EUR-Lex Access to European Union law

This document is an excerpt from the EUR-Lex website

Document 02008R0376-20080613

Commission Regulation (EC) No 376/2008 of 23 April 2008 laying down common detailed rules for the application of the system of import and export licences and advance fixing certificates for agricultural products (Codified version)

Consolidated text: Commission Regulation (EC) No 376/2008 of 23 April 2008 laying down common detailed rules for the application of the system of import and export licences and advance fixing certificates for agricultural products (Codified version)

Commission Regulation (EC) No 376/2008 of 23 April 2008 laying down common detailed rules for the application of the system of import and export licences and advance fixing certificates for agricultural products (Codified version)

2008R0376 — EN — 13.06.2008 — 001.001

This document is meant purely as a documentation tool and the institutions do not assume any liability for its contents

|

COMMISSION REGULATION (EC) No 376/2008 of 23 April 2008 laying down common detailed rules for the application of the system of import and export licences and advance fixing certificates for agricultural products (OJ L 114, 26.4.2008, p.3) |

Amended by:

|

|

|

Official Journal |

||

|

No |

page |

date |

||

|

L 150 |

7 |

10.6.2008 |

||

COMMISSION REGULATION (EC) No 376/2008

of 23 April 2008

laying down common detailed rules for the application of the system of import and export licences and advance fixing certificates for agricultural products

(Codified version)

THE COMMISSION OF THE EUROPEAN COMMUNITIES,

Having regard to the Treaty establishing the European Community,

Having regard to Council Regulation (EC) No 1784/2003 of 29 September 2003 on the common organisation of the market in cereals ( 1 ), and in particular Article 9(2), Article 12(1) and (4) and Article 18 thereof, and the corresponding Articles of the other Regulations on the common organisation of markets in agricultural products,

Whereas:|

(1) |

Commission Regulation (EC) No 1291/2000 of 9 June 2000 laying down common detailed rules for the application of the system of import and export licences and advance fixing certificates for agricultural products ( 2 ) has been substantially amended several times ( 3 ). In the interests of clarity and rationality the said Regulation should be codified. |

|

(2) |

The Community Regulations which introduced import and export licences provide that all imports into the Community and all exports from it of agricultural products are to be subject to the production of such a licence. The scope of such licences should therefore be defined, with the express stipulation that they are not required for operations which do not constitute imports or exports in the strict sense. |

|

(3) |

Where products are subject to inward-processing arrangements, the competent authorities may, in some cases, allow products to be put into free circulation either with or without further processing. In such cases, to ensure that the market is properly managed, an import licence should be required for products actually put into free circulation. However, where a product put into free circulation has been obtained from basic products some of which have been imported from third countries and some of which have been purchased in the Community, only those basic products imported from third countries or obtained from the processing of basic products from third countries need to be taken into consideration. |

|

(4) |

The object of import and export licences and advance fixing certificates is the sound administration of the common market organisation. Some operations relate to small quantities and, in the interests of simplifying administrative procedures, import and export licences and advance-fixing certificates should not be required for such operations. |

|

(5) |

Export licences are not required for the victualling of vessels and aeroplanes in the Community. Since the justification is similar, this provision should also apply to deliveries to platforms and naval vessels and to victualling in third countries. For the same reasons, licences should not be required for the operations covered by Council Regulation (EEC) No 918/83 of 28 March 1983 setting up a Community system of reliefs from customs duty ( 4 ). |

|

(6) |

In view of international trade practice in respect of the products or goods in question, certain tolerances should be allowed with regard to the quantity of products imported or exported as compared with the quantity indicated on the licence or certificate. |

|

(7) |

So that several operations can be carried out at the same time under one licence or certificate, provision should be made for extracts of licences and certificates to be issued which have the same effect as the licences and certificates from which they are extracted. |

|

(8) |

Under the Community rules governing the various sectors covered by the common organisation of agricultural markets, import and export licences and advance fixing certificates are applicable to operations effected in the Community. This arrangement requires common rules to be adopted for drawing up and using such licences or certificates and Community forms and methods to be established for administrative cooperation between Member States. |

|

(9) |

The use of computerised procedures is gradually replacing the manual input of data in the different areas of administrative activity. It should therefore also be possible to use computerised and electronic procedures when issuing and using licences and certificates. |

|

(10) |

The Community Regulations which introduced those licences and certificates provide that they are to be issued subject to the lodging of a security so as to guarantee that the undertaking to import or export will be fulfilled during the period of their validity. It is necessary to define when the undertaking to export or import is fulfilled. |

|

(11) |

In the case of licences with advance fixing of the refund, the licence to be used depends on the tariff classification of the product. In the case of certain mixtures, the rates of refund do not depend on the tariff classification of the product but on special rules laid down for that purpose. Therefore, where the component on which the refund applicable to the mixture is calculated does not correspond to the tariff classification of the mixture, such imported or exported mixtures should not qualify for the rate fixed in advance. |

|

(12) |

Import licences are sometimes used to administer quantitative import arrangements. This is possible only where knowledge of the imports effected under the licences issued is available within a fairly short period. In such cases, the requirement to produce evidence that licences have been used is not merely in the interest of sound administration but becomes essential for administering these quantitative arrangements. The evidence in question is supplied by producing copy No 1 of the licence and, where appropriate, the extracts therefrom. It is possible to supply such evidence within a fairly short period. Such a time limit should therefore be fixed for cases where the Community rules on the licences used to administer quantitative arrangements make reference thereto. |

|

(13) |

In some cases the amount of security required for a licence or certificate may be extremely small. In order to reduce the administrative load, no security should be required in such cases. |

|

(14) |

Since in practice the person using a licence or certificate may not be the holder or transferee, in the interests of legal certainty and administrative efficiency it should be specified which persons are authorised to use the certificate or licence. The necessary link between the titular holder and the person making the customs declaration should be established to this end. |

|

(15) |

An import or export licence confers the right to import or export and so it must be presented at the time when the import or export declaration is accepted. |

|

(16) |

When simplified import or export procedures are used, the requirement to present the licence to the customs authorities may be waived or the licence may be presented subsequently. However, the importer or exporter must be in possession of the licence on the date considered to be that on which the import or export declaration is accepted. |

|

(17) |

In the interests of simplification, the rules may be made more flexible so as to allow Member States to introduce a simplified procedure for the administrative handling of licences, under which licences are kept by the issuing body or, where applicable, the paying agency in the case of export licences with advance fixing of the refund. |

|

(18) |

In the interest of sound administration, licences or certificates and extracts therefrom may not be amended after issue. However, in cases of doubt relating to an error attributable to the issuing body or to obvious inaccuracies and concerning the items appearing on the licence, certificate or extract, a procedure should be introduced whereby inaccurate licences, certificates or extracts may be withdrawn and corrected documents issued. |

|

(19) |

Where a product is placed under one of the simplified arrangements provided for in Articles 412 to 442a of Commission Regulation (EEC) No 2454/93 of 2 July 1993 laying down provisions for the implementation of Council Regulation (EEC) No 2913/92 establishing the Community Customs Code ( 5 ), or in Title X, Chapter I of Appendix I to the Convention of 20 May 1987 on a common transit procedure, no formalities need to be carried out at the customs office of the frontier station in cases where transit begins inside the Community and is to end outside it. In the interests of administrative simplicity, where one of these procedures is applied, special arrangements should be adopted for the release of the security. |

|

(20) |

It can happen that, for reasons outside the control of the party concerned, the document constituting proof of departure from the Community's customs territory cannot be produced although the product has left the said territory or, in the case of operations as specified in Article 36 of Commission Regulation (EC) No 800/1999 of 15 April 1999 laying down common detailed rules for the application of the system of export refunds on agricultural products ( 6 ), reached its destination. Such a situation may impede trade. In such circumstances other documents should be recognised as being equivalent. |

|

(21) |

The Community Regulations which introduced the licences and certificates concerned provide that the security is to be forfeit in whole or in part if import or export is not carried out, or only partly carried out, during the period of validity of the licence or certificate. The action to be taken in such circumstances should be specified in detail, in particular for cases where non-fulfilment of undertakings is due to force majeure. In such cases the obligation to import or export may be considered cancelled or the period of validity of the licence or certificate may be extended. However, in order to prevent possible disruption of the market, that extension should in any case be limited to a maximum of six months calculated from the end of the original period of validity. |

|

(22) |

In order to simplify administrative procedures, the security should be returned in full when the total amount to be forfeit is very small. |

|

(23) |

The security lodged at the time of the issue of the licences or certificates is to be released provided proof is supplied to the competent bodies that the goods concerned have left the Community's customs territory within 60 days from the date on which the export declarations are accepted. |

|

(24) |

It can happen that the security is released for various reasons without the obligation to import or export actually having been fulfilled. In such cases, the wrongly released security should be relodged. |

|

(25) |

In order to make full use of export possibilities for agricultural products eligible for refunds, a mechanism should be introduced to encourage operators to return quickly any licences and certificates which they will not be using to the issuing body. A mechanism should also be introduced to encourage operators to return certificates to the issuing body promptly after their expiry date so that the unused quantities can be reused as quickly as possible. |

|

(26) |

Under Article 3(4) of Council Regulation (EEC, Euratom) No 1182/71 of 3 June 1971 determining the rules applicable to periods, dates and time limits ( 7 ), where the last day of a period is a public holiday, Sunday or Saturday the period ends with the expiry of the last hour of the following working day. In certain cases, that provision results in the period of use of licences or certificates being extended. Such a measure, which is designed to facilitate trade, must not have the effect of changing the economic conditions of the import or export operation. |

|

(27) |

In some sectors of the common organisation of the agricultural markets there is provision for a period of reflection before export licences are issued. The purpose of this period is to allow the market situation to be assessed and, where appropriate, in particular where there are difficulties, to allow pending applications to be suspended, which amounts to rejecting those applications. It should be specified that such suspension is also possible in the case of licences applied for under Article 47 of this Regulation and that once the period of reflection has elapsed the licence application cannot again be suspended. |

|

(28) |

Under Article 844(3) of Regulation (EEC) No 2454/93, products exported under a licence or advance-fixing certificate may qualify for treatment as returned goods only where the Community rules on licences and certificates have been complied with. Special rules should be laid down for applying the system of licences and certificates for products likely to qualify under these arrangements. |

|

(29) |

Under Article 896 of Regulation (EEC) No 2454/93, goods which are put into free circulation under an import licence or advance-fixing certificate are eligible for the system of repayment or remission of import duties only where it is established that the necessary steps have been taken by the competent authorities to cancel the effects of putting those goods into free circulation as regards the licence or certificate. |

|

(30) |

Article 880 of Regulation (EEC) No 2454/93 lays down certain detailed rules for applying Article 896 of that Regulation, in particular that the authorities responsible for issuing licences and certificates must provide confirmation. |

|

(31) |

This Regulation should lay down all the rules necessary for implementing Article 896 of Regulation (EEC) No 2454/93. In some cases it should be possible to comply with Regulation (EEC) No 2454/93 without recourse to the confirmation referred to in Article 880 thereof. |

|

(32) |

When import licences are used to determine the preferential import duty under tariff quotas, there is a danger that forged licences may be used, in particular in cases where there is a large difference between the full duty and the reduced or zero duty. To reduce this danger of fraud, there should be a mechanism for verifying the authenticity of the licences submitted. |

|

(33) |

Where an import licence covering an agricultural product is also used to administer a tariff quota to which preferential arrangements apply, such preferential arrangements are to apply to importers by virtue of the licence or certificate which must, in some cases, be accompanied by a document from a third country. To avoid any overrun in the quota, the preferential arrangements must apply up to the quantity for which the licence or certificate was issued. However, in order to facilitate imports, the tolerance provided for in Article 7(4) should be permitted, provided that it is specified at the same time that the part of the quantity exceeding that shown on the licence or certificate but within the tolerance does not qualify under the preferential arrangements and full duty is payable thereon on import. |

|

(34) |

The measures laid down in this Regulation are in accordance with the opinions of all the management committees concerned, |

HAS ADOPTED THIS REGULATION:

CHAPTER I

SCOPE OF THE REGULATION

Article 1

1. Subject to certain exceptions laid down in Community rules specific to certain products, in particular for products referred to in Council Regulation (EC) No 3448/93 ( 8 ) and its implementing rules, this Regulation lays down common rules for implementing the system of import and export licences and advance fixing certificates (hereinafter referred to respectively as ‘licences’ and ‘certificates’) provided for in Part III, Chapters II and III, of Council Regulation (EC) No 1234/2007 ( 9 ) and in Council Regulation (EC) No 1493/1999 ( 10 ) or established in this Regulation.

2. A licence or a certificate shall be presented for the following products:

(a) in case of import, when the products are declared for free circulation:

(i) products listed in Annex II, Part I, imported under all conditions, other than tariff quotas, save as otherwise provided therein;

(ii) products imported under tariff quotas administered by other methods than a method based on the chronological order of the lodging of applications, according to ‘first come first served’ principle, in accordance with Articles 308a, 308b and 308c of Regulation (EEC) No 2454/93 ( 11 );

(iii) products imported under tariff quotas administered by a method based on the chronological order of the lodging of applications in accordance with Articles 308a, 308b and 308c of Regulation (EEC) No 2454/93, specifically mentioned in Annex II, Part I, to this Regulation;

(b) in case of export:

(i) products listed in Annex II, Part II;

(ii) products referred to in Article 162(1) of Regulation (EC) No 1234/2007 for which an export refund has been fixed, including at an amount of zero or an export tax has been fixed;

(iii) products exported under quotas or for which an export licence needs to be presented for admission under a quota administered by a third country opened in that country for Community products imported.

3. For products referred to in paragraphs 2(a)(i), 2(a)(iii) and 2(b)(i), the amount of the security and the period of validity as set out in Annex II shall apply.

For products referred to in paragraphs 2(a)(ii), 2(b)(ii) and 2(b)(iii), specific implementing rules related to the period of validity and the amount of the security laid down in Community rules specific to those products shall apply.

4. For the purposes of the system of export licences and advance fixing certificates referred to in paragraph 1, when a refund has been fixed for products not listed in Annex II, Part II and an operator does not apply for the refund that operator shall not be required to present a licence or certificate for the export of the products concerned.

CHAPTER II

AREA OF APPLICATION OF LICENCES AND CERTIFICATES

Article 2

A licence or certificate shall not be required and may not be presented in respect of products:

(a) which are not placed in free circulation within the Community; or

(b) in respect of which export is effected:

(i) under a customs procedure which allows import free of the relevant customs duties or charges having equivalent effect, or

(ii) under special arrangements which allow export free of export duties, as referred to in Article 129 of Regulation (EEC) No 2913/92.

Article 3

1. Where products which are subject to inward-processing arrangements and which do not contain basic products as referred to in paragraph 2(a) are placed in free circulation, then, insofar as the products actually placed in free circulation are subject to an import licence, such a licence must be produced.

2. Where products which are subject to either of the arrangements referred to in paragraph 1 and which contain both:

(a) one or more basic products which came within the terms of Article 23(2) of the Treaty but no longer do so as a result of their incorporation in the products put into free circulation; and

(b) one or more basic products which did not come within the terms of Article 23(2) of the Treaty,

are placed in free circulation then, notwithstanding Article 7(1) of this Regulation, for each basic product referred to in point (b) of this paragraph actually used and being a product subject to an import licence, such a licence shall be produced.

However, an import licence shall not be required where the product actually placed in free circulation is not subject to such a licence.

3. The import licence or licences produced when a product as referred to in paragraph 1 or 2 is placed in free circulation may not provide for advance fixing.

4. On exportation of a product subject to either of the arrangements referred to in paragraph 1 and containing one or more of the basic products referred to in paragraph 2(a), then for each such basic product, being a product subject to an export licence, such licence shall be produced.

However, subject to the third subparagraph concerning the advance fixing of refunds, an export licence shall not be required when the product actually exported is not subject to such a licence.

On exportation of compound products qualifying for an export refund fixed in advance on the basis of one or more of their components, the customs status of each such component shall be the sole element to be taken into account when applying the system of licences and certificates.

Article 4

1. A licence shall not be required and may not be produced for the purposes of operations:

(a) as specified in Articles 36, 40, 44 and 45 and Article 46(1) of Regulation (EC) No 800/1999; or

(b) of a non-commercial nature; or

(c) referred to in Regulation (EEC) No 918/83; or

(d) relating to quantities not exceeding those set out in Annex II.

Notwithstanding the first subparagraph, a licence must be produced when the import or export is being made under preferential arrangements which are granted by means of the licence.

Member States shall take precautions against abuse when applying this paragraph, in particular when a single import or export operation is covered by more than one import or export declaration which are manifestly unwarranted for economic or other purposes.

2. For the purposes of paragraph 1, ‘operations of a non-commercial nature’ shall mean:

(a) imports by or consigned to private individuals, provided that such operations satisfy the requirements of Section II(D)(2) of the preliminary provisions of the Combined Nomenclature;

(b) exports by private individuals, provided that such operations satisfy, mutatis mutandis, the requirements referred to in point (a).

3. Member States are authorised not to require an export licence or licences for products and/or goods consigned by private individuals or groups of private individuals with a view to their free distribution for humanitarian aid purposes in third countries where all the following conditions are met:

(a) no refund is applied for by the parties which wish to benefit from this exemption;

(b) such consignments are occasional in nature, comprise varied products and/or goods and do not exceed a total of 30 000 kg per means of transport; and

(c) the competent authorities have sufficient proof as to the destination and/or use of the products and/or goods and the proper execution of the operation.

The following indication shall be inserted in Section 44 of the export declaration: ‘No refund — Article 4(3) of Regulation (EC) No 376/2008’.

Article 5

A licence or certificate shall not be required and may not be produced when products are placed in free circulation under Title VI, Chapter 2 of Regulation (EEC) No 2913/92 governing the treatment of returned goods.

Article 6

1. An export licence shall not be required and may not be produced at the time of acceptance of the re-export declaration for products for which the exporter provides proof that a favourable decision for repayment or remission of import duties has been given in respect of such products under Title VII, Chapter 5, of Regulation (EEC) No 2913/92.

2. Where products are subject on export to presentation of an export licence and the competent authorities accept the re-export declaration before deciding on the application for repayment or remission of import duties, an export licence must be produced. Advance fixing of the export refund or levy shall not be permitted.

CHAPTER III

GENERAL PROVISIONS

SECTION 1

Scope of licences, certificates and extracts

Article 7

1. The import or export licence shall constitute authorisation and give rise to an obligation respectively to import or to export under the licence, and, except in cases of force majeure, during its period of validity, the specified quantity of the products or goods concerned.

The obligations referred to in this paragraph shall be primary requirements within the meaning of Article 20 of Commission Regulation (EEC) No 2220/85 ( 12 ).

2. An export licence fixing the export refund in advance shall give rise to an obligation to export the specified quantity of the relevant product under the licence and, except in cases of force majeure, during its period of validity.

Where exports of products are subject to presentation of an export licence, the export licence with advance fixing of the refund shall determine the right to export and entitlement to the refund.

Where exports of products are not subject to presentation of an export licence, the export licence with advance fixing of the refund shall determine only the entitlement to the refund.

The obligations referred to in this paragraph shall be primary requirements within the meaning of Article 20 of Regulation (EEC) No 2220/85.

3. In the cases specified in Article 47 and in cases where such requirement is provided for in the specific Community rules for the relevant sector, the issue of a licence or certificate shall give rise to an obligation to import from or export to the country or group of countries specified therein.

4. Where the quantity imported or exported is greater by not more than 5 % than the quantity indicated in the licence or certificate, it shall be considered to have been imported or exported under that licence or certificate.

5. Where the quantity imported or exported is less by not more than 5 % than the quantity indicated in the licence or certificate, the obligation to import or export shall be considered to have been fulfilled.

6. For the purposes of paragraphs 4 and 5, if the licence or certificate is issued on a headage basis the result of the 5 % calculation referred to therein shall, where applicable, be rounded off to the next greater whole number of head.

7. Where, under Article 3(4) of Regulation (EEC) No 1182/71, a licence or certificate fixing the export levy or export refund in advance is used on the first working day following the last day of its normal period of validity, the licence or certificate shall be considered to have been used on the last day of its normal period of validity for the purposes of the amounts fixed in advance.

8. Without prejudice to Article 1(3), the period of validity of import and export licences and advance fixing certificates shall be as set out for each product in Annex II.

Article 8

1. Obligations deriving from licences or certificates shall not be transferable. Rights deriving from licences or certificates shall be transferable by their titular holder during the period of its validity. Such transfer may be made in favour of a single transferee only for each licence or certificate or extract therefrom. It shall relate to quantities not yet attributed to the licence or certificate or extract.

2. Transferees may not further transfer their rights but may transfer them back to the titular holder. Transfers back to the titular holder shall relate to quantities not yet attributed to the licence or certificate or extract.

In such cases, one of the entries listed in Annex III, Part A, shall be made by the issuing agency in section 6 of the licence or certificate.

3. In the event of a request for transfer by the titular holder or transfer back to the titular holder by the transferee, the issuing body or the agency or agencies designated by each Member State shall enter the following on the licence or certificate or where appropriate the extract therefrom:

(a) the name and address of the transferee or the entry referred to in paragraph 2;

(b) the date of such entry certified by the stamp of the body or agency.

4. The transfer or transfer back to the titular holder shall take effect from the date of the entry.

Article 9

Extracts from licences or certificates shall have the same legal effects as the licences or certificates from which they are extracted, within the limits of the quantity in respect of which such extracts are issued.

Article 10

Licences or certificates and extracts issued and entries and endorsements made by the authorities of a Member State shall have the same legal effects in each of the other Member States as documents issued and entries and endorsements made by the authorities of these Member States.

Article 11

1. When a licence fixing the refund in advance is used to export a mixture, such mixture shall not be eligible on export for the rate so fixed in advance where the tariff classification of the constituent on which the refund applicable to the mixture is calculated does not correspond to that of the mixture.

2. Where a licence or a certificate fixing the export refund in advance is used to export goods put up in sets, the rate fixed in advance shall apply only to the component which has the same tariff classification as the set.

SECTION 2

Application for and issue of licences and certificates

Article 12

1. No application for a licence or certificate shall be accepted unless it is forwarded to or lodged with the competent body on forms printed and/or made out in accordance with Article 17.

However, competent bodies may accept written telecommunications and electronic messages as valid applications, provided they include all the information which would have appeared on the form, had it been used. Member States may require that a written telecommunication and/or electronic message be followed by an application on a form printed or made out in accordance with Article 17, forwarded or delivered direct to the competent body; in such cases the date on which the written telecommunication or electronic message reached the competent body shall be taken as the day the application is lodged. This requirement shall not affect the validity of applications forwarded by written telecommunication or electronic message.

Where applications for licences or certificates are submitted electronically, the competent authorities of the Member State shall determine how the handwritten signature is to be replaced by another method, which might be based on the use of codes.

2. Applications for licences and certificates may be cancelled only by letter, written telecommunication or electronic message received by the competent body, except in cases of force majeure, by 1 p.m. on the day the application is lodged.

Article 13

1. Section 16 of applications for licences with advance fixing of the refund and of licences themselves shall show the 12-digit code of the product taken from the nomenclature of agricultural products for use with export refunds.

However, where the rate of refund is the same for several codes in the same category, to be determined in accordance with the procedure referred to in Article 195(2) of Regulation (EC) No 1234/2007 and the corresponding Articles of the other Regulations governing market organisations, these codes may be entered together on licence applications and on the licences themselves.

2. Where rates of refund are differentiated according to destination, the country or area of destination, as the case may be, must be indicated in Section 7 both on applications and on the licences themselves.

3. Without prejudice to the first subparagraph of paragraph 1, where a product group as referred to in the second indent of the first subparagraph of Article 4(2) of Regulation (EC) No 800/1999 is defined, the product codes belonging to the group may be entered in Section 22 of licence applications and licences, preceded by the statement, ‘product group referred to in Article 4(2) of Regulation (EC) No 800/1999’.

Article 14

1. Applications containing conditions not provided for in Community rules shall be refused.

2. Without prejudice to Article 1(3), the amount of the security applicable for licences and certificates issued for imports and exports shall be as set out in Annex II. An additional amount may be applicable in case of fixation of an export tax.

No application for a licence or certificate shall be accepted unless an adequate security has been lodged with the competent body not later than 1 p.m. on the day the application is lodged.

3. Where the security on a licence or certificate comes to EUR 100 or less, or where the licence or certificate is drawn up in the name of an intervention agency, no security shall be required.

4. Where Member States avail themselves of the options referred to in Article 5 of Regulation (EEC) No 2220/85, the amount of the security shall be claimed on expiry of the time limit of two months following the date on which the validity of the licence expires.

5. No security shall be required in the case of export licences issued in respect of exports to third countries in connection with non-Community food-aid operations conducted by humanitarian agencies approved for that purpose by the exporting Member State. The Member State shall inform the Commission immediately of such approved humanitarian agencies.

6. Where paragraphs 3, 4 and 5 are applied, the third subparagraph of Article 4(1) shall apply mutatis mutandis.

Article 15

Applications for licences and licences with advance fixing of the refund which are drawn up in connection with a food-aid operation within the meaning of Article 10(4) of the Agreement on Agriculture, concluded as part of the Uruguay Round of multilateral trade negotiations, shall contain in Section 20 at least one of the entries listed in Annex III, Part B, of this Regulation.

The country of destination shall be indicated in Section 7. This licence shall be valid only for exports in the context of such food-aid operations.

Article 16

1. The day an application for a licence or certificate is lodged means the day on which it is received by the competent body, provided it is received not later than 1 p.m., regardless of whether the application is delivered direct to the competent body or forwarded to it by letter or written telecommunication or electronic message.

2. An application for a licence or certificate received by the competent body either on a Saturday, a Sunday or a holiday or after 1 p.m. on a working day shall be deemed to have been lodged on the first working day following the day on which it was in fact received.

3. Where a period of a specified number of days is laid down for the lodging of applications for licences or certificates and where the last day of the period falls on a Saturday, a Sunday or a holiday, the period in question shall end on the first following working day at 1 p.m.

However, such extensions shall not be taken into account for the purpose of calculating the amounts fixed in the licence or certificate or for determining its period of validity.

4. The time limits specified in this Regulation are in Belgian local time.

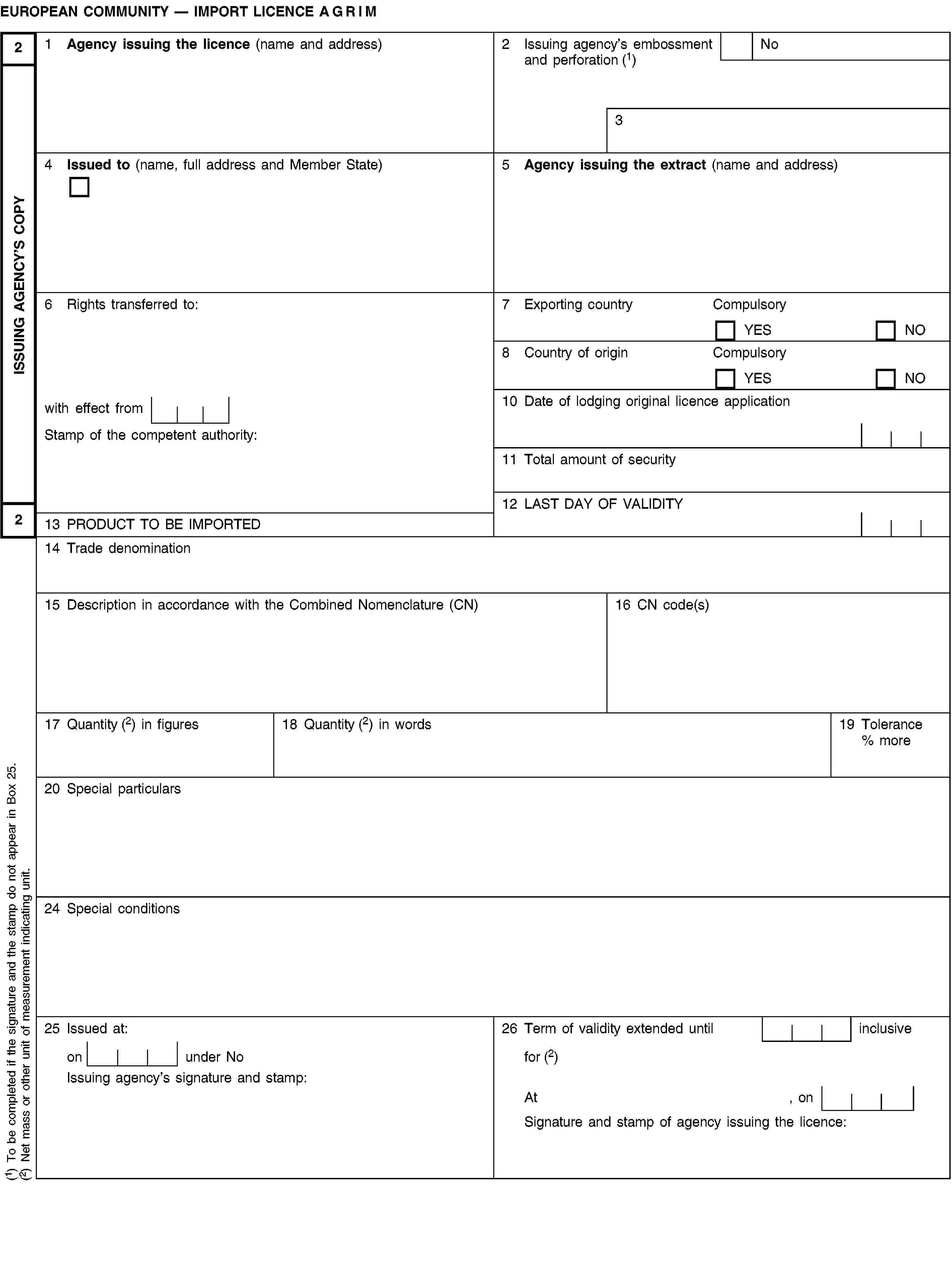

Article 17

1. Without prejudice to the second subparagraph of Article 12(1) and Article 18(1), applications for licences or certificates, licences and certificates and extracts therefrom shall be drawn up on forms conforming to the specimens set out in Annex I. Such forms must be completed following the instructions given therein and in accordance with the specific Community provisions applicable to the relevant product sector.

2. Licence and certificate forms shall be made up in sets containing copy No 1, copy No 2 and the application, together with any extra copies of the licence or certificate, in that order.

However, Member States may require applicants to complete an application form only, instead of the sets provided for in the first subparagraph.

Where, as a result of a Community measure, the quantity for which the licence or certificate is issued may be less than the quantity in respect of which application for a licence or certificate was initially made, the quantity applied for and the amount of the security relating thereto must be entered only on the application form.

Forms for extracts of licences or certificates shall be made up in sets containing copy No 1 and copy No 2, in that order.

3. Forms, including extension pages, shall be printed to white paper free of mechanical pulp, dressed for writing and weighing at least 40 grams per square metre. Their size shall be 210 × 297 mm, the permitted length ranging from 5 mm below the latter figure to 8 mm above; the type space between lines shall be 4,24 mm (one sixth of an inch); the layout of forms shall be followed precisely. Both sides of copy No 1 and the side of the extension pages on which the attributions must appear shall in addition have a printed guilloche pattern background so as to reveal any falsification by mechanical or chemical means. The guilloche background shall be green for forms relating to imports and sepia brown for forms relating to exports.

4. Member States shall be responsible for having the forms printed. The forms may also be printed by printers appointed by the Member State in which they are established. In the latter case, reference to the approval by the Member State must appear on each form. Each form shall bear an indication of the printer's name and address or a mark enabling the printer to be identified and, except for the application form and extension pages, an individual serial number. The number shall be preceded by the following letters according to the Member State issuing the document: ‘AT’ for Austria, ‘BE’ for Belgium, ‘BG’ for Bulgaria, ‘CZ’ for the Czech Republic, ‘CY’ for Cyprus, ‘DE’ for Germany, ‘DK’ for Denmark, ‘EE’ for Estonia, ‘EL’ for Greece, ‘ES’ for Spain, ‘FI’ for Finland, ‘FR’ for France, ‘HU’ for Hungary, ‘IE’ for Ireland, ‘IT’ for Italy, ‘LU’ for Luxembourg, ‘LT’ for Lithuania, ‘LV’ for Latvia, ‘MT’ for Malta, ‘NL’ for the Netherlands, ‘PL’ for Poland, ‘PT’ for Portugal, ‘RO’ for Romania, ‘SE’ for Sweden, ‘SI’ for Slovenia, ‘SK’ for Slovakia and ‘UK’ for the United Kingdom.

At the time of their issue, licences or certificates and extracts may bear an issue number allocated by the issuing body.

5. Application, licences and certificates and extracts shall be completed in typescript or by computerised means. They shall be printed and completed in one of the official languages of the Community, as specified by the competent authorities of the issuing Member State. However, Member States may allow applications only to be hand-written in ink and in block capitals.

6. The stamps of issuing bodies and attributing authorities shall be applied by means of a metal stamp, preferably made of steel. However, an embossing press combined with letters or figures obtained by means of perforation may be substituted for the issuing body's stamp.

7. The competent authorities of the Member States concerned may, where necessary, require licences or certificates and extracts therefrom to be translated into the official language or one of the official languages of that Member State.

Article 18

1. Without prejudice to Article 17, licences and certificates may be issued and used using computerised systems in accordance with detailed rules laid down by the competent authorities. They are known hereinafter as ‘electronic licences and certificates’.

The content of electronic licences and certificates must be identical to that of licences and certificates on paper.

2. Where titular holders or transferees of licences or certificates need to use the electronic form thereof in a Member State which is not linked to the computerised issuing system, they shall request an extract therefrom.

Such extracts shall be issued without delay and at no additional cost on a form as provided for in Article 17.

In Member States linked to the computerised issuing system, such extracts shall be used in the form of the paper extract.

Article 19

1. Where the amounts resulting from the conversion of euro into sums in national currency to be entered on licences or certificates contain three or more decimal places, only the first two shall be given. In such cases, where the third place is five or more the second place shall be rounded up to the next unit, and where the third place is less than five the second place shall remain the same.

2. However, where amounts expressed in euro are converted into pounds sterling, the reference to the first two decimal places in paragraph 1 shall be read as a reference to the first four decimal places. In such cases, where the fifth place is five or more the fourth decimal place shall be rounded up to the next unit and where the fifth place is less than five the fourth place shall remain the same.

Article 20

1. Without prejudice to Article 18 relating to electronic licences and certificates, licences and certificates shall be drawn up in at least two copies, the first of which, called ‘holder's copy’ and marked ‘No 1’, shall be supplied without delay to the applicant and the second, called ‘issuing body's copy’ and marked ‘No 2’, shall be retained by the issuing body.

2. Where a licence or certificate is issued for a quantity less than that for which the application was made, the issuing body shall indicate:

(a) in Sections 17 and 18, the quantity for which the licence or certificate is issued;

(b) in Section 11, the amount of the corresponding security.

The security lodged in respect of the quantity for which a licence or certificate has not been issued shall be released forthwith.

Article 21

1. On application by the titular holder of the licence or certificate or by the transferee, and on presentation of copy No 1 of the document, one or more extracts therefrom may be issued by the issuing body or the agency or agencies designated by each Member State.

Extracts shall be drawn up in at least two copies, the first of which, called ‘holder's copy’ and marked ‘No 1’, shall be supplied or addressed to the applicant and the second, called ‘issuing body's copy’ and marked ‘No 2’, shall be retained by the issuing body.

The body issuing the extract shall, on copy No 1 of the licence or certificate, enter the quantity for which the extract has been issued, increased by the relevant tolerance. The word ‘extract’ shall be entered beside the quantity entered on copy No 1 of the licence or certificate.

2. No further extract may be made of an extract of a licence or certificate.

3. Copy No 1 of an extract which has been used or which is out of date shall be returned by the titular holder to the body which issued the licence or certificate, together with copy No 1 of the licence or certificate from which it derives, so that the body may adjust the entries on copy No 1 of the licence or certificate in the light of those appearing on copy No 1 of the extract.

Article 22

1. For the purpose of determining their period of validity, licences and certificates shall be considered to have been issued on the day on which the application for them was lodged, that day being included in the calculation of such period of validity. However, licences and certificates may not be used until their actual issue.

2. It may be specified that a licence or certificate is to become valid on its actual day of issue, in which case that day shall be included in the calculation of its period of validity.

SECTION 3

Use of licences and certificates

Article 23

1. Copy No 1 of the licence or certificate shall be submitted to the customs office which accepted:

(a) in the case of an import licence, the declaration of release for free circulation;

(b) in the case of an export licence or certificate of advance fixing of the refund, the declaration relating to export.

Without prejudice to Article 2(1)(i) of Regulation (EC) No 800/1999, the customs declaration must be made by the titular holder or, where applicable, the transferee of the licence or certificate, or their representative within the meaning of Article 5(2) of Regulation (EEC) No 2913/92.

2. Copy No 1 of the licence or certificate shall be presented, or held at the disposal of the customs authorities, at the time of acceptance of the declaration referred to in paragraph 1.

3. After the office referred to in paragraph 1 has made the attribution and endorsed copy No 1 of the licence or certificate, it shall be returned to the party concerned. However, Member States may require or allow the party concerned to make the entry on the licence or certificate; in all such cases the entry shall be examined and endorsed by the competent office.

4. Where the quantity imported or exported does not correspond to the quantity entered on the licence or certificate, the entry on the licence or certificate shall be corrected to show the quantity actually imported or exported, within the limits of the quantity in respect of which the licence or certificate has been issued.

Article 24

1. Notwithstanding Article 23, a Member State may allow the licence or certificate to be:

(a) lodged with the issuing body or the authority responsible for payment of the refund;

(b) in cases where Article 18 applies, stored in the database of the issuing body or the authority responsible for payment of the refund.

2. The Member State concerned shall determine the cases in which paragraph 1 shall apply and the conditions to be met by the party concerned in order to benefit from the procedure laid down in that paragraph. In addition, the provisions adopted by that Member State must ensure equal treatment for all certificates issued within the Community.

3. The Member State shall decide which authority is to make the entry on and endorse the licence or certificate.

However, the attribution and its validation and endorsement on the licence or certificate shall also be deemed to have been carried out where:

(a) a document detailing the exported quantities has been generated by computer; this document must be attached to the licence or certificate and filed with it;

(b) the exported quantities have been introduced in an official electronic database of the Member State concerned and there is a link between this information and the electronic certificate; Member States may choose to archive this information by using paper versions of the electronic documents.

The date of the entry shall be considered as the date of acceptance of the declaration referred to in Article 23(1).

4. At the time of acceptance of the customs declaration, the party concerned must indicate on the declaration document that this Article applies and quote the reference number of licence or certificate to be used.

5. In the case of a licence or certificate authorising import or export, the goods may be released only if the competent authority has informed the customs office referred to in Article 23(1) that the licence or certificate indicated on the customs document is valid for the product concerned and has been attributed.

6. Where the products exported are not subject to the production of an export licence but the export refund has been fixed by means of an export licence fixing in advance the export refund, if, as the result of an error, the document used during export to prove eligibility for a refund makes no mention of this Article and/or the number of the licence or certificate, or if the information is incorrect, the operation may be regularised provided the following conditions are met:

(a) an export licence with advance fixing of the refund for the product concerned, valid on the day of acceptance of the declaration, is in the possession of the authority responsible for payment of the refund;

(b) sufficient proof is held at the disposal of the competent authorities to enable them to establish a link between the quantity exported and the licence or certificate covering the export.

Article 25

1. Entries made on licences, certificates or extracts may not be altered after their issue.

2. Where the accuracy of entries on the licence, certificate or extract is in doubt, such licence, certificate or extract shall, on the initiative of the party concerned or of the competent authorities of the Member State concerned, be returned to the issuing body.

If the issuing body considers a correction to be required, it shall withdraw the extract or the licence or certificate as well as any extracts previously issued and shall issue without delay either a corrected extract or a corrected licence or certificate and the corrected extracts corresponding thereto. On such further documents, which shall include the entry ‘licence (or certificate) corrected on …’ or ‘extract corrected on …’, any former entries shall be reproduced on each copy.

Where the issuing body does not consider it necessary to correct the licence, certificate or extract, it shall enter thereon the endorsement ‘verified on … in accordance with Article 25 of Regulation (EC) No 376/2008’ and apply its stamp.

Article 26

1. At the request of the issuing body, the titular holder must return to it the licence or certificate and the extracts therefrom.

2. Where a disputed document is returned or held in accordance with this Article or Article 25, the competent national authorities shall on request give the party concerned a receipt.

Article 27

Where the space reserved for entries on licences, certificates or extracts therefrom is insufficient, the authorities making the entries may attach thereto one or more extension pages containing spaces for entries as shown on the back of copy No 1 of the said licences, certificates or extracts. These authorities shall so place their stamp that one half is on the licence, certificate or extract therefrom and the other on the extension page, and for each further extension page issued a further stamp shall be placed in like manner across such page and the preceding page.

Article 28

1. Where there is doubt concerning the authenticity of a licence, certificate or extract, or entries or endorsements thereon, the competent national authorities shall return the questionable document, or a photocopy thereof, to the authorities concerned for checking.

Documents may also be returned by way of random check; in such case only a photocopy of the document shall be returned.

2. Where a questionable document is returned in accordance with paragraph 1, the competent national authorities shall on request give a receipt to the party concerned.

Article 29

1. Where necessary for the proper application of this Regulation, the competent authorities of the Member States shall exchange information on licences, certificates and extracts therefrom and on irregularities and infringements concerning them.

2. Member States shall inform the Commission as soon as they have knowledge of irregularities and infringements in regard to this Regulation.

3. Member States shall communicate to the Commission the names and addresses of the bodies which issue licences or certificates and extracts therefrom, collect export levies and pay export refunds. The Commission shall publish this information in the Official Journal of the European Union.

4. Member States shall also forward to the Commission impressions of the official stamps and, where appropriate, of the embossing presses used by authorities empowered to act. The Commission shall immediately inform the other Member States thereof.

SECTION 4

Release of securities

Article 30

As regards the period of validity of licences and certificates:

(a) the obligation to import shall be considered to have been fulfilled and the right to import under the licence or certificate shall be considered to have been exercised on the day the declaration referred to in Article 23(1)(a) is accepted, subject always to the product concerned being actually put into free circulation;

(b) the obligation to export shall be considered to have been fulfilled and the right to export under the licence or certificate shall be considered to have been exercised on the day when the declaration referred to in Article 23(1)(b) is accepted.

Article 31

Fulfilment of a primary requirement shall be demonstrated by production of proof:

(a) for imports, of acceptance of the declaration referred to in Article 23(1)(a) relating to the product concerned;

(b) for exports, of acceptance of the declaration referred to in Article 23(1)(b) relating to the product concerned; in addition:

(i) in the case of either export or supplies treated as exports within the meaning of Article 36 of Regulation (EC) No 800/1999, proof shall be required that the product has, within 60 days from the day of acceptance of the export, declaration, unless prevented by force majeure, either, in the case of supplies treated as exports, reached its destination or, in other cases, left the Community's customs territory. For the purposes of this Regulation, deliveries of any products intended solely for consumption on board drilling or extraction platforms, including workpoints providing support services for such operations, situated within the area of the European continental shelf, or within the area of the continental shelf of the non-European part of the Community, but beyond a three-mile zone starting form the baseline used to determine the width of a Member State's territorial sea, shall be deemed to have left the customs territory of the Community;

(ii) in cases where products have been placed under the victualling warehouse procedure provided for in Article 40 of Regulation (EC) No 800/1999, evidence shall be required that the product has, within 30 days of acceptance of the declaration of its placement under that procedure and unless prevented force majeure, been placed in a victualling warehouse.

However, when the 60-day deadline referred to in point (b)(i) of the first paragraph or the 30-day deadline referred to in point (b)(ii) of the first paragraph is passed, the security shall be released in accordance with Article 23(2) of Regulation (EEC) No 2220/85.

The security shall not be forfeited under the second paragraph in the case of quantities for which the refund is reduced in accordance with Article 50(1) of Regulation (EC) No 800/1999 for failure to meet the deadlines referred to in Article 7(1) and Article 40(1) of that Regulation.

Article 32

1. The proof required under Article 31 shall be furnished as follows:

(a) in the cases referred to in Article 31(a), by production of copy No 1 of the licence or certificate and, where applicable, of copy No 1 of the extract or extracts from the licence or certificate, endorsed as provided for in Article 23 or Article 24;

(b) in the cases referred to in Article 31(b), and subject to paragraph 2 of this Article, by production of copy No 1 of the licence or certificate and, where applicable, of copy No 1 of the extract or extracts of the licence or certificate, endorsed as provided for in Article 23 or Article 24.

2. In addition, in the case of export from the Community or of supplies to a destination within the meaning of Article 36 of Regulation (EC) No 800/1999 or the placing of products under the arrangements provided for in Article 40 of that Regulation, additional proof shall be required.

Such additional proof shall be furnished as follows:

(a) where the following operations take place within the Member State in question, such additional proof shall be left to the choice of the Member State in which:

(i) the licence or certificate is issued;

(ii) the declaration referred to in Article 23(1)(b) of this Regulation is accepted; and

(iii) the product:

— left the Community's customs territory. For the purposes of this Regulation deliveries of any products intended solely for consumption on board drilling or extraction platforms, including workpoints providing support services for such operations, situated within the area of the European continental shelf, or within the area of the continental shelf of the non-European part of the Community, but beyond a three-mile zone starting from the baseline used to determine the width of a Member State's territorial sea, shall be deemed to have left the Community's customs territory,

— is delivered to one of the destinations listed in Article 36 of Regulation (EC) No 800/1999, or

— is placed in a victualling warehouse under Article 40 of Regulation (EC) No 800/1999;

(b) in all other cases, the additional proof shall be furnished by:

(i) production of the control copy T5 or copies referred to in Article 912a of Regulation (EEC) No 2454/93 or a certified copy or photocopy of such control copy T5 or copies; or

(ii) an attestation given by the agency responsible for paying the refund that the conditions of Article 31(b) of this Regulation have been fulfilled; or

(iii) equivalent proof as provided for in paragraph 4 of this Article.

Where the sole purpose of the T5 control copy is the release of the security, the T5 control copy shall contain in Section 106 one of the entries listed in Annex III, Part C, to this Regulation.

However, if an extract of a licence or certificate, a replacement licence or certificate or a replacement extract is used, that entry shall also state the number of the original licence or certificate and the name and address of the issuing body.

The documents referred to in points (b)(i) and (ii) shall be sent to the issuing body through official channels.

3. Where, after acceptance of the export declaration as referred to in Article 23(1)(b), a product is placed under one of the simplified arrangements provided for in Articles 412 to 442a of Regulation (EEC) No 2454/93 or in Title X, Chapter I, of Appendix I to the Convention of 20 May 1987 on a common transit procedure for carriage to a station-of-destination or delivery to a consignee outside the Community's customs territory, the T5 control copy required under paragraph 2(b) of this Article shall be sent through official channels to the issuing body. One of the entries listed in Annex III, Part D, to this Regulation shall be entered in section ‘J’ of the T5 control copy under the heading ‘Remarks’.

In the case referred to in the first subparagraph, the office of departure may permit the contract of carriage to be amended so that carriage ends within the Community only if it is established:

(a) that, where the security has already been released, such security has been renewed; or

(b) that the necessary steps have been taken by the authorities concerned to ensure that the security is not released.

Where the security has been released without the product having been exported, Member States shall take appropriate action.

4. Where the T5 control copy referred to in paragraph 2(b) cannot be produced within three months following its issue owing to circumstances beyond the control of the party concerned, the latter may apply to the competent body for other documents to be accepted as equivalent, stating the grounds for such application and furnishing supporting documents.

The supporting documents to be submitted with the application shall be those specified in the second subparagraph of Article 49(3) of Regulation (EC) No 800/1999.

Article 33

For the purposes of Article 37 of Regulation (EC) No 800/1999, the last day of the month shall be taken to be the day of acceptance of the declaration referred to in Article 23(1)(b) of this Regulation.

Article 34

1. On application by the titular holder, Member States may release the security by instalments in proportion to the quantities of products for which proof as referred to in Article 31 has been produced, provided that proof has been produced that a quantity equal to at least 5 % of that indicated in the licence or certificate has been imported or exported.

2. Subject to the application of Articles 39, 40 or 47, where the obligation to import or export has not been met the security shall be forfeit in an amount equal to the difference between:

(a) 95 % of the quantity indicated in the licence or certificate, and

(b) the quantity actually imported or exported.

If the licence is issued on a headage basis, the result of the 95 % calculation referred to above shall, where applicable, be rounded off to the next lesser whole number of head.

However, if the quantity imported or exported amounts to less than 5 % of the quantity indicated in the licence or certificate, the whole of the security shall be forfeit.

In addition, if the total amount of the security which would be forfeit comes to EUR 100 or less for a given licence or certificate, the Member State concerned shall release the whole of the security.

Where all or part of the security has been incorrectly released, it shall be lodged anew in proportion to the quantities concerned with the body that issued the licence or certificate.

However, an instruction for the released security to be lodged anew may only be given within four years following its release, provided the operator acted in good faith.

3. With regard to export licences with advance fixing of the refund:

(a) where the licence or an extract from the licence is returned to the issuing body within the initial two thirds of its term of validity, the corresponding amount of security to be forfeited shall be reduced by 40 %. For this purpose, any part of a day counts as a whole day;

(b) where the licence or an extract from the licence is returned to the issuing body within a period corresponding to the last third of its term of validity or during the month following the expiry date, the corresponding amount of security to be forfeited shall be reduced by 25 %.

The first subparagraph shall apply only to licences and extracts thereof returned to the issuing body during the GATT year for which the licences have been issued and provided that they are returned more than 30 days before the end of that year.

The first subparagraph shall apply unless it is temporarily suspended. Where the refund for one or more products is increased, the Commission, acting in accordance with the procedure referred to in Article 195(2) of Regulation (EC) No 1234/2007 or the corresponding Articles of the other Regulations on the common organisation of the markets, may suspend the application of the first subparagraph for licences applied for before the refund is increased and not returned to the issuing body until the day before the increase.

Licences lodged under Article 24 of this Regulation shall be deemed to have been returned to the issuing body on the date on which the latter receives an application from the licence holder for the security to be released.

4. The proof referred to in Article 32(1) must be produced within two months of the expiry of the licence or certificate, unless this is impossible for reasons of force majeure.

5. Proof of departure from the customs territory or of delivery to a destination within the meaning of Article 36 of Regulation (EC) No 800/1999 or of the placing of products under the arrangements provided for in Article 40 of that Regulation, as referred to in Article 32(2) of this Regulation, must be produced within 12 months of the expiry of the licence or certificate, unless this is impossible for reasons of force majeure.

6. The amount to be forfeited in respect of quantities for which proof concerning the export licence with advance fixing of the refund has not been provided within the time limit set under paragraph 4 shall be reduced:

(a) by 90 % if the proof is provided in the third month following the date of expiry of the licence or certificate;

(b) by 50 % if the proof is provided in the fourth month following the date of expiry of the licence or certificate;

(c) by 30 % if the proof is provided in the fifth month following the date of expiry of the licence or certificate;

(d) by 20 % if the proof is provided in the sixth month following the date of expiry of the licence or certificate.

7. In cases other than those referred to in paragraph 6, the amount to be forfeited in respect of quantities for which proof is not provided within the time limit set in paragraphs 4 and 5, but is provided at the latest in the 24th month following the date of expiry of the licence or certificate, shall be 15 % of the amount which would have been forfeited completely if the products had not been imported or exported. Where, for a given product, there are licences or certificates with different levels of security, the lowest rate applicable to imports or exports shall be used to calculate the amount to be forfeited.

8. The competent authorities may waive the obligation to provide the proof referred to in paragraphs 4 and 5 if they are already in possession of the necessary information.

9. Where a Community provision specifies, by reference to this paragraph, that an obligation is fulfilled by producing proof that the product has reached a specified destination, that proof must be produced in accordance with Article 16 of Regulation (EC) No 800/1999, failing which the security lodged for the licence or certificate shall be forfeited in proportion to the quantity concerned.

That proof shall also be produced within 12 months of the expiry of the licence or certificate. However, where the documents required under Article 16 of Regulation (EC) No 800/1999 cannot be submitted within the prescribed period although the exporter has acted with all due diligence to obtain them within that period, he may be granted an extension of time for the submission of those documents.

10. In the case of import licences for which a Community provision makes this paragraph applicable, paragraphs 4 to 8 notwithstanding, the proof of utilisation of the licence as referred to in Article 32(1)(a) must be produced within 45 days of expiry of the licence, unless this is impossible for reasons of force majeure.

Where the proof of utilisation of licences as specified in Article 32(1)(a) is provided after the prescribed time limit:

(a) where the licence has been used, taking account of the lower tolerance, within the term of validity, 15 % of the total amount of the security as indicated in the licence shall be forfeit by way of a flat-rate deduction;

(b) where the licence has been partly used within the term of validity, the security shall be forfeit in an amount equal to:

(i) the difference between 95 % of the quantity indicated in the licence and the quantity actually imported, plus

(ii) 15 % of the security remaining after the flat-rate deduction made under point (i), plus

(iii) 3 % of the amount of the security remaining after the deduction made under points (i) and (ii), for each day by which the time limit for provision of proof is exceeded.

SECTION 5

Loss of licences and certificates

Article 35

1. This Article shall apply where an export refund greater than zero has been fixed in advance and the relevant licence or certificate or extract therefrom is lost.

2. The body issuing the licence or certificate shall issue at the request of the holder, or of the transferee in cases where the licence, certificate or extract has been transferred, a replacement licence or certificate or a replacement extract, subject to the second subparagraph.

The competent authorities in the Member States may refuse to issue a replacement licence or certificate or a replacement extract if:

(a) the character of the applicant is not such as to guarantee that the aims of this Article will be respected; in each Member State this power shall be exercised in accordance with the principles currently applicable in that State governing non-discrimination between applicants and the freedom of trade and industry;

(b) the applicant has failed to show that he has taken reasonable precautions to prevent the loss of the licence, certificate or extract.

3. A refund determined in the context of a tendering procedure shall be considered a refund fixed in advance.

4. A replacement licence, certificate or extract shall contain the information and entries appearing on the document which it replaces. It shall be issued for a quantity of goods which, with the addition of the tolerance margin, is equal to the available quantity as shown on the lost document. Applicants shall specify that quantity in writing. Where information held by the issuing body shows that the quantity indicated by the applicant is too high, it shall be reduced accordingly without prejudice to the second subparagraph of paragraph 2.

One of the entries listed in Annex III, Part E, underlined in red, shall be entered in Section 22 of replacement licences, certificates or extracts.

5. Where the replacement licence or certificate or replacement extract is lost, no further replacement licence or certificate or extract shall be issued.

6. The issue of a replacement licence, certificate or extract shall be subject to the lodging of a security. The amount of this security shall be calculated by multiplying:

(a) the rate of the refund fixed in advance or, where applicable, the highest rate of refund for the destinations covered, plus 20 %; by

(b) the quantity for which the replacement licence, certificate or extract is to be issued, plus the tolerance margin.

The amount by which the security is increased shall not be less than EUR 3 per 100 kilograms net weight. The security shall be lodged with the body which issued the original licence or certificate.

7. Where the quantity of products exported under a licence or certificate and the replacement licence or certificate, or under an extract and the replacement extract, is greater than that which could have been exported under the original licence, certificate or extract, the security referred to in paragraph 6 corresponding to the excess quantity shall be forfeit, the refund being treated thereby as recovered.

8. In addition, in cases where paragraph 7 applies and where an export levy applies on the date of acceptance of the declaration referred to in Article 23(1)(b) for the excess quantity, the export levy applicable on that day shall be collected.

The excess quantity:

(a) shall be determined in accordance with paragraph 7;

(b) shall be that for which the most recent declaration was accepted under the original licence or certificate, an extract of the original licence or certificate, a replacement licence or certificate, or a replacement extract. In cases where the quantity of the last export is less than the excess quantity, the export or exports immediately preceding shall be taken into account until the depletion of the excess quantity.

Article 3(1) of Commission Regulation (EEC) No 120/89 ( 13 ) shall not apply to the cases covered in this paragraph.

9. Insofar as the security referred to in paragraph 6 has not become forfeit by virtue of paragraph 7, it shall be released 15 months after expiry of the period of validity of the licence or certificate.

10. Where the lost licence, certificate or extract is found, it may not be used and must be returned to the body which issued the replacement licence, certificate or extract. If in such a case the quantity available shown on the original licence, certificate or extract is equal to or larger than the quantity for which the replacement licence, certificate or extract was issued, plus the tolerance margin, the security referred to in paragraph 6 shall be released immediately.

However, if the available quantity is larger, the party concerned may request issue of an extract for a quantity, including the tolerance margin, equalling the remaining available quantity.

11. The competent authorities of the Member States shall provide each other with the information needed to apply this Article.

Where the authorities provide this information by means of a control copy T5 as referred to in Article 912a of Regulation (EEC) No 2454/93 and issued for the purpose of obtaining proof of departure from the Community's customs territory, the number of the original licence or certificate shall be inserted in Section 105 of the control copy T5. Where an extract of a licence or certificate, a replacement licence or certificate, or a replacement extract is used, the number of the original licence or certificate shall be inserted in section 106 of the control copy T5.

Article 36

1. With the exception of the cases referred to in paragraph 2, the competent authority shall refuse to issue a replacement licence or certificate or replacement extract where the issue of licences or certificates for the product in question is suspended or where the issue of licences or certificates is effected within the framework of a quantitative quota.

2. Where the holder or transferee of an import or export licence or advance fixing certificate is able to prove to the satisfaction of the competent authority both that the licence or certificate or an extract therefrom has not been used wholly or in part and that it can no longer be used, particularly because it has been totally or partially destroyed, the body which issued the original licence or certificate shall issue a replacement licence, certificate or extract for a quantity of goods, including the tolerance margin where necessary, equalling the quantity remaining available. In this case the first sentence of Article 35(4) shall apply.

Article 37

Member States shall at quarterly intervals inform the Commission of:

(a) the number of replacement licences, certificates or extracts issued during the previous quarter:

(i) by virtue of Article 35;

(ii) by virtue of Article 36;

(b) the nature and quantity of the goods concerned and the rate of any export refund or export levy fixed in advance.

The Commission shall forward that information to the other Member States.

Article 38

1. Where a licence or certificate or extract therefrom is lost, and the lost document has been used wholly or in part, issuing bodies may, exceptionally, supply the party concerned with a duplicate thereof, drawn up and endorsed in the same way as the original document and clearly marked ‘duplicate’ on each copy.

2. Duplicates may not be used to carry out import or export operations.

3. Duplicates shall be presented to the offices where the declaration referred to in Article 23 was accepted under the lost licence, certificate or extract, or to another competent authority designated by the Member State in which the offices are situated.

4. The competent authority shall make entries on and endorse the duplicate.

5. The duplicate, thus annotated, shall replace the lost copy No 1 of the licence, certificate or extract in providing proof for the purpose or releasing the security.

SECTION 6

Force majeure

Article 39

1. Where, as a result of an event which the operator regards as constituting force majeure, import or export cannot be effected during the period of validity of the licence or certificate, the titular holder shall apply to the competent body of the Member State of issue either for the period of validity of the licence or certificate to be extended or for the licence or certificate to be cancelled. Operators shall provide proof of the circumstance which they consider to constitute force majeure within six months of the expiry of the period of validity of the licence or certificate.

Where they are unable to produce proof within that time limit despite having acted with all due diligence to obtain and forward it, they may be granted further time.

2. Requests to extend the period of validity of a licence or certificate received more than 30 days after the expiry of such period of validity shall be refused.

3. Where the circumstances relied on as constituting force majeure relate to the exporting country and/or the country of origin, in the case of imports, or to the importing country, in the case of exports, such circumstances may be accepted as such only if the issuing body or another official agency in the same Member State was notified as to the countries concerned in good time and in writing.

Notification of the exporting country, country of origin or importing country shall be considered as having been made in good time if the circumstances relied upon as constituting force majeure could not have been foreseen by the applicant at the time of notification.

4. The competent body referred to in paragraph 1 shall decide if the circumstances relied upon constitute force majeure.

Article 40