EUR-Lex Access to European Union law

This document is an excerpt from the EUR-Lex website

Document 32015R0207

Commission Implementing Regulation (EU) 2015/207 of 20 January 2015 laying down detailed rules implementing Regulation (EU) No 1303/2013 of the European Parliament and of the Council as regards the models for the progress report, submission of the information on a major project, the joint action plan, the implementation reports for the Investment for growth and jobs goal, the management declaration, the audit strategy, the audit opinion and the annual control report and the methodology for carrying out the cost-benefit analysis and pursuant to Regulation (EU) No 1299/2013 of the European Parliament and of the Council as regards the model for the implementation reports for the European territorial cooperation goal

Commission Implementing Regulation (EU) 2015/207 of 20 January 2015 laying down detailed rules implementing Regulation (EU) No 1303/2013 of the European Parliament and of the Council as regards the models for the progress report, submission of the information on a major project, the joint action plan, the implementation reports for the Investment for growth and jobs goal, the management declaration, the audit strategy, the audit opinion and the annual control report and the methodology for carrying out the cost-benefit analysis and pursuant to Regulation (EU) No 1299/2013 of the European Parliament and of the Council as regards the model for the implementation reports for the European territorial cooperation goal

Commission Implementing Regulation (EU) 2015/207 of 20 January 2015 laying down detailed rules implementing Regulation (EU) No 1303/2013 of the European Parliament and of the Council as regards the models for the progress report, submission of the information on a major project, the joint action plan, the implementation reports for the Investment for growth and jobs goal, the management declaration, the audit strategy, the audit opinion and the annual control report and the methodology for carrying out the cost-benefit analysis and pursuant to Regulation (EU) No 1299/2013 of the European Parliament and of the Council as regards the model for the implementation reports for the European territorial cooperation goal

OJ L 38, 13.2.2015, p. 1–122

(BG, ES, CS, DA, DE, ET, EL, EN, FR, HR, IT, LV, LT, HU, MT, NL, PL, PT, RO, SK, SL, FI, SV)

In force: This act has been changed. Current consolidated version: 13/03/2021

In force: This act has been changed. Current consolidated version: 13/03/2021

|

13.2.2015 |

EN |

Official Journal of the European Union |

L 38/1 |

COMMISSION IMPLEMENTING REGULATION (EU) 2015/207

of 20 January 2015

laying down detailed rules implementing Regulation (EU) No 1303/2013 of the European Parliament and of the Council as regards the models for the progress report, submission of the information on a major project, the joint action plan, the implementation reports for the Investment for growth and jobs goal, the management declaration, the audit strategy, the audit opinion and the annual control report and the methodology for carrying out the cost-benefit analysis and pursuant to Regulation (EU) No 1299/2013 of the European Parliament and of the Council as regards the model for the implementation reports for the European territorial cooperation goal

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Regulation (EU) No 1303/2013 of 17 December 2013 of the European Parliament and of the Council laying down common provisions on the European Regional Development Fund, the European Social Fund, the Cohesion Fund, the European Agricultural Fund for Rural Development and the European Maritime and Fisheries Fund and laying down general provisions on the European Regional Development Fund, the European Social Fund, the Cohesion Fund and the European Maritime and Fisheries Fund and repealing Council Regulation (EC) No 1083/2006 (1), and in particular Article 52(4), the second and the fifth paragraphs of Article 101, the second paragraph of Article 106, and Articles 111(5), 125(10) and 127(6), thereof,

Having regard to Regulation (EU) No 1299/2013 of 17 December 2013 of the European Parliament and of the Council on specific provisions for the support from the European Regional Development Fund to the European territorial cooperation goal (2), and in particular Article 14(5) thereof,

After consulting the Coordination Committee for the European Structural and Investment Funds,

Whereas:

|

(1) |

Commission Implementing Regulation (EU) No 288/2014 (3) lays down provisions necessary for the preparation of programmes. In order to ensure implementation of the programmes financed by the European Structural and Investment Funds (the ‘ESI Funds’), it is necessary to lay down further provisions for the application of Regulation (EU) No 1303/2013. To facilitate a comprehensive view and the access to those provisions, those provisions should be set out in one implementing act. |

|

(2) |

The model for the progress report on implementation of the Partnership Agreement should set out uniform conditions for presenting information required in each part of the progress report in order to ensure that the information provided in the progress report is consistent and comparable and can, where necessary, be aggregated. To this end and taking into account that all information exchanges between Member States and the Commission should take place electronically through a system established for that purpose, the model should also define the technical characteristics of each field, including the format of the data, the input method and the character limits. The character limits proposed for the text fields are based on the needs of the most comprehensive reports. |

|

(3) |

To comply with the requirements laid down in Regulation (EU) No 1303/2013, the model for the progress report is divided into five parts. Part I sets out the information and assessment required for all the European Structural and Investment Funds. Part II sets out information and assessment required in the progress report on the Youth Employment Initiative. The information set out in Parts III, IV and V of the model for the progress report should be provided for the European Regional Development Fund (ERDF), the European Social Fund (ESF) and the Cohesion Fund where, in accordance with the third subparagraph of Article 111(4) of Regulation (EU) No 1303/2013, Member States with no more than one operational programme per Fund have opted to include the information required by Article 50(5) of the same Regulation and the information referred to in points (a), (b), (c) and (h) of the second subparagraph of Article 111(4) of that Regulation in the progress report on implementation of the Partnership Agreement instead of in the annual implementation reports submitted in 2017 and 2019 and in the final implementation report. Where such information has already been provided in Part I or II of the progress report, it should not be repeated in Part III, IV or V, as all information should be submitted once only. |

|

(4) |

Major projects represent a substantial proportion of EU spending and are of strategic importance for achieving the EU strategy for smart, sustainable and inclusive growth. To ensure uniform application it is necessary to provide a standard format for submitting the information requested for the approval of major projects. The information specified within this model should provide sufficient assurance that the financial contribution from the ERDF and the Cohesion Fund will not result in a substantial loss of jobs in existing locations within the Union. |

|

(5) |

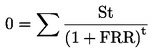

A cost-benefit analysis, including an economic analysis, a financial analysis and a risk assessment is a prerequisite for the approval of a major project. A methodology for carrying out the cost-benefit analysis should be developed based on recognised best practices and with a view to ensuring consistency, quality and rigour, both in carrying out the analysis and in its assessment by the Commission or independent experts. The cost-benefit analysis of major projects should show that the project is desirable from an economic point of view and that the contribution from the ERDF and the Cohesion Fund is needed for the project to be financially viable. |

|

(6) |

To ensure uniform conditions for the implementation of Article 106 of Regulation (EU) No 1303/2013 it is necessary to set out a format of the model for the joint action plan. Taking into account that all information exchanges between Member States and the Commission should take place electronically through a system established for that purpose, the model should also define the technical characteristics of each field, including the format of the data, the input method and the character limits. |

|

(7) |

As the reporting requirements for the Investment for growth and jobs goal and for the European territorial cooperation goal are not identical, it is necessary to set out two models for the implementation reports, one for operational programmes under the Investment for growth and jobs goal and one for cooperation programmes under the European territorial cooperation goal. Nevertheless it should be ensured that where reporting requirements are the same or similar for the two goals, the content of the models is harmonised to the extent possible. |

|

(8) |

A model for the annual and final implementation reports should set out uniform conditions for presenting the information required in each part of the reports. This will ensure that the information provided is consistent and comparable, and can, where necessary, be aggregated. To this end and taking into account that all information exchanges between Member States and the Commission should take place electronically through a system established for that purpose, the model should also define the technical characteristics of each field, including the format of the data, the input method and the character limits. The character limits proposed for the text fields are based on the needs of the most comprehensive reports. |

|

(9) |

In order to comply with the requirements of Regulation (EU) No 1303/2013 for the annual implementation report under the Investment in growth and jobs goal, whereby different types of information are to be reported depending on the year in question, the model is divided into three parts in order to set out clearly the information required for each year's report. Part A sets out the information required every year starting from 2016, Part B sets out additional information to be provided in the reports submitted in 2017 and 2019 and in the final reports and Part C sets out information to be provided in the report submitted in 2019 and in the final report, in addition to the information set out in Parts A and B. In accordance with the third subparagraph of Article 111(4) of Regulation (EU) No 1303/2013, Member States with no more than one operational programme per Fund may include certain information in the progress report instead of the annual implementation reports submitted in 2017 and 2019 and the final implementation report. It is necessary to identify this information in the model to ensure uniform application of those provisions. |

|

(10) |

Pursuant to Article 50(9) of Regulation (EU) No 1303/2013, a citizen's summary of the content of the annual and final implementation reports should be made available to the public. It should be uploaded as a separate file in the form of an annex to the annual and final implementation reports. No specific model is envisaged for the citizen's summary, thus allowing Member States to use the structure and formatting they consider most appropriate. |

|

(11) |

To harmonise standards for the preparation and presentation of the management declaration for which a managing authority is responsible pursuant to point (e) of the first subparagraph of Article 125(4) of Regulation (EU) No 1303/2013, it is necessary to set out uniform conditions for its content in the form of a standard model. |

|

(12) |

To harmonise standards for the preparation and presentation of the audit strategy, the audit opinion and the annual control report for which an audit authority is responsible pursuant to Article 127(4) and the first subparagraph of Article 127(5) of Regulation (EU) No 1303/2013, a model should be provided setting out uniform conditions for the structure, and specifying the nature and the quality of the information to be used in their preparation. |

|

(13) |

In order to allow for the prompt application of the measures provided for in this Regulation, this Regulation should enter into force on the day following that of its publication in the Official Journal of the European Union, |

HAS ADOPTED THIS REGULATION:

Article 1

Model for the progress report

The progress report on implementation of the Partnership Agreement referred to in Article 52(1) of Regulation (EU) No 1303/2013 shall be drawn up in accordance with the model set out in Annex I to this Regulation.

Article 2

Format for submission of the information on a major project

The information required for the approval of a major project, as referred to in points (a) to (i) of the first paragraph of Article 101 of Regulation (EU) No 1303/2013 shall be submitted in accordance with the format set out in Annex II to this Regulation.

Article 3

Methodology for carrying out the cost-benefit analysis

The cost-benefit analysis referred to in point (e) of the first paragraph of Article 101 of Regulation (EU) No 1303/2013 shall be carried out in accordance with the methodology set out in Annex III to this Regulation.

Article 4

Format of the model for the joint action plan

The content of the joint action plan referred to in the first paragraph of Article 106 of Regulation (EU) No 1303/2013 shall be determined in accordance with the model set out in Annex IV to this Regulation.

Article 5

Model for the implementation reports for the Investment for growth and jobs goal

The annual and final implementation reports for the Investment for growth and jobs goal, as referred to in Article 111 of Regulation (EU) No 1303/2013 shall be drawn up in accordance with the model set out in Annex V to this Regulation.

Article 6

Model for the management declaration

The management declaration referred to in point (e) of the first subparagraph of Article 125(4) of Regulation (EU) No 1303/2013 shall be submitted for each operational programme in accordance with the model set out in Annex VI to this Regulation.

Article 7

Models for the audit strategy, the audit opinion and the annual control report

1. The audit strategy referred to in Article 127(4) of Regulation (EU) No 1303/2013 shall be established in accordance with the model set out in in Annex VII to this Regulation.

2. The audit opinion referred to in point (a) of the first subparagraph of Article 127(5) of Regulation (EU) No 1303/2013 shall be drawn up in accordance with the model set out in Annex VIII to this Regulation.

3. The annual control report referred to in point (b) of the first subparagraph of Article 127(5) of Regulation (EU) No 1303/2013 shall be drawn up in accordance with the model set out in Annex IX to this Regulation.

Article 8

Model for the implementation reports for the European territorial cooperation goal

The annual and final implementation reports for the European territorial cooperation goal, as referred to in Article 14 of Regulation (EU) No 1299/2013 shall be drawn up in accordance with the model set out in Annex X to this Regulation.

Article 9

Entry into force

This Regulation shall enter into force on the day following its publication in the Official Journal of the European Union.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 20 January 2015.

For the Commission

The President

Jean-Claude JUNCKER

(1) OJ L 347, 20.12.2013, p. 320.

(2) OJ L 347, 20.12.2013, p. 259.

(3) Commission Implementing Regulation (EU) No 288/2014 of 25 February 2014 laying down rules pursuant to Regulation (EU) No 1303/2013 of the European Parliament and of the Council laying down common provisions on the European Regional Development Fund, the European Social Fund, the Cohesion Fund, the European Agricultural Fund for Rural Development and the European Maritime and Fisheries Fund and laying down general provisions on the European Regional Development Fund, the European Social Fund, the Cohesion Fund and the European Maritime and Fisheries Fund with regard to the model for operational programmes under the Investment for growth and jobs goal and pursuant to Regulation (EU) No 1299/2013 of the European Parliament and of the Council on specific provisions for the support from the European Regional Development Fund to the European territorial cooperation goal with regard to the model for cooperation programmes under the European territorial cooperation goal (OJ L 87, 22.3.2014, p. 1).

ANNEX I

MODEL FOR THE PROGRESS REPORT

PART I

Information and assessment required for all the European Structural and Investment Funds (ESI Funds)

1. Changes in the development needs in the Member State since the adoption of the Partnership Agreement (Article 52(2)(a) of Regulation (EU) No 1303/2013 of the European Parliament and of the Council (1) )

|

(a) |

General description and assessment of the changes in the development needs, including a description of changes in the development needs identified by new relevant country-specific recommendations adopted in accordance with Articles 121(2) and 148(4) of the Treaty. |

|

(b) |

Other elements, where relevant. |

2. Progress towards achievement of the Union strategy for smart, sustainable and inclusive growth, as well as of the Fund-specific missions through the contribution of the ESI Funds to the thematic objectives selected, and in particular in respect to the milestones set out in the performance framework for each programme, and to the support used for climate change objectives (Article 52(2)(b) of Regulation (EU) No 1303/2013)

|

(a) |

A description and assessment of the progress made in achieving the national Europe 2020 targets (3) and of the contribution of the ESI Funds to that end, with reference to the milestones set out in the performance framework, and to the support used for climate change objectives, where appropriate. |

|

(b) |

A description and assessment, with reference to the milestones set out in the performance framework, and to the support used for climate change objectives, where appropriate, of how the ESI Funds have contributed to delivering on the thematic objectives and of the progress made in achieving the expected main results for each of the thematic objectives as set out in the Partnership Agreement, including where appropriate, a description of the contribution of the ESI Funds in achieving economic, social and territorial cohesion, with reference to the milestones set out in the performance framework for each programme. |

|

(c) |

Where applicable, a description of the contribution of the ESI Funds to new relevant country-specific recommendations. |

|

(d) |

Where applicable, a description of how changes in the development needs have been addressed by the ESI Funds. |

|

(e) |

For the 2019 report only: a summary analysis of the data in Table 2 including an assessment of the reasons for the failure to achieve the milestones and of the measures that will be taken to address them. |

|

(f) |

Other elements, where relevant. |

Table 1

Support used for climate change objectives

|

Fund |

|

|

Percentage of support used compared to the Partnership Agreement (% B/A) |

||||

|

ERDF |

<type='N' input='M'> |

<type='N' input='M'> |

<type='P' input='G'> |

||||

|

Cohesion Fund |

<type='N' input='M'> |

<type='N' input='M'> |

<type='P' input='G'> |

||||

|

ESF (5) |

<type='N' input='M'> |

<type='N' input='M'> |

<type='P' input='G'> |

||||

|

EAFRD |

<type='N' input='M'> |

<type='N' input='M'> |

<type='P' input='G'> |

||||

|

EMFF |

<type='N' input='M'> |

<type='N' input='M'> |

<type='P' input='G'> |

||||

|

TOTAL |

<type='N' input='M'> |

<type='N' input='M'> |

<type='P' input='G'> |

Table 2

For 2019 report only — Achievement of milestones based on the assessment of the Member State

|

Programme |

Priority |

Fund (6) |

Category (7) of region |

Thematic (7) objective |

Achievement of milestones (yes/no) |

Union support |

|

<type='S' input='G'> |

<type='S' input='G'> |

<type='S' input='G'> |

<type='S' input='G'> |

<type='S' input='G'> |

<type='C' input='M'> |

<type='N' input='M'> |

|

|

|

|

|

|

|

|

3. For 2017 report only — Actions taken to fulfil the ex ante conditionalities set out in the Partnership Agreement (Article 52(2)(c) of Regulation (EU) No 1303/2013)

Where appropriate, general information and assessment whether the actions taken to fulfil the applicable ex ante conditionalities set out in the Partnership Agreement not fulfilled at the date of adoption of the Partnership Agreement have been implemented in accordance with the timetable established.

|

Applicable general ex ante conditionalities which were completely unfulfilled or partially fulfilled |

Criteria not fulfilled |

Action taken |

Deadline (date) |

Bodies responsible for fulfilment |

Action completed by the deadline (Y/N) |

Criteria fulfilled (Y/N) |

Expected date for full implementation of remaining actions, if applicable |

Commentary (for each action) |

|

<type='S' maxlength=500 input='G'> |

<type='S' maxlength=500 input='G'> |

<type='S' maxlength=1000 input='G'> |

<type='D' input='G'> |

<type='S' maxlength=500 input='G'> |

<type='C' input='M'> |

<type='C' input='M'> |

<type='C' input='M'> |

<type='S' maxlength=2000 input='M'> |

|

|

|

Action 1 |

|

|

|

|

|

|

|

|

Action 2 |

|

|

|

|

|

|

|

Applicable thematic ex ante conditionalities which were completely unfulfilled or partially fulfilled |

Criteria not fulfilled |

Action taken |

Deadline (date) |

Bodies responsible for fulfilment |

Action completed by the deadline (Y/N) |

Criteria fulfilled (Y/N) |

Expected date for full implementation of remaining actions, if applicable |

Commentary (for each action) |

|

<type='S' maxlength=500 input='G'> |

<type='S' maxlength=500 input='G'> |

<type='S' maxlength=1000 input='G'> |

<type='D' input='G'> |

<type='S' maxlength=500 input='G'> |

<type='C' input='M'> |

<type='C' input='M'> |

<type='C' input='M'> |

<type='S' maxlength=2000 input='M'> |

|

|

|

Action 1 |

|

|

|

|

|

|

|

|

Action 2 |

|

|

|

|

|

|

4. Implementation of mechanisms to ensure coordination between the ESI Funds and other Union and national funding instruments and with the European Investment Bank (EIB) (Article 52(2)(d) of Regulation (EU) No 1303/2013)

|

(a) |

An assessment of the implementation of the coordination mechanisms laid down in the Partnership Agreement and, if applicable, of any problems encountered in their implementation. |

|

(b) |

Where applicable, a description of adjusted and new coordination mechanisms. |

|

(c) |

Other elements, where relevant. |

5. Implementation of the integrated approach to territorial development, or a summary of the implementation of the integrated approaches that are based on the programmes, including progress towards achievement of priority areas established for cooperation (Article 52(2)(e) of Regulation (EU) No 1303/2013)

|

(a) |

General commentary and assessment.

<type='S' maxlength=14000 input='M'>

|

|

(b) |

In relation to Article 15(2)(a)(i) of Regulation (EU) No 1303/2013 — Overview of implementation of Community-led local development.

<type='S' maxlength=7000 input='M'>

|

|

(c) |

In relation to Article 15(2)(a)(i) of Regulation (EU) No 1303/2013 — Overview of implementation of integrated territorial investments, where appropriate.

<type='S' maxlength=7000 input='M'>

|

|

(d) |

In relation to Article 15(2)(a)(ii) of Regulation (EU) No 1303/2013, where appropriate, overview of implementation of macro-regional strategies and sea basin strategies.

<type='S' maxlength=7000 input='M'>

|

|

(e) |

In relation to Article 15(2)(a)(iii) of Regulation (EU) No 1303/2013, where appropriate, overview of the implementation of the integrated approach to address needs of geographical area most affected by poverty or of target groups at highest risk of discrimination or social exclusion.

<type='S' maxlength=7000 input='M'>

|

|

(f) |

In relation to Article 15(2)(a)(iv) of Regulation (EU) No 1303/2013, where appropriate, overview of implementation to address demographic challenges of areas which suffer from severe and permanent natural or demographic handicaps.

<type='S' maxlength=7000 input='M'>

|

6. Where appropriate, actions taken to reinforce the capacity of the Member State authorities and beneficiaries to administer and use the ESI Funds (Article 52(2)(f) of Regulation (EU) No 1303/2013)

7. Actions taken and progress achieved towards a reduction in the administrative burden for beneficiaries (Article 52(2)(g) of Regulation (EU) No 1303/2013)

8. The role of the partners referred to in Article 5 of Regulation (EU) No 1303/2013 in the implementation of the Partnership Agreement (Article 52(2)(h) of Regulation (EU) No 1303/2013)

|

(a) |

A description and assessment of the role of the selected partners in the preparation of the progress report, with reference to the Partnership Agreement. |

|

(b) |

A description and assessment of the involvement of the selected partners in the implementation of programmes, including participation in the monitoring committees of the programmes. |

|

(c) |

Other elements, where relevant. |

9. A summary of the actions taken in relation to the application of horizontal principles and policy objectives for the implementation of the ESI Funds (Article 52(2)(i) of Regulation (EU) No 1303/2013)

|

(a) |

A summary of the actions taken in relation to the application of horizontal principles to ensure the promotion and monitoring of these principles in the different types of programme, with reference to the content of the Partnership Agreement:

|

|

(b) |

A summary of arrangements implemented to ensure mainstreaming of horizontal policy objectives, with reference to the content of the Partnership Agreement. |

|

(c) |

Other elements, where relevant. |

PART II

Information and assessment on the Youth Employment Initiative (for the purposes of Article 19(5) of Regulation (EU) No 1304/2013 of the European Parliament and of the Council (8) )

10. Implementation of the Youth Employment Initiative (YEI) (Article 19(5) of Regulation (EU) No 1304/2013)

|

(a) |

A general description of the implementation of the YEI, including how the YEI has contributed to the implementation of the Youth Guarantee and also including concrete examples of interventions supported in the framework of YEI. |

|

(b) |

A description of any problems encountered in the implementation of the YEI and measures taken to overcome these problems. |

|

(c) |

An assessment of the implementation of the YEI with regard to the objectives and targets set and to the contribution to implement the Youth Guarantee. |

PART III

Information and assessment to be provided for cohesion policy if use is made of the option provided by Article 111(4) of Regulation (EU) No 1303/2013 to include certain elements of the annual implementation reports in the progress report — to be provided in 2017 and 2019

11. Additional information and assessment which may be added depending on the content and objectives of the operational programme (Article 111(4) of Regulation (EU) No 1303/2013, included where necessary to complement the other sections of the progress report)

11.1 Progress in implementation of the integrated approach to territorial development, including development of regions facing demographic challenges and permanent or natural handicaps, sustainable urban development, and community led local development under the operational programme.

11.2 Progress in implementation of actions to reinforce the capacity of Member State authorities and beneficiaries to administer and use the Funds.

11.3 Progress in implementation of any interregional and transnational actions.

11.4 Progress in the implementation of measures to address the specific needs of geographical areas most affected by poverty or of target groups at highest risk of poverty discrimination or social exclusion, with special regard to marginalised communities and persons with disabilities, long term unemployment and young people not in employment including, where appropriate, the financial resources used.

PART IV

Information and assessment on the implementation of the YEI in case use is made of the option provided by Article 111(4) of Regulation (EU) of No 1303/2013 — to be provided in 2019 (9)

12. Implementation of the YEI (Article 19(4) of Regulation (EU) No 1304/2013)

|

(a) |

A description of the main findings of the evaluation referred to in Article 19(6) of Regulation (EU) 1304/2013 assessing the effectiveness, efficiency and impact of the joint support from the ESF and the specific allocation to the YEI, including for implementing the Youth Guarantee. |

|

(b) |

A description and assessment of the quality of employment offers received by YEI participants, including the disadvantaged, those from marginalised communities and those leaving education without qualifications. |

|

(c) |

A description and assessment of progress of YEI participants in continuing education, finding sustainable and decent jobs or moving into apprenticeship or quality traineeship. |

PART V

Information and assessment to be provided for cohesion policy if use is made of the option provided by Article 111(4) of Regulation (EU) No 1303/2013 (included where necessary to complement the other sections of the progress report) — to be provided in 2019

13. Programme contribution to achieving the Union strategy for smart, sustainable and inclusive growth (Article 50(5) of Regulation (EU) No 1303/2013)

Information on and assessment of the programme contribution to achieving the Union strategy for smart, sustainable and inclusive growth.

(1) Regulation (EU) No 1303/2013 of the European Parliament and of the Council laying down common provisions on the European Regional Development Fund, the European Social Fund, the Cohesion Fund, the European Agricultural Fund for Rural Development and the European Maritime and Fisheries Fund and laying down general provisions on the European Regional Development Fund, the European Social Fund, the Cohesion Fund and the European Maritime and Fisheries Fund and repealing Council Regulation (EC) No 1083/2006 (OJ L 347, 20.12.2013, p. 320).

(2) Legend for the characteristics of fields:

|

|

type: N = Number, D = Date, S = String, C = Checkbox, P = Percentage |

|

|

input: M = Manual, S = Selection, G = Generated by system |

|

|

maxlength = Maximum number of characters including spaces |

(3) For EAFRD, the description and assessment shall be made towards the targets set by Union priority, as the contribution to Europe 2020 strategy is structured around the six Union priorities

(4) Cumulative, in EUR, based on eligible expenditure declared to the Commission with the cut-off date of 31 December of the previous year.

(5) This also includes the YEI resources (YEI specific allocation and matching ESF support).

(6) For the purpose of this table, the YEI (specific allocation and matching ESF support) is considered as a fund.

(7) Not applicable to EAFRD and EMFF.

(8) Regulation (EU) No 1304/2013 of the European Parliament and of the Council of 17 December 2013 on the European Social Fund and repealing Council Regulation (EC) No 1081/2006 (OJ L 347, 20.12.2013, p. 470). This part is only to be filled out by Member States with YEI eligible regions in accordance with Article 16 of this Regulation.

(9) This part is only to be filled out by Member States with YEI eligible regions in accordance with Article 16 of Regulation (EU) No 1304/2013.

ANNEX II

Format for submission of the information on a major project

MAJOR PROJECT

EUROPEAN REGIONAL DEVELOPMENT FUND / COHESION FUND

INFRASTRUCTURE/PRODUCTIVE INVESTMENT

|

Project title |

<type='S' maxlength=255 input='M'> |

|

CCI |

<type='S' maxlength=15 input='S'> |

A. THE BODY RESPONSIBLE FOR IMPLEMENTATION OF THE MAJOR PROJECT, AND ITS CAPACITY

A.1. Authority responsible for project application (managing authority or intermediate body)

|

A.1.1 |

Name: |

<type='S' maxlength='200' input='M'> (1) |

|

A.1.2 |

Address: |

<type='S' maxlength='400' input='M'> |

|

A.1.3 |

Name of contact person |

<type='S' maxlength='200' input='M'> |

|

A.1.4 |

Position of contact person |

<type='S' maxlength='200' input='M'> |

|

A.1.5 |

Telephone: |

<type='N' input='M'> |

|

A.1.6 |

E-mail: |

<type='S' maxlength='100' input='M'> |

A.2. Body/-ies (2) responsible for project implementation (beneficiary/-ies (3) )

|

A.2.1 |

Name: |

<type='S' maxlength='200' input='M'> |

|

A.2.2 |

Address: |

<type='S' maxlength='400' input='M'> |

|

A.2.3 |

Name of contact person |

<type='S' maxlength='200' input='M'> |

|

A.2.4 |

Position of contact person |

<type='S' maxlength='200' input='M'> |

|

A.2.5 |

Telephone: |

<type='N' input='M'> |

|

A.2.6 |

E-mail: |

<type='S' maxlength='100' input='M'> |

A.3. Details of the undertaking (to be filled in for productive investments only)

A.3.1 Name of the undertaking:

A.3.2 Is the undertaking an SME (4) ? <type='C' input=M>

|

Yes |

☐ |

No |

☐ |

A.3.3 Turnover (value in million EUR and year):

|

A.3.3.1 |

Value in million EUR <type='N' input='M'> |

|

A.3.3.2 |

Year <type='N' input='M'> |

A.3.4 Total number of persons employed (value and year):

|

A.3.4.1 |

Number of persons employed <type='N' input='M'> |

|

A.3.4.2 |

Year <type='N' input='M'> |

A.3.5 Group structure:

Are 25 % or more of the capital or voting rights of the undertaking owned by one enterprise or a group of enterprises falling outside the definition of an SME? <type='C' input='M'>

|

Yes |

☐ |

No |

☐ |

Indicate the name and describe the group structure

A.4. Capacity of the body responsible for project implementation by referring to its technical, legal, financial and administrative capacity (5)

A.4.1 Technical capacity (at minimum please give overview of expertise required for project implementation and indicate the number of staff with such expertise available within the organisation and allocated to the project)

A.4.2 Legal capacity (as minimum information, indicate the legal status of the beneficiary allowing to implement the project, and its capacity to undertake legal action, if necessary).

A.4.3 Financial capacity (at minimum please confirm financial standing of the body responsible for project implementation to demonstrate that it is able to guarantee the liquidity for adequate funding to the project to ensure its successful implementation and future operation in addition to the other activities of the body)

A.4.4 Administrative capacity (as minimum information, please, indicate the EU-funded and/or comparable projects carried out in the last ten years and, in absence of such examples, indicate if technical assistance needs have been considered; please refer to institutional arrangements such as the existence of Project Implementation Unit (PIU) capable to implement and operate the project and, if possible, include the proposed organisational chart for project implementation and operation).

A.5 Provide information on all relevant institutional arrangements with third parties for the implementation of the project and the successful operation of the resulting facilities that have been planned and possibly concluded

A.5.1 Give details of how the infrastructure will be managed after the project is completed (i.e. name of the operator; selection methods — public management or concession; type of contract, etc.).

B. A DESCRIPTION OF THE INVESTMENT AND ITS LOCATION; EXPLANATION AS TO HOW IT IS CONSISTENT WITH THE RELEVANT PRIORITY AXES OF THE OPERATIONAL PROGRAMME(S) CONCERNED, AND ITS EXPECTED CONTRIBUTION TO ACHIEVING THE SPECIFIC OBJECTIVES OF THOSE PRIORITY AXES AND THE EXPECTED CONTRIBUTION TO SOCIO-ECONOMIC DEVELOPMENT

B.1 Operational programme(s) and priority axes

|

CCI of OP |

Priority axis of OP |

|

OP1<type='S' input='S'> |

Priority axis of OP 1<type='S' input='S'> |

|

OP1<type='S' input='S'> |

Priority axis of OP 1<type='S' input='S'> |

|

OP2<type='S' input='S'> |

Priority axis of OP 2<type='S' input='S'> |

|

OP2<type='S' input='S'> |

Priority axis of OP 2<type='S' input='S'> |

B.1.1 Is the project contained in the list of major projects in the operational programme(s)? (6) <type='C' input='M'>

|

Yes |

☐ |

No |

☐ |

B.2. Categorisation of project activity (7)

|

|

Code |

Amount |

Percentage |

||

|

<type='N' input='S'> |

<type='N' input='M'> |

<type='P' input='G'> |

||

|

<type='N' input='S'> |

<type='N' input='M'> |

<type='P' input='G'> |

|||

|

<type='N' input='S'> |

<type='N' input='M'> |

<type='P' input='G'> |

|||

|

<type='N' input='S'> |

<type='N' input='M'> |

<type='P' input='G'> |

|||

|

<type='N' input='S'> |

<type='N' input='M'> |

<type='P' input='G'> |

|||

|

<type='N' input='S'> |

<type='N' input='M'> |

<type='P' input='G'> |

||

|

<type='N' input='S'> |

<type='N' input='M'> |

<type='P' input='G'> |

|||

|

<type='N' input='S'> |

<type='N' input='M'> |

<type='P' input='G'> |

||

|

<type='N' input='S'> |

<type='N' input='M'> |

<type='P' input='G'> |

|||

|

<type='N' input='S'> |

<type='N' input='M'> |

<type='P' input='G'> |

||

|

<type='N' input='S'> |

<type='N' input='M'> |

<type='P' input='G'> |

||

|

<type='N' input='S'> |

<type='N' input='M'> |

<type='P' input='G'> |

||

|

<type='N' input='S'> |

<type='N' input='M'> |

<type='P' input='G'> |

|||

|

<type='N' input='S'> |

<type='N' input='M'> |

<type='P' input='G'> |

||

|

<type='N' input='S'> |

<type='N' input='M'> |

<type='P' input='G'> |

|||

|

<type='N' input='S'> |

<type='N' input='M'> |

<type='P' input='G'> |

||

|

<type='N' input='S'> |

<type='N' input='M'> |

<type='P' input='G'> |

B.3. Project description

B.3.1 Please provide a concise (max. 2 pages) description of the project (presenting its aim, existing situation, issues it will address, facilities to be constructed, etc.), a map identifying the project area (12) , geo-referenced data (13) and the main project components with their individual total cost estimates (without activity cost breakdown).

In case of productive investments a detailed technical description must also be provided including: the work involved specifying its main characteristics, the establishment, main activities and main elements of the financial structure of the enterprise, main aspects of the investment, the description of the production technology and equipment and the description of the products.

B.3.2 Is this project a phase of a major project (14) ? <type='C' input='M'>

|

Yes |

☐ |

No |

☐ |

B.3.3 If the project is a phase of an overall project, provide a concise description of the proposed phases of implementation and explain how they are technically and financially independent. Explain what criteria have been used to determine the division of the project into phases. Please provide a share (percentage) of the overall project which this phase covers. If the project is co-financed by more than one Operational Programme, indicate which parts fall under which Operational Programme and their pro-rata allocation.

B.3.4 Have the Commission previously approved any part of this major project? <type='C' input=M>

|

Yes |

☐ |

No |

☐ |

If yes, please provide the CCI number of the major project approved.

If this project is a part of the major project phased for which the first phase was carried in the 2007-2013, please provide a description of the physical and financial objectives of the previous phase, including a description of the implementation of the first phase and confirm that it is or will be ready to be used for its purpose.

B.3.5 Does the project form part of a Trans-European Network agreed at Union level? <type='C' input='M'>

|

Yes |

☐ |

No |

☐ |

If yes, please give details and give reference to the relevant EU legislation (15).

B.3.6 In case of productive investments is this investment:

|

(i) |

covered under Article 3(1)(a) of Regulation (EU) No 1301/2013 of the European Parliament and of the Council (16)? <type='C' input='M'>

If yes, please, explain how it contributes to creating and safeguarding jobs (notably for young people)

< type='S' maxlength='1750' input='M'>

|

|

(ii) |

covered under Article 3(1)(b) of Regulation (EU) No 1301/2013? <type='C' input='M'>

If yes, please, explain how it contributes to the investment priorities set out in Article 5(1) and (4) Regulation (EU) No 1301/2013, and, if that investment involves cooperation between large enterprises and SMEs, how it contributes to investment priorities in Article 5(2) of that Regulation.

< type='S' maxlength='1750' input='M'>

|

B.4. Project objectives and its consistency with the relevant priority axes of the operational programme or operational programmes concerned, and its expected contribution to achieving the specific objectives and results of those priority axes and the expected contribution to socio-economic development of the area covered by the operational programme.

B.4.1 What are the main project objectives? Please list them here and give short explanation

B.4.2 Please give details on the project's consistency with the relevant priority axes of the operational programme or operational programmes and its expected contribution to achieving the result indicators under the specific objectives of those priority axes

B.4.3 Please explain how the project will contribute to socio-economic development of the area covered by the operational programme

B.4.4 Please explain what measures have been planned/taken by the beneficiary to ensure optimal utilisation of the infrastructure in the operation phase

C. TOTAL COST AND TOTAL ELIGIBLE COST

C.1. Please complete table below taking into account the following

|

(1) |

Ineligible costs comprise (i) expenditure outside the eligibility period, (ii) expenditure ineligible under applicable EU and national rules, (iii) other expenditure not presented for co-financing. NB: The starting date for eligibility of expenditure is the date of submission of the operational programme to the Commission or 1 January 2014, whichever is the earlier (17). |

|

(2) |

Contingencies should not exceed 10 % of total cost net of contingencies. These contingencies may be included in the total eligible costs used to calculate the planned contribution of the funds. |

|

(3) |

A price adjustment may be included, where relevant, to cover expected inflation where the eligible cost values are in constant prices. |

|

(4) |

Recoverable VAT is ineligible. Where VAT is considered eligible, please give reasons. |

|

(5) |

Total cost must include all costs incurred for the project, from planning to supervision and must include VAT regardless of whether it is recoverable or not. |

|

(6) |

The purchase of land not built on and land built on in the amount exceeding 10 % of the total eligible expenditure for the operation concerned in accordance with Article 69(3)(b) of Regulation (EU) No 1303/2013. In exceptional and duly justified cases, a higher percentage may be permitted for operations concerning environmental conservation. |

|

(7) |

Total eligible cost before taking into account of the requirements set out in Article 61 of Regulation (EU) No 1303/2013. |

|

|

EUR |

Total cost (A) |

Ineligible costs (1) (B) |

Eligible costs (C) = (A) – (B) |

Percentage of total eligible costs |

|

|

|

Input |

Input |

Calculated |

Calculated |

|

1 |

Planning/design fees |

<type='N' input='M'> |

<type='N' input='M'> |

<type='N' input='G'> |

<type='P' input='G'> |

|

2 |

Land purchase |

<type='N' input='M'> |

<type='N' input='M'> (6) |

<type='N' input='G'> |

<type='P' input='G'> |

|

3 |

Building and construction |

<type='N' input='M'> |

<type='N' input='M'> |

<type='N' input='G'> |

<type='P' input='G'> |

|

4 |

Plant and machinery or equipment |

<type='N' input='M'> |

<type='N' input='M'> |

<type='N' input='G'> |

<type='P' input='G'> |

|

5 |

Contingencies (2) |

<type='N' input='M'> |

<type='N' input='M'> |

<type='N' input='G'> |

<type='P' input='G'> |

|

6 |

Price adjustment (if applicable) (3) |

<type='N' input='M'> |

<type='N' input='M'> |

<type='N' input='G'> |

<type='P' input='G'> |

|

7 |

Publicity |

<type='N' input='M'> |

<type='N' input='M'> |

<type='N' input='G'> |

<type='P' input='G'> |

|

8 |

Supervision during construction implementation |

<type='N' input='M'> |

<type='N' input='M'> |

<type='N' input='G'> |

<type='P' input='G'> |

|

9 |

Technical assistance |

<type='N' input='M'> |

<type='N' input='M'> |

<type='N' input='G'> |

<type='P' input='G'> |

|

10 |

Sub-TOTAL |

<type='N' input='G'> |

<type='N' input='G'> |

<type='N' input='G'> |

<type='P' input='G'> |

|

11 |

(VAT (4)) |

<type='N' input='M'> |

<type='N' input='M'> |

<type='N' input='G'> |

<type='P' input='G'> |

|

12 |

TOTAL |

<type='N' input='G'> (5) |

<type='N' input='G'> |

<type='N' input='G'> (7) |

<type='P' input='G'> |

Please provide the exchange rate and the reference (where applicable)

If you have any comments regarding any of the items above (e.g. no contingencies envisaged, eligible VAT), please note them below.

C.2. Verification of compliance with State aid rules

Do you consider that this project involves the granting of State aid? <type='C' input='M'>

|

Yes |

☐ |

No |

☐ |

If yes, please fill in the table below (18):

|

|

Amount of aid (EUR) in GGE (19) |

Total amount of eligible cost (EUR) (20) |

Aid intensity (in %) |

State aid number/registry number for block-exempted aid |

|

Approved aid scheme or approved individual aid |

<type='N' input='M'> |

<type='N' input='M'> |

<type='P' input='M'> |

<type='N' input='M'> |

|

Aid falling under a block exemption regulation |

<type='N' input='M'> |

<type='N' input='M'> |

<type='P' input='M'> |

<type='N' input='M'> |

|

Aid in line with the SGEI decision (21) or the regulation on public land passenger traffic (22) |

<type='N' input='M'> |

<type='N' input='M'> |

<type='P' input='M'> |

<type='N' input='M'> |

|

Total aid granted |

<type='N' input='G'> |

Not applicable |

Not applicable |

Not applicable |

If no, please explain in detail the basis for establishing that the project does not involve state aid (23). Please provide this information for all groups of potential State aid recipients, for example, in case of infrastructures, for the owner, the constructors, the operator and for the users of an infrastructure. If applicable, please indicate whether the reason why you consider that the project does not involve State aid is that (i) the project does not concern any economic activity (including activities in the public remit) or that (ii) the recipient(s) of support enjoy a legal monopoly for the relevant activities and are not active in any other liberalised sector (or will keep separate accounts in case the recipient(s) are active in additional sectors).

C.3. Total eligible cost calculation

The total eligible cost amount after taking into account of the requirements set out in Article 61 of Regulation (EU) No 1303/2013 should be used to verify if the project has reached the threshold of a major project in accordance with Article 100 of Regulation (EU) No 1303/2013.

Please choose the relevant option and complete the information as required. For non-revenue-generating operations please choose the method in Article 61(3) (b) of Regulation (EU) No 1303/2013 and set pro-rata application of discounted net revenue at 100 %.

|

Method of calculation of the potential net revenue |

Method used as chosen by the managing authority for the relevant sector, sub-sector or type of operation (24) (Check one box only) |

|

Calculation of the discounted net revenue |

<type='C' input='M'> |

|

Flat rate method |

<type='C' input='M'> |

|

Decreased co-financing rate method |

<type='C' input='M'> |

Calculation of the discounted net revenue (Article 61(3)(b) of Regulation (EU) No 1303/2013):

|

|

|

Value |

|

1. |

Total eligible cost before taking into account of the requirements set out in Article 61 of Regulation (EU) No 1303/2013 (in EUR, not discounted) (Section C.1.12(C)) |

<type='N' input='G'> |

|

2. |

Pro-rata application of discounted net revenue (%) (if applicable) = (E.1.2.9) |

<type='N' input='M'> |

|

3. |

Total eligible cost after taking into account of the requirements set out in Article 61 of Regulation (EU) No 1303/2013 (in EUR, not discounted) = (1) * (2) The maximum public contribution must respect the State aid rules and the amount of total aid granted reported above (if applicable) |

<type='N' input='M'> |

Flat rate method or decreased co-financing rate method (Article 61(3)(a) and Article 61(5) of Regulation (EU) No 1303/2013):

|

|

|

Value |

|

1. |

Total eligible cost before taking into account of the requirements set out in Article 61 of Regulation (EU) No 1303/2013 (in EUR, not discounted) (Section C.1.12(C)) |

<type='N' input='G'> |

|

2. |

Net revenue flat rate as defined in Annex V to Regulation (EU) No 1303/2013 or delegated acts (FR) (%) |

<type='N' input='M'> |

|

3. |

Total eligible cost after taking into account of the requirements set out in Article 61 of Regulation (EU) No 1303/2013 (in EUR, not discounted) = (1) × (1 – FR) (25) The maximum public contribution must respect the state aid rules and the amount of total aid granted reported above (if applicable) |

<type='N' input='M'> |

D. FEASIBILITY STUDIES CARRIED OUT, INCLUDING OPTION ANALYSIS, AND THE RESULTS

D.1. Demand analysis

Please provide a summary of the demand analysis, including the predicted demand growth rate, in order to demonstrate the demand for the project, in accordance with the approach as set out in Annex III (Methodology for carrying out the cost-benefit analysis) to this Regulation. At the minimum the following information should be included:

|

(i) |

methodology for projections; |

|

(ii) |

assumptions and baselines (e.g. traffic in the past, future assumed traffic without the project); |

|

(iii) |

projections for selected options, if applicable; |

|

(iv) |

supply side aspects including the analysis of existing supply and expected (infrastructure) developments; |

|

(v) |

network effect (if any). |

In case of productive investments describe the target markets and a summary of the demand analysis including the demand growth rate, broken down, where appropriate, by Member State and, separately, by third countries considered as a whole.

D.2. Option analysis

D.2.1 Please outline the alternative options considered in feasibility studies (max. 2-3 pages) in accordance with the approach as set out in Annex III (Methodology for carrying out the cost-benefit analysis) to this Regulation. At least the following information should be included

|

(i) |

The total investment cost and operating costs for options considered; |

|

(ii) |

Options for scale (against technical, operational, economic, environmental and social criteria) and options for location of the proposed infrastructure; |

|

(iii) |

Technological options — per component and per system; |

|

(iv) |

Risks involved for each alternative, including risks related to climate change impacts and weather extremes; |

|

(v) |

Economic indicators for options considered, if applicable (26); |

|

(vi) |

Summary table containing all pros and cons for all options considered. |

In addition, in case of productive investments give details of capacity considerations (e.g. capacity of the firm before investment (in units per year), reference date, capacity after investment (in units per year), estimate the capacity utilisation rate).

D.2.2 Please specify the criteria considered in selecting the best solution (with ranking of their importance and method of their evaluation, reflecting the outcomes of the climate change vulnerability and risks appraisal and of the EIA/SEA procedures as appropriate (see: section F below)) and briefly present a justification for the option chosen in accordance with Annex III (Methodology for carrying out the cost-benefit analysis) to this Regulation. (27)

D.3. Feasibility of the option selected

Provide a short summary of the feasibility of the option selected covering the following key dimensions: institutional, technical, environmental, and GHG emissions, climate change impacts and risks on the project (where applicable), and other aspects taking into account identified risks to prove feasibility of the project. Please complete the table by making reference to the relevant documents.

D.3.1 Institutional aspect

D.3.2 Technical aspects including location, designed capacity of the main infrastructure, justification of the project scope and size in the context of the forecasted demand, justification of the choices made with regard to climate and natural disaster risks assessment (where relevant), investment and operating costs estimates

D.3.3 Environmental, and climate change mitigation (GHG emissions) and adaptation aspects (where applicable)

D.3.4 Other aspects

Please complete the reference table below

|

Key dimension of Feasibility Studies (or Business Plan if productive investment) |

Reference (supporting documents and chapter/section/page where the specific information and details can be found) |

|

Demand analysis |

<type='S' maxlength='1750' input='M'> |

|

Option analysis |

<type='S' maxlength='1750' input='M'> |

|

Institutional |

<type='S' maxlength='1750' input='M'> |

|

Technical |

<type='S' maxlength='1750' input='M'> |

|

Environmental, Climate change adaptation and mitigation and disaster resilience (where applicable) |

<type='S' maxlength='1750' input='M'> |

|

Other aspects |

<type='S' maxlength='1750' input='M'> |

E. A COST-BENEFIT ANALYSIS, INCLUDING A FINANCIAL AND AN ECONOMIC ANALYSIS, AND A RISK ASSESSMENT

E.1. Financial analysis

E.1.1. Please provide a short (max. 2-3 pages) description of methodology (description of compliance with Annex III (Methodology for carrying out the cost-benefit analysis) to this Regulation and Section III (Method for calculating the discounted net revenue of operations generating net revenue) of Commission Delegated Regulation (EU) No 480/2014 (28) and exceptions to the application of the methodologies; all key assumptions made concerning operating costs, capital replacement costs, revenues and residual value, macroeconomic parameters used, steps considered in the calculations, data used to perform the analysis) and the main findings of the financial analysis including the results of financial sustainability analysis to demonstrate that the project will not run out of cash in the future (please confirm commitment from project beneficiary, its owners and/or public authorities to finance the investment, operating and replacement costs, and where possible provide financial sustainability tables presenting cash flows projections for the reference period):

E.1.2. Main elements and parameters used in the CBA for financial analysis (all values in euro) (29)

|

|

Main elements and parameters |

Value |

|

|||

|

1 |

Reference period (years) |

<type='N' input='M'> |

||||

|

2 |

Financial discount rate (%) (30) |

<type='P' input='M'> |

||||

|

|

Main elements and parameters |

Value Not discounted |

Value Discounted (Net Present Value) |

Reference to CBA document (chapter/section/page) |

||

|

3 |

Total investment cost excluding contingencies |

<type='N' input='M'> |

<type='N' input='M'> |

< type='S' maxlength='500' input='M'> |

||

|

4 |

Residual value |

<type='N' input='M'> |

<type='N' input='M'> |

< type='S' maxlength='500' input='M'> |

||

|

5 |

Revenues |

|

<type='N' input='M'> |

< type='S' maxlength='500' input='M'> |

||

|

6 |

Operating and replacement costs (31) |

|

<type='N' input='M'> |

< type='S' maxlength='500' input='M'> |

||

|

Pro-rata application of discounted net revenue (32) |

||||||

|

7 |

Net revenue = revenues – operating and replacement costs + residual value = (5) – (6) + (4) |

|

<type='N' input='G'> |

< type='S' maxlength='500' input='M'> |

||

|

8 |

Total investment cost – net revenue = (3) – (7) |

|

<type='N' input='G'> |

< type='S' maxlength='500' input='M'> |

||

|

9 |

Pro-rata application of discounted net revenue (%) = (8)/(3) |

<type='P' input='G'> |

< type='S' maxlength='500' input='M'> |

|||

|

||||||

E.1.3. Main indicators of the financial analysis in accordance with the CBA document

|

|

Without Union support A |

With Union support B |

Reference to CBA document (chapter/section /page) |

||||

|

<type='P' input='M'> |

FRR(C) (33) |

<type='P' input='M'> |

FRR(K) (34) |

< type='S' maxlength='500' input='M'> |

||

|

<type='N' input='M'> |

FNPV(C) |

<type='N' input='M'> |

FNPV(K) |

< type='S' maxlength='500' input='M'> |

||

If a major project shows high financial profitability, i.e. FRR(C) is substantially higher than the financial discount rate, please justify Union contribution in accordance with Annex III to this Regulation

In case of productive investments provide results of FRR(Kp) (35) calculation and its comparison with national benchmarks on expected profitability in the given sector.

E.1.4. Tariff strategy and affordability (if applicable)

E.1.4.1. If the project is expected to generate revenues through tariffs or charges borne by users, please give details of the charging system (types and level of charges, principle or Union legislation on the basis of which the charges have been established).

E.1.4.2 Do the charges cover the operational costs including maintenance and replacement costs of the project (36)? <type='C' input='M'>

|

Yes |

☐ |

No |

☐ |

Please provide details with reference to the tariff strategy. If the answer is ‘no’, indicate the proportion in which operating costs will be covered and sources of financing of costs not covered. If operating aid is provided, please give details. If no charges are envisaged, explain how operating costs will be covered.

E.1.4.3. If the charges differ between various users, are they proportional to the different use of the project/real consumption? (Please provide details in text box) <type='C' input='M'>

|

Yes |

☐ |

No |

☐ |

E.1.4.4 Are the charges proportional to the pollution generated by users? (Please provide details in text box) <type='C' input='M'>

|

Yes |

☐ |

No |

☐ |

E.1.4.5 Has affordability of the charges for users been taken into account? (Please provide details in text box) <type='C' input='M'>

|

Yes |

☐ |

No |

☐ |

E.2. Economic analysis

E.2.1. Please provide a short (max. 2-3 pages) description of methodology (description of compliance with the Implementing Act on methodology for cost benefit analysis and exceptions to the application of the methodology, key assumptions made in valuing costs (including relevant cost components considered — investment costs, replacement costs, operating costs), economic benefits and externalities including those related to environment, climate change mitigation (including, where relevant, incremental greenhouse gas emissions in CO2 equivalent) and climate change resilience and disaster resilience, and the main findings of the socio-economic analysis and explain the relationship with the Analysis of the Environmental Impact (see: section F below) as appropriate:

E.2.2. Give details of economic benefits and costs identified in the analysis together with values assigned to them:

|

Benefit |

Unit value (where applicable) |

Total value (in euro, discounted) (37) |

% of total benefits |

|

< type='S' maxlength='200' input='M'> |

< type='S' maxlength='50' input='M'>… |

<type='N' input='M'> |

<type='P' input='M'> |

|

… |

… |

… |

… |

|

Total |

|

CALCULATED |

100 % |

|

Cost |

Unit value (where applicable) |

Total value (in euro, discounted) |

% of total costs |

|

< type='S' maxlength='200' input='M'> |

< type='S' maxlength='50' input='M'>… |

<type='N' input='M'> |

<type='P' input='M'> |

|

… |

… |

… |

… |

|

Total |

|

CALCULATED |

100 % |

E.2.3. Main indicators of the economic analysis in accordance with the CBA document

|

Main parameters and indicators |

Values |

Reference to CBA document (chapter/section/page) |

||

|

<type='P' input='M'> |

<type='S' maxlength='500' input='M'> |

||

|

<type='P' input='M'> |

<type='S' maxlength='500' input='M'> |

||

|

<type='N' input='G'> |

< type='S' maxlength='500' input='M'> |

||

|

<type='N' input='G'> |

<type='S' maxlength='500' input='M'> |

E.2.4. Employment effects of project

Provide an indication of the number of jobs to be created (expressed in terms of full-time equivalents (FTE)).

|

Number of jobs directly created: |

No (FTE) (A) |

Average duration of these jobs (months) (38) (B) |

|

During implementation phase |

<type='N' input='M'> |

<type='N' input='M'> |

|

During operational phase |

<type='N' input='M'> |

<type='N' input='M'> |

|

Number of jobs indirectly created: (productive investments only): |

No (FTE) (A) |

Average duration of these jobs (months) (B) |

|

During operational phase |

<type='N' input='M'> |

<type='N' input='M'> |

|

Number of jobs safeguarded (productive investments only) |

<type='N' input='M'> |

n.a. |

In addition, for productive investments please give details of the expected impact of the project on employment in other regions of the Union, and define whether the financial contribution from the Funds does not result in a substantial loss of jobs in existing locations within the Union, taking into account recital 92 of the CPR as well as the rules on regional State Aid.

E.2.5. Identify the main non-quantifiable/non-monetisable benefits and costs:

E.3. Risk assessment and sensitivity analysis

E.3.1. Please provide short description of the methodology and summary results including main risks identified

E.3.2. Sensitivity analysis

State the percentage change applied to the variables tested:

Present the estimated effect (as a percentage change) on results of financial and economic performance indexes.

|

Variable tested |

Financial Net Present Value (FNPV(K)) variation (%) |

Financial Net Present Value (FNPV(C)) variation (%) |

Economic Net Present Value variation (ENPV) (%) |

|

<type='S' maxlength='500' input='M'> |

<type='P' input='M'> |

<type='P' input='M'> |

<type='P' input='M'> |

|

|

|

|

|

|

|

|

|

|

Which variables have been identified as critical? State which criterion has been applied and mention the impact of the key variables on the main indicators — FNPV, ENPV.

What are the switching values of the critical variables? Please provide an estimated percentage change for FNPV or ENPV to become zero for each of the critical variables identified.

E.3.3. Risk assessment

Please present a short summary of the risk assessment including a list of risks to which the project is exposed, the risk matrix (39) and interpretation and proposed risk mitigation strategy and the body responsible for mitigating the main risks such as cost overruns, time delays, demand shortfalls; special attention should be given to environmental risks, climate change related risks, and other natural disasters related risks.

E.3.4. Additional assessments carried out, if applicable

If probability distributions for critical variables, quantitative risk analysis or options to assess climate risk and measures have been carried out, please provide details below.

F. AN ANALYSIS OF THE ENVIRONMENTAL IMPACT, TAKING INTO ACCOUNT CLIMATE CHANGE ADAPTATION AND MITIGATION NEEDS, AND DISASTER RESILIENCE

F.1. Consistency of the project with environmental policy

F.1.1 Describe how the project contributes and takes into account the environmental policy objectives including climate change (as guidance, please consider the following: resource efficiency, preservation of biodiversity and ecosystem services, reduction of GHG emissions, resilience to climate change impacts etc.).

F.1.2 Describe how the project respects the precautionary principle, the principle of preventive action, the principle that environmental damage should as a priority be rectified at source and the ‘polluter pays’ principle.

F.2. Application of Directive 2001/42/EC of the European Parliament and of the Council (40) (the ‘SEA Directive’)

F.2.1 Is the project implemented as a result of a plan or programme, other than Operational Programme? <type='C' input='M'>

|

Yes |

☐ |

No |

☐ |

F.2.2. If the reply to question F.2.1 is ‘Yes’, please specify if the plan or programme was made subject to a strategic environmental assessment in accordance with the SEA Directive <type='C' input='M'>

|

Yes |

☐ |

No |

☐ |

|

— |

If the reply is ‘No’, please provide a short explanation:

< type='S' maxlength='1750' input='M'>

|

|

— |

If the reply is ‘Yes’, please provide the non-technical summary (41) of the Environmental Report and the information required by Article 9(1)(b) of that Directive (either an internet link or an electronic copy).

< type='S' maxlength='1750' input='M'>

|

F.3. Application of Directive 2011/92/EU of the European Parliament and of the Council (42) (the ‘EIA Directive’)

F.3.1 In case of non-fulfilment of the ex-ante conditionality on environmental legislation (Directive 2011/92/EU and Directive 2001/42/EC), as per Article 19 of Regulation (EU) No 1303/2013 demonstrate link to the agreed action plan

F.3.2 Is the project listed in EIA Directive annexes (43) :

|

— |

Annex I to the EIA Directive (go to question F.3.3) |

|

— |

Annex II to the EIA Directive (go to question F.3.4) |

|

— |

Neither of the two Annexes (go to question F.4) — please explain below

< type='S' maxlength='1750' input='M'>

|

F.3.3 When covered by Annex I to the EIA Directive, include the following documents (as Appendix 6) and use a text box below for additional information and explanations (44) :

|

(a) |

The non-technical summary of the EIA Report (45). |

|

(b) |

Information on consultations with environmental authorities, the public and if applicable, consultations with other Member States, carried out in accordance with Articles 6 and 7 of the EIA Directive. |

|

(c) |

The decision of the competent authority issued in accordance with Articles 8 and 9 of the EIA Directive (46), including information on how it was made available to the public. |

F.3.4 When covered by Annex II to that Directive, has an EIA been carried out? <type='C' input='M'>

|

Yes |

☐ |

No |

☐ |

|

— |

If the reply is ‘Yes’, please include the necessary documents listed under point F.3.3 |

|

— |

If the reply is ‘No’, please include the following information:

|

F.3.5 Development consent/construction permit (as applicable)

F.3.5.1. Is the project already in the construction phase (at least one works contract)? <type='C' input='M'>

|

Yes* |

☐ |

No |

☐ |

F.3.5.2. Has the development consent/construction permit already been given to this project (for at least one works contract)? <type='C' input='M'>

|

Yes |

☐ |

No (47) |

☐ |

F.3.5.3. If ‘Yes’ (to F 3.5.2.), on which date

F.3.5.4. If ‘No’ (to F 3.5.2.), when was the formal request for the development consent introduced:

F.3.5.5. If ‘No’ (to F 3.5.2.), specify the administrative steps accomplished so far and describe those remaining:

F.3.5.6. By which date is the final decision (or decisions) expected?

F.3.5.7. Specify the competent authority (or authorities), which has issued or will issue the development consent:

F.4. Application of the Directive 92/43/EEC on the conservation of natural habitats and of wild fauna and flora (48) (Habitats Directive); assessment of effects on Natura 2000 sites

F.4.1. Is the project likely to have significant negative effects, either individually or in combination with other projects, on sites included or intended to be included in the Natura 2000 network? <type='C' input='M'>

|

Yes |

☐ |

No |

☐ |

F.4.2 If the reply to question F.4.1 is ‘Yes’, please provide:

|

(1) |

the decision of the competent authority and the appropriate assessment carried out according to Article 6(3) of the Habitats Directive; |

|

(2) |

if the competent authority has determined that the project has significant negative effects on one or more sites included or intended to be included in the Natura 2000 network, please provide:

|

F.4.3 If the reply to question F.4.1 is ‘No’, please attach a completed Appendix 1 declaration filled in by the competent authority and the map indicating the location of the project and Natura 2000 sites. For a non-infrastructure major project (e.g. purchase of equipment), this should be duly explained below and, in that case, it is not obligatory to attach such a declaration.

F.5. Application of Directive 2000/60/EC of the European Parliament and of the Council (50) (the ‘Water Framework Directive’); assessment of effects on water bodies

F.5.1 In case of non-fulfilment of the corresponding ex-ante conditionality, as per Article 19 of Regulation (EU) No 1303/2013, demonstrate link to the agreed action plan

F.5.2 Does the project involve a new modification to the physical characteristics of a surface water body or alterations to the level of bodies of groundwater which deteriorate the status of a water body or cause failure to achieve good water status/potential? <type='C' input='M'>

|

Yes |

☐ |

No |

☐ |

F.5.2.1. If the reply is ‘Yes’, please provide the assessment of the impacts on the water body and a detailed explanation of how all the conditions under Article 4.7 of the Water Framework Directive were/are to be fulfilled.

Indicate also whether the project results from a national/regional strategy in relation to the relevant sector and/or from a river basin management plan, which takes into account all relevant factors (e.g. a better environmental option, cumulative effects, etc.)? If so, please provide full details.

F.5.2.2. If the reply is ‘No’, please attach a completed Appendix 2 declaration filled in by the competent authority. For a non-infrastructure major project (e.g. purchase of equipment), this should be duly explained below and, in that case, it is not obligatory to attach such a declaration.

F.5.3 Please explain how the project fits with the River Basin Management Plan's objectives which have been established for the relevant water bodies.

F.6. Where applicable, information on compliance with other environmental directives

F.6.1 Application of Council Directive 91/271/EEC (51) (the ‘UWWT Directive’) — projects in urban waste water sector

|

(1) |

Please fill-in Appendix 3 to the Application Form (table concerning compliance with the UWWT Directive). |

|

(2) |

Please explain how the project is consistent with the plan or programme associated with the implementation of the UWWT Directive. |

F.6.2 Application of Directive 2008/98/EC of the European Parliament and of the Council (52) (the ‘Waste Framework Directive’) — projects in waste management sector

F.6.2.1. In case of non-fulfilment of the corresponding ex-ante conditionality, as per Article 19 of Regulation (EU) No 1303/2013, demonstrate link to the agreed action plan.

F.6.2.2. Please explain how the project meets the objectives laid down in Article 1 of the Waste Framework Directive. In particular, how the project is consistent with the relevant waste management plan (Article 28), the waste hierarchy (Article 4), and how the project contributes to the achievement of the 2020 recycling targets (Article 11 (2)).

F.6.3 Application of Directive 2010/75/EU of the European Parliament and of the Council (53) (the ‘Industrial Emissions Directive’) — Projects requiring the granting of a permit under that Directive

Please explain how the project complies with the requirements of Directive 2010/75/EU, in particular with the obligation to operate in accordance with an integrated permit based on the Best Available Techniques (BAT) and, where applicable, with the emission limit values set out in that Directive.

F.6.4 Any other relevant environmental directives (please explain below)