EUR-Lex Access to European Union law

This document is an excerpt from the EUR-Lex website

Document 21976A0304(01)

Protocol laying down certain provisions relating to the Agreement establishing an association between the European Economic Community and Malta - Protocol concerning the definition of the concept of 'originating products' and methods of administrative cooperation

Protocol laying down certain provisions relating to the Agreement establishing an association between the European Economic Community and Malta - Protocol concerning the definition of the concept of 'originating products' and methods of administrative cooperation

Protocol laying down certain provisions relating to the Agreement establishing an association between the European Economic Community and Malta - Protocol concerning the definition of the concept of 'originating products' and methods of administrative cooperation

OJ L 111, 28.4.1976, p. 3–66

(DA, DE, EN, FR, IT, NL)

Greek special edition: Chapter 11 Volume 008 P. 11 - 90

In force

In force

ELI: http://data.europa.eu/eli/prot/1976/939(1)/oj

- Date of document:

- 04/03/1976; Date of signature

- Date of effect:

- 01/06/1976; Entry into force See Art 25 And 21976X0506(01)

- Date of signature:

- 04/03/1976; Brussels

- Author:

- European Economic Community, Malta

- Form:

- Protocol

- Internal comment:

- Bilateral agreement, Declaration

- Authentic language:

- Danish, German, English, French, Italian, Dutch

- Treaty:

- Treaty establishing the European Economic Community

- Legal basis:

- Link

- Select all documents based on this document

- Link

- Link

- Select all documents mentioning this document No data available in the table

- Modifies:

-

Relation Act Comment Subdivision concerned From To Completion 21970A1205(01) 01/06/1976 Modifies 21970A1205(01) Amendment 01/06/1976

No data available in the table

- Modified by:

-

Relation Act Comment Subdivision concerned From To Derogated in 21976D0709(01) annex Text 01/07/1976 30/06/1977 Modified by 21977A1027(01) Amendment annex 2 01/01/1978 30/06/1978 Completed by 21977A1027(01) 01/01/1978 Derogated in 31978R1707 annex II Text 01/07/1978 31/12/1978 Modified by 31980R3508 Amendment 30/06/1981 Modified by 21982D0123(01) Replacement article 6 paragraph 1 unnumbered paragraph 2 TEXT 01/02/1982 Modified by 21982D0123(01) Replacement article 6 paragraph 1 unnumbered paragraph 3 01/02/1982 Modified by 21982D0123(01) Replacement article 17 paragraph 2 Text 01/02/1982 Modified by 21984D0530(01) Replacement article 17 paragraph 2 Text 01/06/1984 28/02/1986 Modified by 21984D0530(01) Replacement article 6 paragraph 1 unnumbered paragraph 2 TEXT 01/06/1984 21/02/1986 Derogated in 21984D0726(01) annex Text 01/08/1984 31/07/1986 Modified by 21986D0221(01) Replacement article 17 paragraph 2 Text 01/03/1986 31/12/1987 Modified by 21986D0221(01) Replacement article 6 paragraph 1 unnumbered paragraph 2 TEXT 01/03/1986 31/12/1987 Modified by 21987D1231(02) Replacement article 6 paragraph 1 unnumbered paragraph 2 TEXT 01/01/1988 31/10/1990 Modified by 21987D1231(02) Replacement article 17 paragraph 2 Text 01/01/1988 31/10/1990 Modified by 21989D0727(01) Addition article 6 paragraph 4 01/01/1990 Modified by 21989D0727(01) Replacement article 6 paragraph 2 Text 01/01/1990 Modified by 21989D0727(01) Replacement annex II 01/01/1990 Modified by 21989D0727(01) Amendment annex V 01/01/1990 Modified by 21989D0727(01) Replacement article 4 01/01/1990 Modified by 21989D0727(01) Replacement annex III 01/01/1990 Modified by 21989D0727(01) Replacement annex I 01/01/1990 Modified by 21989D0727(01) Amendment annex IV 01/01/1990 Modified by 21989D0727(01) Replacement article 1 Text 01/01/1990 Modified by 21989D0727(01) Amendment annex VI 01/01/1990 Modified by 21989D0727(01) Replacement article 3 01/01/1990 Modified by 21990D0728(01) Addition article 34 01/04/1989 Modified by 21990D0728(01) Addition article 33 01/04/1989 Modified by 21990D0728(01) Replacement article 20 01/04/1989 Modified by 21990D0728(01) Replacement article 29 01/04/1989 Modified by 21990D0728(01) Replacement article 19 paragraph 2 unnumbered paragraph 2 01/04/1989 Modified by 21990D0728(01) Addition article 32 01/04/1989 Modified by 21990D0728(01) Addition article 31 01/04/1989 - Link

- Related document(s):

-

- 21976X0506(01) Relation

- 31977R1693 Relation

- EUROVOC descriptor:

- Subject matter:

- Directory code:

|

28.4.1976 |

EN |

Official Journal of the European Union |

L 111/3 |

PROTOCOL

laying down certain provisions relating to the Agreement establishing an association between the European Economic Community and Malta

THE COUNCIL OF THE EUROPEAN COMMUNITIES,

of the one part,

THE GOVERNMENT OF THE REPUBLIC OF MALTA,

of the other part,

THE COUNCIL OF THE EUROPEAN COMMUNITIES:

Jean DONDELINGER,

Ambassador Extraordinary and Plenipotentiary, Permanent Representative of Luxemburg, Chairman of the Permanent Representatives Committee;

Theodorus HIJZEN,

Director-General of External Relations of the Commission of the European Communities;

THE GOVERNMENT OF THE REPUBLIC OF MALTA:

Joseph Attard KINGSWELL,

Ambassador Extraordinary and Plenipotentiary, Permanent Delegate of the Republic of Malta to the European Economic Community,

HAVE AGREED AS FOLLOWS:

TITLE I

Measures of adaptation

Article 1

The text of the Agreement and the declarations annexed to the Final Act drawn up in Danish and annexed to this Protocol are authentic in the same way as the original texts.

Article 2

The annual tariff quotas for Malta in application of Article 2 of Annex I to the Agreement shall be increased as follows:

|

CCT heading No |

Description |

Annual Community tariff quota (in metric tons) |

|

55.05 |

Cotton yarn, not put up for retail sale |

910 |

|

56.04 |

Man-made fibres (discontinuous or waste), carded, combed or otherwise prepared for spinning |

800 |

|

60.05 |

Outer garments and other articles, knitted or crocheted, not elastic or rubberized |

190 |

|

61.01 |

Men's and boys' outer garments |

730 |

TITLE II

Transitional measures

Article 3

Denmark shall apply in respect of Malta the reductions in customs duties and charges having equivalent effect provided for in Articles 1, 2, 3 and 5 of Annex I to the Agreement and at rates shown therein.

However, the duties thus reduced may in no case be lower than those applied by Denmark in respect of the Community as originally constituted.

Article 4

1. Ireland and the United Kingdom shall apply to imports originating in Malta the customs duties and rules of origin applied in respect of Malta at the time of entry into force of this Protocol.

This provision shall apply until the entry into force of the provisions governing the second stage but not later than 30 June 1977.

2. Products originating in Malta conforming to the provisions of the Protocol annexed in respect of which the rates of customs duties and charges having equivalent effect, reduced in accordance with Articles 1, 2, 3 and 5 of Annex I to the Agreement and calculated in accordance with Article 5, and in accordance with Articles 13 and 14 of this Protocol, and calculated in accordance with Article 15 are lower than the customs duties and charges having equivalent effect applied by Ireland and the United Kingdom in respect of Malta at the time of entry into force of this Protocol may be imported into Ireland and the United Kingdom at the reduced rates of customs duties and charges having equivalent effect set out in the Agreement.

However, the duties thus reduced may in no case be lower than those applied by Ireland and the United Kingdom in respect of the Community as originally constituted.

3. Should the progressive alignment of the Irish and the United Kingdom tariffs on the Common Customs Tariff result in the application by Ireland and the United Kingdom as regards Malta of customs duties lower than those applied in respect of that State at the time this Protocol enters into force, the first-mentioned customs duties shall be applied.

Article 5

1. The rates on the basis of which the new Member States apply to Malta the reductions provided for in Article 3 and Article 4 (2) shall be those which they apply at the time in respect of third countries.

2. By way of derogation from the provisions of Article 3 and Article 4 (2), should the application of these provisions temporarily result in tariff movements away from alignment on the final duty, the new Member States may maintain their duties until the level of these duties has been reached on the occasion of a subsequent alignment, or they may apply the duty resulting from a subsequent alignment as soon as this alignment reaches or passes the said level.

Article 6

1. The reduced duties calculated in accordance with Articles 3, 4 and 5 shall be applied by rounding to the first decimal place.

2. Subject to the effect to be given by the Community to Article 39 (5) of the Act of Accession as regards the specific duties or the specific part of the mixed duties of the customs tariffs of Ireland and the United Kingdom, the provisions of Articles 4 and 5 shall be applied by rounding to the fourth place of decimals.

Article 7

Where, for the products listed in Annex I to the Agreement, the new Member States apply duties comprising protective and fiscal elements, only the protective elements of those duties, within the meaning of Article 38 of the Act of Accession, shall be aligned on the preferential duties set out in that Annex and reduced as provided in Articles 3, 4 and 5.

Article 8

The arrangements which Denmark applies in respect of Malta, in application of Article 7 of Annex I to the Agreement, may under no circumstances be more favourable than those which it applies in respect of the Community as originally constituted.

Article 9

1. Ireland and the United Kingdom shall apply to imports originating in Malta the quantitative restrictions in force in respect of Malta at the time of entry into force of this Protocol.

This provision shall apply until the entry into force of the provisions governing the second stage but not later than 30 June 1977.

2. The arrangements which Ireland and the United Kingdom apply in respect of Malta may not be less favourable than those provided for in Article 7 of Annex I to the Agreement.

3. However, the quantitative restrictions in force in Ireland which are referred to in Protocol 7 of the Act of Accession shall be abolished as regards Malta in accordance with procedures to be determined, account being taken of the provisions of the above-mentioned Protocol.

Article 10

Malta shall apply in respect of Denmark the reductions in customs duties and charges having equivalent effect provided for in Articles 1, 2, 3 and 4 of Annex II to the Agreement at the rates and in accordance with the timetable set out therein.

Article 11

1. Malta shall continue to apply to imports originating in Ireland and the United Kingdom the tariff and rules of origin applied prior to the Agreement, without prejudice to the protective clauses of that Agreement.

This provision shall apply until the entry into force of the provisions governing the second stage but not later than 30 June 1977.

2. Products originating in Ireland and the United Kingdom in respect of which the rates of customs duties and charges having equivalent effect, reduced in accordance with Article 1 of Annex II to the Agreement, are lower than the customs duties and charges having equivalent effect applied by Malta at the time of entry into force of this Protocol may be imported into Malta at the reduced rates of customs duties and charges having equivalent effect in accordance with the timetable set out in the Agreement and under the rules of origin appropriate thereto.

TITLE III

Origin rules

Article 12

The Protocol annexed replaces the Protocol relating to the definition of the concept of ‘originating products’ and to methods of administrative cooperation referred to in Article 7 of the Agreement.

TITLE IV

Rules applying to certain agricultural products

Article 13

Customs duties on imports into the Community of the products originating in Malta which are listed as follows shall be reduced by the rates indicated for each of them:

|

CCT heading No |

Description |

Rate of reduction |

||||

|

06.02 |

Other live plants, including trees, shrubs, bushes, roots, cuttings and slips |

60 % |

||||

|

06.03 |

Cut flowers and flower buds of a kind suitable for bouquets or for ornamental purposes, fresh, dried, dyed, bleached, impregnated or otherwise prepared: |

|

||||

|

|

|

60 % |

||||

|

06.04 |

Foliage, branches and other parts (other than flowers or buds) of trees, shrubs, bushes and other plants, and mosses, lichens and grasses, being goods of a kind suitable for bouquets or ornamental purposes, fresh, dried, dyed, bleached, impregnated or otherwise prepared |

60 % |

||||

|

07.01 |

Vegetables, fresh or chilled:

|

|

||||

|

|

|

40 % |

||||

|

|

|

|

||||

|

|

|

60 % |

||||

|

|

|

50 % |

||||

|

|

|

|

||||

|

|

|

60 % |

||||

|

|

|

40 % |

||||

|

|

|

60 % |

||||

|

08.02 |

Citrus fruit, fresh or dried:

|

|

||||

|

|

|

60 % |

||||

|

08.08 |

Berries, fresh:

|

|

||||

|

|

|

60 % |

Article 14

The customs duties on imports into the Community of wine of fresh grapes falling within the following tariff headings and originating in Malta, shall be reduced by 75 %, provided that the import prices of such wines plus the customs duties actually levied are not less at any given time than the Community reference price for such time:

|

CCT heading No |

Description |

||||||

|

22.05 |

Wine of fresh grapes; grape must with fermentation arrested by the addition of alcohol: |

||||||

|

|

|

||||||

|

|

ex a) Two litres or less:

|

||||||

|

22.05 (cont'd) |

ex a) Two litres or less:

|

||||||

|

|

|

||||||

|

|

|

Article 15

1. The rates of reduction specified in Articles 13 and 14 shall apply to customs duties actually applied in respect of third countries.

2. Article 4 shall apply to imports into Ireland and the United Kingdom of the products referred to in Articles 13 and 14.

3. However, the duties applied by Denmark as a result of the reductions referred to in paragraph 1 may in no case be lower than those applied by the said country to the Community as originally constituted.

4. By way of derogation from paragraph 1, should the application thereof temporarily result in tariff movements away from alignment on the final duty, Denmark, Ireland and the United Kingdom may maintain their duties until the level of these duties has been reached on the occasion of a subsequent alignment, or they may apply the duty which would result from a subsequent alignment as soon as a tariff movement reaches or passes the said level.

5. The reduced duties calculated in accordance with paragraph 1 shall be applied rounded to the first decimal place.

Subject to the application by the Community of Article 39 (5) of the Act of Accession, as regards the specific duties or the specific part of the mixed duties in the Irish and United Kingdom Customs Tariffs, paragraph 1 shall be applied by rounding to the fourth decimal place.

Article 16

1. Should specific rules be introduced as a result of implementation of its agricultural policy or modification of the existing rules, or should the provisions on the implementation of its agricultural policy be modified or developed, the Community may modify the arrangements laid down in this Protocol in respect of the products concerned.

In such cases the Community shall take appropriate account of the interests of Malta.

2. If the Community, in applying paragraph 1, amends the arrangements made by this Protocol for products covered by Annex II to the Treaty establishing the European Economic Community, it shall accord imports originating in Malta an advantage comparable to that provided for in this Protocol.

3. Consultations may be held within the Association Council on the application of this Article.

Article 17

From the beginning of 1978 in accordance with the procedure adopted for negotiating the Agreement, the Contracting Parties shall review the results of the agricultural provisions as well as any improvements which could be made as from 1 January 1979 on the basis of the experience gained during the functioning of the Agreement and of the objectives defined therein.

TITLE V

Cooperation

Article 18

The Community and Malta shall institute cooperation with the aim of contributing to the development of Malta by efforts complementary to those made by Malta itself and of strengthening existing economic links on as broad a basis as possible for their mutual benefit.

Article 19

In order to achieve the cooperation referred to in Article 18, account shall be taken, in particular, of the following:

|

— |

the objectives and priorities of Malta's development plans and programmes; |

|

— |

the importance of schemes into which different operations are integrated; |

|

— |

the importance of promoting regional cooperation between Malta and other States. |

Article 20

The purpose of cooperation between the Community and Malta shall be to promote, in particular:

|

— |

participation by the Community in the efforts made by Malta to develop its production and economic infrastructure in order to diversify its economic structure. Such participation should be connected, in particular, with the industrialization of Malta and the modernization of its agriculture, fisheries and tourist industry; |

|

— |

the marketing and sales promotion of products exported by Malta; |

|

— |

industrial cooperation aimed at boosting the industrial production of Malta, in particular through projects, programmes and studies designed to:

|

|

— |

cooperation in the fields of science, technology and the protection of the environment; |

|

— |

the encouragement and facilitation of private investments which are in the mutual interest of the parties; |

|

— |

exchange of information on the economic and financial situation, and on the trend thereof, as required for the proper functioning of the Agreement. |

Article 21

1. The Association Council shall define periodically the guidelines of cooperation for the purpose of attaining the objectives set out in the Agreement.

2. The Association Council shall be responsible for seeking ways and means of establishing cooperation in the areas defined in Article 20. To that end it is empowered to make decisions.

Article 22

The Community shall participate in the financing of any projects to promote the development of Malta under the conditions laid down in the Financial Protocol.

Article 23

The Contracting Parties shall facilitate the proper performance of cooperation and investment contracts which are of interest to both parties and come within the framework of the Agreement.

TITLE VI

Final provisions

Article 24

This Protocol and its Annex form an integral part of the Agreement establishing an association between the European Economic Community and Malta.

Article 25

1. This Protocol shall require ratification, acceptance or approval in accordance with the procedures in force in each of the Contracting Parties who shall notify each other of the completion of the procedures necessary to that end.

2. This Protocol shall enter into force on the first day of the second month following the date on which the notifications referred to in paragraph 1 have been effected.

Article 26

This Protocol is drawn up in two copies in the Danish, Dutch, English, French, German and Italian languages, each of these texts being equally authentic.

Til bekræftelse heraf har undertegnede befuldmægtigede underskrevet denne Protokol.

Zu Urkund dessen haben die unterzeichneten Bevollmachtigten ihre Unterschriften unter dieses Protokoll gesetzt.

In witness whereof, the undersigned Plenipotentiaries have affixed their signatures below this Protocol.

En foi de quoi, les plénipotentiaires soussignés ont apposé leurs signatures au bas du présent protocole.

In fede di che, i plenipotenziari sottoscritti hanno apposto le loro firme in calce al presente protocollo.

Ten blijke waarvan de ondergetekende gevolmachtigden hun handtekening onder dit Protocol hebben gesteld.

Udfærdiget i Bruxelles, den fjerde marts nitten hundrede og seksoghalvfjerds.

Geschehen zu Brüssel am vierten März neunzehnhundertsechsundsiebzig.

Done at Brussels on the fourth day of March in the year one thousand nine hundred and seventy-six.

Fait à Bruxelles, le quatre mars mil neuf cent soixante-seize.

Fatto a Bruxelles, addì quattro marzo millenovecentosettantasei.

Gedaan te Brussel, de vierde maart negentienhonderd zesenzeventig.

På Rådet for De europæiske Fællesskabers vegne,

Im Namen des Rates der Europäischen Gemeinschaften,

For the Council of the European Communities,

Pour le Conseil des Communautés européennes,

Per il Consiglio delle Comunità europee,

Voor de Raad van de Europese Gemeenschappen,

For republikken Maltas regering,

Im Namen der Regierung der Republik Malta,

For the Government of the Republic of Malta,

Pour le gouvernement de la république de Malte,

Per il governo della Repubblica di Malta,

Voor de Regering van de Republiek Malta,

ANNEX

PROTOCOL

concerning the definition of the concept of ‘originating products’ and methods of administrative cooperation

TITLE I

Definition of the concept of ‘originating products’

Article 1

For the purpose of implementing the Agreement, the following products, on condition that they were transported directly within the meaning of Article 5, shall be considered as:

|

1. |

products originating in Malta:

|

|

2. |

products originating in the Community:

|

The products in List C in Annex IV shall be temporarily excluded from the scope of this Protocol.

Article 2

The following shall be considered as ‘wholly obtained’ either in Malta or in the Community, within the meaning of Articles 1 (1) (a) and (2) (a):

|

(a) |

mineral products extracted from their soil or from their seabed; |

|

(b) |

vegetable products harvested there; |

|

(c) |

live animals born and raised there; |

|

(d) |

products from live animals raised there; |

|

(e) |

products obtained by hunting or fishing conducted there; |

|

(f) |

products of sea fishing and other products taken from the sea by their vessels; |

|

(g) |

products made aboard their factory ships exclusively from products referred to in subparagraph (f); |

|

(h) |

used articles collected there fit only for the recovery of raw materials; |

|

(i) |

waste and scrap resulting from manufacturing operations conducted there; |

|

(j) |

goods produced there exclusively from products specified in subparagraphs (a) to (i). |

Article 3

1. For the purpose of implementing the provisions of Article 1 (1) (b) and (2) (b), the following shall be considered as sufficient working or processing:

|

(a) |

working or processing as a result of which the goods obtained receive a classification under a heading other than that covering each of the products worked or processed, except, however, working or processing specified in List A in Annex II, where the special provisions of that list apply; |

|

(b) |

working or processing specified in List B in Annex III. |

‘Sections’, ‘Chapters’ and ‘headings’ shall mean the sections, chapters and headings in the Brussels Nomenclature for the classification of goods in customs tariffs.

2. When, for a given product obtained, a percentage rule limits in Lists A and B the value of the materials and parts which can be used, the total value of these materials and parts, whether or not they have changed heading in the course of the working, processing or assembly within the limits and under the conditions laid down in each of those two lists, may not exceed, in relation to the value of the product obtained, the value corresponding either to the common rate, if the rates are identical in both lists, or to the higher of the two if they are different.

3. For the purpose of implementing Article 1 (1) (b) and (2) (b), the following shall always be considered as insufficient working or processing to confer the status of originating product, whether or not there is a change of heading:

|

(a) |

operations to ensure the preservation of merchandise in good condition during transport and storage (ventilation, spreading out, drying, chilling, placing in salt, sulphur dioxide or other aqueous solutions, removal of damaged parts, and like operations); |

|

(b) |

simple operations consisting of removal of dust, sifting or screening, sorting, classifying, matching (including the making up of sets of articles), washing, painting, cutting up; |

|

(c) |

|

|

(d) |

affixing marks, labels or other like distinguishing signs on products or their packaging; |

|

(e) |

simple mixing of products, whether or not of different kinds, where one or more components of the mixture do not meet the conditions laid down in this Protocol to enable them to be considered as originating; |

|

(f) |

simple assembly of parts of articles to constitute a complete article; |

|

(g) |

a combination of two or more operations specified in subparagraphs (a) to (f); |

|

(h) |

slaughter of animals. |

Article 4

Where Lists A and B referred to in Article 3 provide that goods obtained in Malta or in the Community shall be considered as originating therein only if the value of the products worked or processed does not exceed a given percentage of the value of the goods obtained, the values to be taken into consideration for such a percentage shall be:

|

— |

on the one hand, as regards products whose importation can be proved: their customs value at the time of importation, as regards products of undetermined origin: the earliest ascertainable price paid for such products in the territory of the Contracting Party where manufacture takes place; |

|

— |

and on the other hand, the ex-works price of the goods obtained, less internal taxes refunded or refundable on exportation. |

Article 5

1. For the purpose of implementing Article 1, originating products whose transport is effected without entering into territory other than that of the Contracting Parties are considered as transported directly from Malta to the Community or from the Community to Malta. However, goods originating in Malta or in the Community and constituting one single consignment which is not split up may be transported through territory other than that of the Contracting Parties with, should the occasion arise, transhipment or temporary warehousing in such territory, provided that the crossing of the latter territory is justified for geographical reasons and that the goods have remained under the surveillance of the customs authorities in the country of transit or warehousing, that they have not entered into commerce of such countries nor been delivered for home use there and have not undergone operations other than unloading, reloading or any operation designed to maintain them in good condition.

2. Evidence that the conditions referred to in paragraph 1 have been fulfilled shall be supplied to the responsible customs authorities in the Community or in Malta by the production of:

|

(a) |

a through bill of lading issued in the exporting country covering the passage through the country of transit; or |

|

(b) |

a certificate issued by the customs authorities of the country of transit:

|

|

(c) |

or failing these, any substantiating documents. |

TITLE II

Arrangements for administrative cooperation

Article 6

1. Evidence of originating status, within the meaning of this Protocol, of products is given by a movement certificate EUR. 1 of which a specimen is given in Annex V to this Protocol.

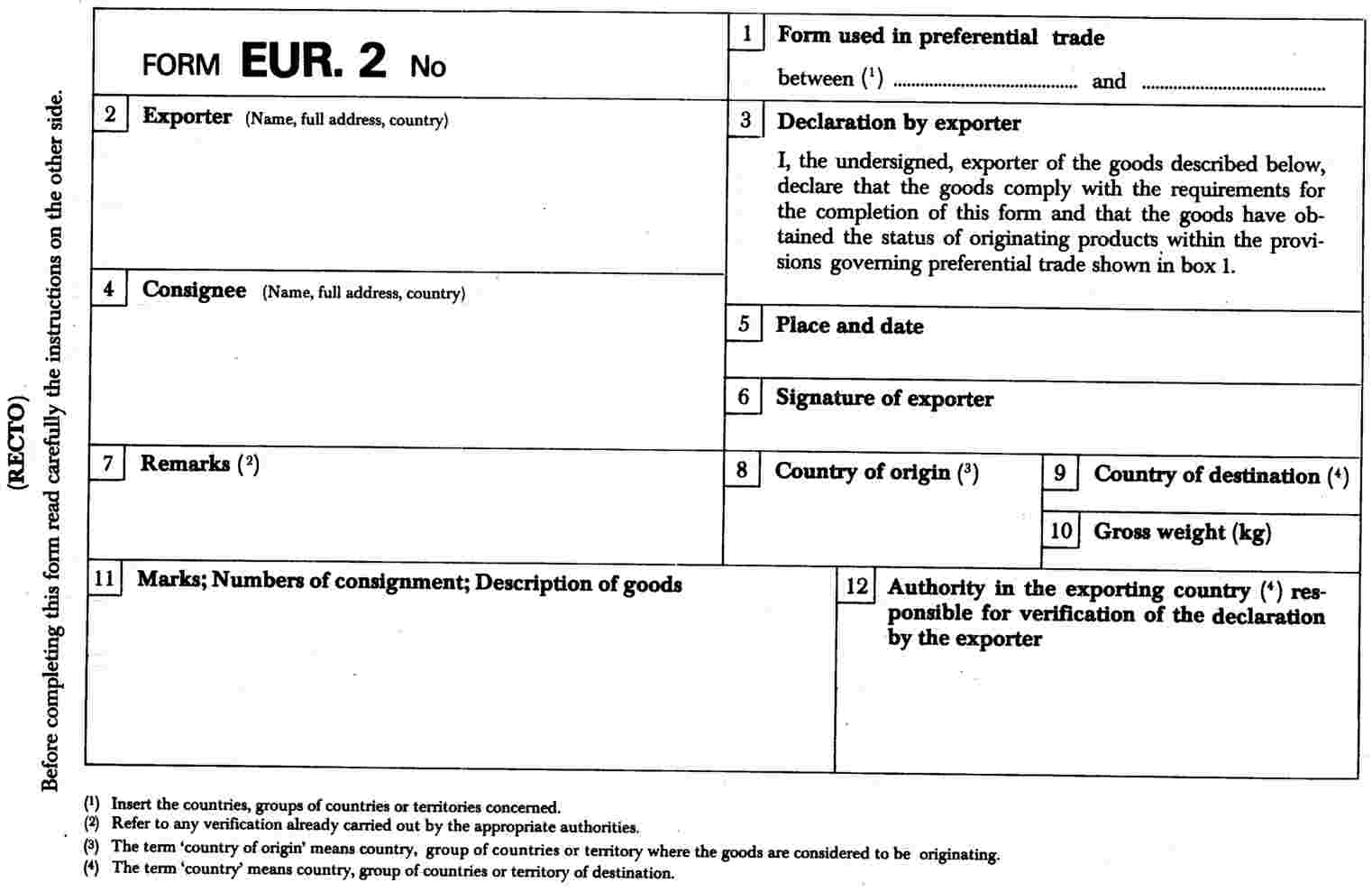

However, the evidence of originating status, within the meaning of this Protocol, of products which form the subject of postal consignments (including parcels), provided that they consist only of originating products and that the value does not exceed 1 000 units of account per consignment, may be given by a form EUR. 2, of which a specimen is given in Annex VI to this Protocol.

The unit of account (u. a.) has a value of 0.88867088 gramme of fine gold. Should the unit of account be changed, the Contracting Parties shall make contact with each other at the level of the Association Council to redefine the value in terms of gold.

2. Without prejudice to Article 3 (3), where, at the request of the person declaring the goods at the customs, a dismantled or non-assembled article falling within Chapter 84 or 85 of the Brussels Nomenclature is imported by instalments on the conditions laid down by the competent authorities, it shall be considered to be a single article and a movement certificate may be submitted for the whole article upon importation of the first instalment.

3. Accessories, spare parts and tools dispatched with a piece of equipment, machine, apparatus or vehicle which are part of the normal equipment and included in the price thereof or are not separately invoiced are regarded as one with the piece of equipment, machine, apparatus or vehicle in question.

Article 7

1. A movement certificate EUR. 1 shall be issued by the customs authorities of the exporting State when the goods to which it relates are exported. It shall be made available to the exporter as soon as actual exportation has been effected or ensured.

2. In exceptional circumstances a movement certificate EUR. 1 may also be issued after exportation of the goods to which it relates if it was not issued at the time of exportation because of errors or involuntary ommissions or special circumstances. In this case, the certificate shall bear a special reference to the conditions in which it was issued.

3. A movement certificate EUR. 1 shall be issued only on application having been made in writing by the exporter. Such application shall be made on a form, of which a specimen is given in Annex V to this Protocol, which shall be completed in accordance with this Protocol.

4. A movement certificate EUR. 1 may be issued only where it can serve as the documentary evidence required for the purpose of implementing the Agreement.

5. Applications for movement certificates EUR. 1 must be preserved for at least two years by the customs authorities of the exporting country.

Article 8

1. The movement certificate EUR. 1 shall be issued by the customs authorities of the exporting State, if the goods can be considered ‘originating products’ within the meaning of this Protocol.

2. For the purpose of verifying whether the conditions stated in paragraph 1 have been met, the customs authorities shall have the right to call for any documentary evidence or to carry out any check which they consider appropriate.

3. It shall be the responsibility of the customs authorities of the exporting State to ensure that the forms referred to in Article 9 are duly completed. In particular, they shall check whether the space reserved for the description of the goods has been completed in such a manner as to exclude all possibility of fraudulent additions. To this end, the description of the goods must be indicated without leaving any blank lines. Where the space is not completely filled a horizontal line must be drawn below the last line of the description, the empty space being crossed through.

4. The date of issue of the movement certificate must be indicated in the part of the certificate reserved for the customs authorities.

Article 9

Movement certificates EUR. 1 shall be made out on the form of which a specimen is given in Annex V to this Protocol. This form shall be printed in one or more of the languages in which the Agreement is drawn up. Certificates shall be made out in one of these languages and in accordance with the provisions of the domestic law of the exporting State; if they are handwritten, they shall be completed in ink and in capital letters.

Each certificate shall measure 210 × 297 mm, a tolerance of up to plus 8 or minus 5 mm in the length may be allowed. The paper used must be white-sized writing paper not containing mechanical pulp and weighing not less than 25 g/m2. It shall have a printed green guilloche pattern background making any falsification by mechanical or chemical means apparent to the eye.

The exporting States may reserve the right to print the certificates themselves or may have them printed by approved printers. In the latter case, each certificate must include a reference to such approval. Each certificate must bear the name and address of the printer or a mark by which the printer can be identified. It shall also bear a serial number, either printed or not, by which it can be identified.

Article 10

1. Under the responsibility of the exporter, he or his authorized representative shall request the issue of a movement certificate EUR. 1.

2. The exporter or his representative shall submit with his request any appropriate supporting document proving that the goods to be exported are such as to qualify for the issue of a movement certificate EUR. 1.

Article 11

A movement certificate EUR. 1 must be submitted, within five months of the date of issue by the customs authorities of the exporting State, to the customs authorities of the importing State where the goods are entered.

Article 12

Movement certificates EUR. 1 shall be submitted to customs authorities in the importing State, in accordance with the procedures laid down by that State. The said authorities may require a translation of a certificate. They may also require the import declaration to be accompanied by a statement from the importer to the effect that the goods meet the conditions required for the implementation of the Agreement.

Article 13

1. A movement certificate EUR. 1 which is submitted to the customs authorities of the importing State after the final date for presentation specified in Article 11, may be accepted for the purpose of applying preferential treatment, where the failure to submit the certificate by the final date set is due to reasons of force majeure or exceptional circumstances.

2. In other cases of belated presentation, the customs authorities of the importing State may accept the certificates where the goods have been submitted to them before the said final date.

Article 14

The discovery of slight discrepancies between the statements made in the movement certificate EUR. 1 and those made in the documents submitted to the customs office for the purpose of carrying out the formalities for importing the goods shall not ipso facto render the certificate null and void if it is duly established that the certificate does correspond to the goods submitted.

Article 15

It shall always be possible to replace one or more movement certificates EUR. 1 by one or more other movement certificates EUR. 1 provided that this is done at the customs office where the goods are located.

Article 16

Form EUR. 2, a specimen of which is given in Annex VI, shall be completed by the exporter or, under his responsibility, by his authorized representative. It shall be made out in one of the languages in which the Agreement is drawn up and in accordance with the provisions of the domestic law of the exporting State. If it is handwritten it must be completed in ink and in capital letters. If the goods contained in the consignment have already been subject to verification in the exporting country by reference to the definition of the concept of ‘originating products’ the exporter may refer to this check in the ‘Remarks’ box of form EUR. 2.

Form EUR. 2 shall be 210 × 148 mm. A tolerance of up to plus 8 or minus 5 mm in the length may be allowed. The paper used shall be white paper dressed for writing not containing mechanical pulp and weighing not less than 64 g/m2.

The exporting States may reserve the right to print the forms themselves or may have them printed by printers they have approved. In the latter case each form must include a reference to such approval. In addition, the form must bear the distinctive sign attributed to the approved printer and a serial number, either printed or not, by which it can be identified.

A form EUR. 2 shall be completed for each postal consignment.

These provisions do not exempt exporters from complying with any other formalities required by customs or postal regulations.

Article 17

1. Goods sent as small packages to private persons or forming part of travellers' personal luggage shall be admitted as originating products without requiring the production of a movement certificate EUR. 1 or the completion of a form EUR. 2, provided that such goods are not imported by way of trade and have been declared as meeting the conditions required for the application of these provisions, and where there is no doubt as to the veracity of such declaration.

2. Importations which are occasional and consist solely of goods for the personal use of the recipients or travellers or their families shall not be considered as importations by way of trade if it is evident from the nature and quantity of the goods that no commercial purpose is in view. Furthermore, the total value of these goods must not exceed 60 units of account in the case of small packages or 200 units of account in the case of the contents of travellers' personal luggage.

Article 18

1. Goods sent from the Community or from Malta for exhibition in another country and sold after the exhibition for importation into Malta or into the Community shall benefit on importation from the provisions of the Agreement on condition that the goods meet the requirements of this Protocol entitling them to be recognized as originating in the Community or in Malta and provided that it is shown to the satisfaction of the customs authorities that:

|

(a) |

an exporter has consigned these goods from the Community or from Malta to the country in which the exhibition is held and has exhibited them there; |

|

(b) |

the goods have been sold or otherwise disposed of by that exporter to someone in Malta or in the Community; |

|

(c) |

the goods have been consigned during the exhibition or immediately thereafter to Malta or to the Community in the state in which they were sent for exhibition; |

|

(d) |

the goods have not, since they were consigned for exhibition, been used for any purpose other than demonstration at the exhibition. |

2. A movement certificate EUR. 1 must be produced to the customs authorities in the normal manner. The name and address of the exhibition must be indicated thereon. Where necessary, additional documentary evidence of the nature of the goods and the conditions under which they have been exhibited may be required.

3. Paragraph 1 shall apply to any trade, industrial, agricultural or crafts exhibition, fair or similar public show or display which is not organized for private purposes in shops or business premises with a view to the sale of foreign goods, and during which the goods remain under customs control.

Article 19

1. When a certificate is issued within the meaning of Article 7 (2) of this Protocol after the goods to which it relates have actually been exported, the exporter must in the application referred to in Article 7 (3) of this Protocol:

|

— |

indicate the place and date of exportation of the goods to which the certificate relates; |

|

— |

certify that no movement certificate EUR. 1 was issued at the time of exportation of the goods in question, and state the reasons. |

2. The customs authorities may issue a movement certificate EUR. 1 retrospectively only after verifying that the information supplied in the exporter's application agrees with that in the corresponding file.

Certificates issued retrospectively must be endorsed with one of the following phrases: ‘NACHTRÄGLICH AUSGESTELLT’, ‘DÉLIVRÉ A POSTERIORI’, ‘RILASCIATO A POSTERIORI’‘AFGEGEVEN A POSTERIORI’, ‘ISSUED RETROSPECTIVELY’, ‘UDSTEDT EFTERFØLGENDE’.

Article 20

In the event of the theft, loss or destruction of a movement certificate EUR. 1, the exporter may apply to the customs authorities which issued it for a duplicate made out on the basis of the export documents in their possession. The duplicate issued in this way must be endorsed with one of the following words: ‘DUPLIKAT’, ‘DUPLICATA’, ‘DUPLICATO’, ‘DUPLICAAT’, ‘DUPLICATE’.

Article 21

Malta and the Community shall take all necessary steps to ensure that goods traded under cover of a movement certificate EUR. 1, and which in the course of transport use a free zone situated in their territory, are not replaced by other goods and that they do not undergo handling other than normal operations designed to prevent their deterioration.

Article 22

In order to ensure the proper application of this title, Malta and the Community shall assist each other, through their respective customs administrations, in checking the authenticity of movement certificates EUR. 1 and the accuracy of the information concerning the actual origin of the products concerned and the declarations by exporters on forms EUR. 2.

Article 23

Penalties shall be imposed on any person who, in order to enable goods to be accepted as eligible for preferential treatment, draws up or causes to be drawn up, either a document which contains incorrect particulars for the purpose of obtaining a movement certificate EUR. 1 or a form EUR. 2 containing incorrect particulars.

Article 24

1. Subsequent verifications of movement certificates EUR. 1 and of forms EUR. 2 shall be carried out at random or whenever the customs authorities of the importing State have reasonable doubt as to the authenticity of the document or the accuracy of the information regarding the true origin of the goods in question.

2. For the purpose of implementing paragraph 1, the customs authorities of the importing State shall return the movement certificate EUR. 1 or the form EUR. 2, or a photocopy thereof, to the customs authorities of the exporting State, giving, where appropriate, the reasons of form or substance for an inquiry. The invoice, if it has been submitted, or a copy thereof shall be attached to the form EUR. 2 and the customs authorities shall forward any information that has been obtained suggesting that the particulars given on the said certificate or the said form are inaccurate.

If the customs authorities of the importing State decide to suspend execution of the Agreement while awaiting the results of the verification, they shall offer to release the goods to the importer subject to any precautionary measures judged necessary.

3. The customs authorities of the importing State shall be informed of the results of the verification as quickly as possible. These results must be such as to make it possible to determine whether the disputed movement certificate EUR. 1 or form EUR. 2 applies to the goods actually exported, and whether these goods can, in fact, qualify for the application of the preferential arrangements.

When such disputes cannot be settled between the customs authorities of the importing State and those of the exporting State, or when they raise a question as to the interpretation of this Protocol, they shall be submitted to the Customs Cooperation Committee.

In all cases the settlement of disputes between the importer and the customs authorities of the importing State shall be under the legislation of the said State.

Article 25

The Association Council may decide to amend the provisions of this Protocol.

Article 26

1. The Community and Malta shall take any measures necessary to enable movement certificates EUR. 1 as well as forms EUR. 2 to be submitted, in accordance with Articles 11 and 12 of this Protocol, from the day on which it enters into force.

2. The certificates of type A.M.1, as well as forms A.M.2. may be used until stocks are exhausted and at the latest up to and including 30 June 1977 under the conditions laid down by this Protocol.

3. The movement certificates EUR. 1 and the forms EUR. 2 printed in the Member States before the date of the entry into force of this Protocol, and which do not conform to the models in Annexes V and VI to this Protocol, may continue to be used until stocks are exhausted, under the conditions laid down by this Protocol.

Article 27

The Community and Malta shall each take the steps necessary to implement this Protocol.

Article 28

The Annexes to this Protocol shall form an integral part thereof.

Article 29

Those products accompanied by a movement certificate A.M.1. issued under the provisions previously in force concerning origin shall be considered as originating products, in the sense of this Protocol, provided that the said certificate was issued before the entry into force of this Protocol.

Article 30

The endorsements referred to in Articles 19 and 20 shall be inserted in the ‘Remarks’ box of the certificate.

ANNEX I

EXPLANATORY NOTES

Note 1 — Articles 1 and 2

The terms ‘the Community’ and ‘Malta’ shall also cover the territorial waters of the Member States of the Community or of Malta respectively.

Vessels operating on the high seas, including factory ships, on which fish caught is worked or processed, shall be considered as part of the territory of the State to which they belong provided that they satisfy the conditions set out in Explanatory Note 5.

Note 2 — Article 1

In order to determine whether goods originate in the Community or in Malta it shall not be necessary to establish whether the power and fuel, plant and equipment, and machines and tools used to obtain such goods originate in third countries or not,

Note 3 — Articles 3 (1) and (2), and 4

The percentage rule constitutes, where the product obtained appears in List A, a criterion additional to that of change of heading for any non-originating product used.

Note 4 — Article 1

Packing shall be considered as forming a whole with the goods contained therein. This provision, however, shall not apply to packing which is not of the normal type for the article packed and which has intrinsic utilization value and is of a durable nature, apart from its function as packing.

Note 5 — Article 2(f)

The term ‘their vessels’ shall apply only to vessels:

|

— |

which are registered or recorded in a Member State or in Malta; |

|

— |

which sail under the flag of a Member State or of Malta; |

|

— |

which are owned to an extent of at least 50 % by nationals of the Member States and Malta or by a company with its head office in a Member State or in Malta, of which the manager, managers, chairman of the board of directors or of the supervisory board, and the majority of the members of such board, are nationals of the Member States or Malta and of which, in addition in the case of partnerships or limited companies, at least half the capital belongs to the Member States or Malta or to public bodies or nationals of the Member States or of Malta; |

|

— |

of which the captain and officers are all nationals of the Member States or of Malta; |

|

— |

of which at least 75 % of the crew are nationals of the Member States or of Malta. |

Note 6 — Article 4

‘Ex-works price’ shall mean the price paid to the manufacturer in whose undertaking the last working or processing is carried out, provided the price includes the value of all the products used in manufacture.

‘Customs value’ shall be understood as meaning the customs value laid down in the Convention concerning the valuation of goods for customs purposes signed in Brussels on 15 December 1950.

ANNEX II

LIST A

List of working or processing operations which result in a change of tariff heading without conferring the status of ‘originating products’ on the products undergoing such operations, or conferring this status only subject to certain conditions

|

Products obtained |

Working or processing that does not confer the status of originating products |

Working or processing that confers the status of originating products when the following conditions are met |

|||||||||||||||||||||||||

|

CCT heading No |

Description |

||||||||||||||||||||||||||

|

02.06 |

Meat and edible meat offals (except poultry liver), salted, in brine, dried or smoked |

Salting, placing in brine, drying or smoking of meat and edible meat offals of heading Nos 02.01 and 02.04 |

|

||||||||||||||||||||||||

|

03.02 |

Fish, dried, salted or in brine, smoked fish, whether or not cooked before or during the smoking process |

Drying, salting, placing in brine; smoking of fish, whether cooked or not |

|

||||||||||||||||||||||||

|

04.02 |

Milk and cream, preserved, concentrated or sweetened |

Preserving, concentrating, or adding sugar to milk or cream of heading No 04.01 |

|

||||||||||||||||||||||||

|

04.03 |

Butter |

Manufacture from milk or cream |

|

||||||||||||||||||||||||

|

04.04 |

Cheese and curd |

Manufacture from products of heading Nos 04.01, 04.02 and 04.03 |

|

||||||||||||||||||||||||

|

07.02 |

Vegetables (whether or not cooked), preserved by freezing |

Freezing of vegetables |

|

||||||||||||||||||||||||

|

07.03 |

Vegetables, provisionally preserved in brine, in sulphur water or in other preservative solutions, but not specially prepared for immediate consumption |

Placing in brine or in other solutions of vegetables of heading No 07.01 |

|

||||||||||||||||||||||||

|

07.04 |

Dried, dehydrated or evaporated vegetables, whole, cut, sliced, broken or in powder, but not further prepared |

Drying, dehydration, evaporation cutting, grinding, powdering of vegetables of heading Nos 07.01 to 07.03 |

|

||||||||||||||||||||||||

|

08.10 |

Fruit (whether or not cooked), preserved by freezing, not containing added sugar |

Freezing of fruit |

|

||||||||||||||||||||||||

|

08.11 |

Fruit provisionally preserved (for example, by sulphur dioxide gas, in brine, in sulphur water or in other preservative solutions), but unsuitable in that state for immediate consumption |

Placing in brine or in other solutions of fruit of heading Nos 08.01 to 08.09 |

|

||||||||||||||||||||||||

|

08.12 |

Fruit, dried, other than that falling within heading No 08.01, 08.02, 08.03, 08.04 or 08.05 |

Drying of fruit |

|

||||||||||||||||||||||||

|

11.01 |

Cereal flours |

Manufacture from cereals |

|

||||||||||||||||||||||||

|

11.02 |

Cereal groats and cereal meal; other worked cereal grains (for example, rolled, flaked, polished, pearled or kibbled, but not further prepared), except husked, glazed, polished or broken rice; germ of cereals, whole, rolled, flaked or ground |

Manufacture from cereals |

|

||||||||||||||||||||||||

|

11.03 |

Flours of the leguminous vegetables falling within heading No 07.05 |

Manufacture from dried leguminous vegetables |

|

||||||||||||||||||||||||

|

11.04 |

Flours of the fruits falling within any heading in Chapter 8 |

Manufacture from fruits of Chapter 8 |

|

||||||||||||||||||||||||

|

11.05 |

Flour, meal and flakes of potato |

Manufacture from potatoes |

|

||||||||||||||||||||||||

|

11.06 |

Flour and meal of sago and of manioc, arrowroot, salep and other roots and tubers falling within heading No 07.06 |

Manufacture from products of heading No 07.06 |

|

||||||||||||||||||||||||

|

11.07 |

Malt, roasted or not |

Manufacture from cereals |

|

||||||||||||||||||||||||

|

11.08 |

Starches; inulin |

Manufacture from cereals of Chapter 10, or from potatoes or other products of Chapter 7 |

|

||||||||||||||||||||||||

|

11.09 |

Wheat gluten, whether or not dried |

Manufacture from wheat or wheat flours |

|

||||||||||||||||||||||||

|

15.01 |

Lard, other pig fat and poultry fat, rendered or solvent-extracted |

Manufacture from products of heading No 02.05 |

|

||||||||||||||||||||||||

|

15.02 |

Fats of bovine cattle, sheep or goats, unrendered; rendered or solvent-extracted fats (including ‘premier jus’) obtained from those unrendered fats |

Manufacture from products of heading Nos 02.01 and 02.06 |

|

||||||||||||||||||||||||

|

15.04 |

Fats and oils, of fish and marine mammals, whether or not refined |

Manufacture from fish or marine mammals caught by fishing vessels of third countries |

|

||||||||||||||||||||||||

|

15.06 |

Other animal oils and fats (including neat's-foot oil and fats from bones or waste) |

Manufacture from products of Chapter 2 |

|

||||||||||||||||||||||||

|

ex ex 15.07 |

Fixed vegetable oils, fluid or solid, crude, refined or purified, but not including Chinawood oil, myrtle-wax, Japan wax or oil of tung nuts, oleococca seeds or oiticia seeds; also not including oils of a kind used in machinery or mechanical appliances or for industrial purposes other than the manufacture of edible products |

Manufacture from products of Chapters 7 and 12 |

|

||||||||||||||||||||||||

|

16.01 |

Sausages and the like, of meat, meat offal or animal blood |

Manufacture from products of Chapter 2 |

|

||||||||||||||||||||||||

|

16.02 |

Other prepared or preserved meat or meat offal |

Manufacture from products of Chapter 2 |

|

||||||||||||||||||||||||

|

16.04 |

Prepared or preserved fish, including caviar and caviar substitutes |

Manufacture from products of Chapter 3 |

|

||||||||||||||||||||||||

|

16.05 |

Crustaceans and molluscs, prepared or preserved |

Manufacture from products of Chapter 3 |

|

||||||||||||||||||||||||

|

17.02 |

Other sugars; sugar syrups; artificial honey (whether or not mixed with natural honey); caramel |

Manufacture from any product |

|

||||||||||||||||||||||||

|

17.04 |

Sugar confectionery, not containing cocoa |

Manufacture from other products of Chapter 17 the value of which exceeds 30 % of the value of the finished product |

|

||||||||||||||||||||||||

|

17.05 |

Flavoured or coloured sugars, syrups and molasses, but not including fruit juices containing added sugar in any proportion |

Manufacture from other products of Chapter 17 the value of which exceeds 30 % of the value of the finished product |

|

||||||||||||||||||||||||

|

18.06 |

Chocolate and other food preparations containing cocoa |

Manufacture from products of Chapter 17 the value of which exceeds 30 % of the value of the finished product |

|

||||||||||||||||||||||||

|

19.01 |

Malt extract |

Manufacture from products of heading No 11.07 |

|

||||||||||||||||||||||||

|

19.02 |

Preparations of flour, meal, starch or malt extract, of a kind used as infant food or for dietetic or culinary purposes, containing less than 50 % by weight of cocoa |

Manufacture from cereals and derivatives thereof, meat and milk, or in which the value of products of Chapter 17 used exceeds 30 % of the value of the finished product |

|

||||||||||||||||||||||||

|

19.03 |

Macaroni, spaghetti and similar products |

|

Manufacture from durum wheat |

||||||||||||||||||||||||

|

19.04 |

Tapioca and sago; tapioca and sago substitutes from potato or other starches |

Manufacture from potato starch |

|

||||||||||||||||||||||||

|

19.05 |

Prepared foods obtained by the swelling or roasting of cereals or cereal products (puffed rice, cornflakes and similar products) |

Manufacture from any product other than of Chapter 17 (1) or in which the value of the products of Chapter 17 used exceeds 30 % of the value of the finished product |

|

||||||||||||||||||||||||

|

19.06 |

Communion wafers, empty cachets of a kind suitable for pharmaceutical use, sealing wafers, rice paper, and similar products |

Manufacture from products of Chapter 11 |

|

||||||||||||||||||||||||

|

19.07 |

Bread, ships' biscuits and other ordinary bakers' wares, not containing added sugar, honey, eggs, fats, cheese or fruit |

Manufacture from products of Chapter 11 |

|

||||||||||||||||||||||||

|

19.08 |

Pastry, biscuits, cakes and other fine bakers', wares, whether or not containing cocoa in any proportion |

Manufacture from products of Chapter 11 |

|

||||||||||||||||||||||||

|

20.01 |

Vegetables and fruit prepared or preserved by vinegar or acetic acid, with or without sugar, whether or not containing salt, spices or mustard |

Preserving vegetables, fresh or frozen or preserved temporarily or preserved in vinegar |

|

||||||||||||||||||||||||

|

20.02 |

Vegetables prepared or preserved otherwise than by vinegar or acetic acid |

Preserving vegetables fresh or frozen |

|

||||||||||||||||||||||||

|

20.03 |

Fruit preserved by freezing, containing added sugar |

Manufacture from products of Chapter 17 of which the value exceeds 30 % of the value of the finished product |

|

||||||||||||||||||||||||

|

20.04 |

Fruits, fruit-peel and parts of plants, preserved by sugar (drained, glace or crystallized) |

Manufacture from products of Chapter 17 of which the value exceeds 30 % of the value of the finished product |

|

||||||||||||||||||||||||

|

ex ex 20.05 |

Jams, fruit jellies, marmalades, fruit purées and fruit pastes, being cooked preparations, containing added sugar |

Manufacture from products of Chapter 17 of which the value exceeds 30 % of the value of the finished product |

|

||||||||||||||||||||||||

|

20.06 |

Fruit otherwise prepared or preserved whether or not containing added sugar or spirit: |

|

|

||||||||||||||||||||||||

|

20.06 (cont'd) |

|

|

Manufacture, without added sugar or spirit, in which the value of the constituent ‘originating products’ of heading Nos 08.01, 08.05 and 12.01, represents at least 60 % of the value of the manufactured product |

||||||||||||||||||||||||

|

|

|

Manufactured from products of Chapter 17 of which the value exceeds 30 % of the value of the finished product |

|

||||||||||||||||||||||||

|

ex ex 20.07 |

Fruit juices (including grape must), whether or not containing added sugar, but unfermented and not containing spirit |

Manufacture from products of Chapter 17 of which the value exceeds 30 % of the value of the finished product |

|

||||||||||||||||||||||||

|

ex ex 21.01 |

Roasted chicory and extracts thereof |

Manufacture from chicory roots, fresh or dried |

|

||||||||||||||||||||||||

|

21.05 |

Soups and broths in liquid, solid or powder forms; homogenized food preparations |

Manufacture from products of heading No 20.02 |

|

||||||||||||||||||||||||

|

22.02 |

Lemonade, flavoured spa waters and flavoured aerated waters, and other non-alcoholic beverages, not including fruit and vegetable juices falling within heading No 20.07 |

Manufacture from fruit juices (2) or in which the value of products of Chapter 17 used exceeds 30 % of the value of the finished product |

|

||||||||||||||||||||||||

|

22.06 |

Vermouths, and other wines of fresh grapes flavoured with aromatic extracts |

Manufacture from products of heading No 08.04, 20.07, 22.04 or 22.05 |

|

||||||||||||||||||||||||

|

22.08 |

Ethyl alcohol or neutral spirits, undenatured, of a strength of 80o or higher; denatured spirits (including ethyl alcohol and neutral spirits) of any strength |

Manufacture from products of heading No 08.04, 20.07, 22.04 or 22.05 |

|

||||||||||||||||||||||||

|

22.09 |

Spirits (other than those of heading No 22.08); liqueurs and other spirituous beverages; compound alcoholic preparations (known as ‘concentrated extracts’) for the manufacture of beverages |

Manufacture from products of heading No 08.04, 20.07, 22.04 or 22.05 |

|

||||||||||||||||||||||||

|

22.10 |

Vinegar and substitutes for vinegar |

Manufacture from products of heading No 08.04, 20.07, 22.04 or 22.05 |

|

||||||||||||||||||||||||

|

ex ex 23.03 |

Residues from the manufacture of maize starch (excluding concentrated steeping liquours), of a protein content, calculated on the dry product, exceeding 40 % dry weight |

Manufacture from maize or maize flour |

|

||||||||||||||||||||||||

|

23.04 |

Oil cake and other residues (except dregs) resulting from the extraction of vegetable oils |

Manufacture from various products |

|

||||||||||||||||||||||||

|

23.07 |

Sweetened forage; other preparations of a kind used in animal feeding |

Manufacture from cereals and derived products, meat, milk, sugar and molasses |

|

||||||||||||||||||||||||

|

ex ex 24.02 |

Cigarettes, cigars, smoking tobacco |

|

Manufacture from products of heading No 24.01 of which at least 70 % by quantity are ‘originating products’ |

||||||||||||||||||||||||

|

ex ex 28.38 |

Aluminium sulphate |

|

Manufacture in which the value of the products used does not exceed 50 % of the value of the finished product |

||||||||||||||||||||||||

|

30.03 |

Medicaments (including veterinary medicaments) |

|

Manufacture in which the value of the products used does not exceed 50 % of the value of the finished product |

||||||||||||||||||||||||

|

31.05 |

Other fertilizers; goods of Chapter 31 in tablets, lozenges and similar prepared forms or in packings of a gross weight not exceeding 10 kg |

|

Manufacture in which the value of the products used does not exceed 50 % of the value of the finished product |

||||||||||||||||||||||||

|

32.06 |

Colour lakes |

Manufacture from materials of heading No 32.04 or 32.05 (3) |

|

||||||||||||||||||||||||

|

32.07 |

Other colouring matter; inorganic products of a kind used as luminophores |

Mixing of oxides or salts of Chapter 28 with extenders such as barium sulphate, chalk barium carbonate and satin white (3) |

|

||||||||||||||||||||||||

|

33.05 |

Aqueous distillates and aqueous solutions of essential oils, including such products suitable for medicinal uses |

Manufacture from products of heading No 33.01 (3) |

|

||||||||||||||||||||||||

|

35.05 |

Dextrins and dextrin glues; soluble or roasted starches; starch glues |

|

Manufacture from maize or potatoes |

||||||||||||||||||||||||

|

37.01 |

Photographic plates and film in the flat, sensitized, unexposed, of any material other than paper, paperboard or cloth |

Manufacture from products of heading No 37.02 (3) |

|

||||||||||||||||||||||||

|

37.02 |

Film in rolls, sensitized, unexposed, perforated or not |

Manufacture from products of heading No 37.01 (3) |

|

||||||||||||||||||||||||

|

37.04 |

Sensitized plates and film, exposed but not developed, negative or positive |

Manufacture from products of heading No 37.01 or 37.02 (3) |

|

||||||||||||||||||||||||

|

38.11 |

Disinfectants, insecticides, fungicides, weed-killers, anti-sprouting products, rat poisons and similar products, put up in forms or packings for sale by retail or as preparations or as articles (for example, sulphur-treated bands, wicks and candles, fly-papers) |

|

Manufacture in which the value of the products used does not exceed 50 % of the value of the finished product |

||||||||||||||||||||||||

|

38.12 |

Prepared glazings, prepared dressings and prepared mordants, of a kind used in the textile, paper, leather or like industries |

|

Manufacture in which the value of the products used does not exceed 50 % of the value of the finished product |

||||||||||||||||||||||||

|

38.13 |

Pickling preparations for metal surfaces; fluxes and other auxiliary preparations for soldering, brazing or welding; soldering, brazing or welding powders and pastes consisting of metal and other materials; preparations of a kind used as cores or coatings for welding rods and electrodes |

|

Manufacture in which the value of the products used does not exceed 50 % of the value of the finished product |

||||||||||||||||||||||||

|

ex ex 38.14 |

Anti-knock preparations, oxidation inhibitors, gum inhibitors, viscosity improvers, anti-corrosive preparations and similar prepared additives for mineral oils, excluding prepared additives for lubricants |

|

Manufacture in which the value of the products used does not exceed 50 % of the value of the finished product |

||||||||||||||||||||||||

|

38.15 |

Prepared rubber accelerators |

|

Manufacture in which the value of the products used does not exceed 50 % of the value of the finished product |

||||||||||||||||||||||||

|

38.17 |

Preparations and charges for fire-extinguishers; charged fire-extinguishing grenades |

|

Manufacture in which the value of the products used does not exceed 50 % of the value of the finished product |

||||||||||||||||||||||||

|

38.18 |

Composite solvents and thinners for varnishes and similar products |

|

Manufacture in which the value of the products used does not exceed 50 % of the value of the finished product |

||||||||||||||||||||||||

|

ex ex 38.19 |

Chemical products and preparations of the chemical or allied industries (including those consisting of mixtures of natural products), not elsewhere specified or included; residual products of the chemical or allied industries, not elsewhere specified or included, excluding:

|

|

Manufacture in which the value of the products used does not exceed 50 % of the value of the finished product |

||||||||||||||||||||||||

|

ex ex 39.02 |

Polymerization products |

|

Manufacture in which the value of the products used does not exceed 50 % of the value of the finished product |

||||||||||||||||||||||||

|

39.07 |

Articles of materials of the kinds described in heading Nos 39.01 to 39.06 |

|

Manufacture in which the value of the products used does not exceed 50 % of the value of the finished product |

||||||||||||||||||||||||

|

40.05 |

Plates, sheets and strip, of unvulcanized natural or synthetic rubber, other than smoked sheets and crepe sheets of heading No 40.01 or 40.02; granules of unvulcanized natural or synthetic rubber compounded ready for vulcanization; unvulcanized natural or synthetic rubber, compounded before or after coagulation either with carbon black (with or without the addition of mineral oil) or with silica (with or without the addition of mineral oil), in any form, of a kind known as masterbatch |

|

Manufacture in which the value of the products used does not exceed 50 % of the value of the finished product |

||||||||||||||||||||||||

|

41.08 |

Patent leather and imitation patent leather; metallized leather |

|

Varnishing or metallizing of leather of heading Nos 41.02 to 41.07 (other than skin leather of crossed Indian sheep and of Indian goat or kid, not further prepared than vegetable tanned, or if otherwise prepared obviously unsuitable for immediate use in the manufacture of leather articles) in which the value of the skin leather used does not exceed 50 % of the value of the finished product |

||||||||||||||||||||||||

|

43.03 |

Articles of furskin |

Making up from furskin in plates, crosses and similar forms (heading No ex ex 43.02) (3) |

|

||||||||||||||||||||||||

|

44.21 |

Complete wooden packing cases, boxes, crates, drums and similar packings |

|

Manufacture from boards not cut to size |

||||||||||||||||||||||||

|

45.03 |

Articles of natural cork |

|

Manufacture from products of heading No 45.01 |

||||||||||||||||||||||||

|

48.06 |

Paper and paperboard, ruled, lined or squared, but not otherwise printed, in rolls or sheets |

|

Manufacture from paper pulp |

||||||||||||||||||||||||

|

48.14 |

Writing blocks, envelopes, letter cards, plain postcards, correspondence cards; boxes, pouches, wallets and writing compendiums, of paper or paperboard, containing only an assortment of paper stationery |

|

Manufacture in which the value of the products used does not exceed 50 % of the value of the finished product |

||||||||||||||||||||||||

|

48.15 |

Other paper and paperboard, cut to size or shape |

|

Manufacture from paper pulp |

||||||||||||||||||||||||

|

48.16 |

Boxes, bags and other packing containers, of paper or paperboard |

|

Manufacture in which the value of the products used does not exceed 50 % of the value of the finished product |

||||||||||||||||||||||||

|

49.09 |

Picture postcards, Christmas and other picture greeting cards, printed by any process, with or without trimmings |

Manufacture from products of heading No 49.11 |

|

||||||||||||||||||||||||

|

49.10 |

Calendars of any kind, of paper or paperboard, including calendar blocks |

Manufacture from products of heading No 49.11 |

|

||||||||||||||||||||||||

|

50.04 (4) |

Silk yarn, other than yarn of noil or other waste silk, not put up for retail sale |

|

Manufacture from products other than those of heading No 50.04 |

||||||||||||||||||||||||

|

50.05 (4) |

Yarn spun from silk waste other than noil, not put up for retail sale |

|

Manufacture from products of heading No 50.03 |

||||||||||||||||||||||||

|

50.06 (4) |

Yarn spun from noil silk, not put up for retail sale |

|

Manufacture from products of heading No 50.03 |

||||||||||||||||||||||||

|

50.07 (4) |

Silk yarn and yarn spun from noil or other waste silk, put up for retail sale |

|

Manufacture from products of heading Nos 50.01 to 50.03 |

||||||||||||||||||||||||

|

ex ex 50.08 (4) |

Imitation catgut of silk |

|

Manufacture from products of heading No 50.01 or from products of heading No 50.03 neither carded nor combed |

||||||||||||||||||||||||

|

50.09 (5) |

Woven fabrics of silk or of waste silk other than noil |

|

Manufacture from products of heading No 50.02 or 50.03 |

||||||||||||||||||||||||

|

50.10 (5) |

Woven fabrics of noil silk |

|

Manufacture from products of heading No 50.02 or 50.03 |

||||||||||||||||||||||||

|

51.01 (4) |

Yarn of man-made fibres (continuous), not put up for retail sale |

|

Manufacture from chemical products or textile pulp |

||||||||||||||||||||||||

|

51.02 (4) |

Monofil, strip (artificial straw and the like) and imitatior catgut, of man-made fibre materials |

|

Manufacture from chemical products or textile pulp |

||||||||||||||||||||||||

|

51.03 (4) |

Yarn of man-made fibres (continuous), put up for retail sale |

|

Manufacture from chemical products or textile pulp |

||||||||||||||||||||||||

|

51.04 (4) |

Woven fabrics of man-made fibres (continuous), including woven fabrics of monofil or strip of heading No 51.01 or 51.02 |

|

Manufacture from chemical products or textile pulp |

||||||||||||||||||||||||

|

52.01 (4) |

Metallized yarn, being textile yarn spun with metal or covered with metal by any process |

|

Manufacture from chemical products, from textile pulp or from natural textile fibres, discontinuous man-made fibres or their waste, neither carded nor combed |

||||||||||||||||||||||||

|

52.02 (5) |

Woven fabrics of metal thread or of metallized yarn, of a kind used in articles of apparel, as furnishing fabrics or the like |

|

Manufacture from chemical products, from textile pulp or from natural textile fibres, discontinuous man-made fibres or their waste |

||||||||||||||||||||||||

|

53.06 (4) |

Yarn of carded sheep's or lambs' wool (woollen yarn), not put up for retail sale |

|

Manufacture from products of heading No 53.01 or 53.03 |

||||||||||||||||||||||||

|

53.07 (4) |

Yarn of combed sheep's or lambs' wool (worsted yarn), not put up for retail sale |

|

Manufacture from products of heading No 53.01 or 53.03 |

||||||||||||||||||||||||

|

53.08 (4) |

Yarn of fine animal hair (carded or combed), not put up for retail sale |

|

Manufacture from raw fine animal hair of heading No 53.02 |

||||||||||||||||||||||||

|

53.09 (4) |

Yarn of horsehair or of other coarse animal hair, not put up for retail sale |

|

Manufacture from raw coarse animal hair of heading No 53.02 or from raw horsehair of heading No 05.03 |

||||||||||||||||||||||||

|

53.10 (4) |

Yarn of sheep's or lambs' wool, of horsehair or of other animal hair (fine or coarse), put up for retail sale |

|

Manufacture from materials of heading Nos 05.03 and 53.01 to 53.04 |

||||||||||||||||||||||||

|

53.11 (5) |

Woven fabrics of sheep's or lambs' wool or of fine animal hair |

|

Manufacture from materials of heading Nos 53.01 to 53.05 |

||||||||||||||||||||||||

|

53.12 (5) |

Woven fabrics of coarse animal hair other than horsehair |

|

Manufacture from products of heading Nos 53.02 to 53.05 |

||||||||||||||||||||||||

|

53.13 (5) |

Woven fabrics of horsehair |

|

Manufacture from horsehair of heading No 05.03 |

||||||||||||||||||||||||

|

54.03 (4) |

Flax or ramie yarn, not put up for retail sale |

|

Manufacture either from products of heading No 54.01 neither carded nor combed or from products of heading No 54.02 |

||||||||||||||||||||||||

|

54.04 (4) |

Flax or ramie yarn, put up for retail sale |

|

Manufacture from materials of heading No 54.01 or 54.02 |

||||||||||||||||||||||||

|

54.05 (5) |

Woven fabrics of flax or of ramie |

|

Manufacture from materials of heading No 54.01 or 54.02 |

||||||||||||||||||||||||

|

55.05 (4) |

Cotton yarn, not put up for retail sale |

|

Manufacture from materials of heading No 55.01 or 55.03 |

||||||||||||||||||||||||

|

55.06 (4) |

Cotton yarn, put up for retail sale |

|

Manufacture from materials of heading No 55.01 or 55.03 |

||||||||||||||||||||||||

|

55.07 (5) |

Cotton gauze |

|