This document is an excerpt from the EUR-Lex website

Document 31993R2454

Commission Regulation (EEC) No 2454/93 of 2 July 1993 laying down provisions for the implementation of Council Regulation (EEC) No 2913/92 establishing the Community Customs Code

Commission Regulation (EEC) No 2454/93 of 2 July 1993 laying down provisions for the implementation of Council Regulation (EEC) No 2913/92 establishing the Community Customs Code

Commission Regulation (EEC) No 2454/93 of 2 July 1993 laying down provisions for the implementation of Council Regulation (EEC) No 2913/92 establishing the Community Customs Code

OJ L 253, 11.10.1993, pp. 1–766

(ES, DA, DE, EL, EN, FR, IT, NL, PT) This document has been published in a special edition(s)

(FI, SV, CS, ET, LV, LT, HU, MT, PL, SK, SL, BG, RO, HR)

No longer in force, Date of end of validity: 30/04/2016; Repealed by 32016R0481

No longer in force, Date of end of validity: 30/04/2016; Repealed by 32016R0481

|

11.10.1993 |

EN |

Official Journal of the European Communities |

L 253/1 |

COMMISSION REGULATION (EEC) No 2454/93

of 2 July 1993

laying down provisions for the implementation of Council Regulation (EEC) No 2913/92 establishing the Community Customs Code

THE COMMISSION OF THE EUROPEAN COMMUNITIES,

Having regard to the Treaty establishing the European Economic Community,

Having regard to Council Regulation (EEC) No 2913/92 of 12 October 1992 establishing the Community Customs Code (1), hereinafter referred to as the ‘Code’, and in particular Article 249 thereof,

Whereas the Code assembled all existing customs legislation in a single legal instrument; whereas at the same time the Code made certain modifications to this legislation to make it more coherent, to simplify it and to plug certain loopholes; whereas it therefore constitutes complete Community legislation in this area;

Whereas the same reasons which led to the adoption of the Code apply equally to the customs implementing legislation; whereas it is therefore desirable to bring together in a single regulation those customs implementing provisions wich are currently scattered over a large number of Community regulations and directives;

Whereas the implementing code for the Community Customs Code hereby established should set out existing customs implementing rules; whereas it is nevertheless necessary, in the light of experience:

|

— |

to make some amendments in order to adapt the said rules to the provisions of the Code, |

|

— |

to extend the scope of certain provisions which currently apply only to specific customs procedures in order to take account of the Code's comprehensive application, |

|

— |

to formulate certain rules more precisely in order to achieve greater legal security in their application; |

Whereas the changes made relate mainly to the provisions concerning customs debt;

Whereas it is appropriate to limit the application of Article 791 (2) until 1 January 1995 and to review the subject matter in the light of experience gained before that time;

Whereas the measures provided for by this Regulation are in accordance with the opinion of the Customs Code Committee,

HAS ADOPTED THIS REGULATION:

PART I

GENERAL IMPLEMENTING PROVISIONS

TITLE I

GENERAL

CHAPTER 1

Definitions

Article 1

For the purposes of this Regulation:

|

1. |

Code means: Council Regulation (EEC) No 2913/92 of 12 October 1992 establishing a Community Customs Code; |

|

2. |

ATA carnet means: the international customs document for temporary importation established by virtue of the ATA Convention; |

|

3. |

Committee means: the Customs Code Committee established in Article 247 of the Code; |

|

4. |

Customs Cooperation Council means: the organization set up by the Convention establishing a Customs Cooperation Council, done at Brussels on 15 December 1950; |

|

5. |

Particulars required for identification of the goods means: on the one hand, the particulars used to identify the goods commercially allowing the customs authorities to determine the tariff classification and, on the other hand, the quantity of the goods; |

|

6. |

Goods of a non-commercial nature means: goods whose entry for the customs procedure in question is on an occasional basis and whose nature and quantity indicate that they are intended for the private, personal or family use of the consignees or persons carrying them, or which are clearly intended as gifts; |

|

7. |

Commercial policy measures means: non-tariff measures established, as part of the common commercial policy, in the form of Community provisions governing the import and export of goods, such as surveillance or safeguard measures, quantitative restrictions or limits and import or export prohibitions; |

|

8. |

Customs nomenclature means: one of the nomenclatures referred to in Article 20 (6) of the Code; |

|

9. |

Harmonized System means: the Harmonized Commodity Description and Coding System; |

|

10. |

Treaty means: the Treaty establishing the European Economic Community. |

CHAPTER 2

Decisions

Article 2

Where a person making a request for a decision is not in a position to provide all the documents and information necessary to give a ruling, the customs authorities shall provide the documents and information at their disposal.

Article 3

A decision concerning security favourable to a person who has signed an undertaking to pay the sums due at the first written request of the customs authorities, shall be revoked where the said undertaking is not fulfilled.

Article 4

A revocation shall not affect goods which, at the moment of its entry into effect, have already been placed under a procedure by virtue of the revoked authorization.

However, the customs authorities may require that such goods be assigned to a permitted customs-approved treatment or use within the period which they shall set.

TITLE II

BINDING TARIFF INFORMATION

CHAPTER 1

Definitions

Article 5

For the purpose of this Title:

|

1. |

binding tariff information: means tariff information binding on the administrations of all Community Member States when the conditions laid down in Articles 6 and 7 are fulfilled; |

|

2. |

applicant: means a person who has applied to the customs authorities for binding tariff information; |

|

3. |

holder: means the person in whose name the binding tariff information is issued. |

CHAPTER 2

Procedure for obtaining binding tariff information — Notification of information to applicants and transmission to the Commission

Article 6

1. Applications for binding tariff information shall be made in writing either to the competent customs authorities in the Member State or Member States in which the information is to be used, or to the competent customs authorities in the Member State in which the applicant is established.

2. An application for binding tariff information shall relate to only one type of goods.

3. Applications shall include the following particulars:

|

(a) |

the holder's name and address; |

|

(b) |

the name and address of the applicant where that person is not the holder; |

|

(c) |

the customs nomenclature in which the goods are to be classified. Where an applicant wishes to obtain the classification of goods in one of the nomenclatures referred to in Article 20 (3) (b) and (6) (b) of the Code, the application for binding tariff information shall make express mention of the nomenclature in question; |

|

(d) |

a detailed description of the goods permitting their identification and the determination of their classification in the customs nomenclature; |

|

(e) |

the composition of the goods and any methods of examination used to determine this, where the classification depends on it; |

|

(f) |

any samples, photographs, plans, catalogues or other documents available which may assist the customs authorities in determining the correct classification of the goods in the customs nomenclature, to be attached as annexes; |

|

(g) |

the classification envisaged; |

|

(h) |

agreement to supply a translation of any attached document in the official language (or one of the official languages) of the Member State concerned if requested by the customs authorities; |

|

(i) |

any particulars to be treated as confidential; |

|

(j) |

indication by the applicant whether to his knowledge binding tariff information for identical or similar goods has already been applied for or issued in the Community; |

|

(k) |

acceptance that the information supplied may be stored on a database of the Commission of the European Communities; however, apart from Article 15 of the Code, the provisions governing the protection of information in force in the Member States shall apply. |

4. Where the customs authorities consider that the application does not contain all the particulars they require to give an informed opinion, they shall ask the applicant to supply the missing information.

5. The list of customs authorities designated by the Member States to receive applications for or to issue binding tariff information shall be published in the C series of the Official Journal of the European Communities.

Article 7

1. Binding tariff information shall be notified to the applicant in writing as soon as possible. If it has not been possible to notify binding tariff information to the applicant within three months of acceptance of the application, the customs authorities shall contact the applicant to explain the reason for the delay and indicate when they expect to be able to notify the information.

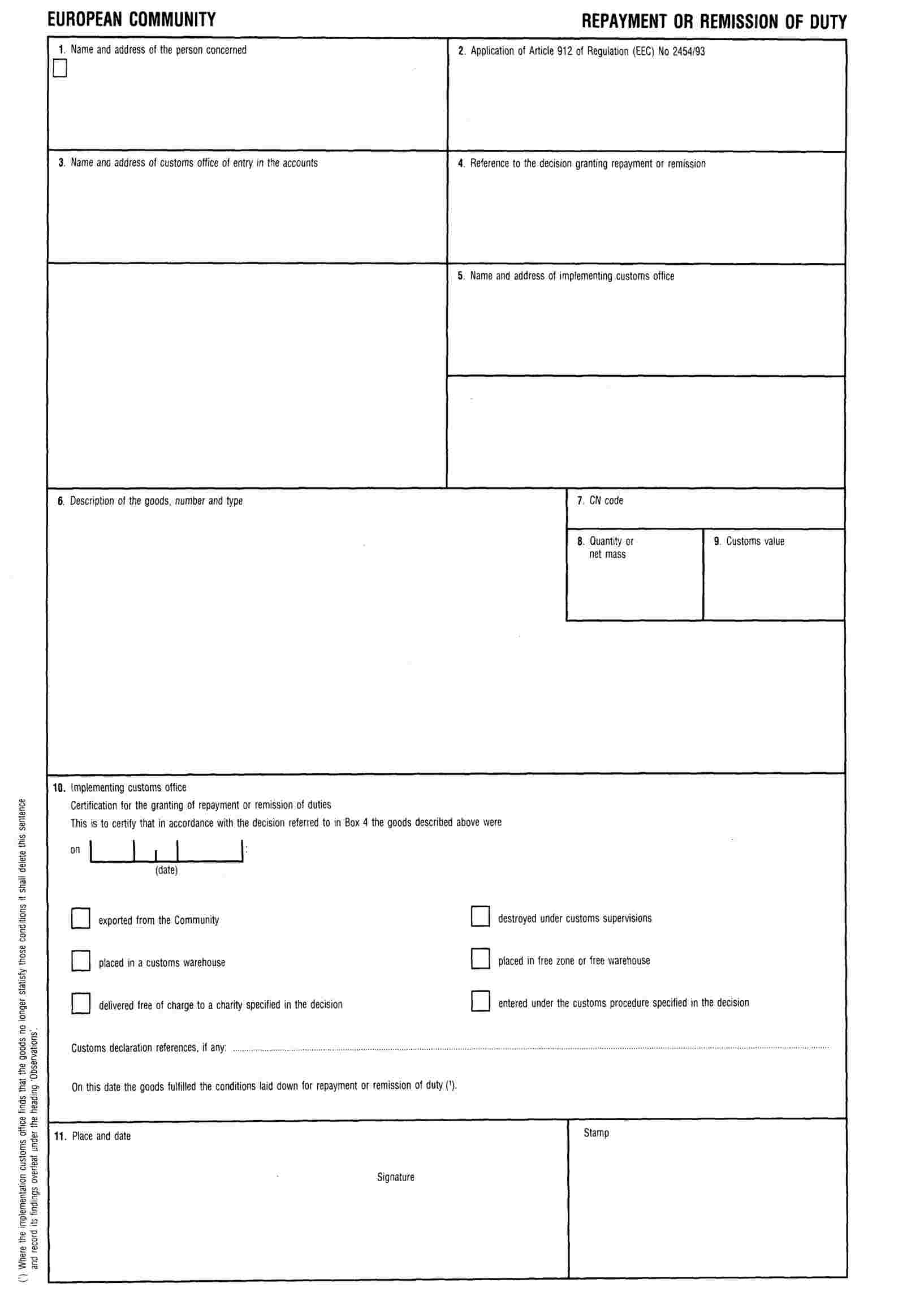

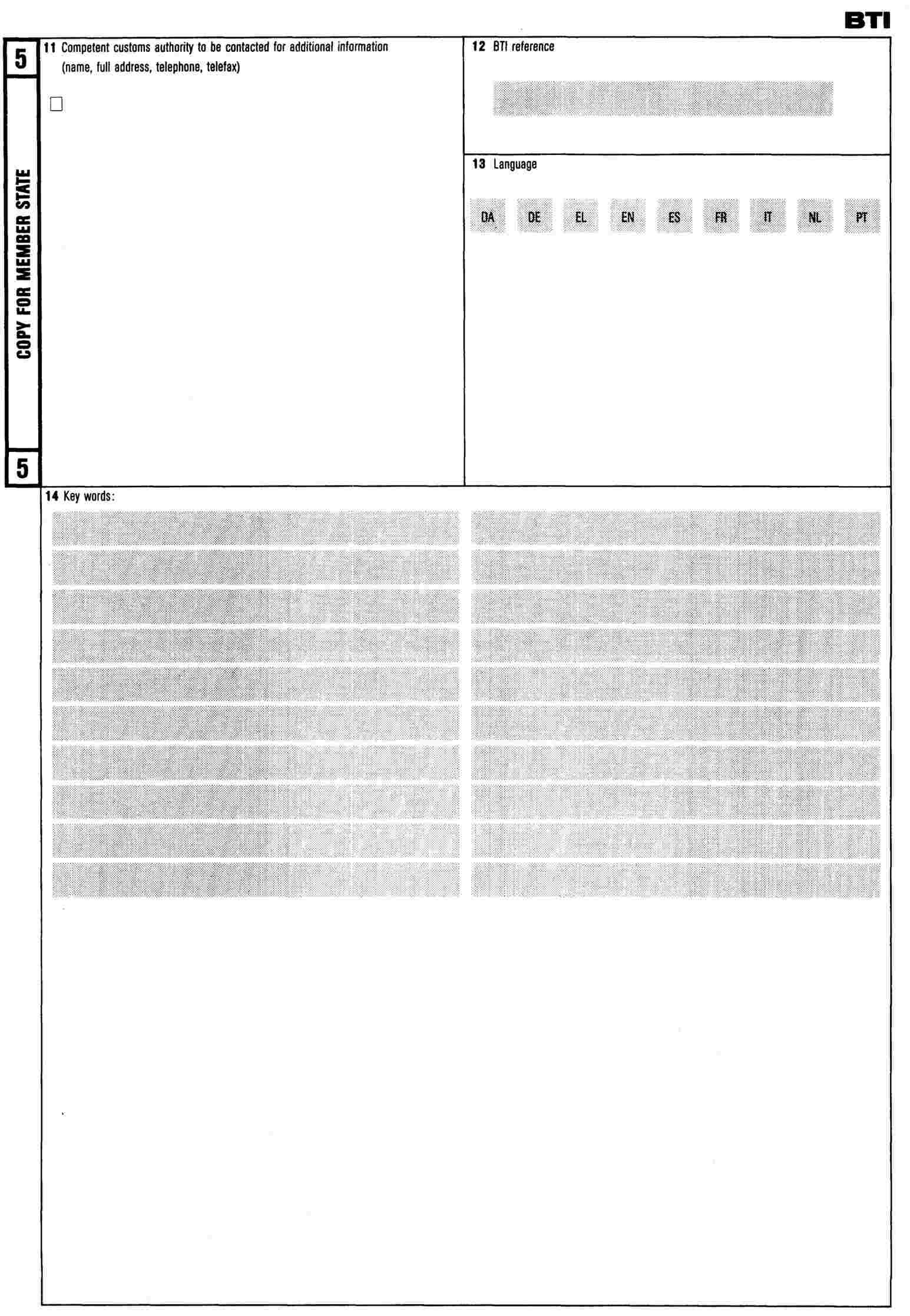

2. Binding tariff information shall be notified by means of a form conforming to the specimen shown in Annex 1. The notification shall indicate what particulars are to be considered as having been supplied on a confidential basis. The possibility of appeal referred to in Article 243 of the Code shall be mentioned.

Article 8

1. A copy of the binding tariff information notified (copy No 2 of Annex 1) and the facts (copy No 4 of the same Annex) shall be transmitted to the Commission without delay by the customs authorities of the Member State concerned. Such transmission shall be effected by electronic means as soon as possible.

2. Where a Member State so requests the Commission shall send it without delay the particulars contained in the copy of the form and the other relevant information. Such transmission shall be effected by electronic means as soon as possible.

CHAPTER 3

Provisions applying in the event of inconsistencies in binding tariff information

Article 9

Where the Commission finds that different binding tariff information exists in respect of the same goods it shall if necessary adopt a measure to ensure the uniform application of the customs nomenclature.

CHAPTER 4

Legal effect of binding tariff information

Article 10

1. Without prejudice to Articles 5 and 64 of the Code, binding tariff information may be invoked only by the holder.

2. The customs authorities may require the holder, when fulfilling customs formalities, to inform the customs authorities that he is in possession of binding tariff information in respect of the goods being cleared through customs.

3. The holder of binding tariff information may use it in respect of particular goods only where it is established to the satisfaction of the customs authorities that the goods in question conform in all respects to those described in the information presented.

4. The customs authorities may ask for this information to be translated into the official language or one of the official languages of the Member State concerned.

Article 11

Binding tariff information supplied by the customs authorities of a Member State since 1 January 1991 shall become binding on the competent authorities of all the Member States under the same conditions.

Article 12

1. Upon adoption of one of the acts or measures referred to in Article 12 (5) of the Code, the customs authorities shall take the necessary steps to ensure that binding tariff information shall thenceforth be issued only in conformity with the act or measure in question.

2. For the purposes of paragraph 1 above, the date to be taken into consideration shall be as follows:

|

— |

for the regulations provided for in Article 12 (5) (a) of the Code concerning amendments to the customs nomenclature, the date of their applicability, |

|

— |

for the regulations provided for in (a) of the same article and paragraph and establishing or affecting the classification of goods in the customs nomenclature, the date of their publication in the ‘L’ series of the Official Journal of the European Communities, |

|

— |

for the measures provided for in (b) of the same article and paragraph, concerning amendments to the explanatory notes to the combined nomenclature, the date of their publication in the ‘C’ series of the Official Journal of the European Communities, |

|

— |

for judgments of the Court of Justice of the European Community provided for in (b) of the same article and paragraph, the date of the judgment, |

|

— |

for the measures provided for in (b) of the same article and paragraph concerning the adoption of a classification opinion or amendments to the explanatory notes to the Harmonized System Nomenclature by the Customs Cooperation Council, the date of the Commission communication in the ‘C’ series of the Official Journal of the European Communities. |

3. The Commission shall communicate the dates of adoption of the measures and acts referred to in this article to the customs authorities as soon as possible.

CHAPTER 5

Provisions applying in the event of expiry of binding tariff information

Article 13

Where, pursuant to the second sentence of Article 12 (4) and Article 12 (5) of the Code, binding tariff information is void or ceases to be valid, the customs authority which supplied it shall notify the Commission as soon as possible.

Article 14

1. When a holder of binding tariff information which has ceased to be valid for reasons referred to in Article 12 (5) of the Code, wishes to make use of the possibility of invoking such information during a given period pursuant to paragraph 6 of that Article, he shall notify the customs authorities, providing any necessary supporting documents to enable a check to be made that the relevant conditions have been satisfied.

2. In exceptional cases where the Commission, in accordance with the last subparagraph of Article 12 (7) of the Code, adopts a measure derogating from the provisions of paragraph 6 of that Article, or where the conditions referred to in paragraph 1 concerning the possibility of continuing to invoke binding tariff information have not been fulfilled, the customs authorities shall notify the holder in writing.

CHAPTER 6

Transitional provision

Article 15

Binding tariff information supplied nationally before 1 January 1991 shall remain valid.

Nevertheless, binding tariff information supplied nationally whose validity extends beyond 1 January 1997 shall be invalid from that date.

TITLE III

FAVOURABLE TARIFF TREATMENT BY REASON OF THE NATURE OF GOODS

CHAPTER 1

Goods subject to the condition that they be denatured

Article 16

Classification under the tariff subheadings listed in column 2 of the table below of the goods listed against each subheading in column 3 shall be subject to the condition that the goods are denatured so as to make them unfit for human consumption, by means of one of the denaturants referred to in column 4 used in the quantities indicated in column 5.

|

Order No |

CN code |

Description |

Denaturant |

||||||

|

Name |

Maximum quantity to be used in g per 100 kg of product to be denatured |

||||||||

|

(1) |

(2) |

(3) |

(4) |

(5) |

|||||

|

1 |

0408 |

Birds' eggs, not in shell, and egg yolks, fresh, dried, cooked by steaming or by boiling in water, moulded, frozen or otherwise preserved, whether or not containing added sugar or other sweetening matter: |

Spirit of turpentine Essence of lavender Oil of rosemary Birch oil |

500 100 150 100 |

|||||

|

– Egg yolks: |

|||||||||

|

0408 11 |

– – Dried: |

Fish meal of subheading 2301 20 00 of the Combined Nomenclature, having a characteristic odour and containing by weight in the dry matter at least:

|

5 000 |

||||||

|

0408 11 90 |

– – – Other |

|

|

||||||

|

0408 19 |

– – Other |

|

|

||||||

|

0408 19 90 |

––– Other |

|

|

||||||

|

0408 91 |

–– Dried: |

|

|

||||||

|

0408 91 90 |

––– Other |

|

|

||||||

|

0408 99 |

–– Other |

|

|

||||||

|

0408 99 90 |

––– Other |

|

|

||||||

|

2 |

1106 |

Flour and meal of the dried leguminous vegetables of heading No 0713, of sogo or of roots or tubers of heading No 0714; flour, meal and powder of the product of Chapter 8: |

Fish oil or fish liver oil, filtered but not deodorized or decoloreized, with no additives |

1 000 |

|||||

|

1106 20 |

– Flour and meal of sogo, roots or tubers of heading No 0714: |

Fish meal of subheading 2301 20 00 of the combined nomenclature, having a characteristic odour and containing by weight in the dry matter at least: |

|

||||||

|

1106 20 10 |

– – Denatured |

|

5 000 |

||||||

|

|

|

|

Chemical name or description |

Common name |

Colour index (2) |

|

|||

|

3 |

2501 00 |

Salt (including table salt and denatured salt) and pure sodium chloride, whether or not in aqueous solution; or containing added anti-caking or free-flowing agents; sea water |

Sodium salt of 4-sulphobenzeneazore-sorcinol, or 2.4-dihydroxyzobenzene-4-sulphonic acid (colour: yellow) |

Chrysoine S |

14 270 |

6 |

|||

|

– Common salt (including table salt and denatured salt) and pure sodium chloride, whether or not in aqueous solution or containing added anti-caking or free-flowing agents |

Disodium salt of l-(4-sulph-1 -phenylazo)-4-aminobenzene-5-sulphonic acid (colour: yellow) |

Fast yellow AB |

13 015 |

6 |

|||||

|

– – Other: |

|||||||||

|

2501 00 51 |

––– Denatured or for industrial uses (including refining) other than the preservation or preparation of foodstuffs for human or animal consumption |

Tetrasodium salt of l-(4-suplho-1 -naphthylazo)-2-naphtol-3,6,8-trisulfonic acid (colour: red) |

Ponceau 6 R |

16 290 |

1 |

||||

|

Tetrabromofluorescein (colour: flourescent yellow) |

Eosine |

45 380 |

0,5 |

||||||

|

Naphtalene |

Naphtalene |

— |

250 |

||||||

|

Powdered soap |

Powdered soap |

— |

1 000 |

||||||

|

Sodium or potassium dichromate |

Sodium or potassium dichromate |

— |

30 |

||||||

|

Iron oxide containing not less than 50 % of Fe2O3 by weight. The iron oxide should be dark red to brown and should take the form of a fine powder of which at least 90 % passes through a sieve having a mesh of 0,10 mm |

Iron oxide |

— |

250 |

||||||

|

Sodium hypochlorite |

Sodium hypochlorite |

|

3 000 |

||||||

|

|

|

|

Name |

|

|||||

|

4 |

3502 |

Albumins, (including concentrates of two or more whey proteins containing by weight more than 80 % whey proteins, calculated on the dry matter), albuminates and other albumin derivatives: |

Oil of rosemary (for liquid albumins only) Crude oil of camphor (for liquid and solid albumins) White oil of camphor (for liquid and solid albumins) Sodium azide (for liquid and solid albumins) Diethanolamine (for solid albumins only) |

150 2 000 2 000 100 6 000 |

|||||

|

3502 10 |

– Egg albumin: |

||||||||

|

3502 10 10 |

– – Unfit, or to be rendered unfit, for human consumption |

||||||||

|

3502 90 |

– Other |

||||||||

|

–– Albumins, other than egg albumin: |

|||||||||

|

3502 90 10 |

––– Unfit, or to be rendered unfit, for human consumption |

||||||||

Article 17

Denaturing shall be carried out in such a way as to ensure that the product to be denatured and the denaturant are homogeneously mixed and cannot be separated again in a manner which is economically viable.

Article 18

By way of derogation from Article 16, any Member State may temporarily approve the use of a denaturant not specified in column 4 of the table referred to in that Article.

In such a case, notification shall be sent to the Commission within 30 days, giving detailed particulars of such denaturants and of the quantities used. The Commission shall inform the other Member States as soon as possible.

The question shall be referred to the Committee.

If, within 18 months of the date of receipt by the Commission of the notification, the Committee has not delivered an opinion to the effect that the denaturant in question should be included in column 4 of the said table, then use of such denaturant shall forthwith cease in all Member States.

Article 19

This Chapter shall apply without prejudice to Council Directive 70/524/EEC (3).

CHAPTER 2

Conditions for tariff classification of certain types of seed

Article 20

Classification under the tariff subheadings listed in column 2 of the table below of the goods listed against each subheading in column 3 shall be subject to the conditions laid down in Articles 21 to 24.

|

Order No |

CN code |

Description |

|

1 |

0701 |

Potatoes, fresh or chilled |

|

0701 10 00 |

– Seed |

|

|

2 |

0712 |

Dried vegetables, whole, cut sliced, broken or in powder, but not further prepared: |

|

0712 90 |

– other vegetables; mixtures of vegetables: |

|

|

– – sweet corn (Zea mays var. saccharata): |

||

|

– – – hybrids for sowing |

||

|

3 |

1001 |

Wheat and meslin: |

|

1001 90 |

– other |

|

|

1001 90 10 |

– – spelt for sowing |

|

|

4 |

1005 |

Maize (corn) |

|

1005 10 |

– Seed: |

|

|

– – hybrid: |

||

|

1005 10 11 |

– – – double hybrids and top cross hybrids |

|

|

1005 10 13 |

– – – three-cross hybrids |

|

|

1005 10 15 |

– – – simple hybrids |

|

|

1005 10 19 |

– – – other |

|

|

5 |

1006 |

Rice |

|

1006 10 |

– rice in the husk (paddy or rough) |

|

|

1006 10 10 |

– – for sowing |

|

|

6 |

1007 00 |

Grain sorghum |

|

1007 00 10 |

– hybrids for sowing |

|

|

7 |

1201 00 |

Soya beans, whether or not broken |

|

1201 00 10 |

– for sowing |

|

|

8 |

1202 |

Ground-nuts, not roasted or otherwise cooked, whether or not shelled or broken: |

|

1202 10 |

– in shell: |

|

|

1202 10 10 |

–– for sowing |

|

|

9 |

1204 00 |

Linseed, whether or not broken: |

|

1204 00 10 |

– for sowing |

|

|

10 |

1205 00 |

Rape or colza seeds, whether or not broken: |

|

1205 00 10 |

– for sowing |

|

|

11 |

1206 00 |

Sunflower seed, whether or not broken: |

|

1206 00 10 |

– for sowing |

|

|

12 |

1207 |

Other oil seeds and oleaginous fruits, whether or not broken: |

|

1207 10 |

– palm nuts and kernels: |

|

|

1207 10 10 |

– – for sowing |

|

|

13 |

1207 20 |

– Cotton seeds: |

|

1207 20 10 |

– – for sowing |

|

|

14 |

1207 30 |

– Castor oil seeds: |

|

1207 30 10 |

– – for sowing |

|

|

15 |

1207 40 |

– Sesamum seeds: |

|

1207 40 10 |

– – for sowing |

|

|

16 |

1207 50 |

– Mustard seeds: |

|

1207 50 10 |

– – for sowing |

|

|

17 |

1207 60 |

– Safflower seeds: |

|

1207 60 10 |

– – for sowing |

|

|

– Other |

||

|

18 |

1207 91 |

– – Poppy seeds: |

|

1207 91 10 |

– – – for sowing |

|

|

19 |

1207 92 |

– – Shea seeds (karite nuts): |

|

1207 92 10 |

– – – for sowing |

|

|

20 |

1207 99 |

– – Other: |

|

1207 99 10 |

– – – for sowing |

Article 21

Seed potatoes shall satisfy the conditions laid down on the basis of Article 15 of Council Directive 66/403/EEC (4).

Article 22

Sweet corn, spelt, hybrid maize, rice and sorghum for sowing shall satisfy the conditions laid down on the basis of Article 16 of Council Directive 66/402/EEC (5).

Article 23

Oil seeds and oleaginous fruits for sowing shall satisfy the conditions laid down on the basis of Article 15 of Council Directive 69/208/EEC (6).

Article 24

Sweet corn, spelt, hybrid maize, rice, sorghum hybrid, oil seeds and oleaginous fruits of a kind to which Council Directives 66/402/EEC and 69/208/EEC do not apply shall not be entered in the subheadings indicated in Article 20 unless the person concerned establishes to the satisfaction of the competent authorities of the Member States that they are actually intended for sowing.

CHAPTER 3

Conditions for tariff classification of bolting cloth as piece goods

Article 25

The tariff classification of bolting cloth, not made up, falling within CN code 5911 20 00 shall be subject to the condition that it is marked as indicated below.

A mark consisting of a rectangle and its diagonals must be reproduced at regular intervals along both edges of the fabric without encroaching on the selvedges, in such a way that the distance between two consecutive marks, measured between the adjacent ends of the rectangles, is not more than one metre and that the marks on one edge are staggered so as to be half way between those on the other edge (the centre of each mark must be equidistant from the centre of the two nearest marks on the opposite edge). Each mark is to be so positioned that the long sides of the rectangle are parallel to the warp of the fabric (see sketch below).

The thickness of the lines forming the sides of the rectangle must be 5 mm, and that of the diagonals 7 mm. The rectangle from the outer edge of the lines must be at least 8 cm in length and 5 cm in width.

The marks must be printed in a single colour contrasting with the colour of the fabric and must be indelible.

CHAPTER 4

Goods for which a certificate of authenticity or quality, or other certificate, must he presented

Article 26

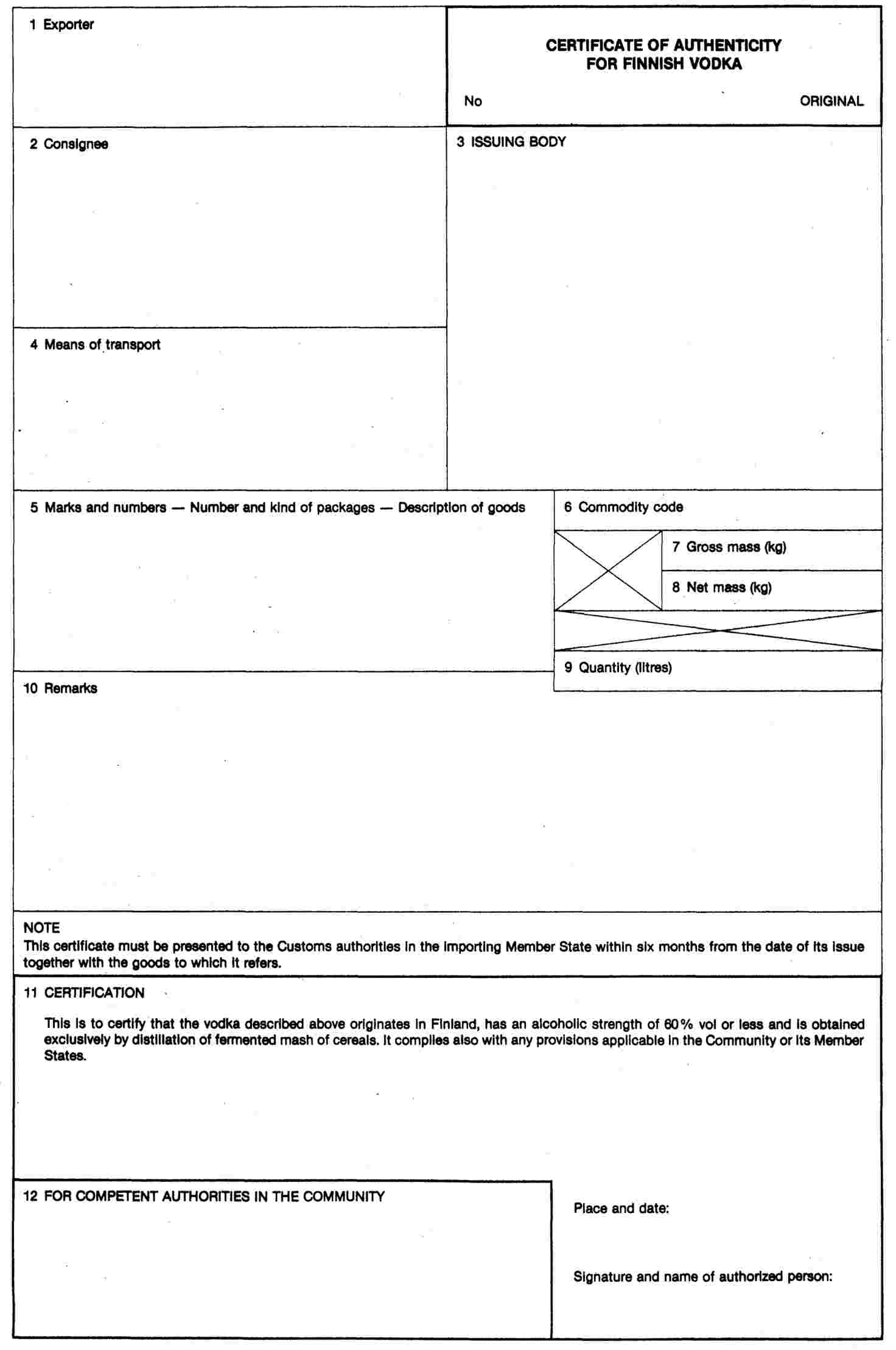

1. Classification under the tariff subheadings listed in column 2 of the table below of the goods listed against each subheading in column 3, imported from the countries shown in column 5, shall be subject to the presentation of certificates meeting the requirements specified in Articles 27 to 34.

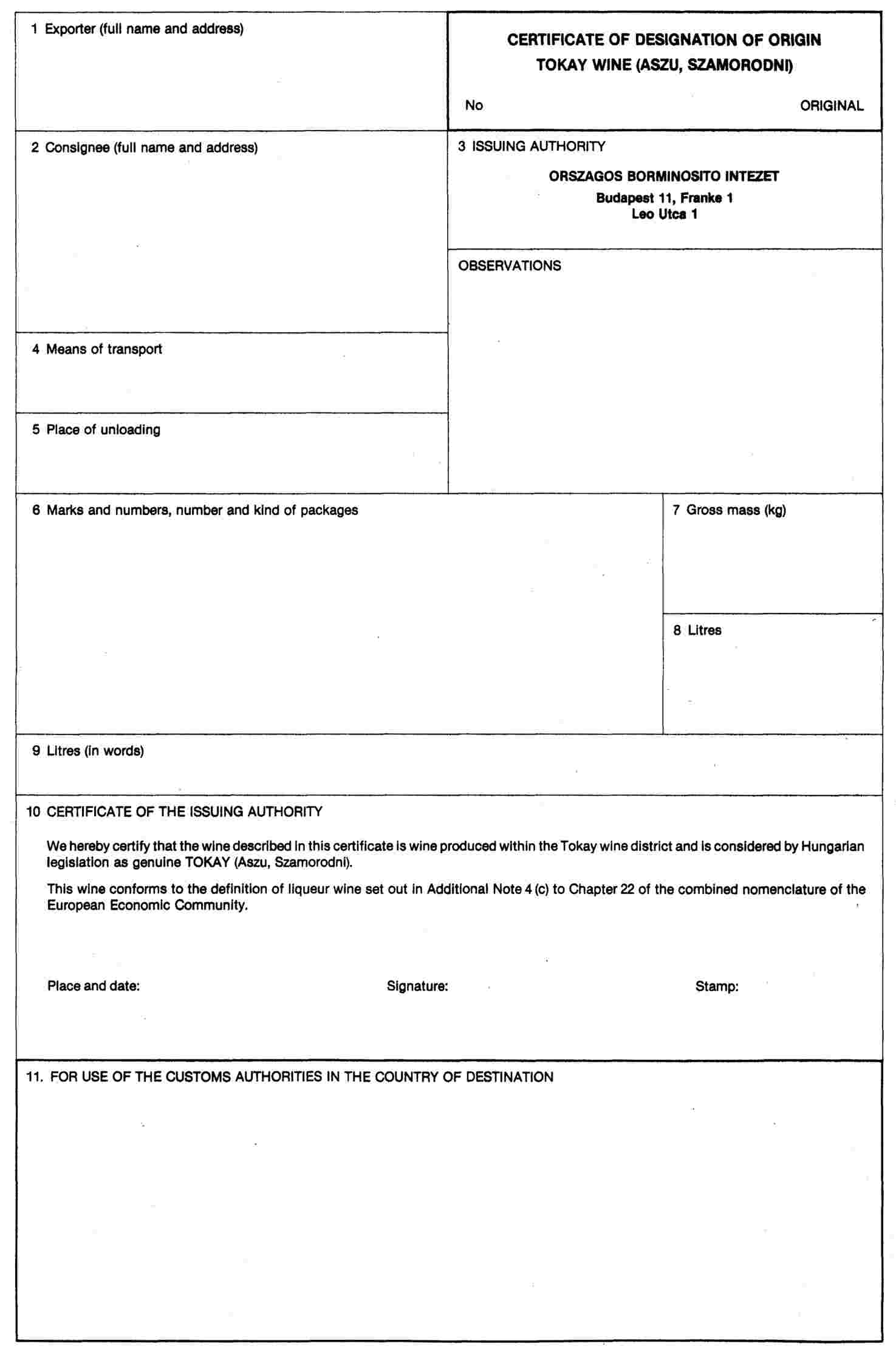

The certificates are shown in Annexes 2 to 8, as indicated in column 4 of the table.

Certificates of authenticity apply to grapes, whisky, vodka and tobacco, certificates of designation of origin to wine, and certificates of quality to sodium nitrate.

2. By way of derogation from the provisions or paragraph 1, for port, Madeira, sherry and Setubal muscatel falling within CN codes 2204 21 41, 2204 21 51, 2204 29 41 and 2204 29 51, the approved commercial document completed and authenticated in accordance with the provisions of Article 9 (2) of Commission Regulation (EEC) No 986/89 (7) shall be presented in place of the certificate of designation of origin.

3. However, tobacco exempt from customs duty on release for free circulation by virtue of a Community provision shall be classified in subheadings 2401 10 10 to 2401 10 49 and 2401 20 10 to 2401 20 49 without presentation of a certificate of authenticity. Such a certificate shall be neither issued nor accepted for tobacco of these types when more than one type is presented in the same immediate packing.

4. In respect of the goods listed under Order No 6 in the following table, for the purposes of this Article:

|

(a) |

flue-cured Virginia type tobacco means tobacco which has been cured under artificial atmospheric conditions by a process of regulating the heat and ventilation without allowing smoke and fumes to come in contact with the tobacco leaves; the colour of the cured tobacco normally ranges from lemon to very dark orange or red. Other colours and combinations of colours frequently result from variations in maturity or cultural and curing techniques; |

|

(b) |

light air-cured Burley type tobacco (including Burley hybrids) means tobacco which has been cured under natural atmospheric conditions and does not carry the odour of smoke or fumes if supplemental heat or air circulation has been applied; the leaves normally range from light tan to reddish colour. Other colours and combinations of colours frequently result from variations in maturity or cultural and curing techniques; |

|

(c) |

light air-cured Maryland type tobacco means tobacco which has been cured under natural atmospheric conditions and does not carry the odour of smoke or fumes if supplemental heat or air circulation has been applied; the leaves normally range from a light-yellow to deep cherry red colour. Other colours and combinations of colours frequently result from variations in maturity or cultural and curing techniques; |

|

(d) |

fire-cured tobacco means tobacco which has been cured under artificial atmospheric conditions by the use of open fires from which wood smoke has been partly absorbed by the tobacco. Fire-cured tobacco leaves are normally thicker than leaves of Burley, flue-cured, or Maryland from the corresponding stalk position. Colours normally range from yellowish-brown to very dark brown. Other colours and combinations of colours frequently result from variations in maturity or cultural and curing techniques. |

|

Order No |

CN code |

Description |

Annex No |

Issuing body |

|||

|

Exporting country |

Name |

Place where established |

|||||

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

|

|

1 |

0806 |

Grapes, fresh or dried: |

2 |

United States of America |

United States Department of Agriculture or its authorized offices (8) |

Washington DC |

|

|

0806 10 |

– Fresh |

||||||

|

– – Table grapes |

|||||||

|

– – – From 1 November to 14 July: |

|||||||

|

0806 10 11 |

– – – – Of the variety Emperor (vitis vinifera cv) from 1 December to 31 January |

||||||

|

2 |

2106 |

Food preparations not elsewhere specified or included: |

3 |

Switzerland |

Union suisse du commerce de fromage SA/Schweizerische Käseunion AG/Unione svizzera per il commercio del fromaggio SA |

Berne |

|

|

2106 90 |

– Other: |

|

|

|

|||

|

2106 90 10 |

– – Cheese fondues |

|

Austria |

Österreichische Hartkäse Export GmbH |

Innsbruck |

||

|

3 |

2204 |

Wine of fresh grapes, including fortified wines; grape must other than that of heading No 2009: |

|

|

Name of wine |

|

|

|

– Other wine; grape must with fermentation prevented or arrested by the addition of alcohol: |

|

|

|

|

|

||

|

2204 21 |

– – in containers holding 2 or less |

|

|

|

|

|

|

|

– – – Other: |

|||||||

|

– – – – Of an actual alcoholic strength by volume exceeding 15 % vol but not exceeding 18 % vol |

|||||||

|

2204 21 41 |

– – – – – Tokay (Aszu and Szamorodni) |

4 |

Hungary |

Tokay (Aszu, Szamorodni) |

Orszagos Borminosito Intezet Budapest II, Frenkel, Leo Utca I (National Institute for the approval of Wines) |

Budapest |

|

|

– – – – Of an actual alcoholic strength by volume exceeding 18 % vol but not exceeding 22 % vol: |

|

|

|

|

|

||

|

2204 21 51 |

– – – – – Tokay (Aszu and Szamorodni) |

|

|

|

|

|

|

|

2204 29 |

– – Other: |

|

|

|

|

|

|

|

– – – Other: |

|||||||

|

– – – – Of an actual alcoholic strength by volume exceeding 15 % vol but not exceeding 18 % vol: |

|||||||

|

2204 29 45 |

– – – – – Tokay (Aszu and Szamorodni) |

|

|

|

|

|

|

|

– – – Of an actual alcoholic strength by volume exceeding 18 % vol but not exceeding 22 % vol: |

|||||||

|

2204 29 55 |

– – – – – Tokay (Aszu and Szamorodni) |

|

|

|

|

|

|

|

4 |

2208 |

Undenatured ethyl alcohol of an actual alcoholic strength by volume of less than 80 % vol; spirits, liqueurs and other spirituous beverages; compound alcoholic preparations of a kind used for the manufacture of beverages: |

|

United States of America |

United States Department of the Treasury, Bureau of Alcohol, Tobacco and Firearms or its authorized regional offices (8) |

Washington DC |

|

|

2208 30 |

– Whiskies: |

|

|

|

|

||

|

– – Bourbon whiskey, in containers holding: |

5 |

||||||

|

2208 30 11 |

– – – 2 litres or less |

|

|

|

|

||

|

2208 30 19 |

– – – More than 2 litres |

|

|

|

|

||

|

5 |

2208 90 |

– Other: |

|

|

|

|

|

|

– – Vodka of an alcoholic strength by volume of 45,4 % vol or less and plum, pear or cherry spirit (excluding liqueurs), in containers holding: |

6 |

Finland |

ALKO Limited |

Salmisaarenranta, 7 00100 Helsinki 10 Finland |

|||

|

– – – 2 litres or less: |

|||||||

|

2208 90 31 |

– – – – Vodka |

|

|

|

|

||

|

– – Other spirituous beverages, in containers holding: |

|||||||

|

– – – 2 litres or less: |

|||||||

|

– – – – Spirits (excluding liqueurs): |

|||||||

|

2208 90 35 |

– – – – – Other |

|

|

|

|

||

|

6 |

2401 |

Unmanufactured tobacco; tobacco refuse: |

7 |

United States of America |

Tobacco Association of the United States or its authorized offices (8) |

Raleigh, North Carolina |

|

|

2401 10 |

– Tobacco, not stemmed/stripped: |

|

|

|

|

||

|

– – Flue-cured Virginia type and light air-cured Burley type tobacco (including Burley hybrids); light air-cured Maryland type and fire-cured tobacco: |

|

Canada |

Directorate General Food Production and Inspection, Agriculture Branch, Canada, or its authorized offices (8) Direction générale de la production et de l'inspection, Section agriculture, Canada, or its authorized offices (8) |

Ottawa |

|||

|

2401 10 10 |

– – – Flue-cured Virginia type |

|

|

|

|

||

|

2401 10 20 |

– – – Light air-cured Burley type (including Burley hybrid) |

|

|

|

|

||

|

2401 10 30 |

– – – Light air-cured Maryland type |

|

Argentina |

Cámara del Tabaco del Salta, or its authorized offices (8) |

Salta |

||

|

– – – Fire-cured tobacco: |

|

|

Cámara del Tabaco del Jujuy, or its authorized offices (8) |

San Salvador de Jujuy |

|||

|

2401 10 41 |

– – – – Kentucky type |

|

|

|

|

||

|

2401 10 49 |

– – – Other |

|

|

Cámara de Comerico Exterior de Misiones or its authorized offices (8) |

Posadas |

||

|

2401 20 |

– Tobacco, partly or wholly stemmed/stripped: |

|

Bangladesh |

Ministry of Agriculture, Department of Agriculture Extension, Cash Crop Division or its authorized offices (8) |

Dacca |

||

|

– – Flue-cured Virginia type and light air-cured Burley type tobacco (including Burley hybrids); light air-cured Maryland type and fire-cured tobacco |

|

Brazil |

Carteira de Comercio Exterior do Banco do Brasil or its authorized offices (8) |

Rio de Janeiro |

|||

|

2401 20 10 |

– – – Flue-cured Virginia type |

|

China |

Shanghai Import and Export Commodity Inspection Bureau of the People's Republic of China or its authorized offices (8) |

Shanghai |

||

|

2401 20 20 |

– – – Light air-cured Burley type (including Burley hybrids) |

|

|

||||

|

2401 20 30 |

– – – Light air-cured Maryland type |

|

|

Shandong Import and Export Commodity Inspection Bureau of the People's Republic of China or its authorized offices (8) |

Qingdao |

||

|

– – – Fire-cured tobacco: |

|

|

|||||

|

2401 20 41 2401 20 49 |

– – – – Kentucky type – – – – Other |

|

|

Hubei Import and Export Commodity Inspection Bureau of the People's Republic of China or its authorized offices (8) |

Hankou |

||

|

Guangdong Import and Export Commodity Inspection Bureau of the People's Republic of China or its authorized offices (8) |

Guangzhou |

||||||

|

Liaoning Import and Export Commodity Inspection Bureau of the People's Republic of China or its authorized offices (8) |

Dalian |

||||||

|

Yunnan Import and Export Commodity Inspection Bureau of the People's Republic of China or its authorized offices (8) |

Kunming |

||||||

|

Shenzhan Import and Export Commodity Inspection Bureau of the People's Republic of China or its authorized offices (8) |

Shenzhan |

||||||

|

Hainan Import and Export Commodity Inspection Bureau of the People's Republic of China or its authorized offices (8) |

Hainan |

||||||

|

Colombia |

Superintendencia de Industria y Comercio — Division de Control de Normas y Calidades or its authorized offices (8) |

Bogota |

|||||

|

Cuba |

Empresa Cubana del Tabaco ‘Cubatabaco’ or its authorized offices (8) |

Havana |

|||||

|

Guatemala |

Dirección de Comercio Interior y Exterior del Ministerio de Economía, or its authorized offices (8) |

Guatemala City |

|||||

|

India |

Tobacco Board, or its authorized offices (8) |

Guntur |

|||||

|

Indonesia |

Lembaga Tembakou, or its authorized offices (8) |

|

|||||

|

Medan |

||||||

|

Sala |

||||||

|

Surabaya |

||||||

|

Jembery |

||||||

|

Mexico |

Secretaria de Comercio, or its authorized offices (8) |

Mexico City |

|||||

|

Philippines |

Philippine Virginia Tobacco Administration, or its authorized offices (8) |

Quezon City |

|||||

|

South Korea |

Office of Korean Monopoly Corporation, or its authorized offices (8) |

Sintanjin |

|||||

|

Sri Lanka |

Department of Commerce, or its authorized offices (8) |

Colombo |

|||||

|

Switzerland |

Administration fédérale des Douanes, Section de l'imposition du tabac, or its authorized offices (8) |

Berne |

|||||

|

Thailand |

Department of Foreign Trade, Ministry of Commerce, or its authorized offices (8) |

Bangkok |

|||||

|

7 |

3102 |

Mineral or chemical fertilizers, nitrogenous: |

8 |

Chile |

Servicio Nacional de Geologia y Mineria |

Santiago |

|

|

3102 50 |

– Sodium nitrate: |

|

|

|

|

||

|

3102 50 10 |

– – Natural sodium nitrate |

|

|

|

|

||

|

3105 |

Mineral or chemical fertilizers containing two or three of the fertilizing elements nitrogen, phosphorus and potassium; other fertilizers; goods of this chapter in tablets or similar form or in packages of a gross weight not exceeding 10 kg: |

|

|

|

|

||

|

3105 90 |

– Other: |

|

|

|

|

||

|

3105 90 10 |

– – Natural potassic sodium nitrate, consisting of a natural mixture of sodium nitrate and potassium nitrate (the proportion of potassium nitrate may be as high as 44 %), of a total nitrogen content not exceeding 16,3 % by weight on the dry anhydrous product |

|

|

|

|

||

Article 27

1. The certificates shall correspond to the specimens in the appropriate annexes indicated in column 4 of the table referred to in Article 26. They shall be printed and completed in one of the official languages of the European Economic Community and, where appropriate, in an official language of the exporting country.

2. Certificates shall measure approximately 210 × 297 millimetres.

The paper used shall be:

|

— |

in the case of the goods listed under Order No 3 in the table referred to in Article 26, white paper free of mechanical pulp, dressed for writing purposes and weighing not less than 55 g/m2 and not more than 65 g/m2. The front of the certificate shall have a printed guilloche pattern background in pink, such as to reveal any falsification by mechanical or chemical means, |

|

— |

in the case of the goods listed under Order Nos 4 and 5 in the table referred to in Article 26, white paper with a yellow border weighing not less than 40 g/m2, |

|

— |

in the case of the other goods in the table, white paper weighing at least 40 g/m2. |

3. In the case of the goods listed under Order No 3 in the table referred to in Article 26, the borders of the certificate may bear decorative designs on their outer edge in a band not exceeding 13 millimetres in width.

4. In the case of goods referred to under Order No 2 in the table referred to in Article 26, the certificate shall be made out in one original and two copies. The original shall be white, the first copy pink and the second copy yellow.

5. In the case of the goods listed under Order No 2 of the table referred to in Article 26, each certificate shall bear an individual serial number given by the issuing body, followed by the nationality symbol appropriate to that body.

The copies shall bear the same serial number and nationality symbol as the original.

6. The customs authorities of the Member State where the goods are declared for release for free circulation may require a translation of the certificate.

Article 28

The certificate shall be completed either in typescript or in manuscript. In the latter case it shall be completed in ink using block capitals.

Article 29

1. The certificate or, in the case of split consignments of the goods listed under Order Nos 1, 6 and 7 in the table referred to in Article 26, a photocopy of the certificate, as provided for in Article 34, shall be presented to the customs authorities of the importing Member State, together with the goods to which it relates, within the following time limits, running from the date of issue of the certificate:

|

— |

two months, in the case of the goods listed under Order No 2 in the table, |

|

— |

three months, in the case of the goods listed under Order Nos 1, 3 and 4 in the table, |

|

— |

six months, in the case of the goods listed under Order Nos 5 and 7 in the table, |

|

— |

24 months, in the case of the goods listed under Order No 6 in the table. |

2. In the case of the goods listed under Order No 2 in the table referred to in Article 26:

|

— |

the original and the first copy of the certificate shall be presented to the appropriate authorities, |

|

— |

the second copy of the certificate shall be sent by the issuing body direct to the customs authorities of the importing Member State. |

Article 30

1. A certificate shall be valid only if it is duly endorsed by an issuing body appearing in column 6 of the table referred to in Article 26.

2. A duly endorsed certificate is one which shows the place and date of issue and bears the stamp of the issuing body and the signature of the person or persons empowered to sign it.

Article 31

1. An issuing body may appear in the table referred to in Article 26 only if:

|

(a) |

it is recognized as such by the exporting country; |

|

(b) |

it undertakes to verify the particulars shown in certificates; |

|

(c) |

it undertakes to provide the Commission and Member States, on request, with all appropriate information to enable an assessment to be made of the particulars shown in the certificates. |

2. The table referred to in Article 26 shall be revised when the condition laid down in paragraph 1 (a) is no longer fulfilled or when an issuing body fails to fulfil one or more of its obligations.

Article 32

Invoices presented in support of declarations for free circulation shall bear the serial number or numbers of the corresponding certificate(s).

Article 33

The countries listed in column 5 of the table referred to in Article 26 shall send the Commission specimens of the stamps used by their issuing body or bodies and authorized offices. The Commission shall communicate this information to the customs authorities of the Member States.

Article 34

In the case of the goods listed under Order Nos 1, 6 and 7 in the table referred to in Article 26, where a consignment is split the original certificate shall be photocopied for each part consignment. The photocopies and the original certificate shall be presented to the customs office where the goods are located.

Each photocopy shall indicate the name and address of the consignee and be marked in red ‘Extract valid for ... kg’ (in figures and letters) together with the place and date of the splitting. These statements shall be authenticated by the customs office stamp and the signature of the customs official responsible. Particulars relating to the splitting of the consignment shall be entered on the original certificate, which shall be retained by the customs office concerned.

TITLE IV

ORIGIN OF GOODS

CHAPTER 1

Non-preferential origin

Section 1

Working or processing conferring origin

Article 35

This chapter lays down, for textiles and textile articles falling within Section XI of the combined nomenclature, and for certain products other than textiles and textile articles, the working or processing which shall be regarded as satisfying the criteria laid down in Article 24 of the Code and shall confer on the products concerned the origin of the country in which they were carried out.

‘Country’ means either a third country or the Community as appropriate.

Subsection 1

Textiles and textile articles falling within Section XI of the combined nomenclature

Article 36

For textiles and textile articles falling within Section XI of the combined nomenclature, a complete process, as specified in Article 37, shall be regarded as a working or processing conferring origin in terms of Article 24 of the Code.

Article 37

Working or processing as a result of which the products obtained receive a classification under a heading of the combined nomenclature other than those covering the various non-originating materials used shall be regarded as complete processes.

However, for products listed in Annex 10, only the specific processes referred to in column 3 of that Annex in connection with each product obtained shall be regarded as complete, whether or not they involve a change of heading.

The method of applying the rules in Annex 10 is described in the introductory notes in Annex 9.

Article 38

For the purposes of the preceding Article, the following shall in any event be considered as insufficient working or processing to confer the status of originating products whether or not there is a change of heading:

|

(a) |

operations to ensure the preservation of products in good condition during transport and storage (ventilation, spreading out, drying, removal of damaged parts and like operations); |

|

(b) |

simple operations consisting of removal of dust, sifting or screening, sorting, classifying, matching (including the making-up of sets of articles), washing, cutting up; |

|

(c) |

|

|

(d) |

the affixing of marks, labels or other like distinguishing signs on products or their packaging; |

|

(e) |

simple assembly of parts of products to constitute a complete product; |

|

(f) |

a combination of two or more operations specified in (a) to (e). |

Subsection 2

Products other than textiles and textile articles falling within Section XI of the combined nomenclature

Article 39

In the case of products obtained which are listed in Annex 11, the working or processing referred to in column 3 of the Annex shall be regarded as a process or operation conferring origin under Article 24 of the Code.

The method of applying the rules set out in Annex 11 is described in the introductory notes in Annex 9.

Subsection 3

Common provisions for all products

Article 40

Where the lists in Annexes 10 and 11 provide that origin is conferred if the value of the non-originating materials used does not exceed a given percentage of the ex-works price of the products obtained, such percentage shall be calculated as follows:

|

— |

‘value’ means the customs value at the time of import of the non-originating materials used or, if this is not known and cannot be ascertained, the first ascertainable price paid for such materials in the country of processing, |

|

— |

‘ex-works price’ means the ex-works price of the product obtained minus any internal taxes which are, or may be, repaid when such product is exported, |

|

— |

‘value acquired as a result of assembly operations’ means the increase in value resulting from the assembly itself, together with any finishing and checking operations, and from the incorporation of any parts originating in the country where the operations in question were carried out, including profit and the general costs borne in that country as a result of the operations. |

Section 2

Implementing provisions relating to spare parts

Article 41

Essential spare parts for use with any piece of equipment, machine, apparatus or vehicle put into free circulation or previously exported shall be deemed to have the same origin as that piece of equipment, machine, apparatus or vehicle provided the conditions laid down in this section are fulfilled.

Article 42

The presumption of origin referred to in the preceding Article shall be accepted only:

|

— |

if this is necessary for importation into the country of destination, |

|

— |

if the incorporation of the said essential spare parts in the piece of equipment, machine, apparatus or vehicle concerned at the production stage would not have prevented the piece of equipment, machine, apparatus or vehicle from having Community origin or that of the country of manufacture. |

Article 43

For the purposes of Article 41:

|

(a) |

‘piece of equipment, machine, apparatus or vehicle’ means goods listed in Sections XVI, XVII and XVIII of the combined nomenclature; |

|

(b) |

‘essential spare parts’ means parts which are:

|

Article 44

Where an application is presented to the competent authorities or authorized agencies of the Member States for a certificate of origin for essential spare parts within the meaning of Article 41, box 6 (Item number, marks, numbers, number and kind of packages, description of goods) of that certificate and the application relating thereto shall include a declaration by the person concerned that the goods mentioned therein are intended for the normal maintenance of a piece of equipment, machine, apparatus or vehicle previously exported, together with the exact particulars of the said piece of equipment, machine, apparatus or vehicle.

Whenever possible, the person concerned shall also give the particulars of the certificate of origin (issuing authority, number and date of certificate) under cover of which was exported the piece of equipment, machine, apparatus or vehicle for whose maintenance the parts are intended.

Article 45

Where the origin of essential spare parts within the meaning of Article 41 must be proved for their release for free circulation in the Community by the production of a certificate of origin, the certificate shall include the particulars referred to in Article 44.

Article 46

In order to ensure application of the rules laid down in this section, the competent authorities of the Member States may require additional proof, in particular:

|

— |

production of the invoice or a copy of the invoice relating to the piece of equipment, machine, apparatus or vehicle put into free circulation or previously exported, |

|

— |

the contract or a copy of the contract or any other document showing that delivery is being made as part of the normal maintenance service. |

Section 3

Implementing provisions relating to certificates of origin

Subsection 1

Provisions relating to universal certificates of origin

Article 47

When the origin of a product is or has to be proved on importation by the production of a certificate of origin, that certificate shall fulfil the following conditions:

|

(a) |

it shall be made out by a reliable authority or agency duly authorized for that purpose by the country of issue; |

|

(b) |

it shall contain all the particulars necessary for identifying the product to which it relates, in particular:

|

|

(c) |

it shall certify unambiguously that the product to which it relates originated in a specific country. |

Article 48

1. A certificate of origin issued by the competent authorities or authorized agencies of the Member States shall comply with the conditions prescribed by Article 47 (a) and (b).

2. The certificates and the applications relating to them shall be made out on forms corresponding to the specimens in Annex 12.

3. Such certificates of origin shall certify that the goods originated in the Community.

However, when the exigencies of export trade so require, they may certify that the goods originated in a particular Member State.

If the conditions of Article 24 of the Code are fulfilled only as a result of a series of operations or processes carried out in different Member States, the goods may only be certified as being of Community origin.

Article 49

Certificates of origin shall be issued upon written request of the person concerned.

Where the circumstances so warrant, in particular where the applicant maintains a regular flow of exports, the Member States may decide not to require an application for each export operation, on condition that the provisions concerning origin are complied with.

Where the exigencies of trade so require, one or more extra copies of an origin certificate may be issued.

Such copies shall be made out on forms corresponding to the specimen in Annex 12.

Article 50

1. The certificate shall measure 210 x 297 mm. A tolerance of up to minus 5 mm or plus 8 mm in the length shall be allowed. The paper used shall be white, free of mechanical pulp, dressed for writing purposes and weigh at least 64 g/m2 or between 25 and 30 g/m2 where air-mail paper is used. It shall have a printed guilloche pattern background in sepia such as to reveal any falsification by mechanical or chemical means.

2. The application form shall be printed in the official language or in one or more of the official languages of the exporting Member State. The certificate of origin form shall be printed in one or more of the official languages of the Community or, depending on the practice and requirements of trade, in any other language.

3. Member States may reserve the right to print the certificate of origin forms or may have them printed by approved printers. In the latter case, each certificate must bear a reference to such approval. Each certificate of origin form must bear the name and address of the printer or a mark by which the printer can be identified. It shall also bear a serial number, either printed or stamped, by which it can be identified.

Article 51

The application form and the certificate of origin shall be completed in typescript or by hand in block capitals, in an identical manner, in one of the official languages of the Community or, depending on the practice and requirements of trade, in any other languages.

Article 52

Each origin certificate referred to in Article 48 shall bear a serial number by which it can be identified. The application for the certificate and all copies of the certificate itself shall bear the same number.

In addition, the competent authorities or authorized agencies of the Member States may number such documents by order of issue.

Article 53

The competent authorities of the Member States shall determine what additional particulars, if any, are to be given in the application. Such additional particulars shall be kept to a strict minimum.

Each Member State shall inform the Commission of the provisions it adopts in pursuance of the preceding paragraph. The Commission shall immediately communicate this information to the other Member States.

Article 54

The competent authorities or authorized agencies of the Member States which have issued certificates of origin shall retain the applications for a minimum of two years.

However, applications may also be retained in the form of copies thereof, provided that these have the same probative value under the law of the Member State concerned.

Subsection 2

Specific provisions relating to certificates of origin for certain agricultural products subject to special import arrangements

Article 55

Articles 56 to 65 lay down the conditions for use of certificates of origin relating to agricultural products originating in third countries for which special non-preferential import arrangements have been established, in so far as these arrangements refer to the following provisions.

(a) Certificates of origin

Article 56

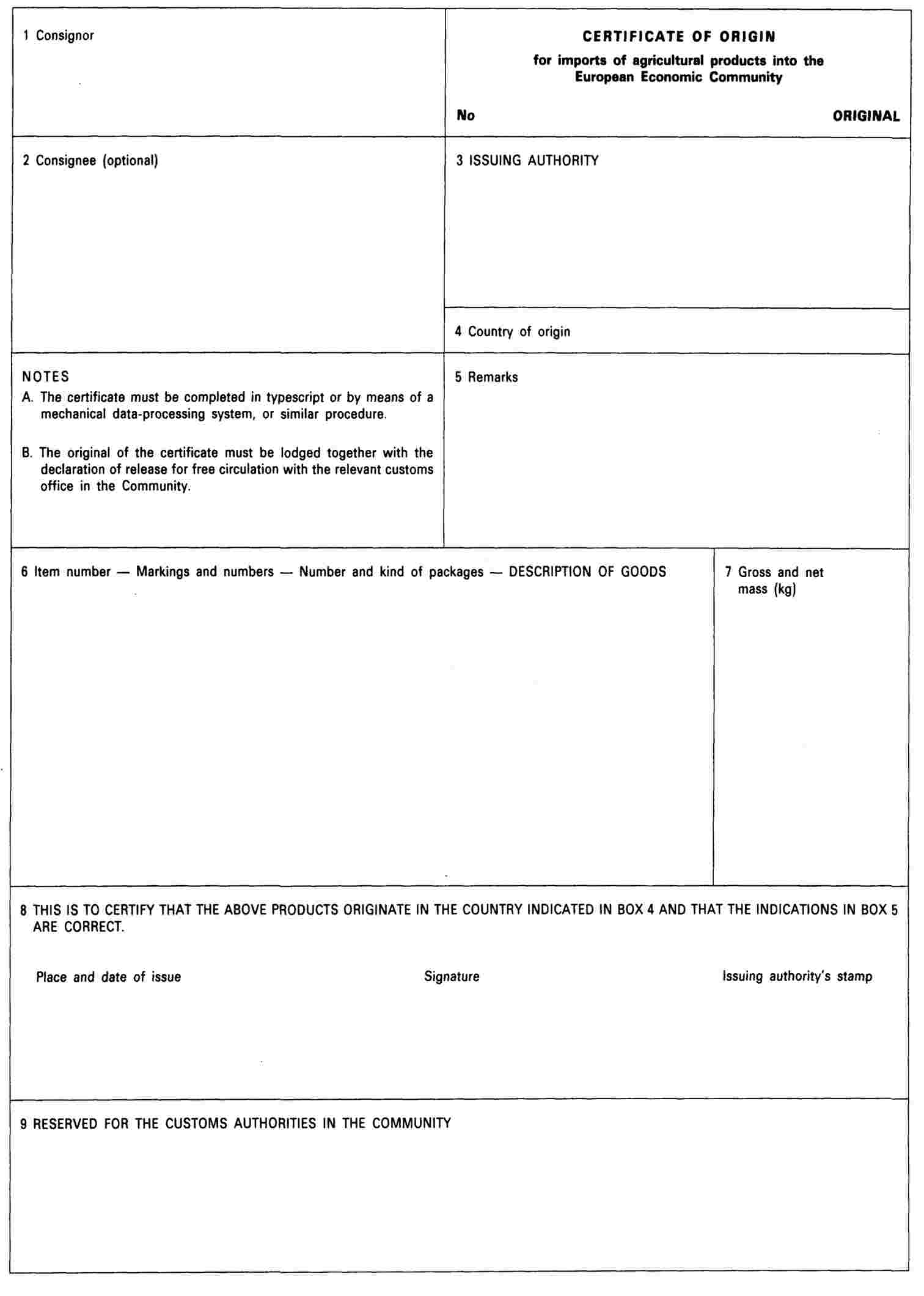

1. Certificates of origin relating to agricultural products originating in third countries for which special non-preferential import arrangements are established shall be made out on a form conforming to the specimen in Annex 13.

2. Such certificates shall be issued by the competent governmental authorities of the third countries concerned, hereinafter referred to as the issuing authorities, if the products to which the certificates relate can be considered as products originating in those countries within the meaning of the rules in force in the Community.

3. Such certificates shall also certify all necessary information provided for in the Community legislation governing the special import arrangements referred to in Article 55.

4. Without prejudice to specific provisions under the special import arrangements referred to in Article 55 the period of validity of the certificates of origin shall be ten months from the date of issue by the issuing authorities.

Article 57

1. Certificates of origin drawn up in accordance with the provisions of this subsection shall consist only of a single sheet identified by the word ‘original’ next to the title of the document.

If additional copies are necessary, they shall bear the designation ‘copy’ next to the title of the document.

2. The competent authorities in the Community shall accept as valid only the original of the certificate of origin.

Article 58

1. The certificate of origin shall measure 210 x 297 mm; a tolerance of up to plus 8 mm or minus 5 mm in the length may be allowed. The paper used shall be white, not containing mechanical pulp, and shall weigh not less than 40 g/m2. The face of the original shall have a printed yellow guilloche pattern background making any falsification by mechanical or chemical means apparent.

2. The certificates shall be printed and completed in one of the official languages of the Community.

Article 59

1. The certificate shall be completed in typescript or by means of a mechanical data-processing system, or similar procedure.

2. Entries must not be erased or overwritten. Any changes shall be made by crossing out the wrong entry and if necessary adding the correct particulars. Such changes shall be initialled by the person making them and endorsed by the issuing authorities.

Article 60

1. Box 5 of the certificates of origin issued in accordance with Articles 56 to 59 shall contain any additional particulars which may be required for the implementation of the special import arrangements to which they relate as referred to in Article 56 (3).

2. Unused spaces in boxes 5, 6 and 7 shall be struck through in such a way that nothing can be added at a later stage.

Article 61

Each certificate of origin shall bear a serial number, whether or not printed, by which it can be identified, and shall be stamped by the issuing authority and signed by the person or persons empowered to do so.

The certificate shall be issued when the products to which it relates are exported, and the issuing authority shall keep a copy of each certificate issued.

Article 62

Exceptionally, the certificates of origin referred to above may be issued after the export of the products to which they relate, where the failure to issue them at the time of such export was a result of involuntary error or omission or special circumstances.

The issuing authorities may not issue retrospectively a certificate of origin provided for in Articles 56 to 61 until they have checked that the particulars in the exporter's application correspond to those in the relevant export file.

Certificates issued retrospectively shall bear one of the following:

|

— |

expedido a posteriori, |

|

— |

udstedt efterfølgende, |

|

— |

Nachträglich ausgestellt, |

|

— |

Εκδοθέν εκ των υστέρων, |

|

— |

Issued retrospectively, |

|

— |

Délivré a posteriori, |

|

— |

rilasciato a posteriori, |

|

— |

afgegeven a posteriori, |

|

— |

emitido a posteriori, |

in the ‘Remarks’ box.

(b) Administrative cooperation

Article 63

1. Where the special import arrangements for certain agricultural products provide for the use of the certificate of origin laid down in Articles 56 to 62, the entitlement to use such arrangements shall be subject to the setting up of an administrative cooperation procedure unless specified otherwise in the arrangements concerned.

To this end the third countries concerned shall send the Commission of the European Communities:

|

— |

the names and addresses of the issuing authorities for certificates of origin together with specimens of the stamps used by the said authorities, |

|

— |

the names and addresses of the government authorities to which requests for the subsequent verification of origin certificates provided for in Article 64 below should be sent. |

The Commission shall transmit all the above information to the competent authorities of the Member States.

2. Where the third countries in question fail to send the Commission the information specified in paragraph 1, the competent authorities in the Community shall refuse access entitlement to the special import arrangements.

Article 64

1. Subsequent verification of the certificates of origin referred to in Articles 56 to 62 shall be carried out at random and whenever reasonable doubt has arisen as to the authenticity of the certificate or the accuracy of the information it contains.

For origin matters the verification shall be carried out on the initiative of the customs authorities.

For the purposes of agricultural rules, the verification may be carried out, where appropriate, by other competent authorities.

2. For the purposes of paragraph 1, the competent authorities in the Community shall return the certificate of origin or a copy thereof to the governmental authority designated by the exporting country, giving, where appropriate, the reasons of form or substance for an enquiry. If the invoice has been produced, the original or a copy thereof shall be attached to the returned certificate. The authorities shall also provide any information that has been obtained suggesting that the particulars given on the certificates are inaccurate or that the certificate is not authentic.

Should the customs authorities in the Community decide to suspend the application of the special import arrangements concerned pending the results of the verification they shall grant release of the products subject to such precautions as they consider necessary.

Article 65

1. The results of subsequent verifications shall be communicated to the competent authorities in the Community as soon as possible.

The said results must make it possible to determine whether the origin certificates remitted in the conditions laid down in Article 64 above apply to the goods actually exported and whether the latter may actually give rise to application of the special importation arrangements concerned.

2. If there is no reply within a maximum time limit of six months to requests for subsequent verification, the competent authorities in the Community shall definitively refuse to grant entitlement to the special import arrangements.

CHAPTER 2

Preferential origin

Section 1

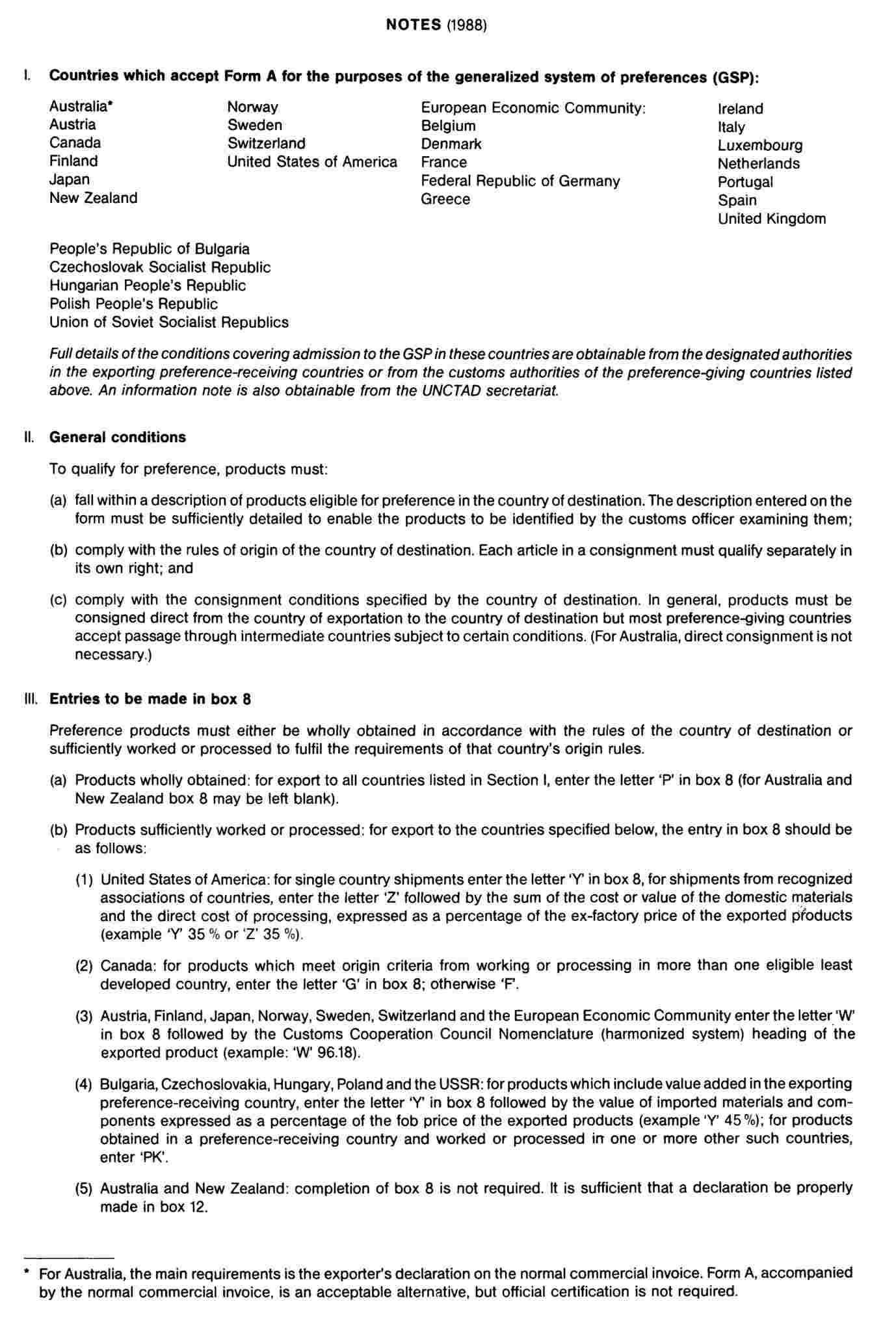

Generalized system of preferences

Subsection 1

Definition of the concept of originating products

Article 66

For the purposes of the provisions concerning generalized tariff preferences granted by the Community to certain products originating in developing countries, the following shall be considered as products originating in a country entitled to those preferences (hereinafter referred to as a ‘beneficiary country’) provided that these products have been transported direct to the Community within the meaning of Article 75:

|

(a) |

products wholly obtained in that country; |

|

(b) |

products obtained in that country in the manufacture of which products other than those referred to in (a) are used, provided that the said products have undergone sufficient working or processing within the meaning of Article 68 (1). |

Article 67

1. The following shall be considered as wholly obtained in a beneficiary country within the meaning of Article 66 (a):

|

(a) |

mineral products extracted from its soil or from its sea bed; |

|

(b) |

vegetable products harvested there; |

|

(c) |

live animals born and raised there; |

|

(d) |

products obtained from live animals there; |

|

(e) |

products obtained by hunting or fishing conducted there; |

|

(f) |

products of sea fishing and other products taken from the sea by its vessels; |

|

(g) |

products made on board its factory ships exclusively from the products referred to in (f); |

|

(h) |

used articles collected there fit only for the recovery of raw materials; |

|

(i) |

waste and scrap resulting from manufacturing operations conducted there; |

|

(j) |

products extracted from marine soil or subsoil outside its territorial waters, provided that it has sole rights to work that soil or subsoil; |

|

(k) |

products produced there exclusively from products specified in (a) to (j). |

2. The term ‘its vessels’ in paragraph 1 (f) shall apply only to vessels:

|

— |

which are registered or recorded in the beneficiary country, |

|

— |

which sail under the flag of the beneficiary country, |

|

— |

which are at least 50 % owned by nationals of the beneficiary country or by a company with its head office in that country, of which the manager or managers, chairman of the board of directors or of the supervisory board, and the majority of the members of such boards are nationals of that country and of which, in addition, in the case of partnerships or limited companies, at least half the capital belongs to that country or to public bodies or nationals of that country, |

|

— |

of which the captain and officers are all nationals of the beneficiary country, and |

|

— |

of which at least 75 % of the crew are nationals of the beneficiary country. |

3. The term ‘in a beneficiary country’ shall also cover the territorial waters of that country.

4. Vessels operating on the high seas, including factory ships on which the fish caught is worked or processed, shall be deemed to be part of the territory of the beneficiary country to which they belong, provided that they satisfy the conditions set out in paragraph 2.

Article 68

1. For the purposes of Article 66 (b), non-originating materials shall be considered to be suffiently worked or processed when the product obtained is classified in a heading different from those in which all the non-originating materials used in its manufacture are classified, subject to paragraphs 2 and 3 below.

Annex 14 contains the notes concerning products made from non-originating materials.

The expressions ‘chapters’ and ‘headings’ used in these provisions shall mean the chapters and the headings (four-digit codes) used in the nomenclature which makes up the Harmonized System.

The expression ‘classified’ shall refer to the classification of a product or material under a particular heading.

2. For a product mentioned in columns 1 and 2 of the List in Annex 15, the conditions set out in column 3 for the product concerned shall be fulfilled instead of the rule in paragraph 1.

|

(a) |

The term ‘value’ in the list in Annex 15 shall mean the customs value at the time of importation of the non-originating materials used or, if this is not known and cannot be ascertained, the first ascertainable price paid for the materials in the country concerned. Where the value of the originating materials used needs to be established, this subparagraph shall be applied mutatis mutandis. |

|

(b) |

The term ‘ex-works price’ in the list in Annex 15 shall mean the price paid for the product obtained to the manufacturer in whose undertaking the last working or processing is carried out, provided the price includes the value of all materials used in manufacture, minus any internal taxes which are, or may be, repaid when the product obtained is exported. |

3. For the purposes of Article 66 (b), the following shall in any event be considered as insufficient working or processing to confer the status of originating products, whether or not there is a change of heading:

|

(a) |

operations to ensure the preservation of products in good condition during transport and storage (ventilation, spreading out, drying, chilling, placing in salt, sulphur dioxide or other aqueous solutions, removal of damaged parts, and like operations); |

|

(b) |

simple operations consisting of removal of dust, sifting or screening, sorting, classifying, matching (including the making-up of sets of articles), washing, painting, cutting up; |

|

(c) |

|

|

(d) |

the affixing of marks, labels or other like distinguishing signs on products or their packaging; |

|

(e) |

simple mixing of products, whether or not of different kinds, where one or more components of the mixture do not meet the conditions laid down in this Title to enable them to be considered as originating products; |

|

(f) |

simple assembly of parts of products to constitute a complete product; |

|

(g) |

a combination of two or more operations specified in (a) to (f); |

|

(h) |

slaughter of animals. |

Article 69

In order to determine whether a product originates in a beneficiary country, it shall not be necessary to establish whether the power and fuel, plant and equipment, and machines and tools used to obtain such products originate in third countries or not.

Article 70

1. By way of derogation from Article 66, for the purposes of determining whether a product manufactured in a beneficiary country which is a member of a regional group originates therein within the meaning of that Article, products originating in any of the countries of that regional group and used in further manufacture in another country of the group shall be treated as if they originated in the country of further manufacture.

2. The country of origin of the final product shall be determined in accordance with Article 71.

3. Regional cumulation shall apply to three separate regional groups of GSP beneficiary countries:

|

(a) |

the Association of South-East Asian Nations (Asean); |

|

(b) |

the Central American Common Market (CACM); |

|

(c) |

the Andean Group. |

4. The expression ‘regional group’ shall be taken to mean the Asean or the CACM or the Andean group as the case may be.

Article 71

1. Products having originating status by virtue of Article 70 shall have the origin of the country of the regional group where the last working or processing was carried out provided that:

|

— |

the value added there, as defined in paragraph 3 of this Article, is greater than the highest customs value of the products used originating in any one of the other countries of the regional group, |

|

— |

the working or processing carried out there exceeds that set out in Article 68 (3) and, in the case of textile products, also those operations referred to in Annex 16. |

2. In all other cases products shall have the origin of the country of the regional group which accounts for the highest customs value of the originating products coming from other countries of the regional group.

3. ‘Value added’ means the ex-works price minus the customs value of each of the products incorporated which originated in another country of the regional group.

Article 72

1. Articles 70 and 71 shall apply only where:

|

(a) |

the rules regulating trade in the context of regional cumulation, as between the countries of the regional group, are identical to those laid down in this section; |

|

(b) |

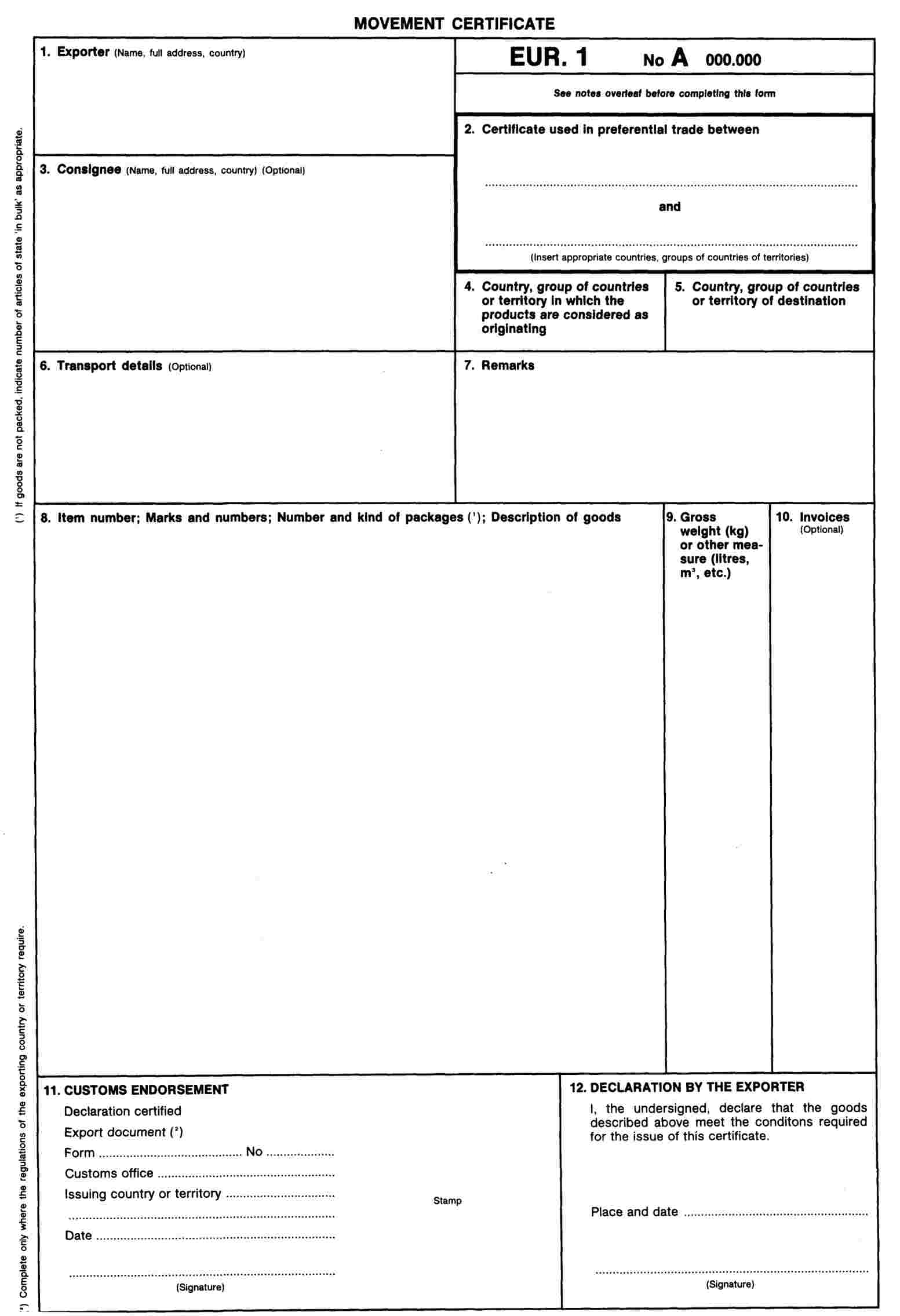

each country of the regional group has undertaken to comply or ensure compliance with the terms of this section and to provide the administrative cooperation necessary both to the Community and to the other countries of the regional group in order to ensure the correct issue of certificates of origin form A and the verification of certificates of origin form A and forms APR. This undertaking shall be transmitted to the Commission through the Secretariat of the regional group. The Secretariats are as follows:

as the case may be. |

2. The Commission shall inform the Member States when the conditions set out in paragraph 1 have been complied with in the case of each regional group.

Article 73