EUR-Lex Access to European Union law

This document is an excerpt from the EUR-Lex website

Document 02004R0794-20140502

Commission Regulation (EC) No 794/2004 of 21 april 2004 implementing Council Regulation (EC) No 659/1999 laying down detailed rules for the application of Article 93 of the EC Treaty

Consolidated text: Commission Regulation (EC) No 794/2004 of 21 april 2004 implementing Council Regulation (EC) No 659/1999 laying down detailed rules for the application of Article 93 of the EC Treaty

Commission Regulation (EC) No 794/2004 of 21 april 2004 implementing Council Regulation (EC) No 659/1999 laying down detailed rules for the application of Article 93 of the EC Treaty

2004R0794 — EN — 02.05.2014 — 007.001

This document is meant purely as a documentation tool and the institutions do not assume any liability for its contents

|

COMMISSION REGULATION (EC) No 794/2004 of 21 april 2004 (OJ L 140, 30.4.2004, p.1) |

Amended by:

|

|

|

Official Journal |

||

|

No |

page |

date |

||

|

L 302 |

10 |

1.11.2006 |

||

|

L 407 |

1 |

30.12.2006 |

||

|

L 82 |

1 |

25.3.2008 |

||

|

L 313 |

1 |

22.11.2008 |

||

|

L 81 |

15 |

27.3.2009 |

||

|

L 308 |

5 |

24.11.2009 |

||

|

L 109 |

14 |

12.4.2014 |

||

Corrected by:

COMMISSION REGULATION (EC) No 794/2004

of 21 april 2004

implementing Council Regulation (EC) No 659/1999 laying down detailed rules for the application of Article 93 of the EC Treaty

THE COMMISSION OF THE EUROPEAN COMMUNITIES,

Having regard to the Treaty establishing the European Community,

Having regard to Council Regulation (EC) No 659/1999 of 22 March 1999 laying down detailed rules for the application of Article 93 of the EC Treaty ( 1 ), and in particular Article 27 thereof,

After consulting the Advisory Committee on State Aid,

Whereas:|

(1) |

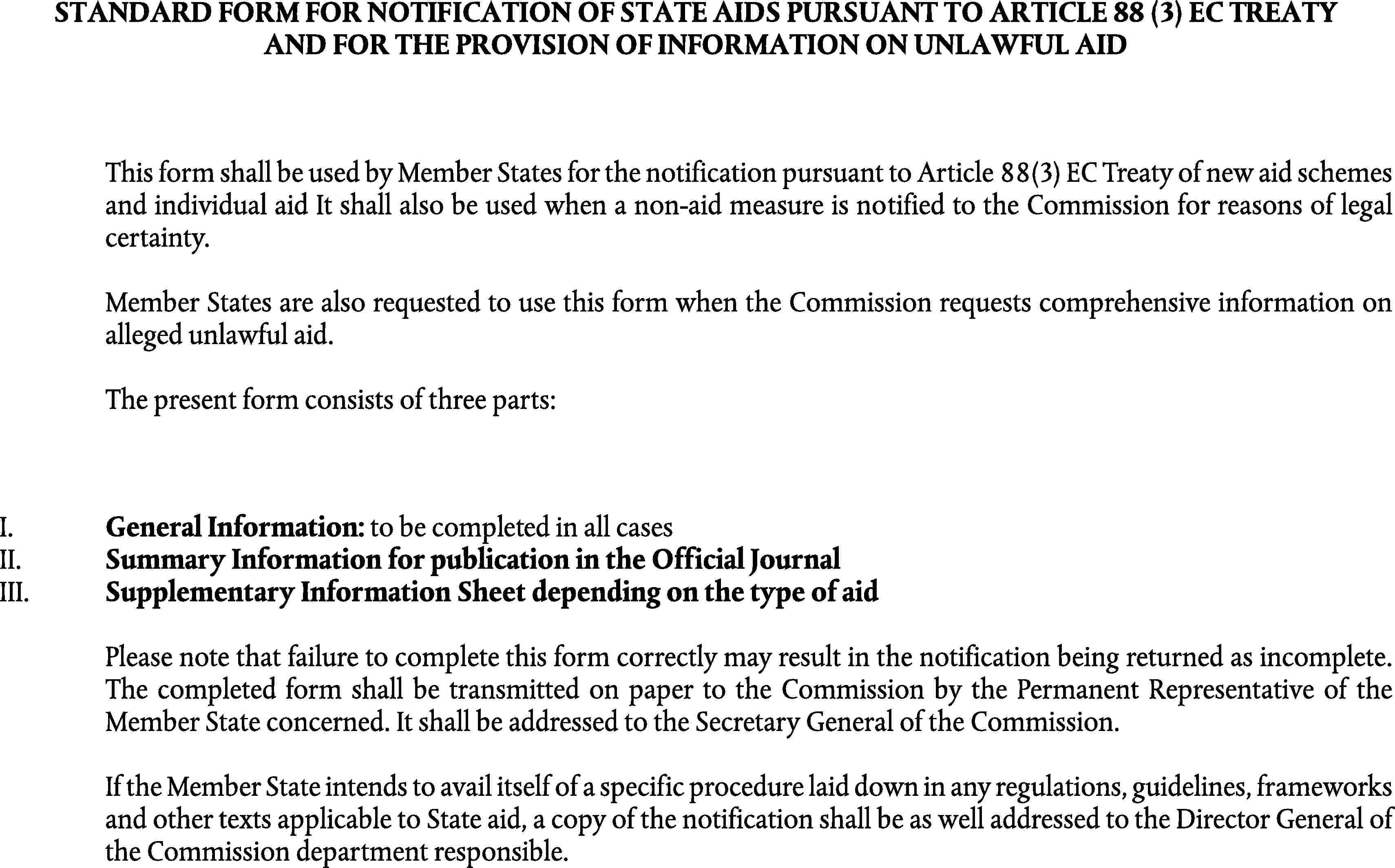

In order to facilitate the preparation of State aid notifications by Member States, and their assessment by the Commission, it is desirable to establish a compulsory notification form. That form should be as comprehensive as possible. |

|

(2) |

The standard notification form as well as the summary information sheet and the supplementary information sheets should cover all existing guidelines and frameworks in the state aid field. They should be subject to modification or replacement in accordance with the further development of those texts. |

|

(3) |

Provision should be made for a simplified system of notification for certain alterations to existing aid. Such simplified arrangements should only be accepted if the Commission has been regularly informed on the implementation of the existing aid concerned. |

|

(4) |

In the interests of legal certainty it is appropriate to make it clear that small increases of up to 20 % of the original budget of an aid scheme, in particular to take account of the effects of inflation, should not need to be notified to the Commission as they are unlikely to affect the Commission’s original assessment of the compatibility of the scheme, provided that the other conditions of the aid scheme remain unchanged. |

|

(5) |

Article 21 of Regulation (EC) No 659/1999 requires Member States to submit annual reports to the Commission on all existing aid schemes or individual aid granted outside an approved aid scheme in respect of which no specific reporting obligations have been imposed in a conditional decision. |

|

(6) |

For the Commission to be able to discharge its responsibilities for the monitoring of aid, it needs to receive accurate information from Member States about the types and amounts of aid being granted by them under existing aid schemes. It is possible to simplify and improve the arrangements for the reporting of State aid to the Commission which are currently described in the joint procedure for reporting and notification under the EC Treaty and under the World Trade Organisation (WTO) Agreement set out in the Commission’s letter to Member States of 2 August 1995. The part of that joint procedure relating to Member States reporting obligations for subsidy notifications under Article 25 of the WTO Agreement on Subsidies and Countervailing measures and under Article XVI of GATT 1994, adopted on 21 July 1995 is not covered by this Regulation. |

|

(7) |

The information required in the annual reports is intended to enable the Commission to monitor overall aid levels and to form a general view of the effects of different types of aid on competition. To this end, the Commission may also request Member States to provide, on an ad hoc basis, additional data for selected topics. The choice of subject matter should be discussed in advance with Member States. |

|

(8) |

The annual reporting exercise does not cover the information, which may be necessary in order to verify that particular aid measures respect Community law. The Commission should therefore retain the right to seek undertakings from Member States, or to attach to decisions conditions requiring the provision of additional information. |

|

(9) |

It should be specified that time-limits for the purposes of Regulation (EC) No 659/1999 should be calculated in accordance with Regulation (EEC, Euratom) No 1182/71 of the Council of 3 June 1971 determining the rules applicable to periods, dates and time limits ( 2 ), as supplemented by the specific rules set out in this Regulation. In particular, it is necessary to identify the events, which determine the starting point for time-limits applicable in State aid procedures. The rules set out in this Regulation should apply to pre-existing time-limits which will continue to run after the entry into force of this Regulation. |

|

(10) |

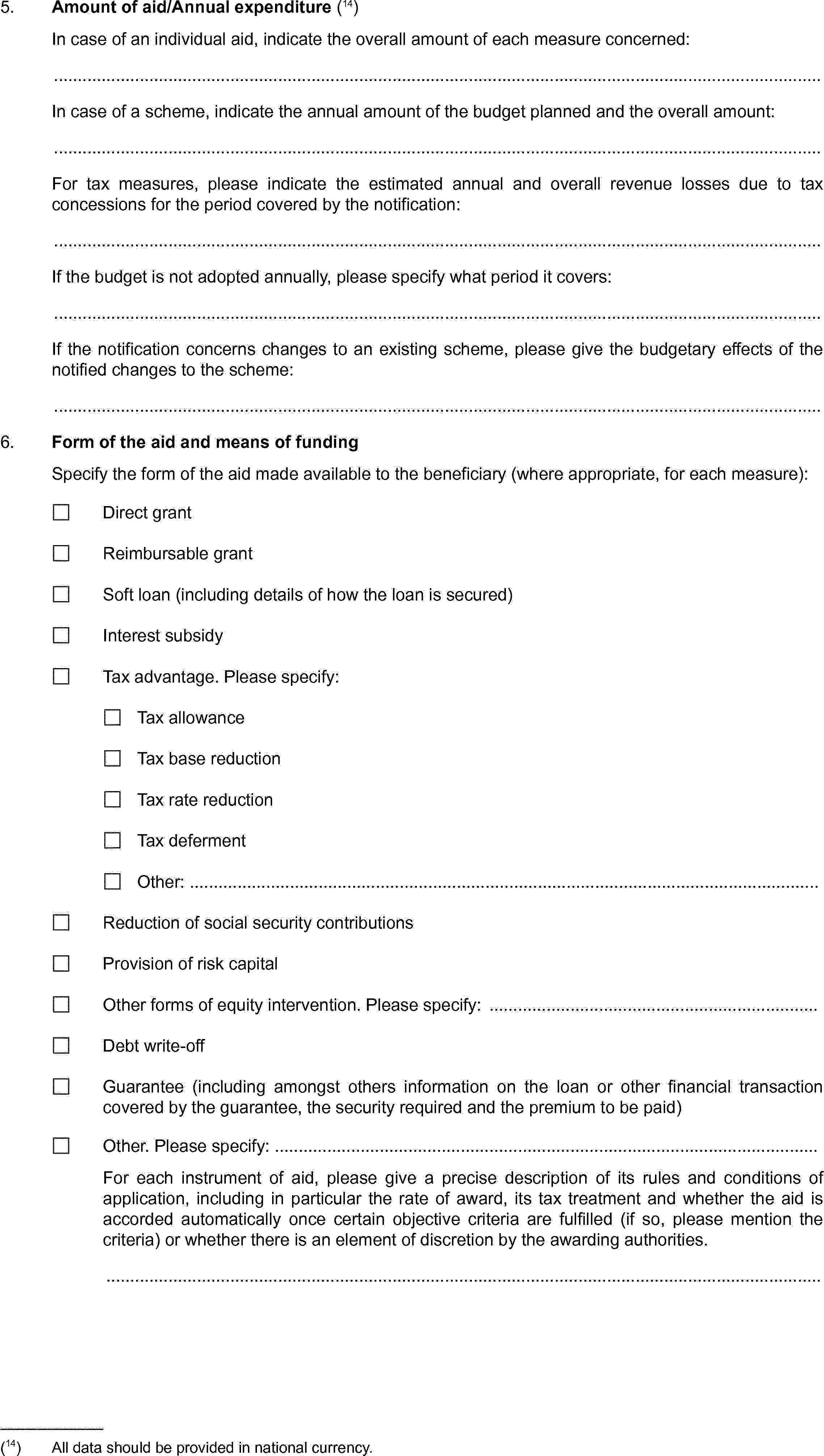

The purpose of recovery is to re-establish the situation existing before aid was unlawfully granted. To ensure equal treatment, the advantage should be measured objectively from the moment when the aid is available to the beneficiary undertaking, independently of the outcome of any commercial decisions subsequently made by that undertaking. |

|

(11) |

In accordance with general financial practice it is appropriate to fix the recovery interest rate as an annual percentage rate. |

|

(12) |

The volume and frequency of transactions between banks results in an interest rate that is consistently measurable and statistically significant, and should therefore form the basis of the recovery interest rate. The inter-bank swap rate should, however, be adjusted in order to reflect general levels of increased commercial risk outside the banking sector. On the basis of the information on inter-bank swap rates the Commission should establish a single recovery interest rate for each Member State. In the interest of legal certainty and equal treatment, it is appropriate to fix the precise method by which the interest rate should be calculated, and to provide for the publication of the recovery interest rate applicable at any given moment, as well as relevant previously applicable rates. |

|

(13) |

A State aid grant may be deemed to reduce a beneficiary undertaking’s medium-term financing requirements. For these purposes, and in line with general financial practice, the medium-term may be defined as five years. The recovery interest rate should therefore correspond to an annual percentage rate fixed for five years. |

|

(14) |

Given the objective of restoring the situation existing before the aid was unlawfully granted, and in accordance with general financial practice, the recovery interest rate to be fixed by the Commission should be annually compounded. For the same reasons, the recovery interest rate applicable in the first year of the recovery period should be applied for the first five years of the recovery period, and the recovery interest rate applicable in the sixth year of the recovery period for the following five years. |

|

(15) |

This Regulation should apply to recovery decisions notified after the date of entry into force of this Regulation, |

HAS ADOPTED THIS REGULATION:

CHAPTER I

SUBJECT MATTER AND SCOPE

Article 1

Subject matter and scope

1. This Regulation sets out detailed provisions concerning the form, content and other details of notifications and annual reports referred to in Regulation (EC) No 659/1999. It also sets out provisions for the calculation of time limits in all procedures concerning State aid and of the interest rate for the recovery of unlawful aid.

2. This Regulation shall apply to aid in all sectors.

CHAPTER II

NOTIFICATIONS

Article 2

Notification forms

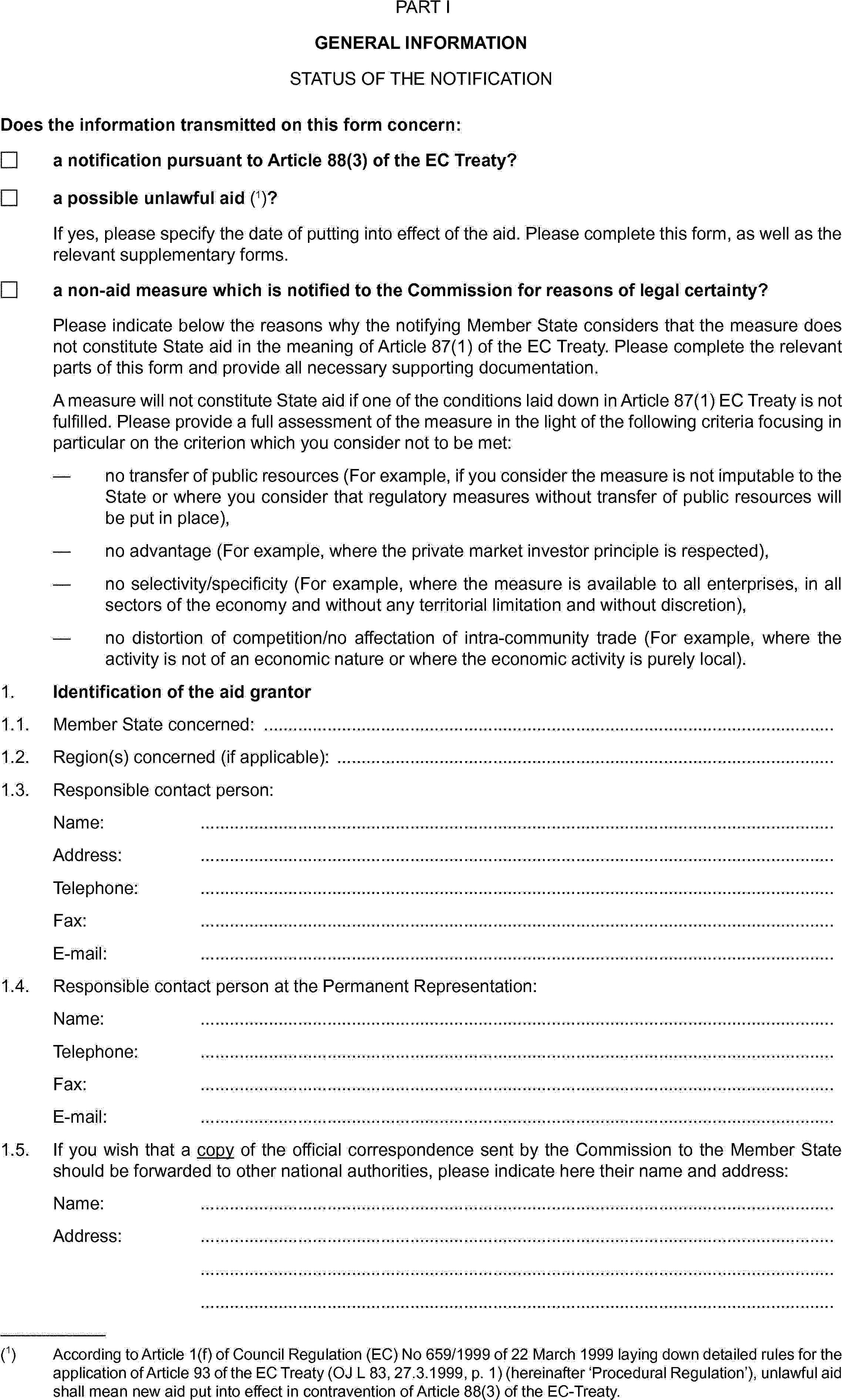

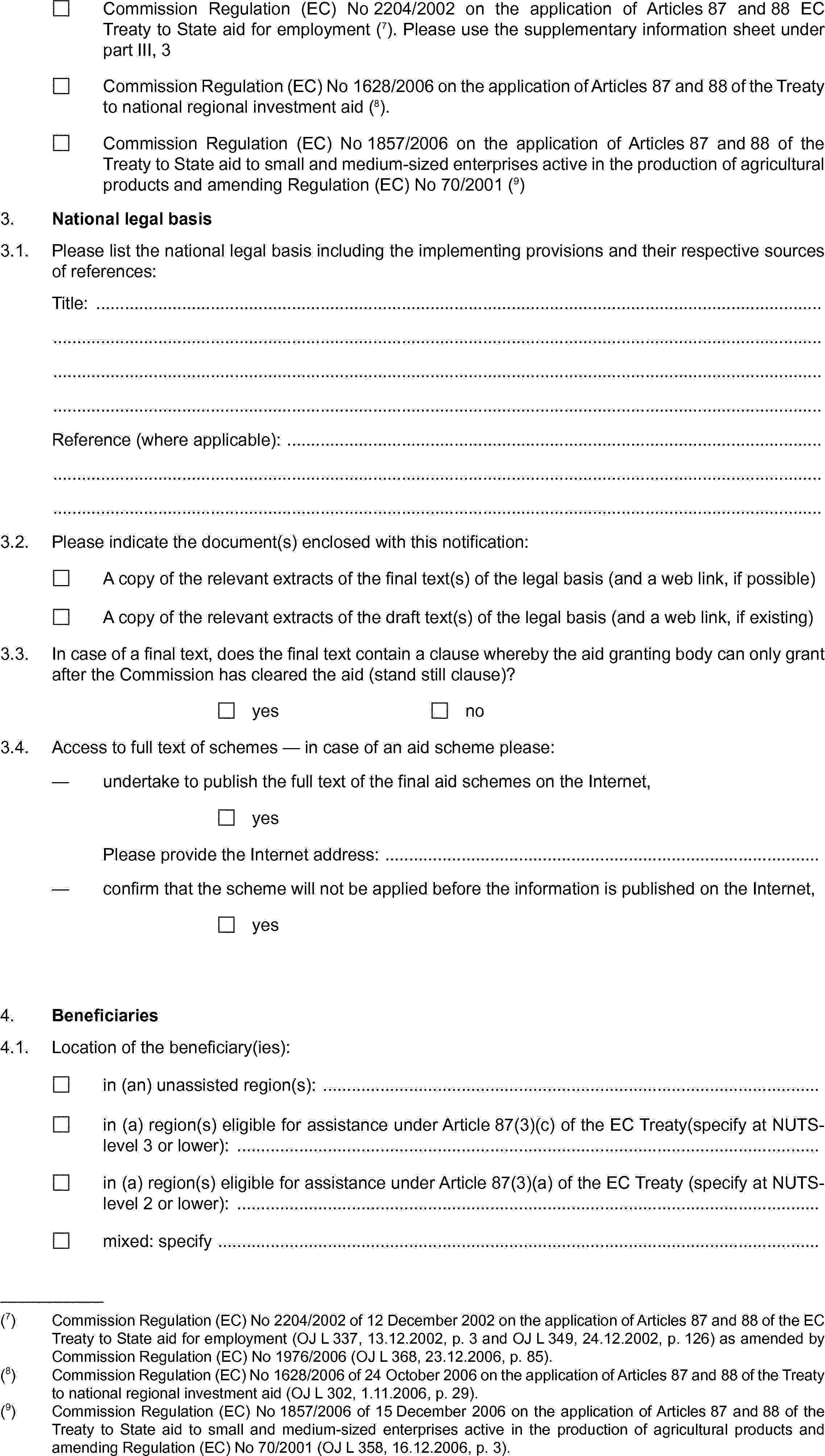

Without prejudice to Member States’ obligations to notify state aids in the coal sector under Commission Decision 2002/871/CE ( 3 ), notifications of new aid pursuant to Article 2(1) of Regulation (EC) No 659/1999, other than those referred to in Article 4(2), shall be made on the notification form set out in Part I of Annex I to this Regulation.

Supplementary information needed for the assessment of the measure in accordance with regulations, guidelines, frameworks and other texts applicable to State aid shall be provided on the supplementary information sheets set out in Part III of Annex I.

Whenever the relevant guidelines or frameworks are modified or replaced, the Commission shall adapt the corresponding forms and information sheets.

Article 3

Transmission of notifications

1. The notification shall be transmitted to the Commission by means of the electronic validation carried out by the person designated by the Member State. Such validated notification shall be considered as sent by the Permanent Representative.

2. The Commission shall address its correspondence to the Permanent Representative of the Member State concerned, or to any other address designated by that Member State.

3. As from 1 July 2008, notifications shall be transmitted electronically via the web application State Aid Notification Interactive (SANI).

All correspondence in connection with a notification shall be transmitted electronically via the secured e-mail system Public Key Infrastructure (PKI).

4. In exceptional circumstances and upon the agreement of the Commission and the Member State concerned, an agreed communication channel other than those referred to in paragraph 3 may be used for submission of a notification or any correspondence in connection with a notification.

In the absence of such an agreement, any notification or correspondence in connection with a notification sent to the Commission by a Member State through a communication channel other than those referred to in paragraph 3 shall not be considered as submitted to the Commission.

5. Where the notification or correspondence in connection with a notification contains confidential information, the Member State concerned shall clearly identify such information and give reasons for its classification as confidential.

6. The Member States shall refer to the State aid identification number allocated to an aid scheme by the Commission in each grant of aid to a final beneficiary.

The first subparagraph shall not apply to aid granted through fiscal measures.

Article 4

Simplified notification procedure for certain alterations to existing aid

1. For the purposes of Article 1(c) of Regulation (EC) No 659/1999, an alteration to existing aid shall mean any change, other than modifications of a purely formal or administrative nature which cannot affect the evaluation of the compatibility of the aid measure with the common market. However an increase in the original budget of an existing aid scheme by up to 20 % shall not be considered an alteration to existing aid.

2. The following alterations to existing aid shall be notified on the simplified notification form set out in Annex II:

(a) increases in the budget of an authorised aid scheme exceeding 20 %;

(b) prolongation of an existing authorised aid scheme by up to six years, with or without an increase in the budget;

(c) tightening of the criteria for the application of an authorised aid scheme, a reduction of aid intensity or a reduction of eligible expenses;

The Commission shall use its best endeavours to take a decision on any aid notified on the simplified notification form within a period of one month.

3. The simplified notification procedure shall not be used to notify alterations to aid schemes in respect of which Member States have not submitted annual reports in accordance with Article 5, 6, and 7, unless the annual reports for the years in which the aid has been granted are submitted at the same time as the notification.

CHAPTER III

ANNUAL REPORTS

Article 5

Form and content of annual reports

1. Without prejudice to the second and third subparagraphs of this Article and to any additional specific reporting requirements laid down in a conditional decision adopted pursuant to Article 7(4) of Regulation (EC) No 659/1999, or to the observance of any undertakings provided by the Member State concerned in connection with a decision to approve aid, Member States shall compile the annual reports on existing aid schemes referred to in Article 21(1) of Regulation (EC) No 659/1999 in respect of each whole or part calendar year during which the scheme applies in accordance with the standardised reporting format set out in Annex IIIA.

Annex IIIB sets out the format for annual reports on existing aid schemes relating to the production, processing and marketing of agricultural products listed in Annex I of the Treaty.

Annex IIIC sets out the format for annual reports on existing aid schemes for state aid relating to the production, processing or marketing of fisheries products listed in Annex I of the Treaty.

2. The Commission may ask Member States to provide additional data for selected topics, to be discussed in advance with Member States.

Article 6

Transmission and publication of annual reports

1. Each Member State shall transmit its annual reports to the Commission in electronic form no later than 30 June of the year following the year to which the report relates.

In justified cases Member States may submit estimates, provided that the actual figures are transmitted at the very latest with the following year’s data.

2. Each year the Commission shall publish a State aid synopsis containing a synthesis of the information contained in the annual reports submitted during the previous year.

Article 7

Status of annual reports

The transmission of annual reports shall not be considered to constitute compliance with the obligation to notify aid measures before they are put into effect pursuant to Article 88(3) of the Treaty, nor shall such transmission in any way prejudice the outcome of an investigation into allegedly unlawful aid in accordance with the procedure laid down in Chapter III of Regulation (EC) No 659/1999.

CHAPTER IV

TIME-LIMITS

Article 8

Calculation of time-limits

1. Time-limits provided for in Regulation (EC) No 659/1999 and in this Regulation or fixed by the Commission pursuant to Article 108 of the Treaty shall be calculated in accordance with Regulation (EEC, Euratom) No 1182/71, and the specific rules set out in paragraphs 2 to 5b of this Article. In case of conflict, the provisions of this Regulation shall prevail.

2. Time limits shall be specified in months or in working days.

3. With regard to timelimits for action by the Commission, the receipt of the notification or subsequent correspondence in accordance with Article 3(1) and Article 3(3) of this Regulation shall be the relevant event for the purpose of Article 3(1) of Regulation (EEC, Euratom) No 1182/71.

4. With regard to timelimits for action by Member States, the receipt of the relevant notification or correspondence from the Commission in accordance with Article 3(2) of this Regulation shall be the relevant event for the purposes of Article 3(1) of Regulation (EEC, Euratom) No 1182/71.

5. With regard to the time-limit for the submission of comments following initiation of the formal investigation procedure referred to in Art. 6(1) of Regulation (EC) No 659/1999 by third parties and those Member States which are not directly concerned by the procedure, the publication of the notice of initiation in the Official Journal of the European Union shall be the relevant event for the purposes of Article 3(1) of Regulation (EEC, Euratom) No 1182/71.

5a. With regard to the time-limit for the submission of the information requested from third parties pursuant to Article 6a(6) of Regulation (EC) No 659/1999, the receipt of the request for information shall be the relevant event for the purposes of Article 3(1) of Regulation (EEC, Euratom) No 1182/71.

5b. With regard to the time-limit for the submission of the information requested from third parties pursuant to Article 6a(7) of Regulation (EC) No 659/1999, the notification of the decision shall be the relevant event for the purposes of Article 3(1) of Regulation (EEC, Euratom) No 1182/71.

6. Any request for the extension of a time-limit shall be duly substantiated, and shall be submitted in writing to the address designated by the party fixing the time-limit at least two working days before expiry.

CHAPTER V

INTEREST RATE FOR THE RECOVERY OF UNLAWFUL AID

Article 9

Method for fixing the interest rate

1. Unless otherwise provided for in a specific decision, the interest rate to be used for recovering State aid granted in breach of Article 88(3) of the Treaty shall be an annual percentage rate which is fixed by the Commission in advance of each calendar year.

2. The interest rate shall be calculated by adding 100 basis points to the one-year money market rate. Where those rates are not available, the three-month money market rate will be used, or in the absence thereof, the yield on State bonds will be used.

3. In the absence of reliable money market or yield on stock bonds or equivalent data or in exceptional circumstances the Commission may, in close co-operation with the Member State(s) concerned, fix a recovery rate on the basis of a different method and on the basis of the information available to it.

4. The recovery rate will be revised once a year. The base rate will be calculated on the basis of the one-year money market recorded in September, October and November of the year in question. The rate thus calculated will apply throughout the following year.

5. In addition, to take account of significant and sudden variations, an update will be made each time the average rate, calculated over the three previous months, deviates more than 15 % from the rate in force. This new rate will enter into force on the first day of the second month following the months used for the calculation.

Article 10

Publication

The Commission shall publish current and relevant historical State aid recovery interest rates in the Official Journal of the European Union and for information on the Internet.

Article 11

Method for applying interest

1. The interest rate to be applied shall be the rate applicable on the date on which unlawful aid was first put at the disposal of the beneficiary.

2. The interest rate shall be applied on a compound basis until the date of the recovery of the aid. The interest accruing in the previous year shall be subject to interest in each subsequent year.

3. The interest rate referred to in paragraph 1 shall be applied throughout the whole period until the date of recovery. However, if more than one year has elapsed between the date on which the unlawful aid was first put at the disposal of the beneficiary and the date of the recovery of the aid, the interest rate shall be recalculated at yearly intervals, taking as a basis the rate in force at the time of recalculation.

CHAPTER Va

HANDLING OF COMPLAINTS

Article 11a

Admissibility of complaints

1. Any person submitting a complaint pursuant to Articles 10(1) and 20(2) of Regulation (EC) No 659/1999 shall demonstrate that it is an interested party within the meaning of Article 1(h) of that Regulation.

2. Interested parties shall duly complete the form set out in Annex IV and provide all the mandatory information requested therein. On a reasoned request by an interested party, the Commission may dispense with the obligation to provide some of the information required by the form.

3. Complaints shall be submitted in one of the official languages of the Union.

CHAPTER Vb

IDENTIFICATION AND PROTECTION OF CONFIDENTIAL INFORMATION

Article 11b

Protection of business secrets and other confidential information

Any person submitting information pursuant to Regulation (EC) No 659/1999 shall clearly indicate which information it considers to be confidential, stating the reasons for such confidentiality, and provide the Commission with a separate non-confidential version of the submission. When information must be provided by a certain deadline, the same deadline shall apply for providing the non-confidential version.

CHAPTER VI

FINAL PROVISIONS

Article 12

Review

The Commission shall in consultation with the Member States, review the application of this Regulation within four years after its entry into force.

Article 13

Entry into force

This Regulation shall enter into force on the twentieth day following that of its publication in the Official Journal of the European Union.

Chapter II shall apply only to those notifications transmitted to the Commission more than five months after the entry into force of this Regulation.

Chapter III shall apply to annual reports covering aid granted from 1 January 2003 onwards.

Chapter IV shall apply to any time limit, which has been fixed but which has not yet expired on the date of entry into force of this Regulation.

Articles 9 and 11 shall apply in relation to any recovery decision notified after the date of entry into force of this Regulation.

This Regulation shall be binding in its entirety and be directly applicable in all Member States.

ANNEX I

▼M3 —————

PART III.2

SUPPLEMENTARY INFORMATION SHEET ON STATE AID FOR TRAINING

This supplementary information sheet must be used for the notification of individual aid pursuant to Article 6(1)(g) of Commission Regulation (EC) No 800/2008 ( 4 ) and covered by the Criteria for the compatibility analysis of training State aid cases subject to individual notification (thereinafter ‘Criteria for the compatibility analysis’) ( 5 ). It must also be used in the case of any individual aid or scheme, which is notified to the Commission for reasons of legal certainty.

If there are several beneficiaries participating in the notified project, please provide the information below for each of them.

COMPATIBILITY OF AID UNDER ARTICLE 87(3)(c) OF THE EC TREATY — DETAILED ASSESSMENT

Aid for training may be considered to be compatible with the common market pursuant to Article 87(3)(c) of the EC Treaty.

The purpose of this detailed assessment is to ensure that high amounts of aid for training do not distort competition to an extent contrary to the common interest, but rather contribute to the common interest. This happens when the benefits of State aid in terms of positive knowledge spill-over outweigh the harm for competition and trade.

The provisions below provide guidance as to the type of information the Commission may require in order to carry out a detailed assessment. The guidance is intended to make the Commission’s decisions and their reasoning transparent and foreseeable in order to create predictability and legal certainty. Member States are invited to provide all the elements that they consider useful for the assessment of the case.

If there are several beneficiaries involved in the project notified as individual aid, please provide the information below for each of them.

Characteristics of the notified measure

1. Please provide a brief description of the measure specifying objective(s) of the measure, aid instrument, structure/organisation of the training, beneficiaries, budget, aid amount, payment schedule, aid intensity, and eligible costs.

2. Does the measure apply to the production and/or processing and/or marketing of the agricultural products listed in Annex I to the EC Treaty?

|

|

yes |

|

no |

3. Does the measure apply to the production, processing and/or marketing of the fisheries and/or aquaculture products listed in Annex I to the EC Treaty?

|

|

yes |

|

no |

4. Is the aid foreseen for the maritime transport sector?

|

|

yes |

|

no |

If yes, please answer the following questions:

(a) Is the trainee not an active member of the crew but a supernumerary on board?

|

|

yes |

|

no |

(b) Shall the training be carried out on board of ships entered into Community registers?

|

|

yes |

|

no |

5. Does the notified measure relate to:

A combination of general and specific training:

|

|

yes |

|

no |

6. Please provide a detailed description of the training project including programme, skills to be acquired, timing, number of hours, participants, organisers, budget, etc.

7. Please provide details on the beneficiary including identity, group of which the beneficiary is a member, annual turnover, number of employees and business activities.

8. If applicable, please indicate the exchange rate which has been used for the purposes of the notification.

9. Please number all documents provided by the Member States as annexes to the notification form and indicate the document numbers in the relevant parts of this supplementary information sheet.

Objective of the aid

10. Please give a detailed description of the objectives of common interest pursued by the notified measure.

Existence of positive externalities ( 8 )

11. Please demonstrate that the training will generate positive externalities and provide the supporting documents.

The following elements may be used for the purposes of demonstrating positive externalities. Please specify those relevant for the notified measure, and provide supporting documents:

|

|

Nature of the training |

|

|

Transferability of the skills acquired during the training |

|

|

Participants to the training |

Appropriate instrument ( 9 )

12. Please explain to what extent the notified measure represents an appropriate instrument to increase training activities and provide the supporting documents.

Incentive effect and necessity of the aid ( 10 )

In order to demonstrate the incentive effect, the Commission requires an evaluation by the Member State in order to prove that without the aid, i.e. in the counterfactual situation, the quantity or quality of the training activities would be smaller.

13. Has/have the supported project(s) started prior to the submission of the application for the aid by the beneficiary/beneficiaries to the national authorities?

|

|

yes |

|

no |

If yes, the Commission considers that the aid does not present an incentive for the beneficiary.

14. If no, specify the relevant dates:

The training project will start on:

The aid application by the beneficiary was submitted to the national authorities on:

Please provide the relevant supporting documents.

15. Please provide the beneficiary’s internal documents on training costs, participants, content and scheduling for two scenarios: training project with aid and training project without aid. Please explain, on the basis of this information, how State aid increases the quantity and/or quality of the planned training activities.

16. Please confirm that there is no legal obligation for the employers to provide the training type covered by the notified measure.

17. Please provide with the beneficiary’s training budgets for previous years.

18. Please explain the relationship between the training programme and business activities of the aid beneficiary.

Proportionality of the aid ( 11 )

Eligible costs must be calculated following Article 39 of Regulation (EC) No 800/2008 and limited to the extra costs necessary to achieve an increase of training activities.

19. Please specify the eligible costs foreseen for the measure

|

|

trainers’ personnel costs |

|

|

trainers’ and trainees’ travel expenses, including accommodation costs |

|

|

depreciation of tools and equipment, to the extent that they are used exclusively for the training project |

|

|

cost of guidance and counselling services with regard to the training project |

|

|

indirect costs (administrative, rent, overheads), transport and tuition costs for participants) up to the amount of the total of the other eligible costs referred to above |

|

|

trainees’ personnel costs ( 12 ). |

20. Please provide a detailed calculation of the eligible costs of the notified measure ensuring that the eligible costs are limited to the part of extra costs necessary to achieve an increase of quality or quantity of training activities.

21. Please provide evidence that the aid is limited to the minimum, i.e. to the part of the extra costs of the training that the company cannot recover by benefiting directly from the skills acquired by its employees during the training.

22. Please specify the aid intensity applicable to the notified measure.

23. Is the general training under the notified measure given to disabled or disadvantaged workers?

|

|

yes |

|

no |

24. Nature of the beneficiary:

|

Large enterprise |

|

yes |

|

no |

|

Medium-sized enterprise |

|

yes |

|

no |

|

Small enterprise |

|

yes |

|

no |

25. Please specify the aid intensity applicable to the notified measure.

26. Is the specific training under the notified measure given to disabled or disadvantaged workers?

|

|

yes |

|

no |

27. Nature of the beneficiary

|

Large enterprise |

|

yes |

|

no |

|

Medium-sized enterprise |

|

yes |

|

no |

|

Small enterprise |

|

yes |

|

no |

Analysis of the distortion of competition and trade ( 13 )

28. Please specify whether the beneficiary received training aid in the past and provide details on the previous aid (dates, amount of aid, and duration of training projects).

29. Please specify the annual training costs of the beneficiary (total training budget for the last three years, proportion of training costs in relation to total costs) and explain how the aid affects the beneficiary’s costs (e.g. percentage of annual training costs and total costs covered by the aid, etc.).

30. Please specify the relevant product and geographic markets on which the beneficiary is active and on which the aid is likely to have an impact.

31. For each of these markets please provide:

— market concentration ratio,

— market share of the beneficiary,

— market shares of the other companies present in these markets.

32. Please describe the structure and competitive situation on the relevant markets and provide supporting documents (e.g. barriers to entry and exit, product differentiation, character of the competition between market participants, etc.).

33. Please describe the features of the sector where the beneficiary is active (e.g. importance of the trained workforce for the business, existence of overcapacity, financing strategies of training for competitors, etc.).

34. If relevant, please provide information on the effects on trade (shift of trade flows).

CUMULATION

35. Is the aid granted under the notified measure combined with other aid?

|

|

yes |

|

no |

If yes, please describe the rules on cumulating aid applicable to the notified aid measure:

OTHER INFORMATION

36. Please indicate here any other information you consider relevant to the assessment of the measure(s) in concerned.

PART III.3

SUPPLEMENTARY INFORMATION SHEET ON STATE AID TO DISADVANTAGED AND DISABLED WORKERS

This supplementary information sheet must be used for the notification of individual aid pursuant to Article 6(1)(h) to (i) of Regulation (EC) No 800/2008 and covered by the Criteria for the compatibility analysis of State aid to disadvantaged and disabled workers subject to individual notification (thereinafter ‘Criteria for the compatibility analysis’) ( 14 ). It must also be used in the case of any individual aid or scheme, which is notified to the Commission for reasons of legal certainty.

If there are several beneficiaries participating in the notified project, please provide the information below for each of them.

COMPATIBILITY OF AID UNDER ARTICLE 87(3)(c) OF THE EC TREATY — DETAILED ASSESSMENT

Aid to disadvantaged and disabled workers may be considered to be compatible with the common market pursuant to Article 87(3)(c) of the EC Treaty.

The purpose of this detailed assessment is to ensure that high amounts of aid to disadvantaged and disabled workers do not distort competition to an extent contrary to the common interest, but actually contribute to the common interest. This happens when the benefits of State aid in terms of the increased net employment of targeted disabled and disadvantaged workers outweigh the harm for competition and trade.

The provisions below provide guidance as to the type of information the Commission may require in order to carry out a detailed assessment. The guidance is intended to make the Commission’s decisions and their reasoning transparent and foreseeable in order to create predictability and legal certainty. Member States are invited to provide all the elements that they consider useful for the assessment of the case.

If there are several beneficiaries involved in the project notified as individual aid, please provide the information below for each of them.

Characteristics of the notified measure

1. Please provide a brief description of the notified measure specifying objective of the aid, aid instrument, beneficiaries, categories of workers concerned, aid amount, payment schedule, duration, aid intensity, and eligible costs.

2. Does the measure apply to the production and/or processing and/or marketing of the agricultural products listed in Annex I to the EC Treaty?

|

|

yes |

|

no |

3. Does the measure apply to the production, processing and/or marketing of the fisheries and/or aquaculture products listed in Annex I to the EC Treaty?

|

|

yes |

|

no |

4. Please provide details on the beneficiary including identity, group of which the beneficiary is a member, turnover, number of employees and business activities.

5. Does the notified measure relate to:

6. If applicable, please indicate the exchange rate which has been used for the purposes of the notification.

7. Please number all documents provided by the Member States as annexes to the notification form and indicate the document numbers in the relevant parts of this supplementary information sheet.

Objective of the aid

8. Please give a detailed description of the objectives of common interest pursued by the notified measure.

Equity objective of common interest ( 18 )

9. Please demonstrate that the notified measure will lead to a net increase of employment of the targeted disabled and disadvantaged workers and quantify the increase.

10. The following elements may be used for the purposes to demonstrate that the notified measure contributes to an equity objective of common interest. Please specify those relevant for the notified measure, and provide supporting documents:

|

|

Number and categories of workers concerned by the measure |

|

|

Employment rates of the categories of workers concerned by the measure on the national and/or regional level and in the undertaking(s) concerned |

|

|

Unemployment rates for the categories of workers concerned by the measure on the national and/or regional level. |

Appropriate instrument ( 19 )

11. Please explain to what extent the notified measure represents an appropriate instrument to increase the employment of disadvantaged and/or disabled workers and provide the supporting documents.

Incentive effect and necessity of the aid ( 20 )

In order to demonstrate the incentive effect, the Commission requires an evaluation by the Member State proving that the wage subsidy is only paid for a disadvantaged or disabled worker in a firm, where the recruitment would have not occurred without the aid.

12. Has/have the supported project(s) started prior to the submission of the application for the aid by the beneficiary/beneficiaries to the national authorities?

|

|

yes |

|

no |

If yes, the Commission considers that the aid does not present an incentive for the beneficiary to increase a net employment of disabled or disadvantaged workers.

13. If no, specify the relevant dates:

The employment commenced on:

The aid application by the beneficiary was submitted to the national authorities on:

Please provide the relevant supporting documents.

14. Does the recruitment lead to an increase, by comparison to a situation without aid, of number of disadvantaged or disabled workers in the undertaking(s) concerned?

|

|

yes |

|

no |

15. If not, have the post or posts fallen vacant following voluntary departure, disability, retirement on grounds of age, voluntary reduction of working time or lawful dismissal for misconduct and not as a result of redundancy?

|

|

yes |

|

no |

16. Please describe any existing or past wage subsidies in the undertaking concerned: categories and number of workers subject to subsidies.

Proportionality of the aid ( 21 )

Eligible costs must be calculated following Articles 40 and 41 of Regulation (EC) No 800/2008 and limited to the extra costs necessary to achieve a net increase of disadvantaged or disabled workers employed.

17. Which are the eligible costs foreseen under the notified measure?

|

|

gross wage, before tax |

|

|

compulsory contributions, such as social security charges |

|

|

child care and parent care costs. |

18. Please provide a detailed calculation of the eligible costs and the period covered ( 22 ) by the notified measure ensuring that the eligible costs are limited to the costs necessary to achieve a net increase of employment of the targeted categories of disadvantaged or disabled workers.

19. Please provide evidence that the aid is limited to the minimum, i.e. the aid amount does not exceed the net additional costs of employing the targeted categories of disadvantaged or disabled workers compared to the costs of employing workers who are not disadvantaged/disabled.

20. Please specify the aid intensity applicable to the notified measure.

21. Please specify the aid intensity applicable to the notified measure.

Analysis of the distortion of competition and trade ( 23 )

22. Please provide information on the aid amount, payment schedule and aid instrument.

23. Please specify whether the beneficiary received aid for disadvantaged or disabled workers in the past and provide details on the previous aid measures (dates, amount of aid, categories and number of workers concerned, and duration of wage subsidies).

24. Please specify the employment costs of the beneficiary (total employment costs, employment costs of targeted disabled and disadvantaged workers, proportion of employment costs in relation to total costs) and explain how the aid effects the beneficiary’s costs (e.g. percentage of employment costs and total costs covered by the aid).

25. Please specify the relevant product and geographic markets on which the beneficiary is active and the aid is likely to have an impact.

26. For each of these markets please provide:

— market concentration ratio,

— market share of the beneficiary,

— market shares of the other companies present in these markets.

27. Please describe the structure and competitive situation on the relevant markets and provide supporting documents (e.g. barriers to entry and exit, product differentiation, character of the competition between market participants, etc.).

28. Please describe the features of the sector where the beneficiary is present (e.g. importance of the labour costs for the sector, existence of overcapacity, etc.).

29. Please describe the situation on the national/regional labour market (e.g. unemployment and employment rates, wage levels, labour law, etc.).

30. If relevant, please provide information on the effects on trade (shift of trade flows).

CUMULATION

31. Is the aid granted under the notified measure combined with other aid?

|

|

yes |

|

no |

32. If yes, please describe the rules on cumulating aid applicable to the notified aid measure:

OTHER INFORMATION

33. Please indicate here any other information you consider relevant to the assessment of the measure(s) in concerned.

PART III.10

SUPPLEMENTARY INFORMATION SHEET ON STATE AID FOR ENVIRONMENTAL PROTECTION

This supplementary information sheet must be used for the notification of any aid covered by the Community Guidelines on State aid for environmental protection (thereinafter the Environmental aid guidelines) ( 24 ). It must also be used for individual aid for environmental protection which does not fall under any block exemption or is subject to individual notification obligation as it exceeds the individual notification thresholds laid down in the block exemption.

1. Basic characteristics of the notified measure

Please fill in the relevant parts of the notification form corresponding to the character of the notified measure. Please find below a basic guidance.

(A) Please specify the type of aid and fill in the appropriate subsections of Section 3 (Compatibility of aid under Article 87(3)(c) of the EC Treaty) of this supplementary information sheet:

Aid for undertakings which go beyond Community standards or which increase the level of environmental protection in the absence of Community standards, fill in Section 3.1

Aid for the acquisition of new transport vehicles which go beyond Community standards or which increase the level of environmental protection in the absence of Community standards, fill in Section 3.1

Aid for SMEs for early adaptation to future Community standards, fill in Section 3.2

Aid for environmental studies, fill in Section 3.3

Aid for energy saving, fill in Section 3.4

Aid for renewable energy sources, fill in Section 3.5

Aid for the cogeneration, fill in Section 3.6

Aid for energy-efficient district heating, fill in Section 3.7

Aid for waste management, fill in Section 3.8

Aid for the remediation of contaminated sites, fill in Section 3.9

Aid for the relocation of undertakings, fill in Section 3.10

Aid involved in tradable permit schemes, fill in Section 3.11

Aid in the form of reductions of or exemptions from environmental taxes, fill in Section 6.

Furthermore, please fill in: Section 4 (Incentive effect and necessity of aid), Section 7 (Criteria triggering a detailed assessment), Section 8 (Additional information for detailed assessment) ( 25 ), and Section 10 (Reporting and monitoring).

(B) Please explain the main characteristics (objective, likely effects of the aid, aid instrument, aid intensity, beneficiaries, budget etc.) of the notified measure.

(C) Can the aid be combined with other aid?

|

yes |

no |

If yes, fill in Section 9 (Cumulation) of this supplementary information sheet.

(D) Is the aid granted in order to promote the execution of an important project of common European interest?

|

yes |

no |

If yes, please fill in Section 5 (Compatibility of aid under Article 87(3)(b) of the EC Treaty) of this supplementary information sheet.

(E) In case the notified individual aid is based on an approved scheme, please provide details concerning that scheme (case number, title of the scheme, date of Commission approval):

(F) Please confirm that if the aid/bonus for small enterprises is granted, the beneficiaries comply with the definition for small enterprises as defined by the Community legislation:

yes

(G) Please confirm that if the aid/bonus for medium enterprises is granted, the beneficiaries comply with the definition for medium enterprises as defined by the Community legislation:

yes

(H) If applicable, please indicate the exchange rate which has been used for the purposes of the notification:

(I) Please number all documents provided by the Member States as annexes to the notification form and indicate the document numbers in the relevant parts of this supplementary information sheet.

2. Objective of the aid

(A) In the light of the objectives of common interest addressed by the Environmental aid guidelines (Section 1.2) please indicate the environmental objectives pursued by the notified measure. Please give a detailed description of each distinct type of aid to be granted under the notified measure:

(B) If the notified measure has already been applied in the past please indicate its results in terms of environmental protection (please indicate the relevant case number and date of Commission approval and, if possible, attach national evaluation reports on the measure):

(C) If the measure is new, please indicate the expected results and the period over which they will be achieved:

3. Compatibility of aid under Article 87(3)(c) of the EC Treaty

If there are several beneficiaries involved in the project notified as individual aid, please provide the information below for each of them.

3.1. Aid for undertakings which go beyond Community standards or which increase the level of environmental protection in the absence of Community standards ( 26 )

3.1.1. Nature of the supported investments, applicable standards

(A) Please specify if the aid is granted for:

investments enabling the beneficiary to increase the level of environmental protection resulting from its activities by improving on the applicable Community standards ( 27 ), irrespective of the presence of mandatory national standards that are more stringent than the Community standard;

or

investments enabling the beneficiary to increase the level of environmental protection resulting from its activities in the absence of Community standards.

(B) Please provide details, including, where applicable, information on the relevant Community standards:

(C) If the aid is granted for reaching the national standard exceeding the Community standards, please indicate the applicable national standards and attach a copy:

3.1.2. Aid intensities and bonuses

In the case of aid schemes, the aid intensity must be calculated for each beneficiary of aid.

(A) What is the maximum aid intensity applicable to the notified measure ( 28 )?

(B) Is the aid granted in a genuinely competitive bidding process ( 29 )?

|

yes |

no |

If yes, please provide details of the competitive process and attach a copy of the tender notice or its draft:

(C) Bonuses:

Do the supported projects benefit from a bonus?

|

yes |

no |

If yes, please specify below.

— Is an SME bonus applied under the notified measure?

—

|

yes |

no |

If yes, please specify the level of bonus applicable ( 30 ):

If yes, please describe how the following conditions are fulfilled:

the eco-innovation asset or project is new or substantially improved compared to the state of the art in its industry in the Community;

the expected environmental benefit is significantly higher than the improvement resulting form the general evolution of the state of the art in comparable activities;

the innovative character of these assets or projects involves a clear degree of risk, in technological, market or financial terms, which is higher that the risk generally associated with comparable non-innovative assets or projects.

Please provide details demonstrating the compliance with the abovementioned conditions:

Specify the level of bonus applicable ( 32 ):

(D) In case of an aid scheme, specify the total aid intensity of the projects supported under the notified scheme (taking into account the bonuses) (%):

3.1.3. Eligible costs ( 33 )

(A) Please confirm that the eligible costs are limited to the extra investment costs necessary to achieve a higher level of environmental protection than required by the Community standards:

yes

(B) Please further confirm that:

the precise environmental protection related cost constitutes the eligible costs, if the cost of investing in environmental protection can be easily identified;

or

the extra investment costs are established by comparing the investment with the counterfactual situation in the absence of aid, i.e. the reference investment ( 34 );

and

the eligible costs are calculated net of any operating benefits and operating costs related to the extra investment for environmental protection and arising during the first five years of the life of the investment concerned.

(C) What form do the eligible costs take?

investments in tangible assets;

investments in intangible assets.

(D) In case of investments in tangible assets please indicate the form(s) of investments concerned:

investments in land which are strictly necessary in order to meet environmental objectives;

investments in buildings intended to reduce or eliminate pollution and nuisances;

investments in plant and equipment intended to reduce or eliminate pollution and nuisances;

investments to adapt production methods with a view to protecting the environment.

(E) In case of investments in intangible assets (technology transfer through the acquisition of operating licenses or of patented and non-patented know how) please confirm that any such intangible asset satisfies the following conditions:

it is regarded as a depreciable asset;

it is purchased on market terms, from an undertaking from which the acquirer has no power of direct or indirect control,

it is included in the assets of the undertaking, and remains in the establishment of the recipient of the aid and is used there for at least five years ( 35 ).

Furthermore, please confirm that if the intangible asset is sold during those five years:

the yield from the sale will be deducted from the eligible costs;

and

all or part of the amount of aid will, where appropriate, be reimbursed.

(F) In case of investments aiming at obtaining a level of environmental protection higher than Community standards, please confirm the relevant statements:

if the undertaking is adapting to national standards adopted in the absence of Community standards, the eligible costs consist of the additional investment costs necessary to achieve the level of environmental protection required by the national standards;

if the undertaking is adapting to or goes beyond national standards which are more stringent than the relevant Community standards or goes beyond Community standards, the eligible costs consist of the additional investment costs necessary to achieve a level of environmental protection higher than the level required by the Community standards ( 36 );

if no standards exist, the eligible costs consist of the investment costs necessary to achieve a higher level of environmental protection than that which the undertaking or undertakings in question would achieve in the absence of any environmental aid;

(G) For aid schemes, please provide a detailed calculation methodology, by reference to the counterfactual situation, which will be applied to all individual aid grants based on the notified scheme, and provide the relevant evidence:

For individual aid measures, please provide a detailed calculation of the eligible costs of the notified investment project, by reference to the counterfactual situation, and provide relevant evidence:

3.1.4. Specific rules on aid for the acquisition of new transport vehicles which go beyond Community standards or which increase the level of environmental protection in the absence of Community standards ( 37 )

In the case of aid for the acquisition of new transport vehicles which go beyond Community standards or which increase the level of environmental protection in the absence of Community standards, in addition to sections 3.1.-3.1.3:

(A) Please confirm that new transport vehicles for road, railway, inland waterway and maritime transport complying with adopted Community standards have been acquired before their entry into force and that the Community standards, once mandatory, do not apply retroactively to already purchased vehicles.

yes

Please provide details:

(B) For retrofitting operations with an environmental protection objective in the transport sector, please confirm that:

the existing means of transport are upgraded to environmental standards that were not yet in force at the date of the entry into operation of those means of transport;

or

the means of transport are not subject to any environmental standards.

3.2. Aid for early adaptation to future Community standards ( 38 )

3.2.1. Basic conditions

(A) Please confirm that the investment is implemented and finalised at least one year before the entry into force of the standard.

|

yes |

no |

If yes, in the case of aid schemes, please provide details on how compliance with this condition is ensured:

If yes, in the case of individual aid please provide details and relevant evidence:

(B) Please provide details of the relevant Community standards, including the dates relevant for ensuring compliance with condition (A):

3.2.2. Aid intensities

What is the basic aid intensity applicable to the notified measure?

— for small enterprises ( 39 ): ;

— for medium-sized enterprises ( 40 ):

— for large enterprises ( 41 ):

3.2.3. Eligible costs

(A) Please confirm that the eligible costs are limited to the extra investment costs necessary to achieve the level of environmental protection required by the Community standard compared to the existing level of environmental protection required prior to the entry into force of this standard:

yes

(B) Please further confirm that:

the precise environmental protection related cost constitutes the eligible costs, if the cost of investing in environmental protection can be easily identified;

or

the extra investment costs are established by comparing the investment with the counterfactual situation in the absence of aid, i.e. the reference investment ( 42 );

and

eligible costs are calculated net of any operating benefits and operating costs related to the extra investment for environmental protection and arising during the first five years of the life of the investment concerned.

(C) What form do the eligible costs take?

investments in tangible assets

investments in intangible assets

(D) In case of investments in tangible assets please indicate the form(s) of investments concerned:

investments in land which are strictly necessary in order to meet environmental objectives;

investments in buildings intended to reduce or eliminate pollution and nuisances;

investments in plant and equipment intended to reduce or eliminate pollution and nuisances;

investments to adapt production methods with a view to protecting the environment.

(E) In case of investments in intangible assets (technology transfer through the acquisition of operating licenses or of patented and non-patented know how) please confirm that any such intangible asset satisfies the following conditions:

it is regarded as a depreciable asset;

it is purchased on market terms, from an undertaking from which the acquirer has no power of direct or indirect control,

it is included in the assets of the undertaking, and remains in the establishment of the recipient of the aid and is used there for at least five years ( 43 ).

Furthermore, please confirm that if the intangible asset is sold during those five years:

the yield from the sale will be deducted from the eligible costs;

and

all or part of the amount of aid will, where appropriate, be reimbursed.

(F) For aid schemes, please provide a detailed calculation methodology, by reference to the counterfactual situation, which will be applied to all individual aid grants based on the notified scheme, and provide the relevant evidence:

For individual aid measures, please provide a detailed calculation of the eligible costs of the notified investment project, by reference to the counterfactual situation, and provide relevant evidence:

3.3. Aid for environmental studies ( 44 )

3.3.1. Studies directly linked to investments aiming at achieving standards which go beyond Community standards, or increase the level of environmental protection in the absence of Community standards

(A) Please confirm if the aid is granted for studies directly linked to investments for the purposes of achieving standards which go beyond Community standards, or increase the level of environmental protection in the absence of Community standards.

|

yes |

no |

If yes, please specify which of the following purposes the investment serves:

it enables the beneficiary to increase the level of environmental protection resulting from its activities by improving on the applicable Community standards, irrespective of the presence of mandatory national standards that are more stringent than the Community standard;

or

it enables the beneficiary to increase the level of environmental protection resulting from its activities in the absence of Community standards.

(B) Please provide details, including, where applicable, the information on the relevant Community standards:

(C) If the aid is granted for studies directly linked to investments aiming at reaching national standards which go beyond Community standards, please indicate the applicable national standards and attach a copy:

(D) Please describe the types of studies that will be supported:

3.3.2. Studies directly linked to investments for the purposes of achieving energy saving

Please confirm that the aid is granted for studies directly linked to investments for the purposes of achieving energy saving.

|

yes |

no |

If yes, please provide evidence on how the purpose of the relevant investment complies with the definition of energy savings as laid down in point 70(2) of the Environmental aid guidelines:

3.3.3. Studies directly linked to investments of producing renewable energy

(A) Please confirm if the aid is granted for studies directly linked to investments for the purposes of producing renewable energy.

|

yes |

no |

If yes, please provide evidence on how the purpose of the relevant investment complies with the definition of production from renewable energy sources, as laid down in point 70(5) and (9) of the Environmental aid guidelines:

(B) Please specify the type(s) of renewable energy sources which are intended to be supported under the investment linked to the environmental study and provide details:

3.3.4. Aid intensities and bonuses

(A) What is the maximum aid intensity applicable to the notified measure ( 45 )?

(B) Is an SME bonus applied under the notified measure?

|

yes |

no |

If yes please specify the level of bonus applicable ( 46 ):

3.4. Aid for energy saving ( 47 )

3.4.1. Basic conditions

(A) Please confirm that the notified measure complies with the definition of energy savings in point 70(2) of the Environmental aid guidelines.

yes

(B) Please specify the type(s) of the supported measures leading to energy saving, as well as the level of energy saving to be attained, and provide details:

3.4.2. Investment aid

3.4.2.1. Aid intensities and bonuses

(A) What is the basic aid intensity applicable to the notified measure ( 48 ):

(B) Bonuses:

— Is an SME bonus applied under the notified measure?

—

|

yes |

no |

If yes, please specify the level of bonus applicable ( 49 ):

(C) Is the aid granted in a genuinely competitive bidding process ( 50 )?

|

yes |

no |

If yes, please provide details regarding the competitive process and attach a copy of the tender notice or its draft:

(D) In case of an aid scheme, specify the total aid intensity of the projects supported under the notified scheme (taking into account the bonuses) (%):

3.4.2.2. Eligible costs ( 51 )

(A) As regards the calculation of the eligible costs, please confirm that the eligible costs are limited to the extra investment costs necessary to achieve energy savings beyond the level required by the Community standards:

yes

(B) Please further clarify whether:

the precise energy saving related cost constitutes the eligible costs, in case the costs of investing in energy saving can be easily identified;

or

the part of the investment directly related to energy saving is established by comparing the investment with the counterfactual situation in the absence of aid, i.e. the reference investment ( 52 );

and

eligible costs are calculated net of any operating benefits and operating costs related to the extra investment for energy saving and arising during the first three years of the life of this investment in the case of SMEs, the first four years in the case of large undertakings that are not part of the EU CO2 Emission Trading System and the first five years in the case of large undertakings that are part of the EU CO2 Emission Trading System ( 53 ).

(C) In the case of investment aid for achieving a level of energy saving higher than Community standards, please confirm which one of the following statements is applicable:

if the undertaking is adapting to national standards adopted in the absence of Community standards, the eligible costs consist of the additional investment costs necessary to achieve the level of environmental protection required by the national standards;

if the undertaking is adapting to or goes beyond national standards which are more stringent than the relevant Community standards or goes beyond Community standards, the eligible costs consist of the additional investment costs necessary to achieve a level of environmental protection higher than the level required by the Community standards ( 54 );

if no standards exist, the eligible costs consist of the investment costs necessary to achieve a higher level of environmental protection than that which the undertaking or undertakings in question would achieve in the absence of any environmental aid;

(D) What form do the eligible costs take?

investments in tangible assets;

investments in intangible assets.

(E) In the case of investments in tangible assets please indicate the form(s) of investments concerned:

investments in land which are strictly necessary in order to meet environmental objectives;

investments in buildings intended to reduce or eliminate pollution and nuisances;

investments in plant and equipment intended to reduce or eliminate pollution and nuisances;

investments to adapt production methods with a view to protecting the environment.

(F) In the case of investments in intangible assets (technology transfer through the acquisition of operating licenses or of patented and non-patented know how) please confirm that any such intangible asset satisfies the following conditions:

it is regarded as a depreciable asset;

it is purchased on market terms, from an undertaking from which the acquirer has no power of direct or indirect control,

it is included in the assets of the undertaking, and remains in the establishment of the recipient of the aid and is used there for at least five years ( 55 ).

Furthermore, please confirm that if the intangible asset is sold during those five years:

the yield from the sale will be deducted from the eligible costs;

and

all or part of the aid amount will be, where appropriate, reimbursed.

(G) For aid schemes, please provide a detailed calculation methodology, by reference to the counterfactual situation ( 56 ), which will be applied to all individual aid grants based on the notified scheme, and provide the relevant evidence:

If the notification concerns an individual aid measure, please provide a detailed calculation of the eligible costs of the notified investment project, by reference to the counterfactual situation, and provide relevant evidence:

3.4.3. Operating aid

(A) Please provide information/calculations demonstrating that the aid is limited to compensating for net extra production costs resulting from the investment taking account of benefits resulting from energy saving ( 57 ):

(B) What is the duration of the operating aid measure ( 58 )?

(C) Is the aid degressive?

|

yes |

no |

What is the aid intensity of the:

— degressive aid (please indicate the degressive rates for each year) ( 59 ): ;

— non-degressive aid ( 60 ):

3.5. Aid for renewable energy sources ( 61 )

3.5.1. Basic conditions

(A) Please confirm that the aid is granted exclusively for the promotion of renewable energy sources as defined by the Environmental aid guidelines ( 62 ).

|

yes |

no |

(B) In the case of biofuel promotion, please confirm that the aid is granted exclusively for the promotion of sustainable biofuels within the meaning of those guidelines.

|

yes |

no |

(C) Please specify the type(s) of renewable energy sources ( 63 ) supported under the notified measure and provide details:

3.5.2. Investment aid

3.5.2.1. Aid intensities and bonuses

(A) What is the basic aid intensity applicable to each renewable energy source supported by the notified measure ( 64 ):

(B) Is an SME bonus applied under the notified measure?

|

yes |

no |

If yes, please specify the level of bonus applicable ( 65 ):

(C) Is the aid granted in a genuinely competitive bidding process ( 66 )?

|

yes |

no |

If yes, please provide details of the competitive process and attach a copy of the tender notice or its draft:

(D) In the case of an aid scheme, specify the total aid intensity of the projects supported under the notified scheme (taking into account the bonuses) (%):

3.5.2.2. Eligible costs ( 67 )

(A) Please confirm that the eligible costs are limited to the extra investment costs borne by the beneficiary compared with a conventional power plant or with a conventional heating system with the same capacity in terms of the effective production of energy;

yes

(B) Please further confirm that:

the precise renewable energy related cost constitutes the eligible costs, in case the cost of investing renewable energy can be easily identified;

or

the extra investment costs are established by comparing the investment with the counterfactual situation in the absence of aid, i.e. the reference investment ( 68 );

and

eligible costs are calculated net of any operating benefits and costs related to the extra investment for renewable sources of energy and arising during the first five years of the life of the investment concerned.

(C) What form do the eligible costs take?

investments in tangible assets;

investments in intangible assets.

(D) In the case of investments in tangible assets, please indicate the form(s) of investments concerned:

investments in land which are strictly necessary in order to meet environmental objectives;

investments in buildings intended to reduce or eliminate pollution and nuisances;

investments in plant and equipment intended to reduce or eliminate pollution and nuisances;

investments to adapt production methods with a view to protecting the environment.

(E) In the case of investments in intangible assets (technology transfer through the acquisition of operating licenses or of patented and non-patented know how) please confirm that any such intangible asset satisfies the following conditions:

it is regarded as a depreciable asset;

it is purchased on market terms, from an undertaking from which the acquirer has not power of direct or indirect control;

it is included in the assets of the undertaking, and remains in the establishment of the recipient of the aid and is used there for at least five years ( 69 ).

Furthermore, please confirm that if the intangible asset is sold during those five years:

the yield from the sale will be deducted from the eligible costs;

and

all or part of the aid amount will be, where appropriate, reimbursed.

(F) For aid schemes, please provide a detailed calculation methodology, by reference to the counterfactual situation, which will be applied to all individual aid grants based on the notified scheme, and provide the relevant evidence:

For individual aid measures, please provide a detailed calculation of the eligible costs of the notified investment project, by reference to the counterfactual situation, and provide relevant evidence:

3.5.3. Operating aid

Following the choice of the operating aid assessment option ( 70 ), please fill in the relevant part of the section below.

3.5.3.1. Option 1

(A) Please provide for the duration of the notified measure the following information demonstrating that the operating aid is granted in order to cover the difference between the cost of producing energy from renewable sources and the market price of the form of energy concerned:

— detailed analysis of the cost of producing energy from each of the relevant renewable sources ( 71 ):

—

—

— detailed analysis of the market price of the form of energy concerned:

—

—

(B) Please demonstrate that the aid will be granted only until the plant has been fully depreciated according to normal accounting rules ( 72 ) and provide a detailed analysis of the depreciation of each type ( 73 ) of the investments for environmental protection:

For aid schemes, please specify how the compliance with this condition will be ensured:

For individual aid, please provide a detailed analysis demonstrating that this condition is fulfilled:

(C) When determining the amount of operating aid, please demonstrate how any investment aid granted to the undertaking in question in respect of a new plant is deducted from production costs:

(D) Does the aid also cover a normal return on capital?

|

yes |

no |

If yes, please provide details and the information/calculations showing the rate of the normal return and give reasons why the chosen rate is appropriate:

(E) For aid for the production of renewable energy from biomass, where the operating aid would exceed the amount of investment, please provide data/evidence (based on calculation examples for aid schemes or detailed calculation for individual aid) demonstrating that the aggregate costs borne by the undertakings after plant depreciation are still higher than the market prices of the energy:

(F) Please specify the precise support mechanisms (taking into account the requirements described above) and, in particular, the methods of calculating the amount of aid:

— for aid schemes based on a (theoretical) example of an eligible project:

—

—

Furthermore, please confirm that the calculation methodology described above will be applied to all individual aid grants based on the notified aid scheme:

yes

— for individual aid please provide a detailed calculation of the aid amount (taking into account the requirements described above):

—

—

(G) What is the duration of the notified measure?

It is the practice of the Commission to limit its authorisation to 10 years. If yes, could you please undertake to re-notify the measure within a period of 10 years?

|

yes |

no |

3.5.3.2. Option 2

(A) Please provide a detailed description of the green certificate or tender system (including, inter alia, the information on the level of discretionary powers, the role of the administrator, the price determination mechanism, the financing mechanism, the penalty mechanism and re-distribution mechanism):

(B) What is the duration of the notified measure ( 74 )?

(C) Please provide data/calculations showing that the aid is essential to ensure the viability of the renewable energy sources:

(D) Please provide data/calculations showing that the aid does not in the aggregate result in overcompensation for renewable energy:

(E) Please provide information/calculations showing that the aid does not dissuade renewable energy producers from becoming more competitive:

3.5.3.3. Option 3 ( 75 )

(A) What is the duration of the operating aid measure ( 76 )?

(B) Please provide for the duration of the notified measure the following information demonstrating that the operating aid is granted to compensate for the difference between the cost of producing energy from renewable sources and the market price of the form of energy concerned:

— detailed analysis of the cost of producing energy from each of the relevant renewable sources ( 77 ):

—

—

— detailed analysis of the market price of the form of energy concerned:

—

—

(C) Is the aid degressive?

|

yes |

no |

What is the aid intensity of the:

— degressive aid (please indicate the degressive rates for each year) ( 78 ):

— ;

— non-degressive aid ( 79 ):

3.6. Aid for cogeneration ( 80 )

3.6.1. Basic conditions

Please confirm that the aid for cogeneration is granted exclusively to cogeneration units satisfying the definition of high efficiency cogeneration as set out in point 70(11) of the Environmental aid guidelines:

|

yes |

no |

3.6.2. Investment aid

Please confirm that:

the new cogeneration unit will overall make primary energy savings compared to separate production as defined by Directive 2004/8/EC and Commission Decision 2007/74/EC.

the improvement of an existing cogeneration unit or conversion of an existing power generation unit into a cogeneration unit will result in primary energy savings compared to the original situation.

Please provide details and evidence demonstrating the compliance with the above mentioned conditions:

3.6.2.1. Aid intensities and bonuses

(A) What is the basic aid intensity applicable to the notified measure ( 81 )?

(B) Bonuses:

— Is an SME bonus applied under the notified measure?

—

|

yes |

no |

If yes, please specify the level of bonus applicable ( 82 ):

(C) Is the aid granted in a genuinely competitive bidding process ( 83 )?

|

yes |

no |

If yes, please provide details of the competitive process and attach a copy of the tender notice or its draft:

(D) In case of an aid scheme, specify the total aid intensity of the projects supported under the notified scheme (taking into account the bonuses) (%):

3.6.2.2. Eligible costs ( 84 )

(A) Please confirm that the eligible costs are limited to the extra investment costs necessary to realise a high efficiency cogeneration plant:

yes

(B) Please further confirm that:

the precise cogeneration related cost constitutes the eligible costs, if the cost of investing in cogeneration can be easily defined;

or

the extra investment costs directly related to cogeneration are established by comparing the investment with the counterfactual situation in the absence of aid, i.e. the reference investment ( 85 );

and

eligible costs are calculated net of any operating benefits and operating costs related to the extra investment and arising during the first five years of the life of the investment concerned.

(C) What form do the eligible costs take?

investments in tangible assets;

investments in intangible assets.

(D) In the case of investments in tangible assets, please indicate the form(s) of investments concerned:

investments in land which are strictly necessary in order to meet environmental objectives;

investments in buildings intended to reduce or eliminate pollution and nuisances;

investments in plant and equipment intended to reduce or eliminate pollution and nuisances;

investments to adapt production methods with a view to protecting the environment.

(E) In the case of investments in intangible assets (technology transfer through the acquisition of operating licenses or of patented and non-patented know how) please confirm that any such intangible asset satisfies the following conditions:

it is regarded as a depreciable asset;

it is purchased on market terms, from an undertaking from which the acquirer has not power of direct or indirect control,