EUROPEAN COMMISSION

EUROPEAN COMMISSION

Brussels, 20.7.2017

SWD(2017) 270 final

COMMISSION STAFF WORKING DOCUMENT

Implementation of Article 325 TFEU by the Member States in 2016

Accompanying the document

REPORT FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT AND THE COUNCIL

Protection of the European Union's financial interests - Fight against fraud 2016 Annual Report

{COM(2017) 383 final}

{SWD(2017) 266 final}

{SWD(2017) 267 final}

{SWD(2017) 268 final}

{SWD(2017) 269 final}

Table of Contents

Measures taken by Member States

1.Summary

2.Horizontal anti-fraud initiatives and measures by Member States

2.1Progress on the development of National Anti-Fraud Strategies in 2016

2.2AFCOS

2.3Public Procurement

2.4Fight against corruption and organised crime

2.5Other measures

3.Anti-fraud measures in Revenue by the Member States

3.1Fight against customs fraud

3.2Fight against organised crime and anti-smuggling

3.3Fight against tax evasion and VAT fraud

4.Sectoral Anti-Fraud Policies, Measures and Results by Member States - Expenditure

4.1Agriculture

4.2Cohesion policy and Fisheries

Table of Figures

Figure 1: Number of measures reported by area

Figure 2: Horizontal v Sectoral

Figure 3: Sectoral measures: revenue

Figure 4: Sectoral measures: expenditure

Figure 5: Measures shown by area addressed and stage/s in the anti-fraud cycle

Figure 6: NAFS: State of play

Measures taken by Member States

1.Summary

Member States reported a significant number (80) of measures in 2016 on the protection of the EU’s financial interests and the fight against fraud, reflecting the adoption of the bulk of Union legislation for the new programming period 2015-2020. Member States were invited to report a maximum of three (most important) anti-fraud measures. This analysis therefore gives a good overview of trends and priorities in the anti-fraud measures implemented by Member States but is not exhaustive.

Member States’ measures covered the entire anti-fraud cycle, mostly in the area of shared management and control of EU funds, followed by measures on public procurement, conflict of interest, corruption, AFCOS, financial crime, definition of fraud, anti-fraud strategy, organised crime and whistle-blowers. Concerning the anti-fraud cycle, most of the measures concerned the prevention stage, followed by detection, investigation and prosecution, recovery and sanctions. The majority of measures were sectoral (73%) rather than horizontal (27%). Of these sectoral measures, twenty concerned revenue in the fields of tax fraud (60%) and customs (40%). Forty-one measures concerned expenditure in a broad range of budgetary areas (cohesion policy, agriculture, fisheries, fund for the most deprived, centralised direct expenditure, migration and asylum, globalisation fund).

Figure 1: Number of measures reported by area

Figure 2: Horizontal v Sectoral

Figure 3: Sectoral measures: revenue

Figure 4: Sectoral measures: expenditure

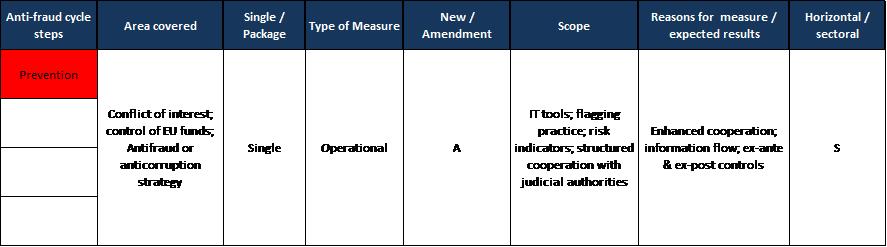

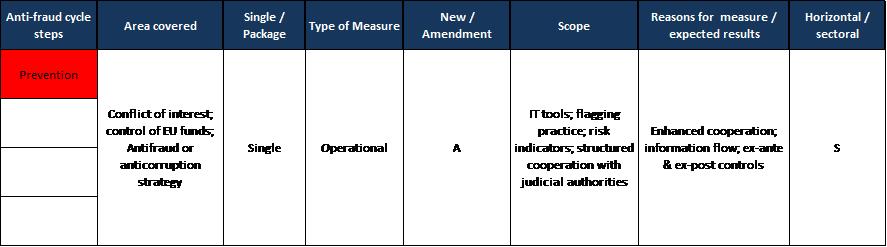

Figure 5: Measures shown by area addressed and stage/s in the anti-fraud cycle

2.Horizontal anti-fraud initiatives and measures by Member States

2.1 Progress on the development of National Anti-Fraud Strategies in 2016

By the end of 2016, a total of nine Member States had adopted a National Anti-Fraud Strategy and transmitted it to the Commission. This represents an increase in the number of National Anti-Fraud Strategies (NAFS) compared to 2015. Moreover, this demonstrates the commitment of Member States to adopt a strategic approach towards combatting fraud and irregularities detrimental to the EU's and national budgets. The Commission welcomes these developments and invites all other Member States to follow the example and establish NAFS in the near future based on the Guidelines prepared (in collaboration with Member States experts).

Figure 6: NAFS: State of play

A National Anti-Fraud Strategy allows for structuring the fight against fraud affecting EU and national budgets at the Member State level. It helps to identify vulnerabilities to fraud in the systems, assess the main fraud risks, set and implement responses; evaluate progress made, adapt the response to the evolution of the fraud trends and the resources available, and ensures the involvement of all relevant stakeholders in particular by means of enhanced collaborative and coordinated actions. A NAFS also helps to ensure harmonisation of the response to fraud risks throughout the country, especially in the case of a decentralised management structure.

The benefits of a National Anti-Fraud Strategy include:

üEnsuring the effective and efficient protection of the EU financial interests (i.e. improving the prevention, detection and fight against corruption and any other illegal activities affecting the financial interests of the Union);

üSetting out a better working framework upon which the institutions involved in the process of implementation and control of EU funds could work together to improve administrative capacity and determine more precisely the roles and responsibilities of the institutions involved. This would ensure effective co-ordination of legislative, administrative and operational activities of the institutions;

üAchieving a higher degree of recovery of unduly spent funds from the budget of the European Union and contributing to proportionate and dissuasive penalties in accordance with the applicable law.

While most strategies cover all EU funds, certain strategies concentrate on structural, agricultural or other specific funds. The questionnaire offered Member States the opportunity to provide further information about the procedure for establishing a NAFS, and these are detailed below as follows:

ØBELGIUM: At present there is no national coordination of the anti-fraud strategies applied by the various departments concerned, but the possibility of drafting a NAFS is being analysed. A legal framework regulating the functioning of AFCOS and cooperation with all the departments concerned is currently being drafted.

ØCZECH REPUBLIC: The NAFS specifically covers legislation governing public procurement.

ØGREECE: Updated of the action plan of their NAFS and stated that integrated the actions in their national management and control system.

ØFRANCE: On 14 September, the Minister for Finance adopted the first-ever national multiannual plan to tackle fraud against public finances. This plan is structured around five strategic priorities and includes specific measures relating to EU funds. These measures relate to risk mapping and investigation techniques, with an alert platform created for the European Social Fund (ESF) and information exchanged to prevent double financing under the European Agricultural Fund for Rural Development (EAFRD).

ØCROATIA: As stated in the PIF report 2014, the Republic of Croatia adopted its National Anti-Fraud Strategy in the field of protection of EU financial interests for the period 2014-2016 in January 2014. The purpose of the strategy was to ensure effective and efficient protection of the EU financial interests by strengthening the ability of the AFCOS system in the Republic of Croatia to carry out predefined measures and achieve the set objectives. The Strategy foresaw the drafting of an Irregularity and Fraud Risk Management Methodology which was developed by the Service for Combating Irregularities and Fraud, Ministry of Finance in 2016. All AFCOS system bodies in the Republic of Croatia (Irregularity Reporting System bodies, AFCOS-service and AFCOS-Network bodies) are obliged to conduct risk assessments in accordance with the methodology. The results of the risk assessment will be taken into account in the new National Anti-Fraud Strategy and will eventually lead to the updating and amending of existing Guidelines, existing legislation etc. Additionally, training needs analysis conducted in accordance with the Training Needs Analysis Methodology for the period 2017-2019 will also, along with a Fraud Risk Management Methodology, provide inputs for developing a new National Fraud Strategy.

ØLATVIA: The AFCOS Latvia Operational Strategy and Action Plan 2017-2019 was adopted on 16 January 2017. The strategy identifies three main objectives: policy planning, internal and external coordination and fraud prevention activities. The Strategy will be revised and updated at least once per year.

ØLITHUANIA: A National anti-corruption programme for 2015-2025 that contains anti-corruption and anti-fraud measures and activities relating to the use of EU funds.

ØMALTA: The NAFS covers both local requirements and international obligations.

ØAUSTRIA: Adopted a national revenue strategy as part of the overall business strategy of the Federal Ministry of Finance.

ØPOLAND: Given the specific nature of the implementation of EU funds in Poland, the size of allocations and the number of institutions involved in the process of the protection of the EU’s financial interests against fraud, Poland considers that it is not appropriate to create one general national strategy. Poland is therefore working on several separate sectorial strategies drawn up by the competent national institutions and adapted to the specific nature of the area at issue.

ØPORTUGAL: Anti-fraud strategies were approved as part of the 2014-2020 operational programmes for the European Structural and Investment Funds (ESIF). The Strategic Plan to Combat Tax and Customs Fraud and Evasion 2015-2017 (Revenue) was approved on 1 January 2015. A crosscutting National Anti-fraud Strategy covering all areas is currently being consolidated, since the fight against fraud is a pressing concern for all the national authorities involved. We also wish to highlight the cooperation agreement between the IGF, in its capacity as AFCOS, and the Portuguese Attorney-General’s Office, which is in the final stages of preparation.

ØROMANIA: Currently has an ongoing procedure for a new NAFS covering the 2017-2023 period, as the NAFS covering the period before its accession to EU (2007) is no longer valid. The anti-fraud department DLAF is responsible for drawing up the National Anti-Fraud Strategy (NAFS) and coordinating its implementation. DLAF prepared the draft NAFS and, in April 2016, sent it to the national bodies involved in the protection of the financial interests of the EU in Romania and asked for their support in developing and implementing the strategy. Specifically, DLAF asked each of those bodies to examine the documents and make proposals and comments; fill in the section that concerned it with relevant information and propose new measures falling within its remit to meet the objectives set out. The draft NAFS was also submitted to the European Anti-Fraud Office (OLAF) for comments and proposals. DLAF has collected and analysed all the replies that it has received, including OLAF’s. DLAF is now taking to following steps to complete the adoption of the Romanian NAFS: updating the NAFS with proposals, adding any necessary information (deadlines, indicators, competent persons, budgetary impact etc.); submitting the updated, complete NAFS to public debate; preparing the final version of the NAFS, submitting the NAFS for adoption by Government Decision; implementing the NAFS; reviewing and updating the NAFS.

ØUNITED KINGDOM: Considers that one strategy covering the various sectors of Agriculture, Structural Funds and Own Resources is not suitable to the situation in the UK. Instead, the UK finds that the best way to fight fraud is for each sector to produce and implement individual strategies to suit their own particular needs.

Background to NAFS

The new Multiannual Financial Framework applicable to the programming period 2014-2020 has been strengthened as regards fraud risk assessment, fraud prevention and detection. For shared management the sectoral Regulations require Member States to put in place effective and proportionate anti-fraud measures, taking into account the risks identified, to take the necessary steps to prevent, detect and sanction fraud and irregularities effectively and to reimburse irregular amounts to the EU budget. However, going beyond the immediate regulatory requirements and embedding these anti-fraud measures in a National Anti-Fraud Strategy (NAFS) is encouraged in order to ensure better monitoring of the fight against fraud detrimental to the financial interests of the EU and that of the Member States, as well as to ensure homogenous and effective practices, especially where the organisational structures are decentralised.

In the last two years, the COCOLAF Fraud Prevention Group focused on various aspects of the NAFS topic. First, as a pilot project, the working group in 2014 prepared the 'Guidelines for National Anti-Fraud Strategies for European Structural and Investment Funds (ESIF)'. These guidelines laid down the foundation for drafting a National Anti-Fraud Strategy, however with a limited scope on expenditure in the field of ESIF. In the following year, another working group was set up to target the practical side of NAFS. As a result, in 2015 the document called 'Practical steps towards drafting of a National Anti-Fraud Strategy' was issued together with a practical tool in the form of an xls file that can be used to carry out the assessment of the state of play with regard to the current measures in place, taking into account all the four stages of the anti-fraud cycle.

The current guidelines represent an update of the NAFS guidelines issued in 2014. The working group in 2016 aimed at revising as well as enlarging the previous guidelines for the NAFS so that it become a horizontal document covering all shared management expenditure: European Structural and Investment Funds (ESIF), Agriculture, Home Affairs Funds (AMIF/ISF) and Fund for European Aid to the Most Deprived (FEAD). In addition, the guidelines were enriched with a number of concrete examples of Member States' practice that have proven to be successful.

2.2 AFCOS

Most of the anti-fraud measures taken by Member States in 2016 were horizontal and did not target a specific budgetary area.

|

Denmark - AFCOS anti-fraud manual

|

Denmark drafted a manual for cooperation in the Danish anti-fraud network (AFCOS network). This targeted the prevention detection; investigation and prosecution stages of the anti-fraud cycle and covered the areas of AFCOS, customs/TOR/Illicit trade and shared management/control of EU funds. The manual provides a comprehensive horizontal overview of the authorities' work to combat fraud involving EU funds, the cooperation in the network and cooperation between the Danish authorities and OLAF. It covers a wide range of issues including: the legal basis in EU law for fighting fraud, national provisions, the conduct of tasks, the organisation of anti-fraud work in the AFCOS network's authorities, horizontal cooperation across authorities in the AFCOS network and procedures for transferring cases to the Public Prosecutor for Serious Economic and International Crime (SøIK).

France adopted a national anti-fraud strategy at the French antiFraud Coordination Service (AFCOS). This measure covers the full range of the anti-fraud cycle from prevention, detection, investigation and prosecution to recovery and sanction and includes the areas of AFCOS and antifraud or anti-corruption strategy. It is the first time that this strategy is multiannual and in addition to measures relating to social security fraud and tax fraud (VAT fraud), it also includes specific measures relating to EU funds. The aim is to improve risk analysis of relevant stakeholders, but also to develop new detection tools, such as an alert platform for the ESF. These measures are multiannual and will be implemented over a three year period from 2016 to 2018. The national strategy includes an organisational measure which consists in creating an alert platform for the ESF, as well as a committee tasked with the examination of any alerts received. In addition, the national strategy includes measures to ensure that information relating to the ESF and the EAFRD will be cross-referenced between management authorities and national administrations. There are also measures aimed at improving knowledge of the risks relating to paying agencies of EU funds by developing risk maps. Finally, in terms of revenue, the fight against intraCommunity VAT fraud is also improved by better systems for crossreferencing information between customs and the tax administration.

Croatia's Service for Combating Irregularities, Fraud Irregularity and Fraud Risk developed a management methodology to promote the fraud prevention function of the Croatian AFCOS. Irregularity Reporting System bodies, AFCOS Service (Service for Combating Irregularities and Fraud) and AFCOS-Network bodies are obliged to conduct assessment of risks related to irregularities and fraud in line with their competences. The purpose of the methodology is to provide instructions and tools for irregularity and fraud risk management in agriculture, fisheries and cohesion expenditure. It is expected to support the identification of the riskiest projects, assessment of exposure of managing authority and certifying authority to fraud risks, assessment of exposure of AFCOS to risks threatening its objectives and identification and implementation of corresponding risk mitigation measures.

Latvia drafted the AFCOS Latvia Operational Strategy and Action Plan 2017-2019. The Strategy is set up for three years and revised annually in the AFCOS Council. The monitoring of implementation is under AFCOS responsibility, however the actions are implemented in cooperation with other competent authorities. The Strategy targets the fraud prevention stage of the anti-fraud cycle and focuses on policy making, coordination and cooperation matters, as well as fraud prevention trainings, public awareness and involvement in the OLAF Anti-Fraud Co-ordinator's Network (OAFCN). Concerning the area of fraud definition, the criminal law evaluation working group concluded that no amendments are needed regarding specific terms to the EU funds as the current law entails all the necessary points but under different articles. The focus shall be on the institutions who are applying the terms in practice (investigators, prosecutors) and to work on common interpretation of terms and respective application.

Latvia also introduced a series of additional horizontal fraud prevention measures:

üAFCOS representation and participation in the OLAF communicators’ network and other meetings, ensuring national participation and representation at the respective level meetings.

üIdentified existing regulatory framework, the necessary functions and the competent authorities in order to determine whether any changes /amendments are needed to ensure that the Administrative Cooperation Agreement with OLAF is executed properly.

üPrepared and signed ACA.

üCommunicated and exchanged information between all competent authorities.

Communicated on preventive measures with the public on antifraud issues in accordance with Anti-Fraud Communicator’s Network (OAFCN) initiatives. Obtained indication of the public's perception and awareness, as well the possible levels of fraud in Latvia in order to determine future courses of action to fraud prevention.

Malta also improved its relationships with various AFCOS services from different EU Member States by participating in a study visit in Riga, Latvia between 31 May till 3 June, hosting a round table with AFCOS Italy between 24-26 August, hosting AFCOS Bulgaria 26-30 September and participating in a study visit in Sofia, Bulgaria between 10-13 October. This measure targeted the prevention, detection, investigation and prosecution stages of the anti-fraud cycle and the areas of public procurement, fraud definition, AFCOS, customs, shared management.

Netherlands set up an AFCOS-team by merging three different units: the unit which deals with OLAF cases, the Customs fraud unit and the excise fraud unit. The main tasks of this 25 person AFCOS-team are to work together with OLAF on fraud cases, and to settle incoming information in such a way as to investigate and pursue as many criminal companies as possible. The Dutch AFCOS-fraud unit has all the necessary expertise to set up strong anti-fraud activities. One of the subtasks of this team is to raise internal and external awareness on the importance of a strong anti-fraud policy.

Finland activated the national AFCOS network and improved cooperation and coordination between the national competent authorities in the field of fraud prevention. The Finnish AFCOS organised first coordination meetings for the national authorities in order to enhance the exchange of information and experiences among the responsible bodies. Closer cooperation will result as more coordinated actions and participation in the OLAF activities. This measure targeted the fraud prevention stage of the anti-fraud cycle in the area of AFCOS, customs and shared management.

2.3 Public Procurement

Progress was made in the area of public procurement. Indeed by 18 April 2016, EU Member States had to transpose the following three directives into national law:

·

Directive 2014/23/EU on the award of concession contracts

·

Directive 2014/24/EU on public procurement

·

Directive 2014/25/EU on procurement by entities operating in the water, energy, transport and postal services sectors

Bulgaria - Public procurement

Bulgaria adopted the Public Procurement Act to target fraud prevention and detection in the field of public procurement and corruption. This is a new framework act transposing Directives 2014/24/EU and 2014/25/EU and other directives applicable in the field of public procurement. The Regulation for implementation of the Public Procurement Act was also adopted by the Council of Ministers. It set outs provisions laying down rules that are to be referred to in implementation of the Act or are essential for its implementation.

The new Public Procurement Act also stipulates: national rules for public procurements under the Directives’ thresholds, wide preliminary control by the Public Procurement Agency, e-procurement, centralized procedures, establishment of Methodological Committee for unifying the practice of the Control Bodies and new administrative penalty rules.

|

Czech Republic - Public procurement

|

Czech Republic also took steps to harmonise national legislation with EU legal provisions fraud prevention in the recovery and sanction stage of the anti-fraud cycle and covering the fields of public procurement, corruption, conflict of interest for the following laws:

üDirective 2014/24/EU of the European Parliament and of the Council of 26 February 2014 on public procurement and repealing Directive 2004/18/EC.

üDirective 2014/25/EU of the European Parliament and of the Council of 26 February 2014 on procurement by entities operating in the water, energy, transport and postal services sectors and repealing Directive 2004/17/EC.

üDirective 2014/23/EU of the European Parliament and of the Council of 26 February 2014 on the award of concession contracts.

üDirective 2014/55/EU of the European Parliament.

üAct No 134/2016 on public procurement. 2016 Action Plan to Fight Corruption

üDraft Act amending Act No 159/2006 on conflict of interest, as amended, and other related acts.

üClarification of the conditions for conflict of interest and its consequences, the obligation of tenderers to disclose their ownership structure, clarification of the conditions for market consultations, under which the contracting authority consults entities pursing commercial activities on the conditions of a tender procedure beforehand.

|

Greece - Public procurement

|

Greece adopted a new legislative framework for public procurement targeting the prevention and detection stages of the anti-fraud cycle in the areas of public procurement and conflict of interest. The framework adopted on 8 August 2016 transposes Directives 2014/24/EU and 2014/23/EU and codifies, consolidates and simplifies the pre-existing institutional framework for public procurement in a single piece of legislation. Law 4413/2016 transposes Directive 2014/23/EU on concessions into Greek law.

|

Spain - Public procurement

|

Spain also took steps to transpose the European Directives on public procurement to boost the prevention stage of the anti-fraud cycle in the areas of public procurement, corruption, conflict of interest. The draft law on public-sector contracts, which transposes into Spanish law Directives 2014/23/EU and 2014/24/EU of the European Parliament and of the Council of 26 February 2014 was approved. In addition, the draft law on procurement procedures in the water, energy, transport and postal services sectors which transposes into Spanish law Directive 2014/25/EU of the European Parliament and of the Council of 26 February 2014 was approved. The measure covers all aspects of public procurement including the definition of the subjective and objective scope of application, the principles that should govern tenders, bans on contracting, the definition of the subject of the contracts, procedures and criteria for awarding the contract, procedures for dealing with breaches of contract law, disclosure and transparency of contracts, amendments to contracts, subcontracting and contract enforcement. The measures taken include the following: (1) an obligation to prevent, detect and resolve conflicts of interest; (2) an extension of the ban on contracting due to incompatibility to cover relatives in the ascending and descending lines and second-degree relatives; (3) the abolishment of the negotiated procedure without publication based on volume; (4) the inclusion of all political parties, unions and employers’ organisations in the scope of the law; (5) a reinforcement of special appeals relating to procurement procedures; (6) the tightening up of rules concerning contracting authorities that are not public bodies and awards to in-house providers.

|

France - Public procurement

|

France took measures addressing transparency of companies participating in public procurement. For example: white lists (lists of companies with a high level of transparency and integrity during participation in public procurement), debarment/black lists (preventive instrument - exclusion from public contracting including procurements), international collaboration (sharing information and collaboration in order to avoid double funding, debarment lists, joint investigations and exchange of best practices, etc.), 'four-eye principle' (requirement that a business transaction should be approved by at least two individuals) and other.

|

Cyprus - Public procurement

|

Cyprus implemented Regulations (KDP138/2016) on Managing the Implementation of Public Procurement Procedures and the Exclusion of Economic Operators from Contract Procedures, which includes:

üApproval of changes to and claims regarding public contracts by competent bodies on the basis of specified financial limits, provided that the conditions laid down in the relevant European directives are met.

üProcedure for receiving supplies.

üProcedure for assessing contractor performance.

üProcedure for excluding economic operators from contract procedures.

|

Latvia - Public procurement

|

Latvia completed preparatory work to transpose EU Procurement Directives into national law. Measures were taken by the Managing Authorities to update internal procedures, improve information systems, set up a working group for risk management and for certain measures in the field of Public Procurement (legislation and trainings). The main amendments to national Public Procurement law during 2016 were the automatic exclusion of candidates or tenderers found guilty in criminal offences such as participating in a criminal organization, bribery, fraud, money laundering or terrorist financing and trafficking in human beings. All contract information must now be published. This measure targets the prevention, detection, recovery and sanction stages of the anti-fraud cycle in the areas of public procurement, corruption, conflict of interest and shared management.

Latvia also carried out preparatory work to implement the electronic procurement procedure that is already available but not obligatory. There are certain conditions for public institutions and the regional councils to use the common procurement institutions services to obtain goods/services. Measures to improve the transparency of companies include some regulation for abnormally low tenders, and ensuring that verifications for average hourly rate are made according to minimum rates. Also the public procurement law was clarified on potential conflict of interest where the employee or official who prepares procurement documentation may not participate in the tender. Latvia has focused its update of existing public procurement procedures and checklists on setting up working groups, improving the reporting system of irregularities, and the discriminatory requirements in tenders. The Procurement Monitoring Bureau organised 32 seminars for 1615 participants on applying the Directives and conflict of interest.

|

Hungary - Public procurement

|

Hungary targeted the prevention and detection stages of the Anti-Fraud Cycle in the areas of public procurement and corruption with activities carried out by the Public Procurement Authority to combat corruption in the public procurement sector:

üorganising information and training sessions for interested parties: a series of events called the Public Procurement Academy;

üincreased inspection activities: checks on negotiated procedures without publication and on the performance of and changes to public procurement contracts;

üactivities aimed at increasing transparency, e.g. keeping a record of qualified suppliers, keeping a list of prohibited suppliers, and publishing a code of ethics

|

Romania - Public procurement

|

Romania adopted a new public procurement legislative package transposing the new EU Directives in the field and setting up a mechanism to prevent conflicts of interest in the award of public procurement contracts. This measure targeted the prevention stage of the anti-fraud cycle in the areas of public procurement, corruption and conflict of interest. The package included: sector-specific procurement, works and service concessions, remedies and means of redress in relation to the award of public procurement contracts, sector-specific procurement contracts and concession contracts for works and services, and the organisation and functioning of the National Complaint Resolution Council (CNSC) and Law setting up a mechanism to prevent conflicts of interest in public procurement procedures.

Where the ex-ante verification procedure identifies a potential conflict of interest in the award of the public procurement contract, the National Integrity Agency (ANI) issues an integrity warning, which it sends to the manager of the entity concerned so that the issue can be rectified. The ‘Prevent’ legislative package launched by the Ministry of Justice in consultation with the National Integrity Agency which does not have a right of legislative initiative is intended to help meet the objectives relating to the prevention of conflicts of interest in public procurement. It has been signed into law by the President of Romania. A new package of four laws transposing the Directives in this field as well as:

üimplementing rules on public procurement;

üsector-specific procurement;

üworks and service concessions;

üremedies and means of redress in relation to the award of public procurement contracts;

üsector-specific procurement contracts and concession contracts for works and services and the organisation and functioning of the National Complaint Resolution Council (CNSC);

ülaw setting up a mechanism to prevent conflicts of interest in public procurement procedures.

2.4 Fight against corruption and organised crime

|

Belgium - Preventing bribery

|

Belgium amended criminal law and criminal procedure criminal sanctions targeting the fraud investigation and prosecution and recovery and sanction stages of the anti-fraud cycle, in the area of corruption. The Potpouri II Act of 5 February 2016 amended two points concerning bribery:

üAmendments to the definition of passive bribery (both public and private bribery) - Articles 246 and 504a of the Penal Code

üStricter punishment for passive and active bribery of a person who exercises a public function in a foreign state or public international organisation, new article 250 of the Criminal Code.

|

France - Fight against corruption

|

France took a series of measures to fight against corruption in public procurement:

üMeasures addressing transparency in public procurement including disclosure of fraudsters, 'naming and shaming', disclosure of beneficiaries, beneficial owners of the contractors and subcontractors, including advance checking, disclosure of the members of evaluation committees, public disclosure of documents/information (public access to key documents including terms of reference individual bids, evaluation sheets and contracts or amendments to the contracts) and other.

üMeasures to improve the effectiveness of public procurement management. These include publishing the e-procurement procedure online, market-based indicators, specialised or centralised procurement authorities, assessment of anti-corruption measures, corruption statistics, integrity pacts (a tool for preventing corruption in public contracting through contractual clauses, for example an agreement between the government agency offering a contract and companies bidding for it that they will abstain from bribery, collusion and other corrupt practices for the extent of the contract).

üMeasures to prevent corruption amongst personnel, including management. Personnel administration (transparent recruitment, advance screening, vetting of candidates, rotation in sensitive posts), rules on ethics (codes of conduct, acceptance of gifts), whistle-blowers (protection of witnesses or employees), anti-corruption training and awareness raising, mandatory disclosure of assets, post-employment rules, sanctions (administrative, disciplinary or financial sanctions, debarment, listing of non-reliable staff), leniency/voluntary disclosure programmes (motivation measure, cooperation with the police during investigation etc. in accordance with/encapsulated in competition and criminal law), wiretapping, agents provocateurs.

|

Lithuania - Fight against corruption

|

Lithuania introduced the Management and Control System for 2014-2020 reinforced by incorporating the Special Investigation Service (STT) – the anti-corruption law enforcement agency responsible for the detection and investigation of corruption related criminal acts and development and implementation of corruption prevention measures. This measure targeted the prevention and detection stage of the anti-fraud cycle in the area of corruption. In this connection, the Procedure for Exchanging Information on the Suspected Corruption Cases with STT was established and co-implementation of the Operational Programme of the European Union Funds Investments in 2014-2020 by STT was provided for in the national legal acts. The Government of the Republic of Lithuania made the following Resolutions:

üNo. 473 of 11 May 2016 "on the Amendment of the Resolution of the Government of the Republic of Lithuania No. 528 of 4 June 2014, on the Allocation of Responsibilities and Functions among the Institutions Implementing the Operational Programme for the European Union Structural Funds Investments in 2014-2020."

üNo. 485 of 18 May 2016 "On the Amendment of the Resolution of the Government of the Republic of Lithuania No. 1090 of 3 October 2014, on the Adoption of the Rules of Administration of the Operational Programme for the European Union Funds Investments in the 2014-2020" entitles institutions that administer the EU funds to inform STT about suspected corruption cases and obliges STT to inform the managing authority about the start and/or the end of pre-trial investigations.

|

Romania - Fight against corruption

|

The following objectives and measures set out in the anti-corruption strategy are of relevance to the fight against fraud: transparency in the management of public resources; management of institutional risks and vulnerabilities; enhancing integrity and reducing vulnerabilities and risks of corruption in priority sectors and fields of activity;

The aim of the 2016-2020 NAS is to promote integrity by applying the legislative and institutional framework rigorously to prevent corruption in Romania. It is a multidisciplinary document addressed to all public bodies representing the executive, the legislature, the judiciary, the local public administrations, the business sector, and civil society. It identifies specific and general objectives for each type of intervention. These are developed through transparency in decision-making and open government.

In conjunction with the sector-specific integrity policies, the previous NAS (2012-2015) brought about, for the first time in the history of public policies in the field, a substantial change in the efficiency of the proposed measures. The results of the anti-corruption measures have had a major impact on the performance of the government and the administration.

The 2016-2020 NAS sets out general and specific objectives for each vulnerability identified by national and international evaluations. The measures laid down in detail by the NAS also include management of institutional risks and vulnerabilities (including whistle-blower protection and the prevention of revolving-doors situations), mitigation of risks of corruption in public procurement and interaction between public bodies and businesses.

|

Romania - Fight against organised crime

|

Romania strengthened the institutional and legislative framework for combating organised crime by making the National Agency for the Administration of Seized Assets (ANABI) operational. This measure targeted the recovery and sanction in the area of organised crime. This will ensure that ANABI becomes operational as required by Law No 318/2015, which states that the Agency should be fully operational within one year after being set up. By setting up this agency, Romania proposes an integrated approach to the recovery of criminal assets, by combining support for criminal prosecution bodies and courts with international cooperation, effective management of seized assets and social re-use of seized goods and assets.

Operationalisation is a complex process that requires new legislation and various other activities as provided for by law. It was necessary to take these steps in 2016, so as enable the process that started in 2015 to continue normally. For the law to be fully implemented, it was necessary to adopt secondary legislation in 2016.

|

Slovenia - Fight against economic crime

|

Slovenia issued guidelines and mandatory instructions for drawing up the police work plan for 2017. This measure targeted the detection, investigation and prosecution stages of the anti-fraud cycle in the areas of financial crime, organised crime, corruption, conflict of interest, fraud definition, and shared management. The guidelines state that the police should continue to detect and investigate economic crime and organised forms of corruption, with particular emphasis on cases that harm the banking system, the budget and EU funds, and cases that result in large-scale material gain, and on stepping up financial investigations and the work of specialised investigation task forces. In cooperation with other authorities, the police continued training for criminal investigators on EU funds in 2016 via the THEMIS training project. The annual police guidelines prioritise:

üdetection and investigation of economic crime and closer interdepartmental cooperation with the national authorities responsible;

Czech Republic - Fight against organised crime

Czech Republic also created the National Centre for the Fight against Organised Crime of the Criminal Police and Investigation Service Office of the Police of the Czech Republic. This measure targeted the fraud detection, investigation and prosecution stages of the anti-fraud cycle, in the areas of public procurement, financial crime, organisational crime, corruption, AFCOS and smuggling/illicit trade. The Centre emerged from the re-structuring of the Department for the detection of corruption and financial crimes. It is a new national police department in charge of detecting and investigating the most serious forms of crime, inter alia in the area of public procurement, corruption and use of EU funds.

|

Estonia - Compulsory information for analysis

|

Estonia made the business registry code for the beneficiaries’ service providers compulsory in the Estonian Managing Information System (MIS) as of March 2016. This requirement simplifies the mass analysis of data and helps to identify conflicts of interests (related persons and other connections). This measure targeted the prevention and detection stages of the anti-fraud cycle and the area of shared management.

Most of the anti-fraud measures taken by Member States in 2016 were horizontal and did not target a specific budgetary area. Particular progress was made in the area of public procurement.

2.5Other measures

|

Belgium - Targeting tax havens

|

Belgium (partially) transposed Directives 2014/86/EU, 2015/121/EU and 2016/1164/EU, in particular by adjusting the applicability of the Dividends Received Deduction (DRF), exempting withholding tax from dividends, introducing a choice between immediate payment or spread payment of exit tax in respect of income tax, and extending reporting obligations for payments to tax havens. The legislative Act reference is: 1 December 2016 (Official Gazette, 8 December 2016) and Programme Act of 1 July 2016.

This measure targeted the fraud prevention stage of the anti-fraud cycle.

|

Estonia - Civil action in a criminal procedure

|

Estonia added to the Criminal Procedure Code a new provision that enables officials to avoid parallel procedures (criminal and civil) and file the state financial claims in criminal proceedings. The new clause sets out the types of property claims that victims can issue. This measure targeted the investigation and prosecution, recovery and sanction stages of the anti-fraud cycle in the areas of financial crime, customs/TOR/illicit trade, shared management.

Spain - Improved fraud detection

Spain's National Anti-Fraud Coordination Service defined criteria regarding the classification and handling of irregularities and suspected fraud in operations or projects that are the subject of criminal proceedings. This measure targeted the detection stage of the anti-fraud cycle in the area of AFCOS by establishing guidelines for national authorities managing, certifying and monitoring EU funding on the classification of irregularities such as suspected fraud. The purpose of the guidelines is to ensure that cases are communicated correctly to the European Anti-Fraud Office and followed up properly by the National Anti-Fraud Coordination Service.

Spain launched a National Subsidy Database (BDNS), which operates as the national subsidy disclosure system for public subsidies and grants (both national subsidies and grants and those financed using European funding). The object is to improve transparency of information on public subsidies (calls for tender, awards, beneficiaries, reimbursements, penalties, etc.) and improve detection of different types of subsidy-related fraud.

This measure targets the prevention and detection stages of the anti-fraud cycle, in particular the detection of fraud involving the double funding of the same project or activity. As of 1 January 2016, the BDNS database centralises all information on all public subsidies for which an application procedure was organised and which were granted by State bodies, the Autonomous Communities and local bodies to any beneficiary.

|

France - Protection of whistle-blowers

|

France created a general framework for the protection of whistle-blowers providing a general definition and protection under criminal law: invalidity of retaliatory measures taken against them and a numerical index identifying lobbyists, which is shared by the parliamentary assemblies, governmental and administrative authorities and local and regional authorities. The High Authority for Transparency in Public Life will check whether lobbyists have in particular met their ethical obligations and failings will be subject to criminal sanctions. A whistle-blower is defined in order to cover a broad range of alerts: any domain in which a crime or offence occurs, a serious and manifest breach of an international commitment duly ratified or approved by France, a unilateral legal instrument of an international organisation adopted on the basis of such a commitment, the law or a regulation, or a threat or serious damage to the general interest. The implementation of procedures for collecting alerts from staff members or freelancers is compulsory.

|

Croatia - Anti-fraud training

|

Croatia's Service for Combating Irregularities and Fraud in 2016 also developed a training needs analysis methodology for the period 2017- 2019.The main purpose of the methodology is to define the methods of identifying training needs of employees of AFCOS system bodies in order to design appropriate educational/training programs. Moreover, the main objective of the methodology is to identify topics that need to be addressed through future trainings of AFCOS system bodies. Identified topics will be included in the annual education plans of AFCOS system bodies.

|

Italy - Inspection campaign

|

Italy carried out an inspection campaign aimed at bringing to light entities which, despite having carried out many transactions with EU and/or non-EU suppliers and/or clients, failed in 2014 to submit the declarations provided for with respect to direct taxes and VAT (those evading all tax likely to be involved in carousel fraud). This measure targeted the detection; investigation and prosecution stages of the anti-fraud cycle in the area of shared management.

|

Lithuania - e-tool for criminal proceedings

|

Lithuania's Integrated Information System of Criminal Proceedings is an e-tool used for storing, managing and providing information related to criminal proceedings. Officials investigating criminal acts are entitled to make online recording and transmission of procedural documents, sanction necessary actions and communicate with prosecutors and judges in a fast manner to avoid wasting time for the signature, transmissions and sending of documents. The system is aimed at promoting cooperation and coordination of law enforcement and other institutions. The system stores information on criminal acts collected by pre-trial investigation institutions, instituted pre-trial investigations, conducted pre-trial investigations, data on pre-trial investigation cases and statistical information on pre-trial investigations. The measure targets the prevention, detection, investigation and prosecution stages of the anti-fraud cycle.

|

Hungary - Anti-fraud training

|

Hungary organised training on fraud prevention and detection for staff managing EU funds targeting the prevention and detection stages of the anti-fraud cycle in the area of shared management.

üAt the Prime Minister's Office request the National Tax and Customs Administration’s Anti-Fraud Coordination Service (the Hungarian AFCOS) organised training courses for some 800 people on ‘Fraud prevention in the field of EU development policy’.

üTraining for new recruits, organised by the Prime Minister’s Office.

üTraining organised for 190 people on ‘Public service ethics and integrity’ in cooperation with the National University of Public Service.

üThe Prime Minister’s Office organised in-house training for 83 people, introducing them to integrity systems.

|

Hungary - Reinforced co-operation

|

Hungary targeted the investigation and prosecution stages of the Anti-Fraud Cycle in the area of financial crime by maintaining contact and exchanging information to make cooperation with bodies and authorities involved in auditing EU support more successful, and making ‘operational’ cooperation (in individual cases) more effective.

|

Netherlands - Fraud awareness

|

Netherlands took a series of actions to increase fraud awareness among staff:

ØOrganization of workshops to increase fraud awareness among the staff members by the Dutch Public Prosecution Office, and the inspection of the ESF to talk about fraud (with funds).

ØIncreasing awareness during work meetings on fraud, by for example, distributing OLAF documents amongst staff (such as ‘detection of forged documents in the field of structural actions’, and ‘Identifying conflicts of interests in public procurement procedures for structural actions – a practical guide for managers’.)

ØThe working program includes a file which must be filled in at every check, including a part on fraud risks.

ØStaff members participated in a three day anti-fraud training course.

|

Austria - Central register of accounts

|

Austria adopted the Registration and Inspection of Accounts Act which requires the establishment of a central register of accounts and deposits for the purposes of tax, fiscal and criminal law. The register covers all current, investment and savings accounts and deposits held by Austrians and foreigners at Austrian credit institutions. This measure targeted the prevention, detection, investigation and prosecution, recovery and sanction stages of the anti-fraud cycle, in the areas of financial crime, organised crime, fraud definition, customs/TOR/illicit trade.

üdetection and investigation of criminal corruption, where the risk of corruption is highest, with an emphasis on investigating criminal offences where the suspects are holders of public office and authority.

ütraining of criminal investigators to acquire knowledge of EU funds and familiarity with EU institutions in the fight against fraud.

Improving the enforceability of (compulsory) articles of the co-financing agreement, which must be used for calls for tender for European funding by bodies involved in implementing cohesion policy that work in the areas of labour, the family, social affairs and equal opportunities, economic development and technology, culture, public administration, justice, infrastructure, environment and spatial planning, education, science, sport and health.

|

Slovakia - Anti-fraud policy

|

Slovakia's Government Office adopted new measures regarding antifraud policy. These measures targeted the fraud prevention and detection stages of the anti-fraud cycle in the areas of fraud definition, anti-fraud or anticorruption strategy.

|

Slovakia - Risk indicators

|

Slovakia's Ministry of Education, Science, Research and Sport adopted new measures regarding the list of risk indicators.

|

Sweden - Anti-fraud training

|

Sweden's SEFI Council undertook a two-day visit to OLAF and the European Commission (DG EMPL and DG REGIO), focusing on the EU’s strategic fraud prevention work. Visit participants included senior managers responsible for this area of activity in the authorities managing EU funds in Sweden, a number of experts from these authorities, representatives from the Swedish Government Offices and representatives from the Swedish Economic Crime Authority’s operational activities. This measure targeted the fraud prevention stage of the anti-fraud cycle in the areas of public procurement, financial crime, organised crime, corruption, conflict of interest, fraud definition, AFCOS, whistle-blower, shared management.

3.Anti-fraud measures in Revenue by the Member States

3.1Fight against customs fraud

|

Denmark - National risk analysis

|

Denmark implemented a measure targeting the fraud prevention and detection stages in the area of customs. When risk analysis is carried out in Customs' analysis units, data is included from a number of sources, mainly declaration data from the Customs System. The data is analysed in the IT systems "Business Intelligence" (BI) and Tableau. Tableau is good at visualising trends and deviations in import patterns. The process of analysing data, mainly using declaration data in BI and Tableau, is a measure which SKAT introduced in 2016. Greater use of Tableau will support the work of detecting patterns of fraud.

|

France - National risk analysis

|

France created the Risk Analysis and Targeting Department (SARC - within the Directorate-General for Customs and Indirect Taxation) in response to new challenges in the field of security, safety and the fight against fraud. This comes at a time when the flow of tax returns is being dematerialised and the new Union Customs Code implemented. It is tasked with analysing risks, determining national targeting criteria to be integrated into computing tools to facilitate controls, orienting controls and investigations, and fulfilling all requests for analyses related to fraud. This measure targeted the prevention and detection stages of the anti-fraud cycle in the area of fraud definition , customs and shared management.

|

Italy - National customs risk assessment

|

Italy launched an application which makes possible, inter alia, entry of and access to, in real time, a set of information concerning the various procedural stages of cases being investigated in connection with information on cases of Own Resources fraud. The Customs and Monopolies Agency therefore has real-time access to data on additional own resources assessed, together with other information useful for operational and accounting management, making it possible to analyse and compare activities undertaken. This measure targeted the recovery and sanction stages of the anti-fraud cycle in the areas of customs/TOR/illicit trade.

|

Austria - National customs control strategy

|

Austria adopted a national customs control strategy including cross-cutting measures relating to terrorism, dual use and proliferation require close cooperation with national licensing authorities, the police and the Federal Defence Ministry. This measure targted the prevention, detection, investigation and prosecution, recovery and sanction stages of the anti-fraud cycle in the areas of financial crime, organised crime, customs, shared management.

|

Portugal - National customs risk assessment

|

Portugal linked up the entire goods-entry cycle to the national risk database (entry summary declaration, declaration for temporary storage and customs declaration). To handle this risk-analysis, assessment and mitigation work relating to safety, security and financial fraud, a National Risk Assessment Centre became fully operational; open 16 hours a day, six days a week, with increased staff numbers. This measure targeted the prevention and detection stages of the anti-fraud cycle in the areas of financial crime, organised crime, smuggling/illlicit trade.

|

Slovenia - National customs control strategy

|

Slovenia adopted a national customs control strategy, targeting the fraud prevention stage of the anti-fraud cycle in the areas of financial crime and shared management. Instructions on reporting established irregularities in the field of EU traditional own resources (TOR) laid down the procedures for reporting cases of fraud and irregularities affecting TOR where the amount at stake exceeds €10,000. This includes a requirement to appoint national coordinator(s)/operator(s) in organisational units, as well as deadlines and procedures for informing coordinators of new cases of fraud and irregularities and of action taken in relation to outstanding cases. The instructions also lay down an obligation to check eligibility, to follow up outstanding cases and to offer specialist assistance. A training course was organised on account of the introduction of VAT payments on imports.

3.2Fight against organised crime and anti-smuggling

|

Bulgaria - Fight against organised crime

|

Bulgaria's inter-departmental coordination centre for combating smuggling and monitoring movements of high-risk goods and freight, set up at the General Directorate Combating Organised Crime of the Ministry of the Interior by Council of Ministers Decree No 89 of 16 April 2015 was very active in 2016. The effective cooperation at inter-departmental level and the coordination by a single coordination centre of operational activities relating to established smuggling and tax abuse ensure that the competent state bodies can take immediate action in terms of risk analysis, identification of counter-measures and joint control activities to be carried out by law enforcement authorities, the National Revenue Agency, the Customs Agency and other public authorities.

Greece amended the National Customs Code to strengthen the fight against the illegal trade in tobacco and set up a Coordination Centre for Combatting Smuggling. This measure targeted the prevention, detection, investigation and prosecution in the area of customs/TOR/Illicit trade. Greek legislation was harmonised with Council Decision 2009/917/JHA on the use of information technology for customs purposes. Directive 2014/40/EU on the approximation of the laws, regulations and administrative provisions of the Member States concerning the manufacture, presentation and sale of tobacco and related products was transposed into Greek law.

|

Finland - Fight against economic crime

|

Finland's customs authority adopted an action plan to combat the shadow economy covering the period 2016-2020 in relation to the national strategy for reducing economic crime and the shadow economy. A key objective is to further improve risk management and controls to protect the EU's own resources. This measure targeted the fraud prevention, detection, and investigation and prosecution stages of the anti-fraud cycle in the area of financial crime, organised crime, whistle-blowers, and customs/TOR/illicit trade.

3.3Fight against tax evasion and VAT fraud

|

Bulgaria - Fight against tax evasion and VAT fraud

|

Bulgaria's National Revenue Agency (NAP) implemented a project under the Hercule III programme (OLAF/2016/D1/022) entitled "increasing the administrative capacity of the National Revenue Agency in the field of intra-Community trade by improving the interaction between administrations of EU Member States in the fight against tax fraud". 45 officials of the National Revenue Agency and the National Agency for Tax Administration of Romania participated in two workshops held under Action 1, to strengthen cooperation in the fight against VAT fraud and in the transport of high risk goods. An agreement was reached to carry out joint checks of high risk goods at the border between the two countries. As a direct effect of the fiscal control activities carried out during the last two years, the National Revenue Agency reports a BGN 1.5 billion increase in the tax base in connection with intra-Community acquisitions declared by firms carrying out imports of goods with high fiscal risk. The two countries agreed to carry out pilot joint inspections at the border check points Silistra-Ostrov and Danube Bridge 2 Vidin-Calafat, signed a Joint Action Protocol and prepared a three-year work programme.

Under Action 2, the National Revenue Agency of Bulgaria and the National Tax and Customs Administration of Hungary organised a working visit to Hungary for a target group of 28 officials, in order to enhance the mutual exchange of good practices between the two Member States and to strengthen administrative cooperation and exchange of operational information for planning and implementing effective national mechanisms in combating fraud affecting the financial interests of the European Union.

|

Czech Republic - Fight against tax evasion and VAT fraud

|

Czech Republic reinforced the position of the Czech Customs Administration as a police authority empowered to conduct criminal proceedings in the area of crimes linked to VAT evasion. Prior to that, the Customs Administration was only competent to conduct criminal proceedings relating to tax offences involving a cross-border element. The human resource burden on the Czech Police was reduced by making use of the expertise of the staff of the Customs Administration in conducting criminal proceedings. This measure targeted the fraud detection, investigation and prosecution stages of the anti-fraud cycle in the areas of financial crime and organised crime.

|

Ireland - VAT reverse charge

|

Ireland introduced the VAT reverse charge for supplies of electricity and gas certificates. The reverse charge makes the recipient rather than the supplier accountable for the VAT on supplies. This ensures that the opportunity to generate significant false repayment claims in the sector is eliminated. This measure took effect from 1 January 2016 following the enactment of the Finance Bill 2015 and targeted the fraud prevention stage of the anti-fraud cycle and the area of financial crime.

|

Ireland - Transparency on VAT numbers

|

In another related measure also targeting the fraud prevention stage of the anti-fraud cycle and the area of financial crime, Ireland gave the Revenue Commissioners the power to publish the fact that a person's VAT number has been cancelled to advise a person's supplier of the fact. This measure took effect in January 2016 after the enactment of the Finance Bill 2015 (December 2015).

|

Lithuania - Fight against tax evasion

|

Lithuania's State Tax Inspectorate is currently developing the Smart Tax Administration System (i.MAS) in order to increase the efficiency of tax administration and detection of tax fraud and fraudulent transaction as well as to reduce the taxpayer's burden. The i.MAS consists of 7 subsystems: e-invoice system (i.SAF); e- waybill system (i.VAZ); analysis, modelling and risk management subsystem (i. MAMC); smart cash registers (i.EKA); applied accounting system (i.APS); standard audit file for tax purposes (i.SAF-T) and smart control (i.KON). i. SAF and i.VAZ have been already put into operation as of October 2016. This measure targets the prevention and detection stage of the anti-fraud cycle with the objective of improving tax administration and tax collection and reducing the taxpayer's burden. It will enable faster detection of tax fraud chains and fraudulent schemes.

|

Latvia - Fight against tax evasion

|

Latvia introduced amendments on the Law on Taxes and Duties and amendments on the Value Added Tax Law. The State Revenue Service has the right to remove the domain name of unregistered economic activity or failure to identify themselves when conducting business activities, as well as operating the suspension of the case; request to the web hosting service the termination (suspension) if the law is violated; and refuse to re-register the domain name of the taxpayer, if the tax audits is planned. In addition, the reverse VAT payment procedure now applies to mobile phones, tablets, laptops and integrated circuit devices; Cereals and industrial crops deliveries and precious metal supplies. This measure targets the fraud prevention and fraud detection stages of the anti-fraud cycle.

|

Poland - Fight against VAT fraud

|

Poland adopted relevant amendments in the area of accounting for VAT on intra-Community purchases of motor fuels in an Act of 7 July 2016 amending the VAT Act and certain other acts. This measure targeted the prevention stages of the anti-fraud cycle, in the area of customs. VAT must now be paid within five days of the day of entry of the motor fuel into Poland, an additional declaration must be submitted for intra-Community purchases of motor fuels, and tax warehouse keepers and registered consignees are now liable for the VAT.

4.Sectoral Anti-Fraud Policies, Measures and Results by Member States - Expenditure

4.1Agriculture

|

Germany - Anti-fraud training

|

Germany participated in five seminars on ‘Fraud prevention within the framework of the CAP’, run by the Commission's Directorate-General for Agriculture and Rural Development with a total of 420 officials from the paying agencies. This administrative measure targeted the fraud prevention and detection stages of the anti-fraud cycle in the areas of shared management and control of EU funds, anti-fraud or anti-corruption strategy.

|

Greece - Fraud prevention

|

Greece established procedures for preventing and combatting fraud in management and control systems for the following programmes:

ØRural Development Programme for Greece 2014-2020 (Ministerial Decision 1065/2016, Government Gazette, Series II, No 1273/4-5-2016)

ØNational Programmes of the Asylum, Migration and Integration Fund and the Internal Security Fund 2014-2020 (Ministerial Decision 82350/2016, Government Gazette, Series II, No 2451/9-8-2016). prevention and detection, area – shared management

|

Luxembourg - Detecting fraud in agriculture

|

Luxembourg's Ministry of Agriculture, the managing authority for the European Agricultural Fund for Rural Development and the European Agricultural Guarantee Fund, created the "Procedure and Special Investigations service - service Procédure et Enquêtes Particulières (PEP)", whose mission is to prevent fraud cases. This measure targeted the detection phase of the anti-fraud cycle in the area of fraud definition, control of EU funds, anti-fraud or anti-corruption strategy.

|

Poland - Fraud risk analysis for agriculture

|

In Poland, an ordinance of the President of the Agency for Restructuring and Modernisation concerned the adoption of a policy for the fight against financial fraud in the Agency (ARiMR). The instrument is intended to optimise the fight against fraud by extending fraud risk analysis to the departments responsible for keeping the national register of agricultural producers and for field inspections. This measure targeted the prevention and detection stages of the anti-fraud cycle in the area of shared management.

|

Slovenia - Computerised accounting system

|

Slovenia developed a computerised accounting system (e-CA) for the certifying authority (MF-SUSEU/CA). Instructions were issued for the recovery of designated EU funds for the 2014-2020 programming period; and the risk register was updated. Agriculture in Slovenia (ARSKTRP) contributed to the amendment of the Agriculture Act (Zkme-1, currently at the coordination stage), which includes additional provisions on non-compliance with or infringement of obligations. The definition of infringements is more detailed, and in accordance with EU law, negligence is included as a form of inadmissible conduct, new legal bases are introduced for annulling decisions where no data or false data is submitted and a special processing procedure has been introduced for applications where there is a suspicion of irregularity.

In 2016 ARSKTRP held training courses for employees and managers on the system for preventing fraud and artificial creation of conditions. Employees at the Ministry of Agriculture, Forestry and Food underwent training on the system for detecting and preventing fraud. A manual of fraud indicators was produced in 2015 and in 2016 it was supplemented and updated by incorporating practical examples from the past. The list of administrative checks was also added to, with the inclusion of questions relating to suspicion of fraud.

|

Slovakia - New internal procedures and checklists

|

Slovakia's Ministry of Agriculture and Rural Development adopted new internal procedures and checklists reflecting amendments of respective legislation (mainly in area of public procurement and verification of eligibility of expenditures).

|

United Kingdom - Anti-fraud strategies

|

The four United Kingdom paying agencies each have their respective anti-fraud strategies in place based on their own risk evaluations. The aim is to reduce the risk of fraud to an absolute minimum. Safeguarding CAP funds is a key element of the strategic approach to prevent fraud. These strategies continued to be reviewed, renewed as needed and updated through 2016. Antifraud strategies are reviewed annually and signed off at senior level in accordance with corporate governance requirements and consistent standards across UK government departments.

4.2 Cohesion policy and Fisheries

|

Belgium - Conflict of interest

|

In Belgium, a request was made to all legal and natural persons involved in a procurement procedure to sign a statement declaring the absence of conflict of interest. This request has also been made to ERDF beneficiaries in Wallonia. This measure is also applicable to Flanders; and will soon be put in place in the ERDF Brussels Capital Region.

|

Bulgaria - Administration of irregularities

|

Bulgaria adopted a Regulation on the administration of irregularities concerning the European Structural and Investment Fund, by Council of Ministers Decree No 173 of 13 July 2016. The Regulation governs relations under public law concerning the administration of irregularities involving the European Structural and Investment Funds (ESIF). This legal measure targets the fraud prevention and detection stages of the anti-fraud cycle in the area of control of EU funds.

Bulgaria also approved a procedure in connection with the provision of access to the risk scoring tool of the European Commission in the field of fraud and irregularities, ARACHNE, pursuant to Order No R249/02.12.2015 of the Deputy Prime Minister for EU Funds and Economic Policy. ARACHNE is fed with information already in place and available in the Information System for Management and Monitoring of the EU Structural Instruments in Bulgaria (ISUN and ISUN 2020). In 2016, 51 users from all Managing Authorities were given access (via individual profiles) to ARACHNE. This measure targets the fraud prevention and detection stages of the anti-fraud cycle in the area of public procurement, conflict of interest and shared management.

|

Denmark - Managing suspected fraud

|

Denmark drafted of an internal procedure for managing cases where there is a report of fraud, or where there is suspected fraud involving EU Structural Funds.

|

Germany - ESF management and control systems - Self-assessment of fraud risks

|

Germany defined the Management and Control Systems for the implementation of its operational programme for the European Social Fund (ESF) in accordance with Regulation (EU) No 1301/2013 of 17 December 2013 and Regulation (EU) No 1304/2013 of 17 December 2013 and Regulation (EU) No 1304/2013 of 17 December 2013. This measure targeted the prevention, detection, recovery and sanction stages of the anti-fraud cycle in the area of shared management.

Germany produced a self-assessment of fraud risks relating to the planned operational programme, as recommended in the European Commission guidelines, by the Managing Authority of the European Regional Development Fund (ERDF). This measure targeted the prevention and detection stages of the anti-fraud cycle in the areas of public procurement and conflict of interest.

|

Estonia - Risk assessment and analyses

|

In Estonia the implementing system, including different level entities and managing authorities, focused more on the risk of measures / projects, awareness-raising among officials and cooperation:

- simple procurement procedures are directed into the E-Procurement Estonia;

- a 'red flag' system is used for projects;

- all counterparts participate in the joint training courses and joint discussions.

This measure targets the prevention and detection stage of the anti-fraud cycle in the area of shared management (agriculture and cohesion policy).

|

Ireland - ERDF anti-fraud measures

|

Ireland implemented anti-fraud measures for ERDF operational programmes. As required under EU Regulation 1303/2013 governing the ESI Funds, Managing Authorities must put in place effective and proportionate anti-fraud measures. These have been introduced for the two regional OPs in Ireland as part of their management and control systems. They include an anti-fraud policy, fraud assessment procedures and a risk register. The Commission's anti-fraud data mining tool - Arachne will also be used under this funding round and has been referred to in the anti-fraud policy. This measure targets the prevention and detection stages of the anti-fraud cycle in the areas of public procurement, corruption, conflict of interest, AFCOS, shared management and control of EU funds.

|

Portugal - Beneficiary information system

|

Portugal rolled-out and updated the suitability, reliability and debt information system for cohesion policy funds (European Regional Development Fund (ERDF), European Social Fund (ESF) and the Cohesion Fund), which includes information on bodies applying for aid and aid beneficiaries under the European Structural and Investment Funds (ESIF). For each beneficiary or potential beneficiary, any factors that would prevent the granting of aid, or which would make it subject to conditions, are entered into the system, using own coding. This measure targeted the fraud prevention stage of the anti-fraud cycle in the areas of conflict of interest, control of EU funds, and anti-fraud or anti-corruption strategy.

|

Croatia - Irregularity management

|

Croatia's Minister of Finance adopted guidelines on Irregularity Management in the context of Structural instruments and ESI Funds drafted by the Service for Combating Irregularities and Fraud. According to Article 5(3)a of the Regulation on the Institutional Framework of the System for Combating Irregularities and Fraud (OG 144/2013), Irregularity Reporting System bodies are obliged to follow procedures which are described within the Guidelines concerned. The purpose of the guidelines is to prescribe procedures for prevention, detection treatment, reporting and follow up of established irregularities related to the use of Structural instruments and ESI Funds. This measure targets the fraud prevention and detection stages of the anti-fraud cycle in the area of AFCOS.

|

Italy - Preventing fraud in fisheries

|

Italy introduced a more appropriate range of penalties for illegal fishing in order to restore credibility to the system by enhancing the preventive function of punishments. In particular, the possession, landing, transshipment, carriage and marketing of undersized fish species (‘juveniles’) was decriminalized. Law No 154/16 (delegations to the Government and further dispositions in subject of simplification, rationalization and competitiveness of the sectors agricultural and agro-food, as well as sanctions in subject of illegal fishing) amends Legislative Decree No 4/2012 (the reference legislation in the field). Administrative fines exist for unlawful acts ranging from EUR 1 000 to EUR 75 000, which are doubled in the event of offences concerning bluefin tuna and swordfish. For fishing, marketing and purveyancing of undersized fishing products of the latter two species, additional penalties have been laid down, such as suspension of the fishing licence for three to six months and withdrawal in the event of repeat offences.

|

Cyprus - Fraud Risk Self-Assessment Tool

|

Cyprus established the Certified Authority within the Treasury of the Republic of Cyprus as regards ESIF and the Food and/or Basic Material Assistance Programme. The Authority has applied the EU Fraud Risk Self-Assessment Tool in respect of the Fund Management and Control System and the impact of specific fraud scenarios. Memoranda, instructions, guidelines and an action plan will be drafted. Procedures for various bodies (IB/MA) to report irregularities, sanctioning, and recovering sponsorship are applied. Also, application of procedures by the Certified Authority of the Treasury of the Republic of Cyprus is followed in respect of public contracts.

Luxembourg has recommended testing of the Arachne tool to the ERDF managing authority in view of a possible adoption of the tool. This measure targets the detection stage of the anti-fraud cycle in the area of conflict of interest and fraud definition. The European Regional Development Fund's Management Authority, the Ministry of Economics, and European Social Fund's Managing Authority, the Ministry of Labour, are both currently implementing and testing the Arachne tool. If it reveals to be sufficient in matters of data (for Luxembourg), it would be installed definitively. For now, only one user in each Ministry is testing it, in tight collaboration with the Commission's services. The use of Arachne would help to identify possible conflict of interests (beneficiary versus supplier, for example), and/or possible suppliers that have or are still facing financial or legal problems. Monitoring this data would help to eliminate future issues with the beneficiary supply chain.

|

Luxembourg - Fraud Risk Self-Assessment Tool

|