EUR-Lex Access to European Union law

This document is an excerpt from the EUR-Lex website

Document 52020AA0011

Opinion No 11/2020 (pursuant to Articles 287(4) and 322(2), TFEU) concerning the draft Council Regulation (EU, Euratom) amending Regulation (EEC, Euratom) No 1553/89 on the definitive uniform arrangements for the collection of own resources accruing from value added tax (document 12771/20, interinstitutional file 2018/0133 (NLE))

Opinion No 11/2020 (pursuant to Articles 287(4) and 322(2), TFEU) concerning the draft Council Regulation (EU, Euratom) amending Regulation (EEC, Euratom) No 1553/89 on the definitive uniform arrangements for the collection of own resources accruing from value added tax (document 12771/20, interinstitutional file 2018/0133 (NLE))

Opinion No 11/2020 (pursuant to Articles 287(4) and 322(2), TFEU) concerning the draft Council Regulation (EU, Euratom) amending Regulation (EEC, Euratom) No 1553/89 on the definitive uniform arrangements for the collection of own resources accruing from value added tax (document 12771/20, interinstitutional file 2018/0133 (NLE))

ECA_OPI_2020_11

OJ C 26, 22.1.2021, p. 1–10

(BG, ES, CS, DA, DE, ET, EL, EN, FR, HR, IT, LV, LT, HU, MT, NL, PL, PT, RO, SK, SL, FI, SV)

|

22.1.2021 |

EN |

Official Journal of the European Union |

C 26/1 |

OPINION No 11/2020

(pursuant to Articles 287(4) and 322(2), TFEU)

concerning the draft Council Regulation (EU, Euratom) amending Regulation (EEC, Euratom) No 1553/89 on the definitive uniform arrangements for the collection of own resources accruing from value added tax (document 12771/20, interinstitutional file 2018/0133 (NLE))

(2021/C 26/01)

CONTENTS

|

|

Paragraph |

Page |

|

Summary |

I-V |

3 |

|

Introduction |

1-5 |

3 |

|

Observations |

6-39 |

4 |

|

Calculation of total net VAT receipts and bases |

15-19 |

6 |

|

Calculation of the frozen multiannual WAR |

20-27 |

7 |

|

Submission of VAT statements and the review procedure |

28-34 |

8 |

|

Reporting on the functioning of the VAT-based own resource system |

35-39 |

8 |

|

Conclusion |

40-43 |

9 |

|

ANNEX |

|

10 |

THE COURT OF AUDITORS OF THE EUROPEAN UNION,

Having regard to the Treaty on the Functioning of the European Union, and in particular Articles 287(4) and 322(2) thereof,

Having regard to the Draft Council Regulation (EU, Euratom) amending Regulation (EEC, Euratom) No 1553/89 of 29 May 1989 on the definitive uniform arrangements for the collection of own resources accruing from value added tax (document 12771/20, interinstitutional file 2018/0133 (NLE)),

Having regard to the proposal for a Council Regulation amending Regulation (EEC, Euratom) No 1553/89 of 29 May 1989 on the definitive uniform arrangements for the collection of own resources accruing from value added tax (COM(2018) 328 final),

Having regard to the Council’s request for an opinion, received on 11 November 2020,

Having regard to Council Decision 2014/335/EU, Euratom of 26 May 2014 on the system of own resources of the European Union (1),

Having regard to Council Regulation (EEC, Euratom) No 1553/89 of 29 May 1989 on the definitive uniform arrangements for the collection of own resources accruing from Value Added Tax (2), as last amended by Council Regulation (EC) No 807/2003 of 14 April 2003 (3),

Having regard to the previous opinions given by the European Court of Auditors on the EU’s system of own resources, in particular Opinion No 5/2018 (4),

Having regard to the final report and recommendations of the High-Level Group on Own Resources (HLGOR) on the future financing of the EU, issued in December 2016 (5).

Whereas:

|

(1) |

The European Council of 24 and 25 March 1999 concluded (6), among other things, that the EU’s own resources system should be equitable, transparent, cost-effective and simple, and that it must be based on criteria which best express each Member State’s ability to contribute; |

|

(2) |

The European Council meeting of February 2013 called for continued work on the Commission’s proposal for a new own resource based on Value Added Tax (VAT) to make it as simple and transparent as possible, to strengthen the link with the EU’s VAT policy and actual VAT receipts, and to ensure equal treatment of taxpayers in all Member States (7); |

|

(3) |

The Commission’s Reflection Paper on the future of EU finances (8) stressed that the current approach to financing is over-complicated, opaque and riddled with complex correction mechanisms, and that the system should be simple, fair and transparent; |

|

(4) |

The resolution on the reform of the EU’s system of own resources adopted by the European Parliament in March 2018 highlighted shortcomings in the way the EU budget is currently financed and called for far-reaching reforms (9); |

|

(5) |

The resolution on the 2021-2027 multiannual financial framework (MFF) adopted by the European Parliament in October 2019 made consent for the MFF conditional upon reform of the EU own resources system, including simplification of the VAT-based own resource (10); |

|

(6) |

The communication (11) from the Commission to the European Parliament, European Council, the Council, the European Economic and Social Committee and the Committee of the Regions of May 2020 on the EU budget powering the recovery plan for Europe presented an overview of the new own resources system (including a simplified VAT-based national contribution); and |

|

(7) |

The European Council meeting of July 2020 concluded (12) that the current VAT-based own resource would be replaced by the Commission’s simplified and refined alternative method. The VAT base to be taken into account for this purpose will not exceed 50 % of each Member State’s Gross National Income (GNI). |

HAS ADOPTED THE FOLLOWING OPINION:

SUMMARY

|

I. |

On 2 May 2018, the Commission proposed a reform of the EU’s financing system for the future budget under the 2021-2027 multiannual financial framework, including simplification of the VAT-based own resource. In our Opinion No 5/2018, we criticised the assumptions used in the Commission’s methodology as described in the proposal. In November 2020, the Council prepared a revised text of its draft Regulation on the calculation of the VAT-based own resource, and requested an opinion from us. This Opinion focuses on the new method proposed for calculating the VAT-based own resource. |

|

II. |

The VAT-based own resource accounted for 11 % of the EU budget in 2019 (17,8 billion euros). It is calculated using a taxable base that is comparable and notionally harmonised among Member States, and is obtained by dividing their net VAT receipts by the corresponding Weighted Average Rate. |

|

III. |

The Council proposal is intended to simplify the calculation, compared to the current method, by eliminating most corrections and compensations, and introducing the use of a definitive multiannual Weighted Average Rate (frozen at its 2016 value). It also includes amended provisions on the submission of VAT statements and the review procedure, and introduces a process for reporting on the functioning of the VAT-based own resource. |

|

IV. |

We welcome the Council proposal. In our view, it significantly simplifies the calculation of the Member States’ VAT-based own resource as compared to the current system. However, we have identified the risk that the definitive multiannual Weighted Average Rate may not be representative for all Member States. |

|

V. |

To improve the current proposal, we suggest the introduction of a mechanism for reviewing the frozen Weighted Average Rate. This should permit a recalculation for those Member States whose VAT-based contributions would be significantly affected by its use instead of the actual Weighted Average Rate. Such a mechanism should be applied using certain triggering indicators, and would prevent distortions of VAT-based contributions during the multiannual financial framework period resulting from significant changes to Member States’ VAT policies. |

INTRODUCTION

|

1. |

The financing system for the EU budget has not been significantly reformed since 1988. The three main categories of revenue in the current system are: Traditional Own Resources (TOR), the Value Added Tax (VAT)-based own resource, and the Gross National Income (GNI)-based own resource. |

|

2. |

On 2 May 2018, the Commission proposed a reform of the EU financing system for the future budget under the 2021-2027 multiannual financial framework (MFF). This included a review of some existing own resources (including a simplified VAT-based own resource); the introduction of a ‘basket’ of three new own resources (based on the Common Consolidated Corporate Tax Base, the European Union Emissions Trading System and plastic packaging waste that is not recycled); the phasing-out of corrections; and an increase in the ceilings for own resources (13). |

|

3. |

In our Opinion No 5/2018, we assessed the proposal for the new EU financing system, including the three above new own resources, and found that it addressed some of the weaknesses we had identified in our previous work on own resources. However, we concluded that the reformed system proposed remained complex. |

|

4. |

Following the Commission’s proposal of May 2018 on reforming own resources, several negotiations took place at the level of the European Parliament and the Council, both on the 2021-2027 MFF, and on the related system of EU financing. Based on the above negotiations, the Commission’s proposal is being amended. The negotiation process is still ongoing and the proposal is being modified in several aspects. |

|

5. |

Regarding the VAT-based own resource, the Council prepared in November 2020 a revised text of its draft Regulation on the calculation of this own resource (including a ‘simplified and refined alternative method’), and requested an opinion from us. This Opinion focuses on the proposed alternative method for calculating the VAT-based own resources (14). |

OBSERVATIONS

|

6. |

The VAT-based own resource accounted for 11 % of the EU budget in 2019 (17,8 billion euros). It is obtained by applying a uniform call rate to a ‘harmonised VAT base’. The call rate is 0,3 % for all Member States except Germany, the Netherlands and Sweden, which benefit from a reduced rate of 0,15 %. |

|

7. |

The current VAT-based own resource system builds on a taxable base that is comparable and notionally harmonised among Member States, and is obtained by dividing their adjusted VAT receipts by the corresponding Weighted Average Rate (WAR).

Box 1

describes how the VAT-based own resource is calculated under the current system, and how it would be calculated under the proposed new system.

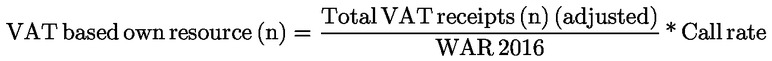

Box 1 How is the VAT-based own resource calculated? The current system: The method for calculating Member States’ VAT-based own resources is based on a comparable and notionally harmonised VAT base. This is done to prevent Member States’ choices of mix of VAT rates (within the limits set in the VAT Directive) from influencing their payable contributions. This complex method takes as its starting point the VAT amount collected by each Member State (its receipts) and, after any necessary corrections, divides this amount by the WAR (see Box 2 ). After introducing the additional compensations, the resulting notionally harmonised VAT base is multiplied by a fixed call rate to obtain each Member State’s contribution. This calculation of the VAT-based own resource is illustrated by the following formula, which is applied for each Member State and for each year (n):

The proposed new system: The Council proposes freezing the WAR at its 2016 value and use this as a ‘definitive’ WAR for the duration of the next multiannual financial framework. As envisaged in the Commission’s proposal of May 2018, it also proposes abolishing all corrections and compensations, except two types: those related to the territorial scope referred to in Articles 6 and 7 of the VAT Directive, and to infringements of that Directive. The new calculation is illustrated by the following formula, which is applied for each Member State and for each year (n):

Where: The VAT-based own resource (n)= contribution amount payable by a Member State in year n. Total VAT receipts (n) (adjusted)= the total net VAT amount collected by that Member State in year n. Call rate= the percentage indicated in the own resources decision (currently 0,3 %). |

|

8. |

The WAR is a complex calculation performed by allocating all taxable transactions to the appropriate VAT rate using statistical data taken from national accounts that are compiled in accordance with the European System of Integrated Economic Accounts (ESA) (15).

Box 2

illustrates how the WAR is calculated, highlighting the difference between the current system and the proposed new one.

Box 2 How is the Weighted Average Rate (WAR) calculated? The WAR results from a statistical analysis of the mix of supplies of goods and services, and the VAT rates applied in all Member States. The weightings applied to all taxable transactions in order to calculate the average VAT rate in each Member State are computed using data from national accounts. The formula for calculating the WAR is as follows: WAR(n) = sum of T(i)*R(i), Where: T(i)= value of the transactions to which VAT rate i applies divided by the aggregate value of all taxable transactions, and R(i)= VAT rate i. The VAT rates used are those applicable in year n. Weights are computed for year n using data from national accounts for the year before last (n-2). Under the proposed new system, the WAR would be calculated for 2016 and frozen. It would then be applied in order to calculate the VAT-based own resource each year from 2021 onwards. An annual WAR would no longer be calculated or inspected and used for year n, as it is under the current system. |

|

9. |

While the VAT receipts collected by national tax authorities are the starting point for the calculation process, there are numerous corrections and compensations to harmonise the taxable transactions among Member States. Therefore, managing this own resource entails significant administrative burden for both the Commission and Member States. |

|

10. |

As mentioned in our Opinion No 2/2012, on a number of occasions we have noted the complexity of the VAT-based own resource calculation (16) and the lack of any direct link between this resource and its tax base. To address these weaknesses, the Commission proposed in May 2018 a simplified method for calculating the VAT-based own resource. This method for simplifying the VAT-based own resource for each Member State included calculating the base using only the share of supplies that were standard-rated in all Member States. |

|

11. |

In our Opinion No 5/2018, we noted that the complex WAR had been replaced by a straightforward standard rate in the calculation process. However, we found that the assumptions used by the Commission to calculate the simplified VAT-based contributions did not adhere to some of the calculation steps of the methodology described in the proposal (17). |

|

12. |

The revised text of the draft Council Regulation of November 2020 proposed a simplified and refined alternative method for the VAT-based own resource. It addresses our above criticisms while keeping the calculation simpler than under the current system. |

|

13. |

The proposed new calculation of the VAT-based own resource follows the same processes to obtain the VAT bases as the current one (see paragraphs 7 and 8 ). These processes have been simplified, in particular for calculating the VAT bases and the definitive multiannual WAR (see Box 1 ). The national contributions are obtained by multiplying these bases by the VAT call rate (0,3 % for all Member States, as per the European Council conclusions of July 2020) (18). |

|

14. |

To assess the proposed new simplified and refined alternative method, we focused on the following key aspects:

For each issue, we will present the proposed provisions and our view on them. |

Calculation of total net VAT receipts and bases

|

15. |

According to the Commission, corrections and compensations have historically had a negligible impact on the VAT-based own resource amount (between 2011 and 2015, an average of 0,5 % of the VAT receipts for corrections and 0,09 % of the VAT bases for compensations). However, their management involved complex calculations and required disproportionate resources of both the Commission and Member States. |

|

16. |

Under the proposed Article 3 of the draft Council Regulation, all compensations and corrections are abolished except two types: those related to the territorial scope referred to in Articles 6 and 7 of the VAT Directive (19), and to infringements of that Directive. This had already been envisaged in the Commission’s proposal of May 2018. |

|

17. |

Corrections and compensations related to the territorial scope have been kept due to provisions in some Member States’ EU accession treaties (20) concerning the calculation of the VAT-based own resource. These corrections and compensations are made mainly because the VAT Directive does not fully apply in some EU territories (e.g. Canary Islands, Ceuta and Melilla, or the Åland Islands). Therefore, the transactions on these territories are not reflected in the Member States’ VAT receipts. For own-resources purposes, such transactions should be included in the VAT base by means of corrections. |

|

18. |

In additional, the Council proposal maintained the compensations resulting from infringement procedures. These are calculated in cases where, for example, a specific product or service in a Member State is exempt from VAT and the Commission considers that such an exemption is in breach of the VAT Directive. At the end of 2019, these compensations applied to nine Member States (21). According to the Council proposal, such adjustments should continue to be taken into account in order to prevent Member States that fail to apply EU law from benefiting from a reduction in the VAT-based own resource amount payable. Until the infringement procedure in question has been closed, the relevant Member State’s VAT statement for own-resource purposes should be adjusted accordingly. |

Our assessment of the proposed calculation of the total net VAT receipts and bases

|

19. |

We welcome the proposed simplification to corrections and compensations in total net VAT receipts and bases, and consider that it will contribute to reducing administrative burden for both the Commission and Member States without significantly affecting the accuracy of the VAT-based contributions. |

Calculation of the definitive multiannual WAR

|

20. |

The proposed Article 4 of the draft Council Regulation sets out the following method for calculating the definitive multiannual WAR:

|

|

21. |

While the proposed method for obtaining the WAR is the same as the current one, we note that the rate obtained is used for multiannual calculations and is frozen for the whole MFF (see Box 1 ). The reference year of 2016 was selected to calculate the definitive multiannual WAR, as that is the year for which the most recent data already subject to Commission inspections in all Member States is available. Our review of previous years’ WARs shows that, while the overall year-on-year trend was generally stable, there were some significant variations from one year to the next in some Member States. This may affect the accuracy of their VAT-based contribution, which would not be corrected until after the end of the MFF period. |

Our assessment of the proposed calculation of the definitive multiannual WAR

|

22. |

We consider that the current calculation of the VAT-based own resource should be simplified. However, such simplification should be balanced with the need to maintain reasonable accuracy in the Member States’ contributions. |

|

23. |

We welcome the proposal, including the calculation of a definitive multiannual WAR for each Member State to be used for the whole MFF period. We note that the reference year selected was 2016. Although we acknowledge the reasons given for using a single year to determine the definitive multiannual WAR, there is a risk that the selected year may not be representative for some Member States. |

|

24. |

We consider that a reasonably accurate WAR is necessary in the proposed simplified method to ensure that each Member State makes a contribution that reflects its VAT base appropriately. Under the proposed method, if a Member State introduced a significant change in its VAT rates, the WAR used to determine the VAT-based own resource amount would not take into account these revised rates. As a result, the VAT base would not accurately reflect the aggregate value of all taxable transactions, and the national contribution amount calculated would not reflect the Member State’s new VAT policy. |

|

25. |

In order to mitigate this risk, the Council should consider introducing, in its proposal, a mechanism for reviewing the definitive multiannual WAR and potentially recalculating it, for those Member States whose VAT-based contribution would be significantly affected by its use instead of the actual WAR. |

|

26. |

Such a mechanism should be triggered by certain important changes (which could be identified by indicators such as significant changes in VAT rates and/or taxable transactions, and/or in VAT receipts). If the recalculated actual WAR differs from the definitive multiannual WAR by more than a certain pre-determined materiality threshold, the former should replace the latter. |

|

27. |

This mechanism should prevent distortions of VAT-based contributions during the MFF period resulting from significant changes to Member States’ VAT policies. The Commission should adopt implementing acts providing further detail on the procedures for applying this mechanism. |

Submission of VAT statements and the review procedure

|

28. |

Article 7 of the proposed draft Council Regulation keeps the same deadline as under the current system (31 July each year) for Member States to deliver their VAT statements, including their VAT bases for the previous year and the revised bases for the preceding years. It also provides for the possibility of extending this deadline in cases where Member States cannot meet it due to exceptional circumstances beyond their control. |

|

29. |

The proposed Article 9 introduces a procedure for cases where the Commission disagrees with Member States’ corrections as reported in their VAT statements (see paragraphs 15 to 18 ). Such disagreement is expressed in a formal letter by the Commission. |

|

30. |

Under this procedure, the Member State concerned may ask the Commission to review the correction concerned within two months of the date of the above letter. The review should conclude with a Commission decision, to be adopted within three months of the Member State’s request. The corrections resulting from this procedure should be taken into account in future VAT statements. |

|

31. |

Neither the review procedure nor legal action taken by a Member State to annul the Commission’s decision affects that country’s obligation to make available, by the statutory deadline, the VAT-based own resource amount corresponding to the corrections. |

Our assessment of the proposal regarding the submission of VAT statements and the review procedure

|

32. |

We take note of the addition of a provision to extend the deadline for submitting VAT statements in cases where Member States cannot meet it due to exceptional circumstances beyond their control. |

|

33. |

We note the introduction of a review procedure to deal with cases where the Commission does not agree with Member States’ corrections as reported in their VAT statements. This procedure involves the Commission reviewing the corrections and adopting a decision within three months of the Member State’s request. This decision may be subject to an action for annulment by the Member State. |

|

34. |

This new review procedure may give Member States an additional possibility of initiating proceedings before the Court of Justice of the European Union against the Commission’s decision concluding the review procedure. However, it may also add considerable burden to the Commission’s management of the VAT-based own resource. |

Reporting on the functioning of the VAT-based own resource system

|

35. |

The new proposed Article 13(a) of the draft Council Regulation obliges the Commission to produce a report on the functioning of the VAT-based own resource system by 1 January 2025 at the latest. |

|

36. |

This report should indicate the number of Member States still applying a WAR that is subject to any notifications concerning outstanding issues (see paragraph 20 (d) and (e) ), and any changes to national VAT rates. In addition, it should include an assessment of whether the VAT-based own resource system and, in particular, the definitive multiannual WAR are effective and adequate. With this report, the Commission should also propose modifications to the definitive multiannual WAR based on more recent data. |

Our assessment on the proposal regarding the reporting on the functioning of the VAT-based own resource system

|

37. |

We welcome the introduction of this obligation for the Commission to report before the end of the MFF on the effectiveness and adequacy of the VAT-based own resource system, and the possibility to revise the WAR. |

|

38. |

When carrying out its assessment for the report, the Commission could also apply our proposed procedure to determine whether the review mechanism needs to be activated (see paragraphs 22 to 27 ). This would involve evaluating the indicators used to monitor triggering events, recalculating the actual WAR and, where necessary, modifying the definitive multiannual WAR for those Member States whose VAT-based contribution would be significantly affected by its use instead the actual WAR. |

|

39. |

The Annex includes suggested amendments to certain provisions of the proposed draft Council Regulation. They concern the issues described above and some additional minor editorial suggestions. |

CONCLUSION

|

40. |

We have, on a number of occasions, reported on the complexity of the VAT-based own resource calculation. In our Opinion No 5/2018, we acknowledged that the Commission’s proposal of May 2018 included a straightforward calculation, but we found that the assumptions used to calculate the simplified VAT-based contributions did not adhere to some of the calculation steps of the methodology described in the proposal. |

|

41. |

In November 2020, the Council proposed a simplified and refined alternative method to calculate the VAT-based own resource. The proposal eliminates most corrections and compensations, as already envisaged in the Commission’s proposal of May 2018, and introduces the use of a definitive multiannual WAR. |

|

42. |

We welcome the Council proposal, which significantly simplifies the current calculation of Member States’ VAT-based contributions. However, we have identified the risk that the definitive multiannual WAR (frozen at its 2016 value) may not be representative for certain Member States in some (future) years. Consequently, it may not ensure that the calculation of the Member States’ VAT bases and related contributions are reasonably accurate. |

|

43. |

In our opinion, to improve the current proposal, a mechanism should be considered for reviewing the frozen multiannual WAR, with a view to recalculation, for those Member States whose VAT-based contribution would be significantly affected by its use instead of the actual WAR. This mechanism should prevent distortions of VAT-based contributions during the MFF period resulting from significant changes to Member States’ VAT policies. |

This Opinion was adopted by the Court of Auditors in Luxembourg on 8 December 2020.

For the Court of Auditors

Klaus-Heiner LEHNE

President

(1) OJ L 168, 7.6.2014, p. 105.

(3) OJ L 122, 16.5.2003, p. 36.

(4) Opinions No 5/2018 (OJ C 431, 29.11.2018, p. 1), No 7/2015 (OJ C 5, 8.1.2016, p. 1), No 7/2014 (OJ C 459, 19.12.2014, p. 1), No 2/2012 (OJ C 112, 18.4.2012, p. 1), No 2/2008 (OJ C 192, 29.7.2008, p. 1), No 2/2006 (OJ C 203, 25.8.2006, p. 50), No 4/2005 (OJ C 167, 7.7.2005, p. 1) and No 7/2003 (OJ C 318, 30.12.2003, p. 1).

(5) Future Financing of the EU - Final report and recommendations of the High Level Group on Own Resources (HLGOR) on the future financing of the EU issued in December 2016.

(6) See Bulletin EU 3-1999.

(7) European Council 7/8 February 2013 conclusions (Multiannual Financial Framework) EUCO 37/13.

(8) COM(2017) 358 final of 28 June 2017.

(9) European Parliament resolution of 14 March 2018 on the reform of the European Union’s system of own resources (2017/2053(INI)).

(10) European Parliament resolution of 10 October 2019 on the on the 2021-2027 multiannual financial framework and own resources: time to meet citizens’ expectations (2019/2833(RSP)).

(11) COM(2020) 442 final of 27 May 2020.

(12) EUCO 10/20, special meeting of the European Council (17, 18, 19, 20 and 21 July 2020), conclusions.

(13) The proposal for a Council Decision on the system of own resources of the European Union (COM(2018) 325 final), the proposal for a Council Regulation on the methods and procedure for making available the Own Resources based on the Common Consolidated Corporate Tax Base, on the European Union Emissions Trading System and on Plastic packaging waste that is not recycled, and on the measures to meet cash requirements (COM(2018) 326 final); the proposal for a Council Regulation laying down implementing measures for the system of Own Resources of the European Union (COM(2018) 327 final); and the proposal for a Council Regulation amending Regulation (EEC, Euratom) No 1553/89 on the definitive uniform arrangements for the collection of own resources accruing from value added tax (COM(2018) 328 final).

(14) Draft Council Regulation (EU, Euratom) amending Regulation (EEC, Euratom) No 1553/89 on the definitive uniform arrangements for the collection of own resources accruing from value added tax (document 12771/20, interinstitutional file 2018/0133 (NLE)).

(15) Regulation (EU) No 549/2013 of the European Parliament and of the Council of 21 May 2013 on the European system of national and regional accounts in the European Union (OJ L 174, 26.6.2013, p. 1).

(16) In our 2017 annual report, we reported weaknesses in the Commission’s verification of the VAT-based own resource, notably in relation to the calculation of the WAR.

(17) See Opinion 5/2018, Annex II.

(18) See footnote 12 .

(19) Council Directive 2006/112/EC of 28 November 2006 on the common system of value added tax (OJ L 347, 11.12.2006, p. 1), as amended.

(20) As an example, Article 187 of the Act concerning the conditions of accession of the Kingdom of Spain and the Portuguese Republic and the adjustments to the Treaties (OJ L 302, 15.11.1985, p. 23) stipulates that: ‘The amount of duties recorded under own resources accruing from value added tax shall be due in its entirety from 1 January 1986. That amount shall be calculated and checked as if the Canary Islands and Ceuta and Melilla were included in the territorial field of application of Sixth Council Directive 77/388/EEC of 17 May 1977 on the harmonization of the laws of the Member States relating to turnover taxes — Common system of value added tax: uniform basis of assessment.’

(21) Germany, Greece, France, Italy, Cyprus, Hungary, Malta, Austria and Poland.

ANNEX

Our suggested amendments to the proposed draft Council Regulation on the VAT-based own resource

|

Draft Council Regulation (EU, Euratom) amending Regulation (EEC, Euratom) No 1553/89 of 29 May 1989 on the definitive uniform arrangements for the collection of own resources accruing from value added tax (document 12771/20, interinstitutional file 2018/0133 (NLE)) |

||

|

Reference to the proposed provisions |

ECA’s suggestion/proposed change |

Comments |

|

Article 4 |

A mechanism should be considered for reviewing the definitive multiannual WAR to prevent distortions of VAT-based contributions during the MFF period resulting from significant changes to Member States’ VAT policies. |

See paragraphs 22 to 27 for further details. |

|

Article 9(1) |

Before the last sentence of the second paragraph, the following sentence should be added: ‘The correction mentioned in the Commission’s letter should be included in the following VAT statement.’ |

We would like to clarify that, in the event of disagreement between the Commission and the Member State, the correction amount communicated by the Commission to the Member State should be considered for the calculation of the VAT-based own resource. This should be included without delay in the Member State’s following VAT statement, and kept as such until the disagreement has been resolved. |

|

Article 10(1) |

The reference to ‘Article 3(2)c’ should be added. |

For completeness, we propose referring also to corrections and compensations related to infringements (see paragraphs 16 and 18 ). |

|

Article 11(2) |

The reference to ‘Article 4(3)’ should be deleted. |

Given that the proposed Article 4 only contains two paragraphs and the calculation of the WAR is described in detail in the proposed Article 4(2), the reference to Article 4(3) is not necessary. |

|

Article 13a |

This provision should be revised in order to mention that the report includes an assessment of the effectiveness of the review process, as well as actions to improve its future application. |

See paragraph 38 for further details. |