EUROPEAN COMMISSION

EUROPEAN COMMISSION

Brussels, 28.10.2015

SWD(2015) 203 final

COMMISSION STAFF WORKING DOCUMENT

Report on Single Market Integration and Competitiveness in the EU and its Member States

Accompanying the document

COMMUNICATION FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT, THE COUNCIL, THE EUROPEAN ECONOMIC AND SOCIAL COMMITTEE AND THE COMMITTEE OF THE REGIONS

Upgrading the Single Market: More Opportunities for People and Business

{COM(2015) 550 final}

{SWD(2015) 202 final}

3 The evolution of integration, performance and remaining barriers in the Single Market

3.1

The evolution of integration in the Single Market

In 2014, intra-EU trade performance improved relative to the two previous years, but it still remains short of what it would have taken to make a significant contribution to the economic recovery. As a percentage of GDP, the total of intra-EU trade in goods was 3 % higher in 2014 than in 2013. The change in trade in services in 2013 was 2.4 %.

Looking into the evolution of intra-EU trade in goods and services over the last decade is particularly relevant at the time of presentation of the new Single Market Strategy. An overview of the most salient trends in the integration of goods and services markets is helpful to identify those areas where the single market is most dynamic. It is also needed to find out whether the expansion of trade is stagnating due to structural developments or restrictions to the free movement of goods, services, capital or labour in the EU economy.

This section looks at trade issues and the next one will present the situation regarding investment and establishment. The rest of the chapter looks into performance and remaining barriers in the single market, presenting some of the main developments that are the subject of priority action by the Single Market Strategy.

3.1.1

Trade in goods: The importance of enlargement for integration in the EU

The crisis had a profound negative impact on the evolution of intra-EU flows of goods. Intra-EU trade in goods contracted by 3 percentage points as a proportion of GDP in 2009 with respect to 2008, while in services it only dropped slightly. After that year, and unlike the evolution of trade in services, trade in goods within the EU has been growing slightly above GDP accounting for around 20 % of EU GDP in 2014 (Figure 3.1).

|

|

|

Figure 3.1:Evolution of intra EU trade

|

|

|

|

Source:Eurostat

|

|

|

These aggregated data conceal very different patterns in the integration of the incumbent Member States in 2004 (EU-15) and those that have joined since then (EU-13). Figure 3.2 shows that the share of trade over their GDP of the first group has remained basically flat since 2004, if we exclude the fall in 2009 due to the crisis (Figure 3.2). Intra-EU exchanges in goods between the Member States of the EU-15 and the rest of the Union have remained practically flat throughout the whole 2004–2014 period, accounting for less than 20 % of GDP (Figure 3.2). As a matter of fact, several of these countries have actually reduced their intra-EU exchanges in the five years from 2010 to 2014 from the previous period, albeit only by a small percentage of their GDP.

|

|

|

Figure 3.2:Intra-EU exchanges of goods as a share of GDP between Member States (2004–2008 and 2010–2014)

|

|

|

|

Source:Eurostat

|

|

|

In contrast with this, the EU-13 group has displayed increasing integration in the EU-28 since 2004 if we exclude the worst days of the crisis. In fact, integration picked up momentum after the crisis. The intensity of intra-EU exchanges of goods between Hungary, Estonia, Lithuania, Latvia, Slovakia, Poland, Romania, the Czech Republic and Slovenia with the EU-28 has increased considerably. These nine of the EU-13 Member States account for much of the trade creation in the single market. Nonetheless, it must be noted that there has been an important increase in the trade in goods between the Netherlands and the rest of the EU-28. In contrast, Greece, UK, France and Italy show the lowest levels of integration in the trade in goods. Of the EU-13, only Cyprus shows a low level of integration in 2014.

|

|

|

Figure 3.3:Intra-EU trade in goods in % of GDP

|

|

|

|

Source:Eurostat

|

|

|

Table 3.1 gives a clear picture of the considerable turnaround in the ranking of integration in trade in goods of the Member States of the Union. In the last five years, two EU-13 countries, Slovakia and Slovenia have taken the lead in the ranking of trade integration in goods from Belgium, the leader in 2010. Large Member States of the EU-15 group remain at the bottom of the table with much lower and in some cases, falling trade integration indicators.

|

|

|

Table 3.1:Evolution in the openness to intra-EU trade in goods of EU-28 (2010–2014)

|

|

|

|

Source:Eurostat

|

|

|

There are reasons to believe that this subdued performance of intra-EU goods markets after the crisis of the EU-15 cannot be attributed to the impact of the crisis only. The stagnation of intra-EU trade between the EU-15 and the rest of the EU started around 2004, well before the crisis struck in late 2008 and 2009. Differences in the trends of integration patterns between the EU-15 and the EU-13 also seem to call for additional explanations. Thus, the causes of the relative stagnation of intra EU exchanges in goods seem to have been present already before the crisis struck the EU economy.

There is no doubt that adhesion has been a very important driver of the integration of the EU-13. The relatively smaller size of the EU-13 Member States could explain, at least in part, these higher integration levels in the EU-13. However, there must be other additional reasons explaining their higher levels of trade integration. For instance, Poland, the largest of these 13 economies with a GDP more than twice as big as the GDP of Ireland, shows a trade integration index greater than Ireland. The very high shares of countries such as Slovakia or Slovenia also point in the same direction. Thus, country size does not seem to be the only variable explaining the higher levels of integration of the EU-13 that joined the Union in or after 2004.

This stagnation of trade in goods between the EU-15 and the rest of the Union needs to be studied in detail in future reports. At this moment, a preliminary analysis of the intra-EU trade flows suggests some possible hypotheses for future work. The impact of the crisis, changing patterns in the geographic location of production activities, some degree of exhaustion of the possibilities of integration in sectors where the removal of obstacles has been successful, and remaining regulatory, structural and behavioural obstacles in other sectors can be included among the “a priori” plausible explanations to consider.

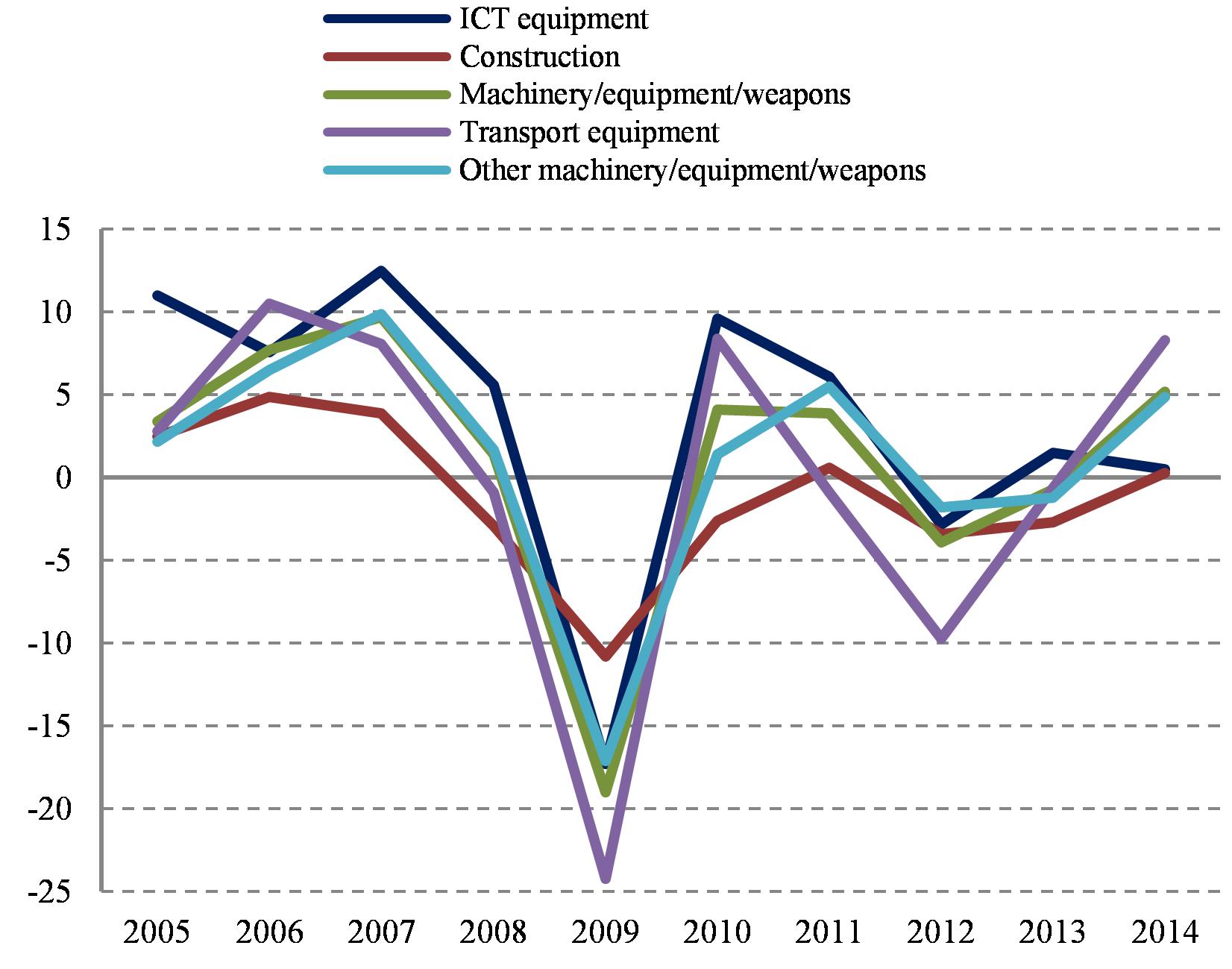

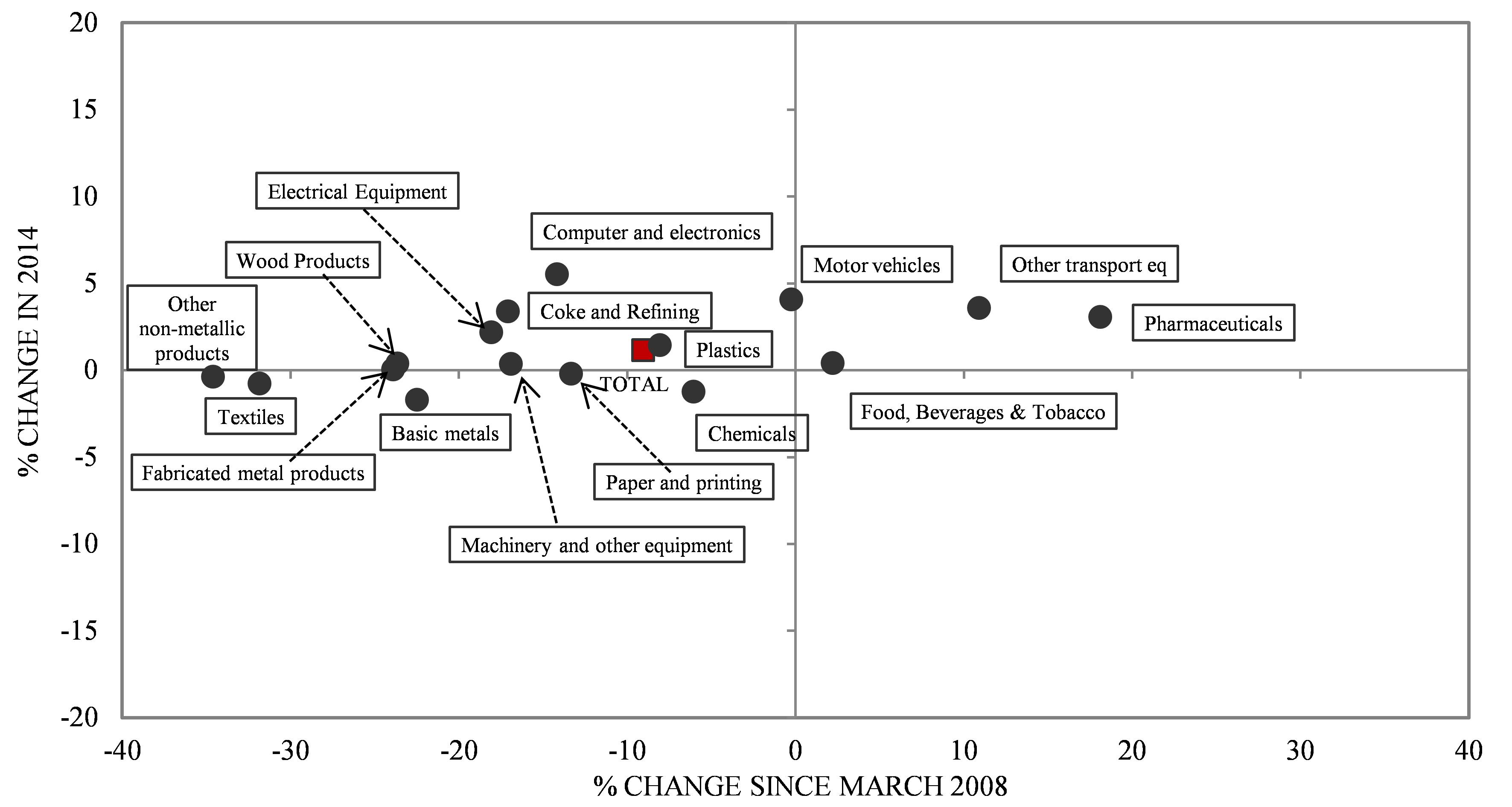

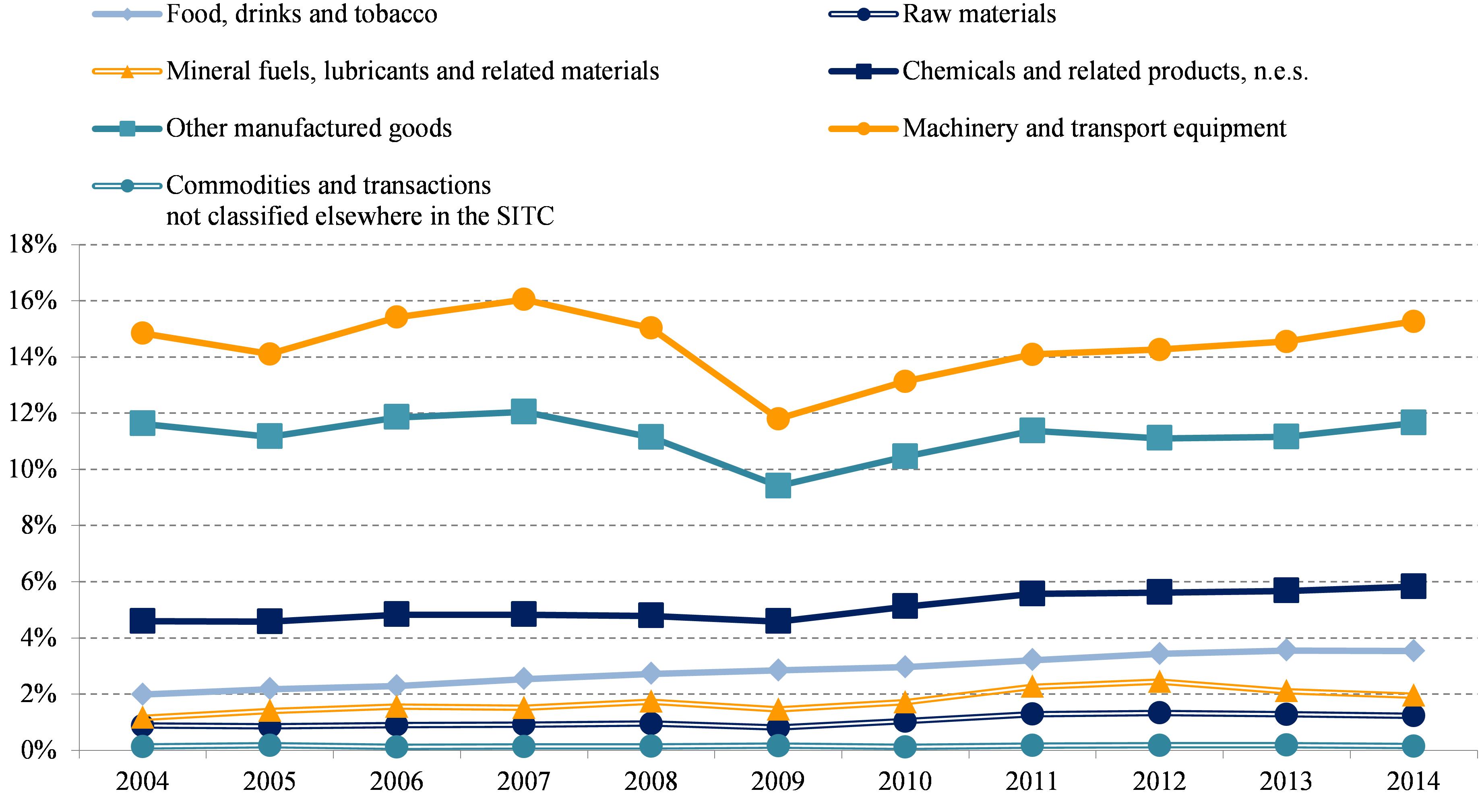

A look at the evolution of trade of different groups of products can also help to give a preliminary glimpse of the sectors driving these trends in the evolution of trade in goods. "Machinery and transport equipment" is by far the most important product group in intra-EU trade in goods with approximately 7 % of GDP for the EU-15. Intra-EU "imports" in this category have fallen by over 9 % between 2007 and 2013, although they recovered in 2014 to almost reach their 2008 level. This major product category includes durable consumption goods (e.g. automobiles) but most importantly, investment goods too. The particularly low level of investment in the EU in recent years may have played a major role in the evolution of intra-EU exchanges of goods for the EU-15. The demand for goods in the "Machinery and transport equipment" group has evolved differently across countries. In Germany, "imports" of these goods from other Member States increased by 48 % in the last 11 years while it fell in Spain and Italy.

|

|

|

Figure 3.4:Intra-EU "imports" of goods in the EU-15 by product groups (2004–2014, million Euro)

|

|

|

|

Source:Eurostat

|

|

|

Imports of other manufactured products have remained stable, as have raw materials and commodities, while other product groups – including chemicals – have expanded more than income for other product groups despite the impact of the crisis and slow growth rates of recent years. Thus, given the weight and evolution of "Machinery and transport equipment" imports until 2013, they appear to have played a determinant role in the stagnation of EU-15 "imports" of goods.

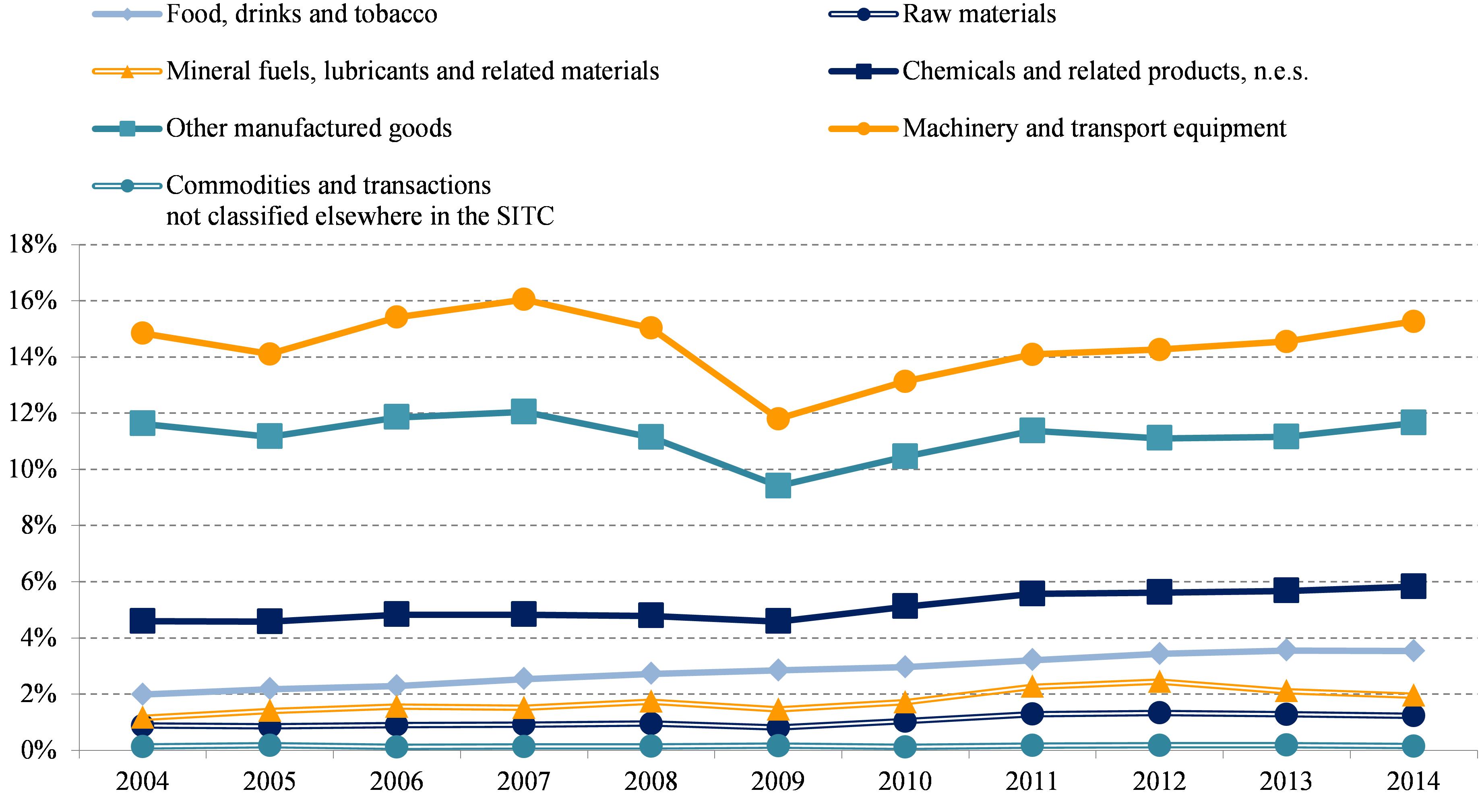

In the EU-13, the demand for "imported" goods suffered more severely the impact of the crisis in 2009 but it recovered quickly and vigorously after 2009. Intra-EU "imports" of the main product groups, machinery and transport equipment and other manufactured products, account for a much higher share of GDP than in the EU-15, since the beginning of this period, reaching almost 16 % of GDP for machinery and transport equipment.

|

|

|

Figure 3.5:Intra-EU "imports" of goods in the EU-13 by product groups (2004–2014, share of GDP)

|

|

|

|

Source:Eurostat

|

|

|

In summary, the analysis by Member State of the evolution of trade in goods shows two different patterns that seem to reflect the different stage of maturity in the single market: the incumbent Member States before 2004 (EU-15), where the impulse of integration seems to have dovetailed and a much more dynamic group of new Member States (EU-13) where the impulse of adhesion remains active. This distinction may be relevant for policy purposes.

A very preliminary look into the sectoral and geographic breakdown of intra-EU flows in goods suggests that the crisis, and in particular the subdued evolution of investment in the EU-15 analysed in Chapter 1, have certainly had a considerable impact. However, other structural and regulatory factors might contribute to explain this evolution of intra-EU exchanges in goods.

In the EU-15, the sluggish growth, a mediocre productivity performance in many countries and the prevalence of obstacles to integration in goods as well as in services sectors keep trade in goods subdued. The quantitative importance of the “Machinery and investment goods” sector seems to have been a key factor explaining the evolution of trade in goods in the EU 15. Low levels of demand for investment goods in these countries must have played an important factors explaining the relative fall in trade in this sectors among the EU-15. But evidence provided by a recent study (see section 3.3.1) points at remaining regulatory barriers in the railway equipment sector as an additional factor limiting exchanges in this rector. In addition, the importance of barriers and inefficiencies in services markets for the development of goods markets should not be underestimated.

Investment dynamics in the emerging EU economies and the consolidation of emerging new trading relations between the EU-15 and the EU-13 countries have supported the higher rates of integration of the relatively “newer” EU Member States. This seems to be confirmed by evidence provided in the foreign direct investment and establishment section below. The impact of a geographic redistribution of at least some production activities following the enlargement may explain the different behaviour of the EU-15 and EU-13 country groups as far a trade in goods is concerned.

However, all this must be considered as preliminary evidence calling for new detailed work to learn more about these patterns. The stagnation of trade flows in goods over a decade may also call for further work on the nature and effects of integration and dynamic efficiency in the single market.

3.1.2

Trade in services: the potential for further integration in the single market

Against this background, the situation of intra-EU exchanges in services is very different. First of all, the share of trade in services over GDP is much lower than in goods. In 2014, the share of total intra-EU exchanges in goods ("imports" plus "exports" divided by two) ranges between 18 % of GDP for EU-15 and more than 40 % for EU-13. For services, these shares go from 4.5 % to less than 7 % of GDP. The nature of services contributes to explain these differences. Services are less suitable to be traded cross-border. Many of them can only be provided if firms or consumers move cross-border. In those cases, establishment in other Member States is often the preferred way for the realisation of service provision. But there are other reasons at play: there remain considerable restrictions hindering cross-border exchanges of services as explained here below and in the Single Market Strategy.

|

|

|

Figure 3.6:Intra-EU exchanges of services between Member States (2004–2014)

|

|

|

|

Source:Eurostat

|

|

|

There is a second interesting difference between intra-EU exchanges in goods and services. Cross-border exchanges in services as a share of GDP show a steady and progressive increase over time and they have not been seriously affected by the crisis. Figure 3.6 shows that both in the EU-15 and in the EU-13, the intra-EU exchanges of services have been growing steadily more than GDP over the 2004 to 2014 period. The 2009 shock of the financial crisis had a much smaller impact on the flows of services than on goods and this impact was short-lived.

|

|

|

Figure 3.7:Intra-EU trade in services in % of GDP

|

|

|

|

Source:Eurostat

|

|

|

The breakdown of intra-EU exchanges in services by sector reveals important differences for various services activities. Easily traded services such as travel and transport account for a significant part of the total transactions with over 24 % and 19 % of the total cross border trade in services in the EU-28. However, "Business services" are the main sector accounting for the largest share of intra-EU trade in services with over 25 % in 2013. Intra-EU exchanges in this sector have grown by 5.6 % between 2010 and 2013, but the fastest growing sector in intra-EU trade terms has been the Maintenance and repair sector with over 15 % growth in those years.

|

|

|

Figure 3.8:Sectoral composition of intra-EU exchanges of services (2010–2013)

|

|

|

|

Source:Eurostat

|

|

|

The signs of maturity or stagnation identified in the previous section for the single market for goods, reflected by different patterns displayed by trade in the EU-15 and EU-13 groups of Member States, are not found in the services markets. The differences in the levels of integration between the two groups of countries are much smaller and the turnaround in the ranking of integration in services across countries is not so clear in favour of the EU-13 countries. Over time, progressive albeit modest improvements in the development of intra-EU exchanges in services sectors can be observed for the EU-28. The most significant improvements are reported by Ireland, Belgium and Hungary. Only Cyprus and Bulgaria show lower trade intensity in the intra-EU exchanges in services in 2010–2013 compared with 2004–2008 (Figure 3.7).

Within services there are sectors with considerable potential of expansion in intra-EU trade. The study on the implementation of the Services Directive and the Communication preparing the mutual evaluation exercise point out the economic importance of business services and construction for employment and growth making those two service sectors priority for the Commission.

The “business services” sector is particularly important because it has a considerable impact on the productivity growth of manufacturing and other services sectors. Trade in “maintenance and repair services” is often associated with the acquisition of capital equipment or consumer durables. In many cases, these activities are often present in the development of new business models or in the bundling of goods and services in "business solutions". They also require the contribution or cross-border operation of skilled labour and/or professionals considered as regulated professions. As explained in the Staff Working Document accompanying the Single Market Strategy, these activities are often subject to national regulations that often hinder the development of these cross-border activities. Despite these difficulties, the considerable growth and increasing trading activities reported by these sectors are evidence of their growth potential once these obstacles are removed.

|

Box 3.1. The importance of business services

In some Member States, the services value added content of manufacturing exports is as high as 30 %, of which 40 % corresponds to business services. An implication of a high use of services in manufacturing exports is that exports of countries with underperforming services would benefit from reform efforts targeting services sectors. In addition:

1.Professional services activities included in the "business service" category such as architects, engineering, legal advice, accounting or management consultancy stand out because of their ‘special’ characteristics: a) they rely greatly on professional knowledge, b) are sources of knowledge and c) are of competitive importance for their clients. They perform, mainly for other companies, ‘services encompassing a high intellectual value-added’ providing customised problem solving assistance, through tacit and codified knowledge exchange. Therefore, their role in the economy goes significantly beyond their shares in value added and employment.

2.They create significant spill-overs because they are used in the production of other goods and services in the economy (supply spillovers) and can thus have a strong impact on other sectors’ economic performance. This is particularly the case of professional services activities included in the business services categories. Thus, the benefits of reforms aiming at liberalising and improving the functioning of those professional services, will spread through the whole economy.

3.The increased fragmentation of production processes into parts that can be outsourced has led to more complex systems for manufacturing production and has enhanced the role of co-ordination and related professional-services. Successful business relies more and more on the value provided by services. Therefore, well-functioning business services contribute to business successes.

4.They can be a significant driver of non-price competitiveness. Business services, in particular professional services, are increasingly being used to differentiate products that can compete on the package of associated services (after-sales service, maintenance, training, etc.). Business services, among which professional services, are among the most important market services sectors for exports of manufacturing, as demonstrated by the 30 % and 40 % proportions referred to above.

|

|

|

Data on the composition and evolution of the very diverse activities included in the “Business services” category are scant and time series are short. However, Eurostat publishes information shedding light on the recent evolution of some of those activities for at least some Member States, although it does not cover the full EU-28. Among them, computer programming and consultancy, employment and data processing services have reported turnover growth since 2008.

|

|

|

Figure 3.9:Turnover of cross-border deliveries of "Business services" subsectors for several EU Member States: value and proportion of total sector turnover (2008–2012)

|

|

|

|

Source:Eurostat

|

|

|

The evolution of cross-border activities of these subsectors was quite different. The bars in Figure 3.9 show the values of the cross-border deliveries of services to another Member State. The lines indicate the share of these intra-EU deliveries over the total turnover of these subsectors.

Legal, accounting and consultancy services seem to be increasingly traded cross-border in the single market. This is due to the relative increase in the cross-border activities in accounting, audit and management consultancy while the value of cross-border deliveries of legal services remains stagnant over these five years.

The share of intra-EU cross-border deliveries of employment services is remarkably low, which probably reflects the relative degree of fragmentation of this market in the EU in national markets.

While data processing displays growth in cross-border services deliveries, the situation seems to be less clear for computer programming and consultancy services. This subsector is probably the fastest growing and largest of the business services activities included in the “business services” category. However, the growth of intra-EU cross-border transactions is barely keeping up with the growth rate of the overall growth of the sector and the share of deliveries over total turnover is relatively flat.

Although this statistical evidence should be taken with caution given the sparsely available data and the short time series, it seems to be well in line with the situation as described by the analysis of legal restrictions in the documentation accompanying the Single Market Strategy.

In summary, the resilience of intra-EU exchanges in services during the crisis shows their importance for the single market. The steady growth of the share of these flows over GDP is a sign of a latent potential for growth in cross-border exchanges in services. The factors limiting this potential are studied in more detail in the Staff Working Document accompanying the Single Market Strategy and the evidence presented here supports the direction the proposals included in the strategy. Given the importance of cross-border investment for services, this analysis must be complemented with a look into intra-EU foreign direct investment.

3.1.3

Foreign Direct Investment and establishment

Foreign direct investment (FDI) has been a very important driver of Europe’s internationalisation and integration. It has also been a very important component of the total investment as measured by Gross Fixed Capital Formation (GFCF). In 2000, total inward FDI in the EU represented almost 40 % of EU GFCF according to Eurostat figures, and intra-EU FDI alone accounted for over 30 % This was an exceptional year, but the level in the past decade was often above 10 % of total investment.

|

|

|

Figure 3.10:Inward and outward FDI in major trading areas of the world (2000–2013, % of GDP)

|

|

|

|

Source:UNCTAD and Eurostat

|

|

|

The fall in the outbound FDI flows has been important between 2004 and 2013. But the reduction in intra-EU investment flows has been much more significant and the evidence suggests that low intra-EU FDI is one of the reasons explaining why investments in the EU are below their long run trends (Figure 3.11).

|

|

|

Figure 3.11:Intra-EU FDI (1994–2012, as a percentage of total outward FDI)

|

|

|

|

Source:Copenhagen Economics for European Commission with UNCTAD and Eurostat data

|

|

|

Intra-EU inward FDI from other Member States can be an indirect indicator of, at least, part of cross-border establishment. Figure 3.12 shows data of investment flows between Member States and the rest of the world, including other EU Member States. The latest data available show intra-EU capital inflows below 4 % of GDP for the last four years. This is about half of the levels reached before the crisis. With the main exceptions of Luxembourg and Ireland, the fall in inward FDI has been almost generalised between 2004 (the worst year for FDI before the crisis) and 2013. In Luxembourg, there has been a steady investment inflow after the crisis that cannot be found in other countries. The Irish case is different: although the level of FDI in 2013 has been considerable, the comparison is distorted by the fall in FDI registered in 2004.

|

|

|

Figure 3.12:Inward FDI by Member State (2000–2013, % of GDP)

|

|

|

|

Source:UNCTAD and Eurostat

|

|

|

The evolution of intra-EU FDI presents some clear analogies with the evolution of trade in goods. Once more, there is a different evolution in the EU-15 and the EU-13 groups of countries. European FDI in EU-15 Member States reached peaks in 2007 and 2011 but it has fallen since 2011 presenting now levels below those attained in 2004. On the other hand, European investment in EU-13 Member States has been growing consistently since the beginning of this century and has been little affected by the crisis.

A look into the sectoral composition of FDI confirms the significance of establishment as a form of integration in other Member States. Eurostat statistics of the activities of foreign affiliates indicate that in 2012, services firms accounted for 74 % of all the foreign affiliates of firms from another Member State operating in the EU-28. These firms also accounted for the same turnover as all intra-EU foreign affiliates. These figures do not include firms in the financial services sectors where cross-border establishment is very frequent.

|

|

|

Figure 3.13:Inflows of intra-EU FDI into the EU-15 and EU-13 Member States (2001-2012, million Euro)

|

|

|

|

Source:European Commission; UNCTAD database

|

|

|

With over 49 000 firms, of wholesale and retail distribution hold the greater stock of foreign affiliates, followed by the real estate and the professional, scientific and technical activities with over 18 000 firms. Manufacturing only accounted for 18 of the total foreign affiliates of intra-EU origin. That percentage is around 4 % for construction.

|

|

|

Table 3.2:Number and turnover of Foreign Affiliates (FATs) of EU firms in other Member States (2012)

|

|

|

|

Source:Eurostat

|

|

|

In summary, there seems to be some prima faciae correspondence or may be complementarities between the evolution of trade in goods and FDI in the EU. Intra-industry and intra-firm trade seem to account for a considerable volume of trade, especially in those sectors that account for a large share of the intra-EU exchanges. FDI in EU-13 countries triggers future trade flows as a result of integration after accession of the EU-13. In EU-15, both trade flows and FDI have remained relatively subdued but the causal links are less clear. FATs figures suggest that the inter-linkages between trade and investment or establishment in integration are very important. More work is needed to understand these factors better because barriers in either cross-border trade or in establishment in other Member States have an impact along value chains distorting the allocation of resources and hampering the growth of firms.

3.2

Single Market Performance

The performance of markets can be measured according to different criteria. The same applies to the single market. This section presents a number of different overall assessments of the changes in the performance of the single market and the regulatory environment that defines it.

This is not an exhaustive assessment because it is not possible to present in this report a complete evaluation of the multiple dimensions of the economic performance of the single market as regards its impact on competitiveness, job creation, efficiency or growth effects as well as its social impacts in areas such as fairness, consumer welfare or cohesion. This is a first assessment focusing on some basic economic dimensions. These include allocative efficiency (goods producers as well as service providers), the performance of public procurement markets, the regulatory environment affecting product markets and the changes in the services sector after the introduction of the Services directive. Some of these assessments will be periodically repeated in the future and others covering additional areas will be developed in the future.

3.2.1

Brief review of the economic effects of the implementation of the Single Market legislation

Product markets

In January 2014, the Commission published a study conducted by CEES with an in-depth Evaluation of the Single Market Legislation for Industrial Products. This study was the basis for the Communication "A vision for the single market for industrial products" adopted on 22 January 2014.

Among others, the objectives of the study included:

Examine how far the body of single market legislation for industrial products is fit for purpose and the extent to which they constitute an effective means of addressing barriers to the functioning of the single market for industrial products;

Identify and analyse any gaps, loopholes, inconsistencies and duplication in IM legislation for industrial products or in administrative requirements for economic operators;

Assess the costs and benefits of Union harmonisation legislation for economic operators and the impact on strengthening industrial competitiveness;

Assess the cumulative impacts of, and interaction between legislation and compliance requirements.

The study concluded that the single market legislation presents a high level of “fitness for purpose”. As stated in the Communication, “The overall conclusion is that single market legislation is relevant to meeting EU objectives relating to the need for technical harmonisation measures with high levels of protection for health and safety and consumers and, to the environment.” (page 7) However, the public consultation and the study also pointed out to a number of performance issues that led to 20 recommendations included in the Communication.

In particular, the study reviewed the efficiency and effectiveness of the implementation mechanisms and checked for compliance costs using a case study approach. Probably, one of the main results of the study was raising awareness about concerns among many stakeholders regarding the effectiveness of market surveillance. These concerns arise from: variations in the human and financial resources made available for market surveillance activities across different Member States, the low likelihood that more complex products such as industrial machinery will be checked and tested by market surveillance authorities for technical compliance due to the lack of adequate technical capacity and practical challenges in testing products against the requirements set out in more complex IM legislation such as the Ecodesign Directive and its implementing regulations.

There are also differences in approach to market surveillance between those authorities as to the degree of emphasis they place on checking products for technical compliance and administrative requirements respectively. There is a perception among economic operators that there remain unacceptably high levels of non-compliance, which undermines the level playing field and serves as a disincentive for firms to invest in meeting European compliance requirements. With regard to e-commerce, from a market surveillance perspective, difficulties were detected in preventing non-compliant products from entering the EU from third countries purchased on-line.

Regarding the costs of compliance, the study concluded that single market legislation does not pose excessive cost burdens, although some pieces of legislation were regarded as costly (especially those with other objectives than product safety). In most of harmonised product groups under review (e.g. electric motors, lifts, petrol pumps and air conditioners), annualised compliance costs do not exceed 1 % of annual turnover of the sector. However, the study encountered difficulties in getting firms to estimate substantive compliance costs at the design and R&D phase for many of the harmonised product groups examined, so the true costs of compliance may be somewhat higher. There was moreover some divergence in estimated compliance costs between different product groups, which does not easily facilitate cross-product comparisons.

There were only two exceptions where compliance costs were higher than 1 %, laptops (2 %) and gardening equipment (3.9 %). In the laptops sector, it was acknowledged that there were cost synergies from investment in compliance with European regulatory requirements when exporting to other global jurisdictions, even if there are differences in technical standards. In the case of gardening equipment, the higher level of compliance costs is mainly because the costs of compliance with environmental legislation (e.g. on outdoor noise, non-road mobile emissions) are relatively high. Administrative costs are still no more than 0.3 % of annual sectoral turnover. Nonetheless, there are concerns as regards the level of administrative costs and burdens associated with some single market compliance requirements. The Staff Working Document accompanying the Single Market Strategy presents detailed quantitative evidence of these case studies.

A further a detailed evaluation of the application of mutual recognition in services has been conducted more recently. Between June 2014 and May 2015, the European Commission commissioned an external evaluation with the view to examine the application of the principle of mutual recognition in the single market for goods. It also aimed at identifying sectors in which the application of the principle is economically most advantageous, but where its functioning remains insufficient or problematic. The evaluation has also been linked to the Regulatory Fitness and Performance (REFIT) Programme.

It pointed at significant barriers impeding the principle of mutual recognition to achieve an optimal application, among which:

Lack of trust among national authorities, which leads to authorities in some Member States adding requirements (such as extra tests) which are not in accordance with the mutual recognition principle.

Lack of knowledge of the application of the mutual recognition principle among competent authorities and businesses, often resulting in the latter abiding by the demands from national authorities to adapt their products that are already lawfully marketed in another Member State.

Lack of cooperation between national authorities, not infrequently leading to delays and incomplete and unhelpful information to the economic operators.

The valuation produced the following main recommendations:

Better monitoring of the implementation of the mutual recognition principle, including through active involvement of the Product Contact Points (PCPs). A strengthened role for PCPs, inter alia through grouping functions and activities related to Single Market issues within relevant Member State administrations to create better dynamics and a single access point for economic operators.

Setting up a mechanism for easier demonstration of “lawful marketing” for economic operators.

Better insight into the magnitude of an incorrect application of the mutual recognition principle for businesses, particularly for SMEs.

Improve dialogue among competent authorities, as well as between the competent authorities and the Commission, including an improved notification procedure that should overcome the current discrepancies between the number of notifications received by the Commission and the number of decisions denying or restricting mutual recognition made by the national authorities.

Awareness raising campaigns for economic operators, business associations and national authorities (including at regional level).

Last but not least, the evaluation identified a number of sectors where action particularly could be taken, most important of which construction and food sectors.

Services: the impact of the services directive

Covering over 45 % of EU GDP, the implementation of the Services Directive has so far been the largest recent reform effort in an area relatively to promote cross-border provision of services and the free establishment within the EU.

Its economic impacts have been assessed in detail in a study issued in 2012. Based on econometric estimations using new data on specific barriers targeted by the Directive as well as simulation results obtained from the Commission’s general equilibrium model (QUEST3), this study estimated the EU-level long-term impact of different scenarios of implementing the Services Directive. The study concluded that the reforms carried out by Member States until the end of 2011 would contribute 0.8 % of EU GDP, with varying impacts across Member States (ranging from below 0.3 % to more than 1.5 %). The study further highlighted the growth potential of an ambitious implementation of the Services Directive and estimated its possible additional economic impact at 1.8 % EU GDP over 20 years, with most of the benefit occurring in the first five years. Within the sectors considered, FDI growth would be 8.8 percentage points higher and productivity 8.9 percentage points higher, on top of the pre-2011 gains referred to above. These effects are found to vary significantly across Member States (Fig 3.14), reflecting differences in sectoral compositions and export and FDI structures.

The study also underlined the importance of the domestic transmission channel. It showed a direct impact on labour productivity of the reduction of specific regulatory barriers thanks to the Directive. For instance, a 10 % reduction of barriers to establishment was found to bring about a 1.6 % increase in labour productivity in services.

|

|

|

Figure 3.14:Impacts of barrier reductions within the analysed sectors in the EU

|

|

|

|

Source:Monteagudo et al. (2015), European Commission, European Economy Economic Papers 456, June 2012.

|

|

|

Additional work has been undertaken since to assess the progress made in implementing the various strands of the directive and update estimates of the related economic impacts. It showed that the pace of national reforms slowed considerably after 2011, compared to the period following the entry into force of the Services Directive, and that reform efforts have been uneven across Member States (Figure 3.15).

|

|

|

Figure 3.15:Number of restrictions in 2014 compared to 2011 by sectors

|

|

|

|

Source:European Commission, own calculations

|

|

|

Based on an improved measurement of the changes in regulatory barriers, the 2015 assessment has shown that the largest reform efforts took place in the restrictions for accountants, hotels, tax advisers, and engineers, while legal services are still the most regulated sector in the EU followed by architects and retail trade (Figure 3.16).

|

|

|

Figure 3.16:Number of restrictions in 2014 compared to 2011 by sectors

|

|

|

|

Source:European Commission, own calculations

|

|

|

For most Member States, there is no evidence of further reductions in regulatory barriers in the period 2012–2014. In some cases this can be explained by the fact that regulatory regimes were already relatively light, but in other cases there has been little reform progress despite recommendations under the European Semester. For Ireland and Hungary, barrier levels are even found to have slightly increased which could have small negative impacts. In contrast, Greece, Estonia, Spain, Italy, and Portugal have made the largest efforts to reduce legal barriers in accordance with the directive, with positive growth impacts of up to 1 % for Greece and 0.3–0.7 % for the Estonia, Spain, Italy and Portugal.

The new assessment concludes that the economic gains of reforms carried out in 2012–2014 are limited, about 0.1 % of GDP growth, and falling short of the estimated potential impact of 1.8 % in the 2012 study. The detailed impacts on GDP, FDI and trade of the Member States are shown in figure 3.17 below.

|

|

|

Figure 3.17:New estimates of the economic impact of the implementation of the Services Directive

|

|

|

|

Source:European Commission, own calculations

|

|

|

The results of these studies indicate that further efforts are needed to ensure enforcement of the existing legislation. This will also foster resource reallocation in the single market through its expected positive impacts on productivity and FDI.

3.2.2

Allocative efficiency across sectors and Member States

Chapter 2 of this report underlined the importance of the reallocation of productive resources to improve the competitiveness of the EU. At present, the importance of this reallocation is enhanced by the digitisation of the economy, changing relative prices of inputs and the new redistribution of labour at global scale.

In this section, we present some simple indicators as a first approximation of the state of play of resource allocation and performance of the single market at present. These indicators and measures will be complemented in future editions of the report with other indicators addressing other dimensions of market performance.

Allocative efficiency (AE) is the most traditional criterion to assess market performance. It refers to the allocation, within or between firms, of productive factors to their most efficient uses. In that sense it is particularly relevant to assess productivity.

This section presents AE indicators for a number of aggregated industrial and services sectors across most Member States (Malta is often missing due to data availability). The productive factor of interest in this context is labour. Efficiency in the allocation of this key factor of production will be assessed against the distribution of labour productivity in the same sector. Expressed in simple terms, the question of allocative efficiency then boils down to analysing the extent to which labour is allocated to the segments of each sector with the highest labour productivity.

|

|

|

Figure 3.18:Allocative efficiency in manufacturing (2007–2013)

|

|

|

|

Source:Eurostat

|

|

|

The AE indicators presented here measure the efficiency of the current allocation of labour across firms within each sector by comparing it with a hypothetical efficiency level that would be achieved if labour would be uniformly distributed across firms. Insofar as the actual distribution of labour is the result of the functioning of the single market in that sector, this can be used as a proxy to measure the performance of the single market from the point of view of the efficient allocation of labour. A limited number of selected sectors are presented here.

|

Box 3.2. Measuring the efficient allocation of labour

To quantify AE for the purposes of this section, the product (θi – θbase)(lpi – lptot) is calculated for each firm size class segment i of every national sector, after which the products are summed across all size classes (5 classes for industrial sectors; 6 for services following Eurostat classification). Following European Commission (2013), the share of sector employment in size class i will be used for θi as a proxy for market share, while θbase represents the baseline hypothesis that market shares (employment proportions) are distributed equally across size classes: 20 % in each of the five size classes for the industrial sectors, 16.7 % in each of the six classes for services. lpi and lptot denote the logarithms of labour productivity in firm size class segment i of a sector and for the sector as a whole respectively. Using logarithms of labour productivity means that the resulting sum of products across all size classes can be given a straightforward interpretation as the percentage gain or loss in relation to the baseline scenario of the observed allocation of labour. If the sum is positive, the observed allocation is better than the hypothetical uniform distribution across firm size classes. If the sum is negative, the observed allocation is less efficient than the hypothetical uniform distribution.

|

|

|

Looking first at manufacturing, labour is more efficiently allocated than the baseline scenario in almost all Member States. Exceptions include Greece and Cyprus. For Ireland and Hungary, data suggest much higher allocative efficiency than in most other Member States. For some countries, data are available for three years (2007, 2010, 2013). Most efficiency gains are around 20 % and relatively stable over time; particularly significant improvements in AE can be reported in Denmark, Belgium and the Czech Republic while falling AE occurred over time in Lithuania, Finland and Cyprus (see Figure 3.18).

In contrast with the situation in manufacturing, in the construction sector, labour is allocated less efficiently than the baseline scenario. Prominent allocative efficiency losses are observed in Greece, Italy, Poland, Hungary and Slovakia. In 2013, the UK and Bulgaria were the only Member States with positive allocative efficiency. It is worth mentioning that this indicator shows a deterioration in the allocative efficiency for a number of countries, particularly in Greece, Spain, Portugal, Slovenia and Belgium in 2013 (see Figure 3.19).

|

|

|

Figure 3.19:Allocative efficiency in construction (2007–2013)

|

|

|

|

Source:Eurostat

|

|

|

Carrying out the same calculations for distributive trades (retail as well as wholesale) and transportation and storage produces the AE values in figures 3.20 and 3.21. With some exceptions, AE values are generally negative in distributive trades (suggesting substantial scope for efficiency gains) and positive in transportation and storage. Germany is an exception, having allocative efficiency in trade but not in transportation and storage. Lithuania stands out as a Member State with allocative efficiency in trade as well as transportation and storage. The results differ slightly from those in European Commission (2013) due to different aggregations of size classes. Over time, efficiency does not seem to be improving significantly in distributive trades, but rather the opposite. Some Member States report further deteriorations in this AE indicator.

|

|

|

Figure 3.20:Allocative efficiency in distributive trade (2007–2013)

|

|

|

|

Source:Eurostat

|

|

|

|

|

|

Figure 3.21:Allocative efficiency in transportation and storage (2007–2013)

|

|

|

|

Source:Eurostat

|

|

|

In professional, scientific and technical services, AE values are generally negative (see Figure 3.22), while in information and communication services they are generally positive. In the former category, particularly low values – indicating scope for allocative efficiency gains – are found for Portugal, Hungary, Italy, Bulgaria and Greece. By contrast, Denmark and the UK are the only Member States with slightly positive AE values. In information and communication, the highest allocative efficiencies are found for Bulgaria, Spain, Croatia and Romania. The results differ slightly from those in European Commission (2013) due to different aggregations of size classes. Over time the situation seems to be worsening in both professional and information services (see Figure 3.23).

|

|

|

Figure 3.22:Allocative efficiency in professional, scientific and technical services (2007–2013)

|

|

|

|

Source:Eurostat

|

|

|

|

|

|

Figure 3.23:Allocative efficiency in information and communication services (2007–2013)

|

|

|

|

Source:Eurostat

|

|

|

The analysis in this section reveals a distinction between goods and services exposed to international competition and sectors catering mainly for their domestic market. In manufacturing, transportation and storage, and information and communication services, allocative efficiency is high in virtually all Member States. The output of these sectors is in many cases traded across borders and EU producers are often exposed to intense global competition.

By contrast, in sectors such as construction; distributive trades; professional, scientific and technical services, competition is more local and producers are under less competitive pressure. In these sectors, the assessment of allocative efficiency often resulted in negative values, indicating that an equal distribution of labour across the different size classes would be more efficient. In such cases there is scope for a more efficient allocation of labour, however it is not possible to predict how important such a reallocation would be for firms, sectors or the economy as a whole.

The evidence presented in this section also suggests that the direction of changes in allocative efficiency in recent years has been very diverse across sectors. While improvements can be detected in manufacturing, the services sectors mentioned in the second group above present further deterioration of their efficiency. The deterioration in allocative efficiency in the construction sector in several countries is an additional cause for concern. If confirmed with further analysis, this gives rise to additional concerns, especially at a time when an increasing volume of resources are being shifted from other sectors toward services.

3.2.3

Overall evolution of product market regulation in the Single Market

Despite the strong commitment to the creation of a competitive product market for goods and services in the EU, significant regulatory and non-regulatory barriers to the smooth functioning of the single market persist. After a period of crisis in which reforms in favour of single competition have stalled in many sectors, reviving the efforts to further eliminating these barriers appears to be a priority, as the single market is widely recognised as one of the main drivers of potential economic growth and competitiveness in the EU. A deeper and fairer single market could allow the EU to reduce the investment gap with respect to commercial partners and increase trade between Member States, facilitating a more efficient reallocation of resources across Member States and delivering at least EUR 521 billion and 4 % of GDP growth in the EU.

This section presents an overview of the evolution of product market regulation from 1998 to 2013 based on the Product Market Regulation indicators (PMRs) elaborated by the OECD. It must be said that these indicators measure the situation of markets taking into account the joint impact of regulations and legislation developed by the Member States in the implementation of EU directives and regulations as well as those developed at their own initiative.

To measure the evolution of obstacles raised by Member States to a deeper and fairer single market and the contribution of national measures, the evolution of economy-wide and sector regulations has been compared with the performances of key indicators of competitiveness and integration.

The analysis shows that all Member States have made significant efforts over the years to improve market performance by reducing barriers and regulations. However, in the last ten years and in particular after the crisis, the momentum of reforms in this field has substantially slowed down, particularly in the EU-15. This is in contrast with the experience of Member States that accessed the EU in 2004 or later: they have made substantial efforts in the same period. These Member States appear to be reporting higher trade integration and faster convergence in terms of competitiveness.

Figure 3.24 shows the performance of Member States concerning barriers to trade and investment. The majority of Member States were able to decrease the level of existing impediments between 2008 and 2013. In particular Hungary, Belgium, Greece, Slovakia, Italy and Poland report the largest weighted reductions. However, the average value in the EU increased with respect to 2008, mainly due to the above average barriers reported in Croatia, the Baltic countries, Cyprus and Malta, which were not included in the 2008 calculations. Moreover, performances in this domain are still heterogeneous in the EU: whilst the Netherlands reports the lowest aggregate score for existing barriers among all OECD countries in 2013, Croatia reports one of the highest absolute value.

|

|

|

Figure 3.24:Barriers to trade and investment (2008–2013)

|

|

|

|

Source:OECD (aggregate index ranging from 0 (no barriers) to 6)

|

|

|

Although the available data do not cover the totality of Member States, it is interesting to observe the evolution of regulation in key sectors such as energy, transport and communication. Whilst barriers have generally decreased for all countries, it can be observed that the largest reductions have occurred in the two decades between 1985 and 2005 for EU-15 member States (Figure 3.25), whilst among the 13 countries which have joined the Union after 2003, those for which the data are available show consistent reductions of the barriers in the 2000–2013 period, in view and after their accession to the Union (Figure 3.26). Moreover, new entrants show a convergence path and among them one group of countries seems to have converged to the frontier while another group seems to have converged towards the values of low performing EU-15 Member States.

|

|

|

Figure 3.25:Regulation in energy, transport and communication, EU-15 (1975–2013)

|

|

|

|

Source:OECD

|

|

|

|

|

|

Figure 3.26:Regulation in energy, transport and communication, EU-13 (1990–2013)

|

|

|

|

Source:OECD (for non-OECD countries only 2013 data is available)

|

|

|

Comparing these trends with data on intra EU-trade, it can be observed that for many Member States, and in particular new entrants in the EU, the generalised increased effort in reducing regulatory barriers corresponded to an increase in intra-EU trade growth. Although other factors certainly contributed to this evolution, this confirms the strong potential of the single market in increasing intra-EU trade and investment.

|

|

|

Figure 3.27:Regulation in professional legal services, EU-13 (2003–2013) vs. EU-15 (1998–2013)

|

|

|

|

Source:OECD (for non-OECD countries only 2013 data is available)

|

|

|

A number of existing barriers to the access and exercise of regulated professions are impeding the full potential of services in the EU. In particular, professional services and retail regulations have been reported to be critical in some Member States, as well as being pointed out by the European Commission and the Council in the 2015 country-specific recommendations to Member States. As outlined in the SWD accompanying the Single Market Strategy, these services are essential to businesses and consumers, thus reducing these barriers could have a substantial effect on the integration and competitiveness of the EU. With respect to other energy, transport and communication sectors, progress in the elimination of barriers in regulated professions was subdued, as can be observed, for example, in figures 3.27 and 3.28 which depict the evolution of existing barriers in legal services and engineering services, showing neither convergence nor substantial progress in the last decade. In addition the implementation of the Country Specific Recommendations (CSRs) by EU Member States dropped significantly in 2013. Member States put the greatest effort into addressing CSRs related to the financial sector whereas CSRs related to structural reforms had the highest percentage rate of non-implementation.

|

|

|

Figure 3.28:Regulation in professional engineering services, EU-13 (2003–2013) vs. EU-15 (1998–2013)

|

|

|

|

Source:OECD (for non-OECD countries only 2013 data is available)

|

|

|

Looking at the aggregate index for all analysed professional services (Figure 3.29), it can be observed that the most substantial progress between 2008 and 2013 has been achieved in Italy, Greece, Spain, Austria and Poland. However, overall policy initiatives in this field have been limited, leaving scope for further improvements that will particularly benefit integration and competitiveness.

|

|

|

Figure 3.29:Regulation in professional services (2008–2013)

|

|

|

|

Source:OECD (aggregate index; data for Latvia not available)

|

|

|

The performance of the retail sector is shown in Figure 3.30. It can be observed that this is one of the areas in which the EU has achieved substantial progress when compared to the 2008 situation. Competition in the retail sector has been fostered through reforms in many Member States and the trend has continued in 2014, with further Member States implementing reforms, offering better market conditions both to consumers and enterprises and improving the functioning of the single market. While the results of the reform process is a notable achievement, the data also show that in many Member States barriers are still high and the space for improvement is still substantial across the EU.

|

|

|

Figure 3.30:Regulation in retail trade (2008–2013)

|

|

|

|

Source:OECD (aggregate index; data for Ireland not available)

|

|

|

3.2.4

Economic convergence in the Single Market

One of the objectives of the European Union is to promote the economic convergence amongst Member States by fostering changes in economic structures and increasing the degree of market competition. Closer economic integration is expected to unleash competitive forces which would lead to further economic convergence. As shown in Box 3.3 below, we observe various degrees of convergence for the EU as a whole (EU-28) in prices, GDP per capita and labour productivity over the last 15 years. However, we do not detect any convergence on these parameters among the fifteen countries that joined the EU before 2004 (EU-15).

A properly functioning Single Market is expected to foster market integration and thus the convergence of prices among Member States. If there are low barriers to trade in goods and services, prices should be similar due to the unconstrained interaction of supply and demand as economic agents take advantage of arbitrage opportunities. We would thus expect to see a decrease in the dispersion of prices across EU Member States, yet this is not exactly what we observe. Indeed, there has been price convergence for the EU as a whole over the last twelve years, with a remarkable convergence among the Member States who joined as from 2004 (EU-13). However, there has been stagnation in the dispersion of prices across the EU-15 over this period. Moreover, we observe a change of trend among the price dispersion in the EU-15 since the onset of the crisis. Indeed, prices started to diverge in the last 5 years, reversing the slight progress achieved in previous years. This may signal a compartmentalisation of the single market with the onset of the crisis.

The effective functioning of the Single Market should also ease the mobility of production factors (labour, capital) across Member States. This enhance mobility of resources should contribute to their efficient reallocation from less productive firms and industries to more productive ones. Even if other factors play a significant role on resource allocation, we could expect that the disappearance of obstacles to the free movement of capital and labour would lead to a convergence in productivity levels.

Ultimately, a convergence in productivity levels should also stimulate the catching up process from less developed economies and therefore would be reflected in a convergence of GDP per capita. However, we see again different performances between the EU-28 and the EU-15. While there has been a slight convergence in the former, there has been divergence in the latter.

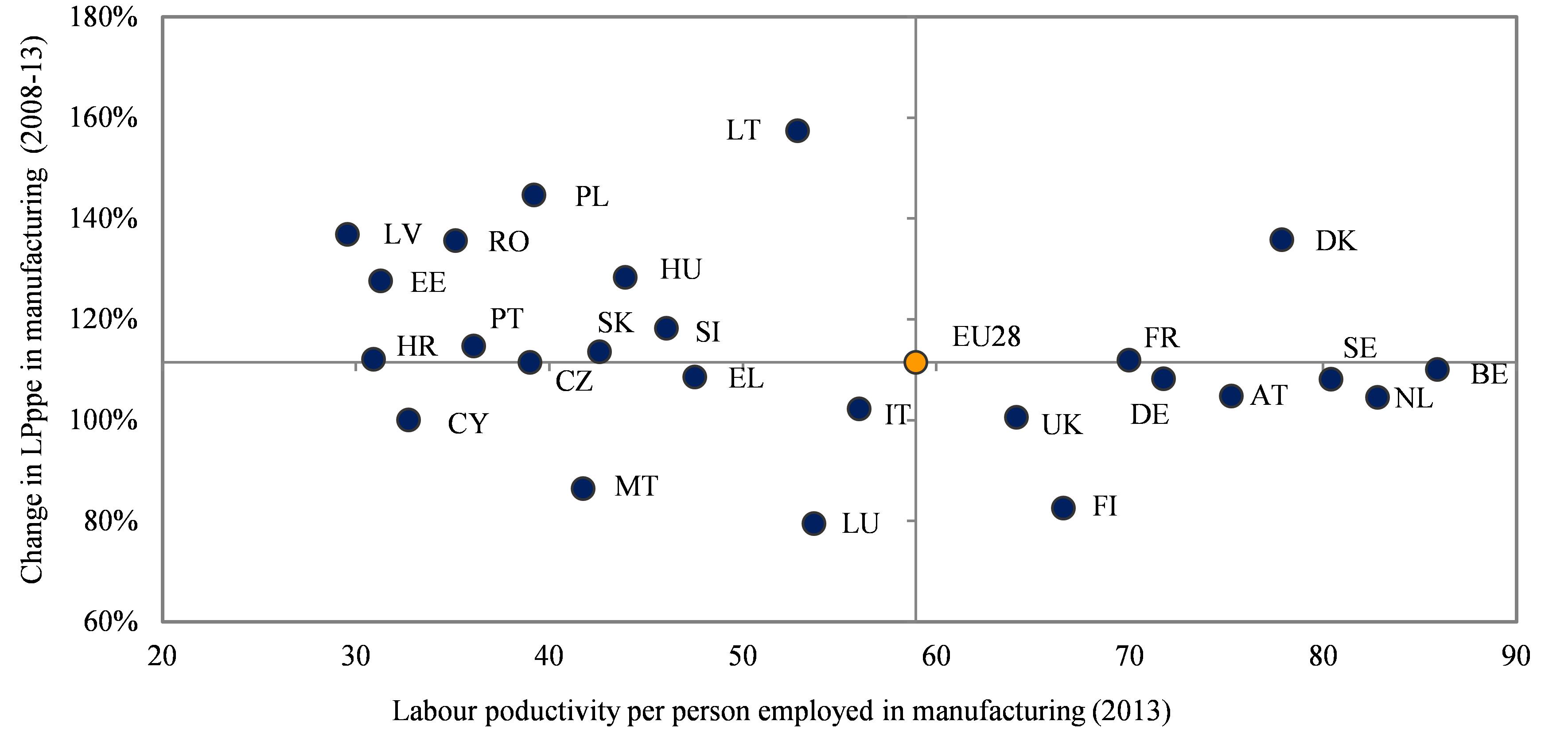

The above-described evolution in the dispersion of prices shows that there has been an overall economic convergence among EU Member States in the last 15 years. However, the analysed parameters seem to imply that the convergence has been driven by the dynamism of those Member States who joined as from 2004, since no convergence is observed amongst those who joined before. Indeed, a more granular analysis of sigma convergence in labour productivity at sectorial level clearly shows the distinct performance of the two groups of Member States. The overall stagnation in the dispersion of labour productivity among the EU-15 is in sharp contrast with a marked reduction among EU-13. This reduction is very sharp in the years just before accession and continues at a more moderate pace afterwards.

This analysis of economic convergence reconfirms the pattern observed in trade and investment. That is, the co-existence of a more sluggish performance of the EU-15 where the single market is relatively more mature, and a more dynamic evolution of the EU-13 resulting from their accession to EU. This validates the unquestionable benefits of joining the single market in terms of a reduction in the economic disparities. However, the dwindling of economic convergence dynamics after accession seems to imply that the single market does not generate endogenous factors that would guarantee the continuation of this convergence in the long term. Reforms of the single market could certainly lead to a higher degree of economic integration and convergence. Indeed, the disappointing performance of the EU-15 may be partly due to the unfinished status of the single market, particularly in the services sector, and the slow or incomplete implementation of reforms in this area. Yet, the challenge is to ensure that reforms establish appropriate mechanisms to maintain economic convergence dynamics amongst Member States in the long run.

|

|

|

Figure 3.31:Coefficient of variation in prices

|

|

|

|

Source:Eurostat, European Commission's calculations

|

|

|

|

Box 3.3.: Sigma convergence in prices

Sigma convergence analysis measures the evolution of the dispersion of a variable to assess whether convergence is taking place. In this section we look at the evolution of the coefficient of variation (that is, standard variation of the variable divided by the mean) prices,. A decrease in the coefficient over time signals a reduction in the dispersion of data and thus a convergence in the analysed parameter. In the same way, an increase in the coefficient signals a surge in dispersion and thus increasing divergence.

The coefficient of variation of comparative price levels for goods in EU-28 sharply decreased after the enlargement of 2004 until the start of the crisis. Afterwards, price dispersion increased, although not fully reversing the previous gains. In contrast, there has been an overall stagnation in the price convergence across those countries that were EU Member States before 2004 (EU-15), with a perceptible increase in the dispersion in the last five years. (see Figure 3.31)

Similar analyses can be carried out for GDP and labour productivity convergence.

|

|

|

3.2.5

The role of the public sector: public procurement markets

The public sector is an important economic player in the EU economy. The size of public expenditures on works, goods, and services (representing more than 19 % of EU GDP) makes public procurement a critical area of single market integration, an important driver of both Member States' and businesses' competitiveness, and a critical lever to help achieve economic recovery and the creation of jobs.

Public procurement is also directly linked to many key policy challenges the EU is facing: growth and jobs, fiscal discipline, modernisation of public administration, trust of citizens in public authorities, innovation, and green and inclusive growth.

3.2.5.1

The untapped potential of public procurement for the integration of EU firms in the Single Market and the performance of public procurement markets

Transparent, fair and competitive procurement markets across the Single Market create business opportunities for European enterprises and contribute directly to economic growth and the creation of jobs. While steps towards a single European procurement market have been taken for decades, there are still significant inefficiencies in public procurement across Member States that limit cross-border expansion or growth in the domestic market.

These include for example:

the different procedures based on the Remedies Directive 2007/66/EC which provides legal tools to aggrieved bidders for breaches of EU procurement law by public bodies or utilities;

the low level of publication of public tenders at EU level (the estimated average of value of tenders with utilities corresponds to 4.7 % of EU GDP);

the varying speed of the implementation of e-procurement in the Member States;

the uneven level of professionalization of public buyers;

the remaining vulnerability to corruption;

the low number of Member States that have defined policies for socially responsible public procurement or for inclusion of innovation aspects, and the absence of consistent approaches in implementing these policies across Member States, especially when they result in (technical) requirements inhibiting access to national markets, may affect the functioning of the Single Market;

rare cases of aggregation of demand in public procurement (14 % of contract award notices at EU level established a framework agreement in 2009–2014, but it varies with type of product/service).

3.2.5.2

The level of publication of public tenders at EU level

One of the key policy issues on Single Market integration is the level of publication of public tenders at EU level. Although EU-wide publication of contracts above certain thresholds is one of the key obligations stemming from the EU rules on public procurement, there are some Members States where the value of procurement published in relation to GDP is far below the EU average of 4.7 % (2009–2013). As pointed out above, despite the fact that increased publicity requirement induces more entry, transparency of below-threshold procurement varies greatly across Member States (Figure 3.32).

|

|

|

Figure 3.32:Value of calls for tender published as a percentage of GDP by Member State (2009–2013)

|

|

|

|

Source:European Commission based on OJ/TED data

|

|

|

Member States in which the value of published tenders is relatively small in relation to their GDP, such as Germany (1.3 %), Luxembourg (1.5 %), Netherlands (2 %) or Austria (2 %), also have a current account surplus, i.e. while benefitting from other countries’ market openness, these countries do not offer symmetric opportunities for European businesses from other Member States. An increase in the value of contracts published EU-wide would generate additional opportunities for European businesses in other Member States, including in Member States with current account deficits.

3.2.5.3

Participation of non-national operators in national public procurement

Other symptoms of deficiencies in the functioning of the Single Market include the low level of participation of non-national operators in the national public procurement markets, with striking inequalities among Member States. For EU-28, the average proportion of contracts which were awarded to foreign companies in 2009–2014 is 4 % and relatively stable, the best performers being Luxembourg (15 %), Malta (15 %), Ireland (13 %), while the countries far below the EU-28 average are Spain (0.6 %), Bulgaria (0.7 %), Poland (0.8 %) and France (0.9 %) (Figure 3.33). The reasons for the low level of participation of non-national operators in the national public procurement markets include indirect buying from branches or subsidiaries, where the differences between Member States in the value of indirect cross-border awards vary from nearly 0 % to 44 % (the EU average is around 13.4 %). Such indirect buying distorts data on the proportion of contracts awarded to foreign companies.

|

|

|

Figure 3.33:Proportion of contracts awarded to foreign companies

|

|

|

|

Source:European Commission based on OJ/TED data

|

|

|

3.2.5.4

The procedures used in public procurement

One of the key elements that indicate the openness and the potential for competition in public procurement is the transparency level, which is mainly given by the type of procedures used. The main procedures, which could also indicate the level of transparency, are the open procedure for high openness and the negotiated-without-competition procedure (NOC) for low openness.

The EU-28 proportion of contract award notices where the NOC procedure was used is 7.6 % in 2009–2014, indicating that the observable part is fairly transparent. But there are certain countries with a very high proportion of contract award notices using the NOC procedure, such as Czech Republic (20 %), Romania (18 %), Slovakia (18 %) and Hungary (17 %). (See Figure 3.34)

|

|

|

Figure 3.34:Proportion of contract award notices where the NOC procedure was used

|

|

|

|

Source:European Commission based on OJ/TED data

|

|

|

3.2.5.5

Competition in public procurement

The final aim of public procurement policy is to achieve the best value for money through high levels of competition among bidders; the proportion of awards with just single bids is an indicator of low levels of competition.

At EU-28 level there were 21 % notices with just one bidder. The highest figures were for Slovakia (50 %), Poland (46 %), Croatia (32 %), Hungary (32 %), Estonia (31 %), Romania (30 %) and Latvia (32 %). The best performers were Ireland (6 %), UK, Netherlands and Denmark (each with 7 %). There is a high potential for improvement for many Member States (Figure 3.35).

|

|

|

Figure 3.35:Proportion of contracts for which there was a single bid (excl. frameworks) (2009–2014)

|

|

|

|

Source:European Commission based on OJ/TED data

|

|

|

3.2.5.6

Aggregation of demand

Aggregation of demand has a high potential to help public authorities obtain best value for money by incentivizing sellers to achieve economies of scale which could be shared with the authorities mainly if competition is strong (or by direct access to wholesale markets). Aggregation also has the potential to help public authorities achieve other important objectives such as social or green targets. There are two options of demand aggregation – buying through an established central purchasing body (CPB) and joint procurement with other entities. Commodities such as electricity are good examples.

At EU-28 level in 2009–2014, the average proportion of contract award notices where the contracting authority is purchasing on behalf of other contracting authorities was 9 %. There are Member States with much higher levels of aggregation than EU-28 such as Ireland (45 %) and UK (23 %), but there are also countries which much lower levels e.g. Bulgaria (1 %), Romania (1 %) and Portugal (2 %) (Figure 3.36).

|

|

|

Figure 3.36:Proportion of contracts award notices where the contracting authority is purchasing on behalf of other contracting authorities (either joint purchasing or central purchasing bodies) (2009–2014)

|

|

|

|

Source:European Commission base on OJ/TED data

|

|

|

3.2.5.7

Good practices

Aggregation of demand

Ireland – Savings in excess of €21 million have been achieved by the National Procurement Service (NPS) when purchasing electricity and natural gas for the public service in 2011. The NPS strategic approach to energy procurement will also ensure that the Irish public sector is on target to meet the national renewable (green) electricity requirements target of 40 % by 2020. Electricity contracts awarded in 2011 will deliver 51.9 % of electricity generated from renewable sources.

Scotland – National framework agreement for the supply of electricity for the Scottish public sector produced estimated savings of £40 million over an initial three year period; open to central government, health, local authorities, universities and colleges, other public bodies or NGOs; over 99 per cent of in-scope Scottish public sector volume is committed to this national agreement.

Italy – Consip acts as the Central Purchasing Body, procuring supplies and services for the entire Italian public sector. Following legislative measures introduced to rationalise public expenditure, the use of Consip tools is rapidly taking up (from € 3.3bn in 2012 to € 4.3bn in 2013). In 2013, the average savings generated by Consip, calculated comparing Consip prices with the average price paid by the PA for comparable goods and services, was 23 %.

Finland – Finland has an efficient central purchasing unit, Hansel Ltd, which generates savings for central government entities through easy and safe public procurement using framework agreements. In 2013, these savings amounted to approximately 240 million euros.

eProcurement

Over the years, public procurement has increasingly benefitted from electronic tools. eTools have proved to be important for simplifying the whole value-chain of public procurement, from preparing calls for tenders and uploading them for all European companies, to submitting bids and evaluating them. The simplification of the publication of notices has also made cross-border business opportunities much easier to find. Finally, an important benefit of electronic procurement, which has started to develop in recent years and is currently gaining momentum, is the use of procurement data to improve the governance of procurement systems and detect procurement anomalies. Whilst e-procurement has been introduced across the EU, the following are examples of good practices:

Czech Republic – zIndex is a tool created for benchmarking public procurement across ministries, municipalities, and other public institutions. Each institution has a graphically attractive profile with a score according to a transparent methodology and is given space to explain its performance. The tool has been created by researchers at the Charles University in Prague.

Portugal – Portugal has been a pioneer in the implementation of e-procurement. The Portuguese legislator made an effort to modernise public procurement, altering the public procurement regime to include new possibilities arising from technological developments. As a result the tender process was made almost completely electronic and in most cases tender procedures do not use any paper documentation at all: in 2011, around 62 % of all tender procedures were carried out through e-platforms, out of which 92 % with a value above the EU Directives' thresholds. Following the introduction of e-procurement, Portuguese hospitals were able to achieve price reductions of 18 % on their procurement contracts. In aggregate, the switch-over to e-procurement in Portugal is estimated to have generated savings of about €650 million in the first year but could have reached €1.2 billion if all contracting authorities had fully implemented it. The potential savings amount to between 6 % and 12 % of total procurement expenditure. Most of the savings were due to lower prices resulting from higher competition (more bids per procedure), although administrative savings were also achieved.

SMEs access to public procurement

Belgium – Belgium has introduced legislative measures to facilitate SME participation in public contracts. Contracting authorities are e.g. no longer allowed to request tenderers to provide facts or data which they can easily verify free of charge in an authenticated web-application database called Digiflow. The database was developed by the federal authority to facilitate the work of contracting authorities and to reduce the administrative burden of tenderers. The use of Digiflow is mandatory to the federal and regional authorities. According to a recent study conducted by DG GROW, the share of SMEs participating in public contracts is slightly higher in Belgium than the EU average (SBA Fact Sheet 2012 – Belgium). This tends to confirm that the measures taken by the Belgian authorities have at least to some extent strengthened the position of SMEs in public contracts.

3.2.6

The role of the public sector: modernisation of public administrations

Modernising public administrations is one of the priorities of the Europe 2020 strategy for growth and jobs. Public Administrations are policy makers, implementers, service providers, regulators but also investors and procurers. Thus their role in improving the competitiveness of the general business environment and creating a climate conducive to investment by the private sector, and growth for the purpose of job creation, is crucial. More specifically, a well-functioning administration facilitates investment by increasing stability, predictability and transparency and by reducing running costs for businesses through the streamlining of procedures and elimination of red tape. It also improves the business entry and exit conditions though the establishment of a simple and stable regulatory framework or through the adoption of transparent and fast insolvency procedures