EUROPEAN COMMISSION

EUROPEAN COMMISSION

Brussels, 7.12.2015

SWD(2015) 261 final

COMMISSION STAFF WORKING DOCUMENT

Accompanying the document

Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of Regions

An Aviation Strategy for Europe

{COM(2015) 598 final}

Table of Content

Chapter I 'THE SUCCESS STORY OF EU AVIATION'

1. A history of EU Aviation Policy

2. The impact of EU Aviation Policy

3. The competitiveness of the different parts of the aviation value network

3.1 Competitiveness of EU airlines in the global context

3.2 Competitiveness of EU airports in the global context

3.3 Competitiveness of Air Navigation Services Providers (ANSPs), auxiliary industry, manufacturing

4. The future of the EU aviation sector in the world

CHAPTER II 'A COMPETITIVE EU AVIATION SECTOR TO IMPROVE CONNECTIVITY, GROWTH AND JOBS'

1. Introduction

2. Enhancing the competitiveness of the EU air transport sector

2.1 A competitive assessment

2.2 Competitiveness in the public opinion

3. Connectivity matters

3.1 Definitions, sources of analysis

3.2 Connectivity within Europe

3.3 Connectivity vis-à-vis other world regions

3.4 Connectivity gaps

3.5 Facilitating Member States' action for regional connectivity

3.6 Promoting international connectivity to the benefit of European consumers and businesses

4. The profitability of the EU aviation value chain

4.1 Promoting market access for EU airlines

4.2 Insolvency laws in Europe

5. The capacity and performance challenges

5.1 Completion of the Single European Sky (SES)

5.2 Airport capacity: revision of the Slot Regulation and role of the Airport Observatory

5.3 The quality, efficiency and cost challenge at EU airports. The role of the Thessaloniki Forum of Airport Charges Regulators

CHAPTER III 'HIGH STANDARDS FOR PUBLIC CONFIDENCE, GROWTH AND JOBS'

1. Introduction

2. Revising the EU aviation safety system

2.1 The safety picture of the EU aviation sector. Regulation 216/2008: lessons learned

2.2 The way forward

2.3 The international dimension of the EU aviation safety system

3. Addressing security threats and vulnerabilities to civil aviation

3.1 The cost of aviation security. Investment in security: the One-Stop-Security concept

3.2 Aviation security equipment

3.3 Air cargo security

3.4 The cybersecurity challenge

4. Addressing decarbonisation, environmental protection and human health

4.1 Environment in the public consultation

4.2 CO2 emissions: the climate change challenge

4.3 Air traffic noise. Emissions and noise at airports

4.4 Inter-modality

4.5 Environmental sustainability of air transport

5. Addressing social, employment and change managements issues in civil aviation

5.1 A state of play

5.2 Change management in civil aviation.

5.3 Highly mobile workers (contracts, social security and taxation)

5.4 Airlines' rule shopping for air licences

5.5 Atypical forms of employment in civil aviation

5.6 The international dimension

6. Addressing social issues in air traffic management

6.1. Problems for air traffic resulting from industrial action

6.2 Air traffic controller (ATCO) mobility

7. Passenger rights and consumer protection: Revision of the passenger rights' regulation. Application of the existing rules

7.1 Revision of the passenger rights' regulation

8. Consumer protection in civil aviation

9. High standards in business conduct & unfair practices in the global aviation market

CHAPTER IV 'HIGH STANDARDS FOR INSTITUTIONAL GOVERNANCE IN EUROPE'

1. Setting the foundation for a high standard Single European Sky institutional governance

2. High standards in cooperation and coordination between European aviation organizations

CHAPTER V 'STRENGTHENING EUROPEAN AVIATION THROUGH RESEARCH, INNOVATION AND INVESTMENT'

1. Introduction

2. Flightpath 2050 and strategic research and innovation agenda (SRIA) recommendations

3. Modernization of ATM through SESAR Research and Deployment

4. Development of new types of aircraft and air vehicles

4.1 Safe development of drone operations

4.2 Improving certification as gate from research to innovation.

5. Digitalising European aviation to the benefit of both cargo and passenger transport

5.1 Improving infrastructure and service provision by deploying and optimising the use of ICT

5.2 Improving safety risk assessment through an Aviation Big Data project

6. Alternative fuels for aviation

Annexes

Abbreviations

|

ACARE

|

–

|

Advisory Council for Aviation Research and Innovation in Europe

|

|

ACC3

|

–

|

Air Cargo or Mail Carrier Operation into the EU from a Third Country airport

|

|

A-CDM

|

–

|

Airport Collaborative Decision Making

|

|

ACI

|

–

|

Airport Council International

|

|

AdP

|

–

|

Aéroports de Paris

|

|

AEA

|

–

|

Association of European Airlines

|

|

AENA

|

–

|

Aeropuertos Españoles y Aeronavegación Aérea

|

|

AF-KLM

|

–

|

Air France - KLM

|

|

AMS

|

–

|

Amsterdam Schiphol Airport

|

|

ANS

|

–

|

Air Navigations Services

|

|

ANSP

|

–

|

Air Navigation Service Provider

|

|

AOC

|

–

|

Air Operator's Certificate

|

|

ASD

|

–

|

Aerospace and Defence Industries Associations of Europe

|

|

ASEAN

|

–

|

Association of Southeast Asian Nations

|

|

ATAG

|

–

|

Air Transport Acton Group

|

|

ATC

|

–

|

Air Traffic Control

|

|

ATCO

|

–

|

Air Traffic Controller

|

|

ATFM

|

–

|

Air Traffic Flow Management (delay)

|

|

ATM

|

–

|

Air Traffic Management

|

|

ATRP

|

–

|

Air Transport Regulation Panel

|

|

AV-CERT

|

–

|

Aviation Response Emergency Team

|

|

BASA

|

–

|

Bilateral Air Safety Agreement

|

|

CAT

|

–

|

Commercial Air Transport

|

|

CDG

|

–

|

Paris Charles De Gaulle Airport

|

|

CEF

|

–

|

Connecting Europe Facility

|

|

CEO

|

–

|

Chief Executive Officer

|

|

CESE

|

–

|

Central, Eastern and South-East Europe

|

|

CO2

|

–

|

Carbon-Dioxide

|

|

CPC

|

–

|

Consumer Protection Cooperation

|

|

CRS

|

–

|

Computerised Reservation System

|

|

DG MOVE

|

–

|

Directorate General of Mobility and Transport

|

|

DG DEVCO

|

–

|

Directorate General for International and Development

|

|

DFS

|

–

|

Deutsche Flugsicherung GmbH

|

|

EAACC

|

-

|

European Aviation Crisis Coordination Cell

|

|

EASA

|

-

|

European Aviation Safety Agency

|

|

EASP

|

–

|

European Aviation Safety Programme

|

|

EASp

|

–

|

European Aviation Safety Plan

|

|

EC

|

–

|

European Commission

|

|

ECAA

|

–

|

European Common Aviation Area

|

|

ECAC

|

–

|

European Civil Aviation Conference

|

|

EEA

|

–

|

European Economic Area

|

|

EESC

|

–

|

European Economic and Social Committee

|

|

EFTA

|

–

|

European Free Trade Association

|

|

EGTS

|

–

|

Electric Taxiing System

|

|

ENAIRE

|

–

|

A Spanish ANSP

|

|

EoSM

|

–

|

Effectiveness of Safety Management

|

|

ETF

|

–

|

European Transport Workers’ Federation

|

|

ETS

|

–

|

Emission Trading System

|

|

EU13

|

–

|

Estonia, Lithuania, Latvia, Poland, Czech Republic, Slovakia, Hungary, Romania, Slovenia, Bulgaria, Croatia, Malta, Cyprus

|

|

EU15

|

–

|

Ireland, United Kingdom, Sweden, Finland, Denmark, Germany, Austria, France, the Netherlands, Belgium, Spain, Portugal, Italy, Luxembourg, Greece

|

|

EUROCAE

|

–

|

European Organisation for Civil Aviation Equipment

|

|

EY

|

–

|

Ernst & Young

|

|

FAA

|

–

|

U.S. Department of Transportations' Federal Aviation Administration

|

|

FAB

|

–

|

Functional Airspace Block

|

|

FSC

|

–

|

Full Service Carrier

|

|

FPI

|

–

|

Service Foreign Policy Instruments of the European External Action Service

|

|

FRA

|

–

|

Frankfurt Airport

|

|

FTE

|

–

|

Full Time Equivalent

|

|

FTO

|

–

|

Flight Training Organisation

|

|

GAMA

|

–

|

General Aviation Manufacturers Association

|

|

GCC

|

–

|

Gulf Cooperation Council

|

|

GDP

H2020

|

–

–

|

Gross Domestic Product

Horizon 2020

|

|

IAG

|

–

|

International Airlines Group

|

|

IATA

|

–

|

International Air Transport Association

|

|

ICAO

|

–

|

International Civil Aviation Organisation

|

|

ICT

|

–

|

Information and communication Technology

|

|

ILO

|

–

|

International Labour Organisation

|

|

ITF

|

–

|

International Transport Workers' Federation

|

|

KLM

|

–

|

Koninklijke Luchtvaart Maatschappij (airline)

|

|

LCC

|

–

|

Low Cost Carrier

|

|

LH

|

–

|

Lufthansa

|

|

LHR

|

–

|

London Heathrow Airport

|

|

MUC

|

–

|

München Airport

|

|

NACE

|

–

|

Statistical classification in the EU

|

|

NATO

|

–

|

North Atlantic Treaty Organization

|

|

NATS

|

–

|

A UK ANSP

|

|

NextGen

|

–

|

Next Generation Air Transportation System (US)

|

|

NGO

|

–

|

Non-Governmental Organisation

|

|

NIS

|

–

|

Networks and Information Security

|

|

OAG

|

–

|

Official Airline Guide

|

|

OECD

|

–

|

Organization for Economic Cooperation and Development

|

|

OPS/AIR/FCL

|

–

|

Operations/Air Worthiness/Flight Crew Licencing

|

|

OR

|

–

|

EU outermost region

|

|

OSS

|

–

|

One-Stop-Security

|

|

PSO

|

–

|

Public Service Obligation

|

|

PwC

|

–

|

PriceWaterhouseCoopers

|

|

RAT

|

–

|

Risk Analysis Tool methodology

|

|

RP2

|

–

|

2nd Reference Period

|

|

RPAS

|

–

|

Remotely Piloted Aircraft System

|

|

RPK

|

–

|

Revenue Passenger Kilometre

|

|

SAFA

|

–

|

Safety Assessment of Foreign Aircraft

|

|

SES

|

–

|

Single European Sky

|

|

SESAR

|

–

|

Single European Sky ATM Research

|

|

SJU

|

–

|

SESAR Joint Undertaking

|

|

SME

|

–

|

Small and Medium Enterprise

|

|

SRIA

|

–

|

Strategic Research and Innovation Agenda

|

|

SWIM

|

–

|

System Wide Information Management

|

|

TAW

|

–

|

Temporary Agency Workers

|

|

TCO

|

–

|

Third Country Operator

|

|

TEN-T

|

–

|

Trans-European Transport Network

|

|

TTE Council

|

–

|

Transport, Telecommunication and Energy Council

|

|

UAE

|

–

|

United Arab Emirates

|

|

UCPD

|

–

|

Unfair Commercial Practices Directive

|

|

UCTD

|

–

|

Unfair Contract Terms Directive

|

|

USD

|

–

|

US dollar

|

|

WGACS

|

–

|

Working Group on Air Cargo Security (of ICAO)

|

|

WCO

|

–

|

World Customs Organisation

|

Chapter I'THE SUCCESS STORY OF EU AVIATION'

1. A history of EU Aviation Policy

Europe has been striving to advance aviation with an entrepreneurial spirit since its early days. From the invention of the Montgolfière, throughout the era of airships towards first fixed wing aeroplanes, from the establishment of the oldest airline in the world still operating under its original name, and the opening of the world’s first airport duty free shop to the great pan-European project of Airbus which is manufacturing the largest commercial airliner of our days: European pioneers have a history of shaping global aviation and European regulators have aimed to match the pioneering spirit of those entrepreneurs and engineers by creating EU aviation policy – a regulatory framework to enable European aviation to safely advance and contribute to jobs and growth in the sector and the wider economy and ultimately to prosperity of EU citizens.

Air transport – a traditionally highly regulated sector: International air transport has traditionally been governed by bilateral agreements between individual countries, restricting the number of airlines on the routes concerned, the number of flights and the possible destinations. States considered aviation a strategic sector and aimed for equal sharing of the market between the designated air carriers of the respective parties, typically the government-owned flag carrier. Bilateral air transport agreements often provided only restricted market access, and regulated the level of competition (number of frequencies, routes, pricing).

Creation of the single aviation market: Over the last 20 years there has been a revolution in the economic and regulatory landscape of air transport in Europe. Before 1987, air transport services between EU Members States were also governed in the fragmented and protected legal framework outlined above. Since then, the EU has gradually moved to a single aviation market through a series of packages of legislation:The "First Package", (14 December 1987) started to relax the established rules. For intra-EU traffic, it limited the right of governments to object to the introduction of new fares. It gave some flexibility to airlines concerning seat capacity-sharing. The "Second Package" (27 July 1990) continued liberalisation efforts in the same areas, allowing greater flexibility over the setting of fares and capacity-sharing. It also gave all EU carriers the right to carry an unlimited number of passengers or cargo between their home country and another EU country (direct cross border market for air services, the right to fly from one country to another and back or "3rd and 4th freedom traffic rights"). The "Third Package" (23 July 1992) fully liberalised tariff setting, capacity, market access, introduced the possibility of Member States to tender public services obligations (PSO) and harmonised requirements for an operating licence for EU airlines. After a transitional period until 1997, EU carriers also gained the right to operate a route within another Member State (so called "Cabotage") which was an unprecedented step in international air transport.

Development of the EU's External Aviation Policy: In 2002, the European Court of Justice ruled that bilateral aviation agreements of Member States with third countries were in breach of fundamental provisions of the EU Treaty ('freedom of establishment') as they did not allow airlines from other Member States to benefit from the provisions of those agreements. For example, a German airline established in France could not benefit from the traffic rights accorded in the agreement between France and Australia. These rights were only available to French airlines. Consequently, the EU additionally developed its external aviation policy to restore legal certainty by negotiating Horizontal Agreements. By 2015, 50 Horizontal Agreements had been concluded which modified in total more than 1000 bilateral air services agreements of Member States with third countries. The 2012 Communication on the EU's External Aviation Policy which has been endorsed by the Council and the European Parliament and stresses the importance of aviation for the EU's economy, growth and jobs and recovery after the financial crisis and serves as guidance for policy-making, action and external aviation relations both at EU and Member State level: Its main aims are to liberalise market access to third countries while ensuring regulatory convergence and a level playing field for open and fair competition in international aviation.

Towards EU-level agreements: Airlines still have less commercial freedom when flying to many countries outside the EU and passengers have less choice. Beyond merely restoring legal certainty, the EU's external aviation policy therefore additionally aims to overcome continued fragmentation and restricted market access for the benefit of EU industry and citizens. EU Member States can still negotiate individual bilateral air services agreements, until the Council grants to the European Commission a negotiating authorisation for negotiating a Comprehensive EU Agreement. Comprehensive EU Agreements supersede the bilateral agreements of EU Member States with the respective third country and in their scope go beyond liberalising traffic rights. They also include comprehensive – hence the name – provisions to address and synchronise the regulatory conditions for open and fair competition and for a sustainable aviation industry including essential aspects such as safety, security, environment and economic regulation. The Council grants the Commission the authorisation to negotiate such agreements on a case-by-case basis. There are two main sub-groups of Comprehensive EU Agreements: Firstly, Neighbourhood Agreements, which aim at including a third country into a wider "Common Aviation Area" of the EU and its neighbouring countries – with all rights (full market access) and obligations (acceptance of the entire EU aviation acquis). Secondly, comprehensive agreements with key partners – strategically important third countries – which are based on the pillars of market access liberalisation and regulatory convergence.

An analysis of statistical trends following the conclusions of EU-level air transport agreements (Chart 1 below) shows growth regard the development of passenger numbers, generally more direct city pairs and more carriers competing in the market. In particular, passenger numbers between the EU and the Western Balkans almost tripled, between the EU and Morocco more than doubled and increased by 52% with Moldova, by 27% with Georgia and by 15% with Israel since the conclusions of the respective agreements. Direct city pairs almost doubled between the EU and Morocco (+87%) and the Western Balkans (+100%) and increased by 54% with Israel and by 30% with Georgia. The number of operating carriers increased by 48% between the EU and Morocco, by 30% between the EU and Georgia, by 59% between the EU and the Western Balkans and by 17% between the EU and Israel.

Chart 1 Trends after conclusion of EU level air transport agreements

Case study: The EU-US Aviation Agreement

The EU-US Air Transport Agreement was negotiated and signed in two stages in 2007 and 2010 and governs the world's largest intercontinental traffic flows and represents an important step towards the normalisation of the international aviation industry. The ultimate objective of the European Union is to create a transatlantic Open Aviation Area: a single air transport market between the EU and the US with free flows of investment and no restrictions on air services, including access to the domestic markets of both parties.

Chart 2 Traffic by air between EU and US

While the agreement does not go that far, it allows – for the first time – airlines to fly without restrictions from any point in the EU to any point in the US. The Agreement triggered a dramatic increase in services particularly in those parts of the transatlantic market that were previously subject to significant restrictions on operations arising from the pre-existing bilateral agreements: The number of individual city pairs increased by 30% and despite, the reduced demand for air traffic in the aftermath of 9/11 and the financial crisis, the number of passengers increased to more than 52 million scheduled passengers in 2014 (+18% since 2004). A comparison with other key extra-EU markets shows that the US is by far the most important extra-EU market. For example, in July 2015, there were 4 million scheduled seats offered on EU-US flights, which is the combined number of seats offered to Switzerland and Turkey which are currently the second and third most important extra-EU markets.

The conclusion of Neighbourhood Agreements resulted in price decreases on flights to Morocco and Western Balkans of 40% in the first five years after signature and a combined economic benefit of 6 billion €.

Case study: The EU-Morocco Aviation Agreement

In 2006, the EU and Morocco signed an aviation agreement which provides for the abolition of all restrictions on nationality, capacity, frequency or routes by European or Moroccan airlines between the two regions. It also provides for far reaching regulatory convergence in areas such as air traffic management, safety, security, environment, competition and consumer protection. The aviation market between Morocco and Europe was previously governed by restrictive bilateral air transport agreements, constraining the potential for growth. Average annual growth of passenger traffic during the period 1994-2005 was 2.3%. Between 2006 and 2014, the traffic went from 5.6 to almost 12 million annual passengers achieving a compound annual growth rate of more than 11% across the period.

An independent study carried out for the European Commission

has estimated the reduction in fares of around 40% between 2006 and 2011 which represents a consumer surplus gain of around €3,5bn. The EU-Morocco aviation agreement contributed to the creation of jobs, notably in the Moroccan tourism sector which in 2013 contributed to 1.8m jobs (direct, indirect and induced) and contributed with 19% (direct, indirect and induced) to the Moroccan GDP. Morocco welcomed more than 10 million tourists in 2013 – most of which are from the EU. This number grew by almost 60% since 2006 – also due to the development of air traffic since the conclusion of the Agreement in 2006.

Chart 3 Evolution of number of passengers between EU-Morocco 2006-2014

Regulation 1008/2008: Regulation 1008/2008, the legal successor of the three legislative packages which established the EU single aviation market, is the basic regulation that organises the internal market. Regulation 1008/2008 establishes who can benefit from the internal market (EU licensed airlines), who delivers the airline licence and how, the articulation of the licence with the safety oversight of the airline, the EU ownership and control requirements of an airline in order to receive a licence, the exception to the freedom to operate (public service obligations, environmental and emergency measures, and traffic distribution within airport systems) or the commercial freedom of airlines to set price provided the respect price transparency provisions. It also contains provisions on code-sharing, as well as on wet and dry leasing.

Regulation 785/2004: Following the terrorist attacks in the United States on 11 September 2011, the European Commission has taken an interest in insurance requirements in the aviation industry. In the framework of the common transport policy, and in order to foster consumer protection and avoid distortion of competition between air carriers, Regulation (EC) No 785/2004 of the European Parliament and of the Council of 21 April 2004 on insurance requirements for air carriers and aircraft operators ensures a proper minimum level of insurance to cover liability of air carriers in respect of passengers, baggage, cargo and third parties. The Regulation applies to all air carriers and to all aircraft operators flying within, into, out of, or over the territory of a Member State. It requires both commercial air carriers and general aviation aircraft operators to be insured, in particular in respect of passengers, baggage, cargo and third parties, to cover the risks associated with aviation-specific liability

Regulation 80/2009: It sets out a code of conduct for Computerised Reservation Systems (CRS) with the objective of offering consumers an unbiased choice of air fares under fair conditions. In evaluating whether the Regulation is achieving this objective during the Fitness Check carried out in 2013 the structure of the market in which CRS providers operate, a structure which is rapidly evolving and inherently complex was considered. The Fitness Check identified a number of areas where the Code could be marginally improved, albeit not necessarily in the immediate future. As providers other than the CRSs continue to develop products, which provide some, but not necessarily all the functionalities of a CRS, it is important to consider the correct scope of Regulation 80/2009 and whether its objective should be limited to ensuring an undistorted market for air travel distribution in market segments where only CRS providers might be considered to have a strong market presence, in particular business travel. In addition, future market developments may require ensuring an unbiased choice to the consumer across all available platforms, which may provide information on the available air travel services to customers. However, the relevant marketing and technological evolutions are still in progress, which renders adaptations to the legislative framework difficult at present.

Development of EU Aviation Safety Policy: Safety is at the centre of the EU's Aviation Policy. Statistically, flying is one of the safest means of transport and Europe has a strong safety record. However, aviation traffic in Europe is predicted to reach 14.4 million flights in 2035 (50% more than in 2012), which must be taken into account when measures are taken with a view to continuously maintain the safety of flying. Aviation safety policy not only gives confidence to EU citizens but contributes to the competitiveness of the EU aviation sector. A strong internal market, underpinned by an effective and efficient regulatory framework also opens up opportunities for businesses to expand successfully on the global market. The EU aviation safety policy is based on a comprehensive set of rules, now covering, after two extensions, all aspects of aviation safety such as manufacturing of aircraft, training of pilots or aircraft operations. Before that a European inter-governmental mechanism was in place that allowed for coordination between national authorities, but the rules resulting from this cooperation were neither uniform nor obligatory. In addition, the European Aviation Safety Agency (EASA) was established in 2002 as a specialised EU body for aviation safety. Since its creation, EASA's role has been to ensure a high uniform level of safety protection for EU citizens within the EU and worldwide, to ensure the high uniform level of environmental protection with respect to aeronautical products and to avoid duplication in the regulatory and certification processes among Member States. EASA also assists the Commission in the development of common aviation safety rules and monitoring the application of EU legislation in all Member States. Other main activity of this agency, of crucial importance to the EU aeronautical industry, is the type certification of aeronautical products – an activity which is funded not by taxpayer's money but entirely through the charges and fees paid by industry (the designers and manufacturers). A successful EU aviation safety policy is an important asset of the EU in international relations. Many of the countries around the world voluntarily apply EU requirements, which are perceived as representing state-of-the-art. This enhances global safety levels – also contributing to the safety of EU citizens travelling outside the EU – and has a catalytic impact on the competitiveness of the EU aeronautic manufacturing industry. The EU aviation safety policy, including through the conclusion of bilateral air safety agreements (BASAs), multilateral efforts in the context of ICAO, EASA certification activities, and technical cooperation projects facilitates the export of EU aeronautical products and services.

Development of EU Aviation Security Policy: Prior to 2001, aviation security was traditionally addressed at national level. Following the terrorist attacks in the United States on 11 September 2001 when commercial aircraft were used as weapons, causing numerous fatalities, the Commission made a legislative proposal to bring aviation security under the EU's regulatory umbrella. This initiative led to the adoption of a first framework regulation that provided the basis for allowing harmonisation of aviation security rules across the European Union with binding effect. That regulatory framework was subsequently overhauled by a new framework, in full effect from 29 April 2010, as laid down by Regulation (EC) No 300/2008 of the European Parliament and of the Council of 11 March 2008 on common rules in the field of civil aviation security and repealing Regulation (EC) No 2320/2002. On the basis of the security standards laid down by the ICAO, the EU has established a framework for common rules in aviation security that serves the economy and society by ensuring that air transport used by citizens and businesses is protected from acts of unlawful interference, such as terrorist acts or sabotage of aircraft. The EU framework has also set up a comprehensive oversight system for ensuring the implementation of EU rules. This requires the Commission to perform inspections to verify the implementation of EU rules, including through Member States' individual national aviation security programmes and national quality control programmes. Primary responsibility for oversight lies with the Member States which must also undertake audits and inspections.

A Single Sky for the Single Aviation Market: Air Traffic Management (ATM) provides the infrastructure for a safe and efficient flow of air traffic. Historically, ATM has always been developed at national level, but such fragmentation has led to inefficiencies which materialised with an exceptional level of congestion in the 1990s. As part of the EU’s aviation policy, the Single European Sky (SES) legislation – an ambitious initiative to reform the architecture of European airspace to meet future safety, capacity, efficiency and environmental needs – entered into force in 2004. The Single European Sky aims at reorganising European airspace according to air traffic patterns, setting common technical and procedural rules and fostering the development of a harmonised European ATM system. Today, an EU performance scheme applies to Member States, with binding targets set in the areas of safety, environment, airspace capacity and cost efficiency. The scheme is now in its second reference period. The new organisation of airspace has started to reduce delays, costs and emissions and improve safety. The airspace has been organised in Functional Airspace Blocks (FAB); nine FABs, involving from two to six States, are expected to deliver more results gradually. The Network Manager for the ATM network functions has been designated in 2011, with major coordination responsibilities for the operational network performance in the areas of capacity and flight efficiency. Since 2011, the Network Manager has gone from being a concept on paper to a successful reality recognised by all stakeholders, bringing tangible benefits to the EU aviation network and adjacent States. Finally, arguably the most significant research programme on ATM, SESAR, has already started to show progress; its deployment phase, supported by the availability of €2.5 billion as EU co-financing for ATM-related projects for the period 2014-2020, should be the major driver in the development of the single European sky in the next decades.

The EU airport policy: Being the starting and ending point of any flight, airports are a vital part of aviation system. They are a key component of the

Single European Sky

and of the

SESAR

programme. They are also increasingly important to the European economy and cohesion. In 2015, Airport Council International Europe (ACI Europe) estimated the total economic impact of airports as 4.1% of the EU economy, when catalytic, induced, indirect and direct economic impacts are considered together. The EU airport policy is made of three pieces of legislation governing respectively airport slots – defined as a permission given by a coordinator to use the full range of airport infrastructure necessary to operate an air service at a coordinated airport on a specific date and time for the purpose of landing or take-off; ground handling services – meaning a variety of services delivered at airports in support of the operation of air services; airport charges – paid by airlines for the use of the airport terminal and runway infrastructure necessary to operate a flight to or from an airport. Regarding slots, the continuous growth in air transport over the decades has increased pressure on the capacity available for aircraft movements at congested airports. There was thus a need for a regulation on airport slots. In 1993, the European Community adopted

Council Regulation (EEC) 95/93

on common rules for the allocation of slots at Community airports, based on the principles governing the system of slot allocation at global level (IATA Worldwide Scheduling Guidelines), in order to ensure the access of air carriers to congested airports of the Community on the basis of principles of neutrality, transparency and non-discrimination. The "use it or lose it" rule (an air carrier having operated its slots for at least 80% during the summer/winter scheduling period is entitled to the same slots in the equivalent scheduling period of the following year (so-called grandfather rights), otherwise the slots are lost) has been temporarily suspended following the events of 11 September 2001, on the occasion of the Iraq war and the SARS epidemic in 2003 and again in 2009 due to the intensity of the economic crisis and its impact on air carriers. In 2004, technical amendments to Regulation 95/93 were adopted, and in 2007 and 2008, the Commission adopted Communications on the application of the Slot Regulation. Further analysis carried out in 2010-2011 showed that the allocation system in place prevents optimal use of the scarce capacity at busy airports. Therefore, in 2011, the Commission proposed changes to the current Regulation mainly to allow for the introduction of market-based mechanisms across the EU provided that safeguards to ensure transparency or undistorted competition are established, including greater independence for slot coordinators. Regarding ground handling services, the market is covered by Directive 96/67/EC dating from October 1996 which gradually opened up the services to competition. This was necessary since the checking-in of passengers, baggage handling, the provision of catering services, etc. used to be a monopoly at many EU airports, and many airlines complained about the relatively high prices for the services provided and sub-optimal efficiency and service quality. According to various evaluations of the Directive by the Commission, the Directive has achieved is main objective of opening access to the ground handling market. But challenges remain, related to deficiencies in the current legal framework which prevent the ground handling market from providing consistently competitive services at all of the airports concerned. Finally, regarding airport charges, Directive 2009/12/EC lays down certain requirements on how airport charges are consulted upon by airports ("Airport Charges Directive"). It also outlaws discrimination in their application and obliges Member States to designate an independent authority to arbitrate in disputes between airports and airlines. These provisions can be regarded as minimum requirements; they do not say how airport charges are calculated, which is subject to different practices in the Member States. Charges for airport security are not addressed directly by EU legislation. The Directive applies at all airports handling more than 5 million passengers per year and at least to the largest airport in each Member State. This currently means around 70 airports in the EU, ranging in size from Ljubljana and Bratislava, each handling some 1.3 million passengers in 2014, to London Heathrow, with 73.4 million passengers in 2014.

Development of EU Air Passenger Rights Policy: The EU has adopted several regulations on air passenger rights designed at encouraging fair and consumer friendly commercial practices and to create a level-playing field for all airlines in the EU. One of the key measures is Regulation (EC) 261/2004 on air passengers' rights in case of denied boarding, long delays and cancellations which became applicable on 17 February 2005. The Regulation, as interpreted by ample jurisprudence by the Court of Justice of the European Union, sets a minimum level of quality standards for passenger protection, adding an important citizen's dimension to the liberalisation of the aviation market. Further, by virtue of Regulation (EC) 1107/2006 persons with disabilities or reduced mobility enjoy specific rights and protection at the airport and during air travel throughout the EU. Finally, by means of Regulation (EC) No 889/2002 amending Council Regulation (EC) 2027/97 on air carrier liability in the event of accidents, the EU aligned its legislation with regard to the liability of a Community air carrier in respect of passengers and their baggage with the provisions of the Montreal Convention to which it is one of the ratifying parties and extended the rules of the Montreal Convention to air services within one Member State. On 13 March 2013, the Commission proposed a revision of Regulation (EC) 261/2004 to ensure that air passengers have new and better rights to information, care and re-routing when they are stranded at an airport. At the same time there would be better complaint handling procedures and enforcement measures for passengers to obtain the rights to which they are entitled. The proposed amendment will ensure a fair balance between passenger and air carrier interests as well as compliance with general principles of EU law as interpreted by the Court of Justice of the European Union.

2. The impact of EU Aviation Policy

Expansion of the airline industry and development of the low cost sector: Global passenger traffic (annual passengers transported) increased from around one billion passengers in 1990 to more than three billion passengers today. Since 1970, global air traffic has doubled every 15 years, a trend which is expected to continue. Passenger numbers carried by EU airlines have seen constant growth rates since 1970 albeit not as steep compared with overall global numbers.

Expansion of the airline industry and development of the low cost sector: Global passenger traffic (annual passengers transported) increased from around one billion passengers in 1990 to more than three billion passengers today. Since 1970, global air traffic has doubled every 15 years, a trend which is expected to continue. Passenger numbers carried by EU airlines have seen constant growth rates since 1970 albeit not as steep compared with overall global numbers.

Chart 4 Passenger traffic by air, EU-US market share vs worldwide 1970-2014

A comparison with the US market, a comparatively mature market, however shows that the share of global passengers transported by US and EU airlines respectively has developed in parallel until 1990 (indicated by the purple line in Chart 4). From the beginning of the liberalisation of the EU Aviation Market, EU airlines could first expand and then maintain their market share and thereby close the gap with US carriers. This development can be explained with the creation of the EU single aviation market which liberalised intra-EU market access for EU airlines. As such it normalised air transport in the sense that it provided opportunities to EU industry which were comparable to US industry with the existing domestic US aviation market. This alleviation of commercial restrictions on EU feeder traffic, as a consequence, allowed EU network airlines to expand and intensify their "hub-and-spoke networks", which led to more passengers for EU airlines and a larger share for EU industry compared to the US.

The number of scheduled weekly seats available within the EU has increased from 5.5 million in 1992 to 13.9 million in 2015 (+152%). Growth rates for the different types of airlines (network carriers, charter and low cost carriers) were similar from 1992-2001. Virtually non-existent until 1995, and with a share of below 10% of weekly scheduled seats prior to 2002, the low cost sector outperformed and by 2012 left behind the network carriers' sector. In 2015, LCC accounted for 48% of seat capacity while network carriers provided less weekly seats than in 1998.

Chart 5 Evolution of supply of scheduled seats 1992-2015

More routes: Liberalisation has sparked the number of intra-EU routes between EU Member States which increased from 874 in 1992 to 3,522 in 2015(+303%, 6.2% average growth p.a.). The number of extra-EU routes increased from 988 in 1992 to 2,621 in 2015 (+165%, 4.3% average growth p.a.). Growth rates for intra-EU routes and extra-EU routes have been similar from 1992-2001, whereas growth of extra-EU routes was stronger from 2001 to 2014. Growth of domestic routes of EU Member States was comparatively flat (from 818 in 1992 to 939 in 2015), plateauing at 1,037 routes in 2010. While the number of intra-EU routes, extra-EU routes and domestic routes all increased in absolute terms, during the process of fully liberalising the market for air transport services, the share of intra-EU routes increased strongly, the share of extra-EU routes remained stable while the share of domestic traffic declined.

Studies show that low-cost carriers made more use of the liberalisation of 5th/7th freedom and "Cabotage" rights within the EU, which are indicated in turquoise and green in the chart below. The route network of network airlines on the other hand is still dominated by 3rd/4th freedom traffic (direct, cross-Member State intra-EU traffic) and domestic traffic provided by an airline licensed in the respective Member State. The low-cost business model focusing on point-point routes, mostly short-haul, is less complex than the hub-and-spoke networks of network airlines, which operate one or more hubs and combine feeder traffic with long-haul routes. This tendency can further be explained by the historical development of air transport services being operated by "flag carriers", traditionally rooted in a home market which is often reflected in an airline's name ("Swiss", "Air China", "Saudia", "Air Canada", "British Airways" etc.). Despite consolidation of the EU air transport market, for instance mergers between Air France and KLM or British Airways and Iberia, airlines continue to operate under their historical brands and with a separate licence, also because of external traffic rights linked to it. In the absence of full acceptance of EU designation by third countries, the regulatory obstacles for pan-European operations are therefore higher for those of the network airlines that operate intercontinental services dependant on bilateral traffic rights or on the acceptance of EU designation. Low cost carriers on the other hand currently focus on intra-EU services or on countries which are covered by EU-level comprehensive aviation agreements that facilitate pan-European operations (e.g. already operated trans-Atlantic services of Norwegian Air Shuttle).

Chart 6 Segmentation of flights by type of business model

Chart 7 Number of intra-EU vs. extra-EU routes

More competition between airlines: The increase of intra-EU routes was accompanied by a strong shift towards more competition on these routes: The number of intra-EU routes served by more than two carriers increased from 93 in 1992 to 599 in 2015 (up by more than 540%) and the number of extra-EU routes with more than two carriers increased from 77 in 1992 to 308 in 2015 (up by 300%).

Overall contribution to jobs and growth: The EU aviation sector directly employs between 1.4 and 2 million people. Aviation has considerable multiplier effects which increase the overall contribution to jobs and growth: In total, the sector supports 4.7 to 5.5 million jobs (including indirect and induced impacts) and if we include catalytic impacts – for instance tourism or the contribution the attractiveness of the EU as a business location – the overall contribution could rise to 9.3 million jobs according to ATAG. The direct contribution to the EU's GDP is €110bn which increases to €300bn taking into account indirect and induced impacts. The multiplier effects of aviation have been estimated through various econometric models: A 10% increase of connectivity/seat capacity stimulates the GDP (per capita) by an additional 0.5%, the GDP growth rate by 1% and leads to an overall increase of labour productivity. The availability of direct intercontinental flights is effectively a major determinant in the location choices of large firms’ headquarters: A 10% increase in the supply of intercontinental flights involves around a 4% increase in the number of headquarters of large firms. A 10% increase of departing passengers in a metropolitan region increases the employment in the services sector of that metropolitan region by 1%. A recent study found that one Euro value added in the air transport industry creates a value of almost three Euro value added for the overall economy. One job in the air transport industry added creates more than three jobs in other sectors. The sectors which are benefitting most from those indirect and induced impacts are other transport services/warehousing, rental and leasing activities, retail, construction, wholesale, provision of personnel, accommodation and gastronomy, financial services. A survey among German companies, from SMEs to multinationals, confirms that air transport is very important or important for 56% of the total companies and for 74% of industry – in particular for mechanical engineering, the automotive and chemical industries.

Since the creation of the single aviation market, employment figures in the air transport sector have remained stable with a strong growth in labour productivity.

Compared to other sectors the aviation sector is characterised by being composed by a smaller number of large enterprises and by a geographic concentration of the economic activity (Germany, France, UK for both air transport services and aerospace manufacturing). The apparent labour productivity of the sector is higher than the EU non-financial business economy average of €44.800 per capita (€75.300 for air transport services and €80.400 for aerospace manufacturing).

Chart 8 Direct passenger air transport employment (persons employed, NACE 51.1) by Member State, 2013

3. The competitiveness of the different parts of the aviation value network

With just 7% of the world’s population, the EU's trade with the rest of the world accounts for around 20% of global trade and 25% of global air traffic (2013 RPKs).

Profitability gap between different parts of the aviation value network: All parts of the aviation value network which is to be understood in a holistic way comprising all parts of the aviation sector (airlines, airports, manufacturing, auxiliary industry, ANSPs just to name a few), are interdependent and interlinked. This symbiotic nature becomes most evident when parts of the value network fail. For instance, industrial action at different elements of the aviation value network (air traffic controllers, pilots, cabin crews) impacts all airspace users across Europe. Cost related to ground handling account for 15%, to route charges of Air Navigation Service Providers (ANSP) for 6% and to airport charges for 4% of the operating cost of AEA airlines. Yet, the profitability of airlines, airports, manufacturing industry, ANSPs and other parts of the aviation value network is starkly differing. For instance, there is a profitability gap of 19 percentage points between globally leading airport groups and airline groups: In 2013, operating margins of top 100 airport groups were on average 23% compared to 4% for top 150 airlines. Differences regarding the regulatory environments do exist between the different parts of the aviation value network – with airlines being the most constrained in terms of market access, access to investment and in general the possibility to consolidate on a global level.

3.1 Competitiveness of EU airlines in the global context

IATA forecasts that 1% of global GDP expenditure will be spent on air transport in 2015. The global number of passenger departures (+6.5%), revenue passenger kilometres (+6.7%) and freight tonnes (+5.3%) are all expected to grow compared to 2014 and continue in line with the overall trend. As such the growth rates of air transport are higher than the growth rates of the world GDP (+2.6% in 2014, +2.9% forecast for 2015) and world trade (+3.0% in 2014, +3.7% forecast for 2015). The average net profit margin of the global airline industry increased from 1.5% in 2013 to 2.2% in 2014 and is forecasted to be 4.0% in 2015.

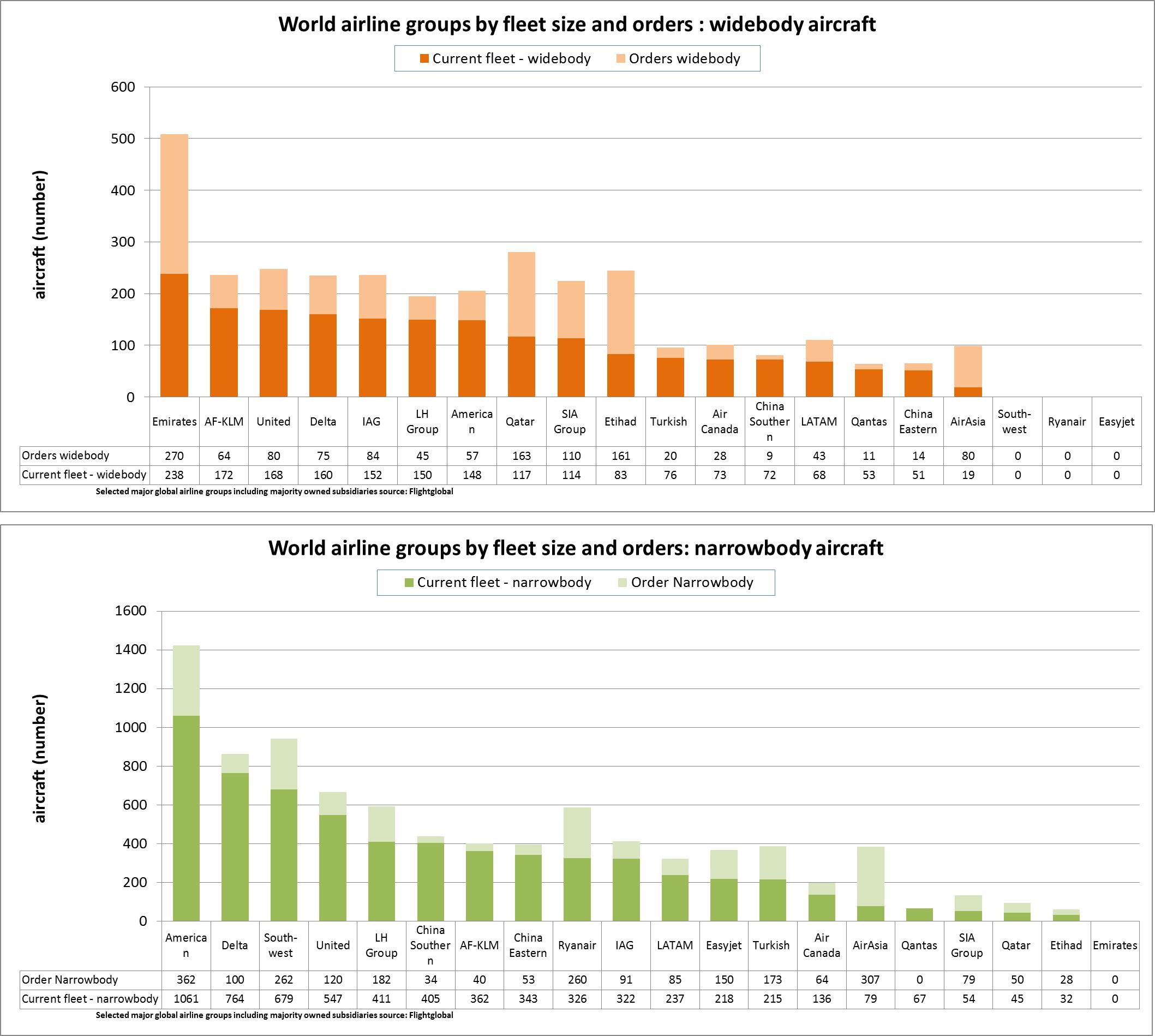

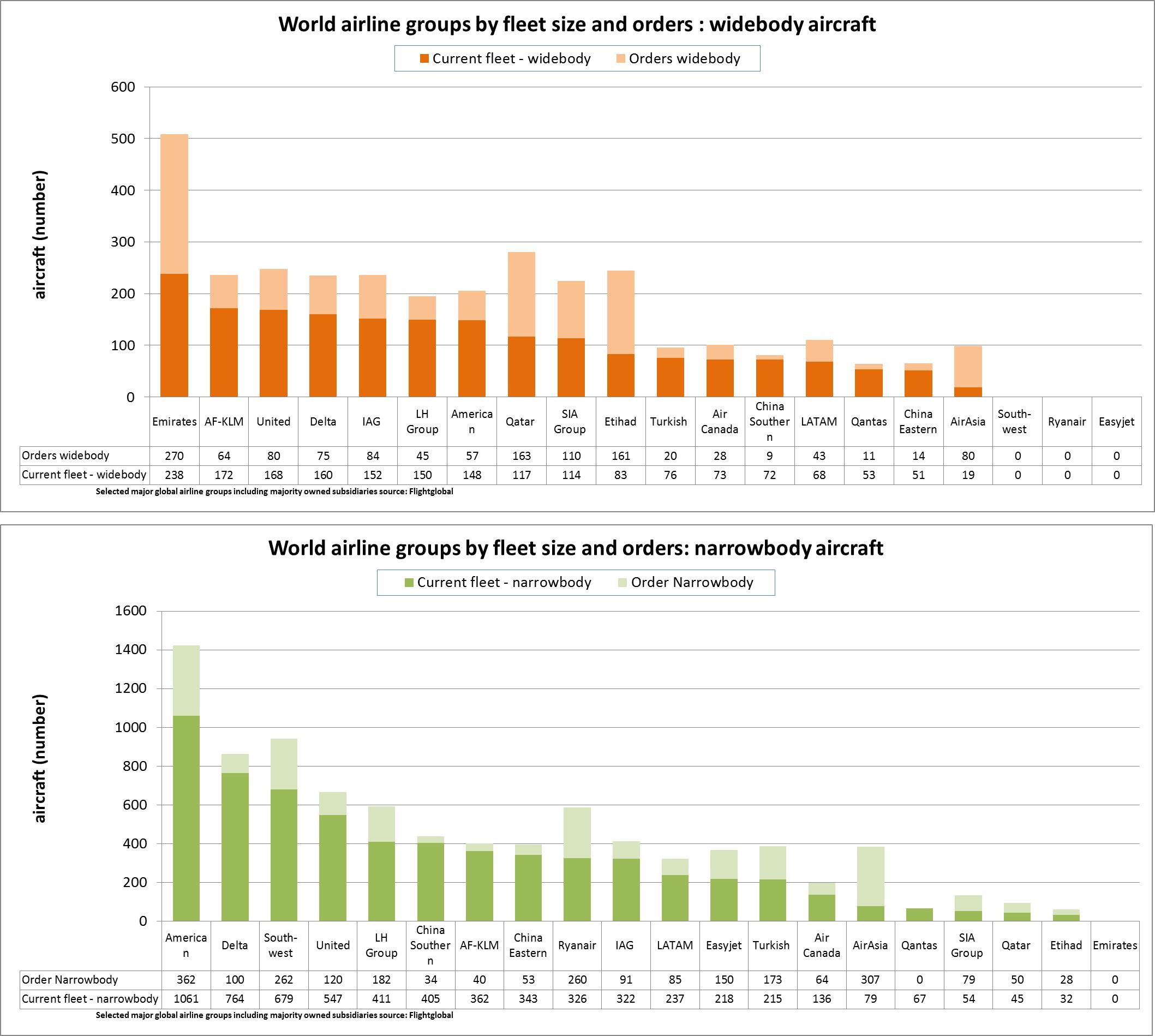

An analysis of the current fleet size, composition and orders of major global airlines shows that the big North American airlines have the largest overall fleets in service.

Charts 9 World airlines by fleet size and orders

Segmented according to widebody and narrowbody aircraft, it shows that the currently largest existing widebody fleets are with Emirates, AF-KLM and United with the largest orders of widebody aircraft placed for Emirates, Qatar Airways, Etihad and Singapore Airlines.

The largest narrow-body fleets are with large US arlines and the largest orders have been placed by American Airlines, AirAsia, Southwest Airlines and Ryanair.

Total orders exceeding airlines' current fleet size can be observed in the cases of Emirates, Singapore Airlines, Qatar Airways, Etihad and AirAsia.

Globally, North American airlines are leading with net profit margins of 3.5% in 2013 and 5.2% in 2014 with no other region exceeding a net profit margin of 2% in 2014. The European airline industry, including also companies based in Russia, Turkey, Switzerland or Norway, reported an average net profit margin of 0.5% in 2013 and 1.6% in 2014, falling short of the global average margins in both years. European airlines' also reported a high breakeven load factor of 64.7% (2014), higher than North America (58.1%), Middle East (59.1%), Latin America (60.1%) or Africa (56.0%) and second only to Asia-Pacific (65.2%). For 2015, IATA forecasts the highest breakeven load factor for European airlines, which means that European airlines need to fill more of the plane in order to breakeven.

Indeed when ranked by RPK as a measure of sales volume of passenger traffic, one can observe the rapid rise of emerging competitors to EU airlines. In terms of RPKs, a comparison of 2007 and 2014 data shows that leading EU airlines have been, or are increasingly left behind fast-growing competitors such as Emirates, Southwest and China Southern while China Eastern Airlines, Air China and Turkish Airlines are growing considerably faster. Ryanair and Easyjet are the leading EU companies which show the strongest growth rates. In comparison with the three large US legacy airlines, the largest EU airlines had a similar or even better performance in terms of RPKs over the period.

Chart 10 World airlines by RPKs

In total, in 2014 there were 32 EU airlines among the leading 150 airline groups by revenue (comprising passenger, leisure and cargo airlines), 30% less than in 2001 and 20% less than 2008. During that period of time, EU airlines fell behind their global competitors in terms of net profit and post an average net loss while the non-EU top 150 airlines are on average profitable. The EU Member State with most airline groups ranked (2014) is the UK (8), followed by Germany and France (3 each), Italy, Ireland, Luxembourg, Spain and Sweden (2 each), and Portugal, Denmark, Finland, Belgium, Greece, Hungary, Czech Republic and Poland (1 each).

Table 1 Overview of the global performance of leading EU airlines since 2001

|

Year

|

Number of EU airlines among top 150

|

Number of EU airlines among top 50

|

Number of EU airlines among top 25

|

Number of EU airlines among top 10

|

Number of EU airlines among top 5

|

Average net profit margin of EU airlines among top 150

|

Average net profit margin of non-EU airlines among top 150

|

|

2001

|

46

|

30

|

7

|

3

|

1

|

-3.1%

|

-4.6%

|

|

2008

|

41

|

24

|

5

|

3

|

2

|

-2%

|

-7.2%

|

|

2013

|

32

|

23

|

4

|

3

|

2

|

-0.4%

|

2.7%

|

In 2001, 2008 and 2014, there were three EU airline groups among the 10 largest airlines ranked by revenues: In 2014, the Lufthansa Group ranked 3rd, Air France-KLM Group 5th and International Airlines Group (IAG) 7th. IAG is the only EU network airline which ranks among the top 10 highest group net profits, whereas Ryanair and Easyjet – both low cost airlines – came 5th and 6th. Current net profit margins of these leading EU airline groups are between -0.8% (Air France) and 15.3% (Ryanair), with Lufthansa reporting a margin of 0.2%, IAG reporting a margin of 5.0% and Easyjet of 9.9%.

Table 2 Overview of financial performance of key EU airline groups in 2014 (in EUR, y-o-y)

|

Airline group

|

Revenue

|

PAX revenue

|

Cargo revenue

|

Other revenue

|

Revenue growth

|

Operating margin

|

Net margin

|

Employment by the airline

|

|

LHG

|

30bn

|

21.6bn

|

2.8bn

|

5.6bn

|

-0.1%

|

3.2%

|

0.2%

|

119,000

|

|

AFKLM

|

24.9bn

|

19.6bn

|

2.7bn

|

2.7bn

|

-2.4%

|

-0.5%

|

-0.8%

|

95,000

|

|

IAG

|

23.6bn

|

20.8bn

|

1.2bn

|

1.6bn

|

7.7%

|

5.1%

|

5.0%

|

60,000

|

|

Ryanair

|

5.7bn

|

4.3bn

|

-

|

1.4bn

|

12.3%

|

18.4%

|

15.3%

|

10,000

|

|

Easyjet

|

6.7bn

|

6.6bn

|

-

|

0.1bn

|

13.1%

|

12.8%

|

9.9%

|

9,000

|

|

Small/midsize network airlines

|

26bn

|

-

|

-

|

-

|

-

|

-

|

-4%

|

65,500

|

As depicted in Table 2, among these leading EU airlines, the Lufthansa Group, including all activities, directly employs 119,000 staff (90,400 of which are based in the EU), the Air France-KLM Group 95,000 staff (92,000 of which are in the EU) and IAG 60,000 staff. Ryanair directly employs 10,000 and Easyjet 9,000 staff. The largest contribution in terms of direct employment in the EU air transport sector is by far made by the large international network carrier groups.

Small and mid-sized EU network airlines which serve smaller hubs and mainly European networks with mostly selected long-haul services, report in average a loss of 4% in 2014. The direct employment is around 65,000 and as such 4 times less compared to the big international network airlines but more than 3 times higher compared to the leading low cost airlines.

All network airlines typically carry belly hold cargo on regular flights. Additionally, some airline groups have dedicated divisions or subsidiaries operating a freighter fleet and some airlines focus solely on cargo or express delivery services. In 2013, 18 EU airlines were among the top 100 cargo airlines and three among the top 10 ranked by cargo traffic. In terms of cargo revenue, 3 EU airlines ranked among the top 10 – dwarfed by FedEx which created as much revenue as its closest 9 competitors combined. Because of the diversity of the cargo business, operated by regular airlines as business divisions or by local subsidiaries of multinational companies along with a few dedicated cargo airlines and the diverging financial reporting standards, profitability in terms of net margins is difficult to compare.

In terms of RPKs of the combined top 50 airlines, those airlines focusing on holiday and charter services represent less than 7% of the overall airline business. 27 EU leisure airlines rank among the top 50 global airlines in this segment and 7 out of the top 10 companies are EU based. Because of the integration of various leisure airlines into larger overall tourism industry, such as TUI or Thomas Cook with their various airline subsidiaries and the diverging financial reporting it is difficult to compare profitability in terms of net margins.

3.2 Competitiveness of EU airports in the global context

During 2013, the global airport industry remained largely unperturbed by economic uncertainties of risks and reported overall revenue growth rates of 5.5% compared to 2012. Latest available ACI figures highlight that the global airport industry net profit margin was 16% while the global return on invested capital (ROIC) was 6.3%. However, the profitability is driven by a comparatively smaller number of airports which account for the lion share of passenger and cargo traffic – indeed 93% of all loss-making airports have fewer than a million passengers. Europe remained the leading region in terms of global airport income but experienced the weakest growth in overall revenues at 2.3%. In terms of Return on Invested Capital (ROIC), EU airports recorded an average of 5.7% (lower for Eurozone airports – 5%) which was below the global average of 6.8%.

In terms of passenger numbers, 9 EU airports rank among the 40 top global airports in 2014, a figure unchanged since 2000. However, due to stronger growth of airports outside of the EU, EU airports fall behind emerging competitors in the ranking of the top 10 global airports: In 2001, London Heathrow (4th), Frankfurt (7th), Paris CDG (8th), and Amsterdam (9th) made it into the top 10, while in 2008 Frankfurt fell back and Amsterdam fell out (London Heathrow came 3rd, Paris CDG 7th and Frankfurt 9th) and in 2014 only London Heathrow (4th) and Paris CDG (9th) were still ranked among the top 10 airports worldwide. Over the same period, Dubai jumped from 75th (2001) to 12th (2008) and to 7th position in 2014 (+520% / +38% growth respectively), Istanbul from 67th, to 30th and to 14th (+ 393% / +51% respectively) and Incheon from 68th to 33rd and to 23rd (+316% / +29% respectively).

In terms of international passengers, which excludes purely domestic traffic and puts stronger emphasis on international connecting and long-haul traffic this trend is even more visible. EU key hub airports (indicated by the blue columns) which have traditionally had a strong position in this ranking are increasing falling behind non-EU hubs.

Chart 11 Top airports by number of international passengers

Airports typically generate aeronautical revenue (passenger charges, landing charges, terminal rentals, security charges etc.), which accounted globally for 65.8 billion USD in 2012, and in Europe for 26.1 billion USD) and non-aeronautical revenue (retail concessions, property income/rent, car parking, food and beverage etc.), which accounted globally for 51.2 billion USD in 2012 and in Europe for 18.2 billion USD). Airport retailing in particular, the largest single component of non-aeronautical revenues, contributed around 15% of total airport revenues in Europe in 2011, growing from 11% in 2008. In absolute terms, revenues increased from €3.1 billion in 2008 to €4.1 billion in 2011.

The overall profitability of the global airport industry is created by 20% of airports whereas 67% of all airports, among them 80% of airports with fewer than one million passengers/year, are loss-making. In the EU, 60% of all airports (2012: 62%) and 77% of airports with fewer than one million passengers/year were loss-making in 2014.

While in total 44% of Europe's airport reported losses, there were also 33 EU airport groups among the leading 100 airport groups by revenue in 2013 – a figure similar to 2008. Average net profit margins among those EU airports are around 10% and slightly behind the global peers. The EU Member State with most airport groups ranked is Germany (6), followed by the UK (5), France (3), Italy and Spain (2 both), and the Netherlands, Austria, Sweden, Ireland, Portugal, Denmark, Finland, Belgium, Greece, Hungary, Czech Republic and Poland (1 each).

Table 3 Overview of financial performance of leading EU airports in 2014 (in EUR, y-o-y)

|

Year

|

Number of EU airports among top 100 (top 50 for 2001)

|

Number of EU airports among top 50

|

Number of EU airports among top 15

|

Number of EU airports among top 5

|

Average net profit margin of EU airports among top 100 (50 for 2001)

|

Average net profit margin of non-EU airports among top 100 (50 for 2001)

|

|

2001

|

17

|

17

|

8

|

4

|

8.7%

|

9.5%

|

|

2008

|

32

|

20

|

6

|

4

|

10.8%

|

10.8%

|

|

2013

|

33

|

17

|

6

|

4

|

10.9%

|

11.9%

|

In 2001, 2008 and 2013, 4 EU groups were leading the global ranking of the airports by revenue: London Heathrow (LHR), AENA, Aeroports de Paris (AdP) and Fraport. Additionally, the Schiphol Group (AMS) ranked 9th and Munich Airport (MUC) 11th in 2013. Current net profit margins of these leading European airport groups are between 8.3% (Munich) and 20.8% (AENA). 39% of their combined revenue comes from non-aeronautical sources.

Table 4 Overview of financial performance of key EU hub airport groups in 2014 (in EUR, y-o-y)

|

Airport group

|

Revenue

|

Aeronauti-cal revenue

|

Revenue growth

|

Operating margin

|

Net margin

|

Employment by the airport operator

|

Direct employment at the airport

|

|

LHR (2013)

|

3.7bn

|

2.3bn

|

10%

|

38.7%

|

12.2%

|

8,000

|

62,000

|

|

AENA

|

2.9bn

|

2.3bn

|

14%

|

27.5%

|

20.8%

|

7,250

|

27,000 (MAD only)

|

|

AdP

|

2.8bn

|

1.6bn

|

7.5%

|

23.8%

|

14.4%

|

9,000

|

114,000

|

|

FRA

|

2.4bn

|

0.9bn

|

8.1%

|

20.6%

|

10.5%

|

20,400

|

78,000 (FRA only)

|

|

AMS

|

1.5bn

|

0.8bn

|

5.3%

|

23.2%

|

18.5%

|

2,000

|

65,000

|

|

MUC

|

1.2bn

|

-

|

1.3%

|

22.1%

|

8.3%

|

8,000

|

32,000

|

Frankfurt, Aéroports de Paris, London Heathrow, Munich, AENA and Schiphol, the leading EU airports (airport operators), provide in total around 54.600 direct jobs. Employment, growth and profit in the airport sector takes place at hubs of the largest EU airlines groups, namely at Heathrow and Madrid, the hubs of British Airways and Iberia (AIG), Paris and Amsterdam, the hubs of Air France and KLM and Frankfurt and Munich the hubs of Lufthansa.

The total employment generated at a hub airport is significantly larger (including airlines, ground handling services, government services, catering and retail, other public passenger services, cargo services, building and maintenance contractors etc.). As an example these services account for 91% of the on-site employment at London Heathrow airport. The total economic contribution of London Heathrow is estimated to support around 190,000 full-time equivalent (FTE) jobs across the UK. In 2001, prior a major airport expansion, Madrid Barajas airport generated 27,000 direct, 25,700 indirect, and 102,500 inducted jobs. In 2013, 1,000 companies based at the three Paris airports operated by Aéroports de Paris, directly employed over 114,000 staff. In total, more than 340,000 jobs were directly or indirectly related, induced or catalytic to the activities of Aéroports de Paris which represent more than 8% of jobs in the Paris region. At Amsterdam Schiphol airport 500 companies directly employ 65.000 people on site. In total, the airport directly and indirectly contributes to 290,000 jobs. Businesses at, around and in the value chain of Frankfurt airport generate directly and indirectly employment of 116,000 jobs (of which 78.000 are on-site, the largest local place of employment in Germany), in addition to 59,000 jobs induced by the airport. Direct employment at the around 550 companies at Munich airport is 32,000 jobs.

For all EU airports, largest contribution to the direct employment at airports is made by airlines which account for 28% of the on-site jobs. A single EU network airline, accounts for more than 3,000 jobs at Berlin airports without using the airport as a main hub. Every new aircraft put into service creates direct employment at airlines (cockpit crew, cabin crew, ground staff, maintenance, customer service), but beyond that contributes to jobs at the airport (handling, technical services, retail, security etc.) and in the whole aviation value chain, including the aeronautical manufacturing industry. The direct employment impact of a narrow-body aircraft (in terms of full-term equivalents at airlines) ranges from 35 to 200 jobs while the direct employment impact of a wide-body aircraft ranges from 100 to 800 jobs. In other words, the direct employment impact of one additional aircraft alone is in the order of small/medium-sized enterprise or greater.

To compare, the total direct employment of Emirates airline, serving 30 destinations in EU, stands at 1.400 staff based in the EU. Emirates offers 15.8m yearly seats with more than 400 weekly frequencies to the EU. Etihad employs 657 staff in the EU and offers 4.4m yearly seats with more than 150 weekly frequencies. Delta, employs 400 staff in the EU and offers over 13m yearly seats with more than 1,000 weekly frequencies.

Considering the most conservative of the above-mentioned scenarios of direct employment created per long haul aircraft it results that the total employment of 28.800 staff related to Emirates' long haul fleet, 8.300 staff related to Etihad's long haul fleet and 16.800 related to Delta's long haul is mostly generated outside the EU. Indeed, taking into account the direct employment of those third country airlines in the EU, between 92% and 97% of direct employment is created at the respective hubs outside the EU. Given the likelihood that the total staff numbers of these airlines exceed the calculated staff numbers of this conservative scenario of employment per aircraft by at least 33% - it is also likely that the overall employment at the respective hubs is even higher. For EU based airlines, the situation would be exactly the opposite – with the vast majority of employment created in the EU instead of in third countries.

An analysis of the total employment impact of the before mentioned key hub airports shows that while employment of the airport operators amounts to 54,600 jobs, direct employment by other companies based at these key hub airports, including in particular international network airlines, is at 378,000 – 8-times the airport operators' direct employment –, with a total contribution to 1,295,000 jobs.

Chart 12 Employment at key hub airports

3.3 Competitiveness of Air Navigation Services Providers (ANSPs), auxiliary industry, manufacturing

The European air traffic management is currently provided by 37 ANSPs which in total employ 57,500 staff (2013). In comparison, the US airspace, which covers about 10% less geographic area but 57% more controlled flights in an more complex airspace with higher density, only has a single ANSP with 35,500 staff.

More than 27,000 – or more than 45% of all EU air traffic controllers – work for the five largest ANSPs.

Comparing the profitability and revenues of ANSPs is difficult because of the different legal set-up and degree of regulation which reflect in annual reports where available. For example, the Spanish ANSP ENAIRE is a public business entity under the Spanish Ministry of Public Works that manages the air navigation in Spain but also holds 51% of AENA, one of the largest EU airport groups. In general, one can distinguish between "en-route" services financed by air navigation charges and other commercial activities or investments. While all streams of revenue are considered for the overall overview (were data is available), the "en-route" profit serves as an indicator of the sector's profitability. In 2013 (2014 data available in September 2015), the profitability of those key ANSPs was between, indicated by the surplus for en-route activity, was between 5.4% (DFS) and 18.4% (ENAIRE). With the exception of NATS, a public-private partnership, all key ANSPs could improve their profitability compared to 2012. In 2013, many of the EU's ANSPs reported an economic surplus well beyond the planned ex-ante margins as specified in the European performance plan under the SES Performance Scheme.

Some ANSPs of other regions of the world operate with a less commercial mandate. For instance, the Canadian ANSP, is operating under the Canadian "Not-for-profit Corporations Act" while the Australian ANSP reported a net profit margin of 3.9% for 2013-2014.

Table 5 Overview of financial performance of key EU ANSP companies in 2014 (in EUR, y-o-y)

|

Company

|

Revenue

|

Revenue growth

|

Operating margin

|

Net margin

|

Surplus for the en-route activity (2012)

|

Surplus for the en-route activity (2013)

|

Employment

|

|

NATS (UK)

|

0.9bn

|

2%

|

-

|

17.2%

|

16.7%

|

10.2%

|

4,300

|

|

DFS (DE)

|

1.1bn

|

-0.2%

|

-

|

3.1%

|

-1.6%

|

5.4%

|

5,600

|

|

DNSA (FR)

|

1.4bn (2012)

|

-

|

-

|

-

|

4.6%

|

8.8 %

|

7,850

|

|

ENAV (IT)

|

0.84bn (2013)

|

1.3%

|

-

|

6%

|

4.9%

|

5.8%

|

5,700

|

|

ENAIRE (ES)

|

-

|

-

|

-

|

-

|

9.9%

|

18.4%

|

3,700

|

Auxiliary industries, such as ground handling and cargo handling, is an integral part of the EU's aviation value chain and in employed around 260,000 staff in 2013

. In 2013 the global industry's turnover was over USD 80bn – around 12% of the airline industry's turnover. Swissport, a European company, is the largest ground handling company in the world. John Menzies and Fraport are other globally leading EU ground handling services providers.

The aeronautical manufacturing industry, and its supply chains which include many SMEs, makes an important contribution of the EU's economy in terms of jobs, investment, research and innovation and foreign trade. The growth of the global aerospace industry and aerospace growth has been outpacing world GDP growth for years, in particular fuelled by strong demand in emerging economies which not least favours EU industry. 4 EU companies rank among the top 10 aeronautical manufacturing companies in terms of revenue, while the other 6 being US companies.

Sales of the EU's civil aeronautical manufacturing industry increased from €81billion in 2012 to €92 billion in 2014. Direct employment in the civil aeronautical manufacturing industry is estimated to be between 287,000 and 381,000 jobs while the direct employment of the aerospace industry – military and civil – as represented by AeroSpace and Defence Industries Association (ASD) stood at 535,000 jobs in 2014.

EU aviation policy has a positive impact on the demand for aeronautical products. By liberalising market access which enables air traffic growth, by ensuring the regulatory framework for a healthy EU aviation sector as a customer base the products and by standardisation and certification efforts which are enablers for the export of aeronautical goods. The aircraft manufacturing industry operates on a world market with a structure and competitive functioning that differs to that of the air transport sector, with a duopoly dominating the market for large civil aircraft.

33% of Airbus' revenue is created in Europe. Airbus employs 138,622 staff (of which around 125,000 are employed in the EU and of which 55,000 are employed in commercial airliner manufacturing. Airbus' order book is currently valued €857.5 billion, its 2014 revenues increased 5% to €60.7 billion and its net income increased 59% to €2.3 billion. 629 aircraft delivered in 2014 set a new company record. The civil aeronautical manufacturing industry also includes airframe producers for the general aviation sector, such as Dassault aviation which delivered 90 civil aircrafts in 2014, providers of air traffic management systems and flight avionics solutions such as Thales (more than 17,000 direct staff) with an order book valued €8.7 billion. Agusta Westland (13,000 direct staff) and Airbus helicopters are both leading helicopter producers while Rolls Royce (24,000 direct staff in the aerospace division) produces engines for aircraft and helicopters – in total to more for than 35 types of commercial aircraft. Together with their supply chains the civil aeronautical manufacturing industry made an important contribution to the EU's economy and exports. Standardisation efforts and regulatory convergence in the field of certification and common rule making by EASA contribute to the competitiveness of this part of the aviation sector. As an significant part of the revenues are generate through exports, aviation projects with key trading partners have been launched with a view to fostering EU industrial interests in key aviation markets where EU industry, such as China.

Chart 13 Job-Profitability discrepancy in the EU

4. The future of the EU aviation sector in the world

In the last 50 years, continuous growth of air traffic has been observed, with only slight slowdowns in times of crisis which however did not change much the overall growth curve

. Air travel has proven to be resilient to external shocks growing 73% over the last 10 years, and there is in general a strong stochastic relation between the growth of economies and the growth of traffic.