EUR-Lex Access to European Union law

This document is an excerpt from the EUR-Lex website

Document 32014R1353

Commission Implementing Regulation (EU) No 1353/2014 of 15 December 2014 amending Implementing Regulation (EU) No 1156/2012 laying down detailed rules for implementing certain provisions of Council Directive 2011/16/EU on administrative cooperation in the field of taxation

Commission Implementing Regulation (EU) No 1353/2014 of 15 December 2014 amending Implementing Regulation (EU) No 1156/2012 laying down detailed rules for implementing certain provisions of Council Directive 2011/16/EU on administrative cooperation in the field of taxation

Commission Implementing Regulation (EU) No 1353/2014 of 15 December 2014 amending Implementing Regulation (EU) No 1156/2012 laying down detailed rules for implementing certain provisions of Council Directive 2011/16/EU on administrative cooperation in the field of taxation

OJ L 365, 19.12.2014, p. 70–74

(BG, ES, CS, DA, DE, ET, EL, EN, FR, HR, IT, LV, LT, HU, MT, NL, PL, PT, RO, SK, SL, FI, SV)

No longer in force, Date of end of validity: 31/12/2015; Implicitly repealed by 32015R2378

No longer in force, Date of end of validity: 31/12/2015; Implicitly repealed by 32015R2378

|

19.12.2014 |

EN |

Official Journal of the European Union |

L 365/70 |

COMMISSION IMPLEMENTING REGULATION (EU) No 1353/2014

of 15 December 2014

amending Implementing Regulation (EU) No 1156/2012 laying down detailed rules for implementing certain provisions of Council Directive 2011/16/EU on administrative cooperation in the field of taxation

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Council Directive 2011/16/EU of 15 February 2011 on administrative cooperation in the field of taxation and repealing Directive 77/799/EEC (1), and in particular Article 20(4) thereof,

Whereas:

|

(1) |

Directive 2011/16/EU requires that exchange of information in the field of taxation takes place using standard forms and computerised formats. |

|

(2) |

Standard forms to be used for exchange of information on request, spontaneous exchange of information, notifications and feedback information are to comply with Annexes I to IV to Commission Implementing Regulation (EU) No 1156/2012 (2). |

|

(3) |

A computerised format is to be used for the mandatory automatic exchange of information on certain specific categories of income and capital which is based on the existing computerised format pursuant to Article 9 of Council Directive 2003/48/EC (3). |

|

(4) |

Regulation (EU) No 1156/2012 should be amended accordingly. |

|

(5) |

The amendments should apply from 1 January 2015 in line with Article 29(1) of Directive 2011/16/EU as regards the entry into force of the laws, regulations and administrative provisions in the Member States necessary to comply with Article 8 of the Directive regarding the mandatory automatic exchange of information. |

|

(6) |

The measures provided for in this Regulation are in accordance with the opinion of the Committee on Administrative Cooperation for Taxation, |

HAS ADOPTED THIS REGULATION:

Article 1

Regulation (EU) No 1156/2012 is amended as follows:

|

(1) |

The following Article 1a is inserted: ‘Article 1a The computerised format to be used for the mandatory automatic exchange of information pursuant to Article 8(1) of Directive 2011/16/EU shall comply with Annex V to this Regulation.’ |

|

(2) |

Annex V to Regulation (EU) No 1156/2012 is added as set out in the Annex to this Regulation. |

Article 2

This Regulation shall enter into force on the third day following that of its publication in the Official Journal of the European Union.

It shall apply from 1 January 2015.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 15 December 2014.

For the Commission

The President

Jean-Claude JUNCKER

(2) Commission Implementing Regulation (EU) No 1156/2012 of 6 December 2012 laying down detailed rules for implementing certain provisions of Council Directive 2011/16/EU on administrative cooperation in the field of taxation (OJ L 335, 7.12.2012, p. 42).

(3) Council Directive 2003/48/EC of 3 June 2003 on taxation of savings income in the form of interest payments (OJ L 157, 26.6.2003, p. 38).

ANNEX

‘ANNEX V

Computerised format referred to in Article 1a

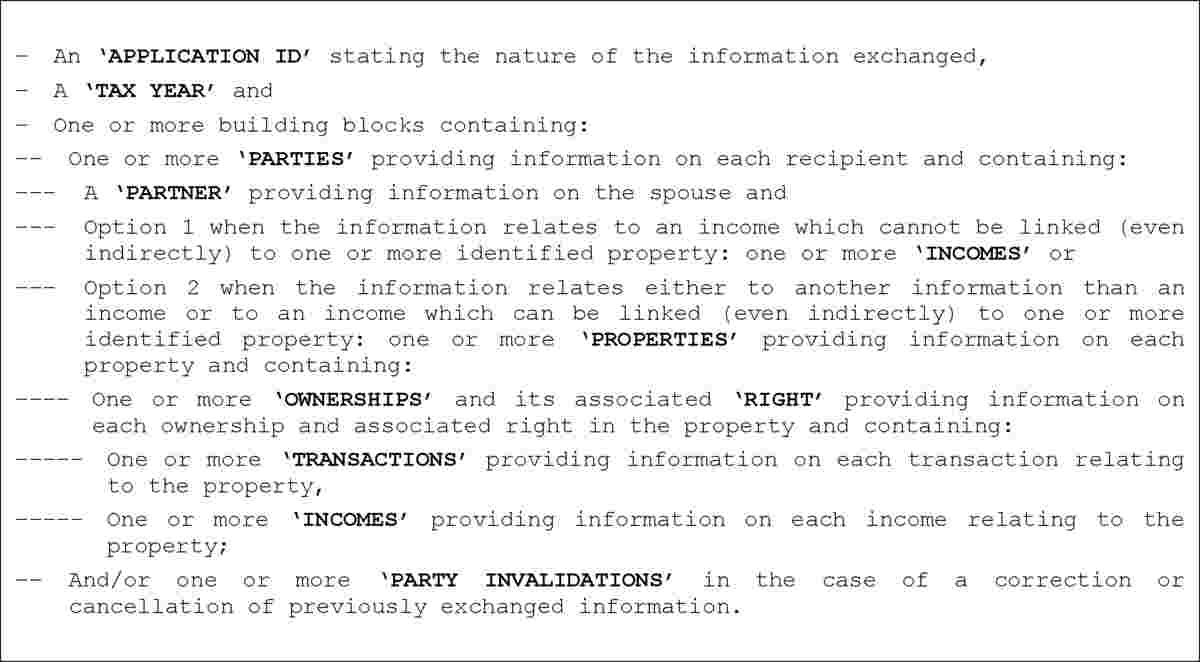

The computerised formats for the mandatory automatic exchange of information pursuant to Article 8 of Directive 2011/16/EU complies with the following tree structure and contains the following classes of elements (1):

|

(a) |

As regards the overall message:

|

|

(b) |

As regards the body for communicating information on income from employment or director's fees:

|

|

(c) |

As regards the body for communicating information on pensions:

|

|

(d) |

As regards the body for communicating information on life insurance products:

|

|

(e) |

As regards the body for communicating information on ownership of and income from immovable property:

|

|

(f) |

As regards the body in case no information is to be communicated in relation to a specific category:

|

|

(g) |

As regards the body for an acknowledgement of receipt of the information for a specific category:  ’ ’ |

(1) However, only the fields actually available and applicable in a given case need to appear in the computerised format used in that case.