EUROPEAN COMMISSION

EUROPEAN COMMISSION

Brussels, 30.9.2015

SWD(2015) 185 final

COMMISSION STAFF WORKING DOCUMENT

IMPACT ASSESSMENT

Accompanying the document

Proposal for a

REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL

laying down common rules on securitisation and creating a European framework for simple and transparent securitisation and amending Directives 2009/65/EC, 2009/138/EC, 2011/61/EU and Regulations (EC) No 1060/2009 and (EU) No 648/2012

and

Proposal for a

REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL

amending Regulation (EU) No 575/2013 on prudential requirements for credit institutions and investment firms

{COM(2015) 472 final}

{COM(2015) 473 final}

{SWD(2015) 186 final}

Contents

1) INTRODUCTION

2) PROCEDURAL ISSUES AND CONSULTATION OF INTERESTED PARTIES

2.1) Procedural issues

2.2) External expertise and consultation of interested parties

3) PROBLEM DEFINITION

3.1) Problem drivers

3.1.1) Investor stigma

3.1.2) insufficient risk-sensitivity of the regulatory framework

3.1.3) Lack of consistency and standardisation

3.2) Problems

3.2.1) Low demand for securitisation products

3.2.2) Simple and transparent securitisation products disadvantaged

3.2.3) High operational costs for investor and issuers

3.3) Consequences

4) OBJECTIVES

4.1) General, specific and operational objectives

4.2) Consistency of the objectives with other EU policies

4.3) Consistency of the objectives with fundamental rights

4.4) Subsidiarity and proportionality

5) POLICY OPTIONS

6) ANALYSIS OF IMPACTS

6.1) Section 1 - STS differentiation

6.1.1) Policy option 1.1: No further EU action (baseline scenario)

6.1.2) Policy option 1.2: EU soft law

6.1.3) Policy option 1.3: EU legislative initiative to specify applicable STS criteria

6.1.4) Impact summary and conclusion

6.2) Section 2 - Scope of the STS definition

6.2.1) Policy option 2.1: Cover only term securitisation

6.2.2) Policy option 2.2: - cover term and ABCP securitisations

6.2.3) Policy option 2.3: cover term, ABCP and synthetic securitisations

6.2.4) Impact summary and conclusion

6.3) Section 3 - Ensuring compliance with STS criteria and consistency in implementation

6.4) Section 4 - Banking and insurance prudential treatment

6.4.1) Option 4.1: - no change to the existing securitisation framework as set out in the CRR

6.4.2) Option 4.2: - develop a preferential capital treatment for STS securitisations

6.4.3) Option 4.3 – baseline: no further action

6.4.4) Option 4.4 – modify treatment for senior tranches only

6.4.5) Option 4.5 – modify treatment for senior and non-senior tranches

6.4.6) Impact summary and conclusion

6.5) Section 5 - Standardisation and harmonisation

6.5.1) Option 5.1 – Baseline - No EU action

6.5.2) Option 5.2 – Establishing a single consistent EU securitisation framework and encouraging market participants to develop further standardisation

6.5.3 Option 5.3 – Adopting a comprehensive EU securitisation framework

6.5.4) Impact summary and conclusion

7) THE RETAINED POLICY OPTIONS AND INSTRUMENT

8) MONITORING AND EVALUATION

ANNEX 1 – Glossary

ANNEX 2 – Stylised facts on securitisation markets

ANNEX 3 – BCBS-IOSCO survey on "Impediments to sustainable securitisation markets"

ANNEX 4 – STS criteria in the LCR and Solvency II delegated acts

ANNEX 5 - Synthetic securitisation

ANNEX 6 - Financing SMEs with the securitisation tool

ANNEX 7 – Summary of responses to the Commission's public consultation on securitisation

ANNEX 8 – Findings from the COM Questionnaire to FSC Members on securitisation

ANNEX 9 – Bibliographical references

1) INTRODUCTION

1.1) Creditless recoveries and the need to repair financial market intermediation

In deep recessions such as the one triggered by the global financial crisis, credit to firms and households drops steeply. Without credit growth recovering, GDP and employment are also much less likely to recover (see ECB (2011) and Abiad et al. (2014)). Furthermore, even when such creditless recoveries do materialize, they tend to be slower and weaker. GDP growth is on average 30% lower in creditless recoveries than in "normal" ones (i.e. in those where credit growth goes back to pre-crisis rates quickly). Creditless recoveries tend to follow after credit booms and banking crises, to depress investment and to affect disproportionally those industries that are more dependent on external finance. All this suggests that impairment in financial intermediation contributes to the below-average GDP performance.

Europe's current situation is one of a creditless recovery: six years after the collapse of Lehman Brothers credit to the private sector and GDP growth are still subdued (see Chart 1) and so is investment. The percentage of unemployed workers is still higher than before the crisis. Moreover, all this follows a credit boom and banking crises in various jurisdictions.

Chart 1 – credit to EU non-financial corporations, % year-on-year growth rate

Source: ECB

If employment and growth are to recover, it is thus pivotal to tackle the frictions still present in the financial system and restart the flow of credit to European firms and households on a sustainable basis. Much has already been done to strengthen the EU financial system and the recent improvement in credit dynamics are a testimony to this. Nonetheless, European banks are still deleveraging and do so by reducing credit to the private sector. With relatively small capital markets, bank deleveraging is thus slowing recovery in Europe.

While deleveraging and negative credit growth do not need to go together (credit to the private sector represents only 28% of EU banks assets), any mechanism helping banks to deleverage in a sustainable way without reducing credit provision would help substantially the recovery of credit, investment and job creation in Europe.

1.2) The role of securitisation

Securitisation, a mechanism by which credit institutions package loans they have granted into a security and sell this to investors, can provide a useful tool to transfer risk to other institutions and raise cheaper funding. By allowing banks to sell some of their assets to investors, securitisation provides them with a tool to deleverage (i.e. reduce their balance sheets) without cutting credit provision to the private sector. Since banks provide the overwhelming majority of credit to EU firms and households, securitisation could help break the link between deleveraging and credit decline in a material way. Securitisation could thus support bank credit provision and allow for a faster recovery.

Chart 2 – Issuance of securitised products in the EU – placed and retained

Source: SIFMA/AFME quoted in EBA 2014

Since 2008, the issuance of securitised product in Europe has fallen by 88% (see Fig.2). Outstanding amounts have declined accordingly (see Fig.3). This notwithstanding the fact that European securitised products have proven remarkably safe during the crisis, generating near-zero losses (Fig. 5 and 6, see also EBA 2014 and BoE-ECB 2014). It was the exposure to US securitised product that caused significant losses to European banks. However, unrelated products such as securitisations based on EU SME loans and residential mortgages suffered significant declines in issuance.

Chart 3 –Outstanding amounts of securitised products in the EU

Source: SIFMA/AFME

Securitisation can also provide important benefits to investors, giving them access to assets they could not otherwise access. This is particularly beneficial for institutional investors such as pension funds and insurance companies that have long-term liabilities and are therefore natural buyers of long-term assets such as mortgages. The majority of institutional investors cannot underwrite mortgages directly but they could gain access to them buying securitised mortgages. Greater investment opportunities would be particularly beneficial in the EU context, where high GDP per capita and relatively small capital markets imply high demand but limited supply of long term assets.

It is not easy to provide a reliable estimate on the additional provision of loans a revival of the securitisation market could provide. This depends indeed on a multitude of factors: a) monetary policy, b) demand for credit, c) developments in alternative funding channels (covered bonds, unsecured credit to name a few). All of these are likely to change through time, affecting the final outcome. With these caveats in mind, one can say however that, all things equal, if the securitisation market would go back to pre-crisis average issuance levels, banks would be able to provide an additional €157bn of credit to the private sector (see issuance data graphed in Figure 2). This would represent a 1.6% increase in credit to EU firms and households. The latter is still 4.7% below its peak. Therefore, while one must be realistic and recognise a revival in the securitisation market would not by itself solve all problems in the EU financial markets, it could provide a material contribution in improving the banking sector ability to provide credit and help alleviating the negative effects of the credit less recovery on jobs and growth.

Additional to these short-term benefits, restarting a safe securitisation market could have further long term benefits. The macroeconomic scenario currently prevailing in the EU hinders securitisation activity in various ways: by reducing credit activity and thus the need to fund it; by delivering an environment of abundant and cheap central bank funding and finally by lowering the best credit rating achievable by securitisation deals in many EU jurisdictions because of sovereign rating caps (discussed in section 3.2.2). All these factors constitute powerful disincentives to securitisation activities that will weigh on the sector until the situation normalises. Nonetheless, once the macro situation normalises and the above impediments subside, having a safe and thriving securitisation market already in place will allow it to reach its full potential. This could lead to more balanced funding structure for the EU economy, with both banking and non-banking credit stably available for borrowers. This is therefore both a short term and a long term project.

The revival of a safe securitisation market could have different effects across Member States. On the one hand, countries with more developed securitisation markets would be more likely to benefit from it. As the chart below shows, the United Kingdom and the Netherlands are the biggest markets as of today, representing half of the outstanding securitisations. On the other hand, the countries where the funding of banks and the credit provision in general tends to be more problematic could also benefit from a revived funding channel. Italy, Spain, Ireland, Portugal and Greece would fall under this category. Also, a single and harmonised framework for EU securitisation could lay the foundations for developing securitisation markets where these are currently not developed, like for instance in Member States in Central and Eastern Europe.

Chart 4 – Outstanding amounts of EU securitised products by country – end 2014

Source: SIFMA/AFME

1.3) The need to avoid past errors

The financial crisis showed also how, if not properly structured, securitisation can magnify financial instability and inflict serious damage to the wider economy. Unsoundly structured securitisation products were central in transforming a relatively local problem such as the slowdown in US housing prices into a near-meltdown of the global financial system in 2008 (see, among others, BCBS-IOSCO (2009), Gorton (2008), Shin (2009), Coval et al. (2009)). The box below provides a summary of what went wrong in securitisation markets during and before the global financial crisis (see next page).

In order to avoid the errors of the past, it is thus paramount to foster only a well-functioning securitisation market whose features are conductive to financial stability, healthy intermediation and growth. To do so, the Commission can rely also on the substantial amount of work that EU and international organisations have already invested in identifying the characteristics associated with safe and performing securitisations.

1.4) International dimension/relation with previous work

A substantial amount of work has already been devoted to such a goal by a number of European and international institutions. The European Commission has already introduced incentives for properly structured securitisation in the Delegated Regulations for Solvency II (2015/35) and the Liquidity Coverage Ratio (henceforth LCR - 2015/62), adopted in October 2014. The ECB and the BoE have carried out work on the topic. International standards to identify simple, transparent and comparable securitisations are being developed by a Task Force led by the BCBS and IOSCO, while the European Banking Association (EBA) has carried out a similar exercise for European banking standards.

Fostering the market for simple, transparent and standardised securitisation is also a central part of the wider effort launched by the Commission to support investment and growth in Europe. As such it is a continuation of the work started with the Communication on long-term financing published in March 2014 and it is a central element of the Capital Markets Union project and the Investment Plan for Europe launched in November 2014. This impact assessment draws on this work and assesses the different options available to support the re-emergence of a securitisation market conductive to growth and stability.

Role of Securitisation in the 2007-2008 financial crisis

Securitisation played a role in amplifying systemic risk by facilitating excessive leverage and risk concentration across the financial sector. The chart below presents a stylized model of the four key elements of the self-reinforcing securitisation chain:

i) poor underlying loan origination practices;

ii) unprecedented issuance of complex and opaque securitised products;

iii) over-reliance on credit rating agencies,

iv) leveraged and unleveraged investors.

2) PROCEDURAL ISSUES AND CONSULTATION OF INTERESTED PARTIES

2.1) Procedural issues

The first meeting of the impact assessment steering group took place on 10 April 2015. The second meeting took place on 19 May 2015 and the third one on 8 June 2015. DGs involved in the steering group were ECFIN, GROW, SG, LS, JUST and COMP. The meeting of the Regulatory Scrutiny Board (RSB) took place on 15 July 2015.

The RSB gave a positive opinion and recommended the following changes:

The report should go beyond the EU level to also explain the situation in the Member States. In particular, it should provide an overview of the situation of loan and securitisation markets across Member States and their likely evolution in the absence of EU intervention. Moreover, it should show the differentiated impact of the policy options in Member States.

The report should clearly link the objectives of the initiative with the identified problems. To this end, the report should describe the larger macroeconomic context and indicate the relative importance of a revival of the securitisation market as one of the instruments to improve the situation of the banking sector, increase the provision of bank credit and prop-up economic activity.

The analysis of the impacts should provide a balanced overview of the pros and cons of each policy option and discuss possible risks that may prevent the attainment of the objectives. It should also describe existing and future risk mitigation instruments.

These comments have been addressed and incorporated in this final version.

2.2) External expertise and consultation of interested parties

Stakeholder consultation

A public consultation on a possible EU framework for simple, transparent and standardised securitisation was carried out between 18 February and 13 May 2015. 121 replies were received. On the whole, the consultation indicated that the priority should be to develop an EU-wide framework for simple, transparent and standardised securitisation (see summary of replies in Annex 7).

Respondents generally agreed that the much stronger performance of EU securitisations during the crisis compared to US ones needs to be recognised and that the current regulatory framework, needs modification. This would help the recovery of the European securitisation market in a sustainable way providing an additional channel of financing for the EU economy while ensuring financial stability.

External expertise

The Commission has gained valuable insights through its participation in the discussions and exchange of views informing the BCBS-IOSCO joint task force on securitisation markets. The Commission has also attentively followed the work relating to key aspects of securitisation carried out by the Joint Committee of the European Supervisory Authorities (ESAs) as well as by its members separately (EBA, ESMA, EIOPA). Three public consultations, carried out in 2014 by ECB-Bank of England (BoE), Basel Committee for Banking Supervision (BCBS) - International Organisation of Securities Commissions (IOSCO) and EBA respectively, have gathered valuable information on stakeholders' views on securitisation markets. In its own consultation, the Commission has built on these, focusing on gathering further details on key issues. Fruitful meetings and exchange of ideas with European central banks and the IMF have enriched the debate and understanding of the issues at stake. On the whole, these international level consultations confirm the views expressed in the Commission’s own consultation, and provide some additional feedback on the relative merits of some of the proposed policy options.

3) PROBLEM DEFINITION

3.1) Problem drivers

3.1.1) Investor stigma

A comparison between default rates in securitised products issued in the US and in the EU shows immediately the different performance of the two asset classes during the crisis. Looking at AAA-rated securities, US products backed by residential mortgages (RMBS) reached default rates of 16% (subprime) and 3% (prime). By contrast, default rates of EU RMBS never rose above 0.1% (see chart 5).

Chart 5 – Default rates of AAA-rated securitised products, EU vs. US

Source: EBA – See glossary annex for acronyms explanation

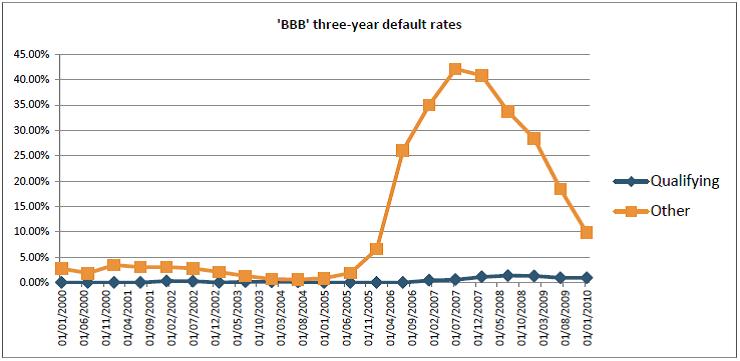

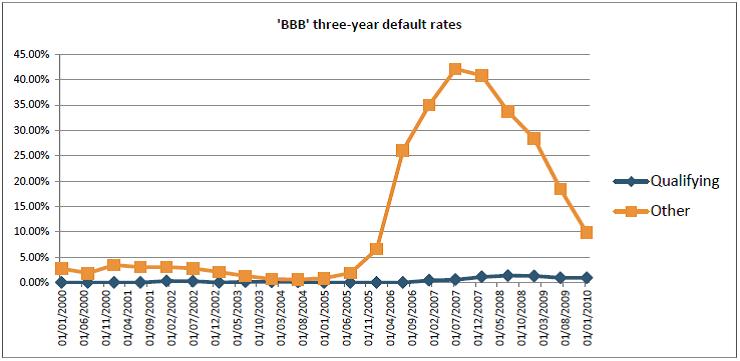

The divergence is even bigger for BBB-rated products where US RMBS' default rates peaked at 62% and 46% (subprime and prime, respectively) while EU products' default rates peaked at 0.2% (see Chart 6). Consequently, as noted in the introduction, losses generated by US products are a multiple of those generated by EU securitisations (see Chart 7).

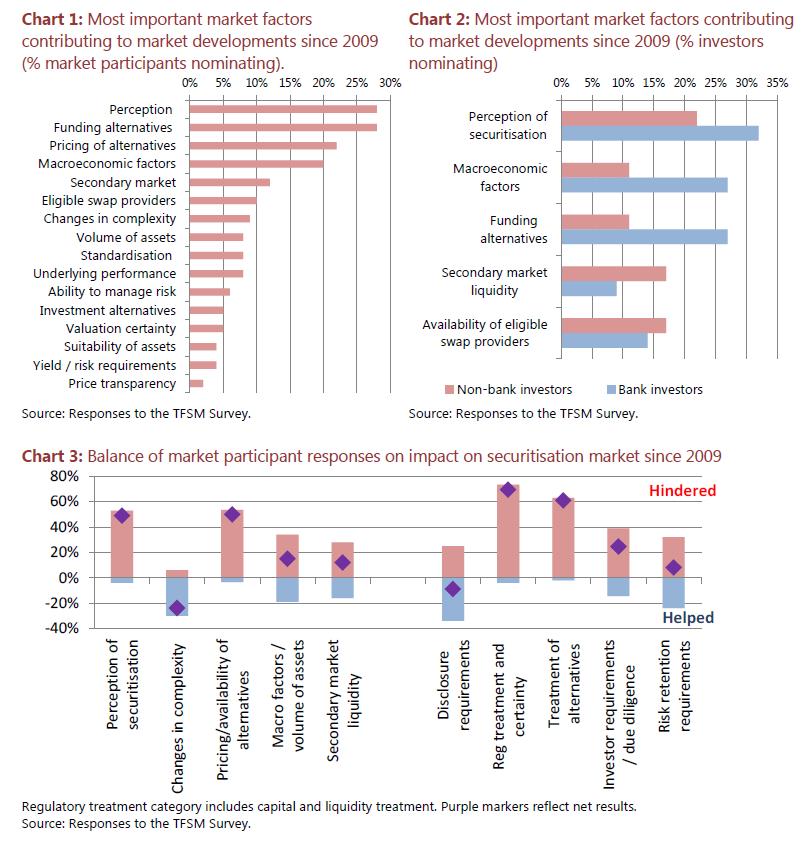

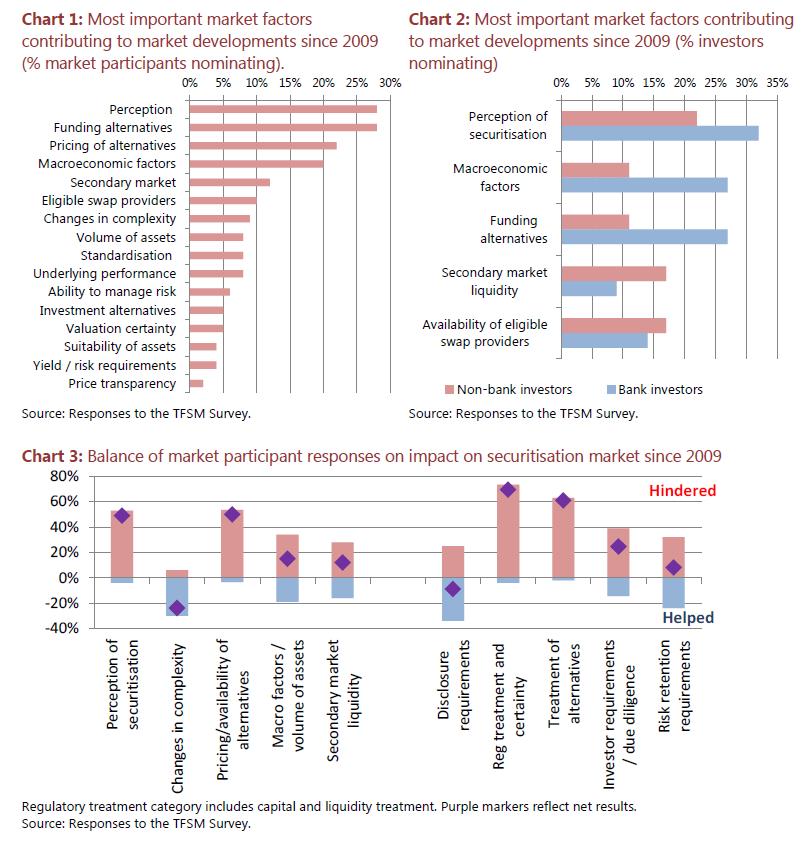

Notwithstanding their strong performance during the crisis, EU securitisation markets have suffered a significant reduction in issuance since 2008 and have not recovered yet. Furthermore, a much higher part of this issuance is still not being placed to investors, but retained by issuers instead. There is a strong consensus among European and international supervisors, regulators, central banks and market participants that the post-crisis reputation of securitised products issued in Europe was severely tarnished by practices and events taking place in the US. In the summer of 2014, the BCBS-IOSCO task force in charge of reviewing developments in securitisation markets conducted a survey among market participants. The survey asked contributors which were, in their views, the factors determining market developments since the crisis. The most common factor mentioned was investor perception (see Annex 3). This led BCBS-IOSCO to conclude: "investors' confidence in securitisation has eroded. From the onset of the crisis, securitisations were perceived as too complex and subject to too many conflicts of interest and asymmetry of information among securitisers, originators and investors".

Chart 6 - Default rates of BBB-rated securitised products, EU vs. US

Source: EBA – See glossary annex for acronyms explanation

In a similar fashion, the first impediment to EU securitisation markets listed by EBA is "post-crisis stigma" (see EBA 2014). The regulatory authority points out that high level of defaults and losses in US markets have contributed "to the spreading of the stigma attached to bad performing asset classes also on those instruments that passed the test of the crisis with relatively good performances"

The same issues are highlighted by the ECB and the Bank of England: "Potential impediments to its [the securitisation market's] revival include a mix of temporary factors, such as the current interest rate environment and the stigma attached to securitisation, and more structural factors" (see ECB-BoE 2014). The two central banks also notice how the EU securitisations' reputation has been tarnished by practices mostly prevalent in the US (poor underwriting standards, complex structures).

3.1.2) insufficient risk-sensitivity of the regulatory framework

Set in the wake of the US securitisation markets crash, capital requirements for exposures to securitisation have been calibrated on such markets' performance. These have however been the worst performers in terms of default and losses generation. Indeed, as shown by Chart 7, the vast majority of losses in securitisation markets globally arose in US subprime mortgage-backed securities and collateralised debt obligations (CDOs).

Chart 7 – Losses generated in 2000-2013 by securitised products, by geographical area

Source: Fitch quoted by EBA – See glossary annex for acronyms explanation

The implications of this regulatory approach are stated clearly by EBA in its latest assessment of the capital treatment of securitised products in Europe: "Calibrating capital requirements following a one-size-fits-all approach led to a focus on the crisis performance of the worst segments of the market (US Subprime and CDOs). The consequence is an unduly conservative treatment of relatively less risky securitisations, showing a very good historical performance during the crisis years, in terms of both observed defaults and losses. […] the substantially different performance across jurisdictions and asset classes has led the current framework to be less risk sensitive". (EBA 2015)

The limited risk sensitivity of the current regulatory capital framework (i.e. the detachment between the risk profile of a securitisation deal and the capital charges imposed on it) comes from the fact that the framework differentiates among securitised products almost exclusively on their credit rating. In other words, two AAA-rated securitisation deals will generate the same capital requirements irrespective of key characteristics such as the homogeneity of the assets underlying the deal, the transparency and completeness of the underlying assets' credit history and the simplicity of the deal's structure.

These characteristics have however determined the performance of securitisation deals during the crisis, with simpler and more transparent products generating losses substantially smaller than more complex and opaque products. The difference is shown neatly in a recent study of the EBA, who split the securitisation universe in two (see EBA 2014). On one side the products that applied principles of alignment of interest between originators of the loans and investors (i.e. risk retention), simple structures (no re-securitisation such as CDO-squared) and no maturity transformation (i.e. EU RMBS or auto loans ABS); on the other side the rest. EBA has then compared the default rate of securitisations with the same credit rating but belonging to the two groups.

Looking at AAA-rated deals, while those applying the above principles of simplicity and transparency never showed on average a default rate higher than 0.1%, the others' default rate peaked at 11.8%. The difference was even bigger among BBB-rated deals, where "principled" securitisations' default rates peaked at around 1% while the others peaked at 42% (see charts 8-9).

The very different default performance of these securitisation groups is reflected in the losses they generated. Asset classes following the principles above (EU RMBS and ABS) generated respectively 0.2% and 0.1% losses in 2000-2013. In the same period, the other assets such as US RMBS and CMBS generated losses in the 6-10% range. More complex, structured credit products such as US CDOs and CDO-squared generated 28.2% losses (see structured credit "SC category" in Chart 7 above).

Even leaving out the most complex structures (such as CDOs) and focusing on some of the most common mortgages backed securities (e.g. RMBS), requiring the same capital charges for investing in an RMBS respecting the principles of simplicity and transparency and another not fulfilling them would be an insufficiently risk sensitive approach.

Chart 8 – Default rates of AAA-rated securitised products, qualifying vs. non-qualifying

Source: EBA

The current capital prudential framework is however mostly based on the securitisation rating. Investing in an AAA-rated RMBS will require today a capital allocation of 0.56% to 1.7%, depending on the approach followed in the Capital Requirement Regulation (CRR) (575/2013) used by the issuing bank (standardised and internal-rating based) and the seniority of the tranche bought. These charges are a multiple of the losses generated by EU RMBS throughout the crisis, whatever their rating. Similar arguments can be applied on BBB-rated deals, where the same capital charges are currently imposed on EU products with an historical 1% default rate and US products with a default rate 42 times higher. The "one-size-fits-all" approach to capital requirements implies that charges are quite disconnected from the risk profile of the products they are imposed on.

Chart 9 – Default rates of BBB-rated securitised products, qualifying vs. non-qualifying

Source: EBA

Supporting this statement, the ECB and BoE have run an exercise similar to EBA's with a different procedure and reached the same conclusions. The central banks have compared the risk weights proposed in the new (Basel III) framework for senior tranches of securitisations (light blue columns in Fig. 9) with the weights that would have covered the losses generated during the crisis securitisations (dark blue columns in Fig. 9). They found that the proposed weights are a multiple of those sufficient to cover losses generated by EU products but are still considerably lower than the weights needed to cover US-generated losses.

Chart 10 – Risk weights covering losses and risk weights proposed by Basel Committee

Source: ECB-BoE

Low risk sensitivity appears also in other aspects of the capital regulatory framework. Comparing the charges imposed on a securitisation deal with those imposed on the assets underlying such product, if held directly, shows that the former is a multiple of the latter. In other words, the prudential capital a bank will be required to hold for a portfolio of its loans is a fraction of the capital that will be required to investors in a securitisation of the same portfolio of loans. This is termed "non-neutrality" of the capital treatment.

As securitisation adds a layer of risk in the form of complexity and model uncertainty, the capital charges for a securitised product should be higher than for its underlying assets (i.e. neutrality is not justified). Nevertheless, the degree of non-neutrality (i.e. the additional capital requirements imposed on the securitisation deal) does not appear fully proportionate by the increase in risk introduced by the securitisation process. EBA calculates, for example, that the capital imposed on a representative EU RMBS is between 1.7 and 2.4 times higher than the capital required to hold the same portfolio of mortgages unsecuritised (see EBA 2014).

The multiple becomes even higher for RMBS or SME loans-backed securitisations issued in countries with low sovereign credit ratings. The EBA has calculated that holding the representative Spanish and Portuguese RMBS requires more than 5 times the capital required to hold the underlying portfolios directly (see Fig. 10 below – pink columns represent capital requirements for holding the mortgages directly, the multi-coloured columns represent capital requirements for holding the same mortgages securitised; the square represent the ratio between the two). Similarly, holding the representative Spanish and Italian securitisation backed by SME loans requires more than 3 times the capital required to hold the underlying SME loans directly. Additional risks introduced by securitisation's complexity and model uncertainty are unlikely to multiply potential losses by a factor of 3 or even 5. While the presence of non-neutrality is justified, it is thus the degree of it that does not seems so. The consequence is, again, a lack of proportionality in the relationship between the riskiness of the securitisation bought and the capital charges required to do so.

Chart 11 – Capital charges on residential mortgages pools – securitised vs. underlying

Source: EBA

One last consideration to be made is on the consistency of capital charges required for different types of investors being exposed to the same product. Substantial differences (between the capital treatment of banks and insurance companies investing in the same product) have been documented. In a comparative study of the current Basel 2.5 and Solvency II frameworks for banks and insurance prudential capital regulations, the authors conclude that there exists "considerable differences in required capital for the same type and amount of asset risk, burdening insurers with almost twice as high capital requirements than banks." (see Laas and Siegle, 2014).

3.1.3) Lack of consistency and standardisation

In recent months the Joint Committee of the European Supervisory Authorities carried out an assessment of the existing EU framework regarding the requirements relating to disclosure, due diligence, supervisory reporting and risk retention. The Committee's objective was to assess whether the existing framework has been set up in a consistent manner across the many pieces of legislation regarding securitisation introduced after the crisis. The Committee's work highlighted how current due diligence requirements show substantial differences depending on the investors involved (banks, insurers, alternative investment funds, etc.) while common requirements can be justified for some investor types (see JC 2015). It also highlighted the importance of accompanying due diligence requirements with disclosure requirements that render the due diligence feasible and not too onerous for investors. The importance of giving investors access to standardised loan-by-loan data is another area where further work is necessary. Finally, on top of differences and inconsistencies in the EU regulatory framework, there are national differences in a variety of key aspects affecting securitisation.

Limited standardisation of information is particularly detrimental to the securitisation of SME loans. It makes it harder for prospective investors to conduct risk assessments, compare the risk-return characteristics between comparable products, making them less attractive. In addition, credit rating agencies typically require 3-5 years of financial performance and credit history when rating a securitised product. This includes information on outstanding balances, collections, collateral, delinquencies, write-offs, recoveries, to estimate the probability distribution of losses that may be generated by the pool. If information is missing or inadequate, as is often the case for small and new companies, this probability distribution cannot be reliably estimated and credit rating agencies may refrain from providing a rating. This immediately excludes potential investors constrained by mandates to only invest in rated products.

3.2) Problems

3.2.1) Low demand for securitisation products

As noticed above, issuance of securitised products in the EU has dropped 88% since the crisis began. While in 2007 70% of the issuance volume was publicly placed to investors, only a year later that percentage had dropped to 13% (see AFME 2014). The subprime crisis had changed drastically investor perception of securitised products and issuers were unable to place most of it, being thus forced to retain it. While some improvement has taken place since, the situation is still far from normalisation. Notwithstanding the reduction in issuance seen since 2008, its vast majority (67% in 2014) is still retained by issuers and used for central bank refinancing operations. Demand for EU securitisation products is thus a fraction of what it used to be before the crisis. Yet this has little to do with the performance of EU securitisation itself. The events in the US (and their damaging effects on EU investors) have altered the perception of the latter with regard to all securitisation products, without geographical or asset class distinctions. This is in line with the BCBS-IOSCO questionnaire ranking investor perception as the most important factor contributing to the decline of securitisation markets since the crisis.

3.2.2) Simple and transparent securitisation products disadvantaged

EBA, BoE and ECB work shows that the capital charges in the current regulatory framework are multiples of those that would have covered the losses generated by EU securitised products during the global financial crisis. It is clear that these products are being disadvantaged by the regulatory framework. This is one of the key reasons behind the persistent subdued state of EU securitisation issuance. As EBA put it, the consequence of the capital regulation's scarce differentiation among securitised products is "an unduly conservative treatment of relatively less risky securitisations, showing a very good historical performance during the crisis years, in terms of both observed defaults and losses."

The negative effects of the scarce risk-sensitivity in the regulatory treatment are exacerbated by its interaction with sovereign caps employed by some credit rating agencies. The conservative regulatory framework, combined with its mechanistic reliance on credit ratings, interacts with sovereign rating caps and renders the regulatory treatment of securitised products issued in low-rated countries punitive and sometimes disconnected from the product's risk profile. This is because securitisation products can have higher credit rating than that of the country the issuer resides in. The difference is however "capped" (i.e. it cannot be more than a certain number of steps). It follows that securitisation products issued in countries with low sovereign ratings are bound to have low ratings and punitive capital charges, no matter how safe, simple and transparent these products may be (see Chart 12). This puts all securitisations issued in the periphery at huge disadvantage, irrespective of their risk profile, as discussed in section 3.1.2.

Chart 12 – Country sovereign ratings and maximum achievable securitisation ratings

Source: Barclays – See glossary annex for acronyms explanation

Credit rating reliance also introduces "cliff edge" risks as downgrades may translate into substantial harshening of the regulatory treatment of a securitisation deal. This results from the overreliance on external credit ratings in the capital treatment of securitisations, leading to fire-sales and such instruments by financial market participants to pre-empt higher capital charges in the case of a downgrade. Again, this is particularly damaging when a securitisation deal has its rating capped by a sovereign rating. In this case, a downgrade of the sovereign translates in a securitisation downgrade and thus a substantial tightening of the regulatory treatment. Furthermore, credit rating agencies link the securitisation rating with that of the many agents present in the securitisation deal (the so-called "ancillary services", for example providers of interest rate swaps or guaranteed investment accounts). This implies that the tightening of the regulatory treatment can be triggered by a downgrade of an ancillary service as well.

3.2.3) High operational costs for investor and issuers

The availability of data on underlying assets and monitoring metrics varies considerably between securitisation deals. This lack of standardisation is also reflected in different structures, availability and form of legal documentation, reporting practices and types of assets. The lack of standardisation increases the costs of implementing due diligence and credit analysis for investors. These costs may also be unnecessarily increased by the implementation mechanism currently envisaged for risk retention rules. These risk retention rules hold investors responsible for ensuring the issuer complies with the rules but do not ensure the data necessary to prove compliance are disclosed to the investor in a standardised and consistent way.

On top of this, not always justified differences in disclosure and due diligence requirements have been identified across different parts of the EU legislation on securitisation (as discussed in section 3.1.3 above). The situation is further complicated by the specific European context, where substantial differences across jurisdictions exist on all these aspects and on others such as the tax and accounting treatment of securitised products, as well as the legal frameworks. This lack of standardisation increases the costs of due diligence for investors. These in turn reduce the attractiveness of cross-border investment in securitisation, limiting the scope for EU market integration and economies of scale. Issuers face additional set-up and disclosure costs because of the need to adapt these differences. This argument is put forward by the ECB and the BoE in their joint paper quoted above (see ECB-BoE 2014).

All these considerations are even more important in the context of SME loans securitisation. This is generally more expensive than securitising other more standard types of loans such as mortgages. In order to be pooled, a portfolio of loans must indeed satisfy some key conditions such as a credit history, clarity on collateral and its availability, and sectoral diversification. From a bank’s perspective, building a portfolio with such characteristics is more difficult with SME loans than with residential mortgages, where there is more uniformity of loans, longer maturity tenors, and regularity of payment streams due to amortisation (see IMF 2014b). Once a suitable portfolio of SME loans is built, the bank faces also higher than average costs of setting up and operating the securitisation structure. For example, the granular information and variety of collateral related to SME loan portfolios require the creation of expensive IT systems and these are then used for portfolios that tend to be smaller in SME than in other securitisations. The same is true for legal costs and documentation.

While these characteristics are intrinsic to SME loans securitisation and thus unavoidable, their negative effect is exacerbated by limited standardisation or outright lack of data on SME loans. As the IMF notes: "operational constraints, such as a lack of uniform reporting standards and credit scoring, make securitization of SME-related claims more costly than, for example, mortgages" (see IMF 2014b). From an investor point of view, the lack of data and the heterogeneity of the underlying loans make it at best time-consuming and costly and at worst impossible to carry out own credit analysis and due diligence. This view is shared by the ECB and BoE who affirm in their joint paper: "facilitating investors’ access to credit data could be especially beneficial for securitisations of asset classes such as SME loans where the level of historical performance information available between incumbents and new entrants is most obviously uneven and generally lacking" (see ECB-BoE 2014).

With set-up and operational costs higher than for other types of securitisations and generally lower returns on the underlying assets, structuring an SME securitisation that is profitable for the issuer and at the same time guarantees a satisfactory return to the investor is often unfeasible. This is shown by an IMF study estimating the return an investor (bank or insurance company) would obtain at different market return rates by investing in a securitised SME deal or holding the portfolio of SME loans directly. The Fund finds that "investment in highly rated senior [SME ABS] bonds would result in a Return on equity (RoE) of about 11.5 percent for banks and 4.5 percent for insurers. This is well below the RoE that banks and insurers would earn by simply holding the SME loan on their books (14.5 percent and 7.5 percent, respectively)". In jurisdictions where the sovereign rating cap binds securitised product into low credit ratings, the disadvantage in investing in SME securitisation is even bigger, rendering SME securitisation even more uneconomical.

The specificity of SME loans has been dealt with by market participants developing dedicated instruments (such as ABCP – asset-backed commercial papers) and structuring techniques (so called "synthetic" securitisations). While these instruments or techniques may be better suited to certain types of SME loans securitisation, their specificities do not fit in the current regulatory framework, impacting on operational costs and limiting the products' attractiveness (please see Annex 5 for a detailed analysis of synthetic securitisation. Annex 6 provides a detailed analysis of the problems affecting SME loans' securitisations and the solutions proposed within this initiative.

3.3) Consequences

Before the crisis the securitisation market was a growing channel of alternative funding to banks and the European economy. In addition its loss performance during the crisis showed good resilience. As a consequence of the problems highlighted in this chapter, as well as the subdued macroeconomic environment described in the introduction, this market is now moribund. A financing channel for the EU economy is impaired, with substantial detriment to potential contribution to growth and employment. Without securitisation, banks' ability to reduce their balance sheet by selling assets is indeed constrained. As a consequence, the current need for deleveraging imposes banks to shrink their balance sheets by reducing credit provision. In the European context, where 80% of financial intermediation takes place through banks, the implications for growth are relevant.

From a long term perspective, the moribund state of the securitisation market deprives the EU economy of a capital market that could provide additional funding when the banking channel cannot because of its own dynamics.

These dynamics are less relevant in the US where issuance has restarted growing after a substantial drop in 2008. US 2014 issuance was still less than half than in 2007 but a positive trend is clearly visible. This is however mostly ascribable to public guarantees from state agencies (Fannie Mae, Freddie Mac and Ginnie Mae), which cover the vast majority of the market. Such guarantees are however not feasible in Europe where an EU-level shared guarantee fund many times the size of currently existing supranational guarantors would be needed. It would also not be advisable as such schemes transfer risk from mortgage markets to the public sector, as recently highlighted by the IMF (see IMF 2014).

Chart 13 - Drivers, problems and consequences chart

4) OBJECTIVES

4.1) General, specific and operational objectives

In light of the analysis of the problems above, the general objective is to revive a safer securitisation market that will improve the financing of the EU economy, weakening the link between banks deleveraging needs and credit tightening in the short run, and creating a more balanced and stable funding structure of the EU economy in the long run. This should in turn benefit end users of credit intermediation: households, SMEs and larger corporations.

Reaching these general objectives requires the achievement of the following more specific policy objectives:

Remove stigma from investors and regulatory disadvantages for simple and transparent securitisation products (tackling problems 1 and 2 described in sections 3.1.1 and 3.1.2)

Reduce/eliminate unduly high operational costs for issuers and investors (tackling problem 3 described in section 3.1.3)

These in turn require the attainment of the following operational objectives:

Differentiate simple, transparent and standardised securitisation ('STS' henceforth) products from more opaque and complex ones. This objective will be measured against the difference in price of STS versus non-STS products. If this objective is achieved, this difference should increase. This should also trigger an increase in the supply of STS products, reason for which the achievement of this objective will also be measured with the growth in issuance of STS products versus non-STS ones.

Support the standardisation of processes and practises in securitisation markets and tackle regulatory inconsistencies. This objective will be measured against: 1) STS products' price and issuance, 2) The degree of standardisation of marketing and reporting material and 3) feedback from market practitioners on operational costs' evolution.

4.2) Consistency of the objectives with other EU policies

The identified objectives are coherent with the EU's fundamental goals of promoting a harmonised and sustainable development of economic activities, a high degree of competitiveness, and a high level of consumer protection, which includes safety and economic interests of citizens (Article 169 TFEU).

4.3) Consistency of the objectives with fundamental rights

Future legislative measures on securitisation, including appropriate sanctions, need to be in compliance with relevant fundamental rights embodied in the EU Charter of Fundamental Rights ("EU CFR"), and particular attention should be given to the necessity and proportionality of the legislative measures. Only the protection of personal data (Article 8), the freedom to conduct a business (Art. 16) and consumer protection (Art. 38) of the EU Charter of Fundamental Rights are to some extent relevant. Limitations on these rights and freedoms are allowed under Article 52 of the Charter. The objectives as defined above are consistent with the EU's obligations to respect fundamental rights. However, any limitation on the exercise of these rights and freedoms must be provided for by the law and respect the essence of these rights and freedoms. Subject to the principle of proportionality, limitations may be made only if they are necessary and genuinely meet the objectives of general interest recognised by the Union or the need to protect the rights and freedoms of others.

In the case of the securitisation legislation, the general interest objective which justifies certain limitations of fundamental rights is the objective of ensuring the market integrity and financial stability. The freedom to conduct a business may be impacted by the necessity to follow certain risk retention and due diligence requirements in order to ensure an alignment of interest in the investment chain and to ensure that potential investors act in a prudent manner. As regards protection of personal data the disclosure of certain loan level information may be necessary to ensure that investors are able to conduct their due diligence. It is however noted that these provisions are currently already in place in EU law. As regards the new securitisation legislation it should not impact on consumers, since the instrument are not intended for consumers. However, for all classes of investors STS securitisation would enable better analyse the risks for the products which contributes to investor protection. We have focused our assessment on the options which might limit these rights and freedoms

4.4) Subsidiarity and proportionality

According to the principle of subsidiarity (Article 5 (3) of the TEU), action on EU level should be taken only when the objectives of the proposed action cannot be achieved sufficiently by Member States alone and can therefore, by reason of the scale or effects of the proposed action, be better achieved by the EU. The objective of the initiative is to revive a safe securitisation market that will improve the financing of the EU economy and ensures financial stability and investor protection.

Securitisation products are part of EU financial markets which are open and integrated. Securitisation links different financial institutions from different Member States and non-Member States: often banks originate the loans that are securitised, while financial institutions such as insurers and investment funds invest in these products and they do so across European borders, but also across the Atlantic. The securitisation market is therefore European/international in nature.

Individual Member State action will not be able to remove the stigma. The EU has advocated at international level for standards to identify simple, transparent and standardised (STS) securitisation that performed well during the financial crisis. Such standards will help investors to identify categories of securitisations that have performed well during the financial crisis and which allow them to analyse the risks involved.

Although implementation of these international standards could be done by Member States, it could lead to divergent approaches in Member States, which would hamper the removal of the stigma and would create a de facto barrier for investors which would have to enter into the details of the each Member State's framework. As regards the insufficient risk-sensitivity of the regulatory framework, the relevant framework is currently laid down in EU law, in particular the Capital Requirements Regulation for banks and in the Solvency II Directive for insurers. Making the regulatory framework more risk-sensitive can thus only be achieved by amending these EU legal acts and thus only by EU action. It should also be noted that to be able to define a more risk-sensitive regulatory treatment for STS securitisation requires the EU to define what STS securitisation is, since otherwise the more beneficial regulatory treatment would in different Member States be available for different types of securitisations. This would lead to an un-level playing field, to regulatory arbitrage which in the end could work against the objective to remove the stigma attached to securitisation. As regards the lack of consistency and standardization EU law has already harmonised a number of elements on securitisation, in particular rules on disclosure, due diligence, supervisory reporting and risk retention. Those provisions have been developed in the framework of different legal acts (CRR, Solvency II, UCITS, CRA Regulation, and AIFMD) which has led to certain discrepancies in the requirements that apply to different investors. Increasing their consistency and further standardisation of these provisions can only be done by EU action.

The action proposed would give a clear and consistent signal throughout the EU that certain securitisations performed well even during the financial crisis, that they can be useful investments for different types of professional investors for which regulatory barriers (lack of an appropriate prudential treatment, inconsistent treatment across financial sectors) will be taken away.

Therefore, the objectives of the proposed action cannot be achieved by action of the Member States and can be better achieved by action by the Union.

The options analysed below will take full account of the principle of proportionality, being adequate to reach the objectives and not going beyond what is necessary in doing. The retained policy options are compatible with the proportionality principle, taking into account the right balance of public interest at stake and the cost-efficiency of the measure. The proposed action will create a simple, clear and consistent framework for investments in securitisation based on uniform definitions, including of simple, transparent and standardised securitisation. The prudential treatment will be carefully calibrated on the basis of extensive historical data, so to ensure that the treatment is proportionate to the risks involved and neither over- nor underestimates the risks of securitisation.

The options retained will be implemented by as closely as possible alignment with the existing EU definitions and provisions on disclosure, due diligence, risk retention and definition of STS securitisation in the LCR and Solvency 2 delegated acts. This will ensure that the market can continue to function as much as possible on the basis of the existing legal framework, so to not unnecessarily increase costs and create regulatory disruption, thereby also continuing to ensure investor protection, financial stability, while contributing to the maximum extent possible to the financing of the EU economy.

5) POLICY OPTIONS

In order to meet the first operational objective, this impact assessment analyses 14 different policy options. For ease of reference, these options have been grouped into different headings, such as options on product differentiation, scope of the differentiation, compliance mechanism and the prudential treatment (see table below).

|

|

Option

|

Description

|

|

Simple Transparent and Standardised criteria

|

|

1.1

|

No action on differentiation

|

Take no further action at EU level to introduce STS criteria

|

|

1.2

|

Soft law by EU

|

Codes of conduct, guidelines or recommendations to encourage Member States to set up specific provisions for STS products and/or endorsement or support to private initiatives

|

|

1.3

|

EU legislative initiative to specify STS criteria

|

Introduction of a legal instrument specifying a set of criteria for STS securitisation products

|

|

Scope of differentiation

|

|

2.1

|

Same scope as LCR and S2

|

The scope of STS securitisations would only cover 'term' securitisation (ABS with medium to long term maturity)

|

|

2.2

|

2.1 + ABCP

|

Additional criteria for identifying STS types of short term securitisations

|

|

2.3

|

2.2 + synthetics

|

Introduce criteria for both ABCP and synthetic securitisations

|

|

Compliance mechanism

|

|

3.1

|

Introduce a self-attestation mechanism

|

Responsibility for compliance with the criteria will lie with the originator of the securitisation

|

|

3.2

|

3.1 + 3rd party assessment

|

Self-attestation by the originator complemented by assessment provided by an independent third-party

|

|

3.3

|

3.1 + ex-ante supervisory approval

|

Self-attestation by the originator complemented by ex-ante supervisory approval.

|

|

Prudential treatment

|

|

Banking prudential treatment

|

|

4.1

|

No change to the existing securitisation framework

|

All securitisations (both STS and non-STS) continue to be subject to the same prudential treatment set out in CRR

|

|

4.2

|

Develop a preferential capital treatment for STS securitisations

|

Amend the existing requirements in the CRR with a new framework that would differentiate between STS and non-STS securitisations with a preferential treatment for the former

|

|

Insurance prudential treatment

|

|

4.3

|

No further action on Insurance prudential treatment

|

Solvency 2 standard formula for capital charges unchanged

|

|

4.4

|

Modify treatment for senior tranches of STS products

|

Refine existing approach - without changing the scope of the differentiated approach (i.e. improve the risk-sensitivity of the calibrations for senior tranches only).

|

|

4.5

|

Modify treatment for all tranches of STS products

|

Extend the differentiated approach to insurers' investments in non-senior tranches of STS securitisation deals and refine the existing approach

|

In order to meet the second operational objective, a total of three different policy options has been analysed in this impact assessment (see table below). Notice that, while options aiming at the achievement of the first objective refer to the regulation of STS products, options aiming at the achievement of the second objective aim at setting the optimal provisions that will apply onto all securitisation products, STS and non-STS alike.

|

B) Options aiming at fostering the standardisation of processes and practises and tackling regulatory inconsistencies

|

|

5.1

|

No further action at EU level

|

Finalise implementation of agreed reforms and address some remaining issues

|

|

5.2

|

Establish a single EU securitisation framework and encourage market participants to develop standardisation

|

Establish a single EU securitisation legislative framework defining securitisation, transparency, disclosure, due diligence and risk retention rules.

|

|

5.3

|

Adopt a comprehensive EU securitisation framework

|

Complementing option 5.2 with an EU securitisation framework harmonising Member States' legal frameworks for securitisation vehicles

|

6) ANALYSIS OF IMPACTS

This section assesses the impacts of each of the policy options, measured against the criteria of their effectiveness in achieving the specific objectives (differentiating STS deals from more opaque and complex ones; fostering standardisation of processes and practises and tackling regulatory inconsistencies) and their efficiency in terms of achieving these objectives for a given level of resources or at lowest cost. Impacts on relevant stakeholders and the coherence of the options with EU policies are also considered. The retained policy options should be those scoring the highest for the relevant specific objective while imposing the smallest costs and impacts on stakeholders. At the end of each section of options assessment and before the impact summary the views of respondents to the public consultation are presented in the "Stakeholder View" boxes.

6.1) Section 1 - STS differentiation

Box 1: What is simple, transparent and standardised securitisation?

The discussions on setting criteria to distinguish between different types of securitisation start with the principles of simplicity, transparency and standardisation. These features are relevant across the whole financial system and form the foundation criteria (see footnote 9, page 30 for links to the criteria list of BCBS-IOSCO and EBA). As a second step, these features can be supplemented with additional criteria based on specific risks and for specific prudential requirements in a given sector. By taking a 'modular approach', this allows for increased consistency across the system and, at the same time, can help address sector specific risks.

6.1.1) Policy option 1.1: No further EU action (baseline scenario)

This option would imply no further EU action aimed at defining criteria to identify STS products and distinguish them from other securitisation products. A distinction between the two is however already included in the provisions of the LCR and the Solvency 2 EU delegated acts.

Box 2: The current differentiation between STS and non-STS securitisation

The LCR delegated act requires all EU banks to hold at any point in time liquid assets enough to cover the cash outflows the bank can suffer in a stressed situation lasting 30 days. "Liquid assets" are defined as assets that that can be sold on private markets with no or little loss of value even in stressed conditions.

The LCR delegated act specifies what types of assets can be considered "highly liquid" and be included on the banks liquidity buffer. To be eligible in the buffer (as "Level 2B" instruments), these instruments have to meet certain criteria (cf. annex 4). All securitisation products not satisfying the criteria are instead excluded and cannot be accounted as cover for the LCR. Similar criteria identify securitisations that enjoy lower prudential requirements under Solvency 2 delegated acts for insurance companies' exposures. Notably, these lower prudential requirements are achievable only by the most senior tranche of a qualifying securitisation deal.

Furthermore, some EU jurisdictions have national legislative frameworks dedicated to securitisation and some of these frameworks include provisions aimed indirectly at promoting the development of simple and transparent instruments.

Finally, the market has started to independently develop differentiation mechanisms. The Prime Collateralised Securities (PCS), for example, aims at defining standards of transparency, simplicity and liquidity in the securitisation market. It does so with the PCS Label, which can be awarded to securitisation deals meeting certain criteria. These criteria have similarities to those identifying STS securitisation in the LCR and Solvency 2 delegated acts. The PCS Label is designed to assist investors and market participants in understanding key aspects of the labelled securities that make them simple, transparent and standardised: the simplicity of the structure, the homogeneity of the assets packaged in the security, the rules incentivising proper underwriting standards and so on. A similar initiative, True Sale International, has developed in Germany.

(a) Effectiveness - ensuring differentiation of STS deals from more opaque and complex ones

Recognising the specific features of STS securitisation instruments and adjusting accordingly the prudential treatment these instruments are subject to, the two delegated acts introduce an important differentiation in the market. However, beyond banks' liquidity and insurance companies' capital charges, STS and non-STS securitisations are indistinct. Therefore, the current differentiation is a preferential treatment granted to some qualifying products in some limited and specific aspects, rather than the existence of a product immediately recognisable by all types of investors (banks, insurance companies, pension funds, UCITS, AIFs). It follows that the problem of stigma would not be efficiently tackled.

On top of this, the regulatory disincentives currently hindering securitisation (see introduction and section 6.4) would not be removed.

Market-developed differentiating mechanisms such as PCS and TSI are unlikely to fight stigma as they would rely on market associations' opinions that have not been tested by events (i.e. PCS-labelled securitisation were never tested in a stressed scenario). More importantly, even if these differentiating mechanisms between securitisation products would be successful in achieving differentiation and fighting stigma, they could not adjust the prudential treatment attached to securitisations and thus improve the economics of EU deals. Furthermore, the current inconsistencies in EU legislation would continue to affect these markets.

In absence of any EU intervention, deals are thus likely to remain uneconomical and the current state of the securitisation market would be unlikely to be reversed: low issuance and fragmentation would persist.

The absence of macroeconomic factors currently hindering securitisation (see introduction) may be a necessary condition for the full development of the securitisation markets potential but it hardly is a sufficient condition. When the macroeconomic environment will improve, without a more risk sensitive prudential framework banks will cover their increasing funding needs with other sources/channels such as covered bonds or subordinated debt that will remain cheaper than securitisation. Also, non-bank investors such as insurance companies will not find attractive to invest in securitisation markets as current capital charges for them, compared with other available investments, are very onerous. As a consequence, a funding and investment diversification opportunity will not be exploited.

(b) Efficiency and impact on stakeholders

A recognisable product, guaranteeing a high level of simplicity, transparency and standardisation of the securitisation structure and its underlying assets, and allowing for a clear understanding of the risks intrinsic in the transaction, is however what is needed to overcome stigma and inspire investor confidence. Such a product must be recognisable and relevant for all investors beyond banks and insurance companies (e.g. UCITS, AIFM...) and across the European Union, reason for which the limited and differing differentiation incorporated in some national legislative frameworks are unlikely to be an efficient means to the end of rebuilding trust and fighting stigma.

Similar considerations hold for market-led initiatives. While beneficial in rebuilding trust and fighting stigma, they are unlikely to be sufficient because, without the involvement of supervision, investors are unlikely to trust privately-awarded labels. Alone, the LCR and Solvency 2 delegated acts, national frameworks and private initiatives are thus unlikely to lead to the emergence of a clearly identifiable STS product for EU investors and issuers, able to overcome the stigma against securitisations.

6.1.2) Policy option 1.2: EU soft law

The Commission could use soft-law instruments such as codes of conduct, guidelines or recommendations to Member States in order to build on the existing delegated acts, national frameworks and market initiatives (PCS, TSI, DSA). These soft law instruments could encourage Member States to set up specific provisions or to encourage STS within their securitisation frameworks. They could also be used to foster further differentiation via endorsement or support to private initiatives such as the PCS and TSI labels and other initiatives to raise awareness of STS products.

(a) Effectiveness - ensuring differentiation of STS deals from more opaque and complex ones

An advantage of this option is that it could be implemented quickly so that the international consensus on STS criteria could be swiftly promoted among Member States and market participants. In a creditless recovery, such as the one currently experienced by the EU, where there is urgency to restart credit flows to firms and households, this would certainly be an important advantage.

Offsetting the advantage of speed there is, however, a major drawback: limited coordination. It would be up to Member States and market organisations to decide whether and how to implement the recommendation/guidelines. Without a coordinated effort, national initiatives are more likely to develop in different ways, potentially creating a set of different provisions and STS standards across the EU. This would change little from the current situation, falling short of introducing the recognisable STS product needed. Timing would also potentially be an issue. Until the number of countries with a differentiating securitisation framework has reached a critical mass, the effect on the market will be negligible. This could take years. Choosing this option would then most likely lead to the creation of different STS products, implemented at different times or not even implemented. The same stands true for market–led initiatives, which could create a set of similar and overlapping STS labels. Finally, the limitations of market-led initiatives highlighted in the previous section are equally valid under this option.

(b) Efficiency and impact on stakeholders

Soft law would entail small costs in terms of administrative burden for EU authorities and market participants alike. However, low costs would be accompanied by low effectiveness in achieving the differentiation objective, thereby suggesting this option would be scarcely efficient. Even if Member States were to react quickly and introduce national legislation identifying STS deals, a soft law action would limit considerably the scope and depth of the initiative. This would impact market participants depriving them of a recognisable STS product, thus changing little from the current situation. The change would be even more negligible in the event of slow and non-harmonised implementation of STS product introduction by Member States.

6.1.3) Policy option 1.3: EU legislative initiative to specify applicable STS criteria

Under this option, a harmonised legal framework specifying a set of criteria for STS products generally applicable across financial sectors would be established. Extensive work to identify what features render a securitisation and the risks it entails clearly understandable and, furthermore, what features have empirically been associated with smaller losses during the crisis has been carried out by a host of authorities and organisations (EBA, BCBS-IOSCO). An international consensus has been reached and a set of agreed key criteria has been identified. The STS definition would therefore be based on this set.

(a) Effectiveness - ensuring differentiation of STS deals from more opaque and complex ones

With the introduction of a single legal instrument defining STS products, two important goals would be achieved that would otherwise not be not achievable by the status quo or via soft law. First, it would provide a STS product that, accompanied by an appropriate level of supervision, could be relevant and trusted for all categories of investors, thereby overcoming stigma and fostering a finer distinction among securitised products than the one currently prevalent in the market. Investors would not, however, be relieved from their responsibility to conduct due diligence and credit risk analysis for STS products (cf. chapter 4). Secondly, it would provide a harmonised definition of STS products applicable across all EU jurisdictions and financial sectors, thereby fostering cross-border harmonisation without conflicting with national frameworks, which would not be impaired/hindered.

(b) Efficiency and impact for stakeholders

The single legal instrument envisaged in this option would have limited costs. These consist of a longer EU legislative procedure (compared to a soft law initiative) and the need to revisit various pieces of legislation and technical standards, some only recently adopted. Market participants would also incur administrative costs in adapting to the new legislation. These would, however, be more than offset by the advantages of creating a more transparent and sustainable market for securitised products, giving market participants another source of funding and investment and, in so doing, creating another safe channel of financing for the European economy.

Stakeholders' view - Respondents to the Commission's public consultation support strongly the introduction of a differentiation instrument based on the modular approach. Criteria developed by EBA/BCBS/IOSCO were seen as a natural and authoritative base for the criteria. Respondents support a differentiation not including credit risk elements and applying to all tranches of a deal, since differentiation is about the originating and structuring procedure. The importance of avoiding a proliferation of criteria/definitions/regimes in EU legislation (CRR, Solvency II, LCR) was highlighted as a key reason for introducing a unified instrument for the definition of STS criteria. These views were equally held across all categories of respondents (e.g. industry associations, market participants, supervisors as well as think tanks). Please see Annex 7 for an extensive summary of responses to the public consultation.

6.1.4) Impact summary and conclusion

Options 1.1 and 1.2 fall short of the need to introduce a recognisable product. Differentiation would be limited to that existing in current EU legislation or, in the case of option 1.2 being chosen, to that eventually introduced by Member States and/or market participants. No guarantee of a standardised EU product setting unified criteria for simple, transparent and comparable criteria that are relevant and recognised by all types of investors would be there. As such, the incentive to issue and invest in STS products would remain limited to certain banks and insurance companies.

By contrast, introducing an STS product that is relevant and, with effective supervision, trusted by all categories of investors is achievable under option 1.3. The STS products should create a harmonised definition of securitisation products whose intrinsic risks can be appropriately analysed, understood and priced by investors. Such a definition would be applicable across all EU jurisdictions and financial sectors. In this way, investors should be able to recognise simple, transparent and standardised products and the indiscriminate stigma against all securitisations should be reduced. Fostering the development of simpler, more transparent and standardised structures, option 1.3 would allow investors, credit rating agencies and supervisors to assess with more precision the risk involved in the assets contained in a securitisations, thereby reducing mechanistic reliance on credit rating to evaluate a deal's riskiness.

In the comparison table below, each option is rated between "--" (very negative), ≈ (neutral) and "++" (very positive) based on the analysis in the previous sections. The benefits are, however, very difficult to quantify in monetary terms. The costs should be understood in a broad sense, not only as compliance costs but also against all the other negative impacts on stakeholders and on the market of alternative options. This is why we have assessed the options based on the respective costs and benefits in relative terms.

In view of the above analysis and the opinion of stakeholders in the public consultation, option 3 (an EU legislative initiative to specify applicable STS criteria), is the preferred option.

|

|

Option

|

Effectiveness

|

Efficiency

|

Impact on Stakeholders

|

|

1.1

|

No action on differentiation

|

(=) Differentiation limited to existing EU legislation.

|

(=) Market participants remain deprived of a recognisable STS product, thus changing little from the current situation

|

(=)

|

|

1.2

|

Soft law by EU

|

(-) Limited coordination potentially creating a set of different provisions and STS standards across the EU.

|

(=) Market participants remain deprived of a recognisable STS product, thus changing little from the current situation

(+) Fast implementation procedure

|

(=) Small costs in terms of administrative burden for EU authorities and market participants, but limited effectiveness

|

|

1.3

|

EU legislative initiative to specify STS criteria

|

(++) Introduction of an STS product that is relevant and trusted for all categories of investors

(++) Creation of a harmonised STS definition applicable across all EU jurisdictions and financial sectors

|

(++) Creation a more transparent and sustainable market for securitised products more than offsets limited costs

|

(-) Longer EU legislative procedure and the need to revisit various pieces of legislation and technical standards, some only recently adopted.

(-) Administrative costs for market participant in adapting to the new legislation.

|

6.2) Section 2 - Scope of the STS definition

During the financial crisis different asset types within the global securitisation market performed very differently. This raises a question about the scope of securitisations that should be eligible for the STS category. This section considers three main policy options for the scope of STS securitisation. The first option is to limit the scope of STS criteria to 'term' securitisations (asset backed securities with maturities longer than one year) currently included in the LCR and Solvency 2 criteria. The second option would extend this also to ABCP securitisations. The third option would allow term, ABCP and synthetic securitisations to be included in the scope.

6.2.1) Policy option 2.1: Cover only term securitisation

This option is the baseline and builds on the existing differentiation approaches developed by the BCBS-IOSCO working group as well as in the Solvency II and LCR Delegated Acts. The scope of STS securitisations would only be open to 'term' securitisation. Furthermore, to be considered as STS, securitisations would require an effective transfer of ownership of the underlying assets from the originator of such assets to a dedicated and legally separate Special Purpose Vehicle that issues the securitisation. In other words, only "true sale" or "cash securitisations" will be eligible, according to BCBS-IOSCO and EBA criteria, thus keeping synthetic securitisations out of the scope of the criteria. This option would also be consistent with the ECB framework for refinancing operations, where synthetics are not accepted as collateral by the central bank.

The non-inclusion of ABCP would be in line with the developments of the BCBS-IOSCO task force as specific criteria are still under development. However, EBA has already prepared a set of specific criteria which adjust the term criteria for specificities of short-term products.

Chart 14: overview of options

(a) Effectiveness - ensuring differentiation of STS deals from more opaque and complex ones