EUR-Lex Access to European Union law

This document is an excerpt from the EUR-Lex website

Document 52012XC0214(03)

Notice of initiation of a partial interim review of the anti-dumping measures applicable to imports of hand pallet trucks and their essential parts originating in the People's Republic of China

Notice of initiation of a partial interim review of the anti-dumping measures applicable to imports of hand pallet trucks and their essential parts originating in the People's Republic of China

Notice of initiation of a partial interim review of the anti-dumping measures applicable to imports of hand pallet trucks and their essential parts originating in the People's Republic of China

OJ C 41, 14.2.2012, p. 14–25

(BG, ES, CS, DA, DE, ET, EL, EN, FR, IT, LV, LT, HU, MT, NL, PL, PT, RO, SK, SL, FI, SV)

- Date of document:

- 14/02/2012; Date of publication

- Author:

- European Commission

- Form:

- Announcements

- Legal basis:

-

- 32009R1225 - A11P3

- Link

- Link

- Link

- Select all documents mentioning this document

- Link

- EUROVOC descriptor:

- Subject matter:

- Directory code:

-

- 11.60.40.20 External relations / Commercial policy / Trade protection / Anti-dumping measures

|

14.2.2012 |

EN |

Official Journal of the European Union |

C 41/14 |

Notice of initiation of a partial interim review of the anti-dumping measures applicable to imports of hand pallet trucks and their essential parts originating in the People's Republic of China

2012/C 41/06

The European Commission (‘the Commission’) has decided on its own initiative to initiate an interim review investigation of the anti-dumping measures applicable to imports of hand pallet trucks and their essential parts originating in the People’s Republic of China pursuant to Article 11(3) of Council Regulation (EC) No 1225/2009 of 30 November 2009 on protection against dumped imports from countries not members of the European Community (1) (‘the basic Regulation’). The review is limited in scope to the examination of dumping.

1. Product

The product subject to this review investigation is hand pallet trucks and their essential parts, i.e. chassis and hydraulics, originating in the People's Republic of China, currently falling within CN codes ex 8427 90 00 and ex 8431 20 00. Hand pallet trucks are defined as trucks with wheels supporting lifting fork arms for handling pallets, designed to be manually pushed, pulled and steered, on smooth, level, hard surfaces, by a pedestrian operator using an articulated tiller. The hand pallet trucks are only designed to raise a load, by pumping the tiller, to a height sufficient for transporting and do not have any other additional functions or uses such as for example (i) to move and to lift the loads in order to place them higher or assist in storage of loads (highlifters); (ii) to stack one pallet above the other (stackers); (iii) to lift the load to a working level (scissorlifts); or (iv) to lift and to weigh the loads (weighing trucks) (‘the product under review’).

2. Existing measures

By Council Regulation (EC) No 1174/2005 (2) the Council imposed a definitive anti-dumping duty on imports of hand pallet trucks and their essential parts originating in the People's Republic of China.

By Council Regulation (EC) No 684/2008 (3) the Council clarified the original product scope.

Following an anti-circumvention investigation in accordance with Article 13 of the basic Regulation, this duty was extended by Council Regulation (EC) No 499/2009 (4) to imports of the same product consigned from Thailand, whether declared as originating in Thailand or not.

Following an expiry review investigation pursuant to Article 11(2) of the basic Regulation, the Council, by Council Implementing Regulation (EU) No 1008/2011 (5) decided that the above mentioned measures should be maintained.

3. Grounds for the review

The Commission has at its disposal sufficient prima facie evidence that, as far as dumping is concerned, the circumstances on the basis of which the existing measures were imposed have changed and that these changes are of a lasting nature.

Based on a comparison of Chinese export prices to the EU with a normal value established on the basis of prices paid or payable in the EU, it is seen that dumping has increased. Chinese imports of hand pallet trucks and their essential parts continue to enter the EU market at dumped prices. More specifically, there are indications that Chinese exporting producers can afford to export the product concerned at low prices because of price distortions in the steel market in the People's Republic of China due to State interference. This development, amongst others, calls into question the validity of the MET granted to one Chinese exporting producer.

In addition, the information at the disposal of the Commission indicates that the capacity of the Chinese exporting producers of hand pallet trucks and of their essential parts is much bigger than China's domestic demand and that the EU market continues to be a very attractive destination for their exports. Indeed, on the basis of Eurostat statistics, it appears that imports from China have replaced almost entirely imports from other third countries in recent years.

Based on the above, it is considered that the circumstances with regard to the dumping as determined in the original investigation have significantly changed and that these changes are of a lasting nature. Consequently, the continued imposition of measures at the existing level appears to be no longer appropriate to offset the effects of injurious dumping.

4. Procedure

The Commission hereby initiates a review investigation in accordance with Article 11(3) of the basic Regulation having determined, after consulting the Advisory Committee, that there is sufficient evidence to justify the initiation of an interim review investigation.

The review investigation will assess whether the continued imposition of the measure is no longer necessary to offset dumping or whether the existing measure is not, or is no longer, sufficient to counteract the dumping which is causing injury.

The investigation will assess whether there is a need for the continuation, removal or amendment of the existing measures.

Procedure regarding dumping

Exporting producers (6) of the product under review from the country concerned, including those that did not cooperate in the investigations which led to the amendment and maintaining of the measures in force, are invited to participate in the Commission review investigation.

4.1. Investigating exporting producers

4.1.1. Procedure for selecting exporting producers to be investigated in the country concerned

(a) Sampling

In view of the potentially large number of exporting producers in the country concerned involved in this proceeding and in order to complete the review investigation within the statutory time-limits, the Commission may limit the exporting producers to be investigated to a reasonable number by selecting a sample (this process is also referred to as ‘sampling’). The sampling will be carried out in accordance with Article 17 of the basic Regulation.

In order to enable the Commission to decide whether sampling is necessary, and if so, to select a sample, all exporting producers, or representatives acting on their behalf, are hereby requested to make themselves known to the Commission. These parties have to do so within 15 days of the date of publication of this notice in the Official Journal of the European Union, unless otherwise specified, by providing the Commission with the following information on their company or companies:

|

— |

name, address, e-mail address, telephone and fax numbers, and contact person, |

|

— |

the turnover in local currency and the volume in pieces of the product under review sold for export to the Union during the period 1st January 2011 to 31st December 2011 for each of the 27 Member States (7) separately and in total, |

|

— |

the turnover in local currency and the volume in pieces of the product under review sold on the domestic market during the period 1st January 2011 to 31st December 2011, |

|

— |

the turnover in local currency and the volume in pieces for the product under review sold to other third countries during the period 1st January 2011 to 31st December 2011, |

|

— |

the precise activities of the company worldwide with regard to the product under review, |

|

— |

the names and the precise activities of all related companies (8) involved in the production and/or sales (export and/or domestic) of the product under review, |

|

— |

any other relevant information that would assist the Commission in the selection of the sample. |

The exporting producers should also indicate whether, in the event that they are not selected to be in the sample, they would like to receive a questionnaire and other claim forms in order to fill it/these in and thus claim an individual dumping margin in accordance with section (b) below.

By providing the above information, the company agrees to its possible inclusion in the sample. If the company is selected to be part of the sample, this will imply completing a questionnaire and accepting a visit at its premises in order to verify its response (‘on-spot verification’). If the company indicates that it does not agree to its possible inclusion in the sample, it will be deemed not to have cooperated in the review investigation. The Commission's findings for non-cooperating exporting producers are based on facts available and the result may be less favourable to that party than if it had cooperated.

In order to obtain the information it deems necessary for the selection of the sample of exporting producers, the Commission will also contact the authorities of the country concerned and may contact any known associations of exporting producers.

All interested parties wishing to submit any other relevant information regarding the selection of the sample, excluding the information requested above, must do so within 21 days of the publication of this notice in the Official Journal of the European Union, unless otherwise specified.

If a sample is necessary, the exporting producers may be selected based on the largest representative volume of exports to the Union which can reasonably be investigated within the time available. All known exporting producers, the authorities of the country concerned and associations of exporting producers will be notified by the Commission, via the authorities of the country concerned if appropriate, of the companies selected to be in the sample.

All exporting producers selected to be in the sample will have to submit a completed questionnaire within 37 days from the date of notification of the sample selection, unless otherwise specified.

The completed questionnaire will contain information on, inter alia, the structure of the exporting producer's company(ies), the activities of the company(ies) in relation to the product under review, the cost of production, the sales of the product under review on the domestic market of the country concerned and the sales of the product under review to the Union.

Companies that had agreed to their possible inclusion in the sample but were not selected to be in the sample shall be considered to be cooperating (‘non-sampled cooperating exporting producers’). Without prejudice to section (b) below, the anti-dumping duty that may be applied to imports from the non-sampled cooperating exporting producers will not exceed the weighted average margin of dumping established for the exporting producers in the sample (9).

(b) Individual dumping margin for companies not included in the sample

Non-sampled cooperating exporting producers may request, pursuant to Article 17(3) of the basic Regulation that the Commission establish their individual dumping margins (‘individual dumping margin’). The exporting producers wishing to claim an individual dumping margin must request a questionnaire and other claim forms in accordance with section (a) above and return them duly completed within the deadlines specified in the following sentence and in section 4.2.2 below. The completed questionnaire reply must be submitted within 37 days of the date of the notification of the sample selection, unless otherwise specified. It must be underlined that, in order for the Commission to be able to establish individual dumping margins for those exporting producers in the non-market economy country, it must be proven that they fulfil the criteria for being granted market economy treatment (‘MET’) or at least individual treatment (‘IT’) as specified in section 4.2.2. below.

However, exporting producers claiming an individual dumping margin should be aware that the Commission may nonetheless decide not to determine their individual dumping margin if, for instance, the number of exporting producers is so large that such determination would be unduly burdensome and would prevent the timely completion of the review investigation.

4.2. Additional procedure with regard to exporting producers in the non-market economy country concerned

4.2.1. Selection of a Market Economy Third Country

Subject to the provisions of section 4.2.2 below, in accordance with Article 2(7)(a) of the basic Regulation, in the case of imports from the country concerned normal value shall be determined on the basis of the price or constructed value in a market economy third country. For this purpose the Commission shall select an appropriate market economy third country. The Commission intends to contact producers in other market economy third countries such as Brazil for the purpose of establishing normal value in respect of the People's Republic of China. Should cooperation not be forthcoming, the Commission envisages using the prices actually paid or payable in the Union again for this purpose. Interested parties are hereby invited to comment on the appropriateness of this choice within 10 days of the date of publication of this notice in the Official Journal of the European Union.

4.2.2. Treatment of exporting producers in the non-market economy country concerned

In accordance with Article 2(7)(b) of the basic Regulation, individual exporting producers in the country concerned, which consider that market economy conditions prevail for them in respect of the manufacture and sale of the product under review, may submit a properly substantiated claim to this effect (‘MET claim’). Market economy treatment (‘MET’) will be granted if the assessment of the MET claim shows that the criteria laid down in Article 2(7)(c) of the basic Regulation (10) are fulfilled. The dumping margin of the exporting producers granted MET will be calculated, to the extent possible and without prejudice to the use of facts available pursuant to Article 18 of the basic Regulation, by using their own normal value and export prices in accordance with Article 2(7)(b) of the basic Regulation.

Individual exporting producers in the country concerned may also, or as an alternative, claim individual treatment (‘IT’). To be granted IT these exporting producers must provide evidence that they fulfil the criteria set out in Article 9(5) of the basic Regulation (11). The dumping margin of the exporting producers granted IT will be calculated on the basis of their own export prices. The normal value for exporting producers granted IT will be based on the values established for the market economy third country selected as outlined above.

Attention is also drawn to section 9 of this notice.

(a) Market economy treatment (MET)

The Commission will send MET claim forms to all the exporting producers in the country concerned selected to be in the sample and to non-sampled cooperating exporting producers that wish to apply for an individual dumping margin, to any known association of exporting producers, as well as to the authorities of the country concerned.

All exporting producers claiming MET should submit a completed MET claim form within 21 days of the date of the notification of the sample selection or of the decision not to select a sample, unless otherwise specified.

(b) Individual treatment (IT)

To apply for IT, exporting producers in the country concerned selected to be in the sample and non-sampled cooperating exporting producers that wish to apply for an individual dumping margin should submit the MET claim form with the sections relevant for IT duly completed within 21 days of the date of the notification of sample selection, unless otherwise specified.

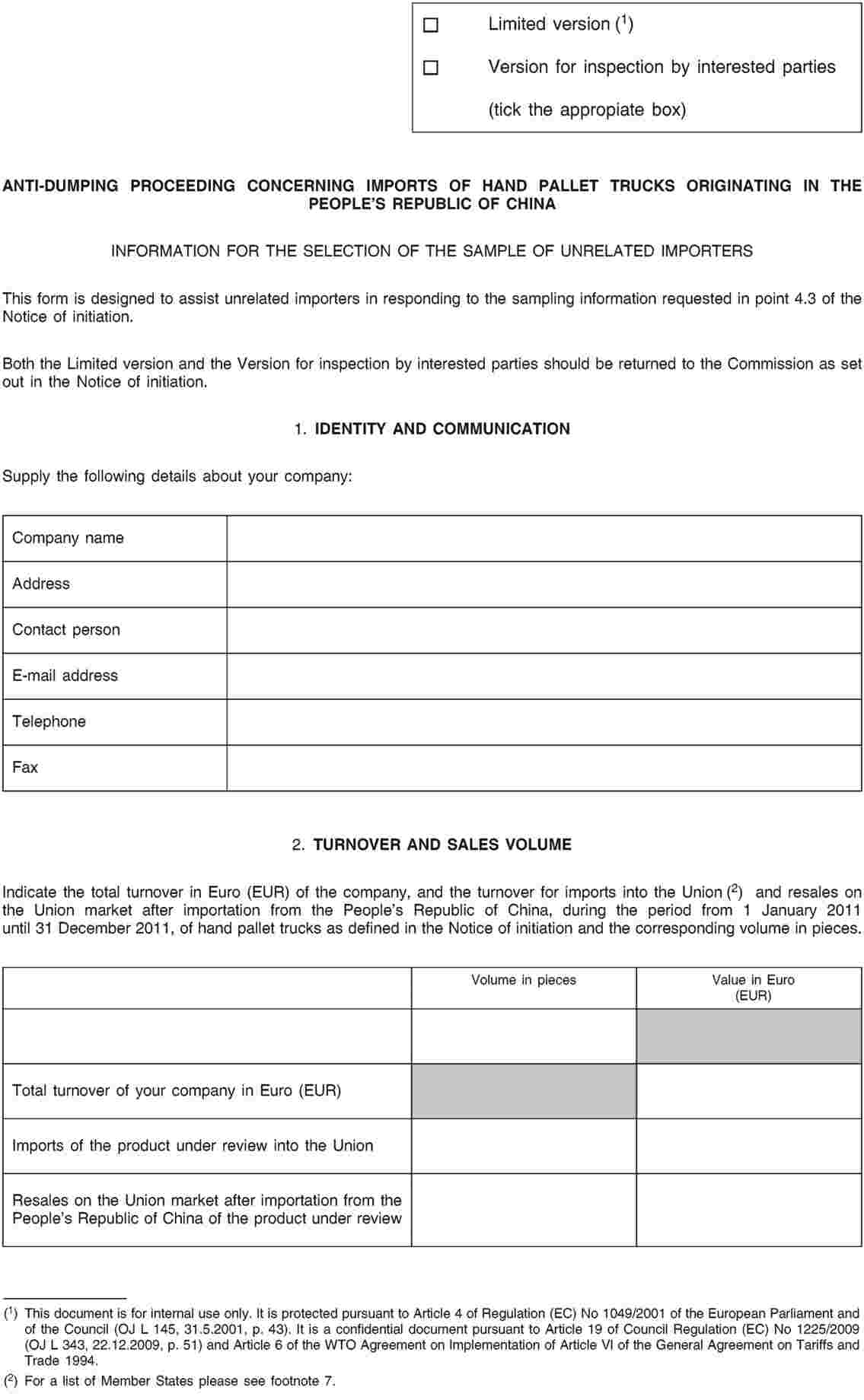

4.3. Investigating unrelated importers (12) (13)

Unrelated importers of the product under review from the country concerned to the Union, including those that did not cooperate in the investigations which led to the amendment and maintaining of the measures in force, are invited to participate in the Commission review investigation.

In view of the potentially large number of unrelated importers involved in this proceeding and in order to complete the review investigation within the statutory time-limits, the Commission may limit to a reasonable number the unrelated importers that will be investigated by selecting a sample (this process is also referred to as ‘sampling’). The sampling will be carried out in accordance with Article 17 of the basic Regulation.

In order to enable the Commission to decide whether sampling is necessary and, if so, to select a sample, all unrelated importers, or representatives acting on their behalf, are hereby requested to make themselves known to the Commission. These parties should do so within 15 days of the date of publication of this notice in the Official Journal of the European Union, unless otherwise specified, by providing the Commission with the following information on their company or companies:

|

— |

name, address, e-mail address, telephone and fax numbers and contact person, |

|

— |

the precise activities of the company with regard to the product under review, |

|

— |

total turnover during the period 1st January 2011 to 31st December 2011, |

|

— |

the volume in pieces and value in EUR of imports into and resales made on the Union market during the period 1st January 2011 to 31st December 2011 of the imported product under review originating in the country concerned, |

|

— |

the names and the precise activities of all related companies (14) involved in the production and/or sales of the product under review, |

|

— |

any other relevant information that would assist the Commission in the selection of the sample. |

By providing the above information, the company agrees to its possible inclusion in the sample. If the company is selected to be part of the sample, this will imply completing a questionnaire and accepting a visit at its premises in order to verify its response (‘on-spot verification’). If the company indicates that it does not agree to its possible inclusion in the sample, it will be deemed not to have cooperated in the review investigation. The Commission's findings for non-cooperating importers are based on the facts available and the result may be less favourable to that party than if it had cooperated.

In order to obtain the information it deems necessary for the selection of the sample of unrelated importers, the Commission may also contact any known associations of importers.

All interested parties wishing to submit any other relevant information regarding the selection of the sample, excluding the information requested above, must do so within 21 days of the publication of this notice in the Official Journal of the European Union, unless otherwise specified.

If a sample is necessary, the importers may be selected based on the largest representative volume of sales of the product under review in the Union which can reasonably be investigated within the time available. All known unrelated importers and associations of importers will be notified by the Commission of the companies selected to be in the sample.

In order to obtain the information it deems necessary for its investigation, the Commission will send questionnaires to the sampled unrelated importers and to any known association of importers. These parties must submit a completed questionnaire within 37 days from the date of the notification of the sample selection, unless otherwise specified. The completed questionnaire will contain information on, inter alia, the structure of their company(ies), the activities of the company(ies) in relation to the product under review and on the sales of the product under review.

4.4. Other written submissions

Subject to the provisions of this notice, all interested parties are hereby invited to make their views known, submit information and provide supporting evidence. Unless otherwise specified, this information and supporting evidence should reach the Commission within 37 days of the date of publication of this notice in the Official Journal of the European Union.

4.5. Possibility to be heard by the Commission investigation services

All interested parties may request to be heard by the Commission investigation services. Any request to be heard should be made in writing and should specify the reasons for the request. For hearings on issues pertaining to the initial stage of the review investigation the request must be submitted within 15 days of the date of publication of this notice in the Official Journal of the European Union. Thereafter, a request to be heard should be submitted within the specific deadlines set by the Commission in its communication with the parties.

4.6. Instructions for making written submissions and sending completed questionnaires and correspondence

All written submissions, including the information requested in this notice, completed questionnaires and correspondence provided by interested parties for which confidential treatment is requested shall be labelled ‘Limited (15)’.

Interested parties providing ‘Limited’ information are required to furnish non-confidential summaries of it pursuant to Article 19(2) of the basic Regulation, which will be labelled ‘For inspection by interested parties’. These summaries should be sufficiently detailed to permit a reasonable understanding of the substance of the information submitted in confidence. If an interested party providing confidential information does not furnish a non-confidential summary of it in the requested format and quality, such confidential information may be disregarded.

Interested parties are required to make all submissions and requests in electronic format (the non-confidential submissions via e-mail, the confidential ones on CD-R/DVD), and must indicate the name, address, e-mail address, telephone and fax numbers of the interested party. However, any Powers of Attorney, signed certifications, and any updates thereof, accompanying market economy treatment and/or individual treatment claim forms or questionnaire replies shall be submitted on paper, i.e. by post or by hand, at the address below. Pursuant to Article 18(2) of the basic Regulation if an interested party cannot provide its submissions and requests in electronic format, it must immediately inform the Commission. For further information concerning correspondence with the Commission, interested parties may consult the relevant web page on the website of Directorate-General for Trade: http://ec.europa.eu/trade/tackling-unfair-trade/trade-defence

Commission address for correspondence:

|

European Commission |

|

Directorate-General for Trade |

|

Directorate H |

|

Office: N105 04/092 |

|

1049 Bruxelles/Brussel |

|

BELGIQUE/BELGIË |

|

Fax +32 22979618 |

|

E-mail: TRADE-11.3-HAND-PALLET-TRUCKS@ec.europa.eu |

5. Non-cooperation

In cases where any interested party refuses access to or does not provide the necessary information within the time-limits, or significantly impedes the investigation, provisional or final findings, affirmative or negative, may be made on the basis of facts available, in accordance with Article 18 of the basic Regulation.

Where it is found that any interested party has supplied false or misleading information, the information may be disregarded and use may be made of facts available.

If an interested party does not cooperate or cooperates only partially and findings are therefore based on facts available in accordance with Article 18 of the basic Regulation, the result may be less favourable to that party than if it had cooperated.

6. Hearing Officer

Interested parties may request the intervention of the Hearing Officer of Directorate-General for Trade. The Hearing Officer acts as an interface between the interested parties and the Commission investigation services. The Hearing Officer reviews requests for access to the file, disputes on the confidentiality of documents, requests for extension of time-limits and requests by third parties to be heard. The Hearing Officer may organise a hearing with an individual interested party and mediate to ensure that the interested parties' rights of defence are being fully exercised.

A request for a hearing with the Hearing Officer should be made in writing and should specify the reasons for the request. For hearings on issues pertaining to the initial stage of the review investigation the request must be submitted within 15 days of the date of publication of this notice in the Official Journal of the European Union. Thereafter, a request to be heard must be submitted within specific deadlines set by the Commission in its communication with the parties.

The Hearing Officer will also provide opportunities for a hearing involving parties to take place which would allow different views to be presented and rebuttal arguments offered on issues pertaining, among others, to dumping, injury, causal link and Union interest.

For further information and contact details interested parties may consult the Hearing Officer's web pages on DG Trade's website: http://ec.europa.eu/trade/tackling-unfair-trade/hearing-officer/index_en.htm

7. Schedule of the review investigation

The review investigation will be concluded, according to Article 11(5) of the basic Regulation within 15 months of the date of the publication of this notice in the Official Journal of the European Union.

8. Processing of personal data

Any personal data collected in this review investigation will be treated in accordance with Regulation (EC) No 45/2001 of the European Parliament and of the Council on the protection of individuals with regard to the processing of personal data by the Community institutions and bodies and on the free movement of such data (16).

9. Important information for exporting producers in non-market economy countries: implications of the WTO Appellate Body Report EC-Antidumping measures on fasteners (WT/DS397) on the way in which the Commission will conduct this investigation

The Commission encourages all exporting producers from the People's Republic of China which is considered to be a non-market economy country in view of the provisions of Article 2(7) of the basic Regulation, to make themselves known within 15 days of the date of publication of this notice in the Official Journal of the European Union, if they are interested in cooperating and obtaining an individual anti-dumping duty, even if they consider that they do not comply with the criteria for obtaining IT. The Commission draws their attention to the following (17).

In EC-Certain Iron or Steel fasteners from China (WT/DS397), the WTO Appellate Body found, inter alia, that Article 9(5) of the basic Regulation is inconsistent with certain provisions of the WTO Anti-Dumping Agreement and with Article XVI:4 of the WTO Agreement.

Article 2 of Council Regulation (EC) No 1515/2001 of 23 July 2001 on the measures that may be taken by the Community following a report adopted by the WTO Dispute Settlement Body concerning anti-dumping and anti-subsidy matters (18) (‘the enabling Regulation’) provides that the Council of the European Union may, inter alia, amend Union measures taken pursuant to the basic Regulation in order to take into account the legal interpretations made in a report adopted by the WTO Dispute Settlement Body with regard to a non-disputed measure, if it considers this appropriate.

Therefore, should the review investigation which is initiated by the present Notice of initiation result in the amendment of the anti-dumping measures in force, in the Commission's view the aforementioned Article 2 would constitute a legal basis for complying with the legal interpretations developed by the WTO Appellate Body in the above mentioned dispute. This would imply, in more practical terms, that if an exporting producer came forward within the deadline set out above and fully co-operated by furnishing all relevant information but did not apply for IT, or applied but was found not to fulfil the criteria, the aforementioned Article 2 of the enabling Regulation could serve, in duly justified cases, as a legal basis for awarding that exporting producer an individual duty. In examining this question, the Commission will take account of the reasoning of the WTO Appellate Body in the above-mentioned dispute, and in particular of the elements discussed in paragraphs 371-384 of its report.

Operators obtaining an individual duty on the basis of this part of this Notice of initiation should be aware that the findings may result in an increase in the duty compared to the one that would apply if no individual duty had been granted.

(1) OJ L 343, 22.12.2009, p. 51.

(2) OJ L 189, 21.7.2005, p. 1.

(3) OJ L 192, 19.7.2008, p. 1.

(4) OJ L 151, 16.6.2009, p. 1.

(5) OJ L 268, 13.10.2011, p. 1.

(6) An exporting producer is any company in the country concerned which produces and exports the product under review to the Union market, either directly or via third party, including any of its related companies involved in the production, domestic sales or exports of the product concerned.

(7) The 27 Member States of the European Union are: Belgium, Bulgaria, Czech Republic, Denmark, Germany, Estonia, Ireland, Greece, Spain, France, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Hungary, Malta, Netherlands, Austria, Poland, Portugal, Romania, Slovenia, Slovakia, Finland, Sweden, and United Kingdom.

(8) In accordance with Article 143 of Commission Regulation (EEC) No 2454/93 concerning the implementation of the Community Customs Code, persons shall be deemed to be related only if: (a) they are officers or directors of one another's businesses; (b) they are legally recognised partners in business; (c) they are employer and employee; (d) any person directly or indirectly owns, controls or holds 5 % or more of the outstanding voting stock or shares of both of them; (e) one of them directly or indirectly controls the other; (f) both of them are directly or indirectly controlled by a third person; (g) together they directly or indirectly control a third person; or (h) they are members of the same family. Persons shall be deemed to be members of the same family only if they stand in any of the following relationships to one another: (i) husband and wife, (ii) parent and child, (iii) brother and sister (whether by whole or half blood), (iv) grandparent and grandchild, (v) uncle or aunt and nephew or niece, (vi) parent-in-law and son-in-law or daughter-in-law, (vii) brother-in-law and sister-in-law. (OJ L 253, 11.10.1993, p. 1). In this context ‘person’ means any natural or legal person.

(9) Pursuant to Article 9(6) of the basic Regulation, any zero and de minimis margins, and margins established in accordance with the circumstances described in Article 18 of the basic Regulation shall be disregarded.

(10) The exporting producers have to demonstrate in particular that: (i) business decisions and costs are made in response to market conditions and without significant State interference; (ii) firms have one clear set of basic accounting records which are independently audited in line with international accounting standards and are applied for all purposes; (iii) there are no significant distortions carried over from the former non-market economy system; (iv) bankruptcy and property laws guarantee legal certainty and stability and (v) exchange rate conversions are carried out at market rates.

(11) The exporting producers have to demonstrate in particular that: (i) in the case of wholly or partly foreign owned firms or joint ventures, exporters are free to repatriate capital and profits; (ii) export prices and quantities and conditions and terms of sale are freely determined; (iii) the majority of the shares belong to private persons. State officials appearing on the Board of Directors or holding key management positions shall either be in a minority or it must be demonstrated that the company is nonetheless sufficiently independent from State interference; (iv) exchange rate conversions are carried out at the market rate and (v) State interference is not such as to permit circumvention of measures if individual exporters are given different rates of duty.

(12) Only importers not related to exporting producers can be sampled. Importers that are related to exporting producers have to fill in Annex 1 to the questionnaire for these exporting producers. For the definition of a related party see footnote 8.

(13) The data provided by unrelated importers may also be used in relation to aspects of this investigation other than the determination of dumping.

(14) For the definition of a related party see footnote 8.

(15) A ‘Limited’ document is a document which is considered confidential pursuant to Article 19 of Council Regulation (EC) No 1225/2009 (OJ L 343, 22.12.2009, p. 51) and Article 6 of the WTO Agreement on Implementation of Article VI of the GATT 1994 (Anti-Dumping Agreement). It is also a document protected pursuant to Article 4 of Regulation (EC) No 1049/2001 of the European Parliament and of the Council (OJ L 145, 31.5.2001, p. 43).

(17) Should sampling for exporting producers be deemed necessary, an individual anti-dumping duty will only be determined for those exporting producers either (i) selected to be in the sample or (ii) for which an individual dumping margin has been determined pursuant to Article 17(3) of the basic Regulation.

(18) OJ L 201, 26.7.2001, p. 10.

ANNEX A

ANNEX B