EUR-Lex Access to European Union law

This document is an excerpt from the EUR-Lex website

Document 52014XC0529(06)

Commission Notice concerning the reimbursement of anti-dumping duties

Commission Notice concerning the reimbursement of anti-dumping duties

Commission Notice concerning the reimbursement of anti-dumping duties

OJ C 164, 29.5.2014, p. 9–20

(BG, ES, CS, DA, DE, ET, EL, EN, FR, HR, IT, LV, LT, HU, MT, NL, PL, PT, RO, SK, SL, FI, SV)

|

29.5.2014 |

EN |

Official Journal of the European Union |

C 164/9 |

Commission Notice

concerning the reimbursement of anti-dumping duties

(2014/C 164/09)

This Notice sets out the guidelines on how to apply for a refund of anti-dumping duties under Article 11(8) of Council Regulation (EC) No 1225/2009 (1) (the ‘basic Regulation’). These guidelines repeal and replace those published in 2002 (2). The purpose of the guidelines is to clarify for the different parties involved in a refund procedure the conditions to be fulfilled by an application and to give a comprehensive step-by-step explanation of the procedure which may lead to a reimbursement.

1. Aim

The refund procedure is intended to reimburse anti-dumping duties paid where it is shown that the dumping margin, on the basis on which duties were established, has been eliminated or reduced. It involves an investigation into the exporting producer’s exports to the Union and a calculation of a new dumping margin.

2. Basic principles governing a refund procedure

2.1. What are the conditions to be fulfilled?

Applications for refund under Article 11(8) of the basic Regulation must demonstrate that the dumping margin, on the basis of which duties were established, has decreased or has been eliminated. In other circumstances, the provisions of chapter 5 of title VII of the Community Customs Code concerning the repayment of import duties may apply (3).

2.2. Who is entitled to apply for a refund?

|

(a) |

Any importer who imported goods into the Union for which anti-dumping duties were established by customs authorities may apply for a refund. |

|

(b) |

Where anti-dumping duties were imposed further to an investigation in which the Commission resorted to a sample of exporting producers to assess dumping pursuant to Article 17 of the Basic Regulation, importers can request a refund regardless of whether the importers’ exporting producers were sampled or not. |

2.3. What is the deadline to apply for a refund?

|

(a) |

Applications must be submitted within maximum six months of the date when the amount of the anti-dumping duties were determined by the competent customs authorities, i.e. the date of notification of the customs debt by the customs authorities under Article 221 of the Community Customs Code. The submission must be done to the competent authority of the Member State in which the goods were cleared for free circulation in the Union (see 3.2. and 3.3 below). |

|

(b) |

Even if an importer is challenging the validity of anti-dumping duties applied to its transactions under the provisions of the Customs legislation of the Union, whether this action suspends the payment of duties or not, the importer must nonetheless introduce an application for a refund within the six-month time limit from the determination of duties in order for the application to be admissible. The Commission may in agreement with the applicant decide to suspend the refund investigation until the liability to the anti-dumping duties has been finally established. |

2.4. How is the revised dumping margin established?

|

(a) |

The Commission will establish, for a representative period, a dumping margin in respect of all the exports of the product concerned made by the exporting producer to all its importers in the Union and not only to the importer claiming a refund. |

|

(b) |

Consequently, the refund investigation will cover all product control numbers (4) falling under the product definition set out in the Regulation imposing the anti-dumping duties and not only those of the products imported into the Union by the applicant. |

|

(c) |

Unless circumstances have changed, the same methodology as the one applied during the investigation which led to the duty will be followed. |

2.5. Whose cooperation is required?

Successful completion of a refund application is not only dependent upon the cooperation of the applicant but also on the cooperation of the exporting producer. The applicant has to ensure that the exporting producer submits the relevant information to the Commission. This implies completing a questionnaire covering a wide range of commercial data for a defined representative period in the past and accepting the examination of such information including a verification visit. An exporting producer cannot ‘partially cooperate’ by submitting only selective data. Any such approach would lead the Commission to the conclusion that it was not cooperating and to the rejection of the application.

2.6. How is confidential information protected?

The rules of confidentiality as laid down in Article 19 of the basic Regulation apply to all information received in connection with the applications for a refund of anti-dumping duties.

2.7. How much may be refunded?

If the admissibility and merits of the application are established, the investigation may result in:

|

— |

no refund of the anti-dumping duties paid when the dumping margin is found equal or higher to the anti-dumping duty collected, or |

|

— |

the refund of a part of the anti-dumping duties paid when the dumping margin has decreased below the anti-dumping duty collected, or |

|

— |

the refund of all of the anti-dumping duties paid when the dumping margin has been eliminated versus the anti-dumping duty collected. |

2.8. What is the deadline to finalise the refund investigation?

The Commission should normally decide on the refund within 12 months and in no circumstances within more than 18 months, from the date on which the application for refund is duly supported by evidence. Under Article 11(8) fourth indent of the basic Regulation, an application is duly supported by evidence where it contains precise information on the amount of anti-dumping duty claimed, all customs documentation related to the establishment and payment of such duties and information on normal values (including normal value in an analogue country in case of exports from a non-market economy country where the exporting producer cannot demonstrate that market economy conditions prevail for it – see points 3.5 and 4(d) below) and export prices for the exporting producer to which the duty applies (see point 4 below).

If a refund be granted, Member States authorities will have 90 days to effect the payment from date when the Commission Decision is notified to them.

3. The application

3.1. Form of the application

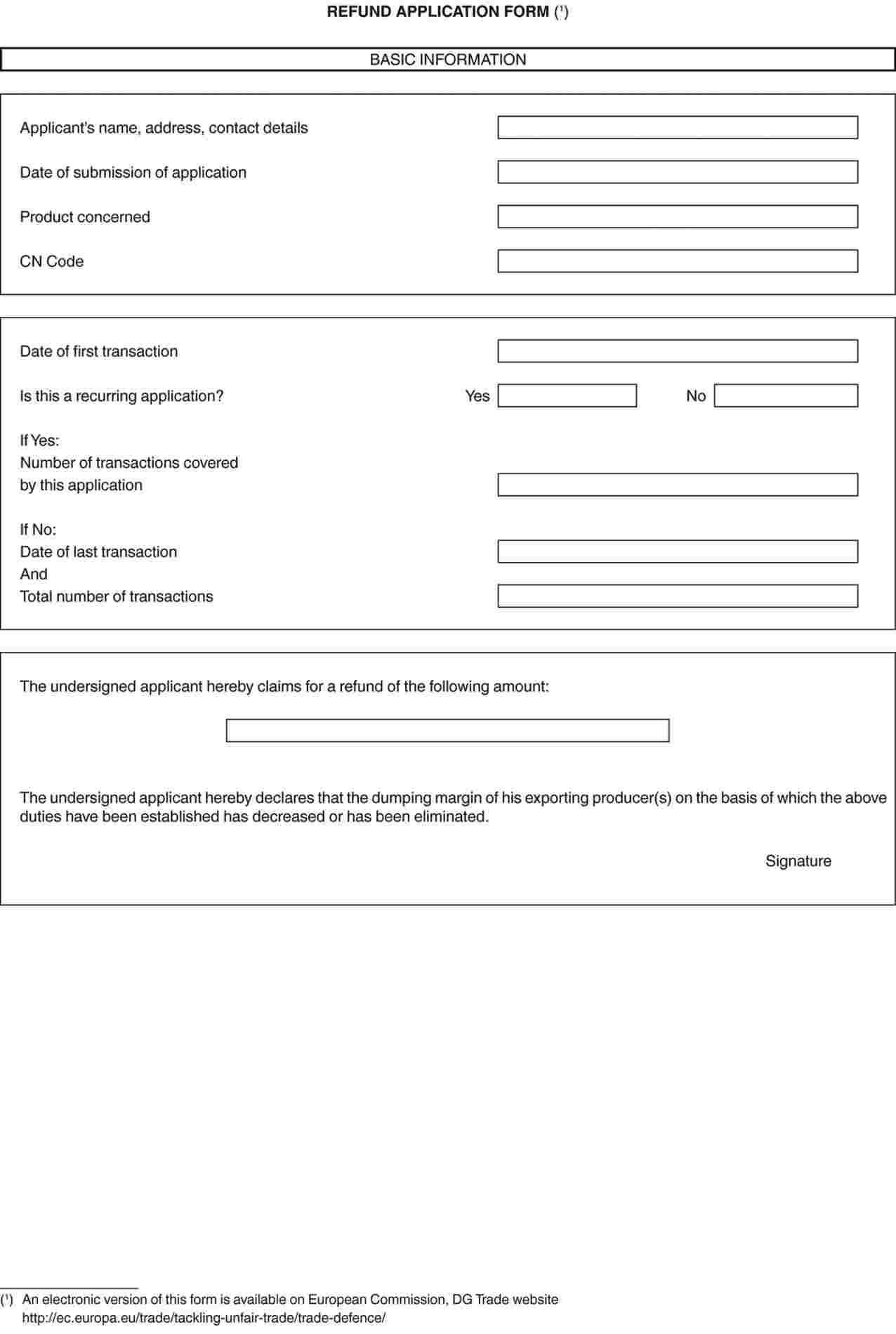

The application must be submitted in writing, in an official language of the Union and signed by a person empowered to represent the applicant. The application must be made on the form attached as Annex I to this notice.

The application must clearly indicate the total amount of anti-dumping duties for which a refund is sought and identify the specific import transactions on which that total is based.

The application must be based on a reduction or an elimination of the dumping margin. It must therefore include a statement that the dumping margin of the applicant’s exporting producer, on the basis of which the anti-dumping duties have been established, has decreased or has been eliminated.

3.2. Submission of the application

The application must be submitted to the competent authorities of the Member State on whose territory the product concerned by the anti-dumping duties was released for free circulation. The list of the competent authorities is published on the website of DG Trade.

The Member State should immediately forward the application and all relevant documentation to the Commission.

3.3. Time-limits for the submission of an application

|

(a) |

Six-month time-limit All applications for reimbursement must be submitted to the competent authorities of the appropriate Member State within the six-month time-limit (5) set out in Article 11(8) second indent of the basic Regulation. The deadline of six months must be respected even in cases where a Regulation imposing the duty in question is being challenged before the Courts of the European Union or where the application of the Regulation is being challenged before national administrative or judicial bodies (see point 2.3(b) above). Depending on each specific case, the six-month time-limit will be counted from:

|

|

(b) |

Date of submission of the application When forwarding the application to the Commission, the Member State must indicate the date of submission of the application, i.e. the date on which the Member State’s competent authority has effectively received the application. For their own benefit, applicants should obtain evidence of the receipt of their application at the offices of the appropriate Member State. For instance:

|

3.4. Evidence requested from the applicant

In order to enable the Commission to process the application, the applicant should enclose with its application submitted to the relevant Member State to the extent possible (6) the below evidence:

|

(a) |

all invoice(s) and other documents on which customs procedures were based; |

|

(b) |

all customs documents identifying the import transactions for which a refund is sought, showing specifically the basis for determining the amount of the duties to be levied (the type, quantity and value of the goods declared and the rate of anti-dumping duty applied), as well as the precise amount of the anti-dumping duties levied; |

|

(c) |

declarations that:

|

|

(d) |

information on normal values and on export prices that show that the dumping margin of the exporting producer has decreased under the level of the duty in force or has been eliminated. This is especially required where the applicant is associated with the exporting producer. If the applicant is not associated with the exporting producer, and if the relevant information is not immediately available, the application should contain a statement from the exporting producer that the dumping margin has been reduced or eliminated and that it will provide to the Commission all the relevant supporting data. This is the data on normal values and on export prices for a representative period during which its goods were exported to the Union. This period will be later determined by the Commission (see 4.1(a) below). If the exporting producer is based in a non-market economy country, the normal value will be determined under Article 2(7)(a) of the basic Regulation unless the exporting producer receives a market economy treatment (MET) under Article 2(7)(c) (see 3.5 below for more information on the procedure regarding non-market economy countries); |

|

(e) |

corporate information relating to the applicant; |

|

(f) |

power of attorney if the application is submitted by a third party; |

|

(g) |

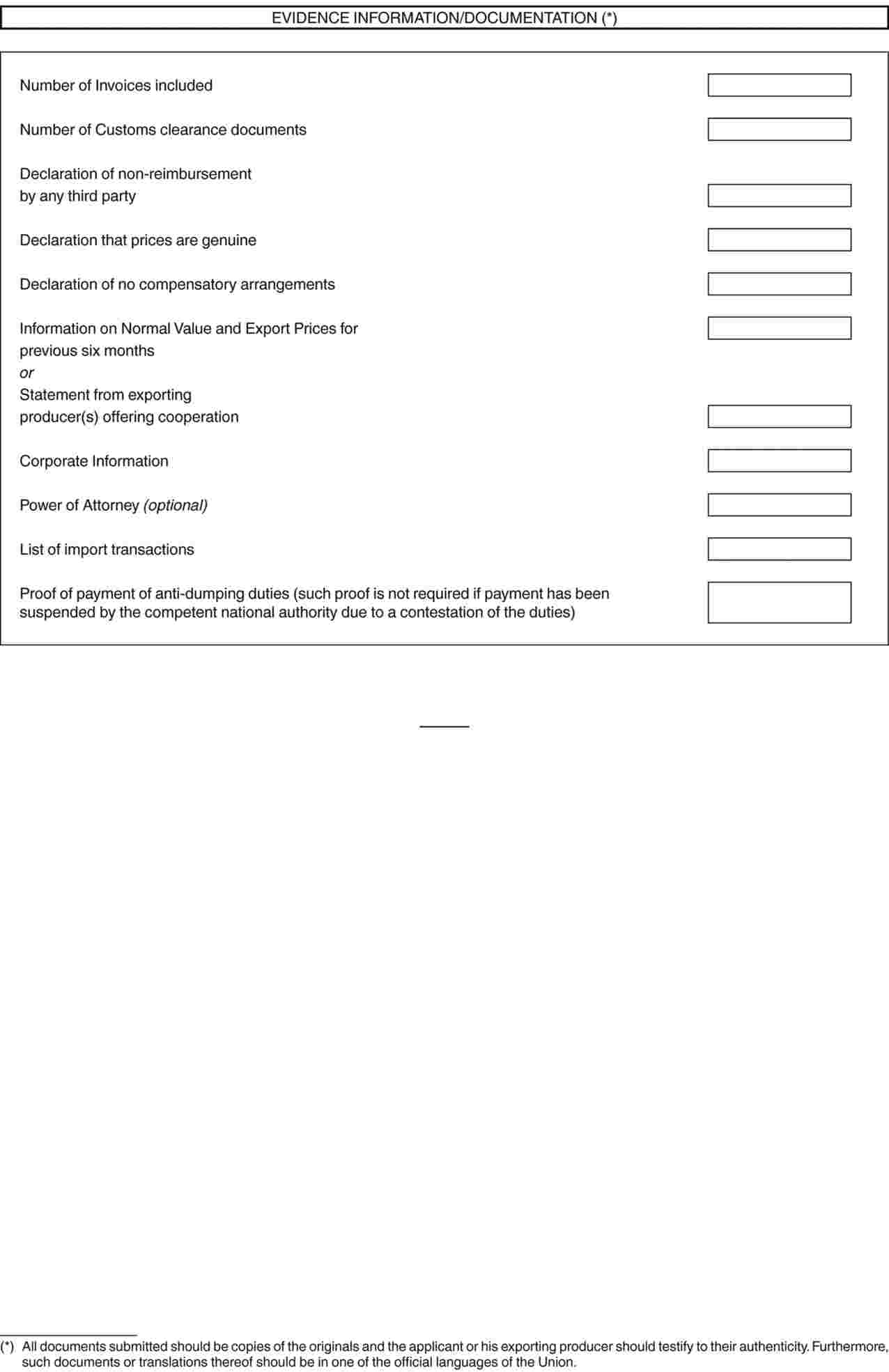

a list of import transaction for which a refund is claimed (for the convenience of the applicant a pre-form with the requested information is attached to this notice as Annex II); |

|

(h) |

proof of payment of anti-dumping duties for which a refund is claimed. Copies of originals of invoices, customs entry forms and other such documents must be provided with a declaration of their authenticity from the applicant or its exporting producer as the case may be. In addition, such documents, or their translations, should be in one of the official languages of the Union. |

The Commission will assess whether the application contains all of the information requested from the applicant. If need be, the Commission will notify the applicant of the information still to be submitted and will specify a representative period of time within which the requested evidence must be submitted. The Commission reserves the right to ask additional evidence that supports the application.

3.5. Evidence in case of exports from non-market economy countries

If a refund is requested for duties on exports from a non-market economy country and MET is not applied, normal value will be established under Article 2(7)(a) of the basic Regulation.

If the normal value is determined on the basis of the price or constructed value in a market economy third country, the applicant should identify and seek the cooperation of a producer in an analogue country.

It should seek cooperation from the same companies which had cooperated in the original investigation, unless it can demonstrate that the use of other producers in the same country or the data of another analogue country is more appropriate.

If the applicant cannot obtain any cooperation, it can propose any other method under Article 2(7)(a) and provide the data necessary to calculate normal values on the basis of such other method. The applicant should provide satisfactory evidence that it has unsuccessfully sought cooperation from all the known producers of the product concerned.

If the applicant fails to provide data for the calculation of normal values in line with Article 2(7)(a) of the basic Regulation, within a reasonable period of time, the Commission shall reject the application due to lack of supporting evidence.

3.6. Recurring applications

As soon as the applicant is aware that it intends to submit more than one application for reimbursement of anti-dumping duties levied on the product concerned, it should notify the Commission. This information is requested in order for the Commission to structure the investigation in the most efficient and effective way.

4. Assessing the merits of an application

The Commission will contact the exporting producer and request information on its normal value and export prices for a given representative period. The application will only be considered duly supported by evidence (7) when all requested information and the completed questionnaires (including replies to any material deficiencies which may have been identified) have been received by the Commission.

|

(a) |

Representative period For the purpose of determining the revised dumping margin, the Commission will specify the representative period which will normally include the date(s) of invoicing of the transaction(s) for which a reimbursement is sought. This period will normally cover a minimum of six months and include a short period prior to the date of invoicing of the first transaction by the exporting producer. |

|

(b) |

Dumping questionnaires Pursuant to Article 6(2) of the basic Regulation, the exporting producer of the applicant and, where appropriate, the related importer(s), will be asked to submit information concerning all their sales to the Union, and not only sales to the applicant, made during the representative period. The information will be sought by means of a questionnaire sent to the applicant’s exporting producer (and to any related importer in the Union) with replies due within 37 days. The exporting producer may send confidential information directly to the Commission and not via de applicant. A non-confidential version of the reply to the questionnaire and of any other confidential information submitted should be provided in accordance with Article 19(2) of the basic Regulation. Such non-confidential information will be made available for inspection by interested parties. |

|

(c) |

Market Economy Treatment If the exporting producer is based in a non-market economy, it can apply for MET for the purposes of the refund investigation. In this case, it will have to submit all the requested information under Article 2(7)(c) of the basic Regulation. If MET is granted to the exporting producer, the normal value will be established on the basis of its own prices and costs under Article 2(1) - (6) of the basic Regulation. If MET in not granted, the normal value will be established under Article 2(7)(c) of the basic Regulation (see point (d) below). The MET determination in a refund investigation has no prospective nature and will apply only for the purpose of determining the dumping margin during the refund representative period. The granting of MET for the purposes of the refund investigation is regardless whether the exporting producer has already been granted MET in the original investigation, or if it has cooperated in the original investigation. |

|

(d) |

Exports from non-market economy countries If a refund is requested for duties on exports from a non-market economy and MET is not applied, normal value shall be established under Article 2(7)(a) of the basic Regulation (see point 3.5 for the necessary evidence to be provided by the applicant). |

|

(e) |

Verification visits Parties submitting information should be aware that the Commission may verify the information received through a verification visit under Article 16 of the basic Regulation. |

4.1. Analysis of merits

|

(a) |

General methodology The revised dumping margin will be established by comparing, for the representative period:

for the exported product(s) in question, in accordance with the relevant provisions of Article 2 of the basic Regulation. Article 11(9) of the basic Regulation provides for the use of ‘the same methodology as in the investigation which led to the duty, with due account being taken of Article 2 (Determination of dumping), and in particular paragraphs 11 and 12 thereof (Use of weighted averages in calculating the dumping margin), and of Article 17 (Sampling).’ The Commission may base the calculation of the revised dumping margin on a sample of the exporting producers, types of product or transactions concerned by the application(s), on the basis of Article 17 of the basic Regulation, in particular paragraph 3. The sampling will apply where the number of exporting producers, types of product or transactions concerned is so large that individual examinations would be unduly burdensome and prevent completion of the investigation in good time. This will be determined at the minimum over a period of 6 months counted from the date of lodging of the first request, or 12 months counted from the date of imposition of definitive measures, whichever is the later. |

|

(b) |

Implementation of Article 11(10) of the basic Regulation Where the export price is constructed under Article 2(9) of the basic Regulation, the Commission shall calculate it with no deduction for the amount of anti-dumping duties paid when conclusive evidence is provided that the duty is duly reflected in resale prices and the subsequent selling prices in the Union. The Commission will examine whether an increase in selling prices to independent Union customers between the original and the refund investigation period incorporates the anti-dumping duties. |

|

(c) |

Use of review findings When examining any application for refund, the Commission may decide at any time to initiate an interim review in accordance with Article 11(3) of the basic Regulation. The procedure regarding the application for refund will be suspended until the termination of the review. The findings of the review investigation may only be used to determine the merits of a refund application provided that the date of invoicing of the transactions for which a refund is being claimed falls within the investigation period of the review. |

|

(d) |

Extrapolation Notwithstanding point (c) above, for purposes of administrative efficiency, the dumping margin established in any investigation may be extrapolated for import transactions submitted for refund not occurring in that investigation period. This is subject to the following conditions:

|

4.2. Non-cooperation

In cases in which the applicant, the exporting producer or the producer in an analogue country (where applicable):

|

— |

supplies false or misleading information, or |

|

— |

refuses access to relevant information or does not provide it within a reasonable period of time, or |

|

— |

significantly impedes the investigation, including impeding the verification of the information to the extent deemed necessary by the Commission |

the information will be disregarded and the Commission will have to conclude that the applicant did not meet its burden of proof obligations.

4.3. Disclosure

Once the investigation of the merits of the application is completed, the applicant will receive disclosure of the essential facts and considerations on the basis of which the Commission intends to adopt a decision on the refund application. The cooperating exporting producer(s) may only receive information on the treatment of their particular data, in particular the resulting calculations of normal value and export prices.

5. Outcome

5.1. Excess amount to be repaid

The excess amount to be reimbursed to the applicant will normally be calculated as the difference between the duty collected and the dumping margin established in the refund investigation, as an absolute sum.

5.2. Payment

The reimbursement should normally be paid by the Member State where anti-dumping duties were determined and later collected within 90 days of the date of the notification of the refund decision.

Whether or not any payment made after 90 days give rise to the payment of interest remains subject to the national legislation of each Member State.

5.3. Revocation of a decision to reimburse

Where it is subsequently found that a decision granting a refund has been adopted on the basis of false or incomplete information, such decision will be revoked retroactively. Indeed, the fact that a refund decision has been based on false or incomplete information amounts to the absence of an objective legal basis for this decision, which therefore deprives ab initio the applicant of the right to obtain a refund and justifies the revocation of the decision.

As a result of such revocation, the refunded amounts corresponding to the original anti-dumping duties will be re-collected.

Once the Commission has adopted a decision to revoke a refund, the Member State concerned ensures that this decision is correctly implemented, within its territory, by recovering the amounts unduly refunded under Article 11(8) of the basic Regulation.

The national authorities of the Member State concerned, when implementing such a decision, act in accordance with the procedural and substantive rules of their own national law. The application of the national law should not affect the scope and effectiveness of the Commission decision to revoke its former decision granting a refund.

5.4. Transparency

The non-confidential version of Commission decisions under Article 11(8) of the basic Regulation are published on the website of DG Trade.

(1) Council Regulation (EC) No 1225/2009 of 30 November 2009 on protection against dumped imports from countries not members of the European Community (OJ L 343, 22.12.2009, p. 51).

(2) Commission Notice concerning the reimbursement of anti-dumping duties (OJ C 127, 29.5.2002, p. 10).

(3) Council Regulation (EEC) No 2913/92 of 12 October 1992 establishing the Community Customs Code (OJ L 302, 19.10.1992, p. 1) as last amended by Council Regulation (EC) No 1791/2006 (OJ L 363, 20.12.2006, p. 1).

(4) Product control numbers are created for the purpose of calculating the dumping margin for each unique type and possible combination of product characteristics, for all products produced and exported to the European Union as well as for those sold domestically.

(5) For computation of the time-limit, see Council Regulation (EEC, Euratom) No 1182/71 of 3 June 1971 determining the rules applicable to periods, dates and time-limits (OJ L 124, 8.6.1971, p. 1).

(6) Where information is not available at the moment of lodging the application such information must be submitted directly to the Commission, after the lodging.

(7) See Article 11(8) fourth indent of the basic Regulation.

ANNEX I

ANNEX II

IMPORT TRANSACTION TABLE (1)

|

a |

b |

c |

d |

e |

f |

g |

h |

i |

j |

k |

l |

m |

n |

|

Transaction # |

Purchase invoice # |

Purchase invoice date |

Name of supplier/exporter |

Name of producer in country of origin |

Country of origin |

Product type (name) |

Product type (reference or model no) |

Tariff/CN code |

QTY purchased |

Invoice value |

Currency |

Unit price |

Date of payment of invoice |

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

p |

q |

r |

s |

t |

u |

v |

w |

x |

y |

z |

aa |

ab |

|

Payment reference |

Exchange rate |

Invoice value in currency of importer |

Incoterms |

Date of shipment |

Freight amount |

Customs record (SAD #) |

Date duties duly established by customs |

Customs value (basis for duty) |

Currency |

AD-duty rate (%) |

AD-duty amount |

Date of payment of duties |

Payment reference |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Explanatory notes to the table:

|

a |

Transaction # |

Each transaction should be marked with a sequential number which should also be put on the supporting documents (e.g. invoice) concerned. |

|

h |

Product type reference, or model No |

State the commercial reference number or code of the product. |

|

s |

Date of shipment |

State the date on which the products were shipped by the supplier. |

|

w |

Customs value (basis for duty) |

This should be the customs value as shown on the customs records. Normally the customs value is based on the invoice value plus freight/insurance expenses. |

|

v |

Date duties duly established by customs |

This is the date on which the duties are determined by customs, which is, in normal cases the date of acceptance of the customs entry. |

|

aa |

Date of payment of duties |

This is the date on which the duties were actually paid to the customs. Thus this should be the date on which the amount concerned was transferred from the company’s bank account to the customs’ bank account. |

|

|

Payment reference |

Provide a reference to the invoice payment records (e.g. bank statement number and date). |

|

|

Currency |

Please use ISO codes. A list of ISO codes is available on internet: http://publications.europa.eu/code/en/en-5000700.htm |

Incoterms

|

EXW |

Ex works |

|

FCA |

Free carrier |

|

FAS |

Free alongside ship |

|

FOB |

Free on board |

|

CFR |

Cost and freight |

|

CIF |

Cost, insurance and freight |

|

CPT |

Carriage paid to |

|

CIP |

Carriage and insurance paid to |

|

DAF |

Delivered at frontier |

|

DES |

Delivered ex ship |

|

DEQ |

Delivered ex quay (duty paid) |

|

DDU |

Delivered duty unpaid |

|

DDP |

Delivered duty paid |

(1) An electronic version of this form is available on the European Commission, DG Trade website http://ec.europa.eu/trade/tackling-unfair-trade/trade-defence/.