27 in the first quarter of 2020 compared to the same quarter in 2019. Pressure on coal intensified in April and May as lockdown restrictions multiplied and dented demand levels. Power demand is expected to recover eventually but by that time rising renewable generation will have prevented coal from clawing back its place in the merit order. Additionally, low gas prices are expected to persist in the months and years ahead, which means that coal should continue to be at a disadvantage to its less CO2-intensive rival. In fact, gas prices fell so low at times in 2020 that they made the least efficient gas plants more competitive than the most efficient lignite plants. This development has been helped by the fact that the carbon market withstood the pandemic and continues to favour cleaner alternatives to coal. Several announcements of accelerated plant closures (Czechia, Denmark, Germany, Italy, Portugal, Spain, Sweden) or abandoned new projects (Poland) confirm the persisting deterioration of coal’s position in the European power sector.

Figure 9 - Monthly electricity generation in the EU27 and the shares of renewables and fossil fuels

Source: ENTSO-E, Eurostat. Data represent net generation.

The marginal costs of each generation technology, which play a crucial role in determining wholesale prices, differ greatly. Wind farms, solar PV installations and hydro power plants have very low or negligible marginal generation costs. Nuclear power plants also display relatively low marginal costs (due to the fact that the cost of nuclear fuel compares very favourably to the amount of energy it is able to release). Coal-, gas- and oil-fired generation technologies have higher running costs (due to a bigger influence of prices of the fuel they burn) and since they usually provide flexibility in response to fluctuating demand patterns, they tend to set the clearing price. Rising generation from intermittent renewables (wind, solar) and other low marginal cost technologies tends to push fossil fuels farther on the merit order curve and, as a result, drags wholesale prices lower, assuming the same level of power demand.

Figure 10

shows monthly coal, gas and emission allowance prices and the European Power Benchmark compared to the average of 2008. Gas prices disconnected from their coal peers in the wake of the Fukushima accident in 2011 as gas-fired power generation in Japan surged to make up for the lost nuclear output. This trend combined with very low carbon prices to seriously undermine the profitability of gas-fired power plants in Europe and gave boost to coal firing in the electricity sector. It is clearly visible that the EPB closely followed coal prices between 2012 and 2016. Afterwards, the trend started to change as European coal and gas prices became more interlinked again. Power prices showed greater correlation with the gas market in 2017, before going back to following coal in 2018. In 2019, as widespread coal-to-gas switching progressed, wholesale power prices seemed to be taking more cues from the gas market. Rising correlation between gas and electricity prices has been detected in markets where the fuel switch has been particularly strong such as the Netherlands, Greece, Germany, Portugal and Spain. This trend continued in 2020 and is expected to strengthen in the years ahead as coal capacities across Europe are retired in an accelerated fashion. Overall, it is obvious that power prices are still greatly influenced by the prices of fossil fuels. However, at local level, higher renewable penetration tends to be associated with lower wholesale prices (Trinomics et altri, 2020).

After a period of low prices between 2011 and 2017, CO2 emission allowances embarked on a rising trajectory since 2018, culminating in the middle of 2019 at 30 €/t, which was the highest level since 2008. The rising trend was underpinned by a tightening of supply through the Market Stability Reserve which started operating in January 2019. Unlike during the last major economic crisis in 2008-2009, the carbon market remained resilient in the wake of the coronavirus pandemic. CO2 prices declined only briefly in the first weeks of the lockdown period in March and gradually recovered in April and May 2020. Monthly averages stayed at or above 20 €/t in the first six months of 2020. Developments in the carbon market significantly contributed to the coal-to-gas switch and to driving current generation capacities as well as planned investments towards the decarbonisation of the European electricity sector. The carbon footprint of power generation in the EU27 declined by 16% in 2019 compared to a year before. The effect of more expensive emission allowances on wholesale power prices has so far been blunted by declining fuel prices, weakening power demand and rising renewable generation. However, in regions with greater reliance on fossil fuels, pricier carbon exerted much stronger upward pressure on electricity prices.

Figure 10 - Monthly coal, natural gas and carbon price indexes, compared to the 2008 average price and the share of renewable energy (right hand scale)

Source: Platts

The growth in renewable energy generation has been helped by supporting policies at EU level as well as at the level of Member States who need to meet their 2020 renewable energy targets. Various instruments such as feed-in-tariffs or feed-in-premiums have incentivised the uptake of wind and solar power in the grid. Falling costs of renewable technologies and higher carbon prices have ignited a wave of investment in new renewable capacities that do not rely on any form of public support. Such renewable projects typically sell part of their production on the open market (day-ahead), while the rest is secured in advance via long-term power purchase agreements, either with industrial electricity consumers or with utilities who then re-sell the electricity to end users. This indicates that in a growing number of markets, renewable technologies are able to compete with other participants without any subsidies. This should be beneficial for consumers as it reduces budgetary needs sourced from renewable taxes imposed on electricity consumption.

Further savings can be expected from the continued integration of European wholesale electricity markets, supported by EU policies. Initiatives such as European Single Intraday Coupling (SIDC), which links intraday markets of more than 20 countries, should bring about more efficiencies thanks to improved liquidity and increased cross-border electricity trade.

At EU level, electricity trade with third countries does not significantly influence wholesale market prices as extra-EU electricity imports or exports are negligible compared to bloc's total consumption. However, for some regions the situation is different (e.g.: Baltic states and Italy), as they source significant amounts of their consumption needs from abroad (see

Figure 11

), which sometimes includes third countries. Of all the regions under observation, only Central Western Europe remained consistently in surplus, retaining its position as Europe’s main exporting region thanks to plentiful and diverse generation capacities, competitive prices and a central position suitable to supply the rest of Europe. The Nordic region shifted repeatedly from surplus to deficit, depending mainly on the regional hydro reservoir level. The other regions remained in a net importer position. As electricity normally flows from areas with lower prices to higher-priced ones, net exporter regions have lower wholesale prices compared to net importers.

The covid-related demand shock reduced importing needs especially in Italy and the British Isles, curbing exports from the CWE region. The Nordic net exports surged in the spring of 2020 on the back of high hydro reservoir levels supported by increased precipitation. The abundance of cheap electricity led to extremely low spot prices in Nord Pool markets in the first half of 2020.

Figure 11 - Net electricity flow positions of individual European regions

Source: ENTSO-E

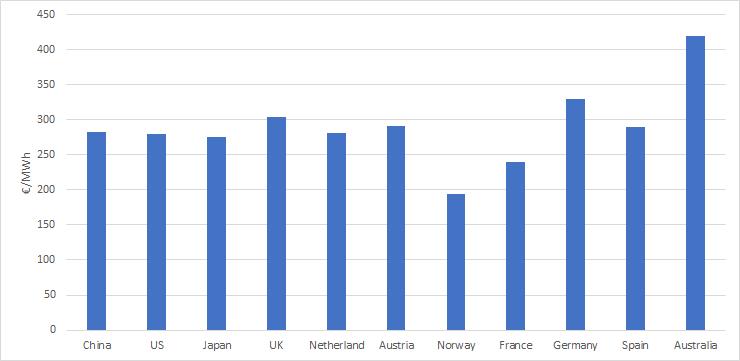

1.1.3 International comparisons

Comparing the average prices in the EU27 with wholesale prices of Europe’s important trading partners can provide a useful insight into how energy cost differentials can impact the competitiveness of European energy-intensive industries with a high international exposure. Electricity bills are only one of the factors determining international competitiveness. A more detailed analysis of the impact of prices on competitiveness can be found in chapter 6.

Figure 12

shows that since 2008 wholesale electricity prices in the US have been mostly lower than in the EU27, with the EU-US price ratio staying close to 2:1 between 2018 and 2019. This can be traced to the abundance of domestically produced, low-cost natural gas that serves as the fuel to price-setting power plants in most US electricity markets. In contrast, prices in Japan increased significantly after the Fukushima accident in 2011 as a large amount of nuclear capacity was put offline and the country had to rely more on burning imported natural gas. This drove Japanese wholesale prices 3-4 times above their EU peers between 2012 and 2014. Since 2016, as nuclear capacities were gradually put back into operation, the wholesale price gap decreased but never disappeared entirely.

The proxy for wholesale prices in China

has accelerated its decline since 2017. The proxy price level is relatively high, but in reality, the wholesale price is likely to be much lower, as suggested in other studies, but for which price data was not usable

.

Figure 13

shows some further examples of wholesale prices of important EU trade partners. Wholesale prices in Canada were one of the lowest in the world over the last twelve years due to the dominant presence of hydro power plants (60%) in the national power mix, supplanted by other renewables and nuclear generation (21% combined). Similarly low power prices were observed in Russia, richly endowed with natural resources of all kinds. Prices in Australia rose above EU levels in 2018 and 2019, while those in Turkey generally followed their EU peers.

An analysis of the evolution of price differentials between the EU27 average and G20 countries in constant 2018 EUR prices shows that price developments across 10 of the 14 non-EU G20 countries have been positive for the EU. In 2008, six countries (AU, CA, ID, RU, ZA and TK) had lower prices than the EU27 average, but this fell to four countries by 2019 (CA, IN, RU, US), with Australia, Turkey and South Africa becoming more expensive than the EU27 and the US and Indonesia becoming cheaper.

Figure 12 - Comparison of wholesale electricity prices in the EU with global trade partners

Source: Trinomics et altri study (2020)

Figure 13 - Comparison of wholesale electricity prices in the EU with global trade partners

Source: Trinomics et altri study (2020)

1.2Retail electricity prices

Main findings

¾Retail electricity prices across all consumer types increased between 2017 and 2019, driven mainly by rising prices of baseload power in the wholesale market in 2017-2018. In the case of households, the average EU27 retail price went up by 4% to 214 €/MWh. Mid-size industrial companies experienced a 5% increase in the average price to 106 €/MWh.

¾The amount of electricity taxes and levies paid by households in the EU27 per MWh has stabilized since 2017 and has fallen in the case of industrial enterprises. Thus, the role of the tax component, which had long acted as the main inflationary element in the total electricity bill, has decreased for the first time.

¾Progress towards the completion of the single energy market continued and brought energy components in individual Member States closer together than ever before: they became 14% and 9% less spread out since 2010 for households and industrial consumers respectively. This contributed to rising convergence in total retail prices for both consumer categories which can be observed since 2016.

¾Taxes and levies remain by far the most important source of differences in retail prices across Member States, displaying dispersion that is three times higher on average than that of the network and energy components. This is caused by a very varied nature of Member States’ policies and fiscal instruments affecting the taxation of electricity consumption. In 2019, environmental taxes paid by households ranged from 1 €/MWh in Luxembourg to 118 €/MWh in Denmark, while applied VAT rates spread from 5% in Malta to 27% in Hungary.

¾The average amount of electricity taxes collected from households to finance renewable support schemes peaked in 2015 at 29 €/MWh and has stabilized in recent years at 25 €/MWh. This is remarkable as renewable generation in the EU27 expanded by 14% between 2015 and 2019 and the share of renewable electricity in the grid is growing rapidly.

¾The average EU27 household electricity price grew annually by 2.3% since 2010, while general inflation, measured by the harmonised index of consumer prices, advanced by 1.4% annually during the same period. Meanwhile, industrial electricity prices in the ID band grew at an annual rate of 1.1%, which compares to the 1.3% annual inflation rate in producer prices. In the case of large consumers and energy-intensive industries in the IF band, electricity prices in 2019 were 5% lower than in 2010.

¾The most recent data available indicate that the substantial decline in wholesale electricity prices induced by the coronavirus pandemic in the first half of 2020 has already had a measurable impact on household retail prices, which have started to decrease. Furthermore, a fall in the tax component also contributed to the decrease in retail household prices. As a result, the average price paid by a representative household in one of EU27 capitals declined by 3% during the first six months of 2020 compared to 2019.

Table 1 - Key figures on the evolution and drivers of retail electricity prices between 2010 and 2019

|

Consumer type

|

Household (DC)

|

Industrial (ID)

|

Large Industrial (IF)

|

|

Component

|

Annual growth

|

Share 2019

|

∆ Share 2010-2019

|

Annual growth

|

Share 2019

|

∆ Share 2010-2019

|

Annual growth

|

Share 2019

|

∆ Share 2010-2019

|

|

Energy

|

-0.2%

|

32%

|

- 8 p.p.

|

-2.5%

|

46%

|

- 17 p.p.

|

-3.2%

|

55%

|

- 15 p.p.

|

|

Network

|

2.3%

|

27%

|

+ 0 p.p.

|

2.2%

|

19%

|

+ 1 p.p.

|

1.2%

|

15%

|

+ 2 p.p.

|

|

Taxes

|

4.7%

|

41%

|

+ 8 p.p.

|

8.5%

|

34%

|

+ 16 p.p.

|

5.7%

|

30%

|

+ 13 p.p.

|

|

Total

|

2.3%

|

|

|

1.1%

|

|

|

-0.6%

|

|

|

Source: DG ENER in-house data collection. Eurostat

Aim and scope of the chapter

The following chapter analyses retail electricity prices, taking an in-depth look at the evolution, composition and drivers of prices paid by final consumers in the EU27 and selected non-Member States from 2010 to 2019.

Data sources

The chapter draws on past in-house data collection efforts by the Directorate General for Energy of the European Commission (DG ENER) used in the previous iteration of this report and, for the most recent period, on publicly available Eurostat databases of electricity price components for household and non-household consumers (nrg_pc_204_c and nrg_pc_205_c).

The chapter is structured along different consumer types. These are defined by Eurostat methodology under Regulation (EU) 2016/1952 of the European Parliament and of the Council of 26 October 2016 on European statistics on natural gas and electricity prices. It differentiates household and industrial consumers, whereas both consumer types are further broken down into consumption bands. Different bands are applied to electricity and natural gas. Due to the derogations granted to several Member States with regard to the provision of statistics pursuant to Regulation (EU) 2016/1952, the complete set of data for the whole EU27 and certain Member States for 2018 are not available and therefore not included in the report.

The chapter commences by examining household electricity prices at EU level and in each reporting country. Next, the chapter looks at electricity prices paid by industrial consumers. It differentiates between two levels of industrial consumption in order to provide a nuanced picture of a diverse group of consumers, from mid-size businesses to manufacturing industries consuming large amounts of energy.

In order to investigate driving forces behind retail price developments, total prices are further decomposed into three main components: Energy and supply (Energy), Network costs (Network) and Taxes, fees, levies and charges (Taxes and levies). The Taxes and levies category is then further disaggregated into six subcomponents (five in the case of gas) designed to display the importance and impact of specific Member State policies in a comparable way.

All figures representing the EU27 are consumption-weighted averages of EU27 Member States. The number of countries included in each EU average can differ across consumption bands, depending on data availability.

1.2.1Household electricity prices

The following section analyses prices paid by household electricity consumers. It examines weighted EU27 averages for the DC band, covering annual consumption of 2500 to 5000 kWh, which is the most common volume for the majority of households. A comparison of reporting countries based on a most representative band is also included. In this case, each Member State (and selected non-Member States) is represented by the consumption band accounting for the largest share in total household consumption. In other words, it is represented by the price for which most electricity in the household category was sold. It is irrespective of the number of consumers in the band.

Evolution of household electricity prices

Retail prices in the DC band grew at an annual rate of 2.3% from 2010 to 2019, while general inflation, measured by the harmonised index of consumer prices, advanced by 1.4% annually during the same period. Thus, electricity has become 9% more expensive in real terms during the last ten years. In absolute terms, the EU27 retail price grew from 175 to 214 €/MWh in the same period.

The average EU27 price rose by 4% between 2017 and 2019, driven mainly by the rising energy component (+7%), which responded to the developments in the wholesale market, and by more expensive network costs (+5%). The taxes and levies category remained unchanged and its share in the total bill decreased by a percentage point to 41%. This was the first time that the dominant tax component saw its importance reduced. It underlines the fact that the inflationary effect of this category, propelled in the past mainly by renewable support policies, has subsided.

Figure 14 - Evolution and composition of the EU household price (DC band)

Source: DG ENER in-house data collection, Eurostat

Long-term trends in main retail price components

Over the last ten years, the composition of household retail prices changed markedly. The share of the energy component decreased by 8 percentage points to 32% in 2019. At the beginning of the decade, the commodity component, determined largely by wholesale prices, was the most important of the three components at EU level.

In absolute terms, the energy component was little changed in 2019 compared to 2010, decreasing by 2% to 68 €/MWh. At Member State level, 13 Member States reported lower energy components in 2019 than in 2010. One of the most remarkable changes occurred in Germany where the energy component declined by 32% to 58 €/MWh in the last decade. In Romania, meanwhile, the same component rose by 76% to 59 €/MWh. Across Member States, energy components were less spread out in 2019 than ten years earlier (their relative standard deviation decreased by 14%) on the back of progressing wholesale market integration and more competition between suppliers.

The share of network costs in the final household bill has been almost constant at 27% throughout the decade. In absolute terms, the network component grew at an annual rate of 2.3% and reached 59 €/MWh in 2019. This underlines the rising need for infrastructure investment necessary to make the grid more flexible and resilient in order to accommodate growing amounts of decentralized and intermittent renewable electricity.

The taxes and levies component has been the most significant driver of retail price developments over the last decade. Whereas in 2010 it accounted for 33% of the average EU27 price for DC households, its share grew to 42% in 2016, before retreating to 41% in 2019. In absolute terms, taxes grew at an annual rate of 5% and reached 87 €/MWh in 2019. The next section analyses in greater detail which specific policies and fiscal instruments were driving this increase.

Composition of taxes, levies, fees and charges

In order to better understand how Member State policies and fiscal instruments impact household retail prices, the taxes levies, fees and charges category is broken down into six subcomponents. It is important to note that only policies and mechanisms that directly impact retail prices are considered. Also, not every tax subcomponent exists or is applied in each Member State. The following chart displays the evolution of EU27 averages.

Figure 15 – Evolution of taxes, fees, levies and charges for EU households since 2010 (DC)

Source: DG ENER in-house data collection, Eurostat

Figure 15

shows that taxes and levies associated with policies designed to support renewable energy sources were the main driver behind the rise in the whole tax component in the first half of the observed decade, growing from 10 €/MWh in 2010 to 29 €/MWh in 2015. Since then, however, a decline in this subcomponent could be observed, as governments gradually embraced more economically efficient forms of public support (by setting subsidy levels at auctions rather than via fixed feed-in-tariffs for instance). Between 2017 and 2019, the renewable tax subcomponent remained unchanged at 25 €/MWh, making up 12% of the total retail price.

Rising VAT and, in the last few years, rising environmental taxes have also contributed to the growth of the tax component. The VAT subcomponent increased from 27 €/MWh in 2010 to 33 €/MWh in 2019, accounting for 16% of the total household bill for electricity at the end of the observed period. Environmental taxes in the EU27 rose from 13 €/MWh in 2010 to 19 €/MWh in 2019, making up 9% of the total retail price. The influence of other subcomponents has been less pronounced.

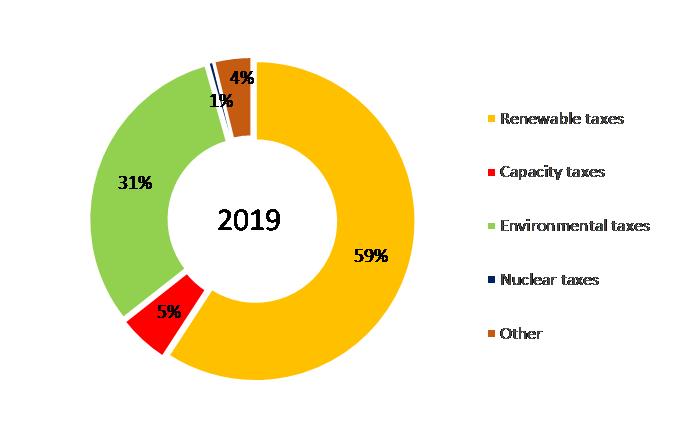

The structure of the taxes and levies component changed very little between 2017 and 2019, as did its absolute value. The share of individual subcomponents in 2019 can be seen in

Figure 16

.

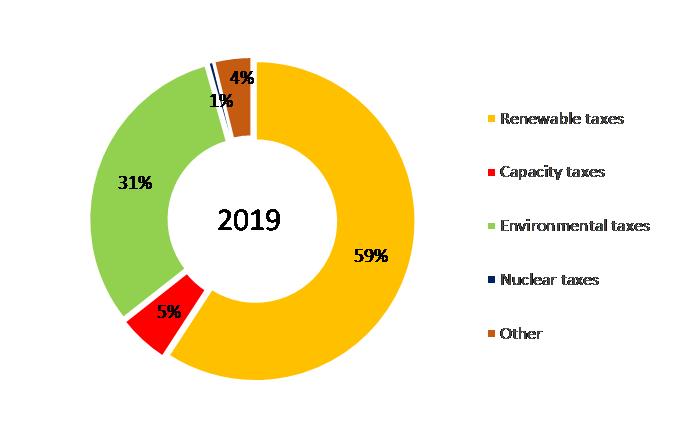

Figure 16 - Composition of the taxes and levies component of household electricity prices in 2019 (DC band)

Source: DG ENER in-house data collection, Eurostat

The next section offers a brief description of individual subcomponents.

Value added tax