EUR-Lex Access to European Union law

This document is an excerpt from the EUR-Lex website

Document 01992R2719-20070101

Commission Regulation (EEC) No 2719/92 of 11 September 1992 on the accompanying administrative document for the movement under duty-suspension arrangements of products subject to excise duty

Consolidated text: Commission Regulation (EEC) No 2719/92 of 11 September 1992 on the accompanying administrative document for the movement under duty-suspension arrangements of products subject to excise duty

Commission Regulation (EEC) No 2719/92 of 11 September 1992 on the accompanying administrative document for the movement under duty-suspension arrangements of products subject to excise duty

No longer in force

No longer in force

1992R2719 — EN — 01.01.2007 — 003.001

This document is meant purely as a documentation tool and the institutions do not assume any liability for its contents

|

COMMISSION REGULATION (EEC) No 2719/92 of 11 September 1992 (OJ L 276, 19.9.1992, p.1) |

Amended by:

|

|

|

Official Journal |

||

|

No |

page |

date |

||

|

L 198 |

5 |

7.8.1993 |

||

|

L 362 |

1 |

20.12.2006 |

||

Amended by:

|

L 236 |

33 |

23.9.2003 |

COMMISSION REGULATION (EEC) No 2719/92

of 11 September 1992

on the accompanying administrative document for the movement under duty-suspension arrangements of products subject to excise duty

THE COMMISSION OF THE EUROPEAN COMMUNITIES,

Having regard to the Treaty establishing the European Economic Community,

Having regard to Council Directive 92/12/EEC of 25 February 1992 on the general arrangements for products subject to excise duty and on the holding, movement and monitoring of such products ( 1 ), and in particular Articles 18 (1) and 19 (1) thereof,

Having regard to the opinion of the Committee on Excise Duties,

Whereas the movement of products subject to excise duty between tax warehouses and between a tax warehouse and a registered or non-registered operator takes place under duty-suspension arrangements; whereas it is necessary to establish in a binding manner the form and content of the accompanying document which might be either an administrative or a commercial document;

Whereas it is also necessary to determine who shall pass on the fourth copy of the accompanying document intended for the competent authorities to those authorities and how this should take place; whereas it is desirable and in line with practice to place this obligation on the consignee in the country of destination, since only he is in a position to make available to his competent authorities this document, which is important for the purposes of the tax supervision, without the danger of it being misdirected; whereas the fourth copy too should carry a certification of receipt, if this is requested by the competent authorities of the Member State of destination, which indicates to those authorities that the goods were received in the consignee's tax warehouse,

HAS ADOPTED THIS REGULATION:

Article 1

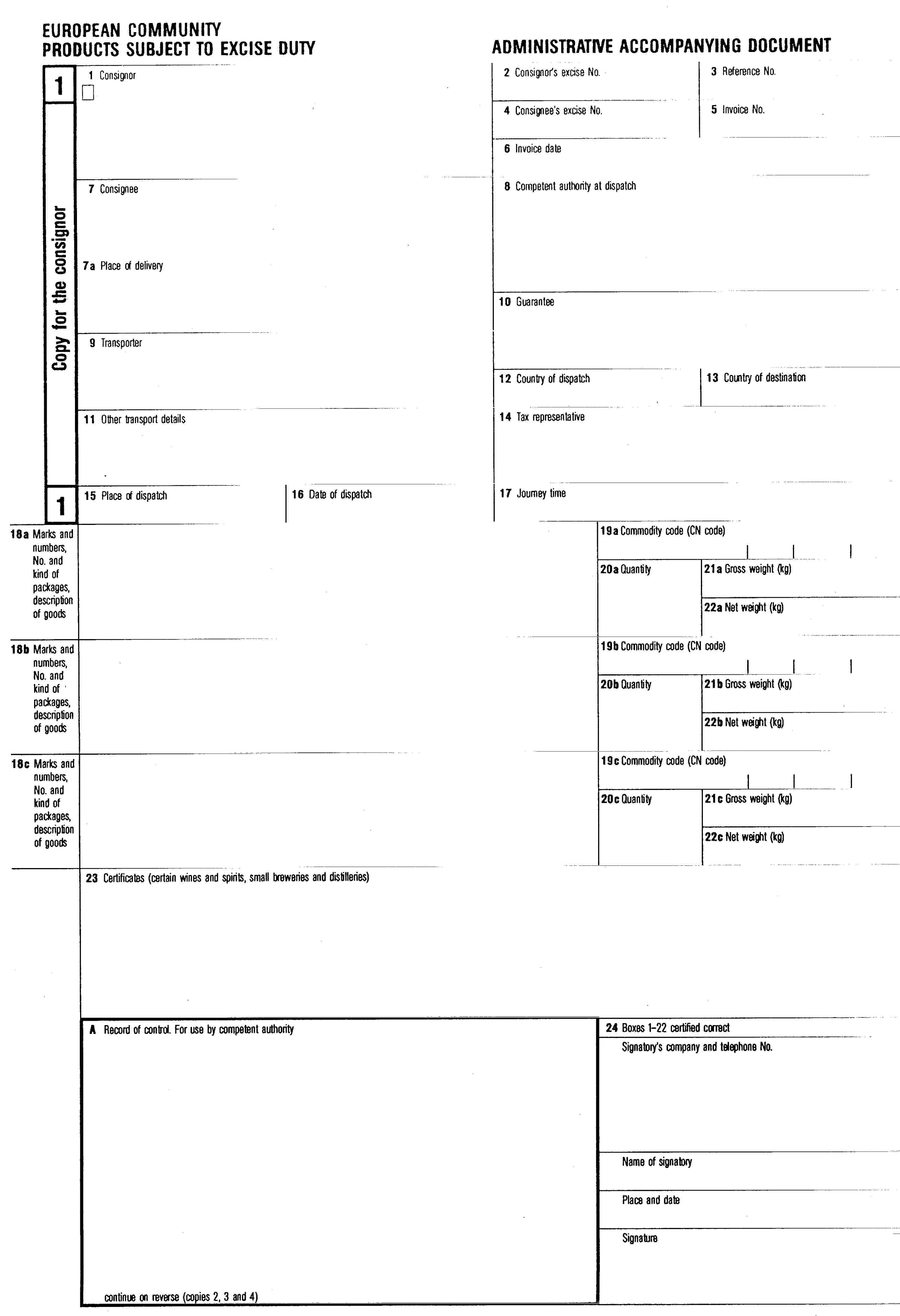

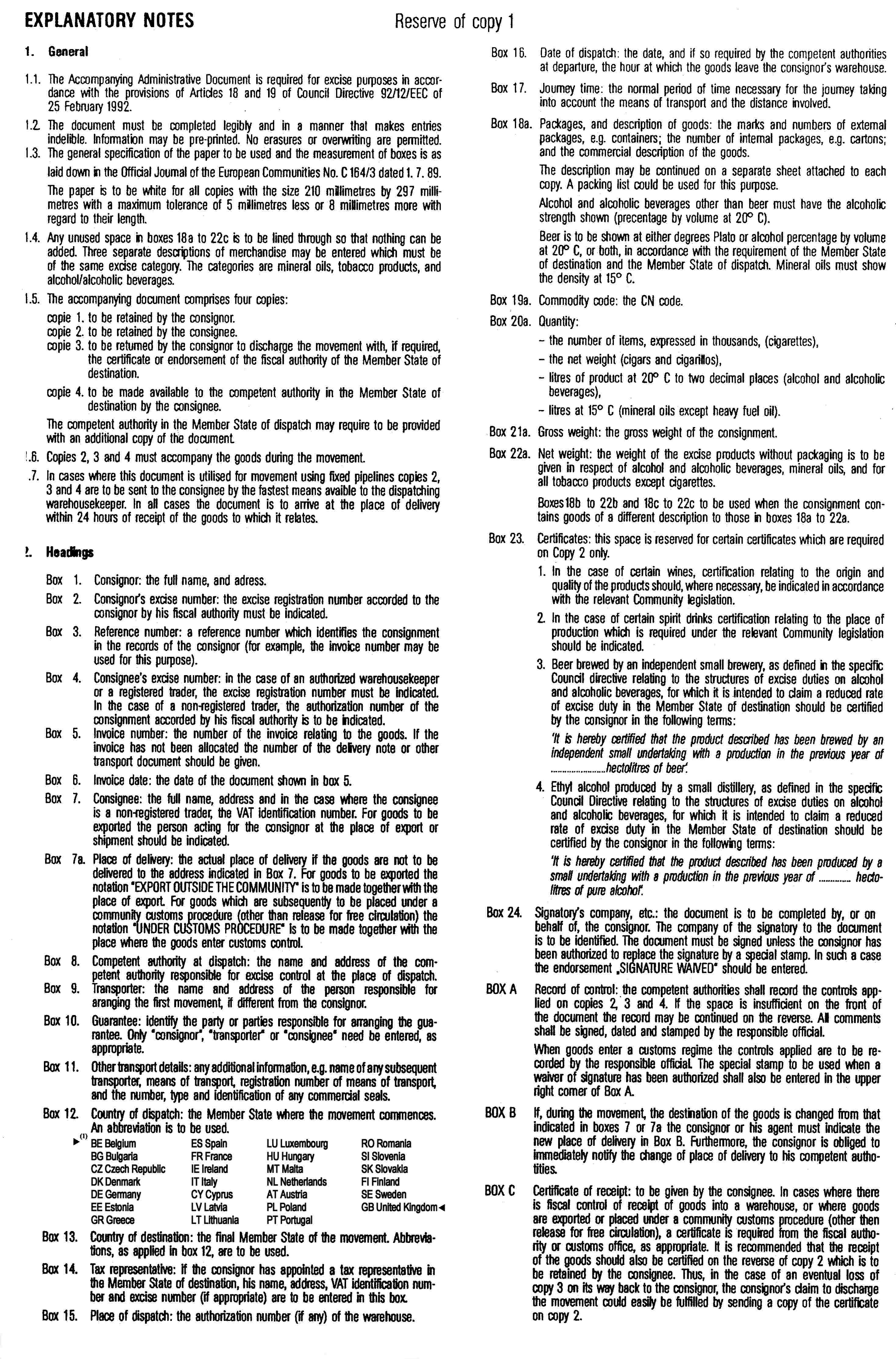

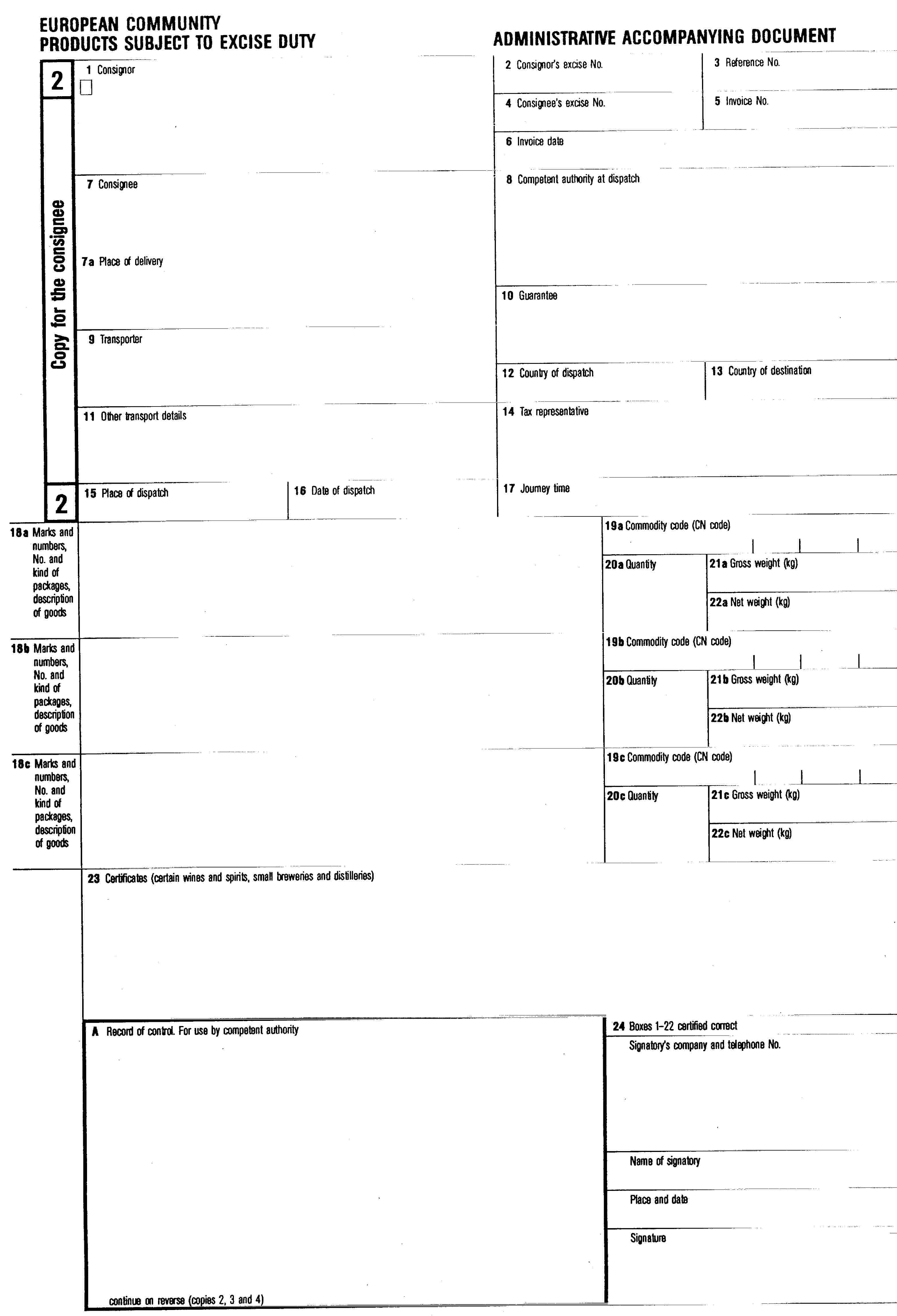

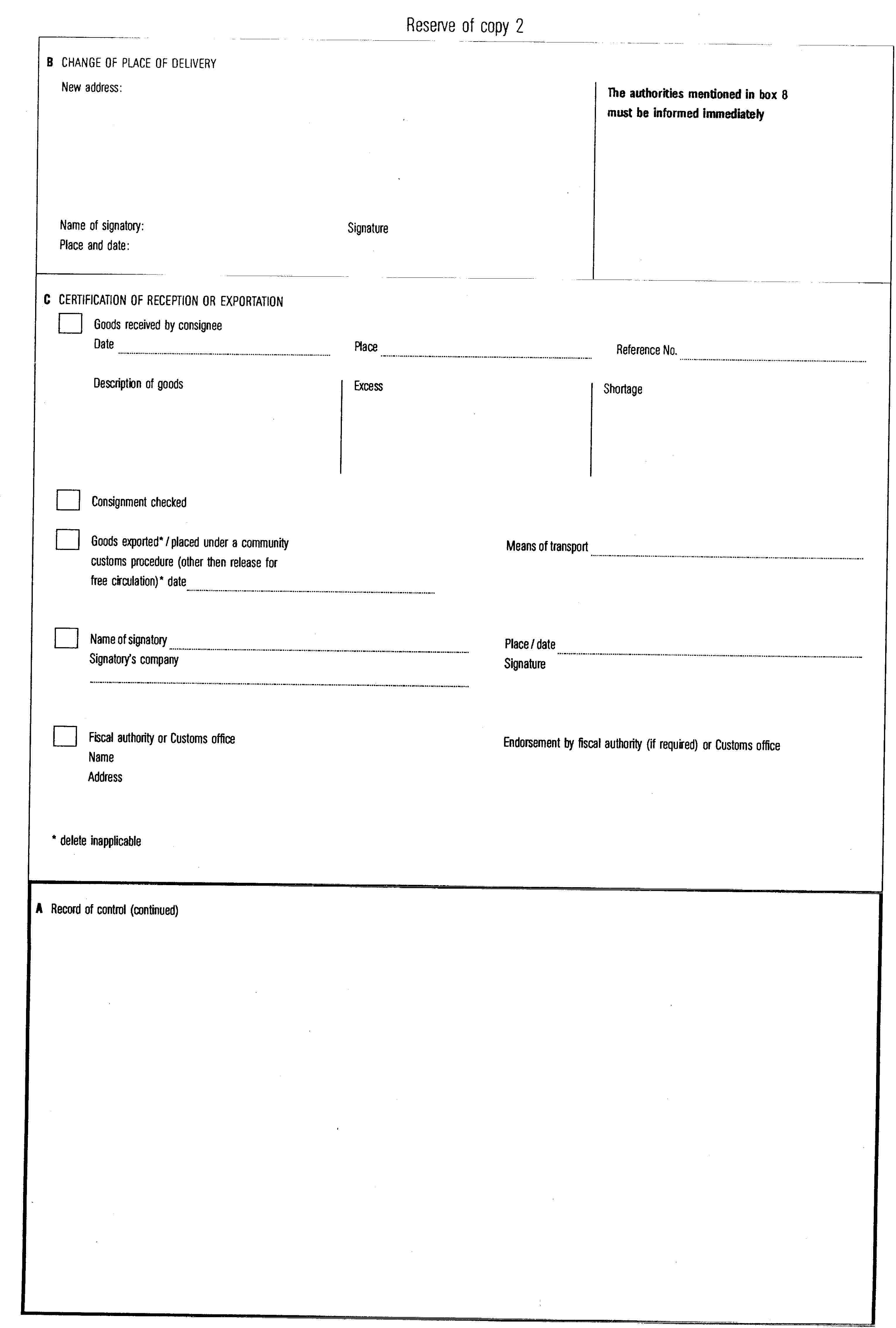

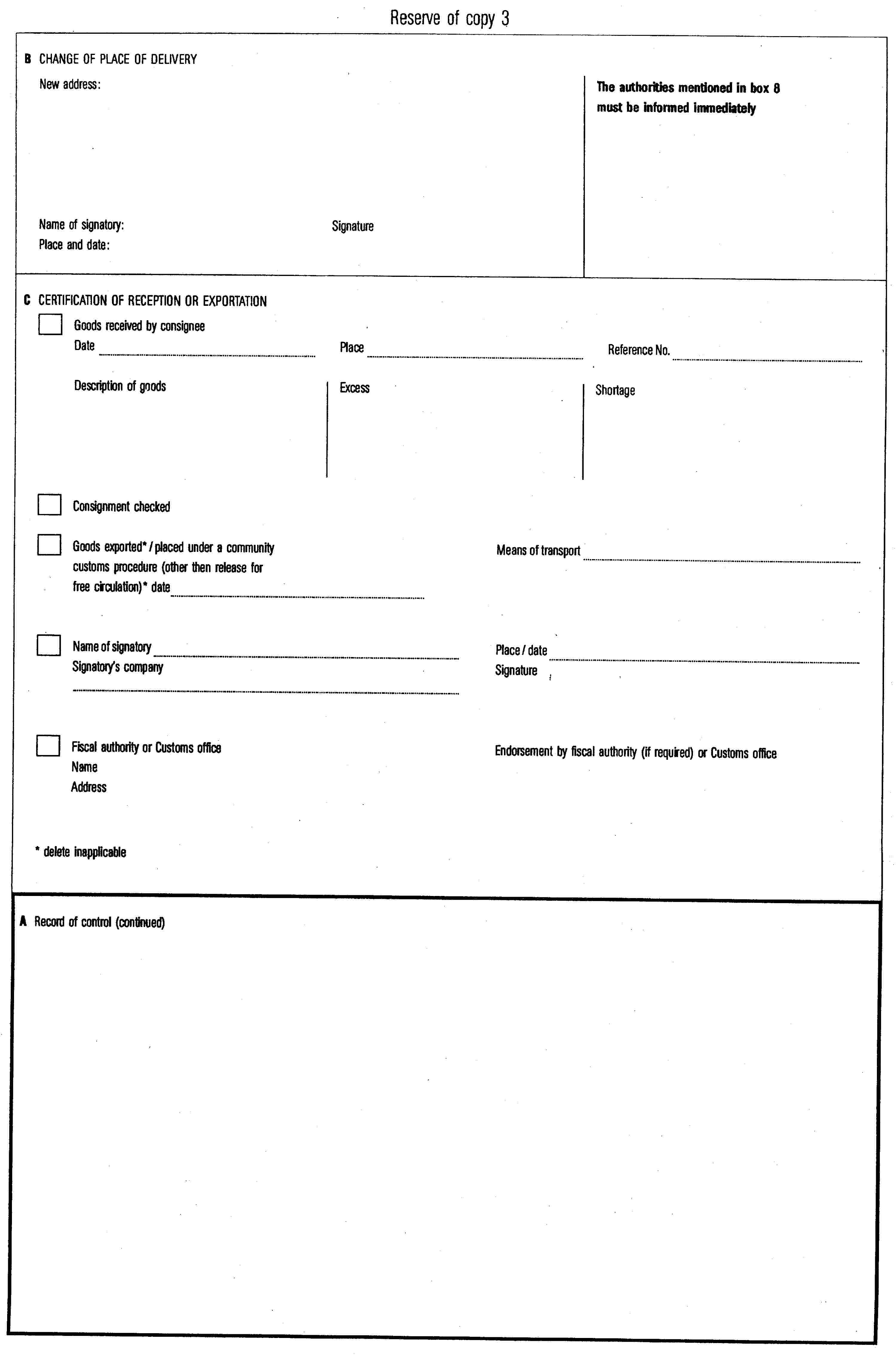

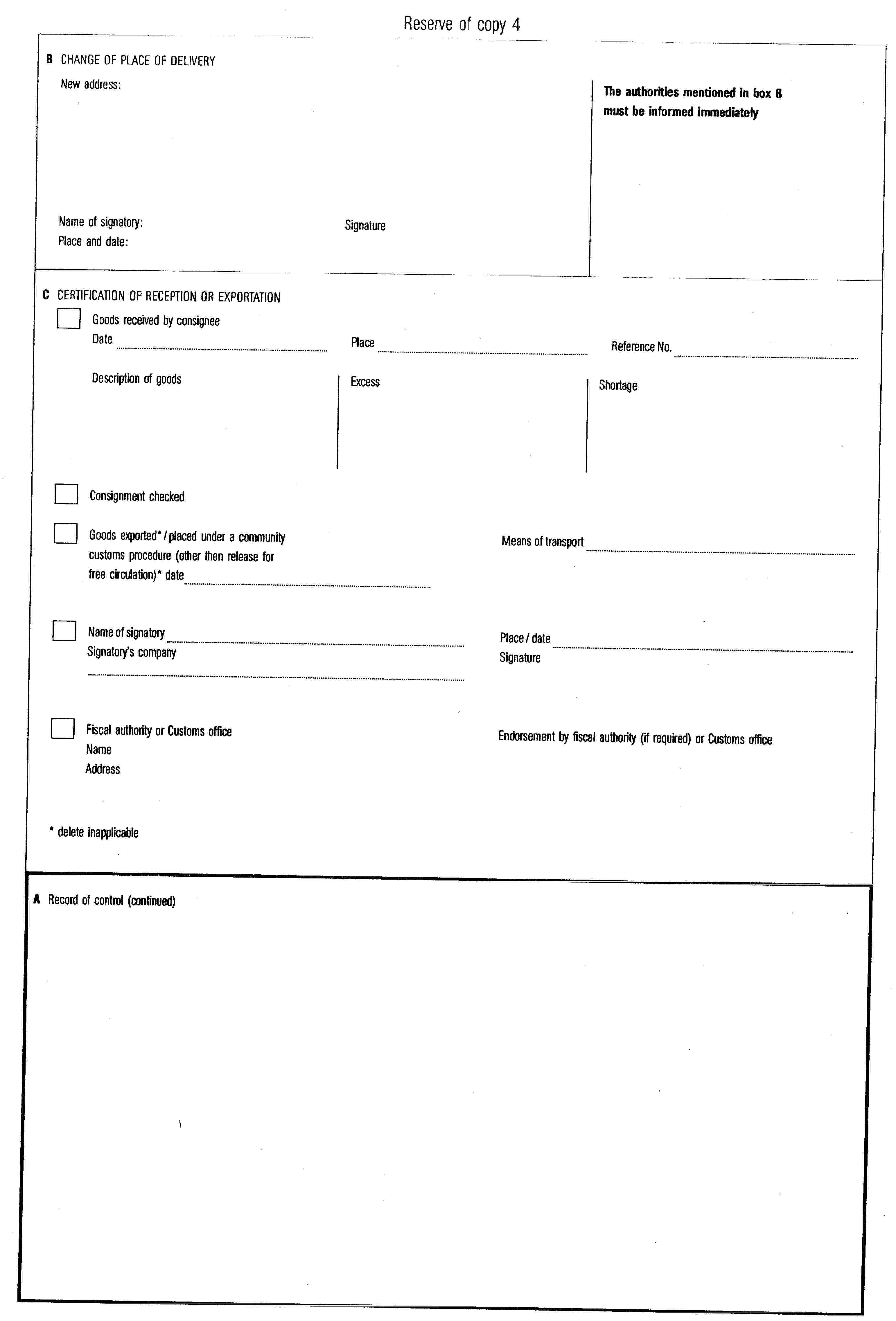

The document shown in Annex I shall be used as the administrative document accompanying the movement under duty-suspension arrangements of products subject to excise duty within the meaning of Article 3 (1) of Directive 92/12/EEC. The instructions concerning completion of the document and the procedures for its use are shown on the reverses of copy 1 of this document.

Article 2

1. A commercial document may replace the administrative document provided it contains the same information required to be shown in the administrative document.

2. A commercial document which does not have the same layout as the administrative document must contain the same elements of information required by the administrative document, and the nature of the information items must be identified by a number corresponding to the relative box number on the administrative document. ►M1 The document shall be marked conspicuously with the following indication: ‘Commercial accompanying document for the movement of products subject to excise duty under duty suspension’. ◄

Article 2a

1. In cases where the accompanying document is drawn up by an electronic or automatic dataprocessing system, the competent authorities may authorize the consignor not to sign the document but to replace the signature by the special stamp shown in Annex II. Such authorization shall be subject to the condition that the consignor has previously given a written undertaking to those authorities that he will be liable for all risks inherent in intra-Community movements of products subject to excise duty under duty-suspension arrangements involving consignments which travel under cover of an accompanying document bearing such special stamp.

2. Accompanying documents drawn up in accordance with paragraph 1 shall contain in that part of Box 24 which is reserved for the consignor's signature, one of the following indications:

— Освободен от подпис

— Dispensa de firma

— Podpis prominut

— Fritaget for underskrift

— Freistellung von der Unterschriftsleistung

— Allkirjanõudest loobutud

— Δεν απαιτείται υπογραφή

— Signature waived

— Dispense de signature

— Dispensa dalla firma

— Derīgs bez paraksta

— Parašo nereikalaujama

— Aláírás alól mentesítve

— Firma mhux meħtieġa

— Van ondertekening vrijgesteld

— Z pominięciem podpisu

— Dispensa de assinatura

— Dispensă de semnătură

— Podpis sa nevyžaduje

— Opustitev podpisa.

3. The special stamp referred to in paragraph 1 shall be placed in the upper right corner of Box A of the administrative accompanying document or, plainly visible, in the corresponding Box of a commercial document. The consignor may also be authorized to pre-print the special stamp.

Article 3

Where products subject to excise duty are moved in fixed pipelines the Member States involved may, by mutual agreement, authorize the type and quantity of goods moved between the consignor tax warehouse and the consignee tax warehouse to be reported by computerized procedures which will replace the accompanying document. Such arrangement should be sufficient to ensure that all the data necessary for inventory control and for collection of duty are provided.

Article 4

The consignee, if required by the competent authorities of the Member State of destination, shall annotate the fourth copy of the accompanying document with the same certification of receipt as on the third copy (copy for return) and shall make it available to the competent authorities to which he reports in accordance with their instructions.

Article 5

This Regulation shall enter into force on 1 January 1993.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

ANNEX

ANNEX II

( 1 ) OJ No L 76, 23.3.1992, p. 1.