EUR-Lex Access to European Union law

This document is an excerpt from the EUR-Lex website

Document 52014XC1115(01)

Summary of Commission Decision of 8 May 2014 declaring a concentration compatible with the internal market and the functioning of the EEA Agreement (Case M.6905 — INEOS/Solvay/JV) (notified under document C(2014) 2984 final) Text with EEA relevance

Summary of Commission Decision of 8 May 2014 declaring a concentration compatible with the internal market and the functioning of the EEA Agreement (Case M.6905 — INEOS/Solvay/JV) (notified under document C(2014) 2984 final) Text with EEA relevance

Summary of Commission Decision of 8 May 2014 declaring a concentration compatible with the internal market and the functioning of the EEA Agreement (Case M.6905 — INEOS/Solvay/JV) (notified under document C(2014) 2984 final) Text with EEA relevance

OJ C 407, 15.11.2014, p. 8–13

(BG, ES, CS, DA, DE, ET, EL, EN, FR, HR, IT, LV, LT, HU, MT, NL, PL, PT, RO, SK, SL, FI, SV)

|

15.11.2014 |

EN |

Official Journal of the European Union |

C 407/8 |

SUMMARY OF COMMISSION DECISION

of 8 May 2014

declaring a concentration compatible with the internal market and the functioning of the EEA Agreement

(Case M.6905 — INEOS/Solvay/JV)

(notified under document C(2014) 2984 final)

(Only the English version is authentic)

(Text with EEA relevance)

2014/C 407/06

On 8 May 2014 the Commission adopted a Decision in a merger case under Council Regulation (EC) No 139/2004 of 20 January 2004 on the control of concentrations between undertakings (1) , and in particular Article 8(2) of that Regulation. A non-confidential version of the full Decision, as the case may be in the form of a provisional version, can be found in the authentic language of the case on the website of the Directorate-General for Competition, at the following address: http://ec.europa.eu/comm/competition/index_en.html

I. INTRODUCTION

|

1. |

On 16 September 2013, the European Commission (‘the Commission’) received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 (the ‘Merger Regulation’) (2) by which INEOS AG (‘INEOS’, Switzerland) and Solvay SA (‘Solvay’, Belgium), jointly referred to as the ‘Notifying Parties’, acquire within the meaning of Article 3(1)(b) and 3(4) of the Merger Regulation joint control of a newly established joint venture (‘JV’), by way of transfer of assets (3). |

II. THE PARTIES AND THE OPERATION

|

2. |

INEOS is the parent of a group of companies which are active in the manufacture of petrochemicals, specialty chemicals and oil products. Its subsidiary, INEOS ChlorVinyls, is a European producer of chlor-alkali products and a supplier of polyvinyl chloride (‘PVC’). |

|

3. |

Solvay is the parent of a group of companies which are internationally active in the research, development, production, marketing and sale of chemicals and plastics. SolVin is a European supplier of PVC resins, controlled by Solvay with 75 % (minus one share), the remaining 25 % (plus one share) being held by BASF. Hereinafter, the terms Solvay and SolVin are used to identify the same group entity. |

|

4. |

On 6 May 2013, the Notifying Parties signed a Letter of Intent (‘LoI’) with a view to combining their European chlorvinyls activities and related businesses in a JV, where each of them will hold a 50 % stake (the ‘Transaction’). The LoI provides exit mechanisms under which INEOS would acquire Solvay's 50 % interest in the JV: the exit arrangements would have to be exercised between three and six years from the joint venture's formation, after which INEOS would be the sole owner of the business. In any event, following the sixth anniversary of the JV, INEOS will become sole owner of the JV. The Transaction was publicly announced on 7 May 2013. |

|

5. |

The Commission considers that, under the terms of the LoI, the Transaction constitutes a concentration within the meaning of Article 3(1)(b) of the Merger Regulation and that it would amount to a full function JV within the meaning of Article 3(4) of the Merger Regulation. |

III. EU DIMENSION

|

6. |

The undertakings concerned had a combined aggregate worldwide turnover of more than EUR 5 000 million in 2011. Each of them has an EU-wide turnover in excess of EUR 250 million and they do not achieve more than two-thirds of their aggregate EU-wide turnover within one and the same Member State. The Transaction has therefore an EU dimension. |

IV. THE PROCEDURE

|

7. |

Based on the results of the first phase market investigation, the Commission raised serious doubts as to the compatibility of the Transaction with the internal market and adopted a decision to initiate proceedings pursuant to Article 6(1)(c) of the Merger Regulation on 5 November 2013. The Notifying Parties submitted their written comments to the Article 6(1)(c) decision on 22 November 2013. |

|

8. |

On 18 November 2013, at the request of the Notifying Parties, the time limit for adopting a final decision in this case was extended by 10 working days. |

|

9. |

On 21 January 2014, the Commission adopted a Statement of Objections (‘SO’). Access to the file was subsequently granted. The Notifying Parties replied to the SO on 5 February 2014. |

|

10. |

A Letter of Facts was sent to the Notifying Parties on 5 February 2014. The Notifying Parties replied to the Letter of Facts on 12 February 2014. |

|

11. |

At the request of the Notifying Parties an Oral Hearing took place on 10 February 2014. |

|

12. |

On 13 February 2014, with the agreement of the Notifying Parties, the Commission extended the time limit for adopting a final decision by 10 working days. |

|

13. |

On 27 February 2014 (‘the Commitments of 27 February 2014’), the Notifying Parties submitted a first set of remedies. These commitments were not subject to market test and were replaced by a revised set of commitments submitted on 7 March 2014, triggering an automatic extension of the time limit for adopting a final decision in this case of an additional 15 working days. These remedies were subsequently modified on 10 and 11 March 2014 (the ‘Commitments of 11 March 2014’). |

|

14. |

A market test was launched on 12 March 2014 to assess whether the modified remedies would be suitable to address the competition concerns identified by the Commission. |

|

15. |

On 13 April 2014 the Notifying Parties submitted a final set of revised commitments, containing further improvements. |

|

16. |

The Advisory Committee discussed the draft of the Decision on 22 April 2014 and issued a favourable opinion. |

V. ASSESSMENT

|

17. |

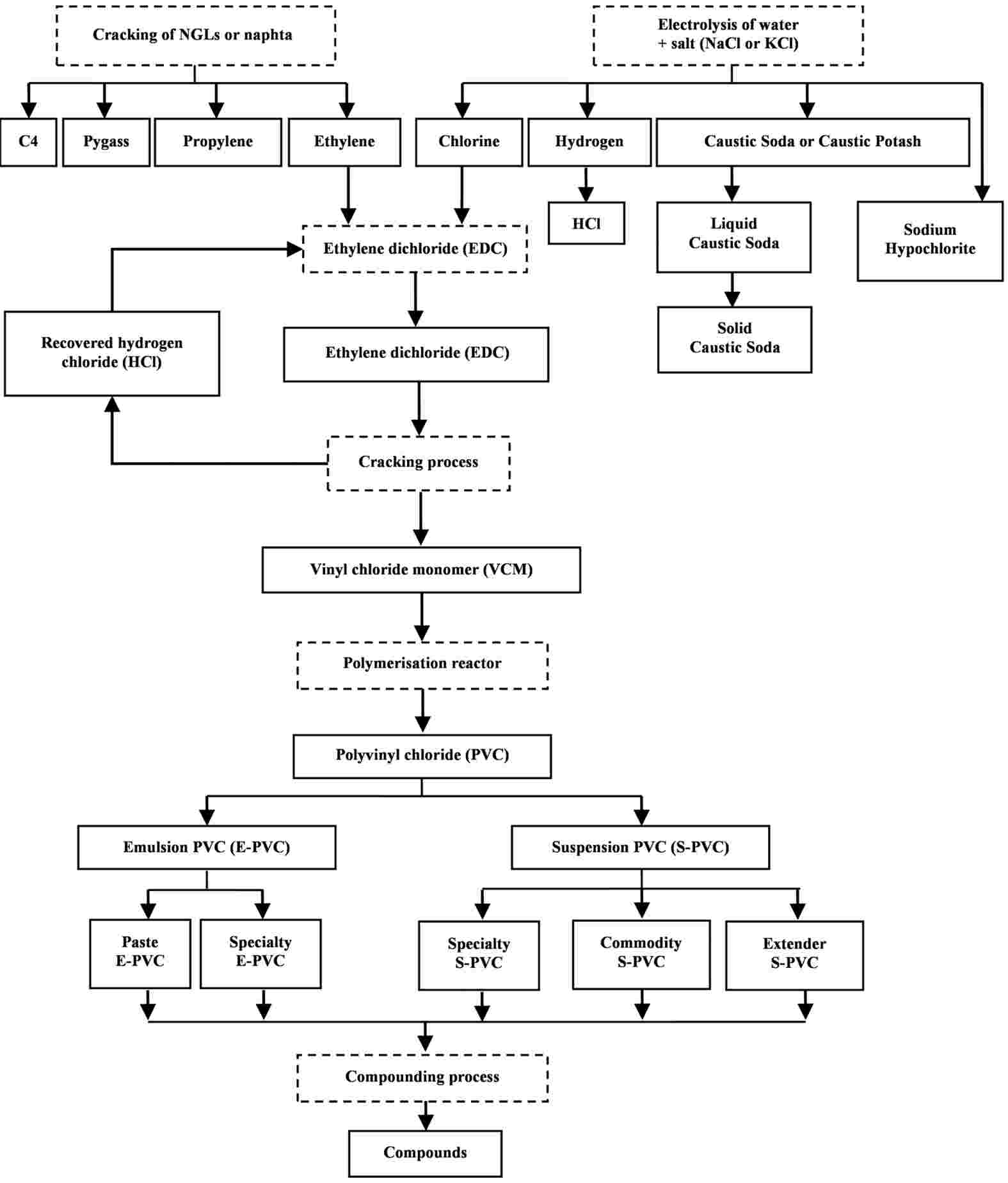

The case concerns a substantial number of markets in relation with the production of PVC (4). The production of PVC is an integrated chain of processes, where chlorine and ethylene are key inputs, as described in the figure below. |

Figure 1

Overview of Processes and Intermediate Products Involved in the Production of PVC

Source: Form CO

|

18. |

The Transaction gives rise to the following horizontally affected markets: (i) suspension PVC (‘S-PVC’), (ii) sodium hypochlorite, (iii) butadiene, (iv) raffinate1, (v) chlorine, (vi) liquid caustic soda, (vii) Vinyl Chloride Monomer (‘VCM’), (viii) hydrochloric acid, (ix) emulsion PVC (‘E-PVC’), (x) methylene chloride, (xi) chloroform. It also results in horizontal overlaps in ethylene, pygas, propylene, butadiene, ethylene dichloride (‘EDC’), and S-PVC compounds. |

|

19. |

The Transaction also gives rise to a number of vertically affected markets: (i) propylene and allyl chloride, (ii) chlorine and EDC, (iii) chlorine and chlorine production technologies, (iv) chlorine and electrocoating, (v) salt and caustic soda, (vi) salt and sodium hypochlorite, (vii) chlorine production technologies and caustic soda, (viii) chlorine production technologies and sodium hypochlorite, (ix) electrocoating and caustic soda, (x) electrocoating and sodium hypochlorite, (xi) EDC and EDC/VCM technologies, (xii) EDC and VCM, (xiii) VCM and EDC/VCM technologies, (xiv) EDC catalysts and EDC, (xv) E-PVC and VCM, (xvi) S-PVC and S-PVC technologies, (xvii) S-PVC and PVC additives, (xviii) E-PVC and PVC additives, (xix) S-PVC and S-PVC compounds, (xx) carbon tetrachloride and perchloroethylene, (xxi) carbon tetrachloride and HFC-365mfc. |

|

20. |

The Commission considers that the Transaction gives rise to competition concerns as regards the horizontal overlaps concerning the S-PVC and sodium hypochlorite markets. The Commission has not raised objections as regards the remaining affected markets. Therefore these other markets will not be discussed in this summary (5). |

1. Product market definition

|

21. |

S-PVC is used for both rigid (unplasticised) and flexible (plasticised) end-applications. Rigid applications include pipes, moulded fittings, and profiles (i.e. window and door frames). Flexible applications include wire and cable insulation films and sheets. S-PVC has many other applications such as the manufacture of bottles. |

|

22. |

The Commission concludes that the relevant product market for the assessment of the effects of the Transaction is the overall market for the production and supply of Commodity S-PVC including all K-values, excluding co-polymers in general as well as High Impact S-PVC. Some differentiating factors between the different grades of Commodity S-PVC are, however, taken into consideration — where relevant — for the purpose of the competitive assessment. In addition, because of supply side considerations, in the computation of market shares based on capacity, the Commission takes into account the ability and the incentive of each PVC supplier to redeploy capacity previously used for other types of S-PVC for the production of Commodity S-PVC. |

|

23. |

Sodium hypochlorite is used in varying strengths for various applications. It is used as a disinfectant and a bleaching agent in household and industrial applications and for water treatment. The majority of sodium hypochlorite production in the EEA is an inevitable by-product in the production of chlorine (‘fatal’ sodium hypochlorite). When demand exceeds the ‘fatal’ volume produced as a by-product of the chlorine production process, sodium hypochlorite can also be produced intentionally (‘voluntary’ sodium hypochlorite.) |

|

24. |

The Commission considers, in line with its precedents, that sodium hypochlorite constitutes a single product market. |

2. Geographic market definition

|

25. |

With regard to the market for Commodity S-PVC, the Commission concludes that the geographic scope of the market is regional and narrower than the whole EEA. Qualitative and quantitative evidence in the Commission's file points to North Western Europe (‘NWE’), a region encompassing Belgium, Luxembourg, Netherlands, Denmark, France, Germany, Ireland, Sweden, Norway and the United Kingdom, as a stand-alone cluster, where competitive conditions are homogeneous. However, for the purpose of this Decision, it is not necessary to reach a definitive view as to whether this regional market encompasses only NWE or extends to a broader geographic area (the so called ‘NWE+’ cluster, that is to say NWE plus Austria, Finland, Italy and Switzerland), because the Transaction results in a significant impediment to effective competition under both market delineations. |

|

26. |

With regard to the market for sodium hypochlorite, taking into account the specificities of the Benelux region and the absence of significant barriers to trade, the Commission concludes that the relevant geographic market for sodium hypochlorite can in this case be considered as regional, encompassing the whole Benelux region. |

3. Competitive assessment

|

27. |

With regard to Commodity S-PVC, INEOS and Solvay are respectively the largest and the second largest supplier in NWE. In 2012 INEOS' market share based on sales and capacity was [30-40] % whilst Solvay's market share on the same year was of approximately [20-30] %. The Transaction would result, both for NWE and NWE+, in the creation of an undisputed market leader with market shares of [50-60] % under all metrics (sales and capacity). |

|

28. |

The Commission also found qualitative and quantitative evidence indicating that INEOS' current position in NWE/NWE+ market can allow it to exercise some degree of market power. More precisely, INEOS' currently holds a strong position in the Commodity S-PVC market, which is partially the result of two previous mergers cleared by the Commission on the basis of the information available at that time. The Commission found evidence that the acquisition of Tessenderlo by INEOS resulted in a [0 to 10 %] price increase in NWE. |

|

29. |

In addition, the Commission found that Solvin is INEOS' most significant competitive constraint and that the remaining Commodity S-PVC suppliers located in NWE and EEA suppliers located outside of this region do not have the incentive, even if taken collectively, of expanding their output sufficiently so as to offset a price increase from the JV. Moreover, imports do not currently play an important role in the market for Commodity S-PVC and are unlikely to increase in the near future to such an extent as to constrain the behaviour of an INEOS/Solvay combined entity post-transaction. |

|

30. |

Finally, on the basis of an economic analysis carried out during Phase II, the Commission considered that the variable cost efficiencies as claimed by the Notifying Parties do not meet the three cumulative criteria set out in the Horizontal Merger Guidelines (6). |

|

31. |

Therefore, the Commission concluded that the Transaction is likely to consolidate the degree of market power hold by INEOS and lead to a significant impediment to effective competition through non-coordinated effects resulting in the creation of a dominant player that will be able and is likely to have the incentive to increase prices and reduce output in the Commodity S-PVC market, whether this is defined as encompassing NWE or NWE+. |

|

32. |

With regard to sodium hypochlorite, the transaction would combine the first and second suppliers in the Benelux region and create a clear market leader with a combined market share of [60-70] %. As a result, any competition between these two important players in the market would cease to exist. Only one significant player would remain, Akzo, with [20-30] %. |

|

33. |

Consequently, the Commission concluded that the Transaction will lead to a significant impediment to effective competition through the creation of a dominant player that will be able and is likely to have the incentive to impose higher prices and reduce output in the sodium hypochlorite market in the Benelux |

4. Conclusion

|

34. |

The Article 8 decision, therefore, concludes that the transaction would significantly impede effective competition in the internal market as a results of its horizontal non coordinated effects in the markets for Commodity S-PVC market in NWE/NWE+ and in the sodium hypochlorite market in the Benelux. |

VI. COMMITMENTS

1. Description of the Commitments

|

35. |

The Commitments finally retained were those submitted by the Parties on 11 March, as revised on 13 April 2014. |

|

36. |

These Commitments consist of the divestment to a up front purchaser of (i) INEOS' vertically integrated PVC chain comprising the membrane electrolysis cellroom, the EDC/VCM plant and related production assets (including sodium hypochlorite production assets) operated by INEOS at Tessenderlo, Belgium (but excluding the on-site mercury electrolysis cellroom and the associated caustic potash production assets) and INEOS' S-PVC plants in Mazingarbe (France) and Beek Geleen (the Netherlands) (the ‘LVM package’) and; (ii) INEOS' vertically integrated PVC chain comprising chlorine and EDC assets at Runcorn (United Kingdom) and VCM/S-PVC operations in Wilhelmshaven (Germany) (the ‘Wilhelmshaven/Runcorn Package’). |

|

37. |

These Commitments remove the overlap almost entirely in terms of S-PVC installed capacity. Moreover, the three S-PVC plants offered are very well located in NWE. The inclusion of upstream assets with good access to key inputs is consistent with the results of the market investigation and the market test showing that vertical integration and ethylene supply are key to compete effectively on the Commodity S-PVC market. These Commitments also remove the entire overlap in the Benelux sodium hypochlorite market. |

|

38. |

Based on the above and taking into account the upfront buyer clause, the Commission concluded that the Commitments submitted on 11 March, as revised on 13 April 2014, were sufficient to remove the competition concerns raised by the Transaction. |

VII. CONCLUSION AND PROPOSAL

|

39. |

The Article 8(2) decision concludes that, subject to full compliance with the Commitments of 11 March 2014, the Transaction would not significantly impede effective competition in the internal market or in a substantial part of it. Consequently, the Commission declares the Transaction compatible with the internal market and the EEA Agreement, in accordance with Articles 2(2) and Article 8(2) of the Merger Regulation and Article 57 of the EEA Agreement. |

(2) With effect from 1 December 2009, the Treaty on the Functioning of the European Union (‘the Treaty’) has introduced certain changes, such as the replacement of ‘Community’ by ‘Union’ and ‘common market’ by ‘internal market’. The terminology of the Treaty will be used throughout this summary of draft decision.

(3) Publication in the Official Journal of the European Union No C 273, 21.9.2013, p. 18.

(4) PVC is manufactured in several steps involving several intermediate products. Moreover, PVC production is closely tied to that of caustic soda.

(5) See Sections 7 and 9 of the Decision.

(6) The Notifying Parties put forward an economic model for the assessment of the effects of the Transaction which includes the claimed efficiencies. The Commission notes that, even reflecting the Notifying Parties current efficiency claims in the modelling results, the Transaction would still result in price effects of a significant magnitude.