EUR-Lex Access to European Union law

This document is an excerpt from the EUR-Lex website

Document 32003R0780

Commission Regulation (EC) No 780/2003 of 7 May 2003 opening and providing for the administration of a tariff quota for frozen meat of bovine animals covered by CN code 0202 and products covered by CN code 02062991 (1 July 2003 to 30 June 2004)

Commission Regulation (EC) No 780/2003 of 7 May 2003 opening and providing for the administration of a tariff quota for frozen meat of bovine animals covered by CN code 0202 and products covered by CN code 02062991 (1 July 2003 to 30 June 2004)

Commission Regulation (EC) No 780/2003 of 7 May 2003 opening and providing for the administration of a tariff quota for frozen meat of bovine animals covered by CN code 0202 and products covered by CN code 02062991 (1 July 2003 to 30 June 2004)

OJ L 114, 8.5.2003, p. 8–15

(ES, DA, DE, EL, EN, FR, IT, NL, PT, FI, SV)

Special edition in Czech: Chapter 03 Volume 038 P. 497 - 504

Special edition in Estonian: Chapter 03 Volume 038 P. 497 - 504

Special edition in Latvian: Chapter 03 Volume 038 P. 497 - 504

Special edition in Lithuanian: Chapter 03 Volume 038 P. 497 - 504

Special edition in Hungarian Chapter 03 Volume 038 P. 497 - 504

Special edition in Maltese: Chapter 03 Volume 038 P. 497 - 504

Special edition in Polish: Chapter 03 Volume 038 P. 497 - 504

Special edition in Slovak: Chapter 03 Volume 038 P. 497 - 504

Special edition in Slovene: Chapter 03 Volume 038 P. 497 - 504

No longer in force, Date of end of validity: 11/12/2010: This act has been changed. Current consolidated version: 01/05/2004

No longer in force, Date of end of validity: 11/12/2010: This act has been changed. Current consolidated version: 01/05/2004

|

8.5.2003 |

EN |

Official Journal of the European Union |

L 114/8 |

COMMISSION REGULATION (EC) No 780/2003

of 7 May 2003

opening and providing for the administration of a tariff quota for frozen meat of bovine animals covered by CN code 0202 and products covered by CN code 0206 29 91 (1 July 2003 to 30 June 2004)

THE COMMISSION OF THE EUROPEAN COMMUNITIES,

Having regard to the Treaty establishing the European Community,

Having regard to Council Regulation (EC) No 1254/1999 of 17 May 1999 on the common organisation of the market in beef and veal (1), as last amended by Commission Regulation (EC) No 2345/2001 (2), and in particular Article 32(1) thereof,

Whereas:

|

(1) |

The WTO schedule CXL requires the Community to open an annual import quota of 53 000 tonnes of frozen beef covered by CN code 0202 and products covered by CN code 0206 29 91. Implementing rules should be laid down for the quota year 2003/2004 starting on 1 July 2003. |

|

(2) |

The 2002/2003 quota was managed in conformity with the provisions of Regulation (EC) No 954/2002 opening and providing for the administration of a tariff quota for frozen meat of bovine animals covered by CN code 0202 and products covered by CN code 0206 29 91 (1 July 2002 to 30 June 2003) (3). These provisions laid down, in particular, stricter criteria for participation so as to avoid registration of fictitious operators. Moreover, reinforced rules on the use of the import licences concerned provided an obstacle towards speculative trade in licences. |

|

(3) |

The experience obtained from the application of those rules has been positive and similar rules should therefore be laid down for the quota year 2003/2004, including a division of the quota into a subquota I, reserved for the traditional importers, and a subquota II to be allocated on application by operators approved by Member States through an approval procedure. |

|

(4) |

With the view of providing at the same time stability in the trade with frozen beef while ensuring a gradual increase in the share of the quota open to all genuine beef traders it is appropriate to increase the quantity being attributed under subquota II. |

|

(5) |

Subquota I should be allocated initially in form of import rights to active importers on the basis of relevant customs documents providing proof that they have imported beef under the same type of quota during the last three quota years. In certain cases administrative errors by the competent national body are liable to restrict traders' access to this part of the quota. Steps should be taken to make good any resulting damage. |

|

(6) |

Operators who can show that they are genuinely involved in importing or exporting beef from or to third countries should be able to apply for approval under subquota II. Proof of that involvement calls for evidence to be presented of recent import of some significance. |

|

(7) |

Where there are obvious reasons to suspect that fictitious operators have applied for registration, Member States should proceed to a more detailed examination of the applications. |

|

(8) |

Penalties should be determined where fictitious operators have applied for registration or the approval was granted on the basis of forged or fraudulent documentation. |

|

(9) |

If criteria for participation in the quota allocation are to be checked, applications must be submitted in the Member States where the operator is entered in the national VAT register. |

|

(10) |

With a view to providing a permanent access to the quota, subquota II should be managed on a half-yearly basis with a simultaneous examination of the licence applications from approved importers. |

|

(11) |

In order to prevent speculation, importers no longer involved in trade in beef should be denied access to the quota and a security relating to import rights should be fixed for each applicant under subquota I. The licence security should be set at a relative high level and the possibility of transferring import licences should be excluded. |

|

(12) |

In order to provide for more equal access to subquota II for all approved operators, each applicant may apply for a maximum quantity to be fixed. |

|

(13) |

To oblige operators to apply for import licences for all the import rights allocated, it should be established that such obligation constitutes a primary requirement within the meaning of Commission Regulation (EEC) No 2220/85 of 22 July 1985 laying down common detailed rules for the application of the system of securities for agriculture products (4), as last amended by Regulation (EC) No 1932/1999 (5). |

|

(14) |

A proper management of the import quota requires that the titular licence holder is a genuine importer. Therefore, such importer should actively participate in the purchase, transport and import of the beef concerned. Presentation of proofs of those activities should therefore also be a primary requirement with regard to the licence security. |

|

(15) |

The cost related to purchase and transport of small consignments from a third country supplier might be excessively high and discourage the use of the licence. It is therefore appropriate to allow import of a small quantity from customs bonded warehouses and provide the consequent derogations as to the release of security. |

|

(16) |

Commission Regulation (EC) No 1291/2000 of 9 June 2000 laying down common detailed rules for the application of the system of import and export licences and advance-fixing certificates for agricultural products (6), as last amended by Regulation (EC) No 325/2003 (7) and Commission Regulation (EC) No 1445/95 of 26 June 1995 on rules of application for import and export licences in the beef and veal sector and repealing Regulation (EEC) No 2377/80 (8), as last amended by Regulation (EC) No 118/2003 (9), are applicable to import licences issued under this Regulation. |

|

(17) |

The Management Committee for Beef and Veal has not given an opinion within the time limit set by its President, |

HAS ADOPTED THIS REGULATION:

PART I

Quota

Article 1

1. A tariff quota totalling 53 000 tonnes expressed in weight of boneless meat is hereby opened for frozen meat of bovine animals covered by CN code 0202 and products covered by CN code 0206 29 91 for the period 1 July 2003 to 30 June 2004.

The order number of the tariff quota shall be 09.4003.

2. For the purposes of the said quota, 100 kilograms of bone-in meat shall be equivalent to 77 kilograms of boneless meat.

3. For the purposes of this Regulation, ‘frozen meat’ means meat that is frozen and has an internal temperature of - 12 °C or lower when it enters the customs territory of the Community.

4. The Common Custom Tariff duty applicable to the quota provided for in paragraph 1 shall be 20 % ad valorem.

5. The quota referred to in paragraph 1 shall be divided into two subquotas:

|

— |

subquota I equal to 18 550 tonnes, |

|

— |

subquota II equal to 34 450 tonnes. |

PART II

Subquota I

Article 2

Community operators may apply for import rights totalling a quantity of 18 550 tonnes on the basis of the quantities imported by them under Commission Regulations (EC) No 995/1999 (10), (EC) No 980/2000 (11) and (EC) No 1080/2001 (12).

However, Member States may accept as the reference quantity import rights under the order number 09.4003 for the preceding quota year which were not allocated because of an administrative error by the competent national body but to which the operator would have been entitled.

Article 3

1. Applications for import rights are valid only from operators who are entered in a national VAT register.

2. Operators who at 1 January 2003 have ceased their activities in the beef and veal sector shall not qualify for any allocation under Article 2.

3. A company formed by the merger of companies each having reference imports pursuant to Article 2 may use those reference imports as basis for its application under that Article.

4. Proof of import shall be provided exclusively by means of customs documents of release for free circulation duly endorsed by the customs authorities.

Member States may accept copies of the above documents duly certified by the competent authorities.

Article 4

1. Applications for import rights accompanied by the documentary proofs referred to in Article 3(4) shall reach the competent authority in the Member State where the applicant is entered in the national VAT register before 13:00, Brussels time, on 23 May 2003.

All quantities presented as reference quantity, in application of Article 2, shall constitute the import rights applied for, where appropriate, in application of Article 1(2).

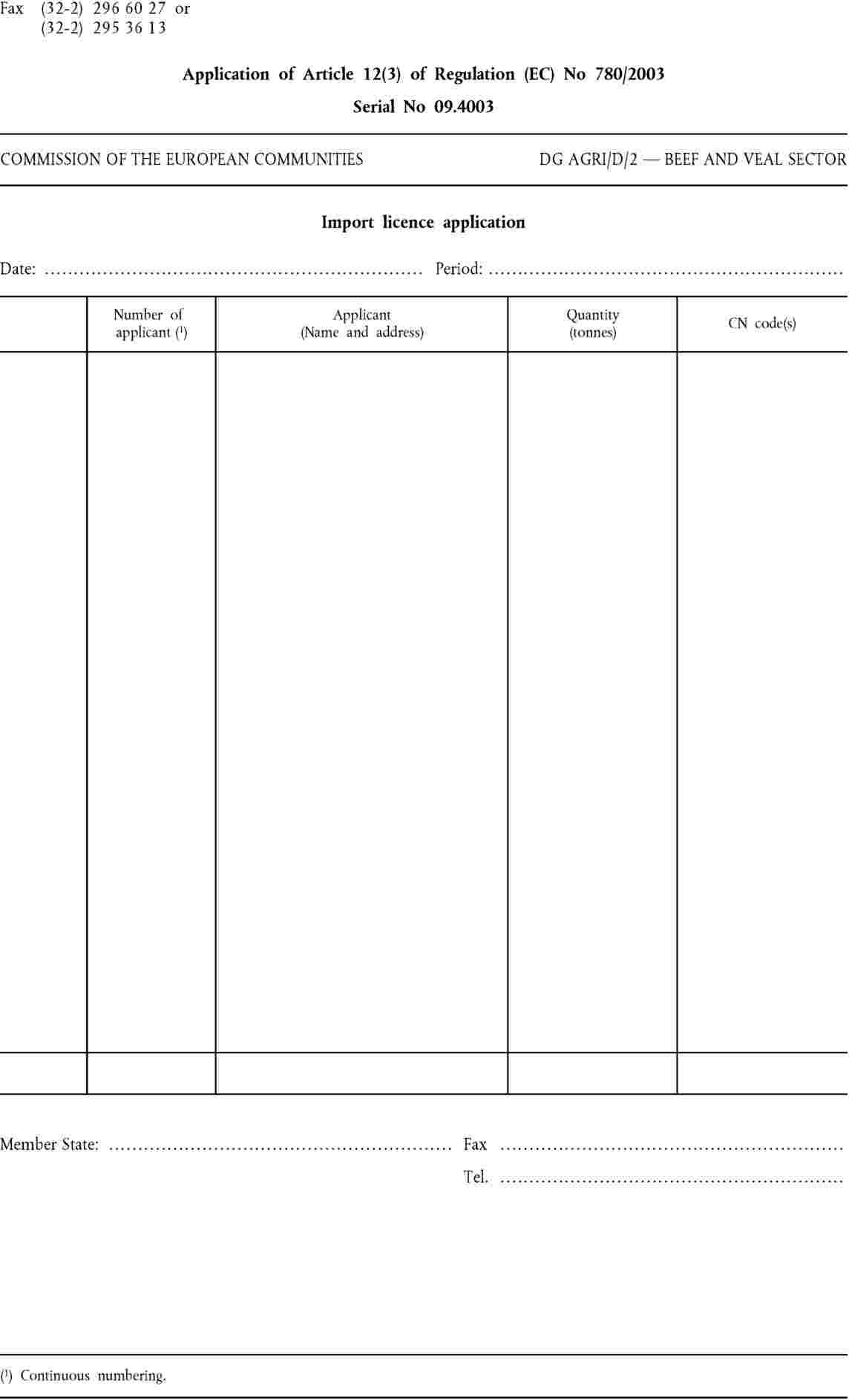

2. After verifying the documents submitted, the Member States shall forward to the Commission no later than 6 June 2003 a list of applicants under this subquota, including in particular their names and addresses and the quantities of eligible meat imported during the reference period concerned.

3. Communications of the information referred to in paragraph 2, including nil returns, shall be sent by fax using the form in Annex I.

Article 5

The Commission shall decide as soon as possible the extent to which import rights under this subquota may be granted. Where the import rights applied for exceed the available quantity referred to in Article 2 the Commission shall fix a corresponding reduction coefficient.

Article 6

1. In order to be valid, the application for import rights must be accompanied by a security of EUR 6 per 100 kilograms net weight.

2. Where application of the reduction coefficient referred to in Article 5 causes less import rights to be allocated than had been applied for, the security lodged shall be released proportionally without delay.

3. The application for one or several import licences totalling the import rights allocated shall constitute a primary requirement within the meaning of Article 20(2) of Regulation (EEC) No 2220/85.

Article 7

1. Imports of the quantities allocated shall be subject to presentation of one or more import licences.

2. Licence applications may be lodged solely in the Member State where the applicant has applied and obtained import rights under subquota I.

Each issuing of import license shall result in a corresponding reduction of the import rights obtained.

3. Licence applications and licences shall contain the following entries:

|

(a) |

one of the following entries in section 20:

|

|

(b) |

one of the following groups of CN codes in section 16:

|

PART III

Subquota II

Article 8

Applications for import licences with regard to subquota II totalling 34 450 tonnes may be lodged only by operators who have been approved in advance for such purposes by the competent authority in the Member State where they are entered in the VAT register. The authority may assign an approval number to each approved operator.

Article 9

1. Approval may be granted to an operator who submits a request to the competent authority before 13:00, Brussels time, on 23 May 2003 accompanied by documentary proof that:

|

(a) |

he/she has been engaged on his/her own account in the commercial activity of importing into the Community, or exporting from the Community, beef falling within CN codes 0201, 0202 or 0206 29 91 during the years 2001 and 2002; |

|

(b) |

by virtue of this activity:

|

in, at least, two operations per year.

Operators who at 1 January 2003 have ceased their activities in the beef and veal sector shall not be approved for the purpose of this subquota.

2. In order to prove the commercial activity of his/her own account as referred to in paragraph 1(a), the operator shall present documentary proofs in form of commercial invoices and official accounts as well as any other documents showing to the satisfaction of the Member State concerned that the required commercial activity is related solely to the applicant concerned.

3. Proof of import or export shall be provided exclusively by means of customs documents of release for free circulation or export documents duly endorsed by the customs authorities.

Member States may accept copies of the above documents duly certified by the competent authorities.

For the purpose of paragraph 1(a) and (b), beef used as the reference quantity under subquota I can be declared as reference quantity under subquota II.

4. Member States shall examine and verify the validity of the documentation presented.

5. Member States shall verify that applicants are not related to one another within the meaning of Article 143 of Commission Regulation (EEC) No 2454/93 (13), where:

|

— |

in the proof of imports or exports referred to in paragraph 3, two or more applicants are entered as having the same postal address, or |

|

— |

two or more applicants at the time of application are registered for VAT purposes on the same postal address, or |

|

— |

Member States have grounds to suspect that applicants are connected in terms of management, staff or operation. |

Where related applicants are consequently identified, all applications concerned shall be rejected unless the applicants concerned can provide further evidence to the satisfaction of the competent authority that they are independent from one another in terms of management, staff and all operations linked to their commercial or technical activity.

6. In application of paragraph 5, where a Member State has grounds to suspect that an applicant is connected in terms of management, staff or operations with an applicant in another Member State, the two Member States shall mutually verify whether a relationship exists within the meaning of Article 143 of Regulation (EEC) No 2454/93.

For this purpose Member States shall establish a list of applicants, containing their name and address, which shall be sent by fax to the Commission before 31 May 2003. The Commission shall subsequently distribute to all Member States the lists received.

7. A company applying for approval formed by a merger of companies each having rights to apply pursuant to paragraphs 1 to 3 shall enjoy the same rights as those former companies.

Article 10

1. The competent authority shall inform applicants of the outcome of the approval procedure before 21 June 2003 and shall, at the same time, send a list to the Commission containing the name and address of each approved operator.

2. Where it is subsequently established that the approval was based upon forged or fraudulent documentation, it shall be withdrawn together with any advantage already granted on the basis of it.

Article 11

Only operators approved in application of Article 10 shall be allowed to apply for import licences under subquota II during the period 1 July 2003 to 30 June 2004.

Article 12

1. Licence applications may be lodged only in the Member State of approval and each approved operator can only lodge one licence application per period. Where an applicant submits more than one application per period, all such applications shall be inadmissible.

2. A licence application may be lodged during the two following periods:

|

— |

1 to 4 July 2003, and |

|

— |

5 to 8 January 2004. |

The quantity available in each of the two periods is 17 225 tonnes. However, where the total quantity applied for in the first period is less than the quantity available, the residual quantity shall be added to the quantity available in the second period.

Each licence application shall not exceed 5 % of the available quantity for the period concerned.

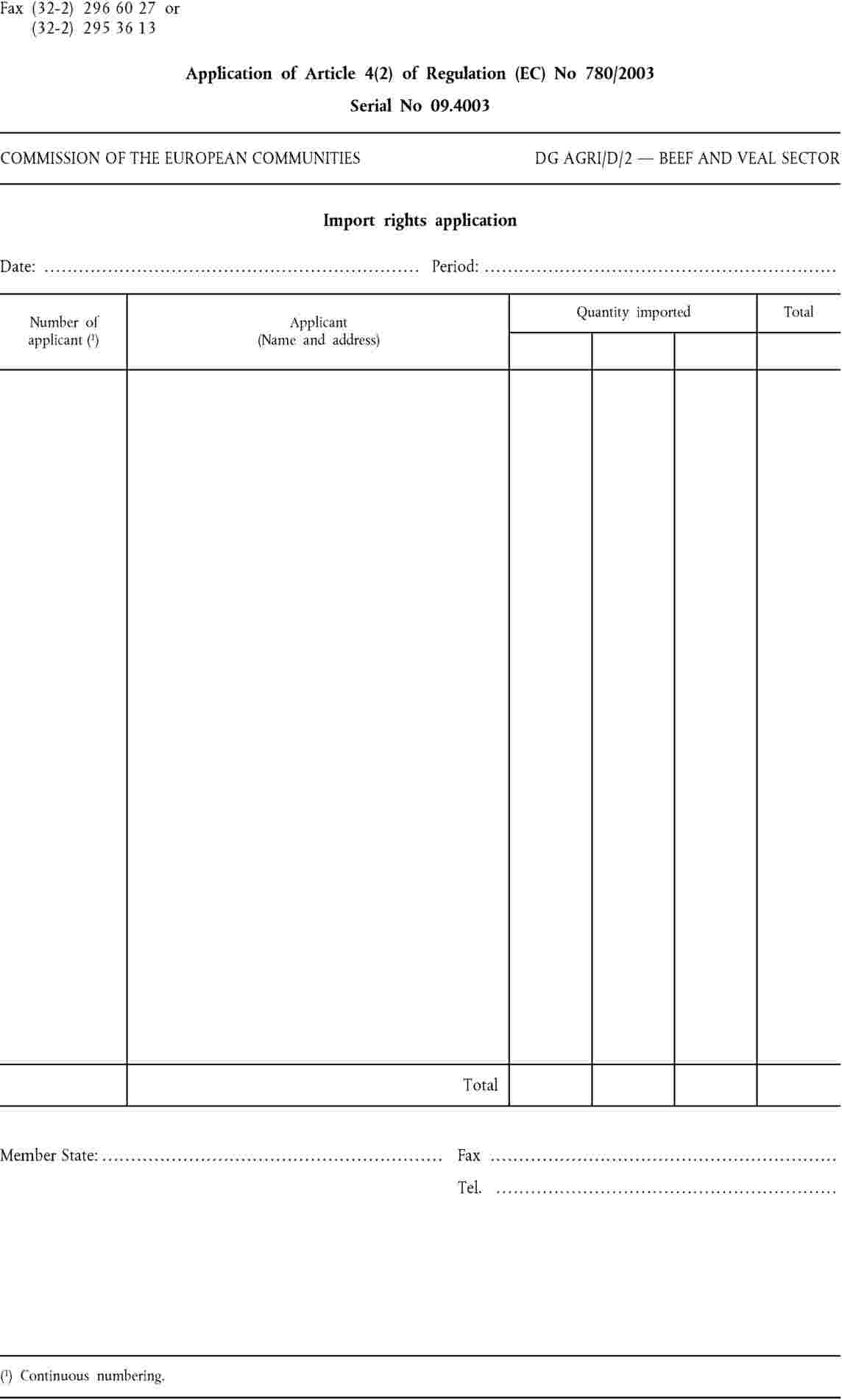

3. By the fifth working day following the end of the period for submission of licence applications, the Member State shall notify the Commission of the applications submitted.

Notifications, including nil returns, shall be sent by fax, using the model in Annex II.

4. The Commission shall decide as soon as possible the extent to which applications may be met. Where the applications exceed the half-yearly quantity available the Commission shall fix a corresponding reduction coefficient.

Member States shall issue the licences no later than five working days after the publication of the decision in the Official Journal of the European Union.

5. Licence applications and licences shall contain the following entries:

|

(a) |

one of the following entries in section 20:

|

|

(b) |

one of the following groups of CN codes in section 16:

|

PART IV

Common provisions

Article 13

For the purpose of applying the arrangements provided for in this Regulation, the frozen meat shall be imported into the customs territory of the Community subject to the conditions laid down in Article 17(2)(f) of Council Directive 72/462/EEC (14).

Article 14

1. Regulations (EC) No 1291/2000 and (EC) No 1445/95 shall apply, save where otherwise provided in this Regulation.

2. Notwithstanding Article 9(1) of Regulation (EEC) No 1291/2000, import licences issued pursuant to this Regulation shall not be transferable and shall confer the right to use the tariff quota only if made out in the same name and address as the one entered as consignee in the customs declaration of release for free circulation accompanying them.

3. Pursuant to Article 50(1) of Regulation (EC) No 1291/2000, the full Common Customs Tariff duty applicable on the date of acceptance of the customs declaration for free circulation shall be collected in respect of all quantities imported in excess of those shown on the import licence.

4. Import licences shall be valid for 180 days from their date of issue as defined in Article 23(2) of Regulation (EC) No 1291/2000. However, no licence shall be valid after 30 June 2004.

5. The security relating to the import licence shall be EUR 120 per 100 kilograms net weight. The security shall be lodged by the applicant together with the licence application. Where in application of Article 12(4) the licence applications are not accepted in full, the security lodged shall be released proportionally without delay.

6. Notwithstanding the provisions of section 4 of Title III of Regulation (EC) No 1291/2000, the security shall not be released until proof has been produced that the titular holder of the licence has been commercially and logistically responsible for the purchase, transport and clearance for free circulation of the quantity of meat concerned.

Such proof shall at least consist of:

|

(a) |

the original commercial invoice made out in the name of the titular holder by the seller or his/her representative, both established in the third country of export, and proof of payment by the titular holder or the opening by the titular holder of an irrevocable documentary credit in favour of the seller; |

|

(b) |

the bill of lading or, where applicable, the road or air transport document, drawn up in the name of the titular holder, for the quantity concerned; |

|

(c) |

copy No 8 of form IM 4 with the name and address of the titular holder being the only indication in box 8; |

|

(d) |

proof of payment of the customs duties by the titular holder or on behalf of him/her. |

7. Notwithstanding the provisions of paragraph 6, each titular holder may, during the first and the second half of the quota year and within a maximum quantity of 10 tonnes per respective half year, customs clear for free circulation under this Regulation meat which previously had been stored under the Community bonded warehousing system.

In that case, the commercial invoice referred to in the first indent of paragraph 6 and the transport documents referred to in the second indent of paragraph 6 may be replaced by the original commercial invoice made out in the name of the titular holder by the owner of the meat not yet cleared for free circulation. Furthermore, the titular holder must present proof of payment of such an invoice.

8. All proofs required for release of the licence security, including those required in Article 35(1) and (2) of Regulation (EC) No 1291/2000, shall be presented to the competent authorities within the deadlines laid down in the first indent of Article 35(4)(a) and in Article 35(4) (c) of that Regulation.

Article 15

This Regulation shall enter into force on the third day following its publication in the Official Journal of the European Union.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 7 May 2003.

For the Commission

Franz FISCHLER

Member of the Commission

(1) OJ L 160, 26.6.1999, p. 21.

(2) OJ L 315, 1.12.2001, p. 29.

(5) OJ L 240, 10.9.1999, p. 11.

(6) OJ L 152, 24.6.2000, p. 1.

(7) OJ L 47, 21.2.2003, p. 21.

(8) OJ L 143, 27.6.1995, p. 35.

(10) OJ L 122, 12.5.1999, p. 3.

(11) OJ L 113, 12.5.2000, p. 27.

(12) OJ L 149, 2.6.2001, p. 11.

(13) OJ L 253, 11.10.1993, p. 1.

(14) OJ L 302, 31.12.1972, p. 28.

ANNEX I

ANNEX II